As filed with the Securities and Exchange Commission on September 16, 2003

Registration No. 333-100655

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

Amendment No. 7 to

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

KINGSWAY FINANCIAL SERVICES INC.

(Exact name of registrant as specified in its charter)

| Ontario | | Not Applicable |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| |

5310 Explorer Drive, Suite 200 Mississauga, Ontario L4W 5H8 (905) 629-7888 | | Mr. James R. Zuhlke Kingsway America Inc. 1515 Woodfield Road, Suite 820 Schaumburg, Illinois 60173 (847) 619-7610 |

(Address and telephone number of Registrant’s principal executive offices) | | (Name, address and telephone number of agent for service) |

KINGSWAY AMERICA INC.

KINGSWAY U.S. FUNDING INC.

KINGSWAY FINANCIAL CAPITAL TRUST I

(Exact name of registrant as specified in its charter)

| Delaware | | 98-0180930 30-0121682 57-6195377 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| |

c/o Kingsway America Inc. 1515 Woodfield Road, Suite 820 Schaumburg, Illinois 60173 (847) 619-7610 | | Mr. James R. Zuhlke Kingsway America Inc. 1515 Woodfield Road, Suite 820 Schaumburg, Illinois 60173 (847) 619-7610 |

(Address and telephone number of Registrant’s principal executive offices) | | (Name, address and telephone number of agent for service) |

Copies to:

Janet O. Love, Esq. Lord, Bissell & Brook 115 South LaSalle Street Chicago, Illinois 60603 (312) 443-0700 | | William R. Kunkel, Esq. Skadden, Arps, Slate, Meagher & Flom (Illinois) 333 West Wacker Drive Chicago, Illinois 60606 (312) 407-0700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 15, 2003

PROSPECTUS

2,000,000 Trust Preferred Securities

Kingsway Financial Capital Trust I

US$50,000,000

% Trust Preferred Securities

(US$25 liquidation amount per trust preferred security)

Fully and Unconditionally Guaranteed by

Kingsway Financial Services Inc.

Kingsway Financial Capital Trust I will sell trust preferred securities to the public. Each trust preferred security represents a corresponding amount of the junior subordinated debentures issued by Kingsway U.S. Funding Inc. and the related rights under the debenture guarantee and the preferred securities guarantee of Kingsway Financial Services Inc. Kingsway Financial Capital Trust I will use the proceeds from the sale of the trust preferred securities to buy the junior subordinated debentures issued by Kingsway U.S. Funding Inc.

Kingsway Financial Capital Trust I will pay you quarterly cumulative cash distributions on the trust preferred securities at an annual rate equal to % on the liquidation amount of US$25 per trust preferred security, beginning on , 2003 from payments on the debentures. Kingsway U.S. Funding Inc. can defer interest payments on the debentures one or more times for up to a maximum of 20 consecutive quarterly periods per deferral period. If it defers interest payments, Kingsway Financial Capital Trust I will defer distribution payments to the holders of the trust preferred securities. The debentures mature, and the trust preferred securities must be redeemed by, , 2033. Kingsway Financial Capital Trust I may redeem all or some of the trust preferred securities at any time, and for any reason, on or after , 2008 or all, but not some, of the trust preferred securities at any time before , 2008 under some circumstances, at a redemption price equal to US$25 per trust preferred security, plus accumulated interest, if any, as described in this prospectus.

The trust preferred securities have been approved for listing on the New York Stock Exchange under the symbol “KFS PrA.”

Investing in the trust preferred securities involves risks. See “Risk Factors” beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

| | Per Preferred Security

| | Total

|

Public offering price | | US$25.00 | | US$50,000,000 |

|

Proceeds to the Kingsway Financial Capital Trust I | | US$25.00 | | US$50,000,000 |

|

Underwriting commissions (1) | | US$ | | US$ |

|

Proceeds (before expenses) to Kingsway U.S. Funding Inc. | | US$ | | US$ |

|

| (1) | | Kingsway U.S. Funding Inc. will pay the underwriters’ commission for the sale of the trust preferred securities to the public and Kingsway Financial Capital Trust I will use all proceeds from the sale of the trust preferred securities to invest in Kingsway U.S. Funding Inc.’s debentures. |

Kingsway Financial Capital Trust I has granted the underwriters a 30-day option to purchase up to 300,000 additional trust preferred securities at US$25 per trust preferred security to cover over-allotments.

The underwriters are offering the trust preferred securities to you. The underwriters will only sell the trust preferred securities after they have purchased the trust preferred securities from Kingsway Financial Capital Trust I. The underwriters entirely or partially may reject any order for trust preferred securities and they may withdraw, cancel or modify the offering without giving you any notice. The underwriters expect to deliver the trust preferred securities against payment therefor in book-entry form through The Depository Trust Company on or about , 2003.

Advest, Inc.

Ferris, Baker Watts

Incorporated

Keefe, Bruyette & Woods, Inc.

Raymond James

Sandler O’Neill & Partners, L.P.

Putnam Lovell NBF Securities Inc.

RBC Capital Markets

The date of this prospectus is , 2003.

PROSPECTUS SUMMARY

This summary highlights only some of the information contained in this prospectus and does not contain all of the information that may be important to you in deciding whether to purchase the trust preferred securities. You should carefully read the entire prospectus and the documents that we have filed with the Securities and Exchange Commission, or SEC, that are incorporated by reference into this prospectus, prior to deciding whether to invest in the trust preferred securities. You should pay special attention to the section of this prospectus entitled “Risk Factors” beginning on page 12 to determine whether an investment in the trust preferred securities is appropriate for you. You may obtain the information incorporated by reference into this prospectus without charge by following the instructions under “Where You Can Find More Information” beginning on page 121.

Unless otherwise specified in this prospectus, “Kingsway Financial,” refers to Kingsway Financial Services Inc., a holding company incorporated under the laws of Ontario, Canada; “Kingsway,” “we,” “our” and “us” refer to Kingsway Financial and its consolidated subsidiaries; “Kingsway America” refers to Kingsway America Inc., the U.S. holding company for all of our U.S. subsidiaries; “Funding Co.” refers to Kingsway U.S. Funding Inc.; the “Trust” refers to Kingsway Financial Capital Trust I; and “you” and “yours” refer to the holders of the applicable securities.

All of the dollar amounts in this prospectus are expressed in Canadian dollars, except where otherwise indicated. References to “Canadian dollars,” “dollars,” “C$” or “$” are to Canadian dollars and any references to “U.S. dollars” or “US$” are to U.S. dollars. As presented in this prospectus, our combined ratios for our Canadian and U.S. segment information include the results of our Bermuda and Barbados reinsurance subsidiaries, respectively.

The Offering

What are the trust preferred securities?

Each trust preferred security represents an undivided beneficial interest in the assets of the Trust. The underwriters are offering 2,000,000 trust preferred securities at a public offering price of US$25 for each trust preferred security. The underwriters may also purchase up to an additional 300,000 trust preferred securities at the public offering price within 30 days after the date of this prospectus to cover any over-allotments.

Who is the Trust?

The Trust is a Delaware statutory trust. The Trust will sell its preferred securities to the public and its common securities to Funding Co. The Trust will use the proceeds from these sales to buy a series of % junior subordinated debentures due 2033 from Funding Co. with the same economic terms as the trust preferred securities. Kingsway Financial will fully and unconditionally guarantee payments of principal and interest on the debentures and the payment of principal and interest on the trust preferred securities to the extent described in this prospectus. The Trust’s assets will consist solely of the debentures and payments received on the debentures.

There are five trustees of the Trust. The three administrative trustees will initially be James R. Zuhlke, Brian K. Williamson and Kelly A. Marketti, each of whom is an officer or employee of Kingsway America. BNY Midwest Trust Company will act as the property trustee of the Trust and The Bank of New York (Delaware) will act as the Delaware trustee.

Who are Kingsway, Kingsway Financial, Kingsway America and Funding Co.?

Kingsway is a specialty provider of personal and commercial lines of property and casualty insurance in the United States and Canada. Kingsway Financial is a holding company incorporated under the laws of Ontario, Canada. Kingsway America is a wholly owned subsidiary of Kingsway Financial and is the U.S. holding company for all of our U.S. subsidiaries. Funding Co. is a wholly owned subsidiary of Kingsway America and was established as a financing entity to raise funds for our U.S. operations. Funding Co. will use the proceeds from the sale of the debentures to the Trust to buy subordinated notes issued by Kingsway America that have economic terms substantially similar to the debentures.

1

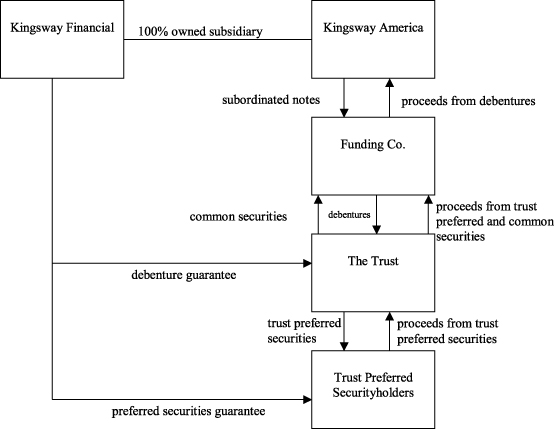

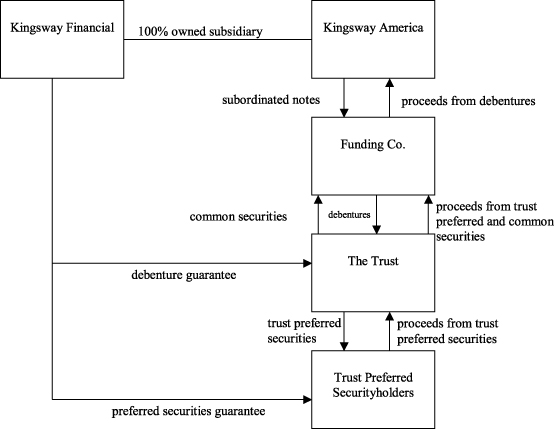

What transactions will take place between Kingsway Financial, Kingsway America, Funding Co., the Trust and you as holders of the trust preferred securities in connection with this offering?

The offering will consist of the following transactions, which will occur simultaneously:

| | • | | The Trust will issue the common securities of the Trust to Funding Co. The Trust will publicly offer the trust preferred securities to you. The Trust will use the proceeds from the offering and sale of the trust preferred securities and the common securities to purchase the debentures from Funding Co. |

| | • | | Funding Co. will use all of the proceeds from the sale of its debentures to purchase subordinated notes from Kingsway America. |

| | • | | Kingsway Financial will issue the preferred securities guarantee and the debenture guarantee. |

| | • | | Kingsway America will issue the subordinated notes. |

The following diagram outlines the relationships among Kingsway Financial, Kingsway America, Funding Co., the Trust and you as holders of the trust preferred securities after completion of this offering.

When will you receive quarterly distributions on the trust preferred securities?

If you purchase the trust preferred securities, you will be entitled to receive cumulative cash distributions at an annual rate of % of the liquidation amount of US$25 per preferred security. Distributions will accumulate from the date the Trust issues the trust preferred securities and will be paid quarterly in arrears on March 31, June 30, September 30 and December 31 of each year, beginning with the first such date after issuance.

2

When can payment of distributions on the trust preferred securities be deferred?

Funding Co. may, on one or more occasions, defer interest payments on the debentures for up to a maximum of 20 consecutive quarterly periods per deferral period, unless an event of default under the indenture has occurred and is continuing. At the end of an interest deferral period, upon payment of all accrued and unpaid interest then due and assuming that no event of default has occurred and is continuing under the indenture, Funding Co. may again elect to defer interest payments for up to 20 consecutive quarterly periods. As long as no default under the indenture has occurred and is continuing, there is no limit to the number of times that interest can be deferred, except that a deferral of interest payments cannot extend beyond the scheduled maturity date of the debentures (which is , 2033).

Kingsway America’s payments of principal and interest payable under the subordinated notes that will be issued to Funding Co. will be Funding Co.’s only source of funds. The subordinated notes will be unsecured and will rank junior to all of Kingsway America’s senior debt, including indebtedness that Kingsway America may incur in the future. Kingsway America may, on one or more occasions, defer interest payments on the subordinated notes for up to a maximum of 20 consecutive quarterly periods per deferral period, unless an event of default under the subordinated notes has occurred and is continuing. At the end of an interest deferral period, upon payment of all accrued and unpaid interest then due and assuming that no event of default has occurred and is continuing under the subordinated notes, Kingsway America may again elect to defer interest payments for up to 20 consecutive quarterly periods. As long as no event of default under the subordinated notes has occurred and is continuing, there is no limit to the number of times that interest can be deferred, except that a deferral of interest payments cannot extend beyond the scheduled maturity date of the subordinated notes (which is , 2033).

If Kingsway America defers interest payments on its subordinated notes issued to Funding Co., Funding Co. will defer interest payments on the debentures, and the Trust will defer its distributions on the trust preferred securities. During this deferral period, distributions will continue to accumulate on the trust preferred securities at an annual rate of % of the liquidation amount of US$25 per trust preferred security. Also, the deferred distributions will themselves accumulate distributions at an annual rate of % to the extent permitted by law. Once Funding Co. makes all deferred interest payments on the debentures, with accrued interest, the Trust will then pay all accumulated and unpaid distributions to you. Funding Co. may again defer interest payments on the debentures if no event of default under the indenture has occurred and is continuing.

During any period in which Funding Co. defers interest payments on the debentures (or if a default under the indenture has occurred and is continuing), subject to limited exceptions, neither Funding Co. nor Kingsway Financial will be permitted to:

| | • | | declare or pay a dividend or distribution on any of its outstanding capital stock; |

| | • | | redeem, purchase, acquire or make a liquidation payment with respect to any of its outstanding capital stock; |

| | • | | make or permit any subsidiary to make, a principal, premium or interest payment (other than payments under the subordinated notes) on, or repay, repurchase or redeem, any debt security that ranks equally with or junior to the debentures, Kingsway Financial’s guarantee of the debentures or the subordinated notes, as the case may be; or |

| | • | | make or permit any subsidiary to make, any guarantee payments with respect to any guarantee of any debt security (other than payments under the debenture guarantee and the preferred securities guarantee), if such guarantee ranks equally with or junior to the debentures or the debenture guarantee, as the case may be. |

3

During any period in which Kingsway America defers interest payments on the subordinated notes, it will be subject to the same restrictions enumerated above, except that it would be permitted to declare and pay dividends to Kingsway Financial and any wholly-owned subsidiary of Kingsway Financial.

If a deferral of payment occurs, you will still be required to recognize the deferred amounts as income for U.S. federal income tax purposes in advance of receiving cash relating to these amounts, even if you are a cash-basis taxpayer.

When can the Trust redeem the trust preferred securities?

The Trust will redeem all of the outstanding trust preferred securities when the debentures are paid at maturity on , 2033. Funding Co. has the option, however, to redeem the debentures at any time on or after , 2008 and up to 90 days prior to , 2033. In addition, Funding Co. may redeem, at any time, all of the debentures if:

| | • | | there is a change in existing laws or regulations, or new official administrative or judicial interpretation or application of these laws and regulations, that causes the interest that Funding Co. pays on the debentures to no longer be deductible for U.S. federal income tax purposes; |

| | • | | the Trust becomes subject to U.S. federal income tax; |

| | • | | the Trust becomes or will become subject to more than an immaterial amount of other taxes or governmental charges; or |

| | • | | there is a change in existing laws or regulations that requires the Trust to register as an investment company under the Investment Company Act of 1940. |

We may also redeem the debentures at any time, and from time to time, in an amount equal to the liquidation amount of any trust preferred securities that we purchase, plus a proportionate amount of common securities, but only in exchange for a like amount of the trust preferred securities and common securities then owned by us.

If your trust preferred securities are redeemed by the Trust, you will receive the liquidation amount of US$25 per trust preferred security, plus any accrued and unpaid distributions to the date of redemption.

What is the nature of Kingsway Financial’s guarantee of the trust preferred securities and the debentures and when will it be required to make payments on the guarantee?

Kingsway Financial will fully and unconditionally guarantee all payments to the Trust under the debentures and will guarantee all payments from the Trust on the trust preferred securities to the extent that there are funds in the Trust for those payments. These two guarantees, together with Kingsway Financial’s other obligations and the rights of the debenture holders and trust preferred holders under the indenture and the trust agreement, in the aggregate, constitute a full, irrevocable and unconditional guarantee by Kingsway Financial on a subordinated basis, of the obligations of the Trust under the trust preferred securities and of the obligations of Funding Co. under the debentures.

The proceeds from the sale of the debentures by Funding Co. to the Trust will be loaned to Kingsway America in exchange for subordinated notes issued by Kingsway America, that have economic terms substantially similar to the terms of the debentures. If Kingsway America defaults on its payments under the subordinated notes, Funding Co. will not have sufficient funds to make payments under the debentures to the Trust and, in the absence of a permitted deferral of interest payments, Kingsway Financial’s debenture guarantee would then obligate it to make or cause Funding Co. to make the debenture payments to the Trust. To the extent there are funds in the Trust, Kingsway Financial’s preferred securities guarantee would obligate it to make or cause the Trust to make related payments under the trust preferred securities. The subordinated notes will rank junior in priority of payment to all of Kingsway America’s senior debt. If Kingsway America defaults on any of its senior debt, it will be prohibited from making payments on the subordinated notes. If Kingsway America experiences a business downturn or a cash shortage, its ability to make payments on the subordinated notes will also be adversely affected. Kingsway Financial’s obligations under the debenture guarantee and the preferred securities guarantee rank junior in priority of payment to all of Kingsway Financial’s senior debt.

4

When can the debentures be distributed to you?

Funding Co., as the depositor of the Trust, has the right to dissolve the Trust at any time. If Funding Co. exercises this right to dissolve the Trust, after satisfaction of any creditors of the Trust in accordance with applicable law, the Trust will be liquidated by distribution of the debentures to holders of the trust preferred securities and the common securities.

What happens if the Trust is dissolved and the debentures are not distributed?

The Trust may also be dissolved in circumstances where the debentures will not be distributed to you. In those situations, after satisfaction of any creditors of the Trust, the Trust will be obligated to pay in cash the liquidation amount of US$25 for each trust preferred security plus accumulated and unpaid distributions to the date such payment is made. The Trust will be able to make this liquidation distribution only if the debentures are redeemed by Funding Co. Funding Co. will not have sufficient funds to redeem the debentures unless Kingsway America redeems the subordinated notes. If the Trust has insufficient assets to pay the full liquidation distribution, then payment will be made on a proportional basis, based on liquidation amounts, to Funding Co., as the holder of the common securities of the Trust, on one hand, and to the holders of the trust preferred securities on the other hand. However, if an event of default under the indenture has occurred and is continuing, the trust preferred securities will have priority over the common securities.

How will the trust preferred securities and the debentures rank in right of payment?

The Trust’s obligations under the trust preferred securities are unsecured and the trust preferred securities will rank equally with the common securities of the Trust with regard to right of payment. The Trust will pay distributions on the trust preferred securities and the common securities pro rata. However, if Funding Co. defaults with respect to the debentures or Kingsway Financial defaults with respect to the debenture guarantee, then no distributions on the common securities of the Trust will be paid until all accumulated and unpaid distributions on the trust preferred securities have been paid.

Funding Co.’s obligations under the debentures and Kingsway Financial’s obligations under the debenture guarantee are unsecured and will rank junior in priority to their existing and future senior debt.

As of June 30, 2003, the total amount of Kingsway’s senior debt that would have effectively ranked senior to the debenture guarantee and the preferred securities guarantee was approximately $234.5 million.

What voting rights will holders of the trust preferred securities have?

Except in limited circumstances, holders of the trust preferred securities will have no voting rights.

Will the trust preferred securities be listed on a stock exchange?

The trust preferred securities have been approved for listing on the New York Stock Exchange under the symbol “KFS PrA.” Trading of the trust preferred securities on the New York Stock Exchange is expected to commence within 30 days after the trust preferred securities are first issued. You should be aware that the listing of the trust preferred securities will not necessarily ensure that a liquid trading market for the trust preferred securities will develop or be maintained.

If the Trust distributes the debentures, we will use our best efforts to list them on the New York Stock Exchange or any other exchange or other organization on which the trust preferred securities are then listed.

In what form will the trust preferred securities be issued?

The trust preferred securities will be represented by one or more global securities that will be deposited with, and registered in the name of, The Depository Trust Company, or DTC, or its nominee. This means that you will not receive a certificate for your trust preferred securities but, instead, will hold your interest through DTC’s book-entry system. The trust preferred securities will be ready for delivery through DTC on or about , 2003.

5

Our Company

Kingsway is a specialty provider of personal and commercial lines of property and casualty insurance in the United States and Canada. Our principal lines of business are non-standard automobile and trucking insurance. Non-standard automobile insurance covers drivers who do not qualify for standard automobile insurance coverage because of their payment history, driving record, place of residence, age, vehicle type or other factors. Such drivers typically represent higher than normal risks and pay higher insurance rates for comparable coverage. We also provide standard automobile insurance as well as insurance for commercial and public vehicles, including taxis.

In addition to automobile insurance, we provide motorcycle insurance, specialized commercial and personal property coverage, warranty insurance and other specialty coverages, such as customs and surety bonds. In the six months ended June 30, 2003, we derived 34.9% of our gross premiums written from non-standard automobile insurance, 30.7% from trucking, 11.9% from commercial and personal property coverages, 13.2% from commercial automobile, 2.9% from motorcycle, 1.9% from standard automobile, 1.0% from warranty and

3.5% from other specialty lines. In the six months ended June 30, 2003, 43.5% of our gross premiums written were generated from personal lines and 56.5% were generated from our commercial lines.

We are a leading provider of non-standard automobile and motorcycle insurance in Canada and have a prominent position in several U.S. markets in which we currently operate, such as Florida, Illinois and South Carolina, based on direct premiums written. We are the third largest writer of non-standard automobile insurance in Illinois and the fourth largest in South Carolina, according to A.M. Best, an insurance company rating organization. In the six months ended June 30, 2003 and the year ended December 31, 2002, we generated 77% of our gross premiums written from the United States and 23% from Canada.

The insurance industry is highly competitive. However, we generally seek to identify and operate in specialty markets which present opportunities for us to effectively compete due to the narrow scope or limited size of the market or the specialty nature of the coverage or risk. These specialty markets may be defined by geographic area, type of insurance or other factors.

We focus on specialty lines of automobile, property and casualty insurance where we believe competition is more limited. We emphasize underwriting profit and will not underwrite risks at rates which we believe are unprofitable in order to increase our premium volume. We believe that by executing this strategy we have been able to deliver returns that have exceeded the average in our industry in both the United States and Canada.

In 2002, our gross premiums written increased 99% to $2.12 billion, compared to $1.1 billion in 2001 and our total revenues increased 94% to $1,818.9 million in 2002, compared to $937.5 million in 2001. Our gross premiums written for the six months ended June 30, 2003 increased 45% to $1,332.5 million, compared to $919.0 million in the first six months of 2002, and our total revenues increased 63% to $1,216.3 million compared to $745.7 million in the first six months of 2002. Our return on equity averaged 11.3% for the fiscal years 1998 to 2002 and for 2002 was 13.8%. For the first six months of 2003, our return on equity was 17.2% on an annualized basis compared to 11.9% for the same period in 2002. As of December 31, 2002, we had total assets of $3.0 billion and shareholders’ equity of $612.9 million. As of June 30, 2003, we had total assets of $3.1 billion and shareholders’ equity of $591.8 million. During the first six months of 2003, our shareholders’ equity was negatively impacted by the unrealized currency translation adjustment of our U.S. dollar denominated assets into Canadian dollars amounting to $74.0 million.

In addition to revenues derived from premiums earned, we also derive revenue from premium financing and investment income, including net realized gains. These sources of revenue amounted to $81.1 million in 2002 as compared to $64.6 million in 2001. In the six months ended June 30, 2003, revenue from premium financing and investment income, including net realized gains, amounted to $43.7 million as compared to $36.1 million in the

6

first half of 2002. In 2002, we generated net income of $79.5 million, an increase of 77% over the $44.9 million earned in 2001. Our net income for the six months ended June 30, 2003 was $51.7 million as compared to $32.5 million in the first half of 2002.

We conduct our operations through our wholly owned subsidiaries in Canada and the United States. We are licensed to write a broad range of property and casualty insurance in all Canadian provinces and territories and in 49 states and the District of Columbia in the United States. We distribute all of our products through independent agents, managing general agents, or MGAs, and brokers.

Corporate Strategy

Our strategy is to build long-term shareholder value by targeting three financial measurements over a five year period: (i) a 15% average after-tax return on shareholders’ equity, (ii) an average combined ratio, a measurement of underwriting profitability, of 96% or less, and (iii) average increases in net premiums earned of 15% per annum. Our strategy is characterized by the following principles:

| | • | | Adhere to a strict underwriting discipline. We manage our business with a strict focus on underwriting profit rather than on premium growth or market share and have demonstrated our willingness to increase pricing or reduce or increase premium volumes based on market conditions. For 2002, our combined ratio was 99.8%. Over the five year period ended December 31, 2002, our combined ratio averaged 99.3%, including 102.0% for our Canadian operations and 98.5% for our U.S. operations. For the six months ended June 30, 2003, our combined ratio was 98.1%, including 105.4% for our Canadian operations and 96.1% for our U.S. operations. Management’s incentive compensation is directly linked to our combined ratio and return on equity objectives. |

| | • | | Apply a specialty focus to regional markets. We seek to identify market segments where we believe competition is more limited, presenting the potential for above average returns. We believe that the non-standard automobile insurance business, our primary business, is presently one such specialty market. Other specialty markets in which we operate include trucking, taxi, motorcycle and warranty insurance. We operate through a network of regionally based operating subsidiaries. This decentralized operating structure allows us to target specialized markets and products based on our underwriting expertise and knowledge of local market conditions. |

| | • | | Rigorously manage claims at the local level. We seek to protect our business through diligent claims management. Our claims are managed by our experienced personnel located in our regional operating subsidiaries and by some of our MGAs. We maintain a culture of rigorously investigating claims, preventing fraud and litigating our claims as necessary before final settlement. |

| | • | | Expand in the United States and Canada. We rely on our detailed understanding of our regional markets to take advantage of any favorable conditions or trends. We look for opportunities to expand our specialty focus into selected regional markets and increase the distribution of our core products in our existing territories. We may also look for opportunities to acquire books of business or other companies which are in line with our specialty focus. For example, we completed the acquisition of American Country Holdings Inc., or ACHI, and its subsidiaries for a purchase price of approximately US$24.0 million in April 2002. ACHI specializes in the underwriting and marketing of commercial property and casualty insurance for the transportation and hospitality industry. This acquisition strengthened our position in the Chicago metropolitan area, where we believe that ACHI is the dominant writer of taxicab insurance. Since late 2001, we have also entered into new programs with several MGAs in the United States to expand the distribution network for our core business lines. In 2002, gross premiums written from these programs were $961.4 million, or 45% of our business, compared to $206.0 million, or 19% of our business, in 2001. |

7

| | • | | Maintain a strong relationship with our agents, MGAs and brokers. We are committed to our distribution network of independent agents, MGAs and brokers. We continually strive to provide the highest level of service to our agents, MGAs and brokers and build relationships at the local level in the markets in which we operate. We communicate with our network through a variety of channels and we look for opportunities to increase efficiency and further reduce our operating costs, including through the use of technology and automation. We also look for opportunities to expand our distribution relationships and enhance our product mix. |

For more details about our business, see the section of this prospectus entitled “The Company,” beginning on page 58.

Recent Developments

Canadian Equity Offering

In July 2003, Kingsway Financial sold 6.71 million common shares to a syndicate of underwriters led by Scotia Capital Inc. The shares were sold only in Canada at a price of $16.70 per share resulting in total gross proceeds of $112.1 million. Approximately $102.4 million of the proceeds of the Canadian offering were used to increase the capital of certain of our insurance subsidiaries, and the remainder will be used for general corporate purposes.

U.S. Acquisition

We recently entered into a non-binding letter of intent for the acquisition of a U.S. insurance company licensed to write insurance in over 35 states. We expect the purchase price to be approximately US$65 million. The transaction is subject to, among other things, completion of due diligence and an actuarial analysis, board approvals, the execution of definitive agreements, and regulatory approvals. We cannot assure you that we will complete this acquisition or, if we complete it, what the ultimate purchase price or other definitive terms will be or what the impact would be on our business or operations. If the acquisition is completed, the acquired company will not be a “significant subsidiary” of Kingsway Financial, as that term is defined in the accounting rules and regulations of the SEC.

Private Placements of Trust Preferred Securities

Since December 2002, we have sold trust preferred securities in three private placements ranging in size from US$15 million to US$17.5 million. In addition, we are currently engaged in discussions regarding a similar private placement of trust preferred securities, and we may engage in additional private placements of trust preferred securities of similar sized offerings in the future.

A.M. Best Ratings Review

On February 27, 2003, A.M. Best affirmed the individual financial strength ratings of our U.S. insurance subsidiaries and lowered the group financial strength rating of our Canadian subsidiaries from A (Excellent) to A- (Excellent). A.M. Best stated that the lowered rating of our Canadian group resulted from a deterioration in the group’s capitalization due to strong premium growth and poor underwriting performance driven by adverse loss development in our Ontario automobile business, which includes the non-standard automobile, standard automobile and motorcycle business in Ontario. Offsetting the negative rating factors, A.M. Best referred to Kingsway’s lead market position as the largest provider of non-standard automobile and motorcycle insurance in Canada and the prospect of improved underwriting and operating performance in 2003. A.M. Best recognized that Kingsway anticipated improved results in Canada in 2003, citing Kingsway’s proactive approach to settling claims and combating fraud in Ontario, significant rate increases that were implemented in 2002 and new

8

regulatory legislation enacted in Ontario. It stated, however, that the rating will remain under pressure pending the ability of our Canadian subsidiaries to improve their capital position and meet their underwriting and operating objectives for 2003. In addition, the financial strength rating for Lincoln General Insurance Company, our largest U.S. subsidiary, remained under review with negative implications pending the completion of our capital raising initiatives and effective management of Lincoln’s premium growth in 2003. A.M. Best expressed concerns regarding our ability to secure significant amounts of new capital both to support our current book of business and to sustain our future growth plans as well as Lincoln General’s ability to maintain profitability and effectively manage its growth and administer the underwriting and claims functions associated with its substantial amount of new business.

On September 15, 2003, A.M. Best affirmed Lincoln’s A- (Excellent) rating. The rating was removed from under review and assigned a negative outlook. This rating action is a result of Lincoln’s strengthened capital position, following our capital raising initiatives and the infusion of new capital into Lincoln in the second quarter of 2003. A.M. Best remains concerned about Lincoln’s underwriting leverage position as well as its ability to effectively manage the additional volume of business. A.M. Best’s negative outlook reflects its concern that Lincoln may need additional capital by year-end if Lincoln continues to strain surplus through premium growth or if loss reserves continue to adversely develop.

We believe that A.M. Best will look favorably upon completion of our current capital raising efforts as long as we limit our growth to manageable levels. However, we cannot assure you that A.M. Best will not downgrade our ratings or place them under review with negative implications, in the future, even if we complete this offering. If we are unable to maintain our current ratings, our ability to write insurance and compete with other insurance companies may be adversely affected.

Litigation

On July 25, 2003, we commenced an action against PricewaterhouseCoopers, LLP, Miller, Herbers, Lehman & Associates, Inc. and the former directors of ACHI relating to the understatement of the reserves of ACHI’s insurance subsidiary for the years 1998 through 2001 and associated costs and damages thereon. These reserve deficiencies occurred prior to our acquisition of ACHI in April 2002. As a result of the deficiencies, we restated ACHI’s financial results for the years ended December 31, 2001 and 2000 and the three months ended March 31, 2002. For a more detailed description of the restatement, see Kingsway’s Report of Foreign Private Issuer on Form 6-K, filed with the SEC on September 12, 2003, as amended, and incorporated by reference in this prospectus.

Corporate Information

Our principal executive offices are located at 5310 Explorer Drive, Suite 200, Mississauga, Ontario L4W 5H8. Our telephone number is (905) 629-7888. Kingsway America is the U.S. holding company for all of our U.S. subsidiaries. Kingsway America’s principal executive offices and the principal offices of Funding Co. and the Trust are located at 1515 Woodfield Road, Suite 820, Schaumburg, Illinois 60173. Kingsway America’s telephone number is (847) 619-7610.

Kingsway Financial’s Web site is www.kingsway-financial.com. Information on our Web site is not incorporated by reference in this prospectus and you should not consider this information as part of this prospectus.

Risk Factors

You should carefully consider all information contained or incorporated by reference in this prospectus before making an investment in the trust preferred securities. In particular, you should consider the risk factors described in the section of this prospectus entitled “Risk Factors” beginning on page 12.

9

Summary Consolidated Financial Data

The following table sets forth our summary consolidated financial data and other financial information as at and for each of the years in the five year period ended December 31, 2002 and as at and for each of the six-month periods ended June 30, 2003 and June 30, 2002. The summary consolidated financial data presented below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 35 of this prospectus and our consolidated financial statements and the related notes included in this prospectus beginning on page F-1.

Our consolidated financial statements contained in this prospectus have been prepared in accordance with Canadian generally accepted accounting principles, which we refer to in this prospectus as Canadian GAAP. Canadian GAAP, as applied to us, conforms in all material respects with U.S. generally accepted accounting principles, which we refer to in this prospectus as U.S. GAAP, except as otherwise described in our consolidated financial statements included in this prospectus beginning on page F-1, where we provide a reconciliation of the differences between Canadian GAAP and U.S. GAAP. We publish our consolidated financial statements in Canadian dollars. The comparability of the operating data in different periods is affected by currency exchange rate fluctuations.

| | | Six Months Ended

June 30,

| | Year Ended December 31,

|

| | | 2003

| | 2002

| | 2002

| | | 2001

| | 2000

| | 1999

| | | 1998

|

| | | (unaudited) | | | | | | | | | | | | |

| | | (in thousands of Canadian dollars, except per share data and ratios) |

AMOUNTS UNDER CANADIAN GAAP: | | | | | | | | | | | | | | | | | | | | | | | |

Statement of Operations Data | | | | | | | | | | | | | | | | | | | | | | | |

Gross premiums written | | $ | 1,332,488 | | $ | 919,044 | | $ | 2,124,691 | | | $ | 1,065,262 | | $ | 643,022 | | $ | 508,595 | | | $ | 409,200 |

Net premiums written | | | 1,273,855 | | | 870,146 | | | 2,009,963 | | | | 1,014,960 | | | 604,693 | | | 468,874 | | | | 320,396 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Revenues: | | | | | | | | | | | | | | | | | | | | | | | |

Net premiums earned | | | 1,172,535 | | | 709,646 | | | 1,737,754 | | | | 872,830 | | | 539,969 | | | 445,557 | | | | 314,651 |

Investment income | | | 29,074 | | | 26,891 | | | 56,316 | | | | 42,692 | | | 37,109 | | | 32,037 | | | | 24,771 |

Premium finance income | | | 5,861 | | | 3,860 | | | 8,539 | | | | 9,861 | | | 7,467 | | | 5,761 | | | | 5,883 |

Net realized gains | | | 8,789 | | | 5,317 | | | 16,259 | | | | 12,079 | | | 10,444 | | | 950 | | | | 6,945 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Total revenues | | | 1,216,259 | | | 745,714 | | | 1,818,868 | | | | 937,462 | | | 594,989 | | | 484,305 | | | | 352,250 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Expenses: | | | | | | | | | | | | | | | | | | | | | | | |

Claims incurred | | | 830,115 | | | 505,914 | | | 1,240,329 | | | | 616,079 | | | 371,946 | | | 304,541 | | | | 193,801 |

Commissions and premium taxes | | | 255,453 | | | 143,208 | | | 372,051 | | | | 167,176 | | | 106,378 | | | 90,844 | | | | 61,927 |

General and administrative | | | 64,425 | | | 58,046 | | | 122,762 | | | | 81,938 | | | 66,925 | | | 61,630 | | | | 39,848 |

Interest expense | | | 9,510 | | | 5,754 | | | 12,274 | | | | 11,399 | | | 11,408 | | | 10,557 | | | | 2,034 |

Amortization of intangible assets | | | 444 | | | — | | | 716 | | | | — | | | — | | | — | | | | — |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Total expenses | | | 1,159,947 | | | 712,922 | | | 1,748,132 | | | | 876,592 | | | 556,657 | | | 467,572 | | | | 297,610 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Income before income taxes | | | 56,312 | | | 32,792 | | | 70,736 | | | | 60,870 | | | 38,332 | | | 16,733 | | | | 54,640 |

Income taxes (benefit) | | | 4,654 | | | 311 | | | (8,796 | ) | | | 10,083 | | | 5,393 | | | (1,896 | ) | | | 20,873 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Net income before goodwill | | | 51,658 | | | 32,481 | | | 79,532 | | | | 50,787 | | | 32,939 | | | 18,629 | | | | 33,767 |

Amortization of goodwill, net of applicable income taxes (1) | | | — | | | — | | | — | | | | 5,856 | | | 5,469 | | | 5,031 | | | | 2,756 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 51,658 | | $ | 32,481 | | $ | 79,532 | | | $ | 44,931 | | $ | 27,470 | | $ | 13,598 | | | $ | 31,011 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Diluted earnings per share | | $ | 1.04 | | $ | 0.66 | | $ | 1.61 | | | $ | 1.19 | | $ | 0.80 | | $ | 0.38 | | | $ | 0.86 |

10

| | | As at June 30, 2003

| | As at December 31,

|

| | | Actual

| | As

Adjusted(2)

| | Pro Forma

As Adjusted(2)(3)

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

| | | (unaudited) | | | | | | | | | | |

| | | (in thousands of Canadian dollars, except per share data) |

AMOUNTS UNDER CANADIAN GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and investments | | $ | 2,171,177 | | $ | 2,278,552 | | $ | 2,344,604 | | $ | 2,078,665 | | $ | 1,223,198 | | $ | 780,510 | | $ | 686,196 | | $ | 627,629 |

Total assets | | | 3,115,170 | | | 3,222,545 | | | 3,289,945 | | | 2,984,434 | | | 1,778,744 | | | 1,173,926 | | | 1,071,710 | | | 1,014,603 |

Unpaid claims | | | 1,357,909 | | | 1,357,909 | | | 1,357,909 | | | 1,200,554 | | | 589,963 | | | 435,322 | | | 444,689 | | | 446,245 |

Bank indebtedness | | | 156,515 | | | 156,515 | | | 156,515 | | | 170,390 | | | 144,516 | | | 143,129 | | | 153,270 | | | 100,863 |

Senior unsecured debentures | | | 78,000 | | | 78,000 | | | 78,000 | | | 78,000 | | | — | | | — | | | — | | | — |

Trust preferred securities | | | 64,408 | | | 64,408 | | | 131,808 | | | 23,636 | | | — | | | — | | | — | | | — |

Total shareholders’ equity | | | 591,808 | | | 699,182 | | | 699,182 | | | 612,925 | | | 536,842 | | | 272,713 | | | 242,042 | | | 250,065 |

Book value per share | | $ | 12.09 | | $ | 12.56 | | $ | 12.56 | | $ | 12.56 | | $ | 11.03 | | $ | 8.01 | | $ | 7.12 | | $ | 6.96 |

| | | | |

| | | Six Months

Ended June 30,

| | | | Year Ended December 31,

| | |

| | | 2003

| | 2002

| | | | 2002

| | 2001

| | 2000

| | 1999

| | |

| | | (unaudited) | | | | | | | | | | | | |

| | | (in thousands of Canadian dollars, except per share data) | | |

AMOUNTS UNDER U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

Statement of Operations Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 52,439 | | $ | 32,900 | | | | | $ | 81,821 | | $ | 46,365 | | $ | 27,608 | | $ | 10,673 | | | |

Diluted earnings per share | | $ | 1.06 | | $ | 0.66 | | | | | $ | 1.66 | | $ | 1.22 | | $ | 0.80 | | $ | 0.30 | | | |

| | | |

| | As at June 30, 2003

| | As at December 31,

| | |

| | | Actual

| | As

Adjusted(2)

| | Pro Forma

As Adjusted(2)(3)

| | 2002

| | 2001

| | 2000

| | 1999

| | |

| | | (unaudited) | | | | | | | | | | |

| | | (in thousands of Canadian dollars, except per share data) | | |

AMOUNTS UNDER U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and investments | | $ | 2,231,722 | | $ | 2,339,097 | | $ | 2,405,149 | | $ | 2,104,223 | | $ | 1,227,667 | | $ | 773,423 | | $ | 661,691 | | | |

Total assets | | | 3,165,269 | | | 3,272,644 | | | 3,340,044 | | | 3,007,064 | | | 1,783,062 | | | 1,167,325 | | | 1,046,909 | | | |

Unpaid claims | | | 1,357,909 | | | 1,357,909 | | | 1,357,909 | | | 1,200,554 | | | 589,963 | | | 435,322 | | | 444,689 | | | |

Bank indebtedness | | | 156,515 | | | 156,515 | | | 156,515 | | | 170,390 | | | 144,516 | | | 143,129 | | | 153,270 | | | |

Senior unsecured debentures | | | 78,000 | | | 78,000 | | | 78,000 | | | 78,000 | | | — | | | — | | | — | | | |

Trust preferred securities | | | 64,408 | | | 64,408 | | | 131,808 | | | 23,636 | | | — | | | — | | | — | | | |

Total shareholders’ equity | | | 637,124 | | | 744,498 | | | 744,498 | | | 626,924 | | | 533,680 | | | 266,112 | | | 217,241 | | | |

Book value per share | | $ | 13.01 | | $ | 13.37 | | $ | 13.37 | | $ | 12.85 | | $ | 10.97 | | $ | 7.81 | | $ | 6.39 | | | |

| | | |

| | | Six Months

Ended June 30,

| | | | Year Ended December 31,

|

| | | 2003

| | 2002

| | | | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

| | | (unaudited) | | | | | | | | | | | | |

Other Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated | | | | | | | | | | | | | | | | | | | | | | | | |

Claims ratio(4) | | | 70.8% | | | 71.3% | | | | | | 71.4% | | | 70.6% | | | 68.9% | | | 68.4% | | | 61.6% |

Expense ratio(5) | | | 27.3% | | | 28.4% | | | | | | 28.4% | | | 28.5% | | | 32.1% | | | 34.2% | | | 32.3% |

| | |

|

| |

|

| | | | |

|

| |

|

| |

|

| |

|

| |

|

|

Combined ratio(6) | | | 98.1% | | | 99.7% | | | | | | 99.8% | | | 99.1% | | | 101.0% | | | 102.6% | | | 93.9% |

Canadian operations(7) | | | | | | | | | | | | | | | | | | | | | | | | |

Claims ratio(4) | | | 77.3% | | | 78.1% | | | | | | 78.3% | | | 73.5% | | | 70.1% | | | 72.7% | | | 60.4% |

Expense ratio(5) | | | 28.1% | | | 30.3% | | | | | | 30.1% | | | 29.6% | | | 31.7% | | | 32.1% | | | 31.6% |

| | |

|

| |

|

| | | | |

|

| |

|

| |

|

| |

|

| |

|

|

Combined ratio(6) | | | 105.4% | | | 108.4% | | | | | | 108.4% | | | 103.1% | | | 101.8% | | | 104.8% | | | 92.0% |

U.S. operations(7) | | | | | | | | | | | | | | | | | | | | | | | | |

Claims ratio(4) | | | 69.0% | | | 68.9% | | | | | | 69.2% | | | 68.9% | | | 67.8% | | | 64.5% | | | 63.5% |

Expense ratio(5) | | | 27.1% | | | 27.7% | | | | | | 28.0% | | | 27.9% | | | 33.1% | | | 36.1% | | | 33.5% |

| | |

|

| |

|

| | | | |

|

| |

|

| |

|

| |

|

| |

|

|

Combined ratio(6) | | | 96.1% | | | 96.6% | | | | | | 97.2% | | | 96.8% | | | 100.9% | | | 100.6% | | | 97.0% |

| | | | | | | | |

Return on equity(8) | | | 17.2% | | | 11.9% | | | | | | 13.8% | | | 13.3% | | | 10.7% | | | 5.5% | | | 13.4% |

| (1) | | Effective January 1, 2002, in accordance with new accounting standards, all existing goodwill and intangible assets with indefinite lives ceased to be amortized to income over time, and are subject to a periodic impairment review to ensure that the fair value remains greater than, or equal to, book value. |

| (2) | | Reflects the proceeds of approximately $107.4 million, net of expenses, from the sale by Kingsway Financial of 6.71 million common shares in July 2003. |

| (3) | | Reflects the proceeds of approximately $67.4 million (US$50 million), based on an offering price of US$25 per trust preferred security. |

| (4) | | The claims ratio is derived by dividing the amount of claims incurred by net premiums earned. |

| (5) | | The expense ratio is derived by dividing the sum of commissions and premium taxes and general and administrative expenses by net premiums earned. |

| (6) | | The combined ratio is the sum of the claims ratio and the expense ratio. |

| (7) | | Canadian and U.S. segment information includes the results of our Bermuda and Barbados reinsurance subsidiaries, respectively. |

| (8) | | Return on equity percentage is net income expressed as a percentage of average shareholders’ equity during the period. Return on equity percentages for the six months ended June 30, 2003 and 2002 are annualized. |

11

RISK FACTORS

An investment in the trust preferred securities involves a number of risks. You should carefully read and consider the following risks as well as the other information contained or incorporated by reference in this prospectus, including the financial statements and the related notes, before investing in the trust preferred securities. The business, financial condition and results of operations of Kingsway, including Funding Co., could be materially adversely affected by any of these risks. Because the Trust will rely on payments it receives on the debentures to make payments on the trust preferred securities, and because the Trust may distribute the debentures in exchange for the trust preferred securities upon liquidation of the Trust, you are making an investment decision with regard to the debentures as well as the trust preferred securities. You should carefully read the information in this prospectus about both of these securities.

Risks Relating to this Offering

Kingsway Financial’s obligation under the debenture guarantee and the preferred securities guarantee, Kingsway America’s obligations under the subordinated notes and Funding Co.’s obligations under the debentures, are subordinated.

Kingsway Financial’s obligations under the debenture guarantee and the preferred securities guarantee will be unsecured and will rank junior in priority of payment to all other debt of Kingsway Financial outstanding at any time, except:

| | • | | debt made equal with or junior to the debenture guarantee or the preferred securities guarantee by its terms; |

| | • | | other debenture guarantees or preferred securities guarantees issued by Kingsway Financial or any of its subsidiaries on behalf of holders of trust preferred securities or other similar securities of any other trust, partnership or other entity affiliated with Kingsway, which is a financing vehicle of Kingsway or an affiliate of Kingsway; |

| | • | | trade accounts payable; and |

| | • | | indebtedness of Kingsway Financial to an employee or an affiliate. |

This means that Kingsway Financial cannot make any payments on the debenture guarantee or the preferred securities guarantee if Kingsway Financial defaults on a payment of any of its other debt, except as described above. In the event of the bankruptcy, liquidation or dissolution of Kingsway Financial, its assets would be available to pay obligations under the debenture guarantee and the preferred securities guarantee only after all payments had been made on the other debt of Kingsway Financial, other than as described above.

Funding Co.’s obligations under the debentures will be unsecured and will rank junior in priority of payment to all of Funding Co.’s senior debt, if any, as described in the section of this prospectus entitled “Description of the Debentures and the Debenture Guarantee” beginning on page 94. Funding Co. will lend the proceeds received from the sale of its debentures to the Trust to Kingsway America in exchange for subordinated notes of Kingsway America. The economic terms of the subordinated notes of Kingsway America will be substantially similar to the terms of the debentures and will be unsecured and rank junior in priority of payment to all of Kingsway America’s senior debt. Therefore, if Kingsway America defaults on a payment of any of its senior debt, Kingsway America cannot make any payments on its subordinated notes and Funding Co. will not have sufficient funds to make any payments on the debentures to the Trust. Kingsway America will not be a party to the indenture and will not be a guarantor of the debentures, since a guaranty of the trust preferred securities and the debentures is being provided by Kingsway Financial, the ultimate parent of the Kingsway group. Further, though Kingsway Financial will guarantee payments on the debentures, Kingsway Financial is an Ontario corporation with its principal place of business in Ontario, Canada, and with reinsurance subsidiaries domiciled in Barbados and Bermuda for the sole purpose of reinsuring risks from Kingsway Financial’s insurance subsidiaries. It may, therefore, be more difficult for debenture holders to pursue remedies against Kingsway Financial than it would have been to pursue remedies against a U.S. guarantor whose assets are located entirely in the United States.

12

As of June 30, 2003, the total amount of Kingsway’s senior debt that would have effectively ranked senior to the debenture guarantee and the preferred securities guarantee was approximately $234.5 million.

Kingsway Financial’s holding company structure effectively subordinates claims against it to claims against its operating subsidiaries.

Kingsway Financial is a holding company with assets consisting primarily of the capital stock of its Canadian operating subsidiaries and Kingsway America, which is a holding company for its U.S. operating subsidiaries. Since Kingsway Financial is a holding company, its right and the rights of its creditors to participate in any asset distributions of any of its subsidiaries on liquidation, reorganization or otherwise, will rank junior to all creditors of the operating subsidiaries, including insureds under policies, except to the extent that Kingsway Financial may itself be a creditor of an operating subsidiary.

Further, the right of creditors of Kingsway Financial (including the holders of the debentures who are creditors of Kingsway Financial by virtue of the debenture guarantee and the holders of trust preferred securities who are creditors of Kingsway Financial by virtue of the preferred securities guarantee) to participate in any distribution of the stock owned by Kingsway Financial in certain of its subsidiaries, including its insurance subsidiaries, may also be subject to approval by insurance regulatory authorities having jurisdiction over such subsidiaries. Consequently, the debenture guarantee, the preferred securities guarantee and, therefore, the trust preferred securities will be structurally subordinated to all liabilities of Kingsway Financial’s subsidiaries.

Funding Co. and Kingsway Financial have made only limited covenants in the indenture, the trust agreement and the preferred securities guarantee agreement, which may not protect your investment in the event they experience significant adverse changes in their financial condition or results of operations.

The indenture governing the debentures and the debenture guarantee, the trust agreement governing the trust preferred securities and the preferred securities guarantee agreement do not require Funding Co. or Kingsway Financial to maintain any financial ratios or specified levels of net worth, revenues, income, cash flow or liquidity. As a result, these governing documents will not protect your investment in the event that Funding Co. or Kingsway Financial experiences significant adverse changes in its financial condition or results of operations. The indenture prevents Funding Co. from incurring indebtedness, in connection with the issuance of any trust preferred securities or any similar securities, that is senior in right of payment to the debentures. Except as described above, neither the indenture, the trust agreement nor the preferred securities guarantee agreement limits the ability of Funding Co. or Kingsway to incur other additional indebtedness that is senior in right of payment to the debentures, payment under the debenture guarantee or the preferred securities guarantee, as the case may be. You should not consider the covenants contained in these governing documents as a significant factor in evaluating whether Funding Co. will be able to comply with its obligations under the debentures or Kingsway Financial will be able to comply with its obligations under the debenture guarantee or the preferred securities guarantee.

In addition, you will have no protection under the terms of the indenture, the trust agreement or the preferred securities guarantee agreement against any sudden decline in Kingsway Financial’s credit quality resulting from any highly leveraged transaction, takeover, merger, recapitalization or similar restructuring or change in control.

Other than additional borrowings available under our $66.5 million unsecured revolving credit facility, we do not presently plan to incur any additional debt in the near future that is senior in right of payment to the debentures, the debenture guarantee and the preferred securities guarantee. We also currently have no plans or proposals that relate to any restructuring or change of control that might cause a change of our credit quality rating.

13

The preferred securities guarantee covers payments only if the Trust has sufficient funds.

The Trust will depend solely on Funding Co.’s interest payments on the debentures or Kingsway Financial’s payments under the debenture guarantee to pay amounts due to you on the trust preferred securities. If Funding Co. defaults on its obligation to pay the principal or interest on the debentures or Kingsway Financial defaults on its obligations under the debenture guarantee, the Trust will not have sufficient funds to pay distributions or the liquidation amount on the trust preferred securities. In that case, you will not be able to rely on the preferred securities guarantee of Kingsway Financial for payment of these amounts because Kingsway Financial’s preferred securities guarantee only applies if the Trust has sufficient funds to make distributions on or to pay the liquidation amount of the trust preferred securities. Instead, you or the property trustee will have to institute a direct action against Funding Co. or Kingsway Financial to enforce the property trustee’s or your pro rata rights under the indenture relating to the debentures or the debenture guarantee, as the case may be, as described under the section of this prospectus entitled “Relationship Among the Trust Preferred Securities, the Debentures and the Guarantees” beginning on page 110.

If our operating subsidiaries are unable to pay dividends, Kingsway Financial may be unable to make payments under the preferred securities guarantee or the debenture guarantee, Kingsway America may be unable to make payments under the subordinated notes and Funding Co. may be unable to make payments on the debentures.

Kingsway Financial conducts its operations through its Canadian subsidiaries and Kingsway America, which conducts its operations through its U.S. operating subsidiaries. Kingsway Financial also has wholly owned reinsurance subsidiaries domiciled in Bermuda and Barbados. As a result, Kingsway Financial’s ability to make payments on the debenture guarantee or the preferred securities guarantee and Kingsway America’s ability to make payments on its subordinated notes (which will allow Funding Co. to make payments on the debentures) will depend primarily on distributions or other payments to Kingsway Financial and Kingsway America from their operating subsidiaries. The payment of distributions, making of loans and advances or other payments to Kingsway Financial and Kingsway America from their respective subsidiaries depends on the earnings of those subsidiaries and is subject to various other business considerations. In addition, distributions and other payments by our insurance and reinsurance subsidiaries are subject to various statutory and regulatory restrictions imposed by the insurance laws of the domiciliary jurisdiction of such subsidiaries, including Barbados and Bermuda. For the year 2003, under these insurance regulatory restrictions, based on our December 31, 2002 financial statements, our insurance and reinsurance subsidiaries would have aggregate dividend capacity of $180.3 million. However, our current credit agreements contain financial covenants that may prevent our subsidiaries from paying any such dividends.

If Kingsway America defers interest payments on the subordinated notes issued to Funding Co., Funding Co. will defer interest payments on the debentures and you will not receive timely distributions on the trust preferred securities.

As long as there is no event of default under the indenture that has occurred and has not been cured or waived, Funding Co. will have the right to defer interest payments on the debentures for up to a maximum of 20 consecutive quarters per deferral period, but not beyond , 2033. At the end of an interest deferral period, upon payment of all accrued and unpaid interest then due and assuming that no event of default has occurred and is continuing under the indenture, Funding Co. may again elect to defer interest payments for up to 20 consecutive quarterly periods. Subject to those parameters, there is no limit on the number of deferral periods that Funding Co. may impose. Deferral periods are periods during which Funding Co. defers interest payments on the debentures. If Funding Co. defers interest payments on the debentures, the Trust will defer payment of distributions on the trust preferred securities. During a deferral period, you will still accumulate distributions at an annual rate of %, compounded quarterly from the relevant distribution date.

Kingsway America’s payments of principal and interest payable under the subordinated notes issued to Funding Co. will be Funding Co.’s only source of funds. The subordinated notes will be unsecured and will rank junior to all of Kingsway America’s senior debt, including indebtedness that Kingsway America may incur in the future. Kingsway America may, on one or more occasions, defer interest payments on the subordinated notes for up

14

to a maximum of 20 consecutive quarterly periods, unless an event of default under the subordinated notes has occurred and is continuing. At the end of an interest deferral period, upon payment of all accrued and unpaid interest then due and assuming that no event of default has occurred and is continuing under the subordinated notes, Kingsway America may again elect to defer interest payments for up to 20 consecutive quarterly periods. Subject to those parameters, there is no limit on the number of deferral periods that Kingsway America may impose. If Kingsway America defers interest payments on the subordinated notes, Funding Co. will defer interest payments on the debentures and the Trust will defer interest payments on the trust preferred securities.

If Funding Co. elects to defer interest payments on the debentures, you will have to include interest in your taxable income before you receive any cash distribution.

Although you will not receive cash distributions during a deferral period, for U.S. federal income tax purposes, you will be required to recognize the interest income that accrues on your proportionate share of the debentures held by the Trust in the tax year in which that interest accrues (determined on a constant yield basis). As a result, you will be required to include this income in your gross income for U.S. federal income tax purposes before you receive any cash distribution with respect to this income. For more information on the tax consequences of interest deferral, see the section of this prospectus entitled “Material U.S. Federal Income Tax Consequences—Interest Income and Original Issue Discount” on page 114.

Funding Co.’s right to defer interest on the debentures could adversely affect the market price of the trust preferred securities.

Due to Funding Co.’s right to defer interest payments on the debentures, the market price of the trust preferred securities may be more volatile than the market prices of other securities without this deferral feature. If Funding Co. exercises its right to defer interest payments on the debentures, the market price of the trust preferred securities would likely be adversely affected. During a deferral period, the trust preferred securities may trade at a price that does not fully reflect the value of accrued but unpaid interest on the debentures. If you sell your trust preferred securities during an interest deferral period, you may not receive the same return on your investment as someone who continues to hold the trust preferred securities.

If you sell your trust preferred securities before the record date for payment, you may incur additional U.S. federal income tax consequences.

If you sell your trust preferred securities before the record date for the payment of distributions, you will not receive payment of a distribution for the period before the disposition. However, you will be required to include accrued but unpaid interest on the debentures through the date of disposition as ordinary income for U.S. federal income tax purposes. In addition, if Funding Co. has, at any time, deferred interest payments on the debentures, you will be required to add the amount of the accrued but unpaid interest to your tax basis in the trust preferred securities. Your increased tax basis in the trust preferred securities will increase the amount of any capital loss or decrease the amount of any capital gain that you may have otherwise realized on the sale. You cannot offset ordinary income against capital losses for U.S. federal income tax purposes, except in a few limited cases. For more information on the tax consequences of selling your trust preferred securities before the record date for the payment of distributions, see the section of this prospectus entitled “Material U.S. Federal Income Tax Consequences—Sales of Trust Preferred Securities” on page 115.

Our ability to deduct interest on the debentures for U.S. federal income tax purposes may be limited or deferred. If so, our income taxes could be increased and we may have a reduced amount of cash available to pay interest or principal to the trust preferred securities holders.

The deduction of interest payable with respect to the debentures as accrued for U.S. federal income tax purposes may be deferred or disallowed (i) pursuant to the earnings stripping rules of Section 163(j) of the United States Internal Revenue Code of 1986, as amended, or the Code, (ii) in the event that the debentures are deemed to be applicable high yield discount obligations within the meaning of Section 163(i) of the Code or (iii) for that portion of the interest expense allocable to the holding of tax-exempt obligations as provided by Section 265 of the Code.

15

Under the earnings stripping rules of Section 163(j) of the Code, because the debentures are guaranteed by Kingsway Financial, a Canadian company, if the debt-to-equity ratio of our U.S. affiliated group exceeds a “safe harbor amount” equal to 1.5 to 1, the U.S. federal income tax deduction for interest accrued on the debentures would potentially be subject to partial or complete deferral or disallowance. The amount deferred or disallowed would be limited to the amount that our U.S. group’s net interest expense exceeds the sum of 50% of the group’s adjusted taxable income plus any unused “excess limitation” from the prior three years. Our U.S. group’s “excess limitation” would be equal to the amount by which 50% of the group’s adjusted taxable income exceeds its net interest expense. Any amount of the deduction for interest disallowed under the earnings stripping rules could be carried over to the succeeding taxable year. Legislation proposed in 2003 would substantially amend the earnings stripping rules. The proposed legislation would eliminate the 1.5 to 1 debt-to-equity safe harbor described above and limit the carryover of disallowed interest to a period of 10 years. The amount deferred or disallowed for a taxable year would be limited to the sum of our U.S. group’s “excess interest expense” and “excess related party interest expense,” but in no case would our deduction for “disqualified interest” be reduced below an amount equal to the sum of the interest includible in our U.S. group’s gross income for the relevant taxable year and an amount equal to 25% (35% for our first taxable year beginning after December 31, 2003) of our U.S. group’s adjusted taxable income. “Excess interest expense” means the excess of the U.S. group’s net interest expense over 50% of the group’s adjusted taxable income, and “excess related party interest expense” is the excess of (i) the lesser of (x) the group’s “disqualified interest” or (y) the group’s net interest expense, over (ii) 25% (35% for our first taxable year beginning after December 31, 2003) of the U.S. group’s adjusted taxable income. “Disqualified interest” includes interest paid on indebtedness guaranteed by a related foreign party on which no gross basis tax is imposed (such as interest paid on the debentures) and certain interest paid to related foreign parties. We believe that our deduction of interest payable with respect to the debentures would not currently be deferred or disallowed pursuant to the existing or proposed limitations. However, we cannot assure you that deductions may not be limited in the future.

Under Section 163(i) of the Code, if a debt instrument is an applicable high yield discount obligation, or AHYDO, then the issuer’s deduction for original issue discount, or OID, on the debt would be deferred until actually paid. Moreover, if the yield to maturity on an AHYDO exceeds the sum of the applicable federal rate (a floating rate published monthly by the Internal Revenue Service) plus six percentage points, a portion of the deduction for OID would be permanently disallowed. For the debentures to be treated as AHYDOs, (i) the yield to maturity on the debentures must equal or exceed the applicable federal rate plus five percentage points, and (ii) the debentures must be issued with “significant” OID, as determined under Section 163(i). As discussed at greater length in “Material United States Income Tax Consequences—Interest Income and Original Issue Discount” on page 114, we do not anticipate that the debentures will be considered to be issued with OID at the time of their original issuance. However, if Funding Co. exercised its right to defer payments of interest on the debentures (or if the exercise of such option was determined not to be remote at the time of issuance), the debentures would be treated as issued with OID at the time of such exercise (or at the time of issuance if the exercise of such option was determined not to be remote). In such case, depending on the difference between the yield to maturity on the debentures and the applicable federal rate, it is possible that the debentures could be treated as AHYDOs and some or all of the deduction for such OID could be deferred or disallowed under the above rules.

Under Section 265(a)(2) of the Code, interest on indebtedness incurred or continued to purchase or carry obligations exempt from U.S. federal income tax is not deductible. The determination of whether the indebtedness incurred by Funding Co. from the issuance of the debentures was continued or incurred to purchase or carry tax-exempt obligations is based on relevant facts and circumstances, and to the extent that we invest in tax-exempt obligations after issuance of the debentures, our deduction for U.S. federal income taxes could be subject to disallowance.