UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of Nov 2024

Commission File Number 001-32535

Bancolombia S.A.

(Translation of registrant’s name into English)

Cra. 48 # 26-85

Medellín, Colombia

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):___

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(2):___

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____________ .

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| BANCOLOMBIA S.A. (Registrant) |

| | |

| Date November 14, 2024 | By: | /s/ MAURICIO BOTERO WOLFF. |

| Name: | Mauricio Botero Wolff. |

| Title: | Vice President of Finance |

November 14, 2024

Medellin, Colombia

BANCOLOMBIA S.A. RELEASES QUARTERLY REPORT FOR THE THIRD QUARTER OF 2024

Explanatory Note

On November 7th of 2024, Bancolombia S.A. furnished on Form 6-K a press release presenting financial information for the fiscal quarter ended September 30, 2024 (the “Press Release”). Since 2023, Bancolombia S.A is also required to file quarterly reports with the Superintendency of Finance of Colombia (SFC), which include a description of material changes relative to the information provided in its most recent annual report and previous quarterly report.

The quarterly report for the fiscal quarter ended September 30, 2024 (the “Quarterly Report”) is furnished with this Form 6-K.

Readers should be aware that the consolidated financial information in the Press Release, and the consolidated financial information in the Quarterly Report for the fiscal quarter ended September 30, 2024, are the same, and the Quarterly Report is being furnished solely to fulfill a new legal reporting requirement in Colombia. Readers should also be aware that the separate or individual financial information of Bancolombia S.A. that is included in the Quarterly Report was prepared solely in accordance with Colombian law, and not international or US standards.

Quarterly Report

July - September 2024

Bancolombia S.A.

Address:

Carrera 48 # 26-85

Medellín, Colombia

ISSUER’S CURRENT SECURITIES

As of September 30, 2024

| | | | | | | | |

| | |

| Type of Share | Common Share | Preferred Share |

| | |

| | |

| Trading System | Stock Exchange | Stock Exchange |

| | |

| | |

Stock Exchanges | Colombian Stock Exchange (BVC) | Colombian Stock Exchange (BVC) |

| | |

| | |

| Shares in Circulation | 509,704,584 | 452,122,416 |

| | |

| | |

Shareholders | 17,447 | 27,951 |

| | |

| | |

Issuance amount | 509,704,584 | 452,122,416 |

| | |

| | |

Amount placed | 509,704,584 | 452,122,416 |

| | |

Bancolombia S.A. also has a Level III ADR listed on the New York Stock Exchange (NYSE). Each ADR represents four preferred shares.

GRUPO BANCOLOMBIA INTERNATIONAL BONDS LEVELS IN USD

(As of September 30, 2024)

| | | | | | | | | | | | | | | | | |

| Isin | Bond | Amount | Yield | Price L | G-Spread |

| Subordinates |

| | | | | |

| US05968LAK89 | BCOLO SUB-27 | USD $462 MM | 7.25% | 99.011 | 272 |

| | | | | |

| | | | | |

| US05968LAL62 | BCOLO SUB-29 | USD $550 MM | 7.68% | 97.021 | 604 |

| | | | | |

| | | | | |

| US05968LAN29 | BCOLO SUB-34 | USD $800 MM | 8.20% | 103.02 | 350 |

| | | | | |

| Common |

| | | | | |

| US05968LAM46 | BCOLO SR 25 | USD $213 MM | 6.11% | 98.256 | 83 |

| | | | | |

| | | | | |

| US06034LAB62 | BANISTMSR 27 | USD $400 MM | 6.60% | 93.560 | 205 |

| | | | | |

I.MANAGEMENT’S DISCUSSION & ANALYSIS ON THE RESULTS OF THE OPERATION AND THE FINANCIAL SITUATION OF THE ISSUER, IN RELATION TO THE RESULTS REPORTED IN THE QUARTERLY FINANCIAL STATEMENTS

CONSOLIDATED BALANCE SHEET GROUP BANCOLOMBIA

Assets

As of September 30, 2024, Grupo Bancolombia's assets totaled COP 353,433 billion, increasing by 0.4% compared to 2Q24. primarily due to the growth in the loan portfolio driven by the mortgage segment, as well as the increase in investments in financial assets and cash resulting from excess liquidity, continuing the trend from the previous quarter.

The Colombian peso depreciated by 0.7% against the US dollar during the third quarter of 2024 and 3.1% over the last 12 months. The average exchange rate was 1.5% higher in 3Q24 compared to 2Q24, and 9.8% lower over the last 12 months.

Loan Portfolio

In 3Q24, the gross loan portfolio grew 0.5% compared to 2Q24 (0.3% growth excluding the exchange rate effect) and 4.6% compared to 3Q23. Over the past 12 months, the portfolio in Colombian pesos grew 2.7%, while the portfolio in U.S. dollars (expressed in USD) grew 8.4%.

Operations in Foreign Banks represented 26.5% of the total gross loan portfolio balance for 3Q24. Meanwhile, the portfolio denominated in currencies other than the Colombian peso, generated by operations in Central America, offshore Bancolombia Panama, Puerto Rico, and the dollar-denominated portfolio in Colombia, accounted for 33.5% of the total portfolio and grew 2.3% (expressed in USD) during the quarter.

Allowances for loan losses decreased by 1.0% during the quarter, totaling COP 16,518 billion, equivalent to 6.1% of the gross loan portfolio at the end of the quarter.

Quarterly, Bancolombia S.A. grew its gross loan portfolio by 0.1%, while Banco Agromercantil grew by 3.6% (measured in USD). On the other hand, Banistmo decreased by 1.2% (measured in USD), and Bancoagrícola decreased by 1.0% (measured in USD). The mortgage portfolio was the main driver of total portfolio growth, driven by the implementation of a rate reduction program for mortgage loans in Colombia. The commercial loan portfolio grew 0.5% in the quarter due to growth in Bam, offsetting the decline in other geographies.

In the consumer loan portfolio, operations in Colombia and Banistmo continue to experience a contraction trend, while Bancoagrícola maintains growth driven by targeted origination strategies on retail clients, which have yielded adequate risk-adjusted returns. Additionally, Bam, which had been experiencing portfolio declines throughout the year, grew by 4.7% in 3Q24, mainly due to growth in credit cards.

Investment Portfolio

As of September 30, 2024, Grupo Bancolombia's investment portfolio totaled COP 35,838 billion, reflecting a 17.2% increase compared to 2Q24 and a 32.4% increase compared to 3Q23. Active positions in liquidity operations rose due to higher liquid asset surpluses compared to the previous quarter. At the end of 3Q24, the debt securities investment portfolio had a duration of 16.5 months and a yield to maturity of 8.9%.

Goodwill and Intangibles

As of September 30, 3Q24, Grupo Bancolombia's intangibles and goodwill totaled COP 9,271 billion, increasing by 0.9% compared to 2Q24. This quarterly variation is mainly explained by the depreciation of the peso against the US dollar and the restatement of Foreign Banks balances.

Funding

As of September 30, 2024, Grupo Bancolombia liabilities totaled COP 311,519 billion, decreasing by 0.2% compared to 2Q24 and increasing by 3.9% compared to 3Q23.

Customer deposits totaled COP 259,759 billion (83.4% of liabilities) at the end of 3Q24, reflecting a 0.7% increase from 2Q24, mainly due to time deposit inflows, particularly online time deposits from retail customers. The net loan-to-deposit ratio was 97.4% at the end of 3Q24, with minimal variation from the 97.5% registered in 2Q24.

The deposit mix shows a quarterly increase in time deposits, with notable growth in those maturing between 0 and 180 days. Sight deposits remain the primary funding source. Savings accounts grew over the quarter mainly on institutional clients, and account for 38% of total funding. Meanwhile, checking accounts decreased during the quarter and represent 12% of funding, while debt securities in issue declined due to maturities in local currency.

Shareholders’ Equity and Regulatory Capital

Shareholders' equity attributable to the owners of the parent company at the end of 3Q24 was COP 40,899 billion, increasing by 4.3% compared to 2Q24 and 9.0% compared to 3Q23. This increase is due to the accumulated profits in the quarter and the restatement of Foreign Banks balances.

The total solvency ratio of Grupo Bancolombia under Basel III was 14.35% in 3Q24, standing 285 basis points above the minimum level required by the Colombian regulator, while the core equity ratio (Tier 1) to risk-weighted assets was 11.58%, 308 basis points above the minimum regulatory capital level (required to meet the new capital requirements in the fourth year of Basel III implementation). The increase in solvency levels for the quarter is mainly due to the issuance of the 2034 subordinated bond in June and retained earnings during the period. The tangible equity ratio, defined as equity minus goodwill and intangible assets over tangible assets, was 8.96% at the end of 3Q24.

Consolidated Income Statement Group Bancolombia

Net income attributable to equity holders of Bancolombia totaled COP 1,501 billion in 3Q24, or COP 1,576 per share (USD $1.51 per ADR). This income represents a 4.3% increase compared to 2Q24, highlighting lower loan provision expenses and reduced interest expenses as the main positive factors. The annualized return on equity (“ROE”) for Grupo Bancolombia was 15.0% for 3Q24 and 15.7% for the last 12 months.

Net Interest Income

Net interest income totaled COP 5,153 billion in 3Q24, decreasing 0.7% compared to 2Q24. This decline is primarily due to a reduction in interest income, driven by lower interest rates on new loans and variable-rate portfolios, partially offset by a decrease in interest expenses. Total interest income from debt instruments and valuation of financial instruments reached COP 764 billion, representing a 40.8% increase for the quarter. This growth is mainly attributed to the strong performance of the investment portfolio, with all products yielding positive results, particularly forwards, options, and swaps.

Net Interest Margin

The annualized net interest margin for investments in 3Q24 was 4.6%, increasing by 197 basis points compared to 2Q24 due to higher valuations of debt securities. The group’s quarterly annualized net interest margin decreased by 22 basis points, from 7.05% to 6.83%.

The quarterly annualized loan portfolio margin was 7.16%, down by 53 basis points from 2Q24 and 40 basis points from 3Q23. The lower lending yield was partially offset by a decrease in interest expense, after a mild loan growth and lower interest rates.

Savings accounts increased by 0.5% compared to 2Q24, while checking accounts decreased by 1.8% compared to the same period. The annualized weighted average cost of deposits was 4.70% in 3Q24, decreasing by 19 basis points compared to 2Q24.

During the third quarter of the year, the Colombia´s Central Bank continued to advance in its expansionary monetary policy with an additional 100 basis points of interest rate cuts during the period, which benefited the overall financing cost of Grupo Bancolombia. However, on the other hand, it negatively impacted interest income generation due to lower interest rates applied to new loan originations and the repricing of current loans tied to floating rates on portfolio.

Fees and Income from Services

Net income from commissions and other services for 3Q24 was COP 1,038 billion, decreasing by 0.3% compared to 2Q24 and increasing by 8.4% compared to 3Q23.

In terms of the quarter, income from debit, credit cards, affiliated establishments and banking operations grew the most due to a higher volume of transactions compared to the second quarter. To a lesser extent, it's worth noting the improved performance of fiduciary activities due to higher volumes of assets under management in investment funds. On the other hand, the line that decreases the most is Bancassurance, due to the anticipation of income accrual recorded in the previous quarter, which reduces total fee income this quarter.

Similarly, the lower fee expenses during the period are primarily attributed to an anticipated accrual of fee expenses on the previous quarter related to the banking agents

Other Operating Income

Total other operating income was COP 762 billion in 3Q24, representing a growth of 2.9% compared to 2Q24. The increase in other operating income is primarily attributed to net foreign exchange. Meanwhile, operating lease income was COP 448 billion in 3Q24, an increase of 1.4% compared to 2Q24 and a decrease of 0.6% compared to 3Q23.

Dividends Received, and Share of Profits

The total dividends and other net income from equity investments in the third quarter of 2024 amounted to COP 92 billion. The quarterly increase is mainly attributed to a one-time effect from the previous period, when there was a recognition of impairment in associates and joint ventures due to the market valuation conducted in 2Q24.

Asset Quality, Provision Charges and Balance Sheet Strength

The principal balance for past due loans (those that are overdue for more than 30 days) totaled COP 13,290 billion at the end of 3Q24, representing 5.1% of the total gross portfolio, whereas 90-day past-due loans totaled COP 9,023 billion, representing 3.4%. The 30-day ratio decreased across all operations, following the trend of

the previous quarter, primarily due to the improved performance of the consumer portfolio in Colombia, which also positively impacted the 90-day ratio, breaking the increasing trend observed since the first quarter of 2023 and remaining stable for 3Q24.

The coverage, measured by the ratio of allowances for loan losses (principal) to PDLs (30 days overdue), was 112.13% at the end of 3Q24, increasing from 112.05% in 2Q24. The deterioration of the loan portfolio (new past due loans including charge-offs) during 3Q24 was COP 1,469 billion. The lower amount compared to 2Q24 is mainly due to the slower deterioration rate as of 30 days in the consumer portfolio in Colombia.

Provision charges (after recoveries) totaled COP 1,589 billion in 3Q24, showing a decrease of 1.8% compared to 2Q24. Overall, it is noteworthy that there was lower provision expense from retail and SME clients, along with the provisions releases due to model parameter updates.

Provisions as a percentage of the average gross portfolio, quarterly annualized, was 2.37% for 3Q24 and 2.39% for the last 12 months. Grupo Bancolombia maintains a balance supported by an adequate level of reserves for overdue loans. Allowances (for the principal) for loan losses totaled COP 14,903 billion, or 5.7% of the gross portfolio at the end of 3Q24, decreasing compared to 2Q24.

Operating Expenses

During 3Q24, operating expenses totaled COP 3,347 billion, representing a growth of 1.4% compared to 2Q24 and 3.2% compared to 3Q23.

Efficiency was 47.7% in 3Q24 and 47.9% for the last 12 months. Personnel expenses (salaries, employee benefits, and bonuses) amounted to COP 1,412 billion in 3Q24, which represents an increase of 4.7% compared to 2Q24 due to the higher provision for bonuses reflecting better results so far this year, and 5.8% compared to 3Q23, which reflects the annual salary adjustment that is implemented differently across each geography.

Meanwhile, general expenses decreased by 0.8% in the quarter and increased by 1.4% compared to 3Q23. The quarterly performance is primarily explained by the lower VAT provision associated with under-execution relative to the expense budget. In the annual analysis, the increase is mainly due to business transformation and cloud migration.

As of September 30, 2024, Grupo Bancolombia had 33,888 employees, 852 branches, 6,121 ATMs, 34,604 banking agents, and more than 32 million customers.

Taxes

Grupo Bancolombia’s income tax for 3Q24 was COP 590 billion, resulting in a lower effective tax rate when compared to the statutory tax rate in Colombia caused by the application of tax benefits in Colombia such as exempt income for social housing in mortgages and investments in productive fixed assets. Additionally, due to the tax benefits in Guatemala, El Salvador, and Panama, corresponding to exempt yields on government-issued securities. Finally, it is worth noting the earnings of the Foreign Banks with lower tax rates when compared to Colombia, which also contributed to a lower tax.

| | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE SHEET | Change |

| (COP million) | Sep-23 | Jun-24 | Sep-24 | Sep-24 /Jun-24 | Sep-24 / Sep-23 | % of Assets | % of Liabilities |

| ASSETS | | | | | | | |

| Cash and balances at central bank | 20,918,925 | | 21,374,700 | | 22,778,795 | | 6.57 | % | 8.89 | % | 6.45 | % | |

| Interbank borrowings | 2,632,178 | | 3,717,447 | | 2,298,108 | | -38.18 | % | -12.69 | % | 0.65 | % | |

| Reverse repurchase agreements and other similar secured lend | 5,464,711 | | 6,373,029 | | 1,298,602 | | -79.62 | % | -76.24 | % | 0.37 | % | |

| Financial assets investment | 27,072,706 | | 30,573,634 | | 35,837,645 | | 17.22 | % | 32.38 | % | 10.14 | % | |

| Derivative financial instruments | 5,945,700 | | 3,444,239 | | 2,464,399 | | -28.45 | % | -58.55 | % | 0.70 | % | |

| Loans and advances to customers | 257,835,266 | | 268,108,682 | | 269,568,504 | | 0.54 | % | 4.55 | % | 76.27 | % | |

| Allowance for loan and lease losses | (16,352,753) | | (16,680,835) | | (16,518,267) | | -0.97 | % | 1.01 | % | -4.67 | % | |

| Investment in associates and joint ventures | 3,139,848 | | 2,850,311 | | 2,920,853 | | 2.47 | % | -6.97 | % | 0.83 | % | |

| Goodwill and Intangible assets, net | 8,890,432 | | 9,191,298 | | 9,271,404 | | 0.87 | % | 4.29 | % | 2.62 | % | |

| Premises and equipment, net | 6,661,634 | | 6,048,006 | | 5,870,602 | | -2.93 | % | -11.87 | % | 1.66 | % | |

| Investment property | 4,539,308 | | 5,423,018 | | 5,467,963 | | 0.83 | % | 20.46 | % | 1.55 | % | |

| Right of use assets | 1,598,754 | | 1,668,641 | | 1,676,615 | | 0.48 | % | 4.87 | % | 0.47 | % | |

| Prepayments | 732,067 | | 839,285 | | 871,958 | | 3.89 | % | 19.11 | % | 0.25 | % | |

| Tax receivables | 2,163,913 | | 1,993,175 | | 2,536,230 | | 27.25 | % | 17.21 | % | 0.72 | % | |

| Deferred tax | 702,862 | | 796,955 | | 729,232 | | -8.50 | % | 3.75 | % | 0.21 | % | |

| Assets held for sale and inventories | 931,022 | | 993,902 | | 945,484 | | -4.87 | % | 1.55 | % | 0.27 | % | |

| Other assets | 5,307,342 | | 5,483,585 | | 5,415,170 | | -1.25 | % | 2.03 | % | 1.53 | % | |

| Total assets | 338,183,915 | | 352,199,072 | | 353,433,297 | | 0.35 | % | 4.51 | % | 100.00 | % | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | |

| LIABILITIES | | | | | | | |

| Deposit by customers | 244,192,701 | | 257,869,276 | | 259,758,641 | | 0.73 | % | 6.37 | % | 73.50 | % | 83.38 | % |

| Interbank Deposits | 716,031 | | 511,000 | | 725,285 | | 41.93 | % | 1.29 | % | 0.21 | % | 0.23 | % |

| Derivative financial instrument | 5,570,293 | | 3,680,218 | | 2,537,577 | | -31.05 | % | -54.44 | % | 0.72 | % | 0.81 | % |

| Borrowings from other financial institutions | 16,213,679 | | 12,938,759 | | 12,935,146 | | -0.03 | % | -20.22 | % | 3.66 | % | 4.15 | % |

| Debt securities in issue | 15,790,127 | | 16,107,674 | | 14,388,708 | | -10.67 | % | -8.88 | % | 4.07 | % | 4.62 | % |

| Lease liability | 1,707,301 | | 1,817,740 | | 1,829,899 | | 0.67 | % | 7.18 | % | 0.52 | % | 0.59 | % |

| Preferred shares | 569,477 | | 555,152 | | 569,477 | | 2.58 | % | 0.00 | % | 0.16 | % | 0.18 | % |

| Repurchase agreements and other similar secured borrowing | 484,747 | | 594,983 | | 2,846,946 | | 378.49 | % | 487.31 | % | 0.81 | % | 0.91 | % |

| Current tax | 886,814 | | 695,645 | | 1,109,561 | | 59.50 | % | 25.12 | % | 0.31 | % | 0.36 | % |

| Deferred tax | 1,742,089 | | 2,128,321 | | 2,215,517 | | 4.10 | % | 27.18 | % | 0.63 | % | 0.71 | % |

| Employees benefit plans | 866,086 | | 895,682 | | 907,574 | | 1.33 | % | 4.79 | % | 0.26 | % | 0.29 | % |

| Other liabilities | 10,949,900 | | 14,199,672 | | 11,694,460 | | -17.64 | % | 6.80 | % | 3.31 | % | 3.75 | % |

| Total liabilities | 299,689,245 | | 311,994,122 | | 311,518,791 | | -0.15 | % | 3.95 | % | 88.14 | % | 100.00 | % |

| SHAREHOLDERS' EQUITY | | | | | | | |

| Share Capital | 480,914 | | 480,914 | | 480,914 | | 0.00 | % | 0.00 | % | 0.14 | % | |

| Additional paid-in-capital | 4,857,454 | | 4,857,454 | | 4,857,454 | | 0.00 | % | 0.00 | % | 1.37 | % | |

| Appropriated reserves | 20,052,460 | | 22,632,835 | | 22,634,127 | | 0.01 | % | 12.87 | % | 6.40 | % | |

| Retained earnings | 7,209,719 | | 5,779,197 | | 7,279,088 | | 25.95 | % | 0.96 | % | 2.06 | % | |

| Accumulated other comprehensive income, net of tax | 4,932,871 | | 5,469,515 | | 5,647,853 | | 3.26 | % | 14.49 | % | 1.60 | % | |

| Stockholders’ equity attributable to the owners of the parent company | 37,533,418 | | 39,219,915 | | 40,899,436 | | 4.28 | % | 8.97 | % | 11.57 | % | |

| Non-controlling interest | 961,252 | | 985,035 | | 1,015,070 | | 3.05 | % | 5.60 | % | 0.29 | % | |

| Total liabilities and equity | 338,183,915 | | 352,199,072 | | 353,433,297 | | 0.35 | % | 4.51 | % | 100.00 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| INCOME STATEMENT | As of | Change | | | | Change |

| (COP million) | Sep-23 | Sep-24 | Sep-24 / Sep-23 | 3Q23 | 2Q24 | 3Q24 | 3Q24/2Q24 | 3Q24/3Q23 |

| Interest income and expenses Interest on loans and financial leases | | | | | | | | |

| Commercial | 12,875,051 | | 12,529,974 | | -2.68 | % | 4,279,353 | | 4,160,195 | | 4,171,772 | | 0.28 | % | -2.51 | % |

| Consumer | 7,671,019 | | 6,404,890 | | -16.51 | % | 2,495,250 | | 2,188,049 | | 2,064,678 | | -5.64 | % | -17.26 | % |

| Small business loans | 128,160 | | 154,170 | | 20.29 | % | 40,809 | | 51,279 | | 49,187 | | -4.08 | % | 20.53 | % |

| Mortgage | 2,952,443 | | 2,920,392 | | -1.09 | % | 839,999 | | 1,019,405 | | 887,935 | | -12.90 | % | 5.71 | % |

| Financial leases | 2,884,510 | | 2,741,999 | | -4.94 | % | 984,525 | | 917,304 | | 869,870 | | -5.17 | % | -11.65 | % |

| Total interest income on loans and financial leases | 26,511,183 | | 24,751,425 | | -6.64 | % | 8,639,936 | | 8,336,232 | | 8,043,442 | | -3.51 | % | -6.90 | % |

| Interest income on overnight and market funds | 145,904 | | 173,880 | | 19.17 | % | 42,277 | | 64,595 | | 47,462 | | -26.52 | % | 12.26 | % |

| Interest and valuation on financial instruments | | | | | | | | |

| Interest on debt instruments using the effective interest method | 765,713 | | 734,322 | | -4.10 | % | 262,316 | | 240,138 | | 236,410 | | -1.55 | % | -9.88 | % |

| Valuation on financial instruments | | | | | | | | |

| Debt investments | 224,942 | | 1,145,725 | | 409.34 | % | 28,066 | | 284,827 | | 562,625 | | 97.53 | % | 1904.65 | % |

| Derivatives | (62,574) | | (95,004) | | 51.83 | % | 65,916 | | (18,588) | | (82,730) | | 345.07 | % | -225.51 | % |

| Repos | 13,367 | | 191,169 | | 1330.16 | % | 73,872 | | 50,792 | | 31,985 | | -37.03 | % | -56.70 | % |

| Others | (37,089) | | (5,530) | | -85.09 | % | (8,741) | | (14,521) | | 15,924 | | -209.66 | % | -282.18 | % |

| Total valuation on financial instruments | 138,646 | | 1,236,360 | | 791.74 | % | 159,113 | | 302,510 | | 527,804 | | 74.47 | % | 231.72 | % |

| Total Interest on debt instruments and valuation on financial instruments | 904,359 | | 1,970,682 | | 117.91 | % | 421,429 | | 542,648 | | 764,214 | | 40.83 | % | 81.34 | % |

| Total interest and valuation on financial instruments | 27,561,446 | | 26,895,987 | | -2.41 | % | 9,103,642 | | 8,943,475 | | 8,855,118 | | -0.99 | % | -2.73 | % |

| Interest expense | | | | | | | | |

| Borrowings from other financial institutions | (1,230,742) | | (1,042,095) | | -15.33 | % | (417,227) | | (332,778) | | (307,744) | | -7.52 | % | -26.24 | % |

| Overnight funds | (26,120) | | (16,111) | | -38.32 | % | (6,527) | | (5,459) | | (6,099) | | 11.72 | % | -6.56 | % |

| Debt securities in issue | (1,105,003) | | (912,742) | | -17.40 | % | (342,631) | | (310,348) | | (317,223) | | 2.22 | % | -7.42 | % |

| Deposits | (9,886,733) | | (9,250,196) | | -6.44 | % | (3,425,707) | | (3,047,647) | | (3,014,675) | | -1.08 | % | -12.00 | % |

| Preferred shares | (42,975) | | (42,975) | | 0.00 | % | (14,325) | | (13,813) | | (14,325) | | 3.71 | % | 0.00 | % |

| Lease liabilities | (84,851) | | (102,433) | | 20.72 | % | (28,993) | | (35,509) | | (33,710) | | -5.07 | % | 16.27 | % |

| Other interest | (42,274) | | (31,931) | | -24.47 | % | (17,012) | | (11,332) | | (8,742) | | -22.86 | % | -48.61 | % |

| Total interest expenses | (12,418,698) | | (11,398,483) | | -8.22 | % | (4,252,422) | | (3,756,886) | | (3,702,518) | | -1.45 | % | -12.93 | % |

| Net interest margin and valuation on financial instruments before impairment on loans and financial leases, off balance sheet credit instruments and other financial instruments | 15,142,748 | | 15,497,504 | | 2.34 | % | 4,851,220 | | 5,186,589 | | 5,152,600 | | -0.66 | % | 6.21 | % |

| Credit impairment charges on loans and advance and financial leases | (6,226,780) | | (5,084,516) | | -18.34 | % | (1,830,584) | | (1,848,078) | | (1,732,478) | | -6.26 | % | -5.36 | % |

| Recovery of charged - off loans | 523,941 | | 599,321 | | 14.39 | % | 230,524 | | 225,017 | | 205,207 | | -8.80 | % | -10.98 | % |

| Credit impairment charges on off balance sheet credit instruments | (12,945) | | (48,289) | | 273.03 | % | (746) | | 5,068 | | (60,193) | | -1287.71 | % | 7968.77 | % |

| Credit impairment charges/recovery on investments | (21,563) | | 10,885 | | -150.48 | % | (8,697) | | (790) | | (1,372) | | 73.67 | % | -84.22 | % |

| Total credit impairment charges, net | (5,737,347) | | (4,522,599) | | -21.17 | % | (1,609,503) | | (1,618,783) | | (1,588,836) | | -1.85 | % | -1.28 | % |

| Net interest margin and valuation on financial instruments after impairment on loans and financial leases and off balance sheet credit instruments and other financial instruments | 9,405,401 | | 10,974,905 | | 16.69 | % | 3,241,717 | | 3,567,806 | | 3,563,764 | | -0.11 | % | 9.93 | % |

| Fees and commission income | | | | | | | | |

| Banking services | 727,719 | | 829,500 | | 13.99 | % | 242,597 | | 289,528 | | 291,138 | | 0.56 | % | 20.01 | % |

| Credit and debit card fees and commercial establishments | 2,243,388 | | 2,406,538 | | 7.27 | % | 745,614 | | 796,641 | | 824,875 | | 3.54 | % | 10.63 | % |

| Brokerage | 20,789 | | 26,741 | | 28.63 | % | 5,782 | | 13,735 | | 6,055 | | -55.92 | % | 4.72 | % |

| Acceptances, Guarantees and Standby Letters of Credit | 80,216 | | 81,254 | | 1.29 | % | 26,987 | | 27,985 | | 25,879 | | -7.53 | % | -4.11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Trust | 344,651 | | 417,290 | | 21.08 | % | 115,292 | | 135,747 | | 145,276 | | 7.02 | % | 26.01 | % |

| Placement of securities and investment banking | 42,818 | | 68,832 | | 60.75 | % | 11,964 | | 35,975 | | 21,763 | | -39.51 | % | 81.90 | % |

| Bancassurance | 711,337 | | 706,917 | | -0.62 | % | 243,683 | | 286,073 | | 212,532 | | -25.71 | % | -12.78 | % |

| Payments and Collections | 711,648 | | 774,951 | | 8.90 | % | 244,242 | | 265,605 | | 269,529 | | 1.48 | % | 10.35 | % |

| Other | 299,359 | | 290,694 | | -2.89 | % | 94,324 | | 96,757 | | 105,732 | | 9.28 | % | 12.09 | % |

| Total fees and commission income | 5,181,925 | | 5,602,717 | | 8.12 | % | 1,730,485 | | 1,948,046 | | 1,902,779 | | -2.32 | % | 9.96 | % |

| Banking services | (1,113,860) | | (1,241,306) | | 11.44 | % | (380,187) | | (426,369) | | (433,088) | | 1.58 | % | 13.91 | % |

| Sales, collections and other services | (620,720) | | (647,361) | | 4.29 | % | (213,284) | | (228,748) | | (211,122) | | -7.71 | % | -1.01 | % |

| Bank correspondents | (340,419) | | (452,205) | | 32.84 | % | (129,267) | | (188,367) | | (155,757) | | -17.31 | % | 20.49 | % |

| Others | (149,400) | | (168,637) | | 12.88 | % | (49,815) | | (62,764) | | (64,468) | | 2.71 | % | 29.41 | % |

| Total fees and commission expenses | (2,224,399) | | (2,509,509) | | 12.82 | % | (772,553) | | (906,248) | | (864,435) | | -4.61 | % | 11.89 | % |

| Total fees and comissions, net | 2,957,526 | | 3,093,208 | | 4.59 | % | 957,932 | | 1,041,798 | | 1,038,344 | | -0.33 | % | 8.39 | % |

| Other operating income | | | | | | | | |

| Derivatives FX contracts | 351,188 | | 159,250 | | -54.65 | % | 85,609 | | 160,894 | | 97,025 | | -39.70 | % | 13.34 | % |

| Net foreign exchange | 655,250 | | 217,385 | | -66.82 | % | 184,395 | | (17,357) | | 116,559 | | -771.54 | % | -36.79 | % |

| Hedging | - | | - | | 0.00 | % | - | | 623 | | - | | -100.00 | % | 0.00 | % |

| Leases | 1,299,993 | | 1,350,230 | | 3.86 | % | 450,973 | | 441,935 | | 448,199 | | 1.42 | % | -0.62 | % |

| Gains (or losses) on sale of assets | 132,789 | | 61,640 | | -53.58 | % | 41,729 | | 15,090 | | 28,645 | | 89.83 | % | -31.35 | % |

| Other reversals | 26,741 | | 27,988 | | 4.66 | % | 11,291 | | 4,723 | | 9,535 | | 101.88 | % | -15.55 | % |

| Others | 576,210 | | 316,233 | | -45.12 | % | 158,569 | | 135,176 | | 62,350 | | -53.87 | % | -60.68 | % |

| Total other operating income | 3,042,171 | | 2,132,726 | | -29.89 | % | 932,566 | | 741,084 | | 762,313 | | 2.86 | % | -18.26 | % |

| Dividends received, and share of profits of equity method investees | | | | | | | | |

| Dividends | 78,324 | | 68,795 | | -12.17 | % | 22,132 | | 23,867 | | 34,928 | | 46.34 | % | 57.82 | % |

| Equity investments | (10,212) | | (5,708) | | -44.10 | % | 1,000 | | (5,701) | | 2,475 | | -143.41 | % | 147.50 | % |

| Equity method | 178,212 | | 187,910 | | 5.44 | % | 49,160 | | 56,023 | | 54,598 | | -2.54 | % | 11.06 | % |

| Others | 54,874 | | (299,764) | | -646.28 | % | - | | (299,764) | | - | | -100.00 | % | — | % |

| Total dividends received, and share of profits of equity method investees | 301,198 | | (48,767) | | -116.19 | % | 72,292 | | (225,575) | | 92,001 | | -140.79 | % | 27.26 | % |

| Total operating income, net | 15,706,296 | | 16,152,072 | | 2.84 | % | 5,204,507 | | 5,125,113 | | 5,456,422 | | 6.46 | % | 4.84 | % |

| Operating expenses | | | | | | | | |

| Salaries and employee benefits | (3,320,352) | | (3,556,054) | | 7.10 | % | (1,087,123) | | (1,194,440) | | (1,180,036) | | -1.21 | % | 8.55 | % |

| Bonuses | (690,891) | | (538,841) | | -22.01 | % | (247,346) | | (153,956) | | (231,512) | | 50.38 | % | -6.40 | % |

| Other administrative and general expenses | (3,591,320) | | (3,813,107) | | 6.18 | % | (1,251,461) | | (1,288,226) | | (1,320,342) | | 2.49 | % | 5.50 | % |

| Taxes other than income tax | (1,093,676) | | (1,125,119) | | 2.87 | % | (398,947) | | (389,932) | | (344,293) | | -11.70 | % | -13.70 | % |

| Impairment, depreciation and amortization | (788,886) | | (804,306) | | 1.95 | % | (257,613) | | (273,482) | | (270,562) | | -1.07 | % | 5.03 | % |

| Total operating expenses | (9,485,125) | | (9,837,427) | | 3.71 | % | (3,242,490) | | (3,300,036) | | (3,346,745) | | 1.42 | % | 3.22 | % |

| Profit before tax | 6,221,171 | | 6,314,645 | | 1.50 | % | 1,962,017 | | 1,825,077 | | 2,109,677 | | 15.59 | % | 7.53 | % |

| Income tax | (1,458,141) | | (1,648,395) | | 13.05 | % | (445,442) | | (363,323) | | (590,192) | | 62.44 | % | 32.50 | % |

| Net income | 4,763,030 | | 4,666,250 | | -2.03 | % | 1,516,575 | | 1,461,754 | | 1,519,485 | | 3.95 | % | 0.19 | % |

| Non-controlling interest | (94,003) | | (61,810) | | -34.25 | % | (24,816) | | (21,980) | | (18,291) | | -16.78 | % | -26.29 | % |

| Net income attributable to equity holders of the Parent Company | 4,669,027 | | 4,604,440 | | -1.38 | % | 1,491,759 | | 1,439,774 | | 1,501,194 | | 4.27 | % | 0.63 | % |

| | | | | | | | |

Stand Alone Balance Sheet Bancolombia S.A.

Financial analysis performed with information prepared under full International Financial Reporting Standards, for the purpose of the Consolidated Financial Statements.

Bancolombia S.A.’s loan portfolio increased by 0.1% in 3Q24 and 2.4% over the last 12 months. The housing portfolio grew by 3.4% in the quarter and was the main driver of portfolio growth both in Colombia and within Grupo Bancolombia. This strong performance is attributed to the interest rate reduction strategy that took effect in July 2024. The commercial portfolio, which had shown sustained expansion in the first half of the year, experienced a decline of 0.1%, primarily due to factoring and leasing products. Consumer loans continue to trend downward, contracting by 1.4% in the third quarter, with the largest decline seen in personal unsecured loans.

In the funding structure, there was an increase in the volume of various types of deposits compared to the previous quarter, mainly driven by time deposits, particularly the virtual investment product. The growth in savings and checking accounts is largely attributed to the institutional segment.

Stand Alone Income Statement Bancolombia S.A.

Financial analysis performed with information prepared under full International Financial Reporting Standards, for the purpose of the Consolidated Financial Statements.

Bancolombia S.A.’s net income for the third quarter of 2024 was COP 1.6 trillion, representing a 12.6% increase compared to the second quarter of 2024. Interest Income from the commercial portfolio decreased due to a combination of lower volume and reduced yield rates. The decrease in interest expenses from lower deposit rates partially offset the income decline. The reduction in provision expenses during the third quarter of 2024 was the main factor contributing to the earnings growth and was due to improvements in retail and SMEs. Additionally, there was a provision release due to model parameter updates. Operating expenses decreased by 1.3% in the quarter, primarily driven by lower tax expenses. Other income due to a base effect relative to the previous period when there was a write-down on associated companies and joint ventures. Bancolombia S.A.'s net interest margin for the third quarter of 2024 was 7.7%, and the annualized quarterly ROE was 16.2%.

II.QUANTITATIVE AND QUALITATIVE ANALYSIS OF THE MARKET RISK TO WHICH THE ISSUER IS EXPOSED AS A RESULT OF ITS INVESTMENTS AND ACTIVITIES SENSITIVE TO MARKET VARIATIONS

Market risk refers to the risk of losses in the Bank’s treasury book due to changes in equity prices, interest rates, foreign-exchange rates and other indicators whose values are set in a public market. It also refers to the probability of unexpected changes in net interest income and economic value of equity as a result of a change in market interest rates.

The guidelines, policies and methodologies for market risks management are maintained in accordance with what was revealed as of December 31, 2023.

GROUP BANCOLOMBIA

The total market risk VaR had an increase of 40.4%, from COP 1,096,000 in December 31, 2023 to COP 1,539,264 in September 30, 2024. The risk factor leading the increment is the exchange rate, which registered a greater exposure to the US dollar; followed by the interest rate factor driven mainly by the increase in United States government bonds and local public debt. The collective investment funds factor registered an increase mainly due a greater exposure of the Colombia Inmobiliario Fund, followed by the share price factor due to valuations in investments.

Market risk exposure has been maintained within the approved levels and is permanently monitored by Senior Management and is an input for the decision-making process to preserve the Bank stability.

BANCOLOMBIA S.A

Market risk management at Bancolombia S.A is the same as previously detailed, carried out for Grupo Bancolombia.

The total market risk VaR had an increase of 35.5%, rising from COP 965,729 in september 2023 to COP 1,308,847 in september 2024. The risk factor leading the increment is the exchange rate, which registered a greater exposure to the US dollar; followed by the interest rate factor driven mainly by the increase in United States government bonds and local public debt. The collective investment funds factor registered an increase mainly due to valuations of the Colombia Inmobiliario Fund. On the other hand, the share price factor registered a decrease due to devaluations in investments.

During the period there have been no violations of the approved exposure limits and the market risk exposure is permanently monitored by Senior Management.

Non-trading instruments market risk measurement

Interest rate risk is understood as the possibility of incurring losses due to a decrease in the economic value of assets or a decrease in the net interest margin, as a consequence of changes in interest rates. These changes show the fluctuations in the financial margin or its impact on equity due to the risks inherent in active and passive transactions, as well as in the administration of the resources that the Bank manages on a day-to-day basis.

Interest Risk Exposure (Banking Book)

The guidelines, policies and methodologies for interest risk management are maintained in accordance with what was revealed as of December 31, 2023.

GROUP BANCOLOMBIA

As of septembrer 30, 2024, the net sensitivity of the banking book in legal currency to positive and parallel variations in interest rates of 100 basis points was COP 581,027. The variation in the sensitivity of the net interest margin between December 2023 and september 2024 is presented by the decrease in liability sensitivity due to the reduction in interbank borrowings, bonds and demand deposits.

On the other hand, the sensitivity to the net interest margin in foreign currency, assuming the same parallel displacement of 100 basis points presented an increase between December 31, 2023 and September 30, 2024 to USD 0.675 due to the increase of the fixed- rate loans offset by the increment in the fixed rate time deposits from the Bank.

BANCOLOMBIA S.A.

The sensitivity of the net interest margin for positions in local currency, to positive and parallel variations in interest rates of 100 basis points, was COP 592,009. The variation in the sensitivity of the net interest margin between December 2023 and September 2024 is due to a decrease in the sensitivity of liabilities, explained by the reduction in the bonds and Interbank borrowings.

On the other hand, the sensitivity of the net interest margin for foreign currency positions was USD -5.95 to 100 basis points. The change between December 2023 versus September 2024 corresponds to the reduction in the Interbank borrowings offset by the increase in the balance of fixed rate CDTs.

III.MATERIAL VARIATIONS THAT HAVE OCCURRED IN THE RISKS TO WHICH THE ISSUER IS EXPOSED, OTHER THAN MARKET RISK, AND THE MECHANISMS IMPLEMENTED TO MITIGATE THEM

LIQUIDITY RISK

Liquidity risk is understood as the inability to fully and timely meet payment obligations on their due dates due to insufficient liquid resources and/or the need to incur excessive funding costs. Situations such as downgrades in the credit ratings of the banks of Grupo Bancolombia would increase the cost of funds and make it more difficult to attract deposits or refinance maturing debt.

The guidelines, policies and methodologies for liquidity risks management are maintained in accordance with what was revealed as of September 30, 2024.

GROUP BANCOLOMBIA

During the third quarter, Grupo Bancolombia has maintained sufficient levels of liquidity, continuing to monitor the established liquidity alerts. Furthermore, liquid assets met the established limits and amply covered the liquidity requirements of the Bank.

In this way, the liquidity coverage indicator presents a reduction from 313.05% in June 2024 to 283.65% in September 2024 considering the increase in Bancolombia's 30-day liquidity requirements. By September 2024, the Bank´s liquid assets amount to COP 49.5 trillions.

BANCOLOMBIA S.A.

During the third quarter of the year, a slight increasing trend was observed in liquidity levels. This behavior is aligned with the increase in deposit accounts and fixed-term deposits.

The liquidity indicator was at 200.0% at the end of September 2024, showing a decrease compared to the end of June 2024. This reduction is mainly due to an increase in the liquidity requirement due to the decrease in active liquidity operations.

On the other hand, the net stable funding ratio (CFEN) has remained at adequate levels, standing at 118.31%

CREDIT RISK

Credit risk is the probability that the Bank will incur losses due to i) non-fulfillment of financial obligations by a customer or counterparty, ii) Deterioration resulting from the decline in their risk rating, iii) a reduction in profits and remunerations and iv) to the benefits delivered in restructuring and recovery costs.

In the third quarter of 2024, the economy demonstrated growth despite the gradual decline in interest rates, ongoing geopolitical tensions, and high unemployment rates in Latin American countries. In response to these challenges, the Bank has continued to support clients by maintaining proactive credit risk management and evaluating specific conditions and requests to meet their credit needs. Additionally, the Bank has developed methodologies, tools, and models to optimize collections. The continuous monitoring and review of credit portfolios from various perspectives remain crucial for identifying and implementing proactive strategies at different stages of the credit cycle.

GROUP BANCOLOMBIA

At the end of September 2024, Grupo Bancolombia reported a slight increase in its portfolio compared to the previous quarter, with a growth in the portfolio balance in pesos of 0.5% (COP 1.5 trillions). This growth is attributed to a better dynamic in mortgage and microcredit portfolio disbursements, primarily at Bancolombia, as well as an increase in the commercial portfolio balance of the corporate segment at Bam. The consumer segment did not experience significant variation during this period. Additionally, the devaluation of the peso against the dollar continued to positively impact the portfolio balance, although to a lesser extent compared to the previous period.

The 30-day past due loan ratio (consolidated) at stood at 5.50% as September of 2024, showing a decrease compared with 5.60% in June 2024. The level of the Bank´s non-performing loans was mainly influenced by improvements in the indicators of the consumer portfolio in Colombia, Guatemala, and Panama, as well as the improved performance of the microcredit segment in Bancolombia and Bancoagrícola in El Salvador. Conversely, the commercial portfolio saw an increase in this ratio, driven by deterioration in the corporate and SME segments at Bancolombia; Macroeconomic factors such as the downward trend in inflation and the gradual intervention of interest rates by central banks continue to stimulate the economy in the regions where the Bank operates. However, geopolitical, social, and economic uncertainties still affect consumption, particularly impacting the commerce, manufacturing, and construction sectors, which are fundamental pillars of these regional economies. All portfolios continue to be managed at different stages of the credit cycle in order to anticipate the materialization of risks and strategies for normalizing and containing the portfolio have been implemented.

The credit cost (annualized) for the third quarter of 2024 was 2.4%, lower than 2.5% registered in the second quarter of 2024. The decrease in this indicator (45%) was concentrated in lower provision expenses in the personal and SME portfolio.

BANCOLOMBIA S.A.

At the end of the third quarter of 2024, Bancolombia presents a portfolio growth of 0.1% compared to June 2024, mainly due to the increase in the balance of the corporate business and real estate solution. The portfolio variation for the commercial modality was -0.14%, consumer -1.39%, mortgage 3.43% and finally for microcredit 10.98%. The 30-day total overdue portfolio indicator closed at 5.22%, which represents a difference of 0.07pp when compared to 5.29% in the second quarter of 2024.

The cost of credit for Bancolombia in the third quarter (annualized) of 2024 was 2.56% lower than the 2.86% registered in the previous quarter. During the period different strategies were developed for the follow-up and recovery of the portfolio in order to normalize and contain the portfolio mainly in the consumer modality.

COUNTRY RISK

This risk refers to the possibility of the Bank incurring losses as a result of financial operations abroad due to adverse economic and/or political conditions in the country receiving those operations, either because of restrictions on the transfer of foreign exchange or because of factors not attributable to the commercial and financial condition of the country receiving those operations. This definition includes, but is not limited to, sovereign risk (SR) and transfer risk (TR) associated with such factors.

The guidelines, policies and methodologies for country risks management are maintained in accordance with what was revealed as of December 31, 2023.

At the end of September 2024 compared to December 2023, no alerts were presented changes in the country ratings in any investment, nor were adjustments made for deterioration. The variation in the value of investments is mainly attributed to variation in the exchange rate, results of the period of some foreign subsidiaries; and distribution of dividends.

OPERATIONAL RISK

The Bank’s operational management framework objective is to carry out an adequate risk management that allows minimizing, avoiding, or reducing the materialization of adverse events and/or reducing their consequences or costs in case of materialization. The operational risk management system has not presented changes in relation to what was revealed at the end of June 2024 in terms of regulations, policies, manuals, methodologies, structure or any other relevant element that may affect its effectiveness.

GROUP BANCOLOMBIA

Until the third quarter of the year, no new risks or changes in existing risks have been identified that significantly modify the exposure to operational risk. The accumulative losses to September of 2024 present an increase of 49% compared to the second quarter of 2024, this variation is mainly explained by the fraud category, due to the increase in the capture of customer data through social engineering techniques.

BANCOLOMBIA S.A.

Until the third quarter of the year, no new risks or changes in existing risks have been identified that significantly modify the exposure to operational risk. The accumulative losses to September of 2024 reaches out to COP 221 billion, COP 199 billion explained by the fraud category, due to the increase in the capture of customer data through social engineering techniques.

OTHER RELEVANT RISK

During the third quarter of 2024, there were no material changes in environmental and social risk; the following are those where changes are evidenced:

•Economic and sector environment

The global situation is dominated by the beginning of the financial easing trend, in view of the monetary policy interest rate cuts already being advanced by the central banks of almost all developed economies. However, the growing geopolitical risks, particularly those related to the war in the Middle East and the elections in the United States, generate uncertainty in the decision-making process of international institutions, and therefore, the positive impact of the drop in developed economies' interest rates for emerging economies is rather limited. Furthermore, the conflict in the Middle East is also generating volatility in commodity prices, with potential inflationary impacts on countries that are net importers of these products and affecting the external vulnerability of those who depend on income from exports in this segment.

For their part, in the Latin American regional environment, the general trend continues to be one of economic growth recovery. In the case of Colombia, 2024 records are marking a clear trend of strengthening annual GDP growth compared to what was seen in 2023. However, this has been highly dependent on the boost from the public sector and public spending, while the dynamism of the private sector has been modest. The continued process of interest rate cuts and inflation reduction could be favorable for strengthening private sector economic activity in Colombia. However, the regulatory uncertainty that continues to prevail in many sectors, with the recent advances in labor reform potentially disrupting business decision-making, will remain a limitation on investment spending and growth.

Meanwhile, the public finances figures continue to be a first-order source of uncertainty. The latest tax collection metrics remain below the National Government's official revenue expectations, which puts pressure on the need for very prudent public spending management, where execution metrics are advancing at a slightly faster pace than desirable to send clear signals that the fiscal rule target for 2024 will be met. Meanwhile, Congress' rejection of the General Budget of the Nation for 2025 led to the need for its definition via decree and possible legal processes, causing the fiscal outlook for next year to continue to be framed by a relatively high-risk environment: the Government maintains an optimistic view of generating fiscal revenues, though the expected resources from the pending Financing Law and from improvements in tax administration efficiency may not materialize. These elements suggest that risks of non-compliance with the fiscal rule target could persist in 2025.

Bancolombia maintains active credit risk management, incorporating macroeconomic scenarios into its provisioning models. Additionally, the Bank has sustained constant sectoral analysis and monitoring to identify both situations and clients that may be affected. Periodically, the individual situation of clients is reviewed in different forums, adopting alternatives when necessary to support them in the development of their businesses and in managing the context.

•Operational resilience, business continuity and technology failures

During the third quarter of 2024, there have been no significant changes that significantly alter the risk exposure in the areas of Cybersecurity and Information Security, Operational Resilience, Business Continuity, and Technological Failures.

Emphasize that, to strengthen cybersecurity and information security management, controls have been implemented, including improvements in access management, parameterization of alerts, and monitoring from the Cybersecurity Operations Center (SOC), code analysis and vulnerability assessments are conducted at various stages of development for technological components, applications, and cloud services. Additionally, regular scans are performed, and proactive efforts are made to address vulnerabilities, secure development practices are also implemented for production releases. These measures have allowed to effectively manage risk exposure.

Regarding operational resilience, business continuity, and technological failures, it continues to implement technological and operational contingencies for key channels and processes, which will allow to respond in a timely and appropriate manner, mitigating impacts on the service to clients.

•Regulatory and legal

As of September 2024, Although the government administration has promoted and issued high impact regulations for the country, with respect to the financial sector, the regulations issued have not had a significant impact. Five new credit modalities (subcategories of microcredit) were created to serve specific sectors of the population, and the formula for calculating the Current Bank Interest Rate (CIBR) was changed. At an indirect level, various provisions and policy measures have had important effects on clients, their payment capacity and the demand for credit (tax reforms, targeting of subsidies, management of environmental licenses, among others).

Prospectively, the payment ecosystem is the main regulatory interest in the short term with: (i) the implementation of Bre-B, the immediate payment system managed by Banco de la República de Colombia; and (ii) the draft decree that aims to establish an immediate payment system with uniform rules and standards for

participants with a focus on promoting interoperability between entities and the adoption of digital payments. On the other hand, the financial regulatory agenda for 2025 includes the following main topics: takeover bids, open data, fiduciary businesses and financial inclusion.

•AML

In the development of the SARLAFT during the third quarter of 2024, the LAFT risk matrices for Valores Bancolombia, Fiduciaria Bancolombia, Banca de Inversión Bancolombia were correctly executed, guaranteeing an adequate result for each one and generating a constant evolution in the mitigation of risks.

Based on requirements and meetings with Colombia´s Financial Superintendency (Superintendencia Financiera de Colombia), the corresponding identification of threats and vulnerabilities to which the societies are exposed continues to be adjusted, with a main focus on crimes against the public administration. On the other hand, for the subsidiaries Fiduciaria and Valores there were modifications for the SARLAFT segmentation, which is an instrument determined by the local regulation and whose purpose is to generate groupings where the characteristics of the individuals of the four risk factors are homogeneous, in addition to the different groups being heterogeneous among themselves. Taking into account the above and seeking better results for Fiduciaria and Valores, the customer factor has evolved, moving some segments from analytical models to expert models, this in line with the special characteristics presented by Fiduciaria and Valores business.

Corporate tool for risk management LAFT, is in production and is currently uploading previous profiles of Bancolombia, national financial subsidiaries and a Foreign Bank (Bancoagricola) regarding the identification, measurement of risks, causes and controls, additionally, automations are being carried out to make the loading process more practical.

This tool accompanies technological evolution to increase the ability to control the half-yearly results of risk profiles at the different levels of aggregation (segment, factor, risk and entity) and greater traceability of historical information, ease of validation and accountability required.

Regarding the training of the Bancolombia personnel, and to continue generating a culture of prevention and management of LAFT risk, various press releases, training courses and training sessions were produced, and four press releases were published in the national media.

In addition, 105 initiatives and projects were accompanied, with the aim of proactively identifying LAFT risks that allows the implementation of controls and management for their adequate mitigation.

•Model Risk

The Risk Vice Presidency maintains a robust Model Risk Policy with broad coverage in independent validation. During the third quarter of the year, adapting to the current macroeconomic context, model risk management and mitigation was strengthened through three strategic initiatives: (i) MRM automation, (ii) optimization of model risk monitoring and (iii) evolution of the validation framework.

The ongoing policy update incorporates criteria on ethical model development, use of generative AI and findings management, aligned with global best practices. These measures ratify our commitment to proactive and ethical risk management, ensuring the robustness of our models and enabling more efficient decision-making processes.

•Political risk

In terms of political risk, without having mitigated the risks associated with the general management of the economy and the structural reforms promoted by the government, during the third quarter of 2024, new risks have been emerging regarding the General Budget of the Nation and the country's fiscal capacities that could materialize in 2025. Indeed, in 2025 the country could face important challenges in terms of credit ratings (with impacts on the ratings of the country's companies) given the fiscal situation. Therefore, the following will have to be overcome: (i) the financing of the General Budget of the Nation where the government is obliged to present the same bill rejected by the legislature (underfunded by 30 trillion) as a decree, with no guarantee that the Financing Law that accompanies it will be approved; (ii) the reactions of the rating agencies to the Legislative Act Bill that modifies the General System of Participations-SGP and that various analysts and institutions have declared fiscally unsustainable; (iii) the challenges in terms of tax collection, where the 2024 goals have not been met; and (iv) the lower revenues from Ecopetrol, whose financial results have been deteriorating, added to the decreasing trend of oil prices in 2025.

•Sustainability strategy

During the third quarter of 2024, we focused on advancing ESG risk management in the commercial portfolio and investment areas:

For the commercial portfolio:

•Work began on the development of the objective transition risk model, which will allow the Bancolombia to obtain a risk level by sector for those that are most vulnerable to the energy transition.

For the investment areas:

•The internal ESG rating methodology for thematic emissions has been finalized, which now includes new types of emissions, such as blue emissions, biodiversity emissions, and emissions tied to sustainability indicator.

•Third-party risk

The outsourcing of activities within the Bancolombia exposes it to the possibility of economic impact derived from the inability to manage a third party or supplier contracted by the Bancolombia, which presents deficiencies to carry out the service. This situation may trigger restrictions in the achievement of strategic objectives, and in some cases, derive in impacts on the operation of the business and increase the exposure in terms of cybersecurity, handling of third party or confidential information, fraud, and reputational cases, which are involved in adverse scenarios for the perception of the public or regulators.

During the third trimester of the current year, the work plan has been carried out to evaluate the critical suppliers of the Bank, in this way we seek to guarantee the control environment in the organization and continue with the evolution of the processes to guarantee the management of the suppliers in the contracting cycle.

•External fraud

During the third quarter of 2024, there has been a variation in external fraud due to the increase in attacks on customers through social engineering techniques to breach their resources in the different products and channels. To mitigate this situation, permanent adjustments are made to the transactional monitoring rules and to the different controls aimed at customer authentication, always seeking a favorable relationship between security and service. In addition, financial education activities are carried out on fraud prevention issues.

•Internal fraud

During the third quarter of the year, the controls associated with information leakage and access control in some critical processes were improved, and those processes in which adequate validation controls should be implemented in case of fraud were identified. During the third quarter of the year, the controls associated with information leakage and access control in some critical processes were improved, and those processes in which adequate validation controls should be implemented in case of fraud were identified. With the above, we expect to improve the control environment and mitigate the risk of misappropriation of assets with increasing assertiveness.

•Human talent risk

Talent risk is the possibility of generating a negative impact on the results of Bancolombia due to the absence of the talents required in the different roles or due to the challenges associated with existing talent, given the Bank inability to design schemes that enable the culture and well-being that attracts, develops, and retains talent.

During the third trimester of the current year, a work plan has been carried out to identify and measure all those risks related to talent to which Bancolombia is exposed and to be able to define the improvement plans to be carried out with the objective of mitigating the risk and keep it managed.

•Inadequate response to market changes

The implementation of the immediate payment system led by Banco de la República (IPS) continues to stand out as a possible critical factor for the erosion of the competitive advantage in transactionality that Bancolombia has historically developed. This situation has implied the mobilization of resources and capabilities within Bancolombia, as well as the making of strategic decisions to face the situation and maintain the preference of our clients and the monetary flows within our ecosystem. Likewise, changes in the market represent opportunities that can materialize in the creation of new sources of business leveraged on information and technology.

During the third quarter of 2024, the arrival of new digital competitors (Fintech) such as Revolut stands out, these new participants are introducing innovative products and business strategies that seek to boost competition and improve the supply of financial services to consumers and despite a more challenging scenario for them in terms of availability of venture capital and funding, Despite a more challenging scenario for them in terms of availability of risk capital and funding, a trend that is leading Fintechs to move from a model based on customer growth to profitable businesses.

Colombia continues to present and consolidate itself as an attractive market for the entry of these new emerging players seeking to expand their operations in the region, given that after Brazil, Colombia is the second market with the second highest adoption rate of neobanks, in addition to a regulator that is prone to enabling the opening of the financial system.

From traditional competitors, Davivienda's acquisition of the ePayco payment gateway stands out, seeking to strengthen its value proposition. On the other hand, in its August report, la Superintendencia Financiera de Colombia reported that 12 of the 30 banks in the country, or 40%, are showing losses. However, it is important to highlight that the banking sector is well positioned to face this circumstance, and banks have made advance provisions that allow them to be prepared for more complex scenarios. Likewise, it is expected that given the latest decisions by the Banco de la República to reduce interest rates to 10.25% (September cut) to reactivate credit and boost important economic sectors such as the construction sector, they will permeate the market and become sources of portfolio growth for financial institutions.

IV.MATERIAL CHANGES IN THE INFORMATION REPORTED IN THE CORPORATE GOVERNANCE ANALYSIS CHAPTER OF THE ANNUAL REPORT

The material changes in the information reported in the Corporate Governance chapter of the annual report are hereby presented:

i.Composition and Supporting Committees of the Board of Directors

In accordance with the modifications made to the composition of the Board of Directors, on September 13, 2024, the Financial Superintendency of Colombia (SFC) issued the last possession official notice, confirming the possession of the seven Directors elected by the Extraordinary Shareholders' Meeting held on June 26, 2024.

Therefore, at the meeting held on September 24, the Board of Directors re-elected Luis Fernando Restrepo Echavarría (independent director) as Chairman of the Board of Directors, and appointed Ricardo Jaramillo Mejía (Director of Asset Management) as its Vice-Chairman. It also authorized the formation of Committees, which, except for the Appointment, Compensation and Development Committee, did not present any changes in their composition.

The Appointment, Compensation and Development Committee is composed of the following members:

•Sylvia Escovar Gómez, independent Director.

•Luis Fernando Restrepo Echavarría, independent Director.

•Ricardo Jaramillo Mejía, Director of Asset Management (new member).

Sylvia Escovar Gómez continues as Chairman of the Appointment, Compensation and Development Committee.

In addition, the Board of Directors authorized the creation of the new Technology and Cybersecurity Committee, whose purpose is to support the Board in the strategic direction and oversight of the Bank's technology and cybersecurity matters. The Committee is comprised of:

•Andrés Felipe Mejía Cardona, independent Director.

•Silvina Vatnick, independent Director.

•Arturo Condo Tamayo, independent Director.

•Juan David Escobar Franco, Director of Asset Management.

The Board of Directors elected Silvina Vatnick as Chairman of the Technology and Cybersecurity Committee.

ii.Changes in the Code of Good Governance

In the session held on August 27, 2024, the Board of Directors approved an amendment to the Code of Good Governance, which had the purpose, among others, to:

•In line with Article 39 of the bylaws, it should be noted that the election of members of the Board of Directors must be expressly included in the agenda of the notice of ordinary or extraordinary meetings of Bancolombia, in order to ensure that shareholders have sufficient time to analyze the proposals.

•Include the procedure set forth in Article 47 of the company's bylaws for the nomination of Board of Directors candidates, formation of slates, and prior evaluation by the Corporate Governance Committee.

•Clarify how to proceed in the event of a conflict of interest in accordance with Decree 046 of 2024, the regulations applicable when belonging to a financial conglomerate, and the Company's Bylaws.

•The inclusion of the Technology and Cybersecurity Committee within the Board Support Committees, taking into account its creation.

•The mandatory adherence to the information management regulations by the members of the Board of Directors, in line with Article 36 of the company's bylaws.

•Clarify that at least two members of the Board of Directors must be independent, observing the 25% requirement stipulated in Law 964 of 2005 for issuers.

•In the context of related party transactions, include within the ordinary course of business operations the purchase of movable and immovable property intended for leasing, rental, and use, as well as capital contributions to subsidiary companies.

iii.Changes in the Senior Management

On August 27, the Board of Directors decided that the Vice-Presidency of Strategy and Finance, headed by Mauricio Botero Wolff, will now report to the President's Office and, therefore, become part of Bancolombia's Senior Management.

i.Changes in the Corporate Structure of Group Bancolombia

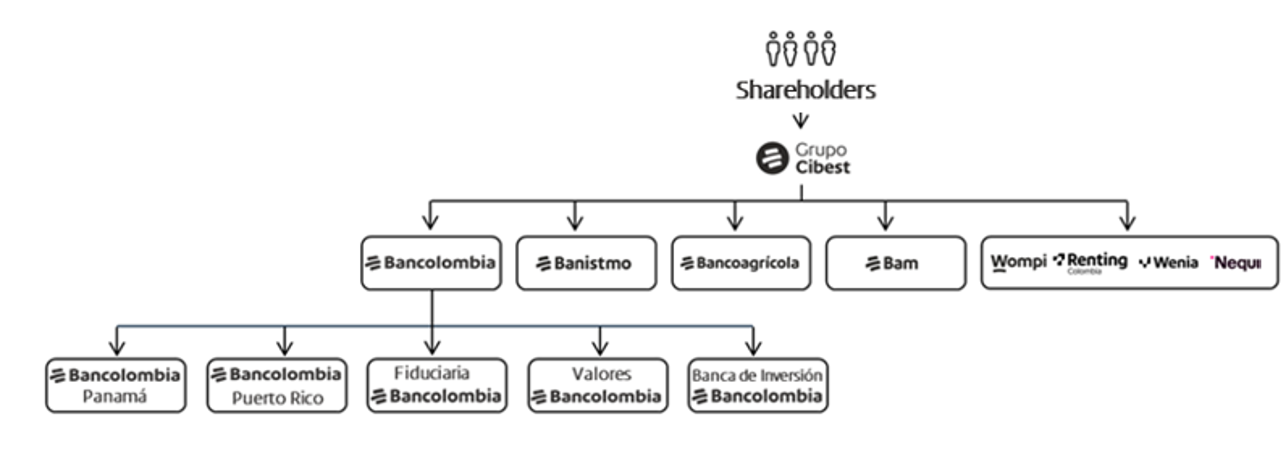

The Board of Directors of Bancolombia authorized its management to advance with the procedures aimed at modifying the corporate structure of Group Bancolombia through the creation of a parent company to be called Grupo Cibest S.A. (“Grupo Cibest”), and the completion of a series of corporate operations to achieve this end (the “Changes in the Corporate Structure”).

The Corporate Structure Changes seek to establish a structure that allows the separation of Bancolombia as a financial entity, on the one hand, and Grupo Cibest as parent company, on the other, to optimize the capital allocation, facilitate the structuring of financial and non-financial businesses, and provide flexibility for corporate development initiatives.

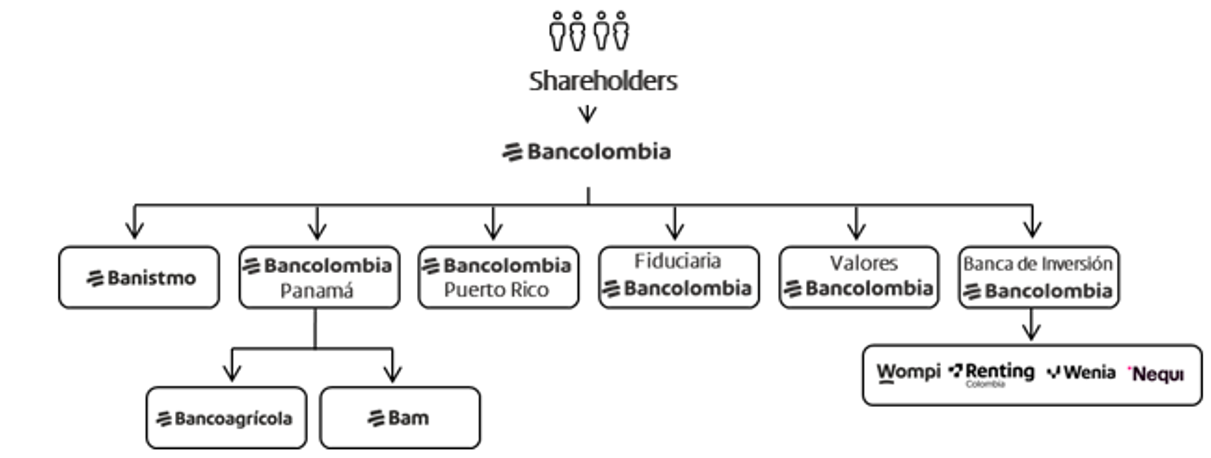

The following chart sets forth a simplified view of the current structure of Grupo Bancolombia:

1This chart is presented for illustrative purposes and is not intended to present the entire structure of Grupo Cibest following the Corporate Structure Changes.

The following chart sets forth a simplified view of the structure following the Corporate Structure Changes1:

The Corporate Structure Changes will be presented, as applicable, for consideration at shareholder meetings of the entities involved, including at an Extraordinary General Shareholders’ Meeting of the common and preferred shareholders of Bancolombia (the “Extraordinary General Shareholders’ Meeting”), once required regulatory authorizations are obtained in Colombia and in other jurisdictions where Bancolombia’s affiliates and subsidiaries operate.

The Changes in the Corporate Structure include the following transactions:

a.The distribution of certain subsidiaries by Bancolombia (Panama) S.A. to Sociedad Beneficiaria BC Panamá S.A.S., a company established by Bancolombia with the sole purpose of being the beneficiary of this distribution and subsequently merged into Bancolombia.

b.The merger of Sociedad Beneficiaria BC Panamá S.A.S into Bancolombia.

c.The distribution of certain assets and subsidiaries of Banca de Inversión Bancolombia S.A. Corporación Financiera to Bancolombia.

d.The distribution of certain assets and subsidiaries of Bancolombia to Grupo Cibest.

Once the Corporate Structure Changes are completed, Grupo Cibest will be the parent company of Bancolombia its affiliates and subsidiaries.

The shareholders of Bancolombia will become shareholders of Grupo Cibest, maintaining the same number of shares and the same percentage investment and under the same terms and conditions they have in Bancolombia at the time the transaction is finalized, which means the transaction will not involve the change in any rights with respect to the common and preferred shares nor any transfer of value to third parties.

Grupo Cibest will issue to the shareholders of Bancolombia the same class of shares (ordinary shares and preferred shares with dividends and no voting rights) with the same rights that those shareholders have in Bancolombia on the date of finalization of the transaction.

Grupo Cibest’s ordinary shares and preferred shares will be listed on the Bolsa de Valores de Colombia – BVC, and Grupo Cibest will maintain an American Depositary Receipt (“ADR”) facility equivalent to Bancolombia’s existing ADR facility, with such ADRs representing interests in Grupo Cibest’s preferred shares and listed on the New York Stock Exchange – NYSE.

Once the Corporate Structure Changes are implemented, Bancolombia will continue to be the issuer of its bonds that are outstanding at the time of the Corporate Structure Changes.

Bancolombia, its affiliates and subsidiaries will continue to offer the same products and services in the same manner as they have been offered to date. Clients will continue to be serviced through the same existing channels, and products will maintain the same terms and conditions, without any change or modification.

The authorization of the Board of Directors includes carrying out all necessary actions to finalize the Corporate Structure Changes, including, but not limited to, those actions aimed at convening the Extraordinary General Shareholders’ Meeting once the required regulatory approvals are obtained.

The information regarding the Corporate Structure Changes will be available at https://www.grupobancolombia.com/relacion-inversionistas/inversionistas/grupo-cibest.

V.MATERIAL CHANGES PRESENTED IN THE FINANCIAL STATEMENTS OF THE ISSUER BETWEEN THE REPORTED QUARTER AND THE DATE OF TRANSMISSION OF THE INFORMATION

Redemption of Bonds maturing in 2025 Bancolombia S.A.

On October 24, 2024, the Bank announced the redemption of bonds maturing in 2025 and 2029; on November 13, 2024, the Bank completed the total redemption of the 3,000% Senior Bonds in circulation maturing in 2025, issued by Bancolombia S.A. (the “2025 Bonds”). The Bank carried out the redemption under the make-whole mechanism (mechanism included in the prospectus of the 2025 Bonds, that allows the total redemption of the 2025 Bonds to be exercised) equivalent to the highest value between (i) the Treasury index (U.S. Treasury 5-year notes) plus 25 basis points accrued and unpaid until the redemption date of the 2025 Bonds and (ii) 100% of the principal of the 2025 Bonds plus the interest accrued and not paid until the redemption date of the 2025 Bonds. The total nominal value of the redemption was USD 212,600.

VI.MATERIAL CHANGES THAT HAVE OCCURRED IN PRACTICES, PROCESSES, POLICIES AND INDICATORS IN RELATION TO SOCIAL AND ENVIRONMENTAL CRITERIA, INCLUDING CLIMATE CRITERIA.

In the third quarter of 2024 there were no material or relevant changes in policies and indicators related to ESG criteria.

VII. GLOSSARY OF TERMS

ADR:American Depositary Shares, or the bank's securities that are listed on the New York Stock Exchange. An ADR represents four preferred shares.

ASG: Environmental, social, and corporate governance, by its initials in Spanish.

Bam: Banco Agromercantil de Guatemala SA.

Bancoagrícola: Banco Agrícola S.A.

“Bancolombia“ or “the Bank”: refers to Bancolombia S.A., a banking institution organized under the laws of the Republic of Colombia, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

IDB: Inter-American Development Bank

CDT: Certificate of Deposit at Term.

COLCAP: reference index of the stock market of the Colombian Stock Exchange.

COP: Colombian pesos.

Dian: Dirección de Impuestos y Aduanas Nacional, tax authority in Colombia.

DJSI: Dow Jones Sustainability Index.

DTF: It is the average interest rate paid by financial institutions for 90-day deposits.

Foreign Banks: refers to Banco Agromercantil de Guatemala S.A. (Bam), a banking institution organized under the laws of the Republic of Guatemala; Banistmo S.A. (Banistmo), a banking institution organized under the laws of the Republic of Panama; and Bancoagrícola S.A. (Bancoagrícola), a banking institution organized under the laws of the Republic of El Salvador.

Foreign Subsidiaries: All foreign subsidiary entities of Bancolombia.

IFC: International Finance Corporation.

LAFT: Money Laundering and Terrorist Financing, by its initials in Spanish.

Nequi: financial platform that accompanies users in their daily lives with financial and non-financial services from third parties. As a 100% digital solution, it complements its offer with functionalities that go beyond saving and managing money.

NYSE: New York Stock Exchange.

Sarlaft: Money Laundering and Terrorist Financing Risk Management System, by its initials in Spanish.

Senior Management: The President and the Vice Presidents who report directly to the President of Bancolombia.

SMMLV: Legal Minimum Monthly Wage in force.

TRM: Representative Market Rate, price of the dollar in the Colombian market, which varies daily.

USD: United States dollars.

UVR: Real Value Units, an indicator tied to the behavior of inflation that is used to calculate the cost of certain housing loans.

UVT: Measure that is used to determine different tax obligations with an equivalent in Colombian pesos.

VIII. ANNEXES

| | | | | | | | | | | | | | |

| | | | |

| Contacts | | | | |

| Mauricio Botero Wolff | Catalina Tobon Rivera | | |

| Financial VP | IR Director | | |

| Tel.: (57 604) 4040858 | Tel: (57 601) 4485950 | | |