Playboy Enterprises, Inc.

December 7, 2006

1

Forward-Looking Statements

This presentation contains “forward-looking statements,” as to expectations, beliefs, plans, objectives and future financial performance, and assumptions

underlying or concerning the foregoing. We use words such as “may,” “will,” “would,” “could,” “should,” “believes,” “estimates,” “projects,” “potential,”

“expects,” “plans,” “anticipates,” “intends,” “continues” and other similar terminology. These forward-looking statements involve known and unknown

risks, uncertainties and other factors, which could cause our actual results, performance or outcomes to differ materially from those expressed or implied

in the forward-looking statements. The following are some of the important factors that could cause our actual results, performance or outcomes to differ

materially from those discussed in the forward-looking statements:

1) Foreign, national, state and local government regulation, actions or initiatives, including:

a) attempts to limit or otherwise regulate the sale, distribution or transmission of adult-oriented materials, including print, television,

video and online materials,

b) limitations on the advertisement of tobacco, alcohol and other products which are important sources of advertising revenue for us, or

c) substantive changes in postal regulations which could increase our postage and distribution costs;

2) Risks associated with our foreign operations, including market acceptance and demand for our products and the products of our licensees;

3) Our ability to manage the risk associated with our exposure to foreign currency exchange rate fluctuations;

4) Changes in general economic conditions, consumer spending habits, viewing patterns, fashion trends or the retail sales environment which,

in each case, could reduce demand for our programming and products and impact our advertising revenues;

5) Our ability to protect our trademarks, copyrights and other intellectual property;

6) Risks as a distributor of media content, including our becoming subject to claims for defamation, invasion of privacy, negligence, copyright,

patent or trademark infringement, and other claims based on the nature and content of the materials we distribute;

7) The risk our outstanding litigation could result in settlements or judgments which are material to us;

8) Dilution from any potential issuance of common stock or convertible debt in connection with financings or acquisition activities;

9) Competition for advertisers from other publications, media or online providers or any decrease in spending by advertisers, either generally or

with respect to the adult male market;

10) Competition in the television, men’s magazine, Internet and product licensing markets;

11) Attempts by consumers or private advocacy groups to exclude our programming or other products from distribution;

12) Our television, Internet and wireless businesses’ reliance on third parties for technology and distribution, and any changes in that technology

and/or unforeseen delays in its implementation which might affect our plans and assumptions;

13) Risks associated with losing access to transponders and competition for transponders and channel space;

14) Failure to maintain our agreements with multiple system operators and direct-to-home operators on favorable terms, as well as any decline

in our access to, and acceptance by, direct-to-home and/or cable systems and the possible resulting deterioration in the terms,

cancellation of fee arrangements or pressure on splits with operators of these systems;

15) Risks that we may not realize the expected increased sales and profits and other benefits from acquisitions;

16) Any charges or costs we incur in connection with restructuring measures we may take in the future;

17) Risks associated with the financial condition of Claxson Interactive Group, Inc., our Playboy TV-Latin America, LLC, joint venture partner;

18 Increases in paper, printing or postage costs;

19) Risks associated with certain minimum revenue amounts under our cable distribution agreements;

20) Effects of the national consolidation of the single-copy magazine distribution system; and

21) Risks associated with the viability of our primarily subscription- and e-commerce-based Internet model

2

2006 Accomplishments

Realigned businesses into two major areas of focus:

media and licensing

Reported continued revenue/profit gains in growth

businesses of licensing and new digital media

Completed deals and implemented projects that

positioned company for 2007 and beyond

Entered LBE business with opening of Palms venue

Initiated cost reduction plan

3

Strategic Priorities

Leverage power of Playboy brand

Globally

Through new licensing ventures

Across new media opportunities

Maintain leadership position in print, domestic TV

Capitalize on new technologies to expand product

offerings

Pursue opportunities in existing businesses

4

Playboy is Best-Selling Monthly Men’s

Magazine and Powerful Brand Driver

Highlights of fall MRI

10 million readers monthly

25% increase in college readers

Highest ‘Involvement Index’

Subscription-driven

circulation model

Expect 10% increase in 4Q

ad revenues

Marketing powerhouse

Playmates and celebrities

Publicity generator

5

Domestic TV Goal:

Maintain Leadership Position

Club Jenna

Challenges

Transition to VOD

Increased competition

Response

Launched new

networks

Acquired CJI

Focused on building

VOD/SVOD business

Fresh!

Shorteez

Spice: Xcess

6

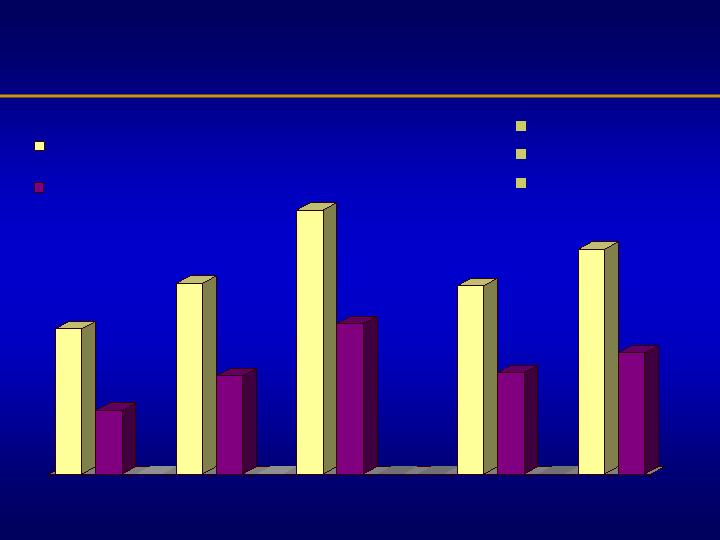

International TV, Online, Mobile

Growth Continues

International TV/Online/Mobile

Revenues in millions of dollars

2004

2005

First Nine Months

2003

2005

2006

$72.9

$99.0

$68.3

$78.5

$85.5

7

Playboy.com Redesigned

to Accelerate Revenue Growth

Tap into fast-

growing ad

revenue stream

Direct consumers

to revenue-

generating

offerings

Add video

content to

existing sites,

PPM/ISVOD

models

8

Mobile Technology Creates

New Revenue Stream

Current business

30 countries

Multimedia partners

Range of content including ring

tones, video, games

Future opportunities

Growing use of video

Introduction of domestic

carriage

9

Licensing Is Fast-Growing, Highest-Margin

Business

Note: Revenue and segment income exclude original art and 50th Anniversary auction sales in 2003.

(Dollars in millions)

Revenues

Licensing

Segment

Income

High margin

Low risk

Image enhancing

$15.6

$6.8

$20.4

$10.5

$16.1

$28.3

2003

2004

2005

First Nine Months

2006

$20.2

$10.9

$24.1

$13.0

2005

10

Develop New Categories That

Resonate With Brand, Consumers

Merchandise

Lingerie

Cosmetics

Bath & Body

Men’s

Apparel

Accessories

Underwear

Lifestyle/Services

11

Pursue Opportunities in

Underdeveloped Markets

Assign new

territories to

performing

licensees

Leverage existing

licensees to

maximize

underdeveloped

territories

Repatriate

international

success into U.S.

12

Expand Existing and New Distribution Outlets

Third-party retailers

High end

Fashion forward

Brand enhancing

Concept boutiques

Seven in existence, currently

in Hong Kong, Kuala

Lumpur, Bangkok,

Melbourne, Las Vegas (2)

and Tokyo

Plan to continue opening

three/year

Other distribution outlets

13

Entertainment Venues Enhance Image,

Improve Margins and Profitability

Palms Venue Opened October 6, 2006

14

15

(In millions of dollars, except per share amounts)

(1) 2005 results include a debt extinguishment charge of $19.3M or $0.58 per share.

(2) 2006 results include a restructuring charge of $2.0M or $0.06 per share.

(3) For reconciliation of EBITDA and Adjusted EBITDA see 8K filing (11/7/2006) available on our

website under Investor Relations-SEC filings.

First Nine Months 2006 Results

2005

(1)

2006

(2)

Revenues

247.2

$

244.9

$

Segment Income

23.6

8.0

Pre-tax Income (Loss)

(2.5)

2.9

Net Loss

(5.3)

(1.4)

Net Loss Per Share

(0.16)

(0.04)

EBITDA

(3)

36.7

40.8

Adjusted for Cash Investments

in Television Programming

(24.3)

(28.3)

Adjusted EBITDA

(3)

12.4

12.5

Nine Months Ended September 30,

2007 Goals

Media

In difficult publishing environment, offset Playboy magazine’s

cost increases with higher advertising revenues

Continue top- and bottom-line growth in online, mobile and

international TV

Execute on domestic TV strategy, increasing buy rates for

new networks and expanding VOD/SVOD take rates

Licensing

Seek new LBE ventures, building on first full year of Palms

venue

Add new distribution outlets, including three concept

boutiques

Expand categories of merchandise and launch in Latin

America and Southeast Asia

16

17