QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 OR 15d-16 under the Securities Exchange Act of 1934

For the month of December 2002

Imperial Tobacco Group PLC

(Translation of registrant's name into English)

Upton Road

Bristol

BS99 7UJ

England

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

Attached to this 6-K are the following items:

Exhibit

- 1.

- Notice of Annual General Meeting

- 2.

- Proxy Form

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | IMPERIAL TOBACCO GROUP PLC

(Registrant) |

Date: January 10, 2003 |

|

By: |

|

/s/ TREVOR M. WILLIAMS

Trevor M. Williams

Assistant Company Secretary |

IMPERIAL TOBACCO GROUP PLC

PO Box 244, Southville, Bristol BS99 7UJ

Dear Shareholder

SIXTH ANNUAL GENERAL MEETING OF IMPERIAL TOBACCO GROUP PLC

I am pleased to inform you that our sixth Annual General Meeting is to be held at the Bristol Marriott Hotel City Centre, on Tuesday, 4 February 2003 at 2.30pm. The formal notice of the Meeting, particulars of the resolutions on which you can vote and details of the administrative arrangements we have made for the Meeting are set out in this leaflet.

I appreciate that you may not be able to attend the Meeting but, in the event of a poll, you can use your vote by completing the voting form (Proxy Form) enclosed. You may, if you wish, appoint your proxy electronically at www.sharevote.co.uk. You will need your personal voting reference number shown on your voting form. Your Directors unanimously recommend that you vote in favour of resolutions 1–15 set out overleaf.

You will find enclosed our Annual Report for the financial year ended 28 September 2002. This details our achievements in the last financial year and your Board's plans for the future direction of the Company. I hope that you find it informative and interesting.

For the safety and comfort of those attending the Meeting, bags, other large items, cameras and recording equipment will not be allowed into the auditorium. However cloakroom facilities will be provided. Please ensure mobile phones are switched off during the Meeting.

Yours sincerely

D C Bonham

Chairman

www.imperial-tobacco.com

Registered in England and Wales No: 3236483 Registered Office: PO Box 244, Upton Road, Bristol BS99 7UJ

NOTICE OF THE SIXTH ANNUAL GENERAL MEETING OF IMPERIAL TOBACCO GROUP PLC

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

It lists the resolutions to be voted on at the Company's Annual General Meeting to be held on 4 February 2003. The Meeting starts at 2.30pm. However, the doors to the Meeting will be open from 1.30pm and you may wish to arrive by 2.00pm to ensure that you are able to take your seat in good time for the start of the Meeting.

Notice is hereby given that the sixth Annual General Meeting of Imperial Tobacco Group PLC will be held at the Bristol Marriott Hotel City Centre, 2 Lower Castle Street, Old Market, Bristol, BS1 3AD on 4 February 2003 at 2.30pm for the transaction of the following business:

ORDINARY BUSINESS

Resolution 1

To receive the Report of the Directors and the Accounts for the financial year ended 28 September 2002.

Resolution 2

To receive the Directors' Remuneration Report for the financial year ended 28 September 2002.

Resolution 3

To declare a final dividend of 23.0 pence per ordinary share payable on 21 February 2003 to those shareholders on the register at the close of business on 24 January 2003.

Resolution 4

To reappoint Mr S P Duffy as a Director of the Company.

Resolution 5

To reappoint Mr M A Häussler as a Director of the Company.

Resolution 6

To reappoint Mr L W Staby as a Director of the Company.

Resolution 7

To reappoint Dr P H Jungels as a Director of the Company.

Resolution 8

THAT PricewaterhouseCoopers be reappointed Auditors of the Company and that their remuneration be fixed by the Directors.

SPECIAL BUSINESS

To consider and, if thought fit, to pass resolutions 9 to 13 as ordinary resolutions and resolutions 14 and 15 as special resolutions:

Resolution 9

THAT the limit on the maximum aggregate annual sum which may be paid by the Company to the Directors by way of fees for their services as set out in Article 90.1 of the Articles of Association be and is hereby increased from £500,000 to £1,000,000.

Resolution 10

THAT the holding period for matching shares awarded under the Rules of the Imperial Tobacco Group PLC Share Matching Scheme to certain executive directors and senior managers, whose awards in 2002 were delayed, be shortened by 45 days from three years to two years 320 days.

Resolution 11

THAT the Rules of the Imperial Tobacco Group PLC Share Matching Scheme be amended to confer discretion on the Remuneration Committee to determine, as a result of such circumstances arising which make the existing vesting date no longer appropriate, that a new vesting date be substituted in relation to outstanding awards of matching shares.

Resolution 12

- (a)

- THAT the Company and its Directors be and are hereby generally and unconditionally authorised for the purposes of Part XA of the Act to make Donations to EU political organisations and to incur EU political expenditure up to an aggregate amount not exceeding £100,000, this authority to expire at the conclusion of the Annual General Meeting of the Company in 2004.

- (b)

- THAT Imperial Tobacco Limited and its Directors be and are hereby generally and unconditionally authorised for the purposes of Part XA of the Act to make Donations to EU political organisations and to incur EU political expenditure up to an aggregate amount not exceeding £100,000, this authority to expire at the conclusion of the Annual General Meeting of the Company in 2004.

- (c)

- THAT Imperial Tobacco International Limited and its Directors be and are hereby generally and unconditionally authorised for the purposes of Part XA of the Act to make Donations to EU political organisations and to incur EU political expenditure up to an aggregate amount not exceeding £100,000, this authority to expire at the conclusion of the Annual General Meeting of the Company in 2004.

- (d)

- THAT Van Nelle Tabak Nederland B.V. (incorporated in The Netherlands) and its Directors be and are hereby generally and unconditionally authorised for the purposes of Part XA of the Act to make Donations to EU political organisations and to incur EU political expenditure up to an aggregate amount not exceeding £100,000, this authority to expire at the conclusion of the Annual General Meeting of the Company in 2004.

- (e)

- THAT John Player & Sons Limited (incorporated in the Republic of Ireland) and its Directors be and are hereby generally and unconditionally authorised for the purposes of Part XA of the Act to make Donations to EU political organisations and to incur EU political expenditure up to an aggregate amount not exceeding £100,000, this authority to expire at the conclusion of the Annual General Meeting of the Company in 2004.

- (f)

- THAT Reemtsma Cigarettenfabriken GmbH (incorporated in Germany) and its Directors be and are hereby generally and unconditionally authorised for the purposes of Part XA of the Act to make Donations to EU political organisations and to incur EU political expenditure up to an aggregate amount not exceeding £100,000, this authority to expire at the conclusion of the Annual General Meeting of the Company in 2004.

- (g)

- THAT Compagnie Indépendante des Tabacs S.A. (incorporated in Belgium) and its Directors be and are hereby generally and unconditionally authorised for the purposes of Part XA of the Act to make Donations to EU political organisations and to incur EU political expenditure up to an aggregate amount not exceeding £100,000, this authority to expire at the conclusion of the Annual General Meeting of the Company in 2004.

For the purpose of Resolution 12, "Ac" means the Companies Act 1985 (as amended by the Political Parties Election and Referendum Act 2000) and "Donation", "EU political organisation" and "EU political expenditure" have the meanings ascribed thereto in Part XA of the Act.

Resolution 13

THAT the Directors be generally and unconditionally authorised for the purposes of section 80 of the Companies Act 1985 (the "Act") to exercise all the powers of the Company to allot relevant securities (within the meaning of section 80(2) of the Act) up to an aggregate nominal amount of £24,300,000. This authority shall expire at the conclusion of the next Annual General Meeting of the Company or, if earlier, on 1 August 2004, save that the Company may before such expiry make an offer or agreement which would or might require relevant securities to be allotted after such expiry and the Directors may allot relevant securities in pursuance of such offer or agreement as if the authority conferred hereby had not expired.

Resolution 14

THAT subject to the passing of Resolution 13, the Directors be hereby generally and unconditionally empowered to allot equity securities (as defined in section 94 of the Act) for cash pursuant to the authority conferred by Resolution 13 as if Section 89(1) of the Act did not apply to any such allotment, provided that this power shall be limited to:

- (i)

- the allotment of equity securities in connection with a rights issue, open offer and other pro rata issue in favour of holders of equity securities where the equity securities respectively attributable to the interest of all such shareholders are proportionate (or as nearly as may be) to the respective number of equity securities held by them but subject to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to fractional entitlements, or legal or practical problems arising under the laws of, or the requirements of any regulatory body or any stock exchange in, any territory; and

- (ii)

- the allotment (otherwise than pursuant to sub-paragraph (i)) of equity securities up to a maximum nominal amount of £3,645,000.

This power shall expire at the conclusion of the next Annual General Meeting of the Company or, if earlier, 1 August 2004, unless previously renewed, varied or revoked by the Company in general meeting, save that the Company may before such expiry make an offer or agreement which would or might require equity securities to be allotted after such expiry and the Directors may allot equity securities in pursuance of such offer or agreement as if the power conferred hereby had not expired.

Resolution 15

THAT the Company be and is hereby generally and unconditionally authorised to make market purchases (within the meaning of Section 163(3) of the Companies Act 1985) of ordinary shares of 10 pence each in the share capital of the Company ("Ordinary Shares") provided that:

- (i)

- the maximum number of Ordinary Shares hereby authorised to be acquired is 72,900,000;

- (ii)

- the minimum price which may be paid for any such share is 10 pence (exclusive of expenses);

- (iii)

- the maximum price which may be paid for any such share is an amount (exclusive of expenses) equal to 105 per cent of the average of the middle market quotations, or the market values, for an Ordinary Share as derived from the London Stock Exchange Daily Official List for the five business days immediately proceeding the day on which the Ordinary Share is contracted to be purchased; and

- (iv)

- the authority hereby conferred shall, unless previously revoked or varied, expire at the conclusion of the next Annual General Meeting of the Company to be held in 2004 or, if earlier, on 1 August 2004 save that the Company may make a contract to purchase Ordinary Shares before such

expiry and may make a purchase of Ordinary Shares in pursuance of any such contract which will or may be executed wholly or partly thereafter.

| Registered Office: | | By order of the Board |

| PO Box 244 | | R C Hannaford |

| Upton Road | | Company Secretary |

| Bristol BS99 7UJ | | |

| Registered in England and Wales number 3236483 | | 3 December 2002 |

Notes

- 1.

- Only holders of Ordinary Shares are entitled to attend and vote at this Meeting. A member entitled to attend and vote is entitled to appoint a proxy or proxies to attend and, on a poll, vote instead of him/her. A proxy need not be a member of the Company. A proxy form is enclosed with this notice and instructions for completion are shown on the form. Proxy forms need to be deposited with the Company's Registrars, Lloyds TSB Registrars, not less than 48 hours before the start of the Meeting. Completion of a proxy form does not preclude a member attending and voting in person at the Meeting.

- 2.

- The following documents, which are available for inspection during normal business hours at the registered office of the Company on any weekday (Saturdays and public holidays excluded) will also be available for inspection at the place of the Annual General Meeting from 1.30pm on the day of the Meeting until the conclusion of the Meeting:

- (i)

- copies of service contracts of the Directors under which they are employed by the Company;

- (ii)

- the Register of Interests of the Directors (and their families) in the share capital of the Company;

- (iii)

- the Memorandum and Articles of Association of the Company; and

- (iv)

- copies of the rules of the Company share schemes and the Employee Benefit Trusts.

- 3.

- The Company, pursuant to Regulation 41 of the Uncertificated Securities Regulations 2001, specifies that only those shareholders registered in the register of members of the Company as at 6.00pm on 2 February 2003 shall be entitled to attend or vote at the aforesaid Meeting in respect of the number of shares registered in their name at that time. Changes to entries on the relevant register of securities after 6.00pm on 2 February 2003 shall be disregarded in determining the rights of any person to attend or vote at the Meeting.

EXPLANATORY NOTES

Report and accounts (Resolution 1)

The Directors of the Company must present the accounts to the Meeting.

Remuneration Committee Report (Resolution 2)

In line with the proposed legislation, this vote will be advisory and in respect of the overall remuneration package and not specific to individual levels of remuneration.

Declaration of a dividend (Resolution 3)

A final dividend can only be paid after it has been approved by the shareholders at a General Meeting. A final dividend of 23.0 pence per Ordinary Share is recommended by the Directors for payment to shareholders who are on the Register at the close of business on 24 January 2003. If approved, the date of payment of the final dividend will be 21 February 2003. An interim dividend of 12.0 pence per ordinary share was paid on 9 August 2002. Adjusting for the impact of the rights issue in April 2002, this represents an increase of 4.2 pence per share, or 15 per cent on the total 2001 dividend.

Reappointment of director (Resolutions 4)

Article 106 of the Company's Articles of Association requires that all directors retire at least every three years. At this Meeting Mr S P Duffy will retire, and stand for reappointment as a director. A short biography of Mr S P Duffy is given in the accompanying report.

Reappointment of directors (Resolutions 5, 6 and 7)

Article 110 of the Company's Articles of Association requires that all newly appointed directors retire at the first Annual General Meeting following their appointment. At this Meeting Mr M A Häussler, Mr L W Staby and Dr P H Jungels, who joined the Board on 1 August 2002, will retire and stand for reappointment as Directors. Short biographies of these Directors are given in the accompanying report.

Reappointment and remuneration of auditors (Resolution 8)

Resolution 8 proposes the reappointment of PricewaterhouseCoopers as Auditors of the Company and authorises the Directors to fix their remuneration.

Increase in maximum Directors' fees (Resolution 9)

Article 90.1 of the Company's Articles of Association states that the aggregate annual sum which the Directors shall receive for their services as Directors of the Company shall not exceed £500,000 or such larger amount as the Company may by ordinary resolution determine. Following the Company's acquisition of Reemtsma, a number of additional appointments have been made to the Company's Board. In light of this and the fact that the new and existing Non-Executive Directors have had to take on increasing responsibilities and time commitments to ensure their duties are carried out effectively, Resolution 9 proposes the increase in that maximum aggregate annual level to £1,000,000.

The amount for which approval is being sought gives some headroom over the total amount currently proposed to be paid to the Non-Executive Directors (Article 90.1 is only relevant to the fees of Non-Executive Directors as the Executive Directors receive their emoluments as employees rather than as Directors), with the intention that the Board has, where appropriate, flexibility to make or vary the terms of Non-Executive appointments without the need to return to shareholders for approval on each occasion. In the year ended 28 September 2002, the total amount of fees paid to Non-Executive Directors under Article 90.1 was £362,000. It is anticipated that the total amount of such fees payable in the year ended 30 September 2003 is £467,000.

Shortening of Share Matching Scheme vesting period (Resolution 10)

It is proposed to shorten the vesting period for matching shares awarded under the Rules of the Imperial Tobacco Group PLC Share Matching Scheme (the "Scheme") to certain Executive Directors and senior managers in 2002. At the time awards would have been made to these Executive Directors and senior managers, along with all other employees who had applied to participate in the Scheme for 2002, the Company was in negotiations for the acquisition of Reemtsma. Accordingly, awards to these Executive Directors and senior managers had to be delayed until such time as the Reemtsma acquisition had been announced and dealings by Directors and relevant employees were permitted by the Financial Services Authority Model Code (the "Model Code").

Following the successful acquisition of Reemtsma, the Board proposes to bring into line the expected vesting date for all awards granted under the Scheme, pursuant to invitations made in December 2001, by shortening the holding period for those awards made to Executive Directors and certain senior managers. Awards to these participants had to be made 45 days later than the other awards made under the Scheme due to the Company being in a prohibited period for the purposes of the Model Code. It is proposed that the relevant holding period for awards made to the Executive Directors and senior managers concerned be reduced by 45 days.

Amendment to Share Matching Scheme rules (Resolution 11)

The Rules of the Scheme currently state that the expected vesting date for matching shares awarded has to be an anniversary date of their allocation. It is proposed that the Rules of the Scheme be amended to give the Board a discretion to substitute a different vesting date, where appropriate. The Board intends to exercise its discretion only in exceptional circumstances, such as those referred to within Resolution 10.

Authority to make donations to EU political organisations and to incur EU political expenditure (Resolution 12)

The Group's policy, since demerger in 1996, has been not to make donations to political parties and we do not intend to change that policy.

The Political Parties, Elections and Referendums Act 2000 ("the 2000 Act") however includes very broad and ambiguous definitions of political donations and expenditure, which may have the effect of covering some normal business activities. These could include making provision for employees to take paid time off to participate in trade union activities and campaign for and hold public office, sponsorship of industrial forums and involvement in seminars and functions to which politicians may be invited.

Your Board will not use this authority to make any political donations in the previously accepted sense and does not intend to make political donations within the meaning of the 2000 Act; however as the penalties for breach of the 2000 Act are severe, your Board, in common with other companies, feels it is prudent to seek authority for the Company to make political donations within the meaning of the 2000 Act. Since the new Act specifically requires that separate authority be sought for subsidiaries that may incur relevant expenditure, you will see that there are effectively seven resolutions proposed within item 12 covering the Company and its major operating subsidiaries within the EU.

Directors' authority to allot securities (Resolution 13)

Your Directors may only allot shares or grant rights over shares if authorised to do so by shareholders. This resolution seeks to renew the authority given to the Directors at the Extraordinary General Meeting held on 8 April 2002 for a period expiring at the conclusion of the next Annual General Meeting of the Company in 2004 or, if earlier, on 1 August 2004. There is no present intention of exercising this authority, which would give Directors authority to allot equity securities up to an aggregate nominal value of £24,300,000, approximately one-third of the Company's issued share capital.

Disapplication of pre-emption rights (Resolution 14)

Under section 89(1) of the Companies Act 1985, if the Directors wish to allot any of the unissued shares for cash (other than pursuant to an employee share scheme) they must in the first instance offer them to existing shareholders in proportion to their holdings. There may be occasions, however, when the Directors will need the flexibility to finance business opportunities by the issue of Ordinary Shares without a pre-emptive offer to existing shareholders. This cannot be done under the Companies Act 1985 unless the shareholders have first waived their pre-emption rights. Resolution 14 asks the shareholders to do this and, apart from rights issues or any other pre-emptive offer concerning equity securities, the authority will be limited to a maximum aggregate nominal value of £3,645,000 which is equivalent to approximately 5 per cent of the Company's issued ordinary share capital as at 3 December 2002.

The resolution seeks to renew the authority granted at the Extraordinary General Meeting held on 8 April 2002. It also seeks a disapplication of the pre-emption rights on a rights issue so as to allow the Directors to make exclusions or such other arrangements as may be appropriate to resolve legal or practical problems which, for example, might arise with overseas shareholders. If given, the authority

will terminate at the conclusion of the next Annual General Meeting of the Company in 2004 or, if earlier, 1 August 2004.

Authority to purchase own shares (Resolution 15)

In certain circumstances, it may be advantageous for the Company to purchase its own shares and Resolution 15 seeks to renew the authority from shareholders to do so. The Directors intend to exercise this power only when, in the light of market conditions prevailing at the time, they believe that the effect of such purchases will be to increase earnings per share and is in the best interest of the shareholders generally. Other investment opportunities, appropriate gearing levels and the overall position of the Company will be taken into account before a decision is made to exercise this authority. Any shares purchased in this way will be cancelled and the number of shares in issue will be accordingly reduced.

The resolution specifies the maximum number of shares which may be acquired (approximately 10 per cent of the Company's issued ordinary share capital as at 3 December 2002) and the maximum and minimum prices at which they may be bought. If given, this authority will expire at the conclusion of the next Annual General Meeting of the Company in 2004.

The Directors intend to seek renewal of this power at subsequent Annual General Meetings.

| |

| |

|

|---|

| | IMPERIAL TOBACCO GROUP PLC | |

|

PROXY FORM

You may appoint another person or persons to attend and vote for you. If you wish to do so, please complete this form and return it in the enclosed reply paid envelope.

| |

| |

|

|---|

| REFERENCE NUMBER | | CARD I.D. | | ACCOUNT NUMBER |

You can submit your proxy electronically at www.sharevote.co.uk using the above numbers.

Before completing, please read the notes on completion of the proxy form overleaf and the explanatory notes in the accompanying notice.

I/We, the undersigned, being a member/members of Imperial Tobacco Group PLC, hereby appoint the Chairman of the Meeting, or

| |

|

|---|

|

|

|

| | | (SEE NOTE 1) as my/our proxy to vote for me/us at the Annual General Meeting of the Company to be held on 4 February 2003 and at any adjournment thereof. |

| | |

Please indicate your vote by marking the appropriate boxes in black ink like this:ý

Resolution

| | For

| | Against

| | Resolution

| | For

| | Against

|

|---|

| 1. | | Report and Accounts | | o | | o | | 11. | Amendment Share Matching Scheme rules | | o | | o |

| 2. | | Report of Remuneration Committee | | o | | o | | 12. | Donations to EU political organisations | | o | | o |

| 3. | | To declare a final dividend | | o | | o | | | a) | Imperial Tobacco Group PLC | | o | | o |

| 4. | | To reappoint Mr S P Duffy (A) (N) | | o | | o | | | b) | Imperial Tobacco Limited | | o | | o |

| 5. | | To reappoint Mr M A Häussler | | o | | o | | | c) | Imperial Tobacco International Limited | | o | | o |

| 6. | | To reappoint Mr L W Staby (A) (N) | | o | | o | | | d) | Van Nelle Tabak Nederland B.V. | | o | | o |

| 7. | | To reappoint Dr P H Jungels (N) (R) | | o | | o | | | e) | John Player & Sons Limited | | o | | o |

| 8. | | Reappointment and remuneration of auditors | | o | | o | | | f) | Reemtsma Cigarettenfabriken GmbH | | o | | o |

| 9. | | Directors' fees | | o | | o | | | g) | Compagnie Indépendante des Tabacs S.A. | | o | | o |

| 10. | | Share Matching Scheme adjustment | | o | | o | | 13. | Authority to allot securities | | o | | o |

| | | | | | | | | 14. | Disapplication of pre-emption rights* | | o | | o |

| | | | | | | | | 15. | Purchase of own shares* | | o | | o |

*Special resolution. (A) Member of the Audit Committee (N) Member of the Nominations Committee. (R) Member of the Remuneration Committee

ADMISSION CARD

Annual General Meeting at the Bristol Marriott Hotel City Centre, 2 Lower Castle Street, Old Market, Bristol BS1 3AD - 4 February 2003, 2.30pm.

If you come to the Annual General Meeting please bring this card. You will be asked to produce it to show that you have the right to attend, speak and vote.

We are making special arrangements to help shareholders who are confined to a wheelchair or are in any other way physically disabled or who are hard of hearing.

Please also see overleaf for directions to the Annual General Meeting.

NOTES ON COMPLETION OF PROXY FORM

- 1.

- As a member entitled to attend and vote you may appoint a proxy or proxies of your own choice to attend and, on a poll, vote instead of you. A proxy need not be a shareholder. Completion and return of a proxy form does not prevent you from attending the Meeting and voting instead of the proxy if you so wish.

- 2.

- Please indicate, by marking the appropriate box as shown, how you wish your proxy/proxies to vote in the event of a poll. Unless otherwise directed, the proxy/proxies will abstain or vote as they think fit on the resolution or any other matter which is subject to a poll, or may properly come before the Meeting.

- 3.

- If you wish to appoint someone other than the Chairman of the Meeting as your proxy, you should insert in block letters the name of the person(s) you wish to appoint in the space provided. If no name is entered, the return of this form, signed, will authorise the Chairman to act as your proxy.

- 4.

- In the case of a corporation, the proxy form must be under its common seal or signed on its behalf by a duly authorised officer or attorney.

- 5.

- In the case of joint holders, any one holder may sign the proxy form. The vote of the senior holder who tenders a vote will be counted. For this purpose seniority is determined by the order in which the names appear on the register of shareholders.

- 6.

- To be valid the proxy form, together with the original or a duly certified copy of the power of attorney or other authority, if applicable, under which it is signed, must be lodged with the Company's Registrars, Lloyds TSB Registrars, Worthing, West Sussex BN99 6DA, not less than 48 hours before the scheduled start of the Meeting or any adjournment thereof. A reply paid envelope is enclosed for your convenience.

INTERNET VOTING

You may, if you wish, appoint your proxy electronically at www.sharevote.co.uk. You will need your personal voting reference number (this is the series of 24 numbers printed under your name on the proxy form). Alternatively, if you have already registered with Lloyds TSB Registrars' on-line portfolio service shareview, you can submit your proxy form at www.shareview.co.uk (click on 'Company Meetings'); full instructions are given on the websites. Please note that any electronic communication found to contain a computer virus will not be accepted.

Please do not fold this form

TIMETABLE OF EVENTS

| |

|

|---|

| Ex-dividend date | | 22 January 2003 |

| Record date | | 24 January 2003 |

Last date for receipt by

Lloyds TSB Registrars of

Dividend Reinvestment Plan

Mandate forms | | 31 January 2003 |

| Last date for lodgement of Proxy forms | | 2 February 2003 |

| Annual General Meeting | | 4 February 2003 |

| Payment of final dividend | | 21 February 2003 |

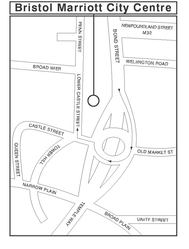

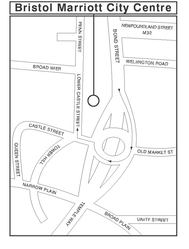

ANNUAL GENERAL MEETING VENUE

2.30pm Tuesday 4 February 2003

Bristol Marriott Hotel City Centre,

2 Lower Castle Street, Old Market, Bristol BS1 3AD

Tel: 0117 929 4281

Directions

From the M4 take junction 19 signposted M32. Follow signs to the city centre. The hotel can be found on Lower Castle Street, off Castle Street.

Parking

An NCP car park is situated next to the hotel.

Rail

A courtesy taxi service from Bristol Temple Meads to the Bristol Marriott City Centre will run from 1.00pm—2.00pm, returning to Bristol Temple Meads at the conclusion of the Meeting.

QuickLinks

SIGNATURES