UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

| | x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

| | ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to _______

Commission File Number: 000-35737

NORTHWEST BIOTHERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or Other Jurisdiction of

Incorporation or Organization) | | 94-3306718

(I.R.S. Employer

Identification No.) |

4800 Montgomery Lane, Suite 800, Bethesda, MD 20814

(Address of principal executive offices) (Zip Code)

(240) 497-9024

(Registrant's telephone number)

N/A

(Former Name, Former Address and Former Fiscal Year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| | | |

| Common Stock, $0.001 par value | | The NASDAQ Capital Market |

| | | |

| Warrants to purchase Common Stock | | The NASDAQ Capital Market |

Securities registered pursuant to section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer ¨

(Do not check if a

smaller reporting company) | | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $18.2 million on June 29, 2012

As of April 1, 2013 the registrant had 27,140,417 shares of Common Stock outstanding.

FORM 10-K/A

EXPLANATORY NOTE

The purpose of this Amendment No. 1 on Form 10-K/A (the “Amendment”) is to amend and restate Part III, Items 10 through 14 of our previously filed Annual Report on Form 10-K for the year ended December 31, 2012, filed with the Securities and Exchange Commission on April 8, 2013 (the “Original Filing”), to include information previously omitted in reliance on General Instruction G to Form 10-K, which provides that registrants may incorporate by reference certain information from a definitive proxy statement prepared in connection with the election of directors. We have determined to include such Part III information by amendment of the Original Filing rather than by incorporation by reference to a definitive proxy statement. Accordingly, Part III of the Original Filing is hereby amended and restated as set forth below.

Except as set forth above, we have not modified or updated disclosures presented in the Original Filing to reflect events or developments that have occurred after the date of the Original Filing. Among other things, forward-looking statements made in the Original Filing have not been revised to reflect events, results or developments that have occurred or facts that have become known to us after the date of the Original Filing (other than as discussed above), and such forward-looking statements should be read in their historical context. Accordingly, this Amendment should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original Filing.

NORTHWEST BIOTHERAPEUTICS, INC.

FORM 10-K

TABLE OF CONTENTS

| PART I | | |

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 19 |

| Item 1B. | Unresolved Staff Comments | 30 |

| Item 2. | Properties | 31 |

| Item 3. | Legal Proceedings | 31 |

| Item 4. | Mine Safety Disclosures | 31 |

| PART II | | |

| Item 5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 31 |

| Item 6. | Selected Financial Data | 34 |

| Item 7. | Management's Discussion and Analysis of Financial Condition And Results of Operations | 34 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 38 |

| Item 8. | Financial Statements and Supplementary Data | 38 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 38 |

| Item 9A. | Controls and Procedures | 38 |

| Item 9B. | Other Information | 39 |

| PART III | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 39 |

| Item 11. | Executive Compensation | 39 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 39 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 39 |

| Item 14. | Principal Accountant Fees and Services | 39 |

| PART IV | | |

| Item 15. | Exhibits and Financial Statement Schedules | 40 |

| | |

| SIGNATURES | 44 |

PART I

This Report on Form 10-K for Northwest Biotherapeutics, Inc. may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements are characterized by future or conditional verbs such as "may," "will," "expect," "intend," "anticipate," believe," "estimate" and "continue" or similar words. You should read statements that contain these words carefully because they discuss future expectations and plans, which contain projections of future results of operations or financial condition or state other forward-looking information. Such statements are only predictions and our actual results may differ materially from those anticipated in these forward-looking statements. We believe that it is important to communicate future expectations to investors. However, there may be events in the future that we are not able to accurately predict or control. Factors that may cause such differences include, but are not limited to, those discussed under Item 1A. Risk Factors and elsewhere in this Form 10-K for the year ended December 31, 2012, as filed with the Securities and Exchange Commission, including the uncertainties associated with product development, the risk that products that appeared promising in early clinical trials do not demonstrate safety and efficacy in larger-scale clinical trials, the risk that we will not obtain approval to market our products, the risks associated with dependence upon key personnel and the need for additional financing. We do not assume any obligation to update forward-looking statements as circumstances change.

Unless the context otherwise requires, “Northwest Biotherapeutics,” the “company,” “we,” “us,” “our” and similar names refer to Northwest Biotherapeutics, Inc. DCVax® is a registered trademark of the Company

ITEM 1. BUSINESS.

Overview

We are a development stage biotechnology company focused on developing immunotherapy products to treat cancers more effectively than current treatments, without toxicities of the kind associated with chemotherapies, and, through a proprietary batch manufacturing process, on a cost-effective affordable basis. initially in both the United States and Europe (the two largest medical markets in the world).

We have developed a platform technology, DCVax, which uses activated dendritic cells to mobilize a patient's own immune system to attack their cancer. The DCVax technology is expected to be applicable to most cancers, and is embodied in several distinct product lines. One of the product lines (DCVax-L) is designed to cover all solid tumor cancers in which the tumors can be surgically removed. Another product line (DCVax-Direct) is designed for all solid tumor cancers which are considered inoperable and cannot be surgically removed. The broad applicability of DCVax to many cancers provides multiple opportunities for commercialization and partnering.

After more than a decade of pre-clinical and clinical development, the DCVax technology has reached late stage development for two different cancers (brain and prostate), with a Phase III clinical trial in glioblastoma multiforme, or GBM, brain cancer currently under way, and a Phase III clinical trial in prostate cancer which was previously cleared to proceed by the U.S. Food and Drug Administration, or FDA, which we anticipate will proceed when we secure a partner. We have also completed a small early stage trial in metastatic ovarian cancer, and we have received clearance from the FDA for early stage trials in multiple other diverse cancers.

In the Phase I/II trials which formed the foundation for reaching these Phase III trials, the clinical results with DCVax were striking. DCVax treatment delayed disease progression and extended survival by years, rather than weeks or months as is typical with cancer drugs. In addition, DCVax was non-toxic: no serious adverse events related to the treatment were seen. These clinical results (both the efficacy and the lack of toxicity) are consistent with a large and growing body of scientific literature and clinical experience, relating to the underlying biology involved.

As of March 31, 2013, our Phase III clinical trial in GBM is being conducted at 43 sites across the United States. We are also in the process of adding further US sites.

The Phase III GBM trial is also progressing in Europe. We have accelerated and strengthened our programs in Europe by partnering with large, prominent institutions, including the Fraunhofer IZI Institute in Germany and Kings College Hospital in the U.K.

In the U.K., we received approval from the Medicines and Healthcare Products Regulatory Authority, or MHRA, on August 23, 2012, to proceed with our Phase III clinical trial in GBM in the U.K.. We have been working on manufacturing arrangements for the clinical trial in the U.K. with both Kings College London and the Fraunhofer Institute, under the oversight and management of Cognate BioServices, to obtain the necessary approvals from the German and U.K. authorities for DCVax products to be able to be manufactured in either Germany or the U.K. for the clinical trial in the U.K. These approvals were completed in February 2013. Four major medical centers in the U.K. are preparing to proceed with the trial.

We have also been working on preparations for the clinical trial in Germany. On July 25, 2012, we announced that manufacturing certification has been received from the German regulatory authorities for the clinical trial in Germany, which is the first step towards implementation of the Phase III trial in Germany. We submitted the application to the German regulatory authority (the Paul Ehrlich Insitute, or PEI) for approval of the Phase III trial. As of March 31, 2013, 24 clinical centers are in varying stages of preparations as trial sites in Germany. Also, in October, 2012, ten major hospital centers across Germany, including the key opinion leaders in brain cancer, all applied to the German healthcare system for reimbursement of DCVax-L for brain cancer.

In parallel with these developments in our Phase III brain cancer program, we have been making arrangements to launch our DCVax-Direct program. On September 20, 2012, we announced that we had obtained approval from FDA for a combined Phase I/II trial with DCVax-Direct for all solid tumor cancers. In the following months, we initiated the processes for manufacturing of the DCVax-Direct products for the clinical trial.

We also entered into collaborations with premiere institutions for the DCVax-Direct trial, as we have done for the DCVax-L trial. On November 6, 2012, we announced that we had entered into a Letter of Intent for such a collaboration with Sarah Cannon Research Institute, which specializes in oncology and has a network of more than 700 physicians in the US and UK who see more than 75,000 new cancer patients per year.

During Q1 of 2013, we have continued and accelerated the manufacturing work and the preparations for launch of the Phase I/II clinical trial with DCVax-Direct for inoperable tumors in multiple diverse cancers. The trial is expected to be launched in Q2 of this year. As is standard with Phase I/II trials, the DCVax-Direct trial will not be blinded, and the results will be visible as the trial proceeds over the course of 2013. The Phase I stage of the trial involves dose escalation and confirmation. The Phase II stage of the trial will focus on efficacy. The primary measure of efficacy will be regression (i.e., shrinkage or elimination) of the inoperable tumors. Such regression is a rapid endpoint: if it is going to occur, is anticipated to occur within a couple months of treatment.

Our DCVax immunotherapies are based on a platform technology involving dendritic cells, the master cells of the immune system, and are designed to reinvigorate and educate the immune system to attack cancers. The dendritic cells are able to mobilize all parts of the immune system, including T cells, B cells and antibodies, natural killer cells and many others. Mobilizing the entire immune system provides a broader attack on the cancer than mobilizing just a particular component, such as T cells alone, or a particular antibody alone. Likewise, our DCVax technology is designed to attack the full set of biomarkers, or antigens, on a patient’s cancer, rather than just a particular selected target or several targets. Clinical experience indicates that when just one or a few biomarkers on a cancer are targeted by a drug or other treatment, sooner or later the cancer usually develops a way around that drug, and the drug stops working. We believe that mobilizing all agents of the immune system, and targeting all biomarkers on the patient’s cancer, contributes to the effectiveness of DCVax.

We believe that the market potential of this technology is particularly large because the DCVax products are expected to be applicable to most or all solid tumor cancers. We believe that the market potential is also enhanced by our two-continent strategy. By conducting our Phase III clinical trial in GBM on an international basis, with trial sites in both the United States and Europe, we believe we are positioned to potentially apply for product approval in both markets.

In clinical trials to date, our DCVax treatments have been achieving what we believe to be striking results. In patients with newly diagnosed GBM, the most aggressive and lethal form of brain cancer, patients treated with full standard of care treatment today (surgery, radiation and chemotherapy), typically have recurrence of their cancer within a median of 6.9 months, and typically die within a median of 14.6 months. In contrast, our early stage clinical trials showed that patients who received DCVax in addition to standard of care typically did not experience recurrence until approximately 2 years, rather than 6.9 months, and typically lived for approximately 3 years, rather than just 14.6 months. This data, if reproducible in a larger study, such as our current Phase III trial, would demonstrate that patients with GBM can derive significant clinical benefit from DCVax treatment. Moreover, long-term follow-up data on the GBM patients treated with DCVax in prior clinical trials show that, as of the latest update, 33% of the patients have reached or exceeded 4 years’ survival, and 27% of the patients have reached or exceeded 6 years’ survival (as compared with the median survival of 14.6 months with standard of care treatment today).

Similar results (i.e., significant extension or doubling of survival time) have been obtained in patients with late stage prostate cancer, either with or without metastases, in our prostate cancer clinical trial. Encouraging early results, significantly delaying progression of the cancer, have also been seen in patients in the initial metastatic ovarian cancer clinical trial.

Nearly as important in clinical trials to date, there has been no toxicity (no serious adverse events) related to DCVax. The broad and rapidly growing body of scientific literature about dendritic cells is consistent with the DCVax clinical experience, and provides added support regarding the lack of toxicity.

We are developing and positioning DCVax as a front line therapy that could potentially become standard of care. Accordingly, we are highly sensitive to the cost and affordability of DCVax. We have spent more than a decade pioneering a unique method of single-batch manufacturing which now results in costs and pricing of DCVax lower than most cancer drugs, even though DCVax is a personalized product.

We have also worked to make DCVax an extremely simple product for both physicians and patients. DCVax is administered to patients as a simple intra-dermal injection in the arm, similar to a flu shot and does not involve any complex procedures for physicians or patients. Unlike chemical or biologic drugs, however, DCVax must remain frozen throughout the distribution and delivery process, until the time of administration to the patient, and cannot be handled at room temperature. Hospitals, pharmacies and physicians may need to adopt new requirements for handling, distribution and delivery of DCVax.

We have continued to focus intensively on manufacturing, as we have done for many years. In the US, due to the levels of demand for the Phase III brain cancer trial, during 2012 we arranged for doubling of the manufacturing capacity for DCVax-L. Our contract manufacturer, Cognate BioServices, undertook the necessary construction for this capacity increase.

In Europe, as part of our partnering arrangements, the Fraunhofer Institute in Germany and Kings College in the U.K. have dedicated their own “cGMP” (clean room) state-of-the-art manufacturing facilities to our programs. We thereby obtained these manufacturing facilities without capital cost to us, and without the 18-month or more lead time usually required.

These manufacturing arrangements at Fraunhofer in Germany and Kings College London in the U.K. have been developed by (including the training of all personnel) and are being supervised by Cognate BioServices, Inc., our contract manufacturer in the U.S., to ensure consistency. Adding these two manufacturing operations in Europe carries several important benefits for us: it increases capacity, it provides local operations to satisfy European regulators, and it provides important risk mitigation in case of any disruption in the U.S. manufacturing operation (In such case, we believe our DCVax product could be produced in Europe for the U.S. market).

During 2012, Fraunhofer, Cognate and we completed the 1-1/2 year long regulatory processes and the final inspections for regulatory approval and certification for the manufacture of DCVax-L for the clinical trial in Germany. In addition, Fraunhofer, Cognate, we and Kings College began the 7-month processes for regulatory approvals and institutional approvals in both the UK and Germany to enable the manufacturing in Germany to supply DCVax-L for the clinical trial in the UK as well. This German supply arrangement is in addition to the manufacturing under development in the UK. Having two manufacturing locations in Europe will provide added flexibility for capacity management as well as risk protection.

Product Information

Immune therapies for cancer

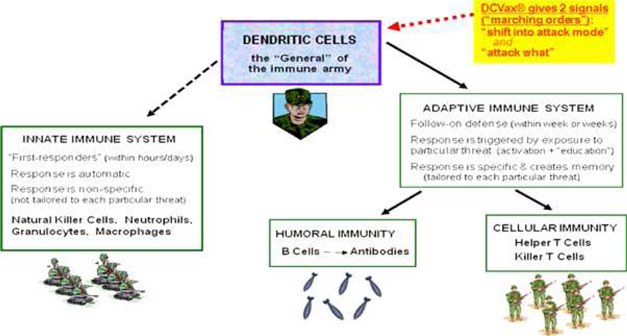

Development of effective immune therapies for cancer has long been a goal of the medical and scientific communities. The human immune system is very powerful, and also very complex: an “army” with many divisions and many different kinds of weapons. A diagram of some key agents and weapons of the immune system is set forth below:

Diagram 1: The immune system “army” includes many diverse agents. Dendritic cells are the “General” of the army.

It has taken decades of research to identify the many different types of agents and weapons, to determine the relationships among them, and to determine how they work together to attack and defeat invaders such as bacteria, viruses and cancers. While the research was in process, early versions of immune therapies against cancers were tried, with mixed results and a number of failures. Over the course of the 1990s and 2000s, the first commercially successful category of immune agents to treat cancers emerged: drugs that consisted of individual antibodies, such as Avastin, Herceptin and Erbitux.

Antibodies are just one category of weapon in the overall immune “army,” and there are many, many kinds of individual antibodies within this category. Each antibody drug, such as Avastin, consists of just a single one of the many kinds of antibodies within this one category of immune weapon. These drugs do not involve the numerous other important agents in the immune army, such as T cells, NK cells, and so on.

Antibody drugs have been moderate medical successes and huge commercial successes. These drugs have delivered moderate extensions of patient survival compared with traditional chemotherapy drugs, with somewhat lesser (though still significant) toxicity. On this basis, these antibody drugs are achieving multi-billion dollars per year in sales.

Now, more broad based immune therapies are starting to come of age: “therapeutic vaccines” designed to mobilize the entire immune “army,” rather than just a single agent or single category of agents. Therapeutic vaccines are similar to preventive vaccines in that they work by mobilizing the immune system. However, therapeutic vaccines are administered to patients who already have a given disease, for the purpose of preventing or delaying recurrence or progression of the existing disease.

Several of the therapeutic vaccines that are now coming of age are focusing on dendritic cells in various ways, or on T cells. The vaccines focusing on dendritic cells offer a broader potential immune response because dendritic cells are the master cells of the immune system — the “General” of the “army.” When dendritic cells are activated against a particular pathogen (or cancer) they, in turn, mobilize all of the other agents (including T cells as well as B cells, NK cells and others) to attack that pathogen (or cancer). The process by which dendritic cells mobilize other agents takes place to a large extent in the lymph nodes.

A major challenge faced by immune therapies for cancer has been that, unlike in a healthy patient with an infectious disease, in cancer patients the dendritic cells fail to do their job, and the other immune agents also fail to do their job. Pathologists analyzing tumor tissue removed from cancer patients have long observed that there are often substantial numbers of immune cells in the surrounding tissue, but they are not infiltrating and attacking the tumor — as though the immune cells have made it to the doorstep of the tumor and then stopped.

The mechanisms by which cancer cells selectively suppress or block the immune system are still the subject of much research. It is known that cancer cells have many such mechanisms, including secretion of biochemical signals that jam normal immune signaling, that make tumor cells invisible to immune detection and/or that convey false messages to the immune system. Different therapeutic vaccines are taking different approaches to trying to overcome these cancer mechanisms and put the immune system back in action.

Many of the therapeutic vaccines for cancer (e.g., Cell Genesys, CancerVax) have targeted existing dendritic cellsin situ in a patient’s body, by administering various compounds or factors that are designed to attract dendritic cells to the tumor or enhance the tumor signals to the dendritic cells (in essence, making the tumor signals “louder”).

We and a few others (e.g., Dendreon) are taking a different approach, based on the belief that existing dendritic cellsin situ in a patient’s body are impaired and their ability to receive and process the necessary signals is blocked. Under this view, if the signaling is blocked, then no matter how “loud” the signal may be, it will not get through and will not achieve the activation needed.

The DCVax Technology

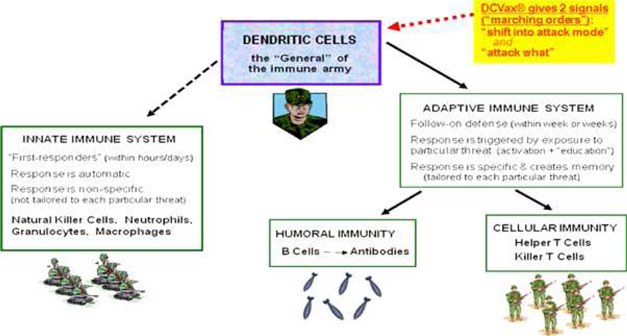

Our platform technology, DCVax, is a personalized immune therapy which consists of a therapeutic vaccine that uses a patient's own dendritic cells, or DCs, the master cells of the immune system, as the therapeutic agent. The patient’s DCs are obtained through a blood draw, or leukapheresis. The DCs are then activated and loaded with biomarkers (“antigens”) from the patient’s own tumor. The activation shifts the DCs into “attack mode.” The loading of biomarkers into the DCs “educates” the DCs aboutwhatto attack. The activated, educated DCs are then isolated with very high purity and constitute the DCVax personalized vaccine.

Injection of DCVax (the activated, educated dendritic cells of the patient) back into the patient, through a simple intra-dermal injection, similar to a flu shot, in the upper arm initiates a potent immune response against cancer cells, mobilizing the overall immune system and doing so in the natural way, with the numerous immune agents acting in their normal roles and in combination with each other. In short, DCVax is designed to restore the potent natural functioning of the immune system which has otherwise been impaired or blocked by the cancer.

Importantly, each activated, educated dendritic cell has a large multiplier effect, mobilizing hundreds of T cells and other immune cells. As a result, small doses of such dendritic cells can mobilize large and sustained immune responses.

Diagram 2: One Educated Dendritic Cell Activates Hundreds of Anti-Cancer Cells

We believe that at least three key aspects of the DCVax technology contribute to the positive results (described more fully below) seen in clinical trials to date:

| (1) | DCVax is personalized, and targets the particular biomarkers expressed onthat patient’stumor. Extensive scientific evidence has shown that there is substantial variation in tumor profiles and characteristics among patients with the “same” cancer. The degree of variation is particularly enormous in some of the most aggressive cancers, such as GBM brain cancer and pancreatic cancer. Cancer drugs are typically keyed to a single target which is believed to be found on the cancer cells’ surface or in one of the cancer cells’ signaling pathways in a substantial percentage of patients with a given type of cancer. Such drugs can be of no use in patients whose cancers do not happen to express that particular target, or cease expressing that target as the disease progresses. Most cancer drugs only achieve clinical benefits in a limited percentage of the patients with the type of cancer being targeted (e.g., 25 – 30% of the patients). In contrast, DCVax has achieved clinical benefits (i.e., longer delay in disease progression and longer extension of survival than with standard of care treatment) in over 80% of the patients who have received DCVax in clinical trials to date. Since DCVax is made with biomarkers from the patient’s own tumor, it is automatically tailored to targets that are present on that patient’s cancer. |

| (2) | DCVax is designed to target not just one but thefull set of biomarkers on the patient’s tumor. As mentioned above, cancer drugs are typically rifle shots aimed at just one target on a patient’s cancer. However, cancer is a complex and variable disease. Tumor profiles vary among patients with the “same” cancer and also vary as the disease progresses. Further, when rifle shot drugs hit individual targets on cancers, the cancers find ways around them (called “escape variants”) — and the rifle shot treatments then usually stop working. DCVax takes the opposite approach: instead of aiming at a single target, DCVax is designed at the full set of biomarkers on a patient’s cancer. Such treatment approach is expected to make it more difficult for tumors to develop escape variants. |

| (3) | DCVax is designed to mobilize theentire immune system , not just one among the many different categories of immune agents in that overall system. As described above, DCVax is comprised of activated, educated dendritic cells, and dendritic cells are the master cells of the immune system, that mobilize or help the entire immune system. Some of the prominent cancer drugs today are composed of just one type of antibody — and antibodies themselves are just one type of agent in the overall immune “army” (see Diagram 1 above). In contrast, the full immune system involves many types of antibodies, and also many other kinds of agents besides antibodies. Similarly, there have been a variety of early immune therapies that failed in the past. These, too, typically involved single agents, such as a single one among the many, many types of immune signaling molecules (e.g., a particular interferon or interleukin), or a single type of agent such as T cells alone, etc. In contrast, dendritic cells mobilize all of these different categories of agents, comprising the whole immune “army,” in combination with each other and in their natural relationships to each other. |

DCVax Product Lines

We have developed several different product lines based on the DCVax technology, to address multiple different cancers and different patient situations. There are two main components to each DCVax product: the immune cells (dendritic cells) and the cancer biomarkers (antigens).

All of our DCVax product lines are made from the patient’s own dendritic cells. The dendritic cells are freshly isolated, and newly matured and activated. We believe that the existing dendritic cells in a cancer patient have already been compromised by the cancer, and we believe that is the reason other vaccines aimed at the existing dendritic cells in patients have largely failed. However, the patient’s body continues to produce new precursors of dendritic cells, and these precursors (monocytes) circulate in the patient’s blood stream. For all DCVax products, these precursors are obtained through a blood draw, and then (through our proprietary manufacturing processes), the precursors are matured into a fresh, uncompromised batch of new dendritic cells.

The antigen (biomarker) component, which is combined with the fresh, personalized dendritic cells, varies among the DCVax product lines.

DCVax-L — is made with cancer antigens from tumor lysate (a protein extract from processed tumor cells) from the patient’s own tumor tissue. As such, DCVax-L incorporates thefull set of tumor antigens, making it difficult for tumors to find ways around it (“escape variants”), as described above. This is the DCVax product that has been used in our brain cancer and ovarian cancer clinical trials, and is currently in our Phase III trial. DCVax-L is expected to be used for any solid tumor cancers in situations in which the patient has their tumor surgically removed as part of standard of care.

DCVax-Direct — is designed for situations in which the tumors are inoperable — where it is not feasible or not desirable for patients to have their tumors surgically removed. This includes situations in which patients have multiple metastases, or for other reasons cannot have their tumors removed. Like DCVax-L, DCVax-Direct also incorporates thefull set of tumor antigens — but it does soin situ in the patient’s body rather than at the manufacturing facility. With DCVax Direct, the fresh, new dendritic cells are partially matured in a special (patent-protected) way so as to be ready to pick up antigens directly from tumor tissue in the patient’s body, and also communicate the information about those antigens to other agents of the immune system, such as T cells. The partially matured dendritic cells are then injected directly into the patient’s tumor(s). There, the dendritic cells pick up the antigensin situ rather than picking up the antigens from lysate in a lab dish at the manufacturing facility, as is done with DCVax-L.

DCVax-Prostate — is designed specifically for late stage, hormone independent prostate cancer. Such cancer involves the spread of micro-metastases beyond the prostate tissue. In most patients, there is no focal tumor which can be surgically removed and used to make lysate, or into which dendritic cells can be directly injected. Instead, the cancer cells are diffuse. We have developed a DCVax product line using a particular proprietary antigen — PSMA (Prostate Specific Membrane Antigen) — which is found on essentially all late stage (hormone independent) prostate cancer. The PSMA is produced through recombinant manufacturing methods, and is then combined with the fresh, personalized dendritic cells to make DCVax-Prostate.

Simplicity of DCVax for Physicians and Patients

All of the DCVax product lines are designed to be very simple for both physicians and patients, to fit within existing medical practices and procedures, and to be deliverable in virtually any clinic or doctor’s office. A number of complex, sophisticated and proprietary technologies are required for the production and frozen storage of DCVax, but these technologies are mostly deployed at the manufacturing facility and do not entail any effort or involvement by physicians or patients.

Front-end simplicity

For all DCVax product lines, the precursors (monocytes) for the fresh, new dendritic cells are obtained through a blood draw. This blood draw can be done not only at the hospital or cancer center where the patient is being treated, but at any blood center such as the Red Cross.

For DCVax-L, the collection of the patient’s tumor tissue, which is to be used to make lysate and provide the antigen component of the vaccine, involves a simple kit. The kit consists of a box with a vial which has a grinder top and is pre-loaded with a proprietary mix of enzymes. Such kits can be kept on hand like any inventory item at medical centers. In the operating room, after the tumor has been surgically removed, instead of disposing of the tissue in the medical waste, the nurse or technician chops the tissue coarsely and drops it into the vial, puts the vial back into the box, and hands the box to a courier pick-up service such as FedEx’s or UPS’ life science division, or a specialized courier such as World Courier.

For DCVax-Direct and DCVax-Prostate, there is no tumor tissue collection involved.

Back-end simplicity

For all DCVax products, administration to the patient involves a simple intra-dermal injection under the skin. All DCVax products are stored frozen in single doses. Such doses are tiny, and require less than 5 minutes to thaw. DCVax must remain frozen throughout the distribution and delivery process, until the time of administration to the patient, and cannot be handled at room temperature before that. Hospitals, pharmacies and physicians may need to adopt new requirements for handling, distribution and delivery of DCVax.

There are no handling steps at the point of care except thawing the frozen DCVax product to room temperature. There are also no intravenous infusions. DCVax-L and DCVax-Prostate are administered through a simple intra-dermal injection, similar to a flu shot, and are just a few drops in size. With the absence of handling steps at the point of care, and the simple intra-dermal injection, these DCVax products can be delivered to patients in virtually any clinic or doctor’s office.

The simplicity for patients also lies in the fact that DCVax is non-toxic. Patients do not have to take a second set of drugs to manage side effects of DCVax.

Clinical Programs and Clinical Trial Results

Overall Clinical Pipeline

Over the last ten years, we have built a robust clinical pipeline with DCVax products for multiple cancers, which we believe provides us with multiple opportunities for success. Our lead products, DCVax-L for GBM brain cancer and DCVax-Prostate for late stage prostate cancer, have reached late stage clinical trials. In addition to these, our DCVax-L has also been administered in an early stage trial for metastatic ovarian cancer, and other DCVax products have been cleared by the FDA to begin early stage trials in multiple other cancers.

The results seen in patients who received DCVax treatments in our Phase I/II clinical trials have been quite consistent. More than 80% of patients who received DCVax in trials to date have shown clinical benefits (longer delays in disease progression and longer extension of survival than with standard of care), compared with only 25 – 30% of patients showing clinical benefits with typical cancer drugs. Further, the clinical effects observed were largely consistent across diverse types of cancer, and diverse patient profiles (including, age, gender, physical condition, and different stages of disease). Nearly as important, in clinical trials to date, there have been no serious adverse events related to the study drug (DCVax).

Brain Cancer (GBM)

As discussed above, GBM is the most aggressive and lethal type of brain cancer. With full standard of care treatment today, including surgery, radiation and chemotherapy, the cancer recurs in a median of just 6.9 months and kills the patient in a median of just 14.6 months. There has been very little improvement in clinical outcomes for GBM patients in the last 30 years. The incidence of GBM appears to be on the rise, for unknown reasons, and there is an urgent need for new and better treatments.

Our Prior Clinical Trials

We, together with our collaborator, Dr. Linda Liau, have conducted two prior Phase I/II clinical trials at UCLA with DCVax-L for GBM brain cancer. These trials consisted of 30 patients with newly diagnosed GBM and recurrent GBM. The newly diagnosed patients who received DCVax in addition to standard of care treatment typically did not have tumor recurrence for a median of approximately 2 years, more than triple the usual time with standard of care, and patients survived for a median of approximately 3 years, approximately 2½ times the usual period attained with standard of care treatment.

Furthermore, a substantial percentage of patients who received DCVax in the prior clinical trials have continued in a “long tail” far beyond even the 3 year median survival. As of the latest long-term data update in July, 2011, 33% of the patients had reached or exceeded 4 years’ median survival and 27% had reached or exceeded 6 years’ median survival, compared with 14.6 months median survival with full standard of care treatment today.

Although the number of patients in our prior clinical trials for GBM has been limited, the difference in clinical outcomes with DCVax has been very large relative to outcomes with standard of care treatments. Comparisons of the patient outcomes in our trials with the outcomes of matched pools of patients treated with the same standard of care, in the same time period at the same hospital, display a high level of statistical significance rarely seen, even in clinical trials with much larger numbers of patients. The data on the results of our prior Phase I/II trials, if reproducible in a larger study, such as our current 312-patient Phase III trial, would demonstrate that patients with GBM can derive significant clinical benefit from DCVax treatment.

The measure of statistical significance, or “p value,” measures the probability that a set of clinical results are due to chance or random events. Accordingly, the smaller the “p value,” the smaller the chance that the results are random and the higher the statistical significance of the results. The FDA generally requires that the results of clinical trials reach a “p value” of .05 or less, meaning that there is a 5% or less chance that the trial results were due to chance or random events.

Comparisons of the clinical results in our two prior clinical trials with DCVax for GBM, with a small number of patients, and the clinical results in a matched pool of patients as described above, achieved the following “p values”:

| · | For the delay in time to recurrence, from 6.9 months with standard of care to approximately 2 years in patients treated with DCVax, the comparison “p value” was .00001 (i.e., a 1 in 100,000 chance that these results were random events). In general, the FDA requires a p value of 0.05 or less for product approval (i.e., a 5 in 100 chance or less that the clinical trial results were random events). |

| · | For the extension of survival time, from 14.6 months with standard of care to approximately 3 years in patients treated with DCVax, the comparison “p value” was .0003 (i.e., a 3 in 10,000 chance that these results were random events). In general, the FDA requires a p value of 0.05 or less for product approval (i.e., a 5 in 100 chance or less that the clinical trial results were random events). |

Following up on these results, in 2007 – 2008, we designed and began a 140-patient randomized, controlled Phase II trial but without a placebo and without blinding (which can only be achieved with a placebo that is indistinguishable from the new treatment being tested), as no placebo had been developed for our living cell product, DCVax. Unfortunately, without a placebo and blinding, patients who were randomized to the control group in the trial knew that this was the case — and, not surprisingly, they tended to drop out of the trial. As a result, that 140-patient Phase II trial had to be stopped and a placebo had to be developed to enable blinding, so that patients would not know whether they were receiving DCVax or a placebo.

Placebos to look indistinguishable from various kinds of pills can readily be made, but creating or selecting a placebo to be indistinguishable from living cells in a vial (such as the living immune cells that comprise DCVax) was a different and difficult challenge. Not only must the placebo look indistinguishable from the DCVaxvisually, it must also not have any positivefunctional action of its own that would muddy the trial results. After considerable work, we succeeded in developing such placebo arrangements and re-designing the Phase II trial to accommodate them, including nearly doubling the number of patients (from 140 to 240 patients).

We obtained a new FDA clearance and re-approvals by all the clinical sites, and commenced the new Phase II trial in early 2008. Unfortunately, we had only been underway for a short period when the economic crisis hit. We were able to keep the trial open, and continue treating the patients already enrolled in the trial, but we had to suspend new enrollment of additional patients into the trial. This suspension continued through the end of 2010, solely due to the severe economic downturn and resulting resource constraints.

In Q1 of 2011, we began the process of resuming new enrollment – obtaining renewals of institutional review board or IRB approvals and other necessary steps. We resumed the enrollment activity in Q2 of 2011. At that time, the trial was only at a dozen sites and only in the US. During 2011, we expanded the trial to 25 sites across the US.

In an amendment to the clinical trial protocol which became effective on May 3, 2012, the FDA, among other things, accepted the re-designation of this ongoing trial from a Phase II to a Phase III. In August 2012, the UK regulatory authority (the Medicines and Healthcare Products Regulatory Authority, or MHRA) also approved this trial to proceed in the UK as a Phase III trial.

Our Current Phase III Clinical Trial

During 2012, the Phase III brain cancer trial was expanded to 42 sites in the US, and nearly 30 additional sites were identified and in varying stages in the UK and Germany.

As of March 31, 2013, there are 43 clinical sites open and operating for the trial across the United States with more expected to become operational during 2013.

Inoperable Solid Tumor Cancers

Our DCVax-Direct product offers a potential new treatment option for the wide range of clinical situations in which patients' tumors are considered “inoperable” because the patient has multiple tumors, or their tumor cannot be completely removed, or the surgery would cause undue damage to the patient and impair their quality of life.

A large number of patients with a variety of cancer types (including lung, colon, pancreatic, liver, ovarian, head and neck, and others) are faced with this situation, because their tumors are already locally advanced or have begun to metastasize by the time symptoms develop and the patients seek treatment. For these patients, the outlook today is bleak and survival remains quite limited.

DCVax-Direct is administered by direct injection into a patient's tumors. It can be injected into any number of tumors, enabling patients with locally advanced disease or with metastases to be treated. DCVax-Direct can also be injected into tumors in virtually any location in the body: not only tissues at or near the surface of the body but also, with ultra-sound guidance, into interior tissues.

As described above, we have been making arrangements to launch our initial Phase I/II clinical trial with DCVax-Direct, which is approved by FDA to proceed in all solid tumor cancers. In the fall of 2012, we initiated the processes for manufacturing DCVax-Direct for the clinical trial. During Q1 of 2013, we have expanded and accelerated the manufacturing preparations, including test runs and other qualification and optimization work.

During 2012, we entered into collaborations with premiere institutions for the DCVax-Direct trial, such as the Sarah Cannon Research Institute, with its network of more than 700 physicians in the US and UK who see more than 75,000 new cancer patients per year. During Q1 of 2013, major cancer centers across the US have contacted us expressing interest in becoming sites in the DCVax-Direct clinical trial, and we have entered into discussions to expand the trial and the collaborations relating to it. We anticipate launching the trial during Q2 of 2013.

As is standard with Phase I/II trials, the DCVax-Direct trial will not be blinded, and the results will be visible as the trial proceeds over the course of 2013. The Phase I stage of the trial involves dose escalation and confirmation. The Phase II stage of the trial will focus on efficacy. The primary measure of efficacy will be regression (i.e., shrinkage or elimination) of the inoperable tumors. Such regression is a rapid endpoint: if it is going to occur, is anticipated to occur within a couple months of treatment.

Prostate Cancer

Prostate cancer is the most common cancer in men in the U.S., accounting for more than 25% of all cancers in men, and nearly twice as many cases per year as lung cancer in men, according to the American Cancer Society. For late stage prostate cancer, there is a pressing unmet need for new treatments. This late stage cancer includes two subsets of patients, comprising two distinct markets: (A) about 80 – 85% of patients do not yet show metastases, have a last good period of life, and typically live for about 36 months; and (B) about 15 – 20% of patients have more aggressive disease, show metastases right away, and only live for about 18 months. Nearly 100,000 men reach these late stages of prostate cancer every year in the United States alone (with similar numbers in Europe). Yet, there is no FDA approved drug specifically for the patients in group A, who comprise the vast majority of late stage prostate cancer patients.

For the patients in group B, there are a growing number of FDA approved drugs, including taxotere (docetaxel), Provenge, Zytiga and Xtandi, but they only add a few months of survival. Taxotere adds about 10 weeks of survival, in only a limited percentage of patients, and has toxic side effects. The Provenge immune therapy developed by Dendreon Corporation adds about 4 months of survival. Zytiga and Xtandi work through different mechanisms of action, and they, too, add only 4 – 5 months of survival.

We believe that DCVax-Prostate can offer a much needed treatment for late stage prostate cancer patients in group A, for whom there is no treatment specifically approved by FDA today. In addition, for patients in group B, we believe that DCVax-Prostate can potentially offer a much longer extension of survival.

Our Prior Clinical Trials

Clinical experience with DCVax-Prostate dates back more than a decade, and has reached the Phase III trial stage. More than one hundred patients were treated with DCVax-Prostate in an academic clinical setting in the mid and late 1990s. Based on encouraging results from those treatments, we undertook a Phase I/II clinical trial with 35 patients at two leading clinical centers: MD Anderson and UCLA. Based upon positive results from that trial, we designed a large 612-patient, Phase III clinical trial, and previously obtained FDA clearance to proceed with this trial. The details of these clinical programs are described below.

Our Phase I/II clinical trial, conducted at MD Anderson and UCLA, included both subsets of hormone independent prostate cancer patients: group A, without visible metastases, and group B, with metastases. As is standard for Phase I/II trials, in our Phase I/II trial all patients in the trial received the DCVax treatment (there was no placebo control arm). For Group A patients, the information below shows a comparison of our clinical results with the natural course of the disease in group A (for whom there is no established standard of care treatment). For group B patients, the information below shows a comparison of our clinical results with the results reported in clinical trials and clinical practice with two of the four treatments that are currently FDA approved for these patients (Taxotere and Provenge). The results of this clinical trial were as follows. Two drugs not shown below (Zytiga and Xtandi) produced clinical outcomes similar to Provenge.

Group A: Hormone Independent Prostate Cancer Patientswithout Metastases

| | | Natural Course of Disease | | With DCVax-Prostate |

Median time to disease progression

(appearance of bone metastases) | | 28 - 34 weeks | | 59 weeks |

| | | | | |

| Median survival | | 36 months | | >54 months and continuing** |

| | | | | **(more than half of these

patients still alive as of

12/31/05-last data follow-up) |

Group B: Hormone Independent Prostate Cancer Patientswith Metastases

| | | With Standard of Care

(Taxotere) | | With Provenge | | With DCVax-Prostate |

| Median survival | | 18.9 months | | 25.9 months | | 38.7 months |

| Overall survival at 3 years | | 11% | | 33% | | 64% |

Thus, in the prior Phase I/II clinical trial, patients without metastases (group A) who were treated with DCVax-Prostate typically lived at least 1½ years longer than patients going through the natural course of the disease.

Patients with metastases (group B) who were treated with DCVax-Prostate lived twice as long as patients typically do with standard of care (receiving the drug taxotere), and more than a year longer than Dendreon has reported that such patients lived when treated with its Provenge immune therapy in the clinical trials upon which FDA approval of Provenge was based.

Following these positive results in both group A and group B patients, we determined to focus our Phase III clinical trial on the patients in group A, because 80-85% of late stage prostate cancer patients fall into this group, while only 15 – 20% fall into group B. In contrast, Dendreon focused its clinical trials on the group B patients, and obtained FDA approval only for that group of patients. Thus, the addressable market for our DCVax-Prostate will be at least four times the size of the addressable market for Provenge. Due to the size and anticipated cost of the Phase III trial (at least $75 million or more), we plan to proceed with that trial only in the context of partnering arrangements.

Target Markets

Since DCVax is expected, ultimately, to be applicable to most types of solid tumor cancers, we believe the potential market for DCVax can be very large. According to the American Cancer Society, 1 in 2 men, and 1 in 3 women in the U.S. will develop some form of cancer in their lifetime. There are nearly 1.5 million new cases of cancer per year in the U.S., and nearly 600,000 deaths from cancer. The statistics are similar in Europe and in much of the rest of the world.

Even focusing just on the two DCVax products which have already reached late stage clinical trials — for GBM brain cancer and for hormone independent prostate cancer, as described above — we believe that the target markets for each of these have very large (billion dollar) revenue potential.

Brain cancer

Brain cancers fall into two broad categories: primary (meaning the cancer first originates in the brain) and metastatic (meaning the cancer first appears elsewhere in the body, but subsequently metastasizes to the brain). In the U.S. alone, on an annual basis, there are some 40,000 new cases of primary brain cancer, and 160,000 new cases of metastatic brain cancer. The numbers are similar in Europe and the rest of the world.

Within the category of primary brain cancer, Grade 4 GBM is the most aggressive and lethal type. Among the 40,000 new cases of primary brain cancer per year in the U.S., at least 12,000 cases are GBM (with some estimates as high as 17,000) and the incidence is increasing.

In addition, brain cancer is a serious medical problem in children 18 years and under. It is the second most frequent type of childhood cancers (after leukemias) and, following progress in reducing death rates from leukemias, it is now the leading cause of childhood cancer deaths.

Very little has changed in the last 30 years in the treatment and clinical outcomes for GBM. With all standard of care treatment today — surgery, radiation and chemotherapy — patients still die within a median of about 14.6 months from diagnosis.

The one drug which has become the standard of care chemotherapy treatment for GBM, Temodar, achieved market saturation extremely rapidly, within two years of product launch. Temodar added 10 weeks of survival (extending survival from its historical 12 months to the 14.6 months typical today), and did so in a limited percentage of patients. Other drugs approved by FDA for GBM, such as Avastin, did not extend survival at all.

Against this backdrop, we believe DCVax is well positioned for this target market. Further, after seeking regulatory approval for DCVax for the GBM subset of primary brain cancers, in the future we plan to conduct clinical trials and seek approval for other (lower grade) primary brain cancers and for metastatic brain cancers.

We believe that the market potential of DCVax for brain cancer, even under conservative assumptions, is very large. For example, if one counts only GBM cases (and not other primary brain cancers nor any metastatic brain cancers), only in the U.S. and Europe (and not rest of world), and one assumes a 50% market share (compared with Temodar whose market share rapidly reached saturation), the number of cases to be treated with DCVax would be at least 12,000 per year.

Prostate cancer

We also believe that the market potential of DCVax for prostate cancer is very large, even under conservative assumptions. Prostate cancer is the most common cancer in men. More than 200,000 new cases per year are diagnosed in the U.S. alone, according to the American Cancer Society, with similar numbers in Europe. Among these, at least 100,000 new cases reach late stage prostate cancer each year in the U.S. (with similar numbers in Europe).

Among these 100,000 new late stage prostate cancer cases per year, 80 – 85% of the patients have no visible metastases, and only 15 – 20% already have visible metastases. As noted above, in prior clinical trials, patients in both groups were treated with DCVax, and both groups showed positive results (substantial extensions of survival, far beyond existing treatment options — including Provenge). We are focusing our Phase III trial on the much larger market: patients without visible metastases, comprising 80 – 85% of the 100,000 new cases per year in the U.S.

If one counts only those 80 – 85,000 late stage patients, only in the U.S. (not counting either Europe or rest of world), and one assumes only a 25% market share (compared with Taxotere, whose market share is very high despite adding only 10 weeks of survival), the number of cases to be treated with DCVax would be 20 – 21,000 cases per year.

Manufacturing of DCVax

We believe that our proprietary manufacturing process for DCVax products is a key to our favorable product economics, and we are positioning DCVax to be a potential front line therapy that can be provided to patients everywhere. We have spent more than a decade honing this manufacturing process.

We have pioneered a manufacturing model under which at least 3 years of treatments are produced in one large batch in each manufacturing cycle. In addition, we have implemented special cryopreservation methods which enable this multi-year quantity of product to be frozen, and kept frozen for years, while maintaining its potency.

Both of these technologies, the multi-year batch manufacturing and the cryopreservation, are essential elements of our manufacturing model and product economics. Together, they enable us to incur the high costs of manufacturing just one time, and then store the multi-year quantity of product, frozen, in single doses. This makes DCVax effectively an “off the shelf” product for the patient, even though it is personalized, and enables the price of DCVax to be at or below the price level of modern, non-personalized cancer drugs while still achieving reasonable profit margins. This is already the case while we are using first generation manufacturing, without automation and have not yet scaled up to obtain significant economies of scale. We believe that both automation and economies of scale will further enhance the product economics.

Our manufacturing process has been taught to, and replicated at, Kings College in England and the Fraunhofer Institute in Germany, so that the same efficiencies and quality controls will be present for the DCVax produced both in Europe and the United States.

Our manufacturing process for DCVax-L takes about 8 days, followed by quality control and sterility testing. It involves several main steps as follows:

Isolation of Precursors. The precursors of new dendritic cells are isolated from the patient's white blood cells, which were obtained through a blood draw and sent to the manufacturing facility.

Differentiation of Precursors into Immature Dendritic Cells. Precursors are differentiated (transformed) into immature dendritic cells through a six-day culture period, during which specific growth factors are applied in a manner that mimics the natural process in a healthy person's body.

Maturation of Dendritic Cells. Immature dendritic cells are exposed to proprietary maturation factors and methods.

Antigen Display and Activation of Dendritic Cells. Cancer-associated antigens or antigen fragments obtained from the patient’s own tumor tissue or, for prostate cancer, produced recombinantly, are added to the maturing dendritic cells. The dendritic cells ingest and process the antigen materials, and then display fragments on their outer cell surfaces (which will serve to pass along the activation signals from these dendritic cells to other agents in the immune system, such as T cells and B cells, when the dendritic cells are injected back into the patient.

Harvest. These matured and activated new dendritic cells are isolated with very high purity, and divided into single-dose vials. They are then frozen and stored until needed.

For DCVax-Direct, our manufacturing process is similar, but simpler as it does not involve full maturation of the dendritic cells and does not involve the antigen display and activation stage. The DCVax-Direct manufacturing process is partly automated with a proprietary system, and takes about 6 days.

We contract out the manufacturing of our DCVax products to Cognate BioServices. Although there are many contract manufacturers for small molecule drugs and for biologics, there are only a few major contract manufacturers in the U.S. that specialize in producing living cell products. Cognate is one of those few and appears to have the most substantial track record of clinical trial approvals from FDA for cellular products. The manufacturing of living cell products is highly specialized and entirely different than production of biologics: the physical facilities and equipment are different, the types of personnel and skill sets are different, and the processes are different.

In addition, the regulatory requirements for living cell products are exceptionally difficult to meet — particularly forpersonalized living cell products, which can vary considerably from patient to patient. We believe that among companies developing such living cell products, nearly all cases in which clinical trials have been put on clinical hold (i.e., stopped) by FDA have been because of product or manufacturing related issues.

Cognate has a leading regulatory track record. According to Cognate, the Cognate team has been responsible for the product and manufacturing aspects of more than 20 INDs (applications for approval of clinical trials) for living cells products, and all of these INDs have been approved. Moreover, the Company believes, based upon information provided by Cognate, that no client of Cognate has been put on clinical hold in connection with its product.

Cognate’s manufacturing facility for clinical-grade cell products is located in Memphis, Tennessee, near the airport. Memphis is a worldwide air shipping hub for both Federal Express and UPS. Cognate's facility is approximately 35,000 square feet and contains substantial expansion space in addition to the portions currently built out and in use. The current manufacturing facilities are sufficient to produce DCVax for at least several thousand patients per year — an amount well in excess of what is needed for the late stage clinical trial under way. There is a large amount of expansion space, which is already planned for build- -out in stages to allow for scale -up of production capacity in a modular fashion as the need increases for commercialization. This would allow Cognate's current facility to increase to a total capacity of some 5,000 patients per year. In addition, the manufacturing arrangements with Fraunhofer in Germany and Kings College London in the United Kingdom provide further manufacturing capacity and flexibility. As a comparison, Dendreon commercially launched its Provenge dendritic cell vaccine for prostate cancer with initial manufacturing capacity for only 2,000 patients per year for a cancer that occurs in at least 100,000 new cases per year In the U.S. alone.

Intellectual Property and Orphan Drug Designation

We have an integrated strategy for protection of our technology through both patents and other mechanisms, such as Orphan Drug status. As of December 31, 2012, we have over 180 issued and pending patents worldwide, grouped into 17 patent families. Some cover the use of dendritic cells in particular DCVax products. Others cover key processes for manufacturing and quality control for DCVax, as well as an automated system which we believe will play a major role in the scale-up of production for large numbers of patients on a cost-effective basis.

During 2012, a dozen new patents were issued to us as part of our worldwide patent portfolio. The newly issued patents covered a variety of subject matter, such as the proprietary partial maturation for DCVax-Direct, the machines and systems to manufacture DCVax-Direct, certain processes for enhancing the potency of dendritic cells in general, certain measures of product quality, and other matters.

The expiration dates of the issued patents in our portfolio range from 2015 to 2026. For some of the earlier dates, we plan to seek extensions of the patent life, and believe we have reasonable grounds for doing so.

In addition to our patent portfolio, we have obtained Orphan Drug designation for our lead product, DCVax-L for brain cancer. Such designation brings with it a variety of benefits, including potential market exclusivity for seven years in the U.S. and ten years in Europe if our product is the first of its type to reach the market.

This market exclusivity applies regardless of patents, according product exclusivity on the market even if the company that developed it has no patent coverage on the product. In addition, the time period for such market exclusivity does not begin to run until product sales begin. In contrast, the time period of a patent begins when the patent is filed and runs down during the years while the product is going through development and clinical trials.

In order to qualify for these incentives, a company must apply for designation of its product as an “Orphan Drug” and obtain approval from the FDA, or its counterpart, abroad. In addition, for the market exclusivity, a product must be either the first of its kind for a particular disease to reach the market, or clinically superior to a product currently on the market. The U.S. and the European Union each granted an Orphan Drug designation for our DCVax-L product for GBM.

Competition

The biotechnology and biopharmaceutical industries are characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. Several companies, such as Dendreon, Celldex Therapeutics, Inc., Ark Therapeutics plc, Oxford Biomedica plc, Argos Therapeutics, Inc., Agenus, Inc., Prima Biomed, Ltd., Avax Technologies, Inc., Immunocellular Therapeutics, Ltd., Activartis, Bavarian Nordic, Bellicum Pharmaceuticals and others are actively involved in the research and development of immune therapies or cell-based therapies for cancer. In addition, other novel technologies for cancer are under development, such as the electro-therapy device of NovoCure. Of these companies, only one has obtained approval of such an immune therapy: Dendreon (for its Provenge treatment of prostate cancer). Additionally, several companies, such as Medarex, Inc., Amgen, Inc., Agensys, Inc., and Genentech, Inc., are actively involved in the research and development of monoclonal antibody-based cancer therapies. Currently, a substantial number of antibody-based drugs are approved for commercial sale for cancer therapy, and a large number of additional ones are under development. Many other third parties compete with us in developing alternative therapies to treat cancer, including: biopharmaceutical companies; biotechnology companies; pharmaceutical companies; academic institutions; and other research organizations, as well as some medical device companies (e.g., NovoCure and MagForce Nano Technologies AG).

We face extensive competition from companies developing new treatments for brain cancer. These include a variety of immune therapies, as mentioned above, as well as a variety of small molecule drugs and biologics. There are also a number of existing drugs used for the treatment of brain cancer that may compete with our product, including, Avastin® (Roche Holding AG), Gliadel® (Eisai Co. Ltd.), and Temodar® (Merck & Co., Inc.).

Most of our competitors have significantly greater financial resources and expertise in research and development, manufacturing, pre-clinical testing, conducting clinical trials, obtaining regulatory approvals and marketing and sales than we do. Smaller or early-stage companies may also prove to be significant competitors, particularly if they enter into collaborative arrangements with large and established companies. These third parties compete with us in recruiting and retaining qualified scientific and management personnel, as well as in acquiring technologies complementary to our programs, and in obtaining sites for our clinical trials and enrolling patients.

Recent Developments

In August 2012, our Board and a majority of our stockholders approved an amendment to our Amended and Restated 2007 Stock Option Plan providing that, on an ongoing basis, effective January 1 each year, the aggregate number of shares of common stock that are available for issuance under the plan shall automatically be increased in such manner as to maintain the option pool capped at twenty percent of our issued and outstanding stock.

On September 25, 2012, we effected a 1-for-16 reverse stock split of our issued and outstanding common stock. In addition, we filed an amendment to our certificate of incorporation increasing our authorized shares of preferred stock from 20,000,000 to 40,000,000.

In December, 2012, we retired $36.4 million in aggregate amount of convertible notes, notes and payables and accrued interest by entering into Conversion Agreements with our non-affiliated and affiliated note holders and creditors, including certain of our directors and executive officers. This aggregate debt amount was converted into 9.8 million common shares and warrants exercisable for 3.8 million shares of common stock. The warrants have an exercise period of five years from the date of issuance and a weighted average exercise price of $3.66 per share.

In April 2012, we announced the addition of two highly respected experts to our Board: Dr. Navid Malik and Mr. Jerry Jasinowski. Dr. Malik is Head of Life Sciences Research for Cenkos Securities Plc. in the UK, and has been one of the most influential analysts in the UK and Europe over the last decade, covering the life sciences industry worldwide. Mr. Jasinowski is a nationally recognized chief executive who headed up the largest industrial trade association in the US (the National Association of Manufacturers) for fourteen years, and has extensive board experience across a wide range of manufacturing, technology, and financial firms, including Fortune 1000 and Fortune 500 companies.

In September 2012, we added a pharma industry veteran, Dr. Guenter Rosskamp, to our management team as CEO of our German subsidiary. Dr. Rosskamp previously served for many years as Head of Central Nervous System Therapeutics, and as head of Strategic Business Development, for Schering AG (now part of Bayer AG). In those capacities, Dr. Rosskamp was responsible for the development and commercialization of multiple drugs.

Corporate Information

We were formed in 1996 and incorporated in Delaware in July 1998. Our principal executive offices are located in Bethesda, Maryland, and our telephone number is (240) 497-9024. Our website address iswww.nwbio.com. The information on our website is not part of this report. We have included our website address as a factual reference and do not intend it to be an active link to our website.

Employees

As of March 31, 2013, we had 8 full-time and 2 part-time employees. We believe our employee relations are satisfactory.

ITEM 1A. RISK FACTORS

RISK FACTORS

Our business, financial condition, operating results and prospects are subject to the following material risks. Additional risks and uncertainties not presently foreseeable to us may also impair our business operations. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and our stockholders may lose all or part of their investment in the shares of our Common Stock.

Risks Related to our Operations

We will need to raise substantial funds, on an ongoing basis, for general corporate purposes and operations, including our clinical trials. Such funding may not be available or may not be available on attractive terms.

We will need substantial additional funding, on an ongoing basis, in order to continue execution of our clinical trials, to move our product candidates towards commercialization, to continue prosecution and maintenance of our large patent portfolio, to continue development and optimization of our manufacturing and distribution arrangements, and for other corporate purposes. Any financing, if available, may include restrictive covenants and provisions that could limit our ability to take certain actions, preference provisions for the investors, and/or discounts, warrants or other incentives. Any financing will involve issuance of equity and/or debt, and such issuances will be dilutive to existing shareholders. There can be no assurance that we will be able to complete any of the financings, or that the terms for such financings will be attractive. If we are unable to obtain additional funds on a timely basis or on acceptable terms, we may be required to curtail or cease some or all of our operations at any time.

We are likely to continue to incur substantial losses, and may never achieve profitability.

As of December 31, 2012, we have an aggregate accumulated cash deficit, since inception of the Company, of $140.0 million, and accumulated non-cash (accounting measures) deficit of $179.1 million, making a combined cash and non-cash accumulated deficit of $319.1 million since the Company’s inception. We may never achieve or sustain profitability.

Our auditors have issued a “going concern” audit opinion.

Our independent auditors have indicated, in their report on our December 31, 2012 financial statements, that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should not rely on our consolidated balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation.

As a development stage company with a novel technology and unproven business strategy, our limited history of operations makes an evaluation of our business and prospects difficult.

We have had a limited operating history and we are still in the process of developing our product candidates through clinical trials. Our technology is novel and involves mobilizing the immune system to fight a patient’s cancer. Immune therapies have been pursued by many parties for decades, and have experienced many failures. In addition, our technology involves personalized treatment products, a new approach to medical products that involves new product economics and business strategies, which have not yet been shown to be commercially feasible or successful. We have not yet gone through scale-up of our operations to commercial scale. This limited operating history, along with the novelty of our technology, product economics, and business strategy, and the limited scale of our operations to date, makes it difficult to assess our prospects for generating revenues commercially in the future.

We will need to expand our management and technical personnel as our operations progress, and we may not be able to recruit such additional personnel and/or retain existing personnel.

As of December 31, 2012, we employ eight (8) full-time employees and two (2) part-time employees. The rest of our personnel are retained on a consulting or contractor basis. Biotech companies would typically have a larger number of employees by the time they reach late stage clinical trials. Such trials require extensive management activities and skill sets, including scientific, medical, regulatory (for FDA and foreign regulatory counterparts), manufacturing, distribution and logistics, site management, business, financial, legal, public relations outreach to both the patient community and physician community, intellectual property, administrative, regulatory (SEC), investor relations and other.

In order to fully perform all these diverse functions, with late stage trials under way at many sites across the U.S. and soon in Europe, we will need to expand our management and technical personnel. However, the pool of such personnel with expertise and experience with living cell products, such as our DCVax immune cell product, is very limited. In addition, we are a small company with limited resources, our business prospects are uncertain and our stock price is volatile. For some or all of such reasons, we may not be able to recruit all the management and technical personnel we need, and/or we may not be able to retain all of our existing personnel. In such event, we may have to continue our operations with a smaller than usual team of personnel, and our business and financial results may suffer.

We rely at present on third-party contract manufacturers. As a result, we may be at risk for capacity limitations and/or supply disruptions.