Exhibit 99.1

Apptix, ASA - NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 1 – Corporate Information

Apptix ASA (“Apptix”, the “Company” or the “Group”) is a public Company registered in Norway and traded on the Oslo Stock Exchange. The Company’s head office is located at 13461 Sunrise Valley Drive, Suite 300, Herndon, Virginia (USA) and its registered business address is Nesoyveien 4, Billingstad, Norway. Apptix is the premier provider of managed and hosted business communication, collaboration, compliance & security, and infrastructure solutions to mid-market and enterprise customers and blue chip channel partners. A cloud services pioneer in the managed hosted space, Apptix has almost 380 000 users under contract around the world; with more than one-third of users in highly regulated industries.

Apptix’s comprehensive portfolio of Cloud solutions includes Microsoft® Exchange, Microsoft Office 365®, SharePoint®, and Lync®, as well as hosted VoIP, encryption, archiving, mobile device management, enterprise back-up, disaster recovery, file synch and share and virtual desktops. Apptix hosted services are delivered across an advanced network infrastructure and built upon best-in-class hardware and software housed in Tier IV, SSAE 16 SOC 1 Type II certified, geographically dispersed interconnected datacenters to ensure the highest level of availability and reliability. 24/7 customer service and support is provided by a fully U.S.-based, industry recognized support department.

Note 2 – Summary of Significant Accounting Policies

2.1 Basis of Preparation

The consolidated financial statements of Apptix ASA have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), as adopted by the EU.

The consolidated financial statements of Apptix ASA have been prepared on a historical cost basis. The consolidated financial statements are presented in USD and all values are rounded to the nearest thousand except when otherwise indicated.

2.2 New and amended standards and interpretations applicable to September 2016 interim financial statements.

The accounting principles used in 2016 are the same as in 2015. The Group has reviewed new and amended IFRS and IFRIC interpretations during the year, along with the annual improvements. Adoption of these revised standards and interpretations did not have any effect on the financial performance or position of the Group

2.3 Basis of Consolidation and Classifcation of Assets and Liabilities

The consolidated financial statements are comprised of the financial statements of Apptix ASA and its fully owned subsidiary Apptix Inc. The financial statements of the subsidiary areprepared for the same reporting year as the parent Company, using consistent accounting policies. Inter-Company transactions and balances, including internal profits and unrealized gains and losses are eliminated in full as part of the consolidation process. As a result of rounding differences, numbers or percentages included within may not add up to the total.

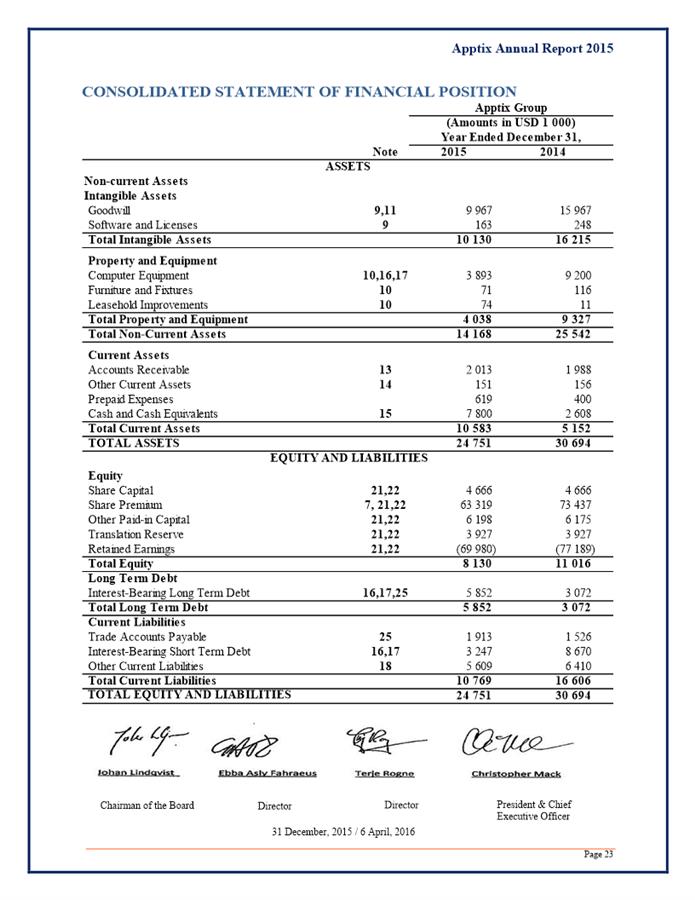

Current assets and liabilities include balances typically due within one year. All other balances are classified as non-current assets and other long-term debt.

2.4 Functional Currency and Presentation Currency

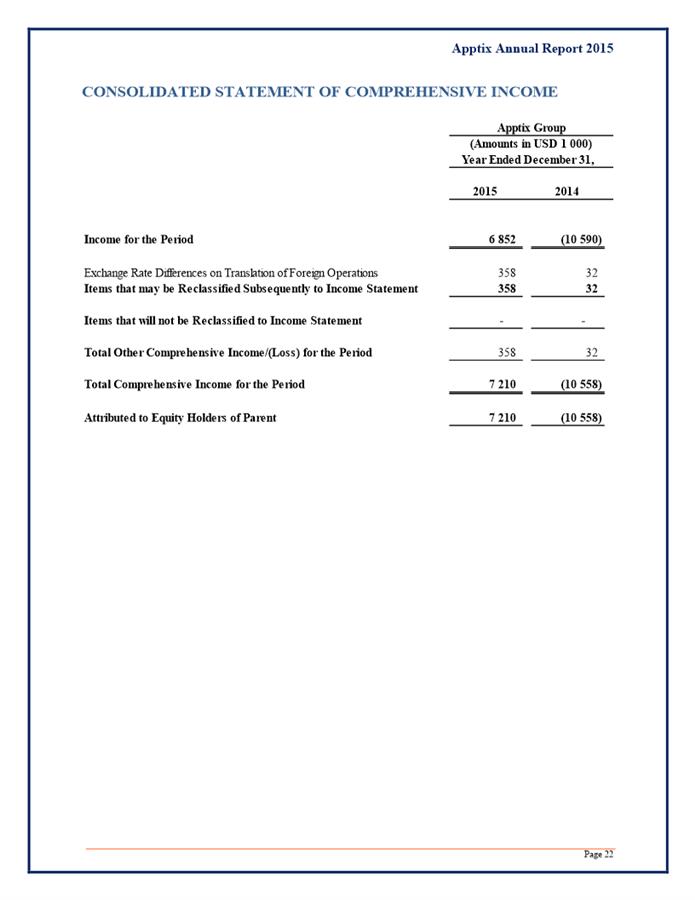

Apptix ASA has a single subsidiary whose primary economic environment is in the United States. The functional currency of this subsidiary is USD. Apptix ASA Group presents its financial statements and notes to the consolidated financial statements in USD, except where a transaction was specifically denominated in NOK. The functional currency of Apptix ASA is NOK and the Company presents its income statement, balance sheet, cash flow and notes in NOK only. The translation principles are as follows: (a) balance sheet figures for companies with a functional currency other than the presentation currency have been translated to the presentation currency at the rate applicable at the balance sheet date (b) income statement figures for companies with a functional currency other than the presentation currency have been translated to the presentation currency at the average exchange rate for the month in which the transaction occurred and (c) exchange rate differences are recognized as part of the other comprehensive income.

2.5 Revenue Recognition

Operating revenues are recognized when persuasive evidence of an agreement exists, the service has been delivered, fees are reliably measurable, collections are probable, and when other significant obligations have been fulfilled. Subscription revenue is earned under monthly subscription license agreements. Annual subscription licenses are amortized into revenue on a monthly basis as the services are delivered. As such, revenue is recognized during the period for which the service was delivered and it has been determined that collection of the related subscription fee is probable. Professional services represents one-time fees for specific work performed that is not included in the monthly subscription license agreement. Professional services (Non-recurring revenue) is recognized once the service has been performed and collection of the associated fee is probable.

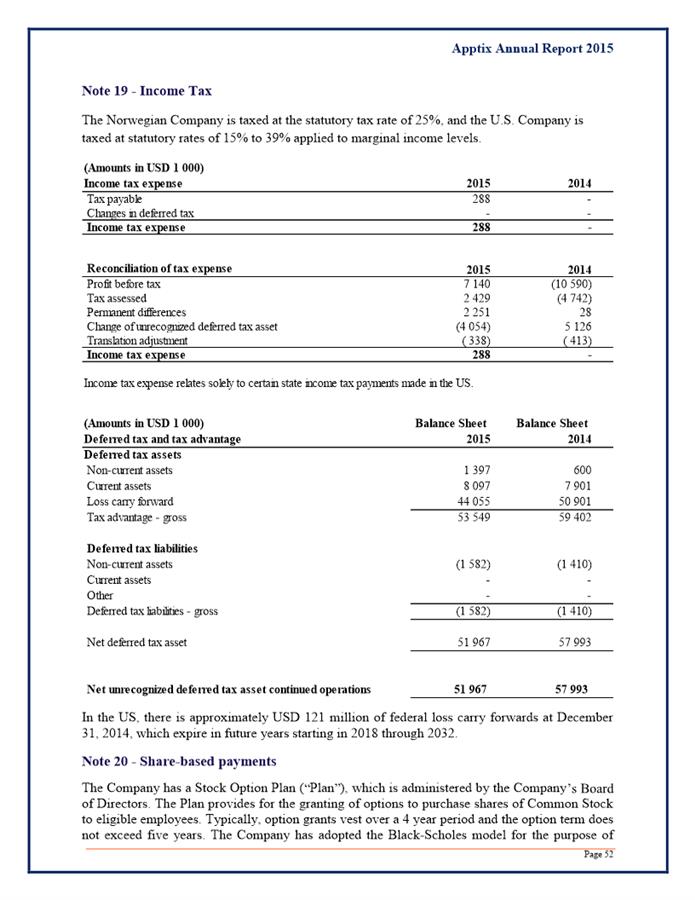

2.6 Income Taxes

The tax expense in the income statement includes taxes payable on the ordinary results for the period as well as the change in deferred tax. Deferred tax is calculated with a nominal tax rate on the temporary differences between the recorded values and tax values, as well as on any tax loss carry-forwards at the balance sheet date. Deferred income tax assets and deferred income tax liabilities are offset, if a legally enforceable right exists to offset current tax assets against current income tax liabilities and the deferred income taxes relate to the same taxable entity and the same taxation authority. Any temporary differences, increasing or reducing taxes that will or may reverse in the same period, are netted. The net deferred tax benefit is recorded as an asset if it is regarded as probable that the Group will be able to realize the benefit through future earnings or realistic tax efficient planning.

2.7 Intangible Assets

Generally, intangible assets are recognized in the balance sheet if it is probable that there are future economic benefits that can be attributed to the asset which is owned by the Company, and the asset’s cost can be reasonably estimated. Intangible assets are recorded at cost. Intangible assets with indefinite useful lives are not amortized, but impairment losses are recognized if the recoverable amount is less than the current carrying value. The recoverable amount is calculated each year or if there are any indications of a decrease of value. Intangible assets with a finite useful life are amortized over the useful life and the need for any impairment losses to be recognized is considered quarterly. Amortization is carried out using the straight-line method over the estimated useful life. The amortization estimate and method is subject to an annual assessment based on the future economic benefits.

Expenditures related to the purchase of software are capitalized in the balance sheet as an intangible asset provided these expenditures do not form part of hardware acquisition costs. Software is amortized using the straight-line method over 3 years. Expenses incurred as a result of maintaining or upholding the future usefulness of software, are expensed as incurred unless the changes in the software increase the future economic benefits.

Acquisitions are accounted for by eliminating the cost price of the shares in the parent Company against equity in the subsidiary at the time of acquisition. The cost of the acquisition is allocated to the assets acquired and the liabilities assumed according to their estimated fair market values at the time of acquisition. The amount allocated to goodwill represents the excess purchase price paid over the fair value of the assets acquired and the liabilities assumed. In the event that the accounting for the business combination is incomplete by the end of the reporting period where the business combination occurs, the provisional amounts recognized at the acquisition date will be adjusted to reflect new information obtained about facts and circumstances that existed as of the acquisition date and, if known, would have affected the measurement of the amounts recognized as of that date. The period where the provisional amounts can be adjusted ends as soon as the necessary information is obtained to complete the purchase price allocation, and will in any case not exceed one year from the acquisition date.APTIX

Goodwill is not amortized; however an assessment is made both quarterly, and when there is an indication the carrying amount cannot be justified by future cash flows. If there is any indication that an impairment loss needs to be recognized, an assessment will be made to determine whether or not the discounted cash flow exceeds the carrying amount of goodwill. If the discounted cash flow is less than the carrying amount, goodwill will be written down to its fair value.

2.8 Property and Equipment

Property and equipment are stated at cost less accumulated depreciation and impairment losses. When assets are sold or disposed of, the gross carrying amount and accumulated depreciation are eliminated, and any gain or loss on the sale or disposal is recognized in the income statement. Depreciation is computed for owned assets using the straight-line method over useful life and is recognized in the income statement. The useful life is equal to the estimated useful economic life since the Company uses the assets until they have no remaining residual value. The depreciation period and method are assessed each year to ensure that the method and period used synchronize with the financial realities of the non-current asset. The same methodology applies to the residual value.

2.9 Leasing

The determination of whether an arrangement is, or contains a lease is based on the substance of the arrangement at inception date as to whether the fulfillment of the arrangement is dependent on the use of a specific asset or assets or the arrangement conveys a right to use the asset.

Finance leases, which transfer to the Group substantially all the risks and benefits incidental to ownership of the leased item are capitalized at the inception of the lease at the fair value of the leased property or, if lower, at the present value of the minimum lease payments. Capitalized finance leases are expensed on a straight-line basis over the estimated period of use. The estimated period of use corresponds to the estimated useful life of the assets, since the Company uses the assets until they have no remaining value. If it is not certain that the Company will take over the asset when the lease expires, the asset is depreciated over the lease’s term or the depreciation period for equivalent assets owned by the Group, whichever is the shorter. Total lease payments, less estimated interest, are recorded as long-term debt at the inception of the lease. The liability is reduced by the lease payments less the estimated interest expense.

Leases for which substantially all the risks and benefits incidental to ownership of the leased item are not transferred to the Group are classified as operating leases. Lease payments are classified as operating costs and recognized in the income statement during the contract period.

2.10 Cash and Cash Equivalents

Cash includes cash on hand and at the bank. Cash equivalents are short-term liquid investments that can be converted into cash within three months to a known amount, and which contain insignificant risk elements.

2.11 Impairment of Assets

Financial instruments are reviewed at each balance sheet date to determine if there has been any decrease in value. Financial assets, which are valued at amortized cost, are written down when it is probable that the Company will not recover the full amount of the asset. The amount of the impairment loss is recognized in the income statement. A previous impairment loss may be reversed if the circumstances warrant such a reversal. A reversal of an impairment loss is presented as income. The carrying amount is only recognized to the extent that it does not exceed what the amortized cost would have been had the impairment loss not been recognized.

The Company utilizes valuation allowance accounts where appropriate for its financial instruments. The Company will directly reduce the carrying value of a financial asset when the impairment has occurred within a current reporting period. The Company will reduce the carrying value of a financial asset by way of increasing its valuation allowance when the impairment occurred outside of the current reporting period.

An assessment of impairment losses on other assets is made when there is an indication that the recoverable amount of an asset has fallen below its carrying amount. If an asset’s carrying amount is higher than the asset’s recoverable amount, an impairment loss will be recognized in the income statement. With the exception of goodwill (see Note 10), impairment losses recognized in the income statements for previous periods are reversed when there is information that the impairment loss no longer exists or the carrying value of the impairment loss should be reduced. The reversal is recognized as revenue or an increase in other reserves. However, no reversal takes place if the reversal leads to the carrying amount exceeding what the carrying amount would have been if appropriate depreciation had occurred.

The recoverable amount is the greater of the fair value of the asset less the net selling costs, or the discounted cash flow from continued use. “Value in use” is the present value of the future cash flows expected to be derived from an asset or cash-generating unit. For assets that do not generate cash inflows, and which are largely independent of those from other assets or groups of assets, the recoverable amount is determined for the cash-generating unit to which the asset belongs.

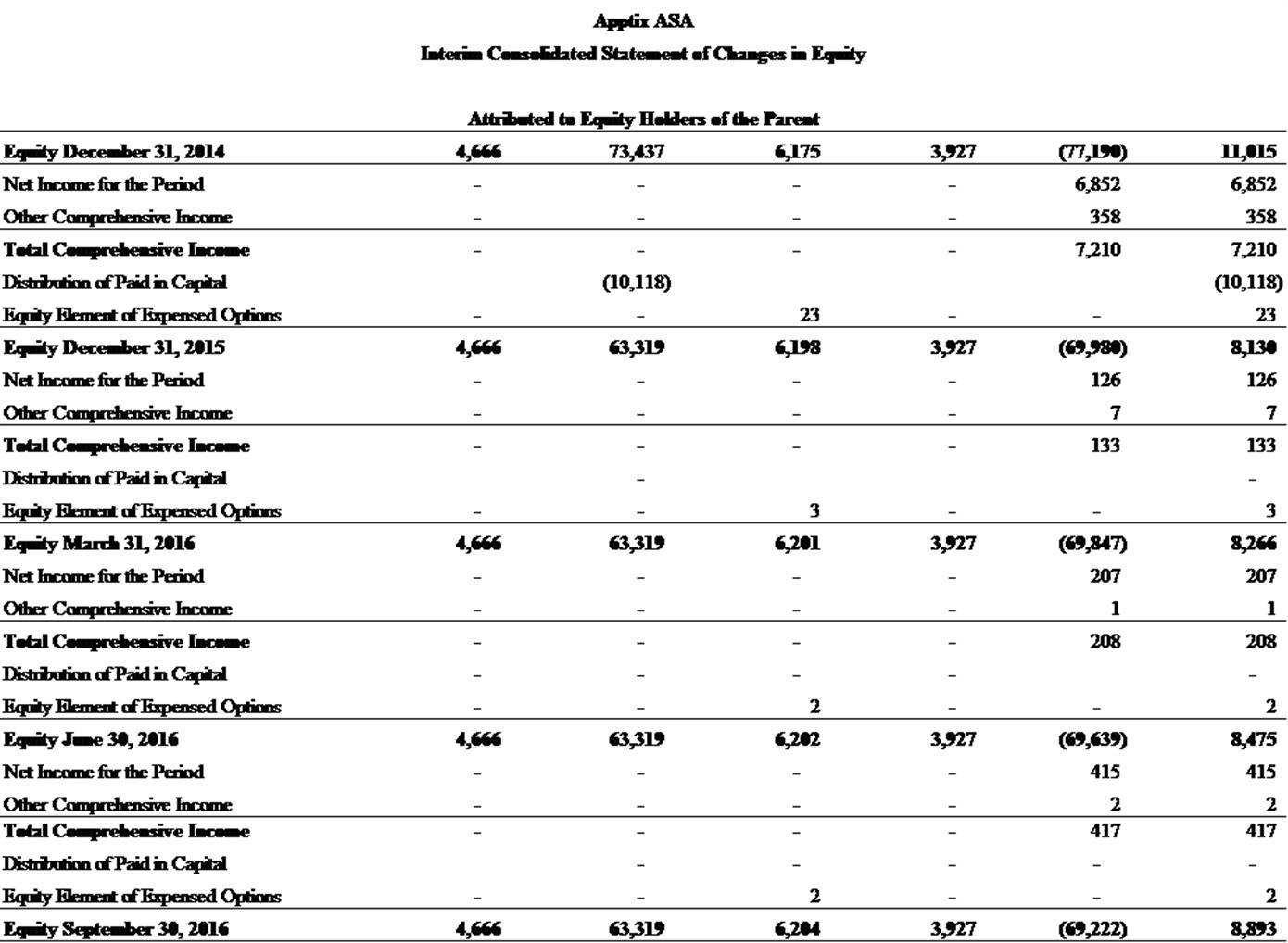

2.12 Equity

Financial instruments are classified as liabilities or equity depending on the underlying financial circumstances. Interest, dividends, gains and losses relating to a financial instrument classified as a liability will be presented as an expense or revenue.

b)

Costs of Equity Transactions

Direct transaction costs relating to an equity offering are recognized against equity after deducting tax expenses. No other costs are directly recognized against equity.

Exchange differences arise in connection with currency differences when foreign entities are consolidated. Currency differences relating to monetary items (liabilities or receivables), which are in reality part of the Company’s net investment in a foreign entity, are treated as an exchange difference. When a foreign operation is sold, the accumulated exchange differences linked to the entity are reversed and recognized in the income statement in the same period as the gain or loss on the sale is recognized.

2.13 Financial Liabilities

All financial liabilities are recognized initially at fair value and, in the case of loans and borrowings and payables, net of directly attributable transaction costs.

After initial recognition, interest-bearing loans and borrowings are subsequently measured at amortized cost using the EIR method. Gains and losses are recognized in profit or loss when the liabilities are derecognized as well as through the EIR amortization process. Amortized cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the EIR. The EIR amortization is included as finance costs in the statement of profit or loss.

2.14 Employee Benefits

The Company provides severance pay in situations where employment contracts are terminated as a result of reorganization. The costs related to severance pay are provided for once management has decided on a plan that will lead to reductions in the workforce and the work of restructuring has started or the reduction in the workforce has been communicated to affected employees.

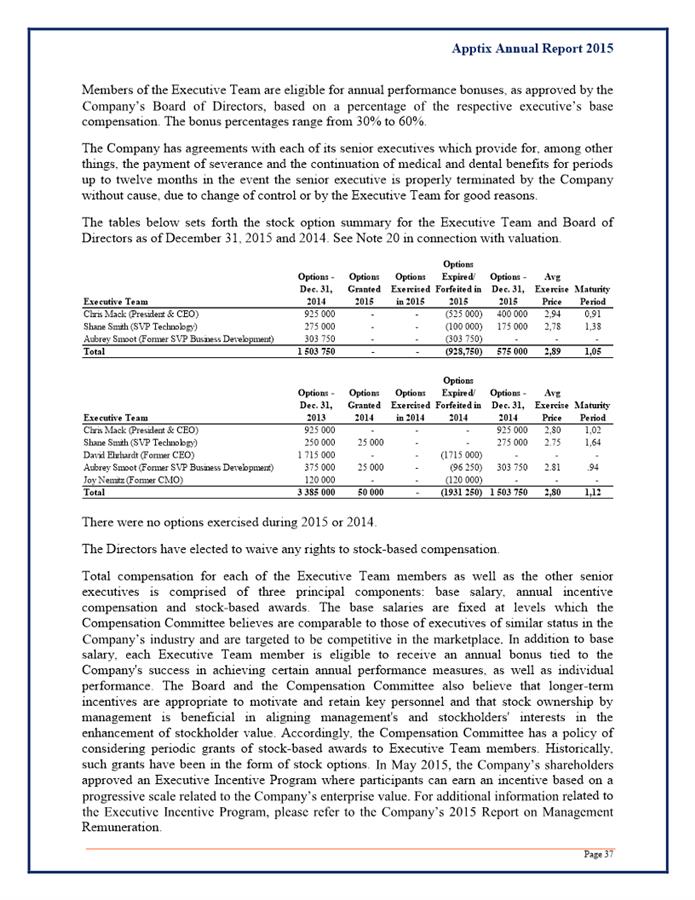

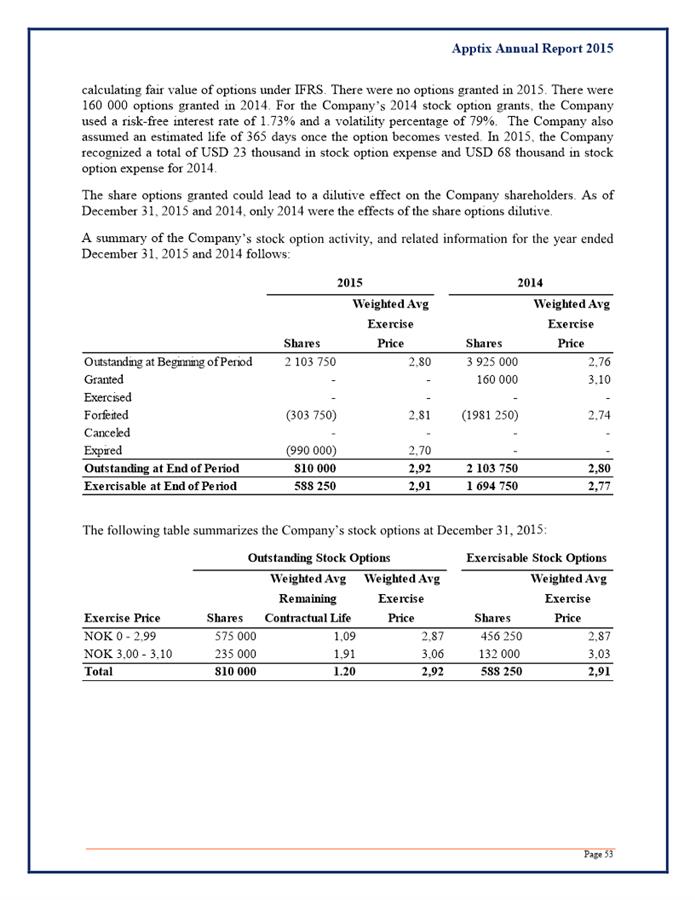

The employees and management of the Company receive compensation in the form of equity-settled share-based payments. The cost of equity-settled transactions is determined by the fair value of the options at the time of the grant. The fair value is determined using an appropriate pricing model. The expense associated with equity-settled transactions is recognized, together with a corresponding increase in equity, during the period over which the service conditions and/or performance conditions are satisfied and the employee is fully entitled to the award (vesting date).

2.15 Provisions

Provisions are recognized when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation.

2.16 Events after the Balance Sheet Date

New information on the Company’s positions at the balance sheet date is taken into account in the interim financial statements. Events occurring after the balance sheet date that do not affect the Company’s position at the balance sheet date, but which will affect the Company’s position in the future, are stated, if significant.

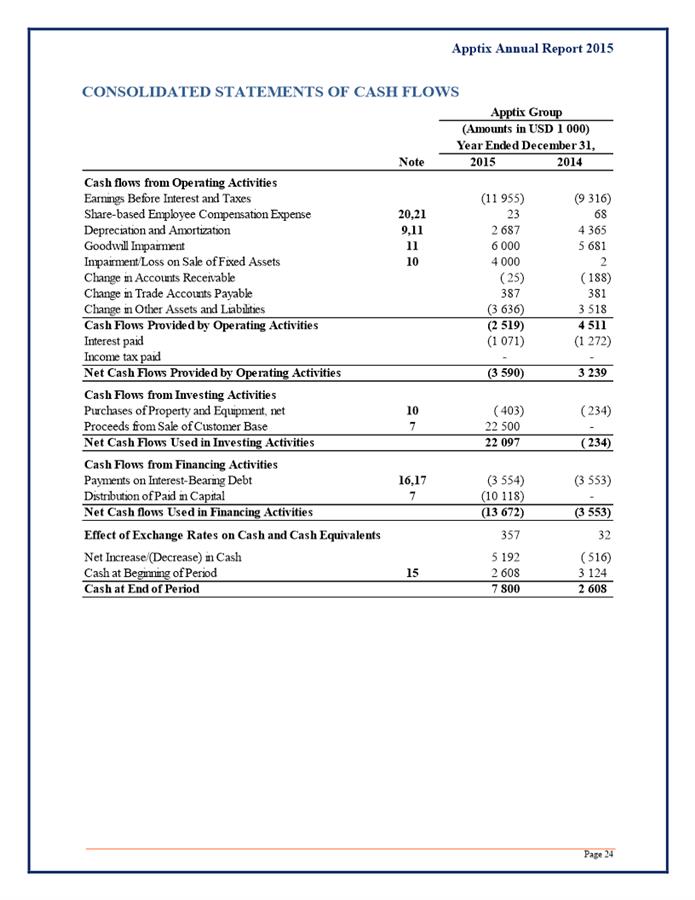

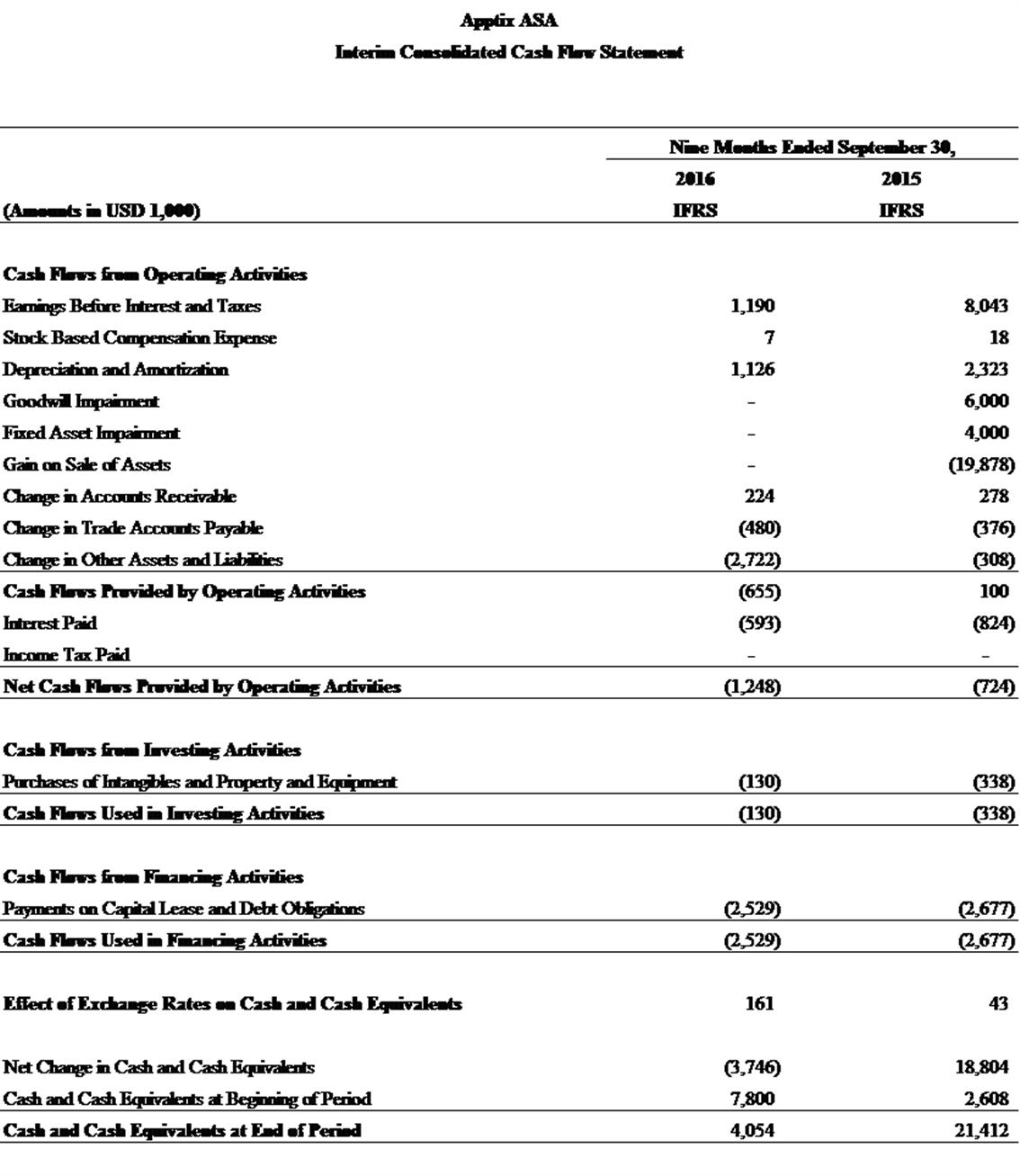

2.17 Cash Flow Statement

The cash flow statement is prepared in accordance with the indirect method. Included in cash and cash equivalents are bank deposits and cash on hand. Cash and cash equivalents are presented at the market value on the balance sheet date.

2.18 Significant Accounting Judgments, Estimates and Assumptions

The preparation of the Group’s consolidated financial statements requires management to make judgments, estimates and assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, and the accompanying disclosures, and the disclosure of contingent liabilities. Uncertainty about these assumptions and estimates could result in outcomes that require a material adjustment to the carrying amount of assets or liabilities affected in future periods.

Key Estimates and Assumptions

The key assumptions concerning the future and other key sources of estimation uncertainty at the reporting date, that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year, are described below. The Group based its assumptions and estimates on parameters available when the consolidated financial statements were prepared. Existing circumstances and assumptions about future developments, however, may change due to market changes or circumstances arising beyond the control of the Group. Such changes are reflected in the assumptions when they occur.

The most significant uncertainty in the Company’s judgment relates to impairment testing of goodwill. The Company reviews whether or not goodwill has been impaired on a quarterly basis. Estimating the value in use requires the Company to estimate the expected cash flows from the cash-generating unit as well as a suitable discount rate in order to calculate the present value of those cash flows. The carrying amount of goodwill at September 30, 2016 was USD 9,9 million. Additional information related to goodwill appears in Note 10. Other significant areas of judgment and estimates include fixed asset impairment, determining expense associated with the issuance of stock options and the establishment of allowances for doubtful accounts.

2.19 Future Changes in Accounting Principles

In the financial statements for 2016 and beyond, the following standards, amendments and interpretations will be effective, along with annual improvements.

The Group does not expect these standards, revisions and interpretations to have a material impact on the financial position or performance of the Group.

The standards and interpretations are summarized below:

IAS 16 Property, Plant and Equipment and IAS 38 Intangible Assets

IAS 16 and IAS 38 both establish the principle for the basis of depreciation and amortization as being the expected pattern of consumption of the future economic benefits of an asset. The IASB has clarified that the use of revenue-based methods to calculate the depreciation of an asset is not appropriate because revenue generated by an activity that includes the use of an asset generally reflects factors other than the consumption of the economic benefits embodied in the asset. The IASB also clarified that revenue is generally presumed to be an inappropriate basis for measuring the consumption of the economic benefits embodied in an intangible asset. This presumption, however, can be rebutted in certain limited circumstances. The amendment adopted by the EU is effective for annual periods beginning on or after 1 January 2016. It is expected that the changes will not give any effect on the financial statements.

IFRS 15 Revenue from Contracts with Customers

The IASB and the FASB have issued their joint revenue recognition standard, IFRS 15 Revenue from Contracts with Customers. The standard replaces existing IFRS and US GAAP revenue requirements. The core principle of IFRS 15 is that revenue is recognised to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard applies to all revenue contracts and provides a model for the recognition and measurement of sales of some non-financial assets (e.g., disposals of property, plant and equipment). The standard is not yet approved by the EU. It is expected that the changes will not give any material effect on the financial statements.

IFRS 16 Leases

IFRS 16 Leases replaces existing IFRS leases requirements. IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract, ie the customer (‘lessee’) and the supplier (‘lessor’). The new leases standard requires lessees to recognise assets and liabilities for most leases, which is a significant change from current requirements. For lessor, IFRS 16 substantially carries forward the accounting requirements in IAS 17. Accordingly, a lessor continues to classify its leases as operating leases or finance leases, and to account for those two types of leases differently. The standard is not yet approved by the EU. The company's preliminary assessment is that this standard will result in changes to the accounting for operational lease.

Annual Improvements to IFRSs (2010 - 2012)

IAS 16 and IAS 38: Revaluation method – proportionate restatement of accumulated depreciation

The amendment to IAS 16.35(a) and IAS 38.80(a) clarifies that revaluation can be performed, as follows:

● Adjust the gross carrying amount of the asset to market value

Or

● Determine the market value of the carrying amount and adjust the gross carrying amount proportionately so that the resulting carrying amount equals the market value.

The IASB also clarified that accumulated depreciation/amortisation is the difference between the gross carrying amount and the carrying amount of the asset (i.e., gross carrying amount – accumulated depreciation/amortisation = carrying amount). The amendment to IAS 16.35(b) and IAS 38.80(b) clarifies that the accumulated depreciation/amortisation is eliminated so that the gross carrying amount and carrying amount equal the market value. The amendment adopted by the EU is effective for annual periods beginning on or after 1 February 2015. It is expected that the changes will not give any effect on the financial statements.

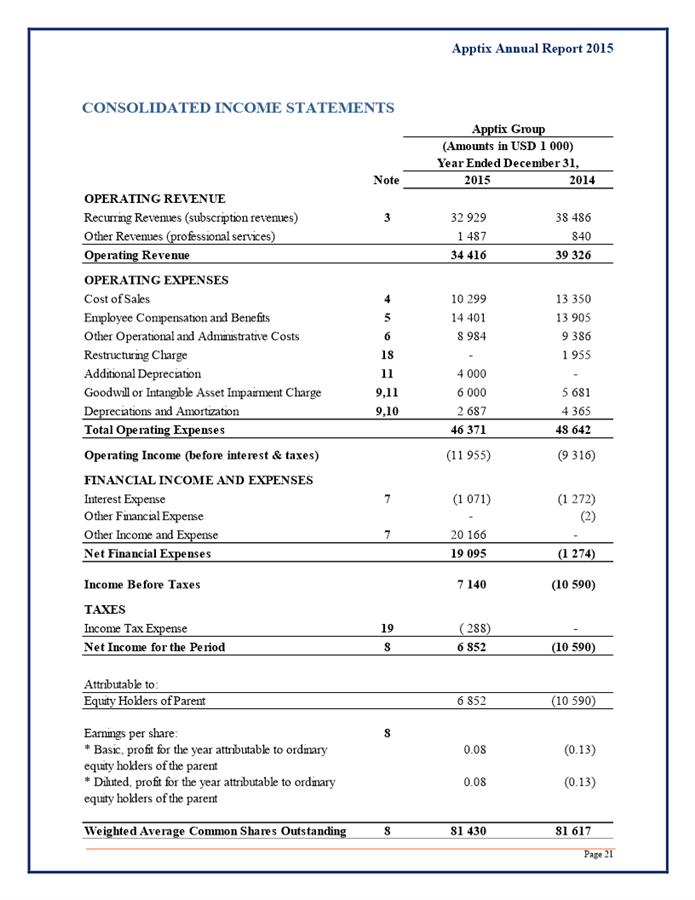

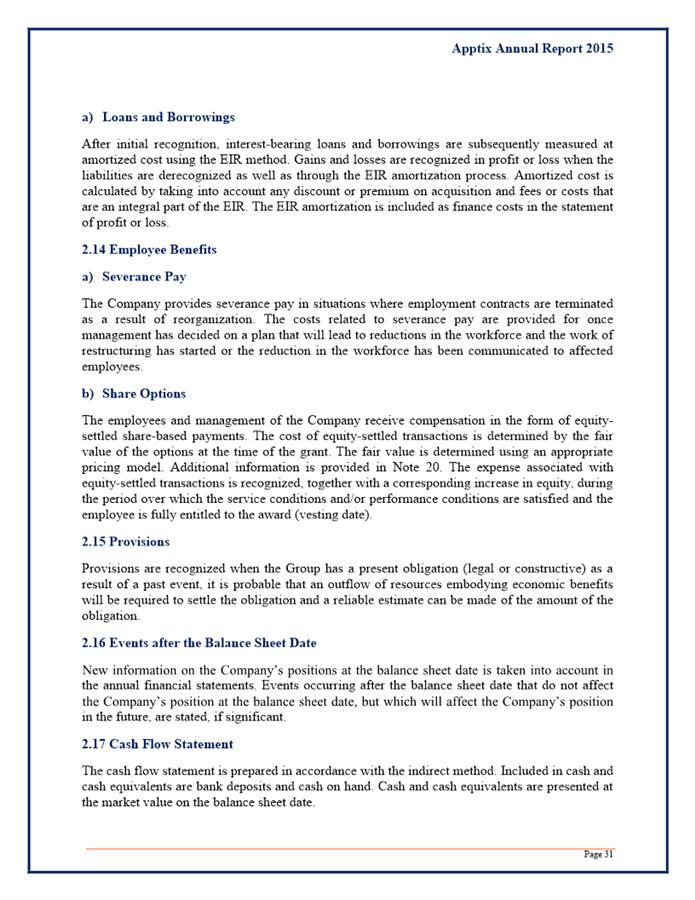

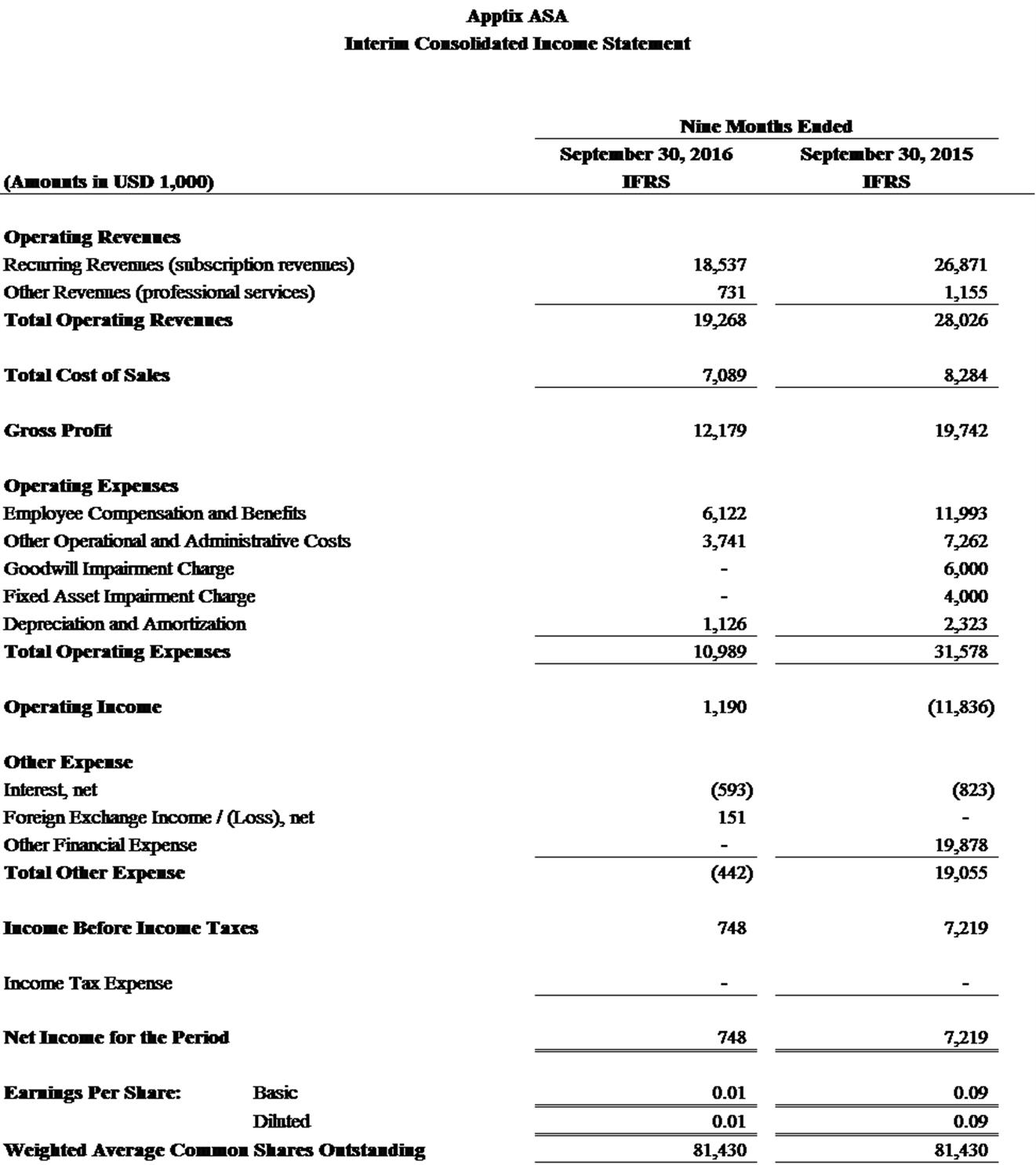

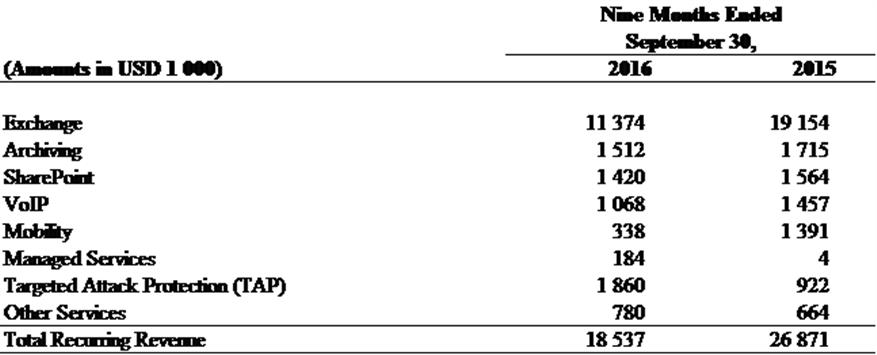

Note 3 – Revenue and Segment Information

The Company has assessed its internal organizational structure, internal reporting system and geographical business units, and concluded that it does not have any reportable segments that should be reported separately. The Company only delivers services that are exposed to the same risk and return (business segment), and the business of the Company is not engaged in providing products or services within a particular economic environment that is subject to risks and returns that are different from those of components operating in other economic environments (geographical segment).

The Company delivers services to its customers via the use of a public hosted cloud environment, a private (i.e. dedicated) or semi-dedicated cloud environment or a hybrid business model which is a combination of both public and private cloud environments.

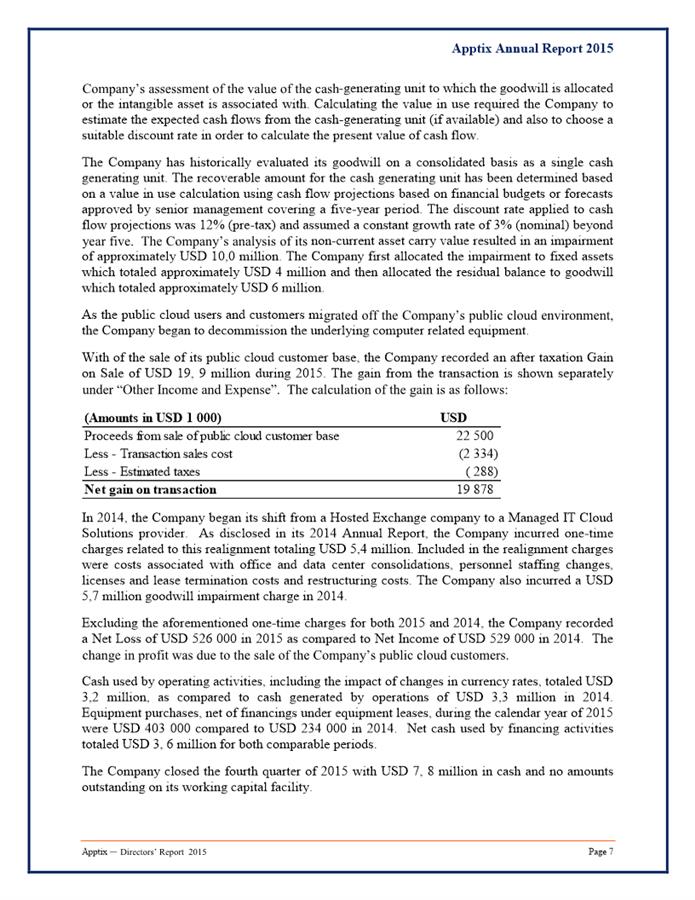

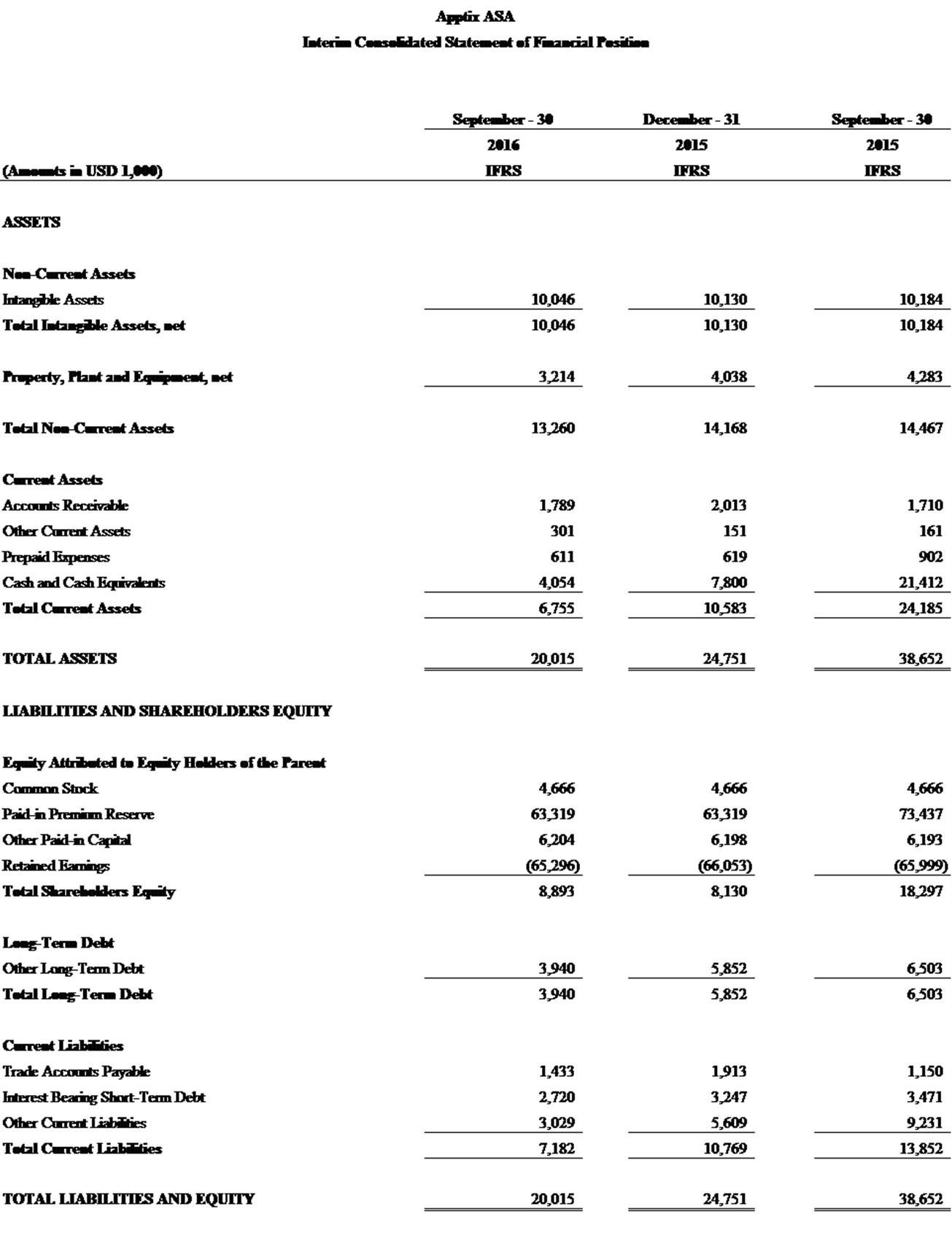

The following table summarizes the components of the Company’s recurring revenue:

Exchange - Microsoft Exchange based Corporate class hosted email, shared calendaring, contacts and task capabilities.

Archiving - Secure indexing of all messages in a tamper-proof storage environment to meet security and regulatory requirements.

SharePoint - Microsoft SharePoint solution allowing corporate collaboration through document sharing, workflows and discussion forums.

VoIP - Enterprise class hosted business phone service replacing traditional PBX business phone systems.

TAP - Comprehensive, cloud-based solution for combatting targeted email attacks.

Mobility - Instant access to email, calendars, contacts, and task lists through a mobile device.

Other Services - All other recurring revenue sources provided by the company

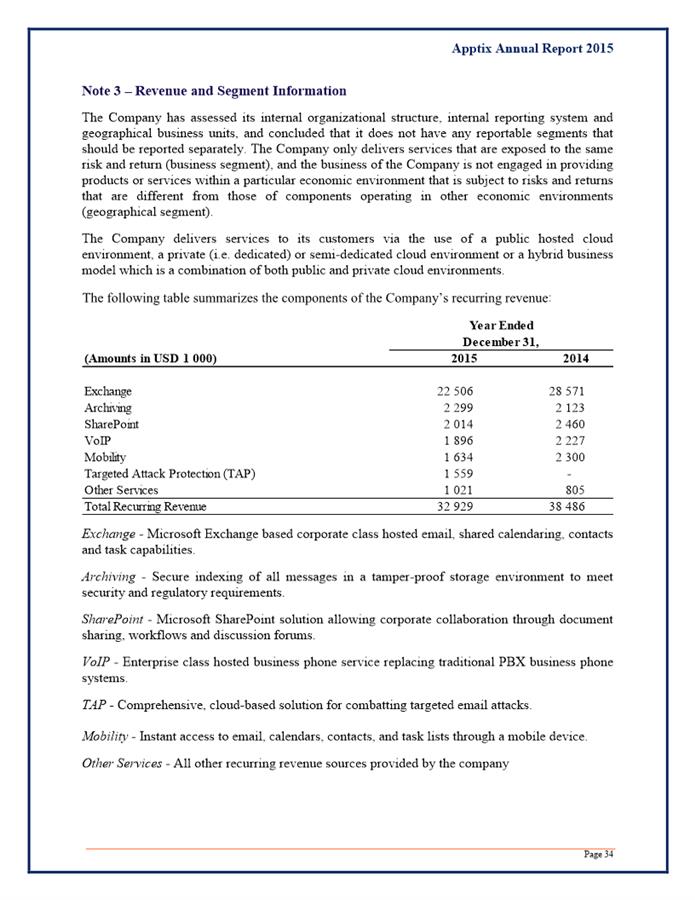

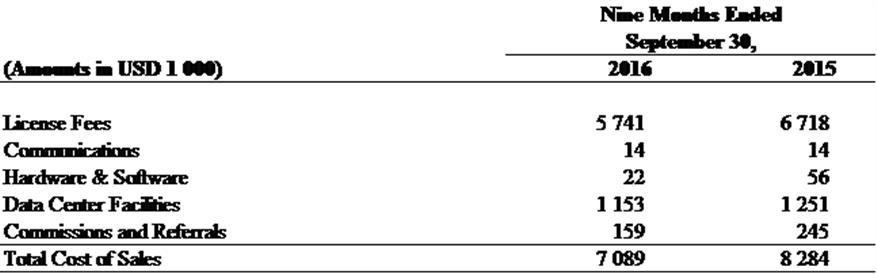

Note 4 - Cost of Sales

The following table summarizes the components of the Company’s Cost of Sales:

clude

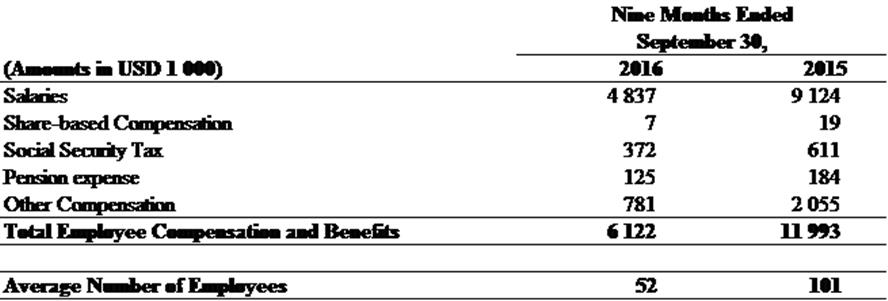

Note 5 – Employee Compensation and Benefits

The following table summarizes the components of the Company’s Compensation and Benefits:

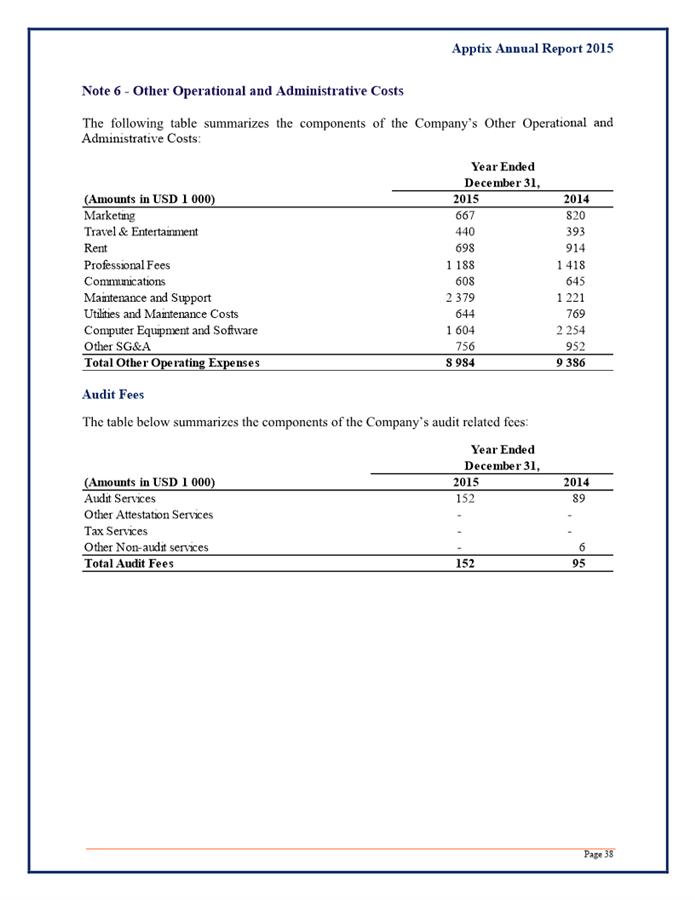

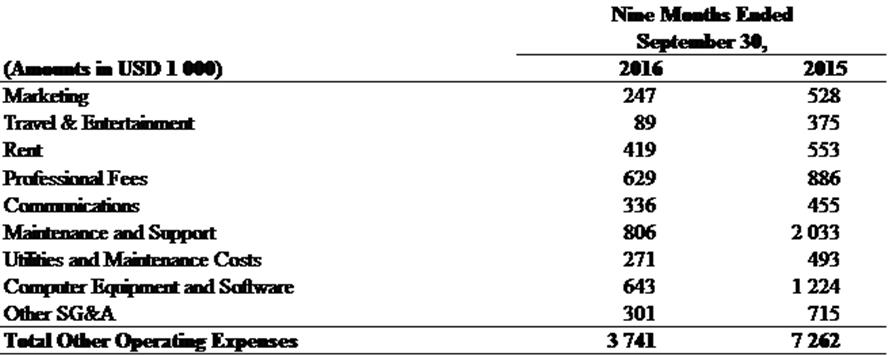

Note 6 - Other Operational and Administrative Costs

The following table summarizes the components of the Company’s Other Operational and Administrative Costs:

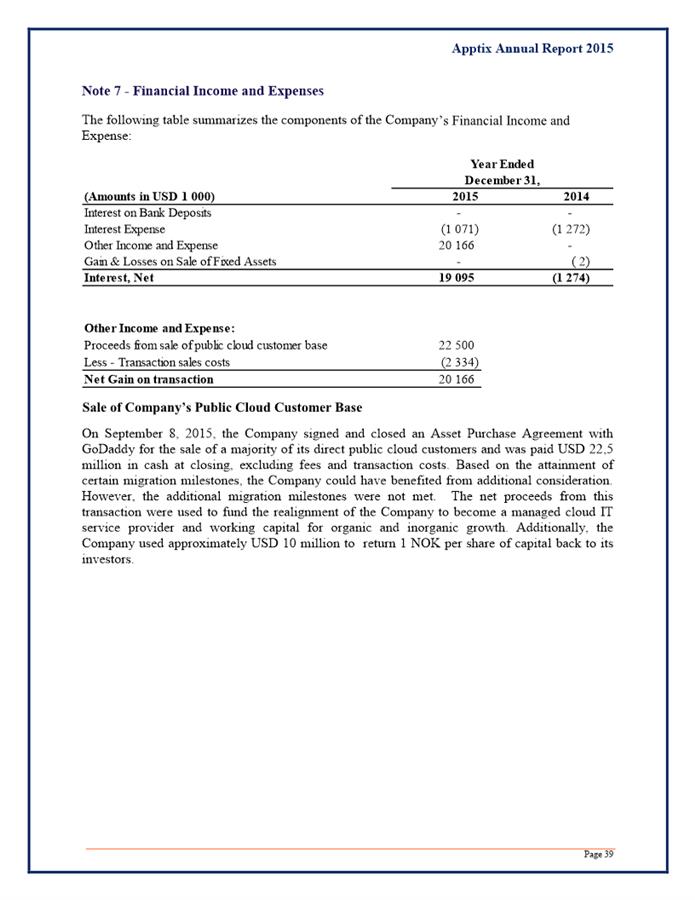

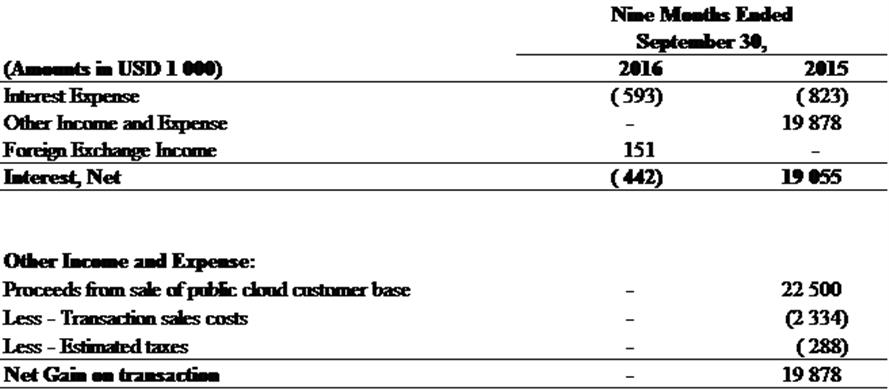

Note 7 - Financial Income and Expenses

The following table summarizes the components of the Company’s Financial Income and Expense:

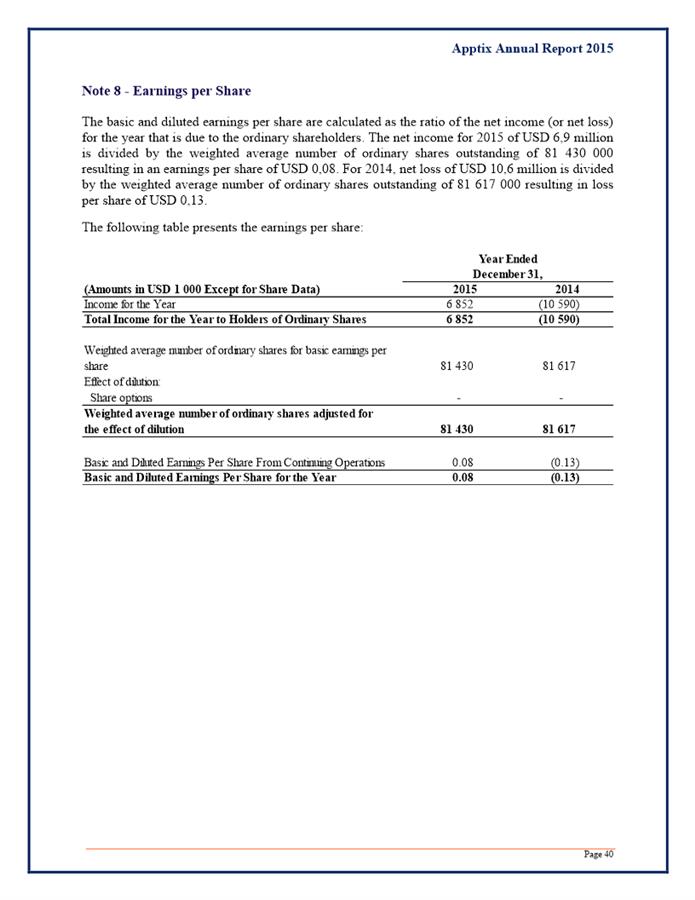

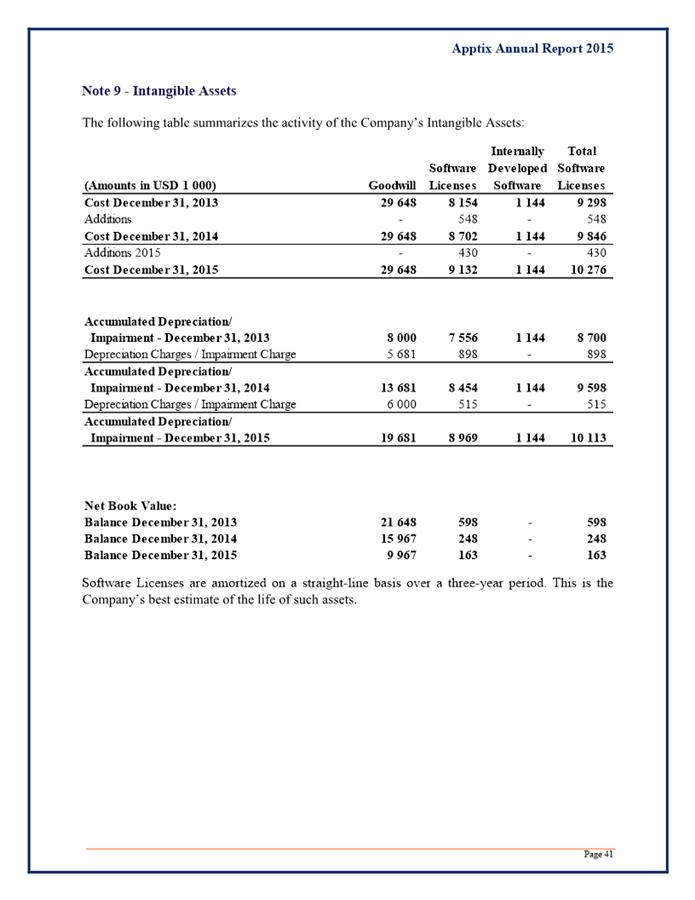

Note 8 - Intangible Assets

The following table summarizes the activity of the Company’s Intangible Assets:

Software Licenses are amortized on a straight-line basis over a three-year period. This is the Company’s best estimate of the life of such assets.

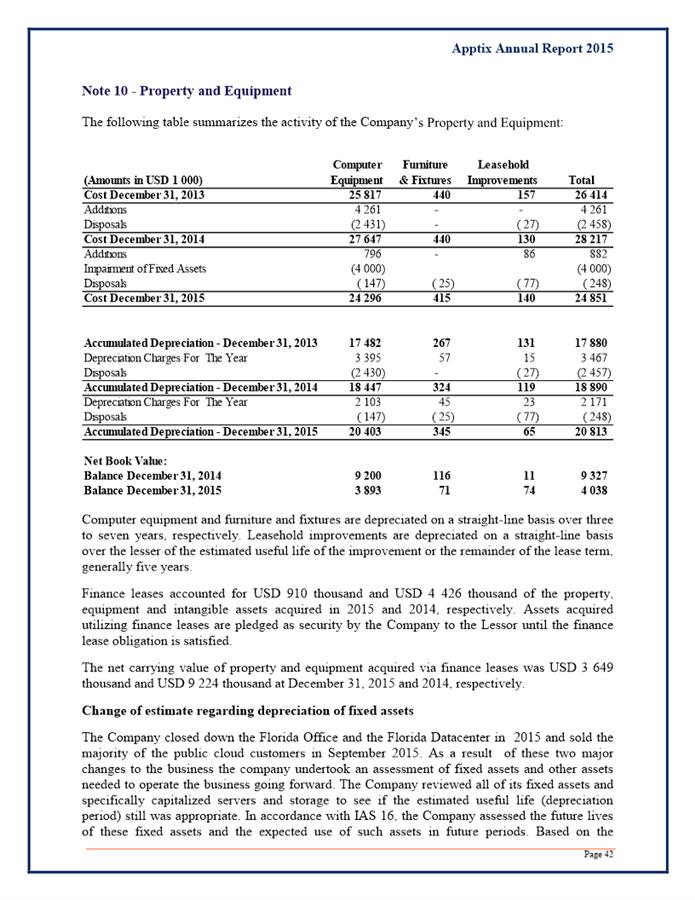

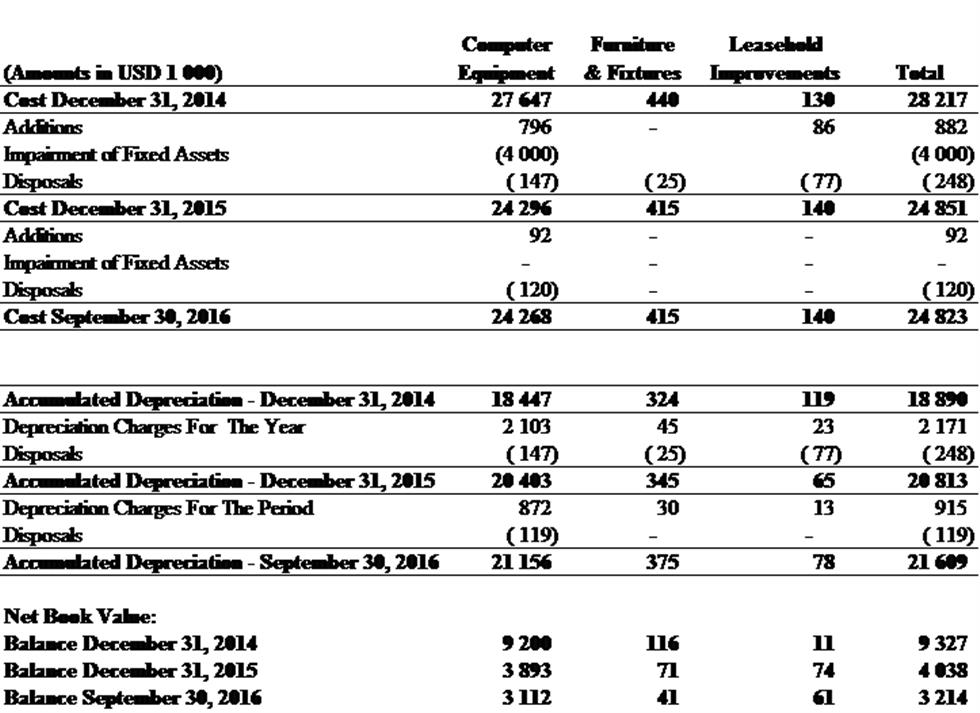

Note 9 - Property and Equipment

The following table summarizes the activity of the Company’s Property and Equipment:

Computer equipment and furniture and fixtures are depreciated on a straight-line basis over three to seven years, respectively. Leasehold improvements are depreciated on a straight-line basis over the lesser of the estimated useful life of the improvement or the remainder of the lease term, generally five years.

Change of estimate regarding depreciation of fixed assets

The Company closed down the Florida Office and the Florida Datacenter in 2015 and sold the majority of the public cloud customers in September 2015. As a result of these two major changes to the business the company undertook an assessment of fixed assets and other assets needed to operate the business going forward. The Company reviewed all of its fixed assets and specifically capitalized servers and storage to see if the estimated useful life (depreciation period) still was appropriate. In accordance with IAS 16, the Company assessed the future lives of these fixed assets and the expected use of such assets in future periods. Based on the Company’s financial forecasts and value in use calculations, the Company determined that useful life of some of the fixed assets needed to be reduced. The result of this assessment was that USD 4 million of the fixed assets was written of as a one time charge.

The Company migrated the public cloud customers to GoDaddy during the fourth quarter of 2015 and began the decommissioning of the underlying computer related equipment in early 2016 leaving the Company with excess equipment and capacity that is not expected to be utilized in future periods.

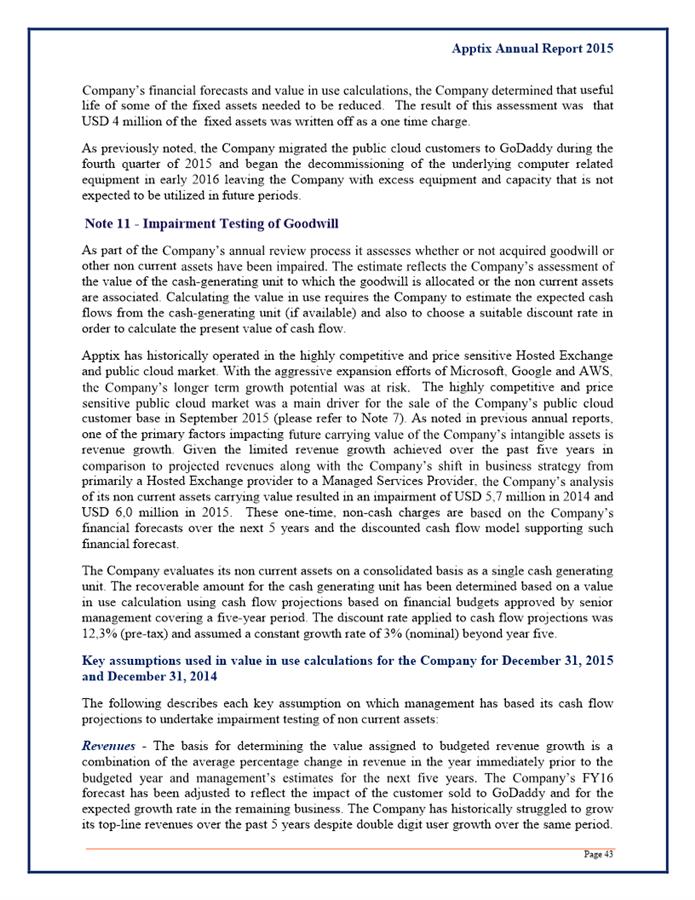

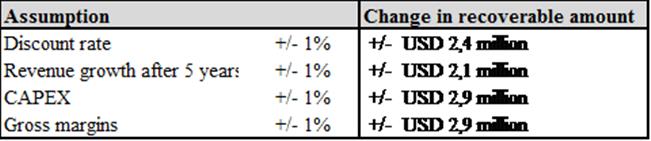

Note 10 - Impairment Testing of Goodwill

As part of the Company’s annual review process it assesses whether or not acquired goodwill or other non current assets have been impaired. The estimate reflects the Company’s assessment of the value of the cash-generating unit to which the goodwill is allocated or the non current assets are associated. Calculating the value in use requires the Company to estimate the expected cash flows from the cash-generating unit (if available) and also to choose a suitable discount rate in order to calculate the present value of cash flow.

Apptix has historically operated in the highly competitive and price sensitive Hosted Exchange and public cloud market. With the aggressive expansion efforts of Microsoft, Google and AWS, the Company’s longer term growth potential was at risk. The highly competitive and price sensitive public cloud market was a main driver for the sale of the Company’s public cloud customer base in September 2015 (please refer to Note 7). As noted in previous annual reports, one of the primary factors impacting future carrying value of the Company’s intangible assets is revenue growth. Given the limited revenue growth achieved over the past five years in comparison to projected revenues along with the Company’s shift in business strategy from primarily a Hosted Exchange provider to a Managed Services Provider, the Company’s analysis of its non current assets carrying value resulted in an impairment of USD 5,7 million in 2014 and USD 6,0 million in 2015 These one-time, non-cash charges are based on the Company’s financial forecasts over the next 5 years and the discounted cash flow model supporting such financial forecast.

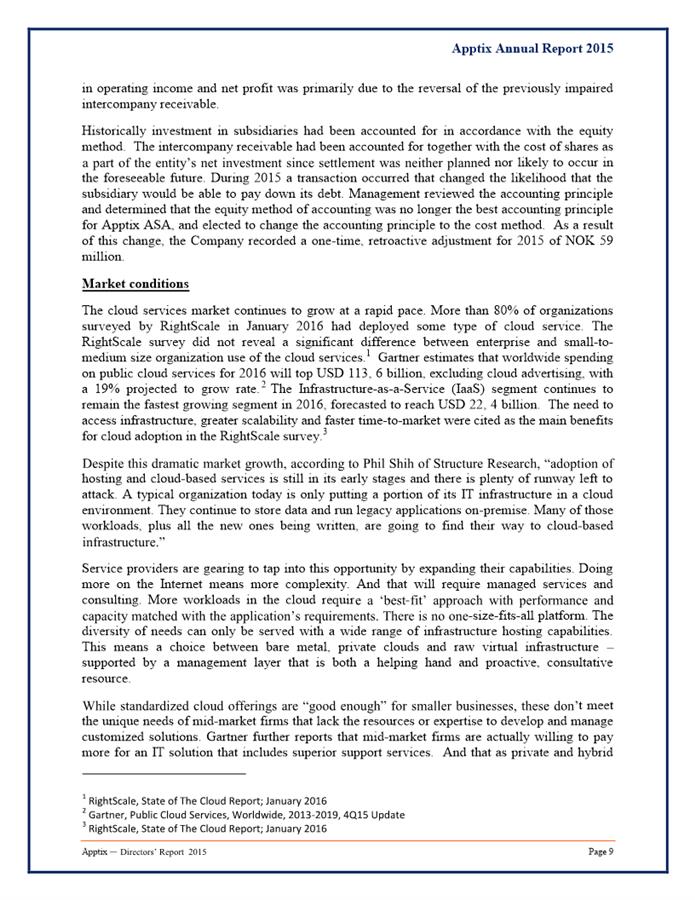

The Company evaluates its non curresnt assets on a consolidated basis as a single cash generating unit. The recoverable amount for the cash generating unit has been determined based on a value in use calculation using cash flow projections based on financial budgets approved by senior management covering a five-year period. The discount rate applied to cash flow projections was 12,3% (pre-tax) and assumed a constant growth rate of 3% (nominal) beyond year five.

Key assumptions used in value in use calculations for the Company for September 30, 2016 and December 31, 2015

The following describes each key assumption on which management has based its cash flow projections to undertake impairment testing of non current assets:

Revenues - The basis for determining the value assigned to budgeted revenue growth is a combination of the average percentage change in revenue in the year immediately prior to the budgeted year and management’s estimates for the next five years. The Company’s FY16 forecast has been adjusted to reflect the impact of the customer sold to GoDaddy and for the expected growth rate in the remaining business. The Company has historically struggled to growth its top-line revenues over the past 5 years despite double digit user growth over the same period. There are a number of contributing factors to this challenge including the downward pricing pressure (in the market) being applied by Microsoft, Google and others. While the Company has added users over the past few years, the ARPU associated with the new users have been at lower rates and not sufficient to offset the higher ARPU churn. The churn has been largely due to customers moving to the largely public cloud service providers such as Microsoft. In the impairment analysis the assumption used is an average increase in revenue of 5% for the period 2017 to 2020 and thereafter a 3% revenue growth. For fiscal year 2016, the revenue growth assumption used was 6%.

Gross Margins - The basis for determining the value assigned to budgeted gross margins is the average gross margins achieved in the year immediately prior to the budgeted year and management’s estimates for the next five years. In the impairment analysis the Company expects a declining gross margin compared to prior years. In 2015 the Company achieved a 70% gross margin and is expecting a gross margin closer to 60% in 2016 and beyond.

Operating Expenses - The basis for determining the value assigned to operating expenses is the forecasted operating expenses based on the revenue projections, using historical costs adjusted for inflation. The Company expects the operating costs to follow changes in revenue. The basis used in the impairment analysis is a consistent percentage of revenue of 48% which an improvement over prior year. The Company expects to remain in this range for the next 5 years. The Company has established a track record of effectively managing its costs and believes its opex scalability to be reasonable.

Capital Expenditures – The Company believes future capital expenditures will be significantly less than historical levels given the sale of the Company’s public cloud customer base. The primary reason for this is the shift in business strategy from a Hosted Exchange service provider to provider of broader, technology based managed services. Some of these services will be self-hosted by the Company while other services will be deployed via a syndication model. Additionally, the cost of hardware or capital equipment continues to become more scalable due to advances in technology. Over the past few years, the Company has made substantial capital investments related to storage and to a lesser degree, servers to free up the storage capacity. These sizable investments (roughly 10% of revenues) were made based on the Company’s previous go-to-market user aggregation strategy. With such excess capacity, the Company has taken a more stringent capex approach for the next 3-5 years. The Company expects to benefit and utilize these new technologies and incorporate such offerings into its service delivery models. The Company used a capital expenditure rate of 5% of revenues for its impairment analysis for future periods beyond 2015.

Pre-Tax Discount Rates – To determine the present value of the future cash flows, the Company has calculated a pre-tax discount rate. The discount rate used is 12,3%. The Company has used a WACC model (Weighted Average Cost of Capital). The basis for the calculations is a presumption of a market premium of 6%, a beta of approximately 0,95, interest free rate of 2,5% and liquidity premium of 2,0%. The Beta is based upon actual trading of the Company shares, but since there are minimal trades of the Company stock, a liquidity premium of 2,0 has been added to the calculation. To determine the cost of debt the Company has used the general market conditions on current availability of equipment lease debt. Pre-tax discount rates reflect management’s estimates of the risk specific to the business as a whole. This benchmark is used by management to assess operating performance and to evaluate future investment proposals.

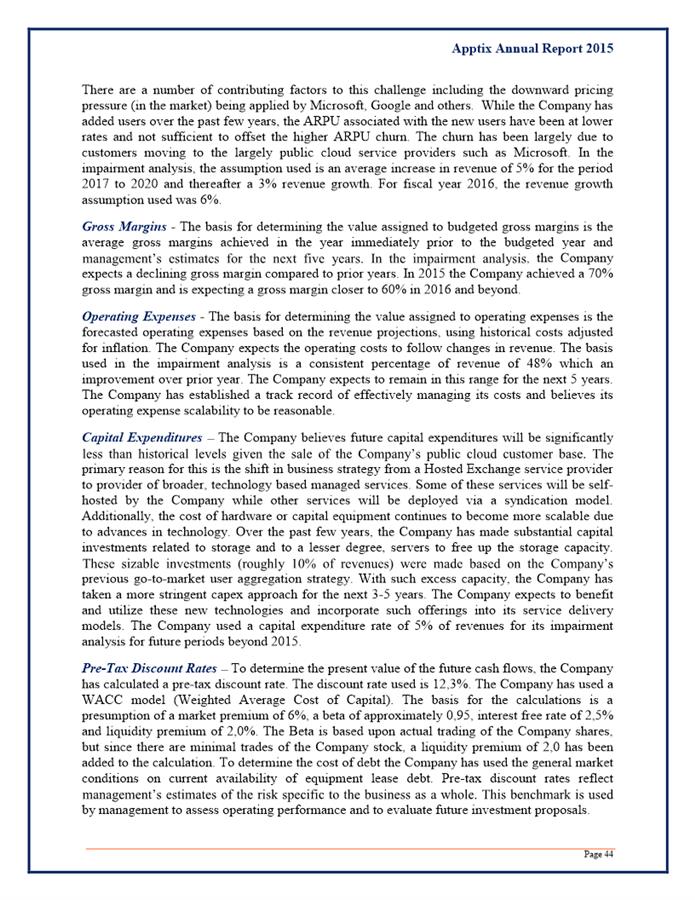

Effect of changes in key assumptions:

With regard to the assessment of value of intangible assets in use, management has evaluated the impact of potential changes in key assumptions on future carrying values of the intangible assets. Depending upon future growth rates, acceptance of the Company’s product and services in the markets it serves, operating costs as well as cost of capital, any adverse change in these key assumptions would, in isolation, have an impact on the carrying value of the Company’s intangible assets in future periods.

The impairment test shows that the recoverable amount of goodwill is USD 10, 7 million. The changes in the following table to assumptions used in the impairment analysis would, in isolation, lead to an (increase)/decrease to the aggregate impairment loss recognized in the year ended December 31, 2015. The table shows how recoverable amount of goodwill will be affected:

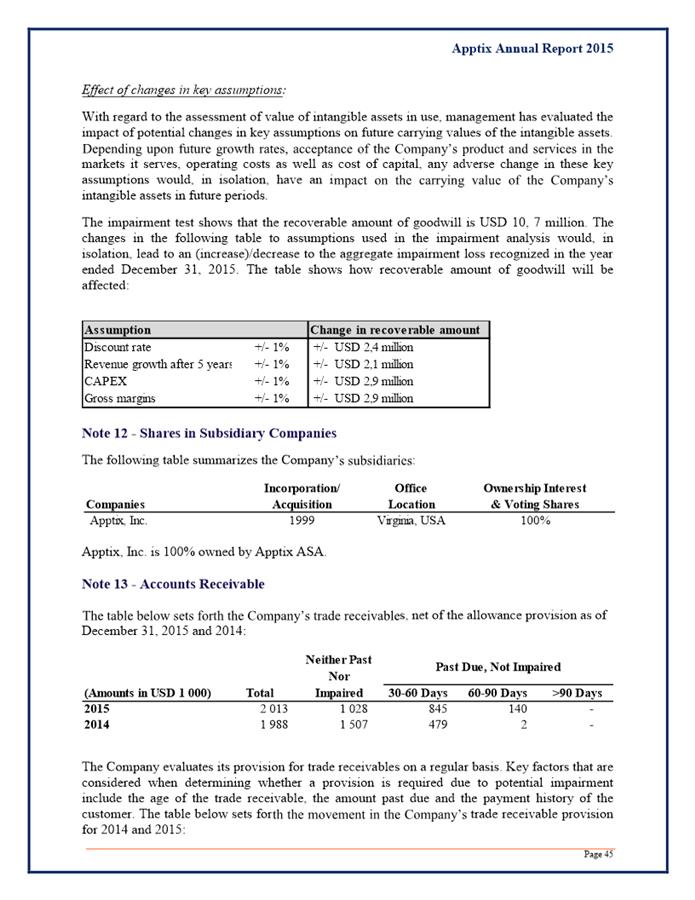

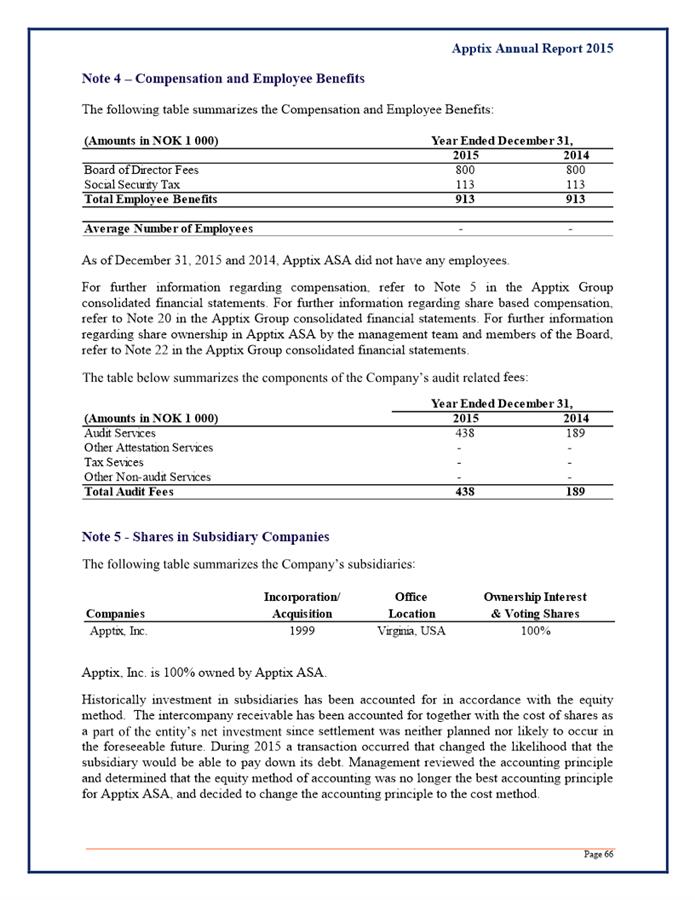

Note 11 - Shares in Subsidiary Companies

The following table summarizes the Company’s subsidiaries:

Apptix, Inc. is 100% owned by Apptix ASA.

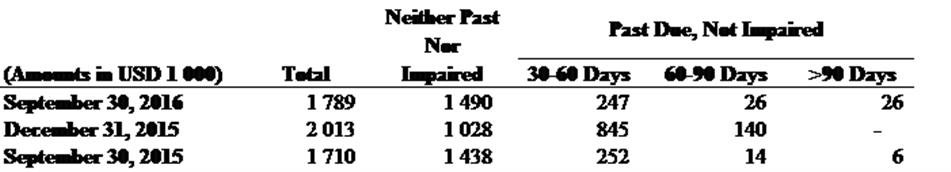

Note 12 - Accounts Receivable

The table below sets forth the Company’s trade receivables, net of the allowance provision as of September 30, 2016, December 31, 2015 and September 30, 2015:

The Company evaluates its provision for trade receivables on a regular basis. Key factors that are considered when determining whether a provision is required due to potential impairment include the age of the trade receivable, the amount past due and the payment history of the customer.

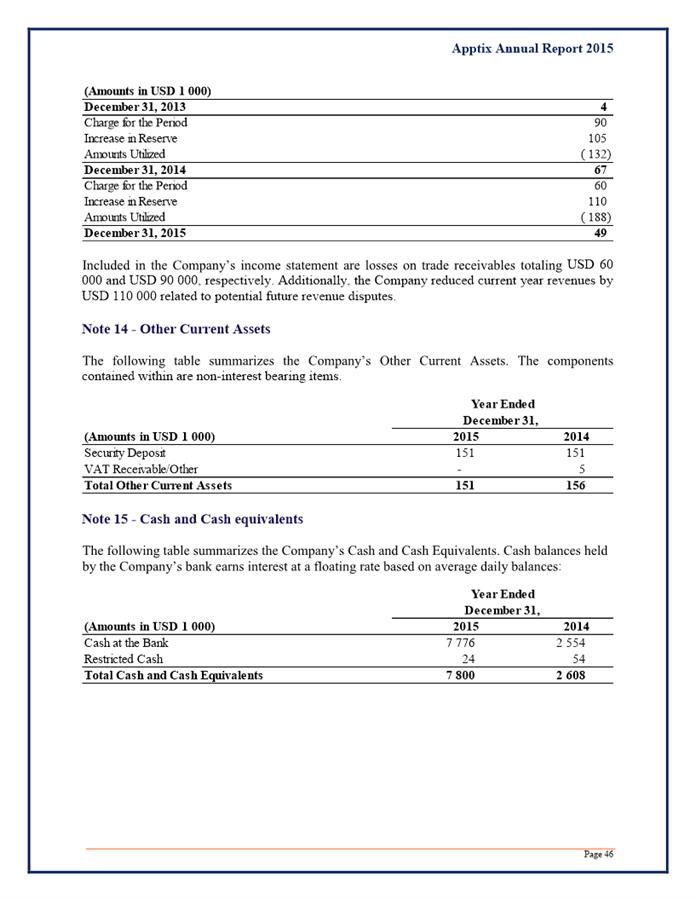

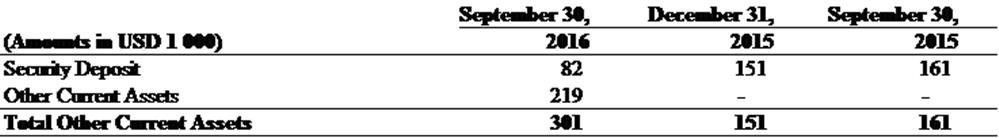

Note 13 - Other Current Assets

The following table summarizes the Company’s Other Current Assets. The components contained within are non-interest bearing items:

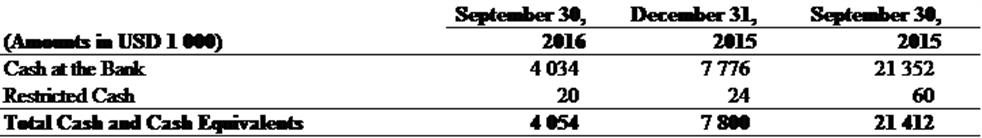

Note 14 - Cash and Cash equivalents

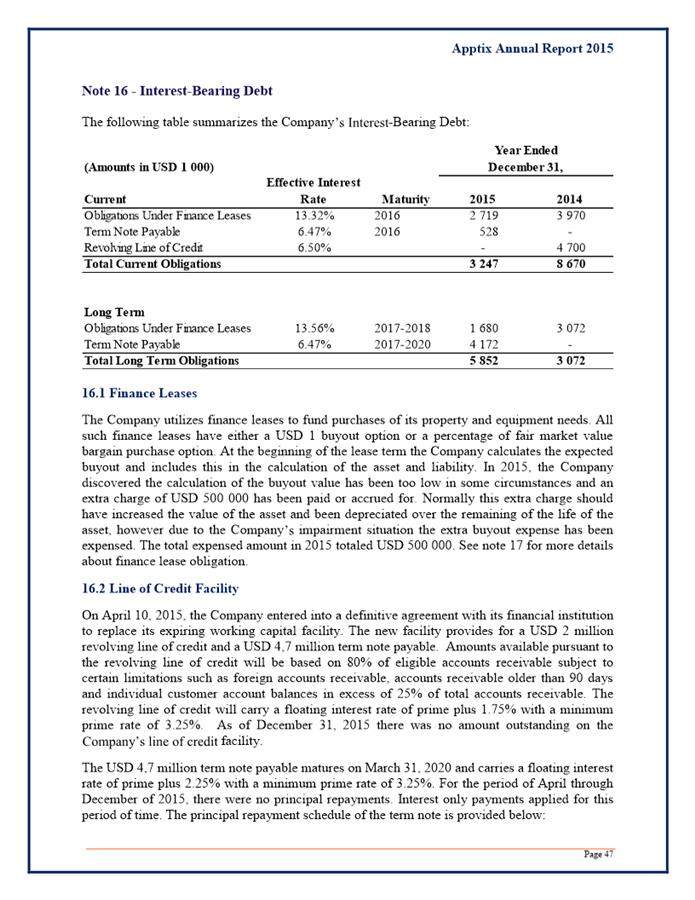

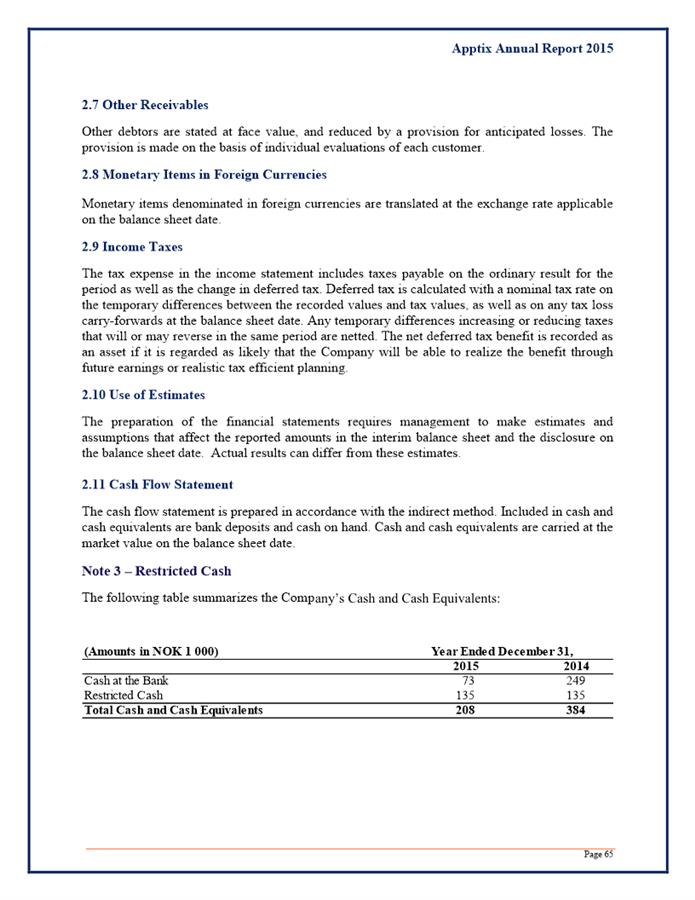

The following table summarizes the Company’s Cash and Cash Equivalents. Cash balances held by the Company’s bank earns interest at a floating rate based on average daily balances:

Note 15 - Interest-Bearing Debt

The following table summarizes the Company’s Interest-Bearing Debt:

15.1 Finance Leases

The Company utilizes finance leases to fund purchases of its property and equipment needs. All such finance leases have either a USD 1 buyout option or a percentage of fair market value bargain purchase option. At the beginning of the lease term the Company calculates the expected buyout and includes this in the calculation of the asset and liability.

15.2 Line of Credit Facility

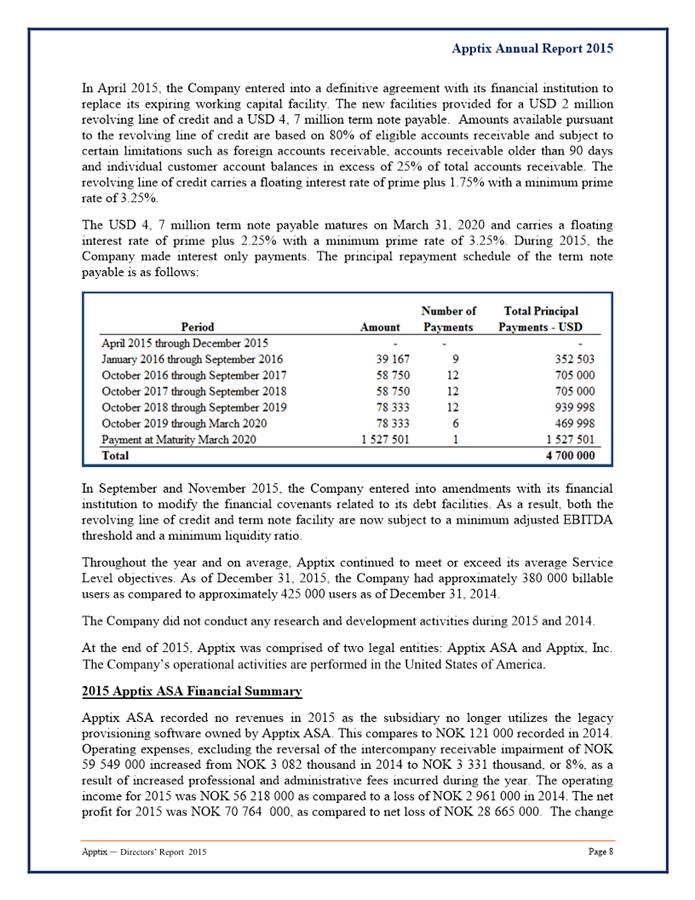

On April 10, 2015, the Company entered into a definitive agreement with its financial institution to replace its expiring working capital facility. The new facility provides for a USD 2 million revolving line of credit and a USD 4,7 million term note payable. Amounts available pursuant to the revolving line of credit will be based on 80% of eligible accounts receivable subject to certain limitations such as foreign accounts receivable, accounts receivable older than 90 days and individual customer account balances in excess of 25% of total accounts receivable. The revolving line of credit will carry a floating interest rate of prime plus 1.75% with a minimum prime rate of 3.25%. As of September 30, 2016 there was no amount outstanding on the Company’s line of credity facility.

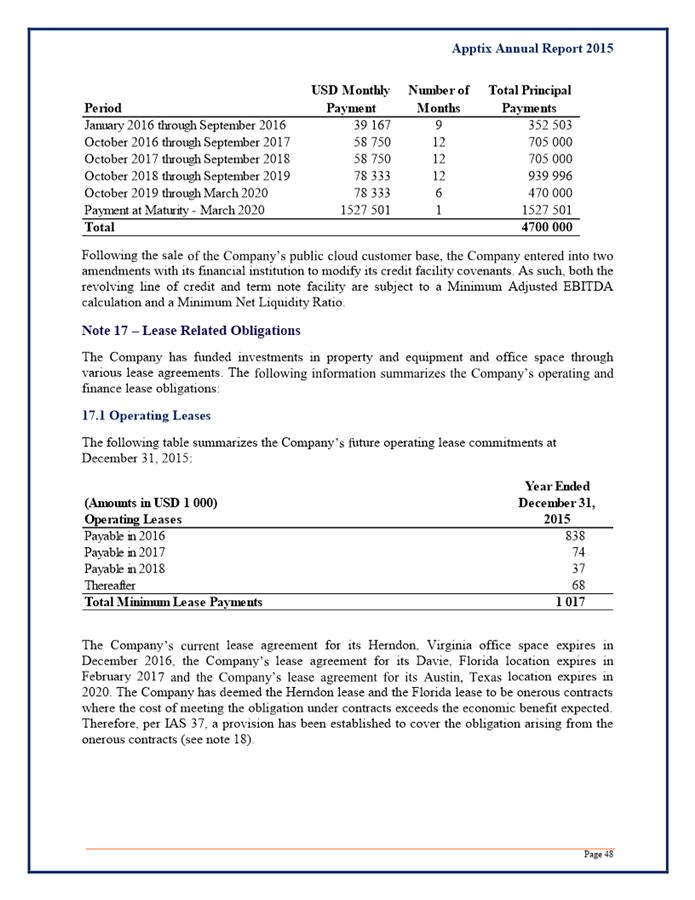

The USD 4,7 million term note payable matures on March 31, 2020 and carries a floating interest rate of prime plus 2.25% with a minimum prime rate of 3.25%. The principal repayment schedule of the term note is provided below:

Following the sale of the Company’s public cloud customer base, the Company entered into two amendments with its financial institution to modify its credit facility covenants. As such, both the revolving line of credit and term note facility are subject to a Minimum Adjusted EBITDA calculation and a Minimum Net Liquidity Ratio.

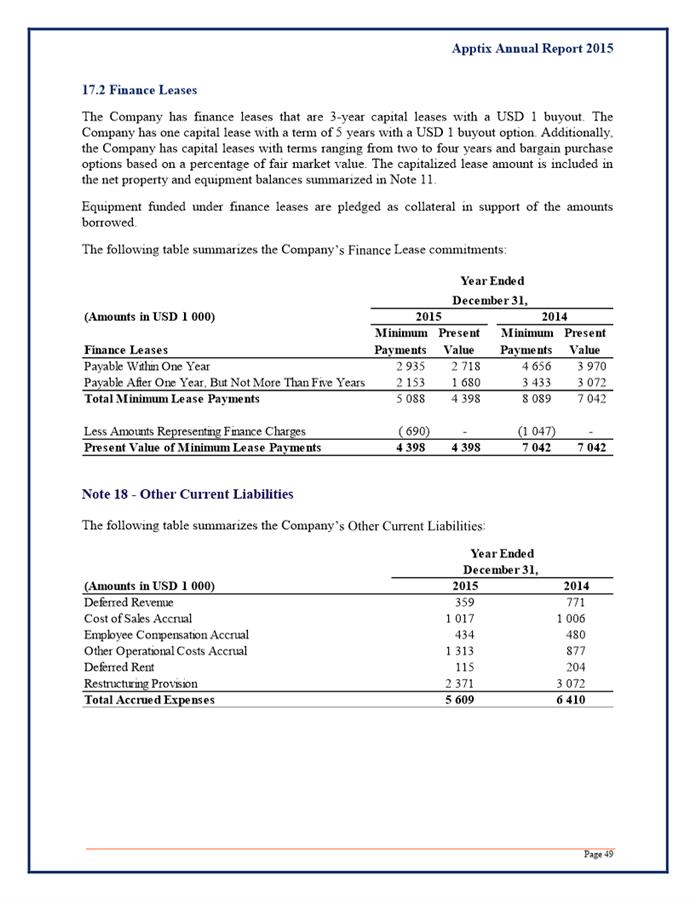

Note 16 – Lease Related Obligations

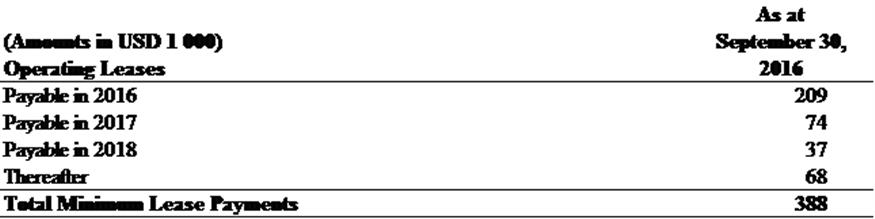

The Company has funded investments in property and equipment and office space through various lease agreements. The following information summarizes the Company’s operating and finance lease obligations:

16.1 Operating Leases

The following table summarizes the Company’s future operating lease commitments at September 30, 2016:

The Company’s current lease agreement for its Herndon, Virginia office space expires in December 2016, the Company’s lease agreement for its Davie, Florida location expires in February 2017 and the Company’s lease agreement for its Austin, Texas location expires in 2020. The Company has deemed the Herndon lease and the Florida lease to be onerous contracts where the cost of meeting the obligation under contracts exceeds the the economic benefit expected. Therefore, per IAS 37, a provision has been established to cover the obligation arising from the onerous contracts.

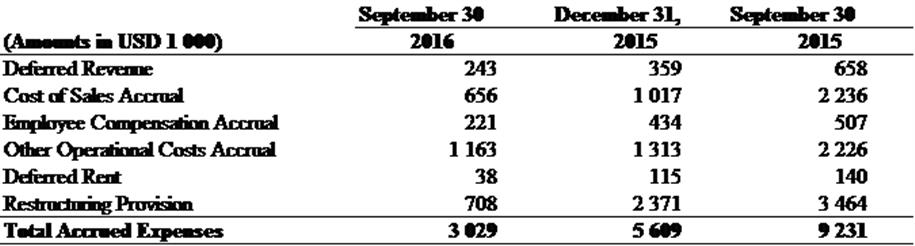

Note 17 - Other Current Liabilities

The following table summarizes the Company’s Other Current Liabilities:

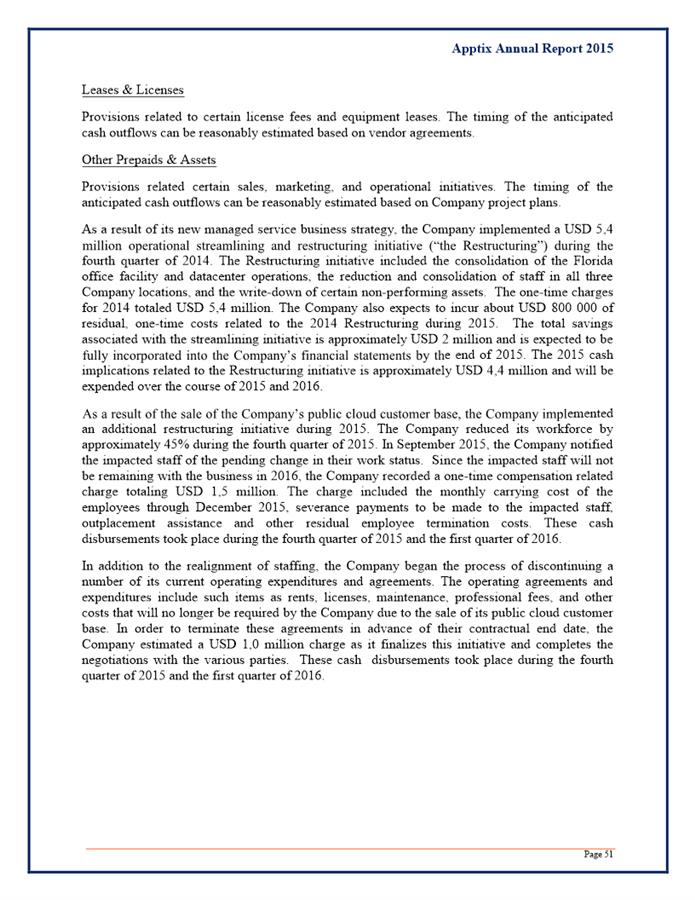

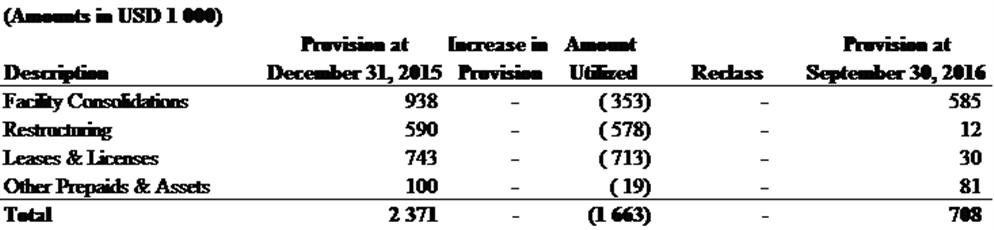

Restructuring Provision

The Company incurred USD 2,5 and 5,4 million of one-time charges in 2015 and 2014 related to the Company’s Operational Streamlining and Restructuring Initiatives. Included in the December 31, 2015 and 2014 Accrued Expenses balance was the remaining provision of USD 2,4 and 3,1 million associated with the Operational Streamlining and Restructuring Initiatives.

The table below summarizes the activity related to the restructuring provision:

Leadership Changes

Provisions related to severance agreements associated with former executive management pursuant to contractual employment agreements. Anticipated cash outflows are based on terms of employment agreements.

Facility Consolidations

Provisions related to the shut down and consolidation of the Company’s Florida office space and Florida datacenter. The timing of the cash flows can be reasonably estimated based on Company’s defined project plans.

Restructuring

Provisions related to severance payments, outplacement assistance or relocation assistance associated with the Company’s facility consolidations. The anticipated cash outflows can be reasonably estimated based on the Company’s defined project plans.

Leases & Licenses

Provisions related to certain license fees and equipment leases. The timing of the anticipated cash outflows can be reasonably estimated based on vendor agreements.

Other Prepaids & Assets

Provisions related certain sales, marketing, and operational initiatives. The timing of the anticipated cash outflows can be reasonably estimated based on Company project plans.

As a result of the sale of the Company’s public cloud customer base, the Company implemented an additional restructuring initative during 2015. The Company reduced its workforce by approximately 45% during the fourth quarter of 2015. In September 2015, the Company notified the impacted staff of the pending change in their work status. Since the impacted staff will not be remaining with the business in 2016, the Company recorded a one-time compensation related charge totaling USD 1,5 million. The charge included the monthly carrying cost of the employees through December 2015, severance payments to be made to the impacted staff, outplacement assistance and other residual employee termination costs. These cash disbursements took place during the fourth quarter of 2015 and the first quarter of 2016.

In addition to the realignment of staffing, the Company began the process of discontinuing a number of its current operating expenditures and agreements. The operating agreements and expenditures include such items as rents, licenses, maintenance, professional fees, and other costs that will no longer be required by the Company due to the sale of its public cloud customer base. In order to terminate these agreements in advance of their contractual end date, the Company estimated a USD 1,0 million charge as it finalizes this initiative and completes the negotiations with the various parties. These cash disbursements took place during the fourth quarter of 2015 and the first quarter of 2016.

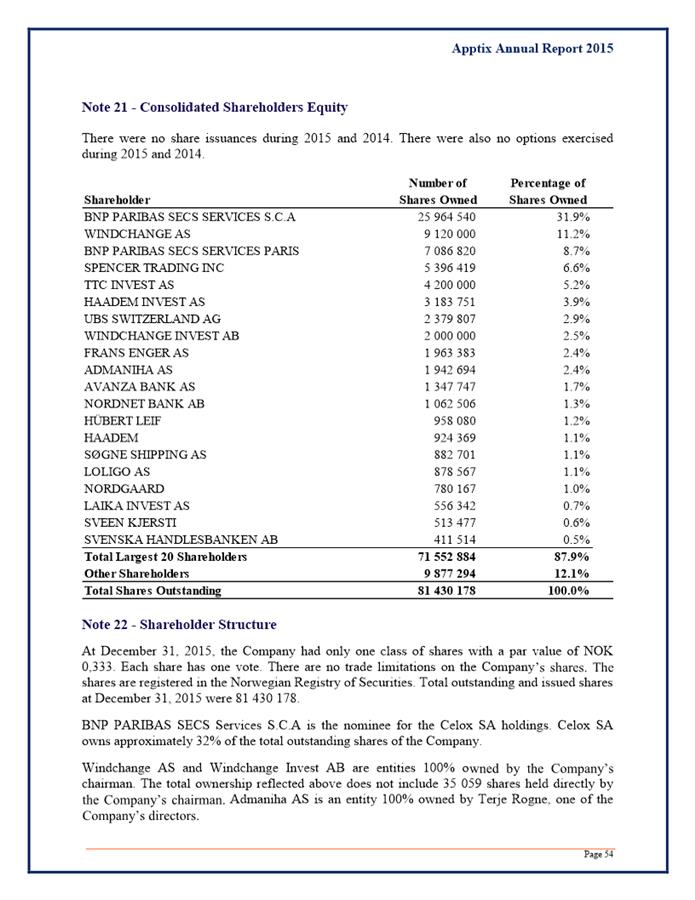

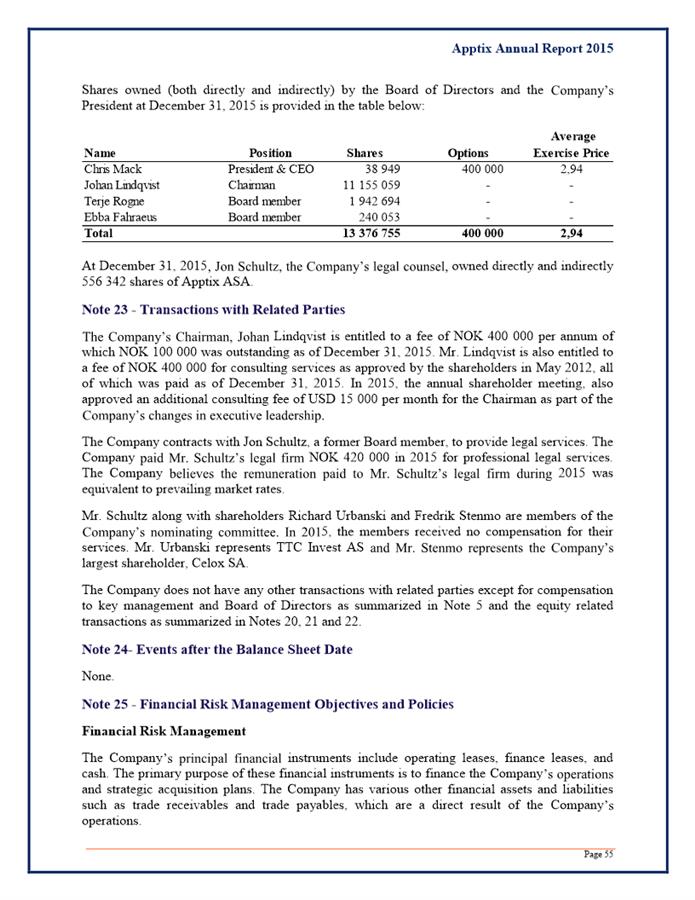

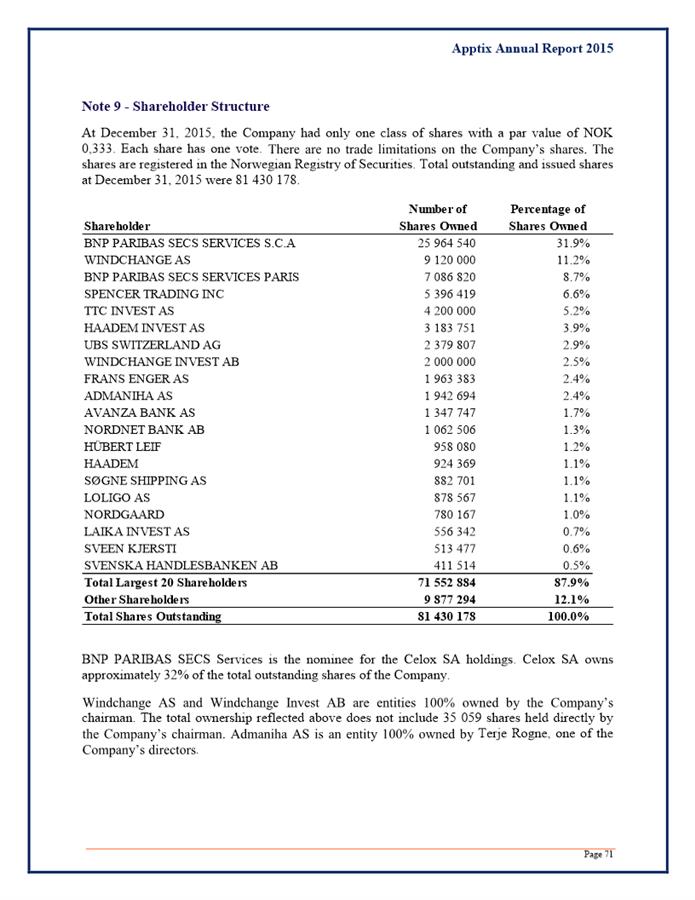

Note 18 - Shareholder Structure

At September 30, 2016, the Company had only one class of shares with a par value of NOK 0,333. Each share has one vote. There are no trade limitations on the Company’s shares. The shares are registered in the Norwegian Registry of Securities. Total outstanding and issued shares at September 30, 2016 were 81 430 178.

Note 19 - Transactions with Related Parties

The Company’s Chairman, Johan Lindqvist is entitled to a director fee of NOK 400 000 per annum of which NOK 100 000 was outstanding as of September 30, 2016. Mr. Lindqvist is also entitled to a fee of NOK 400 000 for consulting services as approved by the shareholders in May 2012. In 2015, the annual shareholder meeting, also approved an additional consulting fee of USD 15 000 per month for the Chairman as part of the Company’s changes in executive leadership.

Note 20 - Events after the Balance Sheet Date

On November 14, 2016 Apptix ASA signed and closed a Stock Purchase Agreement (“SPA”) with Fusion for the sale of Apptix, Inc. (the “Company”), it’s only subsidiary and business operations.

Fusion is a leading provider of integrated cloud solutions to small, medium and large businesses. Fusion’s advanced, proprietary service platform enables the integration of leading edge solutions in the cloud, including cloud voice and unified communications, contact center, cloud connectivity, cloud computing and additional cloud services such as storage and security. Fusion is listed on the NASDAQ Capital Market under ticker FSNN. The Company will be a wholly-owned subsidiary of Fusion and will be a major component of Fusion’s cloud-based Business Services division.

Apptix ASA was paid USD 23.0 million in cash at closing (before any transaction related expenses). Apptix ASA also received a total of 2,997,926 shares of Fusion common stock representing 19.9% of the outstanding Fusion common stock immediately prior to closing and 16.6% immediately following the close. Based on the weighted average stock price of the Fusion shares over the past 180 days, the aggregate equity consideration was valued at USD 5.0 million. The transaction was structured as a “debt-free, cash-free” deal whereby Apptix ASA retained the cash balances of the Company at closing of approximately USD 3.7 million. Apptix ASA was also required to satisfy any of the Company’s outstanding funded debt obligations at closing which totaled approximately USD 7.1 million. Additionally, Apptix ASA incurred approximately USD 2.3 million in transaction related fees and expenses in connection with the transaction. There was no escrow adjustment pursuant to the transaction and all indemnifications along with representations & warranties expired with the closing. Apptix ASA will be receiving approximately USD 17.3 million in net cash proceeds or approximately NOK 1.80 per share. It is the Board of Directors’ intention to distribute NOK 1.65 per share as a dividend in December 2016.

Of the total equity received by Apptix ASA, 50% of the shares, or 1,498,963 shares, were transferred to Apptix ASA at closing with the remaining 50%, or 1,498,963 shares, being transferred to Apptix ASA upon the receipt of two state public utility regulatory commission approvals which are expected within the next 120 days.

The Fusion shares received by Apptix ASA will be subject to Regulation 144 of the United States Securities Act of 1934 restricting the sale of the Fusion stock for up to 12 months following the closing date. Fusion has agreed to file a registration statement with the US Securities and Exchange Commission within 12 months of closing, making the shares freely tradable on the NASDAQ exchange. During this period of time, the shares will be held and owned by Apptix ASA.

Note 21 - Financial Risk Management Objectives and Policies

Financial Risk Management

The Company’s principal financial instruments include operating leases, finance leases, and cash. The primary purpose of these financial instruments is to finance the Company’s operations and strategic acquisition plans. The Company has various other financial assets and liabilities such as trade receivables and trade payables, which are a direct result of the Company’s operations.

It is the Company’s policy not to engage in trading of financial instruments.

The primary risks arising from the Company’s financial instruments are foreign currency risk, credit risk, interest risk and liquidity risk. The Company evaluates its risk exposure in order to determine the potential affect on its business operations by reviewing the products and services provided to the markets the Company serves and the countries in which it conducts business. The Company believes it does not have any significant single concentration of risk.

The policies are summarized below.

Foreign Currency Risk

The Company’s principal operating market is the United States with its functional currency being the US Dollar. The Company has limited operating expense outside of the United States. The Company has limited transactional currency exposure, which results from transactions in a currency other than its functional currency.

Credit Risk

The Company transacts with a wide variety of customers. Most small business customers pay via credit card, dramatically reducing the Company’s credit risk. To ensure that credit risk is managed appropriately, the Company monitors its receivables balance regularly and ceases providing service when customer accounts become significantly overdue. At September 30, 2016, the Company’s maximum credit risk is the carrying value of its trade accounts receivable of 1 789 thousand. The Company believes it does not have any material credit risk associated with trade accounts receivables that are neither past due nor impaired.

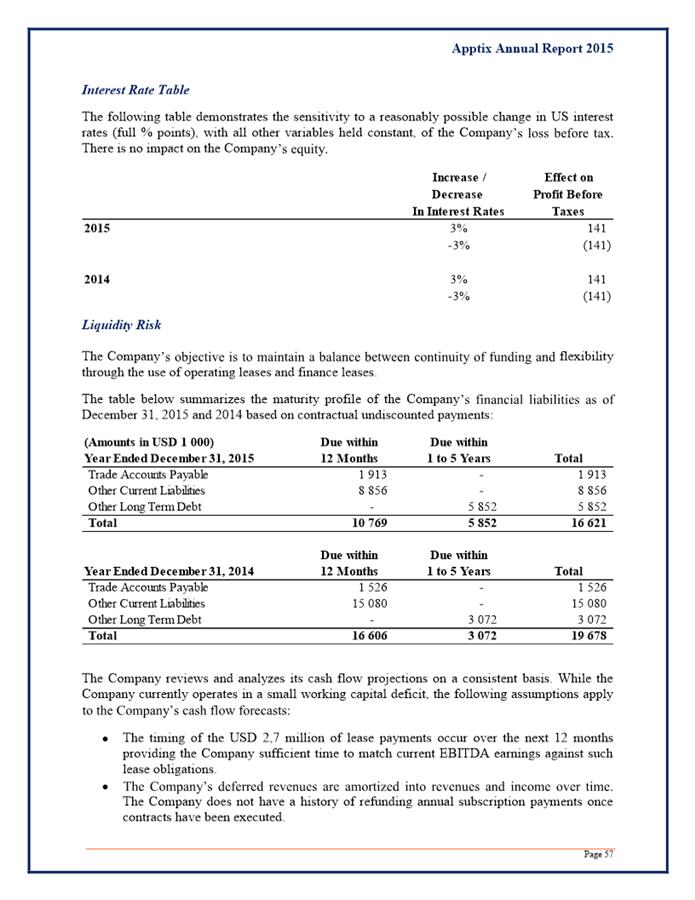

Interest Rate Risk

The Company’s exposure to the risk of interest rate fluctuations relates primarily to the Company’s need to obtain equipment financing for computer hardware and equipment and the Company’s WCLC, as required to support the business. The Company’s lease agreements are primarily fixed rate agreements and not subject to fluctuation while the Company’s WCLC is subject to changes in its financial institution’s prime interest rate. Interest rate fluctuation related to the WCLC is limited to a maximum increase of two percent above the prime interest rate.

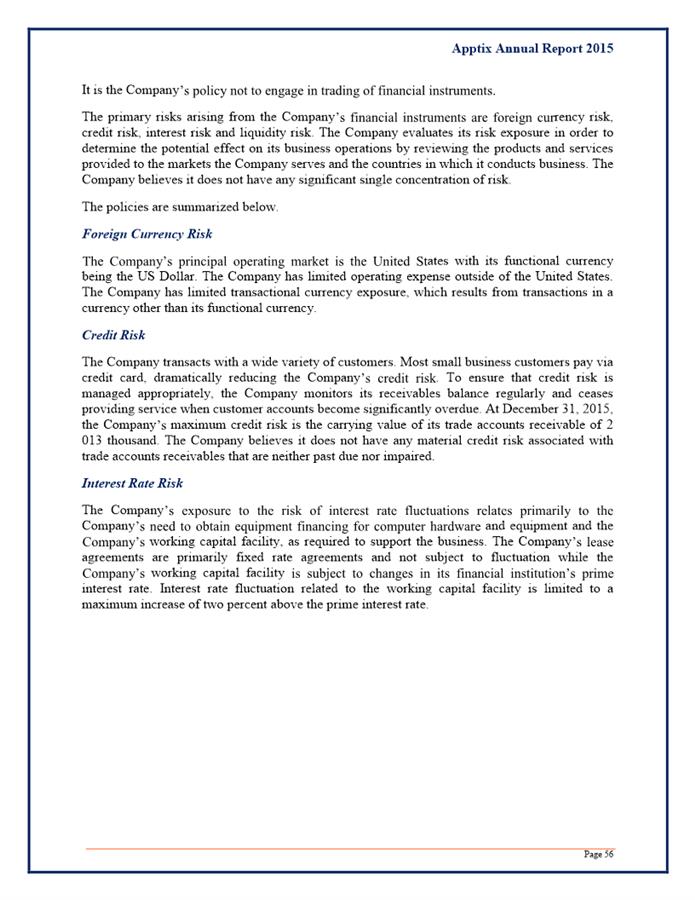

Liquidity Risk

The Company’s objective is to maintain a balance between continuity of funding and flexibility through the use of operating leases and finance leases.

Financial Instruments

The Company’s line of credit facility was secured by a first priority position in all of the assets of the Company except for those assets financed via capital leases. At September 30, 2016, the Company had no amount outstanding under its line of credit facility. The term of the credit facility has been extended through March, 31, 2020 and requires the Company to maintain certain financial covenants such as liquidity ratio (as defined by the financial institution). At September 30, 2016 the Company had USD 4,3 million outstanding under its term loan credit agreement.

Capital Management

The primary objective of the Company’s capital management is to ensure it maintains a strong credit rating and healthy capital ratios in order to support its business and maximize shareholder value. The Company considers both equity and debt financing (i.e. subordinated or convertible debt) as part of the capital resources that it actively manages.

105