- CIB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

F-4 Filing

Bancolombia (CIB) F-4Registration of securities (foreign)

Filed: 2 Dec 24, 4:16pm

As filed with the U.S. Securities and Exchange Commission on December 2, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Bancolombia S.A.

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of Registrant’s Name into English)

Republic of Colombia (State or Other Jurisdiction of | 6029 (Primary Standard Industrial | Not Applicable (I.R.S. Employer Identification Number) |

Carrera 48 # 26-85, Avenida Los Industriales

Medellín, Colombia

Telephone: +57 604 4041918

(Address and telephone number of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

Telephone: (302) 738-6680

(Name, address and telephone number of agent for service)

Copies to:

Sergio J. Galvis, Esq.

Patrick S. Brown, Esq.

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

Telephone: (212) 558-4000

Facsimile: (212) 558-3588

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not ask you to vote until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December 2, 2024

Extraordinary General Shareholders’ Meeting of Bancolombia S.A.

CORPORATE STRUCTURE CHANGES PROPOSAL

Bancolombia S.A. (“Bancolombia”, the “Bank”, “we” or “us”) will call upon an extraordinary general meeting of Bancolombia’s shareholders (the “Extraordinary General Shareholders’ Meeting”) to vote on a transaction regarding the establishment of a holding company structure (the “Corporate Structure Changes”), as a result of which Bancolombia and its affiliates will be reorganized under a new holding company named Grupo Cibest S.A. (“Grupo Cibest”). As part of the Corporate Structure Changes, each common share of Bancolombia will be exchanged for one common share of Grupo Cibest, and each preferred share of Bancolombia will be exchanged for one preferred share of Grupo Cibest, except for shares of Bancolombia held by Grupo Cibest (the “Share Exchange”). Holders of each American depositary share of Bancolombia, which represents four preferred shares of Bancolombia, will receive one Grupo Cibest American depositary share, which will represent four preferred shares of Grupo Cibest (subject to payment of certain applicable depositary fees).

In connection with the Share Exchange, Grupo Cibest will issue 509,703,584 of its common shares to holders of Bancolombia’s common shares and 452,122,416 of its preferred shares to holders of Bancolombia’s preferred shares. Bancolombia’s common shares and preferred shares are listed on the Bolsa de Valores de Colombia (the “Colombian Securities Exchange”) and trade under the symbols “BCOLOMBIA” and “PFBCOLOM,” respectively. Bancolombia’s American depositary shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “CIB.” We expect Grupo Cibest’s common shares and preferred shares will be listed on the Colombian Securities Exchange under the symbols and , respectively, and its American depositary shares will be listed on the NYSE under the symbol .

We believe that the Corporate Structure Changes will allow us to optimize our capital structure and capital allocation strategy, strengthen our financial and non-financial businesses, enhance strategic flexibility, increase visibility into the organization’s value and mitigate risk as a lending institution.

Certain elements of the Corporate Structure Changes, as set forth in more detail herein, must be approved by the holders of Bancolombia’s common shares and preferred shares at the Extraordinary General Shareholders’ Meeting to be held at on , 2025 at a.m. local time. We refer to the elements of the Corporate Structure Changes that are subject to shareholder approval as the “Corporate Structure Changes Approval Matters.” At the Extraordinary General Shareholders’ Meeting, the holders of Bancolombia’s common shares and preferred shares will vote on the approval of the Corporate Structure Changes Approval Matters.

This prospectus has been prepared for holders of Bancolombia’s common shares, preferred shares and American depositary shares residing in the United States to provide information about the proposed Corporate Structure Changes, Share Exchange, the Extraordinary General Shareholders’ Meeting and related matters. We encourage you to read this document in its entirety, including the section entitled “Risk Factors” that begins on page 11.

Holders of Bancolombia’s common shares and holders of Bancolombia’s preferred shares will be entitled to attend and vote, either in person or by representative by granting powers of attorney in writing to authorized representatives, in accordance with Colombian law, at the Extraordinary General Shareholders’ Meeting. Bancolombia has fixed the close of business on , 2025 as the record date for the determination of the holders of Bancolombia’s common shares and holders of Bancolombia’s preferred shares entitled to receive notice of and to vote at the Extraordinary General Shareholders’ Meeting. Holders of Bancolombia’s American depositary shares will be entitled to instruct The Bank of New York Mellon, as depositary, as to how to vote their underlying preferred shares at the Extraordinary General Shareholders’ Meeting in accordance with the procedures set forth in this prospectus, if those holders were recorded on such depositary’s register on , 2025.

Your vote is important, regardless of the number of shares you own.

Juan Carlos Mora Uribe

Chief Executive Officer Bancolombia S.A.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND BANCOLOMBIA A PROXY.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities to be issued in connection with the Share Exchange or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2025 and is expected to be first mailed to shareholders on or about such date.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form F-4 to register with the SEC Grupo Cibest’s common shares and preferred shares to be issued in connection with the Share Exchange. This prospectus is a part of that registration statement. As allowed by SEC rules, this prospectus does not contain all the information you can find in the registration statement or the exhibits to the registration statement.

The SEC’s rules allow us to “incorporate by reference” information into this prospectus. This means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus from the date we file that document. Any reports filed by Bancolombia with the SEC after the date of this prospectus and prior to the date of the Extraordinary General Shareholders’ Meeting will be incorporated by reference into this prospectus and will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus (other than, in each case, documents or information deemed to have been furnished and not filed in accordance with SEC rules).

We incorporate by reference into this prospectus the following documents or information filed by Bancolombia with the SEC:

| (1) | Bancolombia’s Annual Report on Form 20-F for the fiscal year ended December 31, 2023 filed with the SEC on March 26, 2024 (the “2023 Annual Report”); |

| (2) | Bancolombia’s report on Form 6-K filed with the SEC on August 14, 2024 presenting financial information for the quarter ended June 30, 2024, including but not limited to management’s discussion & analysis on the results of the operation and the financial situation of Bancolombia, in relation to the results reported in the quarterly financial statements; |

| (3) | Bancolombia’s report on Form 6-K filed with the SEC on November 14, 2024 presenting financial information for the quarter ended September 30, 2024, including but not limited to management’s discussion & analysis on the results of the operation and the financial situation of Bancolombia, in relation to the results reported in the quarterly financial statements; |

| (4) | any of Bancolombia’s future annual reports on Form 20-F or any amendments to the 2023 Annual Report filed with the SEC under the U.S. Securities Exchange Act of 1934, as amended after the date of this prospectus and prior to the date of the Extraordinary General Shareholders’ Meeting; and |

| (5) | any future reports on Form 6-K that Bancolombia furnishes to the SEC after the date of this prospectus and prior to the date of the Extraordinary General Shareholders’ Meeting that are identified in such reports as being incorporated by reference in Bancolombia’s registration statement on Form F-4 of which this prospectus forms a part. |

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus. You may request a copy of these filings by writing or telephoning Bancolombia at its principal executive offices at the following address:

Bancolombia S.A.

Carrera 48 # 26-85 Avenida Los Industriales

Medellín, Colombia

Attention: Investor Relations

e-mail:ir@bancolombia.com.co

Telephone Number: (57) 604 404 1918

If you would like to request documents from us, please do so by , 2025 in order to receive them before the Extraordinary General Shareholders’ Meeting.

-i-

You should rely only on the information contained in this prospectus to vote on the Corporate Structure Changes Approval Matters. We have not authorized anyone to provide you with information different from that contained in the prospectus. This prospectus is dated , 2025. You should not assume that the information contained in this prospectus is accurate as of any other date.

-ii-

-iii-

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

Comparison of Rights of Bancolombia S.A. Shareholders and Grupo Cibest Shareholders | 48 | |||

| 49 | ||||

| 49 | ||||

| 54 | ||||

Colombian Foreign Exchange Controls and Securities Regulations | 57 | |||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 58 | ||||

| 62 | ||||

| 64 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| A-1 | ||||

| I-1 | ||||

| II-1 | ||||

| III-1 | ||||

| IV-1 | ||||

-iv-

This prospectus converts certain Colombian peso (or “COP”) amounts into U.S. dollars at specified rates solely for the convenience of the reader. The Federal Reserve Bank of New York does not report a rate for Colombian pesos. Unless otherwise indicated, such Colombian peso amounts have been converted at the rate of COP 4,148.04 per US$1.00, which corresponds to the tasa representativa del mercado (“representative market rate”) calculated on June 30, 2024. The representative market rate is computed and certified by the Superintendencia Financiera de Colombia (the “Colombian Superintendence of Finance” or “SFC”) on a daily basis and represents the weighted average of the buy/sell foreign exchange rates negotiated on the previous day by certain financial institutions authorized to engage in foreign exchange transactions (including us). The SFC also calculates and certifies the average representative market rate for each month for purposes of preparing financial statements and converting amounts in foreign currency to Colombian pesos. You should not construe these convenience conversions as a representation that the Colombian peso amounts correspond to, or have been or could be converted into U.S. dollars at the representative market rate or any other rate. On June 30, 2024 and June 30, 2023, the calculated representative market rate was COP 4,148.04 and COP 4,191.28 per US$1.00, respectively.

The following table sets forth the low and high Colombian peso per U.S. dollar exchange rates and the Colombian peso/U.S. dollar representative market rate calculated on the last day of the month, for each of the last six months:

Recent exchange rates of U.S. Dollars per Colombian Peso

Month | Low | High | Period-End | |||||||||

November 2024 (through November 27) | 4,344.55 | 4,478.21 | 4,405.96 | |||||||||

October 2024 | 4,173.66 | 4,413.46 | 4,413.46 | |||||||||

September 2024 | 4,139.43 | 4,285.61 | 4,164.21 | |||||||||

August 2024 | 4,011.37 | 4,184.30 | 4,160.31 | |||||||||

July 2024 | 3,944.97 | 4,148.04 | 4,089.05 | |||||||||

June 2024 | 3,860.92 | 4,175.96 | 4,148.04 | |||||||||

Source: SFC

The following table sets forth the Colombian peso/U.S. dollar representative market rate calculated on the last day of the year and the average Colombian peso/U.S. dollar representative market rate (calculated by using the average of the representative market rates on the last day of each month during the year) for each of the five most recent financial years.

Colombian Peso/US$1.00 representative market rate

Year | Period End | Average | ||||||

2023 | 3,822.05 | 4,330.14 | ||||||

2022 | 4,810.20 | 4,257.12 | ||||||

2021 | 3,981.16 | 3,747.24 | ||||||

2020 | 3,432.50 | 3,691.27 | ||||||

2019 | 3,277.14 | 3,282.39 | ||||||

Source: SFC

-1-

This prospectus contains statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts, but instead represent only Bancolombia’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside Bancolombia’s control. Words such as “anticipate,” “believe,” “estimate,” “approximate,” “expect,” “may,” “intend,” “plan,” “predict,” “target,” “forecast,” “guideline,” “should,” “project” and similar words and expressions are intended to identify forward-looking statements. All forward-looking statements are our management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. In addition to the risks related to Bancolombia’s business, the factors relating to the Corporate Structure Changes discussed under “Risk Factors” and the risks related to the business of Grupo Cibest following the Corporate Structure Changes, among others, could cause Bancolombia’ s actual results to differ, possibly materially, from those described in these forward-looking statements. These forward-looking statements appear in a number of places in this prospectus and include, but are not limited to:

| • | changes in general economic, business, political, social, fiscal or other conditions in Colombia, Panama, El Salvador, Guatemala or the other countries where Bancolombia operates; taking into account (i) economic challenges persisting due to high levels of inflation globally driven in part by supply chain disruptions and geopolitical tensions such as the continuing armed conflict in Ukraine and conflict in the Middle East, which pose potential impacts such as higher prices for energy, raw materials and agricultural items, among others; and (ii) an ambitious legal reform agenda that the government of Colombia is implementing; |

| • | changes in capital markets or in markets in general that may affect policies or attitudes towards lending; |

| • | unanticipated increases in Bancolombia’s financing and other costs, or Bancolombia’s inability to obtain additional debt or equity financing on attractive terms; |

| • | prolonged inflation, changes in foreign exchange rates, interest rates and unemployment rates; |

| • | sovereign risks; |

| • | liquidity risks; |

| • | increases in delinquencies by Bancolombia’s borrowers; |

| • | lack of acceptance of new products or services by Bancolombia’s targeted customers; |

| • | competition in the banking, financial services, credit card services, insurance, asset management, remittances, business and other industries in which Bancolombia operates; |

| • | failure to realize the anticipated benefits of the Corporate Structure Changes and adverse regulatory developments; |

| • | adverse determination of legal or regulatory disputes or proceedings and the consequences thereof; |

| • | changes in official policies, regulations and the Colombian government’s banking policy or the policies and regulations applicable to Grupo Cibest, as well as changes in laws, regulations or policies in other jurisdictions in which Bancolombia does business; |

| • | factors specific to Bancolombia, including changes to the estimates and assumptions underlying Bancolombia’s financial statements; Bancolombia’s success in identifying and managing risks (such as the incidence of loan delinquencies); Bancolombia’s inability to achieve Bancolombia’s financial and capital targets, which may result in failure to achieve any of the expected benefits of Bancolombia’s |

-2-

strategies; a reduction in Bancolombia’s credit ratings, which would decrease Bancolombia’s funding availability; failure to achieve satisfactory results in regulatory stress testing; and changes to the reliability and security of Bancolombia’s data management, data privacy, information and technology infrastructure, including cyber-attack threats which may impact Bancolombia’s ability to serve clients; |

| • | failure to attract, hire or retain key talent; and |

| • | other factors identified or discussed under “Risk Factors” in this prospectus and elsewhere in the documents incorporated in this prospectus by reference. |

Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or revise any forward-looking statements after the date on which they are made in light of new information, future events or other factors.

-3-

This summary highlights the material information appearing in this prospectus. However, it may not contain all of the information that is important to you. You should carefully read the entire prospectus for a complete understanding of the proposed Corporate Structure Changes, including the Share Exchange. In particular, you should read the documents attached to this prospectus and the other documents to which this prospectus refers you. See “Where You Can Find More Information.”

Carrera 48 # 26-85, Avenida Los Industriales

Medellín, Colombia

Telephone: + 57 604 4041918

Bancolombia is one of the largest Colombian financial institutions, with a presence in other countries such as Panama, El Salvador, Puerto Rico, Guatemala and the United States, providing a wide range of financial products and services to a diversified individual, corporate, institutional and government customer base throughout Colombia, Latin America and the Caribbean region.

Bancolombia has grown substantially over the years, both through organic growth and acquisitions. As of June 30, 2024, Bancolombia had on a consolidated basis:

| • | COP 352,199.1 billion in total assets; |

| • | COP 251,427.8 billion in total net loans and financial leases; |

| • | COP 257,869.3 billion in total deposits; and |

| • | COP 39,219.9 billion in stockholders’ equity attributable to the owners of the parent company. |

Bancolombia’s consolidated net income attributable to equity holders for the six months ended June 30, 2024 and for the six months ended June 30, 2023 was COP 1,439.7 billion and COP 1,460.5 billion, respectively, representing an annualized average return on equity attributable to equity holders of 15.32% and 15.75%, respectively, and an annualized average return on assets of 1.69% and 1.70%, respectively.

Bancolombia is a stock company (sociedad anónima) domiciled in Medellín, Colombia, that operates under Colombian laws and regulations, principally the Colombian Code of Commerce, Decree 663 of 1993 and Decree 2555 of 2010, as amended from time to time. Bancolombia was incorporated in Colombia in 1945 under the name Banco Industrial Colombiano S.A. or “BIC.” In 1998, Bancolombia merged with Banco de Colombia S.A., and changed its legal name to Bancolombia S.A. On July 30, 2005, Conavi and Corfinsura merged with and into Bancolombia. Through this merger, Bancolombia gained important competitive advantages in retail and corporate banking that materially strengthened Bancolombia’s multi-banking franchise.

In May 2007, Bancolombia’s wholly-owned subsidiary Bancolombia (Panamá) S.A. (“Bancolombia Panama”) acquired Banagrícola S.A., which controls several subsidiaries, including Banco Agrícola S.A. (“Banco Agrícola”) in El Salvador, and is dedicated to banking, commercial and consumer activities and securities brokerage. Through this first international acquisition, Bancolombia gained a leadership position in the Salvadorian financial market.

In October 2013, Bancolombia acquired a one hundred percent (100%) interest of the outstanding equity of Banistmo S.A. (“Banistmo”), a Panamanian banking entity and its subsidiaries involved in the securities brokerage, trust, consumer finance, and leasing businesses in Panama.

-4-

Also, in October 2013, Bancolombia Panama acquired a 40% interest in Grupo Agromercantil Holding S.A. (“Grupo Agromercantil”), the parent company of Banco Agromercantil de Guatemala S.A. (“BAM”), and certain other companies dedicated to securities brokerage, insurance, and other financial businesses in Guatemala. Bancolombia Panama acquired an additional 20% interest and control of Grupo Agromercantil on December 30, 2015 and acquired the remaining 40% interest on September 29, 2020.

Since 1995, Bancolombia has maintained a listing on the NYSE, where its American depositary shares are traded under the symbol “CIB,” and on the Colombian Securities Exchange, where its preferred shares are traded under the symbol “PFBCOLOM.” Since 1981, Bancolombia’s common shares have been traded on the Colombian Securities Exchange under the symbol “BCOLOMBIA.”

The Corporate Structure Changes (see page 18)

Bancolombia has called an extraordinary general shareholders’ meeting (the “Extraordinary General Shareholders’ Meeting”) for its shareholders to vote on the Corporate Structure Changes Approval Matters relating to the Corporate Structure Changes that will involve the reorganization of Bancolombia and its affiliates under a new holding company named Grupo Cibest. As part of the Corporate Structure Changes, certain non-Colombian banking and non-banking subsidiaries of Bancolombia will be distributed to, and become direct wholly-owned subsidiaries of, Grupo Cibest.

Also, as part of the Corporate Structure Changes, each common share of Bancolombia will be exchanged for one common share of Grupo Cibest, and each preferred share of Bancolombia will be exchanged for one preferred share of Grupo Cibest by means of the Share Exchange, except for shares of Bancolombia held by Grupo Cibest. Holders of each American depositary share of Bancolombia, which represents four preferred shares of Bancolombia, will receive one Grupo Cibest American depositary share, which will represent four preferred shares of Grupo Cibest (subject to payment of certain applicable depositary fees). In connection with the Share Exchange, Grupo Cibest will issue approximately 509,703,584 of its common shares to holders of Bancolombia’s common shares and 452,122,416 of its preferred shares to holders of Bancolombia’s preferred shares.

Certain elements of the Corporate Structure Changes, as set forth in more detail herein, must be approved by the holders of Bancolombia’s common shares and preferred shares at an extraordinary general shareholders’ meeting to be held at on , 2025 at a.m. local time. We refer to the elements of the Corporate Structure Changes that are subject to shareholder approval as the “Corporate Structure Changes Approval Matters.” At the Extraordinary General Shareholders’ Meeting, the holders of Bancolombia’s common shares and preferred shares will vote on the Corporate Structure Changes Approval Matters.

Holders of Bancolombia’s American depositary shares do not need to take any action in order to receive American depositary shares of Grupo Cibest. For a more complete description of the procedure for the exchange of Bancolombia’s American depositary shares for Grupo Cibest American depositary shares in the Share Exchange that forms a part of the Corporate Structure Changes, see “The Corporate Structure Changes—Exchange of Bancolombia S.A. Common Shares, Preferred Shares and American Depositary Shares Into Grupo Cibest Common Shares, Preferred Shares and American Depositary Shares.”

We believe that the Corporate Structure Changes will allow us to optimize our capital structure and capital allocation strategy, strengthen our financial and non-financial businesses, enhance strategic flexibility, increase visibility into the organization’s value and mitigate risk as a lending institution.

The Corporate Structure Changes will involve the following series of steps (the “Transaction Steps”):

| (1) | The distribution (escisión parcial por absorción) of Banagrícola S.A. and Grupo Agromercantil by Bancolombia Panama to Sociedad Beneficiaria BC Panamá S.A.S., a company established by |

-5-

| Bancolombia for the sole purpose of being the beneficiary of this distribution (the “Initial Distribution”); |

| (2) | The merger (fusión por absorción) of Sociedad Beneficiaria BC Panamá S.A.S. into Bancolombia (the “Merger”); |

(3) The distribution (escisión parcial por absorción) of certain assets owned by Banca de Inversión Bancolombia S.A. Corporación Financiera (“Banca de Inversion”), including Wenia Ltd. (“Wenia”), Wompi S.A.S. (“Wompi”), Renting Colombia S.A.S (“Renting”), Nequi S.A. Compañía de Financiamiento (“Nequi”) and Negocios Digitales Colombia S.A.S. (“Negocios Digitales”), and other smaller investments in Internacional Ejecutiva de Aviación S.A., Puntos Colombia S.A.S. and Holding Bursátil Regional S.A, to Bancolombia (the “Asset Distribution”); and

(4) The (i) the distribution (escisión parcial por absorción) of Banistmo, Grupo Agromercantil, Banagrícola S.A., Negocios Digitales, Nequi, Renting, Wompi and Wenia, such that such entities become direct subsidiaries of Grupo Cibest and the distribution of smaller investments in Puntos Colombia S.A.S., P.A. Cadenalco 75 Años, Protección S.A. and Internacional Ejecutiva de Aviación S.A.S. to Grupo Cibest, and (ii) the Share Exchange, as a result of which each common share of Bancolombia will be exchanged for one common share of Grupo Cibest, each preferred share of Bancolombia will be exchanged for one preferred share of Grupo Cibest ((i) and (ii) together, the “Bancolombia Distribution”). Following the Bancolombia Distribution, Bancolombia will become a wholly-owned subsidiary of Grupo Cibest and Grupo Cibest will make an in kind contribution of 5.01% of Bancolombia’s common shares to four of its wholly-owned subsidiaries to comply with the Colombian Commercial Code which requires stock companies to have a minimum of five shareholders at all times and provides that no single shareholder may own 95% or more of a stock company’s subscribed capital stock.

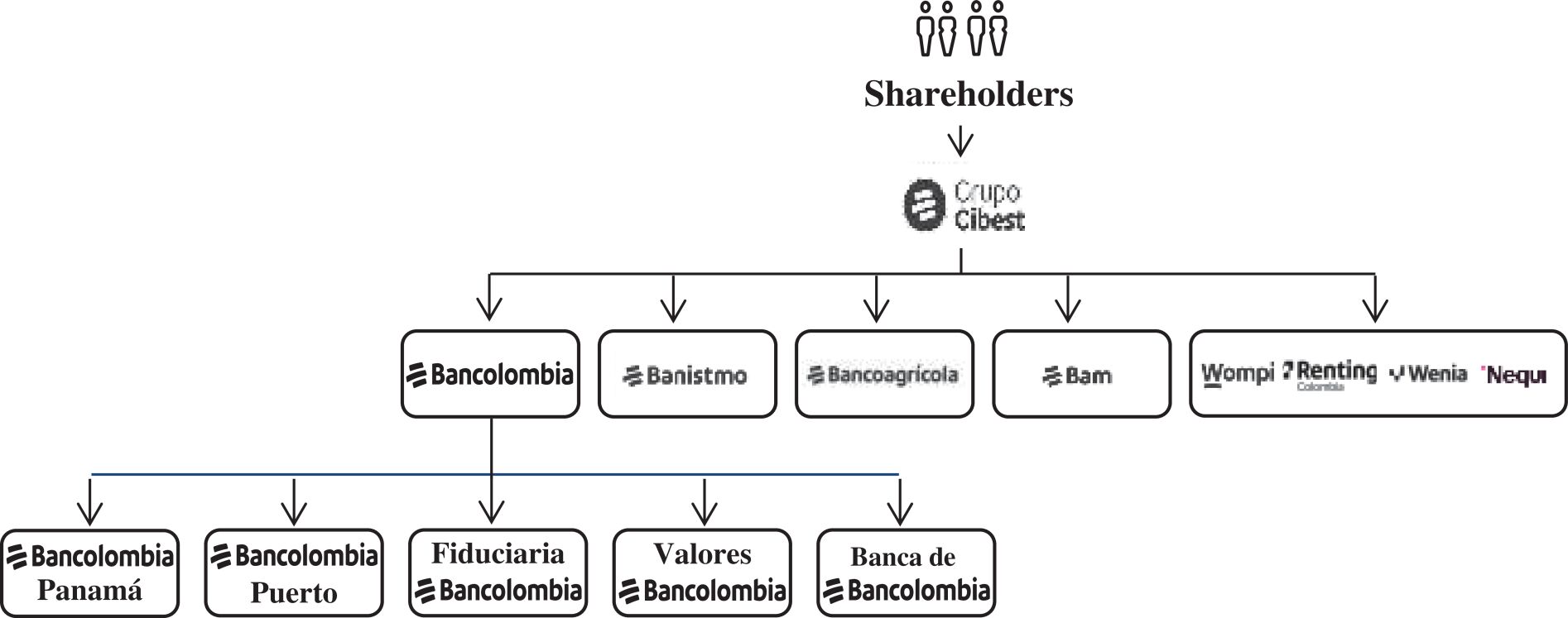

Bancolombia’s organizational structure prior to the Corporate Structure Changes is illustrated by the following chart:

-6-

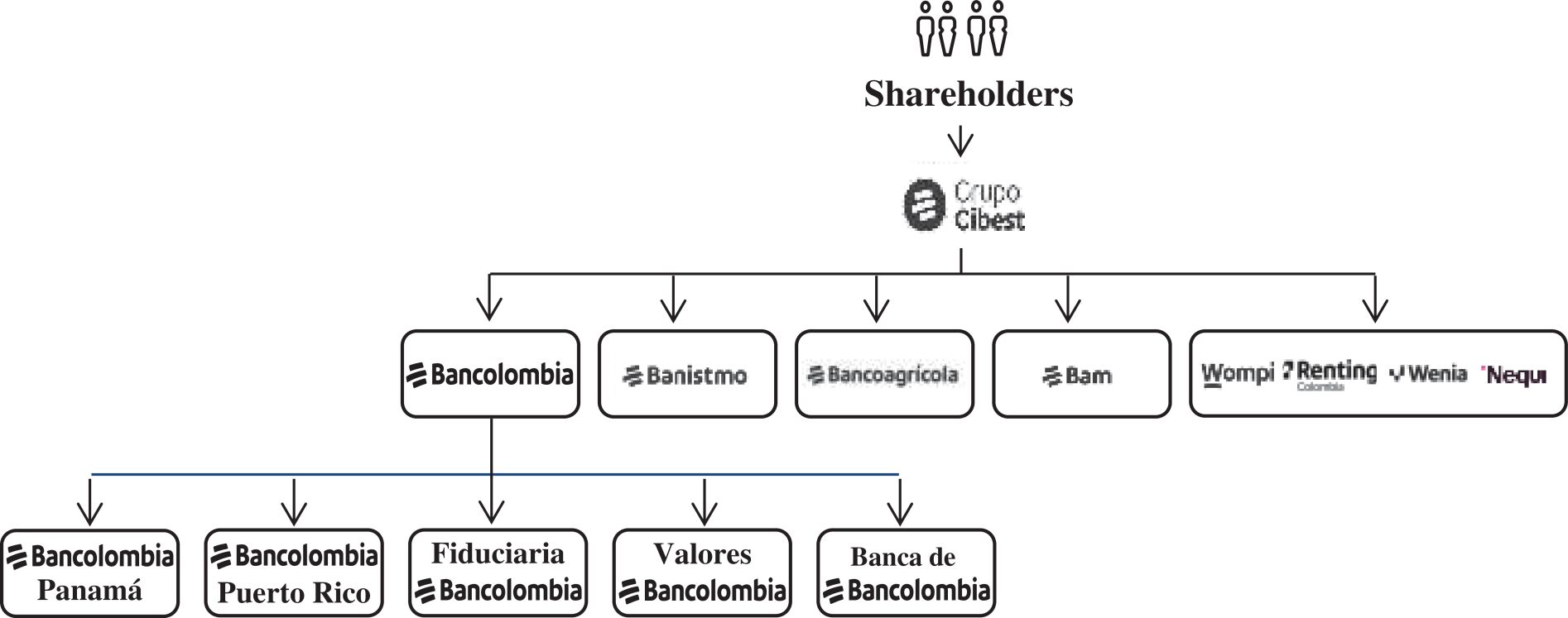

Grupo Cibest’s organizational structure after the Corporate Structure Changes is illustrated by the following chart:

Ownership of Grupo Cibest After the Corporate Structure Changes

In connection with the Share Exchange, Grupo Cibest will issue 509,703,584 common shares to holders of Bancolombia’s common shares and 452,122,416 preferred shares to holders of Bancolombia’s preferred shares. Immediately following the Corporate Structure Changes, including the Share Exchange, former holders of Bancolombia’s common shares will own 100% of the issued common shares of Grupo Cibest (representing 53.0% of Grupo Cibest’s total shares) and former holders of Bancolombia’s preferred shares will own 100% of the issued preferred shares of Grupo Cibest (representing 47.0% of Grupo Cibest’s total shares), in the same proportion and quantity as they had before in Bancolombia. Holders of Grupo Cibest’s American depositary shares will own approximately 29% of the issued preferred shares of Grupo Cibest (representing 13% of Grupo Cibest’s total shares).

Technical Study Rights and Withdrawal Rights (see page 24)

Under Colombian law, shareholders who own, individually or collectively, at least 5% of the outstanding shares of Bancolombia may request an independent technical study of the value of Bancolombia and Grupo Cibest and the corresponding exchange ratio (such right to request an independent technical study, the “Technical Study Right”). Notwithstanding the above, if the exchange rate and the valuation included in the proposed transaction is in accordance with the results of a technical study already provided, a new independent technical study may not be requested by shareholders. In anticipation of the Corporate Structure Changes, an independent technical study was commissioned by Bancolombia and completed by SBI Banca de Inversión S.A. (“SBI”), an independent investment bank in Colombia (such technical study, the “SBI Opinion”). Accordingly, shareholders will not be able to request a new independent technical study in connection with the Corporate Structure Changes. Bancolombia selected SBI to deliver the SBI Opinion because SBI demonstrated the experience and independence requirements that are required in order to provide the technical study under Colombian law, including having no prior material relationship in the past two years. At the date of this prospectus, SBI has presented to the SFC documents that demonstrate their professional suitability, moral solvency and experience for their evaluation by the SFC. SBI was hired exclusively to carry out the analysis required in order to provide the SBI Opinion and was given access to all the documents of the Corporate Structure Changes and all financial records, including those requested by SBI. A fee was negotiated for the delivery of the SBI Opinion, regardless of the conclusion. SBI was given access to all the information that they required in their evaluation and in preparation of the SBI Opinion. An English translation of the SBI Opinion is included as Annex IV to this

-7-

prospectus. Any summary of the opinion of SBI set forth in this document is qualified in its entirety by reference to the full text of such written opinion. The exchange ratio resulting from the independent technical study is binding on all shareholders if the Corporate Structure Changes Approval Matters are approved, unless a supermajority of eighty-five percent (85%) of the shareholders (a “Supermajority”) determine to change the exchange ratio. If a Supermajority determines to change the exchange ratio, shareholders who do not agree to the exchange ratio determined by the Supermajority will have the right to withdraw and have their shares purchased in cash by Bancolombia at the price set forth in the independent technical study (such right, the “Withdrawal Rights”). Holders of our American depositary shares opposing the Share Exchange may not have the same Technical Study Rights or Withdrawal Rights. See “Risk Factors—Holders of Bancolombia’s American depositary shares may not have the ability to exercise Withdrawal Rights associated with the preferred shares underlying their depositary shares.” Given that (i) by means of the Share Exchange, each common share of Bancolombia will be exchanged for one common share of Grupo Cibest, and each preferred share of Bancolombia will be exchanged for one preferred share of Grupo Cibest, and therefore that the Corporate Structure Changes will not alter shareholders’ relative holdings any manner and (ii) an independent technical study has already been completed, we do not anticipate that a Supermajority will vote to change the exchange ratio. For a more complete description of these Technical Study Rights and Withdrawal Rights and the SBI Technical Study, see “The Corporate Structure Changes—Technical Study Rights and Withdrawal Rights.”

Conditions to the Completion of the Corporate Structure Changes (see page 22)

The completion of the Corporate Structure Changes is subject to the satisfaction of the following conditions:

| • | Approval by the SFC of the Corporate Structure Changes; |

| • | Approval by the regulatory authorities in each of Panamá and Guatemala of the aspects of the Corporate Structure Changes relevant to such jurisdiction as determined by applicable law; |

| • | The approval of the listing of Grupo Cibest’s common shares and preferred shares in Colombia by the SFC and the Colombian Securities Exchange; and |

| • | The approval of the Corporate Structure Changes Approval Matters by the holders of Bancolombia’s common shares and preferred shares at the Extraordinary General Shareholders’ Meeting. |

The Extraordinary General Shareholders’ Meeting (see page 16)

The Extraordinary General Shareholders’ Meeting will be held at on , 2025 at a.m. local time. At the meeting, Bancolombia shareholders will be asked to vote on the following matters, among others:

(1) The approval of Bancolombia’s unconsolidated financial statements as of June 30, 2024;

(2) The approval of the Merger (fusión por absorción), including the agreement by and between Bancolombia and Sociedad Beneficiaria BC Panamá S.A.S. (the “Merger Agreement”) (an English translation of the Merger Agreement is included as Annex I to this prospectus);

(3) The approval of the Asset Distribution (escisión parcial por absorción), including the agreement by and between Bancolombia and Banca de Inversion (the “Asset Distribution Agreement”) (an English translation of the Asset Distribution Agreement is included as Annex II to this prospectus); and

(4) The approval of the Bancolombia Distribution (escisión parcial por absorción), including the agreement by and between Bancolombia and Grupo Cibest (the “Bancolombia Distribution Agreement”) (an English translation of the Bancolombia Distribution Agreement is included as Annex III to this prospectus);

We refer to the items listed above in (2)—(4) as the “Corporate Structure Changes Approval Matters.”

-8-

The approval of the Corporate Structure Changes Approval Matters at the Extraordinary General Shareholders’ Meeting will require (i) at least 50% plus one share of all shares issued by Bancolombia, including common and preferred shares, to be present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law, and that (ii) at least 50% plus one share of all of Bancolombia’s common and preferred shares present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law, vote in favor of the Corporate Structure Changes Approval Matters. Holders of Bancolombia’s American depositary shares will be entitled to instruct the depositary as to how to vote the preferred shares represented by such holders’ American depositary shares.

The approval of Bancolombia’s unconsolidated financial statements as of June 30, 2024 will require (i) at least 50% plus one share of all of Bancolombia’s common shares to be present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law and that (ii) at least 50% plus one share of all of Bancolombia’s common shares present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law, vote in favor of such item to be approved.

Accounting Treatment of the Corporate Structure Changes (see page 23)

Under IFRS, we expect that the Corporate Structure Changes will be accounted for as a transaction among entities under common control applying the pooling of interests method of accounting. Upon the completion of the Corporate Structure Changes, Grupo Cibest will initially recognize the transferred assets and liabilities at their book value as of the date of the Corporate Structure Changes in its consolidated financial statements, and no goodwill will be recognized in connection with the transaction.

U.S. Income Tax Consequences of the Share Exchange (see page 23)

The Share Exchange will generally not be a taxable transaction for U.S. tax purposes. See “Tax Considerations—United States Taxation.”

Regulatory Matters (see page 24)

We are working to obtain all necessary regulatory approvals required under Colombian and other laws and regulations in connection with the Corporate Structure Changes. For more details regarding the regulatory approvals required, see “The Corporate Structure Changes—Regulatory Matters.”

Completion and Effectiveness of the Corporate Structure Changes (see page 23)

We will complete the Corporate Structure Changes when all the conditions to completion of the Corporate Structure Changes are satisfied, including the approval of the Corporate Structure Changes Approval Matters by Bancolombia’s shareholders, and approvals by the SFC and other relevant regulatory authorities. See “The Corporate Structure Changes—Conditions to the Completion of the Corporate Structure Changes.” It is anticipated that the Corporate Structure Changes, including the Share Exchange, will become effective within 45 calendar days after the date of the Extraordinary General Shareholders’ Meeting.

Stock Exchange Listings (see page 24)

We expect to apply to list Grupo Cibest’s common shares and preferred shares on the Colombian Securities Exchange and to list Grupo Cibest’s American depositary shares on the NYSE. We expect Grupo Cibest’s common shares and preferred shares will be listed on the Colombian Securities Exchange under the symbols and , respectively, and its American depositary shares will be listed on the NYSE under the symbol .

-9-

Questions About the Corporate Structure Changes

If you have any questions about the Corporate Structure Changes, the Share Exchange or the voting procedures in connection with the Extraordinary General Shareholders’ Meeting, you may contact:

| • | if you are a holder of Bancolombia’s common shares or preferred shares: |

Bancolombia S.A.

Carrera 48 # 26-85 Avenida Los Industriales

Medellín, Colombia

Attention: Investor Relations

Telephone: +57 604 404 1918

e-mail: ir@bancolombia.com.co

| • | if you are a holder of Bancolombia’s American depositary shares: |

The Bank of New York Mellon

240 Greenwich Street, 8W, New York, NY 10286

www.adrbnymellon.com

Michael Vexler

Telephone: (+1) 212-815-2838

e-mail: michael.vexler@bnymellon.com

-10-

As a result of the establishment of a holding company structure through the proposed Corporate Structure Changes, Bancolombia’s and Grupo Cibest’s businesses will be subject to the following new or increased risks. In addition to the risks described below, Bancolombia and Grupo Cibest will continue to be subject to the risks described in the documents that Bancolombia has filed with the SEC that are incorporated by reference into this prospectus. You should carefully consider the following risk factors as well as the other information contained or incorporated into this prospectus in deciding whether to vote in favor of the Corporate Structure Changes Approval Matters.

Risks Relating to the Corporate Structure Changes and Share Exchange

We may fail to realize the anticipated benefits of the Corporate Structure Changes and Share Exchange.

The success of the Corporate Structure Changes will depend, in large part, on the ability of Grupo Cibest to realize the anticipated benefits from the Corporate Structure Changes.

The Corporate Structure Changes and the integration of any companies Grupo Cibest may acquire in the future into the new holding company structure could require a significant amount of time, financial resources and management attention. The realization of the anticipated benefits of the new holding company structure may be blocked, delayed or reduced as a result of many factors, some of which may be outside of our control. These factors include:

| • | difficulties in successfully designing and implementing any unforeseen necessary new or enhanced risk management operations and controls or information technology systems, personnel, policies and procedures as a result of the Corporate Structure Changes; |

| • | failure to leverage Grupo Cibest’s holding company structure to realize operational efficiencies; |

| • | difficulties in reorganizing personnel, networks and administrative functions; |

| • | restrictions under applicable financial conglomerates regulations and other regulations on transactions between the holding company and, or among, its subsidiaries; and |

| • | unforeseen contingent risks relating to the Corporate Structure Changes that may become apparent in the future. |

Accordingly, we may not be able to realize the anticipated benefits of the new holding company structure that will be created pursuant to the Corporate Structure Changes.

Grupo Cibest will depend on limited forms of funding to fund its operations.

Grupo Cibest will have no significant assets other than the shares of its subsidiaries. Its primary sources of funding and liquidity will be dividends from its subsidiaries, sales of the interests in its subsidiaries and direct borrowings and issuances of equity or debt securities at the holding company level. Grupo Cibest’s ability to meet its obligations to its direct creditors and employees and its other liquidity needs and regulatory requirements will depend on timely and adequate dividend distributions from its subsidiaries and its ability to sell its securities or obtain credit from its lenders.

The ability of the subsidiaries of Grupo Cibest, including Bancolombia, to pay dividends to Grupo Cibest will depend on the financial condition and operating results of such subsidiaries. In the future, the subsidiaries of Grupo Cibest may enter into agreements, such as credit agreements with lenders or indentures relating to senior or subordinated debt instruments, that impose restrictions on their ability to make distributions to Grupo Cibest, and the terms of future obligations and the operation of Colombian law could prevent such subsidiaries from making sufficient distributions to Grupo Cibest to allow it to make payments on its outstanding obligations. See

-11-

“Risk Factors—As a holding company, Grupo Cibest will largely depend on receiving dividends from its subsidiaries to pay dividends on its common and preferred shares.” Any delay in receipt of or shortfall in payments to Grupo Cibest from its subsidiaries could result in Grupo Cibest’s inability to meet its liquidity needs and regulatory requirements.

In addition, creditors of Grupo Cibest will generally not be able to assert claims on the assets of the subsidiaries of Grupo Cibest. As for any holding company, Grupo Cibest’s inability to sell its securities or obtain funds from its lenders on favorable terms, or at all, could also result in Grupo Cibest’s inability to meet its liquidity needs and regulatory requirements.

As a holding company, Grupo Cibest will largely depend on receiving dividends from its subsidiaries to pay dividends on its common and preferred shares.

Since the principal assets at the holding company level will be the shares of its subsidiaries, Grupo Cibest’s ability to pay dividends on its common and preferred shares will largely depend on dividend payments from those subsidiaries. The ability of Grupo Cibest’s subsidiaries to pay dividends may be subject to regulatory restrictions under Colombian law. Under the Colombian Commerce Code, a company must distribute at least 50% of its annual net profits to all shareholders, payable in cash, or as determined by the shareholders, within a period of one year following the date on which the shareholders determine the dividends. If the total amount of all reserves of a company exceeds its outstanding capital, this percentage is increased to 70%. The minimum dividend requirement of 50% or 70%, as the case may be, may be waived by a favorable vote of the holders of 78% of a company’s common shares present at the meeting. Under Colombian law, annual net profits are to be applied as follows:

| • | first, an amount equivalent to 10% of net profits is allocated to the legal reserve until such reserve is equal to at least 50% of the paid-in capital; |

| • | second, payment of the minimum dividend on the preferred shares; and |

| • | third, allocation of the remainder of the net profits is determined by the holders of a majority of the common shares entitled to vote on the recommendation of the board of directors and the President and may, subject to further reserves required by the bylaws, be distributed as dividends. In accordance with Colombian law, the dividends payable to the holders of common shares cannot exceed the dividends payable to holders of the preferred shares. |

Grupo Cibest’s subsidiaries may not continue to meet the applicable legal and regulatory requirements for the payment of dividends in the future. If they fail to do so, they may stop paying or reduce the amount of the dividends they pay to Grupo Cibest, which would have an adverse effect on its ability to pay dividends on its common and preferred shares.

The pro forma regulatory capital ratios and financial information included in this prospectus are presented for illustrative purposes only and may not be an indication of the Bancolombia or Grupo Cibest’s, as applicable, regulatory capital ratios or financial condition following the Corporate Structure Changes.

The historical pro forma and projected pro forma regulatory capital ratios and financial information contained in this prospectus are presented for illustrative purposes only, is based on various adjustments, assumptions and preliminary estimates and may not be an indication of Bancolombia’s regulatory capital ratios or Grupo Cibest’s financial condition following the Corporate Structure Changes. The assumptions used in preparing the historical pro forma and pro forma projected regulatory capital ratios and financial information may prove to be inaccurate, and other factors may affect Bancolombia’s regulatory capital ratios or Grupo Cibest’s financial condition following the Corporate Structure Changes, which may cause such regulatory capital ratios and financial condition to differ materially from what is presented in this prospectus.

-12-

The exercise of Withdrawal Rights in respect of a significant number of common shares or preferred shares could increase the costs of the Share Exchange, reduce the capital of Grupo Cibest and hurt its financial condition.

While under Colombian law, shareholders who own, individually or collectively, at least 5% of the outstanding shares of Bancolombia may exercise a Technical Study Right, Bancolombia has already commissioned a technical study which has been completed by SBI for the Corporate Structure Changes. The exchange ratio resulting from such technical study is binding on all shareholders unless a Supermajority determines to change the exchange ratio. If the Supermajority determines to change the exchange ratio, shareholders who do not agree to the exchange ratio determined by such Supermajority have Withdrawal Rights such that the shareholders have the right to withdraw and have their shares purchased in cash by Bancolombia at the price set forth in the independent technical study. If shareholders exercise their Withdrawal Rights, we will be required to pay for the shares by expending funds to purchase such shares, which could increase the costs of the Share Exchange and reduce or adversely affect the capital of Grupo Cibest and its financial condition. Given that (i) by means of the Share Exchange, each common share of Bancolombia will be exchanged for one common share of Grupo Cibest, and each preferred share of Bancolombia will be exchanged for one preferred share of Grupo Cibest, and therefore the Corporate Structure Changes will not alter shareholders’ relative holdings any manner and (ii) an independent technical study has already been completed, we do not anticipate that a Supermajority will vote to change the exchange ratio.

Holders of Bancolombia’s American depositary shares may not have the ability to exercise Withdrawal Rights associated with the preferred shares underlying their depositary shares.

Bancolombia’s shareholders may exercise certain Withdrawal Rights under Colombian law as described herein. However, if you are a holder of Bancolombia’s American depositary shares, you may not have the ability to exercise the Withdrawal Rights in respect of the Share Exchange even if you oppose it. The deposit agreement for Bancolombia’s American depositary shares facility does not require the depositary to take any action in respect of exercising these rights, and there can be no guarantee that the rights will be passed through to the holders of the American depositary shares.

Risks Relating to Grupo Cibest Common Shares, Preferred Shares and American Depositary Shares

There has been no prior market for the common shares, preferred shares or American depositary shares of Grupo Cibest, and the Share Exchange may not result in an active or liquid market for Grupo Cibest common shares, preferred shares or American depositary shares.

Grupo Cibest will be formed as a new entity in connection with the Corporate Structure Changes. Accordingly, there will be no public market for Grupo Cibest’s common shares, preferred shares or American depositary shares prior to their issuance in connection with the Share Exchange. We expect that Grupo Cibest will list its common shares and preferred shares on the Colombian Securities Exchange at the time of the Share Exchange and its American depositary shares on the NYSE. However, an active public market in Grupo Cibest common shares, preferred shares or American depositary shares may not develop or be sustained after their issuance. In addition, if a significant number of Grupo Cibest’s American depositary shareholders withdraw the underlying preferred shares of Grupo Cibest from Grupo Cibest’s American depositary share facility and no additional Grupo Cibest American depositary shares are issued, the liquidity of Grupo Cibest’s American depositary shares would be adversely affected.

The initial market price of Grupo Cibest’s common shares, preferred shares and American depositary shares immediately after their issuance is expected to be determined, among other things, by the market prices of Bancolombia’s common shares, preferred shares and American depositary shares prior to the Share Exchange. The initial market price of Grupo Cibest’s common shares, preferred shares and American depositary shares may not be indicative of prices that will prevail in the trading market over a longer period. You may not be able to resell your Grupo Cibest common shares, preferred shares or American depositary shares at or above the initial

-13-

market price. Market prices of Colombian companies’ stock have been and continue to be volatile. Volatility in the price of Grupo Cibest’s common shares, preferred shares and American depositary shares may be caused by factors outside of Grupo Cibest’s control and may be unrelated or disproportionate to Grupo Cibest’s operating results.

Ownership of Grupo Cibest common shares and preferred shares are restricted under Colombian law.

We are organized as a stock company (sociedad anónima). Our corporate existence is subject to the rules applicable to commercial companies, principally the Colombian Commercial Code which requires stock companies to have a minimum of five shareholders at all times and provides that no single shareholder may own 95% or more of our subscribed capital stock. Article 262 of the Colombian Commerce Code prohibits our subsidiaries from acquiring our stock. These rules will similarly be applicable to Grupo Cibest following the Corporate Structure Changes.

Under Decree 663 of 1993, as amended, any transaction resulting in an individual or entity holding 10% or more of the outstanding shares of any Colombian financial institution, including transactions resulting in holding American depositary shares representing 10% or more of outstanding shares, is subject to the prior authorization of the SFC. This restriction will be indirectly applicable to Grupo Cibest as the parent of Bancolombia. The SFC must evaluate any proposed transaction resulting in a change of ownership of 10% or more of the outstanding shares of a Colombian financial institution based on the criteria and guidelines specified in Decree 663 of 1993. Transactions entered into without the prior approval of the SFC are null and void and cannot be recorded in the institution’s stock ledger. These restrictions are equally applicable to Colombian and foreign investors. To the extent that you enter into a transaction that exceeds the applicable limits set forth above without the prior authorization of the SFC, such transaction will be null and void and cannot be recorded in our stock ledger.

A holder of Grupo Cibest American depositary shares may not be able to exercise Withdrawal Rights provided under Colombian law unless it has withdrawn the underlying shares of Grupo Cibest preferred shares and become its direct shareholder.

In some limited circumstances, certain shareholders may exercise Withdrawal Rights under Colombian law. However, holders of Grupo Cibest’s American depositary shares may not be able to exercise such rights if the depositary refuses to do so on their behalf. The Amended and Restated Deposit Agreement by and between Bancolombia and The Bank of New York Mellon, as depositary, does not require the depositary to take any action in respect of exercising any such rights. In such a situation, holders of Grupo Cibest’s American depositary shares must withdraw the underlying preferred shares from the American depositary share facility (and incur charges relating to such withdrawal) and become Grupo Cibest’s direct shareholders prior to the record date of the shareholders’ meeting at which the relevant transaction is to be approved, in order to exercise Withdrawal Rights under Colombian law.

A holder of Grupo Cibest preferred shares or American depositary shares may not be able to enforce a judgment of a foreign court against Grupo Cibest.

Grupo Cibest is a corporation with limited liability organized under the laws of Colombia. We expect that substantially all of its directors and officers will reside in Colombia, and all or a significant portion of the assets of such directors and officers and a substantial majority of Grupo Cibest’s assets will be located in Colombia. As a result, it may not be possible for holders of Grupo Cibest common shares, preferred shares or American depositary shares to effect service of process within the United States, or to enforce in the United States against Grupo Cibest or its directors and officers judgments obtained in United States courts based on the civil liability provisions of the federal securities laws of the United States. There may be doubt as to the enforceability in Colombia, either in original actions or in actions for enforcement of judgments of U.S. courts, of civil liabilities predicated on the U.S. federal securities laws, as the Supreme Court of Justice of Colombia (Corte Suprema de Justicia de Colombia), determines whether to enforce a U.S. judgment predicated on the U.S. securities laws through a procedural system known under Colombian law as exequatur.

-14-

Grupo Cibest’s bylaws contain an arbitration provision that provides for the exclusive jurisdiction of an arbitral tribunal to be seated at the Medellín Chamber of Commerce. The arbitration provision provides that any conflict arising between the shareholders and Grupo Cibest or between the shareholders and Grupo Cibest’s directors, or between the shareholders themselves which have not been resolved by direct agreement must be resolved by the arbitral tribunal. However, if the parties bring before the Colombian courts any conflict that arises between them, and none of them objects to the judicial proceeding, it will be understood that the parties have waived the arbitration clause in favor of the proceeding before the Colombian courts.

-15-

THE EXTRAORDINARY GENERAL SHAREHOLDERS’ MEETING

The Extraordinary General Shareholders’ Meeting is scheduled to be held at on , 2025 at a.m. local time. The Extraordinary General Shareholders’ Meeting is being held so that the holders of Bancolombia’s common shares and holders of Bancolombia’s preferred shares can consider and vote upon certain matters.

Specifically, Bancolombia shareholders will be asked to vote on the following matters, among others:

(1) The approval of Bancolombia’s unconsolidated financial statements as of June 30, 2024;

(2) The approval of the Merger (Fusión por absorción), which is called a “merger by absorption” in Colombia, including the Merger Agreement (an English translation of the Merger Agreement is included as Annex I to this prospectus);

(3) The approval of the Asset Distribution, including the Asset Distribution Agreement (an English translation of the Asset Distribution Agreement is included as Annex II to this prospectus); and

(4) The approval of the Bancolombia Distribution (escisión parcial por absorción), including the Bancolombia Distribution Agreement (an English translation of the Bancolombia Distribution Agreement is included as Annex III to this prospectus);

We refer to the items listed above in (2)—(4) as the “Corporate Structure Changes Approval Matters.”

Voting Rights, Record Date and Votes Required

Holders of common shares and holders of preferred shares recorded on Bancolombia’s shareholder register as of the applicable record date will be entitled to receive notice of and to vote, either in person or by representative by granting powers of attorney in writing to authorized representatives, in accordance with Colombian law, at the Extraordinary General Shareholders’ Meeting. Holders of Bancolombia’s American depositary shares recorded on the register of The Bank of New York Mellon, as depositary, as of , 2025 will be entitled to instruct such depositary as to how to vote the preferred shares represented by such holders’ American depositary shares at the Extraordinary General Shareholders’ Meeting. Bancolombia’s board of directors has fixed the close of business on , 2025 as the record date for the determination of the holders of Bancolombia’s common shares and holders of Bancolombia’s preferred shares entitled to notice of and to vote at the Extraordinary General Shareholders’ Meeting. Each common share and each preferred share present or represented at the meeting will be entitled to one vote on the matters for which the shareholder is entitled to vote.

The approval of the Corporate Structure Changes Approval Matters at the Extraordinary General Shareholders’ Meeting will require (i) at least 50% plus one share of all shares issued by Bancolombia, including common and preferred shares, to be present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law, and that (ii) at least 50% plus one share of all of Bancolombia’s common and preferred shares present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law, vote in favor of the Corporate Structure Changes Approval Matters. Holders of Bancolombia’s American depositary shares will be entitled to instruct the depositary as to how to vote the preferred shares represented by such holders’ American depositary shares.

The approval of Bancolombia’s unconsolidated financial statements as of June 30, 2024 will require (i) at least 50% plus one share of all of Bancolombia’s common shares to be present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law and that (ii) at least 50% plus one share of all of Bancolombia’s common shares present at the Extraordinary General Shareholders’ Meeting, either in person or through a representative in accordance with Colombian law, vote in favor of such item to be approved.

-16-

Share Ownership of Directors and Senior Management

As of October 31, 2024, the latest date for which such information is currently available, Juan David Escobar owns 88 common shares, and Bancolombia’s senior management and directors do not otherwise own common or preferred shares of Bancolombia.

However, senior management are paid 30% of their yearly bonus in units of a fund, managed by Protección S.A., which invests exclusively in common and preferred shares of Bancolombia. Each contribution has a vesting period of three (3) years after it is made, and the management decisions over those shares are made by Protección S.A., in its role as investment manager.

The board of directors are paid 30% of their compensation in units of a fund, managed by Protección S.A., which invests exclusively in common and preferred shares of Bancolombia. Each contribution has a vesting period of two (2) years after it is made, and the management decisions over those shares are made by Protección S.A., in its role as investment manager.

Voting by Representative for Holders of Bancolombia’s Common and Preferred Shares

Holders of Bancolombia’s common shares and holders of Bancolombia’s preferred shares may vote either in person at the Extraordinary General Shareholders’ Meeting or by representative by granting powers of attorney in writing to authorized representatives, in accordance with Colombian law. Bancolombia recommends sending a scanned copy of the power of attorney to , no later than at p.m. Powers of attorney may not be granted to Bancolombia employees nor to any other person directly or indirectly related to the management of Bancolombia.

Voting Rights of Holders of Bancolombia’s American Depositary Shares

Holders of Bancolombia’s American depositary shares recorded on the register of The Bank of New York Mellon, as depositary, as of as of , 2025 will be entitled to instruct the depositary as to how to vote the preferred shares represented by such holders’ American depositary shares at the Extraordinary General Shareholders’ Meeting. The Bank of New York Mellon will mail a voting instruction card to holders of record of Bancolombia’s American depositary shares as of , 2025. Voting instructions may be delivered to the depositary by completing, signing and delivering a voting instruction card to the depositary prior to the applicable cut-off date. For a holder’s voting instructions to be valid, the depositary must receive the voting instruction card by no later than a.m. (New York Time) on , 2025. Although there is no guarantee, the depositary will try to vote the preferred shares represented by a holder’s American depositary shares in accordance with the instructions of the holder, as far as practical and subject to the requirements of Colombian law. Holders of Bancolombia’s American depositary shares will be able to change their voting instructions after they send their voting instruction card with revised voting instructions to the depositary. However, such revised voting instructions will not be valid unless the depositary receives the new voting instruction card by a.m. (New York Time) on , 2025.

In accordance with the terms of the deposit agreement for the American depositary shares, The Bank of New York Mellon will, to the extent it does not receive timely voting instructions from a holder of Bancolombia’s American depositary shares, vote the shares represented by such unvoted American depositary shares in the same manner and in the same proportion on each matter as the holders of all of the outstanding preferred shares are voted on any particular matter.

If you are a holder of Bancolombia’s American depositary shares and have further questions as to how to exercise your voting rights, you should contact the depositary at:

The Bank of New York Mellon

240 Greenwich Street, 8W, New York, NY 10286

www.adrbnymellon.com

Michael Vexler

Telephone: (+1) 212-815-2838

e-mail: michael.vexler@bnymellon.com

-17-

THE CORPORATE STRUCTURE CHANGES

Background of the Corporate Structure Changes

Bancolombia’s board of directors has determined that it would be beneficial for shareholders of Bancolombia to vote on the Corporate Structure Changes Approval Matters and other matters identified in “The Extraordinary General Shareholders’ Meeting—Time, Place and Purpose.”

Accordingly, on , Bancolombia approved the calling of the Extraordinary General Shareholders’ Meeting at which holders of Bancolombia’s common shares and preferred shares will vote on the Corporate Structure Changes Approval Matters and other matters identified in “The Extraordinary General Shareholders’ Meeting—Time, Place and Purpose.”

Reasons for the Corporate Structure Changes

The purpose of the Corporate Structure Changes is to reorganize Bancolombia and its affiliates under a holding company structure. We expect that the establishment of a holding company structure will allow us to optimize our capital structure and capital allocation strategy, strengthen our financial and non-financial businesses, enhance strategic flexibility, increase visibility into the organization’s value and mitigate risk as a lending institution.

We believe that the establishment of a holding company structure will allow us to:

| i) | Optimize our capital structure and capital allocation strategy: The Corporate Structure Changes will result in Grupo Cibest becoming the parent company of, in addition to Bancolombia, Banistmo, Banagrícola S.A., Grupo Agromercantil, and Nequi as well as other entities for which Bancolombia is currently the parent company. We expect that Grupo Cibest will be able to more efficiently allocate capital for each subsidiary according to the needs of each business. In addition, we anticipate that the improvements to the capital structure of Bancolombia and its affiliates resulting from the Corporate Structure Changes will facilitate opportunities for portfolio growth or the distribution of future dividends. In addition, and as part of the capital allocation strategy following the Corporate Structure Changes, the introduction of a holding company structure will allow for the possibility of share repurchase programs in the future (subject to shareholder approval), which are not possible under our current structure. |

| ii) | Strengthen our financial and non-financial businesses: Grupo Cibest will be able to continue exploring new non-financial business alternatives separately from regulated financial entities in order to maximize value for investors and continue contributing to the growth of the organization. Because Grupo Cibest, as an intermediate holding company according to Colombia Financial Conglomerate Law, will not have capital adequacy requirements, Grupo Cibest will have the flexibility to carry out non-financial businesses through entities that will not require additional capital, therefore optimizing common equity tier 1 capital. The holding company structure will provide the organization the flexibility required so that future strategic growth opportunities can be developed independently from regulated financial entities. |

| iii) | Enhance strategic flexibility: Future acquisitions made by Grupo Cibest will not have an impact on the regulatory capital of the regulated financial entities and will also shield the regulated financial entities from risks or additional capital requirements associated with these transactions. Additionally, the divestment or impairment of investments that are not directly owned by Bancolombia will not have an impact on Bancolombia’s solvency, providing Grupo Cibest with certain investment opportunities that are not available to Bancolombia currently. |

| iv) | Increase visibility into our value: We believe the Corporate Structure Changes will increase visibility into the real value of our organization and its various components. Currently, ascribing a value to our |

-18-

| business is complicated by the fact that Bancolombia is both a parent company of financial and non-financial entities and an operating company at the same time. Banistmo, Banagrícola S.A. (parent of Banco Agrícola), Grupo Agromercantil (parent of BAM), Wenia, Nequi and certain of our other subsidiaries becoming separate subsidiaries of Grupo Cibest, rather than subsidiaries of Bancolombia, will facilitate the independent valuation of each of those entities as well as Bancolombia. We believe the Corporate Structure Changes will enhance how investors view and value our organization by making it easier for the market to understand and determine its fair value. |

| v) | Mitigate risk as a lending institution: The Corporate Structure Changes will mitigate risks to Bancolombia arising from its current regional exposure and multi-sector businesses. Because Bancolombia will cease to be the parent company for various non-Colombian entities, Bancolombia will be insulated from potential risks arising in those other jurisdictions. Additionally, the Corporate Structure Changes will provide for the separation of the financial businesses from most of the existing non-financial businesses, largely isolating Bancolombia’s statement of financial position from the risks associated with such non-financial businesses. Finally, Bancolombia’s solvency ratio will be subject to less exchange rate volatility as a result of the significant reduction of dollar-denominated investments in its statement of financial position. |

As part of the Corporate Structure Changes, by means of the Share Exchange, each common share of Bancolombia will be exchanged for one common share of Grupo Cibest, and each preferred share of Bancolombia will be exchanged for one preferred share of Grupo Cibest, except for shares of Bancolombia held by Grupo Cibest. Holders of each American depositary share of Bancolombia, which represents four preferred shares of Bancolombia, will receive one Grupo Cibest American depositary share, which will represent four preferred shares of Grupo Cibest (subject to payment of certain applicable depositary fees).

In addition to the Share Exchange, Bancolombia will distribute certain assets, liabilities and equity of certain of its subsidiaries that will become direct subsidiaries of Grupo Cibest in the Corporate Structure Changes. Specifically, in connection with the Corporate Structure Changes, (i) Bancolombia Panama will distribute Banagrícola S.A. and Grupo Agromercantil to Sociedad Beneficiaria BC Panamá S.A.S., (ii) Sociedad Beneficiaria BC Panamá S.A.S. will merge into Bancolombia, (iii) Banca de Inversion will distribute certain assets, including Wenia, Wompi, Renting, Nequi and Negocios Digitales and other smaller investments in Internacional Ejecutiva de Aviación S.A., Puntos Colombia S.A.S. and Holding Bursátil Regional S.A, to Bancolombia and (iv) Bancolombia will distribute Banistmo, Grupo Agromercantil, Banagrícola S.A., Negocios Digitales, Nequi, Renting, Wompi and Wenia, as well as smaller investments in Puntos Colombia S.A.S., P.A. Cadenalco 75 Años, Protección S.A. and Internacional Ejecutiva de Aviación S.A.S. to Grupo Cibest. Bancolombia Panama, Bancolombia Puerto Rico Internacional Inc. (“Bancolombia Puerto Rico”), Fiduciaria Bancolombia S.A. (“Fiduciaria Bancolombia”), Valores Bancolombia S.A. Comisionista de Bolsa (“Valores Bancolombia”) and Banca de Inversion will remain wholly-owned subsidiaries of Bancolombia. Following the Bancolombia Distribution, Bancolombia will become a wholly-owned subsidiary of Grupo Cibest and Grupo Cibest will make an in kind contribution of 5.01% of Bancolombia’s common shares to four of its wholly-owned subsidiaries to comply with the Colombian Commercial Code which requires stock companies to have a minimum of five shareholders at all times and provides that no single shareholder may own 95% or more of a stock company’s subscribed capital stock.

-19-

Bancolombia’s organizational structure prior to the Corporate Structure Changes is illustrated by the following chart:

Grupo Cibest’s organizational structure after giving effect to the Corporate Structure Changes is illustrated by the following chart:

We may decide to make further changes to Grupo Cibest’s organizational structure after completion of the Corporate Structure Changes as we seek to maximize management efficiency under the new holding company structure. For example, subsequent to the establishment of Grupo Cibest, we plan to review the conversion of certain of Bancolombia’s remaining subsidiaries to direct subsidiaries of Grupo Cibest, as it might be advantageous for future business development. In addition, new companies may be added as subsidiaries of Grupo Cibest as strategically necessary through acquisitions or other strategic transactions.

Certain Regulatory Capital Ratios and Financial Information

As discussed above, it is expected that the Corporate Structure Changes will help improve the capital structure of Bancolombia and its affiliates in order to maximize opportunities for portfolio growth or the distribution of future dividends and share repurchase programs.

Set forth below are (i) certain pro forma regulatory capital ratios and financial information giving effect to the Corporate Structure Changes on Bancolombia as of and for the year ended December 31, 2023, (ii) certain

-20-

pro forma projected regulatory capital ratios and financial information giving effect to the Corporate Structure Changes on Bancolombia as of and for the year ended December 31, 2024 and (iii) certain projected pro forma financial information for Grupo Cibest as of December 31, 2024 and for the year ended December 31, 2025.

Certain Bancolombia Pro Forma Regulatory Capital Ratios and Financial Information

On a pro forma basis giving effect to the Corporate Structure Changes, as of June 30, 2024, on a consolidated basis Bancolombia’s (i) primary capital to risk-weighted assets ratio (“Tier 1 Capital Ratio”) would have been 10.33% (as compared to 10.98% on a historical basis without giving effect to the Corporate Structure Changes), (ii) Solvency Ratio, which is calculated by the ordinary basic capital after deductions plus additional capital (tier 2) divided by the financial institution’s total risk-weighted assets and off-balance sheet items plus market risk and operational risk on a consolidated basis would have been 12.52% (as compared to 12.60% on a historical basis without giving effect to the Corporate Structure Changes).