| | OMB APPROVAL |

| | OMB Number: | 3235-0116 |

| | Expires: | March 31, 2000 |

| | Estimated average burden

hours per response. . . . . . . . . .9.90 |

| | |

| UNITED STATES | |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| | | | |

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For December 13, 2005

IMPERIAL TOBACCO GROUP PLC

(Translation of registrant’s name into English)

Upton Road, Bristol BS99 7UJ, England

(Address of principle executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes No

| | IMPERIAL TOBACCO GROUP PLC ANNUAL REPORT AND ACCOUNTS

2005 |

strategy focus multi-product international growth

IMPERIAL TOBACCO is the world’s fourth largest international tobacco company, which manufactures, markets and sells a comprehensive range of cigarettes, tobaccos, rolling papers and cigars.

Our Strategy…

is to create sustainable shareholder value by growing our international operations both organically and through acquisitions.

WHAT WE DO…

We produce a comprehensive range of cigarettes, other tobacco products and rolling papers.

Our strategy for brand management is centred on growing brand equity and profitability.

SOME BRAND HIGHLIGHTS

• Davidoff

Our key international premium cigarette brand sold in over 70 countries worldwide.

• West

West is our biggest tobacco brand with annual sales of over 20 billion cigarettes.

• JPS

JPS is a key value brand in our European cigarette portfolio with its major markets being Spain, Germany and France.

• Lambert & Butler

Lambert & Butler has been the UK’s best selling cigarette brand since 1998.

• Drum and Golden Virginia

The world’s top two fine cut tobacco brands.

• Rizla

Rizla is the world’s No.1 rolling paper, sold in over 50 countries.

2

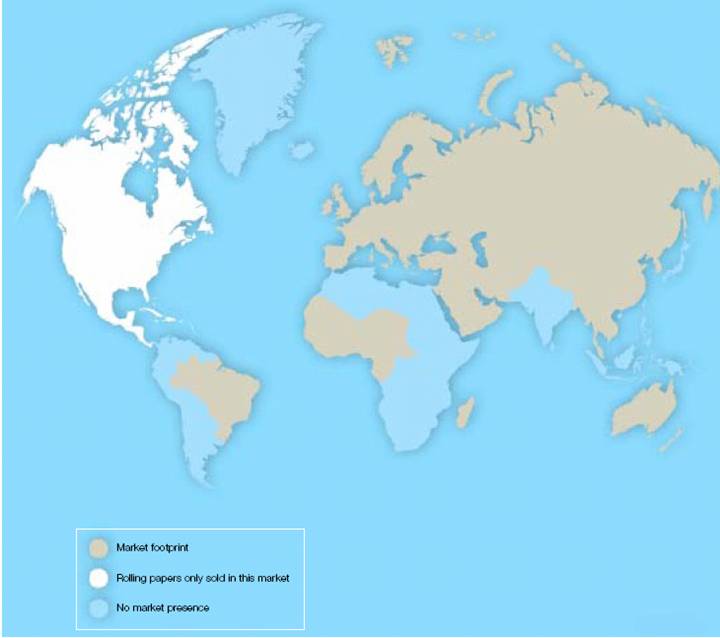

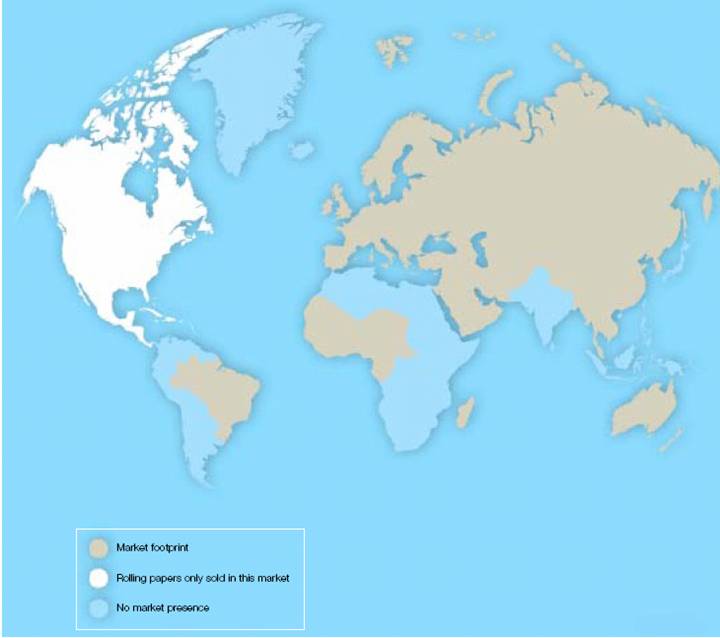

WHERE WE DO IT…

Imperial Tobacco has significant global reach.

We have expanded internationally, with sales in more than 130 countries across Europe, Asia, the Middle East, Africa and Australasia.

Our core markets of the UK and Germany are profitable bases complementing our international footprint.

This geographic and operational diversity provides business resilience and a platform for future growth.

3

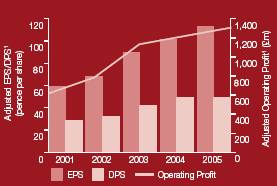

AND HOW WE DID IN 2005…

2005 has been another record year for Imperial Tobacco. This excellent financial performance reflects the continued successful execution of our strategy.

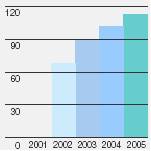

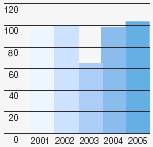

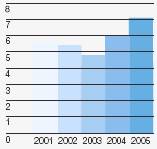

Earnings per share

(adjusted)(1)

112.8p

up 11% on 2004

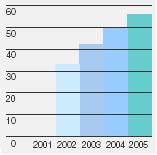

Dividend per share

56p

up 12% on 2004

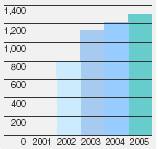

Operating profit

(adjusted)(1)

£1,307m

up 7% on 2004

(In £’s million) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| | | | | | | | | | | | | |

Turnover including duty | | 11,255 | up | 2 | % | 11,005 | | 11,412 | | 8,296 | | 5,918 | |

| | | | | | | | | | | | | |

Turnover excluding duty | | 3,149 | up | 4 | % | 3,032 | | 3,200 | | 2,219 | | 1,474 | |

| | | | | | | | | | | | | |

Operating profit | | 1,044 | up | 18 | % | 885 | | 881 | | 603 | | 604 | |

| | | | | | | | | | | | | |

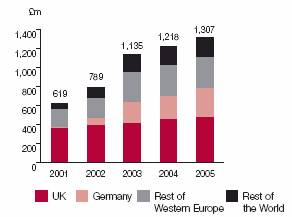

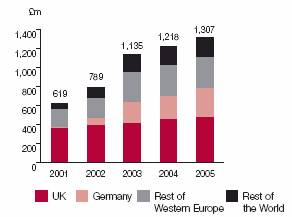

Adjusted operating profit(1) | | 1,307 | up | 7 | % | 1,218 | | 1,135 | | 789 | | 619 | |

| | | | | | | | | | | | | |

Pre-tax profit | | 862 | up | 25 | % | 688 | | 656 | | 423 | | 494 | |

| | | | | | | | | | | | | |

Adjusted pre-tax profit(1) | | 1,123 | up | 11 | % | 1,014 | | 898 | | 642 | | 509 | |

| | | | | | | | | | | | | |

Profit after tax | | 576 | up | 28 | % | 450 | | 424 | | 283 | | 355 | |

| | | | | | | | | | | | | |

Adjusted profit after tax(1) | | 820 | up | 10 | % | 743 | | 655 | | 465 | | 370 | |

| | | | | | | | | | | | | |

(In pence) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| | | | | | | | | | | | | |

Basic earnings per share | | 79.0 | up | 29 | % | 61.4 | | 58.1 | | 41.0 | | 56.6 | |

| | | | | | | | | | | | | |

Adjusted earnings per share(1) | | 112.8 | up | 11 | % | 101.6 | | 90.0 | | 68.4 | | 59.0 | |

| | | | | | | | | | | | | |

Diluted earnings per share | | 78.6 | up | 28 | % | 61.2 | | 57.9 | | 40.8 | | 56.2 | |

| | | | | | | | | | | | | |

Dividend per share | | 56.0 | up | 12 | % | 50.0 | | 42.0 | | 33.0 | | 28.8 | |

(1) Adjusted to exclude amortisation and exceptional items. Management believes that reporting results before amortisation and exceptional items (adjusted operating profit, adjusted profit before tax, adjusted profit after tax and adjusted earnings per share) provides a better comparison of underlying business performance for the year.

4

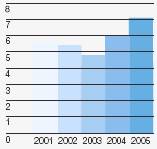

Cash conversion rate(2)

104%

Interest cover(3)

7.1 times

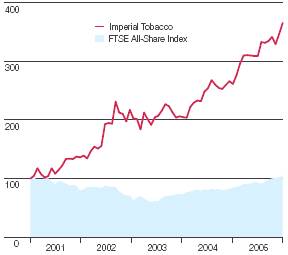

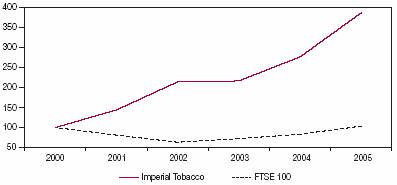

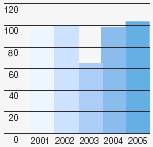

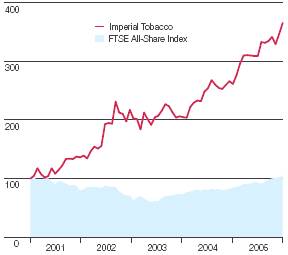

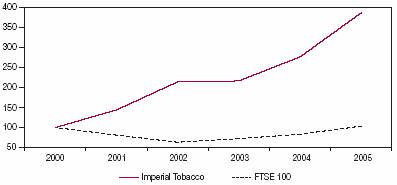

Total Shareholder Return Index(4)

(2) Comparing the cash flow generated after net capital expenditure to our operating profit before amortisation and exceptionals and before restructuring payment of £46 million in 2005.

(3) Operating profit before amortisation and exceptionals divided by the interest charge.

(4) The total investment gain to shareholders, resulting from the movement in the share price and assuming dividends are immediately invested in shares.

5

CHAIRMAN’S STATEMENT

Building on our strengths…

Derek Bonham

Chairman

With another strong financial and operational performance in 2005, I am delighted that our strategy for growth has continued to deliver value for our shareholders.

Our strategy is clear. It is to create sustainable shareholder value by growing our business both organically and through acquisitions. Our focus on this strategy has transformed Imperial Tobacco over the past nine years into the international company it is today.

In the past five years total shareholder return was 265 per cent and we have outperformed the FTSE All-Share Index by 245 per cent. Contributing to that track record, in 2005 total shareholder return was 40 per cent.

EARNINGS AND DIVIDEND

During the year we delivered some pleasing market and brand performances which, combined with our continuing focus on costs and effective cash management, grew adjusted earnings per share by 11 per cent to 112.8 pence. Basic earnings per share was 79.0 pence (2004: 61.4 pence).

As a result of this successful performance, the Board is recommending a final dividend of 39.5(1) pence per share, bringing the total dividend for the year to 56.0 pence, up 12 per cent on 2004 (2004: 50.0 pence). Since 2001 we have grown our dividend by 18 per cent compound.

This financial performance reflected a number of operational highlights that clearly demonstrate the effectiveness of our strategy.

PERFORMANCE

Our core markets of the UK and Germany delivered significant improvements in profits, against a background of market declines, an excellent achievement. Elsewhere, we grew our cigarette shares in a number of markets across the world with some strong brand performances from Davidoff and West.

Our drive for efficiencies and further cost savings across the Group has continued. The ongoing focus on enhancing productivity and improving operational efficiencies within our manufacturing operations has resulted in the closure of three manufacturing sites in the past year, with further rationalisation announced in September.

(1) The dividend will be paid on 17 February 2006 to those shareholders on the register at the close of business on 20 January 2006.

6

We are a highly cash generative tobacco company and we have ensured that shareholders continue to benefit from our effective cash management by initiating a rolling share buyback programme in February 2005. We see this as an efficient use of cash whilst we continue to pursue value creating acquisition opportunities.

BOARD CHANGES

The Board continues to ensure high standards of corporate governance across every aspect of the business. Each year we conduct a review of Board membership to ensure that an appropriate level of independent Non-Executive Directors is maintained through orderly succession, without compromising the effectiveness of the Board and mindful of the independence requirements of the Combined Code.

Simon Duffy and Sipko Huismans will step down as Non-Executive Directors at our AGM in January 2006 having served nine years on the Board. In addition, David Thursfield resigned as a Non-Executive Director in October 2005, due to his increasing level of external commitments. I would like to thank Simon and Sipko for their valuable contributions to the business since 1996 and David for his contribution since 2003. At our AGM in 2006, Iain Napier, who was appointed as Joint Vice Chairman in December 2004, will take on the role of Senior Independent Non-Executive Director.

I have been delighted to welcome both Susan Murray and Colin Day as Non-Executive Directors during the year. Both bring a wealth of experience to the business; Susan has held a number of high-profile marketing and management roles and Colin is an experienced international executive with a strong track record in the consumer sector.

Bruce Davidson, Sales and Marketing Director, resigned from the Board in February. Graham Blashill, formerly Regional Director Western Europe, has extended his responsibilities to cover all of the Group’s global sales and marketing operations and I was delighted to welcome him to the Board as Group Sales and Marketing Director in October 2005.

OUTLOOK

Our balance, both geographically and in the breadth of the products and brands we offer consumers, together with our ingrained focus on costs, leave us well placed to continue to grow the business.

This, combined with our effective use of cash for value creating acquisitions, further organic investments and share buybacks, should ensure that we continue to deliver sustainable growth for our shareholders.

I am grateful to my colleagues on the Board, our senior management team and to our employees worldwide for their impressive contributions and continued commitment to Imperial Tobacco’s success; my sincere thanks to them all.

In conclusion, I am confident that our strategy will continue to deliver good results, with our strong management team ensuring excellence in its execution.

Derek Bonham

Chairman

7

Company Hallmarks

and what they mean to us…

STRONG FINANCIAL PERFORMANCE

BRAND EQUITY

MULTI-PRODUCT ADVANTAGE

PROFITABLE CORE MARKETS

INTERNATIONAL REACH

COST FOCUS

SUCCESSFUL ACQUISITIONS

8

Strong Financial Performance

Our growth is characterised by our consistent financial performance. Our strong cash flows are used effectively to generate superior shareholder returns.

9

Brand Equity

A combination of international strategic, regional and market specific brands ensures that we have strength and depth in our brand portfolio.

10

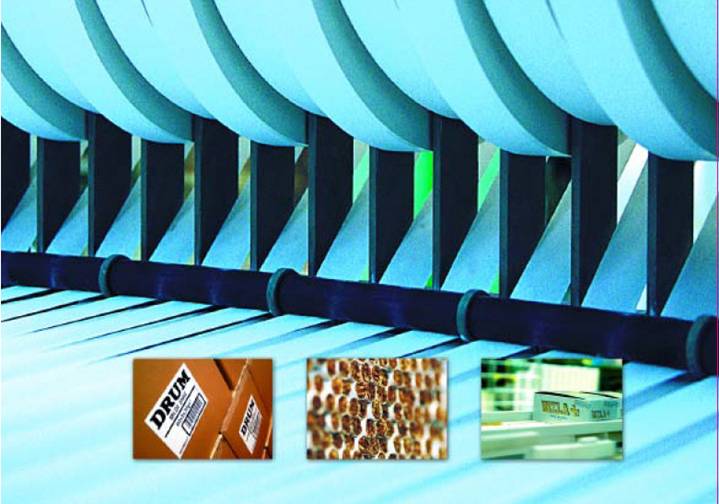

Multi-Product Advantage

We are a multi-product tobacco company. This allows us to respond rapidly to evolving market dynamics and to build brand and market share across product categories.

11

Profitable Core Markets

We have leading market positions in the UK and Germany. These strong and profitable bases support our international development.

12

International Reach

With sales in more than 130 countries and a top three position in over 20 markets we have a strong global footprint.

13

Cost Focus

We have achieved, and continue to seek, performance improvements by focusing on cost and productivity, whilst safeguarding our reputation for quality, flexibility and innovation.

14

Successful Acquisitions

We have a successful track record of integrating our acquisitions and rapidly generating returns. We shall continue to seek and execute further acquisitions which meet our rigorous strategic and financial criteria.

15

OPERATING AND FINANCIAL REVIEW

Another year of great results…

Our focus on a clear and consistent strategy has again produced great results in 2005 with double digit earnings per share growth, building on our outstanding track record.

Gareth Davis

Chief Executive

The fundamental strength of our core business was demonstrated by the improved profits we have delivered in the mature markets of the UK and Germany.

Across Western Europe, Eastern Europe, the Middle East and Asia we increased our cigarette shares in many markets due to the strength of our brand portfolio and our focus on trade marketing and sales excellence. This cigarette share growth reflected strong performances from our international strategic brands Davidoff and West, particularly in the Rest of Western Europe, where volumes grew by 11 per cent and 31 per cent respectively.

Despite a significant cigarette market size reduction in one of our core markets, Germany, we have been very encouraged by the positive trend in our overall cigarette volumes in the second half of the year, reversing the decline of the first half, with annual volumes up 1.5 per cent year on year.

In manufacturing, we continued to focus on the simplification and standardisation of processes, products and packaging. We have delivered an excellent improvement in productivity, up by 15 per cent in 2005. This is due to the closure of a number of factories since May 2004, together with the benefits of machinery redeployment and underlying efficiency gains. As part of our ongoing manufacturing review, in September 2005 we announced a restructuring of our European cigarette operations and the consolidation of our rolling papers production into Belgium, which will result in the closure of our rolling papers factory in South Wales.

We continually review our cost base to ensure that we are structured efficiently and effectively in manufacturing, sales and marketing and our central support functions.

We are proud of the hallmarks of our business: our strong financial performance, our profitable core markets of the UK and Germany, our international reach, our brand equity, our multi-product portfolio, our cost focus and our track record of successful acquisitions.

A fundamental element of our strong financial performance is our ability to turn our profits into cash and ensure its effective utilisation. A rolling share buyback programme was initiated in February 2005 on which we spent around £200 million during the remainder of the financial year.

16

Business Highlights

In the past five years total shareholder return was 265 per cent and we have outperformed the FTSE All-Share Index by 245 per cent.

The fundamental strength of our core business was demonstrated by the improved profits we have delivered in the mature markets of the UK and Germany.

Across Western Europe, Eastern Europe, the Middle East and Asia we increased our cigarette shares in many markets due to the strength of our brand portfolio and our focus on trade marketing and sales excellence.

We continued to invest for sustainable organic growth. With our Turkish factory opening in April, we initially launched Davidoff and Maxim cigarettes with encouraging early results and we added to the portfolio with the introduction of West in September 2005. In China, we built on our already strong relationship with the Yuxi Hongta Group. We enhanced our position in the Scandinavian market through our investment in Swedish snus manufacturer Skruf.

We have delivered an excellent improvement in productivity up by 15 per cent in 2005.

We support sensible and fair regulation that recognises us as a legitimate business producing a legal product and we continue to engage with the relevant authorities constructively.

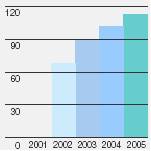

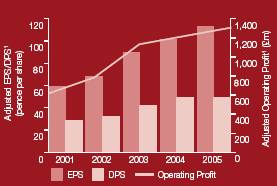

Our Outstanding Track Record

Earnings per share

(adjusted)(1)

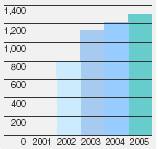

Operating profit

(adjusted)(1)

Successful Track Record

18% compound annual growth in earnings and dividends per share

(1) Adjusted to exclude amortisation and exceptional items. Management believes that reporting results before amortisation and exceptional items (adjusted operating profit, adjusted profit before tax, adjusted profit after tax and adjusted earnings per share) provides a better comparison of underlying business performance for the year.

We continued to invest for sustainable organic growth. With our Turkish factory opening in April, we initially launched Davidoff and Maxim cigarettes with encouraging early results and we added to the portfolio with the introduction of West in September 2005. We increased our direct sales force in Italy and are improving our route to market capabilities in a number of markets, including Russia. In China, we built on our already strong relationship with the Yuxi Hongta Group. We enhanced our position in the Scandinavian market through our investment in Swedish snus manufacturer Skruf, giving us a foothold in snus and also allowing us to distribute our other products through their established selling operation.

Our success is not just about our operational performance. It is also about the Group’s responsible behaviour towards a large number of business partners. These partners accept our contribution to the economic growth of many countries and recognise the engagement of Imperial Tobacco in areas of mutual interest. Our progress in this area is demonstrated further in our annual Corporate Responsibility Review, which will be updated in December 2005 and will be available on our website www.imperial-tobacco.com.

Whilst regulation has increased significantly over the past five years, we are experienced in developing our business successfully in this environment as demonstrated by our consistent results. We support sensible and fair regulation that recognises we are a legitimate business, producing a legal product. We continue our approach of constructive engagement with the authorities in the markets in which we operate. We believe that sensible regulation combined with well thought out voluntary agreements is the most effective way forward.

From a litigation perspective, we were pleased with the judge’s decision in May to dismiss on all counts the McTear claim against Imperial Tobacco in Scotland. We have never lost or settled any tobacco litigation and will continue to defend ourselves robustly against any further speculative claims.

Identifying and developing tomorrow’s leaders is a key activity for all businesses. Several new initiatives were introduced in the year to develop our management team, with the aim of further improving performance and instilling the essence of what makes Imperial Tobacco successful.

Our people are dedicated. They are sales and cost focused and have a tremendous track record. They are not only good at what they do, they are also committed to shareholder value creation and I join the Chairman in thanking our employees worldwide for what they have achieved this year on behalf of our shareholders.

Our unswerving focus on our strategy, to create sustainable shareholder value by growing our operations both organically and through acquisitions, continues to place the Group in a strong position.

2005 has been a great year for Imperial Tobacco. Looking ahead, I believe that we will continue to build on our successes.

17

OPERATING AND FINANCIAL REVIEW

A strong financial performance…

In 2005 a good operational performance, combined with effective cash management, enabled us to deliver 11 per cent growth in adjusted earnings per share.

Robert Dyrbus

Finance Director

Alison Cooper

Director of Finance and Planning

GROUP OPERATING PERFORMANCE

In 2005, adjusted operating profit before amortisation and exceptional items grew 7 per cent to £1,307 million. This growth was driven by our continuing focus on profitable volume development, capitalising on our broad product portfolio and underpinned by effective cost management. Reported operating profit, after amortisation and exceptional items, was up 18 per cent to £1,044 million including a reduction in exceptional items to £57 million (2004: £129 million).

Turnover including duty was £11,255 million compared to £11,005 million in the financial year ending 2004. Turnover excluding duty was up 4 per cent to £3,149 million (2004: £3,032 million), with the Group’s adjusted operating margin up to 41.5 per cent (2004: 40.2 per cent).

The Group’s adjusted operating margin increased to 41.5 per cent.

GROUP OPERATING PERFORMANCE

£m | | 2005 | | 2004 | |

Turnover ex. duty | | 3,149 | | 3,032 | |

| | | | | |

Adjusted operating profit(1) | | 1,307 | | 1,218 | |

Adjusted operating margin(1) | | 41.5 | % | 40.2 | % |

Amortisation | | (206 | ) | (204 | ) |

Exceptional items | | (57 | ) | (129 | ) |

| | | | | |

Reported operating profit | | 1,044 | | 885 | |

(1) Before amortisation and exceptional items.

18

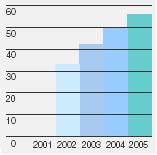

Effective Cash Management

Our five year track record of cash conversion is strong with our operating cash flow after net capital expenditure averaging 92 per cent of adjusted operating profit.

Strong cash generation is a key hallmark of our business and the effective application of our cash is essential in continuing to deliver growth in shareholder value.

Our primary aim is to continue to develop the business through investment in organic growth and by pursuing value creating acquisitions. In order to keep our balance sheet efficient while we are looking for value creating opportunities we commenced a share buyback programme in February.

Cash conversion rate(1)

(1) Comparing the cash flow generated after net capital expenditure to our operating profit before amortisation and exceptionals, before restructuring payments of £46 million in 2005.

Share Buybacks

In the year ended 30 September 2005 we spent around £200 million on 13.5 million shares. The average share price paid was 1475 pence, excluding transaction costs.

Shares were purchased on market on the London Stock Exchange and are held as treasury shares on the balance sheet. We have, and intend to renew at the 2006 AGM, shareholder approval to buy back up to 10 per cent of our issued share capital. The Directors choose to exercise this power only when, in light of market conditions prevailing at the time, they believe that the effect of such purchases will be to increase earnings per share and is in the best interest of shareholders generally.

The share buyback programme is ongoing, and in the absence of value creating acquisitions, we intend to spend up to our annual free cash flow.

The impact of the share buyback programme for the financial year ended September 2005 was to increase adjusted earnings per share by 0.4 pence and basic earnings per share by 0.2 pence, after taking into account an increase in the net interest charge of £3 million and a decrease in the tax charge of £1 million.

REGIONAL PERFORMANCE ANALYSIS

| | Turnover

excluding

duty | | Adjusted

operating

Profit (1) | | Cigarette

volumes | | Fine cut

tobacco

volumes | |

| | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

| | £m | | £m | | £m | | £m | | bn | | bn | | 000’s | | 000’s | |

| | | | | | | | | | | | | | tonnes | | tonnes | |

| | | | | | | | | | | | | | | | | |

UK | | 812 | | 793 | | 477 | | 454 | | 23.9 | | 25.2 | | 2.1 | | 2.0 | |

| | | | | | | | | | | | | | | | | |

Germany | | 630 | | 590 | | 295 | | 237 | | 20.9 | | 23.9 | | 7.1 | | 6.3 | |

| | | | | | | | | | | | | | | | | |

Rest of Western Europe | | 644 | | 634 | | 326 | | 329 | | 17.7 | | 16.5 | | 15.6 | | 16.6 | |

| | | | | | | | | | | | | | | | | |

Rest of the World | | 1,063 | | 1,015 | | 209 | | 198 | | 112.7 | | 107.0 | | 1.8 | | 1.8 | |

| | | | | | | | | | | | | | | | | |

Total as adjusted | | 3,149 | | 3,032 | | 1,307 | | 1,218 | | 175.2 | | 172.6 | | 26.6 | | 26.7 | |

(1) Results before amortisation and exceptional items

In the UK, turnover excluding duty was up 2 per cent to £812 million, with adjusted operating profit up 5 per cent to £477 million. Cigarette volumes were down to 23.9 billion mainly as a result of market volume declines. The profit improvement reflected the benefits of price increases, growth in fine cut tobacco and reduced costs, which more than offset cigarette volume declines and the impact of downtrading.

In Germany, turnover excluding duty increased 7 per cent to £630 million, with adjusted operating profit up 24 per cent to £295 million. This performance was despite a significant decline in the cigarette market size following successive duty rises. Our volumes were more resilient than the market, down 13 per cent to 20.9 billion, reflecting cigarette share growth. Price increases, growth in volumes of other tobacco products and cost efficiencies, both in manufacturing and trading operations, more than compensated for the cigarette volume declines and the impact of downtrading.

In the Rest of Western Europe, turnover excluding duty was up 2 per cent to £644 million. Adjusted operating profit was slightly down at £326 million. The increase in turnover was driven by cigarette volumes, up 7 per cent to 17.7 billion, as market share growth more than compensated for market declines. Our fine cut tobacco volumes were affected by increased downtrading across the region. These volume performances, combined with a movement in the geographic sales mix towards southern Europe, resulted in a slight decrease in profits and margins.

In the Rest of the World, turnover excluding duty was up 5 per cent to £1,063 million with adjusted operating profit up 6 per cent to £209 million. Our cigarette volumes were up 5 per cent to 112.7 billion and fine cut tobacco volumes were stable at 1,800 tonnes. Profits and margins increased, benefiting from volume growth, pricing improvements and operating cost reductions, more than offsetting regional mix effects and market investments.

19

OPERATING AND FINANCIAL REVIEW

INTEREST

The net interest charge for the year decreased to £184 million (2004: £204 million) reflecting reduced debt levels and a lower average all-in cost of debt of 5.3 per cent (2004: 5.6 per cent). This was mainly due to higher levels of floating rate debt, the refinancing of our bank facility at improved margins and maturing capital market debt being replaced with lower cost bank financing. Interest cover before amortisation and exceptional items was 7.1 times (2004: 6.0 times).

PROFIT BEFORE TAX

Group adjusted profit before tax rose 11 per cent to £1,123 million (2004: £1,014 million). After amortisation and exceptional items, reported profit before tax increased by 25 per cent to £862 million (2004: £688 million).

EXCEPTIONAL ITEMS

Reported profit before tax was impacted by exceptional items of £57 million (2004: £129 million) and profit on the sale of fixed assets of £2 million (2004: £7 million). The 2005 exceptional costs related to a number of restructuring initiatives including the closure of our Montreal, Plattsburgh and Dublin factories, and the announced restructuring of our European cigarette operations and the closure of our South Wales factory. These initiatives are anticipated to generate the following annual savings: Dublin £4 million for year ending 30 September 2006; Berlin £10 million and Treforest £3 million both for the year ending 30 September 2007.

ACQUISITIONS

In September, we acquired a 43 per cent stake of the Swedish snus company, Skruf. The consideration of £6 million was satisfied in cash with a commitment to purchase the balance of shares by mid 2009. The acquisition will be accounted for as a 100 per cent owned subsidiary to reflect the substance of the transaction.

The total amortisation charge for the Group for the year was £206 million (2004: £204 million).

TAXATION

The tax charge for the year was £286 million (2004: £238 million), representing an effective tax rate of 27.0 per cent on profit before amortisation. The tax rate on reported profit before tax was 33.2 per cent. The Group continues to benefit from lower tax rates applied to a number of overseas subsidiaries.

EARNINGS AND DIVIDENDS

Adjusted earnings per share increased by 11 per cent to 112.8 pence (2004: 101.6 pence) and basic earnings per share increased by 29 per cent to 79.0 pence (2004: 61.4 pence).

We have proposed a final dividend for the year of 39.5 pence, such that the total dividend for the year is 56.0 pence, an increase of 12 per cent broadly in line with our adjusted earnings growth. This dividend will be paid on 17 February 2006 to those shareholders on the register at the close of business on 20 January 2006. Our dividend policy is progressive, growing dividends broadly in line with adjusted earnings, with around a 50 per cent payout ratio.

The interim dividend of 16.5 pence was paid on 5 August 2005.

FINANCING AND LIQUIDITY

At the year end, our net debt had decreased to £3.3 billion (2004: £3.6 billion) of which 21 per cent was denominated in sterling, 77 per cent in euros and the balance in other currencies. In February we refinanced our core bank facility with a new €2.25 billion, 5 year facility on improved terms. At the year end 55 per cent of gross debt was fixed by interest rate derivatives (2004: 60.2 per cent).

CASH MANAGEMENT AND CAPITAL EXPENDITURE

We have a strong track record of cash conversion averaging 92 per cent over the last five years and this trend continued in 2005 with operating cash flow after net capital expenditure representing 104 per cent of adjusted operating profit.

Gross capital expenditure was £90 million (2004: £103 million), reflecting a maintenance level of capital expenditure plus investment in our factory in Turkey.

Our net capital expenditure was £63 million (2004: £48 million) including proceeds on disposal of fixed assets of £27 million (2004: £55 million).

20

SHARE BUYBACKS

We commenced a share buyback programme in February 2005. By 30 September 2005 we had spent around £200 million buying back 13.5 million shares, representing 1.9 per cent of issued share capital, all of which are held as treasury shares. The average share price paid was 1475 pence, excluding transaction costs.

The impact of the share buyback programme for the financial year ended September 2005 was to increase adjusted earnings per share by 0.4 pence and basic earnings per share by 0.2 pence, after taking into account an increase in the net interest charge of £3 million and a decrease in the tax charge of £1 million.

ADOPTION OF INTERNATIONAL FINANCIAL REPORTING STANDARDS

The financial statements for the year ended 30 September 2005 have been prepared in accordance with UK accounting standards (UK GAAP). For the year ending 30 September 2006, we will report under International Financial Reporting Standards (IFRS).

We communicated our assessment of the key changes that implementing IFRS would have had on our results for 2004, in March 2005 and the related presentation is available on our website. Excluding the impact of IAS39 on derivatives, our adjusted results under IFRS for 2004 would have been marginally different due to pensions accounting, with all other impacts currently assessed as being immaterial. The major impacts on net assets amounted to an uplift of around half a billion pounds at 1 October 2004.

We are preparing a reconciliation of our 2005 UK GAAP primary financial statements to IFRS which we will release on 24 November 2005. It will be posted to shareholders along with the Annual Report and Accounts and will be available on our website, www.imperial-tobacco.com.

Successful Track Record

18% compound annual growth in earnings and dividends per share

Operating Profit by Region

(adjusted)(1)

last 5 years

(1) Adjusted to exclude amortisation and exceptional items. Management believes that reporting results before amortisation and exceptional items (adjusted operating profit, adjusted profit before tax, adjusted profit after tax and adjusted earnings per share) provides a better comparison of underlying business performance for the year.

21

OPERATING AND FINANCIAL REVIEW

United Kingdom

We delivered a good performance, building on the progress we have made in recent years and consolidating our position as the undisputed market leader in cigarettes and fine cut tobacco.

Lambert & Butler

The UK’s best selling cigarette brand family, with a 16% market share.

Golden Virginia

An excellent performance from the UK’s market leader in fine cut tobacco.

Richmond

The UK’s second biggest cigarette brand family had an excellent year.

MARKET DYNAMICS

We estimate that the UK cigarette market was down by around 4 per cent to 51 billion cigarettes. Consumer downtrading continued with growth in both the ultra low price cigarette and fine cut tobacco sectors. We estimate the fine cut tobacco market grew to 3,000 tonnes (2004: 2,900 tonnes).

We operate in a highly regulated environment in which new point of sale advertising restrictions were introduced in December 2004. The UK Government’s Health Bill was published on 27 October 2005, and states that from the summer of 2007, smoking will be banned in all enclosed public places in England and Wales, apart from private members’ clubs and licensed premises that do not serve or prepare food.

We anticipate that in Scotland and Northern Ireland a ban on smoking in public places will be implemented on 26 March 2006 and by April 2007 respectively.

OUR PERFORMANCE

We delivered a strong improvement in operating profits, up 5 per cent to £477 million as a result of price increases, growth in fine cut tobacco volumes and cost reductions.

Our results reflect the strength of our brand portfolio, which includes the UK’s two best selling cigarette brand families, Lambert & Butler and Richmond. Lambert & Butler performed well, maintaining 16.0 per cent of the market, whilst Richmond had an excellent year, growing its share by 1.5 percentage points to 14.7 per cent. The combined brand families accounted for over 30 per cent of the UK market in 2005.

Reflecting market dynamics, our market shares of Regal, Embassy and Superkings declined slightly such that our total UK cigarette market share remained broadly stable at 44.5 per cent.

We increased our fine cut tobacco share to 66.3 percent, with strong growth from Golden Virginia, the UK market leader.

Our excellent performance in this highly regulated environment reflects our continued investment in our skilled sales force and supporting technology.

Our UK co-marketing and logistics agreement with Philip Morris was renegotiated for an additional five years.

OUTLOOK

The UK market continues to make a major contribution to the Group’s overall performance. In the context of moderate market declines and current market sector trends, our strong brand portfolio means we are well placed to build on our market leadership positions in cigarette and fine cut tobacco and to further develop our profits.

22

United Kingdom Market Overview

Financial Highlights | | 2005 | | 2004 | |

Turnover excluding duty | | £ | 812 | m | £ | 793 | m |

Operating Profit | | £ | 477 | m | £ | 454 | m |

| | | | | |

Overall Market Size(1) | | 2005 | | 2004 | |

Cigarette | | 51 | bn | 53 | bn |

Fine Cut Tobacco | | 3,000 | t | 2,900 | t |

| | | | | |

Imperial Tobacco Volumes | | 2005 | | 2004 | |

Cigarette | | 23.9 | bn | 25.2 | bn |

Fine Cut Tobacco | | 2,100 | t | 2,000 | t |

| | | | | |

Imperial Tobacco Market Shares(1) | | 2005 | | 2004 | |

Cigarette | | 44.5 | % | 44.6 | % |

Fine Cut Tobacco | | 66.3 | % | 65.6 | % |

| | | | | |

Key Brand Performances(1) | | 2005 | | 2004 | |

Lambert & Butler | | 16.0 | % | 16.2 | % |

Richmond | | 14.7 | % | 13.2 | % |

Golden Virginia | | 50.8 | % | 50.0 | % |

(1) Imperial Tobacco best estimates

Germany Market Overview

Financial Highlights | | 2005 | | 2004 | |

Turnover excluding duty | | £ | 630 | m | £ | 590 | m |

Operating Profit | | £ | 295 | m | £ | 237 | m |

| | | | | |

Overall Market Size(1) | | 2005 | | 2004 | |

Cigarette | | 101 | bn | 119 | bn |

Other tobacco products (cigarette equivalents) | | 43 | bn | 31 | bn |

| | | | | |

Imperial Tobacco Volumes | | 2005 | | 2004 | |

Cigarette | | 20.9 | bn | 23.9 | bn |

Other tobacco products (cigarette equivalents) | | 10.3 | bn | 8.7 | bn |

| | | | | |

Imperial Tobacco Market Shares(1) | | 2005 | | 2004 | |

Cigarette | | 19.4 | % | 18.9 | % |

Other tobacco products | | 24.2 | % | 28.0 | % |

| | | | | |

Key Brand Performances (Cigarettes)(1) | | 2005 | | 2004 | |

Davidoff | | 1.1 | % | 1.1 | % |

West | | 8.5 | % | 9.0 | % |

JPS | | 1.7 | % | 0.2 | % |

| | | | | |

Key Brand Performances (Other tobacco products)(1) | | 2005 | | 2004 | |

West | | 11.5 | % | 18.0 | % |

JPS | | 6.3 | % | 1.7 | % |

Fairwind | | 1.1 | % | nil | |

(1) Imperial Tobacco best estimates

Germany

Our focus on the profitable development of our German operations has delivered significantly improved results, demonstrating our flexibility to adapt to market conditions.

West

West remains the second largest cigarette brand in Germany.

Davidoff

Davidoff performed well in the premium cigarette sector.

JPS

An excellent performance from JPS cigarettes.

MARKET DYNAMICS

Successive tax increases over the past few years continue to impact the overall market size in Germany and we estimate that the total tobacco market in 2005 was down by 4 per cent to 144 billion cigarette equivalents (2004: 150 billion). The cigarette market decreased by 15 per cent to 101 billion cigarettes partially offset by strong growth in other tobacco products, up by 39 per cent, as consumers sought value brands and products. Reflecting this trend, the low price branded cigarette sector continued to grow and accounted for 7.5 per cent of cigarette sales in September 2005.

The third and final stage of the current round of tobacco tax increases was introduced in September 2005, following those in March and December 2004. We passed on this tax increase to consumers which, for the majority of our cigarette portfolio, entailed reducing pack sizes from 19 to 17 cigarettes and lowering prices by 20 euro cents.

In the case between the German Government and the European Court of Justice (ECJ) regarding the taxation of the Singles make your own product category, the Advocate General published his opinion in July stating that the Singles category should no longer be taxed as fine cut tobacco but at the same higher rate as cigarettes. The ruling of the ECJ is expected on 10 November 2005.

OUR PERFORMANCE

Despite a challenging trading environment, operating profit rose by 24 per cent to £295 million, due to growth in our cigarette share, increased other tobacco product volumes, price increases and the benefits of cost efficiencies in both manufacturing and trading.

We were pleased with the growth in our cigarette share up to 19.4 per cent (2004: 18.9 per cent). The market share development of JPS was particularly impressive with the brand capturing 1.7 per cent of the cigarette market in the 18 months since its launch, finishing the year at 2.8 per cent. Davidoff, Peter Stuyvesant and R1 all continued to perform well in the premium sector and West remained the second largest cigarette brand in Germany with market share of 8.5 per cent.

Within other tobacco products our volumes have grown strongly, largely driven by the growth in Singles, up by 36 per cent, although our annual market share in this sector declined to 24.2 per cent as a result of increased competitor activity. In the second half our share stabilised reflecting good performances from JPS and the recently launched Fairwind.

OUTLOOK

The German market will continue to be challenging and particularly if the awaited ECJ ruling is adverse, but we have prepared a variety of portfolio responses depending on the outcome. Our flexible approach has ensured the improving profitability of our operations in Germany and we believe that this flexibility, combined with our broad product portfolio and our strength in value cigarettes and other tobacco products, will continue to mean we are well positioned.

23

OPERATING AND FINANCIAL REVIEW

rest of Western Europe

We have delivered improvements in our cigarette shares complementing our strong presence in fine cut tobacco and rolling papers.

West

Volumes grew by 31 per cent in 2005.

JPS

JPS volumes up 45 per cent across the region.

Rizla

Rizla sold over 13 billion leaves in the region.

REGIONAL DYNAMICS

We estimate the annual regional cigarette market was down by 3 per cent, but the rate of decline slowed in the second half of the year. The regional fine cut tobacco market declined by 2 per cent due to increased prices. Consumers continued to economise, stimulating growth in the value segments of both cigarette and fine cut tobacco.

The debate on smoking in public places has intensified across the region this year most notably in Italy where further restrictions were introduced. Our experience in Ireland bears out our view that there would be an initial market decline with the impact diminishing over time.

OUR PERFORMANCE

The growth in our cigarette shares more than offset the market volume decline. However operating profit was slightly down at £326 million reflecting the change in sales mix and downtrading within fine cut tobacco.

In the Netherlands, our cigarette market share grew to 4.9 per cent due to the strong performance of West and we introduced JPS Red and JPS Silver in June in the value segment to capitalise on the continued downtrading dynamic. Our fine cut tobacco market share was impacted by downtrading; however, we have seen encouraging progress since we launched the value brands Zilver and Evergreen during the year.

Our domestic cigarette market share in Belgium improved in the second half of the year with an encouraging performance from Route 66.

In Ireland we grew cigarette market share to 25.0 per cent with growth in Superkings.

Although our overall cigarette share declined slightly in France to 3.3 per cent, we have strengthened our value offering by extending the JPS family. We maintained our market leading position in the fine cut tobacco sector with our share at 29 per cent supported by a good performance by Interval.

In Greece, despite downtrading, Davidoff continued to perform strongly in the premium sector with 16 per cent volume growth and with the repositioning of West and the launch of Maxim Slims our market share rose to 7.0 per cent.

In Spain our market share grew to 5.1 per cent, mainly due to the success of the JPS brand family. We are market leaders in the growing fine cut tobacco market and delivered a strong performance with Golden Virginia.

The benefits of investment in a new salesforce in Italy were reflected in our cigarette share which reached 1.6 per cent with growth from Peter Stuyvesant, Route 66 and West.

OUTLOOK

Given the current regional dynamics, we believe the breadth of our product portfolio provides us with opportunities for future growth as we continue to strengthen our position in this region.

24

Rest of Western Europe Regional Overview

Financial Highlights | | 2005 | | 2004 | |

Turnover excluding duty | | £ | 644 | m | £ | 634 | m |

Operating Profit | | £ | 326 | m | £ | 329 | m |

| | | | | |

Overall Market Size(1) | | 2005 | | 2004 | |

Cigarette | | 329 | bn | 338 | bn |

Fine Cut Tobacco | | 30,900 | t | 31,400 | t |

| | | | | |

Imperial Tobacco Volumes | | 2005 | | 2004 | |

Cigarette | | 17.7 | bn | 16.5 | bn |

Fine Cut Tobacco | | 15,600 | t | 16,600 | t |

| | | | | |

Imperial Tobacco Cigarette Market Shares(1) | | 2005 | | 2004 | |

Netherlands | | 4.9 | % | 3.3 | % |

France | | 3.3 | % | 3.5 | % |

Ireland | | 25.0 | % | 24.8 | % |

Italy | | 1.6 | % | 1.1 | % |

Greece | | 7.0 | % | 6.8 | % |

Spain | | 5.1 | % | 4.5 | % |

| | | | | |

Imperial Tobacco Fine Cut Tobacco Market Shares(1) | | 2005 | | 2004 | |

Netherlands | | 50.3 | % | 54.3 | % |

France | | 29.0 | % | 29.5 | % |

Italy | | 57.4 | % | 57.4 | % |

Greece | | 46.2 | % | 49.6 | % |

Spain | | 64.4 | % | 65.3 | % |

(1) Imperial Tobacco best estimates

Rest of the World Regional Overview

Financial Highlights | | 2005 | | 2004 | |

Turnover excluding duty | | £ | 1,063 | m | £ | 1,015 | m |

Operating Profit | | £ | 209 | m | £ | 198 | m |

| | | | | |

Imperial Tobacco Volumes | | 2005 | | 2004 | |

Cigarette | | 112.7 | bn | 107.0 | bn |

Fine Cut Tobacco | | 1,800 | t | 1,800 | t |

| | | | | |

Imperial Tobacco Cigarette Market Shares(1) | | 2005 | | 2004 | |

Taiwan | | 11.4 | % | 11.3 | % |

Australia | | 17.7 | % | 17.7 | % |

Poland | | 15.5 | % | 17.3 | % |

Russia | | 5.3 | % | 5.2 | % |

Ukraine | | 18.9 | % | 20.4 | % |

| | | | | | | | |

(1) Imperial Tobacco best estimates

rest of The World

We continued to build our presence and invest for sustainable growth in our Rest of the World region. Volumes and profit grew as a result of some strong in-market performances.

Maxim

A strong performance from Maxim in Russia with volumes up 30 per cent.

Davidoff

Davidoff up 27 per cent in the Middle East.

Paramount

Launched in Poland in 2005 with 1.8% market share at September.

REGIONAL DYNAMICS

This region consists of both mature and developing markets including the key growth regions of Asia, Eastern Europe, Africa and the Middle East. Many of these markets are highly regulated and we are seeing an increasing level of regulatory debate and activity across the world, in part influenced by the Framework Convention on Tobacco Control.

OUR PERFORMANCE

Operating profit in this region grew by 6 per cent to £209 million with our performances across Asia, Eastern Europe, Africa and the Middle East more than offsetting the impact of challenging trading conditions in Central Europe and Duty Free.

In Asia, we increased our market share in Taiwan to 11.4 per cent with a good performance from Boss, benefiting from the introduction of Boss Blue in July. In both Vietnam and Laos we grew our volumes and share, with a strong performance from Bastos. In China, the co-operation with the Yuxi Hongta Group continued to develop with a number of collaborative workshops and the extension of the West brand distribution to Beijing.

In Australia, profits grew despite market declines. Our cigarette share remained stable at 17.7 per cent with good performances from Peter Stuyvesant and Superkings.

In Central Europe, we continued to develop our business in the region despite increasing competitor activity in the ultra low price segment. In Poland, we regained market share momentum following the repositioning of Route 66 and the introduction of Paramount. Conditions remain challenging across the region and we continue to focus on balancing profit and volume, with some encouraging recent brand launches of Paramount, Golden Gate and Moon.

In Eastern Europe, our volumes grew. Highlights include our Russian market share, up to 5.3 per cent with growth in Maxim, our improved portfolio in the Ukraine with the newly introduced Classic and in the Caucasus, volumes rose by over 70 per cent.

Following the completion of our new cigarette factory in Turkey and our subsequent brand launches into the market in April and September, early progress is encouraging.

In Africa, our profits grew with positive market share developments in Central and Western Africa, and in the Middle East, Davidoff continued to extend our regional presence with volumes up 27 per cent.

OUTLOOK

There are encouraging opportunities for the Group in this region, given the broad spread of markets it encompasses. It is through this very diversity that we are able to manage our regional performance effectively and we continue to focus on profitable volume development while investing for future growth.

25

OPERATING AND FINANCIAL REVIEW

Manufacturing

We delivered further significant cost savings across our manufacturing base. During the year we continued to focus on the simplification and standardisation of our business while reviewing our global manufacturing portfolio in order to remain competitive and reduce costs.

OUR PERFORMANCE

Productivity was up by an excellent 15 per cent with increases in all regions. Cigarette unit costs were down by 6 per cent. We further simplified our product portfolio reducing our blends, materials, ingredients and Stock Keeping Units. Blends were down by 10 per cent during the year, bringing the total reduction to 41 per cent in the past three years. We continue to manage our Stock Keeping Units reducing the opening position by some 9 per cent.

Reflecting our ongoing commitment to address our surplus production capacity, we closed our factories in Dublin, Plattsburgh and Montreal enhancing our productivity and improving operational efficiencies. In September, we announced the closure of the UK rolling papers factory in Treforest, South Wales, and the transfer and consolidation of production to our larger papers plant in Wilrijk, Belgium. We also announced plans to restructure our European cigarette operations, including the relocation of approximately 10 billion cigarettes for the Central and Eastern Europe markets from Germany to Poland.

Standardising our systems is key to our operational efficiency. A consistent product quality rating system, a time to market system, standard factory data collection and control systems and ISO standards for quality and environment all contributed to reduced waste, lower write-off costs, lower energy usage and improved factory performance. We have driven a number of improvements in the year, reflected in our key performance indicators, for example, four sites gained ISO accreditation.

The use of key performance indicators has also helped us in improving our supply chain, which moves more than 700,000 tonnes of products per year. We are implementing an integrated IT system to improve our performance, in the areas of stock visibility, sales forecasting and production planning.

OUTLOOK

We will continue to drive for improvements throughout our manufacturing and supply chain activities as we have done over the last 20 years, focusing on business simplification in all areas, delivering both improvements in product quality and cost savings, while remaining flexible and responsive to market dynamics.

26

Manufacturing Overview

Manufacturing sites

• 21 cigarette factories

• 7 other tobacco products factories

• 4 papers and tubes factories

27

Operating Environment

The operating environment is challenging. We are experienced in managing the issues faced by the industry worldwide and we continue to engage constructively with governments and regulatory authorities at both national and international levels.

SMOKING IN PUBLIC PLACES

In a number of the markets and regions in which we operate the debate on the introduction of restrictions or outright bans on smoking in public places and in the workplace has intensified. As stated previously, we support sensible regulation but believe that outright bans are unnecessary and disproportionate. Our experience in Ireland confirms our view on the impact of restrictions on smoking in public places. It is clear that smokers will continue to smoke; there may be an initial dip in consumption but this diminishes over time.

FRAMEWORK CONVENTION ON TOBACCO CONTROL (FCTC)

Adopted in May 2003, the World Health Organisation’s Framework Convention on Tobacco Control is the first global tobacco treaty that seeks to regulate tobacco products in a number of areas including tobacco advertising, labelling, product testing and submission of ingredient information, as well as product traceability. The Convention also addresses tobacco taxation and calls for tightened legislation to clamp down on smuggling and illicit products. The number of ratifications required for the FCTC to take effect was achieved in November 2004.

We support strong measures to tackle illicit trade and to prevent youth smoking, but we believe that some areas covered by the Convention are more appropriately left to national authorities.

EUROPEAN UNION TOBACCO PRODUCT DIRECTIVE (EUTPD)

The European Commission published its first report on the application of the EUTPD in July 2005. The report does not call for immediate changes to the Directive.

PICTORIAL HEALTH WARNINGS

Following the European Council’s decision in 2003 concerning the use of pictorial health warnings on packs, the European Commission published an image library in May 2005. The use of pictorial health warnings is a Recommendation and is not compulsory.

Thailand introduced pictorial health warnings in March 2005 and the Australian Government will require warnings from March 2006. It is our view that the use of pictorial health warnings is unnecessary. They provide no additional information to the public about the health risks associated with smoking and are designed solely to vilify, stigmatise and shock.

We are not aware of any evidence to suggest that pictorial health warnings have had any impact on consumers’ smoking behaviour in countries where they have already been introduced, such as Canada and Brazil. However, we will comply with all legislation that requires us to display them on our products. We shall continue to raise our concerns with the relevant authorities.

The erosion of our intellectual property rights through ever more intrusive health warnings and other information that we are required to print on packs is a cause for concern and we continue to raise this issue with governments and regulatory bodies accordingly.

ADVERTISING RESTRICTIONS

The European Union Advertising Directive came into effect on 31 July 2005, banning the advertising of tobacco products in the print media, on radio broadcasts and through tobacco related sponsorship for events such as Formula One motor racing and the World Snooker Championship. In 2003, the German Government took legal action against parts of the Directive, arguing that the regulation of tobacco advertising should be a national responsibility. We understand that a ruling is expected in 2006.

28

In the UK, the Tobacco Advertising and Promotion (Point of Sale) Regulations 2004 took effect in December 2004 in England, Wales and Northern Ireland, limiting advertising inside tobacco retailers to a total surface area equivalent to one A5 sheet of paper (including text health warning and quit line telephone number). Scotland has introduced almost identical legislation.

In March 2004 the Irish Government passed the Public Health Tobacco Act, which bans product displays and in-store advertising whilst conferring major search and seize powers on the Office of Tobacco Control. The Act is being challenged in court by a number of tobacco companies including ourselves.

We have stringent, self-imposed policies and standards in place that cover our advertising and promotional activities worldwide, and we do not believe that advertising bans are necessary. Our International Code of Practice for the Marketing of Tobacco Products is available on our website www.imperial-tobacco.com.

In the context of increasing regulation and a challenging global environment we continue to build constructive relationships with governments and regulatory bodies worldwide. Our objective remains to ensure that regulation of tobacco products is sound, proportionate and workable. We do not accept without challenge, regulation that is flawed, unreasonable or disproportionate; nor do we engage lightly in legal challenges. However, we will do so where we believe it is necessary to protect our business interests.

TOBACCO DUTY

Significant duty increases took place this year in several Western Europe countries, most notably in Germany and in the Member States that joined the EU in May 2004. We remain concerned that substantial duty increases encourage the growth of smuggling, illegal cross-border trading and counterfeiting and we are totally opposed to such activities. We continue to work with Customs Authorities in a number of countries to counter this illegal trade. We have signed Memoranda of Understanding (MoU) in seven countries to date. Discussions are progressing in a further twelve countries. The recent signing of the updated MoU in China between local authorities and a coalition of tobacco companies (including Imperial) is the result of continuing activities to tackle counterfeit products.

TOBACCO-RELATED LITIGATION

In Scotland, on 31 May 2005 we received a favourable judgment in the case of McTear v. Imperial Tobacco Limited. The judgment found in favour of the Company on all counts and has not been appealed. Abandonment has been agreed in respect of ten other cases brought against us in Scotland in which individual claimants were seeking damages for alleged smoking-related effects. The one remaining case against us in Scotland is inactive.

In the Republic of Ireland, the number of claims against the Company has fallen from 307 in 1997, to 13 (two of which have been dismissed subject to appeals and one whose statement of claim was served out of time and has been returned); 294 cases have been dismissed, discontinued or are not proceeding. No case has gone beyond service of a statement of claim and replies to notices of particulars.

In Poland, an individual claimant has served proceedings on us. There have been several preliminary hearings and we anticipate judgment in late 2005/early 2006. During 2005, a further individual filed a claim against us which the court rejected on the basis that it failed to comply with legal formalities. On 4 February 2005 a Health Association filed proceedings against us and other tobacco companies. These proceedings have not been formally served on Imperial Tobacco or any of the other tobacco companies.

In the Netherlands, we have received claim letters on behalf of 44 individuals, although 15 of those individuals have now withdrawn. Testimony has been taken from the majority of the remaining potential claimants at preliminary hearings. No proceedings have been commenced.

In Australia, an individual claimant has served proceedings on seven tobacco companies, including our Company. A statement of claim has been served.

To date, no judgment has been entered against Imperial Tobacco and no action has been settled in favour of a claimant in any tobacco-related litigation involving Imperial Tobacco or any of its subsidiaries. Imperial Tobacco has been advised by its lawyers that it has meritorious defences to the legal proceedings in which damages are sought for alleged smoking-related health effects and to threatened actions of a similar nature. We will continue to contest all such speculative litigation against the Group.

29

OUR PEOPLE…

Our success in 2005 was as much about our people as our products and markets. We aim to provide an environment where our employees can maximise their potential.

Kathryn Brown

Group Human Resources

Director

Our employees are focused on delivering results for the benefit of our shareholders. It is their commitment that turns our strategy into reality.

FIDISON ANDRIAMIHAJA

Factory Manager SOCIGA

Libreville Gabon

Managing a factory in Africa presents me with opportunities and challenges as my responsibilities not only include production but also the maintenance and logistics which ensure the smooth running of the factory. The challenge was made even more exciting for me by breaking up borders: that’s how someone born in Madagascar, who grew up in Europe, can today be in charge of a factory in Central Africa. Who knows what’s next…

ANTJE SCHLICHTING

Group Corporate Intelligence Manager

Bristol

I joined Imperial Tobacco from Reemtsma, working in Industry Affairs since 2000. As Head of the Intelligence Team I work on a wide range of regulatory issues, developing the forecasting of long-term trends in the external environment. I enjoy contributing to projects that are not directly linked to my area of work, as well as working and communicating with colleagues worldwide.

THOMAS VEIT

Marketing Manager

Germany/Austria

I head up the Marketing function for Imperial Tobacco in Germany/Austria. Together with my team, we are responsible for strategy and programme development in consumer and trade marketing, as well as the hospitality sector. My job is a challenging but an exciting mix of people management and issues solving, both strategic and operational, in an ever-changing political and cultural environment.

JACQUELINE OKSAS

Operator

Berlin Factory

I have worked in our Berlin factory for 16 years as an operator in the Secondary Department. I survey the production machines, specifically packing machines, along with the quality control of our products. Working at high-speed machines requires concentration and technical understanding. Efficiency as well as compliance of international regulations is key. It is a demanding role but I enjoy being presented with a challenge.

30

We continue to strengthen and develop our employment practices to reflect the international nature of our business. We have revised and applied a continuous improvement methodology to our integrated performance management system, providing a route to highlight the development and communication of the behaviours, which drive personal performance in the business.

The promotion of good working relations with employees through trade unions, works councils and other organisations continued throughout the year. Where reorganisation has impacted on employment, we have ensured that affected employees are treated fairly and responsibly.

What is it like to work for Imperial Tobacco…

NICK PEARSON

Corporate Responsibility Specialist

Bristol

My role allows me to create extensive networks throughout the Group, both hierarchically and geographically. This relationship building is not only critical to achieving my objectives within the Corporate Responsibility department, such as management of the Group Policy process, but is also one of the most enjoyable aspects of my job. It also gives me a good overview of the business as a whole and keeps my role extremely varied and interesting.

BRENDA CHU

HR Manager

Taiwan

I became HR Manager, responsible for our Taiwan office, in 2003. During this time our office has grown more than two-fold, with employees being recruited from all over the world, including Taiwan, Hong Kong, Singapore, Australia, UK and Ireland. The last two years have been fun and challenging. I have enjoyed the sense of achievement which has made the effort worthwhile.

EMRE GENC

Sales Representative

Turkey

I joined Imperial Tobacco Turkey as a sales representative in March 2005, and find my job challenging and exciting. I know that I am at the right place to further my career, and fulfilling my duties gives me great satisfaction. My colleagues and I feel we have made great progress, but continue to work hard to make each day better than the last.

LAURA POWNALL

Customer Service Support

Nottingham

I joined Imperial Tobacco in November 2003 and work in our Customer Service Department as a Support Clerk. My tasks include processing customer and representative’s orders and dealing with their queries. I enjoy contact with customers and I continually strive to build professional business relationships on behalf of the company.

31

CORPORATE RESPONSIBILITY

Our objective is to operate a sustainable and profitable business whilst behaving as a good corporate citizen, integrating Corporate Responsibility into every aspect of the Group.

We recognise that in the ever-changing and competitive market place Corporate Responsibility has an increasingly strategic role and as such are pleased with the advances we have made during the year.

We have now achieved over 75 per cent of the two-year objectives we set in our first Corporate Responsibility Review in 2003. We have incorporated the remainder which remain relevant into a new set of two-year objectives, which will be published in our 2005 Review in December.

We believe there is a real need for informed debate on significant issues of public interest and so in our 2005 Corporate Responsibility Review we will provide more information on issues such as product stewardship, social performance, occupational health and safety and environmental management.

We have increased our interaction and engagement with stakeholders and a number of regional employee workshops have focused on enhancing our expertise in effective stakeholder relationships.

Over the last year we have reviewed and revised our Group policies, which guide and direct how we do business throughout the world, together with our more detailed Group standards which amplify and quantify our performance requirements world-wide. Additionally, we have updated our Corporate Manual for Directors.

PRODUCT STEWARDSHIP AND HEALTH

This year we have made submissions to 39 competent authorities on our product ingredients, for example as required under the EU Tobacco Product Directive, and included data concerning our knowledge of their toxicology.

We continued to consult medical and scientific experts who inform us of their views on scientific developments related to our products. Our own views are based on their advice. Our laboratories continue the routine testing of product ingredients as well as finished products, using internationally standardised tests whenever possible. We continued to commission academic research and further experimental work at accredited contract laboratories using cell-based systems. The scientific difficulty of obtaining meaningful results in this area has been highlighted by three scientific advisory committees to the UK government. We will discuss their findings and our own approach to product stewardship and health in our 2005 Corporate Responsibility Review.

OCCUPATIONAL HEALTH, SAFETY AND THE ENVIRONMENT

We have continued our successful record of achieving ISO certification in our manufacturing facilities worldwide, with four more attaining ISO 14001 certification this year. This brings our total of certified manufacturing facilities to 17 – including our first in both Eastern Europe and Africa.

We have carried out an extensive analysis of our direct and indirect carbon emissions as part of our climate change strategy. This has led to the reframing of our energy reduction targets in terms of carbon dioxide emissions and a greater focus on the management options which may deliver significant reductions and energy savings. In this regard, we continue our successful collaboration with the UK Carbon Trust and the Carbon Disclosure Project.

We continue to improve our occupational health and safety, fire and security risk control processes by providing professional support and management at both a Group and functional level. No fatal injuries occurred throughout our global workforce and our accidents rates were stable. We are increasing our focus on improving our safety performance concentrating on the underlying causes of lost-time accidents.

Frank Rogerson, our Corporate Affairs Director, is the nominated member of the Board with responsibility for Occupational Health, Safety and the Environment.

32

CORPORATE RESPONSIBILITY HIGHLIGHTS

• Our ranking in the 2004 BITC Environment Index was 78/168. Over the last four years, our performance has shown steady improvement. We are pleased that our score has increased from 79 per cent in 2003 to 83 per cent in 2004.

• We participated in the Dow Jones Sustainability Index process for the first time this year. Our overall score was 66 per cent compared with an industry average of 44 per cent.

• We are board members of the Eliminating Child Labour in Tobacco Foundation. Projects are underway in Malawi, Uganda, Tanzania, The Philippines and Kyrgyzstan.

• We have formed partnerships with NGOs engaged in both reforestation and deforestation mitigation programmes in Malawi, Madagascar and Mozambique.

• Our local community investment programmes cover Asia and Australasia, Africa, the UK and Germany.

• We have achieved 41 of the 54 targets we set in the financial period 2003 to 2005 and reassessed and carried over the remainder.

• Our factory in Wilrijk, Belgium, has won the 2005 Rene de Jongh national safety award through committed leadership and workforce co-operation.

• Our factory in Wellington, New Zealand, has achieved the tertiary level requirements for the Government’s ACC Workplace Safety Management Practices Programme, for continuous improvement and best practice.

• Stakeholder engagement training workshops were completed for more than 100 managers worldwide.

SOCIAL PERFORMANCE

Our human rights policy requires that we have rigorous and systematic practices in place. We are setting up audit mechanisms for our compliance with the International Labour Organisation (ILO) core conventions to which we are committed. As part of a rolling four-year programme, we have now completed 13 audits of facilities using SA 8000 as guidance.

Our self assessment programme for our suppliers of tobacco materials has again shown improvements in social and environmental performance. The equivalent programme for non-tobacco suppliers shows generally high levels of performance. These programmes have created a platform for further constructive dialogue with suppliers.

We are committed to behaving as a responsible corporate citizen in the communities in which we work and in society as a whole. To this end, we have continued to expand our community investment activities, committing a total of £1.26m. We are now partnering a number of nongovernmental organisations (NGOs) in projects such as providing clean water sources in Madagascar and reforestation and deforestation mitigation programmes in Malawi, Madagascar and Mozambique. We are also Board members of the Eliminating Child Labour in Tobacco Foundation, www.eclt.org, which runs many successful projects internationally.

33

BOARD OF DIRECTORS

DEREK BONHAM | FRANK ROGERSON | IAIN NAPIER |

ANTHONY ALEXANDER | SIMON DUFFY | PIERRE JUNGELS |

GARETH DAVIS | DAVID THURSFIELD | COLIN DAY |

ROBERT DYRBUS | SIPKO HUISMANS | MATTHEW PHILLIPS |

DAVID CRESSWELL | SUSAN MURRAY | |

34

DEREK BONHAM FCA, AGED 62

Chairman and a Member of the Remuneration Committee

Appointed Non-Executive Chairman on our London Stock Exchange Listing in 1996. He has a wide range of managerial and financial experience gained as a former Executive Chairman of The Energy Group PLC, a former Non-Executive Chairman of Cadbury Schweppes plc, Marconi plc, CamAxys Group plc and Songbird Estates plc and a former Deputy Chairman of Hanson PLC, having previously held a number of senior management and financial positions. He is also a former Non-Executive Director of TXU Corp (USA).

ANTHONY ALEXANDER FCA, AGED 67

Joint Vice Chairman, Senior Independent Director and a Member of the Audit Committee

Appointed Vice Chairman on demerger and acts as senior independent Non-Executive Director. He also serves as a Non-Executive Director of Misys plc and Platinum Investment Trust plc. He is a former Executive Director of Hanson PLC and as Chief Operating Officer he had responsibility for all their UK operating companies.

GARETH DAVIS BA, AGED 55

Chief Executive

Appointed Chief Executive in 1996 and led the successful demerger of the Company from Hanson PLC and its listings on the London and New York Stock Exchanges. With wide experience across all aspects of Imperial Tobacco’s business gained from over 30 years with the Company, he has played a key role in the development of both general strategy and the ongoing expansion programme. In 2003 he was appointed as a Non-Executive Director of Wolseley plc.

ROBERT DYRBUS BSC, FCA, AGED 52

Finance Director

Appointed Finance Director of Imperial Tobacco Limited in 1989 and was one of the three-man Hanson team involved in the strategic reorganisation of the Group. He became Finance Director of the Group on demerger in 1996 and has since played an integral part in shaping the strategic direction of the Group. Previously he was financial controller with Hanson PLC, responsible for Imperial Tobacco and Ever Ready.

DAVID CRESSWELL C ENG, MIEE, AGED 60

Manufacturing Director

Joined Imperial Tobacco in 1961 and was appointed to the Board in June 2003. An electrical engineer by background, he has undertaken a number of senior management roles and has previously held the position of Managing Director for each of Imperial Tobacco’s major operating divisions namely Cigarette, Rolling Paper and Roll Your Own Tobacco.

FRANK ROGERSON BSC, PHD, AGED 52

Corporate Affairs Director

Appointed to the Board in June 2003, having joined Imperial Tobacco in 1977, he has held a number of senior management positions including Managing Director of Cigar and Roll Your Own Tobacco. Appointed Business Development Director in 2000, he was instrumental in negotiations for the acquisition of Reemtsma.

SIMON DUFFY MA, MBA, AGED 55

Non-Executive Director and Chairman of the Audit Committee

Appointed to the Board in 1996 as a Non-Executive Director and Chairman of the Audit Committee. Currently Chief Executive Officer of ntl Inc, he was formerly Chief Executive Officer of End2End Holdings Limited and of World Online International BV and Chief Financial Officer of Orange SA and of EMI Group plc, where he was also Deputy Chairman. Previously Operations Director of United Distillers, he is a former Non-Executive Director of GWR Group plc.

DAVID THURSFIELD AGED 60

Non-Executive Director and Member of the Remuneration Committee (resigned 28/10/05)

Appointed a Non-Executive Director in November 2003. He joined Ford Motor Company in 1979, from British Leyland, and was Executive Vice President, Ford Motor Company and President, International Operations and Global Purchasing responsible for the Premier Automotive Group, Mazda Motor Company, Ford of Europe, Ford Asia Pacific operations and Global Purchasing organisations until his retirement in May 2004. He remains a consultant to Ford.

SIPKO HUISMANS BA, AGED 64

Non-Executive Director and a Member of the Remuneration Committee

Appointed a Non-Executive Director in 1996. He joined Courtaulds in Southern Africa in 1961 and moved to the UK in 1968. He became a Director of Courtaulds in 1984 and was responsible for the Chemical and Industrial business from 1986 until the demerger of Courtaulds Textiles in 1990, when he became Managing Director. He was appointed Chief Executive of Courtaulds from 1991 until his retirement in 1996.

SUSAN MURRAY AGED 48

Non-Executive Director

Appointed a Non-Executive Director in December 2004. She was a member of the Board of Littlewoods Limited from October 1998 until January 2004, latterly as Chief Executive of Littlewoods Stores Limited. Prior to joining Littlewoods she was Worldwide President and Chief Executive of The Pierre Smirnoff Company, part of Diageo plc. Ms. Murray is a fellow of the Royal Society of Arts, a council member of the Advertising Standards Authority and a Non-Executive Director of Enterprise Inns Plc, SSL International PLC and Wm Morrison Supermarkets plc. She has also served as a Non-Executive Director of Aberdeen Asset Management PLC.

IAIN NAPIER ACMA, AGED 56

Joint Vice Chairman, Chairman of the Remuneration Committee and a Member of the Audit Committee

Appointed a Non-Executive Director in 2000. He is currently Group Chief Executive of Taylor Woodrow plc. As a former main board Director of Bass PLC, he was Chief Executive of Bass Leisure and then Chief Executive of Bass Brewers and Bass International Brewers. Following the sale of the Bass beer business in 2000, he became Vice President UK and Ireland for Interbrew SA until August 2001. He is also a former Non-Executive Director of BOC Group plc.

PIERRE JUNGELS CBE (HON) ING GEOL, PHD, C ENG, FELLOW EL, AGED 61

Non-Executive Director and a Member of the Remuneration Committee and the Audit Committee.

Appointed to the Board in August 2002. He has held numerous senior international positions within the oil industry with Shell International, Petrofina SA and British Gas PLC. He became CEO of Enterprise Oil in 1996, leading the business to substantial geographic and financial growth until his retirement in November 2001. He is Non-Executive Chairman of Offshore Hydrocarbon Mapping plc and Rockhopper Exploration PLC and a Non-Executive Director of Woodside Petroleum Ltd and Offshore Logistics Inc.

COLIN DAY MBA, FCCA, AGED 50

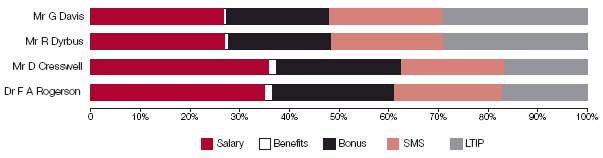

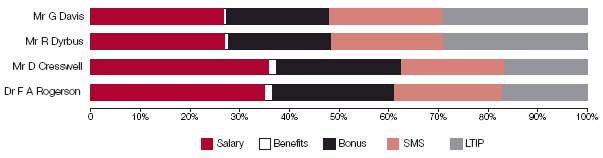

Non-Executive Director