| AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 27, 2020 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________to___________

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report___________

For the transition period from .___________ to___________

Commission file number: 001 - 32535

BANCOLOMBIA S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Republic of Colombia

(Jurisdiction of incorporation or organization)

Carrera 48 # 26-85, Avenida Los Industriales

Medellín, Colombia

(Address of principal executive offices)

Alejandro Mejia Jaramillo, Investor Relations Manager

Tel. +574 4041837, e-mail: almejia@bancolombia.com

Carrera 48 # 26-85, Medellín, Colombia

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each Class | Trading Symbol (s) | Name of each exchange on which registered |

| American Depositary Shares | CIB | New York Stock Exchange |

| Preferred Shares | | New York Stock Exchange* |

| | | |

| * | Bancolombia’s preferred shares are not listed for trading directly, but only in connection with its American Depositary Shares, which are evidenced by American Depositary Receipts, each representing four preferred shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not applicable

(Title of Class)

indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the

period covered by the annual report.

| Common Shares | 509,704,584 |

| Preferred Shares | 452,122,416 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 of 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ |

| | | Emerging growth company ☐ |

(Do not check if a smaller reporting company)

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☒

TABLE OF CONTENTS

CERTAIN DEFINED TERMS

Unless otherwise specified or if the context so requires, in this annual report:

“ADSs” refers to the Bank’s American Depositary Shares (one ADS represents four preferred shares).

“Annual Report” refer to this annual report on Form 20-F.

“ATM” refer to automated teller machine.

“BAM” refer to Banco Agromercantil de Guatemala S.A., a banking institution organized under the laws of the Republic of Guatemala, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

“Banagrícola” refer to Banagrícola S.A., a company incorporated in Panama, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

“Banca de Inversión” refer to Banca de Inversión Bancolombia S.A. Corporación Financiera, a Subsidiary of Bancolombia S.A. organized under the laws of the Republic of Colombia that specializes in providing investment banking services.

“Banco Agrícola” refer to Banco Agrícola S.A., a banking institution organized under the laws of the Republic of El Salvador, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

“Bancolombia”, the “Bank”, “us”, “we” or “our” refer to Bancolombia S.A., a banking institution organized under the laws of the Republic of Colombia, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

“Bancolombia Panama” refer to Bancolombia Panamá S.A., a subsidiary of Bancolombia S.A. organized under the laws of the Republic of Panama that provides banking services to non-Panamanian customers.

“Banistmo” refer to Banistmo S.A., a banking institution organized under the laws of the Republic of Panama, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

“Central Bank” refer to the Central Bank of Colombia (“Banco de la República”).

“Colombia” refer to the Republic of Colombia.

“Colombian banking GAAP” refer to generally accepted accounting Principles in Colombia as regulated by Law 1314 of 2009, Decree 1851 of 2013 and as supplemented by the applicable regulations of the SFC, which differs with IFRS in (i) the recognition of impairment for loans; (ii) the classification and subsequent measurement of debt and equity investments, and (iii) the impairment of foreclosed assets. The Consolidated Financial Statements included in this Annual Report are prepared under IFRS as issued by the International Accounting Standard Board.

“Consolidated Financial Statements” refer to the audited consolidated statements of financial position of the Bank as of December 31, 2019 and 2018 and the audited consolidated statements of income, comprehensive income, changes in equity and cash flows for the years ended December 31, 2019, 2018 and 2017 and related notes included in this Annual Report.

“DTF” refer to the “Depósitos a Término Fijo” rate, the weighted average interest rate paid by finance corporations, commercial banks and financing companies in Colombia for time deposits with maturities of 90 days.

“Fiduciaria Bancolombia” refer to Fiduciaria Bancolombia S.A. Sociedad Fiduciaria, a Subsidiary of Bancolombia organized under the laws of Colombia which provides trust and fund management services.

“Grupo Agromercantil” refer to Grupo Agromercantil Holding S.A., a company organized under the laws of the Republic of Panama and the parent company of BAM, and its consolidated subsidiaries, unless the context otherwise requires.

“IFRS” refer to the International Financial Reporting Standards as issued by the International Accounting Standards Board.

“IRS” refer to the U.S. Internal Revenue Service.

“NYSE” refer to the New York Stock Exchange.

“OCI” refers to Other Comprehensive Income.

“peso”, “pesos” or “COP” refer to the lawful currency of Colombia.

“preferred shares” and “common shares” refer to our issued outstanding and fully paid-in preferred and common shares, designated as “acciones con dividendo preferencial sin derecho a voto” and “acciones ordinarias”, respectively.

“Renting Colombia” refer to Renting Colombia S.A.S., a Subsidiary of Bancolombia S.A. organized under the laws of Colombia, which provides operating lease and fleet management services for individuals and companies.

“Representative Market Rate” refer to “Tasa Representativa del Mercado”, the U.S. dollar representative market rate, certified by the SFC. The Representative Market Rate is an economic indicator of the daily exchange rate on the Colombian market spot of currencies. It corresponds to the arithmetical weighted average of the rates for the purchase and sale of currencies by certain financial institutions (including Bancolombia) authorized to engage in foreign exchange transactions in Colombia.

“SEC” refer to the U.S. Securities and Exchange Commission.

“SMEs” refer to Small and Medium Enterprises.

“SMMLV” refer to “Salario Mínimo Mensual Legal Vigente”, the effective legal minimum monthly salary in Colombia. In 2019, the effective legal minimum monthly salary in Colombia was COP $828.116.

“Subsidiaries” refer to entities controlled by Bancolombia S.A. The Bank controls an investee when the investor is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through the Bank’s power.

“Superintendency of Finance” or “SFC” refer to the Colombian Superintendency of Finance (“Superintendencia Financiera de Colombia”), a technical entity under the Ministry of Finance and Public Credit (“Ministerio de Hacienda y Crédito Público”) with functions of inspection, supervision and control over the entities involved in financial activities, capital markets, insurance and any other services related to the management, use or investment of resources collected from the public.

“Superintendency of Industry and Commerce” or “SIC” refer to the Colombian Superintendency of Industry and Commerce (Superintendencia de Industria y Comercio de Colombia), a technical entity under the Ministry of Commerce, Industry and Tourism (Ministerio de Comercio Industria y Turismo) with functions of supervision and regulation of the competition in several industries, including financial institutions.

“U.S.” or “United States” refer to the United States of America.

“U.S. dollar”, “USD”, and “US$” refer to the lawful currency of the United States.

“UVR” refer to Unidades de Valor Real, a Colombian inflation-adjusted monetary index calculated by the board of directors of the Central Bank and generally used for pricing home-mortgage loans.

“Valores Bancolombia” refer to Valores Bancolombia S.A. Comisionista de Bolsa, a Subsidiary of Bancolombia S.A. organized under the laws of the Republic of Colombia that provides brokerage and asset management services.

Our fiscal year ends on December 31, and references in this annual report to any specific fiscal year are to the 12-month period ended December 31 of such year.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains statements which may constitute forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts but instead represent only the Bank’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside the Bank’s control. The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “predict”, “target”, “forecast”, “guideline”, “should”, “project” and similar words and expressions are intended to identify forward-looking statements. It is possible that the Bank’s actual results may differ, possibly materially, from the anticipated results indicated in or implied by these forward-looking statements.

Information regarding important factors that could cause actual results to differ, perhaps materially, from those in the Bank’s forward-looking statements appear in a number of places in this Annual Report, principally in Item 3. “Key Information – D. Risk Factors” and Item 5. “Operating and Financial Review and Prospects”. These factors include, but are not limited to: (i) changes in general economic, business, political, social, fiscal or other conditions in Colombia, or in any of the other countries where the Bank operates; (ii) changes in capital markets or in markets in general that may affect policies or attitudes towards lending; (iii) unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms; (iv) inflation, changes in foreign exchange rates and/or interest rates; (v) sovereign risks; (vi) liquidity risks; (vii) increases in delinquencies by the Bank’s borrowers; (viii) lack of acceptance of new products or services by the Bank’s targeted customers; (ix) competition in the banking, financial services, credit card services, insurance, asset management, remittances, business and other industries in which the Bank operates; (x) adverse determination of legal or regulatory disputes or proceedings; (xi) changes in official regulations and the Colombian government’s banking policy as well as changes in laws, regulations or policies in other jurisdictions in which the Bank does business and (xii) the negative impact on operations and financial results of the Bank resulting from widespread health emergencies, infectious diseases or pandemics, such as COVID-19.

Forward-looking statements speak only as of the date they are made and are subject to change, and the Bank does not intend, and does not assume any obligation, to update these forward-looking statements in light of new information or future events arising after the date of this Annual Report.

PRESENTATION OF CERTAIN FINANCIAL AND OTHER INFORMATION

Accounting Principles

The audited consolidated statements of financial position of the Bank as of December 31, 2019 and 2018 and the audited consolidated statements of income, of comprehensive income, changes in equity and cash flows for the years ended December 31, 2019, 2018 and 2017 and related notes (the “Consolidated Financial Statements”) included in this Annual Report were prepared in accordance with IFRS as issued by the International Accounting Standards Board (“IASB”) and the related interpretations issued by the IFRS Interpretations Committee (“IFRS IC”). All data included in this report has been prepared in accordance with IFRS as issued by the IASB, except for the data included in Item 4. B.7 Competition, which has been prepared in accordance with the local GAAP of each subsidiary.

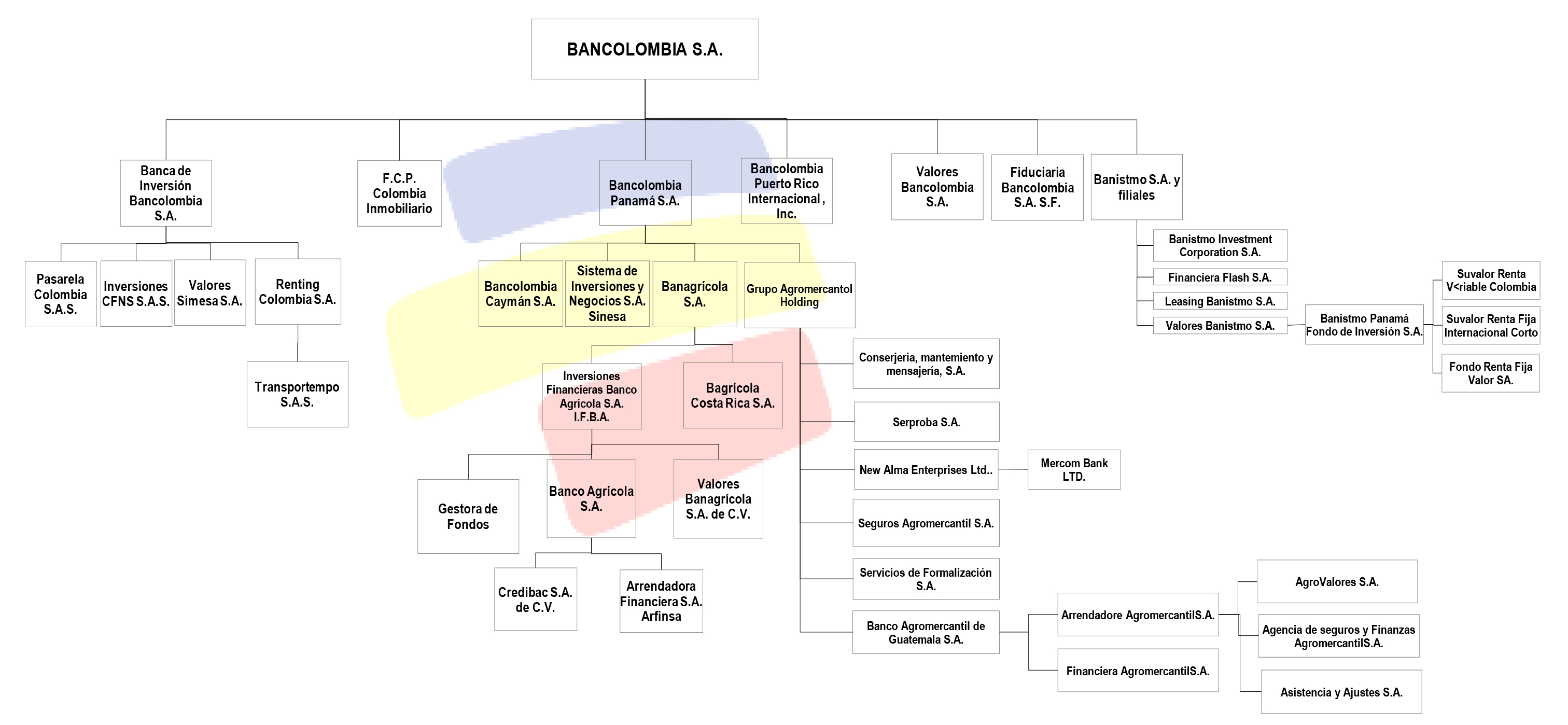

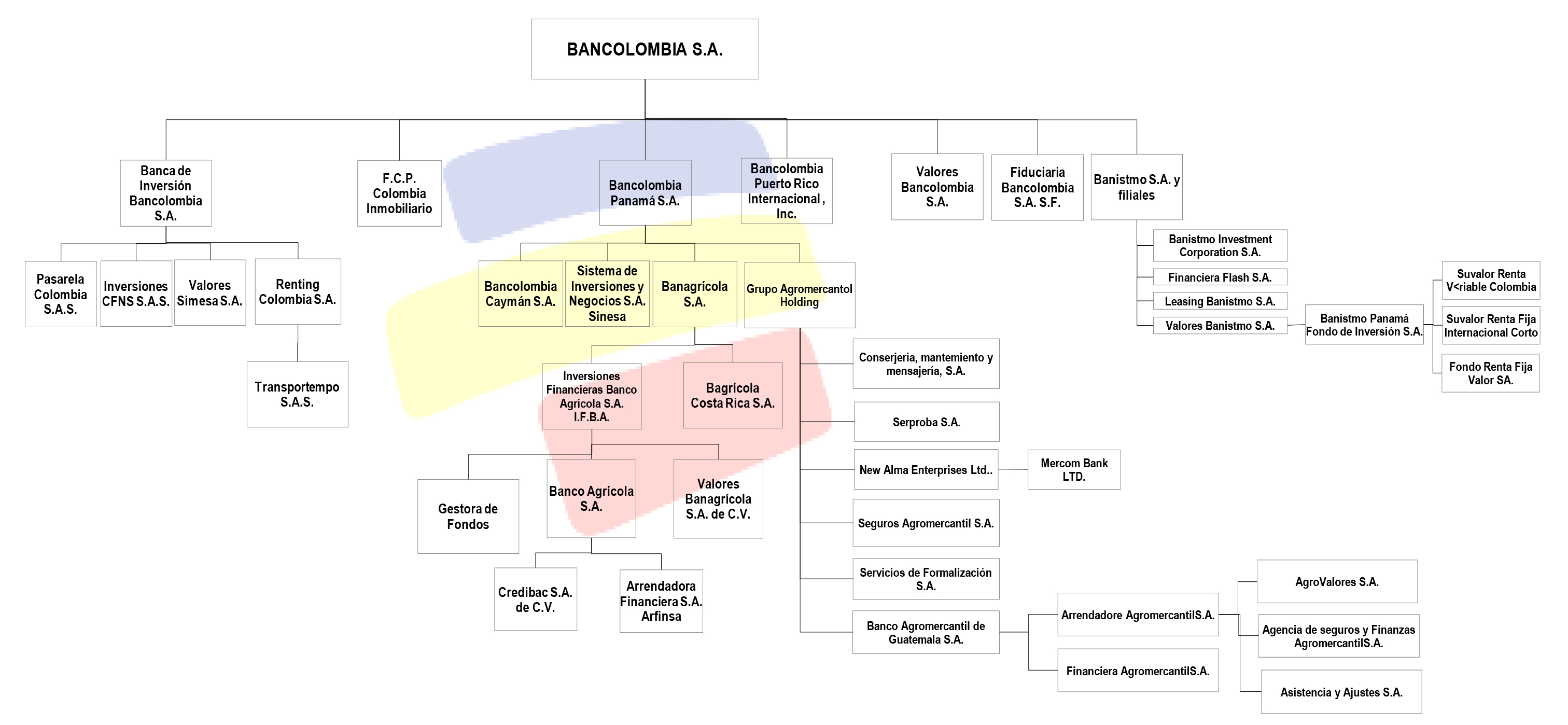

The Consolidated Financial Statements include entities which the Bank controls, directly or indirectly. See Item 4. “Information on the Company – C. Organizational Structure” for an organizational chart depicting Bancolombia and its subsidiaries.

Currencies

The Consolidated Financial Statements are presented in Colombian pesos, which is the functional currency for Bancolombia S.A., and the presentation currency for the Consolidated Financial Statements. The Consolidated Financial Statements as of December 31, 2019 and 2018 and for the three fiscal years ended December 31, 2019, 2018, and 2017 contained in this Annual Report are expressed in millions of pesos.

This Annual Report translates certain pesos amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such peso amounts have been translated at the rate of COP 3,277.14 per USD 1.00, which corresponds to the Representative Market Rate calculated on December 31, 2019. The SFC also calculates and certifies the average Representative Market Rate for each month for purposes of preparing financial statements and converting amounts in foreign currency to pesos. Such conversion should not be construed as a representation that the peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On April 27, 2020, the Representative Market Rate was COP 4,039.87 per USD 1.00.

Rounding Comparability of Data

Certain monetary amounts, percentages and other figures included in this Annual Report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

The Bank maintains an internet site at http://www.grupobancolombia.com/. In addition, certain of the Bank’s Subsidiaries referred to in this Annual Report maintain separate internet sites. For example, Banco Agrícola, Banistmo and Banco Agromercantil de Guatemala maintain internet sites at http://www.bancoagricola.com/, http://www.banistmo.com/, and https://www.bam.com.gt/ respectively. Information included on or accessible through Bancolombia’s internet site or the internet site of any of the Subsidiaries of the Bank is not incorporated into this Annual Report or the fili. All references in this Annual Report to these and other internet sites are inactive textual references to these URLs, or “uniform resource locators”, and are for your informational reference only.

PART I

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

A. | SELECTED FINANCIAL DATA |

The selected consolidated statement of financial position data as of December 31, 2019 and 2018, and the selected consolidated statement of income data for each of the periods ended December 31, 2019, 2018 and 2017, set forth below have been derived from the Consolidated Financial Statements under IFRS as issued by the IASB included in this Annual Report, except for the figures translated to U.S. dollars, which are presented for the convenience of the reader.

The selected consolidated statement of financial position data as of December 31, 2016 and 2015 have been derived from audited consolidated financial statements under IFRS as issued by IASB previously filed with the SEC as part of the Bank’s Annual Report on Form 20-F for the years ended December 31, 2016 and 2015.

The selected consolidated financial data should be read in conjunction with, and is qualified in its entirety by reference to the Consolidated Financial Statements, including the notes thereto, the audit reports of the Bank’s independent registered public accounting firms and the previously consolidated statement filed with the SEC as part of the Bank’s Annual Report on Form 20-F for the years ended December 31, 2017, 2016 and 2015.

The Consolidated Financial Statements of the Bank as of and for the years ended December 31, 2019 and 2018 were audited by PricewaterhouseCoopers Ltda., while the Consolidated Financial Statements of the Bank for the years ended December 31, 2017 and 2016 were audited by Deloitte and Touche Ltda. The Consolidated Financial Statements of the Bank as of and for the year ended December 31, 2015 were audited by PricewaterhouseCoopers Ltda.

| | As of and for the year ended December 31, |

| | 2019(1) | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| CONSOLIDATED STATEMENT OF INCOME DATA: | | | | | | | | | | | | |

| Total interest and valuation on financial instruments | USD | 5,303,614 | COP | 17,380,684 | COP | 16,116,500 | COP | 16,696,393 | COP | 15,748,805 | COP | 11,269,644 |

| Interest expenses | | (1,885,728) | | (6,179,794) | | (5,670,216) | | (6,232,986) | | (6,053,100) | | (4,037,941) |

| Net interest margin and valuation income on financial instruments before impairment on loans and financial leases, and other financial instruments and off balance sheet credit instruments | | 3,417,886 | | 11,200,890 | | 10,446,284 | | 10,463,407 | | 9,695,705 | | 7,231,703 |

| Credit impairment charges on loans and advances and financial leases, net(2) | | (1,032,968) | | (3,385,181) | | (3,851,625) | | (3,468,699) | | (2,643,710) | | (1,667,680) |

| Credit impairment recoveries (charges) on off balance sheet credit instruments | | (7,993) | | (26,195) | | 5,668 | | 7,082 | | (87,442) | | (7,421) |

| Allowances for credit losses on debt investments(2) | | 78 | | 255 | | 2,885 | | - | | - | | - |

| Net interest margin and valuation income on financial instruments after impairment on loans and financial leases and off balance sheet credit instruments | | 2,377,003 | | 7,789,769 | | 6,603,212 | | 7,001,790 | | 6,964,553 | | 5,556,602 |

| Total other operating income(3) | | 1,507,894 | | 4,941,579 | | 4,495,556 | | 4,217,039 | | 3,974,310 | | 3,577,320 |

| Total operating expenses | | (2,518,605) | | (8,253,817) | | (7,482,898) | | (7,226,058) | | (6,970,581) | | (5,898,287) |

| Profit before tax | | 1,366,292 | | 4,477,531 | | 3,615,870 | | 3,992,771 | | 3,968,282 | | 3,235,635 |

| Income tax | | (385,386) | | (1,262,964) | | (829,435) | | (1,238,598) | | (1,176,832) | | (649,250) |

| Profit for the year from continued operations | | 980,906 | | 3,214,567 | | 2,786,435 | | 2,754,173 | | 2,791,450 | | 2,586,385 |

| Net income from discontinued operations | | - | | - | | - | | - | | 163,497 | | 22,513 |

| Net income | | 980,906 | | 3,214,567 | | 2,786,435 | | 2,754,173 | | 2,954,947 | | 2,608,898 |

| Net income attributable to equity holders of the parent company | USD | 951,241 | COP | 3,117,351 | COP | 2,658,864 | COP | 2,615,000 | COP | 2,865,328 | COP | 2,518,890 |

| Non-controlling interest | | 29,665 | | 97,216 | | 127,571 | | 139,173 | | 89,619 | | 90,008 |

| Weighted average of Preferred and Common Shares outstanding(4) | | | | 961,827,000 | | 961,827,000 | | 961,827,000 | | 961,827,000 | | 961,827,000 |

| Basic and diluted earnings per share to common shareholders(4) | | 1.01 | | 3,301 | | 2,825 | | 2,780 | | 3,040 | | 2,680 |

| From continuing operations | | 1.01 | | 3,301 | | 2,825 | | 2,780 | | 2,870 | | 2,656 |

| From discontinued operations | | - | | - | | - | | - | | 170 | | 24 |

Basic and diluted earnings per ADS(4) | | 4.03 | | 13,204 | | 11,300 | | 11,120 | | 12,160 | | 10,720 |

| From continuing operations | | 4.03 | | 13,204 | | 11,300 | | 11,120 | | 11,480 | | 10,624 |

| From discontinued operations | | | | - | | - | | - | | 680 | | 96 |

| Cash dividends declared per share | | | | 1,638 | | 1,092 | | 1,020 | | 950 | | 888 |

| Cash dividends declared per share (stated in USD) | | | | 0.50 | | 0.34 | | 0.34 | | 0.32 | | 0.28 |

| Cash dividends declared per ADS | | | | 6,552 | | 4,368 | | 4,080 | | 3,800 | | 3,552 |

| Cash dividends declared per ADS (stated in USD) | | | | 2.00 | | 1.34 | | 1.37 | | 1.27 | | 1.13 |

| (1) | Translated for convenience only using the Representative Market Rate as computed and certified by the Superintendency of Finance on December 31, 2019 of 3,277.14 per USD 1.00. |

| (2) | IFRS 9 (2014) set significant changes in the assessment of the impairment of the value of financial instruments and therefore their associated risk, going from an incurred loss model to one of expected credit loss. As of December 31, 2019 and 2018, the Bank recognized credit impairment charges based on IFRS 9 model. The allowances for the years ended December 31, 2017, 2016, and 2015 were computed under IAS 39. Accordingly, those amounts are not comparable to the amounts as of December 31, 2018 and 2019. |

| (3) | Includes total fees and commissions net, other operating income and dividends received, and share of profits of equity method investees. See consolidated statement of income to the Consolidated Financial Statements, and for the year ended as of December 31, 2015, see annual reports previously filed with the SEC for the years ended December 31, 2016 and 2015. |

| (4) | The weighted average of preferred and common shares outstanding for the fiscal years ended December 31, 2019, 2018, 2017, 2016 and 2015 are 452,122,416 preferred shares and 509,704,584 common shares. |

| | | | | For the year ended December 31, | | |

| | | 2019(1) | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| SELECTED CONSOLIDATED STATEMENT OF FINANCIAL POSITION DATA: | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | |

| Cash and cash equivalents | USD | 7,243,524 | COP | 23,738,042 | COP | 18,730,810 | COP | 18,165,644 | COP | 20,460,245 | COP | 18,597,614 |

| Financial assets Investments | | 5,133,364 | | 16,822,754 | | 17,361,475 | | 16,377,253 | | 13,060,653 | | 14,277,824 |

| Derivative financial instruments | | 580,676 | | 1,902,955 | | 1,843,708 | | 1,134,372 | | 1,677,970 | | 2,382,168 |

| Loans and advances to customers and financial Institutions | | 55,622,507 | | 182,282,743 | | 173,819,116 | | 160,468,094 | | 151,747,486 | | 145,620,639 |

| Allowance for loans and advances and lease losses(2) | | (3,335,041) | | (10,929,395) | | (10,235,831) | | (8,223,103) | | (6,621,911) | | (5,248,755) |

| Assets held for sale and inventories, net | | 158,293 | | 518,749 | | 636,028 | | 377,003 | | 273,187 | | 1,950,808 |

| Investment in associates and joint ventures | | 722,507 | | 2,367,757 | | 2,149,579 | | 1,565,059 | | 1,298,246 | | 546,549 |

| Investment property | | 608,141 | | 1,992,964 | | 1,732,873 | | 1,657,409 | | 1,581,689 | | 1,505,046 |

| Premises and equipment, net(3) | | 1,168,050 | | 3,827,865 | | 3,368,647 | | 3,127,405 | | 3,115,697 | | 3,052,266 |

| Right of use assets | | 516,339 | | 1,692,116 | | | | | | | | |

| Goodwill and Intangible assets, net | | 2,207,203 | | 7,233,312 | | 7,201,855 | | 6,631,424 | | 6,694,037 | | 7,092,255 |

| Deferred tax, net | | 122,363 | | 401,002 | | 271,177 | | 148,614 | | 222,862 | | 170,482 |

| Other assets, net | | 1,292,973 | | 4,237,249 | | 3,197,045 | | 2,479,037 | | 2,750,883 | | 3,025,971 |

| Total assets | USD | 72,040,899 | COP | 236,088,113 | COP | 220,076,482 | COP | 203,908,211 | COP | 196,261,044 | COP | 192,972,867 |

| Liabilities and stockholders’ equity: Liabilities and equity | | | | | | | | | | | | |

| Deposits by customers | | 47,970,277 | | 157,205,312 | | 142,128,471 | | 131,959,215 | | 124,624,011 | | 121,802,028 |

| Borrowings from other financial institutions | | 4,259,611 | | 13,959,343 | | 16,337,964 | | 13,822,152 | | 18,905,843 | | 19,721,184 |

| Debt instruments in issue | | 6,078,933 | | 19,921,515 | | 20,287,233 | | 19,648,714 | | 18,704,809 | | 19,435,865 |

| Lease liabilities(4) | | 558,897 | | 1,831,585 | | - | | - | | - | | - |

| Other liabilities(5) | | 4,383,316 | | 14,364,739 | | 14,667,589 | | 14,048,580 | | 11,549,401 | | 11,605,871 |

| Total equity | | 8,789,865 | | 28,805,619 | | 26,655,225 | | 24,429,550 | | 22,476,980 | | 20,407,919 |

| Total liabilities and equity | USD | 72,040,899 | COP | 236,088,113 | COP | 220,076,482 | COP | 203,908,211 | COP | 196,261,044 | COP | 192,972,867 |

| (1) | Translated for convenience only using the representative market rate as computed and certified by the Superintendency of Finance of COP 3,277.14 per U.S. 1.00 on December 31, 2019. |

| (2) | IFRS 9 (2014) set significant changes in the assessment of the impairment of the value of financial instruments and therefore their associated risk, going from an incurred loss model to one of expected credit loss. As of December 31, 2019 and 2018, the Bank recognized credit impairment charges based on IFRS 9 model. The allowances for the years ended December 31, 2017, 2016, and 2015 were computed under IAS 39. Accordingly, those amounts are not comparable to the amount as of December 31, 2018 and 2019. |

| (3) | The Bank previously classified land and buildings that were acquired through foreclosure of loans with net carrying amount of 189,296 as of December 31, 2015 in premises and equipment. As of December 31, 2016, and 2015, such assets were reclassified to other assets as they are intended for immediate sale or disposition. |

| (4) | As of January 1, 2019 the Bank adopted IFRS 16 using the modified retrospective adoption method, in which the right-of-use assets are measured as if IFRS 16 had always been applied, using the lessee’s incremental borrowing rate known at the date of transition. See Note 7 to the Consolidated Financial Statements, Leases. |

| (5) | Includes interbank deposits, repurchase agreements and other similar secured borrowing, liabilities relating to assets held for sale, derivative financial instruments, preferred shares, current tax, deferred tax, net, employees benefit plans and other liabilities See consolidated statement of financial position to the Consolidated Financial Statements. |

See ― “Item 8. Financial Information – A. Consolidated Financial Statements and Other Financial Information –A.3. Dividend Policy”, for information about the dividends declared per share in both pesos and U.S. dollars during the fiscal years ended December 31, 2019, 2018, 2017, 2016 and 2015.

SELECTED RATIOS

| | | As of and for the year ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | Percentages, except for operating data | |

| SELECTED RATIOS:(1) | | | | | | | | | | | | | | | | | | | | |

| Profitability ratios: | | | | | | | | | | | | | | | | | | | | |

| Net interest and valuation margin from continuing operations(2) | | | 5.67 | | | | 5.80 | | | | 6.08 | | | | 5.96 | | | | 5.25 | |

| Return on average total assets from continuing operations(3) | | | 1.35 | | | | 1.28 | | | | 1.30 | | | | 1.49 | | | | 1.53 | |

| Return on average stockholders‘ equity attributable to the owners of the parent company(4) | | | 12.09 | | | | 11.50 | | | | 11.99 | | | | 14.52 | | | | 13.62 | |

| Efficiency ratio: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses to net operating income from continuing operations | | | 51.13 | | | | 50.08 | | | | 49.22 | | | | 51.02 | | | | 54.57 | |

| Operating expenses to average total assets from continuing operations | | | 3.57 | | | | 3.62 | | | | 3.60 | | | | 3.64 | | | | 3.62 | |

| Operating expenses to productive assets from continuing operations | | | 4.18 | | | | 4.16 | | | | 4.20 | | | | 4.29 | | | | 4.28 | |

| Capital ratios: | | | | | | | | | | | | | | | | | | | | |

| Technical capital to risk weighted assets(5)(6) | | | 12.82 | | | | 13.47 | | | | 14.18 | | | | 13.26 | | | | 12.46 | |

| Credit quality data: | | | | | | | | | | | | | | | | | | | | |

| Past due loans to loans principal(7) | | | 4.27 | | | | 4.33 | | | | 4.49 | | | | 3.31 | | | | 2.98 | |

| Allowances for loan and lease losses to past due loans principal | | | 133.94 | | | | 128.21 | | | | 107.52 | | | | 125.90 | | | | 115.16 | |

| Allowance for loan and lease losses as a percentage of total loans principal | | | 5.71 | | | | 5.55 | | | | 4.83 | | | | 4.17 | | | | 3.43 | |

| Operational data (in units): | | | | | | | | | | | | | | | | | | | | |

| Number of branches(8) | | | 1,083 | | | | 1,113 | | | | 1,153 | | | | 1,247 | | | | 1,274 | |

| Number of employees(9) | | | 31,075 | | | | 31,040 | | | | 31,061 | | | | 34,567 | | | | 34,392 | |

| (1) | Average balances used to calculate the ratios have been calculated as follows: for eah year presented, for each month, the actual month-end balances were established. The average consolidated balance for such periods is the average of such month-end balances. These averages are calculated using 13 month-end balances. |

| (2) | Net interest and valuation on financial instruments income divided by average interest-earning assets. |

| (3) | Net income attributable to equity holders of the Parent Company divided by average total assets. |

| (4) | Net income attributable to equity holders of the Parent Company divided by average stockholders’ equity attributable to the owners of the parent company. |

| (5) | For an explanation of risk-weighted assets and Technical Capital, see Item 4. “Information on the Company – B. Business Overview – B.8 –Supervision and Regulation” and Item 5 “Operating and Financial Review and Prospects - B. Liquidity and Capital Resources – B.1. Liquidity and Funding - Capital Adequacy". |

| (6) | The Bank’s consolidated capital adequacy was computed considering balance accounts under IFRS for each year presented. |

| (7) | Loans that are past due more than 30 days to loans principal. |

| (8) | Number of branches includes branches of the Bank’s Subsidiaries. For some subsidiaries, the central office is considered a branch. Representative offices are included. |

| (9) | The number of employees includes employees of the Bank’s consolidated Subsidiaries. For the year 2015 Compañía de Financiamiento Tuya S.A had 3,020 employees. For the years 2016, 2017, 2018 and 2019, Tuya S.A. Compañía de Financiamiento is classified as an investment in a joint venture in the Bank’s consolidated financial statements. |

Exchange Rates

On March 31, 2020, the Representative Market Rate was COP 4,054.54 per USD 1.00. The Federal Reserve Bank of New York does not report a rate for pesos; the SFC calculates the Representative Market Rate based on the weighted average of the buy/sell foreign exchange rates quoted daily by certain financial institutions, including Bancolombia, for the purchase and sale of U.S. dollars.

The following table sets forth the low and high peso per U.S. dollar exchange rates and the peso/U.S. dollar representative market rate on the last day of the month, for each of the last six months:

| Recent exchange rates of pesos per U.S. dollars |

| Month | Low | High | Period-End |

| March 2020 | 3,455.56 | 4,153.91 | 4,054.54 |

| February 2020 | 3,355.44 | 3,539.86 | 3,539.86 |

| January 2020 | 3,253.89 | 3,423.24 | 3,423.24 |

| December 2019 | 3,277.14 | 3,508.39 | 3,277.14 |

| November 2019 | 3,318.47 | 3,522.48 | 3,522.48 |

| October 2019 | 3,380.90 | 3,497.34 | 3,383.29 |

The following table sets forth the peso/U.S. dollar representative market rate on the last day of the year and the average peso/U.S. dollar representative market rate (calculated by using the average of the Representative Market Rates on the last day of each month during the year) for each of the five most recent financial years.

| Representative Market Rate |

| Period | Period-End | Average |

| | Peso/USD 1.00 | |

| 2019 | 3,277.14 | 3,297.01 |

| 2018 | 3,249.75 | 2,977.54 |

| 2017 | 2,984.00 | 2,963.13 |

| 2016 | 3,000.71 | 3,039.23 |

| 2015 | 3,149.47 | 2,773.43 |

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

Investors should consider the following risks and uncertainties, and the other factors presented in this Annual Report. In addition, the information referred to below, as well as all other information presented in this Annual Report, should be considered by investors when reviewing any forward-looking statements contained in this Annual Report, in any document incorporated by reference in this Annual Report, in any of the Bank’s future public filings or press releases, or in any future oral statements made by the Bank or any of its officers or other persons acting on its behalf. If any of the following risks occur, the Bank’s business, results of operations and financial condition, its ability to raise capital and its ability to access funding could be materially and adversely affected. These risk factors should not be considered a complete list of potential risks that may affect Bancolombia.

Risk Factors Relating to Colombia and Other Countries Where the Bank Operates.

The ongoing pandemic may adversely affect the Bank´s business and financial results.

The ongoing COVID-19 pandemic may impact our ability to provide services in the ordinary manner due to precautions and health and safety measures instated to avoid the expansion of illnesses. These measures, as well as others implemented by governmental authorities, may have a negative effect on our business operations and financial condition. For more information see “Item 4. Information on the Company – B. Business Overview – B.10. Covid-19 Considerations”.

We implemented procedures to allow most of our staff to work remotely in the geographies were the Bank operates. These procedures may result in incremental security, cybersecurity and operational risks, as well as increased periods of service unavailability. Although part of our physical branches remain open to the public, as required by law, the service hours, number of branches, and number of staff has been limited and, as a result, our customers will migrate from physical service channels to telephone or digital channels, which may lead to network congestions and result in longer customer waiting times.

COVID-19 may significantly impact macro-economic variables in the countries where we operate, which might adversely affect our results. Moreover, we are exposed to the performance of borrowers conducting business in many industries and commercial activities, some of which depend on the performance of the global economy, which will likely emerge in distress from these events.

The current situation associated to the spread of COVID-19 has caused worldwide business and trade disruption. As a result, the banking sector in general, including us, might have lower liquidity levels. In addition, further Expected Credit Losses (“ECLs”) could arise from other parts of our business impacted by the disruption to global supply chains, and through the impact that COVID-19 is having more broadly on economic growth globally. If any such events materialize, it could have a material adverse effect on our business, financial condition, results of operations and prospects.

The general uncertainty regarding the pandemic and other global events such as the performance of the oil prices, has resulted in high volatility on the markets and exchange rates, which has affected and may continue to affect our client’s investment portfolios and foreign exchange exposures, and result in a decrease of assets under management in our wealth management business and an in an increase in default rates. Furthermore, prolonged volatility may have a negative impact on the Bank´s proprietary trading business and on the valuation of our portfolio.

Additionally, our business depends upon, among other things, on the willingness and ability of our customers in multiple sectors of the economy to conduct banking and other financial transactions. These customers may experience a significant economic impact from these events which may result in a lower demand for loans, a decrease in savings and investments, and an inability to perform on their obligations under current loans.

The effects resulting from COVID-19 may have an adverse effect on our operations and, given the uncertainty around the extent and timing of the future spread of COVID-19 and the imposition or relaxation of, protective measures, as of the date of this annual report it is not possible to reasonably estimate at the time the impact to our results of operations, cash flows or financial condition. The risks related to COVID-19 and its impacts are being constantly monitored by our Senior Management and Board of Directors. For more information see “Item 4. Information on the Company - B. Business Overview – B.10. Covid-19 Considerations”.

Changes in economic and political conditions in Colombia, Panama, El Salvador and Guatemala or in other countries where the Bank operates may adversely affect the Bank’s financial condition and results of operations.

The Bank’s financial condition, results of operations and asset quality are significantly dependent on the macroeconomic and political conditions prevailing in Colombia, Panama, El Salvador, Guatemala and the other jurisdictions where the Bank operates. Accordingly, decreases in the growth rate, periods of negative growth, increases in inflation, changes in policy, or future judicial interpretations of policies involving exchange controls and other matters such as currency depreciation, inflation, interest rates, taxation, banking laws and regulations and other political or economic developments in such jurisdictions may affect the overall business environment and may in turn negatively affect the Bank’s financial condition and results of operations.

In particular, the governments of Colombia, Panama, El Salvador and Guatemala have historically exercised substantial influence on their economies, and they are likely to continue to implement policies that will have an important impact on the business and results of operations of the entities in such countries (including the Bank), market conditions and prices and rates of return on securities of local issuers (including the Bank’s securities). Potential changes in laws, public policies and regulations may cause instability and volatility in Colombia, Panama, El Salvador and Guatemala, and their respective markets. Future developments in government policies could negatively affect the Bank’s business and financial condition and the market value of its securities.

Colombia and Panama currently have investment grade credit ratings from international rating agencies, El Salvador and Guatemala do not. As of the date of this Annual Report, El Salvador has a long-term debt rating B- from Fitch, B3 from Moody’s, and B- by S&P. Guatemala has ratings of BB from Fitch, Ba1 from Moody’s and BB- S&P. Downgrades in the ratings of either country, or the failure of Colombia or Panama to maintain investment grade credit ratings, could increase the Bank’s funding costs and adversely affect our results of operation and financial condition.

The economies of the countries in which the Bank operates are vulnerable to external effects that could be caused by significant economic difficulties experienced by their major regional trading partners or by more general contagion effects, which could have a material adverse effect on economic growth in these countries and their ability to service their public debt.

A significant decline in economic growth or a sustained economic downturn of any of Colombia, Panama, El Salvador or Guatemala’s major trading partners (i.e., the European Union, the United States, China and other Latin American countries for Colombia and the United States and European Union for Panama, Guatemala and El Salvador) could have a material adverse impact on Colombia, Panama, El Salvador and Guatemala’s balance of trade and remittances inflows, resulting in lower economic growth.

Deterioration in the economic and political situation in neighbouring countries could adversely affect the economy and cause instability in Colombia, Panama, El Salvador and Guatemala by disrupting their diplomatic or commercial relationships with neighboring countries. Any future tensions may cause political and economic uncertainty, instability, market volatility, low confidence levels and higher risk aversion by investors and market participants that may negatively affect economic activity in any of those jurisdictions.

Events occurring in a market where we do not operate may cause international investors to have an increased risk perception of an entire region or class of investment, which could in turn negatively affect market prices and liquidity of securities issued or owned by the Bank.

Any additional taxes resulting from changes to tax regulations or the interpretation thereof in Colombia, Panama, El Salvador, Guatemala or other countries in where the Bank operates, could adversely affect the Bank’s consolidated results.

Uncertainty relating to tax legislation poses a constant risk to us. Changes in legislation, regulation and jurisprudence can affect tax burdens by increasing tax rates and fees, creating new taxes, limiting deductions and exemptions, and eliminating incentives and non-taxed income. Notably, the Colombian and Salvadorian governments have significant fiscal deficits that may result in future tax increases. Moreover, in Colombia, the tax reform of 2018 resulted in a tax burden that is higher on the banking industry than on other taxpayers and, therefore, we can give no assurance that additional differential treatment will not be imposed in the future. On October 16, 2019, the Colombian Constitutional Court declared the tax reform of 2018 unconstitutional with effect as of January 1, 2020. Consequently, on October 22, 2019, the Colombian government presented to Congress a new tax reform bill to replace the 2018 reform which was signed into law on December 27, 2019. The new tax reform is similar to the 2018 tax reform (except for issues that were challenged in 2019) but does increase the surcharge for financial entities in 4%, from 33% to 37% in 2020. The surcharge for years 2021 and 2022 remains at 3% as initially intended in the 2018 tax reform. Higher taxes such as the surcharge could negatively affect our results of operations and cash flow. In addition, national or local taxing authorities may not interpret tax regulations in the same way as we do, even though the Bank does not normally adopt aggressive positions on tax law interpretation. Differing interpretations could result in future tax litigation and associated costs.

Exchange rate fluctuations may adversely affect the Colombian economy, the market price of the Bank’s ADSs, and the dividends payable to holders of the Bank’s ADSs.

Colombia has adopted a floating exchange rate system. The Central Bank maintains the power to intervene in the exchange market in order to consolidate or dispose of international reserves, and to control any volatility in the exchange rate. From time to time, including during 2019, there have been significant fluctuations in the exchange rate between the Colombian peso and the U.S. dollar. Unforeseen events in the international markets, fluctuations in interest rates, volatility of the oil price in the international markets, or changes in capital flows, may cause exchange rate instability that could generate sharp movements in the value of the peso. Because a portion of our assets and liabilities are denominated in, or indexed to, foreign currencies, especially the U.S. dollar, sharp movements in exchange rates may negatively impact our results. In addition, exchange rate fluctuations may adversely impact the value of dividends paid to holders of our ADSs as well as the market price and liquidity of ADSs.

Colombia has experienced several periods of violence and instability that could affect the economy and the Bank.

Colombia has experienced periods of criminal violence over the past four decades, primarily due to the activities of guerilla groups and drug cartels. Despite the peace treaty between the Colombian government and the Revolutionary Armed Forces of Colombia (“Fuerzas Armadas Revolucionarias de Colombia orFARC”), a lasting decrease in violence or drug-related crime in Colombia or the successful integration of former guerilla members into Colombian society, may not be achieved. In 2018, the Colombian government suspended the peace negotiations with the National Liberation Army (“Ejército de Liberación Nacional”or “ELN”) and in 2019, a minority group of dissidents within FARC announced their return to illegal activities. An escalation of violence or drug-related crime may have a negative impact on the Colombian economy and on us.

Allegations of corruption against the government, politicians and private industry in the countries where we operate could create economic and political uncertainty and could expose us to additional credit risk.

Allegations of corruption against the Colombian government, politicians and private industry in the countries where we operate could create economic and political uncertainty specially, if the investigations triggered by these cases reach conviction or result in further allegations or findings of illicit conduct committed by the accused parties. Furthermore, proven or alleged wrongdoings could have adverse effects on the political and economic stability in such countries. These adverse political and economic effects may negatively impact our business, including by depressing business volumes, reducing our ability to recover amounts we have loaned to persons or projects involved in illicit or allegedly illicit conduct and/or harming our reputation.

Risk Factors relating to the Bank’s Business and the Banking Industry

Our financial results may be negatively affected by changes to accounting standards.

We report our results and financial position in accordance with IFRS as issued by the IASB. Changes to IFRS or interpretations thereof may cause our future reported results and financial position to differ from current expectations. Such changes may also affect our regulatory capital and financial ratios. We monitor potential accounting changes and when possible, we determine their potential impact and disclose significant future changes in our financial statements that we expect as a result of those changes. Currently, there are not a number of issued but not yet effective IFRS changes, that could be expected to impact our reported results, financial position and regulatory capital in the next several years. For further information about developments in financial accounting and reporting standards, see Note 2 to the Consolidated Financial Statements, “Significant Accounting Policies”.

Our financial results may be negatively affected by changes to assumptions supporting the value of our goodwill.

We test the goodwill that we have recognized on the respective financial position of our operating segments for impairment at least annually. Our impairment test in respect of the assets recognized as of December 31, 2019 indicated that our respective goodwill balances are not impaired. The impairment test requires that we make assumptions regarding estimated earnings, discount rates and long-term growth rates impacting the recoverable amount of the goodwill associated with each operating segment and on estimates of the carrying amounts of the operating segments to which the goodwill relates. If the actual results in future periods deviate from the earnings and other assumptions on which our impairment testing is based, the value of the goodwill in any one or more of our businesses may become impaired in the future, resulting in charges to income.

Changes in banking laws and regulations in Colombia and in other jurisdictions in which the Bank operates could adversely affect the Bank’s consolidated results.

Banking laws and regulations, or their official interpretation, in Colombia and in other jurisdictions in which the Bank operates, have a material effect on the Bank’s business and operations. Banking laws and regulations may change frequently, and changes may be adopted, enforced or interpreted in a manner that may have an adverse effect on the Bank’s business.

Moreover, regulators in the jurisdictions in which Bancolombia operates may alter the current regulatory capital requirements to which Bancolombia is subject and thereby require equity increases that could dilute existing stockholders, lead to required asset sales or adversely impact the return on stockholders’ equity and/or the market price of the Bank’s common and preferred shares.

Furthermore, banking laws and regulations may create new types of financial entities whose services could compete with the segments or services offered by the Bank. Increased competition could lead to lower margins for affected products and services and could adversely affect the Bank’s results of operations.

The Bank is subject to regulatory inspections, examinations, inquiries or audits in Colombia and in other countries where it operates, and any sanctions, fines and other penalties resulting from such inspections, examinations, inquiries or audits could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

The Bank is subject to comprehensive regulation and supervision by the banking authorities of Colombia, Panama, El Salvador, Guatemala and the other jurisdictions in which the Bank operates or is an issuer. These Banking authorities have broad powers to adopt regulations and impose other requirements affecting or restricting virtually all aspects of the Bank’s capitalization, organization and operations, including the imposition of anti-money laundering measures and the authority to regulate the terms and conditions on which the banks can extend credit. In the event of non-compliance with applicable regulations, the Bank could be subject to fines, sanctions or the revocation of licenses or permits to operate its business. In Colombia, for instance, if the Bank encounters significant financial problems or becomes insolvent or in danger of becoming insolvent, banking authorities would have the power to take over the Bank’s management and operations. Any sanctions, fines and other penalties resulting from non-compliance with regulations in Colombia, El Salvador, Guatemala, Panama and other jurisdictions in which the Bank operates could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

An increase in constitutional public interest actions (acciones populares) or class actions (acciones de grupo) may affect the Bank’s businesses and results of operations.

Under the Colombian constitution, individuals may initiate constitutional public interest or class actions to protect their collective or class rights, respectively. Colombian financial institutions, including the Bank, have experienced a high number of these actions. The great majority of such actions have been related to fees, financial services and interest rates, and their outcome is uncertain. Pursuant to Law 1425 of 2010, monetary awards for plaintiffs in constitutional actions or class actions were eliminated as of January 1, 2011. Nevertheless, individuals continue to have the right to initiate these actions against the Bank.

Future restrictions on interest rates or banking fees could negatively affect the Bank’s profitability.

In prior years, the Colombian congress has considered various regulatory initiatives regarding banking fees. For instance, on December 27, 2019, Congress approved a new regulation which forces financial institutions to offer certain transactions or services such as national wire-transfers and certain withdrawls or deposits free of charge for clients who have either a savings account, a debit card or a credit card with the financial institution. Although the majority of such initiatives have not been adopted in the past, there might be new initiatives to impose restrictions on banking fees in the future. If we are prohibited or otherwise limited (including by limits with respect to pricing) from continuing to charge our clients for certain products or services, including specified types of transactions, or from imposing charges for products or services that might be introduced in the future, our results of operations and financial condition could be adversely affected.

Colombian tax haven regulation could adversely affect the Bank’s business and financial results.

Decree 1966 of 2014, as modified by Decree 2095 of 2014, and Decree 1625 of 2016 designates 37 jurisdictions as tax havens for Colombian tax purposes although neither Panama nor other countries in which the Bank operates, were included on this list. As a result of the tax haven regulation the Bank’s clients who are residents in such jurisdictions would be subject to (i) higher withholding tax rates including a higher withholding rate on interest and dividends derived from investments in the Colombian securities market, (ii) the transfer pricing regime and its reporting duties, (iii) enhanced ability on the part of Colombian authorities to qualify a conduct as abusive under tax regulations, (iv) non-deductibility of payments made to such residents or entities located in tax havens, unless the required tax amount has been withheld and (v) additional information disclosure requirements, any of which could have a negative impact on Bancolombia’s business and financial results.

In order to avoid Panama’s designation as a tax haven by Colombia, Colombia and Panama signed a memorandum of understanding which states that both countries will negotiate a treaty for the avoidance of double taxation. This treaty is expected to include provisions regarding the exchange of information between Colombian and Panamanian tax authorities. Any failure by Colombia and Panama to enter into such a Treaty, or the designation of Panama as a tax haven by Colombia, could result in a negative impact on the Bank’s customer base and, therefore, a potential negative impact on the Bank’s results of operations and financial condition. On April 28, 2016, the Colombian Ministry of Finance and Public Credit announced the successful conclusion of the negotiations between Colombia and Panama, but as of the date of this Annual Report no treaty has been entered into.

Further, even though, Panama adhered to the Convention on Mutual Administrative Assistance in Tax Matters of the Organization for Economic Cooperation and Development (“OECD”) in 2017, on February 18, 2020, the European Union finance ministers added Panama to its list of non-cooperative jurisdictions for tax purposes for allegedly having shortcomings over exchange of tax information on request based on the OECD’s Global Forum on Transparency and Exchange of Information for Tax Purposes (“Global Forum”) report published in November 2019. We cannot assure whether such decision will have any effect on the designation that Colombia may make as to Panama in the future.

The Bank and most of its Subsidiaries are subject to the U.S. Foreign Account Tax Compliance Act of 2010 and the OECD’s Automatic Exchange of Information - Common Reporting Standard (CRS).

Bancolombia and most of its subsidiaries are considered foreign financial institutions (“FFIs”) under the Foreign Account Tax Compliance Act of 2010 (“FATCA”) (see “Item 4. Information on the Company – B. Business Overview – B.8. Supervision and Regulation – International regulations applicable to Bancolombia and its subsidiaries”). Additionally, Bancolombia and some of its subsidiaries are subject to the reporting obligations derived from the conventions that implement the Common Reporting Standard (“CRS”) approved by the OECD.

Given the size and the scope of the Bank’s international operations, we have taken measures and implemented procedures aimed at complying with FATCA and CRS, including transmitting to the relevant authorities the reports required under FATCA and CRS.

However, if the Bank cannot satisfy the requirements thereunder, certain payments to Bancolombia, or its Subsidiaries, may be subject to withholding under FATCA or other penalties imposed by each government. The possibility of such withholding or penalties and the need for accountholders and investors to provide certain information may discourage some customers or potential customers from banking with us, thereby adversely affecting our results of operations and financial condition. In addition, compliance with the terms of the intergovernmental agreements (“IGA”), particular agreements entered into with the IRS, the international conventions signed for the exchange of information under CRS, the laws or any other regulations enforced in the relevant jurisdictions may increase our compliance costs. Legislation and regulations implementing FATCA and CRS in some of the countries in which the Bank operates remain under development, and the reporting dates vary depending on the jurisdiction.

The Bank is exposed to increased costs and damages in the event of failure of its services providers to perform their obligations under key services contracts

The Bank enters into contracts with third parties who provide certain key services that are essential to its business. These services include online banking platforms, data processing and payment services, clearing and settlement services, software for processing credit and debit card services, and technological infrastructure, among others. The Bank faces the risk of operational disruption, failure or capacity constraints due to its dependency on such third-party vendors for certain components of its systems.

While the Bank conducts due diligence prior to engaging with third party service providers and performs ongoing monitoring of vendor controls, it does not control their operations. If any of our key service providers fails to fulfill any of their contractual obligations or cause disruptions in services (including as a result of a cyberattack, other information security event or a natural or health disaster (such as COVID-19 or other epidemics), failure to handle current or higher volumes, poor performance of services and failure to comply with applicable laws and regulations), the Bank’s ability to conduct its businesses could be adversely affected and could also negatively impact its results of operations and financial position. In addition, the Bank may be required to incur significant additional costs to find replacement providers. Furthermore, the unavailability of the services provided by some technology vendors could result in the unavailability of certain channels through which our clients execute transactions with us until a replacement provider is engaged, which could result in lost revenue, additional costs and, potentially, adverse regulatory consequences and reputational harm.

The Bank has a robust vendor selection process designed to ensure that the service providers appointed are among the most experienced and qualified available in the market. The Bank also, generally requires that service providers have contingency plans, which must be regularly updated to anticipate, identify, and mitigate these potential risks. In addition, in most cases, when contracting a critical service provider, in accordance with applicable regulation, the Bank seeks to include contractual provisions related to SLAs (service level agreements), penalty clauses and insurances to deter the service providers from failing to comply with their contractual obligations.

Notwithstanding the measures described above, the Bank may not be able to prevent all significant negative consequences in case of a material failure of its key service providers.

The Bank is subject to credit risk and estimating exposure to credit risk involves subjective and complex judgments.

A number of our products expose the Bank to credit risk. These products include loans, financial leases, guarantees and lending commitments.

The Bank estimates and establishes reserves for credit risk and potential credit losses. This process involves subjective and complex judgments, including projections of economic conditions and assumptions about the ability of our borrowers to repay their loans. This process is also subject to human error as the Bank’s employees may not always be able to assign an accurate credit risk rating to a client, which may result in the Bank’s exposure to a higher credit risk than one indicated by the Bank’s risk rating system. The Bank may not be able to timely detect these risks before they occur, or due to limited resources or available infrastructure, the Bank’s employees may not be able to effectively implement its credit risk management system, which may increase the Bank’s exposure to credit risk. Moreover, the Bank’s failure to continuously refine its credit risk management system may result in a higher risk exposure for the Bank, which could materially and adversely affect its results of operations and financial position.

Overall, if the Bank is unable to effectively control the level of non-performing or poor credit quality loans in the future, or if its loan loss reserves are insufficient to cover future loan losses, the Bank’s financial condition and results of operations may be materially and adversely affected.

The amount of the Bank’s non-performing loans may increase in the future as a result of factors beyond the Bank’s control, such as changes in the income levels of the Bank’s borrowers, increases in the inflation rate or an increase in interest rates, the impact of macroeconomic trends and political events affecting Colombia and other jurisdictions in which the Bank operates or has exposure (especially Panama, El Salvador and Guatemala) or events affecting specific industries. Any of these developments could have a negative effect on the quality of the Bank’s loan portfolio, requiring the Bank to increase provisions for loan losses and resulting in reduced profits or in losses.

Also, the Bank may suffer unexpected losses if the expected credit loss (ECL) model, used to estimate reserves to products expose to credit risk, becomes less predictive as a result of significant and unexpected changes in the assumptions and scenarios used in the model such as those caused by the outbreak of COVID-19 or other similar diseases which could impact the financial assets’ future cash flow, reduce their recoverable amount and increase the provisions for credit losses.

The Bank is subject to credit risk with respect to its non-traditional banking businesses including investing in securities and entering into derivatives transactions.

Non-traditional sources of credit risk can arise from, among other things: investing in securities, entering into derivative contracts under which counterparties have obligations to make payments to the Bank, and executing securities, futures, currency or commodity trades from the Bank’s proprietary trading desk that fail to settle at the required time due to non-delivery by the counterparty or systems failure by clearing agents, exchanges, clearing houses or other financial intermediaries. Any significant increases in exposure to any of these non-traditional risks, or a significant decline in the credit quality or the insolvency of any of the counterparties, could materially and adversely affect the Bank’s results of operations and financial position.

The Bank is exposed to risks associated with the mortgage loan market.

The Bank is a relevant player in the mortgage loan markets in which it operates. Colombia’s mortgage loan market is highly regulated and has historically been affected by macroeconomic factors, as have the mortgage loan markets of Panama, Guatemala and El Salvador. Although interest rates have been stable, periods of sustained high interest rates have historically discouraged customers from borrowing and have resulted in increased defaults in outstanding loans and deterioration in the quality of assets.

The Bank is subject to concentration of default risks in its loan portfolio. Problems with one or more of its largest borrowers may adversely affect its financial condition and results of operations.

As of December 31, 2019, the aggregate outstanding principal amount of the Bank’s 25 largest credit exposures, on a consolidated basis, represented 7.33% of the Bank’s loan portfolio. No single exposure represented more than 2% of the loan book and all of those loans were corporate loans. Problems with one or more of the Bank’s largest borrowers could materially and adversely affect its results of operations and financial position, see “Item 4. Information on the Company – E. Selected Statistical Information – E.3. Loan Portfolio – Borrowing Relationships”.

The value of the collateral securing the outstanding principal and interest balance of the Bank’s loans may not be sufficient to cover such outstanding principal and interest. In addition, the Bank may be unable to realize the full value of the collateral or guarantees securing the outstanding principal and interest balance of its loans.

The Bank’s loan collateral primarily includes real estate, assets pledged in financial leasing transactions and other assets that are located primarily in Colombia, El Salvador, Panama and Guatemala, the value of which may significantly fluctuate or decline due to factors beyond the Bank’s control. Such factors include market factors, environmental risks, macroeconomic factors and political events affecting the local economy. In addition, the Bank may face difficulties in enforcing its rights as a secured creditor. Timing delays, procedural problems enforcing collateral and local protectionism may make foreclosures on collateral and enforcement of judgments difficult. Any decline in the value of the collateral securing the Bank’s loans may result in a reduction in the recovery from collateral realization and may have an adverse impact on the Bank’s results of operations and financial condition.

The Bank is subject to market risk.

The Bank is directly and indirectly affected by changes in market conditions. Market risk, or the risk of losses in positions arising from movements in market prices, is inherent in the products and instruments associated with our operations, including loans, deposits, securities, bonds, long-term debt, short-term borrowings, proprietary trading in assets and liabilities and derivatives. Changes in market conditions that may affect our financial condition and results of operations include fluctuations in interest and currency exchange rates, securities prices and changes in the implied volatility of interest rates and foreign currency exchange rates, among others.

The Bank’s results of operations are sensitive to fluctuations in interest rates.

The Bank holds a substantial portfolio of loans and debt instruments that have both fixed and floating interest rates. Therefore, changes in interest rates could adversely affect our net interest margins as well as the value of the debt instruments. Increases in interest rates may reduce the market value of the Bank’s debt instruments, leading to smaller gains or larger losses on these investments. Sustained high interest rates have historically discouraged customers from borrowing and have resulted in increased delinquencies in outstanding loans and deterioration in the quality of assets. On the other hand, decreases in interest rates may cause margin compression and lower net interest income as the Bank usually maintains more assets than liabilities at variable rates. Decreasing interest rates also may trigger loan prepayments which could negatively affect the Bank’s net interest income. Generally, in a declining interest rate environment, prepayment activity increases, reducing the weighted average maturity of the Bank’s interest earning assets and adversely affecting its operating results. Prepayment risk also has a significant adverse impact on the Bank’s earnings from its credit card and collateralized mortgage obligations, since prepayments could shorten the weighted average life of these portfolios, which may result in a mismatch in funding or in reinvestment of the prepayment proceeds at lower yields. In addition, these risks could significantly impact the Bank’s portfolio as well as portfolios managed by the Bank and owned by third parties. To the extent we experience withdrawals of third-party assets, our asset management revenues and related income will be adversely affected.

The Bank’s income from its proprietary trading activities is highly volatile.

The Bank derives a portion of its profits from its proprietary trading activities. Income from this activity is highly volatile and depends on numerous factors beyond the Bank’s control, such as the general market environment, overall market trading activity, interest rate levels, fluctuations in exchange rates and general market volatility. A significant decline in the Bank’s trading income, or the incurrence of a trading loss, could adversely affect the Bank’s results of operations and financial position.

The Bank has significant exposure to sovereign risk, and especially Colombian risk, and the Bank’s results could be adversely affected by decreases in the value of its sovereign debt instruments.

The Bank’s debt instruments portfolio is primarily composed of sovereign debt instruments. Therefore, the Bank’s results are exposed to credit, market, and liquidity risk associated with sovereign debt, in particular risk associated with securities issued or guaranteed by the Colombian Government. As of December 31, 2019, the Bank’s total debt instruments represented 6.61% of its total assets, and 37.07% of these securities were issued or guaranteed by the Colombian Government. A significant decline in the value of the securities issued or guaranteed by the Colombian Government could adversely affect the Bank’s debt instruments portfolio and consequently the Bank’s results of operations and financial position.

The Bank is subject to market, liquidity, operational and structural risks associated with its derivative transactions.

The Bank enters into derivative transactions for hedging purposes on its own account and on behalf of its customers. The Bank is subject to market, liquidity (due to difficult to close out a trade prior to maturity or if bid-ask spreads are so large, representing a significant cost) and operational risk associated with these transactions, including basis risk (the risk of loss associated with variations in the spread between the asset yield and the funding and/or hedge cost) and credit or default risk (the risk of insolvency or other inability of the counterparty to a particular transaction to perform its obligations thereunder). In addition, the market practice and documentation for derivative transactions is less developed in the jurisdictions in which the Bank operates as compared to other more economically developed countries, and the court systems in such jurisdictions have limited experience in dealing with issues related to derivative transactions. As a result, there are increased operating and structural risks associated with derivatives transactions in these jurisdictions.

In addition, the execution and performance of derivatives transactions depend on the Bank’s ability to develop adequate control and administrative systems, and to hire and retain qualified personnel. Moreover, the Bank’s ability to adequately monitor, analyze and report these derivative transactions depends, to a great extent, on its information technology systems. These factors may further increase the risks associated with these transactions and could materially and adversely affect the Bank’s results of operations and financial position.

The Bank is subject to operational risks and losses.

The Bank’s businesses are dependent on the ability to process a large number of transactions efficiently and accurately. Operational risks and losses can result from fraud, employee errors, technological failures and failure to properly document transactions or to obtain proper internal authorization, failure to comply with regulatory requirements, breaches of conduct of business rules, equipment failures, natural disasters or the failure of external systems. The Bank has adopted procedures to prevent and manage each of the operational risks, but there can be no assurance that our procedures will be sufficient to prevent losses resulting from these risks.

In addition, the Bank’s businesses are exposed to risk from potential non-compliance with policies, employee misconduct or negligence and fraud, which could result in regulatory sanctions and serious reputational or financial harm. In recent years, a number of financial institutions have suffered material losses due to the actions of employees and third parties. The precautions the Bank takes to prevent and detect employee and third-party misconduct may not always be effective.

The Bank’s businesses rely heavily on data collection, processing and storage systems, the failure of which could materially and adversely affect the effectiveness of its risk management, reputation and internal control system as well as its financial condition and results of operations.

All of the Bank’s principal businesses are highly dependent on the ability to timely collect and process a large amount of financial and other information at its various branches across numerous markets, at a time when transaction processes have become increasingly complex with increasing volume. The proper functioning of financial control, accounting or other data collection and processing systems is critical to the Bank’s businesses and to its ability to compete effectively.