UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006

Commission File No.: 029916

AMERICAN BONANZA GOLD CORP.

(Formerly “American Bonanza Gold Mining Corp.”)

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 305 - 675 West Hastings Street, Vancouver, British Columbia, Canada, V6B 1N2

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares, Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as

of December 31, 2006:100,628,976 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes [ ] No [X]

If this is an annual or transition report, indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that

the registrant was required to file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-

accelerated filer.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

- 1 -

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [X] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

- 2 -

GLOSSARY OF TERMS

The following is a glossary of certain mining and other terms used in this Annual Report:

“AMEC” means AMEC E & C Services Inc.;

“Arrangement” means the arrangement among the Corporation, Old Bonanza, Taurus, Fairstar and FairstarSub relating to the current organizational structure of the Corporation, pursuant to the terms and subject to the conditions set out in the Plan of Arrangement, as amended and supplemented, as more particularly described in this document;

“Arrangement Agreement” means the agreement dated December 21, 2004 and amended on February 21, 2005 among the Corporation, Old Bonanza, Taurus, Fairstar and FairstarSub relating to the Arrangement;

“BCA” means the Business Corporation Act (British Columbia), as amended;

“BLEG” means bulk leach extractable gold;

“Corporation” and “New Bonanza” mean American Bonanza Gold Corp., a corporation incorporated under the BCA on December 10, 2004 as 0710887 B.C. Ltd., and its subsidiaries, unless the context suggests otherwise;

“EDGAR” means the U.S. Securities and Exchange Commission’s Electronic Data Gathering, Analysis, and Retrieval System available for viewing publicly filed documents at www.sec.gov;

“Exploration Stage Corporation” means a company engaged in the search for mineral deposits (reserves) which are not in either the development or production stages;

“Fairstar” means Fairstar Explorations Inc., a corporation incorporated under the laws of Canada;

“FairstarSub” means 0710882 B.C. Ltd., a corporation incorporated under the laws of the Province of British Columbia;

“NI 43-101” means Canadian National Instrument 43-101, Companion Policy 43-101CP, and Form 43-101F1, “Standards of Disclosure for Mineral Projects”, which governs all oral and written disclosure of scientific or technical information, including disclosure of a mineral resource or reserve, made by or on behalf of a Canadian company in respect of a mineral project. NI 43-101 uses for the terms “mineral resource”, “inferred mineral resource”, “indicated mineral resource”, “measured mineral resource”, “mineral reserve”, “probable mineral reserve” and “proven mineral reserve” the meanings ascribed to those terms by the Canadian Institute of Mining, Metallurgy and Petroleum, as the CIM Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by CIM Council on August 30, 2000, as those definitions may be amended from time to time by the Canadian Institute of Mining, Metallurgy and Petroleum. Those definitions are reproduced below in this Glossary for the convenience of readers;

“NPI” means net profits interest, or, the amount payable from the net profit produced by the mine;

“NSR” means net smelter royalty, or, the amount payable from the precious metal produced by the mine after smelting has removed most of the impurities;

- 3 -

“Old Bonanza” means American Bonanza Gold Mining Corp., a corporation incorporated under the BCA which was, immediately prior to the completion of the Arrangement, the parent company of the Corporation;

“Plan of Arrangement” means the plan of arrangement pursuant to the Arrangement Agreement relating to the current organizational structure of the Corporation as more particularly described in this document;

“Royalty” means a payment schedule by which payments are calculated based on a percentage of the value of the mineral produced;

“SEDAR” means the Canadian System for Electronic Document Analysis and Retrieval available for viewing publicly filed documents at www.sedar.com;

“Taurus” means International Taurus Resources Inc., a corporation incorporated pursuant to the laws of the Province of British Columbia;

“TSX” means the Toronto Stock Exchange;

- 4 -

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the U.S.Private Securities Litigation Reform Act of 1995. These forward-looking statements are not guarantees of the Corporation’s future operational or financial performance and are subject to risks and uncertainties. When used in this Annual Report, the words “estimate”, “intend”, “expect”, “anticipate” and similar expressions are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these statements, which speak only as of the date of this Annual Report. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated in such forward-looking statements.

Actual operational and financial results may differ materially from the Corporation’s expectations contained in the forward-looking statements due to various factors, many of which are beyond the control of the Corporation. These factors include, but are not limited to, the need for additional financing to fully execute the Corporation’s business plan, adverse technical factors associated with exploration of the Corporation’ properties, changes in Canadian or U.S. tax or other laws or regulations, material changes in capital expenditures, as well as the risks and uncertainties described in the section entitled “Risk Factors” set forth in Item 3 of this Annual Report.

- 5 -

GLOSSARY OF TECHNICAL TERMS

| Aeolian | Deposits arranged/transported by the wind, due to the erosive action of the wind, such as sand and other loose materials. |

| Ag | Used as the abbreviation for silver. |

| Albite | One of the components of plagioclase. |

| Alteration | Chemical and mineralogical changes in a rock mass resulting from reaction with hydrothermal fluids or changes in pressure and temperature. |

| Anomalous | Adjective describing a sample, location or area at which either (i) the concentration of an element(s) or (ii) a geophysical measurement is significantly different from (generally higher than) the average background concentrations in an area. Though it may not constitute mineralization, an anomalous sample or area may be used as a guide to the possible location of mineralization. |

| Anomaly | An area defined by one or more anomalous points. |

| Argillaceous | Rocks or substances composed of clay, or having a notable proportion of clay in their composition. |

| Argillite | A sedimentary rock composed of compacted mud and clay particles. |

| Argillic | Pertaining to clay or clay minerals. |

| Assay | Quantitative test of minerals and ore by chemical and/or fire techniques. |

| Assemblage | A biostratigraphic unit defined and identified as a group of associated fossils. |

| Au | Aurum (Latin for gold) used as an abbreviation for gold. |

| Axial trace | The intersection of the axial plane of a fold with the surface of the earth or any other specified surface. |

| Azurite | A deep blue common secondary mineral. |

| Barite | A mineral. The principal ore of barium. |

| Biotite | Common rock-forming mineral, dark brown to green in colour. |

| BLM | Bureau of Land Management, the United States federal lands administrative authority. |

| Bonanza-grade | More than 34 grams of gold per tonne or more than one troy ounce of gold per ton. |

| Breccia | A coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix. |

| Bulk sample | A large sample consisting of tons or hundreds of tons which is then milled and the grade computed from the results. |

| Bull quartz | White, coarse-grained, barren quartz. |

| C-Zone | North-east of the open pit at the Copperstone property. |

- 6 -

| Calcite | A mineral, calcium carbonate. One of the commonest minerals. The principal constituent of limestone. |

| Carbonate vein | A vein consisting chiefly of carbonate minerals, such as limestone or dolomite. |

| Chalcopyrite | Copper pyrites. A mineral. An important ore of copper. |

| Channel-sample | Material sampled from a groove cut across a rock exposure. |

| Chlorite | Silicates closely related to micas. Common in low-grade metamorphic rocks. |

| Chrysocolla | A mineral. Usually in green to blue-green masses. |

| Crosscut | A horizontal opening driven across the direction of the main workings. |

| D Zone | North of the open-pit at the Copperstone property. |

| Decline | A passage or tunnel driven at a decline from the surface for the working of a mine. |

| Deformation | Any change in the original form or volume of rock masses produced by tectonic forces; folding, faulting, and solid flow are common modes of deformation. |

| Dip | The acute angle that a rock surface makes with a horizontal plane. Direction of dip is always perpendicular to strike. |

| Doré | Unparted gold and silver poured into moulds when molten to form buttons or bars. |

| Drift | Workings driven in or near a mineralized zone and parallel to the course of the vein or the long dimension of the mineralized zone. |

| Drifting | Proceeding with mining to create a drift. |

| Electron | The elementary particle of mass 9 x 10-28 grams and unit electrical charge. |

| Epidote | A common mineral in metamorphic rocks. |

| Fabric | The orientation in space of the elements of which a rock is composed |

| Face | The surface exposed by excavation. The working face, front, or forehead is the face at the end of the tunnel heading, or at the end a full-size excavation, |

| Fault or Block Fault | A fracture in a rock across which there has been displacement. Block faults are usually steep, and break the earth’s crust into “blocks” that are displaced vertically and/or laterally relative to each other. |

| Fe | Chemical symbol for the element iron. |

| Felsic | Mnemonic term derived from (fe) for feldspar, (l) for lenads of feldspathoids, and (s) for silicia and applied to light-coloured rocks containing an abundance of one or all of these constituents. Also applied to the minerals themselves, such as quartz, feldspars, feldspathoids and muscovite. |

| ft | foot or feet, as the context requires. |

| Gabbroic | Plutonic rock consisting of calcic plagioclase and clinopyroxene, with or without orthopyroxene and olivine. Apatite and magnetite or ilmenite are common accessories. Loosely used: Any coarse-grained igneous rock. |

- 7 -

| Geochemistry | The chemistry of the earth and its rocks, minerals, etc. |

| Geophysical Exploration | Exploring for minerals or determining the nature of Earth materials by measuring a physical property of the rocks and interpreting the results in terms of geologic features or the economic deposits sought. Physical measurements may be taken on the surface, in boreholes, or from airborne or satellite platforms. |

| Glacio-lacustrine | Produced by or belonging to lakes formed by or in relationship to glaciers. |

| Gneiss | A coarse-grained rock in which bands rich in granular minerals alternate with bands in which schistose minerals predominate. |

| Gouge | A layer of soft material along the wall of a vein. Finely abraded material occurring between the walls of a fault. |

| Grade | The amount of valuable mineral in each tone of ore, expressed as ounces per ton or grams per tonne for precious metal and as a percentage by weight for other metals. |

| Granitic | Of, pertaining to, or composed of, granite or granite like rock. |

| Greywacke | Dark, coarse-grained sandstone, usually with an admixture of clay. |

| g/t | Grams per tonne. |

| Hanging wall | The rock on the upper side of a mineral vein or deposit. |

| Hematite | A mineral. The principal ore of iron. |

| Highwall | The unexcavated face of exposed overburden and coal or ore in an opencast mine, or the face or bank on the uphill side of a contour strip mine excavation. |

| Homoclinal | A structural condition in which the beds dip uniformly in one direction. |

| Hydrothermal | Of or pertaining to heated water, to the action of heated water, or to the products of the action in heated water. |

| Intrusion | A body of igneous that involves other rock. |

| Intrusive | A rock formed by the process of emplacement of magma in pre-existing rock. |

| IP | Induced polarization survey. |

Kriging

| 1. A weighted, moving-average interpolation method in which the set of weights assigned to samples minimizes the estimation variance, which is computed as a function of the variogram model and locations of the samples relative to ach other, and to the point or block being estimated.

2. In the estimation of ore reserves by geostatistical methods, the of a weighted, moving-average approach to account for the estimated values of spatially distributed variables, and also to assess the probable error associated with the estimates. |

| Lacustrine | Produced by or belong to lakes. |

| Latite | The extrusive equivalent of monzonite and a variety of trachyandesite in which potash feldspar and plagioclase are present either as normative or modal minerals in nearly equal amounts. |

- 8 -

| Leach | To wash or drain by percolation. To dissolve minerals or metals out of the ore, as by the use of cyanide or chlorine solutions, acids, or water. |

| Lens | A body of ore or rock thick in the middle and thin at the edges. |

| Listric fault | A curved downward-flattening fault, generally concave upward. Listric faults may be characterized by normal or reverse separation. |

| Lithology | The physical character of a rock, generally as determined megascopically or with the aid of a low-power magnifier. The microscopic study and description of rocks. |

| Mafic | Subsilicic, basic. Contrasted with felsic. In general, synonymous with “dark minerals”, as usually used. |

| Malachite | A mineral. Common alteration product of copper ores. |

| Marcasite | White iron pyrites. A common ore mineral. |

| Metallogenic | Relating to the formation of gold deposits, millions of years ago. |

| Metamorphic rock | Includes all those rocks which have formed in the solid state in response to pronounced changes in temperature, pressure, and chemical environment, which take place, in general, below the shells of weathering and cementation. |

| Metasediments | Partly metamorphosed sedimentary rocks. |

| Metasomatize | To replace one mineral by another of different chemical composition owing to reactions set up by the introduction of material from external sources. (Metasomatism = replacement) |

| Mineralization | The process by which a mineral or minerals are introduced into a rock resulting in an economically valuable or potentially valuable deposit. |

| NSR | Net smelter return. |

| Opt | Troy ounces per short ton of gold unless indicated to be another metal. |

| Ore | A mineral or aggregate of minerals more or less mixed with gangue which can be profitably mined given economic circumstances at the time. The Company does not hold any interest in properties where the mineralization has been determined to be ore. |

| Ounce (or oz.) | Meaning a troy ounce. There are 31.1034 grams to a troy ounce and there are 12 troy ounces to a troy pound, a common unit of measurement for precious metals. |

| Outcrop | An exposure on the surface of the underlying rock. |

| Overburden | Material of any nature, consolidated or unconsolidated, that overlies a deposit of useful materials, ores, or coal, especially those deposits that are mined from the surface by open cuts. |

| Panel sample | Material sampled from sections divided across a rib or face. |

| Paragenesis | A general term used to denote a gneiss derived from a sedimentary rock. |

| Petrographic | Some or all of the igneous rocks are derived from a common parent magma. |

| Phyllite | An argillaceous rock intermediate in metamorphic grade between slate and schist. |

- 9 -

| Pleistocene | The earlier of the two epochs comprised in the Quaternary period, in the classification generally used. Also called Glacial epoch, Ice age, Post-Pliocene and Post-Tertiary. Also, the series of sediments deposited during that epoch, including both glacial deposits and ordinary sediments. |

| Plagioclase | A mineral group. One of the commonest rock-forming minerals. |

| Planar | Relating to, or in the form of a plane. |

| Porphyritic | Textural term for igneous rocks in which larger crystals are set in a finer groundmass which may be crystalline or glassy, or both. |

| Porphyry | An igneous rock containing conspicuous crystals or phenocrysts in a fine- grained groundmass; type of mineral deposit in which ore minerals are widely disseminated, generally of low grade but large tonnage. |

| Potassic | Of, pertaining to, or containing potassium. |

| Preciousmetals | Gold, platinum, silver and palladium. |

| Preliminary | A study that includes an economic analysis of the potential viability of mineral |

| Assessment | resources taken at an early stage of the project prior to the completion of a preliminary feasibility study. |

| Propylite | An altered, greenstone-like andesitic rock consisting of such minerals as calcite, chlorite, epidote, serpentine, quartz, pyrite, and iron ore and resulting from hydrothermal alteration. |

| Pyrite | Iron pyrites. Fool’s gold. A mineral. An important ore of sulphur; sometimes mined for the associated gold or copper. |

| Pyroclastic | General term for a class of rocks made up of detrital volcanic materials that have been explosively or aerially ejected from a volcanic vent. |

| Pyrrhotite | Magnetic pyrites. |

| Quartz | A common rock forming mineral composed of silicon and oxygen. |

| Raise | A mine shaft driven from below upward; also called upraise, rise, and riser. |

| Ramp | A fault that is a gravity (normal) fault near the surface of the earth, but curves through the vertical to dip in the opposite direction at depth; where the displacement is that characteristic of thrusts. |

| Reserves: | Mineral Reserve: The economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

- 10 -

| | Probable Mineral Reserve: The economically mineable part of an Indicated, and in some circumstances a Measured, Mineral Resource, demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

Proven Mineral Reserve: The economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| Resistivity | That factor of the resistance of a conductor which depends upon the material and its physical condition. |

| Resources: | Resource: A concentration or occurrence of natural material of intrinsic economic interest in or on the Earth’s crust in such form and quantity and such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

Inferred Mineral Resource: That part of a mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

Indicated Mineral Resource: That part of a mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

Measured Mineral Resource: That part of a mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| Rhyolite | An extrusive igneous (volcanic) rock with phenocrysts of quartz and alkalic feldspar, commonly of porphyritic texture. |

- 11 -

| Rib | The sides of a decline or tunnel. |

| Sedimentary | Rock formed of sediment, as conglomerate, sandstone and shale, formed of fragments of other rock transported from their sources and deposited in water; rocks formed by precipitation from solution as rock salt or gypsum or non- organic secretions of organisms, e.g., most limestone. |

| Sericite | Fine-grained variety of mica. |

| Shear | A fold formed as a result of the minute displacement of beds along closely spaced fractures or cleavage planes. |

| Schist | A medium or coarse-grained metamorphic rock with subparallel orientation of the micaceous minerals which dominate its composition. |

| Silica | Silicon dioxide. |

| Siliceous | Said of a rock containing abundant silica. |

| Silicification | The introduction of or replacement by, silica. Generally the silica formed is fine grained quartz, chalcedony, or opal, and may fill both up pores and replace existing minerals. The term covers all varieties of such processes, whether late magmatic, hydrothermal or diagenetic. |

| Specularite | Hematite, occurring in tabular or disklike crystals of gray colour and splendent metallic luster. |

| Sphalerite | A mineral, dimorphous with wurtzite. Isometric. The principal ore of zinc. |

| Splays | Divergent small faults at the extremities of large normal faults, especially rifts. |

| Stope | An excavation from which the ore has been extracted, either above or below a level, in a series of steps. |

| Stoping | The loosening and removal of ore in a mine either by working upward (overhead or overhand) or downward (underhand). |

| Strata | A tabular or sheet-like body of sedimentary rock. |

| Stratigraphy | That branch of geology which treats of the formation, composition, sequence, and the correlation of stratified rocks as parts of the earth’s crust. |

| Strike | Direction of line formed by intersection of a rock surface with a horizontal plane. Strike is always perpendicular to direction of dip. |

| StructuralControl | The influence of structural features on ore deposition, e.g., ore minerals filling fractures. |

| Sulphide | Group of minerals consisting of metals combined with sulphur; common metallic ores (or ”Sulfide”). |

| Syenite | A plutonic igneous rock consisting principally of alkalic feldspar usually with one or more mafic minerals such as hornblende or biotite. |

| Tailings (tails) | Those portions of washed ore that are regarded as too poor to be treated further. Debris from stamp mills or other ore-dressing machinery. |

| Tertiary | The period of geological time extending from 66 to 2 million years ago, which includes the Palaeogene and Neogene epochs. |

- 12 -

| Ton | Short ton which measures 2,000 pounds. |

| Tonne | Metric ton which measures 2,204.6 pounds or 1000 kilograms. |

| Tpd | Ton per day. |

| Tuff | A rock formed of compacted volcanic fragments, generally less than 4 millimetres in diameter. |

| Ultramafic | Ultrabasic. Some igneous rocks and most varieties of meteorites containing less than 45% silica; containing virtually no quartz or feldspar and composed essentially of ferromagnesian silicates, metallic oxides and sulfides, and native metals, or of all three. |

| Vein | A tabular or sheet-like mineral deposit with identifiable walls, often filling a fracture or fissure. |

| Veinlet | A small vein; the distinction between vein and veinlet tends to be subjective. |

| Volcanic | Pertaining to the activity, structures or rock types of a volcano. |

- 13 -

TABLE OF CONTENTS

- 14 -

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

A. Currency and Exchange Rates

All dollar amounts set forth in this Annual Report are in Canadian dollars, except where otherwise indicated. The following table sets forth the average rate of exchange for the Canadian dollar for the periods indicated (calculated by using the average of the exchange rates on the last day of each month during the period):

| | | (C$ / US$) | | | |

| | 2006 | 2005 | 2004 | 2003 | 2002 |

| Average Rate During Period | 1.1307 | 1.2116 | 1.3015 | 1.3915 | 1.5702 |

The following table sets forth the high and low exchange rates in Canadian dollars, for the periods indicated, in each case based on the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York:

| (C$ / US$) |

| | Feb/07 | Jan/07 | Dec/06 | Nov/06 | Oct/06 | Sep/06 |

| High Rate | 1.1852 | 1.1824 | 1.1652 | 1.1474 | 1.1384 | 1.1272 |

| Low Rate | 1.1586 | 1.1647 | 1.1415 | 1.1275 | 1.1154 | 1.1052 |

On December 31, 2006, the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York was $1.00 US = $1.1652 CDN.

On March 15, 2007, the noon buying rate in New York City for cable transfer in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York was $1.00 US = $1.1757 CDN.

Selected Financial Data

The following table sets forth selected consolidated financial information for the Corporation for, and as of the end of, each of the last five fiscal years ended December 31, 2006. The financial information is derived from the consolidated financial statements of the Corporation and is presented in Canadian dollars. The consolidated financial statements for years 2002 and 2003 were audited by Tony M. Ricci

- 15 -

Inc., Chartered Accountant and the consolidated financial statements for years 2004, 2005 and 2006 were audited by KPMG LLP, Chartered Accountants (see Item 17).

The selected consolidated financial information presented below should be read in conjunction with the audited consolidated financial statements of the Corporation included elsewhere herein.

| | | For the Year Ended December 31, | |

| | | | | | | | | | | | | | | | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| | | $ | | | $ | | | $ | | | $ | | | $ | |

| Net loss (Canadian GAAP) | | (1,740,706 | ) | | (4,215,960 | ) | | (1,219,731 | ) | | (605,214 | ) | | (485,054 | ) |

| Net loss per share (Canadian GAAP) | | (0.02 | ) | | (0.06 | ) | | (0.03 | ) | | (0.02 | ) | | (0.03 | ) |

| Net loss (U.S. GAAP) | | (5,867,442 | ) | | (10,076,457 | ) | | (8,640,303 | ) | | (3,261,451 | ) | | (696,059 | ) |

| Net loss per share (U.S. GAAP) | | (0.06 | ) | | (0.14 | ) | | (0.19 | ) | | (0.11 | ) | | (0.04 | ) |

| Weighted average number of shares | | 96,280,740 | | | 72,356,898 | | | 45,528,057 | | | 30,773,747 | | | 19,078,887 | |

| Total cash and cash equivalents | | 6,150,005 | | | 5,413,900 | | | 9,467,224 | | | 13,406,295 | | | 1,616,691 | |

| Working capital (deficiency) | | 6,980,811 | | | 5,177,422 | | | 8,750,640 | | | 13,089,684 | | | 105,622 | |

| Total debt | | Nil | | | Nil | | | Nil | | | Nil | | | 1,722,131 | |

| Total assets (Canadian GAAP) | | 59,751,226 | | | 54,428,595 | | | 28,688,663 | | | 25,006,389 | | | 10,659,685 | |

| Total assets (US GAAP) | | 36,383,664 | | | 35,077,992 | | | 15,198,557 | | | 18,936,855 | | | 7,246,388 | |

| Shareholders’ equity (Canadian GAAP) | | 57,799,245 | | | 52,261,765 | | | 27,496,142 | | | 24,202,178 | | | 7,696,078 | |

| Shareholders’ equity (US GAAP) | | 33,541,709 | | | 32,911,162 | | | 14,006,036 | | | 18,132,644 | | | 4,282,781 | |

The selected consolidated financial data has been prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Selected financial data has also been provided under United States generally accepted accounting principals (“US GAAP”) to the extent that amounts are different from Canadian GAAP. The consolidated financial statements included in Item 17 in this Annual Report are prepared under Canadian GAAP. Included within these consolidated financial statements in Note 13 is a reconciliation between Canadian and U.S. GAAP.

Under Canadian GAAP, Old Bonanza changed its method for accounting for employee and directors’ stock options to the fair value based method, beginning January 1, 2004. The change was applied retroactively, without restatement, resulting in an increase to deficit and contributed surplus of $2,874,967 as at January 1, 2004. Prior to this change in policy, no compensation expense was recognized. (See note 3 to the consolidated financial statements included herein for a summary of changes in the accounting policies adopted during 2004).

FASB has issued a revision of SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS No. 123(R)”). SFAS No. 123(R) requires a public entity to measure the cost of employee services received in exchange for an award of equity instruments based on the grant date fair value of the award. The compensation cost is to be recognized over the service period which is determined by the vesting period. This statement was effective for the Company as of January 1, 2006 and has been adopted for US GAAP purposes as of that date.

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

- 16 -

D. Risk Factors

General

Precious metals exploration is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Corporation may be affected by numerous factors which are beyond the control of the Corporation and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of mining facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, any of which could result in the Corporation not receiving an adequate return on invested capital.

Exploration and Development Risks

There is no certainty that the expenditures made or to be made by the Corporation in the exploration of its properties will result in discoveries of mineralized material in commercially viable quantities. Most exploration projects do not result in the discovery of commercially mineable ore deposits. Mining operations generally involve a high degree of risk which even a combination of experience, knowledge and careful evaluation may not be able to overcome. The business of gold mining is subject to a variety of risks such as industrial accidents, flooding, environmental hazards such as fires, technical failures, labour disputes and other accidents at the mine facilities. Such occurrences, against which the Corporation cannot or may elect not to insure, may delay production, increase production costs or result in liability. The payment of such liabilities may have a material adverse effect on the Corporation’s financial position.

Mineral Prices

The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of mineral Resources are discovered, a profitable market will exist for the sale of same. Factors beyond the control of the Corporation may affect the marketability of any mineral occurrences discovered. The price of gold has experienced volatile and significant price movements over short periods of time, and is affected by numerous factors beyond the control of the Corporation, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, the United States dollar relative to the Canadian dollar and other currencies), interest rates and global or regional consumption patterns (such as the development of gold coin programs), speculative activities and increased production due to improved mining and production methods.

Operating History

The Corporation and its predecessor companies have no history of earnings. The Corporation has paid no dividends on its shares since incorporation and does not anticipate doing so in the foreseeable future. The only present source of funds available to the Corporation is through the sale of its equity shares or by way of debt facilities. While the Corporation may generate additional working capital through the operation, development, sale or possible syndication of its properties, there is no assurance that any such funds will be generated.

- 17 -

Environmental Regulation

All phases of the Corporation’s operations are subject to environmental regulation in the various jurisdictions in which it operates. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Corporation’s operations, or its ability to develop its properties economically. Before production may commence on any property, the Corporation must obtain regulatory and environmental approvals and permits. There is no assurance such approvals and permits will be obtained on a timely basis, if at all. Compliance with environmental and other regulations may reduce profitability, or preclude economic development of a property entirely.

Competition

The resource industry is intensely competitive in all of its phases, and the Corporation competes with many companies possessing greater financial resources and technical facilities than it. Competition could adversely affect the Corporation’s ability to acquire suitable producing properties or prospects for exploration in the future.

Title Matters

In those jurisdictions where the Corporation has property interests, the Corporation makes a search of mining records in accordance with mining industry practices to confirm satisfactory title to properties in which it holds or intends to acquire an interest, but does not obtain title insurance with respect to such properties. The possibility exists that title to one or more of its properties, particularly title to undeveloped properties, might be defective because of errors or omissions in the chain of title, including defects in conveyances and defects in locating or maintaining such claims, or concessions. The ownership and validity of mining claims and concessions are often uncertain and may be contested. The Corporation is not aware of any challenges to the location or area of its mineral claims. There is, however, no guarantee that title to the Corporation’s properties and concessions will not be challenged or impugned in the future. The properties may be subject to prior unregistered agreements or transfers, and title may be affected by undetected defects.

Dependence on Key Personnel

The success of the Corporation and its ability to continue to carry on operations is dependent upon its ability to retain the services of certain key personnel. The loss of their services to the Corporation may have a material adverse effect on the Corporation. The Corporation does not presently have “key person” life insurance for any of its officers. (See Item 6 “Directors, Senior Management and Employees”).

Conflicts of Interest

Certain of the directors of the Corporation are directors of other mineral resource companies and, to the extent that such other companies may be interested in a project also of interest to the Corporation, or may in the future participate in one or more ventures in which the Corporation participates, such directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises, at a meeting of the directors of the Corporation, a director who has such a conflict will abstain from voting for or against the approval of

- 18 -

such acquisition or participation. In the appropriate cases, the Corporation will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. From time to time several companies may participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participating in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program.

Legal Proceedings Against Foreign Directors

The Corporation is incorporated under the laws of British Columbia, Canada, and some of the Corporation’s directors and officers are residents of Canada. Consequently, it may be difficult for United States investors to effect service of process within the United States upon the Corporation or upon its directors or officers, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the United States Securities Exchange Act of 1934, as amended. Furthermore, it may be difficult for investors to enforce judgments of U.S. courts based on civil liability provisions of the U.S. federal securities laws in a foreign court against the Corporation or any of the Corporation’s non-U.S. resident officers or directors.

Additional Funding Requirements

The business of mineral exploration and extraction involves a high degree of risk with very few properties that are explored ultimately achieving commercial production. At present, none the Corporation’s properties have a known body of commercial ore. As a mining company in the exploration stage, the future ability of the Corporation to conduct exploration and development will be affected principally by its ability to raise adequate amounts of capital through equity financings, debt financings, joint venturing of projects and other means. In turn, the Corporation’s ability to raise such funding depends in part upon the market’s perception of its management and properties, but to a great degree upon the price of gold and the marketability of securities of speculative exploration and development mining companies.

The development of any ore deposits found on the Corporation’s exploration properties depends upon the Corporation’s ability to obtain financing through any or all of equity financing, debt financing, the joint venturing of projects, or other means. There is no assurance that the Corporation will be successful in obtaining the required financing.

Shareholder Dilution

It is likely that additional capital required by the Corporation will be raised through the issuance of additional equity securities, resulting in dilution to the Corporation’s shareholders.

Classification as a Passive Foreign Investment Corporation

The Corporation believes it is a Passive Foreign Investment Company (“PFIC”), as that term is defined in Section 1297 of the Internal Revenue Code of 1986, as amended, and believes it will be a PFIC in the foreseeable future. Consequently, this classification may result in adverse tax consequences for U.S. holders of the Corporation’s shares. For an explanation of these effects on taxation, see the discussion about taxation in Item 10 of this Annual Report. U.S. shareholders and prospective holders of the Corporation’s shares are also encouraged to consult their own tax advisers.

- 19 -

Exploration Stage Corporation

The Corporation has no production revenue. Moreover, the Corporation has no commercially viable properties. The Corporation has completed a preliminary assessment on its Copperstone project located in Arizona, described more fully under Item 4. At this stage and prior to a positive production decision being made on the Copperstone project, the Corporation is deemed an “Exploration Stage Corporation”.

ITEM 4. INFORMATION ON THE CORPORATION

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

ESTIMATES OF MEASURED AND INDICATED RESOURCES

This section uses the terms “measured” and “indicated” resources. The Corporation advises U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

ESTIMATES OF INFERRED RESOURCES

This section uses the term “inferred resources”. The Corporation advises U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

A. History and Development of the Corporation

The Corporation was incorporated in the Province of British Columbia, Canada under the BCA on December 10, 2004 as 0710887 B.C. Ltd. and changed its name to American Bonanza Gold Corp. on February 10, 2005. Pursuant to the Plan of Arrangement described below, the Corporation is the successor to Old Bonanza. Old Bonanza was incorporated under the Business Corporations Act (Alberta) on November 17, 1980 and continued into the Province of British Columbia, Canada on July 19, 1994.

The Corporation’s registered and records office is located at Suite 1500 – 1055 West Georgia Street, Vancouver, BC, V6C 4N7. The Corporation’s corporate head office is located at Suite 305 - 675 West Hastings Street, Vancouver, British Columbia, V6B 1N2, telephone number (604) 688-7523 and its exploration office is located at 290 Gentry Way, Suite 6, Reno, Nevada, United States, 89502.

The Corporation has an authorized share capital of an unlimited number of common shares without par value and an unlimited number of Class A preferred shares, of which 100,628,976 common shares are issued and outstanding and nil Class A preferred shares are issued and outstanding as at December 31,

- 20 -

2006. All of the Corporation’s common shares rank equally with respect to voting rights and liquidation preferences. The Class A preferred shares as a class are issuable in series and entitle holders, on a liquidation or dissolution of the Corporation, to a preference over the holders of common shares with respect to any repayment of capital or distribution of assets. The Class A preferred shares do not entitle holders to vote at general meetings of shareholders. The directors may by resolution determine the number and name of the shares of any series of Class A preferred shares, and any special rights attaching to any series of Class A preferred shares.

Plan of Arrangement

The following summary of certain terms and conditions of the Plan of Arrangement and Arrangement Agreement is not complete and is qualified in its entirety by reference to the full text of the Plan of Arrangement and Arrangement Agreement on file with the SEC.

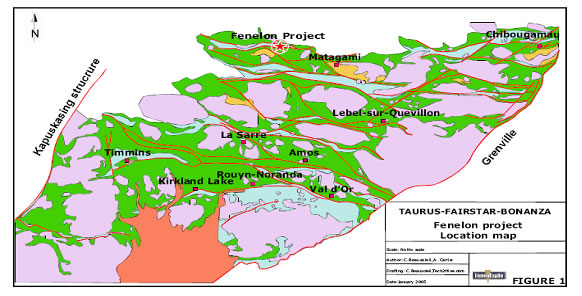

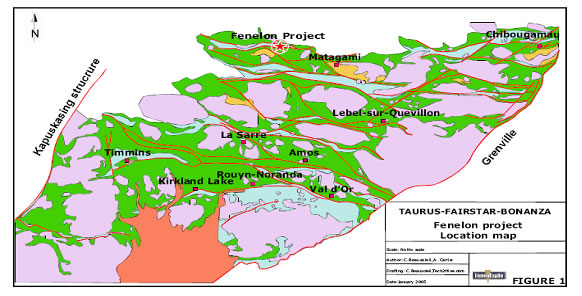

On March 30, 2005, the Corporation, Old Bonanza, Taurus and Fairstar received the final order of the British Columbia Supreme Court for the approval of a statutory Plan of Arrangement for the acquisition of Old Bonanza and Taurus by the Corporation as well as the acquisition of Fairstar’s interest in the Fenelon gold project.

Effective March 30, 2005, pursuant to the Arrangement Agreement, Old Bonanza and Taurus were combined together as subsidiaries of the Corporation and the Corporation acquired Fairstar’s shares in FairstarSub, which holds Fairstar’s 38% interest in the Fenelon Project and the Casa Berardi Claims located in Quebec in exchange for shares of the Corporation.

The Corporation was incorporated specifically in connection with the Arrangement and had no operations prior to the completion of the Arrangement. As the Plan of Arrangement resulted in Old Bonanza shareholders owning approximately 63% of the Corporation, for accounting purposes, the Corporation is treated as a continuance of Old Bonanza.

The shares of the Corporation commenced trading on the TSX at the opening on Thursday, March 31, 2005 under the symbol BZA. Trading of the shares of Old Bonanza and Taurus was halted on the TSX Venture Exchange at the close of business on Tuesday March 29, 2005, and with the completion of the Plan of Arrangement, these two companies were delisted from the TSX Venture Exchange.

Pursuant to the terms of the Plan of Arrangement and Arrangement Agreement, the following transactions were approved and completed on March 30, 2005.

The Corporation, Old Bonanza and Taurus combined by way of a Plan of Arrangement whereby, first, each Old Bonanza common share, option and warrant outstanding at the time of the Arrangement was exchanged for 0.25 of a common share, option and warrant, respectively, of the Corporation and, second, each Taurus common share, option and warrant, was exchanged for 0.20 of a common share, option and warrant, respectively of the Corporation. The expiry dates of options and warrants remained unchanged and the exercise prices were increased in accordance with the above exchange ratios. On completion of the transaction, the Corporation owned 100% of the issued and outstanding shares of Old Bonanza and Taurus and the former shareholders of Old Bonanza and Taurus held approximately 69.4% and 30.6% of the common shares of the Corporation. The exchange transaction between the Corporation and Old Bonanza was a common control transaction which is accounted for at Old Bonanza’s historical cost by the continuity of interests method. Accordingly, Old Bonanza is the acquirer of Taurus’ assets and liabilities for accounting purposes. The consolidated financial statements of the Corporation include the results of operations of Old Bonanza consolidated with those of the

- 21 -

Corporation and Taurus from the date of acquisition. For legal purposes, Old Bonanza and Taurus became wholly owned subsidiaries of the Corporation.

Fairstar transferred its 38% interest in the Fenelon gold project and its interests in the Casa Berardi gold projects in Quebec to its wholly-owned newly incorporated subsidiary company, FairstarSub. The Corporation acquired all outstanding shares of FairstarSub in exchange for 6,500,000 common shares of the Corporation and $300,000 cash paid directly to certain creditors of Fairstar. This transaction has been accounted for as an asset acquisition by the Corporation.

After the transactions discussed above were completed the former shareholders of Old Bonanza, Taurus and Fairstar held approximately 63.3%, 27.9% and 8.8%, respectively, of the Corporation’s common shares. The total number of issued and outstanding common shares of the Corporation after the transaction closed was 74,330,925.

The excess purchase price over the net book value of net assets acquired has been allocated to mineral properties and includes the effect of recording future income tax liabilities on the temporary differences arising on the transactions.

Three Year History

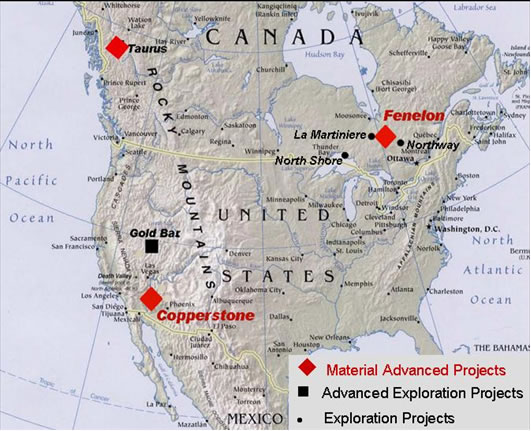

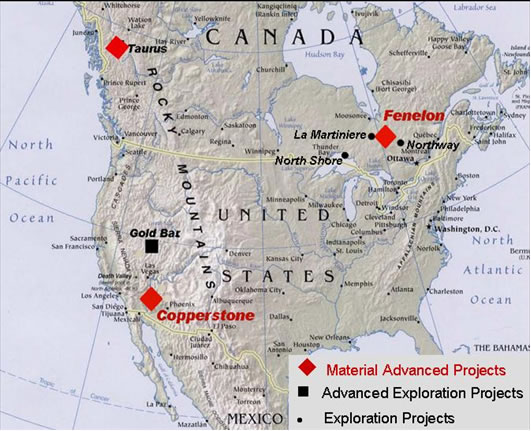

The Corporation is an Exploration Stage Corporation engaged in the identification, acquisition and exploration of precious metal properties located in the American Southwest of the United States, and Canada. The Corporation holds interests in several mineral exploration projects, the material properties being:

| Material | |

| Properties | Jurisdiction |

| Copperstone | Arizona |

| Fenelon | Quebec |

| Taurus | British Columbia |

The Corporation also has interests in several exploration projects located in Quebec, Ontario, Arizona and Nevada which are not sufficiently advanced to be material to the Corporation, and are not considered significant properties by the Corporation at this time.

The Pamlico property was subject to a cash payment of US$425,000 on November 10, 2005 and as a result the Corporation returned the Pamlico project to the property vendor and recognized a write-down of approximately $1,742,720 for the year ended December 31, 2005.

During 2002 and 2003, as a result of improved gold prices, capital markets and a renewed interest in exploration stage mining companies, Old Bonanza raised net proceeds of approximately $20.1 million in equity capital and $1.7 million in debt including $16.9 million in equity capital in the year ended December 31, 2003. During 2004, as a result of the continuation of improved gold prices and capital markets Old Bonanza received an additional $4.3 million in equity capital resulting from warrant exercises.

To finance exploration for the Canadian properties, the Corporation completed a private placement consisting of 8,174,000 common shares which were designated as flow-through shares at a price of $0.45 per flow-through share totaling $3,678,300 and 1,588,000 non-flow-through units at a price of $0.45 per unit totaling $714,600 on August 5, 2005. On December 29, 2005 the Corporation entered into a non-brokered private placement to issue 500,000 flow-through common shares at $0.60 per share for

- 22 -

total proceeds of $300,000. On June 2, 2006 the Corporation completed a private placement consisting of 7,400,000 common shares which were designated as flow-through shares at a price of $0.55 per flow-through share for gross proceeds of $4,070,000, and 7,400,000 units at a price of $0.55 per unit for gross proceeds of $4,070,000. Flow-through funds are restricted for expenditures that qualify as Canadian Exploration Expenditures, as defined in the Income Tax Act (Canada).

During the period 2003 to date, the Corporation’s primary objective has been to advance the Copperstone and Fenelon projects as described below.

The following provides an overview of the location of the Corporation’s properties:

A detailed summary of the Corporation’s projects (excluding those that have been subsequently written off and returned and certain non-material properties) are set forth in “Business Overview” below.

B. Business Overview

General

The Corporation’s material properties are the Copperstone project located in Arizona, the Fenelon Project located in Quebec and the Taurus Property located in British Columbia. The Corporation has entered into an option agreement with Cusac Gold Mines Ltd. for the sale of the Taurus Property to Cusac. See “Information on the Corporation – Property, Plants and Equipment – Taurus Property”. The

- 23 -

Corporation also holds interests in several exploration projects located in Quebec, Ontario, Nevada and Arizona, which are not sufficiently advanced to be material to the Corporation.

The Corporation’s current business objectives are to conduct further drilling and exploration on each of the Copperstone Gold Project and the Fenelon Gold Project, with a view to completing a preliminary feasibility study on one or both of these projects within the next three years. The Corporation obtained a resource estimate and preliminary economic assessment on the Copperstone Property from AMEC on March 27, 2006. The purpose of the preliminary assessment was to (a) formalize the large amount of quality work and data compiled to date, (b) provide a clear picture of those areas with the potential to add resources, and (c) establish a preliminary economic analysis of Copperstone.

The Corporation used the information provided by the preliminary economic assessment to prepare a new three dimensional geologic exploration model at Copperstone. This new exploration model is based on pit mapping, underground mapping, a substantial amount of new drilling, geophysical data and structural modeling, and will guide planned drilling to further expand the resource. The new exploration model was completed in mid 2006, and was used to guide further exploration drilling at Copperstone, designed to expand the resources. A phase I exploration drilling program, based on the new exploration model, was completed in December 2006. Phase II exploration drilling to follow up the positive results of Phase I drilling is scheduled for early spring 2007.

As a mining company in the exploration stage, the future liquidity of the Corporation will be affected principally by the level of exploration expenditures and by its ability to raise an adequate level of capital through the equity markets. In management’s opinion, the Corporation’s current working capital will be sufficient for funding its planned exploration expenditures in 2007 at the Fenelon project and the Copperstone project.

The following sets forth the expenditures made by the Corporation in certain of its projects for the periods indicated:

Summary of Project Expenditures

| | Project | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | $ | | | $ | | | $ | | | $ | |

| | Copperstone | | 22,904,331 | | | 21,732,835 | | | 16,064,009 | | | 9,312,073 | |

| | Fenelon | | 14,183,469 | | | 12,350,507 | | | – | | | – | |

| | Taurus | | 6,583,770 | | | 6,546,020 | | | – | | | – | |

| | Gold Bar | | 1,035,264 | | | 1,013,399 | | | 857,445 | | | 477,407 | |

| | Northway | | 3,915,092 | | | 3,774,047 | | | – | | | – | |

| | Martiniere | | 2,659,280 | | | 2,206,636 | | | – | | | – | |

| | Northshore | | 524,051 | | | 111,873 | | | – | | | – | |

| | Other | | 159,368 | | | 212,348 | | | 173,064 | | | 21,558 | |

| | Pamlico | | - | | | – | | | 1,732,170 | | | 1,595,078 | |

| | | | 51,964,625 | | | 47,947,666 | | | 18,826,688 | | | 11,406,116 | |

Cautionary Note:

None of the mineral properties in which the Corporation holds an interest contain any known commercially viable ore or mineral reserves. All exploration programs proposed for any mineral properties in which the Corporation has an interest are exploratory in nature.

- 24 -

C. Organizational Structure

As of December 31, 2006, the only active subsidiaries of the Corporation were Old Bonanza, which in turn has a wholly owned subsidiary Bonanza Gold Inc. (“Bonanza Gold”) (a Canadian corporation), which in turn has a wholly owned subsidiary, Bonanza Explorations Inc. (“Bonanza Explorations”) (a Nevada corporation).

The following diagram sets out the corporate structure of the Corporation and its active subsidiaries:

| (1) | The Corporation owns the Taurus Property in British Columbia and the Northshore Property in Ontario. |

| (2) | Old Bonanza holds the Corporation’s principal property, the Copperstone Gold Project in Arizona. |

| (3) | Bonanza Exploration Inc. owns the Gold Bar Project, Nevada, and other exploration properties located in Arizona and Nevada. |

| (4) | Taurus’ principal properties are the Fenelon Project in Quebec and the Martiniere Property and Northway-Noyon Gold Project in Quebec, which are in the process of being transferred to the Corporation. |

D. Property, Plants and Equipment

Copperstone

General

The Corporation holds a 100 percent leasehold interest in the Copperstone Project. The landlord is The Patch Living Trust and the lease is for a 10 year term starting June 12, 1995 and was renewed on June 12, 2005. The lease is renewable by the Corporation for one or more ten-year terms at the Corporation’s option under the same terms and conditions. The Corporation is obligated to pay for all permitting and state lease bonding, insurance, taxes, and to pay a 1 percent production gross royalty so long as the price of gold in US dollars is less than US$350 per ounce (royalty increases to 6 percent as price of gold increases to over US$551 per ounce), with a minimum advance royalty per year of US$30,000.

Copperstone Gold Project

In August, 1998, Old Bonanza entered into an agreement with Arctic Precious Metals Inc. (“APMI”), a wholly owned subsidiary of Royal Oak Mines Inc. (“Royal Oak”), to explore and develop the

- 25 -

Copperstone gold property in La Paz County, Arizona, U.S.A. Under the agreement, Old Bonanza acquired 25 percent of APMI’s leasehold interest in the Copperstone project for a cash payment of US$500,000 with an option to increase its interest in the project to 80 percent through property expenditures of US$3 million and a future cash payment to APMI of US$1 million. In 1995 APMI had acquired a renewable lease for the Copperstone project from the Patch Living Trust.

In April, 1999, APMI became subject to Chapter 11 proceedings under U.S. bankruptcy law and in November, 1999 Old Bonanza entered into a conditional Purchase and Sale Agreement with APMI, concerning the purchase by Old Bonanza of the 75 percent interest owned by APMI in the Copperstone project.

In March, 2002, Old Bonanza acquired all APMI’s leasehold interest in the Copperstone mining property by obtaining an assignment of APMI’s interest in the lease with the Patch Living Trust. The assignment was approved in a lengthy US Bankruptcy Court process. As a result, Old Bonanza’s interest in the Copperstone mining property increased from 25 percent to 100 percent, subject only to the existing lease and its royalty arrangements. This acquisition was funded by a loan of US$1,100,000 from Brascan Financial Corporation which was repaid in October 2003.

Copperstone D-Zone Joint Venture

On June 18, 2000, Old Bonanza entered into an agreement with Centennial Development Corporation (“CDC”) for the underground exploration and extraction of mineralized materials from the D-Zone of up to 50,000 tons of mineralized material from the Copperstone property (the “Copperstone D-Zone Joint Venture”).

During 2001, Phase One was completed and Old Bonanza earned an additional 5 percent interest in the Copperstone D-Zone Joint Venture for a total earned interest of 60 percent.

On February 14, 2002, Old Bonanza entered into an agreement with CDC whereby it would acquire the remaining 40 percent interest of the D-Zone Joint Venture not already owned for the following consideration:

(a) assumption of a total of US$325,000 of Copperstone related liabilities and if these liabilities exceed the estimated amount then the additional amounts would be paid equally by CDC and Old Bonanza. These liabilities were previously recorded by Old Bonanza as at December 31, 2000 and as at December 31, 2003 all of these liabilities were either paid or settled;

(b) assumption of an estimated CDC payroll tax liability of up to US$180,000 that may arise. If these liabilities exceed the estimated amount, then the additional amounts would be paid equally by CDC and Old Bonanza;

(c) US$345,000 payable to CDC and or its principal on or before July 31, 2002;

(d) a net smelter royalty of three percent paid to CDC from the first 50,000 tons of mineralized material extracted from the D-Zone, subsequent to repayment of the Brascan Loan; and,

(e) US$70,000 from initial proceeds from extraction of mineralized materials from the D-Zone, following repayment of the Brascan Loan.

- 26 -

During 2002, Old Bonanza paid US$345,000 to CDC in accordance with the above agreement and recorded a further US$180,000 in accounts payable to reflect the estimated CDC payroll tax liability that may arise.

During 2002, Old Bonanza entered into a mining services agreement with an Underground Mining Contractor (“Mining Contractor”) for purposes of the development and extension of an existing underground decline in the D-Zone to establish underground infrastructure for subsequent exploration and development programs. On the basis of meeting certain pre-determined performance criteria the Mining Contractor can earn up to a 5 percent net profits royalty from the D-Zone bulk sample of up to 50,000 tons of mineralized material. The bulk sample program has been deferred indefinitely as a result of the Corporation’s exploration drilling programs.

As at May 9, 2005 the Corporation announced the commissioning of a Pre-Feasibility study for the Corporation’s Copperstone project located in Arizona and described more fully below. AMEC was selected to conduct the study. AMEC is a leading international full service engineering firm recognized by both the mining industry and financial community.

Subsequent to December 31, 2005, the Corporation concluded that the work currently being performed by AMEC will be better optimized by converting the scope of the report from a Pre-Feasibility study to a Preliminary Assessment. In addition to estimating the mineral resources, the Preliminary Assessment; (a) formalized the large amount of quality work and data compiled to date, (b) provided a clear picture of those areas with the potential to add resources, and (c) established a preliminary economic analysis of Copperstone.

William Tilley, P.E. and others prepared a report entitled “Technical Report on the Copperstone Gold Property, La Paz County, Arizona” (the “AMEC Report”). The AMEC Report, dated March 27, 2006, was prepared in compliance with the Canadian Securities Administrators’ National Instrument 43-101. The following information has been summarized from the AMEC Report.

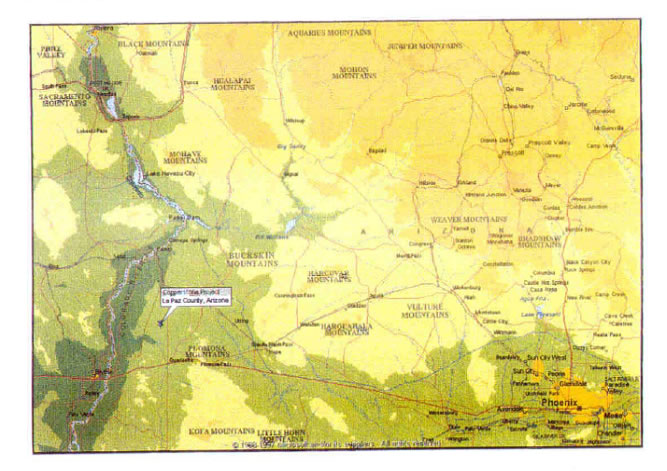

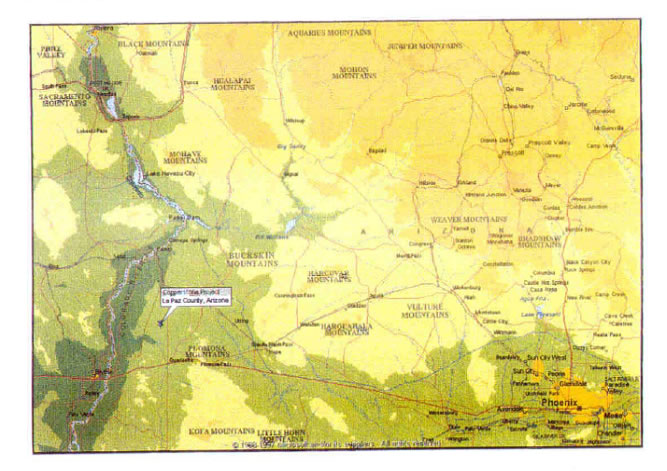

Location and Access

The Copperstone Project is located in La Paz County, Arizona, United States. The closest communities are Quartzite, located 16 km to the south and Parker, located 40 km to the north. Phoenix is 106 km east of the Copperstone Project. The property is accessible from Phoenix on Interstate 10 to Quartzite and Route 95 from Quartzite. An 8 km unpaved mine road connects the property to Route 95.

- 27 -

Title

The Copperstone Project totals approximately 8,821 acres and is located in La Paz County, Arizona, about 16 km north of the town of Quartzite. The property consists of 335 contiguous unpatented lode mining claims covering an area of approximately 6,901 acres (20.6 acres per claim) and comprised of 274 “Copperstone”, 51 CSA, and 10 “Iron Reef” claims. The property also includes mineral leases on Arizona State mineral lands in T 7 N, R 19 W, section 31 and T 7N, R 19 W, sections 6 and 7 totaling approximately 1,920 acres.

The land is under the jurisdiction of the United States Bureau of Land Management (BLM). The Patch Living Trust (“PLT”) of Scottsdale, Arizona owns the title to the central 284 mineral claims. In June 1995, the Copperstone property was leased from PLT by APMI for a 10 year term and is renewable at the option of the lessee. On June 12, 2005, the lease was renewed for an additional 10 years. The annual claim fees payable to the BLM are approximately US$42,000. Annual lease fees paid to the State of Arizona in 2006 was approximately $10,000. An annual minimum US$30,000 advance royalty is payable to PLT under the terms of the lease and is subject to a 1 percent production gross royalty so long as the price of gold in US dollars is less than US$350 per ounce (royalty increases to 6 percent as price of gold increases to over US$551 per ounce).

Accessibility, Climate, Local Resources, Infrastructure, and Physiography

The Copperstone Project is located 16 km north of the town of Quartzite, Arizona and about 40 km south of the town of Parker, the county seat of La Paz. The property is accessible from the Highway 95,

- 28 -

north of Quartzite, and then turning west on a 4-mile gravel road to the mine site. The site access road is well maintained and suitable for all anticipated mine usage. The main east-west line for the Santa Fe railroad is about 15 miles north of the property.

The climate in the area is very dry with an average annual precipitation of 4 inches. Summers are extremely hot with an average temperature from May to September of 88.7 degrees Fahrenheit. Winters are mild with an average temperature from October to April of 63 degrees Fahrenheit. The maximum and minimum temperatures for the area are about 120 degrees Fahrenheit and 20 degrees Fahrenheit, respectively.

Significant infrastructure exists from the previous Cyprus mining operation conducted from 1988 to 1993. The present infrastructure consists of office, shops, storage facilities, various housing trailers, power, and water. Operational water can be available from existing on-site wells while potable water must be trucked on site. Presently, the mine communication utilizes a satellite phone, cell phones, and satellite internet.

The Copperstone Property is located on sandy desert terrain, with scattered small hills and local sand dunes. The area is relatively flat with surface elevations ranging from about 725 to 900 feet.

History

During the period 1987 to 1993, Cyprus Minerals (“Cyprus”) operated a 2,500 ton per day open-pit mine at Copperstone that produced approximately 500,000 ounces of gold from the Copperstone fault. The mine was closed at the economic limit of open-pit mining. Total mine production was 6,000,000 tons at a grade of 0.11 ounces/ton (3.8 g/t) gold. Gold recovery for the life of mine was 89 percent. The strip ratio of the pit was 10:1. Cyprus drilled 496 reverse circulation and 73 core holes for a total of 569 holes. Following the mine closure in 1993, Cyprus reclaimed the tailings pond and removed the Carbon-in-Pulp mill. Office, shop and warehouse facilities remain at the site. Furthermore, the 69 kv power line and substation remains in service, together with the three water wells with a 200 hp pumping capacity.

Geology

The Copperstone Project occurs within the “Basin and Range” province of the south-western USA. The regional geology is strongly influenced by Tertiary age detachment faults and younger high angle normal faults. The Copperstone gold deposit is related to the Moon Mountain or Copper Peak detachment fault. Gold mineralization at Copperstone occurs principally within the moderate to low-angle Copperstone Fault which has been interpreted to be a listric fault associated with the underlying Moon Mountain detachment fault. Gold occurs as native flakes within fault breccia, gouge and shear zones related to the faulting. The wall and host rocks are typically Triassic sediments and Jurassic quartz latite volcanics. Gold is commonly associated with hematite, chlorite, quartz, manganese oxide and copper oxide mineralization.

Gold Mineralization

Gold mineralization at Copperstone occurs mostly as particles with about 80% as small flakes ranging between 4 to 40 microns. Coarse gold ranges in size from 50 to 150 microns. Gold typically is free and associated with early and late stage quartz/amethyst and occasionally calcite.

- 29 -

Coarse gold occurs in the quartz latite porphyry cut by amethyst-quartz vein fringes, as flakes in fracture, and on the wall rock associated with copper oxides. Previous operators concluded that much of the coarse gold is directly depositional in origin, because it occurs as discrete three-dimensional grains.

Mineral Resource and Mineral Reserve Estimations

Results of a NI 43-101 compliant mineral resource and higher grade mineral resource estimate at Copperstone from the March 27, 2006 AMEC Report are as follows:

The AMEC Report estimated total Mineral Resources by tabulating all mineralization within the 1.03 grams Au/tonne grade shell and above a cutoff grade of 1.71 grams Au/tonne (0.05 oz/ton). This represents mineralization that may have reasonable prospects for economic extraction at higher gold prices, economies of scale and the potential for extraction of mineralization from expansion of the existing open pit. The cutoff grade from past mining operations on the property was approximately 0.04 oz/ton, which closely correlates to the cutoff used by AMEC in their report.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

ESTIMATES OF MEASURED AND INDICATED RESOURCES

The table below uses the terms “measured” and “indicated” resources. The Corporation advises U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Table 1A. Mineral Resource Tabulation –Model Capped at

137.1 g Au/t with a 1.71 g Au/t Cutoff Grade

| | | | Average Grade | Contained |

| | | | (grams/tonne | Ounces of |

| Zones | Classification | Tonnes | gold) | Gold |

| A, B, C and D | Measured | 15,600 | 14.61 | 7,333 |

| A, B, C and D | Indicated | 2,408,260 | 5.55 | 429,563 |

| A, B, C and D | Measured & Indicated | 2,423,860 | 5.61 | 436,896 |

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

ESTIMATES OF INFERRED RESOURCES

The table below uses the term “inferred resources”. The Corporation advises U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not

- 30 -

form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

Table 1B. Mineral Resource Tabulation –Model Capped at

137.1 g Au/t with a 1.71 g Au/t Cutoff Grade

| | | | Average Grade | Contained |

| | | | (grams/tonne | Ounces of |

| Zones | Classification | Tonnes | Gold) | Gold |

| | | | | |

| A, B, C and D | Inferred | 532,740 | 5.21 | 89,445 |

In addition to identifying the mineral resource, mineral resources above a cutoff grade of 6.86 g Au/t, and with dilution and mining extraction parameters applied are listed below.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

ESTIMATES OF MEASURED AND INDICATED RESOURCES

The table below uses the terms “measured” and “indicated” resources. The Corporation advises U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Table 2A. Higher Grade Mineral Resources –Model Capped at

137.1 g Au/t with a 6.86 g Au/t Cutoff Grade

| | | | Average Grade | Contained |

| | | | (grams/tonne | Ounces of |

| Zones | Classification | Tonnes | Gold) | Gold |

| A, B, C and D | Measured | 9,340 | 13.51 | 4,028 |

| A, B, C and D | Indicated | 328,820 | 12.55 | 132,807 |

| A, B, C and D | Measured & Indicated | 338,160 | 12.58 | 136,835 |

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING

ESTIMATES OF INFERRED RESOURCES

The table below uses the term “inferred resources”. The Corporation advises U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

- 31 -

U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

Table 2B. Higher Grade Mineral Resources – Model Capped at

137.1 g Au/t with a 6.86 g Au/t Cutoff Grade

| | | | Average Grade | Contained |

| | | | (grams/tonne | Ounces of |

| Zones | Classification | Tonnes | Gold) | Gold |

| | | | | |

| A, B, C and D | Inferred | 3,360 | 10.25 | 1,113 |

The economic parameters applied to this higher grade resource are preliminary and the Mineral Resources have not demonstrated economic viability until financial analyses determine that the resources can be extracted at a profit after recovery of operating and capital costs. Furthermore, in accordance with NI 43-101 Section 2.3.3, the Preliminary Assessment includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the Preliminary Assessment will be realized.

Mineralized domains and gold grades were established using industry accepted statistical methods. Bulk density values were averaged by rock type. A three dimensional block model was then generated using 18 x 12 x 6 foot blocks and interpolated utilizing mine planning software. The resource estimate was then validated with visual checks of block estimates versus drill hole composite grades, and bias checks using numerous statistical methods.

AMEC reviewed available QA/QC data and found the gold, silver, and copper assays from the Corporation and Cyprus drill campaigns to be acceptably accurate. Resampling of core produced in the Royal Oak period of drilling produced poor agreement between original and reassayed core. However Royal Oak data is only 4% of the total assay data base. AMEC recommended that mineralized intervals of Royal Oak holes be reassayed for use in future resource estimates.