SEPARATE STATEMENT OF FINANCIAL POSITION

BANCOLOMBIA S.A.

As of December 31, 2023 and 2022

(Stated in millions of Colombian pesos)

| Note | December 31, 2022 | |

ASSETS |

|

|

|

Cash and cash equivalents | 3 | 24,348,860 | 16,233,804 |

Financial assets investments, net | 4.1 | 13,757,902 | 13,129,374 |

Derivative financial instruments | 4.2 | 6,215,942 | 4,860,893 |

Financial assets investments, net and derivative financial instruments | 19,973,844 | 17,990,267 | |

Loans and advances to customers | 182,921,469 | 179,472,579 | |

Allowance for loans, advances and lease losses | (12,892,352) | (11,268,584) | |

Cartera de créditos y operaciones de leasing financiero, neto | 5 | 170,029,117 | 168,203,995 |

Assets held for sale and inventories, net | 13 | 459,328 | 248,001 |

Investment in subsidiaries | 7 | 24,751,945 | 29,718,697 |

Investment in associates and joint ventures | 8 | 298,598 | 302,761 |

Premises and equipment, net | 10 | 5,446,056 | 5,282,430 |

Investment properties | 11 | 574,550 | 449,253 |

Right of use asset under lease agreements | 6.2.1 | 1,228,649 | 1,116,653 |

Intangible assets, net | 9 | 345,553 | 277,065 |

Deferred tax, net | 12.5 | - | 151,340 |

Other assets, net | 14 | 4,133,838 | 3,201,278 |

TOTAL ASSETS |

| 251,590,338 | 243,175,544 |

LIABILITIES AND EQUITY |

| ||

LIABILITIES |

|

|

|

Deposits by customers | 15 | 170,231,400 | 156,480,283 |

Interbank deposits and repurchase agreements and other similar secured borrowing | 16 | 263,751 | 638,940 |

Derivative financial instruments | 4.2 | 6,699,521 | 4,717,408 |

Borrowings from other financial institutions | 17 | 12,000,269 | 14,161,087 |

Debt instruments in issue | 18 | 10,958,823 | 15,209,620 |

lease contracts liabilities, net | 6.2.2 | 1,352,302 | 1,252,263 |

Preferred shares | 19 | 584,204 | 584,204 |

Current tax | 1,520 | 697,373 | |

Deferred tax, net | 12.5 | 1,113,359 | - |

Employee benefit plans | 20 | 684,439 | 556,513 |

Other liabilities | 21, 22 | 10,619,082 | 10,136,073 |

TOTAL LIABILITIES |

| 214,508,670 | 204,433,764 |

EQUITY |

|

|

|

Share capital | 23 | 480,914 | 480,914 |

Additional paid-in-capital | 4,837,497 | 4,837,497 | |

Appropriated reserves | 24 | 20,292,454 | 16,733,917 |

Retained earnings | 5,935,658 | 6,931,037 | |

Accumulated other comprehensive income, net of tax | 5,535,145 | 9,758,415 | |

TOTAL EQUITY |

| 37,081,668 | 38,741,780 |

TOTAL LIABILITIES AND EQUITY |

| 251,590,338 | 243,175,544 |

The accompanying notes form an integral part of these separate financial statements.

SEPARATE STATEMENT OF INCOME

BANCOLOMBIA S.A.

For the years ended December 31, 2023 and 2022

(Stated in millions of Colombian pesos)

Note | | 2023 | 2022 | |

Interest on loans and financial leases | | | | |

Commercial | | | 13,496,215 | 7,891,866 |

Consumer | | | 8,138,830 | 6,287,886 |

Small business loans | | | 142,804 | 150,887 |

Mortgage | | | 2,916,180 | 2,515,454 |

Financial leases | | | 3,623,476 | 2,396,276 |

Total interest income on loans and financial leases | | | 28,317,505 | 19,242,369 |

Interest income on overnight and market funds | | | 10,404 | 7,827 |

Interest and valuation on financial instruments | 25.1 | | 837,862 | 1,449,187 |

Other interest income | | | 198,822 | 50,232 |

Total interest and valuation on financial instruments | | | 29,364,593 | 20,749,615 |

Interest expenses | 25.2 | | (13,887,154) | (6,545,975) |

Net interest margin and valuation on financial instruments before impairment on loans and financial leases, off balance sheet credit instruments and other financial instruments | | | 15,477,439 | 14,203,640 |

Credit impairment charges on loans, advances and financial leases, net | 5 | | (6,723,335) | (2,956,483) |

Credit (impairment) recovery for other financial instruments | | | (8,858) | (16,309) |

Total credit impairment charges, net | | | (6,732,193) | (2,972,792) |

Net interest margin and valuation on financial instruments after impairment on loans and financial leases and off balance sheet credit instruments and other financial instruments | | | 8,742,529 | 11,230,848 |

Fees and commissions income | 25.3.1 | | 5,333,049 | 4,717,944 |

Fees and commissions expenses | 25.3.2 | | (2,641,905) | (2,206,616) |

Total fees and commissions, net | | | 2,691,144 | 2,511,328 |

Other operating income, net | 25.4 | | 2,903,331 | 779,278 |

Equity method | 7, 8, 25.5 | | 2,040,133 | 1,966,798 |

Dividend income | 25.5 | | 4,482 | 7,777 |

Valuation and gains on sale of equity investments | 25.5 | | 67,640 | (58,864) |

Total income, net | | | 16,451,976 | 16,437,165 |

Operating expenses | | | | |

Salaries and employee benefits | 26.1 | | (3,504,950) | (2,910,394) |

Other administrative and general expenses | 26.2 | | (3,201,592) | (2,904,201) |

Taxes other than income tax | 26.2 | | (1,183,244) | (731,389) |

Impairment, depreciation and amortization | 26.3 | | (899,647) | (800,621) |

Total operating expenses | | | (8,789,433) | (7,346,605) |

Profit before income tax | | | 7,662,543 | 9,090,560 |

Income tax | 12 | | (1,682,813) | (2,157,595) |

Net income | | | 5,979,730 | 6,932,965 |

The accompanying notes form an integral part of these separate financial statements.

SEPARATE STATEMENT OF COMPREHENSIVE INCOME

BANCOLOMBIA S.A.

For the years ended December 31, 2023 and 2022

(Stated in millions of Colombian pesos)

| Note | 2023 | 2022 |

Net income | | 5,979,730 | 6,932,965 |

Other comprehensive income/(loss) that will not be reclassified to net income | | | |

Remeasurement (loss)/income related to defined benefit liability | 20.1 | (24,291) | 36,927 |

Income tax | 12.4 | 9,061 | (17,937) |

Gains on asset revaluation | | - | - |

Income tax | 12.4 | - | (71) |

Net of tax amount | | (15,230) | 18,919 |

Other comprehensive income/(loss) that may be reclassified to net income | | | |

Net gain (loss) on valuation of financial instruments (1) | 4.1 | 68,819 | (28,984) |

Income tax | 12.4 | (19,335) | 5,472 |

Net of tax amount | | 49,484 | (23,512) |

Foreign currency translation adjustments | | | |

Exchange differences | 7 | (5,791,932) | 3,738,815 |

Hedge of net investment in foreign operations | 7 | 1,948,833 | (1,833,087) |

Income tax | 12.4 | (772,755) | 746,232 |

Net of tax amount (2) | | (4,615,854) | 2,651,960 |

Superávit por participación patrimonial | | | |

Unrealized gain/(loss) on investments in subsidiaries using equity method | 7 | 359,968 | 378,470 |

Gain/(loss) on valuation of investments in associates and joint ventures (3) (4) | 8 | 172 | (8,695) |

Income tax | 12.4 | - | 924 |

Net of tax amount | | 360,140 | 370,699 |

Total other comprehensive income that may be reclassified to net income | | (4,206,230) | 2,999,147 |

Total other comprehensive income, net of tax | | (4,221,460) | 3,018,066 |

Total comprehensive income | | 1,758,270 | 9,951,031 |

The accompanying notes form an integral part of these separate financial statements.

| (1) | The net effect as of december 31, 2023, corresponds to realization of OCI equity investments for COP (8,608) reclassified to income for the period, valuation of equity investments for COP 19,082, debt securities for COP 52,063 and realization as a result of the derecognition of interest in BVC for COP 6,282. The net effect as of dicember 31, 2022 is due to realization of OCI equity investments for COP (15,122) reclassified to income for the period, valuation of equity investments for COP 4,320 and debt securities COP (18,182). |

| (2) | In 2023, mainly due to revaluation of the Colombian peso against the U.S. dollar amounting to 20.54%. |

| (3) | The net effect ad of December 31, 2023 relates to valuation, while as of December 21, 2022 relates to valuation for COP 1,812 andrealizarion of OCI in the derecognition of interests in Protección for COP (10,507). |

| (4) | For further information see Note 2. Material Accounting policies, section C 4.1Investments in associates and joint ventures and Note 8. in associates and joint ventures. |

SEPARATE STATEMENT OF CHANGES IN EQUITY

BANCOLOMBIA S.A.

For the years ended December 31, 2023 and 2022

(Stated in millions of Colombian pesos, except per share amounts stated in units of pesos)

| | | Accumulated other comprehensive income | | | ||||||||||||

Note | Share capital | Additional paid in capital | Appropriated reserves | Financial instruments | Adjustments on first-time application of IFRS | Revaluation of assets | Employee benefits | Equity method surplus (1) | Total other comprehensive income, net | Retained earnings | Total equity | ||||||

Balance as of January 1, 2023 | | 480,914 | 4,837,497 | 16,733,917 | 123,805 | 2,557,668 | 2, 137 | (535) | 7,075,340 | 9,758,415 | 6,931,037 | 38,741,780 | |||||

Dividend payment corresponding to 509,704,584 common shares and 452,122,416 preferred shares without voting rights, subscribed and paid as of December 31, 2022, at a rate of COP 3,536 per share, payable as follows: COP 884 per share quarterly, on the following dates: April 3, July 4, October 2, 2023 and January 2, 2024. | | - | - | - | - | - | - | - | - | - | (3,343,319) | (3,343,319) | |||||

Reserve for equity strengthening and future growth. | | - | - | 3,557,980 | - | - | - | - | - | - | (3,557,980) | - | |||||

Reserve for social benefit projects and donations. | | - | - | - | - | - | - | - | - | - | (33,000) | (33,000) | |||||

Reclassification of unclaimed dividends in accordance with Article 85 of the Bank's bylaws to reserves. | | - | - | 557 | - | - | - | - | - | - | - | 557 | |||||

Realization of retained earnings. | | - | - | - | - | (1,810) | - | - | - | (1,810) | 1,810 | - | |||||

Equity method from participation in subsidiaries, associates and joint ventures. | | - | - | - | - | - | - | - | - | - | (42,620) | (42,620) | |||||

Net income | | - | - | - | - | - | - | - | - | - | 5,979,730 | 5,979,730 | |||||

Other comprehensive income | 12.4 | - | - | - | 49,484 (2) | - | - | (15,230) | (4,255,714) | (4,221,460) | - | (4,221,460) | |||||

Equity as of December 31, 2023 | | 480,914 | 4,837,497 | 20,292,454 | 173,289 | 2,555,858 | 2,137 | (15,765) | 2,819,626 | 5,535,145 | 5,935,658 | 37,081,668 | |||||

The accompanying notes form an integral part of these separate financial statements.

| (1) | The balance as of December 31, 2023 includes recognition of the equity method on investments in subsidiaries for COP 6,519,385, equity method of investments in associates for COP (2,223), hedging of foreign investments for COP (4,403,782) and deferred tax for COP 706,246. |

| (2) | The balance as of December, 2023 includes OCI related to valuation of equity investments for COP 19,082, realization of OCI for COP (8,608), valuation of debt securities for COP 52,063, realization of OCI as a result of the derecognition of interest in BVC for COP 6,282 and deferred tax for COP (19,335). |

NOTE 1. REPORTING ENTITY

Bancolombia S.A., hereinafter the Bank, is a credit establishment, listed on the Colombia Stock Exchange (BVC) as well as on the New York Stock Exchange (NYSE), since 1981 and 1995, respectively. The Bank main location is in Medellín (Colombia), main address Carrera 48 # 26-85, Avenida Los Industriales, and was originally constituted under the name Banco Industrial Colombiano (BIC) according to public deed number 388, date January 24, 1945, from the First Notary's Office of Medellin, authorized by the Superintendence of Finance of Colombia (“SFC”). On April 3, 1998, by means of public deed No. 633, BIC merged with Bank of Colombia S.A., and the resulting organization of that merger was named Bancolombia S.A.

The Bank bylaws are found in the public deed number 1441, dated May 6, 2022, at the 20th Notary´s Office of Medellín.

Bancolombia S.A. business purpose is to carry out all operations, transactions, acts and services inherent to the banking business. The Bank may, by itself or through its subsidiaries, own interests in other corporations, wherever authorized by law, according to all terms and requirements, limits or conditions established therein.

The duration contemplated in the bylaws is until December 8, 2044, but it may be dissolved or renewed before the end of that period. The operating license was definitively authorized by the SFC according to Resolution number 3140 of September 24, 1993.

The Bank, through its subsidiaries, has banking operations and international presence in United States, Puerto Rico, Panamá Guatemala and El Salvador. On May 25, 2022 and April 15, 2022, respectively, the Bank obtained the regulatory authorizations and licenses to operate as a broker-dealer and as a registered investment adviser in the United States, through its subsidiaries Bancolombia Capital Holdings USA LLC, Bancolombia Capital LLC, and Bancolombia Capital Advisers LLC, which were incorporated in September 2021.

On June 4, 2021, the Bank signed an agreement for the assignment of the fiduciary rights of the PA FAI Calle 77 trust, subject to condition. Fulfilled the condition on March 1, 2022, the Bank was established as trustor of PA FAI Calle 77, owner of a property that will be used for mortgage rental. The consdieration paid by the Bank was COP 56,968. The main purpose of the trust is to carry out the development, administration, management and operation of the project, on the aforementioned property in the city of Bogotá.

Operations in Barbados through Mercom Bank Ltd. are in the process of being dismantled to the extent that the instruments or obligations related to the assets and liabilities of said entity come due contractually. Its assets, liabilities and contracts were transferred to other companies that are also part of the Bancolombia Group. The operations of Transportempo S.A.S. They have been in liquidation since May 2023.

Additionally, operations in the Cayman Islands through Bancolombia Cayman were in the process of dismantling, for which on November 22, 2023 the Cayman Islands Monetary Authority approved the delivery of the banking license in accordance with Section 20(1). (a) of the Banking and Trust Companies Act (2021 Revision) (the BTCA), therefore, the banking license has been canceled with effect from that date. The company is in liquidation.

On December 14, 2021, the Bank's Board of Directors authorized the legal separation of the Nequi business, the digital platform of Grupo Bancolombia which offers financial services. The Financial Superintendence of Colombia, through Resolution 0843 of July 6, 2022, modified by the Resolution

0955 of July 27, 2022, authorized the constitution of Nequi S.A. Financial Company. The legal separation implied the creation and commercial registration of a new corporation supervised by the Financial Superintendence of Colombia through which Nequi will operate completely as a digital bank (compañía de financiamiento). In order to be able to operate, compliance with all the activities required to obtain the authorization certificate or operating permit must be accredited to the Financial Superintendence of Colombia. On September 2022 the company NEQUI S.A.S. was created with a capitalization of COP 150,000 distributed mainly between Banca de Inversión Bancolombia S.A. with a participation of 94.99% and Inversiones CFNS S.A.S. with 5.01%.

On July 22, 2022, through the subsidiary, Sistemas de Inversiones y Negocios S.A. SINESA, the company Wenia LTD was incorporated in Bermuda, a corporate vehicle whose purpose is to provide technology services. By private document dated October 18, 2022, Wenia LTD as the sole shareholder, registered on November 22, 2022 with the Chamber of Commerce, the commercial company called Wenia S.A.S., whose purpose, among others, is the creation and implementation of operating systems and software applications.

On June 27, 2023, the Bank's Board of Directors evaluated a change in the professional management of the Private Capital Fund Fondo Inmobiliario Colombia and approved the constitution of a new company that arose from a joint venture entered into with Patria Investments to provide said services. On August 28, the company Gestoría Externa de Portafolios S.A. was established, with a capital of one million pesos, 100% owned by the Bancolombia Group. This entity issued shares for an approximate value of COP 19,000, and on November 1, 2023, Patria subscribed 51% of the shares of this company. Said company, Patria Asset Management S.A. (formerly Gestoría Externa de Portafolios S.A.), has as its main corporate purpose the provision of professional management services and external management of collective investment vehicles including collective investment funds and private equity funds in Colombia under the terms of part 3 of the Decree 2555 of 2010, without this constituting the performance of regulated activities exclusive to the entities supervised by the Financial Superintendence of Colombia.

As of december 31, 2023, the Bank has 22,559 employees, operates through 28,468 banking correspondents, 4,582 ATM’s, 578 offices and 494 mobile service points in Colombian territory.

The Bank has the following subsidiaries making up the Bank´s organizational structure, which is currently registered as a corporate group:

| | | | | | | | | | |

| | | | | | PROPORTION OF | | PROPORTION OF | | |

| | JURISDICTION | | | | OWNERSHIP | | OWNERSHIP | | |

ENTITY | | OF | | BUSINESS | | INTEREST AND | | INTEREST AND | | |

| | INCORPORATION | | | | VOTING POWER | | VOTING POWER | | |

| | | | | | HELD BY THE | | HELD BY THE | | |

| | | | | | BANK 2023 | | BANK 2022 | | |

Fiduciaria Bancolombia S.A. Sociedad Fiduciaria | | Colombia | | Trust | | 98.81 | % | 98.81 | % | |

Banca de Inversión Bancolombia S.A. Corporación Financiera | | Colombia | | Investment banking | | 100.00 | % | 100.00 | % | |

Valores Bancolombia S.A. Comisionista de Bolsa | | Colombia | | Securities brokerage | | 100.00 | % | 100.00 | % | |

WOMPI S.A.S. (before “VLIPCO S.A.S.”)(1) | | Colombia | | Technology services provider | | 100.00 | % | 99.98 | % | |

Renting Colombia S.A.S. | | Colombia | | Operating leasing | | 100.00 | % | 100.00 | % | |

Transportempo S.A.S. "Into liquidation" | | Colombia | | Transportation | | 100.00 | % | 100.00 | % | |

Inversiones CFNS S.A.S. | | Colombia | | Investments | | 99.94 | % | 99.94 | % | |

Negocios Digitales Colombia S.A.S. (before “Pasarela Colombia S.A.S.”) | | Colombia | | Payment solutions | | 100.00 | % | 100.00 | % | |

Fondo de Capital Privado Fondo Inmobiliario Colombia | | Colombia | | Real estate investment fund | | 80.47 | % | 80.47 | % | |

P.A. Inmuebles CEM | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. Calle 92 FIC-11 | | Colombia | | Mercantil trust | | 52.31 | % | 52.31 | % | |

P.A. FIC Edificio Corfinsura | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. FIC-A5 | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. FIC Inmuebles | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. FIC Clínica de Prado | | Colombia | | Mercantil trust | | 62.00 | % | 62.00 | % | |

P.A. FIC A6 | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. Central Point | | Colombia | | Mercantil trust | | 60.35 | % | 60.35 | % | |

Fideicomiso Irrevocable de Garantía, Fuente de Pago y Administración Inmobiliaria Polaris | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. Fideicomiso Twins Bay | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

Fideicomiso Lote Av San Martín | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. Fideicomiso Lote 30 | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

Fideicomiso Fondo Inmobiliario Bancolombia | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. Florencia Ferrara | | Colombia | | Mercantil trust | | 44.26 | % | 44.26 | % | |

P.A. Flor Morado Plaza | | Colombia | | Mercantil trust | | 80.47 | % | 80.47 | % | |

P.A. Galería la 33(2) | | Colombia | | Mercantil trust | | 80.47 | % | - | | |

Valores Simesa S.A.(3) | | Colombia | | Investments | | 64.93 | % | 66.33 | % | |

Fideicomiso Lote Distrito Vera B1B2(3) | | Colombia | | Mercantil trust | | 64.61 | % | 66.00 | % | |

Fideicomiso Lote Distrito Vera B3B4(3) | | Colombia | | Mercantil trust | | 64.61 | % | 66.00 | % | |

Fideicomiso Lote B6 Ciudad del Rio(4) | | Colombia | | Mercantil trust | | - | | 66.00 | % | |

P.A. FAI CALLE 77 | | Colombia | | Real estate investment fund | | 98.00 | % | 98.00 | % | |

P.A. NOMAD SALITRE | | Colombia | | Real estate investment fund | | 98.00 | % | 98.00 | % | |

P.A. NOMAD CENTRAL-2(5) | | Colombia | | Real estate investment fund | | 98.00 | % | - | | |

P.A. CALLE 84 (2)(5) | | Colombia | | Real estate investment fund | | 98.00 | % | - | | |

P.A. CALLE 84 (3)(5) | | Colombia | | Real estate investment fund | | 98.00 | % | - | | |

P.A. MERCURIO | | Colombia | | Real estate investment fund | | 100.00 | % | 100.00 | % | |

Wenia S.A.S. | | Colombia | | Technology services | | 100.00 | % | 100.00 | % | |

P.A. Wenia(6) | | Colombia | | Mercantil trust | | 100.00 | % | - | | |

Wenia Ltd. | | Bermuda | | Technology services | | 100.00 | % | 100.00 | | |

Nequi S.A. Compañía de Financiamiento | | Colombia | | Financial services | | 100.00 | % | 100.00 | % | |

Bancolombia Panamá S.A. | | Panama | | Banking | | 100.00 | % | 100.00 | % | |

Sistemas de Inversiones y Negocios S.A. Sinesa | | Panama | | Investments | | 100.00 | % | 100.00 | % | |

Banagrícola S.A. | | Panama | | Investments | | 99.17 | % | 99.17 | % | |

Banistmo S.A. | | Panama | | Banking | | 100.00 | % | 100.00 | % | |

Banistmo Investment Corporation S.A. | | Panama | | Trust | | 100.00 | % | 100.00 | % | |

Leasing Banistmo S.A. | | Panama | | Leasing | | 100.00 | % | 100.00 | % | |

Valores Banistmo S.A. | | Panama | | Securities brokerage | | 100.00 | % | 100.00 | % | |

Banistmo Panamá Fondo de Inversión S.A.(7) | | Panama | | Holding | | 100.00 | % | 100.00 | % | |

Banistmo Capital Markets Group Inc.(7) | | Panama | | Purchase and sale of securities | | 100.00 | % | 100.00 | % | |

Anavi Investment Corporation S.A.(7) | | Panama | | Real estate | | 100.00 | % | 100.00 | % | |

Desarrollo de Oriente S.A.(7) | | Panama | | Real estate | | 100.00 | % | 100.00 | % | |

Steens Enterprises S.A.(7) | | Panama | | Portfolio holder | | 100.00 | % | 100.00 | % | |

Ordway Holdings S.A.(7) | | Panama | | Real estate broker | | 100.00 | % | 100.00 | % | |

Grupo Agromercantil Holding S.A. | | Panama | | Holding | | 100.00 | % | 100.00 | % | |

Banco Agromercantil de Guatemala S.A. | | Guatemala | | Banking | | 99.68 | % | 99.68 | % | |

Seguros Agromercantil de Guatemala S.A. | | Guatemala | | Insurance agency | | 79.92 | % | 79.92 | % | |

Financiera Agromercantil S.A. | | Guatemala | | Financial services | | 100.00 | % | 100.00 | % | |

Agrovalores S.A. | | Guatemala | | Securities brokerage | | 100.00 | % | 100.00 | % | |

Arrendadora Agromercantil S.A. | | Guatemala | | Operating Leasing | | 100.00 | % | 100.00 | % | |

Agencia de Seguros y Fianzas Agromercantil S.A.(8) | | Guatemala | | Insurance agency | | - | | 100.00 | % | |

Asistencia y Ajustes S.A. | | Guatemala | | Roadside and medical assistance services | | 100.00 | % | 100.00 | % | |

Serproba S.A. | | Guatemala | | Maintenance and remodelling services | | 100.00 | % | 100.00 | % | |

Servicios de Formalización S.A. | | Guatemala | | Loans formalization | | 100.00 | % | 100.00 | % | |

Conserjeria, Mantenimiento y Mensajería S.A. "Into liquidation" | | Guatemala | | Maintenance services | | 100.00 | % | 100.00 | % | |

Mercom Bank Ltd.(9) | | Barbados | | Banking | | 99.68 | % | 99.68 | % | |

New Alma Enterprises Ltd. | | Bahamas | | Investments | | 99.68 | % | 99.68 | % | |

Bancolombia Puerto Rico Internacional Inc. | | Puerto Rico | | Banking | | 100.00 | % | 100.00 | % | |

Bancolombia Cayman S.A.(10) | | Cayman Islands | | Banking | | 100.00 | % | 100.00 | % | |

Banco Agrícola S.A. | | El Salvador | | Banking | | 97.36 | % | 97.36 | % | |

Arrendadora Financiera S.A. Arfinsa | | El Salvador | | Leasing | | 97.37 | % | 97.37 | % | |

Credibac S.A. de C.V. | | El Salvador | | Credit card services | | 97.36 | % | 97.36 | % | |

Valores Banagrícola S.A. de C.V. | | El Salvador | | Securities brokerage | | 98.89 | % | 98.89 | % | |

Inversiones Financieras Banco Agrícola S.A. IFBA | | El Salvador | | Investments | | 98.89 | % | 98.89 | % | |

Gestora de Fondos de Inversión Banagrícola S.A. | | El Salvador | | Administers investment funds | | 98.89 | % | 98.89 | % | |

Bagrícola Costa Rica S.A. | | Costa Rica | | Outsourcing | | 99.17 | % | 99.17 | % | |

Bancolombia Capital Holdings USA LLC | | United States | | Holding | | 100.00 | % | 100.00 | % | |

Bancolombia Capital Adviser LLC | | United States | | Investment advisor | | 100.00 | % | 100.00 | % | |

Bancolombia Capital LLC | | United States | | Securities brokerage | | 100.00 | % | 100.00 | % | |

| (1) | During 2022 and 2023, the Bank, through its subsidiary Banca de Inversión S.A., increased its participation through the purchase of shares from minority. |

| (2) | Company consolidated by Fondo de Capital Privado FCP Fondo Inmobiliario Colombia since March 2023. |

| (3) | The decrease in the shareholding is due to the repurchase of outstanding stock carried out by Valores Simesa S.A. during 2023 and 2022. |

| (4) | During 2023, the trust rights were transferred by Valores Simesa S.A.. |

| (5) | During February and April 2023, the Bank was established as trustor of P.A. Nomad Central-2, P.A. Calle 84 (2) and P.A. Calle 84 (3), through a management mercantil trust agreement |

| (6) | On May 17, 2023, Wenia S.A.S. was established as trustor of the trust rights of P.A. Wenia. |

| (7) | Investments in non-operational stage. |

| (8) | Company liquidated as of June 2023. |

| (9) | On September 30, 2021, Mercom Bank Ltd. shareholders authorized the beginning of an organized and gradual process to transfer of the assets and liabilities of Mercom Bank Ltd., to Banco Agromercantil de Guatemala S.A. or other companies of the Bank. |

SEPARATE STATEMENT OF CHANGES IN EQUITY

BANCOLOMBIA S.A.

For the years ended December 31, 2023 and 2022 and

(Stated in millions of Colombian pesos, except per share amounts stated in units of pesos)

| | | Accumulated other comprehensive income | | | ||||||||||||||

Note | Share capital | Additional paid in capital | Appropriated reserves | Financial instruments | Adjustments on first-time application of IFRS | Revaluation of assets | Employee benefits | Equity method surplus (1) | Total other comprehensive income, net | Retained earnings | Total equity | ||||||||

Equity as of January 1, 2022 | | 480,914 | 4,837,497 | 15,017,742 | 147,317 | 2,559,001 | 2,208 | (31,554) | 4,052,681 | 6,729,653 | 4,701,643 | 31,767,449 | |||||||

Dividend corresponding to 509,704,584 common shares and 452,122,416 preferred shares without voting rights, subscribed and paid as of December 31, 2021, at COP 3,120 per share, payable as follows: COP 780 per share quarterly, on the following dates: April 1, July 1, October 6, 2022 and January 2, 2023. | | - | - | - | - | - | - | - | - | - | (2,943,199) | (2,943,199) | |||||||

Reserve for equity strengthening and future growth. | | - | - | 1,715,601 | - | - | - | - | - | - | (1,715,601) | - | |||||||

Reserve for social benefit projects and occasional donations. | | - | - | - | - | - | - | - | - | - | (30,000) | (30,000) | |||||||

Reclassification of unclaimed dividends in accordance with Article 85 of the Bank's bylaws to reserves. | | - | - | 574 | - | - | - | - | - | - | - | 574 | |||||||

Realization of retained earnings. | | - | - | - | - | (1,333) | - | 12,029 | - | 10,696 | (10,696) | - | |||||||

Equity method from subsidiaries, associated and joint ventures. | | - | - | - | - | - | - | - | - | - | (4,075) | (4,075) | |||||||

Net income | | - | - | - | - | - | - | - | - | - | 6,932,965 | 6,932,965 | |||||||

Other comprehensive income | 12.4 | - | - | - | (23,512) (2) | - | (71) | 18,990 | 3,022,659 | 3,018,066 | - | 3,018,066 | |||||||

Equity as of December 31, 2022 | | 480,914 | 4,837,497 | 16,733,917 | 123,805 | 2,557,668 | 2, 137 | (535) | 7,075,340 | 9,758,415 | 6,931,037 | 38,741,780 | |||||||

The accompanying notes form an integral part of these separate financial statements.

| (1) | The balance as of December 31, 2022 includes recognition of the equity method on investments in subsidiaries for COP 11,951,349, equity method of investments in associates for COP (2,395), hedging of foreign investments for COP (6,352,614) and deferred tax for COP 1,479,000. |

| (2) | The balance as of December 31, 2022 includes OCI for financial instruments for COP 4,320, realization of OCI on equity securities for COP (15,122), OCI debt securities for COP (18,182) and deferred tax for COP 5,472. |

SEPARATE STATEMENT OF CASH FLOW

BANCOLOMBIA S.A.

For the years ended December 31, 2023 and 2022

(Stated in millions of Colombian pesos)

| Note | 2023 | 2022 | |

Net income | 5,979,730 | 6,932,965 | ||

Adjustments to reconcile net income to net cash provided by operating activities: | | | ||

Depreciation, amortization and impairment | 26.3 | 899,647 | 800,621 | |

Equity method | 25.5 | (2,040,133) | (1,966,798) | |

Investment recovery | 4.1 | (7,381) | (14,253) | |

Credit impairment charges on loans and financial leases, net | 5 | 6,723,335 | 2,956,483 | |

Other assets impairment | 16,239 | 30,562 | ||

Net interest income | (14,679,270) | (12,797,868) | ||

(Gain) loss on sale of equity assets | 25.5 | (9,553) | 58,984 | |

Gain on sale of portfolio and other assets | 25.4 | (271,834) | (56,682) | |

Gain on sale of property and equipment | 25.4 | (107,390) | (82,569) | |

Gain on repositioning of inventories and sale of assets held for sale | 25.4 | (140,668) | (222,332) | |

Gain on valuation of financial instruments at fair value - Debt instruments | 25.1 | (622,737) | (1,204,565) | |

Gain on valuation of financial instruments at amortized cost | 25.1 | (299,236) | (150,044) | |

(Gain) loss on valuation of equity instruments | | (58,086) | (120) | |

Loss (gain) on valuation of spot transactions | 25.1 | 48,373 | (73,385) | |

(Gain) loss on derivative financial instruments | | (171,022) | 8,187 | |

Gain on valuation of investment property | 11, 25.4 | (27,818) | (11,190) | |

Other provisions | | 29,568 | 90,148 | |

Bonds and short-term benefits | | 553,823 | 483,691 | |

Other non-cash items | 872 | (1,314) | ||

Preferred shares dividend expense | 25.2 | 57,701 | 57,701 | |

Dividends on equity investments | 25.5 | (4,482) | (7,777) | |

Effect of exchange rate changes | (251,857) | 246,969 | ||

Income tax expense (2) | 12 | 1,682,813 | 2,157,595 | |

Change in operating assets and liabilities: | | | ||

Decrease (Increase) Financial instruments measured at fair value through profit and loss | 394,688 | 6,070,278 | ||

Increase Loan portfolio and financial leasing operations | (8,499,818) | (29,605,881) | ||

Increase Other accounts receivable | (319,730) | (220,821) | ||

Decrease Derivatives | 797,574 | 327,816 | ||

Increase Other assets | (814,622) | 310,633 | ||

Increase Deposits | 13,012,343 | 17,156,730 | ||

(Decrease) Increase in accounts payable | 619,969 | 2,638,875 | ||

Increase in other liabilities and provisions | (291,028) | 243,883 | ||

Interest received | 26,877,239 | 17,247,380 | ||

Received dividends | 1,861,195 | 967,319 | ||

Proceeds from sale of assets held for sale and inventories | | 714,668 | 482,999 | |

Recovery of charged-off receivables account | 5 | 428,298 | 443,588 | |

Interest paid | (13,005,427) | (5,595,530) | ||

Income tax paid | | (2,358,248) | (1,631,421) | |

Net cash provided by (used in) operating activities | 16,717,735 | 5,576,919 | ||

Cash flows from investment activities | | | ||

Investments Purchase: | (3,927,726) | (4,445,617) | ||

Investments at amortized cost | (3,111,805) | (3,263,097) | ||

Financial instruments measured at fair value through OCI - Debt securities | (500,235) | - | ||

Investments in subsidiaries | (250,655) | (1,087,902) | ||

Investments in associates and joint ventures | (65,031) | (94,618) | ||

Investments sale: | 3,600,551 | 3,432,373 | ||

Financial instruments measured at fair value through OCI - Debt securities | | 223,199 | 61,917 | |

Financial instruments measured at fair value through OCI – Equity investment | | 8,956 | 16,056 | |

Investments at amortized cost | 3,367,609 | 3,076,492 | ||

Investments in subsidiaries | 787 | 18,953 | ||

Investments in associates and joint ventures | | - | 258,955 | |

Acquisition of property and equipment | | (1,353,713) | (2,305,163) | |

Acquisition of investment property | 11 | (97,479) | (221,834) | |

Proceeds from sale of property and equipment | | 170,304 | 114,797 | |

Acquisition of intangible assets | (129,764) | (68,853) | ||

Net cash used in investing activities | (1,737,827) | (3,494,297) | ||

Cash flows from Financial activities: | | | ||

(Decrease) Increase Interbank | | (482,766) | 482,766 | |

Increase in monetary and related market operations | | 107,576 | (502,379) | |

Opening of financial obligations | | 4,147,659 | 5,596,628 | |

Cancellation of financial obligations | | (4,249,291) | (1,995,941) | |

Lease liabilities | | (118,385) | (104,866) | |

Issuance of debt securities | | 277,506 | 688,814 | |

Cancellation of debt securities | | (2,672,528) | (3,295,205) | |

Dividends paid | (3,298,183) | (2,310,666) | ||

Net cash (used in) provided by Financial activities | (6,288,412) | (1,110,849) | ||

(Decrease) / Increase in cash and cash equivalents, before the effect of exchange rate changes | 8,691,496 | 971,773 | ||

Effect of exchange rate variations on cash and cash equivalents | (576,440) | 508,865 | ||

Increase in cash and cash equivalents | 8,115,056 | 1,480,638 | ||

Cash and cash equivalents at the beginning of the period | 3 | 16,233,804 | 14,753,166 | |

Cash and cash equivalents at the end of the period | 3 | 24,348,860 | 16,233,804 | |

The accompanying notes form an integral part of these separate financial statements.

1

The statement of cash flows includes the following non-cash transactions, which were not reflected in the separate statement of cash flows:

| a) | Restructured loans that were transferred to foreclosed assets as of December 2023 for COP 947,534 and as of December 2022 for COP 545,619. |

| b) | Reclasification from Held-to-maturity to negotiable investments for COP 77,774, for further information, see Note 4. Financial assets investments, net and derivatives. |

| c) | Recognition of interests in Holding Bursatil Regional for COP 25,682 and derecognition of interests in Bolsa de Valores de Colombia for COP 18,453, as a result of the regional integration of the stock exchanges. See note 4.1 in Equity instruments measured at fair value through OCI. |

2

SEPARATE FINANCIAL STATEMENTS NOTES

BANCOLOMBIA S.A.

NOTA 2. MATERIAL ACCOUNTING POLICIES

| A. | Basis for preparation of the financial statements |

The financial statements of the Bank are prepared in accordance with standards accounting and Financial Reporting Standards accepted in Colombia, based on the International Financial Reporting Standards (hereinafter, “IFRS”) issued by the International Accounting Standards Board (hereinafter, “IASB”), as well as the interpretations issued by the International Financial Reporting Interpretations Committee (hereinafter, IFRS-IC), in accordance with the Regulatory Technical Framework issued through the single regulatory decree 2420 of 2015 and its amendments, by the Ministry of Finance and Public Credit and Commerce Industry and Tourism.

This framework exempts the application of IAS 39 and IFRS 9, only with respect to the loan portfolio and its impairment and the classification and valuation of investments, which are recognised, classified and measured in accordance with the provisions of the Superintendencia Financiera de Colombia (“SFC”) contained in Chapter I and II of Circular Externa 100 of 1995, and IFRS 5 for the determination of impairment of foreclosed assets, which are impaired in accordance with the provisions of the SFC. See Note 2. Material Accounting Policies, paragraph C., items 5 and 14. The above provisions are considered Accounting and Financial Reporting Standards accepted in Colombia (NCIF).

Preparation of the separate financial statements undergoing concern basis

Management has assessed the Bank’s ability to continue as a going concern and confirms that the Bank has adequate liquidity and solvency to continue operating the business for the foreseeable future, which is at least, but is not limited to, 12 months from the end of the reporting period. Based on the Bank's liquidity position at the date of authorization of the financial statements, Management maintains a reasonable expectation that it has adequate liquidity and solvency to continue in operation for at least the next 12 months and that the going concern basis of accounting remains appropriate.

The financial statements were prepared on a going concern basis and do not include any adjustments to the reported carrying amounts and classification of assets, liabilities and expenses that might otherwise be required if the going concern basis were not correct.

Assets and liabilities are measured at cost or amortized cost, except for some financial assets and liabilities and investment properties that are measured at fair value. Financial assets and liabilities measured at fair value comprise those classified as assets and liabilities at fair value through profit or loss, debt instruments and equity securities measured at fair value through other comprehensive income (“OCI”) and derivative instruments. Investments in associates and joint ventures are measured using the equity method.

The financial statements are stated in Colombian pesos (“COP”) and figures are stated in millions or billions (when indicated), except earnings per share, diluted earnings per share and the exchange rate, which are stated in units of Colombian pesos, while other currencies (dollars, euro, pounds, etc.) are stated in thousands.

3

In accordance with Colombian law, the Bank is required to prepare separate financial statements, which have been prepared in accordance with the Marco Técnico Normative indicated above. The separate financial statements are those that serve as the basis for the regulatory compliance, distribution of dividends and other appropriations by the shareholders.

| B. | Presentation of the financial statements |

The Bank presents the statement of financial position ordered by liquidity and the statement of income is prepared based on the nature of expenses. Revenues and expenses are not offset unless such treatment is permitted or required by an accounting standard or interpretation and described in the Bank's policies.

The statement of comprehensive income presents net income and items of OCI classified by nature and grouped into those that will not be reclassified subsequently to profit or loss and those that will be reclassified when specific conditions are met. The Bank discloses the amount of income tax relating to each item of OCI.

The statement of cash flows was prepared using the indirect method, whereby net income is adjusted for the effects of transactions of a non-cash nature, changes during the period in operating assets and liabilities, and items of income or expense associated with investing or financing cash flows.

| C. | Material Accounting Policies |

The material accounting policies that the Bank uses in preparing its financial statements are detailed below:

| 1. | Functional currency, transactions and balances in foreign currencies |

The functional and presentation currency of the Bank´s financial statements is the Colombian peso. Therefore, all balances and transactions denominated in currencies other than the Colombian peso are considered as foreign currency, which are translated into the functional currency using the exchange rates at the dates of the transactions.

Foreign exchange gains and losses resulting from the settlement of the transactions and from the translation of monetary assets and liabilities denominated in foreign currencies at period end are generally recognized in net income. They are deferred in equity (other comprehensive income) if they relate to qualifying cash flow hedges and qualifying net investment hedges or are attributable to part of the net investment in a foreign operation.

Non-monetary items that are measured at cost are held at the exchange rate at the transaction date, while those which are measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value was determined. When a gain or loss on a non-monetary item is recognized in the statement of comprehensive income, any exchange component of that gain or loss is recognized in other comprehensive income. Conversely, when a gain or loss on a non-monetary item is recognized in net income, any exchange component of that gain or loss shall be recognized in net income.

The table below sets forth the exchange rate used by the Bank to convert transactions in U.S. dollar into Colombian pesos:

4

| December 31, 2023 | December 31, 2022 |

Year-end exchange rate | 3,822.05 | 4,810.20 |

| 2. | Cash and cash equivalents |

The Bank considers cash and cash equivalents to include cash and balances at banks and the Central Bank, interbank assets and reverse repurchase agreements and other similar secured lending that have original maturities up to 90 days, as shown in Note 3. Cash and cash equivalents.

| 3. | Financial instruments |

A financial instrument is a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Pursuant to Decree 2420 of December 2015 - Sole Regulatory Decree of the Accounting, Financial Reporting and Information Assurance Standards established exceptions for the separate financial statements of credit institutions. This exempted those entities from applying IFRS 9 in relation to the classification and valuation of investments. The SFC was also empowered to issue instructions regarding these exceptions to IFRS, as well as to dictate the procedures for compliance with the prudential regime, outlined in External Circular 034. This circular amends Chapter I - "Classification, valuation and accounting of investments for individual or separate financial statements" of the of the Colombian Basic Accounting and Financial Circular (CBCF). As an entity subject to SFC supervision and classified within Group 1, the Bank adheres to the following investment classification policies:

3.1 Financial assets

3.1.1. Classification and measurement

In accordance with the provisions of the SFC, investments in debt securities are classified as trading, available-for-sale and held-to-maturity.

Trading securities

Securities, specifically debt securities, and any other investments acquired primarily to realize short-term profits from price fluctuations are classified as trading securities.

The difference between their current and previous fair values known as unrealized gains or losses, is recognized in the current period's income statement, impacting the overall results.

Accrued interest on these securities is recorded as an increase in their carrying value, while its subsequent collection is recorded as a decrease. This reflects the principle of matching income and expenses for the period.

Available for sale

5

This category encompasses securities, debt securities, and other investments that are neither classified as trading (marketable) nor held-to-maturity. Their classification as available-for-sale signifies the investor's intent and ability to hold them, evidenced by factors like legal rights, contractual obligations, financial resources, and operational capacity.

The change in the present value of callable yields is recognized in income statement accounts, while the difference between the fair value and the amortized cost at each reporting is recorded in other comprehensive income.

Accrued callable yields are to be maintained as an increase in the value of the investment. Consequently, the collection of such yields is to be accounted for as a decrease in the value of the investment.

When available-for-sale investments are sold, unrealized gains or losses recorded in OCI, are to be recognized as income or expense in the period of sale.

Held to maturity

This refers to those debt securities and, in general, any type of investment for which the investor has the purpose and legal, contractual, financial, and operating capacity to hold them until their maturity or redemption term. The purpose of maintaining the investment corresponds to the positive and unequivocal intention of not selling the security or value.

The updating of the present value of this class of investment is to be recorded as an increase in the value of the investment, affecting the results for the period.

Accrued callable yields are recorded as an increase in the value of the investment. Consequently, the collection of such yields is to be accounted for as a decrease in the value of the investment.

3.1.2. Valuation

The valuation of investments has as its fundamental objective the calculation and disclosure of the fair value or exchange price at which an investment may be traded on a given date, as follows:

Local currency and UVR debt securities

Valuation of debt securities is performed daily, whit results recorded whit the same frequency.

The Bank determines the market value of trading and available for sale debt securities using the daily published prices provided by a pricing provider selected by the Bank and authorized by the SFC to perform this function. Debt securities held to maturity and securities for which no published price exists on a given date are valued exponentially using the internal rate of return calculated at the time of purchase and recalculated at events determined by the SFC.

If the value or security is denominated in UVR, the value determined in accordance with the above is converted to Colombian pesos using the current UVR (Unidad de Valor Real) published by the Banco de la República for the date.

Foreign currency debt securities

6

The present value or market value of the respective security in its currency is determined, using the procedure established in the previous numeral based on prices published by the pricing provider selected by the Bank and authorized by the SFC to perform this function. In the absence of these, those determined in international markets published by Bloomberg are used, or, finally, exponentially based on the internal rate of return calculated at the time of purchase and recalculated in the events determined by the SFC.

If the security is denominated in a currency other than the United States dollar, the value determined in accordance with the previous paragraph is converted into dollars based on the foreign exchange conversion rates authorized by the SFC.

The value thus obtained must be re-expressed in Colombian pesos using the representative market rate (TRM) calculated on the day of the valuation and certified by the SFC or by the value of the unit in force for the same day, as appropriate.

3.1.3. Reclassification of investments

The Bank may reclassify an investment from available-for-sale to trading or held-to-maturity, when it recomposes the significant activities of its business due to changes in the market or in its risk appetite, when a risk contemplated in the investment management of its business model materializes, when it loses its parent or controlling status, if this event involves the decision to sell the investment or the main purpose of obtaining profits from short-term fluctuations from that date.

When available-for-sale investments are reclassified to trading investments, the valuation and accounting rules for the latter are observed. As a result, unrealized gains or losses must be recognized and maintained in OCI as unrealized gains or losses on the date of reclassification, until the sale of the corresponding investment is made.

3.1.4 Provisions or losses due to credit risk rating

Negotiable debt securities available for sale that do not have fair exchange prices, as well as securities classified as held to maturity, have their price adjusted on each valuation date, based on a credit risk rating. as indicated below.

The securities or securities of internal or external public debt issued or guaranteed by the nation, those issued by the Bank of the Republic and those issued or guaranteed by the Financial Institutions Guarantee Fund -FOGAFIN are not subject to this adjustment.

Securities or titles of issues or issuers that have external credit risk ratings

The securities or securities that have credit risk ratings granted by external rating agencies recognized by the SFC, or the securities or debt securities issued by entities that are evaluated by these rating agencies, their book value cannot exceed the following percentages of its nominal value, net of amortizations carried out up to the valuation date:

Long-Term Rating | Maximum% | Short-Term Rating | Maximum% |

BB+, BB, BB- | Ninety (90) | 3 | Ninety (90) |

B+, B, B- | Seventy (70) | 4 | Fifty (50) |

CCC | Fifty (50) | 5 y 6 | Zero (0) |

DD, EE | Zero (0) | | |

7

In investments classified as held to maturity and for which a fair exchange price can be established, the provision corresponds to the difference between their amortized book cost and said price.

Securities or titles of issues or issuers without external rating for credit risk

These securities or titles are evaluated and qualified in accordance with the methodology defined by the Bank. The maximum value defined by the SFC for which these investments are recorded according to their qualification is:

Category | Maximum recorded value % (1) | Investment characteristics |

|---|---|---|

B Acceptable risk, higher than normal | eighty (80) | They present uncertainty factors that could affect the ability to continue to adequately comply with debt services and weaknesses that may affect their financial situation. |

C Appreciable risk | Sixty (60) | They have a high or medium probability of non-compliance with the timely payment of capital and interest and deficiencies in their financial situation that compromise the recovery of the investment. |

D Significant risk | Forty (40) | They present non-compliance with the terms agreed in the title and accentuated deficiencies in their financial situation, so that the probability of recovering the investment is highly doubtful. |

E Bad | Zero (0) | It is estimated to be uncollectible. |

3.1.5 Other financial instruments

Classification and measurement

For investments in companies that do not have a market value provided by a price provider, their fair value will be recognized by subsequent variations in the issuer's equity according to the percentage of participation.

Financial instruments at fair value through profit or loss

They are all those equity investments in which the Bank does not have control or significant influence and that have been acquired with the purpose of selling in the short term and/or reflecting the effects of the change in the market value in the result of the year.

Its valuation is determined by price providers authorized by the SFC.

Financial instruments at fair value with changes in other comprehensive income

They are all those equity investments in which the Bank does not have control or significant influence and that have been acquired with the purpose of strategic maintenance in the long term. The fair value of these investments will be determined by price providers authorized by the SFC.

When the price provider does not have a valuation methodology for these investments, the Bank must affect the value of the investment in the corresponding percentage of participation, on the subsequent variations in the assets of the respective issuer.

8

The Bank may irrevocably choose at the initial moment to carry changes in market value to the other comprehensive income account in equity.

3.1.6 Credit portfolio, financial leasing operations and provisions for credit risk

In accordance with Decree 2420 of 2015, preparers of financial information subject to the supervision of the SFC who are part of group 1 were exempted from the application of IFRS 9 Financial Instruments to credit portfolio operations and their impairment, maintaining the provisions of Chapter II of the CBCF (External Circular 100 of 1995).

The Bank grants loans in the commercial, consumer, mortgage and small business segments, as indicated below, in the forms of ordinary loans, financial leasing operations, factoring, among others.

The loans granted are recorded at their net nominal value of the payments received from customers, except for portfolio purchases that are recorded at their acquisition cost and those granted in foreign currency that are recorded at the exchange rate representative of the market in force at the time. day of disbursement. Accumulated interest is recorded as accounts receivable and advance interest is recorded as a deferred credit to liabilities.

Financial leasing operations are recorded as a credit portfolio for the book value of the asset leased to clients and are subsequently amortized with the payment of fees in the part that corresponds to the payment of the principal balance.

Classification of credits

The structure of the loan portfolio and financial leasing operations are classified as:

living place

They are those that, regardless of their amount, are granted to natural persons, intended for the acquisition of new or used mortgage, or the construction of individual mortgage and comply with the terms of Law 546 of 1999, among them: being denominated in UVR or in legal currency, be guaranteed with a first degree mortgage on the property being financed and the repayment period must be between 5 and 30 years maximum.

Consumer

They are those that, regardless of their amount, are granted to natural persons to finance the acquisition of consumer goods or the payment of services for non-commercial or business purposes, other than those granted under the small business modality.

Small business

Small business are credits constituted by active credit operations referred to in Article 39 of Law 590 of 2000, or the regulations that modify, replace or add to it, as well as those carried out with microenterprises in which the main source of payment of the obligation comes from income derived from its activity.

The debtor's debt balance may not exceed one hundred and twenty (120) legal monthly minimum wages in force at the time of approval of the respective active credit operation. The debt balance is understood to be the amount of current obligations owed by the

9

corresponding microenterprise with the financial sector and other sectors, which are found in the records of the data bank operators consulted by the respective creditor, excluding mortgage loans for mortgage financing and adding the value of the new obligation.

Commercial

All those granted to natural or legal persons for the development of organized economic activities, other than those granted under the modality of small business, are classified as commercial.

Commissions and accounts receivable derived from active credit operations are classified in the modality that corresponds to each of the credits.

3.1.6.1 Evaluation, rating, and provisions for credit risks

The Bank follows chapter XXXI of External Circular 100 of 1995, which establishes the guidelines for credit risk management, through the Integral Risk Management System (SIAR), which comprises the policies, processes, models, provisions, and control mechanisms that allow financial entities to identify, measure and adequately mitigate credit risk.

The Bank evaluates the risk of its loan portfolio on a monthly basis, taking into account the seasonality of the obligations, as well as the level of risk associated with the debtor, the latter at least every six months in May and November of each year, evaluating other risk factors of each debtor, mainly related to its payment capacity and generation of cash flows to cover the debt, according to the agreed conditions.

In addition, it is mandatory to immediately evaluate the credit risk of loans in default after they have been restructured.

The Bank rates and provisions the loan portfolio and financial leasing operations as follows:

General provisions

The Bank constitutes a general provision only for the mortgage and small business modalities, which do not have reference models, of at least one percent (1%) of the total amount of the gross loan portfolio of the two modalities.

General Provision External Circular 026 of 2022

Based on the provisions of external circular 026 of 2022, and to mitigate the impact of the possible materialization of credit risk in an environment of economic slowdown and persistent inflation, the Bank recognized an additional Consumer provision in the statement of income for an amount equivalent to the expense for macroeconomic variables and an expense for the possible use of contingent quotas, based on internal IFRS9 expected loss models. This provision was approved by the board of directors in December of 2022 and will vary according to the internal analysis performed, which will be reported monthly to the risk committee.

December 31, 2022 | December 31, 2023 |

10

Additional Consumer AMP C026 of 2022 | 353,159 | 353,159 |

Individual provisioning

For the commercial and consumer portfolio categories, the Bank's portfolio provisioning rating is established by taking into account the reference models established by the Superintendency through Annex I, Chapter XXXI of the SFC's External Circular 100 of 1995. The mortgage and small business portfolio modalities do not have an associated reference model, therefore their provision is made based on the height of delinquency, as established in Annex II of the circular. The individual loan portfolio provision under the reference models is established as the sum of two individual components, defined as follows:

Pro-cyclical individual component (CIP): Corresponds to the portion of the individual allowance of the loan portfolio that reflects the credit risk of each debtor, at present.

Individual counter-cyclical component (CIC): Corresponds to the portion of the individual allowance for loan portfolio that reflects possible changes in the credit risk of debtors at times when the impairment of such assets increases. This portion is constituted to reduce the impact on the statement of income when such a situation arises. The internal or reference models must consider and calculate this component based on available information reflecting such changes.

To calculate these components of the individual provision, the Superintendency has defined in the aforementioned reference models the matrices "A" and "B" for estimating the probability of default associated with periods of growth and economic stability, which are indicated below.

In no case may the individual counter-cyclical component of each obligation be less than zero, nor may it exceed the value of the expected loss calculated with matrix B; likewise, the sum of these two components may not exceed the value of the exposure.

To determine the methodology to be applied for the calculation of these components, the entities must evaluate on a monthly basis the indicators established by the Superintendency (related to impairment, efficiency, loan portfolio growth and the entity's financial situation), which once calculated will determine the methodology for calculating the components of the individual loan portfolio provisions.

The estimate of the expected loss or individual allowance under the reference models is determined by the following formula:

EXPECTED LOSS = [Asset exposure at default] x [Probability of default] x [Loss given default].

Consumer

EXPECTED LOSS = [Asset exposure at default] x [Probability of default] x [Loss given default] x [Loss given default] x [Forward adjustment] x [K].

Where each of the components is defined as follows:

11

- Probability of default (PI)

Corresponds to the probability that in the 12 months following the closing date of the financial statements the debtors of a given portfolio will default (in accordance with the cases described in paragraph 2.3.1 of Chapter XXXI, External Circular 100 of 1995). The probability of default is established in accordance with matrices issued by the SFC as indicated below.

- Exposure of the asset at default

Corresponds to the value exposed by the Bank to the debtor, consisting of the current balance of principal, interest, interest accounts receivable and other accounts receivable.

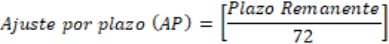

Adjustment for Term

It is the value of the term adjustment which is calculated as follows and is applied for the consumer portfolio. Where the Remaining term corresponds to the number of months remaining against the agreed term of the loan at the date of calculation of the expected loss. In case the agreed term or the remaining term is less than 72, AP will be equal to 1. For the Credit Card and Revolving segments, AP will be equal to 1.For loans originated, disbursed, restructured, or acquired before December 1, 2016, AP will be equal to one (1).Loans originated, disbursed, restructured, or acquired on or after December 1, 2016, should calculate the expected loss by applying the resulting allowance for loan losses (AP).

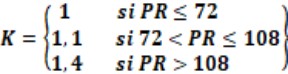

- K

This is the adjustment factor that seeks to recognize the risk associated with the increase in the leverage level of debtors with terms greater than 72 months. This factor will not be applicable to loans granted to pensioners, nor to the Credit Card and Revolving segments. This factor will be applied to loans disbursed as of January 1, 2023. The value of variable K will be assigned according to the following expression:

- Loss given default (PDI)

It is defined as the economic impairment that the debtor would incur in the event that any of the default situations referred to in paragraph 2.3.1 of Chapter XXXI, External Circular 100 of 1995 materializes, namely, commercial loans that are in arrears for more than 150 days, consumer loans that are in arrears for more than 90 days, mortgage loans that are in arrears for more than 180 days and small business that are in arrears for more than 30 days.

The PDI for debtors classified in the default category will gradually increase according to the number of days elapsed after classification in that category.

12

Accordingly, the application of the reference and provisioning models are made as follows:

- Commercial portfolio

Initially, the following classifications are made, and the following variables derived from the portfolio segmentation are taken into account:

Classification of the commercial portfolio by asset level | |

Company size | Level of assets in SMMLV |

Large companies | More than 15,000 |

Medium-sized companies | Between 5,000 and 15,000 |

Small companies | Less than 5,000 |

SMMLV: Minimum Monthly Legal Minimum Wage in force | |

Classification of the commercial portfolio by credit risk level | |

|---|---|

Category | Blackberry height (days) |

Category AA | Between 0 and 29 |

Category A | Between 30 and 59 |

Category BB | Between 60 and 89 |

Category B | Between 90 and 119 |

Category CC | Between 120 and 149 |

Noncompliance | More than 150 |

In addition to the minimum delinquency conditions for the classification of the commercial portfolio, the Bank evaluates other risk factors every six months in May and November in order to assign a rating to each debtor. This risk evaluation is based on information related to the historical behavior of the debt, particular characteristics of the debtors, guarantees backing the obligations, credit behavior with other entities, sectoral variables, payment capacity and financial information up to one year old, among others. In the evaluation of loans to territorial entities, in addition to the aspects that apply to other debtors, the conditions established in Law 358 of 1997 and 617 of 2000 must be taken into account.

The probability of default (PI) is assigned taking into account the following matrices established by the SFC, according to the type of portfolio.

MATRIX A | ||||

|---|---|---|---|---|

Rating | Large company | Medium-sized company | Small business | Individuals |

AA | 1.53% | 1.51% | 4.18% | 5.27% |

A | 2.24% | 2.40% | 5.30% | 6.39% |

BB | 9.55% | 11.65% | 18.56% | 18.72% |

B | 12.24% | 14.64% | 22.73% | 22.00% |

CC | 19.77% | 23.09% | 32.50% | 32.21% |

Noncompliance | 100% | 100% | 100% | 100% |

MATRIX B | ||||

Rating | Large company | Medium-sized company | Small business | Individuals |

AA | 2.19% | 4.19% | 7.52% | 8.22% |

A | 3.54% | 6.32% | 8.64% | 9.41% |

BB | 14.13% | 18.49% | 20.26% | 22.36% |

B | 15.22% | 21.45% | 24.15% | 25.81% |

CC | 23.35% | 26.70% | 33.57% | 37.01% |

13

Noncompliance | 100% | 100% | 100% | 100% |

The PDI by type of guarantee is as follows:

As a prudent measure and based on the portfolio recovery experience established for clients, the Bank uses the following matrix for the SME commercial portfolio, which allows an earlier recognition of the increase in PDI, using the minimum number of days established by the Superintendency and not the maximum number of days within the range of time allowed by the Superintendency. The commercial portfolio of Corporate and Government Banking uses the PDI given by the Superintendency.

MRC | |||||

|---|---|---|---|---|---|

Code | Warranty Type | SEG.PDI SFC | SEG.PDI Policy | ||

A-B-C-G-1-2-3-7-8 | 4-5-6-9-M-S | ||||

Days Noncompliance | PDI | Days Noncompliance | PDI | ||

16 | Assets leased other than real estate | 0-360 | 45% | 0 | 45% |

361-720 | 80% | 1-720 | 80% | ||

>720 | 100% | >720 | 100% | ||

17 | Assets leased under real estate leases | 0-540 | 35% | 0-540 | 35% |

541-1080 | 70% | 541-1080 | 70% | ||

>1080 | 100% | >1080 | 100% | ||

6-11-1 | Commercial and residential real estate | 0 - 540 | 40% | 0 | 40% |

541 - 1080 | 70% | >=1- 90 | 60% | ||

>1080 | 100% | 91-210 | 80% | ||

| >210 | 100% | |||

A-B | Eligible financial collateral: FNG, FAG | 0-99999 | 12% | 0-359 | 12% |

360-539 | 70% | ||||

>=540 | 100% | ||||

4-12-13 | Sovereign nation, Letters of Credit, Deposits Guarantee | 0-99999 | 0% | 0-99999 | 0% |

9-10 | Collection rights | 0-360 | 45% | 0 | 45% |

361-720 | 80% | >=1- 90 | 60% | ||

>720 | 100% | 91-210 | 80% | ||

| >210 | 100% | |||

5 | Ineligible collateral | 0-270 | 55% | 0 | 55% |

271-520 | 70% | >0 | 100% | ||

>520 | 100% |

| |||

| No Warranty | 0-210 | 55% | 0 | 55% |

211-420 | 80% | >0 | 100% | ||

>420 | 100% |

| |||

2-3-7-8 | Other collateral | 0-360 | 50% | 0 | 50% |

361-720 | 80% | >=1- 89 | 90% | ||

>720 | 100% | >89 | 100% | ||

Ratings of Individually analyzed client

The individual provision analysis methodology applies when a client has a significant exposure (greater than COP 20,000) and any of the following conditions:

14

| ● | The client is in default equal to or greater than 90 days. |

| ● | Clients who present at least one written-off instrument. |

| ● | Clients in special states of corporate restructuring or reorganization and insolvency law agreements. |

| ● | Clients on internal watch list with high risk level. |

For these clients, the Bank carries out an individual analysis of their risk situation and establishes the percentage of provision required under an expected loss model similar to the credit risk model under the IFRS9 framework, based on the estimation of the Net Present Value (NPV).) of the expected credit flows.

The estimated provision percentages for each client are reviewed monthly and according to the following ranges, the client's rating will be approved under the SFC standard.

The table is obtained from the average provision level of the last 12 months, taking as reference the corporate and business segments that have the greatest participation in individual VPN clients. As of December 31, 2023, the portfolio that presented an adjustment in its rating, given the previously mentioned criteria, amounts to COP 3,270,244 with a provision of COP 2,341,886

MRC Ratings | Approved Ratings | Corporate Business |

A | B | 0% <6.4% |

BB | B | >=6.4% <7.9% |

B | C | >=7.9% <11.0% |

CC | C | >=11.0% <53.6% |

Default | D - E | >=53.6% |

The rating deteriorations, and therefore provisions, are based on the fact that the reference models establish minimum parameters that must be complemented with analysis of risk factors, capacity to generate future flows that, if insufficient, must be recognized in the statement of financial situation.

The client's rating will be the one with the highest risk between the one approved according to the percentage of provision of the individual analysis and the legal one assigned, in accordance with Chapter XXXI of External Circular 100 of 1995 of the Superintendency, Annex 1 “Commercial Portfolio Reference Model”

To keep the level of provision in both segments approved, the provision must be calculated during closing according to the FULL IFRS level and compared with the COLGAAP/SUPER MODIFIED provision and if the difference between both segments is a greater than $10,000 MM (for client or group) then an Additional individual provision is made.

- Consumer portfolio

15

Initially, the Bank classifies the portfolio credit, like this:

Classification of the consumer portfolio by segment | |

General - automobile | Credits for acquisition of automobile. |

Credit cards | Revolving credit for the acquisition of consumer goods that is used through a plastic card. |

General - others | Credits for the acquisition of consumer goods other than automobile. Credit cards are not included in this segment. |

The rating of the consumer portfolio is carried out by credit risk category. For this purpose, the criteria for assigning the rating vary according to the segments described above and is determined by the following formula:

“Z” variable, is calculated using the following variables:

| ● | Height of arrears at the time of calculation of the provision. |

| ● | Maximum height of arrears in the last 3 years. |

| ● | Height of arrears in the last 3 quarter (quarters are March, June, September, December). |

| ● | If the customer has another consumer credit in the Bank, that has another segment of the credit that is evaluated. |

| ● | Warranty type. |

| ● | Prepaid od the credit card. |

According to the score calculated in the previous point, the rating is assigned by credit risk categories based on the following table, taking into account that the lower the score, the better the rating per risk category is obtained:

Score | General – automobiles | Credit card | General – others |

|---|---|---|---|

AA | 0,2484 | 0,3735 | 0,3767 |

A | 0,6842 | 0,6703 | 0,8205 |

BB | 0,81507 | 0,9382 | 0,89 |

B | 0,94941 | 0,9902 | 0,9971 |

CC | 1 | 1 | 1 |

I | 1 | 1 | 1 |

Probability of default (PI):

It is assigned taking into account the following matrices according to the type of portfolio:

MATRIX A | |||

|---|---|---|---|

Rating | General - automobiles | Credit card | General - other |

AA | 0.97% | 1.58% | 2.10% |

A | 3.12% | 5.35% | 3.88% |

BB | 7.48% | 9.53% | 12.68% |

B | 15.76% | 14.17% | 14.16% |

CC | 31.01% | 17.06% | 22.57% |

Non-compliance | 100% | 100% | 100% |

16

MATRIX B | |||

|---|---|---|---|

Rating | General - automobiles | Credit card | General - other |

AA | 2.75% | 3.36% | 3.88% |

A | 4.91% | 7.13% | 5.67% |

BB | 16.53% | 18.57% | 21.72% |

B | 24.80% | 23.21% | 23.20% |

CC | 44.84% | 30.89% | 36.40% |

Non-compliance | 100% | 100% | 100% |

The Bank uses matrix B to assign the probability of default.

PDI is assigned by collateral type according to the following:

As a measure of prudence and based on the portfolio recovery experience established for the Bank's clients, the following matrix is used, which allows an earlier recognition of the increase in PDI, using the minimum number of days established by the SFC and not the maximum number of days within the time range allowed by the SFC.

Code | Warranty Type | SEG.PDI SFC | SEG.PDI Policy | ||

|---|---|---|---|---|---|

| A-B-C-G-1-2-3-7-8-4-5-6-9-M-S | ||||

Days Noncompliance | PDI | Days Noncompliance | PDI | ||

16 | Assets leased other than real estate | 0-270 | 45% | 0 | 45% |

271-540 | 70% | 1-540 | 80% | ||

>540 | 100% | >540 | 100% | ||

17 | Assets leased under real estate leases | 0-360 | 35% | 0-360 | 35% |

360-720 | 70% | 361-720 | 70% | ||

>720 | 100% | >720 | 100% | ||

6-11-1 | Commercial and residential real estate | 0-360 | 40% | 0 | 40% |

360-720 | 70% | >0-29 | 80% | ||

>720 | 100% | 30-89 | 90% | ||

| >89 | 100% | |||

A-B | Eligible financial collateral: FNG, FAG | 0-99999 | 12% | 0-359 | 12% |

360-539 | 70% | ||||

>539 | 100% | ||||

4-12-13 | Sovereign nation, Letters of Credit, Deposits Guarantee | 0-99999 | 0% | 0-99999 | 0% |

| Collection rights | 0-360 | 45% | 0 | 45% |

9-10 | 361-720 | 80% | >=1-29 | 80% | |

| >720 | 100% | 30-89 | 90% | |

|

|

| >89 | 100% | |

5 | Ineligible collateral | 0-210 | 60% | 0 | 75% |

211-420 | 70% | >=1 - 89 | 90% | ||

>420 | 100% | >=90 | 100% | ||

| Ineligible collateral (Payroll Loans) | <30/06/2018 <30/06/2018 | 60% 45% | < 30/06/2018 | 60% |

>30/06/2018 | 45% | ||||

| No warranty | 0-30 | 75% | 0 | 75% |

| 31-90 | 85% | >=1 - 89 | 90% | |

| >90 | 100% | >=90 | 100% | |

| Other collateral | 0-270 | 50% | 0 | 50% |

2-3-7-8 | 271-540 | 70% | >=1-29 | 85% | |

| >540 | 100% | 30-89 | 90% | |

|

|

| >=90 | 100% | |

17

As of July 1, 2018, a change in the PDI is made for the payroll loans in accordance with Circular 013 issued by the SFC. Additionally, in accordance with Circular 026 issued by the same entity, which is in force as from 2017, the constitution of an additional individual provision, of a temporary nature, is made to those entities whose balance sheets have reported gross consumer portfolio balances for at least the last twenty-five (25) months and whose parameter "α" is greater than zero (α > 0); ); for December 31, 2023 the balance provision generated by this parameter amounts to COP 123,088, which is estimated on a capital balance of COP 38,075,787.

For these purposes, "α" is understood as the 6-month moving average of the semiannual variation of the real annual growth rate of the past-due consumer portfolio.

- Mortgage portfolio

To constitute individual provisions for the mortgage portfolio, the following classifications are made+ and the following variables are taken into account:

Score by credit risk level | |

|---|---|

Score | Height of arrears (month) |

“A” Normal | Until 2 |

“B” Acceptable | More than 2 - until 5 |

“C” Appreciable | More than 5 - until 12 |

“D” Significant | More than 12 - until 18 |

“E” Bad | More than 18 |

The Bank maintains at all times provisions of not less than the percentages indicated below, calculated on the outstanding balance:

Ranking | Capital | Interest and other items | |

| On guaranteed portion | Unsecured portion | |

"A" Normal | 1% | 1% | 1% |

"B" Acceptable | 3.2% | 100% | 100% |

"C" Appreciated | 50% | 100% | 100% |

"D" Significant | 75% | 100% | 100% |

"E" Uncollectible | 100% | 100% | 100% |

- Small business portfolio

To constitute individual provisions for the small business portfolio, the following classifications are made, and the following variables are taken into account.

Score by credit risk level | |

|---|---|

Score | Height of arrears (month) |

“A” Normal | Until 1 month |

“B” Acceptable | More than 1 - until 2 |

“C” Appreciable | More than 2 - until 3 |

“D” Significant | More than 3 y until 4 |

“E” Bad | More than 4 |

18

The Bank must always maintain provisions of not less than the percentages indicated below, calculated on the outstanding balance: