UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ PreliminaryProxy Statement | | |

¨ Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| ¨ Definitive Additional Materials | | |

| ¨ Soliciting Material Pursuant to §240.14a-12 | | |

ARCH CHEMICALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials:

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1. | | Amount previously paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

501 MERRITT 7, NORWALK, CONNECTICUT 06851

March 10, 2006

Dear Fellow Shareholder:

You are cordially invited to attend our 2006 Annual Meeting of Shareholders at 10:15 a.m., local time, on Thursday, April 27th. The meeting will be held at The Dolce Norwalk Center for Leadership and Innovation, 32 Weed Avenue, Norwalk, Connecticut.

You will find information about the meeting in the enclosed Notice and Proxy Statement.

Please be advised that we have not planned a communications segment or any multimedia presentations for the 2006 Annual Meeting.

Whether or not you plan to attend and regardless of how many shares you own, please vote your shares by using the telephone or the Internet or by signing and dating the enclosed proxy card and mailing the lower half of it in the enclosed envelope as soon as possible. If you do plan to attend, please so indicate by checking the appropriate box on the proxy card. Keep the upper half to be used as your admission card to the meeting.

|

| Sincerely, |

|

|

| MICHAEL E. CAMPBELL |

| Chairman, President and Chief Executive Officer |

|

| YOUR VOTE IS IMPORTANT |

| |

| You are urged to vote by telephone, via the Internet or |

| by signing, dating and promptly mailing your proxy |

| card in the enclosed envelope. |

ARCH CHEMICALS, INC.

Notice of Annual Meeting of Shareholders

Norwalk, Connecticut

March 10, 2006

The Annual Meeting of Shareholders of Arch Chemicals, Inc. will be held at The Dolce Norwalk Center for Leadership and Innovation, 32 Weed Avenue, Norwalk, Connecticut, on Thursday, April 27, 2006, at 10:15 a.m., local time, to consider and act upon the following:

(1) The election of two directors.

(2) Ratification of the appointment of the independent registered public accounting firm for 2006.

(3) Such other business as may properly come before the meeting or any adjournment.

The Board of Directors has fixed March 3, 2006 as the record date for determining shareholders entitled to notice of and to vote at the meeting. Only stockholders of record at the close of business on March 3, 2006 will be entitled to vote at the annual meeting and any postponements or adjournments of the meeting.

To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the annual meeting. Most stockholders have three options for submitting their vote: (1) via the Internet, (2) by phone or (3) by mail. For further details, see “How Do I Vote?”

|

| By order of the Board of Directors, |

|

|

| SARAH A. O’CONNOR |

| Secretary |

ARCH CHEMICALS, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To be Held April 27, 2006

Who is Arch Chemicals?

Arch Chemicals, Inc. (“Arch” or the “Company”) is a global biocides company providing innovative, chemistry-based solutions to control the growth of harmful microbes. Our concentration is in water, hair and skin care products, pressure-treated wood, paints and building products, and health and hygiene applications. Arch is traded on the New York Stock Exchange (“NYSE”) under the symbol “ARJ.” The mailing address of the Company’s principal executive office is 501 Merritt 7, P.O. Box 5204, Norwalk, Connecticut 06856-5204.

When and where will the Annual Meeting be held?

The Annual Meeting of Shareholders of the Company (“Annual Meeting”) will be held at The Dolce Norwalk Center for Leadership and Innovation, 32 Weed Avenue, Norwalk, Connecticut, on Thursday, April 27, 2006, at 10:15 a.m., local time.

Who is asking for my vote and why are you sending me this document?

The Board of Directors of the Company (the “Board”) asks that you vote on the matters listed in the Notice of Annual Meeting of Shareholders. The votes will be formally counted at the Annual Meeting on Thursday, April 27, 2006, or if the Annual Meeting is adjourned or postponed, at any later meeting.

We are providing this Proxy Statement and related proxy card to the shareholders of the Company in connection with the solicitation by the Board of proxies to be voted at the Annual Meeting. Shares represented by duly executed proxies in the accompanying form received by the Company prior to the meeting will be voted at the meeting. We are mailing this Proxy Statement and the related proxy card to shareholders beginning on or about March 10, 2006.

What am I being asked to vote on?

(1) The election of two directors.

(2) Ratification of the appointment of the independent registered public accounting firm for 2006.

(3) Such other business as may properly come before the meeting or any adjournment.

How does the Board recommend I vote on the proposals?

The Board recommends a vote FOR the nominees for director identified in “Item 1—Election of Directors” and FOR “Item 2—Ratification of Appointment of Independent Registered Public Accounting Firm.”

Who is eligible to vote?

All shareholders of record at the close of business on March 3, 2006 (the “Record Date”) are entitled to vote at the Annual Meeting.

1

How many shares can vote?

At the close of business on the Record Date, the Company had outstanding 23,953,809 shares of common stock, par value $1 per share (the “Common Stock”). Each shareholder on the Record Date is entitled to one vote for each full share owned by such shareholder on each of the matters voted on at the Annual Meeting. Of those shares of Common Stock outstanding, approximately 1,485,245 shares (or approximately 6.2%) were held in the Arch Common Stock Fund of the Arch Chemicals, Inc. Contributing Employee Ownership Plan (“CEOP”), all of which are held by JPMorgan Chase Bank as the trustee of the CEOP (“CEOP Trustee”).

How do I vote?

You may vote in person at the Annual Meeting or by returning your completed proxy card in the enclosed postage-paid envelope. In addition, shareholders of record, participants in the CEOP and participants in the Olin Corporation Contributing Employee Ownership Plan (“Olin CEOP”) also have a choice of voting over the Internet or by using a U.S. toll-free telephone number. Please refer to the proxy card for further information on how to vote electronically. However, please note that Internet and telephone voting facilities for shares held of record will close at 11:59 p.m., U.S. Eastern time, on April 26, 2006 and for shares held through the CEOP or Olin CEOP will close at 9:00 a.m., U.S. Eastern time, on April 26, 2006. If you do vote by telephone or the Internet, it is not necessary to return your proxy card.Please note that participants in the CEOP and in the Olin CEOP who do not vote by telephone or Internet must return their proxy card in the accompanying envelope so that it is received no later than Noon, U.S. Eastern Time, on April 25, 2006 for their voting instructions to be followed.

Please be aware that if you vote over the Internet, you may incur costs, such as telephone and Internet access charges, for which you will be responsible. Neither the Company nor the Company’s stock transfer agent will charge you for voting your shares via the Internet.

The Internet and telephone voting procedures are set forth on the proxy card.

The method by which you vote will in no way limit your right to vote at the meeting if you later decide to attend in person. However, please note that if your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the shareholder of record, to be able to vote in person at the meeting. CEOP participants must vote through the CEOP Trustee, and participants in the Olin CEOP must vote through the trustee of the Olin CEOP. Shares held in the CEOP or Olin CEOP may not be voted in person at the Annual Meeting.

To what shares does the proxy card apply?

The proxy card supplied by the Company will apply to the number of shares of Common Stock that you hold of record and, if you are a participant in the CEOP or a participant in the Olin CEOP, the number of shares held for your account under the CEOP or Olin CEOP, as the case may be. CEOP participants and Olin CEOP participants will not receive a separate voting instruction card. If you do not execute and return this proxy card or vote electronically, your shares held of record will not be voted and your shares held in the CEOP will be voted by the CEOP Trustee in the same proportion as shares of Common Stock for which the CEOP Trustee has received instructions from other CEOP participants. Olin CEOP participants should consult with their plan administrator on how their shares held in the Olin CEOP will or will not be voted if they do not return a proxy card or otherwise give voting instructions to the trustee of the Olin CEOP.

Am I a shareholder of record?

If your shares are represented by a stock certificate registered in your name or if the Company’s stock transfer agent (The Bank of New York) is holding your shares in a “book entry” account under your name, you are a shareholder of record with respect to those shares so held. If your shares are otherwise owned directly by a bank, broker, or other holder of record, you are not a shareholder of record with respect to the shares so held by such bank, broker or other holder of record.

2

If I return the proxy card or vote electronically, how will my shares be voted?

Where a shareholder of record or CEOP participant timely directs in the proxy (including an electronic vote) a choice regarding any matter that is to be voted on, that direction will be followed. If no direction is made, returned proxies of shareholders of record and CEOP participants will have their registered shares and shares held in the CEOP voted for the election of the director nominees as set forth below and in favor of “Item 2—Ratification of Appointment of Independent Registered Public Accounting Firm.”

As of the date hereof, the Company does not know of any matters other than those referred to in the accompanying Notice which are to come before the meeting. If any other matters are properly presented for action, the persons named in the accompanying form of proxy will vote the proxy in accordance with their best judgment.

If I do not return the enclosed proxy card and do not vote electronically, how will the shares I own of record and through the CEOP or Olin CEOP be voted?

If you do not vote by returning the enclosed proxy card, do not vote electronically and do not vote at the meeting in person or other proxy, your shares held of record by you will not be voted at the Annual Meeting. CEOP participants who do not return the proxy card or vote electronically in a timely manner will have their shares of Common Stock held in the CEOP voted by the CEOP Trustee in the same proportion as shares of Common Stock for which the CEOP Trustee has received instructions from other CEOP participants. Olin CEOP participants should consult with their plan administrator on how their shares held in the Olin CEOP will or will not be voted if they do not return their proxy card or otherwise give voting instructions to the trustee of the Olin CEOP.

What if I own shares of the Company through a bank, broker or other holder of record?

If you hold Common Stock through a bank, broker or other holder of record, you will most likely receive voting instructions from such bank, broker or other holder. In any case, please follow those instructions to assure that your shares are voted and represented at the meeting.

If your shares are owned directly in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the shareholder of record, to be able to vote in person at the meeting. CEOP participants must vote the shares held in the CEOP through the CEOP Trustee.

How are the shares held in the BuyDIRECTSM Investment Program voted?

The Bank of New York (“BNY”) is the Company’s registrar and stock transfer agent. For holders of Common Stock who participate in the BuyDIRECTSM program offered by BNY, BNY will vote any shares of Common Stock that it holds for the participant’s account in accordance with the participant’s electronic vote or with the proxy returned by the participant covering his or her shares of record. If a BuyDIRECTSM participant does not send in a proxy for shares held of record or otherwise vote electronically, BNY will not vote the shares of such participant held in such program.

Can I change my vote after I have returned my proxy card or voted over the telephone or via the Internet?

Yes. Any person who has returned a proxy or voted electronically has the power to revoke it at any time before it is exercised by submitting a subsequently dated proxy, by voting again via the Internet or by telephone, by giving notice in writing to the Company’s Corporate Secretary or by voting in person at the meeting. Please note however that telephone and Internet voting ends for shares held of record at 11:59 p.m., U.S. Eastern time, on April 26, 2006 and for shares held through the CEOP and Olin CEOP at 9:00 a.m., U.S. Eastern time, on April 26, 2006. Please note that participants in the CEOP and in the Olin CEOP who do not vote by telephone or

BuyDIRECTSM is a service mark of BNY.

3

Internet must return their proxy card in the accompanying envelope so that BNY receives it no later than Noon, U.S. Eastern time, on April 25, 2006 if their voting instructions are to be followed. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the shareholder of record to be able to vote in person at the meeting.

What does it mean if I get more than one proxy or voting instruction card?

You will receive one proxy card for each way in which your shares are registered. If you receive more than one proxy card (other than because you are a participant in a savings plan of another company), it is because your shares are registered in different names or with different addresses or are held in different accounts. Please sign and return each proxy card that you receive to ensure that all your shares are voted. To enable us to provide better shareholder service, we encourage shareholders to have all their shares registered in the same name with the same address. You should contact BNY at (866) 857-2223 (U.S. toll free) for instructions on how to change the way your shares are held if you receive more than one mailing.

CERTAIN BENEFICIAL OWNERS

Except as indicated below, the Company knows of no person who was the beneficial owner of more than five percent of Common Stock as of December 31, 2005.

| | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percent of Class

|

FMR Corp.(a) 82 Devonshire Street Boston, MA 02109 | | 2,753,200 | | 11.6 |

| | |

T. Rowe Price Associates, Inc.(b) 100 East Pratt Street Baltimore, MD 21202 | | 2,747,640 | | 11.6 |

| | |

Snyder Capital Management, L.P.(c) Snyder Capital Management, Inc. One Market Plaza Steuart Tower, Suite 1200 San Francisco, CA 94105 | | 1,616,700 | | 6.8 |

| | |

Dimensional Fund Advisors Inc.(d) 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 | | 1,307,928 | | 5.5 |

| (a) | | The Company has been advised in an amended Schedule 13G filing as follows with respect to these shares: Fidelity Management & Research Company (“Fidelity”) beneficially owns 2,551,300 shares, Fidelity Management Trust Company (“FMTC”) beneficially owns 42,200 shares and Fidelity International Limited (“FIL”) beneficially owns 159,700 shares. Fidelity and FMTC are subsidiaries of FMR Corp. (“FMR”). Edward C. Johnson 3rd (“Johnson”), FMR, through its control of Fidelity, and its Funds each has sole dispositive power with respect to the 2,551,300 shares owned by such Funds. Neither Johnson nor FMR has sole voting power with respect to the shares owned by the Funds, which power rests with the Funds’ Board of Trustees. Johnson and FMR, through its control of FMTC, each has sole dispositive power over 42,200 shares and sole voting power over 42,200 shares. A partnership controlled predominately by the family of Mr. Johnson, or trusts for their benefit, owns shares of FIL voting stock with the right to cast approximately 38% of the total votes. |

4

| (b) | | T. Rowe Price Associates, Inc. (“Price Associates”), a registered investment adviser, has advised the Company in an amended Schedule 13G filing that the securities are owned by various individual and institutional investors, including the T. Rowe Price Small-Cap Stock Fund, Inc. (“Price Fund”) (which owns 1,198,100 of the shares). Price Associates has sole voting power with respect to 770,550 of such shares, and Price Fund has sole voting power with respect to 1,198,100 shares. Price Associates has sole dispositive power with respect to all the shares. Price Associates expressly disclaims that it is, in fact, the beneficial owner of the shares. |

| (c) | | Snyder Capital Management, L.P. (“SCMLP”), a registered investment adviser, and Snyder Capital Management, Inc., the general partner of SCMLP, has each advised the Company in an amended Schedule 13G filing that it has shared voting power with respect to 1,404,500 of the shares and shared dispositive power with respect to all of the shares. |

| (d) | | Dimensional Fund Advisors Inc. (“Dimensional”), a registered investment adviser, has advised the Company in a Schedule 13G filing that it has sole voting power and sole dispositive power with respect to the shares. Dimensional states that it furnishes investment advice to four investment companies and serves as an investment manager to certain other commingled group trusts and separate accounts. It expressly disclaims that it is the beneficial owner of the shares. |

5

ITEM 1—ELECTION OF DIRECTORS

Who are the persons nominated by the Board in this election to serve as directors?

The Board of Directors is divided into three classes with the term of office of each class being three years, ending in different years. Mr. Daniel S. Sanders and Ms. Janice J. Teal, whose biographies are shown below, have been nominated by the Board for election as Class I Directors to serve until the 2009 Annual Meeting of Shareholders and until their respective successors have been elected.

CLASS I

NOMINEES FOR A THREE YEAR TERM EXPIRING AT THE 2009 ANNUAL MEETING

| | |

| | DANIEL S. SANDERS, 66, retired in September 2004 as President of ExxonMobil Chemical Company, a subsidiary of Exxon Mobil Corporation which is a publicly held major manufacturer and marketer of basic petrochemicals and specialty products. He held such position since December 1999 when Exxon Corporation and Mobil Corporation merged. In January 1999, he had been appointed President of Exxon Chemical Company and previously served as its Executive Vice President. Prior to those positions, he held various positions over a 43-year period with Exxon Corporation and its subsidiaries. Mr. Sanders is past Chairman of the Board of the American Chemistry Council and past Chairman of the Society of Chemical Industry, American Section. He serves on the Board of Directors of Milliken & Company, Celanese Chemicals and Nalco Holding Company. He is a member of the Council of Overseers of the Jesse H. Jones Graduate School of Management at Rice University. He also serves on the Advisory Board of the University of South Carolina and Furman University. Director since 2004. |

| |

| | JANICE J. TEAL, Ph.D., 53, is Group Vice President and Chief Scientific Officer of Avon Products, a direct seller of beauty and related products, and has held such position since January 1999. From 1995 to 1998, Dr. Teal served as Vice President of Avon Skin Care Laboratories. In 1982, Dr. Teal joined Avon and has since then held management positions in toxicology, product and package safety and package development. Prior to joining Avon, Dr. Teal was a Post-Doctoral Fellow at the New York University Medical Center Institute of Environmental Medicine and holds a Ph.D. and M.S. degrees in Pharmacology from Emory University Medical School, and a Pharmacy Degree from Mercer University. Dr. Teal serves on the Board of Rockland County Economic Development Corporation (REDC), and Rockland County SCORE—Counselors to America’s Small Business. She is also a trustee of Dominican College. Dr. Teal has held memberships in a variety of related professional associations including the Scientific Advisory Board of The Cosmetic, Toiletry and Fragrance Association and their Animal Welfare Committee, Cosmetic Executive Women, Scientific Advisory Board-Johns Hopkins Center for Alternatives to Animal Research; Scientific Advisory Board-Fund for the Replacement of Animals in Medical Experiments, England; and the Society of Cosmetic Chemists. Director since 2003. |

6

Who are the other remaining directors and when are their terms scheduled to end?

CLASS II

DIRECTORS WHOSE TERMS CONTINUE UNTIL THE 2007 ANNUAL MEETING

| | |

| | RICHARD E. CAVANAGH, 59, is President and Chief Executive Officer and a Trustee of The Conference Board, Inc., a leading research and business membership organization. He has held this position since November 1995. Previously, he was Executive Dean of the John F. Kennedy School of Government at Harvard University for eight years. Prior to the position with Harvard, he spent 17 years with McKinsey & Company, Inc., the international management consulting firm, where he led the firm’s public issues consulting practice. Mr. Cavanagh is a Trustee of the BlackRock Mutual Funds (58 closed-end funds), Aircraft Finance Trust, and The Educational Testing Service of which he is Chairman; and a director of The Fremont Group and The Guardian Life Insurance Company. He holds a BA degree from Wesleyan University and an MBA degree from the Harvard Business School. Director since 1999. |

| |

| | MICHAEL O. MAGDOL, 68, is Vice Chairman of the Board of Fiduciary Trust Company International (“FTCI”), a global investment manager for families and institutions and a subsidiary of Franklin Resources, Inc. (“FRI”), and has held this position since 1987. From 1987 to 2002, he also served as FTCI’s Chief Financial Officer. He currently serves as Chair of the Enterprise Risk Management Committee of FRI. Prior to 1987, he was Executive Vice President and Director of J. Henry Schroder Bank. He holds a BSE degree from the University of Pennsylvania. Director since 1999. |

CLASS III

DIRECTORS WHOSE TERMS CONTINUE UNTIL THE 2008 ANNUAL MEETING

| | |

| | MICHAEL E. CAMPBELL, 58, is Chairman of the Board, President and Chief Executive Officer of the Company. Previously, he was Executive Vice President of Olin Corporation (“Olin”) and had global management responsibility for all of Olin’s businesses. Prior to his election as Executive Vice President, Mr. Campbell served as President of the Microelectronic Materials Division. Mr. Campbell is a graduate of the University of New Hampshire and received a J.D. degree from George Washington University. He is a director of MeadWestvaco Corporation. Mr. Campbell serves on the Board of Directors of the National Association of Manufacturers and is a member of the Advisory Committee for Trade Policy and Negotiations which provides overall trade policy advice to the Office of the U.S. Trade Representative. He is a former Chairman of the Board of Directors of the American Chemistry Council. He is also an officer and a member of the Society of Chemical Industry’s Executive Committee. Director since 1999. |

7

| | |

| | H. WILLIAM LICHTENBERGER, 70, retired in 2000 as Chairman and Chief Executive Officer of Praxair, Inc., an industrial gases company, a position he assumed in 1992 when Praxair was spun off from Union Carbide Corporation. In 1986, Mr. Lichtenberger was elected a Vice President of Union Carbide Corporation and was appointed President of the Union Carbide Chemicals and Plastics Company, Inc. He was elected President and Chief Operating Officer and a director of Union Carbide Corporation in 1990. He resigned as an officer and director of Union Carbide Corporation upon Praxair’s spin-off. Mr. Lichtenberger is a graduate of the University of Iowa where he majored in chemical engineering and has a masters degree in business administration from the State University of New York, Buffalo. He is a director of Ingersoll-Rand Company, Huntsman Corporation and AEA Limited, a private equity firm. He was formerly a director of the National Association of Manufacturers, a director of the Chemical Manufacturers Association (currently known as the American Chemistry Council) and a member of The Business Roundtable. Director since 1999. |

| |

| | JOHN P. SCHAEFER, Ph.D., 71, is President of LSST Corporation, a not-for-profit corporation dedicated to building and operating a new astronomical telescope. Previously, he was President of the University of Arizona (1971-1982) and Professor of Chemistry at the University, where he had been a member of the faculty since 1960. Before his appointment as President of the University, he served as head of its Department of Chemistry and Dean of its College of Liberal Arts. Dr. Schaefer received his BS degree in chemistry from the Polytechnic Institute of Brooklyn in 1955 and his Ph.D. degree from the University of Illinois in 1958. After postdoctoral studies at the California Institute of Technology, he taught chemistry at the University of California (Berkeley). Dr. Schaefer’s research interests have been in the area of synthetic and structural chemistry. He served on the Board of Governors of the U.S.-Israeli Binational Science Foundation (1973-1978). He is a director of Research Corporation and Research Corporation Technologies, Inc. He is also a trustee of the Polytechnic Institute of New York. Director since 1999. |

Although Mr. Lichtenberger will reach the Board’s mandatory retirement age at the Annual Meeting, the Board has waived the retirement age for Mr. Lichtenberger to allow it more time to find a replacement who meets the Board’s needs. It is currently expected that Mr. Lichtenberger will continue to serve as a Director for another year.

How will the returned proxies be voted for directors?

If the proxy card is returned and marked with a direction on how to vote with respect to directors or if a person directs a vote electronically as provided on the proxy card, that direction will be followed. If an individual returns a proxy card without a direction on how to vote marked thereon, such individual’s shares of record and shares held in the CEOP, if any, will be voted FOR the election of Mr. Sanders and Ms. Teal. The nominees are directors at the present time. It is not expected that any nominee will be unable to serve as a director, but if he or she is unable to accept election, it is intended that shares represented by proxies in the accompanying form or voted electronically will be voted FOR the election of a substitute nominee selected by the Board, unless the number of directors is reduced.

What vote is required to elect the directors?

The election of the nominee as a director requires the affirmative vote of a plurality of the votes cast in the election. Votes withheld and shares held in street name (“Broker Shares”) that are not voted in the election of directors will not be included in determining the number of votes cast.

8

ADDITIONAL INFORMATION REGARDING THE BOARD OF DIRECTORS

What are the committees of the Board? How often did the Board and each committee meet in 2005?

During 2005, the Board held four meetings. The average attendance by incumbent directors at meetings of the Board and committees of the Board on which they served was 99%. Each such director attended at least 94% of such meetings. At the end of each Board meeting, the non-management, independent directors meet in executive session without the Chief Executive Officer (“CEO”), the only management, non-independent director. In the absence of the CEO, the non-management directors rotate acting as the chair in these executive sessions.

The current standing committees of the Board are an Audit Committee, a Compensation Committee and a Corporate Governance Committee.

The Audit Committee advises the Board on internal and external audit matters affecting the Company, has direct responsibility for the appointment, compensation, oversight of the work of and replacement of the independent registered public accounting firm and the internal audit service provider (including resolution of disagreement between management and the independent registered public accounting firm regarding financial reporting), including recommending the appointment of internal financial, auditing and regulatory personnel and independent auditors of the Company; reviews with such auditors the scope and results of their examination of the financial statements of the Company; reviews the Company’s financial, regulatory and computer annual audit plans; reviews reports and audits of the Company’s internal audit service provider; discusses with independent auditors matters required to be discussed by Independent Standards Board No. 1 and Statement on Auditing Standards No. 61; prepares the Audit Committee Report that appears in the Company’s Proxy Statement; and reviews the presentation of the Company’s financial results and monitors the adequacy of the Company’s internal financial controls. This committee also advises the Board on compliance with the Company’s Code of Ethics, on government and other compliance programs, on corporate and governmental security matters, monitors major litigation and pending internal or external special investigations, with a particular interest in the event there are claims that the Company has acted unethically or unlawfully and reviews the Company’s insurance and risk management process. This committee also reviews audits of expenses of the Company’s senior executives and Directors. This committee has oversight responsibility for compliance with legal mandates in the environmental, health, safety and other regulatory areas. This committee also reviews and evaluates the investment and financial performance of the Company’s pension plans, voluntary employee benefit associations (“VEBAs”) and any thrift plan investment funds, reviews and approves investment policies with respect to the pension plans, VEBAs and any thrift plan funds, approves the selection of thrift plan investment options, approves the appointment of pension plan, VEBA and thrift plan trustees and investment managers and their respective agreements, consults with, and obtains reports from, the pension plan, VEBA and thrift plan trustees and other fiduciaries, approves the charitable contributions budget and program and those other charitable contributions in excess of the CEO’s authority, annually reviews the contributions, financial condition and administration of the Arch Chemicals Government Participation Fund, and reviews, provides advice, and recommends changes, as appropriate, to Management’s programs to maintain and improve community relations. This committee also reviews significant or critical accounting policies in, and effects of regulatory accounting initiatives and off-balance sheet transactions on, the financial statements of the Company; reviews any audit problems encountered and Management’s response; reviews internal controls and procedures and any changes implemented in light of material control deficiencies or weaknesses; determines whether to recommend to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K; monitors activities and results of audits of the computer data center and systems; reviews the adequacy of the Company’s accounting and financial records and system for managing business risk and legal compliance programs; reviews proposed or contemplated significant changes to the Company’s accounting principles and practices and, prior to the filing of certain Securities and Exchange Commission (the “SEC”) reports, reviews with Management, the internal audit service provider and the independent auditor, the impact on the financial statements of estimates which potentially affect the quality of the financial reporting; reviews the Company’s quarterly financial statements prior to the filing on Form 10-Q; establishes and monitors procedures for handling complaints received by the

9

Company regarding accounting, auditing or internal accounting control matters and confidential anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters; advises the Board on corporate and governmental security matters; reviews the Committee’s Charter annually and recommends to the Board any appropriate changes; also the Committee without having to seek Board approval determines funding by the Company for payment of independent auditors and any advisors retained by this committee.

The Board has adopted a written charter for the Audit Committee, and the Board has determined that the members of the Audit Committee meet applicable New York Stock Exchange standards for independence and financial literacy and that Mr. Magdol is the “audit committee financial expert” for purposes of SEC rules. No audit committee member is permitted to serve on more than three audit committees of public companies. The Audit Committee currently consists of Messrs. Magdol, Schaefer (chair) and Ms. Teal. During 2005, nine meetings of this committee were held.

The Compensation Committee administers and sets policy, develops and monitors strategies for the programs which compensate the CEO and other senior executives. This committee approves the salary plans for the CEO and certain other senior executives including total direct compensation opportunity, and the mix of base salary, annual incentive standard and long term incentive guideline awards. It approves the measures, goals, objectives, weighting, payout matrices and actual payouts and certifies performance for and administers the incentive compensation plans for such persons. This committee also administers the 1999 Long Term Incentive Plan, issues an annual Report on Executive Compensation that appears in the Company’s Proxy Statement, approves Executive and Change in Control Agreements, approves and adopts new qualified and non-qualified pension plans, adopts amendments thereto, approves terminations of qualified and non-qualified pension plans, administers the Senior Executive Pension Plan, makes recommendations to the Board on any other matters pertaining to the pension, CEOP and other plans which this committee deems appropriate and reviews plans for management development and succession. This committee also advises the Board on the remuneration for members of the Board. The Compensation Committee currently consists of Messrs. Cavanagh, Lichtenberger (chair) and Sanders. During 2005, two meetings of this committee were held.

The Corporate Governance Committee assists the Board in fulfilling its responsibility to the Company’s shareholders relating to the selection and nomination of Directors, makes recommendations to the Board regarding the selection of the CEO, reviews the nominees for other offices of the Company, coordinates the evaluation of the Board and its committees, develops and recommends to the Board corporate governance guidelines, periodically reviews corporate governance trends, issues and best practices and makes recommendations to the Board regarding the adoption of best practices most appropriate for the governance of the affairs of the Board and the Company, recommends to the Board a slate of nominees to be proposed for election to the Board by shareholders at annual meetings and at other appropriate times, recommends individuals to fill any vacancies created on the Board, makes recommendations to the Board regarding the size and composition of the Board, the particular qualifications and experience that might be sought in Board nominees, assesses whether the qualifications and experience of candidates for nomination and renomination to the Board meet the then current needs of the Board, seeks out possible candidates for nomination and considers suggestions by shareholders, Management, employees and others for candidates for nomination and renomination as Directors, reviews and makes recommendations to the Board regarding the composition, duties and responsibilities of various Board committees from time to time as may be appropriate, reviews and advises the Board on such matters as protection against liability and indemnification, and assesses and reports annually to the Board on the performance of the Board itself as a whole. The members of the Corporate Governance Committee satisfy applicable New York Stock Exchange standards for independence. The Corporate Governance Committee currently consists of Messrs. Cavanagh (chair), Lichtenberger, Magdol, Sanders, Schaefer and Ms. Teal. During 2005, two meetings of this committee were held.

All Board committee charters are available on the Company’s web site athttp://www.archchemicals.com in the Investor Relations section and a paper copy can also be obtained by contacting Investor Relations, Arch Chemicals, Inc., 501 Merritt 7, P.O. Box 5204, Norwalk, Connecticut 06856-5204 or by calling (203) 229-2654.

10

How are Board nominees selected?

The Board itself is responsible, in fact as well as procedurally, for selecting nominees for membership. The Board delegates the screening process to the Corporate Governance Committee with direct input from the CEO. Such committee is responsible for reviewing with the Board the appropriate experience and skills required of new Board members in the context of the current composition of the Board. The Board historically has utilized the services of a search firm to help identify candidates for Director who meet the qualifications outlined below.

It is the Board’s desire to select individuals for nomination to the Board who are most highly qualified and who, if elected, will have the time, qualifications and dedication to best serve the interests of the Company and its shareholders, taking into account such person’s skills, expertise, breadth of experience, knowledge about the Company’s businesses and industries, qualities and capabilities, as well as the needs and objectives of the Board and the Company. A person’s sex, race, religion, age, sexual orientation or disability is not a criterion for service on the Board. In addition, at least two-thirds of the members of the Board must be independent Directors. To be “independent” for this purpose, the Director must not have any direct or indirect material relationship with the Company as determined by the Directors as provided in the Company’s Principles of Corporate Governance which is available on the Company’s website atwww.archchemicals.com in the Investor Relations section.

After a review of identified Board candidates and their background by the Corporate Governance Committee, with the aid of the CEO, the Chair of such committee and the CEO interview potential Board candidates selected by the Corporate Governance Committee. The results of these interviews are reviewed with all Directors before such committee recommends a candidate to the Board for approval.

The Corporate Governance Committee will consider candidates recommended by shareholders for election as directors at future annual meetings. Recommendations must be in writing and submitted to the Corporate Secretary of the Company by December 1, accompanied by the written consent of the candidate along with the information required for director nominations as set forth in the Company’s Bylaws, including:

| | • | | the name and address of the shareholder who intends to make the nomination and any other person on whose behalf the nomination is being made, and of the person or persons to be nominated; |

| | • | | the class and number of shares of the Company that are owned by the shareholder and any other person on whose behalf the nomination is being made; |

| | • | | a representation that the shareholder is a holder of record of shares of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

| | • | | a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; and |

| | • | | any other information regarding the nominee or shareholder that would be required to be included in a proxy statement relating to the election of directors. |

The Corporate Governance Committee has not received any director nominee recommendations from shareholders during 2005.

Does the Company have a process for interested parties to send communications to the Board?

Yes. Shareholders and interested parties may communicate with the whole Board or any member of the Board by writing to such member c/o Corporate Secretary, Arch Chemicals, Inc., P.O. Box 5204, Norwalk, Connecticut 06856-5204. All such communications are passed on to the addressed Board members except for commercial solicitations.

11

Does the Company have a policy regarding director attendance at annual meetings of shareholders?

The policy strongly encourages all Directors to attend the annual meetings of shareholders. Last year the Directors had a 75% attendance record at the 2005 annual meeting of shareholders. Two Directors were absent; one, who is no longer a Director, was absent due to a sudden serious illness.

Has the Board of Directors adopted Principles of Corporate Governance?

Yes. The Company’s Principles of Corporate Governance can be found on the Company’s website by going to the following address:http://www.archchemicals.com in the Investor Relations section under Corporate Governance. A paper copy can also be obtained by contacting Investor Relations, Arch Chemicals, Inc., 501 Merritt 7, P.O. Box 5204, Norwalk, Connecticut 06856-5204 or by calling (203) 229-2654.

What is the categorical independence standard used by the Board to determine whether Board members are independent?

In addition to the independence requirements of the NYSE, the Board has adopted its Principles of Corporate Governance which contain the following definition of independence:

At least two-thirds of the members of the Board shall be independent Directors. To be independent for this purpose, the Director must not have any direct or indirect material relationship with the Corporation as determined by the Directors as provided below. The Board has established the following guidelines to assist it in determining Director independence:

| | (1) | | A Director will not be independent if, within the preceding three years: (i) the Director was employed by the Corporation, (ii) an immediate family member of the Director was employed by the Corporation as an executive officer; (iii) the Director was (but is no longer) a partner in or employed by the Corporation’s external auditor and personally worked on the Corporation’s audit within that time; (iv) an immediate family member of the Director was (but is no longer) a partner in or employed by the Corporation’s independent auditor and personally worked on the Corporation’s audit within that time; (v) an executive officer of the Corporation was on the board of directors of a company which employed the Corporation’s Director, or which employed an immediate family member of the Director as an executive officer; or (vi) the Director or an immediate family member of the Director received in any twelve-month period during such three-year period direct compensation from the Corporation and its consolidated subsidiaries in excess of $100,000 other than director compensation (including committee fees) and pensions or other forms of deferred compensation (provided such compensation is not contingent in any way on continued service). |

| | (2) | | A Director will not be independent if: (a) the Director or the immediate family member of the Director is a current partner of the Corporation’s external auditor firm or internal auditor service provider firm, (b) the Director is a current employee of either such firm, or (c) the Director has an immediate family member who is a current employee of either such firm and who participates in either such firm’s audit, assurance or tax compliance (but not tax planning) practice. |

| | (3) | | The following commercial or charitable relationships will not be considered to be material relationships that would impair a Director’s independence: (i) if a Director is a current employee of, or has an immediate family member who is a current executive officer of another company that has made payments to, or received payments from the Corporation, in any of the last three fiscal years that are less than the greater of $1 million or two percent (2%) of the annual revenues of the company he or she is so associated; (ii) if a Director is an executive officer of another company which is indebted to the Corporation, or to which the Corporation is indebted, and the total amount of either company’s indebtedness to the other is less than two percent (2%) of the total consolidated assets of the company he or she serves as an executive officer; and (iii) if a Director serves as an officer, director or trustee of a charitable organization, and the Corporation’s discretionary |

12

| | charitable contributions to the organization are less than two percent (2%) of that organization’s total annual charitable receipts (excluding for this purpose any and all of the Corporation’s automatic matching of employee and Director charitable contributions). |

The Board will annually review all commercial and charitable relationships of Directors. Whether Directors meet these categorical independence tests will be reviewed and will be made public annually prior to their standing for re-election to the Board.

A Director who was a past director or executive officer of Olin Corporation shall not be disqualified as an independent Director simply because of such past service unless applicable law or regulations require otherwise.

The Board shall have as members such persons that it considers it needs to perform its functions with respect to background, skill sets, diversity and business experience.

All members of the Board (other than Mr. Campbell, the Company’s CEO) are independent within the meaning of the Principles of Corporate Governance and NYSE rules. Relationships between the Company and these independent directors, if any, fall below the percentage thresholds indicated in the definition of independence outlined above.

Has the Company adopted a Code of Ethics?

The Company has a code of conduct that applies to all officers and employees, including the Company’s principal executive officer, principal financial officer and principal accounting officer. The Company’s code of conduct is on its website at:http://www.archchemicals.com in the Investor Relations section under Corporate Governance. The Company will post any amendments to the code of conduct, as well as any waivers that are required to be disclosed by the rules of either the SEC or the NYSE, on its website. A paper copy of the code can also be obtained by contacting Investor Relations, Arch Chemicals, Inc., 501 Merritt 7, P.O. Box 5204, Norwalk, Connecticut 06856-5204 or by calling (203) 229-2654.

13

Report of the Audit Committee

The Audit Committee is established by the Board of Directors. The Board has adopted a written charter for this committee setting out the functions it is to perform. Management has primary responsibility for the Company’s financial statements and the overall reporting process, including the Company’s system of internal controls. The Directors who serve on this committee are all “Independent” for purposes of the New York Stock Exchange listing standards. Thus, the Board of Directors has determined that no Audit Committee member has a relationship to the Company that may interfere with our independence from the Company and its Management.

The Audit Committee reviewed the Company’s audited financial statements for the year ended December 31, 2005 and met with both Management and KPMG LLP (“KPMG”), the Company’s independent registered accounting firm, to discuss those financial statements. Management has represented to this committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

The Audit Committee has received from and discussed with KPMG the written disclosure and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). These items relate to that firm’s independence from the Company. The Audit Committee also considered the compatibility of non-audit services with such firm’s independence. We also discussed with KPMG any matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Based on these reviews and discussions, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

John P. Schaefer, Chair

Michael O. Magdol

Janice J. Teal

February 27, 2006

14

What are the directors paid for their services?

Generally speaking, the Stock Plan for Nonemployee Directors (the “Directors Plan”) (i) provides for the granting annually, at the election of the Board, of a number of shares of Common Stock, options to purchase shares of Common Stock, performance shares or a combination of the foregoing (as determined by the Board) to each nonemployee director and, in the case of a grant of shares of Common Stock, the deferral of the payment of such shares until after such director ceases to be a member of the Board, (ii) permits the Board to determine if all or part of the annual retainer shall be paid in shares of Common Stock, (iii) permits such director, subject to the approval of the Board, to elect to receive his or her meeting fees in the form of shares of Common Stock in lieu of cash, (iv) permits such director, subject to the approval of the Board, to elect to receive in the form of shares of Common Stock the amount by which the annual retainer exceeds the amount payable in shares of Common Stock (“Excess Retainer”) in lieu of cash for such excess and (v) permits such director to elect to defer any meeting fees and Excess Retainer paid in cash and any shares to be delivered under the Directors Plan. Interest on deferred cash and dividends on deferred shares are paid to the nonemployee director unless the director elects to defer such amounts in which case interest is credited quarterly and dividend equivalents are reinvested in phantom shares of Common Stock on the dividend payment date. Deferred shares are paid out in shares of Common Stock unless the Board decides otherwise. Performance shares vest and are paid out, unless deferred by the director, upon the satisfaction of performance goals established by the Compensation Committee. Deferred accounts under the Directors Plan are paid out if there is a “Change in Control” as defined in such plan. The Board sets director compensation for a calendar year in the prior calendar year.

In 2005, each nonemployee director’s deferred stock account under the Directors Plan was credited with 3,250 phantom shares of Common Stock. Such shares will be paid out to a director in cash when he or she ceases to be a director. In addition for 2005, each nonemployee director was entitled to receive $35,000 in cash as a retainer. In 2006, each nonemployee director’s deferred stock account under the Directors Plan was credited with 4,000 phantom shares of Common Stock. Such shares will be paid out to a director in cash when he or she ceases to be a director. In addition for 2006, each nonemployee director was entitled to receive $50,000 in cash as a retainer.

If Board meetings exceeded eight meetings in a calendar year, each nonemployee director would be entitled to receive a $1,500 meeting fee for each Board meeting attended in excess of eight meetings. In 2005, there were less than nine Board meetings.

Each Board committee chair received a $7,500 annual committee chair meeting fee in 2005 and 2006, except in 2005, the Audit Committee chair received a fee of $15,000 and in 2006 the Audit Committee chair received a fee of $20,000.

The shares, cash retainer and fees may be deferred by the director as provided in the Directors Plan into Arch phantom stock accounts and a variety of other phantom investment vehicles.

All directors participate in the Arch charitable giving program with a 100% match for gifts up to $2,500 to eligible charities. Directors who are not officers or employees of the Company or one of its subsidiaries are covered while on Company business under the Company’s business travel accident insurance policy which covers employees of the Company generally. Directors also are reimbursed during the year for expenses incurred in the performance of their duties as directors, such as travel expenses. As part of the director compensation package, the Company offers all directors the use of office space at the Company’s Norwalk headquarters, Company car service and reimbursement for income tax preparation costs.

15

SECURITY OWNERSHIP OF DIRECTORS AND OFFICERS

How much stock is beneficially owned by directors and the individuals named in the Summary Compensation Table?

The following table sets forth the number of shares of Company Common Stock beneficially owned by each Director and nominee for Director, by the individuals named in the summary compensation table on page 20, and by all directors and current executive officers of the Company as a group, as reported to the Company by such persons as of January 13, 2006. Unless otherwise indicated in the footnotes below, the officers, directors, nominees and individuals had sole voting and investment power over such shares. Also included in the table are shares of Common Stock which may be acquired within 60 days.

| | | | |

Name of Beneficial Owner

| | No. of Common Shares Beneficially Owned(a,b)

| | Percent of Class of Common Stock(c)

|

Michael E. Campbell | | 366,568 | | 1.5 |

Hayes Anderson | | 33,059 | | |

Richard E. Cavanagh | | 19,695 | | |

Paul J. Craney | | 69,710 | | |

H. William Lichtenberger | | 22,826 | | |

Michael O. Magdol | | 15,580 | | |

Louis S. Massimo | | 94,996 | | |

Sarah A. O’Connor | | 59,547 | | |

Daniel S. Sanders | | 7,000 | | |

John P. Schaefer | | 25,009 | | |

Janice J. Teal | | 5,000 | | |

Directors and executive officers as a group, including those named above (13 persons) | | 763,325 | | 3.1 |

| (a) | | Included in this table with respect to officers are shares credited under the CEOP. Also included in the case of the incumbent directors (other than Mr. Campbell) are certain shares of Common Stock credited to a deferred account for such directors pursuant to the arrangements described above under “What are the directors paid for their services?” in the amounts of 8,372 for Mr. Cavanagh; 11,426 for Mr. Lichtenberger; 4,380 for Mr. Magdol; none for Mr. Sanders; 11,120 for Mr. Schaefer and none for Ms. Teal. Such shares so credited to these directors have no voting power and are paid out in shares of Common Stock at the end of the deferral period. |

| (b) | | The amounts shown include shares that may be acquired within 60 days following January 15, 2006 through the exercise of stock options as follows: Mr. Campbell, 343,160; Mr. Anderson, 19,154; Mr. Cavanagh, 11,200; Mr. Craney, 61,847; Mr. Lichtenberger, 11,200; Mr. Magdol, 11,200; Mr. Massimo, 89,358; Ms. O’Connor, 54,000; Mr. Sanders, 0; Mr. Schaefer, 11,200; Ms. Teal, 0; and all directors and executive officers as a group, including the named individuals, 649,819. |

| (c) | | Unless otherwise indicated, beneficial ownership of any named individual does not exceed one percent of the outstanding shares of Common Stock. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors and persons who own more than ten percent of a registered class of Arch’s equity securities, to file reports of ownership and changes in ownership with the SEC and the NYSE. Officers, directors and greater than ten-percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on review of the copies of such forms furnished to the Company, or written representations that no Forms 5 were required, the Company believes that during the period January 1, 2005 to December 31, 2005, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten-percent beneficial owners were complied with except a Section 16(a) form was inadvertently filed three business days late with respect to a stock option exercise in June 2005 by Mr. Hayes Anderson, who is the Company’s Vice President, Human Resources.

16

EXECUTIVE COMPENSATION

Report of the Compensation Committee on Executive Compensation

The Compensation Committee, which is currently made up of three independent directors, oversees the administration of total compensation for the named executives. In discharging its responsibilities, the Compensation Committee selects and retains an independent compensation consultant. The consultant reports directly to the Compensation Committee regarding these matters.

Compensation Philosophy

It is the philosophy of the Company to incent and compensate its executives to maximize shareholder value. This philosophy incorporates the following principles:

| | 1. | | Compensation should attract and retain qualified employees and stimulate their profitable efforts on behalf of the Company; |

| | 2. | | Compensation should be internally equitable and externally competitive; and |

| | 3. | | Performance metrics should be directly linked to profitability and shareholder value creation of the Company. |

Executive Compensation Program as Administered in 2005

Generally speaking, the Compensation Committee establishes competitive total compensation opportunities for the CEO and other named executives that are targeted to the median of a group of 21 specialty chemical companies (the “comparator group”) that are similar to Arch in terms of size and scope of operations. An independent consultant provides the Committee with an annual assessment of Arch’s relative position versus its comparator group and against a national data base of industrial companies. This assessment focuses on operating performance and total compensation including each of the following components:

| | • | | Long Term Incentive Award |

Together, these three components comprise the total targeted compensation opportunity determined by targeting the median of the group cited above. Once the total targeted compensation opportunity is determined for the CEO and other named executives, the Compensation Committee, with the advice of the independent outside consultant, determines the competitiveness and appropriate mix of these three components. With the focus on creating alignment between the compensation program and shareholders’ interest, the emphasis of the Company’s executive compensation is on variable compensation that is at risk and aligned with Company performance.

The objectives of the Company’s executive compensation policies are to:

| | • | | Unite the Company’s management as a team. |

| | • | | Reward the achievement of important business goals, based on specific, objective criteria that have been approved in advance by the Committee. |

| | • | | Stress at risk variable pay programs with an emphasis on the long-term financial performance. |

| | • | | Ensure “line of sight” strategic objectives are clearly articulated and their achievement appropriately rewarded. |

17

| | • | | Attract, retain and motivate executives who can significantly contribute to the success of the Company. |

| | • | | Provide a rational, consistent and competitive executive compensation system that is well understood by those to whom it applies. |

Under Section 162(m) of the Internal Revenue Code, publicly traded corporations generally are not permitted to deduct compensation in excess of $1 million paid to certain top executives unless the compensation qualifies as “performance-based compensation.” The company will weigh the benefits of compliance with Section 162(m) against the potential burdens, and reserves the right to pay compensation that may not be fully deductible if it determines, in good faith, that it is in the company’s best interest to do so.

Annual Base Salary

As it does annually, the Committee reviewed the base salaries of each of the named executives in relation to the following three categories: comparable jobs in the comparator group; comparable jobs in general industry; and the financial performance of the Company. The Committee approved salary adjustments for these individuals effective January 1, 2005, based on their individual performance and their salaries relative to the market. Based on this competitive market and the Company’s strong performance, the Committee granted the CEO a 4.9% increase in base salary.

Annual Incentive Bonus

Incentive bonuses for Arch named executives were determined by a comparison of pre-established 2005 targets for EPS and cash flow with actual 2005 financial performance for these measures as well as the achievement of pre-established personal strategic goals. The financial measures were weighted 70% with the remaining 30% applied to achieving personal strategic objectives.

The CEO’s bonus was determined under the Senior Management Incentive Compensation Plan in accordance with the specified financial performance metrics and weightings using EPS and cash flow. For 2005, this resulted in a 69% payout for the CEO under such plan. The CEO’s total bonus payout was $550,000. This consisted of a $304,800 payout from the Company’s Senior Management Incentive Compensation Plan and $245,200, which represented a separate payment regarding the CEO’s performance with respect to the accomplishment of strategic and personal objectives that were established earlier in the year. In awarding compensation, the Committee noted the following with respect to financial measures:

| | • | | Significant improvement in EPS from continuing operations before special items in 2005; and |

| | • | | Improvement in return on equity (“ROE”) to 9% in 2005 and in excess of the target set in 2003. |

In addition, the Committee also recognized:

| | • | | Achievement of record setting Responsible Care performance in the areas of employee recordables and environmental incidents; |

| | • | | Recognition by the American Chemistry Council of Arch’s achieving Responsible Care Management Systems (RCMS) certification at four Arch sites; |

| | • | | Significant sales increase from the successful implementation of its Treatment Products growth initiatives; |

| | • | | Purchase of the remaining 50% of Nordesclor S.A. in Brazil and the acquisition of a small water treatment business in Colombia; and |

| | • | | Completion of the divestiture of our 50% share in Planar Solutions to Fuji Film. |

The Committee believes that the 2005 bonus payments are consistent with the Company’s strategy of rewarding employees for the achievement of important, challenging business goals. In light of the Company’s excellent results for the year, the resulting payouts are reasonable and performance based.

18

Long Term Incentive Award

As indicated earlier, the Committee, with the advice of its independent consultant, established target values for all three components of compensation, including the Long Term Incentive Plan award. This component of compensation is designed to encourage the long-term retention of key executives and to tie a major part of executive compensation directly to Company performance and the long-term enhancement of shareholder value. The Committee granted phantom share units to the named executives on February 9, 2005. With a view consistent with aligning Arch’s named executives with the interests of shareholders, the award of phantom shares was designed to recognize and reward ROE over a three-year period ending December 31, 2007. The phantom share units are earned at the end of the three-year period provided the ROE target is achieved. There is an opportunity for accelerated payout of the phantom share units if the ROE target is met or exceeded by December 31, 2006. If the ROE target is not achieved by the end of 2007, 50% of the phantom share units will be forfeited and 50% of the phantom share units will be paid out in cash as soon as administratively feasible following the end of calendar year 2010 if the executive is still employed at the Company (subject to certain departures with the Committee’s consent).

On January 24, 2005, the restrictions lapsed on a special three-year restricted stock unit grant issued by the Committee on January 24, 2002. The CEO’s restricted stock unit payment of $555,600 was paid in cash in February 2005.

The 2003 Long Term Incentive Plan ROE target of 8% was exceeded at the end of the three-year performance period ending December 31, 2005 and resulted in a cash payout to the CEO and the other named executives.

The Compensation Committee believes these executive compensation policies and programs effectively serve the interests of shareholders and the Company and are appropriately balanced to provide increased motivation for executives to contribute to the Company’s future successes.

H. William Lichtenberger, Chair

Richard E. Cavanagh

Daniel S. Sanders

March 1, 2006

19

The following table shows for the CEO and the other four most highly compensated executive officers of Arch (collectively, the “named executive officers”) cash compensation for the fiscal years 2003-2005.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long Term Compensation

| | All Other Compen- sation(c)

|

| | | | | | | | | Other Annual Compen- sation(a)

| | Awards

| | Payouts

| |

Name and Principal Position as of December 31, 2005

| | Year

| | Salary

| | Bonus

| | | Restricted Stock Awards(b)

| | Securities Underlying Options

| | LTIP Payouts

| |

Michael E. Campbell Chairman, President & Chief Executive Officer | | 2005

2004

2003 | | $

| 750,000

715,000

685,008 | | $

| 550,000

1,141,235

950,000 | | $

| 122,089

92,062

69,477 | | $

| 903,495

800,650

527,220 | | 0

0

43,000 | | $

| 818,960

625,050

0 | | $

| 60,759

61,531

54,949 |

| | | | | | | | |

Hayes Anderson Vice President, Human Resources | | 2005

2004

2003 | |

| 290,000

270,000

260,004 | |

| 130,000

213,760

230,000 | |

| 14,829

16,004

5,640 | |

| 148,335

131,450

73,629 | | 0

0

6,000 | |

| 114,372

83,340

0 | |

| 17,425

16,490

15,432 |

| | | | | | | | |

Paul J. Craney Executive Vice President | | 2005

2004

2003 | |

| 400,000

375,000

330,000 | |

| 205,000

465,250

350,000 | |

| 25,218

24,364

10,400 | |

| 269,700

239,000

145,440 | | 0

0

12,000 | |

| 225,920

138,900

0 | |

| 30,195

27,115

20,540 |

| | | | | | | | |

Louis S. Massimo Executive Vice President & Chief Financial Officer | | 2005

2004

2003 | |

| 425,000

400,000

380,004 | |

| 215,000

490,250

390,000 | |

| 22,400

19,200

11,613 | |

| 269,700

239,000

145,440 | | 0

0

12,000 | |

| 225,920

166,680

0 | |

| 28,791

26,662

22,575 |

| | | | | | | | |

Sarah A. O’Connor Vice President, General Counsel & Secretary | | 2005

2004

2003 | |

| 305,000

295,000

285,000 | |

| 140,000

236,425

250,000 | |

| 12,280

10,680

6,280 | |

| 148,335

131,450

79,083 | | 0

0

6,500 | |

| 122,844

97,230

0 | |

| 18,261

17,386

15,648 |

| (a) | | For Mr. Campbell, figures include an annual automobile allowance and related tax gross-up. For Messrs. Campbell, Anderson and Craney, figures also include tax gross-ups paid as a result of imputed income for the use of an outside personal financial advisor. For all the named individuals, all figures include dividend equivalents paid on performance share units held by such individual. |

| (b) | | Values shown in the table were determined by multiplying the total number of performance retention units granted on the date of grant by the closing price of a share of Common Stock on such date. The total number of restricted stock units and performance retention share units outstanding at December 31, 2005 (including those vesting on such date) and their corresponding value based on the closing price of a share of Common Stock on such date are: for Mr. Campbell, 96,000 units ($2,870,400); for Mr. Anderson, 15,050 units ($449,995); for Mr. Craney, 28,000 units ($837,200); for Mr. Massimo, 28,000 units ($837,200); and for Ms. O’Connor, 15,350 units ($458,965). Grants of performance retention share units made in 2005 are paid out in cash and may vest in year two or in year three if a certain financial target is reached and otherwise vest at the end of 2010 if the recipient is still employed at the Company. Dividend equivalents are paid in cash on all such units. |

| (c) | | Amounts reported in this column for 2005 consist of the following items: |

| | | | | | | | | | | | |

| | | CEOP Match(1)

| | Supplemental CEOP(1)(2)

| | Term Life

Insurance(3)

| | Senior

Executive Life

Insurance Premiums(4)

|

M. E. Campbell | | $ | 6,970 | | $ | 28,400 | | $ | 655 | | $ | 24,734 |

H. Anderson | | | 4,520 | | | 9,040 | | | 131 | | | 3,734 |

P. J. Craney | | | 4,688 | | | 14,063 | | | 0 | | | 11,444 |

L. S. Massimo | | | 4,666 | | | 15,285 | | | 1,365 | | | 7,475 |

S. A. O’Connor | | | 8,646 | | | 5,814 | | | 96 | | | 3,705 |

| (1) | | Includes a basic company match and a performance match which is based on the financial results of the Company. |

| (2) | | The Supplemental CEOP permits participants in the CEOP to make contributions, and the Company to match the same, in amounts permitted by the CEOP but which would otherwise be in excess of those permitted by certain Internal Revenue Service limitations. The 2005 contributions and Company matching amounts made were invested in an Arch phantom stock account under this plan. |

| (3) | | Under Arch’s key executive insurance program, executives may elect additional life insurance which provides for monthly payments to be made to the spouse and dependent children of deceased participants. |

| (4) | | The amount of the premium shown represents the full dollar amount of the premium the Company paid in 2005 for the senior executive life insurance plan. |

The figure for Mr. Anderson also includes relocation payments in the amount of $960 in 2003 made under a relocation policy in connection with Mr. Anderson’s relocation from Arizona to the Company’s Connecticut headquarters.

20

How many 1999 Long Term Incentive Plan (“Long Term Plan”) awards were granted in 2005 as part of 2005 compensation to the individuals named in the Summary Compensation Table?

No stock options were granted to the individuals named in the summary compensation table on page 20, from January 1, 2005 through December 31, 2005.

The following table sets forth as to the individuals named in the summary compensation table on page 20, information relating to the performance share units granted by the Company from January 1, 2005 through December 31, 2005.

1999 Long Term Incentive Plan—Awards In Last Fiscal Year

| | | | | | | | | | |

| | | Number of

Performance

Share Units

(#)(a)

| | Performance

Or Other

Period Until

Maturation

Or Payout(b)

| | Estimated Future Payouts Under Non-Stock Price-Based Plans

|

Name

| | | | Threshold

(#)

| | Target

(#)

| | Maximum

(#)

|

M.E. Campbell | | 33,500 | | 3 yrs. | | 33,500 | | 33,500 | | 33,500 |

H. Anderson | | 5,500 | | 3 yrs. | | 5,500 | | 5,500 | | 5,500 |

P.J. Craney | | 10,000 | | 3 yrs. | | 10,000 | | 10,000 | | 10,000 |

L.S. Massimo | | 10,000 | | 3 yrs. | | 10,000 | | 10,000 | | 10,000 |

S.A. O’Connor | | 5,500 | | 3 yrs. | | 5,500 | | 5,500 | | 5,500 |

| (a) | | Each performance share unit consists of a phantom share of Common Stock that is payable in cash if the performance goal is achieved. Performance share units granted have a three-year performance cycle ending December 31, 2007. The Compensation Committee has established a payment schedule if the Company achieves a certain return on equity (“ROE”) target at the end of 2006 or 2007. If the ROE goal is achieved, 100% of the units will be paid out in cash at the then current market value of the Common Stock. If the performance goal is not achieved by the end of 2007, the units will be forfeited. In certain circumstances, such as retirement and disability, units may be prorated and paid out to the extent earned. In the event of a change in control, units are paid out. Dividend equivalents on the units are paid in cash to the award recipient periodically during the time the units are outstanding. |

| (b) | | Payout occurs if ROE reaches target at the end of year 2 or year 3. |

Performance retention share unit awards were also granted under the Long Term Plan to key employees selected by the Compensation Committee during 2005. The performance retention share unit awards granted in 2005 are shown in the summary compensation table on page 20 in the column “Restricted Stock Awards.”

21

How many Arch stock options were exercised in 2005 by the individuals named in the Summary Compensation Table and what is the value of the unexercised ones?

The following table sets forth as to the individuals named in the summary compensation table on page 20, information regarding options exercised during 2005 and the value of in-the-money outstanding options at the end of 2005.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-end Option Values

| | | | | | | | | | | | | | |

| | | Shares Acquired on Exercise

| | Value Realized

| | Number of Securities

Underlying Unexercised

Options at 12/31/05

| | Aggregate Value of

Unexercised, In-the-Money

Options at 12/31/05(a)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

M.E. Campbell | | 3,704 | | $ | 27,595 | | 348,487 | | — | | $ | 2,951,938 | | — |

H. Anderson | | 5,151 | | | 29,258 | | 19,154 | | — | | | 173,077 | | — |

P.J. Craney | | — | | | — | | 61,847 | | — | | | 524,179 | | — |

L.S. Massimo | | — | | | — | | 89,358 | | — | | | 760,964 | | — |

S.A. O’Connor | | — | | | — | | 54,000 | | — | | | 556,920 | | — |

| (a) | | Value was computed as the difference between the exercise price and the $29.90 per share closing price of Arch Common Stock on December 31, 2005, as reported on the consolidated transaction reporting system relating to NYSE issues. These individuals do not hold any unexercisable employee stock options as of December 31, 2005. |

22

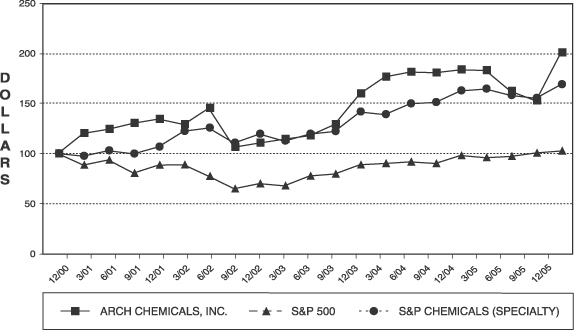

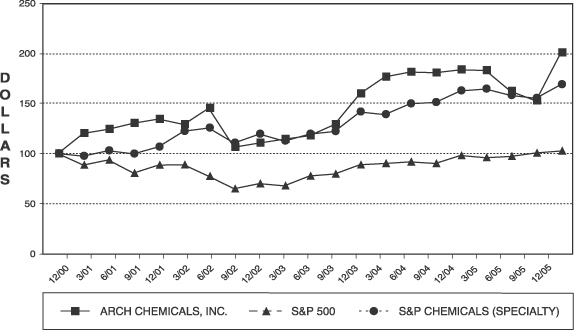

Comparison of Five Year Cumulative Total Return Among Arch Chemicals, Inc.,

the S&P 500 Index and the S&P Chemicals (Specialty) Index