The New Pharma Model™

August 2007

1

The information contained herein includes forward-looking statements. These statements relate to future events

or to our future financial performance, and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, levels of activity, performance, or achievements to be materially different from any future

results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. You

should not place undue reliance on forward-looking statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond our control and which could, and likely will,

materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects

our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions

relating to our operations, results of operations, growth strategy and liquidity. We assume no obligation to publicly

update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ

materially from those anticipated in these forward-looking statements, even if new information becomes available in

the future. Important factors that could cause actual results to differ materially from our expectations include, but are

not limited to, those factors that are disclosed under the heading "Risk Factors" and elsewhere in our documents filed

from time to time with the United States Securities and Exchange Commission and other regulatory authorities.

Statements regarding the regulatory status and/or regulatory compliance of our products, our ability to secure

additional financing, our ability to sustain market acceptance for our products, our dependence on collaborators, our

ability to find and execute strategic transactions, or potential exposure to litigation, our exposure to product liability

claims, and our prices, future revenues and income and cash flows and other statements that are not historical facts

contain predictions, estimates and other forward-looking statements. Although the Company believes that its

expectations are based on reasonable assumptions, it can give no assurance that its goals will be achieved and these

statements will prove to be accurate. Important factors could cause actual results to differ materially from those

included in the forward-looking statements. In addition, please refer to our company website for full prescribing

information for all drug products that might be discussed during this presentation.

Forward Looking Statement

2

Corporate Overview – Auriga at a Glance

Building an innovative, nationwide sales

model that drives revenue growth through a

variable cost, commission-only sales structure

Developing a diversified product portfolio by

acquiring proven brands, the introduction of

line extensions, reformulations, and the

strategic development of our own products

Auriga is a specialty pharmaceutical company

building the first national commission only

sales team.

Our corporate strategy focuses on two

primary objectives:

3

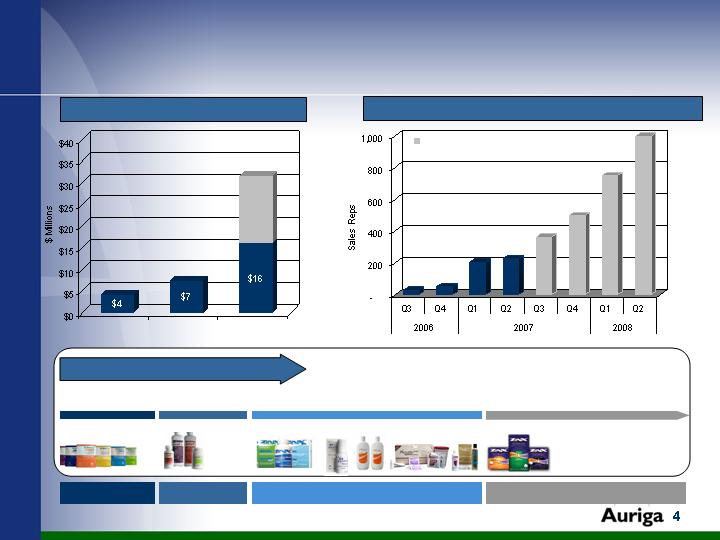

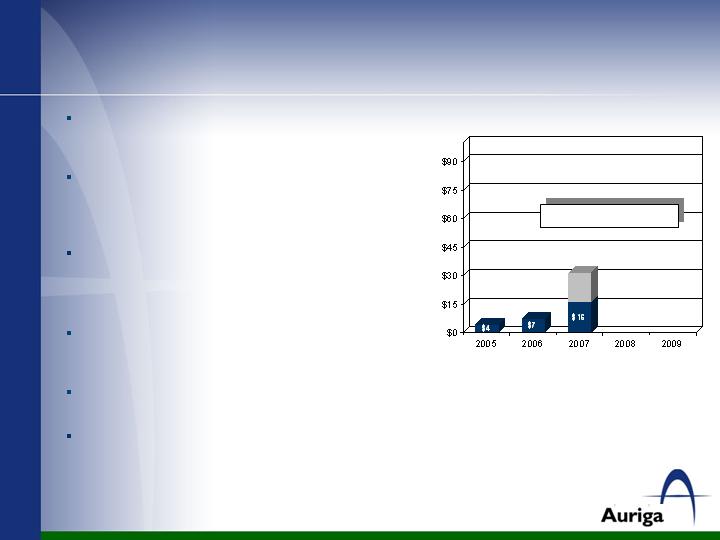

Corporate Overview – Strategic Growth

2007

2006

2005

2006

1H 2007

Future Launches

2005

Extendryl®

Levall®

Aquoral™

Zinx™

Xyralid™

Akurza™

Zinx OTC™

Nasal Gel

Hair Growth

Gross Revenue ($M)

Commission-Based Sales Force (Representatives)

Expanding Product Portfolio

$30 - $33M

Forecasted

4

Auriga’s Diversified Approach

Multiple divisions enable Auriga to drive growth through specialized

market-penetration strategies

Auriga Labs – Multidivisional Approach

Prescription Brands

Advanced Topical

Solutions

Consumer Brands

Stesso TM

Pharmaceuticals

Focused on increasing product demand through multiple nationwide

sales forces: PCP, Respiratory, Dental and Specialty sales teams.

Product lines include: AquoralTM, Extendryl®, Levall®, & ZinxTM

ATS sales team dedicated to Dermatologists, Gastroenterologists

and Colon-Rectal Specialists.

Product lines include: XyralidTM& AkurzaTM

Consumer Brand division focused on pharmacies, mass

merchandise and retail chains.

Product lines include: ZinxTM Lozenges & Convenience Kits, Nasal

Gel & Hair Growth System

Generic division initially focused on life cycle management of our

own products by launching our own authorized generics.

Product lines: Authorized generics

5

Auriga’s sales representatives are 100% commission based

Creates fast-growing, financially-motivated sales force

Lower risk to Auriga – only pays for performance

Attractive opportunity for entrepreneurial, motivated sales people to

earn “uncapped” income

Part-time opportunities to service the unmet needs of smaller or rural

sales territories

Fast path to corporate profitability

Innovative Commission Based Sales Model

6

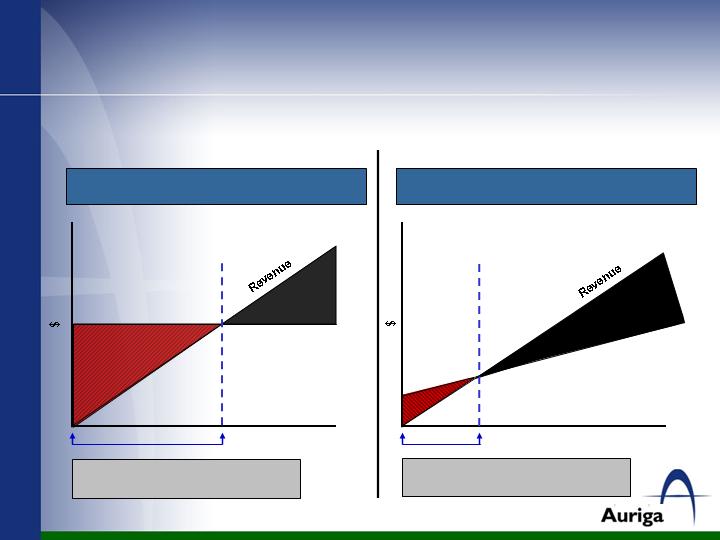

Innovative Commission-Based Sales Model

(Illustrative)

Our innovative business model promotes corporate profitability by

matchingrevenue growth against commission-based variable expenses

Assuming both models generate equivalent revenue

Break-Even Point

Traditional Industry Model (Illustrative)

Auriga’s Model (Illustrative)

Break-Even Point

(2) Operating expenses including

commission-based sales reps

Operating

expenses (2)

(1) Operating expenses including

salaried sales reps

Operating

expenses (1)

Time

Time

7

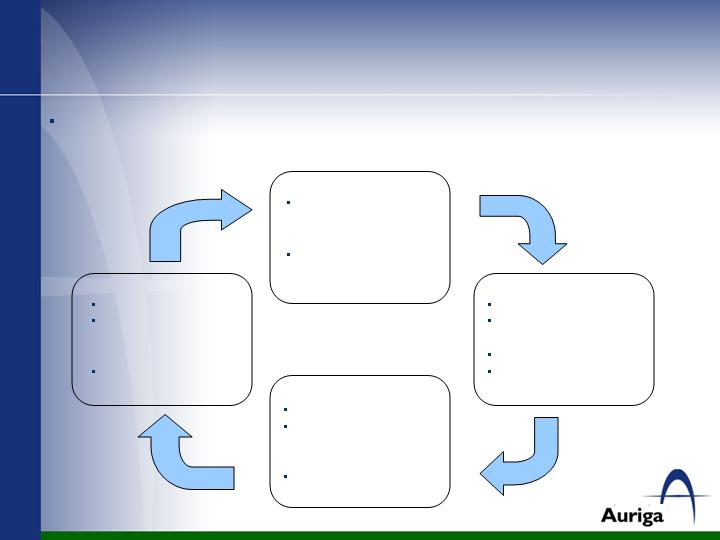

Proprietary System of Sales Force

Development

Our proprietary system of controlled growth acts as a barrier to entry

and differentiates our sales force strategy

Recruiting

Highly selective,

dedicated recruiting

department.

Multiple levels of

screening.

Probationary Period

Field exercises.

Role plays and

simulations.

Testing.

Rapid identification of

under-performers.

Training

On-line modules.

Classroom instruction

after core competencies

mastered.

Field based training.

Management

Performance metrics.

In-house developed

IT systems to track

sales force metrics.

Productive turnover

built into model.

8

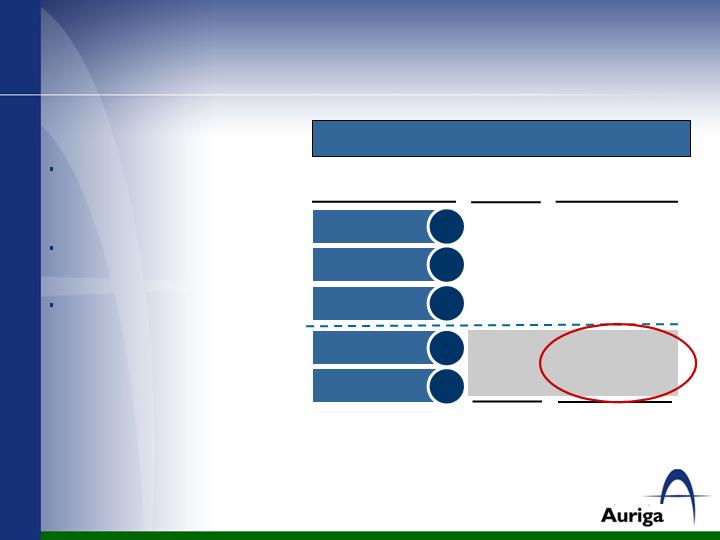

“Productive” Turnover

(1)

Salaried Sales Expense - Assumes 500 Sales Reps @

$140,000 annually – fully loaded employer costs

Excellent

1.

Above Avg.

2.

Average

3.

Below Avg.

4.

Ineffective

5.

Sales Force Tier

5%

15%

30%

35%

15%

100%

$3,500,000

$10,500,000

$21,000,000

$24,500,000

$10,500,000

Sales Force Tier Structure (Illustrative)

Enables Auriga to manage

performance and quickly

eliminate ineffective sales reps

Prevents ineffective sales reps

from occupying key territories

Unlike traditional models, our

commission-based model only

compensates reps for

performance

$70,000,000

% of

Sales

Traditional Salary

Expense (1)

9

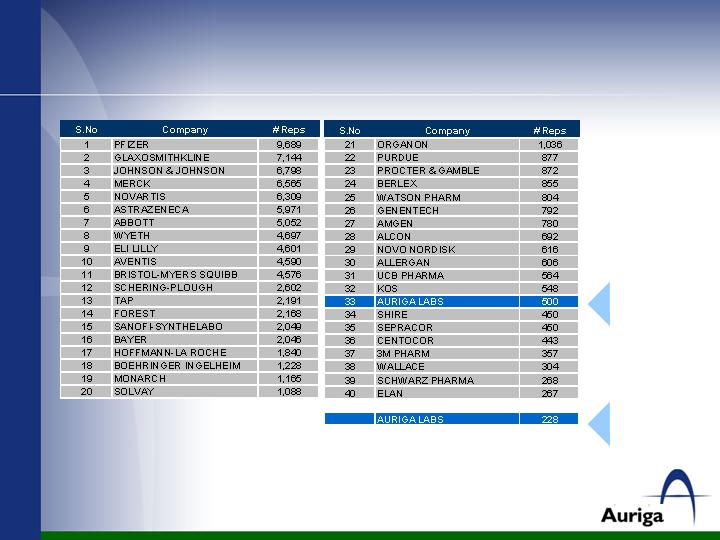

Largest Pharmaceutical Sales Forces –

Number of Sales Representatives

Auriga Labs

as of June 30,

2007

Auriga Labs

projected at

December 31,

2007.

Rankings based on 2005 data.

10

Diversified Product Portfolio

Nasal Gel

Hair Growth

System

Diversified product portfolio focuses on addressing unmet market needs &

utilizing well-known branded lines. Our strategic portfolio enables us to:

Mitigate the impact of seasonality

Diversify our revenue channels

Penetrate and accumulate market share in numerous markets

11

Target Markets – Market Potential

Division

Product Lines

Targeted Market

Market Size (E) – $10.3B

Respiratory (Cold, Cough & Allergy), Rheumatologists

Primary Care Physicians, Pediatricians & Allergists

Auriga’s product lineup targets large and growing market segments:

Prescription Brands

Advanced Topical

Solutions

Consumer Brands

Stesso TM

Pharmaceuticals

Respiratory (cough, cold and allergy), Dermatology, and Xerostomia

(dry mouth)markets

Extendryl®, ZinxTM,

Levall®, Aquoral™

XyralidTM& AkurzaTM

ZinxTM Lozenges &

Convenience Kits,

Nasal Gel & Hair

Growth System

Initially Auriga’s

authorized generics

Sources: IMS Health, Retail Drug Monitor; The Consumer Healthcare Products Association (CHPA),

https://www.chpa-info.org, and IMS Health, NPA, Nov 2006

Market Size (E) – $4.6B

Dermatologists, Gastroenterologists & Colon Rectal

Specialists

Market Size (E) – $5.8B

Retail Chains, Mass Merchandise, and Consumers.

Market Size (E) – $4.5 - $7.5B

Respiratory (Cold, Cough & Allergy), Dermatology

Primary Care Physicians, Pediatricians

12

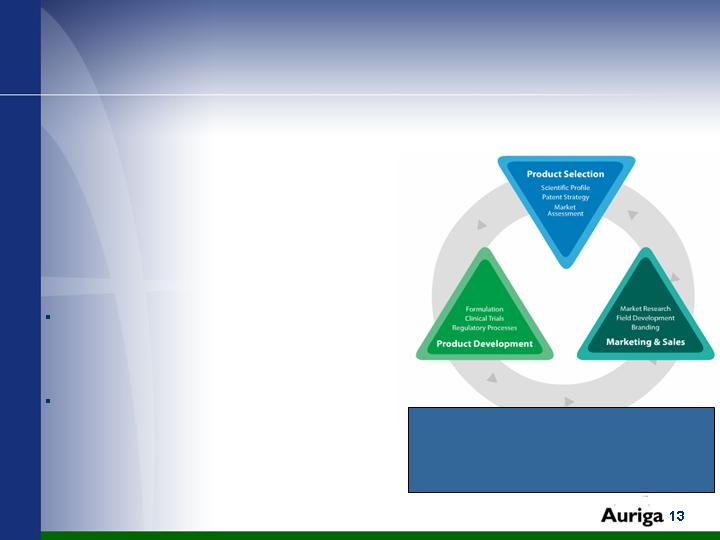

Product Development Pipeline

Our drug development pipeline leverages

novel material science and advanced drug

delivery technologies to produce:

Improved formulations and/or new clinical

indications of successful brands which

expand markets.

Bioequivalent formulations for generic

versions of strategic brand targets.

Auriga’s drug technologies are protected by

patents covering composition of matter and

use, creating a strong proprietary position for

products in the marketplace

Three programs - 505(b)(2) New Drug Applications

Eight programs - Authorized Generics and ANDAs

Two programs - 510(k) Device Applications

13

Fast-Growing Patent Portfolio

Orchestrated Therapy (OT) utility patent - Filed July 2006

Sequential release of cough/cold/allergy actives in various dosage forms

Co administration of Zinc & Cough/Cold Drugs utility patent and

PCT - Filed Jan 2007

Treatment of symptoms with drugs; immune system augmentation

Corticosteroid Solubilization utility patent - Filed Feb 2007

Method for enhancing the solubility and bioavailability of corticosteroids

Multiphasic Methscopolamine Release utility patent - Filed Feb

2007

Various release profiles of methscopolamine across multiple dosage forms

Multiphasic Release Potassium Guaiacolsulfonate Compositions

utility patent - Filed Feb 2007

Various release profiles of K Guai as expectorant and use in fibromyalgia

Cure for the Common Cold utility patent - Issued Apr 2005

Composition and use in-license from Eby covering Zinx products

Peroxidized Oils in the Treatment of Xerostomia patent application

- Filed Jun 2006

Composition of matter and use In-license from Laboratoires Carilene for Aquoral

1

4

5

6

7

2

3

14

Financial Performance

($000’s) except percentages

-

-

-

-

296%

-

231%

YOY %

(6,787)

(2,120)

(4,667)

(6,827)

2,160

(1,366)

3,526

Jun 30, 2006

Unaudited

Unaudited

Statement of Operations

(2,212)

Net Loss

(416)

Loss from Operations

(1,795)

Other Income (Expense)

8,556

Gross Profit

(8,972)

Operating Expenses

(3,116)

Cost of Goods Sold

11,673

Net Revenue

Jun 30, 2007

For the Six Months Ended

Audited

Unaudited

3,561

7,039

6,289

10,560

$ 2,412

Dec 31, 2006

%

Jun 30, 2007

Balance Sheets as of

7,592

6,820

6,820

14,412

$ 6,479

8%

Current Liabilities

-3%

Total Liabilities

113%

Shareholder Equity

36%

Total Assets

169%

Current Assets

(1) Gross Revenue is a non-GAAP measurement, please refer to our public filings for a reconciliation from Gross Revenue to Net Revenue.

Gross Revenue (1)

$ 16,121

$ 3,756

329%

15

Key Statistics: ARGA(OTCBB)

Stock Price (6/30/07) $1.18

Avg. Daily Trading (3 mo.) 170,000

6 mo. Week Low/High $0.59-$2.30

Shares Outstanding 44.2M

Fully-diluted(1) 59.2M

Public Float, est. 12.0M

Market Capitalization $52.2M

Enterprise Value $52.7M

(1)

Includes vested stock options and warrants as of June 30th 2007.

(2)

Gross revenue and EBITDAS are non-GAAP financial measures.

See our Form 10-QSB filed on August 8, 2007 for a reconciliation

to their nearest GAAP financial measures.

(3)

As of June 30, 2007

Insiders & Affiliates 37.9%

Founded Apr. ’05

Year End Dec. 31

Gross Revenue(2)(1H 07) $16.1M

EBITDAS(2)(1H 07) $2.0M

Current Assets(3) $6.5M

Total Assets(3) $14.4M

Total Liabilities(3) $7.4M

16

Positioned for Strong Growth

Divisional sales approach with focused

market penetration strategies.

Nationwide sales model that drives

revenue growth through a variable

cost, commission-only sales structure.

Nationwide sales force of 500 full time

equivalents by year-end and 1000 full

time equivalents by summer of 2008.

Diversified and expanding product

portfolio.

Strategic R&D pipeline.

Forecasted 2007 gross revenue growth to $30 - $33 million,

or over 300% vs. 2006.

$30 - $33M Forecast

Our Business is Your HealthTM

17

For More Information

Auriga Laboratories, Inc.

10635 Santa Monica Blvd,

Ste. 120

Los Angeles, CA 90067

www.aurigalabs.com

Jae Yu

VP of Corporate Development

Tel (310) 461-3612

jyu@aurigalabs.com

Investor Relations

CEOcast

Michael Wachs

Tel (212) 732-4300

mwachs@ceocast.com

18

The New Pharma Model™

ARGA

19