Exhibit 10.2

AMENDMENT NO. 3TO RECEIVABLES PURCHASE AGREEMENT

THIS AMENDMENT NO. 3 TO RECEIVABLES PURCHASE AGREEMENT (the“Amendment”), dated as of July 9, 2009, is entered into among Arch Chemicals Receivables Corp. (the“Seller”), Arch Chemicals, Inc. (the“Servicer”), Three Pillars Funding LLC (“TPF”) and SunTrust Robinson Humphrey, Inc. (f/k/a SunTrust Capital Markets, Inc.) (the“Administrator”);

Reference is hereby made to that certain Receivables Purchase Agreement, dated as of June 27, 2005, as amended among the Seller, the Servicer, TPF and the Administrator (the“Receivables Purchase Agreement”). Terms used herein and not otherwise defined herein which are defined in the Receivables Purchase Agreement or the other Transaction Documents shall have the same meaning herein as defined therein.

NOW,THEREFORE, for good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto hereby agree that the Receivables Purchase Agreement shall be and is hereby amended as follows:

Section 1.Upon execution by the parties hereto in the space provided for that purpose below, the Receivables Purchase Agreement shall be, and it hereby is, amended as follows:

(a) Section 1.2 of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Section 1.2. Incremental Purchases. The Seller shall provide the Administrator with at least two (2) Business Days’ prior written notice in a form set forth as Exhibit II hereto of each Incremental Purchase (each, a “Purchase Notice”). Each Purchase Notice shall be subject to Section 6.2 hereof and, except as set forth below, shall be irrevocable and shall specify the requested Purchase Price (which shall not be less than $1,000,000 or a larger integral multiple of $100,000) and the Purchase Date. Following receipt of a Purchase Notice, the Administrator will determine whether TPF will fund the requested Incremental Purchase through the issuance of Commercial Paper or through a Liquidity Funding. If TPF determines to fund an Incremental Purchase through a Liquidity Funding, the Seller may cancel the Purchase Notice or, in the absence of such a cancellation, the Incremental Purchase will be funded through a Liquidity Funding. On each Purchase Date, upon satisfaction of the applicable conditions precedent set forth in Article VI, TPF shall deposit to the Facility Account, in immediately available funds, no later than 2:00 p.m. (Atlanta time), an amount equal to the requested Purchase Price.

(b) Section 1.3 of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Section 1.3. Decreases. The Seller shall provide the Administrator with prior written notice in conformity with the Required Notice Period in the form of Exhibit XI hereto (a “Reduction Notice”) of any proposed reduction of Aggregate Invested Amount. Such Reduction Notice shall designate (a) the date (the “Proposed Reduction Date”) upon which any such reduction of Aggregate Invested Amount shall occur (which date shall give effect to the applicable Required Notice Period), and (b) the amount of Aggregate Invested Amount to be reduced which shall be applied ratably to all Receivable Interests in accordance with the respective Invested Amounts thereof (the “Aggregate Reduction”). Only one (1) Reduction Notice shall be outstanding at any time.

(c) Section 1.5 of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Section 1.5. Payment Requirements and Computations. All amounts to be paid or deposited by a Seller Party pursuant to any provision of this Agreement shall be paid or deposited in accordance with the terms hereof no later than 12:00 noon (Atlanta time) on the day when due in immediately available funds, and if not received before 12:00 noon (Atlanta time) shall be deemed to be received on the next succeeding Business Day. If such amounts are payable to the Administrator for the account of TPF, they shall be paid to the Administrator’s Account, for the account of TPF until otherwise notified by the Administrator. Upon notice to the Seller, the Administrator may debit the Facility Account for all amounts due and payable hereunder. All computations of Yield which accrues at the Alternate Base Rate shall be made on the basis of a year of 365 or 366 days, as applicable, for the actual number of days elapsed. All computations of CP Costs, Yield (other than Yield which accrues at the Alternate Base Rate), per annum fees calculated as part of any CP Costs, per annum fees hereunder and per annum fees under the Fee Letter shall be made on the basis of a year of 360 days for the actual number of days elapsed. If any amount hereunder shall be payable on a day which is not a Business Day, such amount shall be payable on the next succeeding Business Day.

(d) The reference to“New York” appearing in Section 4.4 of the Receivables Purchase Agreement is hereby deleted and replaced with“Atlanta.”

-2-

(e) Section 7.1(a)(iii) of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

(iii)Compliance Certificate. Together with the financial statements required hereunder, a compliance certificate in substantially the form of Exhibit V which shall include, without limitation, calculations of the Consolidated Interest Coverage Ratio of Arch and the Consolidated Leverage Ratio of Arch, which is signed by such Seller Party’s Authorized Officer, and which is dated the date of such annual financial statement or such quarterly financial statement, as the case may be.

(f) Section 8.5 of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

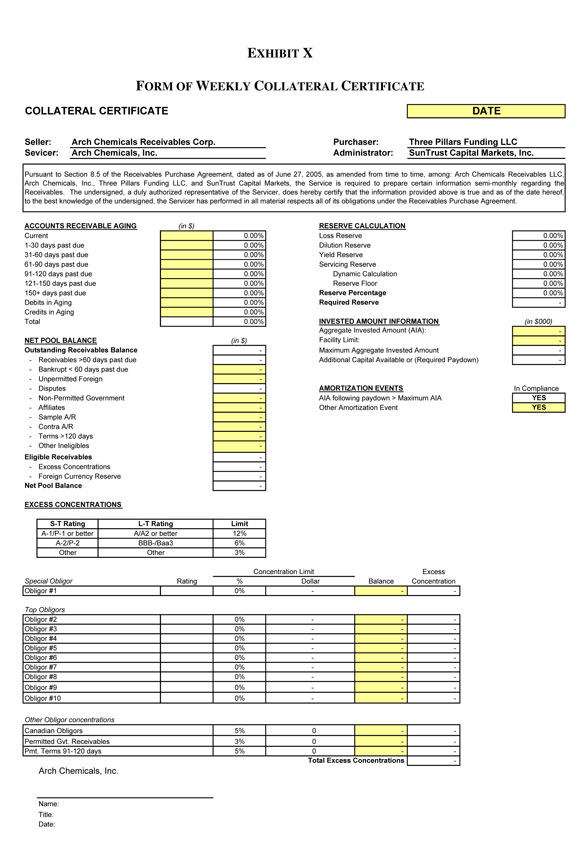

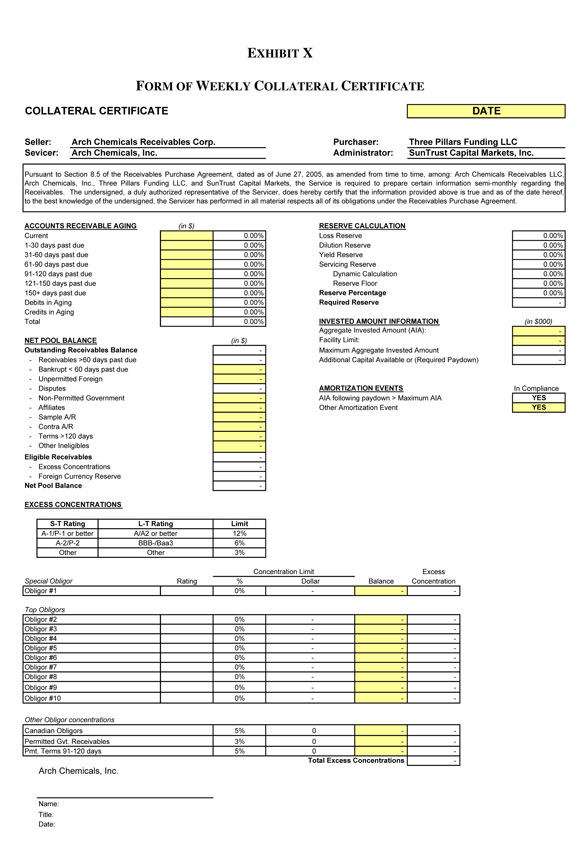

Section 8.5. Receivables Reports. The Servicer shall prepare and forward to the Administrator (a) on each Monthly Reporting Date, a Monthly Report and an electronic file of the data contained therein, (b) at such times as the Administrator may request upon reasonable advance notice, a listing by Obligor of all Receivables together with an aging of such Receivables, (c) on the last Business Day of each month from June through and including November, a Collateral Certificate as of the 15th day of such month and an electronic file of the data contained therein;provided, however,that no Collateral Certificate shall be due in any such month when no Invested Amount is outstanding unless the Seller requests a Purchase during such month and has not delivered a Collateral Certificate or a Monthly Report within the two weeks preceding the proposed Purchase Date, and (d) upon the occurrence of a Weekly Reporting Event, a Weekly Collateral Certificate showing calculations as of the end of each prior week on each Weekly Reporting Date.

(g) Section 9.1(f) of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

(f) Failure of Arch or any of its Subsidiaries other than the Seller to pay Indebtedness in excess of $10,000,000 in aggregate principal amount (hereinafter, “Material Indebtedness”) when due (after giving effect to any applicable grace periods with respect thereto); or the default by Arch or any of its Subsidiaries other than the Seller in the performance of any term, provision or condition contained in any agreement under which any Material Indebtedness was created or is governed, the effect of which is to cause, or to permit the holder or holders of such Material Indebtedness to cause, such Material Indebtedness to become due

-3-

prior to its stated maturity and, unless such Material Indebtedness is earlier accelerated, such default is not cured within 15 days after its occurrence; or any Material Indebtedness of Arch or any of its Subsidiaries other than the Seller shall be declared to be due and payable or required to be prepaid (other than by a regularly scheduled payment) prior to the date of maturity thereof.

(h) The reference to“3.0%” appearing in Section 9.1(h)(i) is hereby deleted and replaced with“2.0%.”

(i) The reference to“6.5” appearing in Section 9.1(h)(iv) is hereby deleted and replaced with“6.0.”

(j) Section 9.1 of the Receivables Purchase Agreement is hereby amended by inserting a new clause (r) and a new clause (s) immediately at the end thereof as follows:

(r) The Consolidated Leverage Ratio of Arch (as defined in the Credit Agreement) as of the last day of any period of four consecutive fiscal quarters of Arch exceeds 3.5:1.0.

(s) The Consolidated Interest Coverage Ratio of Arch (as defined in the Credit Agreement) for any period of for consecutive fiscal quarters of Arch is less than 3.0:1.0.

(k) A new clause (d) is hereby added to Section 13.4 of the Receivables Purchase Agreement as follows:

(d) Notwithstanding any other express or implied agreement to the contrary contained herein, the parties agree and acknowledge that each of them and each of their employees, representatives, and other agents may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transaction and all materials of any kind (including opinions or other tax analyses) that are provided to any of them relating to such tax treatment and tax structure, except to the extent that confidentiality is reasonably necessary to comply with U.S. federal or state securities laws. For purposes of this paragraph, the terms “tax treatment” and “tax structure” have the meanings specified in Treasury Regulation section 1.6011-4(c).

(l) A new defined term“Arch” is hereby added to Exhibit I of the Receivables Purchase Agreement in the appropriate alphabetical order:

Arch: Arch Chemicals, Inc.

-4-

(m) The defined term“Business Day” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Business Day: Any day on which banks are not authorized or required to close in New York, New York or Atlanta, Georgia, and The Depository Trust Company of New York is open for business, and, (i) if the applicable Business Day relates to any computation or payment to be made with respect to the LIBO Rate, any day on which dealings in dollar deposits are carried on in the London interbank market, and (ii) if the applicable Business Day relates to any computation or payment to be made with respect to any Receivable Interests funded through the issuance of Commercial Paper or any CP Costs, any day on which commercial paper markets in the United States are open.

(n) Clauses (c), (d) and (g) of the defined term“Concentration Limit” appearing in Exhibit I of the Receivables Purchase Agreement are hereby amended in their entireties and as so amended shall read as follows:

(c) For any Special Obligor, 22.5% of the aggregate Outstanding Balance of all Eligible Receivables;

(d) For any Obligor not covered by clause (a), (b) or (c) of this definition, 4.0% of the aggregate Outstanding Balance of all Eligible Receivables;

(g) For all Receivables with terms allowing for payment within 91-150 days after invoice date, 10.0% of the aggregate Outstanding Balance of all Eligible Receivables,provided, however,for all Receivables with terms allowing for payment within 121-150 days after invoice date, the Concentration Limit shall equal 3.0% of the aggregate Outstanding Balance of all Eligible Receivables;

(o) The defined term“Credit Agreement” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Credit Agreement: That certain Revolving Credit Agreement, dated as of June 15, 2006, among the Servicer, Banc of America Securities, L.L.C., as Joint Lead Arranger and Joint Book Manager, Bank of America, National Association, and Citizens Bank of Massachusetts, as Co-Syndication Agents, the lenders party thereto, J.P. Morgan Securities Inc., as Joint Lead Arranger and Joint Book Manager, SunTrust Bank, as Documentation

-5-

Agent, and JPMorgan Chase Bank, N.A., as Administrative Agent, as amended through the date of Amendment No. 3 to this Agreement without giving effect to any amendments thereto after the date of Amendment No. 3 to this Agreement unless specifically consented to in writing by the Administrator.

(p) The defined term“Default Rate” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Default Rate: A rate per annum equal to the sum of (i) the Alternate Base Rate plus (ii) 3.0%, changing when and as the Alternate Base Rate changes.

(q) The definition of, and any and all references to the defined terms“Downgraded Liquidity Bank” and“Downgrading Event” are hereby deleted from the Receivables Purchase Agreement.

(r) The reference to“120 days” appearing in clause (v) of the defined term“Eligible Receivable” appearing in Exhibit I of the Receivables Purchase Agreement is hereby deleted and replaced with“150 days.”

(s) A new clause (xviii) is hereby added to the defined term “Eligible Receivable” appearing in Exhibit I of the Receivables Purchase Agreement as follows:

(xviii) the Obligor of which is not Vitafoam Canada.

(t) The defined term“Excess Concentration Amount” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Excess Concentration Amount: At any time with respect to any Obligor, group of Obligors or group of Receivables described in clauses (a)-(g) of the definition of “Concentration Limit” (but without duplication), the amount, if any, by which the aggregate Outstanding Balance of all Eligible Receivables of such Obligor, group of Obligors, or group of Receivables, exceeds the Concentration Limit for such Obligor, group of Obligors, or group of Receivables in each case, at such time.

(u) The defined term“Excluded Receivable” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Excluded Receivable: Any Receivable as to which the Obligor (a) if a natural person, is a resident of a province of

-6-

territory of Canada that is not an Eligible Province or Territory, or, (b) if a corporation or other business organization, is organized under the laws of a province or territory of Canada (other than an Eligible Province or Territory) or any political subdivision thereof and has its chief executive office in a province or territory of Canada (other than an Eligible Province or Territory), or (c) is Vitafoam Canada.

(v) Clause (i) of the defined term“Interest Period”appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

(i) if Yield for such Receivable Interest is calculated on the basis of the LIBO Rate, a period of one, two or three months, or such other period as may be mutually agreeable to the Administrator and the Seller, commencing on a Business Day selected by the Seller or the Administrator pursuant to this Agreement. Such Interest Period shall end on the day in the applicable succeeding calendar month which corresponds numerically to the beginning day of such Interest Period,provided, however,that if there is no such numerically corresponding day in such succeeding month, such Interest Period shall end on the last Business Day of such succeeding month; or

(w) The defined term“LIBO Rate” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

LIBO Rate: For any Interest Period, the rate per annum determined on the basis of (i) the offered rate for deposits in U.S. dollars of amounts equal or comparable to the Invested Amount offered for a term comparable to such Interest Period, which rates appear on Telerate page 3750 (or any successor page) effective as of 11:00 A.M., London time, two Business Days prior to the first day of such Interest Period (the“Rate Setting Day”) or if such rate is unavailable, the rateper annum (rounded upwards, if necessary, to the nearest 1/100th of one percent) based on the rates at which deposits in U.S. dollars for one month are displayed on page“LIBOR” of the Reuters Screen as of 11:00 a.m. (London time) on the Rate Setting Day (it being understood that if at least two (2) such rates appear on such page, the rate will be the arithmetic mean of such displayed rates),provided that if no such offered rates appear on such pages, the LIBO Rate for such Interest Period will be the arithmetic average (rounded upwards, if necessary, to the next higher 1/100th of 1%) of rates quoted by not less than two major banks in New York, New York, selected by the

-7-

Administrator, at approximately 10:00 a.m. (Atlanta time), two Business Days prior to the first day of such Interest Period, for deposits in U.S. dollars offered by leading European banks for a period comparable to such Interest Period in an amount comparable to the Invested Amount, divided by (ii) one minus the maximum aggregate reserve requirement (including all basic, supplemental, marginal or other reserves) which is imposed against the Administrator in respect of Eurocurrency liabilities, as defined in Regulation D of the Board of Governors of the Federal Reserve System as in effect from time to time (expressed as a decimal), applicable to such Interest Period plus (iii) the Applicable Margin.

(x) Clause (a) of the defined term“Liquidity Termination Date” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

(a) the “Liquidity Termination Date” set forth in the Liquidity Agreement, as amended from time to time which date is October 9, 2009 as of the date of Amendment No. 3 to this Agreement, and

(y) The defined term“Receivable” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended by deleting the phrase“other than the Excluded Receivables”appearing at the end of the first sentence thereof.

(z) The defined term“Required Notice Period” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Required Notice Period: The number of days required notice set forth below applicable to the Aggregate Reduction indicated below:

| | |

| AGGREGATE REDUCTION | | REQUIRED NOTICE PERIOD |

| |

| less than 50% of the Purchase Limit | | 2 Business Days |

| |

| greater than or equal to 50% of the Purchase Limit | | 5 Business Days |

(aa) Clause (i) of the defined term“Required Reserve Factor Floor” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

(i) 20% plus

-8-

(bb) The defined term“Stress Factor” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Stress Factor: 2.25.

(cc) The defined term“Voluntary Advance Agreement” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Voluntary Advance Agreement: The Amended and Restated Voluntary Advance Agreement, dated as of June 30, 2009, among TPF, Administrator and SunTrust Bank, as it may be amended, supplemented, restated or otherwise modified from time to time.

(dd) The reference to“120 days” appearing in the defined term“Weighted Average Credit Terms” appearing in Exhibit I of the Receivables Purchase Agreement is hereby deleted and replaced with“150 days.”

(ee) The defined term“Yield” appearing in Exhibit I of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as follows:

Yield: For each Interest Period relating to a Receivable Interest funded through a Liquidity Funding, an amount equal to the product of the applicable Yield Rate for such Receivable Interest multiplied by the Invested Amount of such Receivable Interest for each day elapsed during such Interest Period, annualized on (i) a 360 basis for Yield accruing at the LIBO Rate, or (ii) a 365 or 366 day basis, as applicable, for Yield accruing at the Alternate Base Rate.

(ff) The following new defined terms are hereby added to Exhibit I of the Receivables Purchase Agreement in the appropriate alphabetical order:

Weekly Collateral Certificate: A certificate, in substantially the form of Exhibit X hereto (appropriately completed), furnished by the Servicer to the Administrator pursuant to Section 8.5.

Weekly Reporting Date: Means Wednesday of each calendar week.

Weekly Reporting Event: Means the Consolidated Leverage Ratio (as defined in the Credit Agreement) of Arch

-9-

exceeds 3.25 to 1.0 or the Interest Coverage Ratio (as defined in the Credit Agreement) of Arch is less than 3.5 to 1.0.

(gg) Exhibit III of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as set forth on Exhibit III attached hereto.

(hh) Exhibit IV of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as set forth on Exhibit IV attached hereto.

(ii) Exhibit V of the Receivables Purchase Agreement is hereby amended in its entirety and as so amended shall read as set forth on Exhibit V attached hereto.

(jj) A new Exhibit X is hereby added to the Receivables Purchase Agreement and shall read as set forth on Exhibit X attached hereto.

(kk) A new Exhibit XI is hereby added to the Receivables Purchase Agreement and shall read as set forth on Exhibit XI attached hereto.

Section 2.This Amendment shall become effective on the date the Administrator has received the following:

(i) executed copies of the Amendment to the Receivables Sale Agreement, duly executed by the parties thereto;

(ii) executed copies of this Amendment, duly executed by the parties hereto;

(iii) the Second Amended and Restated Fee Letter, duly executed by each of the parties thereto;

(iv) a Monthly Report as at June 30, 2009, duly executed by Servicer; and

(v) the extension fee set forth in the Second Amended and Restated Fee Letter.

Section 3.1.To induce the Administrator and TPF to enter into this Amendment, the Seller and Servicer represent and warrant to the Administrator and TPF that: (a) their representations and warranties contained in the Receivables Purchase Agreement are true and correct in all material respects as of the date hereof with the same effect as though made on the date hereof (it being understood and agreed that any representation or warranty which by its terms is made as of a specified date shall be required to be true and correct in all material respects only as of such specified date); (b) no Amortization Event exists; (c) this Amendment has been duly authorized by all necessary corporate proceedings and duly executed and delivered by each of the Seller and Servicer, and the Receivables Purchase Agreement, as amended by this Amendment, and each of the other Transaction Documents are the legal, valid and binding obligations of the Seller and Servicer, enforceable against the Seller and Servicer in accordance with their respective terms, except as enforceability may be limited by bankruptcy, insolvency or

-10-

other similar laws of general application affecting the enforcement of creditors’ rights or by general principles of equity; and (d) no consent, approval, authorization, order, registration or qualification with any governmental authority applicable to the Seller or the Servicer is required for, and in the absence of which would adversely effect, the legal and valid execution and delivery or performance by the Seller and Servicer of this Amendment or the performance by the Seller and Servicer of the Receivables Purchase Agreement, as amended by this Amendment, or any other Transaction Document to which they are a party.

Section 3.2.This Amendment may be executed in any number of counterparts and by the different parties on separate counterparts and each such counterpart shall be deemed to be an original, but all such counterparts shall together constitute but one and the same Amendment.

Section 3.3.Except as specifically provided above, the Receivables Purchase Agreement and the other Transaction Documents shall remain in full force and effect and are hereby ratified and confirmed in all respects. The execution, delivery, and effectiveness of this Amendment shall not operate as a waiver of any right, power, or remedy of any the Seller or Administrator under the Receivables Purchase Agreement or any of the other Transaction Documents, nor constitute a waiver or modification of any provision of any of the other Transaction Documents. The Seller agrees to pay on demand all reasonable costs and expenses (including reasonable fees and expenses of counsel) of or incurred by the Administrator and TPF in connection with the negotiation, preparation, execution and delivery of this Amendment.

Section 3.4.This Amendment and the rights and obligations of the parties hereunder shall be construed in accordance with and be governed by the law of the State of New York.

[SIGNATURE PAGESTO FOLLOW]

-11-

IN WITNESS WHEREOF, the parties have caused this Amendment to be executed and delivered by their duly authorized officers as of the date first above written.

| | |

SUNTRUST ROBINSON HUMPHREY, INC. (f/k/a

SunTrust Capital Markets, Inc.), as

Administrator |

| |

| By: | | /s/ Joseph R. Franke |

| Title: | | Director |

|

| THREE PILLARS FUNDING LLC |

| |

| By: | | /s/ Doris J. Hearn |

| Title: | | Vice President |

|

ARCH CHEMICALS RECEIVABLES CORP., as

Seller |

| |

| By: | | /s/ W. Paul Bush |

| Title: | | Vice President & Treasurer |

|

| ARCH CHEMICALS, INC., as Servicer |

| |

| By: | | /s/ W. Paul Bush |

| Title: | | Vice President & Treasurer |

-12-

EXHIBIT III

JURISDICTIONOF ORGANIZATIONOFTHE SELLER PARTIES;

PLACESOF BUSINESSOF THE SELLER PARTIES; LOCATIONSOF RECORDS;

FEDERAL EMPLOYER IDENTIFICATION NUMBER(S)

ARCH CHEMICALS, INC.

Jurisdiction of Organization: Virginia

PRINCIPALPLACESOFBUSINESS:

501 Merritt 7

P.O. Box 5204

Norwalk, CT 06856-5204

(CHIEF EXECUTIVE OFFICE)

P.O. Box 547

2450 Olin Road

Brandenburg, KY 40108-0547

1200 Lower River Road

Charleston, TN 37310

350 Knotter Drive

Cheshire, CT 06410

960 I-10 at West Lake

Lake Charles, LA 70602

100 McKee Road

P.O. Box 205

Rochester, NY 14601-0205

5660 New Northside Drive NW

Suite 1100

Atlanta, GA 30328

1400 Bluegrass Lake Pkwy.

Alpharetta, GA 30004

LOCATION(S)OF RECORDS:

501 Merritt 7

P.O. Box 5204

Norwalk, CT 06856-5204

P.O. Box 547

2450 Olin Road

Brandenburg, KY 40108-0547

1200 Lower River Road

Charleston, TN 37310

350 Knotter Drive

Cheshire, CT 06410

960 I-10 at West Lake

Lake Charles, LA 70602

100 McKee Road

P.O. Box 205

Rochester, NY 14601-0205

5660 New Northside Drive

NW

Suite 1100

Atlanta, GA 30328

1400 Bluegrass Lake Pkwy.

Alpharetta, GA 30004

Federal employer identification number:

06-1526315

Legal, Trade & Assumed Names:

JPL Corporation (former name from Aug. 25, 1998 through Nov. 5, 1998)

ARCH CHEMICALS RECEIVABLES CORP.

Jurisdiction of Organization: Delaware

Organization Number (if any): 3493573

Place(s) of Business: 501 Merritt 7

Norwalk, CT 06851 USA

-2-

Location(s) of Records: 501 Merritt 7

Norwalk, CT 06851 USA

Federal Employer Identification Number: 04-3606375

Legal, Trade and Assumed Names: None

-3-

EXHIBIT IV

NAMESOF COLLECTION BANKS; LOCK-BOXESAND COLLECTION ACCOUNTS

| | |

• PNC Bank, National Association Treasury Management Two Tower Center, 17th Floor East Brunswick, NJ 08816 |

Lock Box: P.O. Box 640060 Pittsburgh, PA 15264-0060 | | Collection Account Number: 1526899 |

| | |

| | | |

• The Northern Trust Company 50 South LaSalle Street Chicago, Illinois 60675 |

Lock Box: P.O. Box 91410 Chicago, IL 60675 | | Collection Account Number: 29432 |

| | |

| | | |

• JP Morgan Chase Bank One Chase Manhattan Plaza New York, NY 10081 |

| | | Collection Account Number: 323-265-286 |

| | |

| | | |

• The Toronto-Dominion Bank Transit 1104 77 Bloor St W Toronto, Ontario M5S1M2 |

Lock Box: P.O. Box 6100 Postal Station F Toronto, ON M4Y2Z2 Lockbox: T6260 | | Collection Account Number: 005120359377 (Canadian Dollars) |

| | |

| | |

| | | |

• Wachovia Bank 191 Peachtree Street Atlanta, GA 30303 |

Lock Box: P.O. Box 932727 Atlanta, GA 31193 P.O. Box 75335 Charlotte, NC 28275-0335 P.O. Box 751822 Charlotte, NC 28275-1822 | | Collection Account Number: 200-0015-143-015 2004500487091 2000021575703 |

-2-

EXHIBIT V

FORMOF COMPLIANCE CERTIFICATE

To: SunTrust Robinson Humphrey, Inc., as Administrator

This Compliance Certificate is furnished pursuant to Section 7.1(a)(iii) of that certain Receivables Purchase Agreement dated as of June 27, 2005 among Arch Chemicals Receivables Corp. (the “Seller”), Arch Chemicals, Inc. (the “Servicer”), TPF Asset Funding Corporation and SunTrust Robinson Humphrey, Inc., as Administrator (the “Agreement”).

THEUNDERSIGNEDHEREBYCERTIFIESTHAT:

1. I am the duly elected of the Seller.

2. I have reviewed the terms of the Agreement and I have made, or have caused to be made under my supervision, a detailed review of the transactions and financial conditions of the Seller and its Subsidiaries during the accounting period covered by the attached financial statements.

3. For the period ending , 20 the Consolidated Interest Coverage Ratio (as such term is defined under the Agreement) of Arch and the Consolidated Leverage Ratio (as such term is defined under the Agreement) of Arch were and , respectively, as further set forth on Schedule I hereto.

4. The examinations described in paragraphs 2 and 3 did not disclose, and I have no knowledge of, the existence of any condition or event which constitutes an Amortization Event or Unmatured Amortization Event, as each such term is defined under the Agreement, during or at the end of the accounting period covered by the attached financial statements or as of the date of this Certificate[, except as set forth in paragraph 5 below].

[5. Described below are the exceptions, if any, to paragraph 4 by listing, in detail, the nature of the condition or event, the period during which it has existed and the action which the Seller has taken, is taking, or proposes to take with respect to each such condition or event: ]

The foregoing certifications, and the financial statements delivered with this Certificate in support hereof, are made and delivered as of , 20 .

By:

Name:

Title:

SCHEDULE ITO COMPLIANCE CERTIFICATE

Calculations of Consolidated Leverage Ratio and Consolidated Interest Coverage Ratio

[ATTACH CALCULATIONSOF RATIOS]

EXHIBIT XI

FORMOF REDUCTION NOTICE

dated , 20

for a reduction on , 20

SunTrust Robinson Humphrey, Inc., as Administrator

Attention: ,

Fax No. ( )

Ladies and Gentlemen:

Reference is made to the Receivables Purchase Agreement dated as of June 27, 2005 (as amended, supplemented or otherwise modified from time to time, the “Receivables Purchase Agreement”) among Arch Chemicals Receivables Corp. (the “Seller”), Arch Chemicals, Inc., as initial Servicer, TPF Asset Funding Corporation, and SunTrust Robinson Humphrey, Inc., as Administrator. Capitalized terms defined in the Receivables Purchase Agreement are used herein with the same meanings.

1. The Seller hereby requests that TPF reduce the Aggregate Invested Amount in an amount equal to $ the (“Aggregate Reduction”) on[ , 20 Insert Date of Reduction which complies with Required Notice Period](the“Proposed Reduction Date”).

2. All payments to Three Pillars Funding LLC must be made by 12:00 pm Eastern Time in order to comply with Section B(1)(a) of the DTC Operational Arrangements and the DTC Notice (B#2078-07) dated September 11, 2007.

IN WITNESS WHEREOF, the Seller has caused this Reduction Notice to be executed and delivered as of this day of , .

ARCH CHEMICALS RECEIVABLES CORP., as the

Seller

By:

Name:

Title: