SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2021

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

Signed Version |

SECOND AMENDMENT TO THE SHAREHOLDERS' AGREEMENT OF BRK INVESTIMENTOS PETROQUÍMICOS S.A. AND BRASKEM S.A.

By this private instrument, entered into between the undersigned parties, namely, on the one hand:

(1) NOVONOR SA – UNDER JUDICIAL RESTRUCTURING PROCEEDINGS, current name of Odebrecht SA – under judicial restructuring proceedings, a joint-stock company, headquartered at Av. Luis Viana, 2841 - Ed. Odebrecht, Paralela Neighborhood, 41730-900, city of Salvador, state of Bahia, registered with the CNPJ/ME under No. 05.144.757/0001-72 (“Novonor SA”) ; and

(2) NSP INVESTIMENTOS S.A. - UNDER JUDICIAL RESTRUCTURING PROCEEDINGS, current name of Odebrecht Serviços e Participações S.A. – under judicial restructuring proceedings, a joint-stock company, headquartered at Rua Lemos Monteiro, 120, 9th floor – Part I, Butantã, city of São Paulo, state of São Paulo, registered with the CNPJ/ME under number 22.606.673/0001-22 (“NSP INV” and, together with Novonor S.A., “Grupo Novonor”); and on the other hand:

(3) PETRÓLEO BRASILEIRO SA - PETROBRAS, a joint-stock company, headquartered in the City of Rio de Janeiro, State of Rio de Janeiro, at Av. República do Chile nº 65, Centro, registered with the CNPJ under nº 33.000.167/0001-01, in this act represented in the form of its bylaws (“Petrobras”); (Novonor Group and Petrobras hereinafter collectively referred to simply as “Parties” or “Shareholders” and, individually and indistinctly, as “Party” or “Shareholder”);

and as intervening consenting:

(4) BRASKEM SA, current name of Copene - Petroquímica do Nordeste SA, a joint-stock company, headquartered in the municipality of Camaçari, State of Bahia, at Rua Eteno nº 1.561, Complexo Basico, Pólo Petroquímico, registered with the CNPJ under nº 42.150.391/ 0001-70, herein represented in accordance with its bylaws (“Braskem” or “Company”);

WHEREAS:

| (i) | Novonor SA, NOVONOR SERVIÇOS E PARTICIPAÇÕES SA - under judicial restructuring proceedings, current corporate name Odebrecht Serviços e Participações SA (“NSP”), PETROBRAS QUÍMICA SA – PETROQUISA, a joint-stock company, headquartered in the City of Rio de Janeiro, State of Rio de Janeiro, at Avenida República do Chile nº 65, Centro, registered with the CNPJ under nº 33.795.055/0001-94 (“Petroquisa”) and Petrobras signed on February 8, 2010 Shareholders' Agreement of BRK Investimentos Petroquímicas SA, a joint-stock company, headquartered in the City of São Paulo, State of São Paulo, at Avenida Rebouças, nº 3970, 32º andar-parte, Pinheiros, CEP 05402-600, registered with the CNPJ under nº 11.395.617/ 0001-70 (“BRK”) and Braskem (“Shareholders' Agreement”); |

Signed Version |

| (ii) | PETROQUISA was incorporated on 01/27/2012 by Petrobras, which succeeded it in all its rights and obligations; |

| (iii) | BRK was incorporated into NSP on 06/30/2012; |

| (iv) | NSP transferred to NSP INV on 12/31/2018 the equity interest in Braskem through the partial spin-off agreement, with NSP INV becoming a direct shareholder of Braskem, replacing NSP in the Shareholders' Agreement; |

(v) | considering that the Parties are studying certain measures to improve Braskem's governance, the Parties wish, pursuant to and for the purposes of Article 118 of Law 6.404, of December 15, 1976, (“Corporate Law by Shares"), enter into this second amendment to the Shareholders' Agreement ("Second Amendment to the Shareholders' Agreement") and, thereby, modify the related obligations to preemptive rights in new opportunities and petrochemical businesses provided for in Clause Nine, pursuant to this Second Amendment to the Shareholders' Agreement. |

1. DEFINITIONS

| 1.1. | Definitions. Except as otherwise provided herein, terms beginning with capital letters that are not defined herein shall have the meanings assigned to them in the Shareholders' Agreement. |

| 2. | PREEMPTIVE RIGHTS IN NEW OPPORTUNITIES AND PETROCHEMICAL BUSINESS |

| 2.1. | The Parties agree to add items 9.3 and 9.3.1 to Clause 9 PREEMPTIVE RIGHTS IN NEW OPPORTUNITIES AND PETROCHEMICAL BUSINESS of the Shareholders' Agreement, in the following terms: |

“9.3 The Parties agree that, if the Company's migration to the trading segment of the Novo Mercado of B3 S.A. – Brasil, Bolsa, Balcão is not implemented, the rights and obligations of the Parties and the Company provided for in this Clause 9 - PREEMPTIVE RIGHTS IN NEW OPPORTUNITIES AND PETROCHEMICAL BUSINESS of the Shareholders' Agreement will cease to be in force, losing all its effects, as of October 31, 2024.

9.3.1. If revoked CLAUSE 9 - RIGHT TO PREFERENCE IN NEW BUSINESS OPPORTUNITIES PETROCHEMICALS of the Shareholders' Agreement, pursuant to Clause 9.3 above, the Parties undertake to sign, subject to the approval by the Company's governance, the termination of the COMPERJ Memorandum of Understanding entered into on 12/14/2011 between Petrobras, Petroquisa, Braskem, Novonor and NSP.”

Signed Version |

| 3. | GENERAL TERMS |

| 3.1. | Ratification. Except as amended in this Second Amendment, all general terms and conditions of the Shareholders' Agreement remain in full force and effect, being hereby ratified. |

| 3.2. | Applicable law. This Second Amendment will be governed by and interpreted in accordance with the legislation of the Federative Republic of Brazil. |

| 3.3. | Dispute Resolution. Any conflicts or divergences arising from this Second Amendment to the Shareholders' Agreement will be resolved in accordance with the terms and conditions of Clause 11 - GOVERNING LAW AND VENUE of the Shareholders' Agreement. |

| 3.4. | Filing. This Second Amendment of the Shareholders’ Agreement shall be filed at the Companies’ headquarters and the obligations or liens shall be recorded with the corresponding records, in accordance with and for the purposes of the provisions in article 118 of the Corporation Law, as applicable. |

| 3.5. | General Terms. Apply to this Second Amendment to the Shareholders' Agreement, in all that fits, the general provisions set forth in clause 10 – GENERAL TERMS of the Shareholders' Agreement. |

| 3.6. | Digital signature. The Parties agree that the execution of this Second Amendment to the Shareholders' Agreement may be made in accordance with the provisions of Provisional Measure 2200-2, of August 24, 2001, being certain that the means of proof of authorship and integrity of this instrument is accepted by the Parties as valid. The last Party to sign this Second Amendment to the Shareholders' Agreement shall confirm the completion of the instrument signing process for the purposes of the provisions in paragraph 2 of article 10 of MP 2.200-2. |

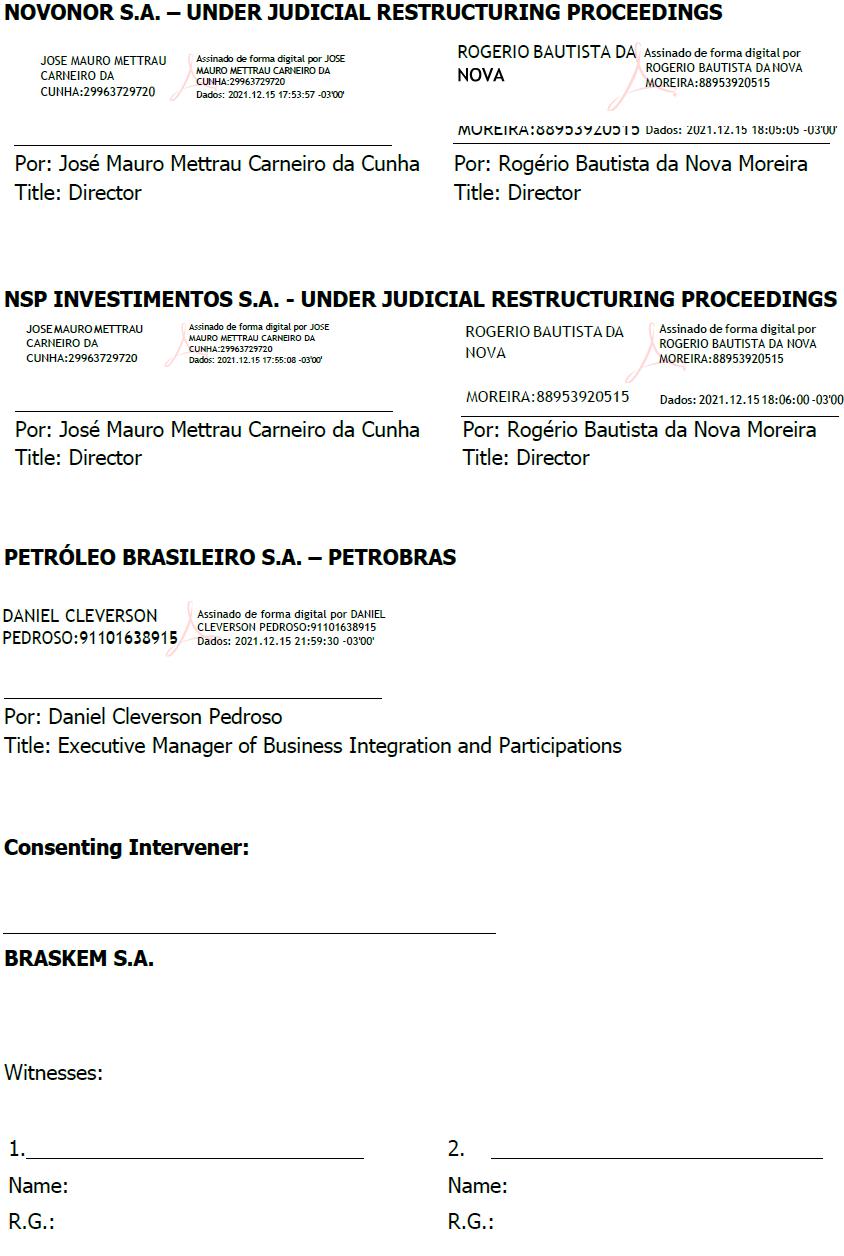

In witness whereof, the Parties and the Company sign the present Second Amendment to the Shareholders' Agreement in the presence of the 2 (two) witnesses undersigned.

São Paulo, 15 de dezembro de 2021.

[signatures on the next page]

Signed Version |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 16, 2021

| BRASKEM S.A. | |||

| By: | /s/ Pedro van Langendonck Teixeira de Freitas | ||

| Name: | Pedro van Langendonck Teixeira de Freitas | ||

| Title: | Chief Financial Officer | ||

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This report on Form 6-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are statements that are not historical facts, and are based on our management’s current view and estimates of future economic and other circumstances, industry conditions, company performance and financial results, including any potential or projected impact of the geological event in Alagoas and related legal proceedings and of COVID-19 on our business, financial condition and operating results. The words “anticipates,” “believes,” “estimates,” “expects,” “plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the potential outcome of legal and administrative proceedings, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting our financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of our management and are subject to a number of risks and uncertainties, many of which are outside of the our control. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors, including the projected impact of the geological event in Alagoas and related legal proceedings and the unprecedented impact of COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders, could cause actual results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the year ended December 31, 2019 filed with the SEC, as well as any subsequent filings made by us pursuant to the Exchange Act, each of which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements in this presentation.