QuickLinks -- Click here to rapidly navigate through this documentSECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.2)

Filed by the Registrantý

|

Filed by a Party other than the Registranto |

Check the appropriate box: |

| ý | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-12

|

MEEMIC HOLDINGS, INC. |

(Name of Registrant as Specified in its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| o | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

Estimated for the purposes of calculating the amount of the filing fee only. The transaction valuation was determined by multiplying 1,073,518 shares of common stock, no par value, of MEEMIC Holdings, Inc. by $29.00 per share and multiplying 120,000 shares of common stock for each Company Option outstanding by $19.00 which represents the difference between the $29.00 and the excercise price of $10.00 for the options. Such number of shares represents the 6,683,563 shares outstanding as of July 30, 2002, less the 5,610,045 shares of common stock of MEEMIC Holdings, Inc. beneficially owned by ProNational Insurance Company on that date, which shares are not subject to the going-private transaction. The amount of the filing fee, calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, equals 1/50th of 1 percent of the value of the transaction.

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

ý |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

MEEMIC Holdings, Inc.

691 North Squirrel Road, Suite 100

Auburn Hills, Michigan 48326

(888) 463-3642

October 21, 2002

Dear Shareholder:

You are cordially invited to attend the 2002 annual meeting of shareholders of MEEMIC Holdings, Inc., a Michigan corporation ("MEEMIC Holdings"), to be held on December 10, 2002, at 11:00 a.m., local time, at 691 N. Squirrel Road, Auburn Hills, Michigan.

As described in the accompanying Proxy Statement, at the Annual Meeting you will be asked to consider and vote upon proposals to:

- 1.

- Approve an Agreement and Plan of Merger, dated as of July 9, 2002 (as amended as of September 18, 2002, the "Merger Agreement"), among ProNational Insurance Company ("ProNational"), Meemic Merger Corp. ("Merger Sub"), a wholly owned subsidiary of ProNational, and MEEMIC Holdings, pursuant to which, subject to the terms and conditions of the Merger Agreement, (a) MEEMIC Holdings will make a tender offer for any and all of its outstanding shares, other than those owned by ProNational, at a price of $29.00 per share net in cash (the "Tender Offer") and (b) following the completion of the Tender Offer, Merger Sub will be merged with and into MEEMIC Holdings, with MEEMIC Holdings being the surviving corporation (the "Merger"), MEEMIC Holdings will become a wholly owned subsidiary of ProNational and each outstanding share of MEEMIC Holdings Common Stock not owned by ProNational will be converted into the right to receive $29.00 in cash; and

- 2.

- Elect seven directors for a one year term expiring at the 2003 annual meeting of shareholders.

Your Board of Directors, based upon the unanimous recommendation of a committee of independent directors (the "Exploratory Committee"), has determined that the terms of the Tender Offer and Merger are fair to, and in the best interests of, MEEMIC Holdings and the holders of shares of Common Stock other than ProNational and its affiliates and associates (the "Independent Shareholders"), and has unanimously approved the Merger Agreement. In arriving at its decision, the Board of Directors gave careful consideration to a number of factors described in the accompanying Proxy Statement, including the opinion of Raymond James & Associates, Inc. ("Raymond James"), financial advisor to the Exploratory Committee, to the effect that, as of the date of such opinion and based upon and subject to the matters stated therein, the consideration to be received by the Independent Shareholders, was fair, from a financial point of view, to the Independent Shareholders. A copy of the written opinion of Raymond James is included as Appendix B to the accompanying Proxy Statement and should be read in its entirety.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF THE DIRECTOR-NOMINEES AND THE APPROVAL AND ADOPTION OF THE MERGER AGREEMENT.

Consummation of the Tender Offer and Merger is subject to certain conditions, including approval and adoption of the Merger Agreement by (i) the affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote thereon and (ii) the affirmative vote of the holders of a majority of the outstanding shares of Common Stock held by the Independent Shareholders. Only

holders of Common Stock of record at the close of business on October 15, 2002 are entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements thereof.

As of October 15, 2002, ProNational owned approximately 84% of the MEEMIC Holdings Common Stock outstanding. To the knowledge of MEEMIC Holdings, ProNational intends to vote its shares in favor of the election of each of the director-nominees and the approval of the Merger Agreement.

You are urged to read the accompanying Proxy Statement, which provides you with a description of the terms of the Merger Agreement and other information relevant to your vote on these matters. A copy of the Merger Agreement is included as Appendix A to the accompanying Proxy Statement. You can also obtain other information about MEEMIC Holdings from documents filed with the Securities and Exchange Commission.

The Tender Offer and Merger are intended to constitute a "going private" transaction for MEEMIC Holdings under the federal securities laws, so that MEEMIC Holdings' Common Stock will no longer be publicly traded on the Nasdaq Stock Market, and MEEMIC Holdings will no longer be required to file periodic and other reports with the Securities and Exchange Commission. If the Tender Offer and Merger are completed, the holders of Common Stock, other than ProNational, will no longer have an interest in the future economic performance of MEEMIC Holdings.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO VOTE YOUR SHARES BY TELEPHONE OR INTERNET OR BY COMPLETING, DATING, SIGNING AND RETURNING THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED. FAILURE TO VOTE YOUR SHARES WOULD HAVE THE SAME EFFECT AS A VOTE AGAINST THE MERGER AGREEMENT. EXECUTED PROXIES WITH NO INSTRUCTIONS INDICATED THEREON WILL BE VOTED "FOR" THE ELECTION OF EACH OF THE DIRECTORS NOMINATED AND "FOR" THE APPROVAL OF THE MERGER AGREEMENT.

Please do not send in any stock certificates at this time. If the Merger Agreement is approved by shareholders, you will be sent instructions concerning the surrender of your shares. Thank you in advance for your participation and prompt attention.

| | | Sincerely, |

|

|

|

| | | Victor T. Adamo

Chief Executive Officer |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE PROPOSED TRANSACTIONS DESCRIBED IN THIS DOCUMENT, PASSED UPON THE FAIRNESS OR MERITS OF THE MERGER AGREEMENT, OR PASSED UPON THE ACCURACY OR ADEQUACY OF THE DISCLOSURE IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

MEEMIC Holdings, Inc.

691 North Squirrel Road, Suite 100

Auburn Hills, Michigan 48326

(888) 463-3642

NOTICE OF 2002 ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the 2002 Annual Meeting of Shareholders of MEEMIC Holdings, Inc. ("MEEMIC Holdings") will be held at 691 N. Squirrel Road, Auburn Hills, Michigan, at 11:00 a.m., local time, on Tuesday, December 10, 2002, for the following purposes:

- 1.

- To consider and vote upon a proposal to approve an Agreement and Plan of Merger, dated as of July 9, 2002 (as amended as of September 18, 2002, the "Merger Agreement"), among ProNational Insurance Company ("ProNational"), which is MEEMIC Holdings' controlling shareholder, Meemic Merger Corp. ("Merger Sub"), a wholly owned subsidiary of ProNational, and MEEMIC Holdings. A copy of the Merger Agreement is attached to the accompanying Proxy Statement as Appendix A. As more fully described in the Proxy Statement, the Merger Agreement provides that, subject to the terms and conditions of the Merger Agreement: (a) MEEMIC Holdings will make a tender offer for any and all of its outstanding shares, other than those owned by ProNational, at a price of $29.00 per share net in cash (the "Tender Offer"), and (b) following the completion of the Tender Offer, Merger Sub would be merged with and into MEEMIC Holdings (the "Merger"), with MEEMIC Holdings continuing as the surviving corporation; MEEMIC Holdings would become a direct wholly owned subsidiary of ProNational, each outstanding share of common stock of MEEMIC Holdings other than shares owned by ProNational would be canceled and shares held by shareholders other than ProNational would be converted into the right to receive $29.00 in cash;

- 2.

- To elect seven directors for a one year term expiring at the annual meeting of shareholders to be held in 2003 and upon the election and qualification of their successors or upon their earlier resignation or removal; and

- 3.

- To transact such other business as may properly come before this meeting or any adjournments or postponements thereof.

The close of business on October 15, 2002 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any adjournments or postponements thereof.

Your vote is important to us. Whether or not you plan to attend the annual meeting, please vote your shares by telephone or Internet or by completing the enclosed proxy card and promptly mailing it to us in the postage-paid envelope that has been provided to you for your convenience. The proxy is revocable and will not affect your right to vote in person if you are a shareholder of record and attend the meeting.

If you have questions about the proposals, including the procedures for voting your shares, please contact Pam Harlin of MEEMIC Holdings' investor relations department, at 888-463-3642.

PLEASE DO NOT SEND YOUR COMMON STOCK CERTIFICATES AT THIS TIME.

| | | By Order of the Board of Directors, |

|

|

|

|

|

Christine C. Schmitt

Secretary

|

October 21, 2002

PROXY STATEMENT

MEEMIC HOLDINGS, INC.

2002 ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement and the accompanying proxy and Notice of 2002 Annual Meeting of Shareholders are being furnished to the holders of outstanding shares of Common Stock, no par value (the "Common Stock"), of MEEMIC Holdings, Inc., a Michigan corporation ("MEEMIC Holdings"), in connection with the solicitation of proxies by its Board of Directors (the "Board") for use at the Annual Meeting of Shareholders to be held on Tuesday, December 10, 2002, at 11:00 a.m. at 691 N. Squirrel Road, Suite 100, Auburn Hills, Michigan 48326, and at any adjournments or postponements thereof (the "Annual Meeting"). This Proxy Statement, the accompanying proxy and Notice of Annual Meeting were first mailed to shareholders on or about October 21, 2002. Shareholders are urged to read and consider carefully the information contained in this Proxy Statement.

As stated in the Notice of Annual Meeting, shareholders will consider and vote at the Annual Meeting upon (1) a proposal to approve an Agreement and Plan of Merger, dated July 9, 2002 (as amended as of September 18, 2002, the "Merger Agreement"), among ProNational Insurance Company ("ProNational"), MEEMIC Merger Corp. ("Merger Sub"), a wholly owned subsidiary of ProNational, and MEEMIC Holdings, and (2) the election of seven directors to serve until the 2003 annual meeting. A copy of the Merger Agreement is attached to this Proxy Statement as Appendix A. Pursuant to the Merger Agreement and subject to satisfaction of the conditions set forth therein, (a) MEEMIC Holdings will make a tender offer for any and all of its outstanding shares, other than those owned by ProNational, at a price of $29.00 per share net in cash (the "Tender Offer") and (b) following the completion of the Tender Offer, Merger Sub would be merged with and into MEEMIC Holdings (the "Merger"), with MEEMIC Holdings continuing as the surviving corporation (the "Surviving Corporation"), MEEMIC Holdings would become a wholly owned subsidiary of ProNational and each outstanding share of Common Stock (other than shares owned by ProNational, which would be canceled) would be converted into the right to receive $29.00 in cash, without interest.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE APPROVAL OF THE MERGER AGREEMENT AND "FOR" THE ELECTION OF THE NOMINEES NAMED IN THE PROXY STATEMENT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE PROXY CARD OR VOTE YOUR SHARES BY TELEPHONE OR INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE PROPOSED TRANSACTIONS DESCRIBED IN THIS DOCUMENT, PASSED UPON THE FAIRNESS OR MERITS OF THE MERGER AGREEMENT, OR PASSED UPON THE ACCURACY OR ADEQUACY OF THE DISCLOSURE IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| SUMMARY TERM SHEET | | 1 |

| | The Parties | | 1 |

| | The Tender Offer and Merger | | 1 |

| | Certain Effects of the Tender Offer and Merger | | 2 |

| | Background of the Tender Offer and Merger | | 3 |

| | Interests of Certain Persons | | 4 |

| | Recommendation of MEEMIC Holdings' Board of Directors | | 4 |

| | Position of ProNational as to the Fairness of the Tender Offer and Merger | | 4 |

| | Opinion of the Financial Advisor | | 4 |

| | Appraisal Rights | | 4 |

| | Financing; Source of Funds | | 5 |

| | Shareholder Lawsuit Challenging the Merger | | 5 |

| | Certain Federal Income Tax Consequences | | 5 |

| | Additional Information | | 5 |

| GENERAL INFORMATION ABOUT VOTING | | 6 |

| FORWARD-LOOKING STATEMENTS | | 7 |

| SPECIAL FACTORS RELATED TO THE TENDER OFFER AND MERGER | | 8 |

| | Consideration of the Merger Agreement at the Annual Meeting | | 8 |

| | The Parties | | 9 |

| | Background of the Tender Offer and Merger | | 9 |

| | Purpose and Structure | | 21 |

| | Recommendation of the Exploratory Committee and Board of Directors of MEEMIC Holdings; Fairness of the Merger Agreement | | 22 |

| | Opinion of Financial Advisor to the Exploratory Committee | | 28 |

| | Plans for MEEMIC Holdings After the Merger | | 33 |

| | Interests of Certain Persons | | 34 |

| | Certain Effects of the Tender Offer and Merger | | 36 |

| | Certain Federal Income Tax Consequences | | 37 |

| | Anticipated Accounting Treatment | | 37 |

| | Appraisal Rights | | 38 |

| | Regulatory Approvals | | 38 |

| | Sources of Funds; Fees and Expenses | | 38 |

| | The Merger Agreement | | 39 |

| | Selected Financial Data | | 46 |

| | Pro Forma Data | | 48 |

| | Directors and Executive Officers of MEEMIC Holdings, Proassurance, Pronational and Merger Sub | | 52 |

| | Market Price of MEEMIC Holdings Common Stock and Dividend Information | | 53 |

| | Certain Transactions in the Common Stock | | 53 |

| | Shareholder Litigation | | 55 |

| ELECTION OF DIRECTORS | | 55 |

| | Nominees | | 56 |

| | Board Committees and Meetings | | 57 |

| | Report of the Audit Committee | | 57 |

| | Director Compensation | | 58 |

| EXECUTIVE COMPENSATION | | 59 |

| | Summary Compensation Table | | 59 |

| | Option Grants in Last Fiscal Year | | 60 |

| | Option Exercises and MEEMIC Holdings | | 61 |

i

| | Severance Agreements | | 61 |

| | Compensation Committee Report | | 61 |

| | Compensation Committee Interlocks and Insider Participation | | 62 |

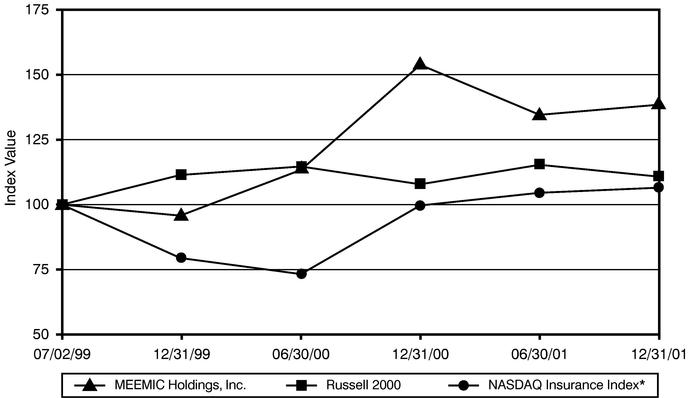

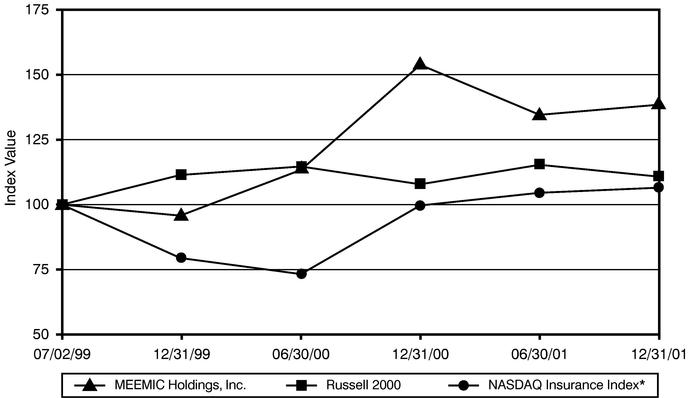

| | Stock Performance Graph | | 63 |

| RELATED PARTY TRANSACTIONS | | 64 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS | | 64 |

| INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS | | 65 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 66 |

| SHAREHOLDER PROPOSALS | | 66 |

| OTHER MATTERS | | 66 |

| ADDITIONAL INFORMATION | | 66 |

| AVAILABLE INFORMATION | | 67 |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | 67 |

| APPENDIX A—AGREEMENT AND PLAN OF MERGER, AS AMENDED | | A-1 |

| APPENDIX B—FAIRNESS OPINION OF RAYMOND JAMES | | B-1 |

| APPENDIX C—CERTAIN INFORMATION REGARDING DIRECTORS AND EXECUTIVE OFFICERS OF MEEMIC HOLDINGS, PROASSURANCE, PROFESSIONALS GROUP, PRONATIONAL AND MERGER SUB | | C-1 |

ii

SUMMARY TERM SHEET

This Summary Term Sheet highlights important selected information from this Proxy Statement relating to the proposed Tender Offer and Merger. This Summary Term Sheet may not contain all of the information that is important to you. To understand more fully the proposed Tender Offer and Merger, you should read this entire Proxy Statement and all of its appendices before voting. We have included page references parenthetically below to direct you to more complete descriptions of the topics presented in this Summary Term Sheet. Additional information about MEEMIC Holdings has been filed with the Securities and Exchange Commission and is available upon request without charge. See "Additional Information" on page 66 of this Proxy Statement. Capitalized terms used but not defined in this Summary Term Sheet shall have the meanings ascribed to them on the first page of this Proxy Statement.

The Parties (p. 9)

- •

- MEEMIC Holdings is the holding company for MEEMIC Insurance Company, a Michigan stock insurance company and MEEMIC Insurance Services Corporation, a Michigan corporation. MEEMIC Holdings' Common Stock is traded on the Nasdaq National Market under the symbol "MEMH."

- •

- ProNational is an insurance company and the controlling shareholder of MEEMIC Holdings. ProNational is a subsidiary of Professionals Group, Inc. and an indirect wholly owned subsidiary of ProAssurance Corporation. ProNational owns approximately 5.6 million shares of MEEMIC Holdings Common Stock, which represents approximately 84% ownership of MEEMIC Holdings.

- •

- Merger Sub was recently organized by ProNational for the sole purpose of effecting the Merger. It has no material assets and has not engaged in any activities except in connection with the Merger. ProNational is the sole shareholder of Merger Sub.

The Tender Offer and Merger (p. 39)

- •

- We entered into the Merger Agreement with ProNational and Merger Sub on July 9, 2002. The purpose of the Tender Offer and Merger is to cause us to become a wholly owned subsidiary of ProNational by causing us to acquire all of the shares not owned by ProNational, which we refer to as the public shares, and to provide liquidity to the holders of the public shares at a premium to the trading price at the time the transaction price was approved.

- •

- If the Merger Agreement is approved by shareholders as set forth in this Proxy Statement, we would promptly commence the Tender Offer for any and all of our outstanding shares, other than those owned by ProNational, at a price of $29.00 per share net in cash. The Tender Offer will be open for a minimum of 20 business days, at which time we would purchase the tendered shares. However, we are not required to purchase the shares tendered in the Tender Offer and will be entitled to terminate the Tender Offer if:

- •

- We have not received approval of our request for exemption from regulations governing the acquisition of control from the Michigan Office of Financial and Insurance Services (which exemption was obtained on July 25, 2002) or have not received any other required governmental approvals;

- •

- We have not received any required consent under ProAssurance's credit facility;

- •

- There is in effect any court order or injunction preventing us from consummating the Tender Offer or the Merger, or holding that the price to be paid to shareholders is not adequate;

- •

- We have received notice from A.M. Best Company or Standard & Poors of their intention to lower our rating or the rating of any of ProAssurance's insurance subsidiaries below "A-" after giving effect to the Tender Offer or the Merger, or if the ratings have in fact been lowered;

- •

- The representations of ProNational and Merger Sub are not true in all material respects as of the date of the Merger Agreement and as of the expiration of the Tender Offer;

- •

- The Merger Agreement has been terminated:

- •

- due to a material breach;

- •

- under circumstances involving a competing offer;

- •

- due to the Tender Offer not being completed by February 28, 2003; or

- •

- due to any condition becoming impossible to satisfy after using commercially reasonable efforts.

- •

- If the Merger Agreement is not approved by shareholders as set forth in this Proxy Statement, the Tender Offer will not be commenced and the Merger Agreement will be terminated.

- •

- After the Tender Offer is completed, the Merger would be closed and become effective if all of the conditions to closing set forth in the Merger Agreement are satisfied or waived. If you own our Common Stock at the effective time of the Merger, you will be entitled to receive $29.00 in cash, without interest, for each share of Common Stock that you own, your shares will no longer represent shares of Common Stock and we will become a wholly owned subsidiary of ProNational. If you do not tender your shares in the Tender Offer, you will not be entitled to any payments for your MEEMIC Holdings Common Stock unless the Merger is consummated.

- •

- The conditions to our obligation to close the Merger include:

- •

- The receipt of approval of the Merger Agreement by the independent shareholders as provided in this Proxy Statement;

- •

- The approval of our request for exemption from the Michigan Office of Financial and Insurance Services from regulations governing the acquisition of control (which exemption was obtained on July 25, 2002) and the receipt of any other required governmental approvals;

- •

- The receipt of any required consent under ProAssurance's credit facility;

- •

- The absence of any notice from A.M. Best Company or Standard & Poors of their intention to lower our rating or the rating of any of ProAssurance's insurance subsidiaries below "A-" after giving effect to the Tender Offer or the Merger, or the actual reduction of any such ratings; and

- •

- The absence of any court order or injunction preventing us from consummating the Merger, or holding that the price to be paid to shareholders is not adequate and the absence of pending or threatened litigation involving the Merger. It is highly unlikely that this condition will be waived and so there may be a significant delay in closing the Merger after the Annual Meeting or the Merger Agreement may be terminated in the event that this condition is not satisfied. We expect that the Merger will be consummated as soon as practicable after the necessary shareholder approval is received and all conditions have been satisfied or waived.

- •

- Options held by our employees and directors at the effective time of the Merger, all of which are fully vested, will entitle the holders of those options to receive the difference between $29.00 and the exercise price per share of their options for each share the options entitle them to purchase.

Certain Effects of the Tender Offer and Merger (p. 36)

- •

- After the Tender Offer is consummated, the Common Stock may cease to be quoted on the Nasdaq Stock Market, in which case price quotations would no longer be available. In addition, if the number of shareholders of record of the Common Stock following the Tender Offer is less than 300, we will be eligible to terminate the registration of the Common Stock under the Securities Exchange Act of 1934. If the registration is terminated, we will no longer be eligible for Nasdaq Stock Market listing or obligated to file periodic public company reports with the Securities and

2

Shareholder Litigation; Waiver of Rights (p. 55)

It is our position that if you tender your shares in the Tender Offer or vote to approve the Merger Agreement, you will waive any rights you may have to pursue claims against any of the parties to the Merger Agreement, and their officers, directors, and representatives, arising from the Tender Offer and Merger and the activities leading to those events. This waiver includes all claims that the price is not adequate to the Independent Shareholders, and all claims that any of the parties to the Merger Agreement or their officers, directors and representatives breached fiduciary duties owed to you by proceeding with the Tender Offer and the Merger. For a more detailed description of the now-dismissed litigation challenging the Tender Offer and Merger, see "Special Factors Related to the Tender Offer and Merger—Shareholder Litigation". No court has considered or ruled on the validity of our position and there can be no assurance that a court will agree with our position.

Background of the Tender Offer and Merger (p. 9)

Following the conversion of MEEMIC and our subscription offering of stock to policyholders and management, our Common Stock was not actively traded and it became apparent that the relatively small number of public shares outstanding would not support an active and liquid trading market. Open market purchases of our Common Stock by ProNational following the conversion further diminished trading activity and liquidity in the market for our Common Stock. Moreover, ProNational recognized that it would be more efficient for us to be a wholly owned subsidiary, due to the costs involved with filing public reports and the increased difficulty in transferring capital. As a result, we and ProNational have considered from time to time the possibility of a transaction that would either liquidate the public shares or eliminate ProNational's interest in MEEMIC Holdings. On March 28, 2001, at its regular meeting, the Board considered again the ramifications of "going private" and various related legal considerations. At the conclusion of these deliberations, the Board established the "Exploratory Committee," consisting of Messrs. Hoeg and Wood, the independent members of the Board, for the purpose of reviewing possible structures of transactions whereby we would become privately held and to represent the interests of our shareholders other than ProNational and the "affiliates" and "associates" of ProAssurance, whom we refer to as the independent shareholders. In January 2002, the Exploratory Committee recommended that we consider a plan to provide liquidity to the independent shareholders through a going private transaction, although no definitive structure of the transaction was recommended. In March 2002, the Board met to discuss the Exploratory Committee's recommendation and to negotiate a potential price. As a result of this process and negotiations between the committee and representatives of ProAssurance, the Merger Agreement was approved at a meeting held on July 9, 2002 and we and ProNational signed the Merger Agreement.

3

Interests of Certain Persons (p. 34)

Some of our officers and directors have interests that may be in addition to, or different from, the interests of the independent shareholders. Those relationships include:

- •

- each of our directors, other than Thomas Hoeg and James Wood, is also a member of the board of directors of ProAssurance or an officer of ProAssurance or MEEMIC Holdings;

- •

- some of our directors and executive officers own currently exercisable options to purchase Common Stock for which they will receive cash in the Merger equal to the difference between $29.00 and the option exercise price;

- •

- A. Derrill Crowe, Victor Adamo, Lynn Kalinowski and Howard Friedman, who are currently directors of MEEMIC Holdings, are also directors of Merger Sub and will remain in such capacity with MEEMIC Holdings after the Merger until their successors are duly elected or appointed; and

- •

- Pursuant to the Merger Agreement, our officers will remain the officers of MEEMIC Holdings after the Merger until their successors are duly elected or appointed.

Recommendation of MEEMIC Holdings' Board of Directors (p. 22)

Our Board recommends that you approve and authorize the Merger Agreement. In arriving at the recommendation and determination that the Tender Offer and Merger are fair to, and in the best interests of, MEEMIC Holdings and our independent shareholders, the Board carefully considered the terms of the Merger Agreement and various other factors, both positive and negative.

Position of ProNational as to the Fairness of the Tender Offer and Merger (p. 27)

ProNational believes that the Tender Offer and Merger are fair to MEEMIC Holdings and our independent shareholders and, to our knowledge, intends to vote for approval of the Merger Agreement. ProNational has expressly relied upon the opinion of Raymond James & Associates, Inc. delivered to MEEMIC Holdings' Board in arriving at its conclusions that the Merger Agreement is fair to MEEMIC Holdings and our independent shareholders.

Opinion of the Financial Advisor (p. 28)

In connection with the Merger, the financial advisor to the Exploratory Committee, Raymond James & Associates, Inc. delivered a written opinion to the committee as to the fairness, from a financial point of view, of the consideration provided for in the Merger Agreement to our independent shareholders.

The full text of Raymond James' written opinion, dated June 18, 2002, is attached to this Proxy Statement as Appendix B. We encourage you to read this opinion carefully in its entirety for a description of the procedures followed, assumptions made, matters considered and limitations on the review undertaken. RAYMOND JAMES' OPINION IS ADDRESSED TO THE EXPLORATORY COMMITTEE OF THE BOARD AND DOES NOT CONSTITUTE A RECOMMENDATION TO YOU OR ANY OTHER SHAREHOLDER OF MEEMIC HOLDINGS AS TO ANY MATTER RELATING TO THE MERGER AGREEMENT.

Appraisal Rights (p. 38)

Under the Michigan Business Corporation Act, record holders of shares of Common Stock will not be entitled to statutory appraisal rights because the consideration being paid in the Merger is cash and the Common Stock is traded on the Nasdaq Stock Market.

4

Financing; Source of Funds (p. 38)

The consideration to be paid in the Tender Offer and Merger will be funded out of our general funds.

Shareholder Lawsuit Challenging the Merger (p. 55)

On March 18, 2002, an individual, purportedly a MEEMIC Holdings' shareholder, filed a lawsuit challenging the Merger in the Sixth Circuit Court in Oakland County, Michigan against MEEMIC Holdings, its directors and ProAssurance seeking to enjoin the Merger and to recover damages. The lawsuit was dismissed on September 11, 2002.

Certain Federal Income Tax Consequences (p. 37)

Generally, you will be taxed on the receipt of cash for your shares as a result of the Tender Offer and Merger. In most cases, your tax liability will be equal to the amount by which the cash you receive in exchange for your shares exceeds your tax basis in your MEEMIC Holdings Common Stock. Your tax basis will generally be what you paid for your MEEMIC Holdings Common Stock. Special rules may apply to you. You should consult with your tax advisor to understand fully your tax situation.

Additional Information (p. 66)

If you have more questions about the Tender Offer and Merger or would like additional copies of this Proxy Statement, you should contact:

Pam Harlin

Investor Relations

MEEMIC Holdings, Inc.

691 N. Squirrel Road, Suite 100

Auburn Hills, Michigan 48326

5

GENERAL INFORMATION ABOUT VOTING

Who can vote?

You can vote your shares of common stock at the meeting only if our records show that you owned the shares on October 15, 2002, the date fixed by the Board as the "Record Date" for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. On each matter submitted to a shareholder vote, you will get one vote for each share of common stock you owned on that date. A total of 6,672,343 shares of common stock can vote at the meeting.

How do I vote if I am a shareholder of record?

If you are a shareholder of record on the Record Date, you can vote on matters that are properly presented at the meeting in four ways:

- •

- You can come to the meeting and cast your vote; or

- •

- You can vote by phone by calling toll-free on a touch tone telephone the telephone number on the enclosed proxy card, entering the control number located on the enclosed proxy card, and following the instructions on the enclosed proxy card; or

- •

- You can vote using the Internet by following the instructions on the enclosed proxy card; or

- •

- You can vote by signing, dating and returning the enclosed proxy card in the enclosed envelope.

If you sign and return the enclosed proxy card so that it is received before the Annual Meeting or vote by telephone or the Internet prior to the meeting, the persons named on the enclosed proxy card will vote your shares as you instruct. If you do not indicate how you wish to vote, the persons named on the enclosed proxy will vote FOR the Merger Agreement, FOR each of the director-nominees nominated by your Board of Directors, and, to the extent permitted by applicable law, in their discretion on any other proposal considered at the Annual Meeting. If you vote by phone or Internet, do not mail your proxy card. The Board currently does not intend to present any other matters at the Annual Meeting.

How do I vote if my shares are held in "street name"?

If your shares are held in the name of your broker, a bank, or other nominee, then that party should give you instructions for voting your shares.

Can I revoke my proxy or change my vote after I return my proxy card or vote by phone?

Yes. You may revoke your proxy at any time prior to its exercise by filing with the Secretary of MEEMIC Holdings a duly executed revocation or a proxy bearing a later date, including a proxy voted by telephone or Internet, or, if you are a record owner, by voting in person at the Annual Meeting. Your attendance at the meeting will not, by itself, revoke your proxy.

What is the quorum requirement?

A quorum of shareholders is necessary to hold a valid meeting. If holders of at least one-third of the shares of Common Stock entitled to vote at the meeting are represented by proxy or in attendance at the Annual Meeting, then a quorum will exist. Abstentions and broker non-votes will be included in the calculation of the number of votes represented at the Annual Meeting.

What do I need to do now?

After carefully reading the material provided to you, please sign and mail your proxy card in the enclosed return envelope as soon as possible so that your shares can be represented at the Annual Meeting, even if you plan to attend the meeting in person.

6

Should I send my MEEMIC Holdings Common Stock certificates now?

No. You should continue to hold your stock certificates. If the Tender Offer is commenced, you will receive a package containing instructions on how to exchange your shares for cash.

What happens if I do not vote?

The approval of the Merger Agreement requires the affirmative vote of the holders of a majority of the outstanding shares owned by persons other than ProNational and the affiliates and associates of ProAssurance. If you are one of these shareholders, your failure to vote has the effect of a vote against the Merger Agreement, even if you are otherwise in favor of the Tender Offer and Merger. If the Merger Agreement does not receive the required shareholder approval at the Annual Meeting, the Merger Agreement will be terminated and the Tender Offer and Merger will not occur.

FORWARD-LOOKING STATEMENTS

The forward-looking statements made in this Proxy Statement, including without limitation financial projections as well as statements about our expectations and possible or assumed future results, were based on various assumptions and are subject to risks and uncertainties, including without limitation the regulatory environment, economic conditions, unanticipated changes in business conditions, unanticipated changes in reserves, the interest rate environment, inflation and other factors contained in our annual and quarterly reports filed with the Securities and Exchange Commission, all of which are difficult or impossible to predict and many of which are beyond the control of MEEMIC Holdings. Consequently, there can be no assurance that MEEMIC Holdings will achieve such results. While we believe that our forward-looking statements are reasonable, you should not place undue reliance on any such forward-looking statements, which speak only as of the date made. You should understand that a number of factors, all of which are difficult to predict and many of which are beyond our control, could affect our future results and any other expectations expressed in our forward-looking statements. This could cause our actual results, performance and experience to differ materially from those expressed in our forward-looking statements.

7

SPECIAL FACTORS RELATED TO THE TENDER OFFER AND MERGER

Consideration of the Merger Agreement at the Annual Meeting

The Board, based upon the unanimous recommendation of the Exploratory Committee with respect to the fairness of the Merger Agreement, has determined that the Merger Agreement is fair to, and in the best interests of, MEEMIC Holdings and its shareholders other than ProNational and the affiliates and associates of ProAssurance (the "Independent Shareholders") and has unanimously approved the Merger Agreement. ACCORDINGLY, THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" APPROVAL OF THE MERGER AGREEMENT. See "Special Factors Related to the Tender Offer and Merger—Background of the Merger," "—Purpose and Structure" and "—Recommendation of the Exploratory Committee and the Board of Directors of MEEMIC Holdings; Fairness of the Merger Agreement."

The affirmative vote of holders of a majority of the (i) outstanding shares of Common Stock entitled to vote thereon and (ii) outstanding shares owned by Independent Shareholders are required to approve the Merger Agreement under the Michigan Business Corporation Act ("MBCA") and MEEMIC Holdings' Articles of Incorporation. The obligation of MEEMIC Holdings and ProNational to consummate the Tender Offer and Merger is subject, among other things, to the condition that the shareholders and Independent Shareholders approve the Merger Agreement. To the knowledge of MEEMIC Holdings, ProNational and MEEMIC Holdings' directors and executive officers intend to vote the shares of Common Stock beneficially owned by them for the approval of the Merger Agreement. Directors and executive officers of MEEMIC Holdings, ProNational, ProAssurance or their subsidiaries are not considered Independent Shareholders for purposes of determining whether the requisite approval has been obtained. If the Merger Agreement is not approved by the Independent Shareholders, the Merger Agreement will be terminated by the parties and the Merger and Tender Offer will not occur. The table below sets forth certain information with respect to the ownership of the outstanding shares of Common Stock as of the Record Date by ProNational, the directors and executive officers of MEEMIC Holdings, the other affiliates and associates of ProAssurance and the Independent Shareholders.

Name of Beneficial Owner

| | Number of

Shares Owned

| | Percent of

Outstanding Class

| |

|---|

| ProNational Insurance Company | | 5,610,045 | | 84.1 | % |

| All directors and executive officers of MEEMIC Holdings as a group | | 93,208 | | 1.4 | % |

ProAssurance affiliates and associates

(other than ProNational and the directors and executive officers of MEEMIC Holdings) | | 0 | | — | |

| | |

| |

| |

| Total shares owned by ProNational, ProAssurance and their affiliates and associates | | 5,703,253 | | 85.5 | % |

| Total shares owned by Independent Shareholders | | 969,090 | | 14.5 | % |

| | |

| |

| |

| Total outstanding shares as of the Record Date | | 6,672,343 | | 100 | % |

| | |

| |

| |

The affirmative vote of 484,546 shares owned by the Independent Shareholders is required to approve the Merger Agreement. Because the required vote of the Independent Shareholders on the Merger Agreement is based upon the total number of outstanding shares of Common Stock held by the Independent Shareholders, the failure to submit a proxy card (or to vote by telephone, Internet or in person at the Annual Meeting) or the abstention from voting by a shareholder will have the same effect as a vote against approval of the Merger Agreement. Brokers holding shares of Common Stock as nominees will not have discretionary authority to vote such shares in the absence of instructions from the beneficial owners thereof. Broker non-votes will have the same effect as a vote against approval of the Merger Agreement.

8

If for any reason the Annual Meeting is adjourned, at any subsequent reconvening of the Annual Meeting, all proxies will be voted in the same manner as such proxies would have been voted at the original convening of the Annual Meeting, except for any proxies which have theretofor effectively been revoked or withdrawn.

The Parties

MEEMIC Holdings

MEEMIC Holdings, a Michigan corporation, is the holding company for MEEMIC Insurance Company ("MEEMIC") and MEEMIC Insurance Services Corporation ("MEIA Agency") and conducts all of its operations through MEEMIC and MEIA Agency. MEEMIC is a Michigan-licensed property and casualty insurance company that provides personal lines insurance primarily to educational employees and their immediate families in the state of Michigan. MEIA Agency is the exclusive distributor of MEEMIC's products and represents over 95 insurance sales representatives. MEEMIC Holdings' Common Stock is traded on the Nasdaq National Market under the symbol "MEMH." MEEMIC Holdings' principal executive offices are located at 691 N. Squirrel Road, Suite 100, Auburn Hills, Michigan 48326 and its telephone number is (888) 463-3642.

ProNational

ProNational is a Michigan insurance corporation and the controlling shareholder of MEEMIC Holdings. ProNational and its subsidiaries and affiliates are primarily engaged in providing professionals and entities with professional liability insurance, service and related products in 8 states. ProNational is a subsidiary of Professionals Group, Inc. ("Professionals Group") and an indirect wholly owned subsidiary of ProAssurance Corporation ("ProAssurance"). ProNational's and Professionals Group's principal executive offices are located at 2600 Professionals Drive, Okemos, Michigan 48805-0150 and its telephone number is (800) 292-1036.

ProNational's parent, ProAssurance, a Delaware corporation, is an insurance holding company formed by the June 2001 consolidation of Medical Assurance and Professionals Group, two specialty property/casualty insurance groups doing business in the United States. ProAssurance's direct and indirect subsidiaries are engaged in professional liability insurance and automobile, homeowners, umbrella and boat insurance coverage and are licensed to write business in 45 states. As a holding company, ProAssurance does not conduct any business of its own. ProAssurance's stock is listed on the New York Stock Exchange under the symbol "PRA". Dr. A. Derrill Crowe is the Chairman and Chief Executive Officer of ProAssurance and beneficially owns approximately 9% of its common stock. Dr. Crowe's and ProAssurance's principal executive offices are located at 100 Brookwood Place, Suite 500, Birmingham, Alabama 35209-6811 and their telephone number is (205) 877-4400.

Merger Sub

Merger Sub is a Michigan corporation recently organized by ProNational for the sole purpose of effecting the Merger. It has no material assets and has not engaged in any activities except in connection with the Merger. ProNational is the sole shareholder of Merger Sub. Merger Sub's principal executive offices are located at c/o ProNational, 2600 Professionals Drive, Okemos, Michigan 48805-0150 and its telephone number is (800) 292-1036.

Background of the Tender Offer and Merger

The following discussion of contacts among the parties to the Merger Agreement and their affiliates and advisors does not describe each and every of the many conversations and meetings among the parties concerning the Merger Agreement and related transactions or the various conversations they have had with their respective financial and legal advisors. It is intended to provide a description of the material

9

contracts, negotiations and discussions in connection with the Merger Agreement. All references to ProNational in this section after June 27, 2001 are also intended to refer to ProAssurance unless the context otherwise requires.

In April 1997, prior to the formation of MEEMIC Holdings, MEEMIC and Professionals Group completed the following series of transactions. Professionals Group contributed $21.5 million to MEEMIC to increase MEEMIC's working capital in exchange for a "surplus note" which bore interest at 8.5% per year and was payable on April 7, 2009. Principal and interest generally could not be paid under the surplus note unless the payment was approved by the Michigan Office of Financial and Insurance Services and MEEMIC's board of directors and only if MEEMIC had sufficient surplus earnings to make the payment. Repayment of the surplus note was subordinate to MEEMIC's other liabilities. In addition, Professionals Group agreed to provide management services and strategic advice to MEEMIC under a management services agreement. MEEMIC paid a fee under this agreement equal to $2.10 per month for each policy in force on the first day of the month, up to a maximum of $2.1 million per year plus reasonable expenses. Also in April 1997, the MEEMIC directors resigned and were replaced on the board by nominees of Professionals Group, giving Professionals Group control of MEEMIC, and an officer of Professionals Group became MEEMIC's president. Further, MEEMIC agreed to a quota share reinsurance arrangement with ProNational, which became effective July 1, 1997. Under this arrangement, MEEMIC transferred to ProNational a 40% share of its net liability resulting from losses occurring under policies written or renewed during the term of the agreement and paid to ProNational 40% of its net written premiums on these policies less MEEMIC's expenses related to the policies. The amount of liabilities transferred was reduced by any other applicable reinsurance and the amount paid by MEEMIC was reduced by a share of MEEMIC's expenses. The $21.5 million invested by Professionals Group was used in September 1997 to pay the initial cash portion of the purchase price for MEIA Agency. Professionals Group also provided a guarantee as security for the payment of the remaining term note portion of the purchase price.

MEEMIC Holdings was organized in 1998 to be the holding company for MEEMIC and MEIA Agency and to facilitate the conversion of MEEMIC from a mutual insurance company to a stock insurance company. On July 1, 1999, MEEMIC completed its conversion from a mutual to a stock insurance company and became a wholly-owned subsidiary of MEEMIC Holdings. Pursuant to the plan of conversion, ProNational acquired a total of 5,065,517 shares at $10 per share by fulfilling its obligation as standby underwriter and by converting principal and interest due it under a surplus note from MEEMIC. Directors and officers acquired 294,050 shares and policyholders acquired the remaining 1,239,933 shares issued in the conversion at $10.00 per share.

In accordance with MEEMIC's plan of conversion, ProNational served as standby purchaser of common shares not acquired by policyholders, directors and officers, thereby providing assurance that MEEMIC would secure the capital required to complete the conversion. The plan of conversion also provided ProNational with the ability to acquire majority ownership of MEEMIC Holdings notwithstanding the results of the subscription offering. Because of its ownership position, ProNational has had, since the conversion, a significant influence over the policies and affairs of MEEMIC Holdings and is in a position to determine the outcome of substantially all corporate actions requiring shareholder approval, including the election of directors, the merger or sale of MEEMIC Holdings as a whole, the sale of all or substantially all of MEEMIC Holdings' assets and the adoption of most amendments to MEEMIC Holdings' articles of incorporation. A majority of the members of the Board are nominees of ProNational or its affiliates. However, the Tender Offer and Merger have been structured to require the approval of both ProNational and the Independent Shareholders.

Following the conversion, the Common Stock was not actively traded and it became apparent that the relatively small number of public shares outstanding would not support an active and liquid trading market. For example, the average daily trading volume of MEEMIC Holdings Common Stock from July 15, 1999 to February 1, 2000 was only 3,700 shares, and was just 1,600 shares per day from October 1, 1999 to February 1, 2000. On many days, no shares were traded at all. Moreover, ProNational recognized

10

that it would be more efficient for MEEMIC Holdings to be a wholly owned subsidiary, due to the costs involved with filing public reports and the increased difficulty in transferring capital. As a result, MEEMIC Holdings and ProNational have considered from time to time the possibility of a transaction that would either liquidate the shares of Common Stock not owned by ProNational (the "Public Shares") or eliminate ProNational's interest in MEEMIC Holdings.

In February 2000, MEEMIC Holdings began considering its strategic and financial alternatives, including the possibility of acquiring ProNational's MEEMIC Holdings shares, in light of the inactive trading market and the ongoing discussions regarding a proposed business combination between Professionals Group, the then publicly-traded parent of ProNational, and Medical Assurance, Inc., a publicly traded insurance holding company engaged primarily in offering professional malpractice insurance. In view of the difference in MEEMIC Holdings' lines of insurance business from those of ProNational and Medical Assurance, Medical Assurance had indicated in the course of its discussions that it might be willing to divest MEEMIC Holdings after completing the business combination with Professionals Group. Kevin Clinton, the Chief Executive Officer of MEEMIC Holdings at that time, with the concurrence of Thomas Hoeg, one of MEEMIC Holdings' independent directors, developed a proposal pursuant to which MEEMIC Holdings would be granted an option by ProNational to acquire ProNational's shares of MEEMIC Holdings stock at a price of $18 per share. It was anticipated that MEEMIC Holdings could complete an offering of its common stock to fund its exercise of the option, thereby increasing the number of publicly-owned shares and improving the trading market for the shares.

On February 24, 2000, a committee of MEEMIC Holdings' two independent directors, Mr. Hoeg and James Wood, was formed by the Board to represent and protect the interests of the holders of the Public Shares and to consider the proposed option along with any other alternatives available to MEEMIC Holdings. The committee met on February 24, 2000 and determined to retain Dykema Gossett PLLC to serve as its legal counsel and Raymond James & Associates, Inc. ("Raymond James") to serve as its financial advisor. The committee determined that it should consider the option as well as (1) whether ProNational should spin off its MEEMIC Holdings Common Stock to Professionals Group's shareholders, (2) whether MEEMIC Holdings should consider buying all of the Public Shares and going private, (3) taking no action, or (4) selling the entire company to a third party. The committee recognized that any alternative it recommended would require ProNational's concurrence. A few days after the meeting, counsel for the Committee circulated a draft option agreement to ProNational and its counsel.

The independent committee met three times during March 2000. On March 14, 2000, the committee members, Mr. Clinton and representatives of Dykema Gossett met and discussed a February 28, 2000 meeting between Professionals Group and its representatives and Medical Assurance and its representatives at which the proposed combination between those two companies was discussed. The committee was advised, regarding the proposal to grant an option to MEEMIC Holdings to purchase the MEEMIC Holdings Common Stock owned by ProNational, that both Professionals Group and Medical Assurance were willing to entertain the idea but that Professionals Group was not interested in proceeding with the option unless it could make a tax election under Section 338(h)(10) of the Internal Revenue Code of 1986 to treat the sale of the shares as an asset sale that would yield more favorable tax treatment and that Professionals Group would not be eligible to do so unless it increased its ownership of MEEMIC Holdings to more than 80%. Professionals Group also expressed its unwillingness to allow the option to be exercisable unless the transaction with Medical Assurance or some other change in control transaction occurred involving Professionals Group. The committee also discussed Professionals Group's request to exempt Medical Assurance from the applicability of Chapter 7A of the MBCA, an anti-takeover statute that would be triggered by certain future business combination transactions between the combined companies and MEEMIC Holdings. Finally, the committee discussed the hiring of Raymond James as its financial advisor and authorized Mr. Hoeg to negotiate a suitable engagement letter.

On March 20, 2000, counsel for the committee circulated a second draft of the option agreement, which reflected comments received from ProNational and its counsel during the first and second weeks of

11

March 2000. In response to these comments, the exercisability of the option was limited so that it would only be exercisable if any person became the beneficial owner of at least 24.9% of MEEMIC Holdings' Common Stock directly or through an agreement to merge or otherwise acquire Professionals Group or ProNational. In addition, provisions relating to the method of payment (a combination of cash and debt), regulatory approvals and mutual indemnification were added and the term of MEEMIC Holdings' covenant not to compete was lengthened.

On March 24, 2000, a meeting occurred among the committee members, Mr. Clinton and representatives of Dykema Gossett and Raymond James. Mr. Clinton reported on the progress of due diligence and negotiations with Medical Assurance. Then, the representatives from Raymond James discussed at length various positive and negative aspects of alternatives available to MEEMIC Holdings, including the proposed option, the sale of MEEMIC Holdings to a third party, making an offer to acquire Professionals Group or taking no action. Regarding the proposed option and acquisition of the shares owned by ProNational, the attendees noted that it would permit MEEMIC Holdings to control its own destiny, maintain its identity, realize value by executing its business plan and create an attractive valuation if it should ever decide to pursue a sale of the company. The proposed option would, however, have required MEEMIC Holdings to incur significant debt upon exercise, would not by itself increase the market float for or liquidity of the public shares and carried execution and market risk with respect to management's ability to execute its business plan. A potential sale of MEEMIC Holdings would permit the company to establish and maximize the sale value of the company and could provide liquidity to all shareholders at a premium to market. However, it was noted that valuations for companies in the property and casualty industry were at historic lows, that the final sale price may not accurately reflect the future growth potential of the company and that there were differing and potentially conflicting value expectations among the Independent Shareholders and ProNational. A potential offer for Professionals Group would diversify the company's business lines and geographic coverage, reduce administrative expenses and increase ownership and control for existing MEEMIC Holdings shareholders. Such an acquisition, however, would require MEEMIC Holdings to incur a significant amount of debt, might not be a prudent investment of capital and would be difficult to explain to investors. Taking no action would require no additional indebtedness and would not divert management's attention from operations, but could leave control of the company's fate in the hands of Professionals Group or Medical Assurance or result in the sale of MEEMIC Holdings at a less than optimal price. The committee also noted the recent interest expressed by Professionals Group to acquire the Public Shares if the proposed transaction with Medical Assurance did not proceed. The committee reached no conclusions at the meeting but agreed to continue considering all of the alternatives available as events unfolded.

The committee met again on March 31, 2000. Based on the prior discussions and deliberations regarding the various alternatives and the current status of negotiations between Professionals Group and Medical Assurance, the committee determined that MEEMIC Holdings should pursue the option with ProNational in order to preserve its ability to respond to future developments and protect the interests of the Independent Shareholders, and should not pursue the other alternatives discussed until the option was in place. Counsel was directed to attempt to complete negotiations on the terms of the option, which had been ongoing since February. The committee also discussed various comments that had been received on the proposed terms of the option from ProNational. These comments included the addition of a two year limit on the option from the date of execution, further limitation on the exercisability of the option so that it would be triggered only by the transaction with Medical Assurance or by a hostile acquisition of control of MEEMIC Holdings directly or through the acquisition of Professionals Group or ProNational, further modification of the term and scope of the covenant not to compete, limitation of covenants by ProNational not to transfer its shares of Common Stock or replace the directors during the term of the option agreement, and limitation on MEEMIC Holdings' ability to transfer the option. A revised version of the option agreement reflecting these changes was circulated to ProNational on April 17, 2000.

12

During the ensuing days, negotiations on the terms of the option stalled. ProNational expressed its view that it did not intend to sell its stake in MEEMIC Holdings at that time and though it was willing to continue negotiations to explore whether there was a transaction that would be acceptable, Professionals Group's pending negotiations to combine with Medical Assurance could be jeopardized by a potential sale of its MEEMIC Holdings shares. Subsequent discussions with A. Derrill Crowe, chief executive officer of Medical Assurance in April 2000 confirmed ProNational's belief that the sale of its MEEMIC Holdings shares would jeopardize the transaction being negotiated between Professionals Group and Medical Assurance and that Medical Assurance wanted MEEMIC Holdings to remain part of Professional Group. Discussions regarding the option terminated.

On May 24, 2000, Mr. Hoeg and a representative of Raymond James made a presentation on behalf of the committee to Professionals Group's board of directors. The meeting was also attended by representatives of Dykema Gossett. The purpose of the meeting was to discuss the current status of MEEMIC Holdings and the perceived benefits to Professionals Group, MEEMIC Holdings and the Independent Shareholders of a transaction that would "unlock the value" of MEEMIC Holdings, which value was not adequately reflected in the market price of the Professionals Group shares. Mr. Hoeg expressed the committee's view that the small number of common shares available for trading in the public market made it very difficult for the holders of the Public Shares to liquidate their positions or to acquire additional shares without having a significant impact on the price. The Raymond James representative believed that MEEMIC Holdings was likely worth more as an independent company than as a subsidiary of a medical malpractice insurer. As a result, the committee and Raymond James believed that either ProNational's stake should be sold to MEEMIC Holdings, sold or otherwise distributed to Professionals Group's shareholders, or sold to a third party as part of a sale of all of MEEMIC Holdings.

The Raymond James representative made a presentation of the advantages and disadvantages of these alternatives to Professionals Group. According to the representative of Raymond James, a sale of ProNational's MEEMIC Holdings stock to MEEMIC Holdings would unlock the value of MEEMIC Holdings for all shareholders, provide liquidity to Professionals Group and create an independent MEEMIC Holdings with its own identity in a niche market. It was noted, though, that it would be difficult to set the value, the companies' relationship created a potential conflict of interest, MEEMIC Holdings' purchase of the shares would require debt financing, the transaction would not provide liquidity to MEEMIC Holdings' shareholders and that there is execution and market risk associated with MEEMIC Holdings' business plan. A sale of all of MEEMIC Holdings to a third party would unlock the value of MEEMIC Holdings for all shareholders, could result in the recognition of a premium to market value, would provide a process for establishing and maximizing the value of MEEMIC Holdings and would provide liquidity for all shareholders. Raymond James pointed out, however, that valuations for property and casualty companies at that time were at historic lows, initiating the sale process at that time could result in a failure to realize value associated with future growth and performance, a sale process would be potentially disruptive, there may be conflicting value expectations between Professionals Group and the Independent Shareholders and there was a risk that MEEMIC Holdings would lose its separate identity as a result of the sale. A distribution of ProNational's MEEMIC Holdings stock to Professionals Group's shareholders would deliver the full value of the shares to Professionals Group's shareholders, create an independent MEEMIC Holdings and preserve the potential for realizing the company's maximum value by allowing it to execute its business plan. A distribution, however, would result in adverse tax consequences to shareholders and significant transaction costs and time requirements. A sale of ProNational's MEEMIC Holdings shares to Professionals Group shareholders through a rights offering would unlock the value and deliver it to Professionals Group's shareholders, would preserve the potential for realizing MEEMIC Holdings' maximum value by allowing it to execute its business plan and create an independent MEEMIC Holdings with its own identity in a niche market. A rights offering would, however, increase excess capital at Professionals Group, decrease return on equity, require new capital investment by Professionals Group's shareholders and result in significant transaction costs and time requirements.

13

In response to the presentation, the Professionals Group board did not act on any of these suggestions, but decided to form a special committee comprising those Professionals Group board members who did not own shares in MEEMIC Holdings. The committee was charged with studying ProNational's potential purchase of MEEMIC Holdings' shares and making a recommendation to the Professionals Group board. MEEMIC Holdings' independent committee was advised that ProNational was considering a potential acquisition of the Public Shares, although ProNational had no formal plan or proposal. In response to this information, on June 21, 2000, MEEMIC Holdings' Board expanded the scope of its committee's responsibilities to include the potential consideration and negotiation with ProNational to purchase the Public Shares, to retain advisors in connection with such transaction and to consider other alternatives available to MEEMIC Holdings.

On June 22, 2000, Professionals Group and Medical Assurance executed their Consolidation Agreement pursuant to which the two companies would become subsidiaries of a new holding company, ProAssurance. The agreement contained a provision that the acquisition of more than 80% and up to 100% of the outstanding voting stock of MEEMIC Holdings by Professionals Group prior to the completion of the consolidation, or by ProAssurance or its subsidiaries after the completion of the consolidation, would be beneficial as it would allow MEEMIC Holdings to become a consolidated subsidiary of ProAssurance for federal income tax reporting purposes. The agreement also provided that for five years after the completion of the consolidation, ProAssurance would not sell or otherwise dispose of, and would not permit any of its subsidiaries to sell or otherwise dispose of, the MEEMIC Holdings Common Stock or the business of MEEMIC Holdings unless such sale or disposition has been approved by a special committee of ProAssurance's Board of Directors comprising three directors of ProAssurance, at least two of whom are non-management directors who were formerly directors of Professionals Group. Professionals Group and Medical Assurance announced the signing of the Consolidation Agreement on June 23, 2000.

A few days after the announcement of the Consolidation Agreement, MEEMIC Holdings received an unsolicited contact from a publicly traded personal lines property and casualty insurer based in the Midwestern United States which was interested in purchasing all of MEEMIC Holdings' outstanding stock. The interested party expressed no price or valuation range. Following discussions by MEEMIC Holdings management with ProNational and the committee regarding the expression of interest, ProNational contacted the third party to express that it was not interested in selling its Company shares at that time. In view of ProNational's ownership position, the third party withdrew its expression of interest.

Open market purchases of MEEMIC Holdings Common Stock by ProNational following the signing of the Consolidation Agreement further diminished trading activity and liquidity in the market for MEEMIC Holdings Common Stock. From June 2000 through October 2000, ProNational purchased 451,266 shares of MEEMIC Holdings Common Stock. As a result of these purchases, ProNational's ownership percentage increased from 77.3% to 84.1% during this period.

The special committee of the Professionals Board met several times regarding a potential acquisition of the Public Shares, and reviewed materials from its financial advisor. At a meeting held on August 9, 2000, this committee determined that it would neither take nor recommend that any action be taken with respect to a tender offer for the Public Shares or a merger. The special committee notified MEEMIC Holdings' independent committee of its decision on August 14, 2000. On October 17, 2000, Professionals Group publicly announced that it would consider making a tender offer for the shares of MEEMIC Holdings sometime in early 2001, but that it was not proceeding with a tender offer at that time.

On November 27, 2000, at its regular meeting, MEEMIC Holdings' Board considered a suggestion by Mr. Clinton to consider a self-tender for the Public Shares. Following a discussion of this suggestion, the Board established a committee consisting of Messrs. Hoeg, Wood and Clinton and Ms. Putallaz to consider formulating a plan for MEEMIC Holdings to repurchase shares of its stock. Mr. Clinton subsequently discussed this alternative with ProNational, but due to concern by ProNational that such action could delay

14

the pending regulatory approvals relating to the Professionals Group/Medical Assurance consolidation, no further action was taken.

At the November Board meeting, in view of concerns that ProNational's continuing market purchases could reduce the public float to levels that would result in the stock no longer complying with Nasdaq listing requirements, Mr. Clinton also proposed consideration of a stock dividend for the purpose of increasing public float. Mr. Adamo, on behalf of ProNational, assured the Board that ProNational did not intend at that time to purchase shares in the market to the extent that the stock would no longer comply with Nasdaq requirements. As a result, the Board determined that no action needed to be taken on the proposed stock dividend.

On March 28, 2001, at its regular meeting, the Board considered again the ramifications of "going private" and various related legal considerations. At the conclusion of these deliberations, the Board determined that it wished to again pursue such a transaction but, recognizing ProNational's long-standing position that it did not wish to divest its position, it did not intend to entertain alternatives that would involve a divestiture by ProNational of its MEEMIC Holdings shares. The Board determined that the committee considering such a transaction should include only directors who are not affiliated with ProNational, ProAssurance or MEEMIC Holdings. Accordingly, the committee established in November 2000 was dissolved and the Board established the "Exploratory Committee," consisting of Messrs. Hoeg and Wood, the independent members of the Board, for the purpose of reviewing possible structures of transactions whereby MEEMIC Holdings would become privately held. The committee was charged with examining the feasibility of structuring a transaction that is fair to the holders of the Public Shares and was given authority to retain professional advisors of their choosing. As compensation for their service on the Exploratory Committee, each of the committee members was entitled to a $25,000 fee, in addition to any other compensation payable to them as Board members.

Due to the impending consolidation of Professionals Group and Medical Assurance, discussions continued among the Exploratory Committee members but no significant progress occurred. Because of the potential conflict between the interests of the Board, on the one hand, and the Exploratory Committee, which was representing the interests of the Independent Shareholders, on the other hand, it was determined that the Committee should hire separate counsel. As a result, in May 2001, the Exploratory Committee hired Mika, Myers, Beckett & Jones, PLC as its legal counsel. In June 2001, the Board suspended the Exploratory Committee's activities in light of the pending consolidation transaction.

Soon after the consolidation transaction was completed, ProNational began to receive unsolicited inquiries to acquire MEEMIC Holdings. The first inquiry was received in early July 2001 from a publicly held life and property and casualty insurer based in the Midwestern United States. Although ProNational did not intend to sell MEEMIC Holdings, it agreed to meet with representatives of the interested party in an effort to gather information, as it believed doing so was in the best interests of the ProAssurance shareholders. The interested party executed a confidentiality agreement and ProNational responded to a preliminary due diligence request near the end of July 2001. On or about August 20, 2001, ProNational received a letter from this party's chief executive officer expressing that its preliminary, non-binding indication of value for 100% ownership was $30.00 per share. The letter was careful to note that this indication of value was subject to the party's conduct of and satisfaction with due diligence. In addition, the valuation assumed that the parties would make a certain tax election and that a proposed reinsurance arrangement between MEEMIC Holdings and this party would receive the required regulatory approvals. In a follow-up call and correspondence from the party's investment banker shortly thereafter, Dr. Crowe and the investment banker discussed the possibility of a price of $35 - $36 per share, but the investment banker did not believe such a price would be acceptable to the party. Dr. Crowe responded by reiterating his view that MEEMIC Holdings was not for sale. Although the party's investment banker sent a due diligence request list and a memorandum discussing some details of the preliminary valuation shortly after the telephone conversation, there was no further response from ProNational and contact thereafter ceased.

15

ProNational was contacted by a personal lines insurer based in the Northeastern United States in July 2001 inquiring whether MEEMIC Holdings was for sale. Again, in an effort to gather information, ProNational had a preliminary meeting with this entity and received a signed confidentiality agreement from this entity in August 2001, and responded to its due diligence requests over the next two months. In early December 2001, the entity's chief executive officer informed Dr. Crowe that it was hiring an investment banker and would be ready to discuss a price in a few weeks (subject to additional due diligence). Dr. Crowe met with representatives of the entity and its investment banker on January 14, 2002, where he reiterated ProNational's position that MEEMIC Holdings was not for sale. ProNational made a further response to a due diligence request in late February 2002. Neither ProNational nor MEEMIC Holdings have received any further contact from this party.

In early September 2001, ProNational was contacted again by the property and casualty insurance company that had expressed interest in the summer of 2000. After the party executed a confidentiality agreement, ProNational responded to its request to forward some preliminary due diligence materials. Shortly thereafter, however, the chief executive officer of the party contacted Dr. Crowe to withdraw the party's expression of interest due to unspecified internal issues the party had. Neither ProNational nor MEEMIC Holdings have received any further contact from this party.