AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 11, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 20-F

(Mark One)

¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to__________

OR

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report___________

Commission file number: 001-32535

BANCOLOMBIA S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Republic of Colombia

(Jurisdiction of incorporation or organization)

Carrera 48 # 26-85, Avenida Los Industriales

Medellín, Colombia

(Address of principal executive offices)

Juan Esteban Toro Valencia, Investor Relations Manager

Carrera 48 # 26-85, Medellín, Colombia

Tel. +5744041837, Fax. + 574 4045146, e-mail: juatoro@bancolombia.com

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registeredpursuant to Section 12(b) of the Act.

Title of each Class | Name of each exchange on which registered |

| American Depositary Shares | New York Stock Exchange |

| Preferred Shares | New York Stock Exchange* |

| * | Bancolombia’s preferred shares are not listed for trading directly, but only in connection with its American Depositary Shares, which are evidenced by American Depositary Receipts, each representing four preferred shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the

period covered by the annual report.

| Common Shares | 509,704,584 |

| Preferred Shares | 278,122,419 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 of 15(d) of the Securities Exchange Act of 1934

Yes ¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company

(Do not check if a smaller reporting company)

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other x |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ¨ No ¨

TABLE OF CONTENTS

| CERTAIN DEFINED TERMS | i |

| | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | iii |

| | |

| PRESENTATION OF CERTAIN FINANCIAL AND OTHER INFORMATION | iv |

| | |

| PART I | | 1 |

| | | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 1 |

| | | |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 1 |

| | | |

| ITEM 3. | KEY INFORMATION | 1 |

| A. | SELECTED FINANCIAL DATA | 1 |

| B. | CAPITALIZATION AND INDEBTEDNESS | 7 |

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS | 7 |

| D. | RISK FACTORS | 7 |

| | | |

| ITEM 4. | INFORMATION ON THE COMPANY | 17 |

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY | 17 |

| B. | BUSINESS OVERVIEW | 20 |

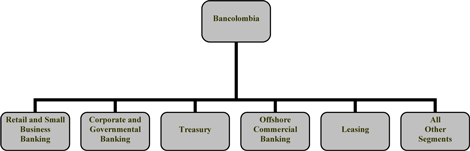

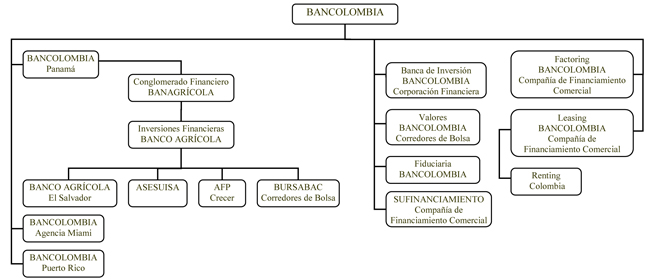

| C. | ORGANIZATIONAL STRUCTURE | 38 |

| D. | PROPERTY, PLANT AND EQUIPMENT | 40 |

| E. | SELECTED STATISTICAL INFORMATION | 40 |

| | | |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | 66 |

| | | |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 66 |

| A. | OPERATING RESULTS | 66 |

| B. | LIQUIDITY AND CAPITAL RESOURCES | 80 |

| C. | RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES, ETC. | 84 |

| D. | TREND INFORMATION | 84 |

| E. | OFF-BALANCE SHEET ARRANGEMENTS | 85 |

| F. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS | 85 |

| G. | CRITICAL ACCOUNTING POLICIES AND ESTIMATES | 86 |

| H. | RECENT U.S. GAAP PRONOUNCEMENTS | 95 |

| I. | RELATED PARTY TRANSACTIONS | 97 |

| | | |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 98 |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 98 |

| B. | COMPENSATION OF DIRECTORS AND OFFICERS | 101 |

| C. | BOARD PRACTICES | 102 |

| D. | EMPLOYEES | 103 |

| E. | SHARE OWNERSHIP | 104 |

| | | |

| ITEM 7. | MAJOR STOCKHOLDERS AND RELATED PARTY TRANSACTIONS | 104 |

| A. | MAJOR STOCKHOLDERS | 104 |

| B. | RELATED PARTY TRANSACTIONS | 105 |

| C. | INTEREST OF EXPERTS AND COUNSEL | 107 |

| | | |

| ITEM 8. | FINANCIAL INFORMATION | 107 |

| A. | CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION | 107 |

| B. | SIGNIFICANT CHANGES | 112 |

| | | |

| ITEM 9. | THE OFFER AND LISTING. | 113 |

| A. | OFFER AND LISTING DETAILS | 113 |

| B. | PLAN OF DISTRIBUTION | 114 |

| C. | MARKETS | 114 |

| D. | SELLING STOCKHOLDERS | 114 |

| E. | DILUTION | 115 |

| F. | EXPENSES OF THE ISSUE | 115 |

| | | |

| ITEM 10. | ADDITIONAL INFORMATION | 115 |

| A. | SHARE CAPITAL | 115 |

| B. | MEMORANDUM AND ARTICLES OF ASSOCIATION | 115 |

| C. | MATERIAL CONTRACTS | 115 |

| D. | EXCHANGE CONTROLS | 115 |

| E. | TAXATION | 116 |

| F. | DIVIDENDS AND PAYING AGENTS | 120 |

| G. | STATEMENT BY EXPERTS | 120 |

| H. | DOCUMENTS ON DISPLAY | 120 |

| I. | SUBSIDIARY INFORMATION | 120 |

| | | |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 120 |

| | | |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 126 |

| D. | AMERICAN DEPOSITARY SHARES | 126 |

| | | |

| PART II | | 128 |

| | | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 128 |

| | | |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 128 |

| | | |

| ITEM 15. | CONTROLS AND PROCEDURES | 128 |

| | | |

| ITEM 16. | RESERVED | 129 |

| A. | AUDIT COMMITTEE FINANCIAL EXPERT | 129 |

| B. | CORPORATE GOVERNANCE AND CODE OF ETHICS | 129 |

| C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 129 |

| D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 130 |

| E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 130 |

| F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 130 |

| G. | CORPORATE GOVERNANCE | 130 |

| | | |

| PART III | | 132 |

| | | |

| ITEM 17. | FINANCIAL STATEMENTS | 132 |

| | | |

| ITEM 18. | FINANCIAL STATEMENTS | 132 |

| | | |

| ITEM 19. | EXHIBITS | 132 |

Unless otherwise specified or if the context so requires, in this annual report:

References to “ADSs” refer to our American Depositary Shares (one ADS represents four preferred share),

References to the “Annual Report” refer to this annual report on Form 20-F.

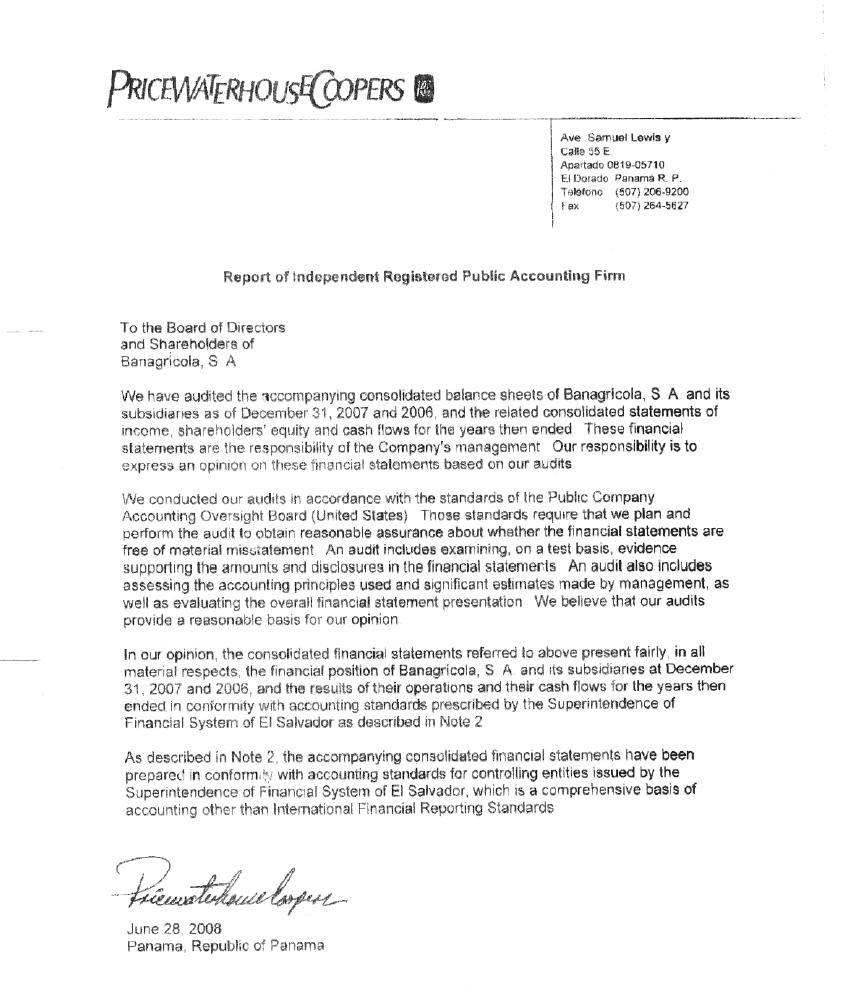

References to “Banagrícola” refer to Banagrícola S.A., a company incorporated in Panamá and authorized to operate as a bank holding company under the laws of the Republic of El Salvador, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Banca de Inversión” refer to Banca de Inversión Bancolombia S.A. Corporación Financiera, a Subsidiary of Bancolombia S.A. organized under the laws of the Republic of Colombia that specializes in providing investment banking services

References to “Banco Agrícola” refer to Banco Agrícola S.A., a banking institution organized under the laws of the Republic of El Salvador, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Bancolombia”, the “Bank”, “us” , “we” or “our” refer to Bancolombia S.A., a banking institution organized under the laws of the Republic of Colombia, which may also act under the name of Banco de Colombia S.A., including its Subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Bancolombia Panamá” refer to Bancolombia Panamá S.A., a Subsidiary of Bancolombia organized under the laws of the Republic of Panama that provides a complete line of banking services mainly to Colombian customers.

References to “Central Bank” refer to the Central Bank of Colombia.

References to “Colombia” refer to the Republic of Colombia.

References to “Conavi” refer to Conavi Banco Comercial y de Ahorros S.A. as it existed immediately before the Conavi/Corfinsura merger (as defined below).

References to the “Conavi/Corfinsura merger” refer to the merger of Conavi and Corfinsura with and into Bancolombia, with Bancolombia as the surviving entity, which took effect on July 30, 2005 pursuant to a Merger Agreement dated February 28, 2005.

References to “Corfinsura” refer to Corporación Financiera Nacional y Suramericana S.A., as it existed immediately before the Conavi/Corfinsura merger, taking into account the effect of its spin-off of a portion of its investment portfolio effective July 29, 2005.

References to “DTF” refer to the Depósitos a Término Fijo rate, the weighted average interest rate paid by finance corporations, commercial banks and commercial finance companies in Colombia for certificates of deposit with maturities of 90 days.

References to “Factoring Bancolombia” refer to Factoring Bancolombia S.A., a Subsidiary of Bancolombia organized under the laws of the Republic of Colombia that specializes in accounts receivable financing.

References to “Fiduciaria Bancolombia” refer to Fiduciaria Bancolombia S.A., a Subsidiary of Bancolombia which is the largest fund manager among its peers, including other fund managers and brokerage firms in Colombia.

References to “Leasing Bancolombia” refer to Leasing Bancolombia S.A. Compañía de Financialmiento Comercial, a Subsidiary of Bancolombia organized under the laws of the Republic of Colombia that specializes in leasing activities, offering a wide range of financial leases, operating leases, loans, time deposits and bonds.

References to “preferred shares” and “common shares” refer to our authorized preferred and common shares, designated as acciones preferencialesand acciones ordinarias, respectively.

References to “Renting Colombia” refer to Renting Colombia S.A., a Subsidiary of Bancolombia which provides operating lease and fleet management services for individuals and companies.

References to “Representative Market Rate” refer to Tasa Representativa del Mercado , the U.S. dollar representative market rate, certified by the Superintendency of Finance. The Representative Market Rate is an economic indicator of the daily exchange rate on the Colombian market spot of currencies. It corresponds to the arithmetical weighted average of the rates of purchase and sale of currencies of interbank transactions of the authorized intermediaries.

References to “SMEs” refer to Small and Medium Enterprises.

References to “SMMLV” refer to Salario Mínimo Mensual Legal Vigente, the effective legal minimum monthly salary in Colombia.

References to “peso”, “pesos” or “COP” refer to the lawful currency of Colombia.

References to “Subsidiaries” refer to subsidiaries of Bancolombia in which Bancolombia holds, directly or indirectly, 50% or more of the outstanding voting shares.

References to “Superintendency of Finance” refer to the Colombian Superintendency of Finance ( Superintendencia Financiera de Colombia), a technical entity under the Ministry of Finance and Public Credit holding the inspection, supervision and control over the persons involved in financial activities, stock market, insurance and any other related to the management, use or investment of resources collected from the public.

References to “U.S.” or “United States” refer to the United States of America.

References to “U.S. dollar”, “U.S. dollars”, and “US$” refer to the lawful currency of the United States.

References to “UVR” refer to Unidades de Valor Real, a Colombian inflation-adjusted monetary index calculated by the board of directors of the Central Bank and generally used for pricing home-mortgage loans.

References to “Valores Bancolombia” refer to Valores Bancolombia S.A. Comisionista de Bolsa, a Subsidiary of Bancolombia organized under the laws of the Republic of Colombia that provides brokerage and asset management services to over 200,000 clients.

The term “billion” means one thousand million (1,000,000,000).

The term “trillion” means one million million (1,000,000,000,000).

Our fiscal year ends on December 31, and references in this annual report to any specific fiscal year are to the twelve-month period ended December 31 of such year.

This Annual Report contains statements which may constitute forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts but instead represent only the Bank’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside the Bank’s control. The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “predict”, “target”, “forecast”, “guideline”, “should”, “project” and similar words and expressions, are intended to identify forward-looking statements. It is possible that the Bank’s actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements.

Information regarding important factors that could cause actual results to differ, perhaps materially, from those in the Bank’s forward-looking statements appear in a number of places in this Annual Report, principally in “Item 3. Key Information – D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects”, and include, but are not limited to: (i) changes in general economic, business, political, social, fiscal or other conditions in Colombia, or in any of the other countries where the Bank operates; (ii) changes in capital markets or in markets in general that may affect policies or attitudes towards lending; (iii) unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms; (iv) inflation, changes in foreign exchange rates and/or interest rates; (v) sovereign risks; (vi) liquidity risks; (vii) increases in defaults by the Bank’s borrowers and other loan delinquencies; (viii) lack of acceptance of new products or services by the Bank’s targeted customers; (ix) competition in the banking, financial services, credit card services, insurance, asset management, remittances, business and other industries in which the Bank operates; (x) adverse determination of legal or regulatory disputes or proceedings; (xi) changes in official regulations and the Colombian government’s banking policy as well as changes in laws, regulations or policies in the jurisdictions in which the Bank does business; (xii) regulatory issues relating to acquisitions; and (xiii) changes in business strategy.

Forward-looking statements speak only as of the date they are made and are subject to change, and the Bank does not intend, and does not assume any obligation, to update these forward-looking statements in light of new information or future events arising after the date of this Annual Report.

Accounting Principles

The accounting practices used in the preparation of the Bank’s consolidated financial statements follow the special regulations of the Superintendencia Financiera de Colombia (the “Superintendency of Finance”) and generally accepted accounting principles in Colombia (collectively, “Colombian GAAP”). Together, these requirements differ in certain significant respects from generally accepted accounting principles in the United States (“U.S. GAAP”). Note 31 to the Bank’s audited consolidated financial statements included in this Annual Report provides a description of the principal differences between Colombian GAAP and U.S. GAAP as they relate to the Bank’s audited consolidated financial statements and provides a reconciliation of net income and stockholders’ equity for the years and dates indicated herein. References to Colombian GAAP in this Annual Report are to Colombian GAAP as supplemented by the applicable regulations of the Superintendency of Finance.

For consolidation purposes under Colombian GAAP, financial statements of the Bank and its Subsidiaries must be prepared under uniform accounting policies. In order to comply with this requirement, financial statements of foreign Subsidiaries were adjusted as required by Colombian regulations.

For 2009, the Bank’s consolidated financial statements include companies in which it holds, directly or indirectly, 50% or more of outstanding voting shares. The Bank consolidates directly Leasing Bancolombia, Fiduciaria Bancolombia, Banca de Inversión, Sufinanciamiento, Bancolombia Puerto Rico Internacional, Inc., Patrimonio Autónomo Sufinanciamiento, Bancolombia Panamá, Valores Bancolombia and Factoring Bancolombia. As described below, some of the Bank’s Subsidiaries also consolidate their own subsidiaries. Bancolombia Panamá consolidates Bancolombia Cayman S.A., Sistema de Inversiones y Negocios S.A., Sinesa Holding Company Limited, Future Net S.A., Suleasing International USA Inc. and Banagrícola (which, in turn, consolidates Banco Agrícola Panamá S.A, Inversiones Financieras Banco Agrícola S.A., Banco Agrícola, Arrendadora Financiera S.A., Credibac S.A. de C.V., Bursabac S.A. de C.V., AFP Crecer S.A., Aseguradora Suiza Salvadoreña S.A. and Asesuisa Vida S.A.). Banca de Inversión consolidates with Inmobiliaria Bancol S.A., Valores Simesa S.A., Inversiones CFNS Ltda., Todo Uno Colombia S.A. and Inversiones Valores y Logística S.A. The Bank’s Subsidiary Leasing Bancolombia consolidates Leasing Perú, Renting Colombia (which, in turn, consolidates Renting Perú S.A.C., Capital Investments SAFI S.A., Fondo de Inversión en Arrendamiento Operativo Renting Perú, Transportes Empresariales de Occidente Ltda. and RC Rent a Car S.A.). The Bank’s Subsidiary Valores Bancolombia consolidates Suvalor Panamá S.A and Suvalor Panamá Fondo de inversión and the Bank’s Subsidiary Fiduciaria Bancolombia consolidates Fiduciaria GBC S.A.

Currencies

The Bank maintains accounting records in Colombian pesos. The audited consolidated financial statements of Bancolombia S.A. for the years ended December 31, 2007, 2008 and 2009 (collectively, including the notes thereto, the “Financial Statements”) contained in this Annual Report are expressed in pesos.

This Annual Report translates certain peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such peso amounts have been translated at the rate of COP 2,044.23 per US$ 1.00, which corresponds to the Representative Market Rate calculated on December 31, 2009 the last business day of the year. The Representative Market Rate is computed and certified by the Superintendency of Finance, the Colombian banking regulator, on a daily basis and represents the weighted average of the buy/sell foreign exchange rates negotiated on the previous day by certain financial institutions authorized to engage in foreign exchange transactions (including Bancolombia S.A.). The Superintendency of Finance also calculates and certifies the average Representative Market Rate for each month for purposes of preparing financial statements and converting amounts in foreign currency to Colombian pesos. Such conversion should not be construed as a representation that the peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On May 25, 2010, the Representative Market Rate was COP 1,989.51 per US$ 1.00.

Rounding Comparability of Data

Certain monetary amounts, percentages and other figures included in this Annual Report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Information included on or accessible through Bancolombia’s internet site is not part of this Annual Report

This Annual Report refers to certain websites as sources for certain information contained herein. Information contained in or otherwise accessible through these websites is not a part of this Annual Report. All references in this Annual Report to these and other internet sites are inactive textual references to these URLs, or “uniform resource locators”, and are for your informational reference only.

The Bank maintains an internet site at www.grupobancolombia.com. In addition, certain of the Bank’s Subsidiaries referred to in this Annual Report maintain separate internet sites. For example, Banco Agrícola maintains an internet site at www.bancoagricola.com.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

The selected consolidated financial data as of December 31, 2009 and 2008, and for each of the three fiscal years in the period ended December 31, 2009 set forth below has been derived from the Bank’s audited consolidated financial statements included in this Annual Report. The selected consolidated financial data as of December 31, 2007, 2006 and 2005, and for each of the two fiscal years in the period ended December 31, 2005 set forth below have been derived from the Bank’s audited consolidated financial statements for the respective periods, which are not included herein.

The Bank’s consolidated financial statements for each period were prepared in accordance with Colombian GAAP.

The selected consolidated financial data should be read in conjunction with the Bank’s consolidated financial statements, related notes thereto, and the reports of the Bank’s independent registered public accounting firms.

| | | As of and for the year ended December 31, | |

| | | | | | | | | | | | | 2007 (10) (11) | | | | | | | |

| | | (in millions of COP and thousands of US$ (1) , except per share and per American Depositary Share (“ADS”) amounts) | |

| CONSOLIDATED STATEMENT OF OPERATIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Colombian GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income | | US$ | 3,144,313 | | | COP | 6,427,698 | | | COP | 6,313,743 | | | COP | 4,810,408 | | | COP | 3,013,732 | | | COP | 3,200,084 | |

| Interest expense | | | (1,284,306 | ) | | | (2,625,416 | ) | | | (2,753,341 | ) | | | (2,002,090 | ) | | | (1,246,229 | ) | | | (1,150,274 | ) |

| Net interest income | | | 1,860,007 | | | | 3,802,282 | | | | 3,560,402 | | | | 2,808,318 | | | | 1,767,503 | | | | 2,049,810 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Provisions for loans and accrued interest losses, net of recoveries (2) | | | (539,859 | ) | | | (1,103,595 | ) | | | (1,155,262 | ) | | | (617,868 | ) | | | (195,361 | ) | | | (123,575 | ) |

Provision for foreclosed assets and other assets, net of recoveries (3) | | | (24,351 | ) | | | (49,779 | ) | | | 22,095 | | | | 20,833 | | | | 45,179 | | | | (7,465 | ) |

| Net interest income after provisions | | | 1,295,797 | | | | 2,648,908 | | | | 2,427,235 | | | | 2,211,283 | | | | 1,617,321 | | | | 1,918,770 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Fees and income from services and other operating income, net (4) | | | 923,061 | | | | 1,886,949 | | | | 1,964,084 | | | | 1,510,129 | | | | 1,139,094 | | | | 962,277 | |

| Operating expenses | | | (1,416,252 | ) | | | (2,895,145 | ) | | | (2,639,997 | ) | | | (2,271,418 | ) | | | (1,871,000 | ) | | | (1,654,805 | ) |

| Net operating income | | | 802,606 | | | | 1,640,712 | | | | 1,751,322 | | | | 1,449,994 | | | | 885,415 | | | | 1,226,242 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net non-operating income excluding minority interest | | | 45,607 | | | | 93,232 | | | | 31,888 | | | | 12,058 | | | | 45,346 | | | | 4,650 | |

| Minority interest (loss) | | | (7,377 | ) | | | (15,081 | ) | | | (18,511 | ) | | | (13,246 | ) | | | (6,352 | ) | | | (6,496 | ) |

| Income before income taxes | | | 840,836 | | | | 1,718,863 | | | | 1,764,699 | | | | 1,448,806 | | | | 924,409 | | | | 1,224,396 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income taxes | | | (226,008 | ) | | | (462,013 | ) | | | (474,056 | ) | | | (361,883 | ) | | | (174,880 | ) | | | (277,515 | ) |

| Net income | | US$ | 614,828 | | | COP | 1,256,850 | | | COP | 1,290,643 | | | COP | 1,086,923 | | | COP | 749,529 | | | COP | 946,881 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average of Preferred andCommon Shares outstanding (5) | | | | | | | 787,827,003 | | | | 787,827,003 | | | | 758,313,771 | | | | 727,827,005 | | | | 652,882,756 | |

Basic and Diluted net income per share (5) | | | 0,78 | | | | 1,595 | | | | 1,638 | | | | 1,433 | | | | 1,030 | | | | 1,450 | |

Basic and Diluted net income per ADS (12) | | | 3,12 | | | | 6,380 | | | | 6,552 | | | | 5,732 | | | | 4,119 | | | | 5,800 | |

Cash dividends declared per share (6) | | | | | | | 637 | | | | 624 | | | | 568 | | | | 532 | | | | 508 | |

Cash dividends declared per share (6) (stated in U.S. Dollars) | | | | | | | 0,31 | | | | 0,28 | | | | 0,28 | | | | 0,24 | | | | 0,22 | |

| Cash dividends declared per ADS | | | | | | | 2,547 | | | | 2,496 | | | | 2,272 | | | | 2,128 | | | | 2,032 | |

| Cash dividends declared per ADS (stated in U.S. Dollars) | | | | | | | 1,25 | | | | 1,11 | | | | 1,13 | | | | 0,95 | | | | 0,88 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | US$ | 560,837 | | | COP | 1,146,480 | | | COP | 849,920 | | | COP | 1,015,644 | | | COP | 941,183 | | | COP | 891,121 | |

Basic and Diluted net income per common share (8) | | | 0.71 | | | | 1,455 | | | | 1,326 | | | | 1,683 | | | | 1,619 | | | | 1,715 | |

Basic and Diluted net income per ADS (8 ) (12) | | | 2.84 | | | | 5,820 | | | | 5,304 | | | | 6,732 | | | | 6,476 | | | | 6,860 | |

| | (1) | Amounts stated in U.S dollars have been translated at the rate of COP 2,044.23 per US$ 1.00, which is the Representative Market Rate calculated on December 31, 2009 (the last business day of 2009), as reported and certified by the Superintendency of Finance. Such translations should not be construed as representations that the pesos amounts represent, or have been or could be converted into, United States dollars at that or any other rate. |

| | (2) | Represents the provision for loan, accrued interest losses and other receivables, net and recovery of charged-off loans. Includes a provision for accrued interest losses amounting to COP 12,379 million, COP 14,825 million, COP 35,543 million, COP 58,721 million and COP 46,840 million for the years ended December 31, 2005, 2006, 2007, 2008 and 2009, respectively. |

| | (3) | Represents the provision for foreclosed assets and other assets and the recovery of provisions for foreclosed assets and other assets. |

| | (4) | Represents the total fees and income from services, net and total other operating income. |

| | (5) | The weighted average of preferred and common shares outstanding for fiscal year 2005, include 198,261,641 preferred shares and 454,621,115 common shares. For fiscal year 2006, it included 218,122,419 preferred shares and 509,704,584 common shares. For fiscal year 2007, it included 253,300,502 preferred shares and 509,704,584 common shares. For fiscal years 2008 and 2009, it included 218,122,419 preferred shares and 509,704,584. |

| | (6) | This data is presented on an annualized basis. |

| | (7) | See “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP” to our Financial Statements included in this Annual Report. |

| | (8) | Under U.S. GAAP, these shares are considered outstanding since the beginning of the earliest period presented. Net income per share under U.S. GAAP is presented on the basis of net income available to common stockholders divided by the weighted average number of common shares outstanding (198,261,641 preferred shares and 454,621,115 common shares for 2005; 509,704,584 for 2006, 2007, 2008 and 2009). See “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP”. |

| | (9) | The consolidated statement of operations for the year ended December 31, 2005, includes Conavi and Corfinsura’s results since the beginning of the year. For U.S. GAAP purposes, see “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP – m) Business combinations” to our Financial Statements included in this Annual Report. |

| (10) | The consolidated statement of operations for the year ended December 31, 2007 includes Banagrícola’s results since the beginning of the year. For U.S. GAAP purposes, see “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP – m) Business combinations” to our Financial Statements included in this Annual Report. |

| (11) | The consolidated statement of operations for the year ended on December 2007 was modified due to reclassifications made particularly in commissions from banking services and other services, administrative and other expenses and other income, with the purpose of better presenting comparative information regarding the gains on the sale of mortgage loans. The selected financial data for year 2006 has not been reclassified to the 2008 presentation because the amounts are insignificant and do not have a material impact on the consolidated statement of operations for each of the respective years. |

| (12) | Basic and diluted net income per ADS for any period is defined as basic and diluted net income per share multiplied by four as each ADS is equivalent to four preferred shares of Bancolombia. Basic and diluted net income per ADS should not be considered in isolation, or as a substitute for net income, as a measure of operating performance or as a substitute for cash flows from operations or as a measure of liquidity. Each ADS is equivalent to four preferred shares of Bancolombia. |

| | | As of and for the year ended December 31, | |

| | | | | | | | | | | | | | | | | | | |

| | | (in millions of COP and thousands of US$ (1) , except per share and per American Depositary Share (“ADS”) amounts) | |

| CONSOLIDATED BALANCE SHEET | | | | | | | | | | | | | | | | | | |

| Colombian GAAP: | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | |

| Cash and due from banks | | US$ | 2,437,871 | | | COP | 4,983,569 | | | COP | 3,870,927 | | | COP | 3,618,619 | | | COP | 1,548,752 | | | COP | 1,241,435 | |

| Overnight funds | | | 1,168,552 | | | | 2,388,790 | | | | 1,748,648 | | | | 1,609,768 | | | | 457,614 | | | | 488,587 | |

| Investment securities, net | | | 4,361,013 | | | | 8,914,913 | | | | 7,278,276 | | | | 5,774,251 | | | | 5,677,761 | | | | 8,459,703 | |

| Loans and financial leases, net | | | 19,376,639 | | | | 39,610,307 | | | | 42,508,210 | | | | 36,245,473 | | | | 23,811,391 | | | | 17,920,370 | |

| Accrued interest receivable on loans, net | | | 165,639 | | | | 338,605 | | | | 505,658 | | | | 398,560 | | | | 255,290 | | | | 198,266 | |

| Customers’ acceptances and derivatives | | | 100,462 | | | | 205,367 | | | | 272,458 | | | | 196,001 | | | | 166,395 | | | | 133,420 | |

| Accounts receivable, net | | | 394,713 | | | | 806,885 | | | | 828,817 | | | | 716,106 | | | | 562,598 | | | | 590,313 | |

| Premises and equipment, net | | | 485,288 | | | | 992,041 | | | | 1,171,117 | | | | 855,818 | | | | 712,722 | | | | 623,729 | |

| Operating leases, net | | | 412,407 | | | | 843,054 | | | | 726,262 | | | | 488,333 | | | | 167,307 | | | | 143,974 | |

| Foreclosed assets, net | | | 39,461 | | | | 80,668 | | | | 24,653 | | | | 32,294 | | | | 18,611 | | | | 31,360 | |

| Prepaid expenses and deferred charges | | | 90,895 | | | | 185,811 | | | | 132,881 | | | | 137,901 | | | | 46,462 | | | | 26,898 | |

| Goodwill | | | 418,605 | | | | 855,724 | | | | 1,008,639 | | | | 977,095 | | | | 40,164 | | | | 50,959 | |

| Other assets | | | 451,156 | | | | 922,265 | | | | 1,093,850 | | | | 580,642 | | | | 675,265 | | | | 563,588 | |

| Reappraisal of assets | | | 360,217 | | | | 736,366 | | | | 612,683 | | | | 520,788 | | | | 348,364 | | | | 330,915 | |

| Total assets | | US$ | 30,262,918 | | | COP | 61,864,365 | | | COP | 61,783,079 | | | COP | 52,151,649 | | | COP | 34,488,696 | | | COP | 30,803,517 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities and stockholders’ equity: | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | US$ | 20,618,683 | | | COP | 42,149,330 | | | COP | 40,384,400 | | | COP | 34,374,150 | | | COP | 23,216,467 | | | COP | 18,384,982 | |

Borrowings ( 5) | | | 1,975,878 | | | | 4,039,150 | | | | 5,947,925 | | | | 4,851,246 | | | | 3,516,426 | | | | 3,927,551 | |

| Other liabilities | | | 4,228,025 | | | | 8,643,056 | | | | 9,333,909 | | | | 7,726,983 | | | | 4,109,191 | | | | 5,113,694 | |

| Stockholders’ equity | | | 3,440,332 | | | | 7,032,829 | | | | 6,116,845 | | | | 5,199,270 | | | | 3,646,612 | | | | 3,377,290 | |

| Total liabilities and stockholders’ equity | | US$ | 30,262,918 | | | COP | 61,864,365 | | | COP | 61,783,079 | | | COP | 52,151,649 | | | COP | 34,488,696 | | | COP | 30,803,517 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. GAAP: (2) | | | | | | | | | | | | | | | | | | | | | | | | |

| | US$ | 3,470,875 | | | COP | 7,095,266 | | | COP | 6,422,815 | | | COP | 5,937,554 | | | COP | 4,549,018 | | | COP | 4,125,996 | |

Stockholders’ equity per share (6) | | | 4.41 | | | | 9,006 | | | | 8,153 | | | | 7,830 | | | | 6,250 | | | | 6,320 | |

Stockholders’ equity per ADS (6) | | | 17.64 | | | | 36,024 | | | | 32,612 | | | | 31,320 | | | | 25,001 | | | | 25,280 | |

| (1) | Amounts stated in U.S. dollars have been converted at the rate of COP 2,044.23 per US$ 1.00, which is the Representative Market Rate calculated on December 31, 2009 (the last business day of 2009) as reported and certified by the Superintendency of Finance. |

| (2) | Refer to “Note 31, Differences between Colombian Accounting Principles for Banks and U.S. GAAP” to the Financial Statements included in this Annual Report for the reconciliation to U.S. GAAP. |

| (3) | The consolidated balance sheet for the year ended December 31, 2005, includes Conavi and Corfinsura’s results. For U.S. GAAP purposes, see “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP – m) Business combinations”. |

| (4) | The consolidated statement of operations for the year ended December 31, 2007 includes Banagrícola’s results. For U.S. GAAP purposes, see “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP – m) Business combinations”. |

| (5) | Includes interbank borrowing and domestic development banks borrowings and other. |

| (6) | The weighted average (rounded to the nearest million) of preferred and common shares outstanding was 653 million for the fiscal year ended December 31, 2005, 728 million for the fiscal year ended December 31, 2006, 758 million for the fiscal year ended December 31, 2007, 788 million for the fiscal year ended December 31, 2008 and 2009. Stockholders’ equity per share is equal to Stockholders’ equity under U.S. GAAP divided by the weighted average of preferred and common shares outstanding,. Stockholders’ equity per ADS is equal to stockholders’ equity per share multiplied by four preferred shares of Bancolombia (Each ADS is equivalent to four preferred shares of Bancolombia). Stockholders’ equity per ADS should not be considered in isolation, or as a substitute for net income, as a measure of operating performance or as a substitute for cash flows from operations or as a measure of liquidity. |

See “Item 8. Financial Information – A. Consolidated Statements and Other Financial Information – A.3. Dividend Policy”, for information about the dividends declared per share in both pesos and U.S. dollars during the fiscal years ended in December 31, 2009, 2008, 2007, 2006 and 2005.

Differences Between Colombian and U.S. GAAP Results

The Bank’s consolidated financial statements have been prepared in accordance with Colombian GAAP, which are the accounting principles and policies that are summarized in “Note 2, Summary of Significant Accounting Policies” to the Bank’s Financial Statements included in this Annual Report. These accounting principles and policies differ in some significant respects from U.S. GAAP. A reconciliation of net income and stockholders’ equity under U.S. GAAP is included in “Note 31, Differences between Colombian Accounting Principles for Banks and U.S. GAAP” to the Financial Statements included in this Annual Report.

Consolidated net income under U.S. GAAP for the year ended December 31, 2009 was COP 1,146,480 million (compared with COP 849,920 million for fiscal year 2008 and COP 1,015,644 million for fiscal year 2007). The difference in some significant adjustments between Colombian and U.S. GAAP results are described in “Note 31, Differences between Colombian Accounting Principles for Banks and U.S. GAAP” – to the Financial Statements included in this Annual Report.

| | | As of and for the year ended December 31, | |

| | | 2009 | | | 2008 | | | | | | | 2006 | | | | | |

| | | (Percentages, except for operating data) | |

SELECTED RATIOS: (1) | | | | | | | | | | | | | | | | | |

| Colombian GAAP: | | | | | | | | | | | | | | | | | |

| Profitability ratios: | | | | | | | | | | | | | | | | | |

Net interest margin (2) | | | 7.22 | | | | 7.70 | | | | 7.60 | | | | 6.19 | | | | 8.12 | |

Return on average total assets (3) | | | 2.01 | | | | 2.34 | | | | 2.52 | | | | 2.31 | | | | 3.30 | |

Return on average stockholders’ equity (4) | | | 19.59 | | | | 23.68 | | | | 26.13 | | | | 22.10 | | | | 31.49 | |

| Efficiency Ratio: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses as a percentage of interest, fees, services and other operating income | | | 50.89 | | | | 47.79 | | | | 52.60 | | | | 64.37 | | | | 54.94 | |

| Capital ratios: | | | | | | | | | | | | | | | | | | | | |

| Period-end stockholders’ equity as a percentage of period-end total assets | | | 11.37 | | | | 9.90 | | | | 9.97 | | | | 10.57 | | | | 10.96 | |

Period-end regulatory capital as a percentage of period-end risk- weighted assets (5) | | | 13.23 | | | | 11.24 | | | | 12.67 | | | | 11.05 | | | | 10.93 | |

| Credit quality data: | | | | | | | | | | | | | | | | | | | | |

Non-performing loans as a percentage of total loans (6) | | | 2.44 | | | | 2.35 | | | | 1.77 | | | | 1.36 | | | | 1.48 | |

“C”, “D” and “E” loans as a percentage of total loans (9) | | | 5.11 | | | | 4.40 | | | | 3.10 | | | | 2.54 | | | | 3.38 | |

Allowance for loan and accrued interest losses as a percentage of non-performing loans (10) | | | 241.08 | | | | 224.53 | | | | 223.67 | | | | 252.87 | | | | 259.02 | |

Allowance for loan and accrued interest losses as a percentage of “C”, “D” and “E” loans (9) | | | 115.25 | | | | 120.21 | | | | 127.38 | | | | 135.06 | | | | 113.59 | |

| Allowance for loan and accrued interest losses as a percentage of total loans | | | 5.89 | | | | 5.29 | | | | 3.95 | | | | 3.43 | | | | 3.84 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATING DATA: | | | | | | | | | | | | | | | | | | | | |

Number of branches (7) | | | 889 | | | | 890 | | | | 888 | | | | 701 | | | | 678 | |

Number of employees (8) | | | 21,201 | | | | 19,728 | | | | 24,836 | | | | 16,222 | | | | 14,562 | |

| (1) | Ratios were calculated on the basis of monthly averages. |

| (2) | Net interest income divided by average interest-earning assets. |

| (3) | Net income divided by average total assets. |

| (4) | Net income divided by average stockholders’ equity. |

| (5) | For an explanation of risk-weighted assets and Technical Capital, see “Item 4. Information on the Company – B. Business Overview – B.7. Supervision and Regulation – Capital Adequacy Requirements”. |

| (6) | Non-performing loans are microcredit loans that are past due 30 days or more, mortgage and consumer loans that are past due 60 days or more and commercial loans that are past due 90 days or more. (Each category includes financial leases). |

| (7) | Number of branches includes branches of the Bank’s Subsidiaries. |

| (8) | The number of employees includes employees of the Bank’s consolidated Subsidiaries. |

| (9) | See “Item 4. Information on the Company – E. Selected Statistical Information – E.3. Loan Portfolio – Classication of the loan portfolio and Credit Categories for a description of “C”, “D” and “E” Loans”. |

| (10) | Selected ratios for the year ended December 31, 2005, include Conavi and Corfinsura’s results. For U.S. GAAP purposes, see “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP – m) Business combinations”. |

| (11) | Selected ratios for the year ended December 31, 2007 include Banagrícola’s results. For U.S. GAAP purposes, see “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP – m) Business combinations”. |

| (12) | The selected ratios for the year 2007 were modified to reflect certain reclassifications made in commissions from banking services and other services, administrative and other expenses and other income that conform to the presentation of 2008 figures, in order to provide a better basis of comparison with respect to 2008 figures regarding the gains on the sale of mortgage loans. No such changes were made for 2006, as the reclassifications would not have a material impact on the figures for that period, and accordingly, would not be material for comparative purposes. |

Exchange Rates

On May 31, 2010, the Representative Market Rate was Ps 1,971.55 per $1.00. The Federal Reserve Bank of New York does not report a rate for pesos; the Superintendency of Finance calculates the Representative Market Rate based on the weight average of the buy/sell foreign exchange rates quoted daily by certain financial institutions, including BC, for the purchase and sale of U.S. dollars.

The following table sets forth the high and low Peso/U.S. dollar exchange rates for the last six months:

Recent exchange rates of U.S. Dollars per Peso;

| Month | | Low | | | High | |

| | | | | | | |

| December 2009 | | | 1,989.94 | | | | 2,054.10 | |

| January 2010 | | | 1,957.82 | | | | 2,044.23 | |

| February 2010 | | | 1,914.87 | | | | 2,003.76 | |

| March 2010 | | | 1,888.05 | | | | 1,934.21 | |

| April 2010 | | | 1,911.07 | | | | 1,973.05 | |

| May 2010 | | | 1,950.44 | | | | 2,029.54 | |

The following table sets forth the average peso/U.S. dollar Representative Market Rate for each of the five most recent financial years, calculated by using the average of the exchange rates on the last day of each month during the period.

| |

Representative Market Rate | |

| | | |

| | | | |

| 2009 | | | 2,179.64 | |

| 2008 | | | 1,993.80 | |

| 2007 | | | 2,069.21 | |

| 2006 | | | 2,359.13 | |

| 2005 | | | 2,320.77 | |

| | | | | |

| Source: Superintendency of Finance. | | | | |

| | B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| | C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

Investors should consider the following risks and uncertainties, and the other information presented in this Annual Report. In addition, the factors referred to below, as well as all other information presented in this Annual Report, should be considered by investors when reviewing any forward-looking statements contained in this Annual Report, in any document incorporated by reference in this Annual Report, in any of the Bank’s future public filings or press releases, or in any future oral statements made by the Bank or any of its officers or other persons acting on its behalf. If any of the following risks occur, the Bank’s business, results of operations and financial condition, its ability to raise capital and its ability to access funding could be materially and adversely affected. These risk factors should not be considered a complete list of potential risks that may affect Bancolombia.

Risk Factors Relating to Colombia and Other Countries Where the Bank Operates

Changes in economic and political conditions in Colombia and El Salvador or in the other countries where the Bank operates may adversely affect the Bank’s financial condition and results of operations.

The Bank’s financial condition, results of operations and asset quality are significantly dependent on the macroeconomic and political conditions prevailing in Colombia, El Salvador and the other jurisdictions in which the Bank operates. Accordingly, decreases in the growth rate, periods of negative growth, increases in inflation, changes in policy, or future judicial interpretations of policies involving exchange controls and other matters such as (but not limited to) currency depreciation, inflation, interest rates, taxation, banking laws and regulations and other political or economic developments in or affecting Colombia, El Salvador or the other jurisdictions where the Bank operates may affect the overall business environment and may in turn impact the Bank’s financial condition and results of operations.

In particular, the governments of Colombia and El Salvador have historically exercised substantial influence on each other’s economies, and their policies are likely to continue to have an important effect on Colombian and Salvadorian entities (including the Bank), market conditions, prices and rates of return on securities of local issuers (including the Bank’s securities). On June 1, 2009, a member of the FMLN party took office as President of El Salvador after 20 years of rule by the ARENA party and, accordingly, significant changes in Salvadorian laws, public policies and regulations could occur. In May 2010, Presidential elections will be held in Colombia. The uncertainties characteristic of a change in government, including potential changes in laws, public policies and regulations, may cause instability and volatility in Colombia and its markets.

Future developments in government policies could impair the Bank’s business or financial condition or the market value of its securities.

The economies of the countries where the Bank operates remain vulnerable to external shocks that could be caused by significant economic difficulties experienced by their major regional trading partners or by more general “contagion” effects, which could have a material adverse effect on their economic growth and their ability to service their public debt.

A significant decline in the economic growth or a sustained economic downturn of any of Colombia’s or El Salvador’s major trading partners (i.e., United States, Venezuela and Ecuador for Colombia and the United States for El Salvador) could have a material adverse impact on Colombia’s and El Salvador’s balance of trade and remittances inflows, resulting in lower economic growth.

The recent global economic downturn, which began in the U.S. financial sector and then spread to different economic sectors and countries around the world, has had, and is expected to continue to have, adverse effects on the economies of the countries where the Bank operates. Colombia and El Salvador for instance, have experienced decreases in economic growth that have resulted in higher past due loans and loan loss provisions for the Bank, as well as in lower demand for its products.

Deterioration in the economic and political situation of neighboring countries could affect national stability or the Colombian economy by disrupting Colombia’s diplomatic or commercial relationships with these countries. Recent political tensions between Colombia and Venezuela have produced lower trade levels that have adversely impacted economic activity. Further trade restrictions by Venezuela may deepen these adverse effects, while increasing tensions may cause political and economic uncertainty, instability, market volatility, lower confidence levels and higher risk aversion by investors and market participants that may negatively affect economic activity.

A contagion effect, in which an entire region or class of investment is disfavored by international investors, could negatively affect Colombia and El Salvador or other economies where the bank operates (i.e., Panama, Cayman Islands, Peru and Puerto Rico), as well as the market prices and liquidity of securities issued or owned by the Bank.

Any additional taxes resulting from changes to tax regulations or the interpretation thereof in Colombia, El Salvador or other countries where the Bank operates, could adversely affect the Bank’s consolidated results.

Uncertainty relating to tax legislation poses a constant risk to the Bank. Colombian and Salvadorian national authorities have levied new taxes in recent years. Changes in legislation, regulation and jurisprudence can affect tax burdens by increasing tax rates and fees, creating new taxes, limiting stated expenses and deductions, and eliminating incentives and non-taxed income. Notably, the Colombian and Salvadorian governments have significant fiscal deficits that may result in future tax increases. Additional tax regulations could be implemented that could require the Bank to make additional tax payments, negatively affecting its results of operations and cash flow. In addition, national or local taxing authorities may not interpret tax regulations in the same way that the Bank does. Differing interpretations could result in future tax litigation and associated costs.

Exchange rate volatility may adversely affect the Colombian economy, the market price of our ADSs, and the dividends payable to holders of the Bank’s ADSs.

Colombia has adopted a floating exchange rate system. The Colombian Central Bank maintains the power to intervene on the exchange market in order to consolidate or dispose of international reserves, and as to control any volatility in the exchange rate. From time to time, there have been significant fluctuations in the exchange rate between the Colombian peso and the U.S. dollar. For instance, the peso appreciated 1.99% in 2006, appreciated 10.01% in 2007, depreciated 11.36% in 2008, and appreciated 8.89% in 2009. Unforeseen events in the international markets, fluctuations in interest rates or changes in capital flows, may cause exchange rate instability that could generate sharp movements in the value of the peso. Given that a portion of our assets and liabilities are denominated in, or indexed to, foreign currencies, especially the U.S. dollar, sharp movements in exchange rates may negatively impact the Bank’s results. In addition, exchange rate fluctuations may adversely impact the value of dividends paid to holders of the Bank’s ADSs as well as the market price and liquidity of ADSs.

Colombia has experienced several periods of violence and instability, and such instability could affect the economy and the Bank.

Colombia has experienced several periods of criminal violence over the past four decades, primarily due to the activities of guerilla groups and drug cartels. In response, the Colombian government has implemented various security measures and has strengthened its military and police forces by creating specialized units. Despite these efforts, drug-related crime and guerilla activity continue to exist in Colombia. These activities, their possible escalation and the violence associated with them may have a negative impact on the Colombian economy or on the Bank in the future. The Bank’s business or financial condition and the market value of the Bank’s securities and any dividends distributed by it, could be adversely affected by rapidly changing economic and social conditions in Colombia and by the Colombian government’s response to such conditions.

Risk Factors Relating to the Bank’s Business and the Banking Industry

Instability of banking laws and regulations in Colombia and in other jurisdictions where the Bank operates could adversely affect the Bank’s consolidated results.

Changes in banking laws and regulations, or in their official interpretation, in Colombia and in other jurisdictions where the Bank operates, may have a material effect on the Bank’s business and operations. Since banking laws and regulations change frequently, they could be adopted, enforced or interpreted in a manner that may have an adverse effect on the Bank’s business.

Although Bancolombia currently complies with capital requirements, future additional capital requirements could adversely affect the levels of return for stockholders’ and/or the Bank’s market price of its common and preferred shares.

Bancolombia’s continuous assessment of its capital position aims at ensuring that Bancolombia and its financial subsidiaries maintain sufficient capital consistent with their risk profile, all applicable regulatory standards and guidelines as well as external rating agency conditions. There can be no assurance, however, that future regulation will not change or require Bancolombia or its subsidiaries to comply with additional capital. Moreover, the various regulators in the world have not reached consensus as to the appropriate level of capitalization for financial services institutions. Regulators in the jurisdictions where Bancolombia operate may alter the current regulatory capital requirements to which Bancolombia is subject and thereby necessitate equity increases that could dilute existing stockholders, lead to required asset sales or adversely impact the return on stockholders’ equity.

Banking regulations, accounting standards and corporate disclosure applicable to the Bank and its subsidiaries differ from those in the United States and other countries.

While many of the policies underlying Colombian banking regulations are similar to those underlying regulations applicable to banks in other countries, including those in the United States, Colombian regulations can differ in a number of material respects from those other regulations. For example, capital adequacy requirements for banks under Colombian regulations differ from those under U.S. regulations and may differ from those in effect in other countries. The Bank prepares its annual audited financial statements in accordance with Colombian GAAP, which differs in significant respects to U.S. GAAP and International Financial Reporting Standards (“IFRS”). Thus, Colombian financial statements and reported earnings may differ from those of companies in other countries in these and other respects. Some of the differences affecting earnings and stockholders’ equity include, but are not limited to the accounting treatment for restructuring, loan origination fees and costs, deferred income taxes and the accounting treatment for business combination accounting. Moreover, under Colombian GAAP, allowances for non-performing loans are computed by establishing each non-performing loan’s individual inherent risk using criteria established by the Superintendency of Finance that differs from that used under U.S. GAAP. See “Item 4. Information on the Company – E. Selected Statistical Information – E.4. Summary of Loan Loss Experience – Allowance for Loan Losses”.

Although the Colombian government is currently undertaking a review of present regulations relating to accounting, audit, and information disclosure, with the intention of seeking convergence with international standards, current regulations continue to differ in certain respects from those in other countries.

In addition, there may be less publicly available information about the Bank than is regularly published by or about U.S. issuers or issuers in other countries.

The Bank is subject to regulatory inspections, examinations, inquiries or audits in Colombia and in other countries where it operates, and any sanctions, fines and other penalties resulting from such inspections and audits could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

The Bank is subject to comprehensive regulation and supervision by the banking authorities of Colombia, El Salvador and the other jurisdictions in which the Bank operates. These regulatory authorities have broad powers to adopt regulations and other requirements affecting or restricting virtually all aspects of its capitalization, organization and operations, including the imposition of anti-money laundering measures and the authority to regulate the terms and conditions of credit that can be applied by banks. In the event of non-compliance with applicable regulations, the Bank could be subject to fines, sanctions or the revocation of licenses or permits to operate its business. In Colombia, for instance, in the event the Bank encounters significant financial problems or becomes insolvent or in danger of becoming insolvent, banking authorities would have the power to take over the Bank’s management and operations. Any sanctions, fines and other penalties resulting from non-compliance with regulations in Colombia and in the other jurisdictions where the Bank operates could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

Moreover, banking and financial services laws and regulations are subject to continuing review and changes, and any such changes in the future may have an adverse impact on the Bank’s operations, including making and collecting loans and other extensions of credit, which could materially and adversely affect the Bank’s results of operations and financial position.

The increase of constitutional actions ( acciones populares), class actions ( acciones de grupo ) and other legal actions involving claims for significant monetary awards against financial institutions may affect the Bank’s businesses.

Under the Colombian Constitution, individuals may initiate constitutional or class actions to protect their collective or class rights, respectively. In recent years, Colombian financial institutions, including the Bank, have experienced a substantial increase in the aggregate number of these actions. The great majority of such actions are related to fees, financial services and interest rates, and their outcome is uncertain. Although during 2009 the aggregate number of such actions brought against the Bank remained stable as compared to 2008 and 2007, the number of such actions might not remain stable in the future. The number of these actions may increase in the future and could significantly affect the Bank’s business.

The Bank and members of its senior management are defendants in several legal proceedings.

The Bank is a party to lawsuits arising in the ordinary course of business that can be expensive and lengthy. In addition, the Bank and its management, including the Bank’s current President and Vice-President, are currently involved in several legal proceedings related to the acquisition of its predecessor entity. An unfavorable resolution to any of the lawsuits or investigations could negatively affect the Bank’s reputation and the price of its outstanding securities. See “Item 8. Financial Information – A. Consolidated Statements and Other Financial Information – A.1. Consolidated Financial Statements – A.2. Legal Proceedings in this Annual Report”.

Future restrictions on interest rates or banking fees could negatively affect the Bank’s profitability.

In the future, regulations in the jurisdictions where the Bank operates could impose limitations regarding interest rates or fees. Any such limitations could materially and adversely affect the Bank’s results of operations and financial position.

In particular, there has been an ongoing dispute in Colombia among merchants, payment services and banks regarding interchange fees. Specifically, in 2004, the Superintendency of Commerce and Industry started an investigation against Credibanco and Redeban, entities that participate in Colombia’s payment services system, for an alleged illegal anticompetitive agreement based on the way in which interchange fees were determined at that time.

The Superintendency of Commerce and Industry has determined that there was a breach in the compliance of some commitments signed by Redeban, Credibanco and the banks and imposed a fine, a decision that was confirmed in September 2009.

As a consequence of the dispute described above, interchange fees in Colombia have been declining in recent years, while further pressures may lead to additional decreases, which in turn could impact the Bank’s financial results.

The Bank is subject to credit risk.

A number of our products expose the Bank to credit risk, including loans, financial leases, lending commitments and derivatives. Changes in the income levels of the Bank’s borrowers, increases in the inflation rate or an increase in interest rates could have a negative effect on the quality of the Bank’s loan portfolio, causing the Bank to increase provisions for loan losses and resulting in reduced profits or in losses.

The Bank estimates and establishes reserves for credit risk and potential credit losses. This process involves subjective and complex judgments, including projections of economic conditions and assumptions on the ability of our borrowers to repay their loans. This process is subject to human error as the Bank’s employees may not always be able to assign an accurate credit rating to a client, which may result in the Bank’s exposure to higher credit risks than indicated by the Bank’s risk rating system. The Bank may not be able to timely detect these risks before they occur, or due to limited resources or available tools, the Bank’s employees may not be able to effectively implement its credit risk management system, which may increase its exposure to credit risk. Moreover, the Bank’s failure to continuously refine its credit risk management system may result in a higher risk exposure for the Bank, which could materially and adversely affect its results of operations and financial position.

Overall, if the Bank is unable to effectively control the level of non-performing or poor credit quality loans in the future, or if its loan loss reserves are insufficient to cover future loan losses, the Bank’s financial condition and results of operations may be materially and adversely affected.

In addition, the amount of the Bank’s non-performing loans may increase in the future, including loan portfolios that the Bank may acquire through auctions or otherwise, as a result of factors beyond the Bank’s control, such as the impact of macroeconomic trends and political events affecting Colombia or other jurisdictions where the Bank operates, or events affecting specific industries.

The recent economic downturn has adversely affected, and may continue to adversely affect, Bancolombia’s asset quality levels, which in turn have produced higher provision charges.

Recent lower economic activity has affected, and may continue to affect, consumer confidence levels, consumer spending, bankruptcy rates, and levels of incurrence and default on consumer and commercial debt, among other factors, in the markets where Bancolombia operates. Any of these factors, along with persistently high levels of unemployment, may result in a greater likelihood of delinquencies and past due loans, which in turn, could result in a higher level of loan losses and allowances for credit losses, all of which could adversely affect our earnings.

The Bank is subject to credit risks with respect to its non-traditional banking businesses including investing in securities and entering into derivatives transactions.

Non-traditional sources of credit risk can arise from, among other things: investing in securities of third parties, entering into derivative contracts under which counterparties have obligations to make payments to the Bank, and executing securities, futures, currency or commodity trades from the Bank’s proprietary trading desk that fail to settle at the required time due to non-delivery by the counterparty or systems failure by clearing agents, exchanges, clearing houses or other financial intermediaries. Any significant increases in exposure to any of these non-traditional risks, or a significant decline in credit risk or bankruptcy of any of the counterparties, could materially and adversely affect the Bank’s results of operations and financial position.

The Bank is exposed to risks associated with the mortgage loan market.

Bancolombia is a leader in the Colombian mortgage loan market. Colombia’s mortgage loan market is highly regulated and has historically been affected by various macroeconomic factors such as periods of sustained high interest rates which have historically discouraged customers from borrowing and have resulted in increased defaults in outstanding loans and deterioration in the quality of assets.

The Bank is subject to concentration default risks in its loan portfolio. Problems with one or more of its largest borrowers may adversely affect its financial condition and results of operations.

The aggregate outstanding principal amount of the Bank’s 25 largest borrowing relationships represented approximately 12% of its total consolidated loan portfolio as of December 31, 2009. Problems with one or more of the Bank’s largest borrowers could materially and adversely affect its results of operations and financial position. For more information, see “Item 4. Information on the Company – E. Selected Statistical Information – E.3. Loan Portfolio – Borrowing Relationships”.

The value of the collateral or guarantees securing the outstanding principal and interest balance of the Bank’s loans may not be sufficient to cover such outstanding principal and interest. In addition, the Bank may be unable to realize the full value of the collateral or guarantees securing the outstanding principal and interest balance of its loans.

The Bank’s loans collateral primarily includes real estate, assets pledged in financial leasing transactions and other assets that are located primarily in Colombia and El Salvador, the value of which may significantly fluctuate or decline due to factors beyond the Bank’s control. Such factors include macroeconomic factors and political events affecting the local economy. Any decline in the value of the collateral securing the Bank’s loans may result in a reduction in the recovery from collateral realization and may have an adverse impact on the Bank’s results of operations and financial condition. In addition, the Bank may face difficulties in enforcing its rights as a secured creditor. In particular, timing delays and procedural problems in enforcing against collateral and local protectionism, may make foreclosures on collateral and enforcement of judgments difficult, and may result in losses, that could materially and adversely affect the Bank’s results of operations and financial position.

The Bank is subject to market risk.

We are directly and indirectly affected by changes in market conditions. Market risk, or the risk that values of assets and liabilities or revenues will be adversely affected by variation in market conditions, is inherent in the products and instruments associated with our operations, including loans, deposits, securities, bonds, long-term debt, short-term borrowings, proprietary trading in assets and liabilities and derivatives. Changes in market conditions that may affect our financial condition and results of operations include fluctuations in interest and currency exchange rates, securities prices, changes in the implied volatility of interest rates and foreign exchange rates, among others.

The Bank is subject to fluctuations in interest rates, which may materially and adversely affect its results of operations and financial condition.

The Bank holds a substantial portfolio of loans and debt securities that have both fixed and floating interest rates. Therefore, changes in interest rates could adversely affect our net interest margins as well as the prices of these securities. Increases in interest rates may reduce gains or the market value of the Bank’s debt securities. Sustained high interest rates have historically discouraged customers from borrowing and have resulted in increased delinquencies in outstanding loans and deterioration in the quality of assets. On the other hand, decreases in interest rates may cause margin compression and lower net interest income as the Bank usually maintains more assets than liabilities at variable rates. Decreasing interest rates also may trigger loan prepayments which could negatively affect the Bank’s net interest income. Generally, in a declining interest rate environment, prepayment activity increases which reduces the weighted average maturity of the Bank’s interest earning assets and adversely affects its operating results. Prepayment risk also has a significant adverse impact on credit card and collateralized mortgage obligations, since prepayments could shorten the weighted average life of these portfolios, which may result in a mismatch in funding or in reinvestment at lower yields. In addition, the Bank may incur costs which, in turn, may impact its results as it implements strategies to reduce future interest rate exposure.

The Bank’s income from its proprietary trading activities is highly volatile.

The Bank’s trading income is highly volatile. The Bank derives a portion of its profits from its proprietary trading activities and any significant reduction in its trading income could adversely affect the Bank’s results of operations and financial position. The Bank’s trading income is dependent on numerous factors beyond its control, such as the general market environment, overall market trading activity, interest rate levels, fluctuations in exchange rates and general market volatility. A significant decline in the Bank’s trading income, or the incurrence of a trading loss, could adversely affect the Bank’s results of operations and financial position.

The Bank’s results could be negatively impacted by the depreciation of sovereign debt securities.

The Bank’s debt securities portfolio is primarily composed of sovereign debt securities, including securities issued or guaranteed by the Colombian government. Therefore, the Bank’s results are exposed to credit, market, and liquidity risk associated with sovereign debt. As of December 31, 2009, the Bank’s total debt securities represented 13.6% of its total assets, and 40% of these securities were issued or backed by the Colombian government. A significant decline in the value of the securities issued or guaranteed by the Colombian government could adversely affect the Bank’s debt securities portfolio and consequently the Bank’s results of operations and financial position.

The Bank is subject to market, operational and structural risks associated with its derivative transactions.

The Bank enters into derivative transactions for hedging purposes and on behalf of its customers. The Bank is subject to market and operational risks associated with these transactions, including basis risk (the risk of loss associated with variations in the spread between the asset yield and the funding and/or hedge cost) and credit or default risk (the risk of insolvency or other inability of the counterparty to a particular transaction to perform its obligations thereunder). In addition, the market practice and documentation for derivative transactions is less developed in the jurisdictions where the Bank operates as compared to other more developed countries, and the court systems in such jurissdications have limited experience in dealing with issues related to derivative transactions. As a result, there is increased operating and structural risks associated with derivatives transactions in these jurisdictions.

In addition, the execution and performance of derivatives transactions depend on the Bank’s ability to develop adequate control and administrative systems, and to hire and retain qualified personnel. Moreover, the Bank’s ability to adequately monitor, analyze and report these derivative transactions depends, to a great extent, on its information technology systems. These factors may further increase the risks associated with these transactions and could materially and adversely affect the Bank’s results of operations and financial position.

The Bank is subject to operational risks.

The Bank’s businesses are dependent on the ability to process a large number of transactions efficiently and accurately. Operational risks and losses can result from fraud, employee errors, and failure to properly document transactions or to obtain proper internal authorization, failure to comply with regulatory requirements, breaches of conduct of business rules, equipment failures, natural disasters or the failure of external systems. The Bank’s currently adopted procedures may not be effective in controlling each of the operational risks faced by the Bank.

The Bank’s businesses rely heavily on data collection, processing and storage systems, the failure of which could materially and adversely affect the effectiveness of its risk management, reputation and internal control system as well as its financial condition and results of operations.

All of the Bank’s principal businesses are highly dependent on the ability to timely collect and process a large amount of financial and other information at its various branches across numerous markets, at a time when transaction processes have become increasingly complex with increasing volume. The proper functioning of financial control, accounting or other data collection and processing systems is critical to the Bank’s businesses and to its ability to compete effectively. A partial or complete failure of any of these primary systems could materially and adversely affect the Bank’s decision making process, its risk management and internal control systems, the quality of its service, as well as the Bank’s ability to respond on a timely basis to changing market conditions. If the Bank cannot maintain an effective data collection and management system, its business operations, financial condition, reputation and results of operations could be materially and adversely affected. The Bank is also dependent on information systems to operate its website, process transactions, respond to customer inquiries on a timely basis and maintain cost-efficient operations. The Bank may experience operational problems with its information systems as a result of system failures, viruses, computer hackers or other causes. Any material disruption or slowdown of its systems could cause information, including data related to customer requests, to be lost or to be delivered to the Bank’s clients with delays or errors, which could reduce demand for the Bank’s services and products and could materially and adversely affect the Bank’s results of operations and financial position.

Any failure to effectively improve or upgrade the Bank’s information technology infrastructure and management information systems in a timely manner could adversely affect its competitiveness, financial condition and results of operations.