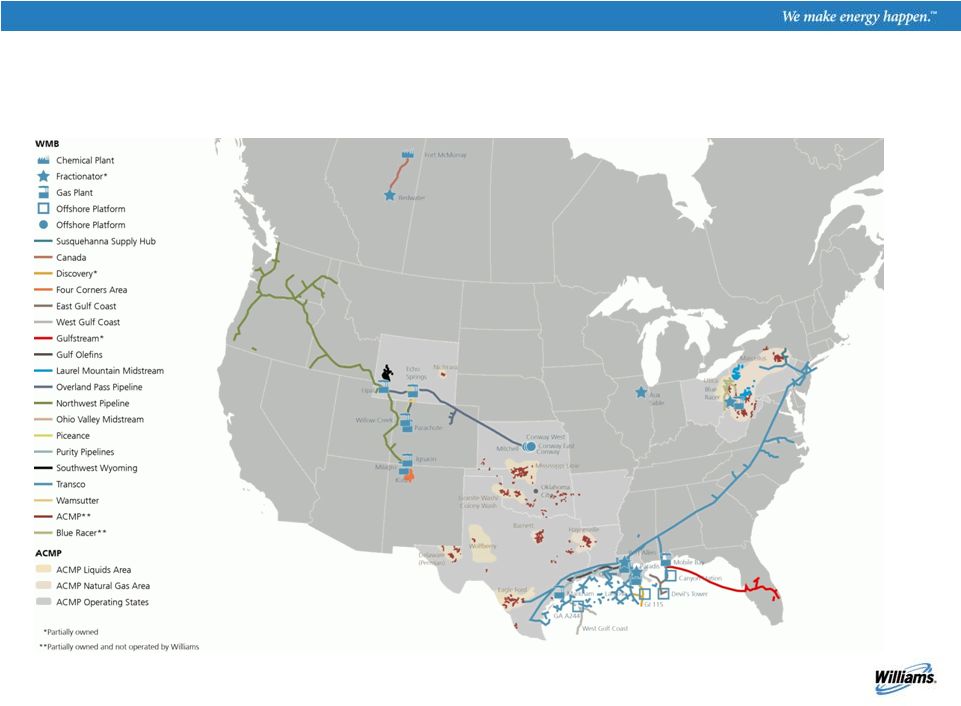

© 2014 The Williams Companies, Inc. All rights reserved. 2 Our reports, filings, and other public announcements may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements relate to anticipated financial performance, management's plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions and other matters. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this report that address activities, events or developments that we expect, believe or anticipate will exist or may occur in the future, are forward-looking statements. Forward-looking statements can be identified by various forms of words such as "anticipates," "believes," "seeks," "could," "may," "should," "continues," "estimates," "expects," "forecasts," "intends," "might," "goals," "objectives," "targets," "planned," "potential," "projects," "scheduled," "will," "assumes," "guidance," "outlook," "in service date" or other similar expressions. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to management and include, among others, statements regarding: Forward-looking Statements • The closing of, and the sources of funding for, the anticipated transaction with certain Global Infrastructure Partners funds (the “GIP Purchase”); • Expected production increases in in the producing areas served Access Midstream Partners, L.P. (“ACMP”), as well as its levels of cash distributions with respect to general partner interests, incentive distribution rights, and limited partner interests; • Increases in our fee-based revenues as a percentage of our gross margin following the GIP Purchase; • Planned increases in our dividends following the GIP Purchase; • The timing of the drop-down of our remaining NGL & Petchem Services assets and projects; • The completion of the proposed merger (the “Proposed Merger”) of ACMP and Williams Partners L.P. (“WPZ”), including the approval of the Proposed Merger by the conflicts committees of each partnership and the exchange ratio to be utilized in the Proposed Merger; • The benefits of the Proposed Merger to unitholders of ACMP and WPZ, respectively, and to our stockholders; • The operations, performance, levels of distributions, and distribution coverage of the merged partnership following the Proposed Merger; • Our future credit ratings and the future credit ratings of WPZ and ACMP; • The expected timing for the restart of WPZ’s Geismar, Louisiana, olefins plant; • The expected timing of receipt and amounts of proceeds from insurance claims related to the Geismar plant; • Amounts and the nature of future capital expenditures; • Expansion and growth of our business and operations; • Financial condition and liquidity; • Business strategy; • Cash flow from operations or results of operations, including cash flow per share following the GIP Purchase; • The levels of dividends to stockholders; • Natural gas, natural gas liquids and olefins, supply, prices and demand; and • Demand for our services |