SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2023

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

BRASKEM S.A.

Corporate Taxpayer ID (CNPJ): 42.150.391/0001-70

Company Registry: 29.300.006.939

Publicly Held Company

MATERIAL FACT

PRODUCTION & SALES REPORT

SECOND QUARTER 2023

São Paulo, July 26, 2023 – Braskem S.A. (“Braskem” or “Company”) reports to its shareholders and the market its Production & Sales Report for the second quarter of 2023. Note that the information herein is based on preliminary data and that figures were not revised by the independent auditor of the Company.

For more information, contact Braskem’s Investor Relations Department by calling +55 (11) 3576-9531 or emailing braskem-ri@braskem.com.br.

Contents

| 1. OPERATIONAL OVERVIEW 2Q23 | 2 |

| 2. INDUSTRIAL PERFORMANCE 2Q23 | 2 |

| 2.1 BRAZIL | 2 |

| 2.2 UNITED STATES & EUROPE | 3 |

| 2.3 MEXICO | 3 |

| 3. SALES PERFORMANCE 2Q23 | 4 |

| 3.1 BRAZIL | 4 |

| 3.2 UNITED STATES & EUROPE | 5 |

| 3.3 MEXICO | 6 |

| 1. | OPERATIONAL OVERVIEW 2Q23 |

In the second quarter of 2023, the global demand scenario remained impacted mainly by (i) the lower level of global consumption as a result of the high interest rates and the persistent inflationary pressure; (ii) the de-stocking effect in the converters chain; and (iii) the recovery of industrial activity in China below market expectations.

Besides the lower demand observed during the period, the new PE and PP capacities coming online kept impacting petrochemical spreads in the international market. In this regard, the Company’s operational performance in 2Q23 was affected when compared to 1Q23.

| 2. | INDUSTRIAL PERFORMANCE 2Q23 |

| 2.1 | BRAZIL |

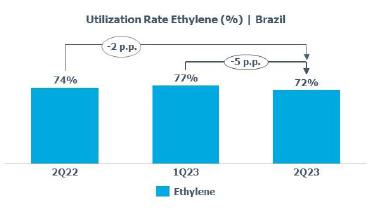

Average utilization rate of petrochemical crackers: decreased compared to 1Q23 (-5 p.p.) due to (i) the production adjustment to the lower demand in the period; and (ii) short unscheduled shutdowns and feedstock supply restrictions at the Rio de Janeiro and Rio Grande do Sul petrochemical complexes. Compared to 2Q22, the average utilization decreased by 2 p.p. due to the production adjustment regarding lower spreads in the international market due to the weaker global demand.

Average utilization rate of green ethylene: increased compared to 1Q23 (+75 p.p.) and decreased compared to 2Q22 (-13 p.p.) due to the process of operations resumption after concluding the project for expanding by 30% the current production capacity of the green ethylene unit at the Rio Grande do Sul Complex.

| 2 |

|

| 2.2 | UNITED STATES & EUROPE |

Average utilization rate of PP plants: stable in relation to 1Q23 and 2Q22, explained by the lower production volume in the United States due to the scheduled maintenance shutdown at the PP plants between April and May, which was partially offset by the higher production volume in Europe explained by higher feedstock supply, given the unscheduled shutdown at suppliers in 1Q23 and 2Q22.

| 2.3 | MEXICO |

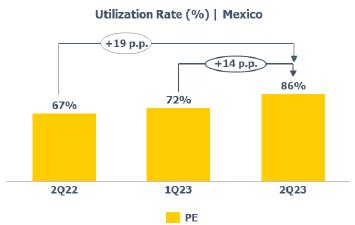

Average utilization rate of PE plants: increased compared to 1Q23 (+14 p.p.) and 2Q22 (+19 p.p.) due to (i) higher ethane supply by Pemex, which reached an average of 36,000 barrels per day, above the contractual volume; and (ii) higher supply of imported ethane, which complemented the feedstock supply with an average of 21,000 barrels per day under the Fast Track solution.

| 3 |

|

| 3. | SALES PERFORMANCE 2Q23 |

| 3.1 | BRAZIL |

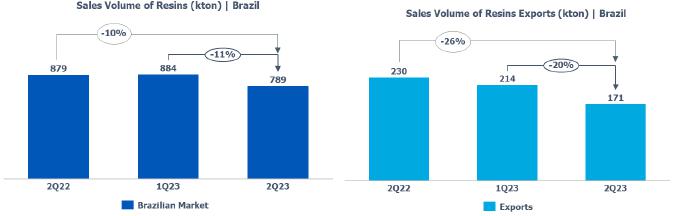

Resin sales volume: in the Brazilian market, resin sales volume decreased from 1Q23 (-11%), in line with the contraction of the Brazilian resin market, due to the lower demand for PE, PP, and PVC, mainly from the packaging, household appliances, and hospital materials. Compared to 2Q22, resin sales volume in the Brazilian market decreased (-10%), reflecting the higher imports of PE, PP, and PVC in the period.

Exports decreased in 2Q23 in relation to 1Q23 (-20%) and 2Q22 (-26%) due to fewer opportunities in the international market, given high inventories in the global chain resulting from lower demand in the period.

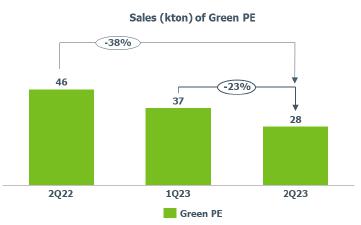

Green PE sales volume: decreased in relation to 1Q23 (-23%) and compared with 2Q22 (-38%) as a result of the effect of the Green PE restocking process following the conclusion of the scheduled maintenance shutdown for the conclusion of the project for expanding the current production capacity of the green ethylene.

| 4 |

|

Main chemicals sales volume[1]: in the Brazilian market, sales volume declined in relation to 1Q23 (-13%) and 2Q22 (-16%), mainly due to the lower sales volume (i) of ethylene and benzene given the lower demand for derivatives of these products; and (ii) of gasoline due to lower product availability for sale.

Exports increased compared to 1Q23 (+36%) and 2Q22 (+62%), mainly due to better commercial opportunities in the international market.

| 3.2 | UNITED STATES & EUROPE |

PP sales volume: increased compared to 1Q23 (+3%), explained by higher PP sales volume in the United States due to higher demand after the de-stocking process in the chain during 1Q23. In relation to 2Q22, sales volume increased (+2%), mainly due to higher product availability for sale in Europe, given the higher utilization rate in the period.

[1] Main chemicals refer to: ethylene, propylene, butadiene, cumene, gasoline, benzene, toluene and paraxylene due to the representation of these products in the segment’s net revenue.

| 5 |

|

| 3.3 | MEXICO |

PE sales volume: increased in relation to 1Q23 (+8%) and 2Q22 (+13%) due to the higher product availability for sale given the higher utilization rate in the period.

| 6 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 26, 2023

| BRASKEM S.A. | |||

| By: | /s/ Pedro van Langendonck Teixeira de Freitas | ||

| Name: | Pedro van Langendonck Teixeira de Freitas | ||

| Title: | Chief Financial Officer | ||

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This Material Fact notice may contain forward-looking statements. These statements are not historical facts but are based on the current view and estimates of the Company's management regarding future economic and other circumstances, industry conditions, financial performance, and results, including any potential or projected impact from the geological event in Alagoas and related legal procedures on the Company's business, financial condition and operating results. The words “project,” “believe,” “estimate,” “expect,” “plan” and other similar expressions, when referring to the Company, are used to identify forward-looking statements. Statements related to the possible outcome of legal and administrative proceedings, implementation of operational and financing strategies and investment plans, guidance on future operations, as well as factors or trends that affect the financial condition, liquidity or operating results of the Company are examples of forward-looking statements. Such statements reflect the current views of the Company's management and are subject to various risks and uncertainties, many of which are beyond the Company’s control. There is no guarantee that the events, trends or expected results will actually occur. The statements are based on various assumptions and factors, including general economic and market conditions, industry conditions and operating factors. Any change in these assumptions or factors, including the projected impact from the geological event in Alagoas and related legal procedures and the unprecedented impact on businesses, employees, service providers, shareholders, investors and other stakeholders of the Company could cause actual results to differ significantly from current expectations. For a comprehensive description of the risks and other factors that could impact any forward-looking statements in this document, especially the factors discussed in the sections, see the reports filed with the Brazilian Securities and Exchange Commission (CVM). This Material Fact is not an offer of securities for sale in Brazil. No securities may be offered or sold in Brazil without being registered or exempted from registration, and any public offering of securities carried out in Brazil will be made by means of a prospectus that may be obtained from Braskem and which will contain detailed information on Braskem and management, as well as its financial statements.