- WLY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

John Wiley & Sons (WLY) DEF 14ADefinitive proxy

Filed: 7 Aug 06, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant T |

|

|

|

| ||

Filed by a Party other than the Registrant £ |

|

|

|

| ||

|

|

|

|

|

|

|

Check the appropriate box: |

|

|

|

| ||

|

|

|

|

|

|

|

£ |

| Preliminary Proxy Statement |

| £ |

| Confidential, for Use of the Commission Only |

T |

| Definitive Proxy Statement |

|

|

| (as permitted by Rule 14a-6(e)(2)) |

£ |

| Definitive Additional Materials |

|

|

|

|

£ |

| Soliciting Material Pursuant to § 240.14a-12 |

|

|

|

|

JOHN WILEY & SONS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

| ||||

Payment of filing fee (Check the appropriate box): | ||||||

T |

| No fee required. | ||||

£ |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

|

|

|

|

| ||

| (1 | ) |

| Title of each class of securities to which transactions applies: | ||

|

|

|

|

| ||

| (2 | ) |

| Aggregate number of securities to which transactions applies: | ||

|

|

|

|

| ||

| (3 | ) |

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): | ||

|

|

|

|

| ||

| (4 | ) |

| Proposed maximum aggregate value of transaction: | ||

|

|

|

|

| ||

| (5 | ) |

| Total fee paid: | ||

|

|

|

|

| ||

£ | Fee paid previously with preliminary materials. | |||||

|

|

|

|

| ||

£ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

|

|

|

|

| ||

(1 | ) | Amount previously paid: | ||||

|

|

|

|

| ||

(2 | ) | Form, schedule or registration statement no.: | ||||

|

|

|

|

| ||

| (3 | ) | Filing party: | ||||

|

|

|

|

| ||

| (4 | ) | Date filed: | ||||

|  | 111 River Street Hoboken, NJ 07030-5774 (201) 748-6000 |

| Peter Booth Wiley Chairman of the Board |

August 7, 2006

TO OUR SHAREHOLDERS:

We cordially invite you to attend the 2006 Annual Meeting of Shareholders to be held on Thursday, September 21, 2006 at 9:30 A.M., at the Company's headquarters, 111 River Street, Hoboken, New Jersey. The official Notice of Meeting, Proxy Statement, and separate forms of proxy for Class A and Class B Shareholders are enclosed with this letter. The matters listed in the Notice of Meeting are described in the attached Proxy Statement.

The Board of Directors welcomes and appreciates the interest of all our shareholders in the Company's affairs, and encourages those entitled to vote at this Annual Meeting to take the time to do so. We hope you will attend the meeting, but whether or not you expect to be personally present, please vote your shares, either by signing, dating and promptly returning the enclosed proxy card (or, if you own two classes of shares, both proxy cards) in the accompanying postage-paid envelope, by telephone using the toll-free telephone number printed on the proxy card, or by voting on the Internet using the instructions printed on the proxy card. This will assure that your shares are represented at the meeting. Even though you execute this proxy, vote by telephone or via the Internet, you may revoke your proxy at any time before it is exercised by giving written notice of revocation to the Secretary of the Company, by executing and delivering a later-dated proxy (either in writing, telephonically or via the Internet) or by voting in person at the Annual Meeting. If you attend the meeting you will be able to vote in person if you wish to do so, even if you have previously returned your proxy card, voted by telephone or via the Internet.

Your vote is important to us, and we appreciate your prompt attention to this matter.

Sincerely, | ||

| Chairman of the Board |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS To our Shareholders: The Annual Meeting of Shareholders of John Wiley & Sons, Inc. (the “Company”) will be held at the Company's headquarters, 111 River Street, Hoboken, New Jersey, on Thursday, September 21, 2006 at 9:30 A.M., for the following purposes: 1. To elect a board of eight (8) directors, of whom three (3) are to be elected by the holders of Class A Common Stock voting as a class and five (5) are to be elected by the holders of Class B Common Stock voting as a class. 2. To ratify the appointment by the Board of Directors of the Company's independent public accountants for the fiscal year ending April 30, 2007. 3. To transact such other business as may properly come before the meeting or any adjournments thereof. Shareholders of record at the close of business on July 24, 2006 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. Please vote by proxy in one of these ways: August 7, 2006 Your vote is important to us. Whether or not you plan to be present at the Annual Meeting, please vote your proxy either via the Internet, by telephone, or by mail. Signing and returning the proxy card, voting via the Internet or by telephone does not affect your right to vote in person if you attend the Annual Meeting.

111 River Street

Hoboken, NJ 07030-5774

(201) 748-6000

TO BE HELD SEPTEMBER 21, 2006• Use the toll-free telephone number shown on your proxy card or voting instructions form (if you receive proxy materials from a broker or bank); • Visit the Internet website at www.proxyvote.com; or • Sign, date and promptly return your proxy card in the postage-prepaid envelope provided. BY ORDER OF THE BOARD OF DIRECTORS

JOSEPHINE BACCHI

Secretary

Hoboken, New Jersey

PROXY STATEMENT This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of John Wiley & Sons, Inc. (the “Company”) of proxies to be used at the Annual Meeting of Shareholders to be held on September 21, 2006 at the time and place set forth in the accompanying Notice of Meeting and at any and all adjournments thereof. This Proxy Statement and accompanying forms of proxy relating to each class of Common Stock, together with the Company's Annual Report to Shareholders for the fiscal year ended April 30, 2006 (“fiscal 2006”), are first being sent or given to shareholders on August 7, 2006. The executive offices of the Company are at 111 River Street, Hoboken, New Jersey 07030-5774. TABLE OF CONTENTS I. Voting Securities— Only shareholders of record at the close of business on July 24, 2006 are entitled to vote at the Annual Meeting of Shareholders on the matters that may come before the Annual Meeting. At the close of business on July 24, 2006, there were 46,892,364 shares of Class A Common Stock, par value $1.00 per share (the “Class A Stock”), and 10,253,248 shares of Class B Common Stock, par value $1.00 per share (the “Class B Stock”), issued and outstanding and entitled to vote. The holders of Class A Stock, voting as a class, are entitled to elect three (3) directors, and the holders of Class B Stock, voting as a class, are entitled to elect five (5) directors. Each outstanding share of Class A and Class B Stock is entitled to one vote for each Class A or Class B director, respectively. The presence in person or by proxy of a majority of the outstanding shares of Class A or Class B Stock entitled to vote for directors designated as Class A or Class B directors, as the case may be, will constitute a quorum for the purpose of voting to elect that class of directors. All elections shall be determined by a plurality of the class of shares voting thereon. Only shares that are voted in favor of a particular nominee will be 1

Record Date—

Principal Holders

counted toward such nominee's achievement of a plurality. Shares present at the meeting that are not voted for a particular nominee or shares present by proxy where the shareholder properly withheld authority to vote for such nominee (including broker non-votes) will not be counted toward such nominee's achievement of a plurality. The holders of the Class A and Class B Stock vote together as a single class on all other business that properly comes before the Annual Meeting, with each outstanding share of Class A Stock entitled to one-tenth (1/10) of one vote and each outstanding share of Class B Stock entitled to one vote. Proposal 2 requires approval by a majority of votes cast at the Annual Meeting. Abstentions and broker non-votes are not counted in determining the votes cast, but do have the effect of reducing the number of affirmative votes required to achieve a majority for such matters by reducing the total number of shares from which the majority is calculated. If you are a beneficial shareholder and your broker holds your shares in its name, the broker is permitted to vote your shares on the election of directors and the ratification of KPMG LLP as our independent auditor even if the broker does not receive voting instructions from you. The following table and footnotes set forth, at the close of business on July 24, 2006, information concerning each person owning of record, or known to the Company to own beneficially, or who might be deemed to own, 5% or more of its outstanding shares of Class A or Class B Stock. The table below was prepared from the records of the Company and from information furnished to it. The percent of total voting power reflected below represents the voting power on all matters other than the election of directors, as described above. 2Name and Address Class of

Stock Common Stock

Owned Beneficially Percent

of Class Percent of

Total Voting

PowerE.P. Hamilton Trusts, LLC

965 Mission Street

San Francisco, CA(1) A

B 462,338

8,125,536 1.0

79.2%

% 0.3

54.4%

%Deborah E. Wiley

111 River Street

Hoboken, NJ(2)(3)(4) A

B 1,253,976

38,820 2.7

0.4%

% 0.8

0.3%

%Peter Booth Wiley

111 River Street

Hoboken, NJ(2)(3)(5) A

B 1,224,630

12,240 2.6

0.1%

% 0.8

0.1%

%Bradford Wiley II

111 River Street

Hoboken, NJ(2)(3) A

B 1,199,647

12,240 2.6

0.1%

% 0.8

0.1%

%Private Capital Management

Naples, Fl

Investment Manager(6) A 7,520,584 16.0 % 5.0 % Pioneer Investment Management, Inc.

Boston, MA

Investment Manager(6) A 3,843,569 8.2 % 2.6 % The Bass Management Trust

and Certain Other Persons

and Entities

201 Main Street

Fort Worth, TX(7) A 3,363,743 7.2 % 2.6 % United States Trust Corporation

New York, NY

Investment Manager(6) A 2,986,867 6.4 % 2.0 % (1) Bradford Wiley II, Deborah E. Wiley and Peter Booth Wiley, as members of the E.P. Hamilton Trusts, LLC established for the purpose of investing in, owning and managing securities of John Wiley & Sons, Inc., share investment and voting power.

II. Corporate To promote the best corporate governance practices, the Company adheres to the Corporate Governance Principles (“Principles”) set forth below. The Board of Directors (the “Board”) and management believe that these Principles, which are consistent with the requirements of the Securities and Exchange Commission and the New York Stock Exchange, are in the best interests of the Company, its shareholders and other stakeholders, including employees, authors, customers and suppliers. The Board is responsible for ensuring that the Company has a management team capable of representing these interests and of achieving superior business performance. Pursuant to the New York Stock Exchange's Corporate Governance regulations, the Company is considered a “controlled company,” defined as a company where more than 50 percent of the voting power is held by an individual, a group, or another company. As such, the Company would be exempt from certain corporate governance standards. However, the Board believes it is in the best interest of the Company and its shareholders to abide by all of the regulations, except for the requirement that the Governance Committee be comprised of independent directors only. The Board has chosen to take an exemption to this requirement because it believes that a Wiley family member's participation on this Committee will result in a collaborative process to promote the highest standards in the recruitment of new directors and in governance generally. 1. Primary Duties The Board, which is elected annually by the shareholders, exercises oversight and has final authority and responsibility with respect to the Company's affairs, except with respect to those matters reserved to shareholders. All major decisions are considered by the Board as a whole. The Board elects the Chief Executive Officer (“CEO”) and other corporate officers, acts as an advisor to and resource for management, and monitors management's performance. The Board plans for the succession of the CEO. The Compensation Committee annually evaluates the CEO's performance, approves the CEO's compensation, and informs the Board of its decisions. The Board also oversees the succession process for certain other management positions, and the CEO reviews with the Board annually his assessment of key management incumbents and their professional growth and development plans. The Board also: 3(2) Bradford Wiley II, Deborah E. Wiley and Peter Booth Wiley, as general partners of a limited partnership, share voting and investment power with respect to 301,645 shares of Class A Stock. For purpose of this table, each is shown as the owner of one-third of such shares. (3) Bradford Wiley II, Deborah E. Wiley and Peter Booth Wiley, as co-trustees, share voting and investment power with respect to 55,072 shares of Class A Stock and 36,720 shares of Class B Stock under the Trust of Esther B. Wiley. For purposes of this table, each is shown as the owner of one-third of such shares. (4) Includes 540 shares of Class A Stock and 8,660 shares of Class B Stock of which Deborah E. Wiley is custodian for minor children. (5) Includes 2,948 shares of Class A Stock which Peter Booth Wiley has the right to acquire under an option granted under the 1990 Director Stock Plan, as Amended and Restated as of June 22, 2001. (6) Based on filings with the Securities and Exchange Commission, including filings pursuant to Rule 13f-1 of the Securities Exchange Act of 1934, and other information deemed reliable by the Company. (7) Based on filings with the Securities and Exchange Commission pursuant to Regulation 13D of the Securities Exchange Act of 1934, includes The Bass Management Trust, Perry R. Bass, Nancy L. Bass, Lee M. Bass, and certain other persons.

Governance

Principles a) reviews the Company's business and strategic plans and actual operating performance; b) reviews and approves the Company's financial objectives, investment plans and programs; and

2. Director Independence The Board has long held that it is in the best interests of the Company for the Board to consist of a substantial majority of independent Directors. The Board annually determines that a Director is independent if he or she has no material relationship, either directly or indirectly, with the Company, defined as follows: When determining the independence of a Director, the ownership of, or beneficial interest in, a significant amount of stock, by itself, is not considered a factor. 3. Composition of the Board Under the Company's By-Laws, the Board has the authority to determine the appropriate number of directors to be elected so as to enable it to function effectively and efficiently. Currently, a ten-member Board is considered to be appropriate, though size may vary. The Governance Committee makes recommendations to the Board concerning the appropriate size of the Board, as well as selection criteria for candidates. Each candidate is selected based on background, experience, expertise, and other relevant criteria, including other public and private company boards on which the candidate serves. In addition to the individual candidate's background, experience and expertise, the manner in which each board member's qualities complement those of others and contributes to the functioning of the Board as a whole are also taken into account. The Governance Committee nominates a candidate, and the Board votes on his or her candidacy. The shareholders vote annually for the entire slate of Directors. Any nominee Director who receives a greater number of “withheld” votes from his or her election than “for” votes shall tender his or her resignation for consideration by the Governance 4 c) provides oversight of internal and external audit processes and financial reporting. a) The Director is not and has not been employed in an executive capacity by the Company or its subsidiaries within the three years immediately prior to the annual meeting at which the nominees of the Board will be voted upon. b) The Director is not a significant advisor or consultant to the Company (including its subsidiaries); does not have direct, sole responsibility for business between the Company and a material supplier or customer; and does not have a significant personal services contract with the Company. c) The Director is not an executive officer, an employee, and does not have an immediate family member who is an executive officer or employee, of an organization that makes payments to, or receives payments from, the Company in an amount that, in any single fiscal year, exceeds 2% of such other organization's consolidated gross revenues. d) The Director is not, and has not been within the past three years, employed by or affiliated with a firm that provided independent audit services to the Company; the Director is not, and does not have an immediate family member who is a current partner of the firm that is the Company's external auditor; and the Director or an immediate family member was not within the past three years a partner or employee of the Company's external audit firm and personally worked on the Company's audit within that time. e) The Director does not have an immediate family member who is a current employee of the Company's external audit firm and who participates in that firm's audit, assurance or tax compliance practice. f) The Director is not, and has not been in the past three years, part of an interlocking directorship involving compensation committees. g) The Director is not a member of the immediate family of Peter Booth Wiley, Bradford Wiley II and Deborah E. Wiley, or management, as listed in the Company's proxy statement.

Committee. The Governance Committee shall recommend to the Board the action to be taken with respect to such resignation. 4. Director Eligibility Directors shall limit the number of other board memberships (excluding non-profits) in order to insure adequate attention to Wiley business. Directors shall advise the Chairman of the Board and the Chairman of the Governance Committee in advance of accepting an invitation to serve on a new board. Whenever there is a substantial change in the Director's principal occupation, a Director shall tender his or her resignation and shall immediately inform the Board of any potential conflict of interest. The Governance Committee will recommend to the Board the action, if any, to be taken with respect to the resignation or the potential conflict of interest. The Board has established a retirement age of 70 for its Directors. The Board may in its discretion nominate for election a person who has attained age 70 if it believes that under the circumstances it is in the Company's best interests. 5. Board and Management Communication The Board has access to all members of management and external advisors. As appropriate, the Board may retain independent advisors. The CEO shall establish and maintain effective communications with the Company's stakeholder groups. The Board schedules regular executive sessions at the end of each meeting. Non-management directors meet at regularly scheduled sessions without management. The Chairman of the Board presides at these sessions. In addition, the independent directors meet at least once each year in an executive session presided over by the Chairman of the Governance Committee. Employees and other interested parties may contact the non-management directors via email at: non-managementdirectors@wiley.com, or by mail addressed to Non-Management Directors, John Wiley & Sons, Inc., 111 River Street, Mail Stop 7-02, Hoboken, NJ 07030-5774. 6. Board Orientation and Evaluation The Board annually conducts a self-evaluation to determine whether the Board as a whole and its individual members, including the Chairman, are performing effectively. The Board sponsors an orientation process for new Directors, which includes background materials on governance, law, board principles, financial and business history and meetings with members of management. The Board also encourages all of its Directors to take advantage of educational programs to improve their effectiveness. 7. Director Compensation The Governance Committee periodically reviews and recommends to the Board its members' annual retainer, which is composed of cash and restricted stock grants for all non-employee Directors. In determining the appropriate amount and form of director compensation, the Board regularly evaluates current trends and compensation surveys, as well as the amount of time devoted to Board and committee meetings. As a long-standing Board principle, non-employee Directors receive no compensation from the Company other than for their service as Board members and reimbursement for expenses incurred in connection with attendance at meetings. Share ownership by each Director is encouraged. To this end, each Director is expected to own, at a date no later than three years after election to the Board, shares of common stock valued at not less than three times that Director's annual cash compensation to which the Director is entitled for Board service. Furthermore, non-employee Directors are encouraged to take their cash compensation in the form of Company shares. 5

8. Board Practices and Procedures The Chairman of the Board and the CEO jointly set the agenda for each Board meeting. Agenda items that fall within the scope and responsibilities of Board committees are reviewed with the chairs of the committees. Any Board member may request that an item be added to the agenda. Board materials are provided to Board members sufficiently in advance of meetings to allow Directors to prepare for discussion at the meeting. Various managers regularly attend portions of Board and committee meetings in order to participate in and contribute to relevant discussions. 9. Board Committees The Board has established four standing committees: Executive, Audit, Compensation, and Governance. The Governance Committee recommends to the Board the members and chairs for each of these committees. The Audit Committee and the Compensation Committee are composed of independent Directors only. The Audit Committee has the sole responsibility for retention and dismissal of the Company's independent auditors. The Governance Committee is composed of independent directors and a member of the Wiley family, as permitted under the New York Stock Exchange's rules applicable to “controlled companies.” The Board believes that the family's participation in the Committee will result in a collaborative process to promote the highest standards in the recruitment of new directors and in governance generally. The Governance Committee recommends to the Board the members and chairs for each of the committees. The chair and membership assignments for all committees are reviewed regularly and rotated as appropriate. The chairs of the committees determine the frequency, length and agenda of meetings for each committee meeting. As in the case of the Board, materials are provided in advance of meetings to allow members to prepare for discussion at the meeting. The scope and responsibilities of each committee are detailed in the committee charters, which are approved by the Board. Each committee annually reviews its charter, and the Governance Committee and the Board review all charters from time to time. With the permission of the chairman of the committee, any Board member may attend a meeting of any committee. 10. Periodic Review The Governance Committee and the Board review these Principles annually. These Principles stated above, Committee Charters, the Business Conduct and Ethics Policy and the Code of Ethics for Senior Financial Officers are published on our web site at www.wiley.com, under the “About Wiley—Investor Relations—Corporate Governance” captions. Copies are also available free of charge to shareholders on request to: Corporate Secretary, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030-5774. III. Certain The Board is currently composed of eight members. Two directors, Bradford Wiley II and Peter Booth Wiley, are brothers. The Board has affirmatively determined that all of our directors, except William J. Pesce, Bradford Wiley II and Peter Booth Wiley, meet the independence guidelines the Board set forth in our Corporate Governance Principles, as noted above. The Company does not have a policy that requires the attendance of all directors at the Annual Meetings, but it has been long-standing practice for directors to attend. All eight directors attended the 2005 Annual Meeting. The Board met four times during fiscal 2006 and acted twice by Written Consent. Board committees met a total of twenty times during fiscal 2006. All incumbent directors attended at least 94% of the aggregate number of meetings of the Board and of the committees on which such director sat with seven of our directors attending 100% of these meetings. 6

Information

Concerning

the Board

The following table indicates current membership and total meetings held of the Board's standing committees: Warren J. Baker Kim Jones Matthew S. Kissner Raymond W. McDaniel, Jr. William J. Pesce William B. Plummer Bradford Wiley II Peter Booth Wiley FY2006 Meetings *Chairman The charters for each committee are annexed to this Proxy Statement as Exhibits A through D. Executive Committee. The Executive Committee exercises the powers of the Board as appropriate in any case where immediate action is required and the matter is such that an emergency meeting of the full Board is not deemed necessary or possible. Audit Committee. The Audit Committee assists the Board in fulfilling its fiduciary responsibilities relating to the Company's financial statements filed with the Securities and Exchange Commission, accounting policies, and the adequacy of disclosures, internal controls and reporting practices of the Company and its subsidiaries; evaluates, retains, compensates and, if appropriate, terminates the services of the independent public accounting firm which is to be engaged to audit the Company's financial statements, including reviewing and discussing with such firm their independence and whether providing any permitted non-audit services is compatible with their independence; maintains financial oversight of the Company's employees' retirement and other benefit plans; and makes recommendations to the Board with respect to such matters. The Committee holds discussions with management prior to the release of quarterly earnings, and also reviews quarterly results prior to filings. The Board has determined that all members of the Committee are Audit Committee “financial experts,” as defined under the rules of the Securities and Exchange Commission. All members of the Committee are independent under the rules of the New York Stock Exchange, currently applicable to the Company. Compensation Committee. The Compensation Committee evaluates the performance of the CEO and reports its decisions to the Board; reviews and approves the principles and policies for compensation and benefit programs company-wide, and monitors the implementation and administration of such programs; oversees compliance with governmental regulations and accounting standards with respect to employee compensation and benefit programs; monitors executive development practices in order to insure succession alternatives for the organization; and grants options and makes awards under the 2004 Key Employee Stock Plan. All members of the Committee are independent under the rules of the New York Stock Exchange, currently applicable to the Company. Governance Committee. The Governance Committee assists the Board in the selection of Board members by identifying appropriate general qualifications and criteria for directors as well as qualified candidates for election to the Board; assists the Chairman of the Board in proposing committee assignments; assists the Board in evaluating, maintaining and improving its own effectiveness; evaluates the Chairman of the Board's performance; evaluates director compensation and benefits; and makes recommendations to the Board regarding corporate governance policies. Additional Information About the Governance Committee. The Board selects new candidates based on a recommendation of the Governance Committee. The Committee evaluates all director candidates in accordance with the director membership criteria described in the 7Name Audit Compensation Executive Governance X X X * X X * X * X X X X * X X 7 4 0 9

Corporate Governance Principles. The Committee considers a candidate's background, experience, expertise, and other relevant criteria, including other public and private company boards on which the candidate serves. The manner in which each Board member's qualities complement those of others and contributes to the functioning of the Board as a whole are also taken into account. The Committee has retained a search firm, at the expense of the Company, to identify potential director candidates. The search firm provides background material on potential candidates, and provides guidance pertaining to the particular experience, skills and other characteristics that the Board is seeking. The search firm conducts initial interviews with potential candidates, and candidates who merit further consideration are then interviewed by members of the Committee, other directors and key senior management personnel. The Governance Committee considers the results of these interviews when making its recommendations to the Board. Shareholders who wish to recommend a director candidate to the Governance Committee should follow the procedures set forth under “Deadline for Submission of Shareholder Proposals” on page 24 of this proxy statement. The recommendation should include the candidate's name, biographical data, and a description of his or her qualifications. Directors' Our non-employee directors currently receive an annual retainer of $40,000 and committee chairmen, except the chairman of the Executive Committee, receive an additional annual retainer of $4,000. No fees are paid for attendance at meetings. No non-employee director receives any other compensation from the Company, except for reimbursement of expenses incurred for attendance at Board meetings. Directors who are employees do not receive an annual retainer for Board or committee service. Pursuant to the Director Stock Plan, our non-employee directors receive an annual award of Class A shares equal in value to 100 percent of their annual total cash compensation, excluding the additional fees paid to committee chairmen and any expense reimbursements. In September 2005, a total of 7,608 Class A shares were awarded to directors. The table below indicates the total cash compensation received by each non-employee director during Fiscal 2006. Warren J. Baker Kim Jones* Matthew S. Kissner* Raymond W. McDaniel, Jr. William B. Plummer* Bradford Wiley II *Committee Chairman Non-employee directors are also eligible to participate in the Company's Deferred Compensation Plan for Directors' Fees (the “Deferred Plan”). The purpose of the Deferred Plan is to provide eligible directors with flexibility in their tax planning. Five directors currently participate. Insurance with The By-Laws of the Company provide for indemnification of directors and officers in connection with claims arising from service to the Company to the extent permitted under the New York State Business Corporation Law. The Company carries insurance in the amount of $20,000,000 with Federal Insurance Company and the National Union Insurance Company at an annual premium of $332,100. The current policy expires on November 14, 2006. Transactions In the ordinary course of business, John Wiley & Sons and its subsidiaries may have transactions with companies and organizations whose executive officers are also Wiley directors. None of these transactions in fiscal 2006 exceeded the threshold for disclosure under 8

CompensationName Annual

Retainer Committee

Chair

Retainer Annual

Stock

Award(a) Total $ 40,000 $ 40,000 $ 80,000 $ 40,000 $ 4,000 $ 40,000 $ 84,000 $ 40,000 $ 4,000 $ 40,000 $ 84,000 $ 40,000 $ 40,000 $ 40,000 $ 4,000 $ 40,000 $ 84,000 $ 40,000 $ 40,000 $ 80,000 (a) Dollar value of annual shares awarded on September 15, 2005 under the Director Stock Plan valued at the closing price of $42.08 per share.

Respect to

Indemnification

of Directors

and Officers

with Directors'

Companies

our Corporate Governance Guidelines, which is 2% of the gross revenues of either Wiley or the other organization. IV. Election of Eight (8) directors are to be elected to hold office until the next Annual Meeting of Shareholders, or until their successors are elected and qualified. Unless contrary instructions are indicated or the proxy is previously revoked, it is the intention of management to vote proxies received for the election of the persons named below as directors. Directors of each class are elected by a plurality of votes cast by that class. If you do not wish your shares to be voted for particular nominees, please so indicate in the space provided on the proxy card, or follow the directions given by the telephone voting service or the Internet voting site. THE HOLDERS OF CLASS A STOCK ARE ENTITLED TO ELECT 30% OF THE ENTIRE BOARD. AS A CONSEQUENCE, THREE (3) DIRECTORS WILL BE ELECTED BY THE HOLDERS OF CLASS A STOCK. THE HOLDERS OF CLASS B STOCK ARE ENTITLED TO ELECT FIVE (5) DIRECTORS. All the nominees are currently directors of the Company, and were elected to their present terms of office at the Annual Meeting of Shareholders held in September 2005. Except as otherwise indicated below, all of the nominees have been engaged in their present principal occupations or in executive capacities with the same employers for more than the past five years. Peter Booth Wiley, William J. Pesce and Josephine Bacchi have agreed to represent shareholders submitting proper proxies by mail, via the Internet, or by telephone, and to vote for the election of the nominees listed herein, unless otherwise directed by the authority granted or withheld on the proxy cards, by telephone or via the Internet. Although the Board has no reason to believe that any of the persons named below as nominees will be unable or decline to serve, if any such person is unable or declines to serve, the persons named above may vote for another person at their discretion. 9

Directors

10 Directors to be Elected by Class A Shareholders

Kim Jones, a director since 2004, is Vice President of Global Education, Government and Health Sciences at Sun Microsystems, Inc. as of July 2006. Prior to that she was Vice President of Global Education and Research Line of Business at Sun from 1998 to 2006; Director of International Sales Development from 1991 to 1998; and held a variety of sales and business development positions from 1987 to 1991. She serves on the Board of Trustees of the Western Governors University, and is on the Board of Directors of the Global Educational Learning Community, the Sun Foundation, and the World Bank Institute Advisory Council. She is a member of the Business Higher Education Forum and of Sun Microsystems' Diversity Council. Age 49.

Raymond W. McDaniel, Jr., a director since 2005, has been Chairman and Chief Executive Officer of Moody's Corporation since April 2005. He previously served as Chief Operating Officer of Moody's Corporation from January 2004; President of Moody's Corporation from October 2004; and President of Moody's Investors Service since 2001. In prior assignments with Moody's, he served as Senior Managing Director for Global Ratings & Research; Managing Director for International; and Director of Moody's Europe, based in London. He has been a member of Moody's Corporation Board of Directors since 2003. Age 48.

William B. Plummer, a director since 2003, has been Vice President & Treasurer of Alcoa, Inc. since 2000. He also serves on the Board of Directors of the Alcoa Foundation. Prior to that he was with Mead Corporation as President, Gilbert Paper Division during 2000; Vice President, Corporate Strategy and Planning from 1998 to 2000; Treasurer from 1997 to 1998; and Vice President, Equity Capital Group, General Electric Capital Corporation from 1995 to 1997. Age 47. Directors to be Elected by Class B Shareholders

Warren J. Baker, a director since 1993, has been President of California Polytechnic State University since 1979 and was a Member of the National Science Board from 1985 to 1994. He was a Regent of the American Architectural Foundation from 1995 to 1998, and was Chairman of the Board of Directors of the ASCE Civil Engineering Research Foundation from 1989 to 1991. He is a Fellow of the American Society of Civil Engineers; a Member of the Board of Directors of the California Council on Science and Technology; Co-Chair of the California Joint Policy Council on Agriculture and Higher Education; Board member of the National Association of State Universities and Land Grant Colleges (NASULGC); Chair of the NASULGC Commission on Information Technologies; Member of the Business-Higher Education Forum; Board Member of the Society of Manufacturing Engineers Education Foundation from 2003 to 2005; and Director of Westport Innovations, Inc. Age 68.

Matthew S. Kissner, a director since 2003, is founder, President and Chief Executive Officer of The Kissner Group, an investment and management firm established in 2005 focusing on the information infrastructure of the US Healthcare Industry. He is an Operating Partner of Advent International, a private equity company, and sits on the boards of two of its private portfolio companies. Prior to that he was Executive Vice President and Group President, Global Enterprise Solutions, Pitney Bowes, Inc., from 2004 to 2005; Executive Vice President and Group President of Information Based Solutions and Document Messaging Technologies from 2001 to 2004; and President, Small Business Solutions and Pitney Bowes Financial Services from 1999 to 2001. He is a member of the Regional Plan Association. Age 52.

11

William J. Pesce has been our President and Chief Executive Officer and a director since May 1, 1998. He was previously Chief Operating Officer since May 1997; Executive Vice President, Educational and International Group since February 1996; and Vice President, Educational Publishing since September 1989. He is a Member of the Board of Overseers of The Stern School of Business at New York University; the Board of Trustees of William Paterson University; the Board of Directors of the Association of American Publishers; and is on the Executive Committee of the Business-Higher Education Forum. Age 55.

Bradford Wiley II, a director since 1979, was our Chairman of the Board from January 1993 until September 2002, and was an editor in Higher Education from 1989 to 1998. He was previously a newspaper journalist, viticulturist and winery manager. Age 65.

Peter Booth Wiley, a director since 1984, has been our Chairman of the Board since September 2002. He is an author and journalist, and a Member of the Board of the University of California Press. Age 63.

Beneficial The table below shows the number of shares of the Company's Class A and Class B Stock beneficially owned by the current directors, and the executive officers named in the Summary Compensation Table on page 17 and all directors and executive officers of the Company as a group as of July 24, 2006. The percent of total voting power reflected below represents the voting power on all matters other than the election of directors, as described on page 1. 12

Ownership of

Directors and

Management Shares of

Class A and

Class B Stock

Beneficially

Owned(1) Additional

Shares

Beneficially

Owned(2) Totals Percent

of

Class(1) Percent

of

Total

Voting

Power Deferred

Stock

Units(3)Warren J. Baker A 8,201 A 4,955 A 13,156 — — 9,954.12 B — B — — — Ellis E. Cousens(4) A 73,101 A 100,000 A 173,101 0.4 % — B — B — — — Kim Jones A — A — — — 1,550.68 B — B — — — Stephen A. Kippur(4) A 211,988 A 158,200 A 370,188 0.8 % — B — B — — — Matthew S. Kissner A — A — — — 5,121.68 B — B — — — Bonnie E. Lieberman(4) A 106,327 A 170,528 A 276,855 0.6 % — B — B — — — Raymond W. McDaniel, Jr. A 500 A 500 — — 1,015.63 B — B — — — William J. Pesce(4) A 537,469 A 1,038,900 A 1,576,369 3.3 % 1.0 % B — B — — — William B. Plummer A — A — — — 5,121.68 B — B — — — Gary M. Rinck(4)(5) A 43,329 A 43,329 — — B — B — — — Bradford Wiley II(6)(7)(8) A 1,353,759 A 1,353,759 2.9 % 1.0 % B 2,720,752 B 2,720,752 27.0 % 18.2 % Peter Booth Wiley(6)(7)(8) A 1,378,742 A 2,948 A 1,381,690 2.9 % 1.0 % B 2,720,752 B 2,720,752 27.0 % 18.2 % All directors and executive officers as a A 5,363,487 A 1,681,867 A 7,045,354 14.4 % 5.0 % group (18 persons) B 8,188,852 B 8,188,852 80.0 % 55.0 %

Section 16(a) Beneficial Section 16(a) of the Securities Exchange Act of 1934 requires the Company's officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission and the New York Stock Exchange. Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based on our review we believe that during fiscal 2006, our directors, officers and greater than ten percent beneficial owners met all filing requirements, except for Edward J. Melando, Vice President, Corporate Controller and Chief Accounting Officer. Due to an administrative oversight, his Form 4 filed on June 22, 2005 failed to include an award of 3,000 Class A shares received as restricted stock, subject to forfeiture until vested. An amended Form 4 was filed to correct this oversight. V. Executive Report of the Executive Compensation Philosophy and Objectives. The Compensation Committee of the Board of Directors (the “Committee”), which is composed of three independent directors, administers the Company's executive compensation program. The objectives that guide the Committee in formulating its recommendations are to: 13 (1) This table is based on the information provided by the individual directors or executives. In the table, percent of class was calculated on the basis of the number of shares beneficially owned as determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, divided by the total number of shares issued and outstanding plus the number of shares of the class issuable to the individual director or executive officer pursuant to the options exercisable under the Company's stock option plans on or before September 24, 2006. (2) Shares issuable pursuant to options exercisable under the Company's stock option plans on or before September 24, 2006. (3) This amount represents the number of shares of Class A Common Stock credited to the participating director's account pursuant to the Deferred Compensation Plan for Directors' Fees, described on page 8. The shares will be issued upon the director's retirement. (4) Includes Class A shares of restricted stock subject to forfeiture awarded under the Company's long-term incentive plans (see Summary Compensation Table, footnote (a), page 17 as follows: Mr. Pesce—207,642 shares; Mr. Cousens—60,051 shares; Mr. Kippur—51,121 shares; Ms. Lieberman—46,036 shares; and Mr. Rinck—22,000 shares. (5) Includes 16,000 Class A shares of restricted stock awarded under an employment agreement and subject to forfeiture until vested. (6) Bradford Wiley II and Peter Booth Wiley, as co-members with Deborah E. Wiley, of the E.P. Hamilton Trusts LLC, share voting and investment power with respect to 462,338 shares of Class A Stock and 8,125,536 shares of Class B Stock. For purposes of this table, each is shown as the owner of one-third of such shares. (7) Bradford Wiley II and Peter Booth Wiley, as co-trustees with Deborah E. Wiley, share voting and investment power with respect to 55,072 shares of Class A Stock and 36,720 shares of Class B Stock under the Trust of Esther B. Wiley. For purposes of this table, each is shown as the owner of one-third of these shares. (8) Bradford Wiley II and Peter Booth Wiley, as general partners of a limited partnership with Deborah E. Wiley, share voting and investment power with respect to 301,645 shares of Class A Stock owned by the partnership. For purposes of this table, each is shown as the owner of one-third of such shares.

Ownership Reporting

Compliance

Compensation

Compensation

Committee • Attract and retain executives of the highest caliber by compensating them at levels that are competitive in the marketplace. • Motivate and reward such executives based on corporate, business unit and individual performance through compensation systems and policies that include variable incentives.

In administering the Executive Compensation program, the Committee attempts to ensure the following: The Program The senior executive compensation program is composed of three key elements: Base Salaries. Base salaries reflect competitive marketplace data and evaluated individual performance and future potential. Base salary increases for senior executives other than the CEO are recommended annually by Mr. Pesce and are reviewed and approved by the Committee. Annual Incentives. Annual incentives are payable for the achievement of annual performance goals established by the Committee and for individual performance and contributions. In fiscal 2006 target annual incentives ranged from 60% of salary for Senior Executives to 110% of base salary for Mr. Pesce. For fiscal 2006 the corporate performance measures were revenue, earnings per share and cash flow. Strategic business unit performance goals were based on revenue, EBITA and cash flow. Payouts, if any, can range from 0 to 200% of the targeted incentive, depending on the level of achievement of financial goals and individual objectives between threshold and outstanding measures of performance. In fiscal 2006 the Company 14 • Align executives' and shareholders' interests through awards of equity components dependent upon the performance of the Company. • That compensation is merit based in that the total compensation opportunity for each senior executive is based on an assessment of sustained individual performance, current responsibilities and future potential. • That there is a correlation between compensation (both annual and long-term) and the Company's performance. The program is structured such that at senior executive levels a larger portion of annual and total compensation is variable, based on the Company's performance, and a larger portion of total compensation is composed of stock based compensation. • That senior executives/members of the Wiley Leadership Team have a significant, ongoing ownership stake in the Company in order to strengthen the alignment of our senior executives' interests with those of our shareholders. • That the program is fully competitive with the total compensation programs of competitor companies in the publishing/information and media industries when performance goals are achieved. To that end the Committee annually reviews a compensation survey as a guidepost to determine whether the Company's compensation levels and programs are competitive and meet the Company's stated objectives. The most recent survey compiled by Towers Perrin includes publishing companies regarded as comparable and for which data are available, as well as other companies in the northeast region of the U.S. comparable in size to the Company. Base salaries, annual incentive awards and long-term incentive grants are determined within the framework of position responsibilities, future potential and the competitive market data. • That ordinarily it is in the best interest of the Company to retain flexibility in its compensation programs to enable it to appropriately reward, retain and attract executive talent necessary to the Company's success. To the extent such goals can be met with compensation that is designed to be deductible under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), such as the 2004 Key Employee Stock Plan and the Executive Annual Incentive Plan, each approved by the shareholders in September 2004, such compensation plans will be used. However, the Committee recognizes that in appropriate circumstances, compensation that is not deductible under the Code may be paid at the Committee's discretion. • Base salaries • Annual incentives • Long-term stock-based incentives

slightly exceeded its revenue goal, essentially achieved its EPS goal and exceeded its cash flow goals, resulting in a performance payout factor of 117% on corporate financial goals. Long-Term Stock Based Incentives. The long-term incentive compensation program for senior executives consists of restricted performance shares and stock options. These stock-based incentives are intended to align the interests of senior management with those of the Company's shareholders. Fiscal 2006 CEO Compensation In establishing Mr. Pesce's compensation for fiscal 2006, the Committee applied the principles outlined in this report in the same manner that they were applied to other executives. Base salary, annual incentive, and long-term incentive grant guidelines and awards were determined within the framework of the position's responsibilities, individual performance and the external marketplace. In this regard, the Committee considered all of the variables and made decisions after considering all of the data. For fiscal 2006, the Committee noted that under Mr. Pesce's leadership the Company achieved growth of 7% in revenue, 10% growth in earnings per share and achieved free cash flow of $150,400,000. In addition, the Company completed acquisitions to enhance its business portfolio and invested in technology initiatives and new business models designed to ensure and enhance its future competitiveness. Initiatives were also established to enhance the Company's leadership capabilities and to support its collaborative, performance-driven culture. For the second consecutive year, the Company was named to Fortune Magazine's 100 Best Companies to Work For, the only publishing company to make this list. Mr. Pesce's 2006 compensation consisted of the following: 15 • Restricted Performance Shares. At the beginning of each fiscal year a new three year cycle begins. At that time, the Committee establishes the targeted number of restricted performance shares for each senior executive. During this performance period no shares are issued and consequently the executive has neither voting nor dividend rights to those shares. At the end of the three year performance cycle actual shares are awarded based upon performance against established earnings per share and cumulative cash flow goals. The number of shares awarded can range from 0 to 200% of the target award. Once awarded, the shares become restricted for a two year period and vest at 50% on the first anniversary after the end of the performance period and 50% on the second anniversary after the end of the performance period. During the restricted period the executives are entitled to voting and dividend rights on the shares earned. For the fiscal 2004–2006 performance cycle EPS was achieved at 103.85% of target and cash flow performed at 114% of target, resulting in a payout of 169% of the targeted shares. • Stock Options. Option grants are awarded on an annual basis, have terms of ten years and generally vest 50% in the fourth year and 50% in the fifth year from the date of grant. All employees' stock options have exercise prices that are equal to the current market price of Class A Stock as of the grant date. The ultimate value of the stock option grants is aligned with increases in shareholder value and is dependent upon increases in the market price per share over and above the grant price. In fiscal 2006, all executives, including Mr. Pesce, received approximately 65% of their targeted long-term incentive in stock options. The Committee believes that the ultimate goal of the long-term plan is to align the interests of shareholders and management. To reinforce this principle, the Committee established stock ownership guidelines for all senior officers participating in the long-term plan. Ownership guidelines are four times base salary for Mr. Pesce and two and one-half times base salary for all other senior officers participating in the long-term plan. Participants have five years in which to attain these guidelines. Eighty-eight percent of the executives with at least five years of service have met or exceeded their targeted shareholdings. • Base Salary. Effective July 1, 2005, the Committee increased Mr. Pesce's base salary by 5.1% to $830,000 based on its assessment of the variables described above.

Closing Statement The Committee believes that the quality, expertise and motivation of the Company's leadership and key employees has made and can continue to make a significant difference in the long-term performance of the Company. The Committee further believes that compensation should vary with the Company's financial performance so that executives are appropriately rewarded when challenging targets are achieved. Conversely, there should be commensurate risks to compensation when performance is below established goals. In its view, the Committee believes that the Company's Annual (EAIP) and Long-Term (ELTIP) Compensation Plans are meeting the goals contained in the Program's philosophy and objectives. Compensation Committee 16 • Annual Incentive. In June of 2005, the Committee determined the target annual incentive award for Mr. Pesce to be 110% of base salary ($913,000), contingent upon the achievement of financial goals and personal objectives approved by the Committee at that meeting, consistent with the Executive Annual Incentive Plan (EAIP). Based on the Company's aggregate performance against financial goals as discussed above, and the Committee's evaluation of Mr. Pesce's performance against strategic personal objectives established and reviewed by the Committee, an annual incentive of $1,201,280 was awarded. • Long-Term Stock Based Incentives. In June of 2005, Mr. Pesce received long-term incentive awards consisting of 35,000 restricted performance shares, which will be issued in June of 2008, contingent upon the attainment of financial goals as discussed above, and will vest as follows: 50% April 30, 2009, 50% April 30, 2010. In addition, Mr. Pesce was awarded stock options for 185,000 shares vesting as follows: 50% on April 30, 2009 and 50% of April 30, 2010. These awards, along with those of other proxy-named executives, are disclosed in the option grants and long-term incentive plan awards tables which follow. • Payout of 2004 Long-Term Performance Share Award. In June of 2006, the Committee reviewed and approved the degree of achievement and award payout to Mr. Pesce for the 2004 ELTIP, which covered the fiscal years 2004, 2005 and 2006, and which concluded on April 30, 2006. The achievement of EPS and cash flow targets in excess of plan resulted in a payout factor of 169%, and Mr. Pesce was awarded 67,720 restricted performance shares vesting as follows: 50% April 30, 2007, 50% April 30, 2008. The dollar value of Mr. Pesce's Long-Term Restricted Performance Share Award payout is shown in the Long-Term Compensation Payouts column of the Summary Compensation table.

Matthew S. Kissner, Chairman, Warren J. Baker, Kim Jones

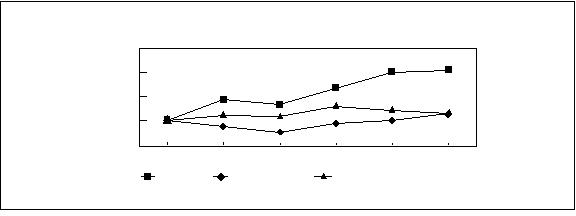

50 100 150 250 200 JWA Dow Jones World Publishing Index Russell 1000 4/01 4/02 4/03 4/04 4/05 4/06 PERFORMANCE GRAPH Total Return The above graph provides an indicator of the cumulative total return to shareholders of the Company's Class A Common Stock as compared with the cumulative total return on the Russell 1000 and the Dow Jones World Publishing Index, for the period from April 30, 2001 to April 30, 2006. The Company has elected to use the Russell 1000 Index as its broad equity market index because it is currently included in that index. Cumulative total return assumes $100 invested on April 30, 2001 and reinvestment of dividends throughout the period. Summary The above table sets forth, for the fiscal years indicated, the compensation of the CEO and the four other most highly compensated executive officers of the Company. 17

2001 2002 2003 2004 2005 2006 John Wiley & Sons, Inc. Class A $ 100.00 $ 143.60 $ 133.39 $ 167.95 $ 200.11 $ 204.76 Dow Jones World Publishing Index 100.00 111.42 108.43 129.63 121.28 115.84 Russell 1000 100.00 88.02 76.17 94.38 101.17 115.94

Compensation

Table �� Long Term Compensation Annual Compensation Awards Payouts Name and

Principal Position Year Salary Bonus Other Annual

Compen-

sation Restricted Stock

Awards(a) Securities

Underlying

Option/SARs LTIP

Payouts All Other

Compen-

sation(b)William J. Pesce

President, Chief

Executive

Officer and Director 2006

2005

2004 $

$823,333

783,333

750,000 $ 1,201,280

1,036,283

1,185,938 —

— $ 2,481,261

1,802,359

1,034,280 190,000

185,000

200,000 —

— $ 6,600

6,300

6,150 Ellis E. Cousens

Executive Vice President, Chief Financial and Operations Officer 2006

2005

2004 445,000

416,667

400,000 493,015

498,015

470,000 —

— 620,315

514,955

310,284 60,000

60,000

55,000 —

— 6,600

6,350

5,938 Stephen A. Kippur

Executive Vice

President

and President,

Professional/Trade 2006

2005

2004 436,667

416,667

400,000 462,334

426,829

396,396 —

— 620,315

303,057

269,096 55,000

55,000

55,000 —

— 12,838

10,364

11,680 Bonnie E. Lieberman

Senior Vice President and General Manager, Higher Education 2006

2005

2004 332,500

316,667

300,000 441,930

138,060

166,980 —

—

— 496,252

180,221

129,285 50,000

50,000

50,000 —

—

— 7,348

7,600

7,237 Gary M. Rinck

Senior Vice

President and

General Counsel 2006

2005

2004 387,500

270,833

43,109 330,013

300,234

— —

—

— —

—

— 25,000

25,000

25,000 —

—

— 10,771

254,236

—

Option/SAR Grants in The above table shows potential realizable value at assumed annual stock appreciation rates of 5% and 10% over the ten year term of the options. The rates are as required to be stated by the Securities and Exchange Commission and are not intended to forecast possible future actual appreciation, if any, in the Company's stock price. Future gains, if any, will depend on actual future appreciation in the market price. Aggregated The above table provides information as to options exercised by each of the named executive officers during fiscal 2006 and the value of the remaining options held by each executive officer at year end, measured using the closing price of $36.64 for the Company's Class A Common Stock on April 30, 2006. 18(a) When awards of restricted stock are made pursuant to the Company's long term incentive plans, the Committee may establish a period during which the Class A shares of restricted stock shall be subject to forfeiture in whole or in part if specified objectives or considerations are not met. Restricted stock awards were made for achievement of financial performance objectives for the respective three-year periods ended April 30, 2006, April 30, 2005 and April 30, 2004. The stock is non-voting and not eligible for dividends until the shares have been earned at the end of the three year period. Restrictions lapse as to 50% at the end of the first and second fiscal year, respectively, after the fiscal year in which earned. Restricted stock awards reflect the market value as of the fiscal year-end indicated. Aggregate restricted stock holdings as of April 30, 2006 were as follows: Mr. Pesce—207,642 shares valued at $7,608,003; Mr. Cousens—60,051 shares valued at $2,200,269; Mr. Kippur—51,121 shares valued at $1,873,073; Ms. Lieberman—46,036 shares valued at $1,686,759; Mr. Rinck—22,000 shares valued at $806,080. (b) In 2006, represents matching Company contributions to the Employee Savings Plan and the Deferred Compensation Plan.

Last Fiscal Year 2006Individual Grants(a) Potential Realizable

Value at Assumed

Annual Rates of Stock

Appreciation for

Option TermName Number of

Securities

Underlying Options/

SARs Granted % of Total

Options/SARs

Granted to

Employees

in Fiscal

Year Exercise or

Base Price Expiration

Date(b) 5% 10% William J. Pesce 185,000 18.3% $ 38.55 June 22, 2015 $ 4,485,119 $ 11,366,173 Ellis Cousens 60,000 5.9% $ 38.55 June 22, 2015 $ 1,454,633 $ 3,686,326 Stephen A. Kippur 55,000 5.4% $ 38.55 June 22, 2015 $ 1,333,414 $ 3,379,132 Bonnie E. Lieberman 50,000 4.9% $ 38.55 June 22, 2015 $ 1,212,194 $ 3,071,939 Gary M. Rinck 25,000 2.5% $ 38.55 June 22, 2015 $ 606,097 $ 1,535,969 (a) The Company has three shareholder approved plans in effect, each of which relates to Class A shares: the 2004 Key Employee Stock Plan, the Long Term Incentive Stock Plan and the 1991 Key Employee Stock Plan. The exercise price of all stock options is determined by the Committee and may not be less than 100% of the fair market value of the stock on the date of grant of the options. The Committee also determines at the time of grant the period and conditions for vesting of stock options. In the event of a change of control, as defined on page 21, all outstanding options shall become immediately exercisable up to the full number of shares covered by the option. No option grants have SARs associated with the grants, and no SARs were granted during fiscal 2006. (b) Options are subject to earlier termination in certain events relating to termination of employment.

Option/SAR

Exercises in Last

Fiscal Year and

Fiscal Year-End

Option/SAR Values Number of Securities

Underlying Unexercised

Options/SARs

at Fiscal Year-End Value of Unexercised

In-the-Money Options/SARs

at Fiscal Year-End(b)Name Shares Acquired

on Exercise Value

Realized(a) Exercisable Unexercisable Exercisable Unexercisable William J. Pesce 79,432 $ 2,487,299 1,038,900 672,500 $ 20,650,691 $ 4,236,875 Ellis E. Cousens 0 $ 0 100,000 200,000 $ 1,450,450 $ 1,199,850 Stephen A. Kippur 30,000 $ 849,844 158,200 190,000 $ 2,392,461 $ 1,716,100 Bonnie E. Lieberman 19,000 $ 595,541 170,528 158,500 $ 2,949,329 $ 906,565 Gary M. Rinck 0 $ 0 0 50,000 $ 0 $ 118,750 (a) Market value of underlying shares at exercise minus the option price. (b) Market value of underlying shares at fiscal year end minus the option price. These values are presented pursuant to SEC rules. The actual amount, if any, realized upon exercise will depend upon the market price of the Class A shares relative to the exercise price per share of the stock options at the time of exercise.

Long Term Estimated future payments assuming financial performance targets are achieved under the 2006 long-term incentive compensation plan for the named executives are as indicated above. Executive The Company has employment agreements with Messrs. Pesce, Cousens, Kippur, Rinck, and Ms. Lieberman (collectively the “Executives”), which provide for base salaries (reflected in the Summary Compensation Table on page 17) and for benefits and incentive compensation as provided for senior officers generally, and as described in the Compensation Committee's report on page 13. Mr. Pesce's contract expires in March 2009, and renews for successive three year terms. The agreements for Messrs. Cousens, Kippur and Ms. Lieberman expire in March 2007, and Mr. Rinck's agreement expires in March 2008. These agreements automatically renew for successive two-year terms in the absence of notice by either party. In the case of a termination by the Company other than for cause (as defined), or Constructive Discharge (as defined), or the Company's failure to renew (in each case, absent a “Change of Control” or “Special Change of Control,” as defined), the Executive will be entitled to 36 months severance in the case of Mr. Pesce, and 18 or 24 months severance, depending on length of service, in the case of other Executives. Severance would include salary and benefits for all Executives, and for Messrs. Pesce and Kippur, prorated cash incentive payments at target levels and long-term incentives for plan cycles ending within one year after termination as was provided in the prior agreements with these two executives. In the case of a termination by the Company or a Constructive Discharge following a “Special Change of Control” or “Change of Control,” severance for any executive would include prorated cash incentive payments at target levels, long-term incentives for plan cycles ending within one year after termination, and accelerated vesting of stock options and restricted stock grants to Executive. In the event that any payment or benefit received by an Executive pursuant to the terms of an agreement would be subject to Excise Tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended, the Company will pay the Executive an additional amount, so that the net amount retained by the Executive after payment of the Excise Tax shall not be reduced. All Executives are prohibited from competing with the Company for a period of twelve months following resignation from the Company for any reason other than a resignation for “Good Reason” following a “Change of Control,” as those terms are defined in the 1989 and 2005 Supplemental Executive Retirement Plan (see page 21). 19

Incentive Plans—

Awards in Last

Fiscal Year Estimated Future Payouts

under Non-Stock Priced-Based

Plans(a)(b)Name Number of

Shares, Units or

Other Rights(#) Performance of

Other Periods Until

Maturation or Payout Threshold

(#) Target

(#) Maximum

(#)William J. Pesce 35,000 May 1, 2005 to April 30, 2008 8,750 35,000 70,000 Ellis Cousens 12,000 May 1, 2005 to April 30, 2008 3,000 12,000 24,000 Stephen A. Kippur 10,000 May 1, 2005 to April 30, 2008 2,500 10,000 20,000 Bonnie E. Lieberman 10,000 May 1, 2005 to April 30, 2008 2,500 10,000 20,000 Gary M. Rinck 6,000 May 1, 2005 to April 30, 2008 1,500 6,000 12,000 (a) Financial performance targets and relative weighting of each target, as well as the threshold, target and outstanding levels of performance, are set at the beginning of the three-year plan cycle and include earnings per share, and cash flow targets, as defined, for the end of the three-year period. For the fiscal 2006 long term plan, the amount of shares earned will be based on financial targets established for fiscal 2008. No long term incentive is payable unless the threshold is reached on at least one financial measure. (b) These awards consist of restricted performance shares. The Committee may, in its discretion, direct that the payout be made wholly or partly in cash. The restricted shares would vest as to 50% on April 30, 2009 and the remaining 50% on April 30, 2010.

Employment

Agreements

Retirement Plan Benefits are provided to eligible employees under the Company's tax-qualified, non-contributory defined benefit retirement plan (the “Retirement Plan”) and non-qualified supplemental retirement plan (the “Supplemental Retirement Plan”). Prior to January 1, 2005, benefits under the Retirement Plan provided for annual normal retirement benefits payable at normal retirement age of 65 based on certain factors times average final compensation times years of service not to exceed 35 (the “Previous Benefit Formula”). Effective January 1, 2005 the Retirement Plan formula was revised to realign our practices and programs with competitive market practice, which provides all participants with enhanced future benefits. After January 1, 2005 benefits are calculated as the sum of a frozen benefit as of December 31, 2004, calculated under the Previous Benefit Formula, plus an annual benefit earned for benefit service after January 1, 2005. The amount of each year's accrual is the sum of total annual compensation (annual base salary, plus 100% of overtime pay and bonus) for the year up to and including 80% of that year's Social Security Wage base times 1.0%, plus total annual compensation for the year in excess of 80% of that year's Social Security Wage Base times 1.3%. The plan recognizes a maximum of 35 years of benefits service. If the total benefit service is greater than 35 years at age 65 when the participant retires, the benefit will be equal to the 35 consecutive years of benefit accruals that produce the highest combined amount. The frozen benefit calculated under the Previous Benefit Formula for the combined Retirement Plan and Supplemental Retirement Plan for Messrs. Pesce, Cousens, Kippur, Rinck and Ms. Lieberman as of December 31, 2004 is $88,581, $35,074, $139,824, $3,399 and $46,108, respectively. The Supplemental Retirement Plan provides benefits that would otherwise be denied participants by reason of certain Internal Revenue Code limitations on tax-qualified plan benefits. Average final compensation and total annual compensation are determined under the Supplemental Retirement Plan in the same manner as under the Retirement Plan, except that a participant's compensation is not subject to the limitations under the Internal Revenue Code. Years of service under the Retirement Plan and Supplemental Retirement Plan are the number of years and months, limited to 35 years, worked for the Company and its subsidiaries after attaining age 21. The following table illustrates estimates of the annual retirement benefits payable at normal retirement age under both the Retirement Plan and the Supplemental Retirement Plan. The estimates assume an annual salary increase of 3%, as well as an annual increase in the Social Security Wage Base of 2.5%. Benefits shown are computed as a single life annuity beginning at Normal Retirement, and are not subject to any deduction for offset amounts. 1989 and 2005 The participants under the 1989 Supplemental Executive Retirement Plan (“1989 SERP”), as amended by the Board on June 22, 2001, are executives of the Company or its affiliates listed on a schedule to the plan, as amended from time to time. The basic 1989 SERP benefit (the “primary benefit”) consists of ten annual payments commencing on retirement (at or after age 65) determined by multiplying the participant's base salary rate at retirement by 2.5, reducing the result by $50,000 and dividing the remainder by five. The plan also provides for an alternative early retirement benefit for participants who retire after age 55 with five years of service, a reduced payment for participants whose employment is terminated prior to age 65 other than on account of death (and who do not 20Name Years of Service

at Normal

Retirement Normal Retirement

Date Annual

BenefitWilliam J. Pesce 27 June 2016 $ 393,276 Ellis E. Cousens 16 March 2017 $ 192,953 Stephen A. Kippur 33 April 2012 $ 223,452 Bonnie E. Lieberman 24 October 2013 $ 124,687 Gary M. Rinck 13 March 2017 $ 124,477

Supplemental

Executive Retirement

Plan

qualify for early retirement), and a survivor benefit for the beneficiaries of a participant who dies prior to age 65 while employed by the Company or an affiliate. The 1989 SERP provides the participants with a guaranteed total annual retirement benefit beginning at age 65 for ten years (taking into account retirement benefits under the Company's Retirement Plan, referred to above, the Supplemental Retirement Plan and the primary benefit under the 1989 SERP) of 50% to 65% (depending on the executive's position with the Company) of average compensation over the executive's highest three consecutive years. Under certain circumstances, if a participant works for a competitor within 24 months following termination of employment, no further payments would be made to the participant under SERP. The 1989 SERP also provides that following a change of control (defined in the same manner as under the Company's stock option plans discussed below) and the termination of the participant's employment without cause as defined, or a termination by the participant for good reason as defined, the participant is entitled to a lump sum payment of the then present value of his benefits under SERP computed as if the participant had attained age 65 on the date of his termination. The estimated annual benefits under the 1989 SERP payable over ten years upon retirement at age 65 for Messrs. Pesce, Cousens, and Rinck are $1,156,600, $502,000, and $357,800, respectively. In March 2005 the Board froze participation in the 1989 SERP and adopted the 2005 SERP. All active participants in the 1989 SERP, except those who were directors, 5% owners, or who were within two years of the normal retirement age of 65, were given the option, prior to December 31, 2005, to waive their right to all benefits under the 1989 SERP and receive benefits under the 2005 SERP in consideration of that waiver. Four participants elected to do so, including Mr. Kippur and Ms. Lieberman. The 2005 SERP provides a lifetime annual benefit commencing at age 65, determined by multiplying the executive's average compensation over the highest three consecutive years times a service factor, which is the sum of years of service up to 20 years times 2%, plus years of service in excess of 20 times 1%, to a maximum of 35 years of total service. The 2005 SERP provides a reduced early retirement benefit for participants calculated in the same manner as the 1989 Plan. The participant may elect to receive his benefit in the form of a joint and survivor benefit on an actuarial equivalent basis. All other terms of the 2005 SERP are substantially the same as the 1989 SERP. The estimated annual benefits under the 2005 SERP payable over their lifetime at age 65 for Mr. Kippur and Ms. Lieberman are $343,042 and $252,502, respectively. Stock Options, Under the 2004 Key Employee Stock Plan (the “Plan”), qualified employees are eligible to receive awards that may include stock options, performance stock awards and restricted stock awards as described in footnote (a) of the Summary Compensation Table. No more than 8,000,000 shares may be issued over the life of the Plan, and no more than 600,000 shares of stock shall be cumulatively available for grants of options, performance-based stock awards, or restricted stock in any one calendar year to any one individual. Upon a “change of control,” as defined, all outstanding options shall become immediately exercisable up to the full number of shares covered by the option. The Committee shall specify in a performance stock award whether, and to what effect, in the event of a change of control, an employee shall be issued shares of common stock with regard to performance stock awards held by such employee. Following a change of control, all shares of restricted stock that would otherwise remain subject to restrictions shall be free of such restrictions. A change of control is defined as having occurred if either (a) any “person” hereafter becomes the beneficial owner, directly or indirectly, of 25% or more of the Company's then outstanding shares of Class B Stock (and such person did not have such 25% or more beneficial ownership on January 1, 1989) and the number of shares of Class B Stock so owned is equal to or greater than the number of shares of Class B Stock then owned by any other person; or (b) individuals who constituted the Board of Directors on January 1, 1991 (the “incumbent board”) cease for any reason to constitute at least 64% of the full board. Any person becoming a director subsequent to such date whose election or nomination for election by the Company's 21

Performance Stock,

and Restricted Stock