UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

Commission File No.: 000-29916

AMERICAN BONANZA GOLD CORP.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 305 - 675 West Hastings Street, Vancouver, British Columbia, Canada, V6B 1N2

(Address of principal executive offices)

Catherine Tanaka, Corporate Secretary

Tel: 604-688-7511

Fax: 604-681-0122

Email:ctanaka@americanbonanza.com

Suite 305 - 675 West Hastings Street, Vancouver, British Columbia, Canada, V6B 1N2

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares, Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of December 31, 2010:130,199,272 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ X ]

If this is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer.

| Large accelerated filer [ ] | | Accelerated filer [ ] | | Non-accelerated filer [ X ] | |

Indicate by checkmark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP [ ] | | International Financial Reporting Standards as issued

by the International Accounting Standards Board [ ] | | Other [ X ] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [ X ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [ X ]

GLOSSARY OF TERMS

The following is a glossary of certain mining and other terms used in this Annual Report:

“AMEC” means AMEC E & C Services Inc.;

“Arrangement” means the arrangement among the Corporation, Old Bonanza, Taurus, Fairstar and FairstarSub relating to the current organizational structure of the Corporation, pursuant to the terms and subject to the conditions set out in the Plan of Arrangement, as amended and supplemented, as more particularly described in this document;

“Arrangement Agreement” means the agreement dated December 21, 2004 and amended on February 21, 2005 among the Corporation, Old Bonanza, Taurus, Fairstar and FairstarSub relating to the Arrangement;

“BCA” means the Business Corporation Act (British Columbia), as amended;

“BLEG” means bulk leach extractable gold;

“Bonanza”,“Corporation” and “New Bonanza” mean American Bonanza Gold Corp., a corporation incorporated under the BCA on December 10, 2004 as 0710887 B.C. Ltd., and its subsidiaries, unless the context suggests otherwise;

“EDGAR” means the U.S. Securities and Exchange Commission’s Electronic Data Gathering, Analysis, and Retrieval System available for viewing publicly filed documents at www.sec.gov;

“Fairstar” means Fairstar Explorations Inc., a corporation incorporated under the laws of Canada;

“FairstarSub” means 0710882 B.C. Ltd., a corporation incorporated under the laws of the Province of British Columbia;

“NI 43-101” means Canadian National Instrument 43-101, Companion Policy 43-101CP, and Form 43-101F1, “Standards of Disclosure for Mineral Projects”, which governs all oral and written disclosure of scientific or technical information, including disclosure of a mineral resource or reserve, made by or on behalf of a Canadian company in respect of a mineral project. NI 43-101 uses for the terms “mineral resource”, “inferred mineral resource”, “indicated mineral resource”, “measured mineral resource”, “mineral reserve”, “probable mineral reserve” and “proven mineral reserve” the meanings ascribed to those terms by the Canadian Institute of Mining, Metallurgy and Petroleum, as the CIM Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by CIM Council on December 11, 2005, as those definitions may be amended from time to time by the Canadian Institute of Mining, Metallurgy and Petroleum. Those definitions are reproduced below in this Glossary for the convenience of readers;

“NPI” means net profits interest, or, the amount payable from the net profit produced by the mine;

“NSR” means net smelter royalty, or, the amount payable from the precious metal produced by the mine after smelting has removed most of the impurities;

“Old Bonanza” means American Bonanza Gold Mining Corp., a corporation incorporated under the BCA which was, immediately prior to the completion of the Arrangement, the parent company of the Corporation;

“Original Copperstone Report” means the technical report entitled “NI 43-101 Technical Feasibility Report, Copperstone Project, La Paz County, Arizona” dated February 2, 2010 prepared under the supervision of Todd Fayram, B.S. Eng, MMSA, Continental Metallurgical Services and filed on SEDAR on March 22, 2010;

“Plan of Arrangement” means the plan of arrangement pursuant to the Arrangement Agreement relating to the current organizational structure of the Corporation as more particularly described in this document;

“Revised Copperstone Report” means the technical report entitled “NI 43-101 Technical Feasibility Report, Copperstone Project, La Paz County, Arizona” dated February 2, 2010 and revised January 10, 2011 prepared by Dr. Corby Anderson, MMSA, C. Eng Fl ChemE, Tom Buchholz, B.S. Eng. MMSA, Chris Pratt, LPG, and Jonathan Brown, M.B.A., C.P.G.

“Royalty” means a payment schedule by which payments are calculated based on a percentage of the value of the mineral produced;

“SEDAR” means the Canadian System for Electronic Document Analysis and Retrieval available for viewing publicly filed documents at www.sedar.com;

“Taurus” means International Taurus Resources Inc., a corporation incorporated pursuant to the laws of the Province of British Columbia; and

“TSX” means the Toronto Stock Exchange.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the U.S.Private Securities Litigation Reform Act of 1995. These forward-looking statements are not guarantees of the Corporation’s future operational or financial performance and are subject to risks and uncertainties.

In certain cases, forward-looking statements can be identified by the use of words such as “believe”, “intend”, “may”, “will”, “should”, “plans”, “anticipates”, “believes”, “potential”, “intends”, “expects” and other similar expressions. Forward-looking statements reflect our current expectations and assumptions, and are subject to a number of known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements, particularly as they relate to the actual results of exploration activities, the estimation or realization of mineral reserves and mineral resources, the timing of construction at the Copperstone Mine, the timing of commencement of and amount of estimated future production, capital expenditures, operating costs, costs and timing of the development of new mineral deposits, requirements for additional capital, future prices of precious and base metals, possible variations in ore grade or recovery rates, failure of plant, equipment or processes to operate as anticipated, accidents, labour disputes, road blocks and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, currency fluctuations, title disputes or claims limitations on insurance coverage, credit payment risks, global financial conditions and the timing or magnitude of such events are inherently risky and uncertain.

Key assumptions upon which the Company’s forward-looking statements are based include the following:

the price for gold will not fall significantly;

the assumptions in the financial analysis in the Revised Copperstone Report are materially accurate;

the Company will be able to secure additional financing to continue its exploration and development activities;

there will be no significant adverse changes in currency exchange rates;

there will be no significant changes in the ability of the Company to comply with environmental, safety and other regulatory requirements;

the Company will be able to obtain regulatory approvals (including licenses and permits) in a timely manner;

the absence of any material adverse effects arising as a result of political instability, terrorism, sabotage, natural disasters, equipment failures or adverse changes in government legislation or the socio-economic conditions in the surrounding area to the Company’s operations;

the Company’s capital costs and operating costs will not increase significantly;

the Company will be able to procure mining extraction plant and equipment in a timely manner; and

key personnel will continue their employment with the Company.

additional assumptions are included, among other places, in this Annual Report under Item 4. “Information on the Corporation”.

These assumptions should be considered carefully by investors. Investors are cautioned not to place undue reliance on the forward-looking statements or the assumptions on which the Company’s forward-looking statements are based. Investors are advised to carefully review and consider the risk factors identified in this Annual Report under the heading “Risk Factors” for a discussion of the factors that could cause the Company’s actual results, performance and achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Investors are further cautioned that the foregoing list of assumptions is not exhaustive and it is recommended that prospective investors consult the more complete discussion of the Company’s business, financial condition and prospects that is included in this Annual Report including the documents incorporated by reference herein.

Although the Company believes that the assumptions on which the forward-looking statements are made are reasonable, based on the information available to the Company on the date such statements were made, no assurances can be given as to whether these assumptions will prove to be correct. The forward looking statements expressed herein are made as of the date of this Annual Report. The Company does not undertake to update such forward looking statements except where required to do so by law. Investors should not place undue reliance on forward-looking statements. The forward-looking statements contained in this Annual Report are expressly qualified by this cautionary statement.

GLOSSARY OF TECHNICAL TERMS

| Aeolian | Deposits arranged/transported by the wind, due to the erosive action of the wind, such as sand and other loose materials. |

| Ag | Used as the abbreviation for silver. |

| Albite | One of the components of plagioclase. |

| Alteration | Chemical and mineralogical changes in a rock mass resulting from reaction with hydrothermal fluids or changes in pressure and temperature. |

| Anomalous | Adjective describing a sample, location or area at which either (i) the concentration of an element(s) or (ii) a geophysical measurement is significantly different from (generally higher than) the average background concentrations in an area. Though it may not constitute mineralization, an anomalous sample or area may be used as a guide to the possible location of mineralization. |

| Anomaly | An area defined by one or more anomalous points. |

| Argillaceous | Rocks or substances composed of clay, or having a notable proportion of clay in their composition. |

| Argillite | A sedimentary rock composed of compacted mud and clay particles. |

| Argillic | Pertaining to clay or clay minerals. |

| Assay | Quantitative test of minerals and ore by chemical and/or fire techniques. |

| Assemblage | A biostratigraphic unit defined and identified as a group of associated fossils. |

| Au | Aurum (Latin for gold) used as an abbreviation for gold. |

| Axial trace | The intersection of the axial plane of a fold with the surface of the earth or any other specified surface. |

| Azurite | A deep blue common secondary mineral. |

| Barite | A mineral. The principal ore of barium. |

| Biotite | Common rock-forming mineral, dark brown to green in colour. |

| BLM | Bureau of Land Management, the United States federal lands administrative authority. |

| Bonanza-grade | More than 34 grams of gold per tonne or more than one troy ounce of gold per ton. |

| Breccia | A coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix. |

| Bulk sample | A large sample consisting of tons or hundreds of tons which is then milled and the grade computed from the results. |

| Bull quartz | White, coarse-grained, barren quartz. |

| C-Zone | North-east of the open pit at the Copperstone property. |

| Calcite | A mineral, calcium carbonate. One of the commonest minerals. The principal constituent of limestone. |

| Carbonate vein | A vein consisting chiefly of carbonate minerals, such as limestone or dolomite. |

| Chalcopyrite | Copper pyrites. A mineral. An important ore of copper. |

| Channel-sample | Material sampled from a groove cut across a rock exposure. |

| Chlorite | Silicates closely related to micas. Common in low-grade metamorphic rocks. |

| Chrysocolla | A mineral. Usually in green to blue-green masses. |

| Crosscut | A horizontal opening driven across the direction of the main workings. |

| D Zone | North of the open-pit at the Copperstone property. |

| Decline | A passage or tunnel driven at a decline from the surface for the working of a mine. |

| Deformation | Any change in the original form or volume of rock masses produced by tectonic forces; folding, faulting, and solid flow are common modes of deformation. |

| Dip | The acute angle that a rock surface makes with a horizontal plane. Direction of dip is always perpendicular to strike. |

| Doré | Unparted gold and silver poured into moulds when molten to form buttons or bars. |

| Drift | Workings driven in or near a mineralized zone and parallel to the course of the vein or the long dimension of the mineralized zone. |

| Drifting | Proceeding with mining to create a drift. |

| Electron | The elementary particle of mass 9 x 10-28 grams and unit electrical charge. |

| Epidote | A common mineral in metamorphic rocks. |

| Fabric | The orientation in space of the elements of which a rock is composed |

| Face | The surface exposed by excavation. The working face, front, or forehead is the face at the end of the tunnel heading, or at the end a full-size excavation, |

| Fault or BlockFault | A fracture in a rock across which there has been displacement. Block faults are usually steep, and break the earth’s crust into “blocks” that are displaced vertically and/or laterally relative to each other. |

| Fe | Chemical symbol for the element iron. |

| Felsic | Mnemonic term derived from (fe) for feldspar, (l) for lenads of feldspathoids, and (s) for silicia and applied to light-coloured rocks containing an abundance of one or all of these constituents. Also applied to the minerals themselves, such as quartz, feldspars, feldspathoids and muscovite. |

| ft | foot or feet, as the context requires. |

| Gabbroic | Plutonic rock consisting of calcic plagioclase and clinopyroxene, with or without orthopyroxene and olivine. Apatite and magnetite or ilmenite are common accessories. Loosely used: Any coarse-grained igneous rock. |

| Geochemistry | The chemistry of the earth and its rocks, minerals, etc. |

| GeophysicalExploration | Exploring for minerals or determining the nature of Earth materials by measuring a physical property of the rocks and interpreting the results in terms of geologic features or the economic deposits sought. Physical measurements may be taken on the surface, in boreholes, or from airborne or satellite platforms. |

| Glacio-lacustrine | Produced by or belonging to lakes formed by or in relationship to glaciers. |

| Gneiss | A coarse-grained rock in which bands rich in granular minerals alternate with bands in which schistose minerals predominate. |

| Gouge | A layer of soft material along the wall of a vein. Finely abraded material occurring between the walls of a fault. |

| Grade | The amount of valuable mineral in each tone of ore, expressed as ounces per ton or grams per tonne for precious metal and as a percentage by weight for other metals. |

| Granitic | Of, pertaining to, or composed of, granite or granite like rock. |

| Greywacke | Dark, coarse-grained sandstone, usually with an admixture of clay. |

| g/t | Grams per tonne. |

| Hanging wall | The rock on the upper side of a mineral vein or deposit. |

| Hematite | A mineral. The principal ore of iron. |

| Highwall | The unexcavated face of exposed overburden and coal or ore in an opencast mine, or the face or bank on the uphill side of a contour strip mine excavation. |

| Homoclinal | A structural condition in which the beds dip uniformly in one direction. |

| Hydrothermal | Of or pertaining to heated water, to the action of heated water, or to the products of the action in heated water. |

| Intrusion | A body of igneous that involves other rock. |

| Intrusive | A rock formed by the process of emplacement of magma in pre-existing rock. |

| IP | Induced polarization survey. |

| Kriging | 1. A weighted, moving-average interpolation method in which the set of weights assigned to samples minimizes the estimation variance, which is computed as a function of the variogram model and locations of the samples relative to ach other, and to the point or block being estimated.

2. In the estimation of ore reserves by geostatistical methods, the of a weighted, moving-average approach to account for the estimated values of spatially distributed variables, and also to assess the probable error associated with the estimates. |

| Lacustrine | Produced by or belong to lakes. |

| Latite | The extrusive equivalent of monzonite and a variety of trachyandesite in which potash feldspar and plagioclase are present either as normative or modal minerals in nearly equal amounts. |

| Leach | To wash or drain by percolation. To dissolve minerals or metals out of the ore, as by the use of cyanide or chlorine solutions, acids, or water. |

| Lens | A body of ore or rock thick in the middle and thin at the edges. |

| Listric fault | A curved downward-flattening fault, generally concave upward. Listric faults may be characterized by normal or reverse separation. |

| Lithology | The physical character of a rock, generally as determined megascopically or with the aid of a low-power magnifier. The microscopic study and description of rocks. |

| Mafic | Subsilicic, basic. Contrasted with felsic. In general, synonymous with “dark minerals”, as usually used. |

| Malachite | A mineral. Common alteration product of copper ores. |

| Marcasite | White iron pyrites. A common ore mineral. |

| Metallogenic | Relating to the formation of gold deposits, millions of years ago. |

| Metamorphicrock | Includes all those rocks which have formed in the solid state in response to pronounced changes in temperature, pressure, and chemical environment, which take place, in general, below the shells of weathering and cementation. |

| Metasediments | Partly metamorphosed sedimentary rocks. |

| Metasomatize | To replace one mineral by another of different chemical composition owing to reactions set up by the introduction of material from external sources. (Metasomatism = replacement) |

| Mineralization | The process by which a mineral or minerals are introduced into a rock resulting in an economically valuable or potentially valuable deposit. |

| NSR | Net smelter return. |

| Opt | Troy ounces per short ton of gold unless indicated to be another metal. |

| Ore | A mineral or aggregate of minerals more or less mixed with gangue which can be profitably mined given economic circumstances at the time. The Company does not hold any interest in properties where the mineralization has been determined to be ore. |

| Ounce (or oz.) | Meaning a troy ounce. There are 31.1034 grams to a troy ounce and there are 12 troy ounces to a troy pound, a common unit of measurement for precious metals. |

| Outcrop | An exposure on the surface of the underlying rock. |

| Overburden | Material of any nature, consolidated or unconsolidated, that overlies a deposit of useful materials, ores, or coal, especially those deposits that are mined from the surface by open cuts. |

| Panel sample | Material sampled from sections divided across a rib or face. |

| Paragenesis | A general term used to denote a gneiss derived from a sedimentary rock. |

| Petrographic | Some or all of the igneous rocks are derived from a common parent magma. |

| Phyllite | An argillaceous rock intermediate in metamorphic grade between slate and schist. |

| Pleistocene | The earlier of the two epochs comprised in the Quaternary period, in the classification generally used. Also called Glacial epoch, Ice age, Post-Pliocene and Post-Tertiary. Also, the series of sediments deposited during that epoch, including both glacial deposits and ordinary sediments. |

| Plagioclase | A mineral group. One of the commonest rock-forming minerals. |

| Planar | Relating to, or in the form of a plane. |

| Porphyritic | Textural term for igneous rocks in which larger crystals are set in a finer groundmass which may be crystalline or glassy, or both. |

| Porphyry | An igneous rock containing conspicuous crystals or phenocrysts in a fine-grained groundmass; type of mineral deposit in which ore minerals are widely disseminated, generally of low grade but large tonnage. |

| Potassic | Of, pertaining to, or containing potassium. |

| Precious metals | Gold, platinum, silver and palladium. |

| PreliminaryAssessment | A study that includes an economic analysis of the potential viability of mineral resources taken at an early stage of the project prior to the completion of a preliminary feasibility study. |

| Propylite | An altered, greenstone-like andesitic rock consisting of such minerals as calcite, chlorite, epidote, serpentine, quartz, pyrite, and iron ore and resulting from hydrothermal alteration. |

| Pyrite | Iron pyrites. Fool’s gold. A mineral. An important ore of sulphur; sometimes mined for the associated gold or copper. |

| Pyroclastic | General term for a class of rocks made up of detrital volcanic materials that have been explosively or aerially ejected from a volcanic vent. |

| Pyrrhotite | Magnetic pyrites. |

| Quartz | A common rock forming mineral composed of silicon and oxygen. |

| Raise | A mine shaft driven from below upward; also called upraise, rise, and riser. |

| Ramp | A fault that is a gravity (normal) fault near the surface of the earth, but curves through the vertical to dip in the opposite direction at depth; where the displacement is that characteristic of thrusts. |

| Reserves: | Mineral Reserve: The economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| Probable Mineral Reserve: The economically mineable part of an Indicated, and in some circumstances a Measured, Mineral Resource, demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| Proven Mineral Reserve: The economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| Resistivity | That factor of the resistance of a conductor which depends upon the material and its physical condition. |

| Resources: | Resource: A concentration or occurrence of natural material of intrinsic economic interest in or on the Earth’s crust in such form and quantity and such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| Inferred Mineral Resource: That part of a mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

| Indicated Mineral Resource: That part of a mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| Measured Mineral Resource: That part of a mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| Rhyolite | An extrusive igneous (volcanic) rock with phenocrysts of quartz and alkalic feldspar, commonly of porphyritic texture. |

| Rib | The sides of a decline or tunnel. |

| Sedimentary | Rock formed of sediment, as conglomerate, sandstone and shale, formed of fragments of other rock transported from their sources and deposited in water; rocks formed by precipitation from solution as rock salt or gypsum or non-organic secretions of organisms, e.g., most limestone. |

| Sericite | Fine-grained variety of mica. |

| Shear | A fold formed as a result of the minute displacement of beds along closely spaced fractures or cleavage planes. |

| Schist | A medium or coarse-grained metamorphic rock with subparallel orientation of the micaceous minerals which dominate its composition. |

| Silica | Silicon dioxide. |

| Siliceous | Said of a rock containing abundant silica. |

| Silicification | The introduction of or replacement by, silica. Generally the silica formed is fine grained quartz, chalcedony, or opal, and may fill both up pores and replace existing minerals. The term covers all varieties of such processes, whether late magmatic, hydrothermal or diagenetic. |

| Specularite | Hematite, occurring in tabular or disklike crystals of gray colour and splendent metallic luster. |

| Sphalerite | A mineral, dimorphous with wurtzite. Isometric. The principal ore of zinc. |

| Splays | Divergent small faults at the extremities of large normal faults, especially rifts. |

| Stope | An excavation from which the ore has been extracted, either above or below a level, in a series of steps. |

| Stoping | The loosening and removal of ore in a mine either by working upward (overhead or overhand) or downward (underhand). |

| Strata | A tabular or sheet-like body of sedimentary rock. |

| Stratigraphy | That branch of geology which treats of the formation, composition, sequence, and the correlation of stratified rocks as parts of the earth’s crust. |

| Strike | Direction of line formed by intersection of a rock surface with a horizontal plane. Strike is always perpendicular to direction of dip. |

| StructuralControl | The influence of structural features on ore deposition, e.g., ore minerals filling fractures. |

| Sulphide | Group of minerals consisting of metals combined with sulphur; common metallic ores (or “Sulfide”). |

| Syenite | A plutonic igneous rock consisting principally of alkalic feldspar usually with one or more mafic minerals such as hornblende or biotite. |

| Tailings (tails) | Those portions of washed ore that are regarded as too poor to be treated further. Debris from stamp mills or other ore-dressing machinery. |

| Tertiary | The period of geological time extending from 66 to 2 million years ago, which includes the Palaeogene and Neogene epochs. |

| Ton | Short ton which measures 2,000 pounds. |

| Tonne | Metric ton which measures 2,204.6 pounds or 1000 kilograms. |

| Tpd | Ton per day. |

| Tuff | A rock formed of compacted volcanic fragments, generally less than 4 millimetres in diameter. |

| Ultramafic | Ultrabasic. Some igneous rocks and most varieties of meteorites containing less than 45% silica; containing virtually no quartz or feldspar and composed essentially of ferromagnesian silicates, metallic oxides and sulfides, and native metals, or of all three. |

| Vein | A tabular or sheet-like mineral deposit with identifiable walls, often filling a fracture or fissure. |

| Veinlet | A small vein; the distinction between vein and veinlet tends to be subjective. |

| Volcanic | Pertaining to the activity, structures or rock types of a volcano. |

TABLE OF CONTENTS

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

Currency and Exchange Rates

All dollar amounts set forth in this Annual Report are in Canadian dollars, except where otherwise indicated. The following table sets forth the average rate of exchange for the Canadian dollar for the periods indicated (calculated by using the average of the exchange rates on the last day of each month during the period):

| | | | | | (C$) | | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Average Rate During Period | | 1.0299 | | | 1.1373 | | | 1.0693 | | | 1.0665 | | | 1.1307 | |

The following table sets forth the high and low exchange rates in Canadian dollars, for the periods indicated, in each case based on the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York:

| | | | | (C$) | | | | | | | | | | | | | |

| | | Feb/11 | | | Jan/11 | | | Dec/10 | | | Nov/10 | | | Oct/10 | | | Sep/10 | |

| High Rate | | 0.9958 | | | 1.0015 | | | 1.0175 | | | 1.0266 | | | 1.0319 | | | 1.0535 | |

| Low Rate | | 0.9714 | | | 0.9869 | | | 0.9946 | | | 1.0000 | | | 1.0048 | | | 1.0256 | |

On December 31, 2010, the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York was $1.00 US = $0.9946 CDN.

On March 30, 2011, the noon buying rate in New York City for cable transfer in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York was $1.00 US = $0.9717 CDN.

Selected Financial Data

The following table sets forth selected consolidated financial information for the Corporation for, and as of the end of, each of the last five fiscal years ended December 31, 2010. The financial information is derived from the consolidated financial statements of the Corporation and is presented in Canadian dollars. The consolidated financial statements as at December 31, 2010 and 2009 and for the years ended December 31, 2010, 2009 and 2008 were audited by KPMG LLP, Chartered Accountants (see Item 17).

The selected consolidated financial information presented below should be read in conjunction with the audited consolidated financial statements of the Corporation included elsewhere herein.

| | For the Year Ended December 31, | |

| | | | | | | |

| | 2010 | 2009 | 2008 | 2007 | 2006 | |

| | | $ | $ | $ | $ | |

| Net loss (Canadian GAAP) | (6,661,268) | (11,041,089) | (3,883,826) | (946,457) | (1,740,706) | |

| Net loss per share (Canadian GAAP) | (0.05) | (0.09) | (0.03) | (0.01) | (0.02) | |

| Net loss (U.S. GAAP) | (6,533,571) | (10,055,195) | (7,098,594) | (2,456,339) | (5,867,442) | |

| Net loss per share (U.S. GAAP) | (0.05) | (0.09) | (0.06) | (0.02) | (0.06) | |

| Weighted average number of shares | 122,765,013 | 117,594,853 | 115,662,976 | 100,958,861 | 96,280,740 | |

| Total cash and cash equivalents | 3,104,650 | 957,923 | 2,650,636 | 4,266,063 | 6,150,005 | |

| Working capital | 7,979,474 | 2,638,431 | 5,726,261 | 5,963,158 | 6,958,811 | |

| Total debt | Nil | Nil | Nil | Nil | Nil | |

| Total assets (Canadian GAAP) | 41,583,325 | 45,335,078 | 57,167,469 | 60,963,361 | 59,751,226 | |

| Total assets (US GAAP) | 14,616,133 | 18,285,759 | 28,283,648 | 35,009,200 | 36,383,664 | |

| Shareholders’ equity (Canadian GAAP) | 40,503,949 | 44,610,786 | 55,428,282 | 59,336,557 | 57,799,245 | |

| Shareholders’ equity (US GAAP) | 13,536,757 | 17,561,467 | 27,393,069 | 34,200,947 | 33,541,709 | |

The selected consolidated financial data has been prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Selected financial data has also been provided under United States generally accepted accounting principals (“US GAAP”) to the extent that amounts are different from Canadian GAAP. The consolidated financial statements included in Item 17 in this Annual Report are prepared under Canadian GAAP. Included within the consolidated financial statements in Note 15 is a reconciliation between Canadian and U.S. GAAP.

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

General

Precious metals exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Corporation may be affected by numerous factors which are beyond the control of the Corporation and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of mining facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, any of which could result in the Corporation not receiving an adequate return on invested capital.

Uncertainties and risks relating to the start-up of operations at the Copperstone Mine

There are inherent construction and permitting-related risks to the development of all new mining projects. These risks include:

availability and delivery of critical equipment;

hiring of key personnel for construction and commissioning;

delays associated with contractors;

budget overruns due to changes in the cost of fuel, power, materials, supplies and currency fluctuations; and

potential opposition from non-governmental organizations, First Nations, environmental groups or local groups.

While the Corporation has undertaken systematic work programs at the Copperstone Mine to mitigate these risks, it is common in new mining operations to experience such unexpected costs, problems and delays during construction, development and mine start-up, often due to circumstances beyond the Corporation’s control. In addition, delays in the commencement of mineral production often occur. Accordingly, the Corporation cannot provide assurance that its activities will result in profitable mining operations at the Copperstone Mine. The Corporation will be required to rely upon outside consultants, engineers and others for construction expertise in respect of building the Copperstone Mine. The Corporation will also rely on an outside contractor for mining services, and will be dependent on such contractor’s expertise. While the Corporation has taken or will take steps to ensure such consultants have industry experience, there is no guarantee that such consultants and contractors will prove to have the required skills. The Corporation’s operations, earnings and ultimate financial success could be materially adversely affected.

Additional Funding Requirements

The Corporation believes it has sufficient funds to restart mining at the Copperstone Mine. If there is a shortfall in the funds required, the Corporation will require additional financing in the near future in order complete construction of the mine and to advance the Copperstone Mine towards production and to carry out its other acquisition, exploration and development activities. Failure to obtain such financing on a timely basis could cause a delay in the development timeline of the Copperstone Mine, cause the Corporation to forfeit its interest in certain properties, miss certain acquisition opportunities, delay or indefinitely postpone further exploration and development of its projects with the possible loss of such properties and reduce or terminate its operations. If the Corporation’s future revenues decrease as a result of lower commodity prices, or otherwise, it will affect the Corporation’s ability to expend the necessary capital to replace its reserves or to maintain its production. If the Corporation’s cash flow from operations is not sufficient to satisfy its capital expenditure requirements, there can be no assurance that additional debt or equity financing will be available on terms acceptable to the Corporation to meet these requirements or be available on favourable terms.

Permits and Licenses

The operations of the Corporation will require licenses, permits and other approvals from various governmental authorities, including those responsible for managing the use of public lands and management of public resources such as air and water. Governmental authorities that will be, or have already, issuing permits include: the United States Department of the BLM, the ADEQ, the EPA, La Paz County in Arizona, the United States Mine Safety and Health Administration (“MSHA”), the Arizona State Mine Inspector, and the United States Federal Communication Commission (the “FCC”). There can be no assurance that the Corporation will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development, construction and operation of the Copperstone Mine, or that once received, the Corporation will be able to maintain such permits and licenses. The failure to obtain a material permit or license, or the loss of such permit or license, could have a material adverse effect on the Corporation’s business and operations.

Current Global Financial Conditions

The recent events in global financial markets have had a profound impact on the global economy. The mining industry has been impacted by these market conditions. Some of the key impacts include volatility in global equities, commodities, foreign exchange, precious metals markets and a lack of market liquidity. A continued slowdown in the financial markets or other economic factors such as fuel and energy costs, the state of the financial markets, interest rates and tax rates may adversely affect the Corporation’s development. The global credit/liquidity crisis could impact the cost and availability of finance and the Corporation’s overall liquidity. The devaluation and volatility of global equity markets impacts the valuation of the Common Shares. If these increased levels of volatility and market instability continue, the Corporation’s operations and financial conditions could be adversely impacted.

Exploration, Development and Production Risks

An investment in the Corporation’s Common Shares is speculative due to the nature of the Corporation’s involvement in the evaluation, acquisition, exploration and development and production of minerals.

Mineral exploration and development involves a high degree of risk and there is no assurance that expenditures made on future exploration by the Corporation will result in new discoveries of commercial quantities of ore.

While the Corporation has a limited number of specific identified exploration or development prospects, management will continue to evaluate prospects on an ongoing basis in a manner consistent with industry standards. The long-term commercial success of the Corporation depends on its ability to find, acquire, develop and commercially produce reserves. No assurance can be given that the Corporation will be able to locate satisfactory properties for acquisition or participation. Moreover, if such acquisitions or participations are identified, the Corporation may determine that current markets, terms of acquisition and participation or pricing conditions make such acquisitions or participations uneconomic. The Corporation has no earnings record and no producing resource properties.

The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish Mineral Reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is difficult to ensure that the exploration or development programs planned by the Corporation will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade, metallurgy and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection.

The Corporation’s operations will be subject to all of the hazards and risks normally encountered in the exploration, development and production of minerals. These include unusual and unexpected geological formations, rock falls, seismic activity, flooding and other conditions involved in the extraction of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although precautions to minimize risk will be taken, operations are subject to hazards that may result in environmental pollution, and consequent liability that could have a material adverse impact on the business, operations and financial performance of the Corporation.

Uncertainty of Mineral Reserves and Mineral Resources

Mineral reserves and resources estimates for the Corporation’s properties are estimates of the size and grade of deposits based on limited sampling and on certain assumptions and parameters. No assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery of gold will be realized. The ore grade actually recovered may differ from the estimated grades of the mineral reserves and mineral resources. Prolonged declines in the market price of gold may render mineral reserves containing relatively lower grades of gold mineralization uneconomic to exploit and could materially reduce the Corporation’s reserves. Should such reductions occur, the Corporation could be required to take a material write-down of its investment in mining properties or delay or discontinue production or the development of new projects, resulting in increased net losses and reduced cash flow. Market price fluctuations of gold, as well as increased production costs or reduced recovery rates, may render mineral reserves containing relatively lower grades of mineralization uneconomical to recover and may ultimately result in a restatement of mineral resources. Short-term factors relating to mineral reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may impair the profitability of a mine in any particular accounting period. Mineral reserves are not revised in response to short-term cyclical price variations in metal markets. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Uncertainty Relating to Inferred Mineral Resources

Inferred Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Due to the uncertainty which may attach to Inferred Mineral Resources, there is no assurance that Inferred Mineral Resources will be upgraded to Proven and Probable Mineral Reserves as a result of continued exploration.

Prices, Markets and Marketing of Natural Resources

The price of the Common Shares, the Corporation’s financial results and exploration, development and mining activities are anticipated to be significantly adversely affected by declines in the price of gold and silver. The price of gold fluctuates widely and is affected by numerous factors beyond the Corporation’s control such as the sale or purchase of metals by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major metals-producing countries throughout the world. Future serious declines in the price of gold could cause continued development of and commercial production from Primero’s properties to be impracticable. Depending on the price of gold, cash flow from future mining operations may not be sufficient and the Corporation could be forced to discontinue production and may lose its interest in, or may be forced to sell, some of its properties. Future production from the Copperstone Mine is dependent on gold prices that are adequate to make these properties economic. Furthermore, Mineral Reserve calculations and life-of-mine plans using significantly lower gold prices could result in material write-downs of the Corporation’s investment in mining properties and increased amortization, reclamation and closure charges. Government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of natural resources and environmental protection, are all factors which may effect the marketability and price of natural resources. The exact effect of these factors cannot be accurately predicted, but any one or a combination of these factors could result in the Corporation not receiving an adequate return for shareholders.

Need for Additional Mineral Reserves

Because the Copperstone Mine has a limited life based on Proven and Probable Mineral Reserves, the Corporation will be required to continually replace and expand its Mineral Reserves as it produces gold. The Corporation’s ability to maintain or increase its annual production of gold will be dependent in significant part on its ability to expand Mineral Reserves at the Copperstone Mine, to bring new mines into production and to complete acquisitions.

Title Matters

Although title to the properties has been reviewed by the Corporation, no assurances can be given that there are no title defects affecting such properties. The properties may be subject to prior unregistered liens, agreements or transfers, or other undetected title defects. There is no guarantee that title to the properties will not be challenged or impugned. The Corporation is satisfied, however, that evidence of title to each of the properties is adequate and acceptable by prevailing industry standards.

Environmental Risks

All phases of the natural resources business present environmental risks and hazards and are subject to environmental regulation pursuant to a variety of international conventions and state and municipal laws and regulations. Environmental legislation provides for, among other things, restrictions and prohibitions on spills, releases or emissions of various substances produced in association with operations. The legislation also requires that facility sites and mines be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. Compliance with such legislation can require significant expenditures and a breach may result in the imposition of fines and penalties, some of which may be material. Environmental legislation is evolving in a manner expected to result in stricter standards and enforcement, larger fines and liability and potentially increased capital expenditures and operating costs. The discharge of tailings or other pollutants into the air, soil or water may give rise to liabilities to government bodies and third parties and may require the Corporation to incur costs to remedy such discharge. No assurance can be given that environmental laws will not result in a curtailment of production or a material increase in the costs of production, development or exploration activities or otherwise adversely affect the Corporation’s financial condition, results of operations or prospects.

Companies engaged in the exploration and development of mineral properties generally experience increased costs and delays as a result of the need to comply with applicable laws, regulations and permits. The Corporation believes it is in substantial compliance with all material laws and regulations which currently apply to its activities.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, causing operations to cease or be curtailed and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in natural resource exploration and development activities may be required to compensate those suffering loss or damage by reason of its activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Amendments to current laws, regulations and permits governing operations and activities of natural resources companies, or more stringent implementation thereof, could have a material adverse impact on the Corporation and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in developments of new properties.

Regulatory Requirements

Natural resource activities may be affected in varying degrees by political and financial instability, inflation and haphazard changes in government regulations relating to this industry. Any changes in regulations or shifts in political or financial conditions are beyond the Corporation’s control and may adversely affect the Corporation’s business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, environmental legislation and safety.

No Significant Revenues

To date, the Corporation has not recorded any revenues and has no dividend record. The Corporation has also not commenced commercial production on any property. There can be no assurance that significant losses will not occur in the near future or that the Corporation will be profitable in the future. The Corporation’s operating expenses and capital expenditures may increase in subsequent years as consultants, personnel and equipment costs associated with advancing exploration, development and commercial production of the Corporation’s properties increase. The Corporation expects to continue to incur losses unless and until such time as it achieves commercial production and generates sufficient revenues to fund its continuing operations. The development of the Corporation’s properties will require the commitment of substantial resources to conduct time-consuming development. There can be no assurance that the Corporation will generate any revenues or achieve profitability.

Dilution and Future Sales of Common Shares

The Corporation may issue additional Common Shares in the future, which may dilute a shareholder’s ownership interest in the Corporation.

Going Concern

Values attributed to the Corporation’s assets may not be realizable. The Corporation has a limited operating history and its ability to continue as a going concern depends upon a number of significant variables. The amounts attributed to the Corporation’s exploration properties in its financial statements represent acquisition and exploration costs and should not be taken to represent realizable value. Further, the Corporation has no proven history of performance, revenues, earnings or success. As such, the Corporation’s ability to continue as a going concern, the ability of the Corporation to obtain the necessary financing to complete the development of its mineral property interests (if required) and to thereafter commence the profitable production of minerals therefrom or alternatively, upon the Corporation’s ability to dispose of its interests on a profitable basis.

Reliance on Operators and Key Employees

The success of the Corporation will be largely dependent upon the performance of its management and key employees. The Corporation does not have any key man insurance policies and therefore, there is a risk that the death or departure of any member of management or any key employee could have a material adverse effect on the Corporation. In assessing the risk of an investment in the Corporation’s Common Shares, potential investors should realize that they are relying on the experience, judgment, discretion, integrity and good faith of the management of the Corporation. (See Item 6 “Directors, Senior Management and Employees”)..

Availability of Equipment

Natural resource exploration, development and extraction activities are dependent on the availability of mining, drilling and related equipment in the particular areas where such activities will be conducted. Demand for such limited equipment or access restrictions may affect the availability of such equipment to the Corporation and may delay exploration, development or extraction activities. Certain equipment may not be immediately available, or require long lead time orders. A delay in obtaining necessary equipment for mineral extraction could have a material adverse effect on the Corporation’s operations and financial results.

Competition

The Corporation actively competes for acquisitions, leases, licences, concessions, claims, skilled industry personnel and other related interests with a substantial number of other companies, many of which have significantly greater financial resources than the Corporation.

The Corporation’s ability to successfully bid on and acquire additional property rights to participate in opportunities and to identify and enter into commercial arrangements with other parties will be dependent upon developing and maintaining close working relationships with its future industry partners and joint operators and its ability to select and evaluate suitable properties and to consummate transactions in a highly competitive environment.

Insurance

The Corporation’s involvement in the exploration for and development of natural resource properties may result in the Corporation becoming subject to liability for certain risks, and in particular unexpected or unusual geological operating conditions, including rock bursts, cave ins, fires, floods, earthquakes, pollution, blow-outs, property damage, personal injury or other hazards. Although the Corporation will obtain insurance in accordance with industry standards to address such risks, such insurance has limitations on liability that may not be sufficient to cover the full extent of such liabilities. In addition, such risks may not, in all circumstances be insurable or, in certain circumstances, the Corporation may elect not to obtain insurance to deal with specific risks due to the high premiums associated with such insurance or other reasons. The payment of such uninsured liabilities would reduce the funds available to the Corporation. The occurrence of a significant event that the Corporation is not fully insured against, or the insolvency of the insurer or such event, could have a material adverse effect on the Corporation’s financial position, results of operations or prospects.

No assurance can be given that insurance to cover the risks to which the Corporation’s activities will be subject will be available at all or at economically feasible premiums. Insurance against environmental risks (including potential for pollution or other hazards as a result of the disposal of waste products occurring from production) is not generally available to the Corporation or to other companies within the industry. The payment of such liabilities would reduce the funds available to the Corporation. Should the Corporation be unable to fund fully the cost of remedying an environmental problem, the Corporation might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy.

The Market Price of the Common Shares May Be Subject to Wide Price Fluctuations

The market price of the Common Shares may be subject to wide fluctuations in response to many factors, including variations in the operating results of the Corporation, divergence in financial results from analysts’ expectations, changes in earnings estimates by stock market analysts, changes in the business prospects for the Corporation, general economic conditions, changes in mineral reserve or resource estimates, results of exploration, changes in results of mining operations, legislative changes and other events and factors outside of the Corporation’s control. As a result of any of these factors, the market price of the Common Shares at any given point in time may not accurately reflect the long-term value of the Corporation.

In addition, stock markets have from time to time experienced extreme price and volume fluctuations, which, as well as general economic and political conditions, could adversely affect the market price for the Common Shares.

The Corporation is unable to predict whether substantial amounts of Common Shares will be sold in the open market. Any sales of substantial amounts of Common Shares in the public market, or the perception that such sales might occur, could materially and adversely affect the market price of the Common Shares.

Negative Operating Cash Flow

The Corporation had negative operating cash flow for its financial year ended December 31, 2010. Until at least such time as the Corporation is able to produce revenue from operations, the Corporation does not expect to have any positive cash flow. To the extent that the Corporation has negative cash flow in future periods, the Corporation may need to deploy a portion of its cash reserves to fund such negative cash flow.

Loss of Entire Investment

An investment in the Common Shares is speculative and may result in the loss of an investor’s entire investment. Only potential investors who are experienced in high risk investments and who can afford to lose their entire investment should consider an investment in the Corporation.

Currency Exposure

Currency fluctuations may affect the costs the Corporation incurs at its operations and may affect the Corporation’s operating results and cash flows. The principal source of funds for the Corporation has traditionally been through the sale of its common shares, which are sold in Canadian dollars, while a significant portion of the Corporation’s expenditures are incurred in United States dollars. Additionally, gold is sold throughout the world principally based upon the United States dollar price. Fluctuations in the exchange rate of the Canadian dollar to the United States dollar could have a material adverse effect on the Corporation’s results of operations, may delay the development of its mineral projects, and reduce the funds available for further mineral exploration.

Joint Venture Interests

The Corporation may enter into joint ventures with one or more mining companies in respect of its other mineral properties.The Corporation may require additional funding to meet obligations under any joint venture agreement, and there is no guarantee such funding will be available. The inability of the Corporation to meet its funding commitments under any joint venture agreement could result in the dilution of the Corporations interest in the property subject to the joint venture agreement. In addition, should any of the Corporation’s joint venture partners determine not to fund their commitments under such joint venture agreement, the development of that project may be materially delayed or stopped, and the operations or financial results of the Corporation materially affected.

Conflicts of Interest

Certain of the directors of the Corporation are directors of other mineral resource companies and, to the extent that such other companies may be interested in a project also of interest to the Corporation, or may in the future participate in one or more ventures in which the Corporation participates, such directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises, at a meeting of the directors of the Corporation, a director who has such a conflict will abstain from voting for or against the approval of such acquisition or participation. In the appropriate cases, the Corporation will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. From time to time several companies may participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participating in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program.

Legal Proceedings Against Foreign Directors

The Corporation is incorporated under the laws of British Columbia, Canada, and some of the Corporation’s directors and officers are residents of Canada. Consequently, it may be difficult for United States investors to effect service of process within the United States upon the Corporation or upon its directors or officers, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the United States Securities Exchange Act of 1934, as amended. Furthermore, it may be difficult for investors to enforce judgments of U.S. courts based on civil liability provisions of the U.S. federal securities laws in a foreign court against the Corporation or any of the Corporation’s non-U.S. resident officers or directors.

Shareholder Dilution

It is likely that additional capital required by the Corporation will be raised through the issuance of additional equity securities, resulting in dilution to the Corporation’s shareholders.

Classification as a Passive Foreign Investment Corporation

The Corporation believes it is a Passive Foreign Investment Corporation (“PFIC”), as that term is defined in Section 1297 of the Internal Revenue Code of 1986, as amended, and believes it will be a PFIC in the foreseeable future. Consequently, this classification may result in adverse tax consequences for U.S. holders of the Corporation’s shares. For an explanation of these effects on taxation, see the discussion about taxation in Item 10 of this Annual Report. U.S. shareholders and prospective holders of the Corporation’s shares are also encouraged to consult their own tax advisers.

ITEM 4.INFORMATION ON THE CORPORATION

A.History and Development of the Corporation

The Corporation was incorporated in the Province of British Columbia, Canada under the BCA on December 10, 2004 as 0710887 B.C. Ltd. and changed its name to American Bonanza Gold Corp. on February 10, 2005. Pursuant to the Plan of Arrangement described below, the Corporation is the successor to Old Bonanza. The Corporation was incorporated specifically in connection with the Arrangement and had no operations prior to the completion of the Arrangement. As the Plan of Arrangement resulted in Old Bonanza shareholders owning approximately 63% of the Corporation, for accounting purposes, the Corporation is treated as a continuance of Old Bonanza. Old Bonanza was incorporated under the Business Corporations Act (Alberta) on November 17, 1980 and continued into the Province of British Columbia, Canada on July 19, 1994.

The Corporation’s registered and records office is located at Suite 1500 – 1055 West Georgia Street, Vancouver, BC, V6C 4N7. The Corporation’s corporate head office is located at Suite 305 - 675 West Hastings Street, Vancouver, British Columbia, V6B 1N2, telephone number (604) 688-7523 and its exploration office is located at 290 Gentry Way, Suite 6, Reno, Nevada, United States, 89502.

The Corporation has an authorized share capital of an unlimited number of common shares without par value and an unlimited number of Class A preferred shares, of which 130,199,272 common shares are issued and outstanding and nil Class A preferred shares are issued and outstanding as at December 31, 2010. All of the Corporation’s common shares rank equally with respect to voting rights and liquidation preferences. The Class A preferred shares as a class are issuable in series and entitle holders, on a liquidation or dissolution of the Corporation, to a preference over the holders of common shares with respect to any repayment of capital or distribution of assets. The Class A preferred shares do not entitle holders to vote at general meetings of shareholders. The directors may by resolution determine the number and name of the shares of any series of Class A preferred shares, and any special rights attaching to any series of Class A preferred shares.

March 2005 Plan of Arrangement

Effective March 30, 2005, pursuant to the Arrangement Agreement, Old Bonanza and Taurus were combined together as subsidiaries of the Corporation and the Corporation acquired Fairstar’s shares in FairstarSub, which held Fairstar’s 38% interest in the Fenelon Project and the Casa Berardi Claims located in Quebec in exchange for shares of the Corporation.

The exchange transaction between the Corporation and Old Bonanza was a common control transaction which is accounted for at Old Bonanza’s historical cost by the continuity of interests method. Accordingly, Old Bonanza is the acquirer of Taurus’ assets and liabilities for accounting purposes. The consolidated financial statements of the Corporation include the results of operations of Old Bonanza consolidated with those of the Corporation and Taurus from the date of acquisition. For legal purposes, Old Bonanza and Taurus became wholly owned subsidiaries of the Corporation.

Fairstar transferred its 38% interest in the Fenelon gold project and its interests in the Casa Berardi gold projects in Quebec to its wholly-owned newly incorporated subsidiary company, FairstarSub. The Corporation acquired all outstanding shares of FairstarSub in exchange for 6,500,000 common shares of the Corporation and $300,000 cash paid directly to certain creditors of Fairstar. This transaction has been accounted for as an asset acquisition by the Corporation.

The excess purchase price over the net book value of net assets acquired has been allocated to mineral properties and includes the effect of recording future income tax liabilities on the temporary differences arising on the transactions.

The shares of the Corporation commenced trading on the TSX at the opening on March 31, 2005 under the symbol BZA. Trading of the shares of Old Bonanza and Taurus was halted on the TSX Venture Exchange at the close of business on March 29, 2005, and with the completion of the Plan of Arrangement, these two companies were delisted from the TSX Venture Exchange.

Three Year History

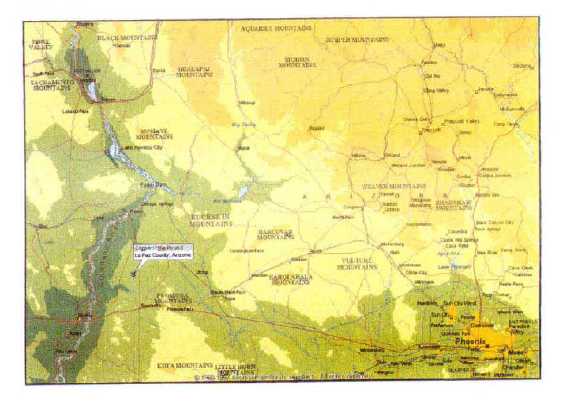

The Corporation is a Development Stage Corporation engaged in the identification, acquisition and exploration of precious metal properties located in the American Southwest of the United States. The Corporation holds interests in several mineral exploration projects, the material property being:

| Material | |

| Properties | Jurisdiction |

| | |

| Copperstone | Arizona |

The following provides an overview of the location of the Corporation’s properties:

The Corporation has interests in several other exploration projects located in Arizona and Nevada which are not sufficiently advanced to be material to the Corporation, and are not considered significant properties by the Corporation at this time. Due to limited exploration activities in the previous three years and/or limited plans for the property, the Corporation wrote down the carrying value of Goldbar, Northshore and some other properties by $2,075,404 as of December 31, 2008.

A detailed summary of the Corporation’s projects (excluding those that have been subsequently written off and returned and certain non-material properties) are set forth in “Business Overview” below.

Disposition of Taurus Property

On June 7, 2007 the Corporation signed a definitive option agreement with respect to its 100% owned Taurus property in the historic mining camp of Cassiar, British Columbia, whereby Cusac Gold Mines Ltd. (“Cusac”) could acquire 100% of the Taurus property by making certain cash and share payments to the Corporation. On December 19, 2007, as part of Hawthorne Gold Corporation’s (“Hawthorne”) proposed merger with Cusac, Bonanza agreed to the assignment to Hawthorne of the definitive option agreement between Bonanza and Cusac regarding the Taurus property. On December 23, 2008 the Corporation amended the option agreement with Hawthorne. Under the amended agreement, Hawthorne issued to Bonanza 6.75 million common shares of Hawthorne. On December 31, 2008 Bonanza received 6.75 million shares of Hawthorne representing 12.7% of the issued and outstanding shares of Hawthorne and transferred its interest in the Taurus property to Hawthorne. Total consideration received by Bonanza on the sale of the Taurus property included $3,000,000 in cash and 6,828,947 common shares of Hawthorne. The Corporation recognized a loss on sale of the Taurus property of $977,782 in 2008. During 2009, the Corporation disposed 1,300,000 of its holding of Hawthorne shares and during the year ended December 31, 2010, the Corporation sold the remaining 5,528,947 shares.

Termination of Noyon-Northway Joint Venture

On November 15, 2007, the Corporation entered into a letter of intent with Agnico-Eagle Mines Limited ("Agnico-Eagle"), to jointly explore and develop the Noyon-Northway Property and Agnico-Eagle's adjoining Vezza Property. The letter of intent was replaced by a formal option and joint venture agreement on December 10, 2007. On July 20, 2009, Agnico-Eagle elected to terminate the Option Agreement. Under the terms of the Option Agreement, because Agnico-Eagle has not exercised its option, each company resumed full ownership of its respective Properties that were subject to the Option Agreement. Bonanza assumed ownership of the Noyon-Northway Properties on the Termination Date without any obligations to Agnico-Eagle.

Development of Copperstone Mine

The Corporation’s focus for the past three years has been on the exploration and development and, if warranted, commencement of commercial production at the Copperstone Mine. In connection with this goal, on February 3, 2010 the Corporation Bonanza announced the positive results of its NI 43-101 compliant 2010 Feasibility Study (the “Study”) at Copperstone (see Section D – Property, Plants and Equipment – Copperstone). The Study began during 2008, and was designed to update the preliminary economic assessment completed on March 27, 2006. Based on the Study, the Corporation determined to proceed with the the development of the Copperstone Mine. The following are the milestones the Corporation met during 2010 and the first two months of of 2011 towards the development of the Copperstone Mine.

Purchase of Mill Equipment

On August 16, 2010, Bonanza completed the purchase of a 700 ton per day milling and flotation/gravity plant for the Copperstone Mine. The mill was located in Calumet, Michigan, and includes a rod mill, ball mill, fume scrubber, flotation cells, cleaner cells, concentrate filter drum, tank thickeners, water storage tank, concentrate ore samplers, cyclones, duplex gravity concentrating jigs, the mill building, control panel and conveyor. The mill does not include a crusher and crusher building, which Bonanza still requires. The mill has operated for only two years and is in very good condition, and comes with a full set of engineering drawings, which will help accelerate construction timelines and reduce costs. The purchase price paid by the Company for the plant, being US$400,000 in cash and 1,250,000 Common Shares (the “Mill Shares”) of Bonanza, for a total purchase price of approximately US$612,500 (based on a valuation for the Mill Shares of $0.17 per share) represents significant cost savings to the Company and is expected to reduce the capital cost of bringing the Copperstone Mine into production by over $500,000. Major components of the milling and flotation circuit have been delivered to Bonanza’s Arizona based construction contractor’s yard in preparation for the commencement of construction.

In addition to the milling facilities, the Corporation also purchased a jaw crusher and a cone crusher. The jaw crusher is a Nordberg P1008VF Portable Jaw Plant with ST1008 Jaw Crusher (32" x 40"), a 16 foot x 44" Vibrating Grizzly feeder, a Kent Model KHB-86 Rock Breaker with 16' Boom and an associated control tower. The crusher has a capacity of up to 200 tons per hour and will crush all of the coarse run-of-mine mill feed for the planned mining operations. The equipment was purchased from Earthworks Machinery Company of Roseville, California. The cone crusher is a Nordberg 4 foot cone crusher and includes a 16 foot x 6 foot screen and associated conveyors and motors. Delivery for the equipment is expected during May 2011. The equipment was purchased from J.W. Jones Company of Paragon, Indiana.

Mine Contractor