File No. 333-______

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JANUARY 16, 2015

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

JNL Variable Fund LLC

(Exact Name of Registrant as Specified in Charter)

(517) 381-5500

(Registrant’s Area Code and Telephone Number)

225 West Wacker Drive

Suite 1200

Chicago, Illinois 60606

(Address of Principal Executive Offices and Mailing Address)

With copies to:

SUSAN S. RHEE, ESQ. JNL Variable Fund LLC Vice President, Counsel & Secretary 1 Corporate Way Lansing, Michigan 48951 | DIANE E. AMBLER, ESQ. K&L Gates LLP 1601 K Street, N.W. Washington, DC 20006 |

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this Registration Statement will become effective on February 27, 2015 pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of securities being registered: Class A and Class B shares of beneficial interest in the series of the registrant designated as the JNL/Mellon Capital S&P® 24 Fund.

No filing fee is required because the registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares (File Nos. 333-68105 and 811-09121).

JNL VARIABLE FUND LLC

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following papers and documents:

Cover Sheet

Contents of Registration Statement

Letter to Contract owners

Part A - Information Statement/Prospectus

Part B - Statement of Additional Information

Part C - Other Information

Signature Page

Exhibits

JACKSON NATIONAL LIFE INSURANCE COMPANY

JACKSON NATIONAL LIFE INSURANCE COMPANY OF NEW YORK

1 Corporate Way

Lansing, Michigan 48951

February 27, 2015

Dear Contract owner:

We are writing to inform you of an important matter concerning your allocation of contract values under your variable life insurance policy or variable annuity contract to the investment division of your separate account that invests in the JNL/Mellon Capital Value Line® 30 Fund (the “Acquired Fund”), a series of JNL Variable Fund LLC (“VF LLC”). At a meeting held on January 13, 2015, the Board of Managers of the Acquired Fund (the “Board”) approved a reorganization pursuant to which the Acquired Fund will be reorganized with and into the JNL/Mellon Capital S&P® 24 Fund (the “Acquiring Fund,” and together with the Acquired Fund, the “Funds”), a series of VF LLC. Members were first notified of the reorganization in a supplement dated January 16, 2015 to the Acquired Fund’s Prospectus, dated April 28, 2014, as supplemented.

The Board, after careful consideration, approved the reorganization. After considering the recommendation of Jackson National Asset Management, LLC (“JNAM”), the investment adviser to the Funds, the Board concluded that: (i) the reorganization will benefit the members of each Fund; (ii) the reorganization is in the best interests of each Fund; and (iii) the interests of the members of each Fund will not be diluted as a result of the reorganization.

Effective April 24, 2015 (the “Closing Date”), you will indirectly own shares in the Acquiring Fund equal in dollar value to your interest in the Acquired Fund on the Closing Date. No sales charge, redemption fees or other transaction fees will be imposed in the reorganization. The reorganization will not cause any fees or charges under your contract to be greater after the reorganization than before, and the reorganization does not alter your rights under your contract or the obligations of the insurance company that issued the contract. Although the Reorganization is not expected to be a tax-free reorganization for Federal income tax purposes, the VF LLC believes that there will be no adverse tax consequences to Contract owners as a result of the Reorganization.

While no action is required of you with regard to the reorganization, you may wish to take other actions relating to your future allocation of premium payments under your insurance contract to the various investment divisions (“Division(s)”) of the separate account. You may execute certain changes prior to the reorganization, in addition to following the reorganization with regard to the Acquiring Fund.

All actions with regard to the Acquired Fund need to be completed by the Closing Date. In the absence of new instructions prior to the Closing Date, future premium payments previously allocated to the Acquired Fund Division will be allocated to the Acquiring Fund Division. The Acquiring Fund Division will be the Division for future allocations under the Dollar Cost Averaging, Earnings Sweep and Rebalancing Programs. In addition to the Acquiring Fund Division there are other Divisions investing in mutual funds that seek capital appreciation. If you want to transfer your Contract Value out of the Acquired Fund Division prior to the reorganization you may do so and that transfer will not be treated as a transfer for the purpose of determining how many subsequent transfers may be made in any period or how many may be made in any period without charge. In addition, after the reorganization if you want to transfer your Contract Value out of the Acquiring Fund Division you may do so within 60 days following the Closing Date and that transfer will not be treated as a transfer for the purpose of determining how many subsequent transfers may be made in any period or how many may be made in any period without charge. You will be provided with an additional notification of this free-transfer policy on or about April 27, 2015.

If you want to change your allocations instructions as to your future premium payments or the programs, if you require summary descriptions of the other underlying funds and Divisions available under your contract, or additional copies of the prospectuses for other funds underlying the Divisions, please contact:

For Jackson variable annuity policies:

| | Annuity Service Center |

| | P.O. Box 30314 |

| | Lansing, Michigan 48909-7814 |

| | 1-800-644-4565 |

| | www.jackson.com |

For Jackson variable universal life policies:

| | Jackson® Service Center |

| | P.O. Box 30502 |

| | Lansing, Michigan 48909-8002 |

| | 1-800-644-4565 |

| | www.jackson.com |

For Jackson New York variable annuity policies:

| | Jackson of NY Service Center |

| | P.O. Box 30313 |

| | Lansing, Michigan 48909-7813 |

| | 1-800-599-5651 |

| | www.jackson.com |

For Jackson New York variable universal life policies:

| | Jackson of NY® Service Center |

| | P.O. Box 30901 |

| | Lansing, MI 48909-8401 |

| | 1-800-599-5651 |

| | www.jackson.com |

NO ACTION ON YOUR PART IS REQUIRED REGARDING THE REORGANIZATION. YOU WILL AUTOMATICALLY RECEIVE SHARES OF THE ACQUIRING FUND IN EXCHANGE FOR YOUR SHARES OF THE ACQUIRED FUND AS OF THE CLOSING DATE. THE BOARD IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

| | Very truly yours, |

| | |

| | Mark D. Nerud |

| | President and Chief Executive Officer |

| | JNL Variable Fund LLC |

INFORMATION STATEMENT

for

JNL/Mellon Capital Value Line® 30 Fund, a series of JNL Variable Fund LLC

and

PROSPECTUS

for

JNL/Mellon Capital S&P® 24 Fund, a series of JNL Variable Fund LLC

Dated

February 27, 2015

1 Corporate Way

Lansing, Michigan 48951

(517) 381-5500

This Combined Information Statement and Prospectus (the “Information Statement/Prospectus”) is being furnished to owners of variable life insurance policies or variable annuity contracts or certificates (the “Contracts”) (the “Contract owners”) issued by Jackson National Life Insurance Company (“Jackson National”) or Jackson National Life Insurance Company of New York (each, an “Insurance Company” and together, the “Insurance Companies”) who, as of February 27, 2015, had net premiums or contributions allocated to the investment divisions of an Insurance Company’s separate accounts (the “Separate Accounts”) that are invested in shares of beneficial interest in the JNL/Mellon Capital Value Line® 30 Fund (the “Value Line Fund” or the “Acquired Fund”), a portfolio of the JNL Variable Fund LLC (the “VF LLC”). The VF LLC is an open-end management investment company registered with the Securities and Exchange Commission (“SEC”).

This Information Statement/Prospectus is being provided to the Insurance Companies and mailed to Contract owners and other members on or about March 4, 2015.

| THE SEC HAS NOT APPROVED OR DISAPPROVED THE SECURITIES DESCRIBED IN THIS INFORMATION STATEMENT/PROSPECTUS OR DETERMINED IF THIS INFORMATION STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. |

At a meeting of the VF LLC Board of Managers held on January 13, 2015, the Board of Managers approved the Plan of Reorganization, which provides for the reorganization of the Value Line Fund into the JNL/Mellon Capital S&P® 24 Fund (“S&P 24 Fund” or the “Acquiring Fund”), a series of the VF LLC. The reorganization referred to above is referred to herein as the “Reorganization.”

This Information Statement/Prospectus, which you should retain for future reference, contains important information regarding the Reorganization that you should know. Additional information about the VF LLC has been filed with the SEC and is available upon oral or written request without charge.

The following documents have been filed with the SEC and are incorporated by reference into this Information Statement/Prospectus:

| 1. | The Prospectus and Statement of Additional Information of the VF LLC, each dated April 28, 2014, as supplemented, with respect to the Value Line Fund and the S&P 24 Fund (File Nos. 333-68105 and 811-09121); |

| 2. | The Annual Report to Members of the VF LLC with respect to the Value Line Fund and the S&P 24 Fund for the fiscal year ended December 31, 2013 (File Nos. 333-68105 and 811-09121); |

| 3. | The Semi-Annual Report to Members of the VF LLC with respect to the Value Line Fund and the S&P 24 Fund for the fiscal year ended June 30, 2014 (File Nos. 333-68105 and 811-09121); |

| 4. | The Statement of Additional Information dated March 4, 2015, relating to the Reorganization (File No. [__________________]). |

For a free copy of any of the above documents, please call or write to the phone numbers or address below.

Members and Contract owners can learn more about the Acquired Fund in the VF LLC’s Annual Report listed above, which has been furnished to members and Contract owners. Members and Contract owners may request another copy thereof, without charge, by calling 1-800-873-5654 (Annuity and Life Service Center), 1-800-599-5651 (NY Annuity and Life Service Center), 1-800-777-7779 (for contracts purchased through a bank or financial institution) or 1-888-464-7779 (for NY contracts purchased through a bank or financial institution), or writing the JNL Variable Fund LLC Service Center, P.O. Box 30314, Lansing, Michigan 48909-7814 or by visiting www.jackson.com.

The VF LLC is subject to the informational requirements of the Securities Exchange Act of 1934, as amended. Accordingly, it must file certain reports and other information with the SEC. You can copy and review information about the VF LLC at the SEC’s Public Reference Room in Washington, DC, and at certain of the following SEC Regional Offices: New York Regional Office, 3 World Financial Center, Suite 400, New York, New York 10281; Miami Regional Office, 801 Brickell Avenue, Suite 1800, Miami, Florida 33131; Chicago Regional Office, 175 W. Jackson Boulevard, Suite 900, Chicago, Illinois 60604; Denver Regional Office, 1961 Stout Street, Suite 1700, Denver, Colorado 80294; Los Angeles Regional Office, 444 South Flower Street, Suite 900, Los Angeles, California 90071; Boston Regional Office, 33 Arch Street, 23rd Floor, Boston, MA 02110; Philadelphia Regional Office, One Penn Center, 1617 JFK Boulevard, Suite 520, Philadelphia, PA 19103; Atlanta Regional Office, 950 East Paces Ferry, N.E., Suite 900, Atlanta, GA 30326; Fort Worth Regional Office, Burnett Plaza, Suite 1900, 801 Cherry Street, Unit 18, Fort Worth, TX 76102; Salt Lake Regional Office, 15 S. West Temple Street, Suite 6100, Salt Lake City, UT 84101; San Francisco Regional Office, 44 Montgomery Street, Suite 2800, San Francisco, CA 94104. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. Reports and other information about the VF LLC are available on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information from the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Washington, DC 20549, at prescribed rates.

TABLE OF CONTENTS

| | |

| | |

| | 1 |

| | 1 |

| | 2 |

| | 3 |

| | 3 |

| | 3 |

| | 4 |

| | 6 |

| | 6 |

| | 7 |

| | 9 |

| | 10 |

| | 10 |

| | 10 |

| | 10 |

| | 12 |

| | 12 |

| | 12 |

| | 12 |

| | 12 |

| | 13 |

| | 13 |

| | 14 |

| | 15 |

| | 15 |

| | 15 |

| | 15 |

| | 16 |

| | 17 |

| | 17 |

| | 17 |

| | 18 |

| | 20 |

| | A-1 |

| | B-1 |

| | C-1 |

You should read this entire Information Statement/Prospectus carefully. For additional information, you should consult the Plan of Reorganization, a copy of which is attached hereto as Appendix A.

This Information Statement/Prospectus is being distributed to members with amounts invested in the Acquired Fund as of February 27, 2015 to inform them of the Plan of Reorganization, whereby the Acquired Fund will be reorganized into the Acquiring Fund. (The Acquired Fund and Acquiring Fund are sometimes referred to herein as a “Fund.”)

The Acquired Fund’s shares are divided into two classes, designated Class A and Class B shares (“Acquired Fund Shares”). The Acquiring Fund’s shares also are divided into two classes, designated Class A and Class B shares (“Acquiring Fund Shares”). The rights and preferences of each class of Acquiring Fund Shares are identical to the class of Acquired Fund Shares.

The Plan of Reorganization provides for:

| · | the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange for Acquiring Fund Shares having an aggregate net asset value equal to the Acquired Fund’s net assets; |

| · | the Acquiring Fund’s assumption of all the liabilities of the Acquired Fund; |

| · | the distribution to the members (for the benefit of the Separate Accounts, as applicable, and thus the Contract owners) of those Acquiring Fund Shares; and |

| · | the complete termination of the Acquired Fund. |

A comparison of the investment objective, investment policies, strategies and principal risks of the Acquired Fund and the Acquiring Fund is included in “Comparison of Investment Objectives, Policies and Strategies” and “Comparison of Principal Risk Factors” below. The Funds have identical distribution procedures, purchase procedures, exchange rights and redemption procedures, which are discussed in “Additional Information about the Acquiring Fund” below. Each Fund offers its shares to Separate Accounts and certain other eligible investors. Shares of each Fund are offered and redeemed at their net asset value without any sales load. You will not incur any sales loads or similar transaction charges as a result of the Reorganization.

The Reorganization is expected to be effective as of the close of business on April 24, 2015, or on a later date the VF LLC decides upon (the “Closing Date”). As a result of the Reorganization, each member invested in shares of the Acquired Fund would become an owner of shares of the Acquiring Fund. Such member would hold, immediately after the Closing Date, Class A or Class B shares of the S&P 24 Fund having an aggregate value equal to the aggregate value of the Class A or Class B Value Line Fund shares, as applicable, that were held by the member as of the Closing Date. Similarly, each Contract owner whose Contract values are invested in shares of the Value Line Fund would become an indirect owner of shares of the S&P 24 Fund. Each such Contract owner would indirectly hold, immediately after the Closing Date, Class A or Class B shares of the S&P 24 Fund having an aggregate value equal to the aggregate value of the Class A or Class B Value Line Fund Shares, as applicable, that were indirectly held by the Contract owner as of the Closing Date. The VF LLC believes that there will be no adverse tax consequences to Contract owners as a result of the Reorganization. Please see “Additional Information about the Reorganization – Federal Income Tax Consequences of the Reorganization” below for further information.

The VF LLC’s Board of Managers (the “Board”) unanimously approved the Plan of Reorganization with respect to the Value Line Fund. The VF LLC’s Operating Agreement and applicable state law do not require member approval of the Reorganization. Moreover, Rule 17a-8 under the Investment Company Act of 1940, as amended (the “1940 Act”), does not require member approval of the Reorganization, provided certain conditions are met. Because applicable legal requirements do not require member approval under these circumstances and the Board has determined that the Reorganization is in the best interests of Acquired Fund, member are not being asked to vote on the Reorganization. Please see “Additional Information about the Reorganization – Board Considerations” below for further information.

The following summarizes key information regarding the Funds and the Reorganization. More complete discussions are located elsewhere in the Information Statement/Prospectus.

| · | The Funds have similar investment objectives. The Value Line Fund seeks capital appreciation and the S&P 24 Fund seeks total return through capital appreciation. The Funds also have the same fundamental policies and restrictions. Both the Value Line and S&P 24 Funds are “non-diversified” funds for the purposes of the 1940 Act. For a detailed comparison of the each Fund’s fundamental policies and restrictions, see “Comparison of Fundamental Policies” below. |

| · | Although the Funds have similar investment objectives, they have different principal investment strategies. While each Fund invests primarily in common stocks, the investment sub-adviser to each Fund employs different methodologies for screening investment opportunities. The Value Line Fund seeks to achieve its objective by investing in common stocks of 30 companies that the sub-adviser ranks well with respect to a long-term trend of earnings, prices, recent earnings, price momentum, and earnings surprise. Similarly, the S&P 24 Fund also seeks to achieve its objective by investing in common stocks of companies that have the sub-adviser determines has the potential for capital appreciation selected from a subset of stocks included in the S&P 500® Index. For a detailed comparison of the each Fund’s investment policies and strategies, see “Comparison of Investment Objectives, Policies and Strategies” below. |

| · | The Funds also have substantially similar risk profiles, although there are differences of which you should be aware. Each Fund’s principal risks include foreign regulatory risk, limited management, trading cost and rebalance risk, market risk, and non-diversification risk. The Value Line Fund, however, also is subject to license termination risk, while the S&P 24 Fund is not. For a detailed comparison of the each Fund’s risks, see “Comparison of Principal Risk Factors” below. |

| · | Jackson National Asset Management, LLC (“JNAM” or the “Adviser”) serves as the investment adviser and administrator for the Funds and would continue to manage and administer the S&P 24 Fund after the Reorganization. JNAM has received an exemptive order from the SEC that generally permits JNAM, with approval from the VF LLC’s Board of Managers, to appoint, dismiss and replace each Fund’s sub-adviser(s) and to amend the advisory agreements between JNAM and the sub-advisers without obtaining member approval. However, any amendment to an advisory agreement between JNAM and the VF LLC that would result in an increase in the management fee rate specified in that agreement (i.e., the aggregate management fee) charged to a Fund will be submitted to members for approval. JNAM has appointed Mellon Capital Management Corporation (“Mellon Capital”) to manage the assets of the S&P 24 Fund. JNAM has also appointed Mellon Capital to manage the assets of the Value Line Fund. It is anticipated that Mellon Capital will continue to advise the S&P 24 Fund after the Reorganization. As noted above, Mellon Capital uses a different proprietary stock selection criteria to determine the holdings of each Fund. Thus, while shareholders of the Value Line Fund will be merged into a different Fund, they still will have access to investments procured through a specialized process run by the same sub-adviser. For a detailed description of the Adviser and the S&P 24 Fund’s sub-adviser, please see “Additional Information about the Acquiring Fund - The Adviser” and “- The Sub-Adviser” below. |

| · | The Value Line Fund and S&P 24 Fund had net assets of approximately $821 million and $813 million, respectively, as of June 30, 2014. Thus, if the Reorganization had been in effect on that date, the combined Fund would have had net assets of approximately $1,635 million. |

| · | Class A members of the Value Line Fund will receive Class A shares of the S&P 24 Fund, and Class B members of the Value Line Fund will receive Class B shares of the S&P 24 Fund, pursuant to the Reorganization. Members will not pay any sales charges in connection with the Reorganization. Please see “Comparative Fee and Expense Tables,” “Additional Information about the Reorganization” and “Additional Information about the Acquiring Fund” below for more information. |

| · | It is estimated that the total annual fund operating expense ratios for the S&P 24 Fund’s Class A and Class B shares, following the Reorganization, will be lower than those of the Value Line Fund’s Class A and Class B |

shares, respectively. For a more detailed comparison of the fees and expenses of the Funds, please see “Comparative Fee and Expense Tables” and “Additional Information about the Acquiring Fund” below.

| · | Both Funds are subject to the same management fee schedule with a maximum management fee equal to an annual rate of 0.34% of average daily net assets. In addition, both Funds pay an administrative fee to JNAM as administrator to the Fund at the rate of 0.15% of the Fund’s average daily net assets. For a more detailed description of the fees and expenses of the Funds, please see “Comparative Fee and Expense Tables” and “Additional Information about the Acquiring Fund” below. |

| · | Following the Reorganization, the combined Fund will be managed in accordance with the investment objective, policies and strategies of the S&P 24 Fund. It is not expected that the S&P 24 Fund will revise any of its investment policies following the Reorganization to reflect those of the Value Line Fund. JNAM has reviewed each Fund’s current portfolio holdings and determined that although the Value Line Fund’s holdings are permissible investments for the S&P 24 Fund, none of the Value Line Fund’s current holdings meet the S&P 24 Fund’s investment screens. It is currently anticipated that all of the Value Line Fund’s holdings will be liquidated in connection with the Reorganization. The proceeds of such liquidation will be reinvested in assets that are consistent with the S&P 24 Fund’s investment screens. Although any sale of portfolio investments in connection with the Reorganization will be conducted in an orderly manner, the need for the Fund to sell such investments may result in its selling securities at a disadvantageous time and price and could result in the Fund’s realizing gains or losses (which could be significant) that otherwise would not have been realized and incurring transaction costs (which also could be significant) that otherwise would not have been incurred. |

| · | The costs and expenses associated with the Reorganization including those relating to preparing, filing, printing and mailing of material, disclosure documents and related legal fees, including the legal fees incurred in connection with the analysis under the Internal Revenue Code of 1986 (the “Code”) of the taxability of this transaction and the preparation of the tax opinion, and obtaining a consent of independent registered public accounting firm will be borne by JNAM. The Value Line Fund will bear its proportionate share of the transaction expenses associated with the Reorganization. Such expenses are estimated to be $157,000. No sales or other charges will be imposed on Contract owners in connection with the Reorganization. Please see “Additional Information about the Reorganizations” below for more information. |

The following tables show the fees and expenses of each class of shares of each Fund and the estimated pro forma fees and expenses of each class of shares of the Acquiring Fund after giving effect to the proposed Reorganization. Fees and expenses for each Fund are based on those incurred by each class of its shares for the fiscal year ended December 31, 2013. The pro forma fees and expenses of the Acquiring Fund Shares assume that the Reorganization had been in effect for the year ended December 31, 2013. The tables below do not reflect any fees and expenses related to the Contracts, which would increase overall fees and expenses. See a Contract prospectus for a description of those fees and expenses.

Shareholder Fees

(fees paid directly from your investment)

| | Value Line Fund | S&P 24 Fund | Pro Forma

S&P 24 Fund |

| Not applicable. |

Annual Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | Value Line Fund | S&P 24 Fund | Pro Forma

S&P 24 Fund |

| | Class A | Class B | Class A | Class B | Class A | Class B |

| Management Fee | 0.29% | 0.29% | 0.29% | 0.29% | 0.28% | 0.28% |

| Distribution and/or Service Fees (12b-1 fees) | 0.20% | 0.00% | 0.20% | 0.00% | 0.20% | 0.00% |

Other Expenses1 | 0.23% | 0.23% | 0.17% | 0.17% | 0.17% | 0.17% |

| Total Annual Fund Operating Expenses | 0.72% | 0.52% | 0.66% | 0.46% | 0.65% | 0.45% |

1 “Other Expenses” include an Administrative Fee of 0.15% payable to JNAM.

This example is intended to help you compare the costs of investing in the Funds with the cost of investing in other mutual funds. This example does not reflect fees and expenses related to the Contracts, and the total expenses would be higher if they were included. The example assumes that:

| · | You invest $10,000 in a Fund; |

| · | Your investment has a 5% annual return; |

| · | The Fund’s operating expenses remain the same as they were as of December 31, 2013; and |

| · | You redeem your investment at the end of each time period. |

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Value Line Fund | | | | |

| Class A | $74 | $230 | $401 | $894 |

| Class B | $53 | $167 | $291 | $653 |

| S&P 24 Fund | | | | |

| Class A | $67 | $211 | $368 | $822 |

| Class B | $47 | $148 | $258 | $579 |

Pro Forma S&P 24 Fund, as of 12/31/2013 | | | | |

| Class A | $66 | $208 | $362 | $810 |

| Class B | $46 | $144 | $252 | $567 |

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the fiscal year ended December 31, 2013, the portfolio turnover rates for the Value Line Fund and S&P 24 Fund were 98% and 74% for Class A Shares and 74% and, for Class B Shares 98% and 74% respectively, of the average value of the respective Fund.

The following table compares the investment adviser and sub-adviser of the S&P 24 Fund with those of the Value Line Fund.

| Acquiring Fund | Acquired Fund |

| S&P 24 Fund | Value Line Fund |

Investment Adviser Jackson National Asset Management, LLC Sub-Adviser Mellon Capital Management Corporation (“Mellon Capital”) | Investment Adviser Jackson National Asset Management, LLC Sub-Adviser Mellon Capital |

The following table compares the investment objectives and principal investment policies and strategies of the S&P 24 Fund with those of the Value Line Fund. The Board may change the investment objective of a Fund without a vote of the Fund’s members. For more detailed information about each Fund’s investment strategies and risk, see Appendix B.

| Acquiring Fund | Acquired Fund |

| S&P 24 Fund | Value Line Fund |

Investment Objective The investment objective of the JNL/Mellon Capital S&P® 24 Fund is total return through capital appreciation. | Investment Objective The investment objective of the JNL/Mellon Capital Value Line® 30 Fund is to provide capital appreciation. |

Principal Investment Strategies The S&P 24 Fund seeks to achieve its objective by investing in the common stocks of companies that have the potential for capital appreciation. To select the stocks for the S&P 24 Fund, the Sub-Adviser selects a portfolio of common stocks of the 24 companies selected from a subset of stocks included in the Standard & Poor's 500 Composite Stock Price Index (“S&P 500® Index”). The 24 companies are selected on each “Stock Selection Date.” The Stock Selection Date will be on or about January 1 of each year. The Sub-Adviser generally uses a buy and hold strategy, trading only around each Stock Selection Date, when cash flow activity occurs and for dividend reinvestment. The Sub-Adviser may also trade for mergers if the original stock is not the surviving company. | Principal Investment Strategies The Value Line 30 Fund seeks to achieve its objective by investing in the common stocks of 30 companies that Value Line® gives a #1 ranking for “TimelinessTM”. The 30 companies are selected each year by the Sub-Adviser, Mellon Capital Management Corporation, based on certain positive financial attributes. Value Line® ranks 1,700 stocks, representing approximately 94% of the trading volume on all U.S. stock exchanges. Of these 1,700 stocks, only 100 are given Value Line’s #1 ranking for TimelinessTM, which reflects Value Line's view of their probable price performance during the next six months relative to the other stocks ranked by Value Line®. Value Line® bases its rankings on a long-term trend of earnings, prices, recent earnings, price momentum, and earnings surprise. The 30 companies are chosen only once annually from the 100 stocks with the #1 ranking on each Stock Selection Date. The Stock Selection Date will be on or about January 1 of each year. The Sub-Adviser generally uses a buy and hold strategy, trading only around each Stock Selection Date, when cash flow activity occurs and for dividend reinvestment. The Sub-Adviser may also trade for mergers if the original stock is not the surviving company. |

Companies which, as of the Stock Selection Date, Standard & Poor’s has announced will be removed from the S&P 500® Index will be removed from the universe of securities from which the S&P 24 Fund stocks are selected. | Companies which, as of the Stock Selection Date, Value Line has announced will be removed from Value Line’s #1 ranking for TimelinessTM will be removed from the universe of securities from which the Value Line 30 Fund stocks are selected. |

| Acquiring Fund | Acquired Fund |

| S&P 24 Fund | Value Line Fund |

The 24 companies are selected only once annually on each Stock Selection Date using the following steps: · The Sub-Adviser ranks all of the S&P economic sectors in the S&P 500® Index by market capitalization. The eight largest sectors are selected; · The Sub-Adviser ranks the stocks in each of those eight sectors among their peers based on three distinct factors: o Factor 1: Highest return on assets. Stocks with high return on assets achieve better rankings. o Factor 2: Highest buyback yield. Buyback yield measures the percentage decrease in shares of common stock outstanding versus one year earlier. Those stocks with greater percentage decreases receive better rankings. o Factor 3: Highest bullish interest indicator. The bullish interest indicator, compares the number of shares traded in months in which the stock price rose to the number of shares traded in months which the stock price declined as a percentage of total shares traded over the past twelve months. Those stocks with a high bullish interest indicator achieve better rankings; · The Sub-Adviser selects the three companies from each of the eight sectors with the highest combined ranking on these three factors for S&P 24 Fund. In the event of a tie within a sector, the stock with the higher market capitalization is selected; · The Sub-Adviser then selects an approximately equal-weighted portfolio of the 24 companies; and · The Sub-Adviser reviews the liquidity profile of the companies selected, and, when deemed appropriate, will remove the illiquid securities that may cause undue market impact and replace them with the next highest ranked companies with better liquidity in each sector. | The 30 companies are chosen on each Stock Selection Date as follows: · Starting with the 100 stocks that Value Line® gives its #1 ranking for Timeliness™, the stocks of companies considered to be securities related issuers, and the stocks of companies whose shares are not listed on a U.S. securities exchange are removed from consideration; · Next, the Sub-Adviser calculates the ratio of cash flow per share to stock price. The 70 stocks with the highest ratio of cash flow per share to stock price are selected; · From the selected companies, the Sub-Adviser selects the 30 companies with the highest six-month price appreciation; and · The Sub-Adviser reviews the liquidity profile of the companies selected, and, when deemed appropriate, will remove the illiquid securities that may cause undue market impact and replace them with the next highest ranked companies with better liquidity. These securities will be weighted by market capitalization subject to the restriction that no stock will comprise less than 1% or more than 10% of the portfolio on each “Stock Selection Date.” These securities will be adjusted on a proportional basis to accommodate this constraint. |

Between Stock Selection Dates, when cash inflows and outflows require, the Sub-Adviser makes new purchases and sales of common stocks of the 24 selected companies in approximately the same proportion that such stocks are then held in the S&P 24 Fund (determined based on market value). | Between Stock Selection Dates, when cash inflows and outflows require, the Sub-Adviser makes new purchases and sales of common stocks of the 30 selected companies in approximately the same proportion that such stocks are then held in the Value Line 30 Fund (determined based on market value). |

| Certain provisions of the 1940 Act limit the ability of the S&P 24 Fund to invest more than 5% of the S&P 24 Fund’s total assets in the stock of any company that derives more than 15% of its gross revenues from securities related activities (“Securities Related Companies”). If a Securities Related Company is selected by the strategy described | Certain provisions of the 1940 Act and the Internal Revenue Code of 1986 may limit the ability of the Fund to invest in certain securities in excess of certain percentage limitations. Any amount that cannot be allocated due to these limitations will be allocated among the remaining portfolio securities. |

| Acquiring Fund | Acquired Fund |

| S&P 24 Fund | Value Line Fund |

| above, the Sub-Adviser may depart from the S&P 24 Fund’s investment strategy only to the extent necessary to maintain compliance with these provisions. Any amount that cannot be allocated to a Securities Related Company because of the 5% limit will be allocated among the remaining portfolio securities. In addition, certain provisions of the 1940 Act and the Internal Revenue Code of 1986 may limit the ability of the Fund to invest in certain securities in excess of certain percentage limitations. Any amount that cannot be allocated due to these limitations will be allocated among the remaining portfolio securities. | |

An investment in a Fund is not guaranteed. As with any mutual fund, the value of a Fund’s shares will change, and an investor could lose money by investing in a Fund. The following table compares the principal risks of an investment in each Fund. For an explanation of each such risk, see “Additional Information about the Reorganizations – Description of Risk Factors” below.

| Risks | S&P 24 Fund | Value Line Fund |

| Foreign regulatory risk | X | X |

| License termination risk | | X |

| Limited management, trading cost and rebalanced risk | X | X |

| Market risk | X | X |

| Non-diversification risk | X | X |

Each Fund is subject to certain fundamental policies and restrictions that may not be changed without member approval. The following table compares the fundamental policies of the S&P 24 Fund with those of the Value Line Fund.

| Acquiring Fund | Acquired Fund |

| S&P 24 Fund | Value Line Fund |

| (1) No Fund may issue senior securities. | Same. |

| (2) A Fund will not borrow money, except for temporary or emergency purposes, from banks. The aggregate amount borrowed shall not exceed 25% of the value of a Fund’s assets. In the case of any borrowing, a Fund may pledge, mortgage or hypothecate up to 15% of its assets. | Same. |

| Acquiring Fund | Acquired Fund |

| S&P 24 Fund | Value Line Fund |

| (3) A Fund will not underwrite the securities of other issuers except to the extent the Fund may be considered an underwriter under the Securities Act of 1933, as amended, when selling portfolio securities. | Same. |

| (4) A Fund will not purchase or sell real estate or interests therein. | Same. |

| (5) A Fund will not lend any security or make any other loan if, as a result, more than 33 1/3% of the Fund’s total assets would be lent to other parties (but this limitation does not apply to purchases of commercial paper, debt securities or repurchase agreements). | Same. |

| (6) A Fund may invest in repurchase agreements and warrants and engage in futures and options transactions and securities lending. | Same. |

| (7) The Fund is not a “diversified company,” as that term is defined in the 1940 Act. | Same. |

The performance information shown below provides some indication of the risks of investing in each Fund by showing changes in the Funds’ performance from year to year and by showing how each Fund’s average annual returns compared with those of a broad measure of market performance. Past performance is not an indication of future performance.

The returns shown in the bar chart and table do not include charges imposed under the Contracts. If these amounts were reflected, returns would be less than those shown.

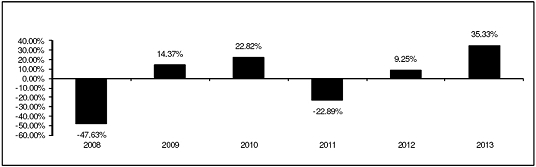

| Value Line Fund – Calendar Year Total Returns (Class A) |

| Best Quarter (ended 9/30/2010) | Worst Quarter (ended 09/30/2011) |

| 21.70% | -33.74% |

| Value Line Fund – Calendar Year Total Returns (Class B) |

| Best Quarter (ended 9/30/2010) | Worst Quarter (ended 09/30/2011) |

| 21.86% | -33.71% |

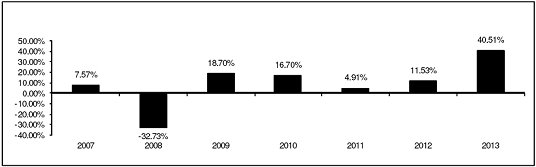

| S&P 24 Fund – Calendar Year Total Returns (Class A) |

| Best Quarter (ended 12/31/2013) | Worst Quarter (ended 12/31/2008) |

| 14.88% | -21.87% |

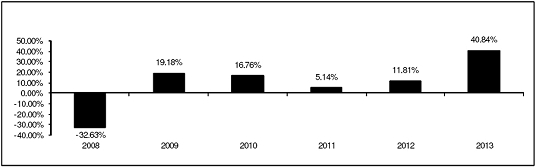

| S&P 24 Fund – Calendar Year Total Returns (Class B) |

| Best Quarter (ended 12/31/2013) | Worst Quarter (ended 12/31/2008) |

| 14.94% | -21.88% |

| Value Line Fund – Average Annual Total Returns as of December 31, 2013 |

| | 1 Year | 5 Year | Since Inception |

| Value Line Fund – Class A | 34.83% | 9.70% | 5.00%1 |

| Value Line Fund – Class B | 35.33% | 9.88% | -2.65%2 |

| S&P 500 Index | 32.39% | 17.94% | 7.65%3 |

1 Inception Date: October 4, 2004.

2 Inception Date: December 3, 2007.

3 As measured since October 4, 2004. Average annual total returns as of December 31, 2013 as measured since December 3, 2007 is 6.14%.

| S&P 24 Fund – Average Annual Total Returns as of December 31, 2013 |

| | 1 Year | 5 Year | Since Inception |

| S&P 24 Fund – Class A | 40.51% | 17.89% | 2.92%1 |

| S&P 24 Fund – Class B | 40.84% | 18.17% | 3.10%2 |

| S&P 500 Index | 32.39% | 17.94% | 7.65%3 |

1 Inception Date: May 1, 2006.

2 Inception Date: December 3, 2007.

3 As measured since May 1, 2006. Average annual total returns as of December 31, 2013 as measured since December 3, 2007 is 6.14%.

The following table shows the capitalization of each Fund as of June 30, 2014 and of the S&P 24 Fund on a pro forma combined basis as of June 30, 2014 after giving effect to the proposed Reorganization on that date. The actual net assets of the Value Line Fund and the S&P 24 Fund on the Closing Date will differ due to fluctuations in net asset values, subsequent purchases, and redemptions of shares. No assurance can be given as to how many shares of the S&P 24 Fund will be received by members of Value Line Fund on the Closing Date, and the following table should not be relied upon to reflect the number of shares of S&P 24 Fund that will actually be received.

| | Net Assets | Net Asset Value Per Share | Shares Outstanding |

| Value Line Fund – Class A | $820,941,355 | $16.88 | 48,648,015 |

| S&P 24 Fund – Class A | 812,784,408 | 14.77 | 55,047,536 |

| Adjustments | (156,945) (a) | | 6,923,035 (b) |

Pro forma S&P 24 Fund – Class A | 1,633,568,819 | 14.77 | 110,618,586 |

| Value Line Fund – Class B | 290,213 | 8.34 | 34,789 |

| S&P 24 Fund – Class B | 546,041 | 13.08 | 41,733 |

| Adjustments | (55) (a) | | (12,606) (b) |

Pro forma S&P 24 Fund – Class B | 836,198 | 13.08 | 63,916 |

| (a) | The costs and expenses associated with the Reorganization relating to preparing, filing, printing and mailing of material, disclosure documents and related legal fees, including the legal fees incurred in connection with the analysis under the Code of the taxability of this transaction and the preparation of the tax opinion, and obtaining a consent of independent registered public accounting firm will be borne by JNAM. It is currently anticipated that all of the Value Line Fund’s holdings will be liquidated in connection with the Reorganization. The proceeds of such liquidation will be reinvested in assets that are consistent with the S&P 24 Fund’s investment screens. The Value Line Fund will bear its proportionate share of the transaction expenses associated with the Reorganization. Such expenses are estimated to be $157,000. No sales or other charges will be imposed on Contract owners in connection with the Reorganization. Please see “Additional Information about the Reorganizations” below for more information. |

| (b) | The adjustment to the pro forma shares outstanding number represents an increase in Class A Shares outstanding and a decrease in the Class B Shares outstanding of the Value Line Fund to reflect the exchange of shares of the S&P 24 Fund. |

The Reorganization provides for the acquisition of all the assets and all the liabilities of the Value Line Fund by the members of the S&P 24 Fund. If the Reorganization had taken place on June 30, 2014, the members of the Value Line Fund would have received 55,571,050 and 22,183 Class A and Class B shares, respectively, of the S&P 24 Fund.

After careful consideration, the VF LLC’s Board of Managers unanimously approved the Plan of Reorganization with respect to the Value Line Fund.

* * * * *

The terms of the Plan of Reorganization are summarized below. The summary is qualified in its entirety by reference to the Plan, a copy of which is attached as Appendix A.

The assets of the Acquired Fund will be acquired by, and in exchange for, Class A shares and Class B shares, respectively, of the Acquiring Fund and the liabilities of the Acquired Fund will be assumed by the Acquiring Fund. The Acquired Fund will then be terminated by the VF LLC, and the Class A shares and Class B shares of the Acquiring Fund distributed to Class A and Class B members, respectively, of the Acquired Fund in the redemption of the Class A and Class B Acquired Fund shares. Immediately after completion of the Reorganization, the number of shares of the Acquiring Fund then held by former members of the Acquired Fund may be different than the number of shares of the Acquired Fund that had been held immediately before completion of the Reorganization, but the total investment will remain the same (i.e., the total value of each class of Acquiring Fund shares held immediately after the completion of the Reorganization will be the same as the total value of each class of Acquired Fund shares formerly held immediately before completion of the Reorganization).

It is anticipated that the Reorganization will be consummated as of the close of business on April 24, 2015, or on a later date the VF LLC decides upon (the “Closing Date”), subject to the satisfaction of all conditions precedent to the closing. It is not anticipated that the Acquired Fund will hold any investment that the Acquiring Fund would not be permitted to hold (“non-permitted investments”).

The members of the Acquired Fund will receive Class A or Class B shares of the Acquiring Fund in accordance with the procedures provided for in the Plan of Reorganization. Each such share will be fully paid and non-assessable by the VF LLC when issued and will have no preemptive or conversion rights. The Acquiring Fund is a series of the VF LLC.

The VF LLC may issue an unlimited number of full and fractional shares of beneficial interest of the Acquiring Fund and divide or combine such shares into a greater or lesser number of shares without thereby changing the proportionate beneficial interests in the VF LLC. Each share of the Acquiring Fund represents an equal proportionate interest in that Fund with each other share. The VF LLC reserves the right to create and issue any number of Acquiring Fund shares. In that case, the shares of the Acquiring Fund would participate equally in the earnings, dividends, and assets of the particular Fund. Upon liquidation of the Acquiring Fund, members are entitled to share pro rata in the net assets of such Fund available for distribution to members.

The VF LLC currently offers two classes of shares – Class A and Class B shares. The VF LLC has adopted, in the manner prescribed under Rule 12b-1 under the 1940 Act, a plan of distribution pertaining to the Class A shares of the Acquiring Fund. The maximum distribution and/or service (12b-1) fee for the Acquiring Fund’s Class A shares is equal to an annual rate of 0.20% of the average daily net assets attributable to those shares. Because these distribution/service fees are paid out of the Acquiring Fund’s assets on an ongoing basis, over time these fees will increase your cost of investing and may cost more than paying other types of charges.

At a meeting of the VF LLC’s Board of Managers held on January 13, 2015, JNAM recommended that the Board of Managers consider and approve the Reorganization. The Board of Managers requested, and JNAM provided, such information regarding the Reorganization as the Board determined to be necessary to evaluate the Reorganization. In connection with the Reorganization proposed by JNAM, the Managers, including the Managers who are not “interested persons” (as that term is defined in the 1940 Act) of the VF LLC (“Disinterested Managers”), considered the materials provided by JNAM and discussed the potential benefits to the members of the Acquired Fund under the proposed Reorganization. The Reorganization is part of a restructuring designed to eliminate the duplication of costs and other inefficiencies arising from offering overlapping funds with similar investment objectives and investment strategies that serve as investment options for the Contracts issued by the Insurance Companies and certain qualified and nonqualified plans. The Reorganization also seeks to increase assets under management in the Acquiring Fund and achieve economies of scale. The objective is to ensure that a consolidated family of investments offers a streamlined, complete, and competitive set of underlying investment options to serve the interests of members, Contract owners and plan participants.

In determining whether to approve the Reorganization with respect to the Acquired Fund and the Acquiring Fund, the Managers, including the Disinterested Managers, considered many factors, including:

| · | Investment Objectives and Investment Strategies. The Reorganization will permit the Contract owners with Contract values allocated to the Acquired Fund to continue to invest in a professionally managed fund having similar investment objectives to that of the Acquired Fund currently. The Value Line Fund seeks capital appreciation and the S&P 24 Fund seeks total return through capital appreciation. Although the Funds have similar investment objectives, they have different principal investment strategies. While each Fund invests primarily in common stocks, the investment sub-adviser to each Fund employs different methodologies for screening investment opportunities. Mellon Capital, the investment sub-adviser to each Fund, uses a different proprietary stock selection criteria to determine the holdings of each Fund. Thus, while shareholders of the Value Line Fund will be merged into a different Fund, they still will have access to investments procured through a specialized process run by the same sub-adviser. The Funds also have the same fundamental policies and restrictions. |

For a full description of key similarities of and differences between the investment objectives and investment strategies of the Acquired Fund and Acquiring Fund, see “Comparison of Investment Objectives, Policies and Strategies”.

| · | Operating Expenses. The proposed Reorganization will result in total annual fund operating expense ratios that are lower than those of the Acquired Fund currently. As set forth above, as of its most recent fiscal year end of December 31, 2013, the Acquired Fund had total annual fund operating expenses that were higher than the Acquiring Fund. See “Comparative Fee and Expense Tables.” |

| · | Larger Asset Base. The Reorganization would benefit Contract owners and others with beneficial interests in the Acquired Fund by allowing them to invest in a combined Fund with a substantially larger asset base than that of the Acquired Fund currently. As of June 30, 2014, the Value Line Fund had net assets of approximately $821 million as compared to net assets of approximately $813 million for the S&P 24 Fund. See “Capitalization.” JNAM informed the Managers that the combined Funds would realize greater economies of scale as a result of the larger asset base. |

| · | Performance. The Acquiring Fund has had better performance than the Acquired Fund recently. During calendar year 2013 the S&P 24 Fund returned 40.51% and 40.84% for Class A shares and Class B shares, respectively. By comparison, over the same time frame, the Value Line Fund returned 34.83% and 35.33% for Class A shares and Class B shares, respectively. JNAM also informed the Managers that the S&P 24 Fund has achieved its investment results with less volatility and that the combined Fund offers members better risk-adjusted performance. |

| · | Investment Adviser, Sub-Advisers and Other Service Providers. The Acquired Fund will retain the same investment adviser and other service providers under the Reorganizations as it has currently. The investment adviser for the Acquiring Fund, JNAM, is the same as for the Acquired Fund. The sub-adviser for the Acquiring Fund is Mellon Capital, which is also the sub-adviser for the Acquired Fund. See “Comparison of Investment Adviser and Sub-Adviser.” The custodian for the Acquiring Fund, J.P. Morgan Chase Bank, N.A., is the same as for the Acquired Fund and will remain the same immediately after the Reorganization, although the Aquiring Fund may change its custodian in the near future. The transfer agent for the Acquiring Fund, is the same as for the Acquired Fund and will remain the same after the Reorganization. The distributor for shares of the Acquiring Fund, Jackson National Life Distributors LLC, is the same as for the Acquired Fund and will remain the same after the Reorganization. |

| · | Tax Consequences of Reorganization. Contract owners are not expected to have adverse tax consequences as a result of the Reorganization. Although the Reorganization will be a taxable transaction for the Funds, the Reorganization is not expected to result in any material adverse federal income tax consequences to shareholders of the Acquired Fund that are Separate Accounts, in light of their tax-favored status. |

| · | Costs of Reorganization. The costs and expenses associated with the Reorganization relating to preparing, filing, printing and mailing of material, disclosure documents and related legal fees, including the legal fees incurred in connection with the analysis under the Code of the taxability of this transaction and the preparation of the tax opinion, and obtaining a consent of independent registered public accounting firm will be borne by JNAM. It is currently anticipated that all of the Value Line Fund’s holdings will be liquidated in connection with the Reorganization. The proceeds of such liquidation will be reinvested in assets that are consistent with the |

S&P 24 Fund’s investment screens. The Value Line Fund will bear its proportionate share of the transaction expenses associated with the Reorganization. Such expenses are estimated to be $157,000. No sales or other charges will be imposed on Contract owners in connection with the Reorganization.

In summary, in determining whether to recommend approval of the Reorganization, the Board of Managers, including the Disinterested Managers, each separately considered a variety of factors including (1) the terms and conditions of the Reorganization and whether the Reorganization would result in dilution of members, Contract owners' and plan participants' interests; (2) the compatibility of the Funds' investment objectives, investment strategies and investment restrictions, as well as shareholder services offered by the Funds; (3) the expense ratios and information regarding the fees and expenses of the Funds; (4) the advantages and disadvantages to members, Contract owners and plan participants of having a larger asset base in the combined Fund; (5) the relative historical performance of the Funds; (6) the management of the Funds; (7) the federal tax consequences to Contract owners of the Reorganization; and (8) the costs of the Reorganization.

JNAM also advised the Board of Managers that the VF LLC’s Operating Agreement and applicable state law do not require member approval of the Reorganization. Moreover, JNAM advised the Managers that Rule 17a-8 under 1940 Act does not require member approval of the Reorganization because there is no material difference between the investment policies that under Section 13 of the 1940 Act could not be changed without a vote of a majority of its outstanding voting securities of the Acquired Fund and the Acquiring Fund, there is no material difference between the respective advisory and sub-advisory contracts, and the distribution fees permitted under the VF LLC’s Rule 12b-1 Plan are the same for both Funds.

For the reasons described above, the VF LLC’s Board of Managers, including all of its Disinterested Managers, determined that the Reorganization would be in the best interests of the Acquired Fund, and that the interests of the Acquired Fund’s Contract owners and other investors would not be diluted as a result of effecting the Reorganization. At the Board meeting held on January 13, 2015, the Board voted unanimously to approve the proposed Reorganization. In addition, the Board of Managers determined that because applicable legal requirements do not require member approval under these circumstances, members would not be asked to vote on the Reorganization.

A Fund’s performance may be affected by one or more risk factors. For a detailed description of a Fund’s risk factors, please see Appendix B “More Information on Strategies and Risk Factors.”

The Reorganization is not expected to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), but instead will be treated as a taxable sale of assets by the Acquired Fund to the Acquiring Fund.

Contract owners with premiums or contributions allocated to the investment divisions of the Separate Accounts as well as others that are invested in Acquired Fund shares generally will not recognize gain or loss for Federal income tax purposes as a result of the Reorganization.

Contract owners and other investors are urged to consult their tax advisers as to the specific consequences to them of the Reorganization, including the applicability and effect of state, local, foreign and other taxes.

This section provides information about the VF LLC, the Manager and the Sub-Adviser for the Acquiring Fund.

The VF LLC is organized as a Delaware limited liability company and is registered with the SEC as an open-end management investment company. Under Delaware law and the VF LLC’s Certificate of Formation and Operating Agreement, the management of the business and affairs of the VF LLC is the responsibility of the Board of Managers of the VF LLC.

Jackson National Asset Management, LLCSM (“JNAM®” or the “Adviser”), 1 Corporate Way, Lansing, Michigan 48951, is the investment adviser to the VF LLC and provides the VF LLC with professional investment supervision and management. The Adviser is a wholly owned subsidiary of Jackson National, which is in turn a wholly owned subsidiary of Prudential plc, a publicly traded company incorporated in the United Kingdom. Prudential plc is not affiliated in any manner with Prudential Financial Inc., a company whose principal place of business is in the United States of America. Prudential plc is also the ultimate parent of Curian Capital, LLC, the sponsor of investment companies that are in the same group of investment companies as the VF LLC, PPM America, Inc. and Eastspring Investments (Singapore) Limited.

JNAM acts as investment adviser to the VF LLC pursuant to an Investment Advisory and Management Agreement. The Investment Advisory and Management Agreement continues in effect for each Fund from year to year after its initial two-year term so long as its continuation is approved at least annually by (i) a majority of the VF LLC who are not parties to such agreement or interested persons of any such party except in their capacity as Managers of the VF LLC, and (ii) the members of the affected Fund or the Board of Managers. It may be terminated at any time upon 60 days notice by the Adviser, the VF LLC, or by a majority vote of the outstanding shares of a Fund with respect to that Fund, and will terminate automatically upon assignment. Additional Funds may be subject to a different agreement. The Investment Advisory and Management Agreement provides that the Adviser shall not be liable for any error of judgment, or for any loss suffered by any Fund in connection with the matters to which the agreement relates, except a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its obligations and duties, or by reason of its reckless disregard of its obligations and duties under the agreement.

The Adviser and the VF LLC, together with other investment companies of which the Adviser is investment adviser, have been granted an exemption from the SEC that allows the Adviser to hire, replace or terminate unaffiliated sub-advisers with the approval of the Board of Managers, but without the approval of members. The order allows the Adviser to materially amend a sub-advisory agreement with unaffiliated sub-advisers with the approval of the Board of Managers, but without members approval. However, any amendment to an advisory agreement between the Adviser and the VF LLC that would result in an increase in the management fee rate specified in that agreement (i.e., the aggregate management fee) charged to a Fund will be submitted to members for approval. Under the terms of the exemption, if a new sub-adviser is hired by the Adviser, members in the affected Fund will receive information about the new sub-adviser within 90 days of the change. The order allows the Funds to operate more efficiently and with greater flexibility. The Adviser provides the following oversight and evaluation services to the Funds, including, but not limited to the following services: performing initial due diligence on prospective sub-advisers for the Funds; monitoring the performance of sub-advisers; communicating performance expectations to the sub-advisers; and ultimately recommending to the Board of Managers whether a sub-adviser’s contract should be renewed, modified or terminated.

As compensation for its services, the Adviser receives a fee from the VF LLC computed separately for the Acquiring Fund, accrued daily and payable monthly. The fee the Adviser receives from the Acquiring Fund is set forth below as an annual percentage of the net assets of the Acquiring Fund.

| Acquiring Fund | Assets | Advisory Fee (Annual Rate Based on Average Net Assets) |

| S&P 24 Fund | $0 to $50 million $50 to $100 million $100 to $750 million Over $750 million | 0.34% 0.31% 0.28% 0.27% |

The Adviser selects, contracts with and compensates sub-advisers to manage the investment and reinvestment of the assets of the Funds of the VF LLC. The Adviser monitors the compliance of such sub-advisers with the investment objectives and related policies of each Fund and reviews the performance of such sub-advisers and reports periodically on such performance to the Board of Managers of the VF LLC. Under the terms of each of the Sub-Advisory Agreements, the sub-adviser manages the investment and reinvestment of the assets of the assigned Fund, subject to the supervision of the Board of Managers of the VF LLC. The sub-adviser formulates a continuous investment program for each such Fund

consistent with its investment objectives and policies outlined in its Prospectus. Each sub-adviser, implements such programs by purchases and sales of securities. Each sub-adviser regularly reports to the Adviser and the Board of Managers of the VF LLC with respect to the implementation of such programs. As compensation for its services, each sub-adviser receives a fee from the Adviser computed separately for the applicable Fund, stated as an annual percentage of the net assets of such Fund.

In addition to the investment advisory fee, the Acquiring Fund pays to JNAM (“Administrator”) an Administrative Fee as an annual percentage of the average daily net assets of the Fund as set forth below.

| Acquiring Fund | Assets | Administrative Fee (Annual Rate Based on Average Net Assets) |

| S&P 24 Fund | All Assets | 0.15% |

In return for the Administrative Fee, the Administrator provides or procures all necessary administrative functions and services for the operation of the Funds. In addition, the Administrator, at its own expense, arranges and pays for routine legal, audit, fund accounting, custody (except overdraft and interest expense), printing and mailing, a portion of the Chief Compliance Officer costs and all other services necessary for the operation of each Fund. Each Fund is responsible for trading expenses including brokerage commissions, interest and taxes, and other non-operating expenses. Each Fund is also responsible for nonrecurring and extraordinary legal fees, interest expenses, registration fees, licensing costs, a portion of the Chief Compliance Officer costs, directors and officers insurance, the fees and expenses of the disinterested Managers and of independent legal counsel to the disinterested Managers (categorized as “Other Expenses” in the fee tables).

The Acquiring Fund’s investments are selected by Mellon Capital Management Corporation (“Mellon Capital”), the sub-adviser. The following table describes the Acquiring Fund’s sub-adviser, portfolio managers and the portfolio managers’ business experience. Information about the portfolio managers’ compensation, other accounts they manage and their ownership of securities of the Acquiring Fund is available in the VF LLC’s Statement of Additional Information dated April 28, 2014, as supplemented.

| Acquiring Fund | Sub-Adviser & Portfolio Manager | Business Experience |

| S&P 24 Fund | Mellon Capital 50 Fremont Street, Suite 3900, San Francisco, California 94105 Karen Q. Wong, CFA Richard A. Brown, CFA Thomas Durante, CFA | Karen Q. Wong, CFA is a Managing Director, Head of Equity Portfolio Management at Mellon Capital. Ms. Wong joined Mellon Capital in 2000 as an associate portfolio manager. In 2001 she was promoted to a senior associate, in 2003 to an assistant vice president, in 2004 to a vice president and in 2006 to a director. Ms. Wong heads a team of portfolio managers covering domestic and international passive equity funds. Ms. Wong holds a M.B.A. from San Francisco State University. Ms. Wong has 15 years of investment experience. Ms. Wong is a member of the CFA Institute and the CFA Society of San Francisco. Richard A. Brown, CFA, has been a Director, Equity Portfolio Management at Mellon Capital since 2002. Mr. Brown holds an M.B.A. from California State University at Hayward. Mr. Brown joined Mellon Capital in 1995 as senior associate portfolio manager, was promoted to Vice President in 1998, and to his current position in 2002. Mr. Brown heads a team of portfolio managers covering domestic and international passive equity funds. Mr. Brown has 18 years of investment experience. Mr. Brown is a member of CFA Institute, formerly the Association for Investment Management and Research (“AIMR”), and the CFA Society of San Francisco. Mr. Brown |

| | | has been a manager of the Fund since its inception. Thomas Durante, CFA, Managing Director, Equity Portfolio Management has been at Mellon Capital since 2000. Mr. Durante holds a B.A. degree from Fairfield University in Accounting. Mr. Durante has 31 years of investment experience, and 14 years at Mellon Capital Management. Mr. Durante heads a team of portfolio managers covering domestic and international index portfolios. He is responsible for the refinement and implementation of the equity portfolio manager process. Prior to joining Mellon Equity Associates, LLP, he worked in the fund accounting department for Dreyfus. Mr. Durante is a member of the CFA Institute and the CFA Society of Pittsburgh. Mr. Durante has been a manager of the Fund since 2010. |

The VF LLC has adopted a multi-class plan pursuant to Rule 18f-3 under the 1940 Act. Under the multi-class plan, the Acquiring Fund has two classes of shares, Class A and Class B. The Class A shares and Class B shares of the Acquiring Fund represent interests in the same portfolio of securities, and will be substantially the same except for “class expenses.” The expenses of the Acquiring Fund will be borne by each Class of shares based on the net assets of the Fund attributable to each Class, except that class expenses will be allocated to each Class. “Class expenses” will include any distribution or administrative or service expense allocable to the appropriate Class and any other expense that JNAM determines, subject to ratification or approval by the Board, to be properly allocable to that Class, including: (i) printing and postage expenses related to preparing and distributing to the members of a particular Class (or Contract owners funded by shares of such Class) materials such as Prospectuses, member reports and (ii) professional fees relating solely to one Class.

The VF LLC has adopted, in accord with the provisions of Rule 12b-1 under the 1940 Act, a Distribution Plan (“Plan”). The Board of Managers, including all of the Independent Managers, must approve, at least annually, the continuation of the Plan. Under the Plan, each Fund will pay a Rule 12b-1 fee at an annual rate of up to 0.20% of the Fund’s average daily net assets attributed to Class A interests, to be used to pay or reimburse distribution and administrative or other service expenses with respect to Class A interests. Jackson National Life Distributors LLC (the “Distributor”), as principal underwriter, to the extent consistent with existing law and the Plan, may use the Rule 12b-1 fee to reimburse fees or to compensate broker-dealers, administrators, or others for providing distribution, administrative or other services.

The Distributor also has the following relationships with the sub-advisers and their affiliates. The Distributor receives payments from certain of the sub-advisers to assist in defraying the costs of certain promotional and marketing meetings in which they participate. The amounts paid depend on the nature of the meetings, the number of meetings attended, the costs expected to be incurred, and the level of the sub-adviser’s participation. A brokerage affiliate of the Distributor participates in the sales of shares of retail mutual funds advised by certain of the sub-advisers and receives selling and other compensation from them in connection with those activities, as described in the prospectus or statement of additional information for those funds. In addition, the Distributor acts as distributor of the Contracts issued by the Insurance Companies.

Only Separate Accounts, registered investment companies, and qualified and certain non-qualified plans of the Insurance Companies may purchase shares of the Acquiring Fund. If an investor invests in the Fund under a Contract or a plan that offers a Contract as a plan option through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and the salesperson to recommend the Fund over another investment.

Shares of the VF LLC are currently sold to Separate Accounts of the Insurance Companies to fund the benefits under certain Contracts; to qualified and certain unqualified retirement plans; and to other regulated investment companies that in turn are sold to Separate Accounts. The Separate Accounts, through their various sub-accounts, invest in designated Funds and purchase and redeem the shares of the Funds at their NAV. There is no sales charge.

Shares of the Acquiring Fund are not available to the general public directly. The Acquiring Fund is managed by a sub-adviser who also may manage publicly available mutual funds having similar names and investment objectives. While the Acquiring Fund may be similar to, and may in fact be modeled after, publicly available mutual funds, purchasers should understand that the Acquiring Fund is not otherwise directly related to any publicly available mutual fund. Consequently, the investment performance of publicly available mutual funds and the Acquiring Fund may differ substantially.

The NAV per share of the Acquiring Fund is determined at the close of regular trading on the New York Stock Exchange (normally 4:00 p.m., Eastern time) each day that the New York Stock Exchange is open. Calculations of the NAV per share of the Acquiring Fund may be suspended by the VF LLC’s Board of Managers. The NAV per share is calculated by adding the value of all securities and other assets of a Fund, deducting its liabilities, and dividing by the number of shares outstanding. Generally, the value of exchange-listed or -traded securities is based on their respective market prices, bonds are valued based on prices provided by an independent pricing service and short-term debt securities are valued at amortized cost, which approximates market value.

The Board of Managers has adopted procedures pursuant to which the Adviser may determine, subject to Board verification, the “fair value” of a security for which a current market price is not available or the current market price is considered unreliable or inaccurate. Under these procedures, in general the “fair value” of a security shall be the amount, determined by the Adviser in good faith that the owner of such security might reasonably expect to receive upon its current sale.

The Board of Managers has established a pricing committee to review fair value determinations. The pricing committee will also review restricted and illiquid security values, securities and assets for which a current market price is not readily available, and securities and assets for which there is reason to believe that the most recent market price does not accurately reflect current value (e.g., disorderly market transactions) and determine/review fair values pursuant to the “Pricing Policies and Procedures” adopted by the Board of Managers of the VF LLC.

The Acquiring Fund may invest in securities primarily listed on foreign exchanges and that trade on days when the Acquiring Fund does not price its shares. As a result, the Acquiring Fund’s NAV may change on days when members are not able to purchase or redeem the Acquiring Fund’s shares.

Because the calculation of the Acquiring Fund’s NAV does not take place contemporaneously with the determination of the closing prices of the majority of foreign portfolio securities used in the calculation, there exists a risk that the value of foreign portfolio securities will change after the close of the exchange on which they are traded, but before calculation of the Acquiring Fund’s NAV (“time-zone arbitrage”). Accordingly, the VF LLCs procedures for pricing of portfolio securities also authorize the Adviser, subject to verification by the Managers, to determine the “fair value” of such foreign securities for purposes of calculating the Acquiring Fund’s NAV. When fair valuing such foreign securities, the Adviser will adjust the closing prices of all foreign securities held in the Acquiring Fund’s portfolio, based upon an adjustment factor for each such security provided by an independent pricing service, in order to reflect the “fair value” of such securities for purposes of determining the Acquiring Fund’s NAV. When fair-value pricing is employed, the foreign securities prices used to calculate the Acquiring Fund’s NAV may differ from quoted or published prices for the same securities.

These procedures seek to minimize the opportunities for time zone arbitrage in Acquiring Fund that invest all or substantial portions of their assets in foreign securities, thereby seeking to make that Fund significantly less attractive to “market timers” and other investors who might seek to profit from time zone arbitrage and seeking to reduce the potential for harm to other Fund investors resulting from such practices. However, these procedures may not completely eliminate opportunities for time zone arbitrage, because it is not possible to predict in all circumstances whether post-closing events will have a significant impact on securities prices.

All investments in the VF LLC are credited to the member’s account in the form of full and fractional shares of the designated Fund (rounded to the nearest 1/1000 of a share). The VF LLC does not issue share certificates.

The interests of the Acquiring Fund’s long-term members may be adversely affected by certain short-term trading activity by other Contract owners invested in the Separate Accounts. Such short-term trading activity, when excessive, has the potential to interfere with efficient portfolio management, generate transaction and other costs, dilute the value of Acquiring Fund shares held by long-term members and have other adverse effects on the Acquiring Fund. This type of excessive short-term trading activity is referred to herein as “market timing.” The Acquiring Fund is not intended as a vehicle for market timing. The Board of Managers has adopted the policies and procedures set forth below with respect to frequent trading of Acquiring Fund shares.

The Acquiring Fund, directly and through its service providers, and the insurance company and qualified retirement plan service providers (collectively, “service providers”) with the cooperation of the insurance companies takes various steps designed to deter and curtail market timing. For example, regarding round trip transfers, redemptions by a member from a sub-account investing in the Acquiring Fund is permitted; however, once a complete or partial redemption has been made from a sub-account that invests in the Acquiring Fund, through a sub-account transfer, members will not be permitted to transfer any value back into that sub-account (and corresponding Acquiring Fund) within fifteen (15) calendar days of the redemption. We will treat as short-term trading activity any transfer that is requested into a sub-account that was previously redeemed within the previous fifteen (15) calendar days, whether the transfer was requested by the members or a third party authorized by the member. The Insurance Companies have entered into agreements with the VF LLC to provide upon request certain information on the trading activities of contract owners in an effort to help curtail market timing.

In addition to identifying any potentially disruptive trading activity, the Acquiring Fund’s Board of Managers has adopted a policy of “fair value” pricing to discourage investors from engaging in market timing or other excessive trading strategies for the Acquiring Fund. The VF LLC’s “fair value” pricing policy applies to all Funds where a significant event has occurred. The Acquiring Fund’s “fair value” pricing policy is described under “Investment in VF LLC Shares” above.