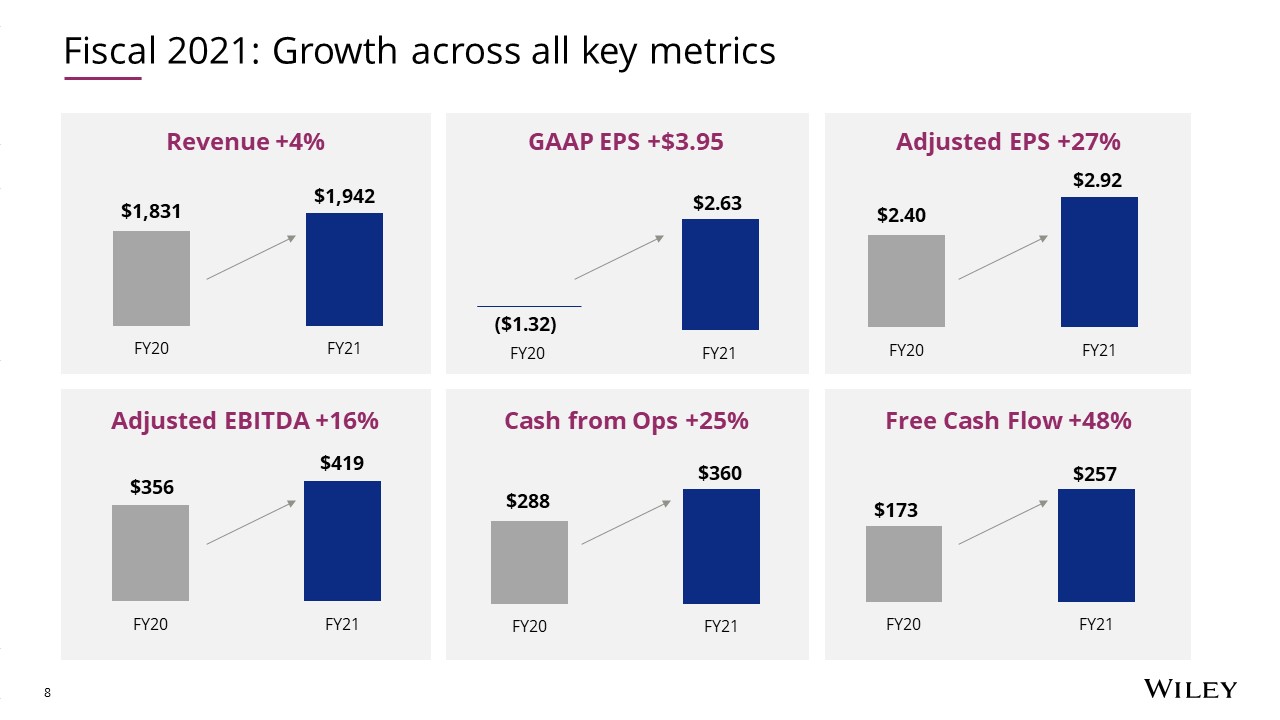

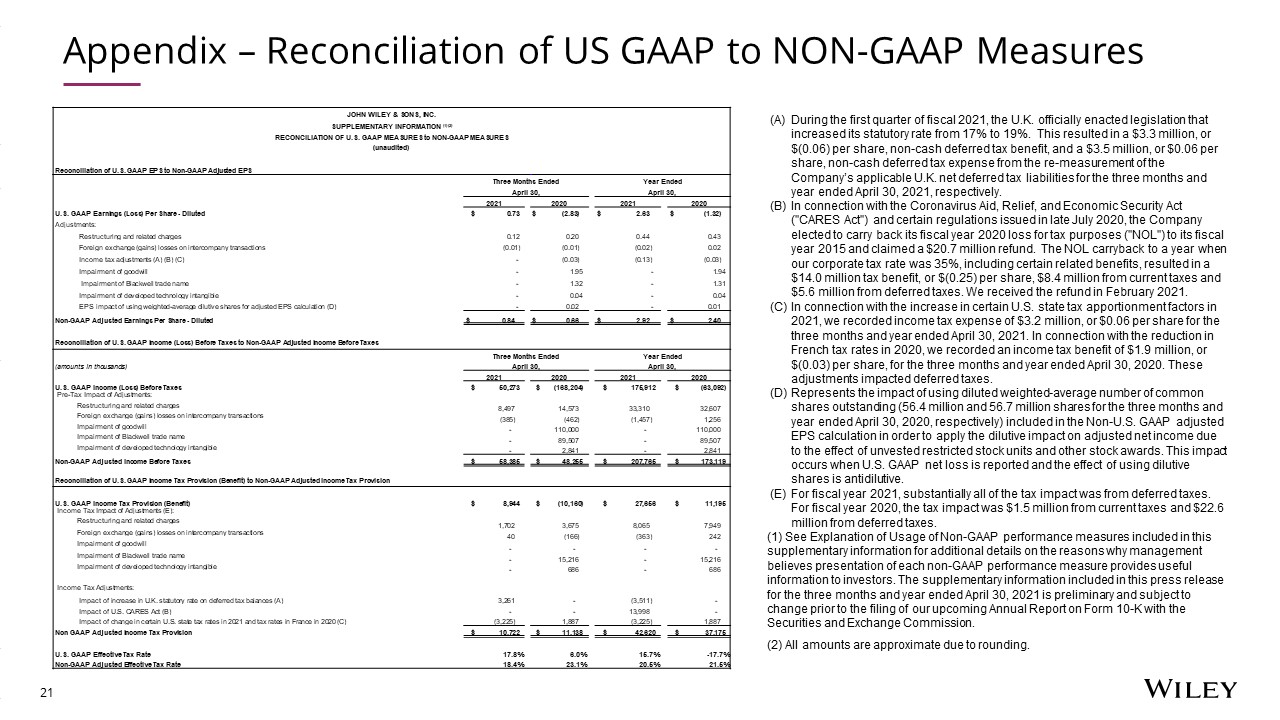

Appendix – Reconciliation of US GAAP to NON-GAAP Measures JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1) (2) RECONCILIATION OF U.S. GAAP MEASURES to NON-GAAP MEASURES (unaudited) Reconciliation of U.S. GAAP EPS to Non-GAAP Adjusted EPS Three Months Ended Year Ended April 30, April 30, 2021 2020 2021 2020 U.S. GAAP Earnings (Loss) Per Share - Diluted $ 0.73 $ (2.83) $ 2.63 $ (1.32) Adjustments: Restructuring and related charges 0.12 0.20 0.44 0.43 Foreign exchange (gains) losses on intercompany transactions (0.01) (0.01) (0.02) 0.02 Income tax adjustments (A) (B) (C) - (0.03) (0.13) (0.03) Impairment of goodwill - 1.95 - 1.94 Impairment of Blackwell trade name - 1.32 - 1.31 Impairment of developed technology intangible - 0.04 - 0.04 EPS impact of using weighted-average dilutive shares for adjusted EPS calculation (D) - 0.02 - 0.01 Non-GAAP Adjusted Earnings Per Share - Diluted $ 0.84 $ 0.66 $ 2.92 $ 2.40 Reconciliation of U.S. GAAP Income (Loss) Before Taxes to Non-GAAP Adjusted Income Before Taxes Three Months Ended Year Ended (amounts in thousands) April 30, April 30, 2021 2020 2021 2020 U.S. GAAP Income (Loss) Before Taxes $ 50,273 $ (168,204) $ 175,912 $ (63,092) Pre-Tax Impact of Adjustments: Restructuring and related charges 8,497 14,573 33,310 32,607 Foreign exchange (gains) losses on intercompany transactions (385) (462) (1,457) 1,256 Impairment of goodwill - 110,000 - 110,000 Impairment of Blackwell trade name - 89,507 - 89,507 Impairment of developed technology intangible - 2,841 - 2,841 Non-GAAP Adjusted Income Before Taxes $ 58,385 $ 48,255 $ 207,765 $ 173,119 Reconciliation of U.S. GAAP Income Tax Provision (Benefit) to Non-GAAP Adjusted Income Tax Provision U.S. GAAP Income Tax Provision (Benefit) $ 8,944 $ (10,160) $ 27,656 $ 11,195 Income Tax Impact of Adjustments (E): Restructuring and related charges 1,702 3,675 8,065 7,949 Foreign exchange (gains) losses on intercompany transactions 40 (166) (363) 242 Impairment of goodwill - - - - Impairment of Blackwell trade name - 15,216 - 15,216 Impairment of developed technology intangible - 686 - 686 Income Tax Adjustments: Impact of increase in U.K. statutory rate on deferred tax balances (A) 3,261 - (3,511) - Impact of U.S. CARES Act (B) - - 13,998 - Impact of change in certain U.S. state tax rates in 2021 and tax rates in France in 2020 (C) (3,225) 1,887 (3,225) 1,887 Non GAAP Adjusted Income Tax Provision $ 10,722 $ 11,138 $ 42,620 $ 37,175 U.S. GAAP Effective Tax Rate 17.8% 6.0% 15.7% -17.7% Non-GAAP Adjusted Effective Tax Rate 18.4% 23.1% 20.5% 21.5% (A) During the first quarter of fiscal 2021, the U.K. officially enacted legislation that increased its statutory rate from 17% to 19%. This resulted in a $3.3 million, or $(0.06) per share, non-cash deferred tax benefit, and a $3.5 million, or $0.06 per share, non-cash deferred tax expense from the re-measurement of the Company’s applicable U.K. net deferred tax liabilities for the three months and year ended April 30, 2021, respectively. (B) In connection with the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act") and certain regulations issued in late July 2020, the Company elected to carry back its fiscal year 2020 loss for tax purposes ("NOL") to its fiscal year 2015 and claimed a $20.7 million refund. The NOL carryback to a year when our corporate tax rate was 35%, including certain related benefits, resulted in a $14.0 million tax benefit, or $(0.25) per share, $8.4 million from current taxes and $5.6 million from deferred taxes. We received the refund in February 2021. (C) In connection with the increase in certain U.S. state tax apportionment factors in 2021, we recorded income tax expense of $3.2 million, or $0.06 per share for the three months and year ended April 30, 2021. In connection with the reduction in French tax rates in 2020, we recorded an income tax benefit of $1.9 million, or $(0.03) per share, for the three months and year ended April 30, 2020. These adjustments impacted deferred taxes. (D) Represents the impact of using diluted weighted-average number of common shares outstanding (56.4 million and 56.7 million shares for the three months and year ended April 30, 2020, respectively) included in the Non-U.S. GAAP adjusted EPS calculation in order to apply the dilutive impact on adjusted net income due to the effect of unvested restricted stock units and other stock awards. This impact occurs when U.S. GAAP net loss is reported and the effect of using dilutive shares is antidilutive. (E) For fiscal year 2021, substantially all of the tax impact was from deferred taxes. For fiscal year 2020, the tax impact was $1.5 million from current taxes and $22.6 million from deferred taxes. (1) See Explanation of Usage of Non-GAAP performance measures included in this supplementary information for additional details on the reasons why management believes presentation of each non-GAAP performance measure provides useful information to investors. The supplementary information included in this press release for the three months and year ended April 30, 2021 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission. (2) All amounts are approximate due to rounding.