Second Quarter Fiscal 2025 Earnings Review December 5, 2024 NYSE: WLY

SAFE HARBOR STATEMENT This release contains certain forward-looking statements concerning the Company's operations, performance, and financial condition. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements. Any such forward-looking statements are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company and are subject to change based on many important factors. Such factors include, but are not limited to: (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company's journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key online retailers; (vi) the seasonal nature of the Company's educational business and the impact of the used book market; (vii) worldwide economic and political conditions; (viii) the Company's ability to protect its copyrights and other intellectual property worldwide (ix) the ability of the Company to successfully integrate acquired operations and realize expected opportunities; (x) the ability to realize operating savings over time and in fiscal year 2025 in connection with our multiyear Global Restructuring Program and completed dispositions; (xi) cyber risk and the failure to maintain the integrity of our operational or security systems or infrastructure, or those of third parties with which we do business; (xii) as a result of acquisitions, we have and may record a significant amount of goodwill and other identifiable intangible assets and we may never realize the full carrying value of these assets; (xiii) our ability to leverage artificial intelligence technologies in our products and services, including generative artificial intelligence, large language models, machine learning, and other artificial intelligence tools; and (xiv) other factors detailed from time to time in our filings with the SEC. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances. NON-GAAP MEASURES In this presentation, Wiley provides the following non-GAAP performance measures: Adjusted Revenue Adjusted Earnings Per Share (“Adjusted EPS”); Free Cash Flow less Product Development Spending; Adjusted Operating Income and margin; Adjusted EBITDA and margin; Organic revenue; and Results on a constant currency (“CC”) basis. Management believes non-GAAP financial measures, which exclude the impact of restructuring charges and credits and certain other items, and the impact of divestitures and acquisitions provide a useful comparable basis to analyze operating results and earnings. See the reconciliations of non-GAAP financial measures and explanations of the uses of non-GAAP measures in the supplementary information. We have not provided our 2025 outlook for the most directly comparable U.S. GAAP financial measures, as they are not available without unreasonable effort due to the high variability, complexity, and low visibility with respect to certain items, including restructuring charges and credits, gains and losses on foreign currency, and other gains and losses. These items are uncertain, depend on various factors, and could be material to our consolidated results computed in accordance with U.S. GAAP. 2

3 Wiley enables the creation of knowledge and its application in science, learning, innovation, and other critical areas of the knowledge economy The Knowledge Company

Q225 Earnings Presentation.pptx 4 Second Quarter 2025 Summary Revenue growth driven by solid performance in Learning and modest growth in Research Continued margin expansion and EPS growth in line with executed plans AI progress accelerating with healthy pipeline and market in early development Leadership changes focused on skills and experience around core and moving faster as an organization Reinvestments in Research and culture of continuous improvement to benefit us long term

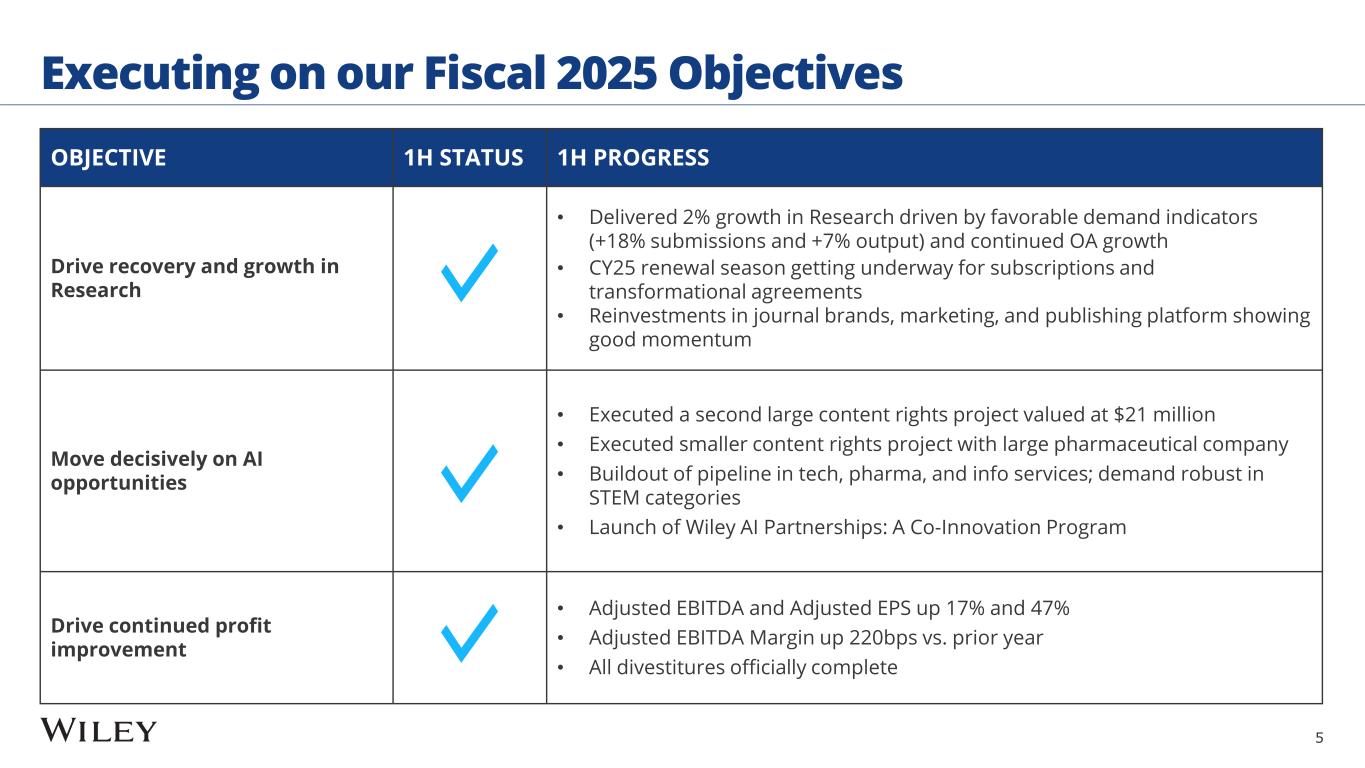

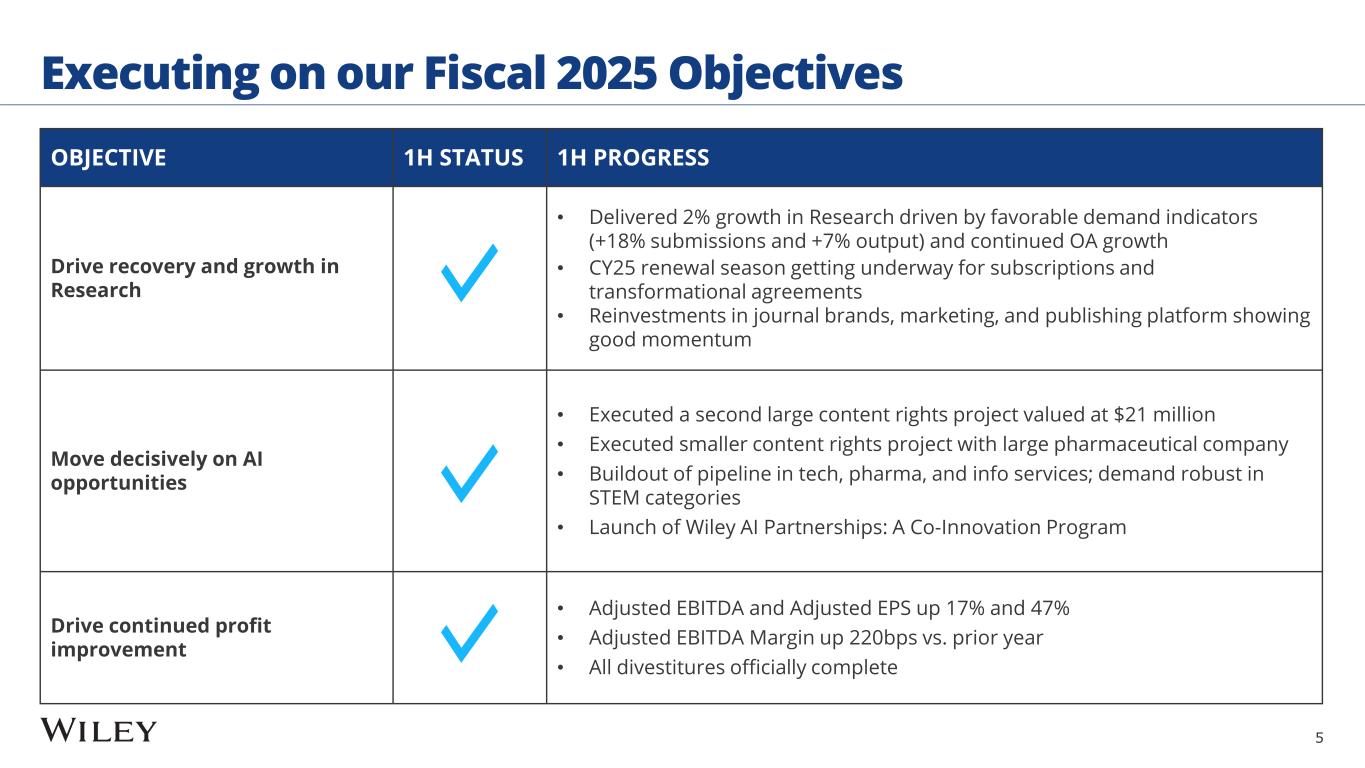

Q225 Earnings Presentation.pptx 5 Executing on our Fiscal 2025 Objectives OBJECTIVE 1H STATUS 1H PROGRESS Drive recovery and growth in Research • Delivered 2% growth in Research driven by favorable demand indicators (+18% submissions and +7% output) and continued OA growth • CY25 renewal season getting underway for subscriptions and transformational agreements • Reinvestments in journal brands, marketing, and publishing platform showing good momentum Move decisively on AI opportunities • Executed a second large content rights project valued at $21 million • Executed smaller content rights project with large pharmaceutical company • Buildout of pipeline in tech, pharma, and info services; demand robust in STEM categories • Launch of Wiley AI Partnerships: A Co-Innovation Program Drive continued profit improvement • Adjusted EBITDA and Adjusted EPS up 17% and 47% • Adjusted EBITDA Margin up 220bps vs. prior year • All divestitures officially complete

Q225 Earnings Presentation.pptx 6 Second Quarter Performance Adjusted Revenue growth driven by solid growth in Learning and modest growth in Research GAAP EPS increase mainly due to impairment and restructuring charges in prior year Adjusted EBITDA growth driven by revenue performance and run-rate cost savings offsetting reinvestment Adjusted EPS growth further augmented by accrued interest from divestitures Adj. Revenue* ▲3% $423M GAAP EPS ▲$1.09 $0.74 Adj. EPS* ▲36% $0.97 Adj. EBITDA* ▲14% $106M *Adjusted Revenue, Adjusted EPS, and Adjusted EBITDA performance excludes businesses held for sale or sold. Adjusted numbers exclude impact of foreign exchange Q2 Summary

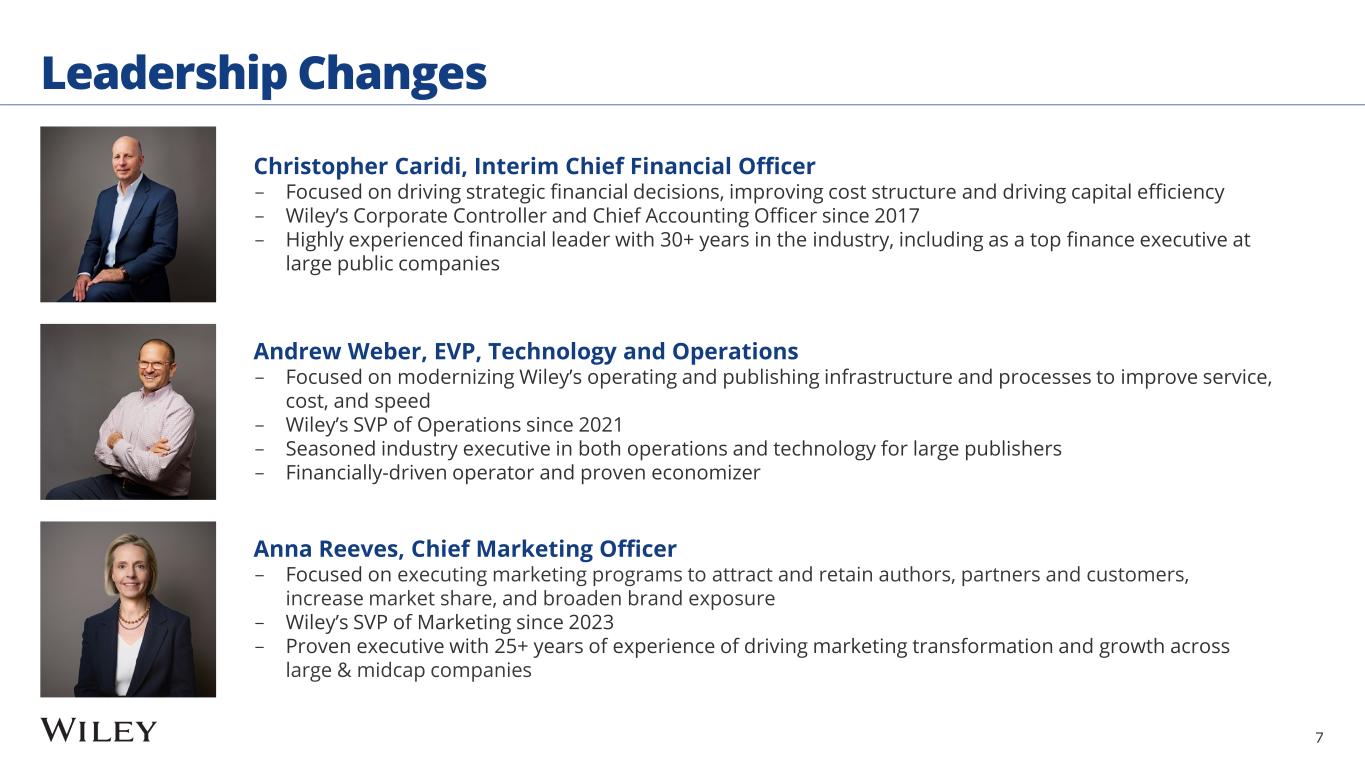

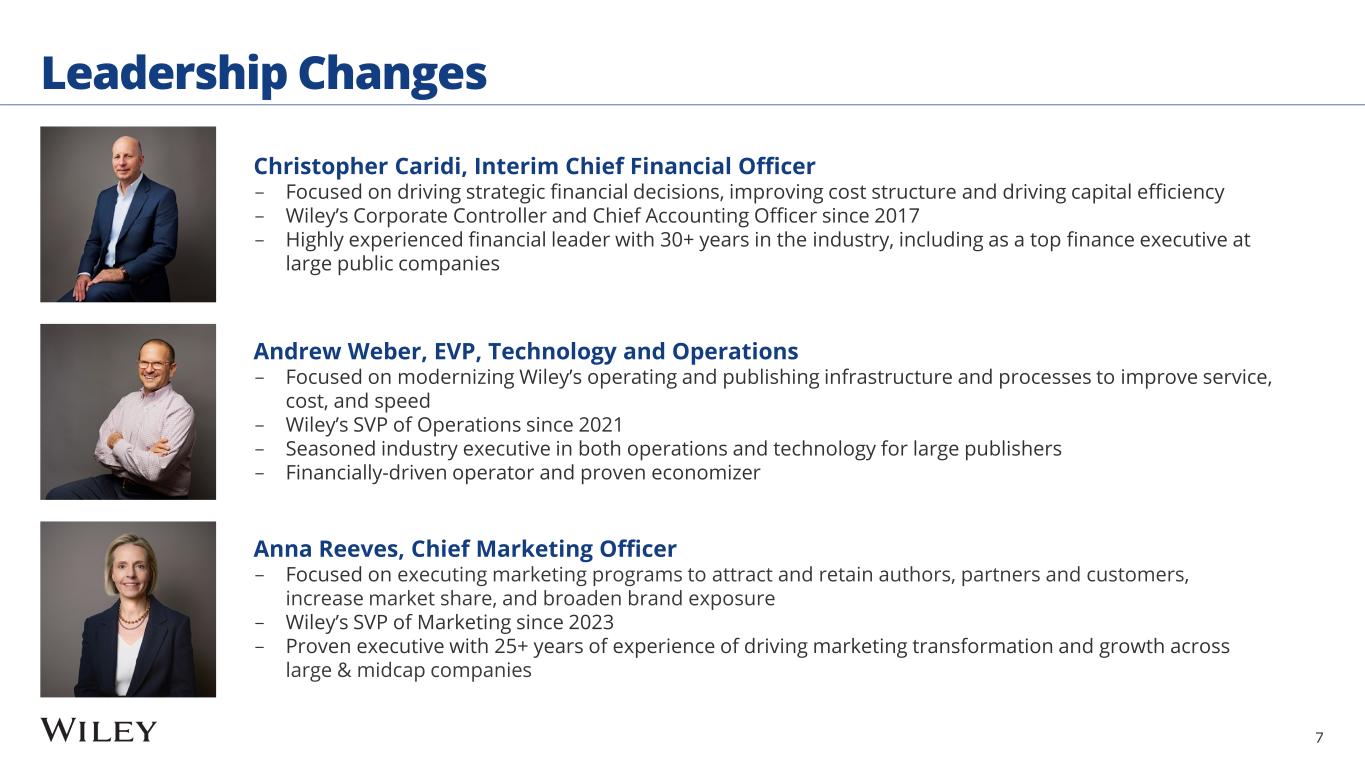

Q225 Earnings Presentation.pptx 7 Leadership Changes Andrew Weber, EVP, Technology and Operations - Focused on modernizing Wiley’s operating and publishing infrastructure and processes to improve service, cost, and speed - Wiley’s SVP of Operations since 2021 - Seasoned industry executive in both operations and technology for large publishers - Financially-driven operator and proven economizer Christopher Caridi, Interim Chief Financial Officer - Focused on driving strategic financial decisions, improving cost structure and driving capital efficiency - Wiley’s Corporate Controller and Chief Accounting Officer since 2017 - Highly experienced financial leader with 30+ years in the industry, including as a top finance executive at large public companies Anna Reeves, Chief Marketing Officer - Focused on executing marketing programs to attract and retain authors, partners and customers, increase market share, and broaden brand exposure - Wiley’s SVP of Marketing since 2023 - Proven executive with 25+ years of experience of driving marketing transformation and growth across large & midcap companies

Q225 Earnings Presentation.pptx 8 AI Strategic Progress O bj ec ti ve s St ra te gi c Pi lla rs Improve speed and efficiency through faster colleague engagement, customer responsiveness, and productivity Drive share gains, revenue growth and margin expansion from faster, more efficient publishing and expanded product offerings Drive incremental, high margin revenue growth through IP licensing for training and commercializing LLMs across industries Productivity Empower colleagues and redesign core business functions for customer engagement and productivity gains Publishing Innovation Transform publishing experience for authors and editors; add new customer features and develop new AI products Licensing & Applications Leverage high-quality content and data catalog to train and develop AI applications and new business models Q 2 Pr og re ss Focused on three key areas: Research Integrity, Content Creation, and Publishing Efficiency; launched refer and transfer pilot using AI to match articles to journals, giving a better experience to authors, reviewers and editors Built robust pipeline focused on tech, pharma, and information services sectors; demand remains strong, particularly in STEM fields; Co- innovation program announced with first partner Featured as AI early adopter in Salesforce’s earnings call; 25% of colleagues recently reported productivity gains from AI tools

Q225 Earnings Presentation.pptx 9 Reinvesting in Quality Growth while Expanding Margins AREA INVESTMENTS EXPECTATIONS Q2 PROGRESS Grow Research Publishing market share • Expand editorial capacity • Expand journal portfolio • Optimize Go To Market to drive author engagement and retention • Drive author and partner communications • As a scale and quality leader, our aim is to meet and exceed market growth of 3-4% over time • Advanced brand extension seeing strong momentum, 22 journals in market with 6 more planned • Marketing head elevated to CMO and executive team; brand revitalization launched Transform publishing and author experience through Research Publishing Platform • Accelerate Research End-to- End Publishing Platform development • Add features around Research integrity and refer and transfer • Stand up new content offerings • Material reduction in publishing time and cost per article • Greater article throughput • Over 350 journals now migrated over to new platform • Operations and technology organizations combined under one leader for speed and focus Drive AI growth from licensing and applications • Continued expansion of content catalogs • Investments in content management, rights management, and business development • Leverage and expand corporate customer base • Deliver incremental revenue growth through training and applications, focusing on recurring models • Continued buildout of business development pipeline in tech, pharma, and information services • Partner innovation program launched to develop AI applications

Segment Performance Outlook Financial Position

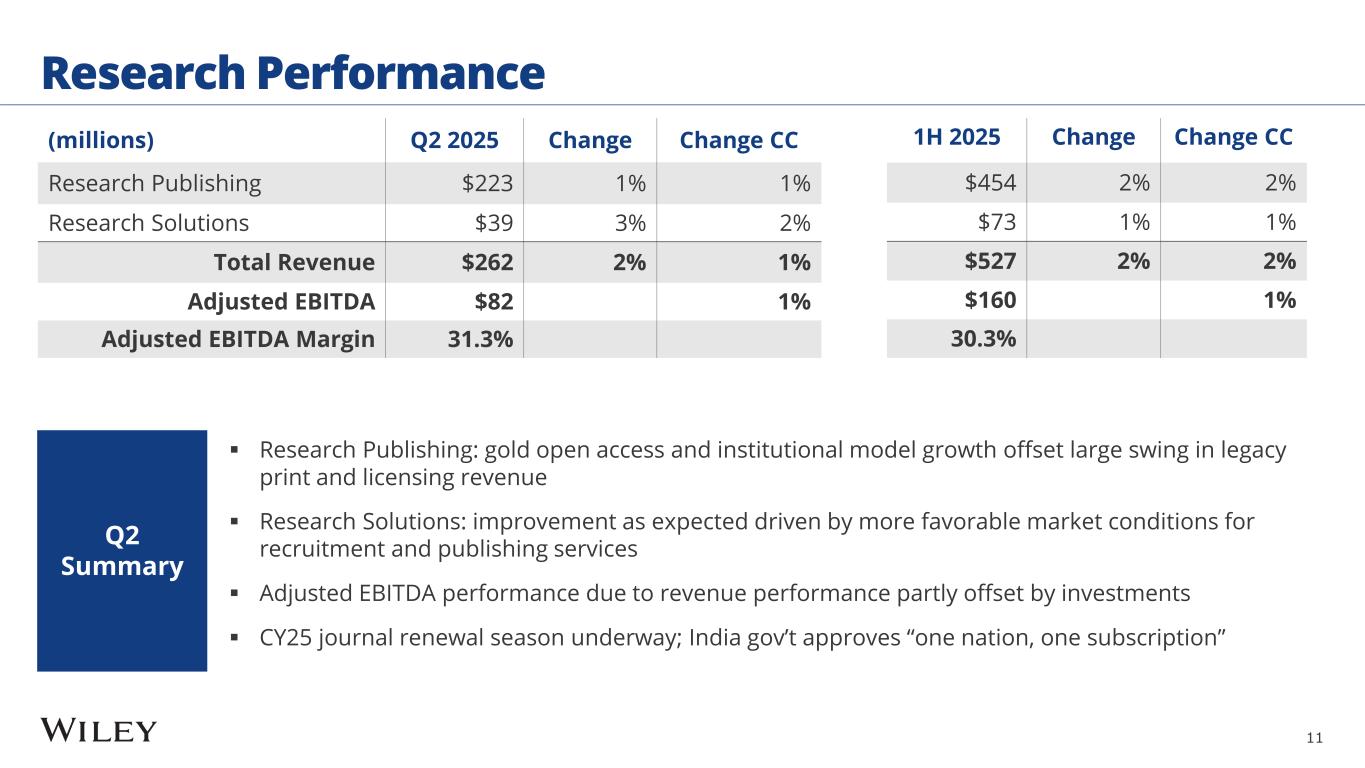

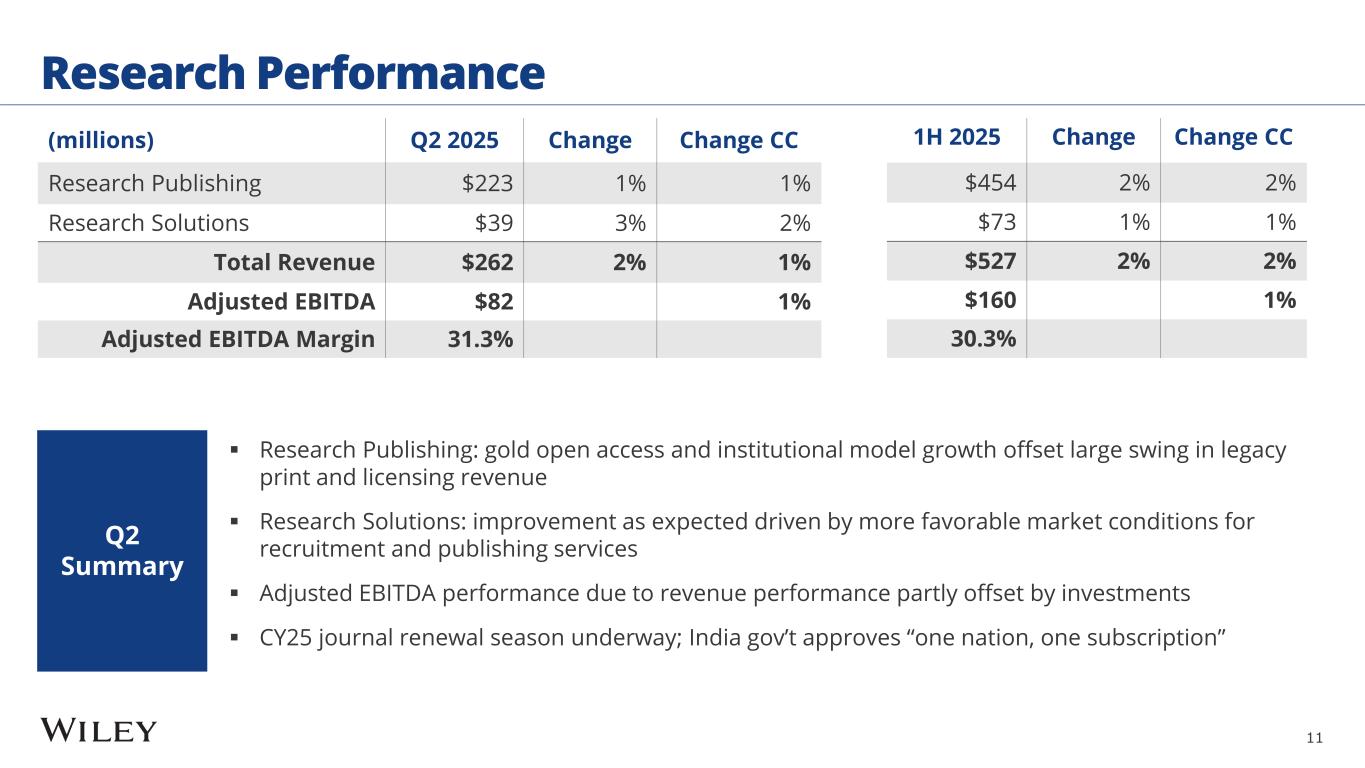

Q225 Earnings Presentation.pptx 11 Research Performance (millions) Q2 2025 Change Change CC Research Publishing $223 1% 1% Research Solutions $39 3% 2% Total Revenue $262 2% 1% Adjusted EBITDA $82 1% Adjusted EBITDA Margin 31.3% Q2 Summary Research Publishing: gold open access and institutional model growth offset large swing in legacy print and licensing revenue Research Solutions: improvement as expected driven by more favorable market conditions for recruitment and publishing services Adjusted EBITDA performance due to revenue performance partly offset by investments CY25 journal renewal season underway; India gov’t approves “one nation, one subscription” 1H 2025 Change Change CC $454 2% 2% $73 1% 1% $527 2% 2% $160 1% 30.3%

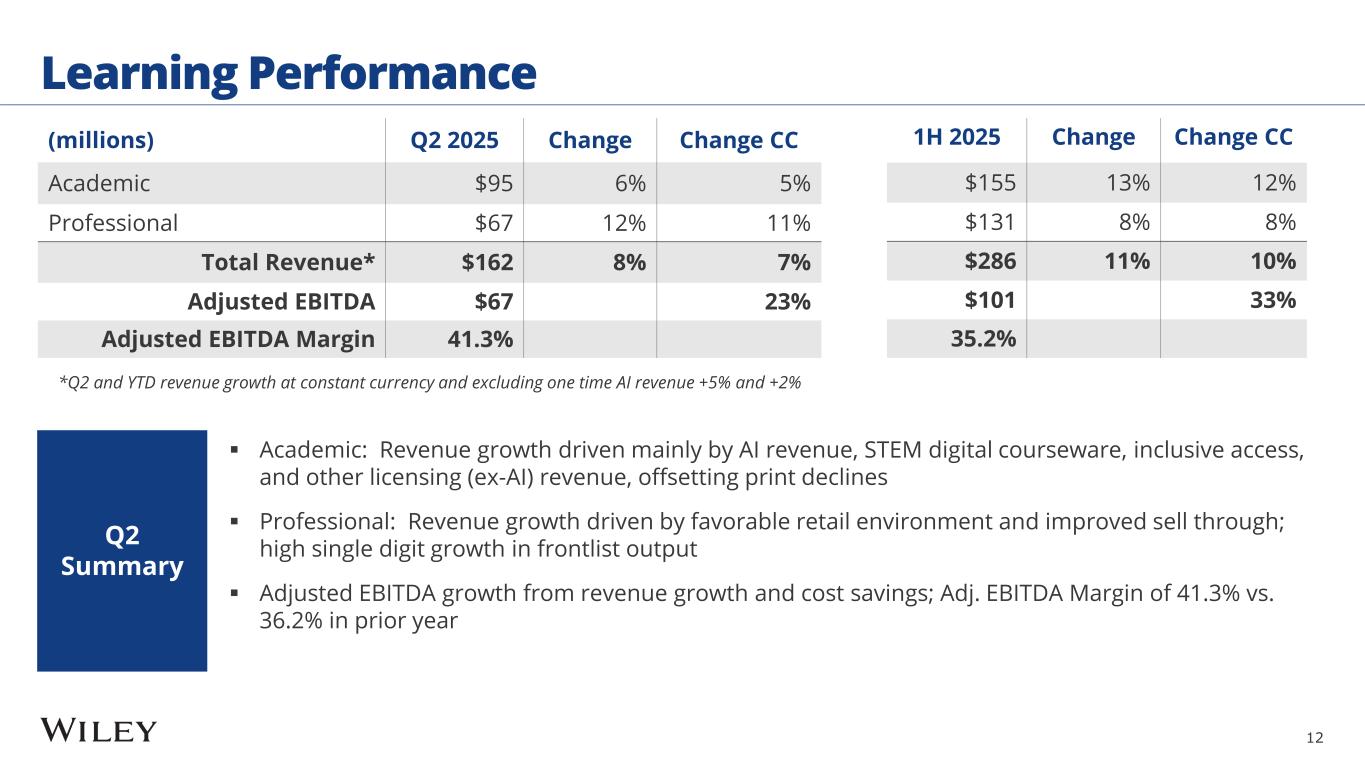

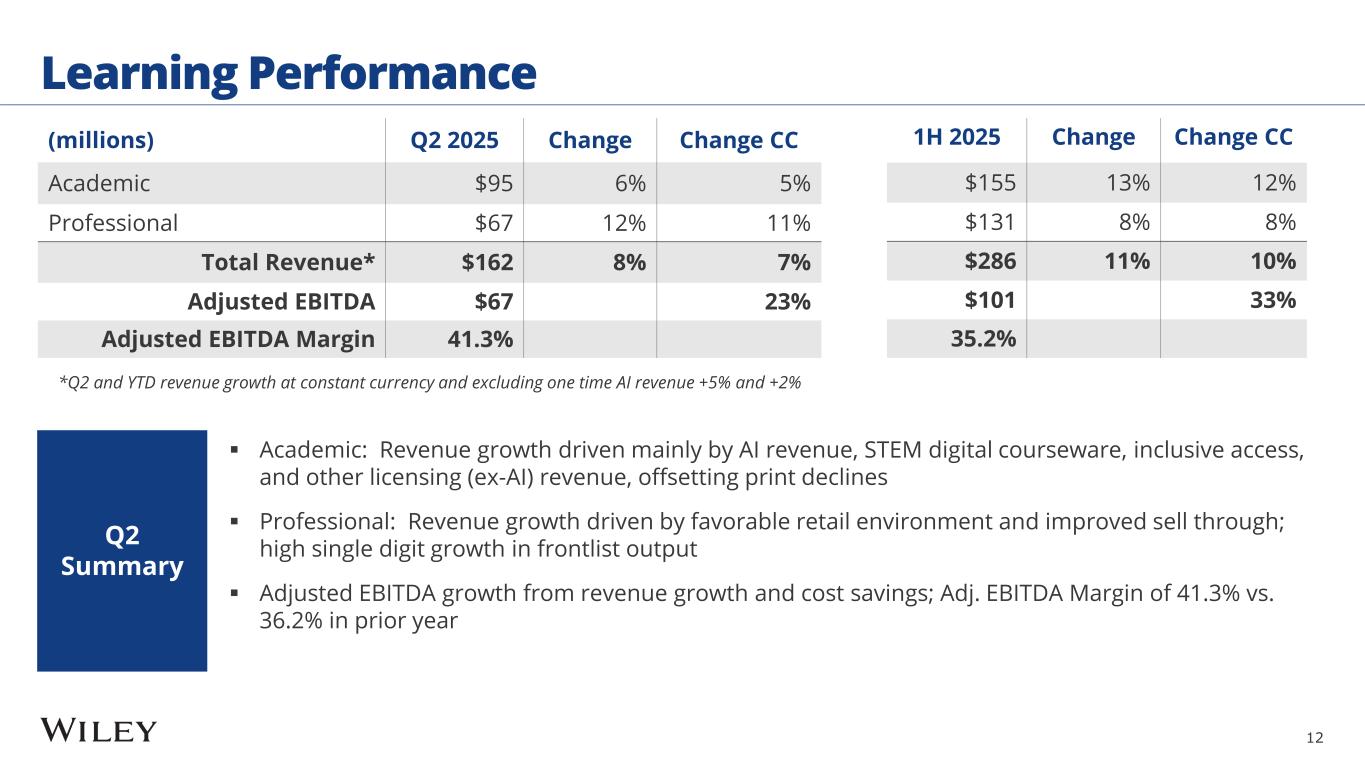

Q225 Earnings Presentation.pptx 12 Learning Performance Academic: Revenue growth driven mainly by AI revenue, STEM digital courseware, inclusive access, and other licensing (ex-AI) revenue, offsetting print declines Professional: Revenue growth driven by favorable retail environment and improved sell through; high single digit growth in frontlist output Adjusted EBITDA growth from revenue growth and cost savings; Adj. EBITDA Margin of 41.3% vs. 36.2% in prior year (millions) Q2 2025 Change Change CC Academic $95 6% 5% Professional $67 12% 11% Total Revenue* $162 8% 7% Adjusted EBITDA $67 23% Adjusted EBITDA Margin 41.3% 1H 2025 Change Change CC $155 13% 12% $131 8% 8% $286 11% 10% $101 33% 35.2% *Q2 and YTD revenue growth at constant currency and excluding one time AI revenue +5% and +2% Q2 Summary

Q225 Earnings Presentation.pptx 13 2H Quarterly Phasing Uneven second half anticipated with Q3 challenged and Q4 elevated • Q3: challenged by seasonal fluctuations in Learning and current year investments • Q4: significant portion of FY25 revenue and profit growth expected - Strong momentum and favorable revenue comps in Research - Good underlying performance expected in Learning excluding the large AI contract in prior year Reaffirming full year outlook across all metrics

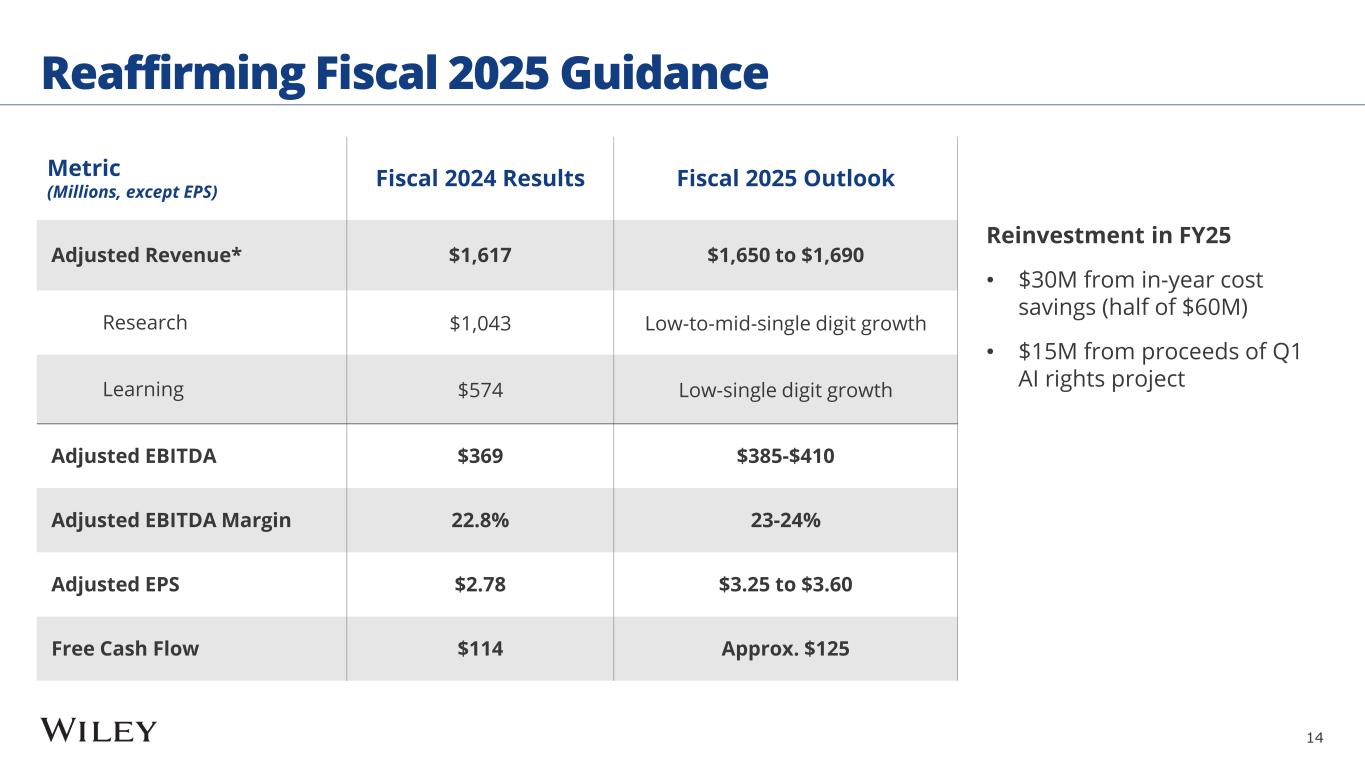

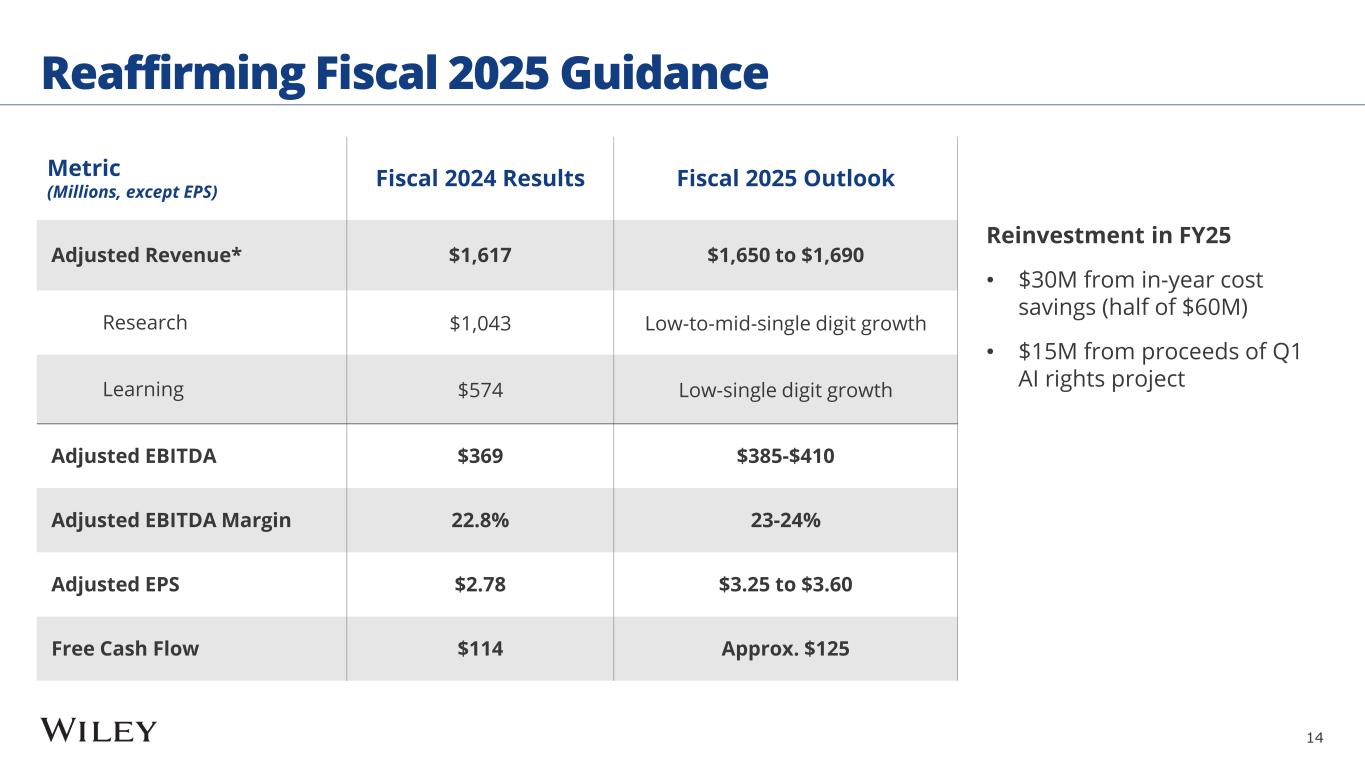

Q225 Earnings Presentation.pptx 14 Reaffirming Fiscal 2025 Guidance Metric (Millions, except EPS) Fiscal 2024 Results Fiscal 2025 Outlook Adjusted Revenue* $1,617 $1,650 to $1,690 Research $1,043 Low-to-mid-single digit growth Learning $574 Low-single digit growth Adjusted EBITDA $369 $385-$410 Adjusted EBITDA Margin 22.8% 23-24% Adjusted EPS $2.78 $3.25 to $3.60 Free Cash Flow $114 Approx. $125 Reinvestment in FY25 • $30M from in-year cost savings (half of $60M) • $15M from proceeds of Q1 AI rights project

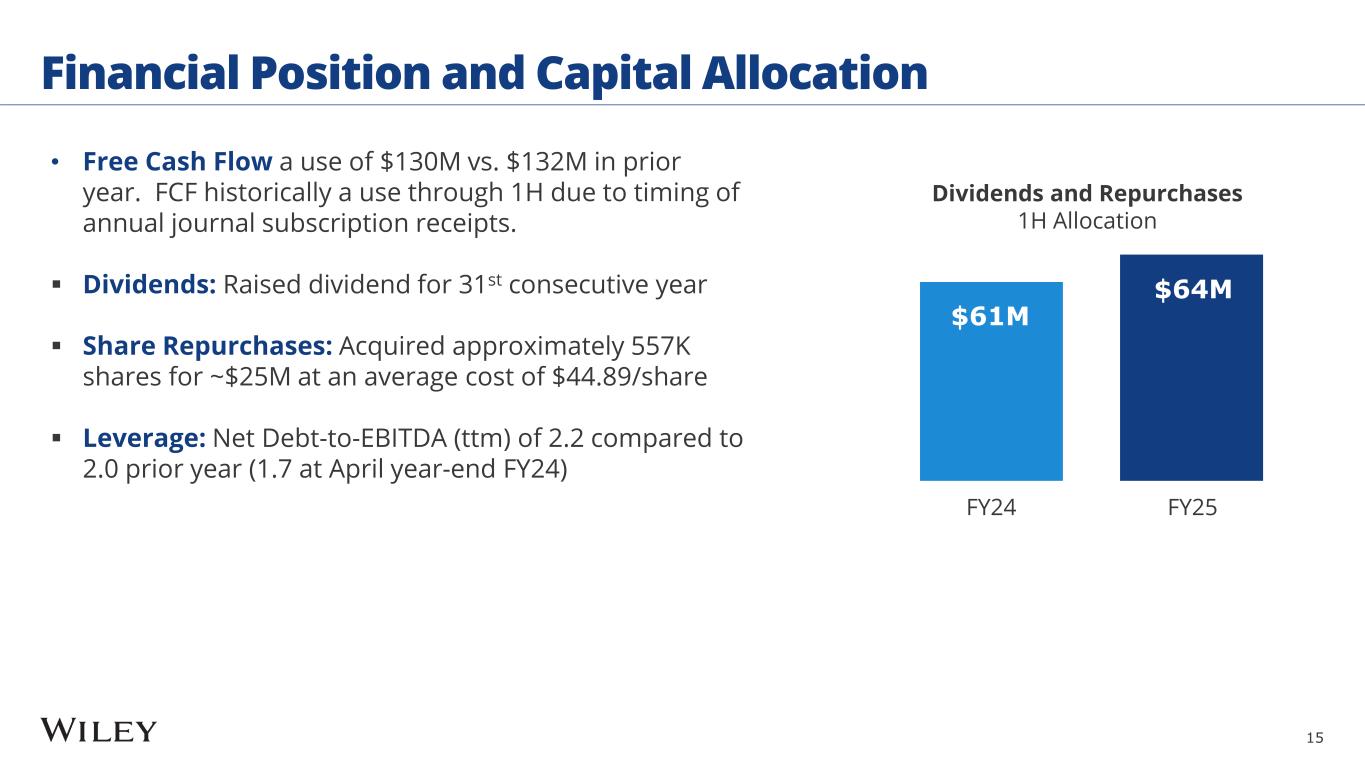

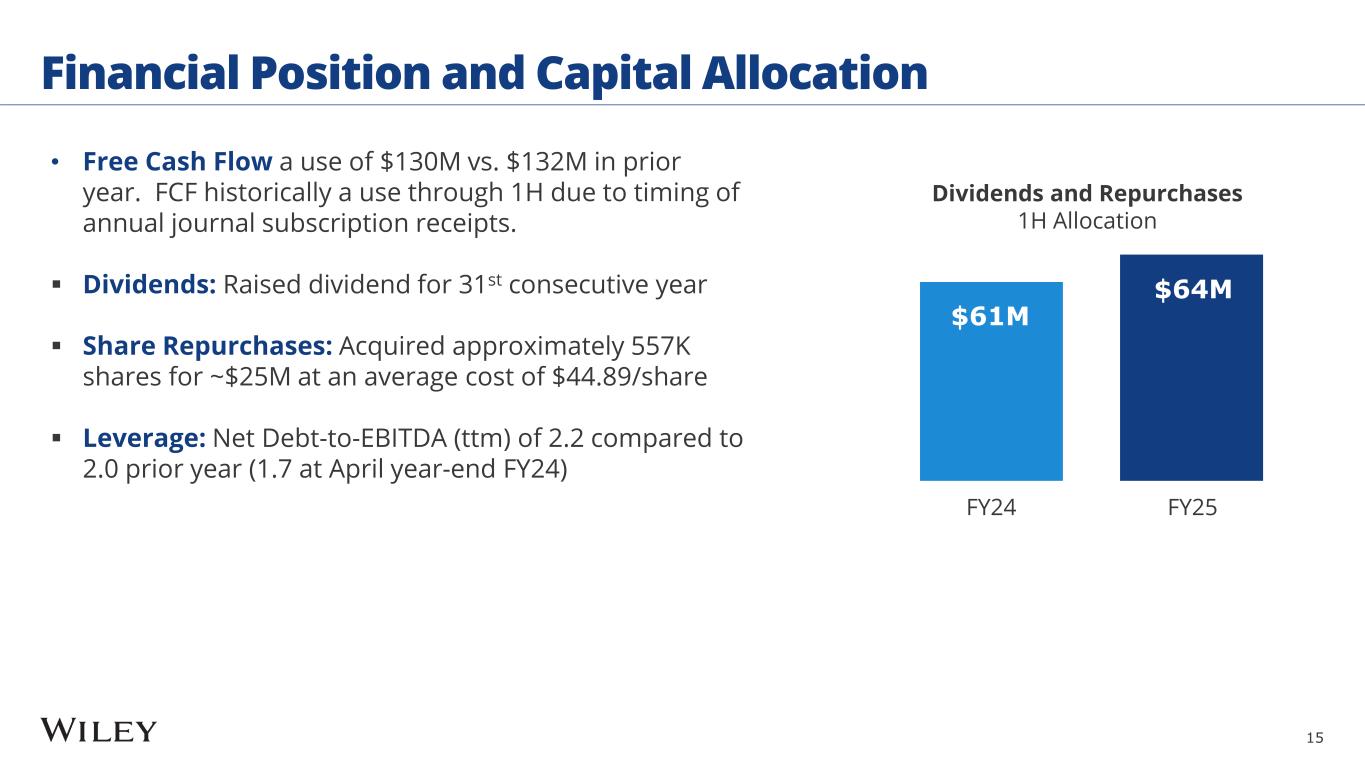

Q225 Earnings Presentation.pptx 15 Financial Position and Capital Allocation $64M $61M • Free Cash Flow a use of $130M vs. $132M in prior year. FCF historically a use through 1H due to timing of annual journal subscription receipts. Dividends: Raised dividend for 31st consecutive year Share Repurchases: Acquired approximately 557K shares for ~$25M at an average cost of $44.89/share Leverage: Net Debt-to-EBITDA (ttm) of 2.2 compared to 2.0 prior year (1.7 at April year-end FY24) Dividends and Repurchases 1H Allocation FY24 FY25

Summary

Q225 Earnings Presentation.pptx 17 Executive Summary Revenue growth drive by solid performance in Learning and modest growth in Research Continued margin expansion and EPS growth in line with executed plans AI progress accelerating with healthy pipeline and market in early development Leadership changes focused on skills and experience around core and moving faster as an organization Guidance ranges reaffirmed; 1H performance as expected Reinvestments in Research and culture of continuous improvement to benefit us long term

Thank you for joining us investors.wiley.com Contact: Brian Campbell brian.campbell@wiley.com +1 (201) 748-6874

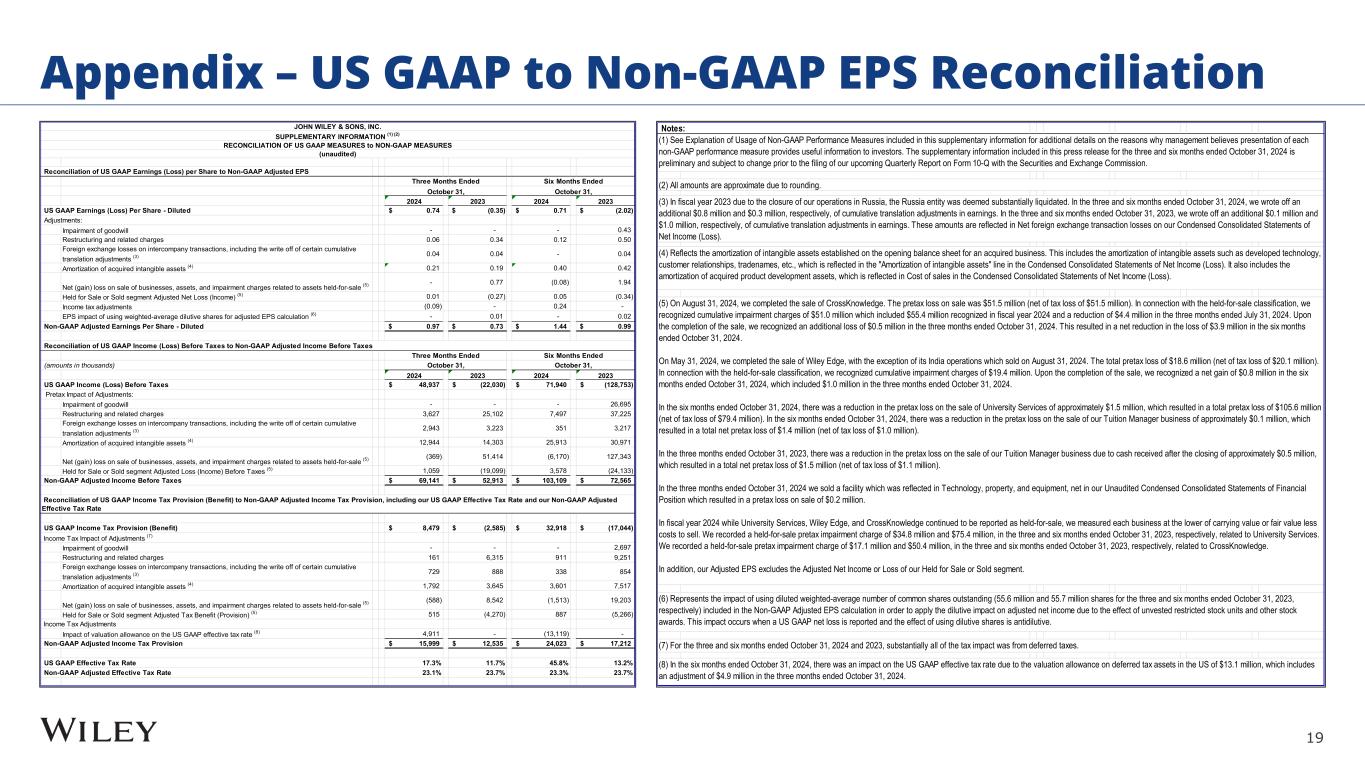

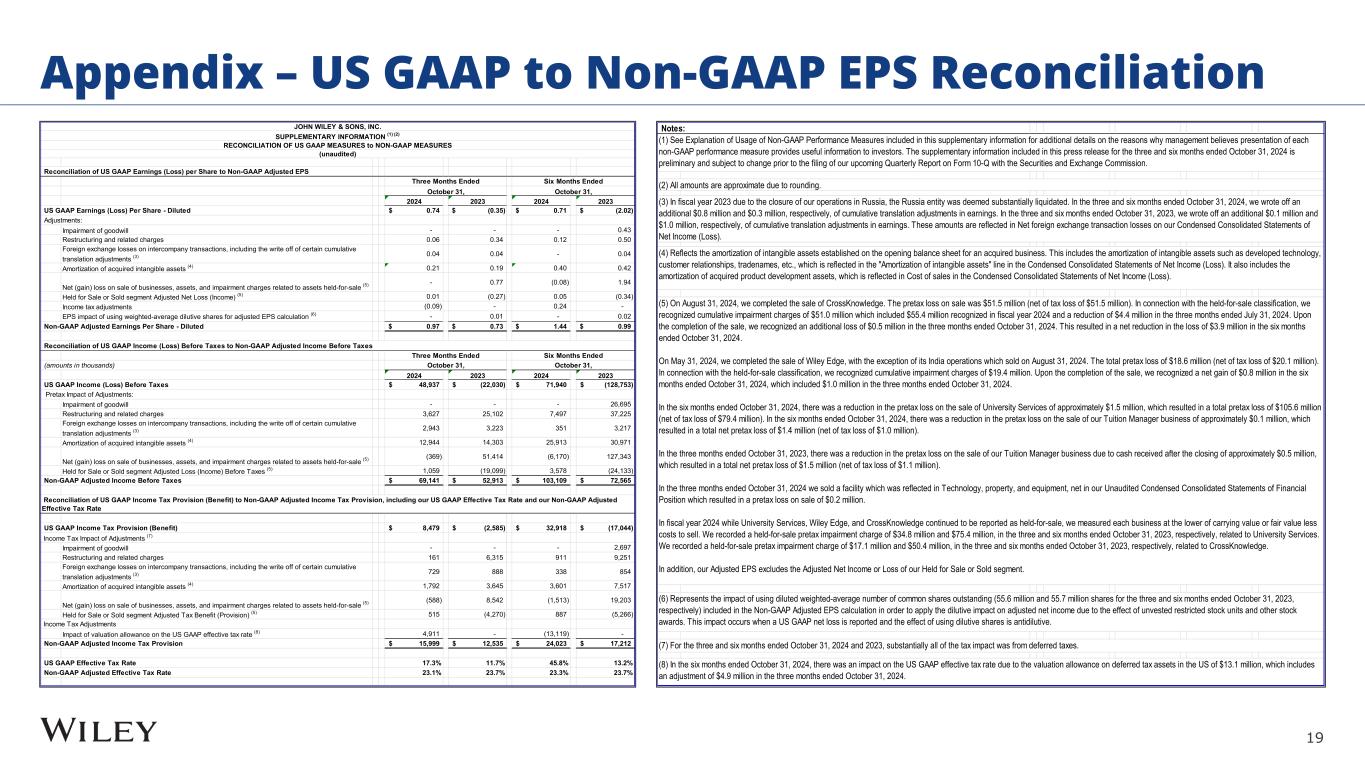

Q225 Earnings Presentation.pptx 19 Appendix – US GAAP to Non-GAAP EPS Reconciliation Reconciliation of US GAAP Earnings (Loss) per Share to Non-GAAP Adjusted EPS 2024 2023 2024 2023 US GAAP Earnings (Loss) Per Share - Diluted 0.74$ (0.35)$ 0.71$ (2.02)$ Adjustments: Impairment of goodwill - - - 0.43 Restructuring and related charges 0.06 0.34 0.12 0.50 Foreign exchange losses on intercompany transactions, including the write off of certain cumulative translation adjustments (3) 0.04 0.04 - 0.04 Amortization of acquired intangible assets (4) 0.21 0.19 0.40 0.42 Net (gain) loss on sale of businesses, assets, and impairment charges related to assets held-for-sale (5) - 0.77 (0.08) 1.94 Held for Sale or Sold segment Adjusted Net Loss (Income) (5) 0.01 (0.27) 0.05 (0.34) Income tax adjustments (0.09) - 0.24 - EPS impact of using weighted-average dilutive shares for adjusted EPS calculation (6) - 0.01 - 0.02 Non-GAAP Adjusted Earnings Per Share - Diluted 0.97$ 0.73$ 1.44$ 0.99$ (amounts in thousands) 2024 2023 2024 2023 US GAAP Income (Loss) Before Taxes 48,937$ (22,030)$ 71,940$ (128,753)$ Impairment of goodwill - - - 26,695 Restructuring and related charges 3,627 25,102 7,497 37,225 Foreign exchange losses on intercompany transactions, including the write off of certain cumulative translation adjustments (3) 2,943 3,223 351 3,217 Amortization of acquired intangible assets (4) 12,944 14,303 25,913 30,971 Net (gain) loss on sale of businesses, assets, and impairment charges related to assets held-for-sale (5) (369) 51,414 (6,170) 127,343 Held for Sale or Sold segment Adjusted Loss (Income) Before Taxes (5) 1,059 (19,099) 3,578 (24,133) Non-GAAP Adjusted Income Before Taxes 69,141$ 52,913$ 103,109$ 72,565$ US GAAP Income Tax Provision (Benefit) 8,479$ (2,585)$ 32,918$ (17,044)$ Impairment of goodwill - - - 2,697 Restructuring and related charges 161 6,315 911 9,251 Foreign exchange losses on intercompany transactions, including the write off of certain cumulative translation adjustments (3) 729 888 338 854 Amortization of acquired intangible assets (4) 1,792 3,645 3,601 7,517 Net (gain) loss on sale of businesses, assets, and impairment charges related to assets held-for-sale (5) (588) 8,542 (1,513) 19,203 Held for Sale or Sold segment Adjusted Tax Benefit (Provision) (5) 515 (4,270) 887 (5,266) Impact of valuation allowance on the US GAAP effective tax rate (8) 4,911 - (13,119) - Non-GAAP Adjusted Income Tax Provision 15,999$ 12,535$ 24,023$ 17,212$ US GAAP Effective Tax Rate 17.3% 11.7% 45.8% 13.2% Non-GAAP Adjusted Effective Tax Rate 23.1% 23.7% 23.3% 23.7% Pretax Impact of Adjustments: Reconciliation of US GAAP Income Tax Provision (Benefit) to Non-GAAP Adjusted Income Tax Provision, including our US GAAP Effective Tax Rate and our Non-GAAP Adjusted Effective Tax Rate Income Tax Impact of Adjustments (7) Income Tax Adjustments October 31, October 31, October 31, October 31, Reconciliation of US GAAP Income (Loss) Before Taxes to Non-GAAP Adjusted Income Before Taxes Three Months Ended Six Months Ended JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1) (2) RECONCILIATION OF US GAAP MEASURES to NON-GAAP MEASURES (unaudited) Three Months Ended Six Months Ended Notes: (8) In the six months ended October 31, 2024, there was an impact on the US GAAP effective tax rate due to the valuation allowance on deferred tax assets in the US of $13.1 million, which includes an adjustment of $4.9 million in the three months ended October 31, 2024. (1) See Explanation of Usage of Non-GAAP Performance Measures included in this supplementary information for additional details on the reasons why management believes presentation of each non-GAAP performance measure provides useful information to investors. The supplementary information included in this press release for the three and six months ended October 31, 2024 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. (2) All amounts are approximate due to rounding. (3) In fiscal year 2023 due to the closure of our operations in Russia, the Russia entity was deemed substantially liquidated. In the three and six months ended October 31, 2024, we wrote off an additional $0.8 million and $0.3 million, respectively, of cumulative translation adjustments in earnings. In the three and six months ended October 31, 2023, we wrote off an additional $0.1 million and $1.0 million, respectively, of cumulative translation adjustments in earnings. These amounts are reflected in Net foreign exchange transaction losses on our Condensed Consolidated Statements of Net Income (Loss). (4) Reflects the amortization of intangible assets established on the opening balance sheet for an acquired business. This includes the amortization of intangible assets such as developed technology, customer relationships, tradenames, etc., which is reflected in the "Amortization of intangible assets" line in the Condensed Consolidated Statements of Net Income (Loss). It also includes the amortization of acquired product development assets, which is reflected in Cost of sales in the Condensed Consolidated Statements of Net Income (Loss). (5) On August 31, 2024, we completed the sale of CrossKnowledge. The pretax loss on sale was $51.5 million (net of tax loss of $51.5 million). In connection with the held-for-sale classification, we recognized cumulative impairment charges of $51.0 million which included $55.4 million recognized in fiscal year 2024 and a reduction of $4.4 million in the three months ended July 31, 2024. Upon the completion of the sale, we recognized an additional loss of $0.5 million in the three months ended October 31, 2024. This resulted in a net reduction in the loss of $3.9 million in the six months ended October 31, 2024. On May 31, 2024, we completed the sale of Wiley Edge, with the exception of its India operations which sold on August 31, 2024. The total pretax loss of $18.6 million (net of tax loss of $20.1 million). In connection with the held-for-sale classification, we recognized cumulative impairment charges of $19.4 million. Upon the completion of the sale, we recognized a net gain of $0.8 million in the six months ended October 31, 2024, which included $1.0 million in the three months ended October 31, 2024. In the six months ended October 31, 2024, there was a reduction in the pretax loss on the sale of University Services of approximately $1.5 million, which resulted in a total pretax loss of $105.6 million (net of tax loss of $79.4 million). In the six months ended October 31, 2024, there was a reduction in the pretax loss on the sale of our Tuition Manager business of approximately $0.1 million, which resulted in a total net pretax loss of $1.4 million (net of tax loss of $1.0 million). In the three months ended October 31, 2023, there was a reduction in the pretax loss on the sale of our Tuition Manager business due to cash received after the closing of approximately $0.5 million, which resulted in a total net pretax loss of $1.5 million (net of tax loss of $1.1 million). In the three months ended October 31, 2024 we sold a facility which was reflected in Technology, property, and equipment, net in our Unaudited Condensed Consolidated Statements of Financial Position which resulted in a pretax loss on sale of $0.2 million. In fiscal year 2024 while University Services, Wiley Edge, and CrossKnowledge continued to be reported as held-for-sale, we measured each business at the lower of carrying value or fair value less costs to sell. We recorded a held-for-sale pretax impairment charge of $34.8 million and $75.4 million, in the three and six months ended October 31, 2023, respectively, related to University Services. We recorded a held-for-sale pretax impairment charge of $17.1 million and $50.4 million, in the three and six months ended October 31, 2023, respectively, related to CrossKnowledge. In addition, our Adjusted EPS excludes the Adjusted Net Income or Loss of our Held for Sale or Sold segment. (6) Represents the impact of using diluted weighted-average number of common shares outstanding (55.6 million and 55.7 million shares for the three and six months ended October 31, 2023, respectively) included in the Non-GAAP Adjusted EPS calculation in order to apply the dilutive impact on adjusted net income due to the effect of unvested restricted stock units and other stock awards. This impact occurs when a US GAAP net loss is reported and the effect of using dilutive shares is antidilutive. (7) For the three and six months ended October 31, 2024 and 2023, substantially all of the tax impact was from deferred taxes.

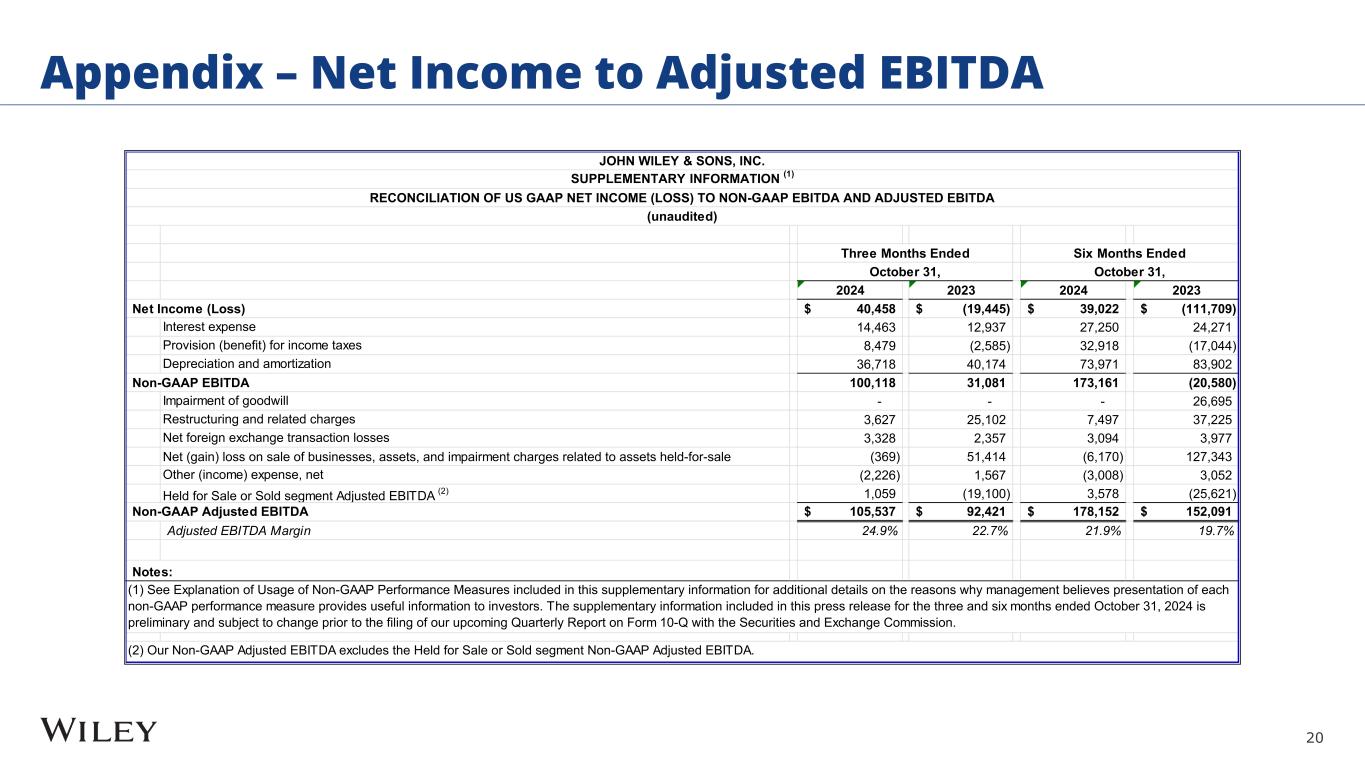

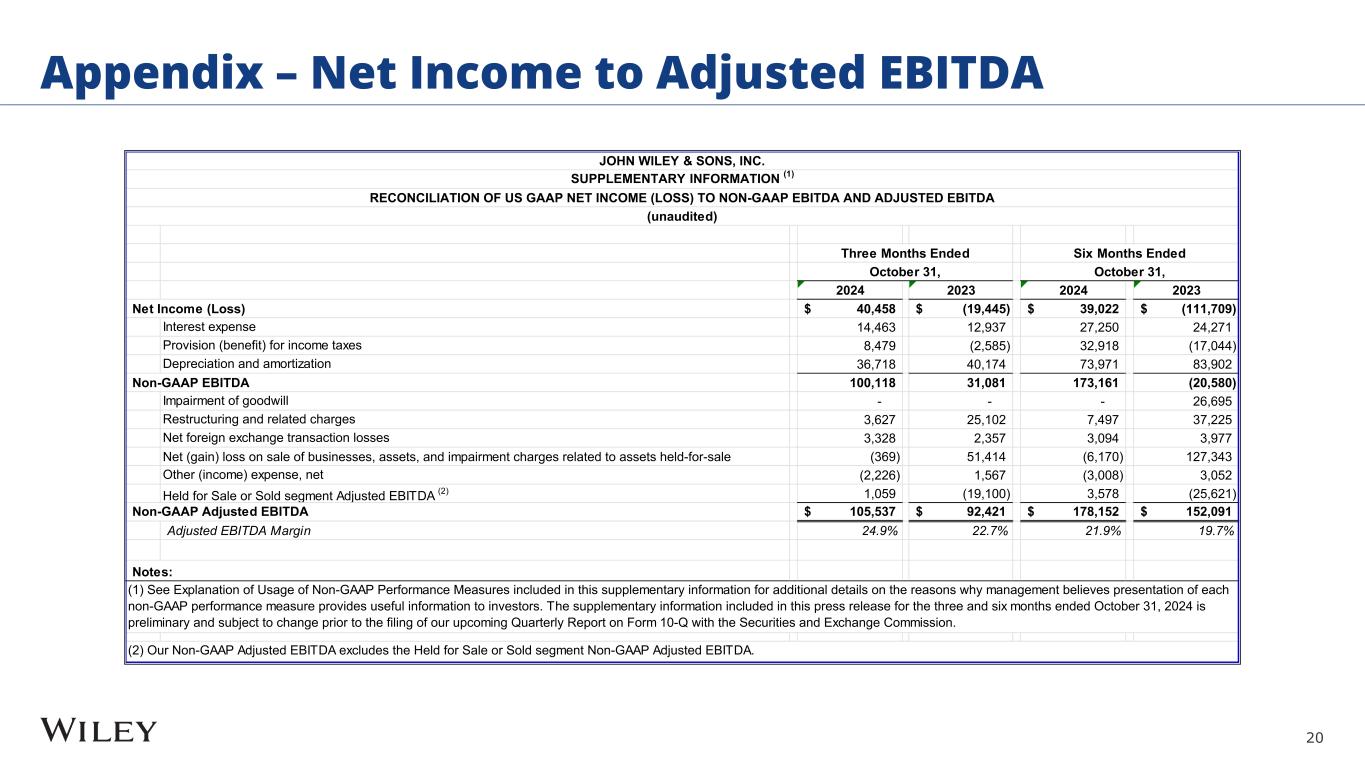

Q225 Earnings Presentation.pptx 20 Appendix – Net Income to Adjusted EBITDA 2024 2023 2024 2023 Net Income (Loss) 40,458$ (19,445)$ 39,022$ (111,709)$ Interest expense 14,463 12,937 27,250 24,271 Provision (benefit) for income taxes 8,479 (2,585) 32,918 (17,044) Depreciation and amortization 36,718 40,174 73,971 83,902 Non-GAAP EBITDA 100,118 31,081 173,161 (20,580) Impairment of goodwill - - - 26,695 Restructuring and related charges 3,627 25,102 7,497 37,225 Net foreign exchange transaction losses 3,328 2,357 3,094 3,977 Net (gain) loss on sale of businesses, assets, and impairment charges related to assets held-for-sale (369) 51,414 (6,170) 127,343 Other (income) expense, net (2,226) 1,567 (3,008) 3,052 Held for Sale or Sold segment Adjusted EBITDA (2) 1,059 (19,100) 3,578 (25,621) Non-GAAP Adjusted EBITDA 105,537$ 92,421$ 178,152$ 152,091$ Adjusted EBITDA Margin 24.9% 22.7% 21.9% 19.7% Notes: (1) See Explanation of Usage of Non-GAAP Performance Measures included in this supplementary information for additional details on the reasons why management believes presentation of each non-GAAP performance measure provides useful information to investors. The supplementary information included in this press release for the three and six months ended October 31, 2024 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. (2) Our Non-GAAP Adjusted EBITDA excludes the Held for Sale or Sold segment Non-GAAP Adjusted EBITDA. October 31, October 31, JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1) RECONCILIATION OF US GAAP NET INCOME (LOSS) TO NON-GAAP EBITDA AND ADJUSTED EBITDA (unaudited) Three Months Ended Six Months Ended