Bonanza

AMERICAN BONANZA GOLD CORP.

Suite 1238, 200 Granville Street

Vancouver, British Columbia

Canada, V6C 1S4

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

Notice is hereby giventhat the Annual and Special Meeting of Shareholders (the “Meeting”) of American Bonanza Gold Corp. (the “Corporation”) will be held in the Ferguson Room at the Terminal City Club, 837 West Hastings Street, Vancouver, British Columbia, on Wednesday, June 26, 2013, at the hour of 10:00 a.m. (Pacific Time), for the following purposes:

| 1. | To receive and consider the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2012 and the Auditor’s Report thereon; |

| | |

| 2. | To fix the number of directors for the ensuing year at five; |

| | |

| 3. | To elect five directors to serve until the next annual general meeting of shareholders or until their successors are elected or appointed; |

| | |

| 4. | To appoint KPMG LLP, Chartered Accountants as auditor of the Corporation and to authorize the directors to fix their remuneration; |

| | |

| 5. | To consider, and if thought advisable, to approve a special resolution authorizing an alteration of the Corporation’s Articles to include advance notice provisions; and |

| | |

| 6. | To transact such other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

The Board of Directors has fixed May 10, 2013 as the record date for determining the shareholders who are entitled to vote at the Meeting. Shareholders who are unable to attend the Meeting in person are requested to read, complete, sign and mail the enclosed Form of Proxy in accordance with the instructions of their broker or as set out in the Form of Proxy, the Proxy Statement and Information Circular accompanying this Notice. Please advise Computershare Investor Services Inc. of any change in your mailing address.

DATED at Vancouver, British Columbia this 23rd day of May, 2013.

BY ORDER OF THE BOARD OF DIRECTORS

Signed: Catherine Tanaka

Corporate Secretary

AMERICAN BONANZA GOLD CORP.

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

MANAGEMENT INFORMATION CIRCULAR

as at May 23, 2013 unless otherwise indicated

This Management Information Circular is furnished to the common shareholders (“Shareholders”) by the management of AMERICAN BONANZA GOLD CORP. (the “Corporation” or the “Company”) in connection with the solicitation of proxies to be voted at the Annual and Special Meeting (the “Meeting”) of the Shareholders to be held on Wednesday, June 26, 2013 and at any adjournment thereof, at the time and place and for the purposes set out in the Notice of Meeting.

MANAGEMENT SOLICITATION AND APPOINTMENT OF PROXIES

The persons named in the accompanying form of proxy are officers and/or directors of the Corporation. A Shareholder entitled to vote at the Meeting has the right to appoint a person (who need not be a Shareholder) to attend and act for and on the Shareholder’s behalf at the Meeting other than the persons designated as proxyholders in the accompanying form of proxy. To exercise this right, the Shareholder must either:

| | (a) | on the accompanying form of proxy, strike out the printed names of the individuals specified as proxyholders and insert the name of the Shareholder’s nominee in the blank space provided; or |

| | | |

| | (b) | complete another proper form of proxy. |

To be valid, a proxy must be dated and signed by the Shareholder or by the Shareholder’s attorney authorized in writing. In the case of a Corporation, the proxy must be signed by a duly authorized officer of or attorney for the Corporation.

The completed proxy, together with the power of attorney or other authority, if any, under which the proxy was signed or a notarially certified copy of the power of attorney or other authority, must be delivered to Computershare Investor Services Inc. by mail or fax no later than forty eight (48) hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting, or any adjournment thereof.

REVOCATION OF PROXIES

A Shareholder who has given a proxy may revoke it at any time before the proxy is exercised:

| | (a) | by an instrument in writing that is: |

| | | | |

| | | (i) | signed by the Shareholder, the Shareholder’s attorney authorized in writing or, where the Shareholder is a corporation, a duly authorized officer or attorney of the corporation; and |

| | | | |

| | | (ii) | delivered to Computershare Investor Services Inc. by mail, Proxy Department, 100 University Avenue, 9thfloor, Toronto, Ontario M5J 2Y1 or by fax: Within North America: 1-866-249-7775 Outside North America: 1-416-263-9524, no later than forty eight (48) hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting, or adjournment thereof; or |

| | | | |

| | (b) | in any other manner provided by law. |

VOTING OF SHARES AND PROXIES AND EXERCISE OF DISCRETION BY PROXYHOLDERS

Voting By Show of Hands

Voting at the Meeting generally will be by a show of hands, with each Shareholder or proxyholder present in person being entitled to one vote for each common share held or represented by proxy.

Voting By Poll

Voting at the Meeting will be by poll only if a poll is:

| | (a) | requested by a Shareholder present at the Meeting in person or by proxy; |

| | | |

| | (b) | directed by the Chairperson; or |

| | | |

| | (c) | required by law. |

On a poll, each Shareholder and each proxyholder will have one vote for each common share held or represented by proxy.

Approval of Resolutions

To approve a motion for an ordinary resolution, a simple majority of the votes cast in person or by proxy will be required.

Exercise of Discretion by Proxyholders

A Shareholder may indicate the manner in which the persons named in the accompanying form of proxy are to vote with respect to a matter to be acted upon at the Meeting by marking the appropriate space.If the instructions as to voting indicated in the proxy are certain, the shares represented by the proxy will be voted or withheld from voting in accordance with the instructions given in the proxy.

If the Shareholder specifies a choice in the proxy with respect to a matter to be acted upon, then the shares represented will be voted or withheld from the vote on that matter accordingly. If no choice is specified in the proxy with respect to a matter to be acted upon, the proxy confers discretionary authority with respect to that matter upon the proxyholder named in the accompanying form of proxy. It is intended that the proxyholder named by management in the accompanying form of proxy will vote the shares represented by the proxy in favour of each matter identified in the proxy and for the nominees of the Corporation’s Board of Directors for directors and auditor.

The accompanying form of proxy also confers discretionary authority upon the named proxyholder with respect to amendments or variations to the matters identified in the accompanying Notice of Meeting and with respect to any other matters which may properly come before the Meeting. As of the date of this Management Proxy Circular, management of the Corporation is not aware of any such amendments or variations, or any other matters, that will be presented for action at the Meeting other than those referred to in the accompanying Notice of Meeting. If, however, other matters that are not now known to management properly come before the Meeting, then the persons named in the accompanying form of proxy intend to vote on them in accordance with their best judgment.

- 2 -

SOLICITATION OF PROXIES

It is expected that solicitations of proxies will be made primarily by mail and possibly supplemented by telephone or other personal contact by directors, officers and employees of the Corporation without special compensation. The Corporation may reimburse Shareholders’ nominees or agents (including brokers holding shares on behalf of clients) for the costs incurred in obtaining authorization to execute forms of proxy from their principals. The costs of solicitation will be borne by the Corporation.

VOTING BY NON-REGISTERED (BENEFICIAL) SHAREHOLDERS

The following information is of significant importance to Shareholders who do not hold common shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders (those whose names appear on the records of the Corporation as the registered holders of common shares).

If common shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those common shares will not be registered in the shareholder’s name on the records of the Corporation. Such common shares will more likely be registered under the names of the shareholder’s broker or an agent of that broker. In the United States, the vast majority of such common shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

You should carefully follow the instructions of your broker or intermediary in order to ensure that your common shares are voted at the Meeting.

The form of proxy supplied to you by your broker will be similar to the Proxy provided to registered shareholders by the Corporation. However, its purpose is limited to instructing the intermediary on how to vote on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge (formerly “ADP Investor Communication Services”) in the United States and in Canada. Broadridge mails a voting instruction form in lieu of a Proxy provided by the Corporation. The voting instruction form will name the same persons as the Corporation’s Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Beneficial Shareholder of the Corporation), other than the persons designated in the voting instruction form, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative (who may be yourself) in the blank space provided in the voting instruction form. The completed voting instruction form must then be returned to Broadridge by mail or facsimile or given to Broadridge by phone or over the internet, in accordance with Broadridge’s instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting and the appointment of shareholder representatives.If you receive a voting instruction form from Broadridge, you cannot use it to vote common shares directly at the Meeting - the voting instruction form must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have the common shares votedor to have an alternate representative duly appointed to attend the Meeting and to vote your Common Shares at the Meeting.

- 3 -

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting common shares registered in the name of your broker, you, or a person designated by you, may attend at the Meeting as proxyholder for your broker and vote your common shares in that capacity. If you wish to attend at the Meeting and indirectly vote your common shares as proxyholder for your broker, or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the voting instruction form provided to you and return the same to your broker in accordance with the instructions provided by such broker, well in advance of the Meeting.

There are two kinds of beneficial owners – those who object to their name being made known to the issuers of securities which they own (called OBOs for Objecting Beneficial Owners) and those who do not object to the issuers of the securities they own knowing who they are (called NOBOs for Non-Objecting Beneficial Owners). The Corporation has decided to take advantage of those provisions of National Instrument 54-101 that permit it to directly deliver proxy-related materials to its NOBOs. As a result NOBOs can expect to receive a scannable Voting Instruction Form (“VIF”) from the Corporation’s Transfer Agent, Computershare Investor Services Inc. (“Computershare”). These VIFs are to be completed and returned to Computershare in the envelope provided or by facsimile. In addition, Computershare provides both telephone and internet voting as described on the VIF itself which contain complete instructions. Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the shares represented by the VIFs they receive.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation is authorized to issue an unlimited number of common shares without par value, of which 234,396,111 are issued and outstanding on May 10, 2013 (the “record date”). The Corporation is also authorized to issue an unlimited number of Class A preferred shares without par value, of which none have been issued. The Board of Directors has fixed May 10, 2013 as the record date for Shareholders of the Corporation who are listed on its Register of Shareholders to be entitled to receive notice of and to attend and vote at the Meeting or any adjournment of the Meeting. The holders of common shares entitled to vote at the Meeting are entitled to one vote for each common share held as at the record date. The following table sets forth the ownership of the Corporation’s shares by those parties which, to the knowledge of management, owned ten percent (10%) or more of the outstanding common shares of the Corporation as at May 10, 2013:

Name and Municipality of Residence | Number of Common Shares

owned or controlled | Percentage of Issued

Share Capital |

| Sprott Asset Management LP | 28,266,912 | 12.1% |

PRESENTATION OF FINANCIAL STATEMENTS

The audited financial statements of the Corporation for the year ended December 31, 2012, together with the report of the auditors thereon, will be placed before the Meeting. A copy of the Corporation’s Annual Report for the year ended December 31, 2012 may be obtained by a Shareholder upon request without charge from the Corporation, at Suite 1238, 200 Granville Street, Vancouver, BC, V6C 1S4.

- 4 -

APPOINTMENT OF AUDITORS

The Board of Directors of the Corporation recommend the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office until the next Annual General Meeting of Shareholders at a remuneration to be fixed by the Board of Directors. KPMG LLP Chartered Accountants, were first appointed as auditors of the Corporation on March 25, 2005.

The persons named in the enclosed form of proxy, unless directed by the Shareholder completing the proxy to abstain from doing so, intend to vote for the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office until the next Annual General Meeting of Shareholders at a remuneration to be fixed by the Directors of the Corporation.

ELECTION OF DIRECTORS

The directors of the Corporation for the ensuing year will be elected at this Meeting.

Majority Voting Policy

The Board of Directors (the “Board”) of the Corporation adopted a majority voting policy in order to promote enhanced director accountability. The policy provides that voting in respect of each director nominee will be conducted on an individual nominee basis. The policy also provides that each director should be elected by the vote of a majority of the common shares, represented in person or by proxy, at any meeting for the election of directors. The Board will ensure that the number of common shares voted “for” or “withheld” for each director nominee is recorded and promptly made public after the meeting. If any nominee for election as director receives, from the common shares voted at the meeting in person or by proxy, a greater number of votes “withheld” than votes “for” his or her election, the director will promptly tender his or her resignation to the Board following the meeting, to take effect upon acceptance by the Board. The nomination committee will expeditiously consider the director’s offer to resign and make a recommendation to the Board whether to accept that offer. Within 90 days of the Meeting, the Board will make a final decision concerning the acceptance of the director’s resignation and announce that decision by way of a press release. Any director who tenders his or her resignation will not participate in the deliberations of the Board or any of its committees pertaining to the resignation.

This policy does not apply to a contested election of directors, that is, where the number of nominees exceeds the number of directors to be elected. If any director fails to tender his or her resignation as contemplated in the policy, the Board will not re-nominate that director in the future. Subject to any corporate law restrictions, where the Board accepts the offer of resignation of a director and that director resigns, the Board may exercise its discretion with respect to the resulting vacancy and may, without limitation, leave the resultant vacancy unfilled until the next annual meeting of shareholders, fill the vacancy through the appointment of a new director whom the Board considers to merit the confidence of the shareholders, or a call a special meeting of shareholders to elect a new nominee to fill the vacant position.

Advanced Notice Policy

The Board of Directors of the Company (the “Board”) has adopted an advance notice policy (the “Advance Notice Policy”) with immediate effect. The Advance Notice Policy provides for advance notice to the Company in circumstances where nominations of persons for election to the Board are made by Shareholders of the Company other than pursuant to (i) a requisition of a meeting made pursuant to the provisions of the BCBCA or (ii) a shareholder proposal made pursuant to the provisions of the BCBCA.

- 5 -

The purpose of the Advance Notice Policy is to foster a variety of interests of the Shareholders and the Company by ensuring that all Shareholders - including those participating in a meeting by proxy rather than in person - receive adequate notice of the nominations to be considered at a meeting and can thereby exercise their voting rights in an informed manner. Among other things, the Advance Notice Policy fixes a deadline by which holders of Common Shares must submit director nominations to the Company prior to any annual or special meeting of Shareholders and sets forth the minimum information that a shareholder must include in the notice to the Company for the notice to be in proper written form.

The Board intends to place the provisions of the Advance Notice Policy before the Shareholders of the Company as an amendment to the Articles of the Company for approval at the Meeting. If the approval of the amendment is not received at the Meeting by special resolution of Shareholders, the Advance Notice Policy will terminate and be of no further force and effect following the termination of the Meeting.

The foregoing is merely a summary of the Advance Notice Policy, is not comprehensive and is qualified by the full text of such policy, a copy of which is attached to this Information Circular as Schedule “A”. See also “Particulars of Matters to be Acted Upon – Advance Notice Policy”.

As of the date of the Management Information Circular, the Company has not received notice of a nomination in compliance with the Advance Notice Policy.

Nominees

The persons named below are the nominees of management for election as directors. Each director elected will hold office until his successor is elected or appointed, unless his office is earlier vacated under any of the relevant provisions of the Articles of the Corporation or theBusiness Corporations Act (British Columbia).It is the intention of the persons named as proxyholders in the enclosed form of proxy to vote for the election to the Board of Directors the persons named below. The management of the Corporation does not contemplate that any of such nominees will be unable to serve as a director; however, if for any reason any of the proposed nominees do not stand for election or are unable to serve as such, PROXIES IN FAVOUR OF MANAGEMENT DESIGNEES WILL BE VOTED FOR ANOTHER NOMINEE IN THEIR DISCRETION UNLESS THE SHAREHOLDER HAS SPECIFIED IN HIS PROXY THAT HIS SHARES ARE TO BE WITHHELD FROM VOTING IN THE ELECTION OF DIRECTORS.

The following table sets out the names of management’s nominees for election as directors, all major offices and positions with the Corporation and any of its significant affiliates each now holds, each nominee’s principal occupation, business or employment (for the five preceding years for new director nominees), the period of time during which each has been a director of the Corporation and the number of Common Shares of the Corporation beneficially owned by each, directly or indirectly, or over which each exercised control or direction, as at May 10, 2013:

- 6 -

Name of Nominee,

Current Position with the

Corporation and

Province or State and

Country of Residence

|

Principal Occupation and, if not

at Present an Elected Director,

Occupation during the Past Five

Years

|

Period as a

Director of the

Corporation

|

Common Shares Beneficially

Owned or Controlled(5)

|

James F. Bagwell

Director

Florida, United States | Partner in ABBA Corp. a private

consulting company.

| March 25, 2005

| common shares: 990,000(8)

|

Brian P. Kirwin

President, Chief Executive

Officer and Director

Nevada, United States | President and CEO of American

Bonanza Gold Corp.

| March 25, 2005

| common shares: 5,851,823(6)

|

Robert McKnight(1)(2)(3)(4)

Director

British Columbia, Canada | Executive Vice President and CFO of

Nevada Copper Corp.

| March 25, 2005

| common shares: 450,000(7)

|

Jamie Newall(1)(2)(3)(4)

Director

London, United Kingdom | Investments Director of Intrepid

Financial

| March 29, 2011

| common shares: Nil(9)

|

Wayne Tisdale(1)(2)(3)(4)

Director

Portomassa, Malta

| Mr. Tisdale runs his own merchant

banking company and sits on the board

of directors of a number of private and

public companies on the TSX Venture

Exchange. | December 20, 2012

| common shares: 16,971,785

|

Notes:

| (1) | Member, Audit Committee |

| (2) | Member, Compensation Committee |

| (3) | Member, Governance Committee |

| (4) | Member, Nomination Committee |

| (5) | This information has been furnished by the respective individuals as at May 10, 2013 |

| (6) | Mr. Kirwin also holds incentive stock options to purchase 2,007,296 shares at Cdn.$0.39 per share expiring March 2, 2016. |

| (7) | Mr. McKnight holds incentive stock options to purchase 400,000 shares at Cdn.$0.39 expiring March 2, 2016 and 550,000 shares at Cdn.$0.53 per share expiring September 1, 2016. |

| (8) | Mr. Bagwell also holds incentive stock options to purchase 400,000 shares at Cdn.$0.39 expiring March 2, 2016 and 800,000 shares at Cdn.$0.53 per share expiring September 1, 2016. |

| (9) | Mr. Newall holds incentive stock options to purchase 100,000 shares at Cdn.$0.365 per share expiring June 23, 2016. |

Shareholders can vote for all of the proposed nominees, vote for some of the proposed nominees and withhold for others, or withhold for all of the proposed nominees.Unless otherwise instructed, the named proxyholders will vote FOR the election of each of the proposed nominees set forth above as directors of the Corporation.

Corporate Cease Trade Orders or Bankruptcies

Except as disclosed in this Management Proxy Circular and below, none of the persons proposed as directors or executive officer within the last 10 years before the date of this information circular, acted in that capacity for any company, including the Corporation, that was:

| (a) | subject to a cease trade or similar order or an order denying the relevant company access to any exemptions under securities legislation, for more than 30 consecutive days; or |

| | |

| (b) | was subject to an event that resulted, after the director or executive officer ceased to be a director or executive officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under the securities legislation, for a period of more than 30 consecutive days, state the fact and describe the basis on which the order was made and whether the order is still in effect; or |

- 7 -

| (c) | within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| | |

| (d) | has become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director; or |

| | |

| (e) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| | |

| (f) | has been subject to any penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director. |

COMPENSATION OF EXECUTIVE OFFICERS

In this section, “Named Executive Officer” or “NEO” means:

| (a) | the Corporation’s chief executive officer (“CEO”); |

| | |

| (b) | the Corporation’s chief financial officer (“CFO”); |

| | |

| (c) | each of the Corporation’s, including any of its subsidiaries, three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000, as determined in accordance with subsection 1.3(6) of Form 51-102F6 Statement of Executive Compensation, for that financial year; and |

| | |

| (d) | each individual who would be a Named Executive Officer under paragraph (c) but for the fact that the individual was neither an executive officer of the Corporation or its subsidiaries, nor acting in a similar capacity, at the end of that financial year. |

Compensation Discussion and Analysis

The Compensation Committee (the “Committee”) is composed of Wayne Tisdale, Robert McKnight and Jamie Newall, all of whom are independent within the meaning of National Instrument 52-110 Audit Committee. All of the members of the Committee have extensive experience in matters of executive compensation particularly as it relates to the mining industry. In addition, each member of the Committee keeps abreast on a regular basis of trends and developments affecting executive compensation. The function of the Committee generally is to assist the Board in carrying out its responsibilities relating to executive and director compensation, including reviewing and recommending director compensation, overseeing the Corporation’s base compensation structure and equity-based compensation programs, recommending compensation of the Corporation’s officers and employees, and evaluating the performance of officers generally and in light of annual goals and objectives. The Board adopted a charter for the Committee in July, 2005, as summarized below:

- 8 -

The Committee shall recommend to the Board of Directors the form and amount of compensation to be paid by the Corporation to directors for service on the Board and on Board committees.

The Committee shall review the Corporation’s base compensation structure and the Corporation's incentive compensation, stock option and other equity-based compensation programs and recommend changes in or additions in such structure and plans to the Board of Directors as needed.

The Committee shall recommend to the Board of Directors the annual base compensation of the Corporation's executive officers and senior managers (collectively the "Officers").

The Committee shall recommend to the Board of Directors corporate goals and objectives under any incentive compensation plan adopted by the Corporation for Officers and non-Officer personnel providing services to the Corporation, and establish incentive compensation participation levels for Officers and non-Officer personnel providing services to the Corporation under any such incentive compensation plan. In determining the incentive component of compensation, the Committee will consider the Corporation’s performance and relative shareholder return, the values of similar incentive at comparable companies and the awards given in past years.

The Committee shall periodically review with the CEO their assessments of corporate officers and senior managers and succession plans, and make recommendations to the Board regarding appointment of officers and senior managers.

The Committee shall recommend to the Nominating and Corporate Governance Committee the qualifications and criteria for membership on the Committee.

The Board assumes responsibility for reviewing and monitoring the long-range compensation strategy for the senior management of the Corporation although the Committee guides it in this role.

The Board is responsible, in participation with management, for reviewing and identifying what are perceived to be the principal risks to the Corporation. These risks include, but are not limited to, those arising from the Corporation’s compensation policies and practices, such as the risk that an executive officer or other employee is incentivized to take inappropriate or excessive risks, or that such policies and practices give rise to any other risks that are reasonably likely to have a material adverse effect on the Corporation. The Board undertakes this review with management on at least an annual basis, and ensures that the Committee adequately considers risks arising from the Corporation’s compensation policies and practices when determining its recommendations to the Board regarding the compensation of executive officers. The Corporation uses the following practices to discourage or mitigate inappropriate or excessive risk-taking by directors and executive officers:

the structure of incentive compensation is designed not to focus on a single metric, which in the Corporation’s view could be distortive, but instead a combination of both corporate and personal objectives;

the Corporation has an appropriate compensation mix, including fixed and performance based compensation with short and longer term performance conditions and multiple forms of compensation; and

the Board has discretion in assessing the annual incentive awards paid to executive officers of the Corporation based on both individual and corporate performance.

- 9 -

No risks have been identified as arising from the Corporation’s compensation policies and practices which are considered reasonably likely to have a material adverse effect on the Corporation.

In order to further mitigate the potential for NEOs and Directors taking inappropriate or excessive risks relating to compensation, the Board has passed a resolution which prohibits directors andNEOs from purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars, or units of exchange funds) that are designed to hedge or offset a decrease in market value of equity securities granted as compensation held, directly or indirectly, by a director orNEOs.

Mr. Kirwin, President & Chief Executive Officer, Mr. Chan, Chief Financial Officer, and Mr. Todd Fayram, Chief Operating Officer, work on the Corporation’s activities on a full-time basis.

Philosophy and Objectives

The compensation program for the executive officers of the Corporation is broadly designed to ensure that the level and form of compensation achieves certain objectives, including:

| | (a) | attracting and retaining talented, qualified and effective executives; |

| | | |

| | (b) | motivating the short and long-term performance of these executives; and |

| | | |

| | (c) | better aligning their interests with those of the Corporation’s Shareholders. |

In compensating its executive officers, the Corporation has employed a combination of base salary, bonus compensation and equity participation through its stock option plan.

Base Salary

In the Board’s view, paying base salaries which are competitive in the markets in which the Corporation operates is a first step to attracting and retaining talented, qualified and effective executives. A number of the Corporation’s directors serve on the board of directors of similar sized companies in the resource sector. Determinations of salary are based on the Board’s knowledge of salaries paid to executives of these similar sized companies and information gathered from documents available publicly on SEDAR. Companies that the Board considers comparable include Atna Resources Ltd. and B2Gold Corp.

Bonus Incentive Compensation

The payment of bonus incentive compensation is subject to the discretion of the Board. Generally, the Board will consider the payment of executive bonus compensation dependent upon the performance of the individual executive, sufficient cash resources being available for the granting of bonuses and, where applicable, the executive meeting the strategic objectives and milestones established by the Board.

The Corporation’s principal objective for 2012/2013 is to bring the Corporation’s Copperstone Mine into profitable commercial production. The compensation program for the CEO was re-structured in March, 2011 to reward him for achieving that goal. The following milestones were set for the CEO for 2011/2012:

| | 1. | $100,000 bonus was granted and be payable on the date of receipt of the remaining major Copperstone operating permit (the ADEQ Aquifer Protection Permit). This milestone was achieved and the bonus was paid in April, 2011 to the CEO. |

- 10 -

| | 2. | $100,000 bonus will be granted at the beginning of profitable commercial production at Copperstone. |

Equity Participation

The Corporation believes that encouraging its executives and employees to become shareholders is the best way of aligning their interests with those of its Shareholders. Equity participation is accomplished through the Corporation’s stock option plan. Stock options are granted to executives and employees taking into account a number of factors, including the amount and term of options previously granted, base salary and bonuses and competitive factors. Senior management puts forth their recommendations for stock option grants to the Board. The amounts and terms of options granted are determined by the Board.

Actions, Decisions or Policies Made After December 31, 2012

Given the evolving nature of the Corporation’s business, the Board continues to review and redesign the overall compensation plan for senior management so as to continue to address the objectives identified above.

Subsequent to December 31, 2012, 3,780,000 options were cancelled.

There were no actions, decisions or policies made since December 31, 2012 that would affect a reader’s understanding of NEO compensation.

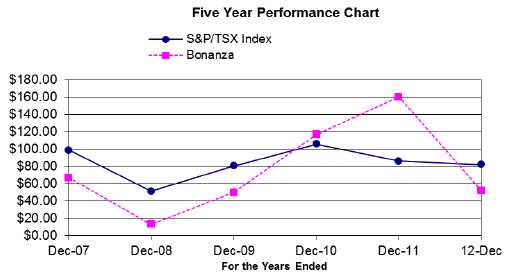

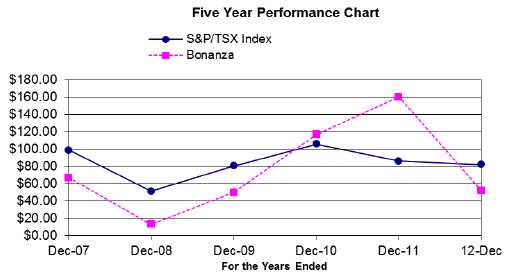

Performance Graph

The common shares of the Corporation currently trade on the Toronto Stock Exchange (the “TSX”) under the symbol “BZA”.

The following graph compares the cumulative shareholder return on the Corporation’s Common Shares for the last five fiscal years against the return of the S&P/TSX Composite Total Return Index based on a $100 investment on January 1, 2007 to December 31, 2012.

- 11 -

The performance graph shows a general correlation between the performance of the Corporation’s Common Shares and the performance of the S&P/TSX Composite Total Return Index for the last five years.

Option-Based Awards

The Corporation has in place a stock option plan which was established to provide incentive to qualified parties to increase their proprietary interest in the Corporation and thereby encourage their continuing association with the Corporation. Management proposes stock option grants to the board of directors based on such criteria as performance, previous grants, and hiring incentives. All grants require approval of the board of directors. The stock option plan is administered by the directors of the Corporation and provides that options will be issued to directors, officers, employees or consultants of the Corporation or a subsidiary of the Corporation.

Summary Compensation Table

The compensation paid to the Corporation’s NEOs during the three most recent financial years ended December 31, 2010, 2011 and 2012 is as set out below and expressed in Canadian dollars unless otherwise noted:

Name And

Principal

Position

| Year

| Salary

($)

| Share-

Based

Awards

($)

| Option-

Based

Awards(1)(2)

($)

| Non-Equity Incentive

Plan Compensation

($)

| Pension

Value

($)

| All

Other

Compen

-sation

($)

| Total

Compen-

sation(1)(2)

($)

|

Annual

Incentive

Plans

| Long-

Term

Incentive

Plans

|

Brian Kirwin,

President & Chief Executive

Officer | 2012

2011

2010 | 275,000(US)

253,744(US)

190,000(US) | Nil

Nil

Nil | Nil

802,360(US)

Nil | Nil

100,000(US)

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 275,000(US)

1,156,104(US)

190,000(US) |

Joe Chan

Chief Financial Officer

| 2012

2011

2010 | 150,000

143,750

135,000 | Nil

Nil

Nil | Nil

24,000

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 150,000

167,750

135,000 |

Todd Fayram(3)

Chief Operating Officer

| 2012

2011

2010 | 181,042(US)

259,560(US)

Nil | Nil

Nil

Nil | Nil

117,944(US)

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 181,042(US)

377,504(US)

Nil |

Notes:

(1) For the market value of the unexercised options as at December 31, 2012 please refer to the Option-Based Awards table below.

(2) The fair value of stock options has been estimated using the Black-Scholes option pricing model assuming a risk free interest rate of 2.16%, no expected dividend yield, stock price volatility of 75.6% and expected life of 5 years. The weighted average fair value of options granted during the twelve months ended December 31, 2011 was $0.27. No stock options were awarded in 2012.

(3) Todd Fayram was appointed Chief Operating Officer on March 29, 2011.

- 12 -

Outstanding Share-based Awards and Option-based Awards

The Corporation does not have any share-based awards.

The following table sets out all option based awards outstanding as at December 31, 2012, for each NEO:

| Option-Based Awards |

Name

| Number of securities

underlying

unexercised options

(#) |

Option

exercise price

($) |

Option

expiration date

|

Value of unexercised

in-the-money options

($)(1) |

Brian Kirwin, President & Chief

Executive Officer

| 600,000

830,000

2,885,488 | 0.07

0.06

0.39 | Aug 6, 2013

Jan 26, 2014

Mar 2, 2016 | 51,000

78,850

Nil |

Joe Chan

Chief Financial Officer | 100,000

| 0.39

| Mar 2, 2016

| Nil

|

Todd Fayram

Chief Operating Officer | 280,000

500,000 | 0.09

0.39 | July 28, 2014

March 2, 2016 | 18,200

Nil |

Notes:

(1) In-the-money options are those where the market value of the underlying securities as at the most recent fiscal year end exceeds the option exercise price. The closing market price of the Corporation’s common shares on the TSX as at December 31, 2012 was $0.155 per share.

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets out the value vested or earned under incentive plans during the year ended December 31, 2012, for each NEO:

Name

| Option-based awards – Value

vested during the year

($)(1) | Share-based awards –

Value vested during the

year

($) | Non-equity incentive plan

compensation – Value earned

during the year

($) |

Brian Kirwin

President & Chief

Executive Officer |

Nil

|

N/A

|

N/A

|

Joe Chan

Chief Financial Officer |

Nil |

N/A |

N/A |

Todd Fayram

Chief Operating Officer |

Nil

|

N/A

|

N/A

|

Notes:

(1) All options granted to NEO’s were not subject to a vesting schedule and therefore were exercisable immediately upon granting. The grant price and market price on the grant date were the same and therefore there was no value earned.

See “Securities Authorized Under Equity Compensation Plans” for further information on the Corporation’s Share Option Plan.

Termination and Change of Control Benefits

As of December 31, 2012, the Corporation has an employment agreement with Brian P. Kirwin dated April 1, 2003, amended on July 1, 2006 and March 29, 2011. Under this agreement the Corporation agreed to pay Mr. Kirwin a base annual salary of US$275,000, is required to work full time for the Corporation and is eligible to receive stock options and a performance based bonus at the discretion of the Compensation Committee and the Board and other standard benefits made available by the Corporation.

- 13 -

In addition, under this agreement an amount equal to 36 months salary is payable in the event of a termination without cause.

The estimated incremental payments from the Corporation to Mr. Kirwin on (i) termination without cause or (ii) termination without cause or resignation with cause within 12 months following a change of control, assuming the triggering event occurred on December 31, 2012, are as follows:

NEO

| Termination Without Cause

| Change of Control

|

| Brian Kirwin | Salary | US$825,000 | US$825,000 |

| Bonus | Nil | Nil |

| Options | Nil | Nil |

Director Compensation

Directors compensation is $24,000 per year. As of December 31, 2012, only $32,667 in Director’s fees was paid. The remaining fees of $98,710 remain unpaid as of December 31, 2012.

The compensation for directors, excluding a director who is included in disclosure for an NEO, for the Corporation’s most recently completed financial year of December 31, 2012 is:

Name(1)

| Fees

Earned

($) | Share-

based

awards

($) | Option-

based

awards

($) | Non-equity

incentive plan

compensation

($) | Pension

Value

($) | All other

compensation

($) | Total

Compen-

sation

($) |

| James Bagwell | 24,000 | Nil | Nil | Nil | Nil | Nil | 24,000 |

| Robert McKnight | 24,000 | Nil | Nil | Nil | Nil | Nil | 24,000 |

| Ronald Netolitzky(2) | 24,000 | Nil | Nil | Nil | Nil | Nil | 24,000 |

| Giulio Bonifacio(3) | 34,667 | Nil | Nil | Nil | Nil | Nil | 34,667 |

| Jamie Newall | 24,000 | Nil | Nil | Nil | Nil | Nil | 24,000 |

| Wayne Tisdale(4) | 710 | Nil | Nil | Nil | Nil | Nil | 710 |

Notes:

| (1) | Brian Kirwin does not appear on this table as he is a NEO. |

| (2) | Ron Netolitzky resigned as Director of the Corporation on February 6, 2013. |

| (3) | Giulio Bonifacio resigned as Director of the Corporation on May 14, 2013 |

| (4) | Wayne Tisdale was appointed a Director of the Corporation on December 20, 2012. |

Outstanding Share-based Awards and Option-based Awards The Corporation does not have any share-based awards.

The following table sets out all option based awards outstanding as at December 31, 2012, for each director, excluding a director who is already set out in disclosure for an NEO for the Corporation:

- 14 -

Option-Based Awards

|

Name(1)

| Number Of Securities

Underlying Unexercised

Options

(#)

| Option

Exercise

Price

($)

| Option

Expiration Date

| Value Of Unexercised In-

The-Money Options(2)

($)

|

James Bagwell

| 400,000

800,000 | 0.39

0.53 | March 2, 2016

September 1, 2016 | Nil

Nil |

Giulio Bonifacio(3)

| 700,000

3,080,000 | 0.39

0.53 | March 2, 2016

September 1, 2016 | Nil

Nil |

Robert McKnight

| 400,000

550,000 | 0.39

0.53 | March 2, 2016

September 1, 2016 | Nil

Nil |

Ron Netolitzky(4)

| 400,000

550,000 | 0.39

0.53 | March 2, 2016

September 1, 2016 | Nil

Nil |

| Jamie Newall | 100,000 | 0.365 | June 23, 2016 | Nil |

| Wayne Tisdale | Nil | Nil | Nil | Nil |

Notes:

(1) Brian Kirwin does not appear on this table as he is a NEO.

(2) In-the-money options are those where the market value of the underlying securities as at the most recent fiscal year end exceeds the option exercise price. The closing market price of the Corporation’s common shares on the TSX as at December 31, 2012 (i.e. fiscal year end) was $0.155 per share.

(3) Giulio Bonifacio resigned as Director of the Corporation on May 14, 2013

(4) Ron Netolitzky resigned as Director of the Corporation on February 6, 2013.

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets out the value vested or earned under incentive plans during the year ended December 31, 2012, for each director, excluding a director who is already set out in disclosure for a NEO for the Corporation:

Name(1)

| Option-Based Awards –

Value

Vested During The Year

($)(2)

|

Share-Based Awards – Value

Vested During The Year

($)

| Non-Equity Incentive Plan

Compensation – Value

Earned During The Year

($)

|

| James Bagwell | Nil | N/A | N/A |

| Giulio Bonifacio(3) | Nil | N/A | N/A |

| Robert McKnight | Nil | N/A | N/A |

| Ronald Netolitzky(4) | Nil | N/A | N/A |

| Jamie Newall | Nil | N/A | N/A |

| Wayne Tisdale | Nil | N/A | N/A |

Notes:

(1) Brian Kirwin does not appear on this table as he is a NEO.

(2) All options granted to Director’s were not subject to a vesting schedule and therefore were exercisable immediately upon granting. The grant price and market price on the grant date were the same and therefore there was no value earned.

(3) Giulio Bonifacio resigned as Director of the Corporation on May 14, 2013 (4) Ron Netolitzky resigned as Director of the Corporation on February 6, 2013.

- 15 -

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLAN

The only equity compensation plan which the Corporation has in place is the stock option plan (the “Plan”) which was originally approved by the Shareholders on March 24, 2005. The Plan was re-approved by the shareholders at the annual general meeting held in June 2011. The Plan has been established to provide incentive to qualified parties to increase their proprietary interest in the Corporation and thereby encourage their continuing association with the Corporation. The Plan is administered by the directors of the Corporation. The Plan provides that options will be issued to directors, officers, employees or consultants of the Corporation or a subsidiary of the Corporation. The Plan provides that the number of Common Shares issuable under the Plan, together with all of the Corporation's other previously established or proposed share compensation arrangements, may not exceed 10% of the total number of issued and outstanding Common Shares. All options expire on a date not later than five years after the date of grant of such option.

The following table sets out equity compensation plan information as at the end of the financial year ended December 31, 2012.

Equity Compensation Plan Information

| Number of securities to

be issued upon exercise

of outstanding options

| Weighted-average exercise

price of outstanding options

| Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected in

column (a)) |

| Plan Category | | | |

| Equity compensation plans re- approved by securityholders – on June 24, 2011 (the Plan) | 11,039,044 | $0.436 | 8,980,91 |

| Equity compensation plans not approved by securityholders | Nil | Nil | Nil |

| Total | 11,039,044 | $0.436 | 8,980,391 |

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

No director, senior officer or executive officer, nor any proposed nominee for director, nor any associate of any of them, has been indebted to the Corporation at any time during the previous fiscal year.

INTEREST OF INSIDERS IN MATERIAL TRANSACTIONS

This Information Circular, including the disclosure below, briefly describes (and, where practicable, states the approximate amount of) any material interest, direct or indirect, of any informed person of the Corporation, any proposed director of the Corporation, or any associate or affiliate of any informed person or proposed director, in any transaction since the commencement of the Corporation’s most recently completed financial year or in any proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries.

The Corporation’s related parties consists of companies which have certain directors in common as follows:

- 16 -

| Related Party | Nature of Transactions |

| Mesa Exploration Corp.(1) | General and administration |

Notes:

(1) Mr. Kirwin is a director of Mesa Exploration Corp.

The Corporation recovered under cost-sharing arrangements from the related parties, $162,902 for the year ended December 31, 2012 ($186,500 – December 31, 2011), for office shared costs and general administration. As of December 31, 2012, a receivable balance of $2,121 remained outstanding.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None of the directors or senior officers of the Corporation, no management nominee for election as a director of the Corporation, none of the persons who have been directors or senior officers of the Corporation since the commencement of the Corporation’s last completed financial year and no associate or affiliate of any of the foregoing has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the meeting.

MANAGEMENT CONTRACTS

The management functions of the Corporation are performed by the Corporation’s directors and senior officers and the Corporation has no management agreements or arrangements under which such management functions are performed by persons other than the directors and senior officers of the Corporation.

CORPORATE GOVERNANCE DISCLOSURE

The following Corporate Governance Disclosure meets the requirements of National Instrument 58-101 –Disclosure of Corporate Governance Practices, applicable to issuers whose securities are listed on the TSX.

Board of Directors

The Board is currently composed of five directors. Three of the five current directors are considered independent. The three independent directors are Robert McKnight, Wayne Tisdale and Jamie Newall. Brian Kirwin is an Executive Officer of the Corporation, and James Bagwell performs communication services for Corporation and therefore are not independent directors.

Certain directors are presently a director of one or more other reporting issuers, as follows:

| Name of Director | Corporation | Exchange |

| Brian Kirwin | Mesa Exploration Corp. | TSXV |

| Robert McKnight | Savant Explorations Ltd | TSXV |

Jamie Newall

| Declan Resources Inc.

eShippers Management Ltd.

Opal Energy Corp.

Suparna Gold Corp. | TSXV

NEX

TSXV

TSXV |

Wayne Tisdale

| Declan Resources Inc.

Suparna Gold Corp. | TSXV

TSXV |

- 17 -

The independent directors meet without non-independent directors and members of management on an ad hoc basis as necessary to fulfil their duties as independent directors or to assess transactions in which non-independent members or members of management may have an interest. No such meetings were held during 2012.

During 2012, the Board considered, reviewed and approved various resolutions by way of Director’s resolutions and consented to in writing by all members of the Board. Directors’ attendance at Board meetings for 2012 were as follows:

| Directors | Meetings Attended |

| James F. Bagwell | 8 of 8 |

| Brian Kirwin | 8 of 8 |

| Robert McKnight | 8 of 8 |

| Jamie Newall | 8 of 8 |

| Wayne Tisdale(1) | Nil(1) |

Notes:

(1) Wayne Tisdale became a Director of the Corporation on December 20, 2012

Mandate of the Board of Directors

The text of the Board’s written mandate, extracted from the Corporation’s Corporate Governance Guidelines and Policies, is set out below:

Director Responsibilities

Oversee Management of the Corporation.The principal responsibilities of the directors are to oversee the management of the Corporation and, in so doing, serve the best interests of the Corporation on behalf of its Shareholders. These responsibilities require that the directors attend to the following:

| | • | review and approve on a regular basis, and as the need arises, fundamental operating, financial, and other strategic corporate plans which take into account, among other things, the opportunities and risks of the business; |

| | | |

| | • | evaluate the performance of the Corporation, including the appropriate use of corporate resources; |

| | | |

| | • | evaluate the performance of, and oversee the progress and development of, senior management and take appropriate action, such as promotion, change in responsibility and termination; |

| | | |

| | • | implement senior management succession plans; |

| | | |

| | • | evaluate the Corporation’s compensation programs; |

| | | |

| | • | establish a corporate environment that promotes timely and effective disclosure (including appropriate controls, procedures and incentives), fiscal accountability, high ethical standards and compliance with applicable laws and industry and community standards; |

| | | |

| | • | evaluate the Corporation’s systems to identify and manage the risks faced by the Corporation; |

- 18 -

| | • | review and decide upon material transactions and commitments; |

| | | |

| | • | develop a corporate governance structure that allows and encourages the Board to fulfill its responsibilities; |

| | | |

| | • | provide assistance to the Corporation’s senior management, including guidance on those matters that require Board involvement; and |

| | | |

| | • | evaluate the overall effectiveness of the Board and its committees. |

Exercise Business Judgment.In discharging their fiduciary duties of care, loyalty and candor, directors are expected to exercise their business judgment to act in what they reasonably and honestly believe to be the best interests of the Corporation and its Shareholders free from personal interests. In discharging their duties, when appropriate, the directors normally are entitled to rely on the Corporation’s senior executives and its outside advisors, auditors and legal counsel but also should consider second opinions where circumstances warrant.

Understand the Corporation and its Business.Directors are expected to become and remain informed about the Corporation and its business, properties, risks and prospects.

Establish Effective Systems.Directors are responsible for determining that effective systems are in place for the periodic and timely reporting to the Board on important matters concerning the Corporation. Directors should also provide for periodic reviews of the integrity of the Corporation’s internal controls and management information systems.

Protect Confidentiality and Proprietary Information.Directors are responsible for establishing policies that are intended to protect the Corporation’s confidential and proprietary information from unauthorized or inappropriate disclosure. Likewise, all discussions and proceedings of the Board of Directors must be treated as strictly confidential and privileged to preserve open discussions between directors and to protect the confidentiality of Board discussions.

Board, Committee and Shareholder Meetings.Directors are responsible for attending Board meetings and meetings of committees on which they serve. They must devote the time needed, and meet as frequently as necessary, to properly discharge their responsibilities.Indemnification.The directors are entitled to indemnification from the Corporation in the circumstances permitted by applicable law and, when available on reasonable terms, directors’ and officers’ liability insurance.

Majority Voting for Election of Directors

The Board adopted a policy regarding majority voting for the election of directors. The policy is described above under “Election of Directors – Majority Voting Policy.”

Position Descriptions

The Board has not adopted specific position descriptions for the Chair and the Chair of each Board committee. The Board has adopted a set of Corporate Governance Guidelines which govern the workings of the Board. The Chair is expected to establish the meeting schedule for the Board, and establish an agenda for each Board meeting. The Board has also adopted charters for each of the Board committees – the Audit Committee, Compensation Committee, Nominating Committee and Governance Committee.

- 19 -

The Chair of each committee is required to ensure that the duties of the committee set out in its respective charter are met. The Board has developed a position description for the Chief Executive Officer.

Director Orientation and Continuing Education

The Board and the Corporation’s senior management conduct orientation programs for new directors. The orientation programs include presentations by management to familiarize new directors with the Corporation’s projects, strategic plans, its significant financial, accounting and risk management issues, its compliance programs, its code of business conduct and ethics, its principal officers, its internal and independent auditors and its outside legal advisors. In addition, the orientation program includes a review of the Corporation’s expectations of its directors in terms of time and effort, a review of the directors’ fiduciary duties and visits to Corporation headquarters and, to the extent practical, certain of the Corporation’s significant facilities.

While the Corporation does not have a formal continuing education program, in order to enable each director to better perform his or her duties and to recognize and deal appropriately with issues that arise, the Corporation provides the directors with suggestions to undertake continuing director education, the cost of which is borne by the Corporation. All of the board members have significant experience in governance of both public and private companies, which the Board believes ensures the effective operating and governances of the Corporation and Board.

Ethical Business Conduct

The Board of Directors, has adopted a Code of Ethics which applies to the employees, officers and directors of the Corporation. The Code of Ethics is included in the Corporation’s annual information form on Form 20-F for the year ended December 31, 2005, which is available with the Corporation’s documents on SEDAR atwww.sedar.com.The Board does not have an outside auditor for monitoring compliance with the Code. The Board relies upon the Corporation’s whistle blower policy, audit by the Corporation’s auditor of the annual financial statements, and self regulation by management to ensure compliance with the Code of Ethics.

In accordance with the requirements of the British ColumbiaBusiness Corporations Actand the Corporation’s Code of Ethics, directors and officers are required to declare any material interest they may have in any transaction or agreement with the Corporation, and if a director to abstain from voting on any director approval of the transaction. The Board has established a Governance Committee comprised entirely of independent directors, one of whose responsibilities is to consider questions of independence and make recommendations to the plenary Board with respect to director independence and conflicts of interest. Where appropriate, the Board will form a committee of the independent directors to consider transactions in which executive officers have an interest, or will be affected differently than other Shareholders.

Nomination of Directors

The Board adopted a charter for the Nominating Committee in July, 2005. The duties of the Nominating Committee are to recommend to the Board the criteria for Board membership, and to identify and recommend to the Board the potential individuals qualified to become Board members. The Corporation’s Nominating Committee is comprised of Robert McKnight, Jamie Newall and Wayne Tisdale. At least annually, the Board reviews its composition and determines what additional skills the Board requires. The Nominating Committee is then tasked with identifying potential directors, whose resumes are then be submitted to the plenary Board for review and approval. The Nominating Committee determined during 2010 that additional independent Board representation was appropriate, and recommended the appointment of Jamie Newall to the Board in March, 2011 and Wayne Tisdale in December, 2012.

- 20 -

Evaluation of Executive Officers and Executive Compensation

The Compensation Committee is responsible for overseeing the evaluation of the CEO. See “Executive Compensation Discussion and Analysis” for a summary of the charter of the Compensation Committee. The Compensation Committee determines the nature and frequency of the evaluation, supervises the conduct of the evaluation and prepares an assessment of the performance of the CEO, which is discussed with the plenary Board. The Board reviews the assessment to ensure that the CEO is providing the best leadership for the Corporation over the long and short-term. The Compensation Committee also discusses with the Board the recommendations of the CEO with regards to the compensation of the other members of senior management.

Compensation of the CEO and other members of senior management are determined by the independent members of the Board based upon the recommendations the Compensation Committee. The CEO and other members of management sitting on the Board are not present during voting or deliberations on executive compensation. The Compensation Committee also recommends to the Board the appropriate level of director compensation.

Other Committees

The Corporation also has a Governance Committee in place comprised of Wayne Tisdale, Robert McKnight and Jamie Newall, all of whom are independent directors. The duties of the Governance Committee are: (i) to consider questions of independence and possible conflicts of interest of Board members and of senior management and make recommendations regarding such matters to the Board; (ii) to recommend assignments to committees of the Board; (iii) recommend to the Board appropriate governance policies; (iv) oversee the evaluation of the Board and its committees; and (v) monitor communications with Shareholders regarding governance matters.

Assessments

The Corporation has not instituted a formal process for assessing the effectiveness of Board members. The Corporation has a small Board and assessments of the contribution of Board members are done informally, as required, under the leadership and guidance of the Governance Committee.

AUDIT COMMITTEE DISCLOSURE

Information required by National Instrument 52-110, Audit Committees, is presented in the Corporation’s Form 20-F under the heading Item 16A – Audit Committee Financial Expert, which is filed onwww.sedar.com.

AUDIT COMMITTEE CHARTER

The Corporation’s audit committee is governed by a written charter that sets out its mandate and responsibilities. A copy of the audit committee charter is set out in the Corporation’s Information Circular prepared for the Corporation’s June 8, 2007 annual general meeting and filed on SEDAR on May 14, 2007.

- 21 -

PARTICULARS OF MATTERS TO BE ACTED UPON

Advance Notice Provision

The directors of the Corporation are proposing that the Articles of the Corporation are altered to include an advance notice provision (the “Advance Notice Provision”), which will: (i) facilitate orderly and efficient annual general or, where the need arises, special, meetings; (ii) ensure that all shareholders receive adequate notice of the director nominations and sufficient information with respect to all nominees; and (iii) allow shareholders to register an informed vote. The full text of the proposed alteration of the Articles to include the Advance Notice Provision is set out in Appendix A to this Information Circular.

1. Purpose of the Advance Notice Provision

The purpose of the Advance Notice Provision is to provide shareholders, directors and management of the Corporation with direction on the procedure for shareholder nomination of directors. The Advance Notice Provision is the framework by which the Corporation seeks to fix a deadline by which holders of record of common shares of the Corporation must submit director nominations to the Corporation prior to any annual or special meeting of shareholders and sets forth the information that a shareholder must include in the notice to the Corporation for the notice to be in proper written form.

2. Effect of the Advance Notice Provision

Subject only to the Act and the Articles, only persons who are nominated in accordance with the following procedures shall be eligible for election as directors of the Corporation. Nominations of persons for election to the Board may be made at any annual meeting of shareholders, or at any special meeting of shareholders if one of the purposes for which the special meeting was called was the election of directors: (a) by or at the direction of the Board, including pursuant to a notice of meeting; (b) by or at the direction or request of one or more shareholders pursuant to a proposal made in accordance with the provisions of the Act, or a requisition of the shareholders made in accordance with the provisions of the Act; or (c) by any person (a “Nominating Shareholder”): (A) who, at the close of business on the date of the giving of the notice provided for below in the Advance Notice Provision and on the record date for notice of such meeting, is entered in the securities register as a holder of one or more shares carrying the right to vote at such meeting or who beneficially owns shares that are entitled to be voted at such meeting; and (B) who complies with the notice procedures set forth below in the Advance Notice Provision.

In addition to any other applicable requirements, for a nomination to be made by a Nominating Shareholder, the Nominating Shareholder must have given timely notice thereof in proper written form to the Corporate Secretary of the Corporation at the principal executive offices of the Corporation.

To be timely, a Nominating Shareholder’s notice to the Corporate Secretary of the Corporation must be made: (a) in the case of an annual meeting of shareholders, not less than 30 nor more than 65 days prior to the date of the annual meeting of shareholders; provided, however, that in the event that the annual meeting of shareholders is to be held on a date that is less than 40 days after the date (the “Notice Date”) on which the first public announcement of the date of the annual meeting was made, notice by the Nominating Shareholder may be made not later than the close of business on the tenth (10th) day following the Notice Date; and (b) in the case of a special meeting (which is not also an annual meeting) of shareholders called for the purpose of electing directors (whether or not called for other purposes), not later than the close of business on the fifteenth (15th) day following the day on which the first public announcement of the date of the special meeting of shareholders was made. In no event shall any adjournment or postponement of a meeting of shareholders or the announcement thereof commence a new time period for the giving of a Nominating Shareholder’s notice as described above. Notwithstanding the foregoing, the Board may, in its sole discretion, waive the time periods summarized above, or otherwise waive the application, in whole or in part, of the Advance Notice Provisions.

- 22 -

To be in proper written form, a Nominating Shareholder’s notice to the Corporate Secretary of the Corporation must set forth: (a) as to each person whom the Nominating Shareholder proposes to nominate for election as a director: (A) the name, age, business address and residential address of the person; (B) the principal occupation or employment of the person; (C) the class or series and number of shares in the capital of the Corporation which are controlled or which are owned beneficially or of record by the person as of the record date for the meeting of shareholders (if such date shall then have been made publicly available and shall have occurred) and as of the date of such notice; and (D) any other information relating to the person that would be required to be disclosed in a dissident’s proxy circular in connection with solicitations of proxies for election of directors pursuant to the Act and Applicable Securities Laws (as defined below); and (b) as to the Nominating Shareholder giving the notice, any proxy, contract, arrangement, understanding or relationship pursuant to which such Nominating Shareholder has a right to vote any shares of the Corporation and any other information relating to such Nominating Shareholder that would be required to be made in a dissident’s proxy circular in connection with solicitations of proxies for election of directors pursuant to the Act and Applicable Securities Laws (as defined below).

The Corporation may require any proposed nominee to furnish such other information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve as a director of the Corporation or that could be material to a reasonable shareholder’s understanding of the independence, or lack thereof, of such proposed nominee.

No person shall be eligible for election as a director of the Corporation unless nominated in accordance with the provisions of the Advance Notice Provision; provided, however, that nothing in the Advance Notice Provision shall be deemed to preclude discussion by a shareholder (as distinct from the nomination of directors) at a meeting of shareholders of any matter in respect of which it would have been entitled to submit a proposal pursuant to the provisions of the Act. The Chairman of the meeting shall have the power and duty to determine whether a nomination was made in accordance with the procedures set forth in the foregoing provisions and, if any proposed nomination is not in compliance with such foregoing provisions, to declare that such defective nomination shall be disregarded.

For purposes of the Advance Notice Provision: (a) “public announcement” shall mean disclosure in a press release reported by a national news service in Canada, or in a document publicly filed by the Corporation under its profile on the System of Electronic Document Analysis and Retrieval at www.sedar.com; and (b) “Applicable Securities Laws” means theSecurities Act (British Columbia) and the equivalent legislation in the other provinces and in the territories of Canada, as amended from time to time, the rules, regulations and forms made or promulgated under any such statute and the published national instruments, multilateral instruments, policies, bulletins and notices of the securities commissions and similar regulatory authorities of each applicable provinces and territories of Canada. Notwithstanding any other provision of the Advance Notice Provision, notice or any delivery given to the Corporate Secretary of the Corporation pursuant to the Advance Notice Provision may only be given by personal delivery, facsimile transmission or by email (provided that the Corporate Secretary of the Corporation has stipulated an email address for purposes of this notice, at such email address as stipulated from time to time), and shall be deemed to have been given and made only at the time it is served by personal delivery, email (at the address as aforesaid) or sent by facsimile transmission (provided that receipt of confirmation of such transmission has been received) to the Corporate Secretary at the address of the principal executive offices of the Corporation; provided that if such delivery or electronic communication is made on a day which is a not a business day or later than 5:00 p.m. (Vancouver time) on a day which is a business day, then such delivery or electronic communication shall be deemed to have been made on the subsequent day that is a business day.

- 23 -

The Advance Notice Provision will be subject to an annual review, and will reflect changes as required by securities regulatory agencies or stock exchanges, or so as to meet industry standards.

3. Shareholder Confirmation

Under the Articles and the Act, the Corporation’s governing statute, the alteration of the Corporation’s Articles requires the approval of more than two-thirds of the votes cast in person or represented by proxy at the Meeting by the shareholders of the Corporation by a special resolution. Accordingly, shareholders will be asked at the Meeting to vote on a special resolution, the text of which is contained below (the “Advance Notice Provision Resolution”), to approve the alteration of the Articles of the Corporation to include the Advance Notice Provision.

4. Recommendation of the Board

The Board has concluded that the Advance Notice Provision is in the best interests of the Corporation and its shareholders. Accordingly, the Board unanimously recommends that the shareholders ratify, confirm and approve an alteration of the Corporation’s Articles by voting FOR the Advance Notice Resolution at the Meeting.

PROXIES RECEIVED IN FAVOUR OF MANAGEMENT WILL BE VOTED IN FAVOUR OF THE ALTERATION OF THE ARTICLES, UNLESS THE SHAREHOLDER HAS SPECIFIED IN THE PROXY THAT HIS OR HER COMMON SHARES ARE TO BE VOTED AGAINST SUCH RESOLUTION.

At the Meeting, Shareholders will be asked to vote on the following special resolution, with or without variation:

“BE IT RESOLVED AS A SPECIAL RESOLUTION THAT:

| a. | the Articles of the Corporation be altered by adding the text substantially as set forth in Appendix A to this Circular as and at §14.12 of the Articles; |

| | |

| b. | the Corporation be authorized to revoke this special resolution and abandon or terminate the alteration of the Articles if the Board deems it appropriate and in the best interest of the Corporation to do so without further confirmation, ratification or approval of the shareholders; and |

| | |

| c. | any one director or officer of the Corporation be and is hereby authorized and directed to do all such acts and things and to execute and deliver, under the corporate seal of the Corporation or otherwise, all such deeds, documents, instruments and assurances as in his or her opinion may be necessary or desirable to give effect to the foregoing resolutions.” |

ADDITIONAL INFORMATION

Additional information relating to the Corporation can be found on SEDAR atwww.sedar.com. Shareholders may contact the Corporation at Suite 1238, 200 Granville Street, Vancouver, BC, V6C 1S4, telephone: 604-688-7523, to request copies of the Corporation’s financial statements and MD&A. Financial information is provided in the Corporation’s comparative financial statements and MD&A for its most recently completed financial year.

- 24 -

OTHER MATTERS

The Board is not aware of any other matters which it anticipates will come before the Meeting as of the date of mailing of this Information Circular.

The contents of this Information Circular and its distribution to shareholders have been approved by the Board of the Corporation.

DATEDat Vancouver, British Columbia, May 23, 2013.

BY ORDER OF THE BOARD OF DIRECTORS