Exhibit 99.1

| | Imperial Tobacco Group PLC |

| | Annual Report and Accounts 2006 |

Building on our success

The Group at a Glance

Imperial Tobacco is the world’s fourth largest international tobacco company, which manufactures, markets and sells a comprehensive range of cigarettes, tobaccos, rolling papers and tubes.

| | Overview | | Our Brands |

| | | | |

Group | | Imperial Tobacco products are available in over 130 countries worldwide. Our geographic and product diversity provides business resilience and a strong platform for future growth. | | • Our key premium international cigarette brand Davidoff has a strong foothold in Asia and a growing presence in a number of markets worldwide. • West is our biggest selling cigarette brand with its major markets in Germany and in Central and Eastern Europe. • Complementing our cigarette portfolio we are world leaders in fine cut tobacco, papers and tubes with brands such as Golden Virginia, Drum and Rizla. |

| | | | |

United Kingdom | | We have clear market leadership in the UK, which is a key profit centre for the Group, with strong positions in cigarette, fine cut tobacco and papers. | | • Lambert & Butler has been the UK’s best selling cigarette for 8 consecutive years with Richmond the UK’s number two cigarette brand. • Golden Virginia is the UK’s leading fine cut tobacco brand. • UK key brands:

Lambert & Butler, Richmond, Windsor Blue, Superkings, Embassy, Regal, Golden Virginia, Drum, Rizla. |

| | | | |

Germany | | Germany is an important contributor to our overall results. Our cigarette market share is growing and although trading conditions are challenging, our broad portfolio enables us to respond to changing consumer dynamics. | | • Our cigarette brand JPS has been the main driver behind the growth in our cigarette share, with West a key brand in Germany in both cigarette and other tobacco products. • Germany key brands:

West, Davidoff, JPS, Cabinet, Peter Stuyvesant, R1, Drum, Van Nelle. |

| | | | |

Rest of Western

Europe | | Building on our leading position in fine cut tobacco and papers, we have growing cigarette shares in a number of markets in our Rest of Western Europe region, despite a highly competitive and regulated environment. | | • Davidoff, West and JPS are performing strongly in the premium, mid and value segments across the region. • Rest of Western Europe key brands:

Davidoff, West, JPS, Route 66, Bastos, Interval, Van Nelle, Golden Virginia, Drum, Rizla. |

| | | | |

Rest of

the World | | Our Rest of the World region is diverse with over 100 countries, with different dynamics, opportunities and challenges. We are growing our market shares and sales volumes in many markets across the region. | | • Davidoff is growing across this region with line extensions in the Middle East, Asia and Eastern Europe and launches into Africa. • Rest of the World key brands:

Davidoff, West, Paramount, Route 66, Excellence, Boss, Prima, Maxim, Horizon, Classic, Rizla. |

2006 Financial Performance

Revenue Less Duty | £3,162m |

| |

Adjusted Profit from Operations | £1,356m |

Contributions to the Group | | Revenue Less Duty | | Adjusted Profit from Operations |

| |

| |

|

| | £835m | | £506m |

| | | | |

Contributions to the Group | | Revenue Less Duty | | Adjusted Profit from Operations |

| |

| |

|

| | £584m | | £274m |

| | | | |

Contributions to the Group | | Revenue Less Duty | | Adjusted Profit from Operations |

| |

| |

|

| | £637m | | £324m |

| | | | |

Contributions to the Group | | Revenue Less Duty | | Adjusted Profit from Operations |

| | | | |

| |

| |

|

| | £1,106m | | £252m |

Key Global Brands

Our key global brands of Davidoff, West, Drum, Golden Virginia and Rizla are complemented by a strong portfolio of regional and local brands such as Lambert & Butler, JPS, Horizon, Maxim, Excellence and Route 66.

Manufacturing

Our 32 factories are focused on production quality, business simplification and optimising our cost base. We continue to increase productivity and reduce our unit costs.

Cigarette factories | | 21 |

| | |

Other tobacco product factories | | 8 |

| | |

Papers and tubes factories | | 3 |

www.imperial-tobacco.com

Financial Highlights

(In £’s million) | | 2006 | | % change | | 2005 | |

Revenue | | 11,676 | | +4 | % | 11,229 | |

Revenue less duty | | 3,162 | | +1 | % | 3,123 | |

Profit from operations | | 1,311 | | +6 | % | 1,240 | |

Adjusted profit from operations | | 1,356 | | +5 | % | 1,297 | |

Profit before tax | | 1,168 | | +8 | % | 1,078 | |

(In pence) | | 2006 | | % change | | 2005 | |

Basic earnings per share | | 122.2 | | +13 | % | 108.6 | |

Adjusted earnings per share | | 122.2 | | +9 | % | 112.2 | |

Diluted earnings per share | | 121.6 | | +12 | % | 108.1 | |

Dividend per share | | 62.0 | | +11 | % | 56.0 | |

Management believes that reporting adjusted measures provides a better comparison of business performance for the year and reflects the way in which the business is controlled. Accordingly, adjusted measures of profit from operations, net finance costs, profit before tax, taxation and earnings per share exclude, where applicable, restructuring costs, retirement benefit net finance income, fair value gains and losses on derivative financial instruments and related taxation effects. Reconciliations between adjusted and reported profit from operations, net finance costs and profit before tax are included within note 1 to the financial statements, adjusted and reported taxation in note 6, and adjusted and reported earnings per share in note 8. The term adjusted is not a defined term under International Financial Reporting Standards and may not be comparable with similarly titled measures reported by other companies.

Adjusted Earnings Per Share

(pence) | | Dividend Per Share

(pence) | | Adjusted Profit from

Operations (£million) | |

| | | | | |

122.2 | p | 62 | p | £ | 1,356 | m |

+9% on 2005 | | +11% on 2005 | | +5% on 2005 | |

| | | | | | |

Contents

Davidoff

Davidoff is our key premium international cigarette brand.

1

Operating and Financial Review

Chairman’s Statement

Building on our success

“On the tenth anniversary of our listing on the London Stock Exchange, I am extremely pleased that the successful execution of our strategy has again delivered a strong set of results.”

Derek Bonham, Chairman

Earnings and Dividends

This year’s results build on our impressive track record, clearly demonstrating our consistent ability to create sustainable shareholder value.

Growing sales volumes, good brand performances, our ongoing focus on costs, and effective cash management have delivered an increase in adjusted earnings per share of 9 per cent to 122.2 pence. Basic earnings per share were 122.2 pence (2005: 108.6 pence).

The Board recommends a final dividend of 43.5 pence per share bringing the total dividend for the year to 62.0 pence, up 11 per cent on 2005 (2005: 56.0 pence).(1)

An Outstanding Track Record

The last decade has been a wonderfully exciting time in the long history of Imperial Tobacco. Since listing in 1996, we have transformed a largely UK business into the world’s fourth largest international tobacco company. Total shareholder return over this period ranks us second amongst FTSE 100 companies. £100 invested in Imperial Tobacco in 1996 would have grown to almost £800 by 2006, over 6 times the return of the FTSE All-Share Index. The share price has risen from 329 pence(2) in 1996 to an all time high of 1,843 pence during this year. Adjusted earnings per share and dividends have both grown by a compound 15 per cent.

Since 1996, we have invested £5.2 billion in acquisitions which have enabled us to significantly increase our geographic footprint and enhance our product and brand portfolio. These acquisitions, combined with our underlying organic growth, have delivered significant returns to shareholders. Fundamental to our success has been our

(1) If approved, the dividend will be paid on 16 February 2007 to those shareholders on the register at close of business on 19 January 2007.

(2) Adjusted to reflect the bonus element of the two-for-five discounted rights issue in 2002.

2

focus on profitable top-line growth combined with a rigorous approach to controlling costs and effectively utilising the cash we generate.

An excellent management team, supported by a dedicated and highly skilled work force, has converted our plans into the tangible results we have consistently delivered.

Corporate Governance

Our dedication to delivering excellent results is matched by our commitment to maintaining high standards of corporate governance. We believe our reporting has always been open and transparent, and this year we have refined our approach to include the latest UK legislative requirements.

Board

In accordance with our corporate governance practices and as part of our ongoing evaluation of Board performance, we regularly review Board membership to ensure that we have the skills and expertise necessary to run our international business.

This year I was pleased to welcome Graham Blashill as Group Sales and Marketing Director, and Ken Burnett and Charles Knott as Non-Executive Directors. David Thursfield resigned as a Non-Executive Director in October last year. Simon Duffy and Sipko Huismans retired as Non-Executive Directors at the end of the 2006 Annual General Meeting, both having served nine years on the Board. I thank them most warmly.

I will shortly be retiring as Chairman and will be succeeded by Iain Napier, currently Joint Vice Chairman and Senior Independent Director. I have been pleased to work alongside Iain since his appointment to the Board in 2000, and wish him every success.

This is my last annual report and it has been a pleasure and a privilege to serve as your Chairman. Above all, it has been tremendously enjoyable, due to the friendship and dedicated support of all my Board colleagues over the years.

The Group is in good shape and in capable hands. I am confident that Imperial Tobacco will continue to achieve sustainable growth, creating value for its shareholders.

Derek Bonham

Chairman

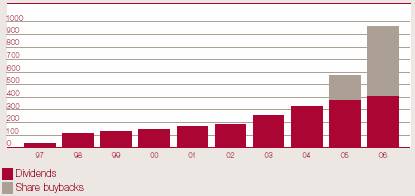

Total Shareholder Return

Total shareholder return since our listing in 1996 ranks us second amongst FTSE 100 companies.

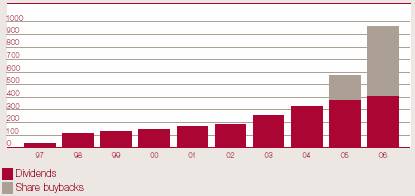

In the past ten years we have returned more than £2.8 billion to shareholders by way of dividends and share buybacks.

Total Shareholder Return (Index)

Cash Returned to Shareholders (£m)

3

Operating and Financial Review

Chief Executive’s Review

Delivering our strategy

“We have again demonstrated the strength of our strategy and our organic growth credentials. Our brands and in-market performances and the commitment of our people have all contributed to another great year.”

Gareth Davis, Chief Executive

Performance Overview

Our success in 2006 has been reflected in a 7 per cent growth in our cigarette volumes and share gains across all our regions. In the UK, a good performance from our existing brand portfolio has been complemented by the successful national launch of Windsor Blue. In Germany, JPS has continued to grow strongly. In the Rest of Western Europe and Rest of the World regions, we have grown our shares in most of our markets.

Our key premium international cigarette brand Davidoff performed well, with global volumes up 6 per cent on last year to 14 billion cigarettes. In September 2006, we acquired the worldwide cigarette trademark for the brand, having been the long term licensee since the acquisition of Reemtsma in 2002. We have had considerable success with Davidoff cigarettes in the last four years and this acquisition will provide us with greater flexibility to develop the brand and accelerate its international growth.

In addition to our acquisition of the Davidoff cigarette trademark, we bought Gunnar Stenberg, a Norwegian distributor of tobacco products and accessories, in February 2006, extending our position in Scandinavia.

In our manufacturing operations, our cigarette unit costs reduced by 6 per cent reflecting excellent progress in our simplification and standardisation programmes. In July, to further improve operational efficiencies and our competitive position, we announced the closure of our other tobacco product factories in Liverpool and Lahr. The closure of the Treforest papers factory and the relocation of our

4

Central European cigarette production to Poland announced last year have now been completed.

In order to ensure the effective use of our cash we increased our rolling share buyback programme to an annual rate of around £600 million in February 2006. In our current financial year, we spent £556 million, including transaction costs, acquiring 32.5 million shares which are held as Treasury shares. The average price paid was £17.02. As at 30 September 2006, we held 46.0 million Treasury Shares representing 6.3 per cent of our issued share capital.

Our success is as much due to our people as it is to our products and brands. Our employees’ enthusiasm and commitment are great assets for Imperial Tobacco, ensuring we continue to deliver on our strategy and create value for our shareholders. My sincere thanks to them all for yet another great year.

Regulation

We have demonstrated our ability to successfully develop our business in highly regulated environments. Regulation continued to increase during the year in many markets in which we operate. We believe that we are well positioned to effectively manage regulatory challenges. We welcome constructive dialogue with governments and regulatory bodies in pursuit of sensible, practical and proportionate regulation.

Corporate Responsibility

In my introduction to our most recent Corporate Responsibility Review, I reiterated our commitment to corporate responsibility and our performance across many measured criteria has continued to improve. More detail on our progress is included onpages 32 to 35 of this report and on our website www.imperial-tobacco.com

Outlook

Looking ahead, we believe that we are in a strong position. Our widening geographic footprint combined with our broad product portfolio offers many opportunities to leverage and build brand equity, with long term sustainable growth prospects across the business.

Our unrelenting focus on cost and efficiency throughout every part of the business will continue. We remain committed to seeking value creating acquisitions that meet our established criteria. Our rolling share buyback programme is an effective use of our cash flow in the meantime.

Finally, I would like to thank my Chairman, Derek, for his guidance and wise counsel over the years. It has been a privilege to serve as his Chief Executive.

Gareth Davis

Chief Executive

2006 Highlights

��

Our success in 2006 has been reflected in a 7 per cent growth in our cigarette volumes and share gains across

all our regions.

• Drum and Golden Virginia continued to support our world leadership position in fine cut tobacco.

• Building on our considerable success with Davidoff cigarettes in recent years, we acquired the worldwide cigarette trademark in September 2006.

• In manufacturing, we reduced our cigarette unit costs by 6 per cent and made excellent progress in our simplification and standardisation programmes.

• We increased our rolling share buyback programme to an annual rate of around £600 million in February 2006, in order to ensure the effective use of our cash.

5

Operating and Financial Review

World Tobacco Market Context

World Tobacco Market Context

In 2005(1) an estimated 3.5 trillion cigarettes (2004: 3.6 trillion cigarettes) were sold globally, excluding China. Against this background of relatively stable global cigarette consumption, the four largest international tobacco companies, Philip Morris, British American Tobacco, Japan Tobacco and Imperial Tobacco, have a share of around 64 per cent.

Whilst there are local variations, cigarettes are manufactured using two principal tobacco blends, Virginia blendand American blend, each accountingfor approximately half of the worldmarket. Virginia blend products arepredominant in the UK, Africa and mostAsian markets, including China andIndia. American blend products arepredominant in continental, Centraland Eastern Europe, the United Statesand Latin America. Fine cut tobacco ismanufactured using blends of lightand dark tobacco.

Alternatives to cigarettes and fine cut tobacco products include smokeless tobaccos, cigars and pipe tobacco.

Consumption

Some developed markets, including those within the EU, have experienced reduced duty-paid cigarette sales volumes due to significant excise-driven price increases, resulting in increased cross-border inflow and some reduced consumption. On the other hand, some developing markets such as those in Asia, Central and Eastern Europe are experiencing increases in cigarette consumption as a result of rising Gross Domestic Product.

In recent years, there has been a consumer trend towards international branded cigarettes at the expense of local brands. This is likely to continue with volumes of international premium brands remaining relatively stable whilst those in the mid and value price segments may continue to grow.

Duty Increases

In the EU, tax-driven price increases are stimulating growth in value cigarette brands and fine cut tobacco products as consumers downtrade. Governments continue to drive excise increases globally as a key instrument to reduce tobacco consumption.

Duty increases are generally passed on to the consumer. However, in some markets such as in the EU accession countries, which have derogation periods within which they must reach the EU minimum tax level, duty increases have been partly or wholly absorbed by tobacco manufacturers, which has the effect of reducing market profitability.

Regulation

Tobacco legislation and regulation continue to increase in speed, scope, scale and sophistication. For example, restrictions on smoking in public places and pictorial health warnings have been adopted in a number of markets.

The Framework Convention on Tobacco Control took effect on 27 February 2005 and by the end of September 2006 had been ratified by 140 countries, as well as the EU.

(1) Most recent year for which worldwide information is available.

6

Operating and Financial Review

Strategic Overview

Delivering shareholder value

Our Strategy

Our strategy is to create sustainable shareholder value by growing both organically and through acquisitions.

Our Strategic Objectives

We actively pursue three primary objectives which underpin our strategy:

• Sales development

• Cost optimisation and efficiency improvements

• Effective cash management

7

Building sales Growth

Our Five Key Brands

Brands

Our broad brand and product portfolio includes international cigarette brands such as Davidoff and West and strong regional brands such as JPS, Lambert & Butler, Richmond and Horizon. Complementing our cigarette portfolio is our world leadership in fine cut tobacco, papers and tubes with brands such as Golden Virginia, Drum and Rizla. Our brand strategy takes a portfolio approachresponsive to individual market dynamics and price segmentation. We believe there is considerable potential to leverage and build our brand equity.

Trade Marketing

As regulation increases and conventional direct communication between manufacturers and consumers is progressively withdrawn, effectiveness at the point of sale is vital. Our trade marketing objective is to ensure that our brands are available, have impact and are appealing to our consumers.

8

Graham Blashill

Group Sales and Marketing Director

“Sales and marketing excellence are essential to achieving profit growth. We continue to build our sales and trade marketing skills and share best practice to ensure our comprehensive portfolio of brands are available, have impact and are appealing to consumers globally.”

Market Opportunities

With sales in over 130 countries, we have a strong international profile. Our position in mature European markets is balanced by developing markets such as those in Asia and Eastern Europe. We see opportunities, both organic and acquisition led, to enhance and extend our existing operations in our Rest of Western Europe and Rest of the World regions, with the UK and Germany continuing to be key contributors to the overall results.

9

Driving productivity & cost efficiencies

Efficiency Improvements

A continual focus on reducing costs and improving efficiency supports our sales development.

We aim to optimise our manufacturing operations whilst maintaining sufficient flexibility to adapt to changing demand.

Simplification and Standardisation

Our focus on simplification and standardisation continues to deliver profit improvements.

Cost Optimisation

Throughout every aspect of Imperial Tobacco, our culture is focused on cost optimisation and value creation. This frees up funds for us to invest in top-line development.

10

David Cresswell

Manufacturing Director

“We are focused on manufacturing high quality products and simplifying and standardising our manufacturing operations, ensuring a fast and flexible response and delivering cost savings. Throughout every aspect of Imperial Tobacco, our culture is focused on cost optimisation and value creation.”

11

Effective cash management

10 Years of Acquisitions

|

|

|

|

|

|

|

|

1996 | 1997 | 1998 | 1999 | 2000 | | 2001 | 2002 |

Imperial Tobacco

Listed on the London Stock Exchange as a FTSE 100 company. | Rizla

Imperial Tobacco acquired Rizla, the world’s number one manufacturer of rolling papers. | Douwe Egbert Van Nelle

The acquisition of Douwe Egbert Van Nelle extended our fine cut tobacco brand portfolio with Drum and Van Nelle. | Australasia Acquisition

We acquired a portfolio of cigarettes, fine cut tobacco and rolling papers in Australasia, together with a factory in New Zealand. | Mayfair Vending

Imperial Tobacco’s vending subsidiary, Sinclair Collis, acquired Mayfair Vending, a UK cigarette vending machine operator. | EFKA Group

The EFKA Group, a German-based manufacturer of rolling papers and tubes became part of Imperial Tobacco.

Baelen Group

The Baelen Group, a Belgian manufacturer of fine cut tobacco, was acquired. | Tobaccor

Imperial Tobacco acquired a 75 per cent interest in Tobaccor, the second largest cigarette manufacturer and distributor in sub Saharan Africa. The balance was acquired by October 2004. | Reemtsma

Imperial Tobacco acquired a 90.01 per cent interest in Reemtsma Cigarettenfabriken GmbH, the German-based international company. The remainder was acquired in 2004. |

12

Robert Dyrbus

Finance Director

“We look to ensure that the cash we generate is used efficiently, through acquisitions, organic investment and returning funds to our shareholders, adding to our value creation.”

|

|

|

2004 CTC Tube Company of Canada Imperial Tobacco acquired the business and assets of tubes manufacturer CTC Tube Company of Canada. | 2005 Skruf Imperial Tobacco invested in Skruf, a Swedish manufacturer of snus. | 2006 Davidoff Imperial Tobacco acquired the worldwide Davidoff cigarette trademark. Gunnar Stenberg AS A Norwegian distributor of tobacco products and accessories, is acquired by Imperial Tobacco. |

10 Year EPS and Dividend Record

Value Creating Acquisitions

Since 1996, we have invested £5.2 billion in acquisitions which have delivered significant shareholder value. We are committed to continuing to expand our business through both acquisitions and organic investment opportunities. In order to maintain balance sheet efficiency while we assess such opportunities, we have an ongoing share buyback programme.

Our Share Buyback Programme

In order to ensure an effective use of our cash we have our rolling share buyback programme, at an annual rate of around £600 million.

Dividends

Our policy is progressive, growing dividends broadly in line with adjusted earnings per share with around a fifty per cent pay out ratio.

Effective Cash Conversion

We continue to be highly cash generative with an ongoing annual cash conversion rate of around 100 per cent. Our focus is on managing capital expenditure, working capital, tax efficiency and interest costs. Our objective is then to ensure the disciplined allocation of that cash to generate shareholder value.

13

Operating and Financial Review

Principal Risks and Uncertainties

Principal Risks and Uncertainties

A detailed assessment of strategic risks is undertaken by management and is embedded into our corporate planning process.

Each area of the business is required to formally review their principal areas of risk and uncertainty so that major risks are reviewed at all levels across the Group. This is an ongoing process, ensuring there are clear and consistent procedures for monitoring, updating and implementing appropriate controls to manage the identified risks. The Board acknowledges responsibility for the Group’s systems of internal control. More detailed information on the Group’s approach to risk management is found in the Corporate Governance Report.

We are subject to the same general risks and uncertainties as any other business, for example, the political stability in the countries in which we operate and source our raw materials, the impact of natural disasters and changes in general economic conditions including currency and interest rate fluctuations, and the impact of competition.

Outlined below is a description of the principal risks and uncertainties that are specific to, and may impact, our business. Not all these factors are within the Group’s control. There may be other risks and uncertainties which are unknown to the Group or which may not be material now but could turn out to be material in the future.

Regulation

The tobacco industry is subject to substantial and increasing regulation. For many years the trend has been towards an increasingly restrictive regulatory environment. In many of the markets in which we operate, there are regulatory restrictions affecting the manufacture, development, sale, distribution, marketing and advertising of tobacco products. Increased regulation, including the introduction of public place smoking bans, may have an adverse effect on the demand for our products.

Excise Duty

Increasing excise duties on tobacco products are likely to reduce the demand for tobacco products. Tobacco products are subject to excise duty which, in many of the markets in which we operate, represents a substantial percentage of the retail price and has been steadily increasing in recent years. Increasing levels of excise duty have encouraged consumers in affected markets to switch from premium price cigarettes to lower price cigarettes and fine cut tobacco. Given our strengthin lower priced cigarettes and our worldleading position in fine cut tobacco we are well positioned to benefit from downtrading caused by increased levels of duty.

However, substantial increases in excise duties and any significantly unfavourable change in the tax treatment of fine cut tobacco may have an adverse effect on the size of individual duty-paid markets for our products. Excise duty increases have also encouraged both legal and illegal cross-border trade from countries with lower levels of duty and the production of counterfeit tobacco products.

Within such an environment there is a risk that we may be subject to investigation by customs or other authorities. Although we have implemented procedures to detect and control illegal trading of our products, such procedures can provide only reasonable and not absolute assurance of detecting non-compliance by managing rather than eliminating risk.

Key Market Dependency

The continued organic growth of the business is underpinned by our key markets. Any material decline in the performance of these markets may impact our future profit development.

Competition Law

We have significant market positions in certain markets. As a result, we may be subject to investigation for alleged infringement of competition law in these markets, which could result in adverse regulatory action by relevant authorities, including the potential for monetary fines, and negative publicity. In 2003,we received an enquiry from the Office of Fair Trading (OFT) in the UK into an alleged infringement of UK competition law. Information relating to the operation of the UK tobacco supply chain was supplied to the OFT in October 2003 and again during April 2005. The OFT’s enquiry is ongoing. Further information is included in theCorporate Governance Report.

Litigation

We may incur substantial costs in connection with health-related litigation. Various tobacco litigation claims are pending against the Group. To date, no tobacco litigation claim brought against Imperial Tobacco has been successful and/or resulted in the recovery of damages. However, if any individual claim were to be successful, it may lead to further claims, which if successful may result in a significant liability for damages. Regardless of the outcome of pending litigation, the costs of defending such claims can be substantial and may not be fully recoverable.

14

Operating and Financial Review

Key Performance Indicators

Key Performance Indicators

Key performance indicators are the principal measures used by the Board to assess performance against our strategy. These are reviewed on a regular basis.

Total Shareholder Return

2006 Performance

Our total shareholder return was 14 per cent.

Total shareholder return is the total investment gain to shareholders, resulting from the movement in the share price and assuming dividends are immediately invested in shares.

Adjusted Earnings Per Share

2006 Performance

Adjusted earnings per share increased by 9 per cent to 122.2 pence.

Adjusted earnings per share is adjusted profit after tax attributable to the equity holders of the Company divided by the weighted average number of ordinary shares in issue during the period. This excludes shares held to satisfy employee share schemes and shares purchased by the Company and held as Treasury shares.

Adjusted Operating Margin

2006 Performance

Our adjusted operating margin increased to 42.9 per cent.

This represents the adjusted profit from operations divided by revenue less duty.

Cash Conversion Rate

2006 Performance

Our cash conversion rate in 2006 was 98 per cent.

Cash conversion is calculated as cash flow from operations before tax payments less net capital expenditure relating to property, plant, equipment and software as a percentage of adjusted profit from operations.

Cigarette Market Share

2006 Performance

In our two key markets, the UK and Germany, our cigarette market shares grew to 45.5 per cent and 20.7 per cent respectively. Detailed performances in other markets can be found in our regional overviews on pages 18 to 26.

We estimate market shares as the volume of our brands sold by retailers in the year as a percentage of total market volumes.(1)

Volumes

2006 Performance

In 2006 our cigarette volumes grew to 186.9 billion cigarettes. Our fine cut tobacco volumes were 25,500 tonnes.

Volumes represent the number of units sold in the year.

Productivity

2006 Performance

Productivity was up by 6 per cent, excluding our Lahr factory in Germany, which was impacted by the cessation of Singles production.

Productivity is measured as factory output divided by paid hours.

Total Shareholder Return | |

| |

14% | |

| 2005: 40% |

| |

Adjusted Earnings Per Share | |

| |

122.2p | |

| 2005: 112.2p |

| |

Adjusted Operating Margin | |

| |

42.9% | |

| 2005: 41.5% |

| |

Cash Conversion Rate | |

| |

98% | |

| 2005: 101% |

| |

Cigarette Market Share(1) | |

| |

UK | |

45.5% | |

| 2005: 44.5% |

Germany | |

20.7% | |

| 2005: 19.4% |

| |

Volumes | |

| |

Cigarettes | |

186.9bn | |

| 2005: 175.2bn |

| |

Fine Cut Tobacco | |

25,500t | |

| 2005: 26,600t |

| |

Productivity | |

| |

up by 6%(2) | |

| 2005: up by 15% |

(1) Imperial Tobacco estimates.

(2) Excluding our Lahr factory in Germany, which was impacted by the cessation of Singles production.

15

16

Operating and Financial Review

Group Performance

Successful year of growth

In 2006, revenue was £11,676 million compared to £11,229 million in 2005. Revenue less duty was £3,162 million (2005: £3,123 million).

Adjusted profit from operations was up 5 per cent to £1,356 million and Group adjusted operating margins were up to 42.9 per cent (2005: 41.5 per cent). Reported profit from operations grew 6 per cent to £1,311 million (2005: £1,240 million).

Growing volumes, combined with increased efficiencies across the business and continued effective cash management, delivered 9 per cent growth in adjusted earnings per share. Basic earnings per share increased by 13 per cent to 122.2 pence. (2005: 108.6 pence).

Group Operating Performance

| | 2006 | | 2005 | |

| | £m | | £m | |

Revenue less duty | | 3,162 | | 3,123 | |

Adjusted profit from operations | | 1,356 | | 1,297 | |

Adjusted operating margin | | 42.9 | % | 41.5 | % |

Restructuring costs | | (45 | ) | (57 | ) |

Profit from operations | | 1,311 | | 1,240 | |

Regional Performance Analysis

| | Revenue

less duty | | Adjusted profit

from operations | | Cigarette

volumes | | Fine cut

tobacco volumes | |

| | 2006 | | 2005 | | 2006 | | 2005 | | 2006 | | 2005 | | 2006 | | 2005 | |

| | £m | | £m | | £m | | £m | | bn | | bn | | 000’s

tonnes | | 000’s

tonnes | |

UK | | 835 | | 800 | | 506 | | 468 | | 23.4 | | 23.9 | | 2.1 | | 2.1 | |

Germany | | 584 | | 630 | | 274 | | 294 | | 20.7 | | 20.9 | | 6.4 | | 7.1 | |

Rest of Western Europe | | 637 | | 644 | | 324 | | 326 | | 20.1 | | 17.7 | | 15.1 | | 15.6 | |

Rest of the World | | 1,106 | | 1,049 | | 252 | | 209 | | 122.7 | | 112.7 | | 1.9 | | 1.8 | |

Total | | 3,162 | | 3,123 | | 1,356 | | 1,297 | | 186.9 | | 175.2 | | 25.5 | | 26.6 | |

Detail on our regional performance can be found on pages 18 to 26 of this report.

The financial statements for the year ended 30 September 2006 have been prepared using International Financial Reporting Standards (IFRS) as endorsed by the European Union. In November 2005, we restated our 2005 results which were originally reported under UK GAAP, in accordance with IFRS. For full details, visit the investor section of our website www.imperial-tobacco.com Subsequent to releasing our restated 2005 results, we have reclassified certain advertising and promotion expenditure and retirement benefit net financing income within our income statement. These changes do not impact the previously reported IFRS profit before tax for 2005. Full details of these changes are set out in note 30 to the financial statements.

17

United Kingdom

Our strategy in the UK is to build on our market leadership position.

Performance Highlights

| | 2006 | | 2005 | |

Revenue less duty | | £ | 835 | m | £ | 800 | m |

Adjusted profit from operations | | £ | 506 | m | £ | 468 | m |

Imperial Tobacco cigarette volumes | | 23.4 | bn | 23.9 | bn |

Imperial Tobacco fine cut tobacco volumes | | 2,100 | t | 2,100 | t |

Market Dynamics

• The UK is a mature market which has experienced moderate market declines in recent years. Imperial Tobacco is the market leader in cigarette, fine cut tobacco and rolling papers.

• The value and economy segments of the cigarette market are growing as consumers downtrade.

• The UK is a highly regulated environment with one of the highest rates of tobacco tax in the world.

• A ban on smoking in public places was implemented in Scotland in March 2006. Similar bans are due to take effect in both Wales and in Northern Ireland in April 2007 and in England during summer 2007.

| | 2006(1) | | 2005(1) | |

Total market size cigarette volumes | | 49.1 | bn | 50.8 | bn |

Total market size fine cut tobacco volumes | | 3,250 | t | 3,050 | t |

Imperial Tobacco’s market share in cigarettes(2) | | 45.5 | % | 44.5 | % |

Imperial Tobacco’s market share in fine cut tobacco | | 65.3 | % | 66.3 | % |

(1) Imperial Tobacco estimates.

(2) Excludes Private Label.

18

Operating and Financial Review

United Kingdom

We grew our UK cigarette market share, further enhancing our market leading position.

Market Dynamics

We estimate that the UK cigarette market was down 3 per cent to 49.1 billion (2005: 50.8 billion) with consumer downtrading continuing. The value and economy sectors now account for over 40 per cent of the total UK cigarette market. The fine cut tobacco market grew to 3,250 tonnes (2005: 3,050 tonnes).

A ban on smoking in public places was introduced in Scotland in March 2006.

Our Performance

In the UK, revenue less duty rose 4 per cent to £835 million, with adjusted profit from operations up 8 per cent to £506 million.Cigarette volumes were down 2 per centto 23.4 billion. This profit performance reflects improvements in cigarette market share and the benefits of price increases which more than offset market volume declines and downtrading.

We delivered an excellent operational performance in the UK, growing our cigarette market share to 45.5 per cent (2005: 44.5 per cent). Windsor Blue,launched nationally in January 2006 in the economy sector, grew to 2.2 per cent market share in September. New variants Superkings and Smooth and the relaunch of the celebration packs grew the UK’s number one cigarette brand Lambert & Butler to 16.2 per cent share. The number two brand, Richmond, has benefited from a packaging improvement and continued to perform well with a market share of 15.5 per cent. Reflecting downtrading dynamics, our Regal, Embassy and Superkings brands remained under pressure.

We are the UK market leaders in fine cut tobacco, however our market share declined to 65.3 per cent (2005: 66.3 per cent) due to continued competitor activity.

• Lambert & Butler

Lambert & Butler is the UK’s best selling cigarette brand.

Key Brands

• New variants Superkings and Smooth and the relaunch of the celebration packs grew the market share of the UK’s number one cigarette brand, Lambert & Butler.

• Richmond, the UK’s number two brand has benefited from a packaging improvement.

• In January 2006 we launched Windsor Blue nationally in the economy sector. The brand grew to 2.2 per cent market share in September 2006.

• In the UK we are market leaders in fine cut tobacco with our brands Golden Virginiaand Drum.

Brand Performance: Cigarette | | Market Share 2006(1) | | Market Share 2005(1) | |

Lambert & Butler | | 16.2 | % | 16.0 | % |

Richmond | | 15.5 | % | 14.7 | % |

| | | | | |

Brand Performance: Fine Cut Tobacco | | Market Share 2006(1) | | Market Share 2005(1) | |

Golden Virginia | | 49.5 | % | 50.8 | % |

Drum | | 15.8 | % | 15.5 | % |

(1) Imperial Tobacco estimates.

We won the Convenience Tracking Programme Best Supplier, as voted by Retailers in 2006. This is an accolade that recognises the effectiveness and commitment of our sales teams and support functions. We have won this award three times in the last four years.

Outlook

In the context of further regulation, we do not expect smoking bans in the UK to have significant long term effect on our business. We believe smokers will continue to choose to smoke regardless of regulations and our view is supported by experiences in other markets.

The diversity of our brand and product portfolio continues to provide further opportunities within a downtrading environment. This, along with our commitment to sales and marketing excellence and our focus on costs, efficiency and flexibility, ensures we have a strong platform from which we seek to deliver further improvements in profits.

19

Germany

Germany remains a key contributor to the overall results. Our strategy is to build on the momentum of our growing cigarette market share, with our broad portfolio enabling us to respond to changing consumer dynamics.

Performance Highlights

| | 2006 | | 2005 | |

Revenue less duty(1) | | £ | 584 | m | £ | 630 | m |

Adjusted profit from operations(1) | | £ | 274 | m | £ | 294 | m |

Imperial Tobacco cigarette volumes | | 20.7 | bn | 20.9 | bn |

Imperial Tobacco other tobacco product volumes (as cigarette equivalents) | | 9.5 | bn | 10.4 | bn |

Market Dynamics

• The cigarette market has declined in Germany due to the impact of successive duty increases.

• Imperial Tobacco is the number two in cigarettes; with a leading position in other tobacco products.

• Consumers are downtrading, with the low price branded cigarette sector growing strongly.

• Production of Singles stopped in March due to a change in duty status of the product.

| | 2006(2) | | 2005(2) | |

Total market size cigarettes | | 92 | bn | 101 | bn |

Total market size other tobacco products (as cigarette equivalents) | | 43 | bn | 43 | bn |

Imperial Tobacco’s market share in cigarettes | | 20.7 | % | 19.4 | % |

Imperial Tobacco’s market share in other tobacco products (as cigarette equivalents) | | 21.8 | % | 24.2 | % |

(1) The results from our Austrian operations are included in Germany region.

(2) Imperial Tobacco estimates, excluding Austria.

20

Operating and Financial Review

Germany

While trading conditions remain challenging in Germany, we have been pleased with the growth in our cigarette market share.

Market Dynamics

We estimate that the overall tobacco market in 2006 was down 6 per cent to 135 billion cigarette equivalents (2005: 144 billion).The cigarette market fell by 9 per cent to 92 billion cigarettes, (2005: 101 billion), following the further duty increase in September 2005. Other tobacco products were stable at 43 billion cigarette equivalents. The low price branded cigarette sector has continued to grow strongly as consumers downtrade, accounting for 11.4 per cent (2005: 5.6 per cent) of the market, with the Private Label sector continuing to decline to 13.4 per cent (2005: 15.9 per cent).

Production of Singles ceased in March 2006, following a ruling from the European Court of Justice which resulted in a change in the duty status of the product, although products remained on retailers shelves until September.

Regulatory developments include the bill to restrict tobacco advertising in Germany, which has reached the German parliamentand is expected to take effect during 2007. The debate on smoking in public places continues with several political initiatives taken at federal and state level. A voluntaryagreement with the hospitality association is currently in place.

Our Performance

In Germany, our revenue less duty decreased by 7 per cent to £584 million, with adjusted profit from operations down 7 per cent to £274 million. These resultsreflect the overall market volume decline, downtrading into value cigarette brands and the cessation of Singles products, partly offset by cigarette market share growth and cost efficiencies.

We grew our cigarette share to 20.7 per cent (2005: 19.4 per cent) driven by an excellent performance from JPS. Thebrand captured the majority of marketshare growth in the low price brandedcigarette segment, with market share upto 3.8 per cent (2005: 1.7 per cent).Increased downtrading in the mid-priced cigarette segment resulted in West share dropping to 8.2 per cent (2005: 8.5 per cent). In recent months, our limited edition West packs have delivered additional salesvolumes and the brand’s performancehas stabilised, with a number of further initiatives planned to strengthen the brand. Davidoff performed robustly in a downtrading environment with a stable market share of 1.1 per cent.

Our market share of other tobacco products was down to 21.8 per cent (2005: 24.2 per cent). Prior to the change in duty status of Singles there was increased competition in this market segment, with a resulting impact on our other tobacco products share. In anticipation of consumers migrating fromSingles, we launched West Single Tobacco in March and JPS Single Tobacco in May with encouraging initial results.

Outlook

Our primary focus for Germany continues to be in managing the migration of Singles consumers to our alternative products.We are monitoring developments and our strength in value cigarettes and other tobacco products means we are well positioned to manage consumer migration. In addition, we will continue to work on our cost base in order to remain competitive.

• West

West is our biggest selling cigarette brand.

Key Brands

• JPS continues to grow strongly. The brand has captured the majority of market share growth in the low price branded cigarette segment.

• Germany is a key market for our strategic cigarette brand West. With increased downtrading, market share of West was down, however our limited edition West packs have delivered additional sales volumes, with a number of further initiatives planned.

• Our highly profitable premium cigarette brand Davidoff performed robustly given marketdynamics in Germany.

• We have a leading position in other tobacco products with traditional fine cut tobacco products such as West and JPS and new make your own products such as our recentlylaunched West Single Tobacco.

Brand Performance: Cigarette | | Market Share 2006(1) | | Market Share 2005(1) | |

West | | 8.2 | % | 8.5 | % |

JPS | | 3.8 | % | 1.7 | % |

Davidoff | | 1.1 | % | 1.1 | % |

| | | | | |

Brand Performance: Other Tobacco Products | | Market Share 2006(1) | | Market Share 2005(1) | |

West | | 7.6 | % | 11.5 | % |

JPS | | 7.5 | % | 6.3 | % |

(1) Imperial Tobacco estimates, excluding Austria.

21

Rest of Western Europe

Our strategy in the Rest of Western Europe is to continue to grow our cigarette market shares and build on our regional leadership in fine cut tobacco, while ensuring our key brands are available to travelling consumers.

Performance Highlights

| | 2006 | | 2005 | |

Revenue less duty | | £ | 637 | m | £ | 644 | m |

Adjusted profit from operations | | £ | 324 | m | £ | 326 | m |

Imperial Tobacco cigarette volumes | | 20.1 | bn | 17.7 | bn |

Imperial Tobacco fine cut tobacco volumes | | 15,100 | t | 15,600 | t |

Regional Dynamics

The mature markets in the Rest of Western Europe region are becoming more regulated. With increasing levels of duty, there is downtrading in the region in both cigarette and fine cut tobacco.

| | 2006(1) | | 2005(1) | |

Regional market size: cigarette | | 320 | bn | 329 | bn |

Regional market size: fine cut tobacco | | 30,400 | t | 30,900 | t |

Imperial Tobacco Performance

| | Cigarette | | Fine Cut Tobacco | |

| | Market Share(1) | | Market Share(1) | | Market Share(1) | | Market Share(1) | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

Netherlands | | 8.9 | % | 4.9 | % | 51.1 | % | 51.1 | %(2) |

Belgium | | 10.2 | % | 9.5 | % | 10.4 | % | 11.6 | % |

Italy | | 1.5 | % | 1.6 | % | 54.1 | % | 57.4 | % |

Ireland | | 26.2 | % | 26.2 | %(2) | 67.4 | % | 67.0 | % |

France | | 3.6 | % | 3.3 | % | 28.0 | % | 29.0 | % |

Spain | | 6.4 | % | 5.1 | % | 58.8 | % | 64.4 | % |

Greece | | 8.4 | % | 7.0 | % | 45.2 | % | 46.2 | % |

(1) Imperial Tobacco estimates.

(2) Restated as AC Nielsen bases changed.

22

Operating and Financial Review

Rest of Western Europe

In the Rest of Western Europe our cigarette shares have continued to grow in the majority of markets, complementing our leading position in fine cut tobacco.

Regional Dynamics

We estimate that the annual regional cigarette market was down by 3 per cent with the annual regional fine cut tobacco market down 2 per cent. The value segments in both cigarette and fine cut tobacco have grown as a result of consumer downtrading and an increasinglycompetitive pricing environment.

Restrictions on smoking in public places were introduced in Spain and Belgium in January 2006, and debate on this issue continues in other markets across the region.

Our Performance

Our regional cigarette volumes have grown by 14 per cent with improvements in our market shares more than offsetting the market volume decline. Despite our good cigarette volume performance, adjusted profit from operations was broadly stable at £324 million, reflecting declines in travel retail, particularly in Spain, and an increasingly competitive fine cut tobacco market.

In the Netherlands, our cigarette market share grew to 8.9 per cent (2005: 4.9 per cent), driven by the strong growth of West and JPS. In January 2006, we entered into a distribution agreement with Altadis. Our fine cut tobacco market share remained stable at 51.1 per cent with Zilver and Evergreen benefiting from the downtrading dynamic.

In Belgium, our domestic cigarette share progressed to 10.2 per cent (2005: 9.5 per cent), driven by the growth of Route 66, and supported by the stabilisation of Bastos.

Following the introduction of restrictions on smoking in public places in Italy last year, the market decline is now slowing with anoverall estimated cigarette market decline of 5 per cent this year. Our cigarette share is slightly down at 1.5 per cent (2005: 1.6 percent), with minimum pricing, introduced by the Italian Government in August 2005,reducing our ability to develop our portfolio.

In Ireland, with the overall cigarette market size up slightly to an estimated 5.7 billion (2005: 5.6 billion), our cigarette market share was unchanged at 26.2 per cent with a strong performancefrom Superkings.

We grew our cigarette share in France to 3.6 per cent (2005: 3.3 per cent) due to the success of the JPS family. Wemaintained our position in the fine cut tobacco sector with a robust performance from the market leader Interval at14.9 per cent (2005: 15.1 per cent).Our overall fine cut tobacco share declined to 28.0 per cent (2005: 29.0 per cent).

In Spain, we made significant domestic progress with JPS growing our cigarette market share to 6.4 per cent (2005: 5.1 per cent). However, trading conditions remain challenging following excise tax increases in February 2006 which were mainly absorbed by tobacco manufacturers,reducing the estimated profitablilty of the market by more than 30 per cent.

In Greece, our cigarette market share progressed to 8.4 per cent (2005: 7.0 per cent) due to another strong performance from Davidoff in the premium segment, now up to 3.3 per cent (2005: 2.7 per cent), supported by West.

Outlook

We expect that further regulatory changes in the region will continue to cause moderate reductions in market sizes. France is likely to implement restrictions on smoking in public places next year and pictorial health warnings are planned to be introduced in Belgium early next year. We also expect the competitive and pricing environment to remain challenging in the near term.

We will focus on further improving our cigarette market shares and addressing the pressures on our fine cut tobacco business.We believe the breadth of our productportfolio continues to provide us with future opportunities for growth.

• JPS

JPS is our key brand in the low price branded cigarette segment.

Key Brands

• Our cigarette brands Davidoff, West and JPS performed strongly across the Rest of Western Europe in the premium, mid and value segments.

• Davidoff volumes up 15%

• West volumes up 32%

• JPS volumes up 82%

• In the Netherlands, the largest market for fine cut tobacco in the region, our value brands Zilver and Evergreen performed well, reflecting the regional downtrading trends.

• We grew our Rizla volumes across the region.

23

Rest of the World

The Rest of the World is a diverse region, with over 100 countries with different dynamics, opportunities and challenges.

Performance Highlights

| | 2006 | | 2005 | |

Revenue less duty | | £ | 1,106 | m | £ | 1,049 | m |

Adjusted profit from operations | | £ | 252 | m | £ | 209 | m |

Imperial Tobacco cigarette volumes | | 122.7 | bn | 112.7 | bn |

Imperial Tobacco fine cut tobacco volumes | | 1,900 | t | 1,800 | t |

Regional Dynamics

• We believe there are opportunities to continue to expand in this region in terms of brand portfolio and market presence.

• In Asia, we have a strong premium position in Taiwan, complemented by a growing presence in Vietnam and Laos.

• Our Australasia region contains the profitable developed markets of Australia and New Zealand where we have cigarette shares of over 17 per cent and a strong position in fine cut tobacco.

• We are growing market shares in Central Europe with our comprehensive brand portfolio and coverage.

• Our major markets in Eastern Europe are Russia and the Ukraine, complemented by a growing business in the Caucasus and Turkey.

• In Africa, we have a well established presence in the sub Saharan region with brands such as Excellence, and in the Middle East we have growing market shares with Davidoff.

Imperial Tobacco Performance

| | Cigarette | | Cigarette | |

| | Market Share 2006(1) | | Market Share 2005(1) | |

Taiwan | | 11.1 | % | 11.4 | % |

Australia | | 17.8 | % | 17.7 | % |

Poland | | 16.1 | % | 15.5 | % |

Russia | | 5.5 | % | 5.3 | % |

Ukraine | | 19.0 | % | 18.9 | % |

(1) Imperial Tobacco estimates.

24

Operating and Financial Review

Rest of the World

Key Brands

• Davidoff is our premium cigarette brand and we grew volumes in the region by 6% to 11 billion cigarettes.

• Davidoff continues to grow rapidly in the Middle East, with volumes up over 30%, and it was launched into a number of African markets. We have extended the brand further with Davidoff Neon in Taiwan.

• In our Rest of the World region, we have a number of important regional and local brands.

• We are growing volumes in Eastern Europe with Classic and Maxim.

• In Africa Excellence is performing well.

• Poland is a key market for our Paramount cigarette brand.

• Horizon is our main cigarette brand in Australia.

In 2006, we delivered volume and cigarette share gains in many markets in the Rest of the World region.

Revenue less duty was up 5 per cent to £1,106 million and adjusted profit from operations was up 21 per cent to £252 million. These results reflect strong cigarette volume growth supported by continued investment in the region partially offset by the ongoing competitive challenges in Central Europe.

Asia

Overview

With rising GDP and increasing population, Asia is the world’s fastest growing economic region and represents 50 per cent of globalcigarette consumption. The regulatoryenvironment is mixed with some marketsin the process of adopting the recommendations of the Framework Convention on Tobacco Control.

We have a strong premium position in Taiwan and a growing presence in Vietnam and Laos. In China, we benefit from our positive collaboration with the StateTobacco Monopoly Administration and theYuxi Hongta Group. Our key brands in the region include Davidoff, Boss, Bastos and the ‘A’ brand family.

Our Performance

In Taiwan we launched the first king size Davidoff cigarette, Davidoff Neon, in December 2005, which has captured 0.5 per cent market share. Our volumes benefited as a result of a Boss packagingimprovement and the Davidoff Neon launch, however our overall market share was down slightly to 11.1 per cent (2005: 11.4 percent). In Vietnam, Bastos held market share at 10.3 per cent (2005: 10.2 per cent) while in Laos we delivered strong volume growth from the ‘A’ brand family.

Australasia

Overview

The mature markets of Australia and New Zealand are among the most highly regulated in the world, with pictorial health warnings in Australia and extensive restrictions on display and smoking in public places. However, we have demonstrated our ability to continue to grow our profit. Key brands include Horizon and Peter Stuyvesant in cigarettes and Drum and Champion in fine cut tobacco.

Our Performance

In Australia, our cigarette share was up slightly at 17.8 per cent (2005: 17.7 per cent) with a good performance from Peter Stuyvesant and Brandon. Our fine cut tobacco share was down to 62.0 per cent (2005: 63.4 per cent), due to increased

• Davidoff Neon

Davidoff Neon was launched in Taiwan in December 2005.

25

competitor activity. John Brandon also performed well in New Zealand, growingour market share to 17.6 per cent(2005: 17.0 per cent).

Central Europe

Overview

In Central Europe the trading environment continues to be challenging. Duty increases have taken place across the region, ascountries move further towards EU minimum excise rates, impacting volumes. We are well represented across the region with key markets including Poland, Hungary Slovenia, Slovakia and the Czech Republic. Our regional brands include Route 66, Golden Gate, Moon and Paramount. In Scandinavia, our acquisition of the Norwegian distributor of tobacco products, Gunnar Stenberg, in February 2006,and our investment in the Swedish snus company, Skruf, have provided a base from which to develop our business.

Our Performance

Across the region we have increased our cigarette market shares: Poland to 16.1 per cent (2005: 15.5 per cent), Hungary to 14.5 per cent (2005: 12.6 per cent) and the Czech Republic to 9.6 per cent (2005: 7.2 per cent), with growth driven by the performance of our value brands. We launched Davidoff, West and Paramount in both Sweden and Norway during the year.

Eastern Europe

Overview

Our Eastern Europe region is experiencing strong economic development and, while some restrictions are in place, our ability to communicate with consumers is significantlygreater than in the EU. Our establishedpositions in Russia and the Ukraine arecomplemented by a growing business in the Caucasus and in Turkey. Our key brands in the region include Davidoff, West, Maxim, Classic and Prima.

Our Performance

We grew volumes by 14 per cent across the region. In Russia, our market share was up to 5.5 per cent, (2005: 5.3 per cent) with a strong performance from Maxim.

To increase our retail coverage and improve efficiencies we formed a joint merchandising force with Altadis in February 2006. In the Ukraine our market share was stable at 19.0 per cent (2005: 18.9 per cent) and we continue to invest in our market leading brand Prima. In Turkey our market sharegrew to 1.4 per cent (2005: 0.4 per cent) with a good performance from Klasik.

Africa and the Middle East

Overview

We have an established presence with brands such as Excellence in the sub Saharan region of Africa, Good Look in Madagascar and Davidoff in the Middle East. Regulation is increasing with differing levels of restrictions in place or evolving in all markets. As the trading environment may be subject to political instability, the effective regional management of our operations is important to ensure continued supply and distribution.

Our Performance

We delivered market share improvements with the continued growth of Excellencein Côte d’Ivoire and Good Look in Madagascar. Following the decision to end the licensed manufacturing and distributionarrangements with British American Tobacco in West Africa, we have benefited from increased volumes and market shares. With the cessation of our manufacturing agreement with Phillip Morris, we are restructuring our operations in Senegal. We have recently launched Davidoff in Senegal, Gabon, Burkina Faso and Côte d’Ivoire and there are positive signs of development in all markets. Davidoff continued to grow strongly in the Middle East region with volumes up 31 per cent, notably in Saudi Arabia with Davidoff One.

United States

Overview

We have been monitoring developments in the United States for a considerable period of time and have been encouraged by therecent positive developments in the litigation landscape. As the second largest market in the world, representing 7 per cent of world cigarette volumes and a significantly higher percentage of world profit, the US offers great potential for the Group. We currently sell and distribute papers and tubes in theUS and have a basic infrastructure in place.

We recently applied for membership of the Master Settlement Agreement, which is a pre-requisite for our market entrance. Ourentry into this profitable market with tobacco products would be organically and without any historic liabilities.

Outlook

The Rest of the World is a diverse region with over 100 countries with different dynamics, opportunities and challenges. This year’s performance has demonstrated our ability to deliver organic growth in the region. We will continue to invest in our key markets, core brands and route to market to capitalise on our results to date. We see many opportunities to continue to develop our footprint in terms of brand portfolio and market presence.

26

Operating and Financial Review

Manufacturing

Manufacturing

The drive for excellence across our manufacturing base continues. In 2006, we delivered significant cost savings further optimising our cost base and simplifying and standardising our business.

• Overall productivity was up by 6%(1).

• We simplified our product portfolio by reducing blends by 8% and ingredients by 10%.

• We have increased our ISO14001 accreditation to 19 locations.

Our Performance

We reduced our unit costs across the Group, including a further reduction in cigarette unit costs of 6 per cent. We increased our overall productivity by 6 per cent, (excluding our Lahr factory in Germanywhich was impacted by the cessation ofSingles production). We continued ourfocus on simplification across our product portfolio, reducing our blends, ingredients and stock keeping units.

As part of our ongoing review to improve operational efficiencies we announced a number of restructurings during the year. This included announcing the closure ofour factories in Liverpool in the UK and Lahr in Germany, the latter as a direct result of the change in tax status of Singles and unfiltered eco-cigarillos in Germany. Both facilities are due to be closed by March 2007. We completed the restructuring of part of our European cigarette operations, with our Central European cigarette production relocated from Germany to Poland and the closure in the UK of our Treforest papers factory as announced last year. A number of activities within central manufacturing support have also been consolidated.

We have continued our capital investment programme. This concentrates on harmonising cigarette pack formats in Europe and increasing capacity in line with growing sales volumes in Eastern Europe, particularly in Volgograd and Kiev. In addition, a significant machinery upgrade programme is in progress across our Africanfactories, utilising surplus machinery. This will deliver further improvements in efficiency and quality.

We have delivered further operational efficiencies through the use of standard systems and processes, which are reflected in our manufacturing performance indicators.

We continued our programme of ISO14001 accreditation with four locations certified during the year. A total of 59 per cent of our factories are now ISO14001 accredited.

Across our supply chain, we have focused on the competitiveness of our distribution network and the development of our planning process. Distribution has been reviewed and rationalised, providing greater flexibility and support, as well as delivering cost savings.

Outlook

Our objectives are focused on manufacturing quality products, on reducing complexity and on optimising our cost base. Our continuous process of review, should ensure our manufacturing footprint remains flexible and responsive in line with changing market requirements, delivering further efficiency improvements across all our manufacturing activities.

(1) Excluding our Lahr factory in Germany, which was impacted by the cessation of Singles production.

27

Operating and Financial Review

Financial Review

Strong financial performance

In 2006, adjusted profit from operations was up 5 per cent, to £1,356 million, as a result of our continuing sales development and efficiency gains. Reported profit from operations was £1,311 million, up by 6 per cent (2005: £1,240 million).

Restructuring Costs

Reported profit from operations was impacted by restructuring costs of £45 million (2005: £57 million). The 2006 costs relate to the announced closuresof our Lahr and Liverpool factories. Annual savings of around £4 million are expected in our 2007 financial year with additional annual savings of £7 million in our 2008 financial year.

Net Finance Costs

Reported net finance costs of £143 million (2005: £162 million) include retirement benefit net finance income of £46 million (2005: £22 million) and fair value losseson interest rate derivatives of £1 million (2005: not applicable). Eliminating these items, adjusted net finance costs totalled £188 million (2005: £184 million) givingadjusted interest cover of 7.2 times(2005: 7.0 times). The increase in adjusted net finance costs is due to a marginal increase in our average all-in cost of debt to 5.4 per cent (2005: 5.3 per cent). Our average adjusted net debt was stable during the year at £3.5 billion.

Profit Before Tax

Reported profit before tax increased by 8 per cent to £1,168 million (2005: £1,078 million).

Taxation

The tax charge for the year was £310 million (2005: £288 million), representing an effective tax rate of 26.5 per cent (2005: 26.7 per cent).

Earnings and Dividends

Adjusted earnings per share increased by 9 per cent to 122.2 pence (2005: 112.2 pence) and basic earnings per share increased by 13 per cent to 122.2 pence (2005: 108.6 pence).

We have proposed a final dividend of 43.5 pence such that the total dividend for the year is 62.0 pence, an increase of 11 per cent, just ahead of our adjustedearnings per share growth. This dividend will be paid on 16 February 2007 to those shareholders on the register at the close of business on 19 January 2007. Our dividend policy is progressive, growing dividendsbroadly in line with adjusted earnings per share, with around a 50 per cent payout ratio.

Acquisitions

In September 2006, we acquired the worldwide Davidoff cigarette trademark from Tchibo Holding AG for a cash consideration of €540 million (£368 million). We also acquired Gunnar Stenberg, a Norwegian distributor of tobacco products and accessories in February 2006 and paid the final instalment on the Tobaccor acquisition in December 2005.

Capital Expenditure

Gross capital expenditure in relation to property, plant, equipment and software was £82 million (2005: £102 million), reflecting a maintenance level of capital expenditure. Our net capital expenditure was £67 million (2005: £75 million) including proceeds on disposal of fixed assets of £15 million (2005: £27 million).

Financing

At the end of the year our reported net debt increased to £3.9 billion (2005: £3.3 billion). Eliminating the fair value of interest rate derivatives and accrued interest of £0.1 billion (2005: not applicable), our adjusted net debt was £3.8 billion (2005: £3.3 billion). A reconciliation of reported to adjusted net debt is included within note 28 to the financial statements. The increase in adjusted net debt is due to the acquisition of the Davidoff cigarette trademark and the level of the share buyback programme being greater than our free cash flow after dividends. Our cash conversion of 98 per cent (2005: 101 per cent) is in line with our target rate of around 100 per cent.

In April 2006 we agreed an increase in our core committed bank facility of €1.5 billion on existing terms. Following this increase our core committed bank facility totalled £2.5 billion.

28

Operating and Financial Review

Operating Environment

Understanding our operating environment

“We have a long history of co-operation with authorities in the markets in which we operate and we remain committed to working constructively with governments and regulatory bodies worldwide.

We believe that sound, reasonable and practical regulation combined with well thought out voluntary agreements is the most effective way forward.”

Frank Rogerson, Corporate Affairs Director

SMOKING IN PUBLIC PLACES

Smoking in public places continues to be an important issue. A number of countries around the world including Ireland, Italy,Norway and New Zealand already havecomprehensive bans in place and othersare likely to follow in the future.

Our View

• Imperial Tobacco recognises that other people’s tobacco smoke can be unpleasant or annoying and can raise concerns leading to calls to ban smokingin the workplace. However, it is our view that the scientific evidence, taken as a whole, is insufficient to establish that other people’s tobacco smoke is a cause of any disease. We believe that concerns about smoking in public places can be resolved through common sense and courtesy and by introducing practical solutions such aswell-ventilated smoking and no-smokingareas into workplaces, restaurants, bars and other public places.

29

2006 Summary

• In January 2006, Spain introduced a public smoking ban for all hospitality venues that serve food or allow children on the premises, although bars and restaurants that are smaller than 100 square metres are exempt from the ban. Larger venues may provide a separate area for customers who wish to smoke. This was followed by a public smoking ban in Scotland which took effect in March 2006. In Scotland, smoking is no longer allowed inside any workplace including bars, pubs and restaurants. Similar regulations are scheduled to take effect in England, Wales and Northern Ireland in 2007.

The European Commission is expected to adopt a Green Paper on Smoke Free Environments later in 2006, to reflect comments received during the informal consultation period. Although the Commission does not have the competence to enact an EU-wide smoking ban, it seeks to encourage Member States to adopt minimum standards for smoke-free environments.

Our experiences in markets where severe smoking restrictions or bans are in place, supports our view on the impact of this legislation. Smokers will continue to choose to smoke; there may be an initial dip in consumption but this diminishes over time.

FRAMEWORK CONVENTION ON TOBACCO CONTROL (FCTC)

Adopted in May 2003, the World Health Organisation’s (WHO) Framework Convention on Tobacco Control (FCTC) is the first global tobacco treaty that seeks to regulate tobacco products in a number of areas including tobacco advertising, labelling, product testing and the submission of ingredient information, as well as product traceability. The FCTC also addresses tobacco taxation and calls for tightened legislation to clamp down on smuggling and illicit products.

Our View

• Imperial Tobacco respects the WHO’s overall objective that underpins the FCTC and would favour reasonable, practical regulation and self-regulatory initiatives. However, it is our belief that some of the FCTC provisions seek to go beyond reasonable objectives and impose a supranational regulatory regime covering a wide range of areas better addressed by national regulators, who are familiar with local conditions. Moreover, it gives the WHO authority to establish rules in areas well outside its core competence – areas that fall under the jurisdiction of other bodies such as the World Trade Organisation or the International Standards Organisation.

2006 Summary

• The Conference of Parties (all countries which have ratified the FCTC) held its first session in February 2006. During the meeting, participating parties agreed to draft two protocols (on illicit trade and on cross-border advertising) and two guidelines (on environmental tobacco smoke and on product regulation) to supplement the original text of the Convention. The draft protocols and guidelines are to be presented for discussion at the next session of the Conference of the Parties which is due to take place next year.

PICTORIAL HEALTH WARNINGS

Pictorial health warnings are mandatory in a number of countries including Canada and Brazil. A number of countries, around the world are considering the use of pictorial health warnings while others have decided against their use.

Our View

• We do not believe that pictorial health warnings are necessary. It is our view that such warnings are designed solely to shock and stigmatise smokers, and we disagree with their use. We believe that pictorial health warnings make no overall contribution to the public awareness of the risks associated with smoking, which are already well known. We believe that we are entitled to use our packaging to enable our consumers to distinguish our products from those of our competitors.

2006 Summary

• To date, eight countries worldwide require pictorial health warnings to be printed on packs whilst others are currently discussing the use of pictorial health warnings or have already introduced draft legislation. In March 2006, Australia introduced 14 rotating warnings to cover 30 per cent of the front and 90 per cent of the back of tobacco product packaging. In the European Union, Belgium is the only country that has already passed legislation and cigarette packs carrying the new warnings are expected to be on the shelves next year.

30

EXCISE DUTY

Cigarettes and other tobacco products are subject to excise duties, which generally represent a significant percentage of theretail price of the products. International disparities in the rates of excise duty imposed on tobacco products have created an environment that encourages the growth of smuggling, illegal cross-border trading and counterfeiting.

Our View

• We remain totally opposed to smuggling,illegal cross-border trading andcounterfeiting. We are committedto working with customs and exciseauthorities around the world to tacklesuch activities.

2006 Summary

• Although the level of duty increases inWestern European countries was lessmarked in 2006 than in the previousyear, Member States that joined the EUin May 2004 continue to implement duty increases as they move towards the minimum EU level.

We have continued to work with customs authorities in a number of countries around the world to counter the illegal trade in tobacco products and we have now signed Memoranda of Understanding (MoU) in a total of eleven countries. Discussions are progressing in a number of other countries. In March 2006, together with the other major UK tobacco manufacturers, we signed an industry MoU with HM Revenue & Customs that builds on the success of previous MoUs.

TOBACCO-RELATED LITIGATION

We are not facing any active tobacco-related litigation in the UK.

In the Republic of Ireland, the number of claims has fallen from 307 in 1997, to 11, ten of which are subject to pendingdismissal motions.

In Poland, we are currently facing two individual claims, one on appeal following a favourable judgment in March 2006. In February 2006, we received a favourable judgment in a case brought against us (and other tobacco companies) by a Health Association. The Association has not appealed against the judgment.

Despite threats to do so, no proceedings have been commenced against us in the Netherlands.

The only case against us in Australia was dismissed in February 2006. The claimant has not appealed.

To date, no judgment has been entered against Imperial Tobacco and no action has been settled in favour of a claimant in anytobacco-related litigation involving Imperial Tobacco or any of its subsidiaries. Imperial Tobacco has been advised by its lawyers that it has meritorious defences to the legal proceedings in which damages are sought for alleged smoking-related health effects and to threatened actions of a similar nature. Wewill continue to contest all such speculative litigation against us.

For more information

www.imperial-tobacco.com

31

Corporate Responsibility Highlights

Achieved all environmental performance targets set for 2010 ahead of schedule.

• Energy consumption down(1) by 11 per cent.

• CO2 emissions down(1) by 20 per cent.

• Waste output down(2) by 3 per cent.

• Waste to landfill down(2) by 32 per cent.

• Water consumption down(1) by 12 per cent.

• Achieved ISO 14001 certification at 4 more manufacturing sites.

• Created significant partnerships with local NGOs, especially in the areas of the environment, malaria control and HIV/AIDS.

• Scored 73% (66% in 2005) in the SAM Research assessment for the Dow-Jones Sustainability Index 2006, against a sector average of 66% (the highest sector score was 79%).

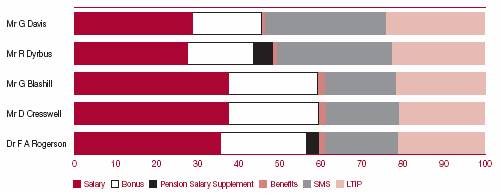

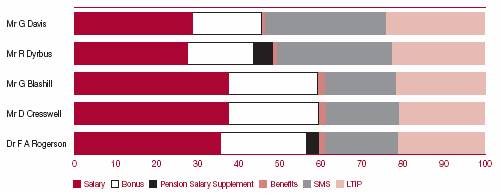

• Named as 64th in the 2006 ‘Top 100 Companies That Count’ by the UK’s Business in the Community.