Section 16(a) Beneficial Ownership Reporting Compliance

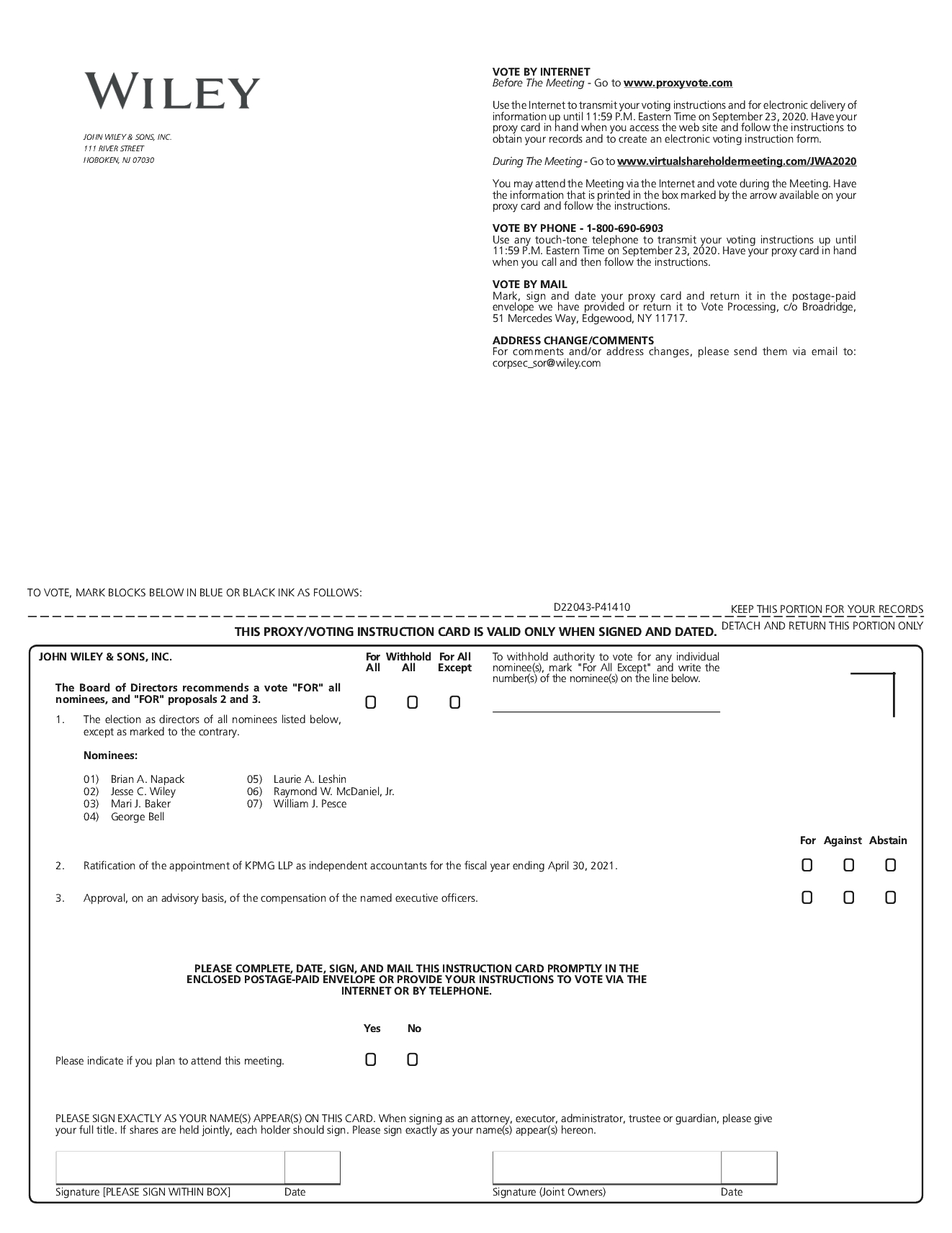

Section 16(a) of the Exchange Act and related regulations require our directors, executive officers, and beneficial owners holding more than 10% of our common stock to report their initial ownership of our common stock and any changes in that ownership with the SEC. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. We assist our directors, executive officers, and greater than 10% shareholders complying with these requirements. Based solely upon a review of the copies of these reports furnished to us and written representations from such officers, directors and stockholders, with respect to the Fiscal 2020 period, we are not aware of any required Section 16(a) reports that were not filed on a timely basis, except that, due to administrative oversight, required Form 4 reports relating to the award of restricted stock units were not filed on a timely basis for Brian Napack, John Kritzmacher, Gary Rinck, Judy Verses, and Clay Stobaugh. A delinquent Form 4 filing was also filed for Christopher Caridi relating to the shares surrendered to cover withholding tax liability due upon the vesting of a restricted stock award.

REPORT OF THE AUDIT COMMITTEE

The following is the report of the Audit Committee of the Company with respect to the Company’s audited financial statements for the fiscal year ended April 30, 2020.

Fees of Independent Registered Public Accounting Firm

Audit Fees

Total aggregate fees billed by KPMG LLP (“KPMG”) for professional services in connection with the audit and review of the Company’s Consolidated Financial Statements, and statutory audits of the Company’s international subsidiaries were $2,663,000 and $2,420,000 in fiscal years 2020 and 2019, respectively.

Audit Related Fees

The aggregate fees billed for audit related services, including employee benefit plan audits, and agreed-upon procedures in the U.K. were $39,000 and $210,000 in fiscal years 2020 and 2019, respectively.

Tax Fees

The aggregate fees billed for services rendered by KPMG tax personnel, except those services specifically related to the audit of the financial statements, were $530,000 and $610,000 in fiscal years 2020 and 2019, respectively. Such services include tax planning, tax return reviews, advice related to acquisitions, tax compliance and compliance services for expatriate employees.

Other Non-Audit Fees

The aggregate non-audit fees were $0 for both fiscal years 2020 and 2019.

The Audit Committee has advised the Company that in its opinion the services rendered by KPMG LLP are compatible with maintaining their independence.

The Audit Committee is responsible for oversight of the Company’s accounting, auditing and financial reporting process on behalf of the Board of Directors. The Committee currently consists of three members who, in the judgment of the Board of Directors, are independent and financially literate, as those terms are defined by the Securities and Exchange Commission (the “SEC”) and the listing standards of the New York Stock Exchange (the “NYSE”). The Board of Directors has determined that all the members of the Committee satisfy the financial expertise requirements and the Chair of the Committee has the requisite experience to be designated as an “audit committee financial expert” as that term is defined by the rules of the SEC and the NYSE.

Management has the primary responsibility for the preparation, presentation and integrity of the financial statements of the Company; for maintaining appropriate accounting and financial reporting policies and practices; and for internal controls and procedures designed to assure compliance with generally accepted US accounting standards and applicable laws and regulations. The Committee is responsible for the oversight of these processes. In this fiduciary capacity, the