Forward-Looking Statements

The information contained herein includes forward-looking statements. These statements relate to

future events or to our future financial performance, and involve known and unknown risks,

uncertainties and other factors that may cause our actual results, levels of activity, performance,

or achievements to be materially different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements. You should not place

undue reliance on forward-looking statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond our control and which could,

and likely will, materially affect actual results, levels of activity, performance or achievements. Any

forward-looking statement reflects our current views with respect to future events and is subject to

these and other risks, uncertainties and assumptions relating to our operations, results of

operations, growth strategy and liquidity. We assume no obligation to publicly update or revise

these forward-looking statements for any reason, or to update the reasons actual results could

differ materially from those anticipated in these forward-looking statements, even if new

information becomes available in the future. Important factors that could cause actual results to

differ materially from our expectations include, but are not limited to, those factors that are

disclosed under the heading "Risk Factors" and elsewhere in our documents filed from time to

time with the United States Securities and Exchange Commission and other regulatory

authorities. Statements regarding the regulatory status and/or regulatory compliance of our

products, our ability to secure additional financing, our ability to sustain market acceptance for our

products, our dependence on collaborators, our ability to find and execute strategic transactions,

or potential exposure to litigation, our exposure to product liability claims, and our prices, future

revenues and income and cash flows and other statements that are not historical facts contain

predictions, estimates and other forward-looking statements. Although the Company believes that

its expectations are based on reasonable assumptions, it can give no assurance that its goals will

be achieved and these statements will prove to be accurate. Important factors could cause actual

results to differ materially from those included in the forward-looking statements.

Auriga Defined

A specialty pharmaceutical

company building an innovative

sales force designed to rapidly

grow market share while

preserving resources for

pipeline development and

acquisitions

Auriga Highlights

Currently focused on niches of

Respiratory/Derm/Psych/GI

Growing an innovative sales force

2007 Revenue Projected at $26-27 million

Robust development pipeline with major long-

term growth potential

Approximately $50MM market capitalization*

Rapidly expanding intellectual property portfolio

*market cap as of 10/31/06

Sales Force Structural Plan

Respiratory

Psych

Derm

70-90 reps*

100-120 reps*

30-45 reps*

*represents expected size of sales force upon completion of 2007 expansion

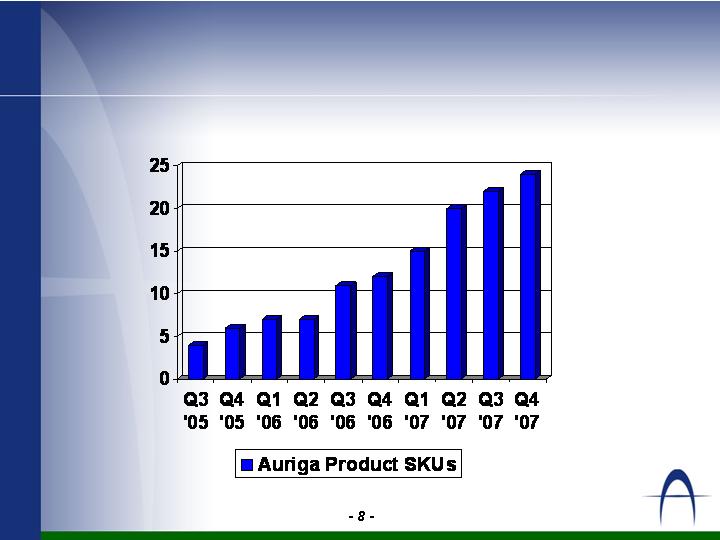

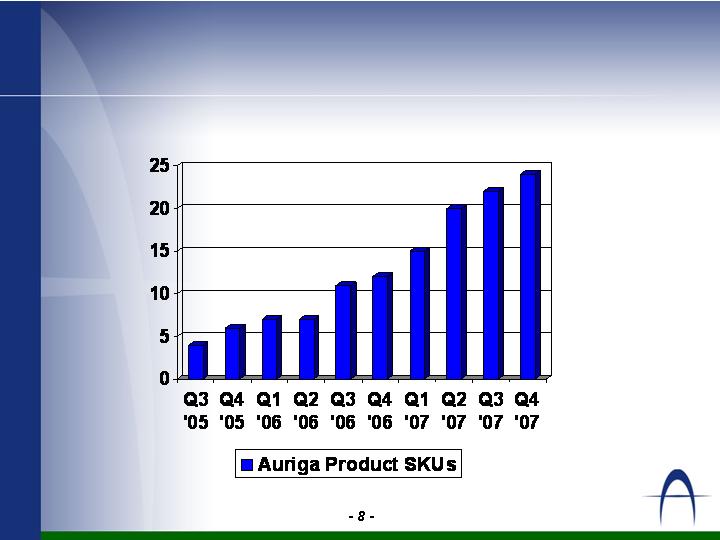

Current Product Portfolio

Extendryl® line of cough/cold/allergy products

Marketed Rx prescription products

7 SKUs currently

10 SKUs by end of 2007

Levall® line of cough/cold products

Marketed Rx prescription products

4 SKUs currently

6 SKUs by end of 2007

Aquoral™ spray for xerostomia

Recently approved 510(k) Rx device

Launch scheduled for February 2007

New Products to be launched/acquired

OTC cough cold allergy products

5 SKUs by end of 2007

Psychiatric Product

acquisition/in-license a product in 2007

Branded Dermatology Products

7 SKUs by end of 2007

Medical Foods/Homeopathic Treatments

2 SKUs by end of 2007

Growth and Diversification of Product

Portfolio

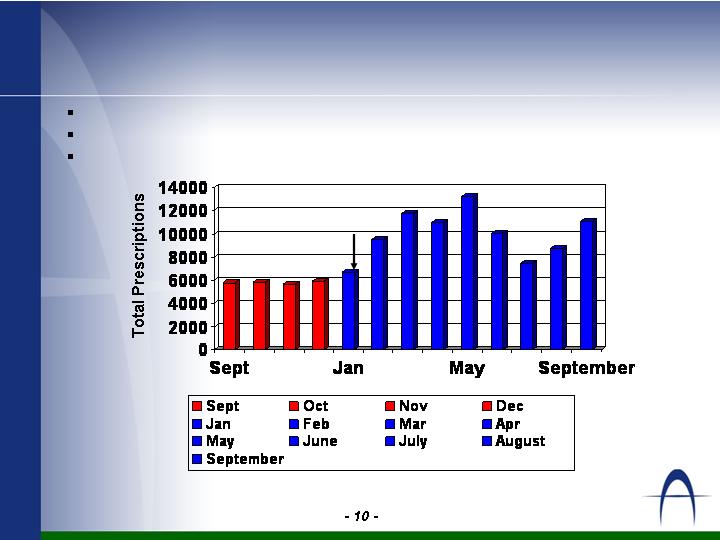

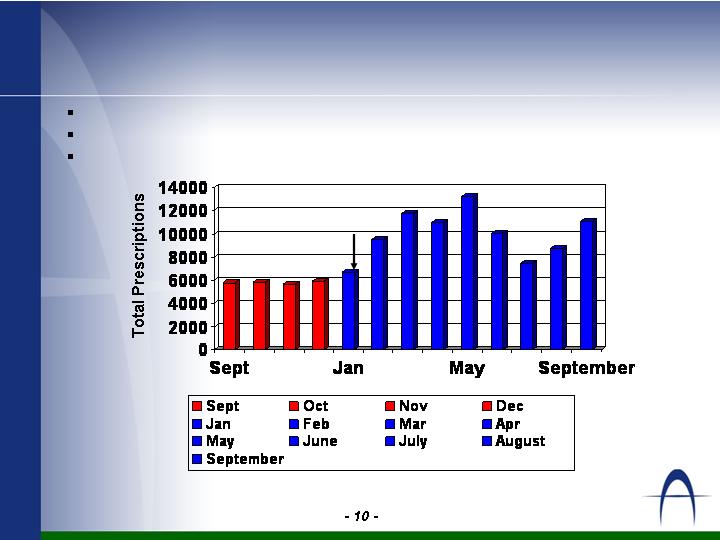

Extendryl® Line

Rx for seasonal/perennial allergy symptoms

Competes in $6.0 billion U.S. prescription

and OTC market for CCA products

Launching Extendryl G in Fall 2006

Extendryl® Seniors

Extendryl® Juniors

Extendryl® Chewables

Extendryl® Syrup

Extendryl® PSE

Extendryl® DM

Extendryl® HC

Extendryl® G

Extendryl® Performance

140,029 TRx in 2005

257,559 TRx forecast for 2006

375,000 TRx forecast for 2007

Source = IMS National Prescription Audit (NPA)

Salesforce

Promotion

Begins

2005

2006

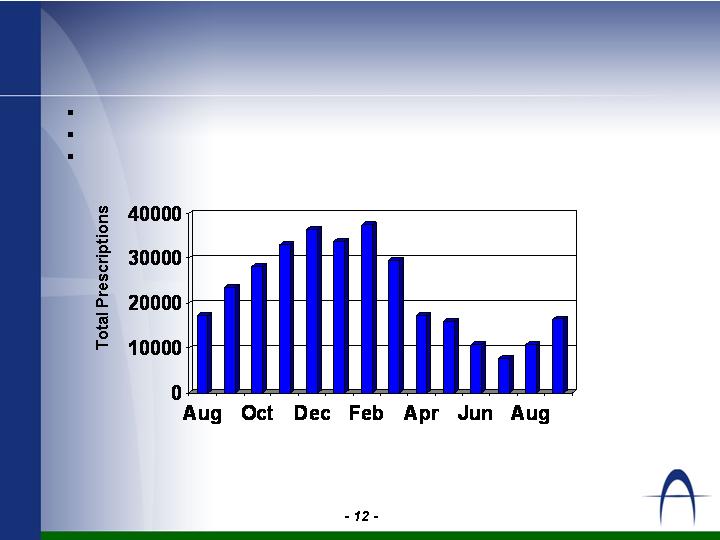

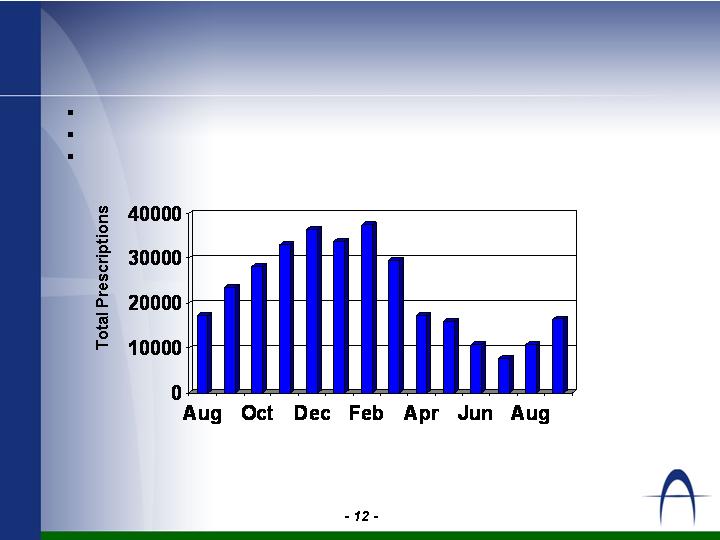

Levall™ Line

Rx for cough/cold symptoms

Competes in $6.0 billion U.S. prescription

and OTC market for CCA products

Launching several line extensions in 2007

Levall™ 5.0

Levall™ Liquid

Levall™ - 12

Levall™ G

Levall™ Performance

* Includes Levall branded Rx &

Auriga-owned Levall generics

383,946 TRx in 2005

370,769 TRx forecast for 2006

482,000 TRx forecast for 2007

2005

2006

Aquoral™ Spray

Recently approved mouth spray for treatment of

xerostomia (dry mouth)

Dry mouth affects >25 million people in U.S.

Caused by serious medical conditions and by many

medications

Total market could be >$1 billion

Product launch will be February 2007

Signed co-promotion agreement with

Pharmelle (Urology) in October 2006

Auriga Sales Team

Currently 34 representatives selling

12- 15 new representatives attending training during November

60 by January

120 by March 2007

200+ by July 2007

A typical 200 person sales force can cost $27,000,000 annually (200

reps at fully-loaded average cost of $135,000 per representative)

Sales force model encourages constantly turning over lower

performers and ensures that expenses do not outpace revenue

The commission structure allows the greatest share of voice with

minimal investment

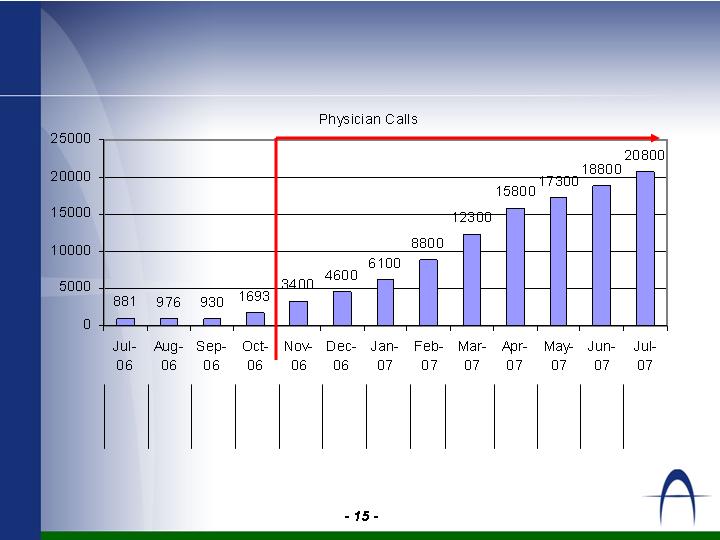

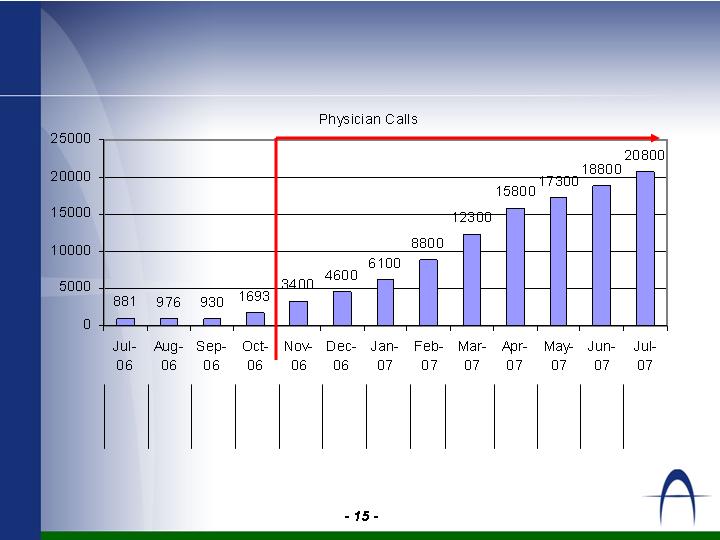

Sales Rep Count & Physician Calls

188

208

173

158

123

88

61

46

34

23

14

14

15

# of

Reps

**

Projection

** Rep numbers show reps on board 1st day of the month

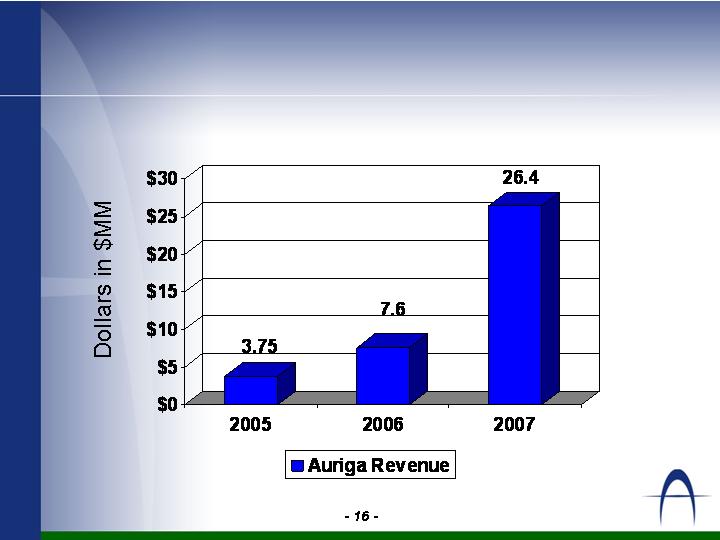

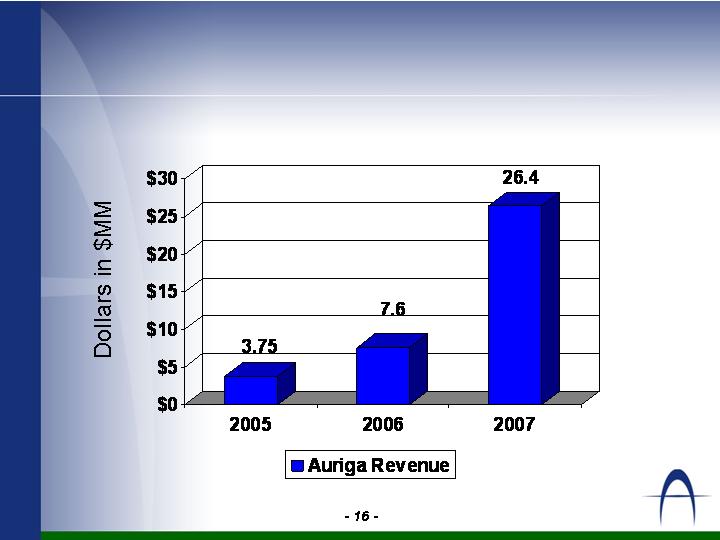

Revenue by Year

2006 and 2007 based on projections

Auriga Sales Management

Utilizing the “mentor” concept

Top performing representatives assigned a number of

direct reports while still maintaining their current

business.

Mentors get a piece of each representative’s commission

Majority of mentoring via telephone

Allows newer representatives immediate access to top

performers

Keeps manager expenses low (salaries and travel)

Product Lifecycle Management

Auriga will use regulatory and intellectual property

strategies along with authorized generic arrangements to

gain and protect market share

Example of Effective Use of Regulatory and IP Strategies

to Gain and Protect Market Share

Mucinex® (Adams Respiratory Therapeutics)

DESI cough/cold product approved via 505(b)(2)

Auriga Development Project Goals

Solid return on investment

Auriga makes a considerable multiple over the

development dollars spent to bring product to market

Exclusivity

Eradicate or minimize possible substitution

Use proprietary technology and/or have patents to keep

competition down and out

The “Hook”

That significant difference/competitive

advantage/memorable feature that keeps doctors and

patients coming back for more

AU-015 Projected Profile

GI Anti-Inflammatory Market: $2-3 BB Annual

GI Anti-Inflammatory TRx: 4.9 MM Annual

86% of TRx currently sulfasalazine/mesalamine

4% is oral steroid (locally delivered)

Steroid therapy is newer therapy (Entocort™ EC)

American College of Gastroenterology recently made steroids 1st line therapy

This class will grow significantly in coming years

AU-015 Sales Potential: $200 MM Annual

Investigational alternate therapy for Inflammatory Bowel Diseases utilizing 505(b)(2) NDA platform

Agreement with Degussa for development of novel oral corticosteroid delivery

Improved topical localization

Extremely low absorption means fewer side effects

Pre-IND Meeting with FDA Q1 2007

Q2 2011 approval

Patent Filings

Orchestrated Therapy (OT) utility patent filed 31 July 2006

Sequential release formulations of cough/cold/allergy actives

Rapid Dissolve/Extended Release (RD/ER) provisional patent filed April 2006

Novel mixed-release tablet formulation containing cough/cold therapeutic agents that

provides immediate and extended dosing

Corticosteroid Solubilization provisional patent filed September 2006

Method for enhancing the solubility and bioavailability of fluticasone

Multiphasic Methscopolamine Release provisional patent filed September 2006

Various release profiles of methscopolamine across multiple dosage forms and

combinations

Coadministration of Zinc and Cough/Cold Drugs provisional patent filed

September 2006

Treatment of symptoms with drugs; immune system augmentation

Multi-Phase Release Potassium Guaiacolsulfonate Compositions provisional

patent filed October 2006

Various release profiles of K Guai as expectorant and use in fibromyalgia

Experienced Management Team

Name

Position

Experience

Philip Pesin Chairman and CEO FDA Regulatory, M&A, Business

Development, Intellectual Property,

founder of Sorrento Financial

Group and other start-up

organizations

Andrew Shales COO Sales and marketing; Solvay,

UCB, First Horizon, Synthon,

Zyrtec® & Keppra® brands, built

several commercial teams

Alan Roberts SVP Scientific Affairs Regulatory & scientific affairs;

Mikart, Solvay, First Horizon

Mischelle Hall VP Marketing Marketing roles at UCB, First Horizon,

Sigma Tau and Synthon

Scientific Advisory Board

Glynn Wilson, Ph.D. (Advisory Board Chairman)

Former head of drug delivery, SKB

John Staniforth, Ph.D., FRSC

Drug delivery and pharmaceutical technologies pioneer, Penwest

James McGinity, Ph.D.

Pharmaceutics thought leader with emphasis on extrusion,

microencapsulation, and polymer coatings, University of TX

(Austin)

Matthew Heil, Ph.D.

Immunologist with expertise in pharmaceutical formulations &

development

Snapshot

Ticker Symbol: OTCBB: ARGA

Founded: April 2005

Reverse Merger: May 2006

Shares Outstanding/Fully Diluted: 40MM/62MM

Insider Ownership (diluted): 50%

Equity/Debt/Acquisitions: approx $15MM**

Revenue 2007E approx $26MM

Market Cap: approx $50MM*

Public Float: approx 1.7MM shares

*market cap as of 10/31/06

** debt free by 6/30/07