[IMPERIAL TOBACCO LOGO] IMPERIAL TOBACCO GROUP PLC

PO Box 244, Southville, Bristol BS99 7UJ

Tel: +44 (0) 117 963 6636

Fax: +44 (0) 117 966 7859

IMPERIAL TOBACCO GROUP PLC

P.O. BOX 244, UPTON ROAD

BRISTOL B599 #7 UJ

ENGLAND

As of May 20, 2008

Citibank, N.A. - ADR Department

388 Greenwich Street

New York, New York 10013

Restricted ADSs /May 2008 Rights Offering (Cusip # 453142R94)

Ladies and Gentlemen:

Reference is made to (i) the Amended and Restated Deposit Agreement, dated

as of November 2, 1998 (the "Deposit Agreement"), by and among Imperial Tobacco

Group PLC, a public limited company incorporated under the laws of England (the

"Company"), Citibank, N.A., a national banking association organized and

existing under the laws of the United States of America, as Depositary (the

"Depositary"), and the Holders and Beneficial Owners of American Depositary

Shares (the "ADSs") evidenced by American Depositary Receipts (the "ADRs")

issued thereunder and (ii) the Letter Agreement, dated as of September 21, 2007

(the "Uncertified ADS Letter Agreement"), by and between the Company and the

Depositary relating to the issuance of uncertificated ADSs (the "Uncertificated

ADS"). All capitalized terms used, but not otherwise defined herein, shall have

the meaning assigned thereto in the Deposit Agreement.

The Company intends to offer and sell Shares pursuant to a rights offering

to its existing shareholders (the "Rights Offering"). Neither the rights (the

"Rights") nor the Shares to be issued in the Rights Offering will be registered

under the United States Securities Act of 1933, as amended (the "Securities

Act") and accordingly the Rights and Shares may only be sold pursuant to an

applicable exemption from registration under the Securities Act and any Shares

offered and sold to US Persons (as defined in Regulations S under the Securities

Act) will be Restricted Securities. The Company desires to establish procedures

to enable certain Beneficial Owners listed on Exhibit A hereto who would

otherwise hold restricted Shares upon exercise of Rights in the Rights Offering

(the "Permitted Offerees") to hold such Shares as Restricted ADSs (as

hereinafter defined and hereinafter used as so defined). The Depositary is

willing to accommodate the issuance of Restricted ADSs upon exercise of Rights

in the Rights Offering provided (a) the terms of deposit of the Restricted

Securities neither (i) prejudices any substantial rights of existing Holders and

Beneficial Owners of ADSs under the Deposit Agreement nor (ii) violates or

conflicts with any law, rule or administrative position applicable to the ADSs,

and (b) the terms of the Deposit Agreement are supplemented to accommodate a

deposit of Restricted Securities.

The purpose and intent of this Letter Agreement is to supplement the

Deposit Agreement for the purpose of accommodating (i) the issuance of

Restricted ADSs, (ii) the sale or transfer of such Restricted ADSs and (iii)

certain ancillary transactions further described below solely in connection with

the Rights Offering. The Company and the Depositary agree that this Letter

Agreement shall be filed as an exhibit to the Company's next Registration

Statement on Form F-6 under the Securities Act.

For good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, the Company and the Depositary hereby agree,

notwithstanding the terms of the Deposit Agreement, as follows:

1. Authority to Issue Restricted ADSs. The Deposit Agreement is hereby

supplemented to authorize the Depositary to establish under the terms and

conditions of the Deposit Agreement and upon the written request and at the

expense of the Company, procedures enabling the deposit of Shares that

constitute Restricted Securities into the depositary receipts facility in order

to permit the holders of such Shares (such Shares, the "Restricted Shares") to

hold their ownership interests in such Restricted Shares in the form of ADSs

issued under the terms of the Deposit Agreement as supplemented hereby. The

Depositary agrees to establish procedures permitting the deposit of Restricted

Shares into the depositary receipts facility and the issuance of ADSs

representing deposited Restricted Shares (such ADSs, the "Restricted ADSs", and,

if applicable, the ADRs evidencing such Restricted ADSs, the "Restricted ADRs"),

upon receipt of a written request from the Company to accept certain specified

Restricted Shares for deposit or as otherwise set forth in this Letter

Agreement. The Company agrees to assist the Depositary in the establishment of

such procedures and agrees that it shall take all steps reasonably requested by

the Depositary to ensure that the establishment of such procedures does not

prejudice any substantial rights of existing Holders of ADSs and does not

violate the provisions of the Securities Act or any other applicable laws, rules

or administrative positions including, without limitation, by entering into

letter agreements with the Depositary to set forth the specific terms of the

procedures applicable to any specific deposit of Restricted Shares and issuance

and transfer of Restricted ADSs.

The depositors of the Restricted Shares and the holders of the Restricted

ADSs may be required to provide such written certifications, agreements or other

documents as the Depositary or the Company may deem necessary or appropriate

prior to (i) the deposit of Restricted Shares, (ii) the transfer of the

Restricted ADRs and the Restricted ADSs evidenced thereby, (iii) the removal of

the transfer and other restrictions with respect to Restricted ADSs/Restricted

ADRs in order to create unrestricted ADSs/ADRs, or (iv) the withdrawal of the

Restricted Shares represented by Restricted ADSs. The Company shall provide to

the Depositary in writing the legend(s) to be affixed to the Restricted ADRs, or

transmitted to holders of Restricted ADSs, in the case of Uncertificated ADSs,

which legend(s) shall (i) be in a form reasonably satisfactory to the Depositary

and (ii) set forth the specific circumstances under which the Restricted ADRs

and the Restricted ADSs evidenced thereby may be transferred or the Restricted

Shares withdrawn.

2

The Restricted ADSs issued upon the deposit of Restricted Shares shall be

separately identified on the books of the Depositary and the Restricted Shares

so deposited shall be held separate and distinct from all other Deposited

Securities held under the terms of the Deposit Agreement that are not Restricted

Shares. The Restricted Shares and the Restricted ADSs shall not be eligible for

the pre-release transactions set forth in Section 5.10 of the Deposit Agreement.

The Restricted ADSs shall not be eligible for inclusion in any book-entry

settlement system, including, without limitation, The Depository Trust Company

("DTC"). The Restricted ADSs shall not in any way be fungible with the ADSs

(that are not Restricted ADSs) issued under the terms of the Deposit Agreement.

Except as set forth in this Letter Agreement and except as required by

applicable law, the Restricted ADSs and the Restricted ADRs, if applicable,

shall be subject to the terms of the Deposit Agreement and shall, to the maximum

extent permitted by law and to the maximum extent practicable, be treated as

ADSs and ADRs, respectively, issued and outstanding under, the terms of the

Deposit Agreement. In the event that, in determining the rights and obligations

of parties hereto or any holder of Restricted ADSs, any conflict arises between

(a) the terms of the Deposit Agreement and (b) the terms of (i) this Letter

Agreement or (ii), if applicable, the applicable Restricted ADR, the terms and

conditions set forth in this Letter Agreement, and if applicable, of the

applicable Restricted ADR shall be controlling and shall govern the rights and

obligations of the parties pertaining to the deposited Restricted Shares, the

applicable Restricted ADSs and the applicable Restricted ADRs.

2. Permitted Offeree Deposits. The Company hereby consents, under Section

2.02 of the Deposit Agreement, to the deposit by the Permitted Offerees of

Restricted Shares and the issuance and delivery by the Depositary of the

corresponding number of Restricted ADSs in respect thereof in the form of

Uncertificated ADSs, upon the terms of this Letter Agreement, to the Permitted

Offerees or their respective designees. The Restricted ADSs described in the

immediately preceding sentence and the Restricted Shares represented thereby are

referred to herein as the "Designated Restricted ADSs" and the "Designated

Shares", respectively.

In furtherance of the foregoing, the Company requests the Depositary, and

the Depositary agrees upon the terms and subject to the conditions set forth in

this Letter Agreement, to (i) establish procedures to enable (x) the deposit of

the Designated Shares with the Custodian by the Company in order to enable the

issuance by the Depositary to the Permitted Offerees of the Designated

Restricted ADSs issued under the terms of this Letter Agreement upon receipt of

a written request from the Company to accept certain specified Restricted Shares

for deposit in connection with the exercise of Rights by Permitted Offerees in

the Rights Offering, and (y) the transfer of the Designated Restricted ADSs, the

removal of the transfer and other restrictions with respect to Designated

Restricted ADSs in order to create unrestricted ADSs, and the withdrawal of the

Designated Shares, in each case upon the terms and conditions set forth in the

Deposit Agreement as supplemented by the terms of this Letter Agreement, and

(ii) to deliver to an account statement (the "Account Statement") to the holder

of Designated Restricted ADSs upon issuance of the Designated Restricted ADSs,

in each case upon the terms set forth herein. Nothing contained in this Letter

Agreement shall in any way obligate the Depositary, or give authority to the

Depositary, to accept any Shares (other than the Restricted Shares described

herein) for deposit under the terms hereof.

3

3. Company Assistance. The Company agrees to (i) provide commercially

reasonable assistance upon the request of and to the Depositary in the

establishment of such procedures to enable the acceptance of the deposit solely

by the Company of the Designated Shares in connection with the exercise of

Rights by Permitted Offerees in the Rights Offering, the issuance of Designated

Restricted ADSs, the transfer of Designated Restricted ADSs, the withdrawal of

the Restricted Shares and the conversion of Designated Restricted ADSs into

freely transferable ADSs, and (ii) take all commercially reasonable steps

requested by the Depositary to insure that the acceptance of the deposit of the

Designated Shares, the issuance of the Designated Restricted ADSs, the transfer

of the Designated Restricted ADSs, the conversion of Designated Restricted ADSs

into freely transferable ADSs, and the withdrawal of Designated Shares, in each

case upon the terms and conditions set forth herein, do not prejudice any

substantial existing rights of Holders and Beneficial Owners of ADSs and do not

violate the provisions of the Securities Act or any other applicable laws.

In furtherance of the foregoing, the Company shall cause (A) its U.S.

counsel to deliver an opinion to the Depositary stating, inter alia, that the

deposit of Designated Shares by the Company and the issuance and delivery of

Designated Restricted ADSs upon exercise of Rights by Permitted Offerees in the

Rights Offering, in each case upon the terms contemplated herein, do not require

registration under the Securities Act and that the Designated Restricted ADSs,

when so issued, will be legally issued, and (B) its English counsel to deliver

an opinion to the Depositary stating, inter alia, that (i) the Company has duly

authorized and executed the Letter Agreement, (ii) the Letter Agreement

constitutes a legal, valid and binding obligation of the Company under English

law enforceable against the Company upon its terms, (iii) all approvals required

by English law to permit the deposit of Designated Shares under the Deposit

Agreement and the Letter Agreement have been obtained, and (iv) the terms of the

Letter Agreement and the transactions contemplated by the Letter Agreement do

not and will not contravene or conflict with any English law of general

application.

4. Limitations on Issuance of Restricted ADSs. In connection with the

exercise of Rights by Permitted Offerees in the Rights Offering, the Company

hereby instructs the Depositary, and the Depositary agrees, upon the terms and

subject to the conditions set forth in this Letter Agreement, to issue and

deliver Designated Restricted ADSs only (x) in the case of an initial issuance

upon receipt of (i) a deposit of the Designated Shares by the Company (ii) the

opinions of counsel identified in Section 3 hereof, (iii) payment of the

applicable fees, taxes and expenses otherwise payable under the terms of the

Deposit Agreement upon the deposit of Shares and the issuance of ADSs

(including, without limitation, stamp duty reserve taxes), (iv) an Investor

Representation Letter substantially in the form attached hereto as Exhibit B

hereto, (v) a duly executed Instruction Letter substantially in the form

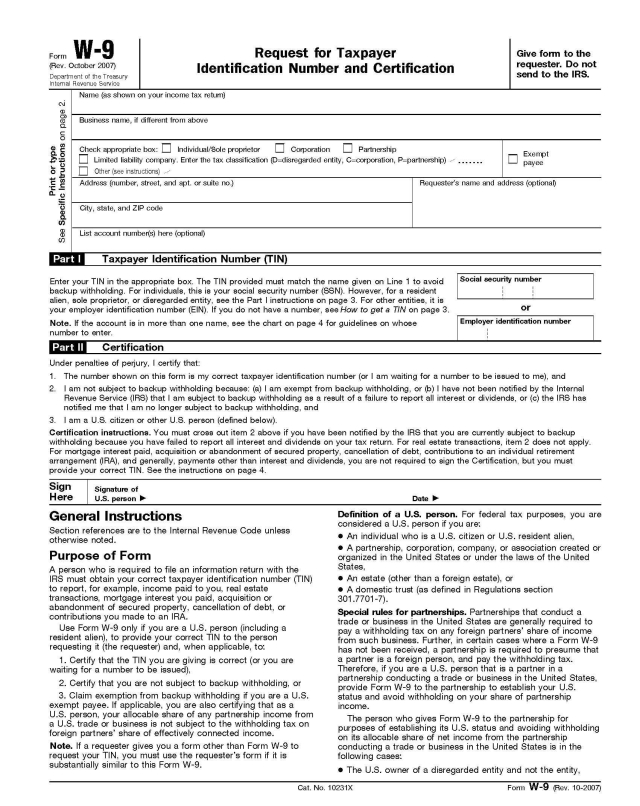

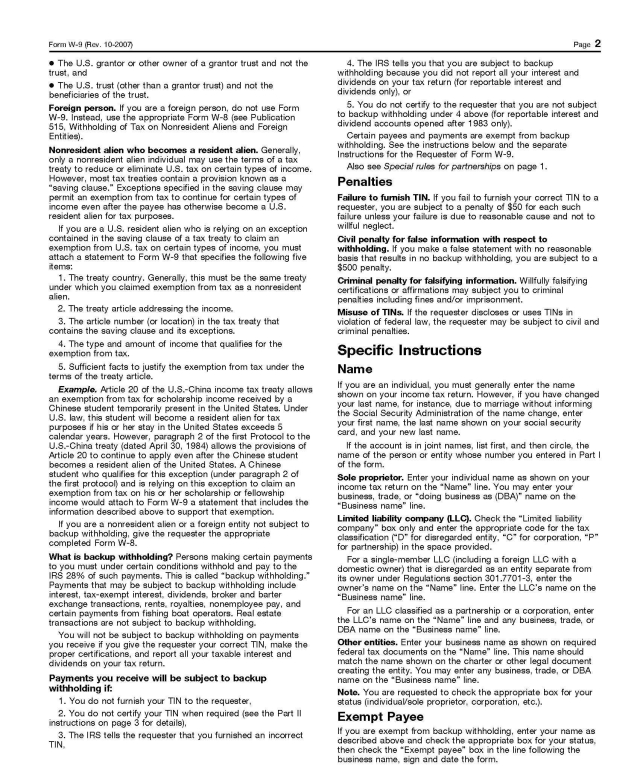

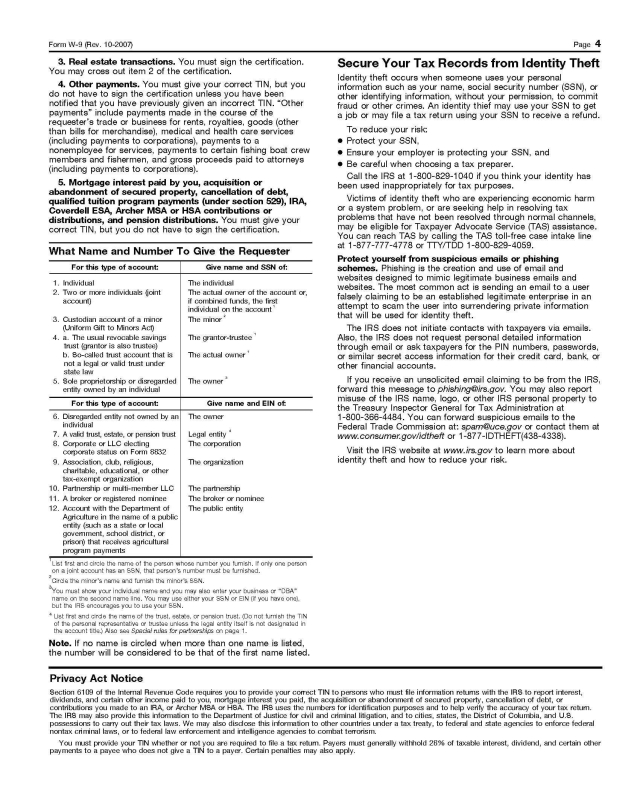

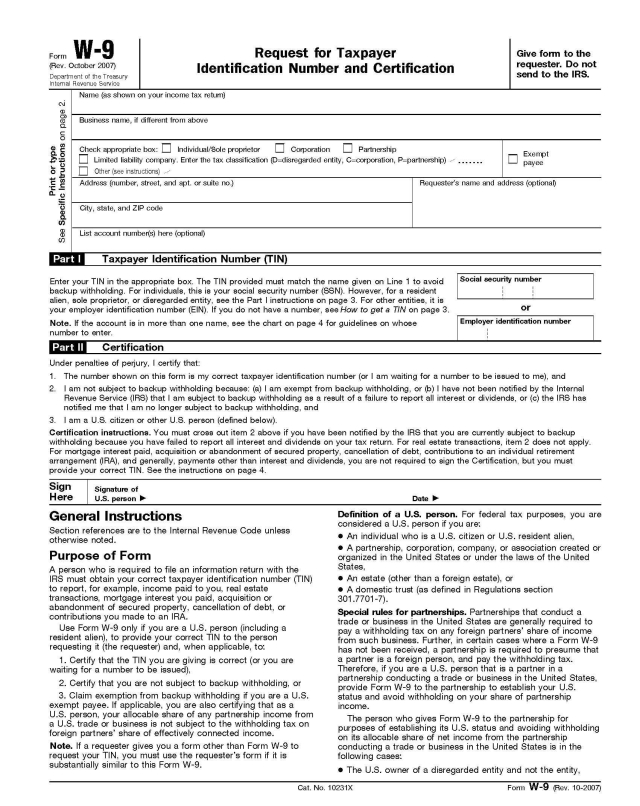

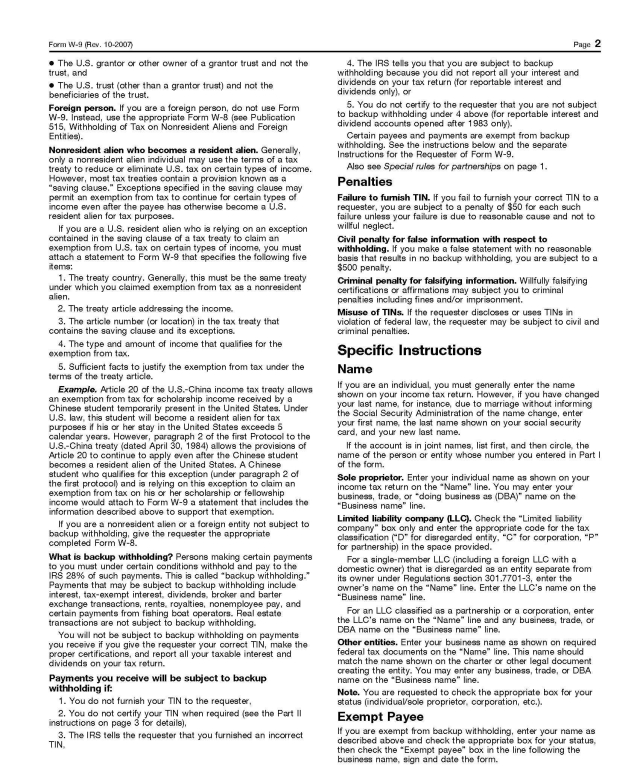

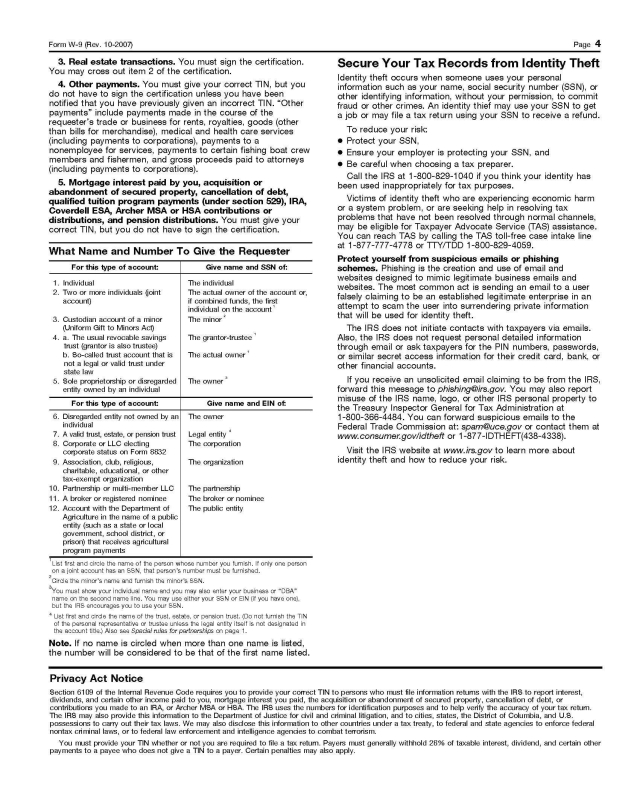

attached hereto as Exhibit C, (vi) a Form W-9, and (vii) a DTC Participant

Instruction Form substantially in the form attached hereto as Exhibit D and (y)

in the event of any corporate action of the Company which results in the

issuance of Restricted ADSs to the holder(s) of the Designated Restricted ADSs.

The Designated Restricted ADSs issued upon the deposit of Designated

Shares shall be separately identified on the books of the Depositary under CUSIP

#453142R94 and the Designated Shares shall be held separate and distinct by the

Custodian from the other Deposited Securities held by the Custodian in respect

of the ADSs issued under the Deposit Agreement that are not Restricted ADSs.

4

The Depositary is hereby authorized and directed to issue the Designated

Restricted ADSs as Uncertificated ADSs registered in the books of the Depositary

in the name of the Permitted Offerees or their designees for the benefit of the

Permitted Offerees subject to the restrictions specified in paragraph 5 below.

5. Stop Transfer Notation and Legend. The books of the Depositary shall

identify the Designated Restricted ADSs as "restricted" and shall contain a

"stop transfer" notation to that effect. The Account Statement to be sent by the

Depositary to the Permitted Offerees upon the issuance of Designated Restricted

ADSs shall contain a statement to the effect that the Designated Restricted ADSs

are subject to restrictions on transfer and cancellation described in this

Letter Agreement. The Account Statement shall contain the following legend:

THE RESTRICTED AMERICAN DEPOSITARY SHARES ("RESTRICTED ADSs") CREDITED TO

YOUR ACCOUNT AND THE UNDERLYING RESTRICTED SHARES ("RESTRICTED SHARES") OF THE

COMPANY ARE SUBJECT TO THE TERMS OF THE LETTER AGREEMENT, DATED AS OF MAY [__],

2008 (THE "LETTER AGREEMENT"), THE UNCERTIFICATED ADS LETTER AGREEMENT, DATED AS

OF SEPTEMBER 21, 2007 (THE "UNCERTIFICATED ADS LETTER AGREEMENT" AND TOGETHER

WITH THE RESTRICTED LETTER AGREEMENT, THE "LETTER AGREEMENTS"), AND THE DEPOSIT

AGREEMENT, DATED AS OF NOVEMBER 2, 1998, AS AMENDED AND SUPPLEMENTED (AS SO

AMENDED AND SUPPLEMENTED, THE "DEPOSIT AGREEMENT"). ALL TERMS USED BUT NOT

OTHERWISE DEFINED HEREIN SHALL, UNLESS OTHERWISE SPECIFICALLY DESIGNATED HEREIN,

HAVE THE MEANING GIVEN TO SUCH TERMS IN THE RESTRICTED LETTER AGREEMENT, OR IF

NOT DEFINED THEREIN, IN THE DEPOSIT AGREEMENT.

HOLDERS AND BENEFICIAL OWNERS OF THE RESTRICTED ADSs BY ACCEPTING AND

HOLDING THE RESTRICTED ADSs, AND ANY INTEREST THEREIN, SHALL BE BOUND BY THE

TERMS OF THE DEPOSIT AGREEMENT AND THE LETTER AGREEMENTS. AT THE TIME OF

ISSUANCE, THE RESTRICTED ADSs HAD NOT BEEN REGISTERED UNDER THE UNITED STATES

SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), OR REGISTERED OR

QUALIFIED UNDER ANY APPLICABLE STATE SECURITIES LAWS. THESE SECURITIES MAY NOT

BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT PURSUANT TO (A) AN

EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT IN A TRANSACTION

REGISTERED OR QUALIFIED UNDER APPLICABLE STATE SECURITIES LAWS, OR (B) AN

AVAILABLE EXEMPTION FROM SUCH REGISTRATION OR QUALIFICATION REQUIREMENTS. UNLESS

A REGISTRATION STATEMENT IS EFFECTIVE WITH RESPECT TO THESE SECURITIES, AS A

CONDITION TO PERMITTING ANY TRANSFER OF THESE SECURITIES, EACH OF THE DEPOSITARY

AND THE COMPANY MAY REQUIRE THAT IT BE FURNISHED WITH AN OPINION OF COUNSEL

REASONABLY SATISFACTORY TO THE DEPOSITARY AND THE COMPANY TO THE EFFECT THAT NO

REGISTRATION OR QUALIFICATION IS LEGALLY REQUIRED FOR SUCH TRANSFER.

5

PRIOR TO THE TRANSFER OF THE RESTRICTED ADSs, A HOLDER OF RESTRICTED ADSs

WILL BE REQUIRED TO PROVIDE TO THE DEPOSITARY AND TO THE COMPANY A CERTIFICATION

IN THE FORM ATTACHED TO THE RESTRICTED LETTER AGREEMENT. PRIOR TO THE WITHDRAWAL

OF THE RESTRICTED SHARES, A HOLDER OF RESTRICTED ADSs WILL BE REQUIRED TO

PROVIDE TO THE DEPOSITARY AND TO THE COMPANY A WITHDRAWAL CERTIFICATION IN THE

FORM ATTACHED TO THE RESTRICTED AGREEMENT. THE TRANSFER AND OTHER RESTRICTIONS

SET FORTH HEREIN AND IN THE LETTER AGREEMENT SHALL REMAIN APPLICABLE WITH

RESPECT TO THE RESTRICTED ADSs AND THE RESTRICTED SHARES UNTIL SUCH TIME AS THE

PROCEDURES SET FORTH IN THE RESTRICTED LETTER AGREEMENT FOR REMOVAL OF

RESTRICTIONS ARE SATISFIED. NEITHER THE COMPANY NOR THE DEPOSITARY MAKES ANY

REPRESENTATION AS TO THE AVAILABILITY OF THE EXEMPTION PROVIDED BY RULE 144

UNDER THE SECURITIES ACT FOR RESALE OF THE RESTRICTED SHARES OR THE RESTRICTED

ADSs. A COPY OF THE DEPOSIT AGREEMENT AND OF THE LETTER AGREEMENTS MAY BE

OBTAINED FROM THE DEPOSITARY OR THE COMPANY UPON REQUEST.

6. Limitations on Transfer of Designated Restricted ADSs. The Designated

Restricted ADSs shall be transferable only by the Holder thereof upon delivery

to the Depositary of (i) all applicable documentation otherwise contemplated by

the Deposit Agreement, and (ii) such other documents as may reasonably be

requested by the Depositary under the terms hereof (including, without

limitation, opinions of U.S. counsel as to compliance with the terms of the

legend set forth above in Section 5).

7. Limitations On Cancellation of Designated Restricted ADSs. The Company

instructs the Depositary, and the Depositary agrees, not to release any

Designated Shares or cancel any Designated Restricted ADSs for the purpose of

withdrawing the underlying Designated Shares unless (x) the conditions

applicable to the withdrawal of Shares from the depositary receipts facility

created pursuant to the terms of the Deposit Agreement have been satisfied

(except for any conditions relating to the Shares not being Restricted

Securities) and (y) the Depositary shall have received from the person

requesting the withdrawal of the Designated Shares a duly completed and signed

Withdrawal Certification substantially in the form attached hereto as Exhibit E

(such certification, a "Withdrawal Certification").

8. Fungibility. Except as contemplated herein and except as required by

applicable law, the Designated Restricted ADSs evidenced thereby shall, to the

maximum extent permitted by law and to the maximum extent practicable, be

treated as ADSs issued and outstanding under the terms of the Deposit Agreement

that are not Restricted ADSs. Nothing contained herein shall obligate the

Depositary to treat Holders of Designated Restricted ADSs on terms more

favorable than those accorded to Holders of ADSs under the Deposit Agreement.

9. Limitations On Exchange of Designated Restricted ADSs for ADSs. The

Company instructs the Depositary, and the Depositary agrees, to cancel the

Designated Restricted ADSs and to issue and deliver freely transferable ADSs in

respect thereof upon receipt of (i) a duly completed and signed Resale

Certification and Issuance Instruction, substantially in the form attached

hereto as Exhibit F (the "Resale Certification and Issuance Instruction"), (ii)

an opinion of U.S. counsel to the Company stating that transaction pursuant to

which the Designated Restricted ADSs are being sold is exempt from regulations

under the Securities Act, (iii) payment of the issuance for taxes and expenses

otherwise payable under the terms of the Deposit Agreement and this Letter

Agreement, and (iv) any other documents as may reasonably be requested by the

Depositary under the terms of the Deposit Agreement and this Letter Agreement.

6

10. Removal of Restrictions. The Depositary shall remove all stop transfer

notations from its records in respect of Designated Restricted ADSs and shall

treat such Designated Restricted ADSs on the same terms as the ADSs outstanding

under the terms of the Deposit Agreement that are not Designated Restricted ADSs

upon receipt of (x) written instructions from the Company to do so, and (y) an

opinion of U.S. counsel to the Company stating, inter alia, that the Designated

Restricted ADSs and the Designated Shares may be freely transferred under U.S.

securities laws. Upon receipt of such instructions and opinion of counsel, the

Depositary shall take all actions necessary to remove any distinctions

previously existing between the applicable Restricted ADSs and the ADSs that are

not Restricted ADSs, including, without limitation, by (a) removing the stop

transfer notations on its records in respect of the applicable ADSs previously

identified as Designated Restricted ADSs and (b) making the formerly Designated

Restricted ADSs eligible for Pre-Release Transactions and for inclusion in the

applicable book-entry settlement system.

11. Representations and Warranties. The Company hereby represents and

warrants that (a) the Designated Shares being deposited by the Company for the

purpose of the issuance of Restricted ADSs are validly issued, fully paid and

non-assessable, and free of any preemptive rights of the holders of outstanding

Shares, (b) the Designated Shares are of the same class as, and rank pari passu

with, the other Shares on deposit under the Deposit Agreement and (c) to the

Company's knowledge, none of the terms of the Letter Agreement and none of the

transactions contemplated in the Letter Agreement violate any court judgment or

order made against the Company or any material contract to which it is a party.

Such representations and warranties shall survive the deposit of the Designated

Shares and the issuance of Designated Restricted ADSs.

12. Indemnity. Each of the Company and the Depositary acknowledges and

agrees that the indemnification and other provisions of Section 5.08 of the

Deposit Agreement shall apply to the acceptance of Designated Shares for

deposit, the issuance of Designated Restricted ADSs, the transfer of the

Designated Restricted ADSs, the addition/removal of the transfer and other

restrictions set forth herein with respect to ADSs/Restricted ADSs, and the

withdrawal of Designated Shares, in each case upon the terms set forth herein,

as well as to any other acts performed or omitted by the Depositary as

contemplated by this Letter Agreement.

This Letter Agreement shall be interpreted and all the rights and

obligations hereunder shall be governed by the laws of the State of New York

without regard to the principles of conflicts of law thereof. This Letter

Agreement may be executed in one or more counterparts, each of which shall be

deemed an original and all of such counterparts shall constitute the same

agreement.

7

The Company and the Depositary have caused this Letter Agreement to be

executed and delivered on their behalf by their respective officers thereunto

duly authorized as of the date set forth above.

IMPERIAL TOBACCO GROUP PLC

By: /s/ Robert Dyrbus

---------------------------

Name: Robert Dyrbus

Title: Finance Director

CITIBANK, N.A.

as Depositary

By: /s/ Richard Etienne

---------------------------

Name: Richard Etienne

Title: Vice President

8

EXHIBITS

A Permitted Offerees

B Investor Representation Letter

C Instruction Letter

D DTC Participant Instruction Form

E Withdrawal Certification

F Resale Certification and Instruction Letter

EXHIBIT A

to

Letter Agreement, dated as of May 20, 2008

(the "Letter Agreement"), by and between

Imperial Tobacco Group PLC

and

Citibank, N.A.

_____________________

PERMITTED OFFEREES

_____________________

Exh. A-1

Name Address

- ------------------------------------------- -------------------------------------------

Barrow, Hanley, Mewhinney & Strauss, Inc. 3300 Ross Avenue

31st Floor

Dallas, TX 75201-2708

Lazard Asset Management LLC 30 Rockefeller Plaza

59th Floor

New York, NY 10112-5900

Dreman Value Management LLC Harborside Financial Center Plaza 10

Suite 800

Jersey City, NJ 07311-4037

Deutsche Investment Management Americas, Inc. 345 Park Avenue

New York, NY 10154-0115

USAA Investment Management Corp. 9800 Fredericksburg Road

San Antonio, TX 78288-0227

Renaissance Technologies Corp. 800 Third Avenue

33rd Floor

New York, NY 10022-7604

Jane Street Capital LLC 1 New York Plaza

33rd Floor

New York, NY 10004-1901

Fidelity Management And Research 245 Summer Street

14th Floor

Boston, MA 02210-1133

American Beacon Balanced Fund 4151 Amon Carter Boulevard

MD 2450

Fort Worth, TX 76155

USAA Value Fund 9800 Fredericksburg Road

San Antonio, TX 78288-0227

USAA Growth And Income Fund 9800 Fredericksburg Road

San Antonio, TX 78288-0227

Mutuals Advisors, Inc Plaza of the Americas

700 North Pearl Street

Suite 900

Dallas, TX 75201-7434

A-2

Name Address

- ------------------------------------------- -------------------------------------------

UBS Securities LLC 1285 Avenue of the Americas

17th Floor

New York, NY 10019-6096

Parametric Portfolio Associates 1151 Fairview Avenue North

Seattle, WA 98109-4418

Northern Trust Investments 50 South LaSalle Street

Chicago, IL 60603-1006

New York State Teachers Retirement System 10 Corporate Woods Drive

Albany, NY 12211-2395

Kayne Anderson Rudnick Investment 1800 Avenue of the Stars

Management LLC 2nd Floor

Los Angeles, CA 90067-4219

Wright Investors Service, Inc. 440 Wheelers Farms Road

Milford, CT 06460-1847

Citigroup Global Markets (United States) 388 Greenwich Street

New York, NY 10013-2396

State Street Global Advisors 1 Lincoln Street

Boston, MA 02111-2900

SG Americas Securities LLC 1221 Avenue of the Americas

New York, NY 10020-1001

Morgan Stanley & Co., Inc. 1585 Broadway

New York, NY 10036-8200

Munder Capital Management 480 Pierce Street

Birmingham, MI 48009-6063

Merrill Lynch, Pierce, Fenner & Smith, Inc. 4 World Financial Center

250 Vesey Street

New York, NY 10080-0001

Morgan Asset Management, Inc. 417 North 20th Street

Suite 1500

Birmingham, AL 35203-3203

ING Investment Management Co. 230 Park Avenue

13th Floor

New York, NY 10169-0011

A-3

Name Address

- ------------------------------------------- -------------------------------------------

Wells Fargo Bank N.A. 420 Montgomery Street

5th Floor

San Francisco, CA 94104-1205

Edge Asset Management, Inc. 1201 Third Avenue

8th Floor

Seattle, WA 98101-3029

Bear Steams & Co., Inc. 383 Madison Avenue

28th Floor

New York, NY 10179-0001

Goldman Sachs & Co. 1 New York Plaza

New York, NY 10004-1901

Credit Suisse (US) 11 Madison Avenue

6th Floor

New York, NY 10010-3646

Vontobel Asset Management, Inc. 450 Park Avenue

7th Floor

New York, NY 10022-2663

Columbia Management Advisors, Inc. 100 Federal Street

21st Floor

Boston, MA 02110-1898

Van Kampen Asset Management 2800 Post Oak Boulevard

Houston, TX 77056-6198

Ingalls & Snyder Asset Management 61 Broadway

31st Floor

New York, NY 10006-2802

Acadian Asset Management, Inc. 1 Post Office Square

20th Floor

Boston, MA 02109-2106

UBS Global Asset Management 1 North Wacker Drive

Chicago, IL 60606-2807

Claymore Advisors LLC 2455 Corporate West Drive

Lisle, IL 60532-3622

A-4

Name Address

- ------------------------------------------- -------------------------------------------

Blackrock Advisors, Inc. 800 Scudders Mill Road

Plainsboro, NJ 08536

FAF Advisors 601 Second Avenue South

16th Floor

Minneapolis, MN 55402-4302

Hancock Bank Of Mississippi 2510 14th Street

Gulfport, MS 39502-1947

PNC Bank NA 398 North Main Street

Doylestown, PA 18901-3447

Riversource Investments LLC 707 Second Avenue South

17th Floor

Minneapolis, MN 55402-2405

Wells Fargo Investments LLC 999 Third Avenue

Suite 4300

Seattle, WA 98104-4019

Clearbridge Advisors 620 Eighth Avenue

48th Floor

New York, NY 10018-1618

Fifth Third Asset Management, Inc. 38 Fountain Square Plaza

Cincinnati, OH 45263-3191

Harris Investment Management, Inc. 190 South LaSalle Street

4th Floor

Chicago, IL 60603-3410

Ferris, Baker Watts, Inc. 435 Brannan Street

Suite 205

San Francisco, CA 94107-1743

JPMorgan Chase Bank NA

RBC Capital Markets (US)

A-5

EXHIBIT B

to

Letter Agreement, dated as of May 20, 2008

(the "Letter Agreement"), by and between

Imperial Tobacco Group PLC

and

Citibank, N.A.

_____________________

Investor Representation Letter

_____________________

Exh. B-1

INVESTMENT LETTER

Imperial Tobacco Group PLC

_____________ __, 2008

Please facsimile (and then send the original of) this INVESTMENT LETTER to one

of the following facsimile numbers and addresses:

Facsimile: John Stocks at ABN AMRO Incorporated on +1 212 409 7269

or

Carlos Lopes at Morgan Stanley on +1 212 404 9577

or

ECM Syndicate Desk at Citigroup Global Markets Inc. on +1 212 723 8831

or

Sheree Downey at Lehman Brothers Inc., c/o Lehman Brothers

International (Europe) on +44 (0)20 7067 8446 and Duncan Smith at Lehman

Brothers Inc., c/o Lehman Brothers International (Europe) on +44 (0)20 7067 8200

Imperial Tobacco Group PLC

c/o John Stocks

Director, Corporate Broker & US ECM

ABN AMRO Incorporated

55 East 52nd Street

New York, New York 10055

or

Carlos Lopes

Equity Syndicate Operations

Morgan Stanley

1 New York Plaza

New York, New York 10004

or

ECM Syndicate Desk

Citigroup Global Markets Inc.

388 Greenwich Street

New York, New York 10028

or

Sheree Downey

Lehman Brothers Inc.

c/o Lehman Brothers International (Europe)

25 Bank Street

London E14 5LE

and

Duncan Smith

Lehman Brothers Inc.

c/o Lehman Brothers International (Europe)

25 Bank Street

London E14 5LE

and

Exh. B-2

Citibank, N.A.

c/o Computershare

Citibank Team - 3rd Floor

Attn: Jane Valdez

525 Washington Blvd.

Jersey City, New Jersey 07310

Ladies and Gentlemen:

In connection with our intention to subscribe for new ordinary shares of 10

pence each (the "Ordinary Shares", which term, to the extent applicable, shall

be deemed include Restricted ADSs (as defined below)) in the capital of Imperial

Tobacco Group PLC (the "Company") whether (A) by exercising (or causing the

Depositary (as defined below) to exercise) pre-emptive rights (the "Rights",

which term shall be deemed to include any entitlements represented by

provisional allotment letters ("PALs") as well as nil-paid rights and fully-paid

rights) issued in the rights offering (the "Rights Offering") and attributed to

us or (B) by purchasing new Ordinary Shares in the subsequent placement (the

"Placement" and, together with the Rights Offering, the "Offerings") of any new

Ordinary Shares that were not subscribed for in the Rights Offering, and for the

express benefit of the Company, the underwriters to the Offerings and Citibank,

N.A., as depositary (the "Depositary") under the Amended and Restated Deposit

Agreement, dated as of November 2, 1998 (the "Amended and Restated Deposit

Agreement"), among the Company, the Depositary and all holders and beneficial

owners of American Depositary Shares evidenced by American Depositary Receipts

issued thereunder, as supplemented by that certain Uncertificated ADS Side

Letter dated as of September 21, 2007 (the "Uncertificated ADS Side Letter") and

that certain Restricted Side Letter, dated as of May 20, 2008 (the "Restricted

Side Letter" and together with the Amended and Restated Deposit Agreement and

the Uncertificated ADS Side Letter, the "Deposit Agreement") and with the

intention that the Company, the underwriters to the Offerings and the Depositary

rely hereon, we represent, warrant agree and confirm that:

(a) we understand and acknowledge that the Rights and new Ordinary Shares are

being offered in a transaction not involving any public offering in the

United States within the meaning of the United States Securities Act of

1933, as amended (the "Securities Act"), and that the Rights and the new

Ordinary Shares have not been and will not be registered under the

Securities Act or any state securities laws.

(b) we are (a) both an institutional "accredited investor" within the meaning

of Rule 501(a)(1), (2), (3) or (7) under the Securities Act and a

"qualified institutional buyer" as defined in Rule 144A under the

Securities Act (a "Qualifying Investor") and (b) aware that any offer or

sale of the Rights and/or the new Ordinary Shares to us pursuant to the

Offerings will be made by way of a private placement in reliance on an

exemption from registration under the Securities Act;

(c) in the normal course of our business, we invest in or purchase securities

similar to the Rights and the new Ordinary Shares and (a) we have such

knowledge and experience in financial and business matters that we are

capable of evaluating the merits and risks of an investment in the Rights

and/or new Ordinary Shares, (b) we are able to bear the economic risk of

an investment in the Rights and/or the new Ordinary Shares for an

indefinite period and (c) we have concluded on the basis of information

available to us that we are able to bear the risks associated with such

investment;

Exh. B-3

(d) we are purchasing the Rights and/or the new Ordinary Shares in the

Offerings (a) for our own account or for the account of one or more other

Qualifying Investors for which we are acting as duly authorized fiduciary

or agent or (b) for a discretionary account or accounts as to which we

have complete investment discretion and the authority to make these

representations, in either case, for investment purposes and not with a

view to distribution within the meaning of the Securities Act;

(e) we have received and read a copy of the Prospectus relating to the

Offerings, including the documents and information incorporated by

reference or deemed included therein, have had the opportunity to ask

questions of representatives of the Company concerning the Company, the

Offerings, the Rights and the new Ordinary Shares, and have made our own

investment decision to acquire the Rights and/or the new Ordinary Shares

in the Offerings on the basis of our own independent investigation and

appraisal of the business, financial condition, prospects,

creditworthiness, status and affairs of the Company, the Offerings, the

Rights and the new Ordinary Shares;

(f) we acknowledge and agree that we have held and will hold the Prospectus

and any PAL in confidence, it being understood that this Prospectus and

any PAL that we have received or will receive are solely for our use and

that we have not duplicated, distributed, forwarded, transferred or

otherwise transmitted this Prospectus, any PAL or any other presentational

or other materials concerning the Offerings (including electronic copies

thereof) to any persons within the United States, and acknowledge and

agree that such materials shall not be duplicated, distributed, forwarded,

transferred or otherwise transmitted by it. We have made our own

assessment concerning the relevant tax, legal and other economic

considerations relevant to an investment in the Rights and new Ordinary

Shares.

(g) we acknowledge and agree that we have not acquired the Rights and/or the

new Ordinary Shares in the Offerings as a result of any general

solicitation or general advertising, including advertisements, articles,

notices or other communications published in any newspaper, magazine or

similar media or broadcast over radio or television, or any seminar or

meeting whose attendees have been invited by general solicitation or

general advertising;

(h) we acknowledge and agree that the Rights and the new Ordinary Shares may

not be reoffered, sold, pledged or otherwise transferred, and that we will

not directly or indirectly reoffer, sell, pledge or otherwise transfer the

Rights or the new Ordinary Shares, except (a) in an offshore transaction

in accordance with Rule 904 of Regulation S under the Securities Act or

(b) with respect to the new Ordinary Shares only, pursuant to Rule 144 (if

available) upon delivery of an opinion of counsel reasonably satisfactory

to the Company (unless the delivery of such opinion is waived by the

Company); and that in each case, such offer, sale pledge or transfer must,

and will, be made in accordance with any applicable securities laws of any

state or other jurisdiction of the United States;

Exh. B-4

(i) we understand and acknowledge that no representation has been, or will be,

made by the Company or the underwriters to the Offerings as to the

availability of Rule 144 under the Securities Act or any other exemption

under the Securities Act or any state securities laws for the reoffer,

pledge or transfer of the new Ordinary Shares;

(j) we understand that Rights and the new Ordinary Shares are "restricted

securities" within the meaning of Rule 144(a)(3) under the Securities Act

and that, for so long as they remain "restricted securities", the new

Ordinary Shares may not be deposited into any unrestricted depositary

facility established or maintained by a depositary bank, including the

current unrestricted American Depositary Receipt facility maintained by

the Depositary;

(k) if we were provided a PAL, we understand and acknowledge that the PALs

have not been and will not be registered under the Securities Act and we

will not sell or otherwise transfer a PAL in the United States and will

only sell or otherwise transfer or renounce a PAL in an offshore

transaction in accordance with Rule 904 of Regulation S under the

Securities Act;

(l) to the extent we have received or do receive a PAL, we understand and

acknowledge that it shall bear a legend substantially in the form below:

"THIS PROVISIONAL ALLOTMENT LETTER AND THE NEW ORDINARY SHARES OF IMPERIAL

TOBACCO GROUP PLC (THE "COMPANY") TO WHICH IT RELATES HAVE NOT BEEN AND

WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS

AMENDED, OR UNDER THE APPLICABLE SECURITIES LAWS OF ANY STATE OF THE

UNITED STATES. NEITHER THE NEW ORDINARY SHARES NOR THE PROVISIONAL

ALLOTMENT LETTERS MAY, SUBJECT TO CERTAIN EXCEPTIONS, BE OFFERED, SOLD,

TAKEN UP OR DELIVERED, DIRECTLY OR INDIRECTLY, INTO OR WITHIN THE UNITED

STATES OR ITS TERRITORIES OR POSSESSIONS."

(m) we understand and acknowledge that upon the initial issuance thereof, and

until such time as the same is no longer required under the Securities Act

or applicable state securities laws, the certificates representing the new

Ordinary Shares (other than Restricted ADSs which shall bear a similar

legend) (to the extent such new Ordinary Shares are in certificated form),

and all certificates issued in exchange therefore or in substitution

thereof, shall bear a legend substantially in the form below:

(n) "THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES

SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), OR ANY OTHER

APPLICABLE SECURITIES LAW. BY ITS ACCEPTANCE OF THESE SECURITIES THE

PURCHASER REPRESENTS THAT IT IS BOTH AN INSTITUTIONAL ACCREDITED INVESTOR

WITHIN THE MEANING OF RULE 501 (a)(1), (2), (3) or (7) OF THE SECURITIES

ACT (AN "INSTITUTIONAL ACCREDITED INVESTOR") AND A QUALIFIED INSTITUTIONAL

BUYER ("QIB") AS DEFINED IN RULE 144A UNDER THE SECURITIES ACT AND THAT IT

Exh. B-5

IS EITHER PURCHASING FOR ITS OWN ACCOUNT OR FOR THE ACCOUNT OF OTHER

PURCHASERS WHO ARE BOTH INSTITUTIONAL ACCREDITED INVESTORS AND QIBs AND

AGREES (A) THAT THE SECURITIES ARE NOT BEING ACQUIRED WITH A VIEW TO

DISTRIBUTION AND ANY RESALE OF SUCH SECURITIES WILL BE MADE ONLY IN AN

OFFSHORE TRANSACTION IN ACCORDANCE WITH RULE 904 OF REGULATION S OR

PURSUANT TO RULE 144 (IF AVAILABLE) UPON DELIVERY OF AN OPINION OF US

COUNSEL REASONABLY SATISFACTORY TO THE COMPANY (UNLESS THE DELIVERY OF

SUCH OPINION IS WAIVED BY THE COMPANY) TO THE EFFECT THAT THE RESALE IS

EXEMPT FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT, AND (B)

THAT SO LONG AS THE SHARES ARE "RESTRICTED SECURITIES" WITHIN THE MEANING

OF RULE 144(A)(3) OF THE SECURITIES ACT, THEY MAY NOT BE DEPOSITED INTO

ANY UNRESTRICTED DEPOSITARY RECEIPT FACILITY.

A RESALE IN ACCORDANCE WITH RULE 904 OF THE SECURITIES ACT MAY INCLUDE A

TRANSACTION WHERE NO DIRECTED SELLING EFFORTS ARE MADE IN THE UNITED

STATES, THE OFFER IS NOT MADE TO A PERSON IN THE UNITED STATES AND EITHER

(A) AT THE TIME THE BUY ORDER IS ORIGINATED, THE BUYER IS OUTSIDE THE

UNITED STATES, OR THE SELLER AND ANY PERSON ACTING ON ITS BEHALF

REASONABLY BELIEVE THAT THE BUYER IS OUTSIDE THE UNITED STATES, OR (B) THE

TRANSACTION IS EXECUTED IN, OR THROUGH THE FACILITIES OF THE LONDON STOCK

EXCHANGE AND NEITHER THE SELLER NOR ANY PERSON ACTING ON ITS BEHALF KNOWS

THAT THE TRANSACTION HAS BEEN PRE-ARRANGED WITH A BUYER IN THE UNITED

STATES";

(o) we understand and acknowledge that the Company may make notation on its

records or give instructions to the registrar and any transfer agent of

the Rights or the new Ordinary Shares and to the Depositary under its

American Depositary Receipt facility in order to implement the

restrictions on transfer set forth and described herein;

(p) none of the underwriters to the Offering, their affiliates, or persons

acting on its or their behalf have made any representation to us, express

or implied, with respect to the Company, the Offerings, the Rights or the

new Ordinary Shares, or the accuracy, completeness or adequacy of such

financial and other information concerning the Company, the Offerings, the

Rights and the new Ordinary Shares;

(q) we understand that the Prospectus relating to the Offerings has been

prepared in accordance with UK format and style, which differs from US

format and style. In particular, but without limitation, the financial

information contained In the Prospectus has been prepared in accordance

with UK generally accepted accounting principles or International

Financial Reporting Standards, and thus may not be comparable to financial

statements of US companies prepared in accordance with US generally

accepted accounting principles; and

Exh. B-6

(r) to the extent we receive new Ordinary Shares represented by American

Depositary Shares in the Offerings ("Restricted ADSs"), (i) we understand

that the Restricted ADSs to be delivered to us will be issued under the

terms of the Deposit Agreement, (ii) we agree to be bound by the terms of

the Deposit Agreement and by the terms of the legend set forth therein;

and (iii) we understand and agree that the Restricted ADSs issued to us

are not identical to or fungible with the ADSs issued under the terms of

the Deposit Agreement and as such, they may not, so long as such

Restricted ADSs are issued pursuant to the Deposit Agreement, be entitled

to all the rights and benefits of holders of ADSs under the Deposit

Agreement that are not Restricted ADSs.

We understand that the foregoing representations, warranties, agreements

and acknowledgements are required in connection with US and other

securities laws and that you and your respective affiliates, the

underwriters of the Offerings and their respective affiliates, and the

Depositary are entitled to rely on this letter and on the accuracy of the

representations, warranties, agreements and acknowledgements contained

herein, and you and your respective affiliates, the underwriters, and the

Depositary are irrevocably authorized to produce this letter or a copy

hereof to any interested party in any administrative or legal proceeding

or official inquiry with respect to the matters covered hereby.

This letter shall be governed by and construed in accordance with the laws

of the State of New York, without giving effect to any contrary result

otherwise required by applicable conflict or choice of law rules.

Very truly yours,

By Institution: ______________________________

Signature: ______________________________

Name(s):

Title(s):

Institution's Address: ______________________________

______________________________

______________________________

______________________________

______________________________

Daytime Telephone Number ______________________________

(including area code):

Exh. B-7

- --------------------------------------------------------------------------------

(Please note that this INVESTMENT LETTER does not represent an order to

subscribe for Ordinary Shares of the Company by exercising your Rights.)

(To subscribe for new Ordinary Shares by exercising your Rights, please contact

your custodian.)

- --------------------------------------------------------------------------------

Exh. B-8

EXHIBIT C

to

Letter Agreement, dated as of May 20, 2008

(the "Letter Agreement"), by and between

Imperial Tobacco Group PLC

and

Citibank, N.A.

_____________________

Instruction Letter

_____________________

Exh. C-1

May ___, 2008

Citibank, N.A.

388 Greenwich Street

New York, New York 10013

Attention: Depositary Receipt Department

Ladies and Gentlemen:

Reference is hereby made to that certain Amended and Restated Deposit Agreement,

dated as of November 2, 1998 (the "Original Deposit Agreement"), by and among

Imperial Tobacco Group PLC, a public limited company incorporated under the laws

of England (the "Company"), Citibank, N.A., a national banking association

organization under the laws of the United States of America, as Depositary (the

"Depositary"), and the Holders and Beneficial Owners of American Depositary

Shares ("Unrestricted ADSs") evidenced by American Depositary Receipts

("Unrestricted ADRs") issued thereunder, as supplemented by that certain

Uncertificated ADS Side Letter (the "Uncertificated ADS Side Letter"), dated

September 21, 2007, by and between the Company and the Depositary and that

certain Restricted Side Letter, dated as of May 20, 2008, by and between the

Company and the Depositary (the "Side Letter" and together with the Original

Deposit Agreement and the Uncertificated ADS Side Letter, the "Deposit

Agreement"). Capitalized terms used herein without definition shall have the

meaning assigned thereto in the Deposit Agreement.

As previously communicated to you, we propose a rights offering (the "Rights

Offering") of up to 338,741,960 ordinary shares with a par value of 10 pence per

share (the "Shares"). Holders of existing shares (the "Existing Shares") of the

Company will be allocated rights ("Rights") to purchase one Share ("New Shares")

for every two Existing Shares held at the close of business (London Time) on May

20, 2008 (the "Record Date") at a price of 1475 pence each (the "Subscription

Price").

The New Shares, Restricted ADSs (as hereinafter defined) and the Rights

allocated to holders of Existing Shares and Unrestricted ADSs of the Company

have not been and will not be registered under the Securities Act of 1933, as

amended (the "Securities Act") or under the securities laws of any state of the

United States. Accordingly, the New Shares, the Restricted ADSs and the Rights

may generally not be offered, sold, resold, delivered or transferred directly or

indirectly to US persons or in or into the United States. We will be making

offers of Rights and New Shares to a limited number of our holders of

Unrestricted ADSs in the U.S. provided they are persons whom we reasonably

believe are both "qualified institutional buyers" as defined in Rule 144A under

the Securities Act and institutional "accredited investors" within the meaning

of Rule 501(a)(1), (2), (3) or (7) under the Securities Act ("Qualifying

Investors") in a private placement (the "Private Placement"). Those Qualifying

Investors who are holders of Unrestricted ADSs and are offered the opportunity

to participate in the Rights Offering will be allowed to subscribe for one

Restricted ADS for every two ADSs they hold as of May 23, 2008.

Exh. C-2

In connection with the Rights Offering, you are hereby instructed to take the

following actions:

1. You shall not mention the Private Placement to holders of Unrestricted ADSs

("ADS Holders") or distribute any announcement or other materials received by

you or the Custodian describing the Rights Offering to ADS Holders except (i) as

instructed herein or otherwise instructed in writing by us or (ii) notifications

of record date, payable date, etc. in accordance with industry standard for ADSs

listed on the NYSE and for transactions of the type described herein.

2. Set forth on Schedule I attached hereto is a list of (i) ADS Holders who are

Qualifying Investors (each, an "Eligible ADS Participant") to whom we desire to

offer the opportunity to participate in the Rights Offering and receive the New

Shares deliverable upon exercises of the Rights in the form of restricted

American Depositary Shares ("Restricted ADSs") and (ii) the number of ADSs

believed by us to be held by the Eligible ADS Participant.

3. On the basis of the number of ADSs believed to be held by the Eligible ADS

Participants (on the basis of the information provided by us to you as

contemplated in paragraph 2 above), you shall compute the number of ADSs held by

ADS Holders who are not "Eligible ADS Participants" and the number of Rights

allocated in respect of such holders. On or about May 28, 2008, you shall

instruct the Custodian to use commercially reasonable efforts to sell such

Rights on the London Stock Exchange. The proceeds of such sale or sales shall be

included in the "Proceeds" provided for in Paragraph 8 below.

4. We will provide to each Eligible ADS Participant (a) an ADS Transmittal

Letter (the "ADS Transmittal Letter") substantially in the form attached hereto

as Exhibit A, (b) a form of instruction from the Eligible ADS Participant (the

"Holder Instruction") attached as Annex A to the ADS Transmittal Letter, (c) a

form of Investor Letter of Representation (the "Investor Letter of

Representation") attached as Annex B to the ADS Transmittal Letter, (d) a Form

W-9 (the "Form W-9") and Guidelines for Certification of Taxpayer Identification

Number of Form W-9 attached as Annex C to the ADS Transmittal Letter and (e) a

DTC Participant Instruction Form (the "DTC Participant Instruction Form")

attached as Annex D to the ADS Transmittal Letter (items (a) through (e)

collectively the "ADS Supplemental Materials"). Prior to delivering any

instruction to the Custodian for the exercise of any Rights on behalf of an

Eligible ADS Participant, you shall have received from such Eligible ADS

Participant (i) the Investor Letter of Representation certifying the matters

stated therein for the relevant accounts of such Eligible ADS Participant, (ii)

the Holder Instruction, (iii) the Form W-9, (iv) the DTC Participant Instruction

Form and (v) the Total Payment Due (as defined below). You shall in turn provide

such documents to the Custodian to allow for the valid exercise of the Rights of

such Eligible ADS Participant in accordance with the terms of the Rights

Offering.

5. As described in the Holder Instruction, you shall assist each Eligible ADS

Participant in the calculation of the total payment due (the "Total Payment

Due") from the Eligible ADS Participant, which shall comprise payment in US

dollars of (a) the U.S. dollar equivalent of the Subscription Price indicated in

the ADS Transmittal Letter per New Share that such Eligible ADS Participant

instructs you to subscribe for on its behalf, (b) 5% of the U.S. dollar

equivalent of the Subscription Price per New Share (the "Currency Adjustment

Amount") that such Eligible ADS Participant instructs you to subscribe for on

its behalf to provide for any possible exchange rate fluctuation, which amount

will be refunded to such Eligible ADS Participant if it exceeds the actual

exchange rate fluctuation, if any, (c) your non-refundable administrative fee of

Exh. C-3

US$.03 per Restricted ADS to be issued and (d) 1.5% of the US equivalent of the

Subscription Price per New Share to provide for the U.K. stamp duty reserve tax

charge. In the event the Currency Adjustment Amount is insufficient to cover the

costs of purchasing the relevant amount of pounds sterling in the market on the

date you purchase pounds sterling, you will request from such Eligible ADS

Participant and such Eligible ADS Participant must provide a payment of

additional amount necessary to purchase pounds sterling at the prevailing

exchange rate. The final itemized calculation of the Total Payment Due shall be

set forth in the Eligible ADS Participant's Holder Instruction.

6. If at any time on or prior to 3:00 p.m. on June 4, 2008 (the "ADS Rights

Expiration Date"), the Depositary receives (a) an executed Holder Instruction,

(b) an executed Investor Letter of Representation, (c) a completed Form W-9 for

the exercising Eligible ADS Participant, (d) payment of the Total Payment Due

agreed upon between you and the exercising Eligible ADS Participant and set

forth in Annex A to the Holder Instruction, and (e) the DTC Participant

Instruction Form, then you shall exercise Rights through the Custodian in an

amount equal to that specified in the Holder Instruction. If exercise of the

Rights specified in a Holder Instruction would result in the issuance of a

fractional Restricted ADS, you shall sell, in accordance with Paragraph 9 below,

the portion of Rights specified in such Holder Instruction which corresponds to

the fractional Restricted ADS, and exercise the remaining number of Rights

specified in such Holder Instruction so that only whole numbers of Restricted

ADSs are issued.

7. You shall request the Custodian to cause the Rights allocated in respect of

the Existing Shares for the benefit of any Eligible ADSs Participant to be

segregated from the other Rights. You shall notify the Custodian that the Rights

that are exercised are being exercised on behalf of Eligible ADS Participants

and shall provide the Custodian with an instruction to exercise the relevant

number of Rights for which you have received proper instructions and the Total

Payment Due as of the ADS Rights Expiration Date.

8. You shall cause the Unrestricted ADSs with respect to which an Eligible ADS

Participant has provided the necessary documentation and the Total Amount Due

prior to the ADS Expiration Date to be segregated by DTC under a separate

"contra" CUSIP number which is 453991663.

9. On or about the ADS Rights Expiration Date, you shall instruct the Custodian

to (a) exercise the aggregate number of Rights for which Holder Instructions and

the Total Payment Due have been received from Eligible ADS Participants and (b)

to use commercially reasonable efforts to sell on the London Stock Exchange the

remaining Rights held by it as the Custodian. Any proceeds from such sales shall

be combined with proceeds from sale of Rights on behalf of ADS Holders who were

ineligible to participants in the Rights Offering (as realized in paragraph 3

above). You shall distribute on a pro rata basis all the proceeds from the sale

of Rights pursuant to paragraphs 3, 6 and 9, if any, to ADS Holders other than

those on whose behalf Rights have been exercised in accordance with the Deposit

Agreement.

10. After delivery of the cash proceeds from the sale of the Rights to Eligible

ADS Participants who did not exercise their Rights and ADS Holders who were not

eligible to participate in the Rights Offering, you will cause DTC to transfer

the segregated Unrestricted ADSs of the participating Eligible ADS Participants

to the base CUSIP number for the Unrestricted ADS.

Exh. C-4

11. From the date Restricted ADSs are issued to persons who exercise Rights,

which is anticipated to be June 12, 2008, until 40 days thereafter you shall not

permit (a) the deposit of any Shares pursuant to the Deposit Agreement or (b)

the pre-release of any ADSs on the basis of Shares, without first, in either

case, receiving from the depositor or the recipient, as the case may be, an

executed certificate substantially in the form attached as Exhibit B.

12. Upon confirmation from the Custodian of receipt of New Shares in a

segregated "restricted" account, you shall issue Restricted ADSs under the Side

Letter to the participating Eligible ADS Participants as indicated in such

Holder Instructions.

13. Information about us, including press releases, is generally available on

our website at www.imperial-tobacco.com and we file reports and other

information with the Securities and Exchange Commission. Those reports and other

information concerning us can be read and copied at the SEC's Public Reference

Room at 450 Fifth Street, N.W., Washington, D.C. 20549 or on the SEC website at

www.sec.gov. To the extent that any ADS Holder requests additional information

about the Rights Offering, you are hereby instructed to direct them to contact

David Watkins at Hoare Govett Limited, 250 Bishopsgate, London EC2M 4AA, United

Kingdom or at telephone number +44 207 678 1853.

14. We shall cause our U.S. counsel to deliver to you at the time of the launch

of the Rights Offering, which is expected to occur on or about May 20, 2008, an

opinion of such counsel that no registration of the Rights or the Shares issued

in respect thereof is required under the US Securities Act of 1933, as amended

(which opinion is subject to various assumptions and qualifications as noted

therein, and does not include whether registration under the Securities Act is

required for any subsequent offer or resale of the New Shares or Rights).

We acknowledge and agree that the indemnities provided in Section 5.08 of the

Deposit Agreement shall apply to any acts performed or omitted by you, the

Custodian and any of your or our respective directors, employees, agents and

Affiliates pursuant to the (a) instructions provided in this letter of

instructions or (b) the Rights Offering generally, including without limitation,

any and all liability or expenses which may arise out of the payment of stamp

duty and any other taxes payable in connection with the Rights Offering.

The Company understands and agrees to pay Citibank for its services as rights'

agent a fee of $10,000 plus reasonable out-of-pocket expenses. The $10,000 fee

will be reduced by such amount which Eligible ADS Participants pay in

administration fees in connection with taking up their rights in the form of

Restricted ADSs.

Exh. C-5

This letter of instruction shall be governed by and construed in accordance with

the laws of the State of New York.

Kind regards,

IMPERIAL TOBACCO GROUP PLC

By:

--------------------------

Name: Robert Dyrbus

Title: Finance Director

Exh. C-6

Schedule I

Eligible ADS Participant Number of ADSs

- ------------------------ --------------

Barrow, Hanley, Mewhinney & Strauss, Inc. 22,712,610

Lazard Asset Management LLC 1,033,429

Dreman Value Management LLC 918,595

Deutsche Investment Management Americas, Inc. 711,040

USAA Investment Management Corp. 187,701

Renaissance Technologies Corp. 182,200

Jane Street Capital LLC 159,603

Fidelity Management And Research 147,773

American Beacon Balanced Fund 121,900

USAA Value Fund 119,300

USAA Growth And Income Fund 76,700

Mutuals Advisors, Inc 72,000

UBS Securities LLC 54,705

Parametric Portfolio Associates 54,172

Northern Trust Investments 53,907

New York State Teachers Retirement System 37,500

Kayne Anderson Rudnick Investment Management LLC 31,160

Wright Investors Service, Inc. 25,385

Citigroup Global Markets (United States) 19,850

State Street Global Advisors 12,138

SG Americas Securities LLC 11,683

Morgan Stanley & Co., Inc. 11,384

Munder Capital Management 11,300

Exh. C-7

Eligible ADS Participant Number of ADSs

- ------------------------ --------------

Merrill Lynch, Pierce, Fenner & Smith, Inc. 11,157

Morgan Asset Management, Inc. 9,912

ING Investment Management Co. 8,101

Wells Fargo Bank N.A. 7,947

Edge Asset Management, Inc. 5,600

Bear Stearns & Co., Inc. 4,682

Goldman Sachs & Co. 4,572

Credit Suisse (US) 4,057

Vontobel Asset Management, Inc. 3,160

Columbia Management Advisors, Inc. 2,838

Van Kampen Asset Management 2,683

Ingalls & Snyder Asset Management 2,483

Acadian Asset Management, Inc. 2,480

UBS Global Asset Management 2,184

Claymore Advisors LLC 2,048

Blackrock Advisors, Inc. 1,643

FAF Advisors 1,085

Hancock Bank Of Mississippi 1,011

PNC Bank NA 902

Riversource Investments LLC 770

Wells Fargo Investments LLC 745

Clearbridge Advisors 516

Fifth Third Asset Management, Inc. 313

Harris Investment Management, Inc. 218

Exh. C-8

Eligible ADS Participant Number of ADSs

- ------------------------ --------------

Ferris, Baker Watts, Inc. 189

JPMorgan Chase Bank NA 100

RBC Capital Markets (US) 84

Exh. C-9

Exhibit A

ADR Transmittal Letter

Exh. C-10

Imperial Tobacco Group PLC

P.O. Box 244, Upton Road

Bristol B599 #7UJ

England

May 23, 2008

To Whom It May Concern:

Enclosed are the following documents relating to the one (1) for two (2) rights

offering (the "Rights Offering") of up to 338,741,960 ordinary shares, nominal

value 10 pence per share (the "Shares"), of Imperial Tobacco Group PLC (the

"Company"):

(a) an ADS Holder Instruction Form (Annex A);

(b) an Investor Letter of Representation (Annex B);

(c) a Form W-9 and Guidelines for Certification of Taxpayer Identification

Number on Substitute Form W-9 (Annex C); and

(d) a DTC Participant Instruction Form (Annex D).

We are sending you these documents because the Company reasonably believes that

you (A) were as of the date hereof a holder of American Depositary Shares

("ADSs") evidenced by American Depositary Receipts ("ADRs") issued under the

Amended and Restated Deposit Agreement, dated as of November 2, 1998, by and

among the Company, Citibank, N.A. ("Citibank") and all Holders and Beneficial

Owners from time to time of ADSs evidenced by ADRs issued thereunder (the

"Amended and Restated Deposit Agreement") as supplemented by that certain

Uncertificated ADS Side Letter, dated as of September 21, 2007 (the

"Uncertificated ADS Side Letter"), by and between the Company and Citibank and

the Restricted Side Letter, dated as of May __, 2008, by and between the Company

and Citibank (the "Restricted Side Letter" and, collectively with the Amended

and Restated Deposit Agreement and the Uncertificated ADS Side Letter, the

"Deposit Agreement") AND (B) are as of the date hereof both an institutional

"accredited investor" within the meaning of Rule 501(a)(1), (2), (3) or (7)

under the Securities Act of 1933, as amended (the "Securities Act"), and a

"qualified institutional buyer" ("QIB") within the meaning of Rule 144A under

the Securities Act (a "Qualifying Investor").

Holders of existing Shares (the "Existing Shares") of the Company have been

allocated rights ("Rights") to purchase one (1) Share ("New Shares") for every

two (2) Existing Shares owned at a price of 1475 pence per New Share or U.S.$

28.72 per New Share (based on the U.S. dollar - U.K. pound sterling exchange

rate(1) on May 19, 2008 of US$ 1.9472 per (pound) 1.00) (the "Subscription

Price").

Exh. C-11

As a Qualifying Investor holding ADSs, you are being given the opportunity to

exercise the Rights allocated to the Existing Shares represented by your ADSs,

subject, however, to the terms set forth in this letter and the Prospectus,

dated May 20, 2008 (collectively, the "Prospectus"). For every two ADSs a

Qualifying Investor holds as of May 23, 2008 (the "Rights Record Date"), such

Qualifying Investor will be allowed to subscribe for two (2) New Shares

evidenced by one (1) Restricted ADS (as defined below). If you wish to exercise

the Rights allocated to the Existing Shares represented by your ADSs, you must

pay the Subscription Price in U.S. dollars. In addition, you must pay a currency

adjustment amount (subject to refund depending on currency fluctuations), an

administrative fee and all applicable stamp duty reserve or other applicable

taxes all as described herein.

This letter describes and summarizes your rights as a Qualifying Investor

holding ADSs to exercise the Rights allocated to the Existing Shares represented

by your ADSs and to subscribe for New Shares evidenced by Restricted ADSs (as

defined below). This letter must be read in conjunction with the Prospectus. If

you have not previously received a copy of the Prospectus, please contact David

Watkins of Hoare Govett Limited at +44 207 678 1853.

You should note that, as a Qualifying Investor interested in exercising your

Rights and subscribing for New Shares in the Rights Offering, your investment in

the United States must be made on a private placement basis. In order to pursue

this matter further, you must sign and return the enclosed Investor Letter of

Representations.

None of the New Shares, the Restricted ADSs representing such New Shares or the

Rights have been or will be registered under the Securities Act, or under the

securities laws of any state of the United States. Accordingly, subject to

certain exceptions, the New Shares, the Restricted ADSs representing such New

Shares and the Rights may not be offered, sold, resold, delivered or

transferred, directly or indirectly, in or into the United States or for the

account or benefit of a U.S. Person within the meaning of Regulation S under the

Securities Act.

The New Shares and the Restricted ADSs representing the New Shares subscribed

for in the Rights Offering and offered in the United States will be "restricted

securities" as defined in Rule 144(a)(3) under the Securities Act. Accordingly,

such New Shares will not be accepted for deposit into the existing unrestricted

ADR facility established under the Deposit Agreement nor any other depositary

receipt facility established or maintained by a depositary bank under which

freely transferable ADSs are issued. The Restricted ADSs issued in the Rights

Offering will not be identical to or fungible with the ADSs issued under the

Deposit Agreement that are not Restricted ADSs.

- ----------

(1) The exchange rate is the noon buying rate in New York City for cable

transfers in foreign currencies as certified for customs purposes by the

Federal Reserve Bank of New York, expressed in U.S. Dollars per

(pound)1.00.

Exh. C-12

1. Timetable

The following timetable will apply to your participation in the Rights Offering.

All times referred to in this timetable are New York City times.

May 23, 2008 ADS Record Date

3:00 pm on ADS Expiration Date (latest time for delivery of instruction and payment)

June 4, 2008

June 12, 1008 Date New Shares credited to CREST stock accounts

June 18, 2008 Date of despatch of definitive share certificates for New Shares

Promptly after Issuance Date for Restricted ADSs

June 13, 2008

2. ADS Record Date

The record date for determining those Qualifying Investors who are eligible,

subject to applicable U.S. securities laws, to participate in the Rights

Offering is May 23, 2008.

3. Method of Subscription and Payment

As a Qualifying Investor, you can exercise any or all of the Rights to which you

are entitled by:

(a) Delivering a duly completed and executed ADS Holder Instruction Form to

Citibank, indicating, among other things, the total number of Restricted

ADSs you wish to subscribe upon exercise of your Rights;

(b) Arranging for payment to Citibank for the Total Payment Due (as defined

below);

(c) Delivering a duly completed and executed Investor Letter of

Representations to Citibank, with a copy to one of the addresses set forth

on the last page of this letter;

(d) Delivering a duly completed and executed Substitute Form W-9 to

Citibank(1); and

(e) Arranging for the delivery of a duly completed and executed DTC

Participant Instruction Form(2).

- ----------

(1) If you are unable, for any reason, to provide a duly completed and

executed Substitute Form W-9, you should contact Jane Valdez at

Computershare at 201-222-4133 to determine whether any applicable

additional documentation is required.

(2) If you are a registered holder of ADSs holding your ADS outside of DTC

delivery of the DTC Participant Instruction Form is not required.

Exh. C-13

If you hold your ADSs in more than one account or through more than one DTC

participant or custodian bank, you may deliver a single ADS Holder Instruction

Form to Citibank to provide instructions for your aggregate Rights entitlements,

but you will be required to provide Citibank with the following information with

respect to each account:

(a) the DTC participant name (the "DTC Participant");

(b) the DTC Participant number;

(c) a contact at the DTC Participant, with contact details; and

(d) such other information relating to any intervening custodians between the

DTC Participant and the Qualifying Investor to enable Citibank to identify

the holdings of such Qualifying Investor.

In order to segregate ADSs held in book-entry form through DTC with respect to

which a Qualifying Investor has elected to exercise Rights for Restricted ADSs

from the ADSs of holders who have not elected to exercise, or do not qualify

for, such option and are therefore entitled to receive a pro rata share of any

proceeds from any sale of unexercised Rights, The Depository Trust Company

("DTC") has agreed to segregate positions on which an election to exercise the

Rights for Restricted ADSs has been made under a separate contra-CUSIP number.

The number to be used for this purpose is 453991663. An ADS holder who is not a

registered holder of ADSs outside of DTC and is submitting an ADS Holder

Instruction Form must cause the DTC Participant through which it holds its ADSs

to provide Citibank a letter in the form attached hereto as Annex D authorizing

DTC to have its nominee, Cede & Co., temporarily deduct the position with

respect to which the option to exercise the Rights for Restricted ADSs has been

elected from the DTC Participant's holdings under the Company's ADS CUSIP

453142101, temporarily credit the position to an account maintained on behalf of

Citibank, and indicate that movement in the DTC Participant's account under the

Company's ADS contra-CUSIP 453991663 . DTC will return this position to the

Participant's account under the base CUSIP number upon instructions from

Citibank once the proceeds from the sale of the Rights not exercised by ADS

holders have been distributed pro rata to the holders of ADSs who did not elect

to exercise the Rights for Restricted ADSs or were not eligible for such option.

Inquiries regarding this process should be directed to Citibank, N.A., C/O

Computershare, Citibank Team - 3rd Floor, 525 Washington Blvd, Jersey City, NJ

07310, Attn: Jane Valdez, Phone: +1-201-222-4133. Please note that while the

ADSs are under the contra-CUSIP number the beneficial owner will not be able to

engage in any transactions with respect to such ADSs.

The ADS Holder Instruction Form, the Investor Letter of Representations, the

Form W-9 and the DTC Participant Instruction Form must be received no later than

3:00 pm on June 4, 2008 by Citibank at the following address:

Exh. C-14

Citibank, N.A.

C/O Computershare

Citibank Team - 3rd Floor

525 Washington Blvd

Jersey City, NJ 07310

Attn: Jane Valdez

Phone: +1-201-222-4133

Payment of the Total Payment Due (as defined below) must be received no later

than 3:00 pm on June 4, 2008 by Citibank and may be made in the form of

certified checks payable to "Citibank, N.A." or by wire transfer in accordance

with the following instructions. You should follow standard practice to ensure

that the amounts transferred are received and identifiable. The specific

information required for transmission to Citibank of the Total Payment Due is

listed below.

ABA No.: 021000089

Bank Name: Citibank N.A.

Account No.: 3685-8172

Reference: Imperial Tobacco Rights

Bank Address: 388 Greenwich St.

Bank Contact Person: Mr. Mark Gherzo

Contact Phone No.: +1 212 816-6657

Contact E-mail: mark.gherzo@citi.com

The Total Payment Due shall comprise payment of (a) the U.S. dollar equivalent

of the Subscription Price per New Share that you instruct Citibank to subscribe

for on your behalf, (b) the Currency Adjustment Amount (as defined below), (c)

the U.K. Stamp duty reserve tax of 1.5% of the U.S. dollar equivalent of the

Subscription Price per New Share to be represented by Restricted ADSs, and (d)