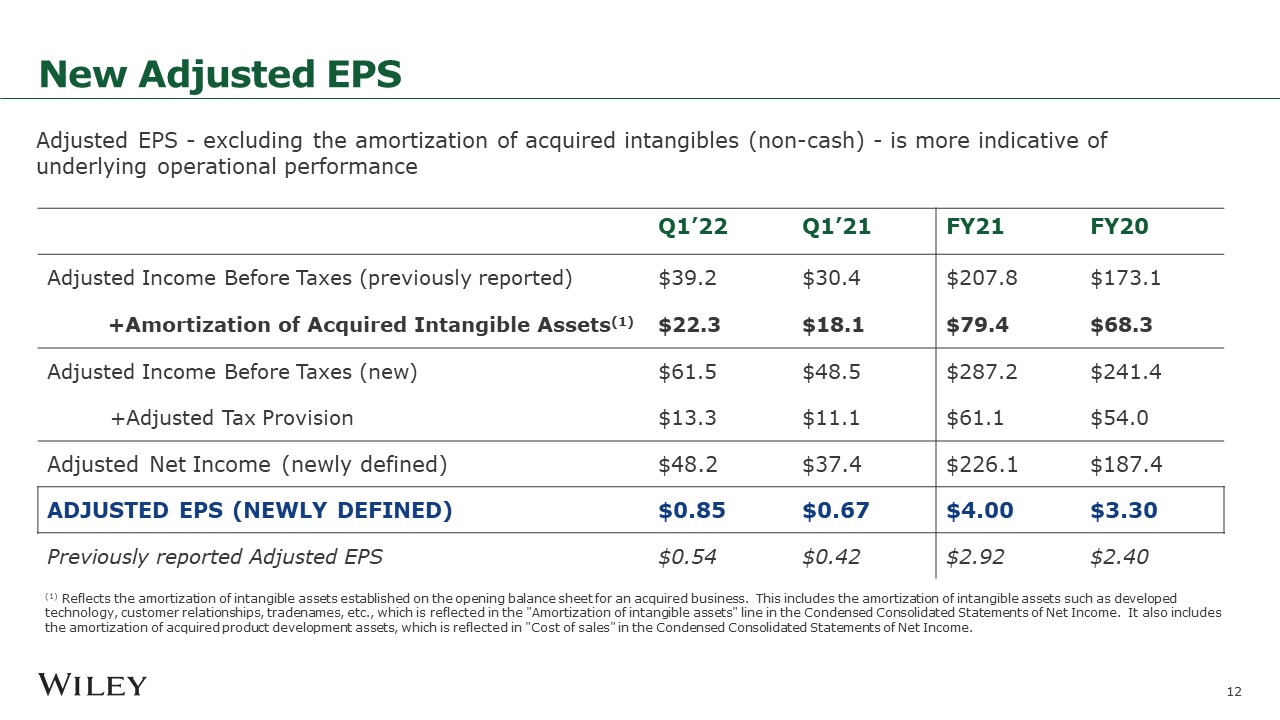

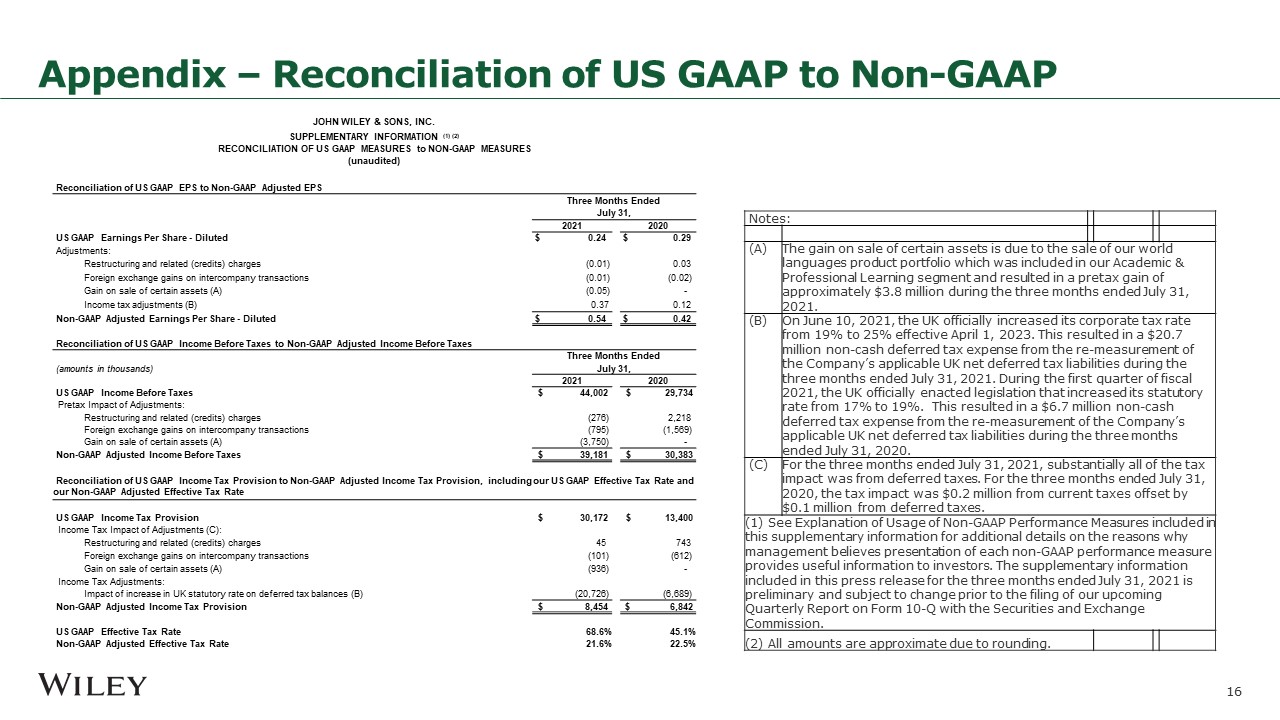

Appendix – Reconciliation of US GAAP to Non-GAAP JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1) (2) RECONCILIATION OF US GAAP MEASURES to NON-GAAP MEASURES (unaudited) Reconciliation of US GAAP EPS to Non-GAAP Adjusted EPS Three Months Ended July 31, 2021 2020 US GAAP Earnings Per Share - Diluted $ 0.24 $ 0.29 Adjustments: Restructuring and related (credits) charges (0.01) 0.03 Foreign exchange gains on intercompany transactions (0.01) (0.02) Gain on sale of certain assets (A) (0.05) - Income tax adjustments (B) 0.37 0.12 Non-GAAP Adjusted Earnings Per Share - Diluted $ 0.54 $ 0.42 Reconciliation of US GAAP Income Before Taxes to Non-GAAP Adjusted Income Before Taxes Three Months Ended (amounts in thousands) July 31, 2021 2020 US GAAP Income Before Taxes $ 44,002 $ 29,734 Pretax Impact of Adjustments: Restructuring and related (credits) charges (276) 2,218 Foreign exchange gains on intercompany transactions (795) (1,569) Gain on sale of certain assets (A) (3,750) - Non-GAAP Adjusted Income Before Taxes $ 39,181 $ 30,383 Reconciliation of US GAAP Income Tax Provision to Non-GAAP Adjusted Income Tax Provision, including our US GAAP Effective Tax Rate and our Non-GAAP Adjusted Effective Tax Rate US GAAP Income Tax Provision $ 30,172 $ 13,400 Income Tax Impact of Adjustments (C): Restructuring and related (credits) charges 45 743 Foreign exchange gains on intercompany transactions (101) (612) Gain on sale of certain assets (A) (936) - Income Tax Adjustments: Impact of increase in UK statutory rate on deferred tax balances (B) (20,726) (6,689) Non-GAAP Adjusted Income Tax Provision $ 8,454 $ 6,842 US GAAP Effective Tax Rate 68.6% 45.1% Non-GAAP Adjusted Effective Tax Rate 21.6% 22.5% Notes: (A) The gain on sale of certain assets is due to the sale of our world languages product portfolio which was included in our Academic & Professional Learning segment and resulted in a pretax gain of approximately $3.8 million during the three months ended July 31, 2021. (B) On June 10, 2021, the UK officially increased its corporate tax rate from 19% to 25% effective April 1, 2023. This resulted in a $20.7 million non-cash deferred tax expense from the re-measurement of the Company’s applicable UK net deferred tax liabilities during the three months ended July 31, 2021. During the first quarter of fiscal 2021, the UK officially enacted legislation that increased its statutory rate from 17% to 19%. This resulted in a $6.7 million non-cash deferred tax expense from the re-measurement of the Company’s applicable UK net deferred tax liabilities during the three months ended July 31, 2020. (C) For the three months ended July 31, 2021, substantially all of the tax impact was from deferred taxes. For the three months ended July 31, 2020, the tax impact was $0.2 million from current taxes offset by $0.1 million from deferred taxes. (1) See Explanation of Usage of Non-GAAP Performance Measures included in this supplementary information for additional details on the reasons why management believes presentation of each non-GAAP performance measure provides useful information to investors. The supplementary information included in this press release for the three months ended July 31, 2021 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. (2) All amounts are approximate due to rounding.