UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14C-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

Of the Securities Exchange Act of 1934

Check the appropriate box:

x | Preliminary information statement. |

| o | Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2)). |

| o | Definitive information statement. |

DAVEL COMMUNICATIONS, INC.

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (check the appropriate box):

| x | No fee required. |

| | |

o | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

| |

| (5) | Total fee paid: |

| |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

Davel Communications, Inc.

200 Public Square, Suite 700

Cleveland, Ohio 44114

(216) 241-2555

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

Our Board of Directors is furnishing this information statement to all holders of record of the issued and outstanding shares of our common stock, $0.01 par value per share (“Common Stock”), as of the close of business on March 7, 2005 (the “Record Date”), in connection with our proposed Amendment to our Certificate of Incorporation (“Amendment”) to effectuate a 1-for-97,500,000 reverse stock split (the “Reverse Stock Split”) and, in lieu of issuing fractional shares, to pay $0.015 per share to any holder of less than 97,500,000 shares. If consummated, the Reverse Stock Split would enable us to provide liquidity to our minority stockholders and terminate our periodic reporting obligations under Section 13 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and the registration of our Common Stock under Section 12(g) of the Exchange Act (collectively, “Registration and Periodic Reporting Obligations”). Following the Reverse Stock Split, we expect that shareholders who will be cashed out will receive payment for their shares 60 days after the date of this Information Statement.

Section 242 of the Delaware General Corporation Law requires us to obtain stockholder approval of the Amendment. We have one class of capital stock outstanding, our common stock (the “Common Stock”). Only stockholders of record at the close of business on the Record Date are entitled to approve and adopt the Amendment. As of the Record Date, 615,018,963 shares of Common Stock were issued and outstanding, held of record by approximately 1,615 stockholders. Each share of Common Stock issued and outstanding on the Record Date is entitled to one vote with regard to the approval and adoption of the Amendment. There are no dissenters’ rights of appraisal with respect to the Amendment.

Under the Delaware General Corporation Law and our bylaws, our stockholders may approve the Amendment without a meeting, without prior notice and without a vote if a written consent to the Amendment is signed by the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote on the action were present and voted (here, a majority of the outstanding shares of Common Stock). Davel Acquisition Corp., a wholly-owned subsidiary of Mobilepro Corp. (together “Mobilepro”) holds a majority of the outstanding shares of Common Stock. Mobilepro has approved the Amendment by written consent dated effective as of March 7, 2005. Accordingly, your consent is not required and is not being solicited in connection with the Amendment, and approval of the transaction is assured. See “The Reverse Stock Split- Approval of the Reverse Stock Split By Our Directors and Stockholders”.

We will pay the expenses of furnishing this information statement, including the cost of preparing, assembling and mailing this information statement. We anticipate that this information statement will be sent or given on or about March 31, 2005 to the record holders of Common Stock as of close of business on the Record Date, and that the Amendment will be filed with the Delaware Secretary of State and become effective no earlier than the twentieth day after this information statement is sent or given to those holders of Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Reverse Stock Split, passed upon the merits or fairness of the Reverse Stock Split, or passed upon the adequacy or accuracy of the disclosure in this information statement. Any representation to the contrary is a criminal offense.

INFORMATION STATEMENT

Summary Term Sheet

This summary term sheet, highlights selected information from the information statement and addresses material terms of the transaction. You should carefully read this entire information statement and the other documents to which we refer you for a more complete understanding of the matters being described in this summary term sheet. In addition, we incorporate by reference important business and financial information into this information statement. You may obtain the information incorporated by reference into this information statement without charge by following the instructions in the section entitled “Where You Can Find More Information.”

Reverse Stock Split

Purpose of the Reverse Stock Split

The purpose of the Reverse Stock Split is to make the Company a private company. The Reverse Stock Split is a means by which Mobilepro will be able to effectively purchase the 4.8% of shares of our outstanding Common Stock that it does not beneficially own (the “Minority Stockholders”). As a result, the Reverse Stock Split will enable us to terminate our Registration and Periodic Reporting Obligations so that we may continue future operations as a private company, relieving us of the costs, administrative burdens and competitive disadvantages associated with operating as a public company. We intend to accomplish this purpose by reducing the number of holders of record of our Common Stock to fewer than 300 by cashing out the fractional shares that would otherwise result from the Reverse Stock Split. See “Reasons for the Reverse Stock Split”.

Independent Fairness Opinion

Our Board of Directors engaged Reznick Fedder & Silverman Financial Advisors Group, L.L.C. (“Reznick”) to opine as to the fairness, from a financial point of view, of the consideration, in the amount of $0.015 per share, to be received by the Minority Stockholders set forth in the Loan Purchase Agreement and Transfer and Assignment of Shares and related agreements entered into between, among others, the former Lenders to the Company as Sellers, Mobilepro as Buyer, and the Company (the “Loan Purchase Agreement”).

Findings of the Board of Directors

Our Board of Directors, Davel Acquisition, and Mobilepro believe that the Reverse Stock Split is in the best interest of, and substantively and procedurally fair to, all of our unaffiliated stockholders, who will be redeemed pursuant to the Reverse Stock Split. Our Board of Directors further concluded that the advantages of the Reverse Stock Split to the unaffiliated stockholders outweighed the disadvantages, and that it was substantively and procedurally fair to them, and, therefore, that the transaction was in all of our stockholders’ best interests. See “Special Factors Considered in Approving the Reverse Stock Split”.

Approval of Board of Directors

On February 17, 2005, our Board of Directors adopted resolutions authorizing and approving the Amendment and the implementation of the Reverse Stock Split. Our Board of Directors consists of three members, each of whom are executive officers and employees of Mobilepro. The Board of Directors directed management to submit the Amendment to our stockholders for approval and reserved the right to abandon the Amendment and the Reverse Stock Split at any time prior to the Effective Time. See “The Reverse Stock Split - Approval of the Reverse Stock Split By Our Board of Directors and Stockholders” and “Substantive and Procedural Factors Considered by Our Board of Directors as to the Fairness of the Reverse Stock Split”.

Approval of Stockholders

We had approximately 1,615 stockholders of record holding an aggregate of 615,018,963 shares of Common Stock outstanding as of the Record Date. Of those shares, approximately 95.2%, or 585,271,794 shares, were controlled by Mobilepro. Each stockholder is entitled to one vote per share. The proposed action to implement the Reverse Stock Split requires the affirmative vote or written consent of the holders of a majority of the outstanding shares of our common stock as of the Record Date. Mobilepro, holding a majority of our voting power, approved the Amendment by written consent effective as of March 7, 2005. See “The Reverse Stock Split - Approval of the Reverse Stock Split By Our Board of Directors and Stockholders”.

Estimated Effective Time

We anticipate that the Amendment will be filed with the Delaware Secretary of State and the Reverse Stock Split will become effective on or about April 20, 2005 (“Effective Time”). However, in no event will the Reverse Stock Split be consummated earlier than that twentieth day after this information statement is sent or given to those persons or entities that held Common Stock as of the Record Date. See “The Reverse Stock Split - Effective Time of the Reverse Stock Split”.

Implementation and Effects of Reverse Stock Split

Following the Reverse Stock Split, we anticipate that Mobilepro will be the sole stockholder of record holding all of the outstanding shares of our Common Stock.

Every holder of record of Common Stock at the Effective Time will be entitled to receive one share of our Common Stock in exchange for every 97,500,000 shares of Common Stock held by that holder immediately prior to the Effective Time. No fractional shares will be issued. Instead, in lieu of issuing fractional shares to holders who would otherwise be entitled to receive a fractional share of our Common Stock as a result of the Reverse Stock Split (“Cashed-Out Stockholders”), we will pay cash consideration at the rate of $0.015 for each share of Common Stock that was outstanding before the Effective Time but was not converted into a full share of post-split Common Stock (the “Cash Consideration”).

TABLE OF CONTENTS

| Summary Term Sheet | - |

| Purpose of the Reverse Stock Split | - |

| Independent Fairness Opinion | - |

| Findings of the Board of Directors | - |

| Approval of Board of Directors | - |

| Approval of Stockholders | - |

| Estimated Effective Time | - |

| Implementation and Effects of Reverse Stock Split | - |

| Basic Terms | 6 |

| Effective Time of the Reverse Stock Split | 6 |

| Approval of the Reverse Stock Split by Our Board of Directors and Stockholders | 6 |

| Effects if Reverse Stock Split is Not Consummated | 7 |

| Stock Certificates | 7 |

| Provision for Unaffiliated Stockholders | 8 |

| Source of Funds and Financial Effect of the Reverse Stock Split | 8 |

| Fees and Expenses | 8 |

| Accounting Consequences | 8 |

| Certain Legal Matters | 9 |

| Regulatory Filings and Approvals | 9 |

| Background of the Transaction | 9 |

| Approval of the Reverse Stock Split | 13 |

| Purposes of the Reverse Stock Split | 13 |

| Alternatives Considered by the Board of Directors | 13 |

| Reasons for the Reverse Stock Split | 14 |

| Cost Savings | 14 |

| Financial Information | 15 |

| Competitive Disadvantage | 15 |

| Procedural Factors Favoring the Reverse Stock Split | 15 |

| The Reverse Stock Split Provides Our Stockholders with Liquidity | 15 |

| No Unusual Conditions to the Reverse Stock Split | 15 |

| The Reverse Stock Split Ration was Calculated Without Bias Toward Any Particular Group of Stockholders and Will Apply Equally to All Shares of Our Common Stock | 15 |

| Procedural Factors Disfavoring the Reverse Stock Split; Interests of Mobilepro in the Reverse Stock Split | 16 |

| The Reverse Stock Split Will be Approved by Mobilepro, Without a Vote by Unaffiliated Stockholders | 16 |

| As a Result of the Reverse Stock Split, Mobilepro will own 100% of our Common Stock | 16 |

| Substantive Factors Favoring the Reverse Stock Split | 16 |

| Agreement to Purchase Interests of Minority Stockholders | 16 |

| Direct and Indirect Cost Savings | 16 |

| The Reverse Stock Split Offers Stockholders the Opportunity to Receive Cash as a Premium In Lieu of Fractional Shares | 16 |

| Substantive Factors Disfavoring the Reverse Stock Split | 17 |

| Inability to Participate in Any Future Increase in the Value of Our Common Stock | 17 |

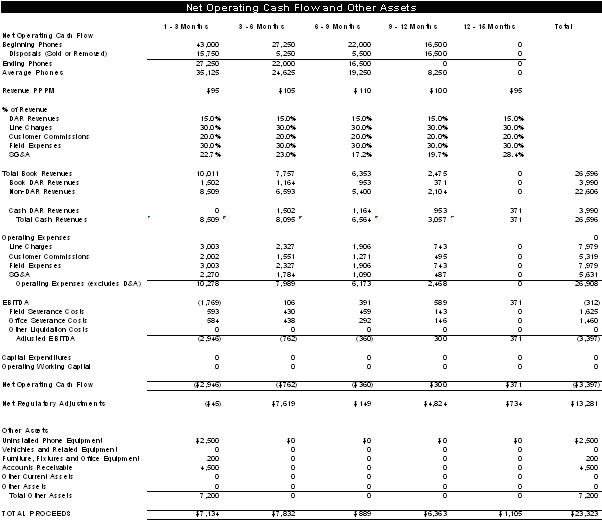

| Analysis of Skyworks Securities | 17 |

| Opinion of the Board’s Financial Advisor | 23 |

| Analysis of the Board of Directors | 29 |

| Board of Directors’ Determination and Recommendation | 32 |

| General Examples of Potential Effects of the Reverse Stock Split | 32 |

| Effect of the Reverse Stock Split on Option and Warrant Holders | 32 |

| Effects of the Reverse Stock Split on Our Company | 33 |

| Conduct of Our Business After the Reverse Stock Split - Future Company Plans | 33 |

| Reservation of Right to Abandon the Reverse Stock Split | 34 |

| Escheat Laws | 34 |

| Appraisal Rights | 34 |

| Material Federal Income Tax Consequences | 34 |

| Other Information | 39 |

| Regulatory Approvals | 39 |

| Background Information Concerning Our Directors, Executive Officers and Controlling Stockholders | 39 |

| Prior Transactions Between Mobilepro and Our Company | 42 |

| Interests of Certain Persons in or Opposition to the Reverse Stock Split - Security Ownership of Certain Beneficial Owners and Management | 43 |

| Market Prices of Our Common Stock and Dividend Policy | 45 |

| Financial Statements, Supplementary Financial Information, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk | 46 |

| Forward Looking Statements | 46 |

| Legal Proceedings | 46 |

| Where You Can Find More Information | 47 |

SPECIAL FACTORS

The Reverse Stock Split

Basic Terms

Under the terms of the Reverse Stock Split, every holder of record at the Effective Time will be entitled to receive one share of our Common Stock in exchange for every 97,500,000 shares held by such person immediately prior to the Effective Time. No fractional shares will be issued. Instead, in lieu of issuing fractional shares to Cashed-Out Stockholders who would otherwise be entitled to receive a fractional share of our Common Stock as a result of the Reverse Stock Split, we will pay Cash Consideration at the rate of $0.015 for each share of Common Stock that was outstanding immediately prior to the Effective Time but was not converted into a full share of post-split Common Stock.

Because of the limited trading market for our Common Stock and the number of shares held by Mobilepro, a stockholder is unable to purchase enough shares on the open market to avoid becoming a Cashed-Out Stockholder as a result of the Reverse Stock Split and will be unable to retain an equity interest in our Company.

For payment purposes, we intend for the Reverse Stock Split to treat stockholders holding Common Stock in a street name through a nominee, such as a bank or broker, in the same manner as stockholders whose shares are registered in their own names. Nominees will be instructed to effect the Reverse Stock Split for their beneficial holders. Accordingly, we also refer to those street name holders who receive a cash payment instead of fractional shares as Cashed-Out Stockholders. However, nominees may have different procedures, and stockholders holding shares in street name should contact their nominees.

The Reverse Stock Split is structured to be a Rule 13E-3 transaction under the Exchange Act because it is intended to, and if completed, will reduce the number of record holders of our Common Stock to fewer than 300, which will position us to terminate our Registration and Periodic Reporting Obligations. In connection with the Reverse Stock Split, we have filed a Rule 13E-3 Transaction Statement on Schedule 13E-3 with the Commission. We intend to apply for the termination of our Registration and Periodic Reporting Obligations as soon as practicable after the Effective Time.

Effective Time of the Reverse Stock Split

We anticipate that the Amendment will be filed with the Delaware Secretary of State and the Reverse Stock Split will become effective on or about April 20, 2005. However, in no event will the Effective Time of the Reverse Stock Split be earlier than the twentieth day after this information statement is sent or given to those persons or entities that held Common Stock as of the Record Date. The record date for determining the shares of our Common Stock that will be subject to the Reverse Stock Split will be the Effective Time.

Approval of the Reverse Stock Split By Our Board of Directors and Stockholders

As detailed below in “Approval of the Board of Directors,” our Board of Directors has approved the Amendment and the implementation of the Reverse Stock Split and reserved the right to abandon the Amendment and the Reverse Stock Split at any time prior to the Effective Time. Under the Delaware General Corporation Law and our bylaws, our stockholders may approve the Amendment and Reverse Stock Split without a meeting, without prior notice and without a vote if a written consent to the Amendment is signed by the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote on the action were present and voted (here, a majority of the outstanding shares of Common Stock). Mobilepro, which holds a majority of the outstanding shares of our Common Stock, has approved the Amendment by written consent dated effective as March 7, 2005. Accordingly, no other stockholder approval is required and is not being solicited in connection with the Amendment.

No special compensation was paid to the Company’s current Board of Directors in connection with evaluating this transaction. In connection with the negotiation, review and approval of the Loan Purchase Agreement, the Company appointed a special committee of two disinterested directors (the “Special Committee”). Messrs. James Chapman and Andrew Barrett served on the Special Committee, with Mr. Chapman serving as the Chairman. In connection with the services rendered each member of the Special Committee received a one-time payment of $35,000. Mr. Chapman received an additional payment of $15,000 as consideration for his services as Chairman.

Information about Mobilepro, the stockholder that consented to the Amendment and the number of shares of Common Stock owned as of the Record Date and included in the written consent approving the Reverse Stock Split is as follows:

Name of Stockholder | Number of Shares |

| | |

| Davel Acquisition Corp. | 585,271,794 |

| c/o Mobilepro Corp. | |

| 6701 Democracy Blvd. | |

| Suite 300 | |

| Bethesda, MD 20817 | |

Additional beneficial ownership information is contained below in “Interests of Certain Persons in or Opposition to the Reverse Stock Split - Security Ownership of Certain Beneficial Owners and Management”.

Effects if Reverse Stock Split is Not Consummated

If the Reverse Stock Split is not consummated, our Registration and Periodic Reporting Obligations will continue, and we will not benefit from the substantial reduction in general and administrative costs associated with being a non-reporting company. In addition, our senior management will have to continue to devote significant time to our Registration and Reporting Obligations, which they will not be able to devote to other company operations. See “Reasons for the Reverse Stock Split - Cost Savings”.

Stock Certificates

Our transfer agent, Mellon Investor Services, has been appointed as our exchange agent to carry out the exchange of existing Common Stock certificates for new Common Stock certificates and to send cash payments in lieu of issuing fractional shares. Promptly following the Effective Time, the transfer agent will send a letter of transmittal to each affected stockholder. The letter will describe the procedures for surrendering stock certificates in exchange for new Common Stock certificates and/or the Cash Consideration. Upon receipt of the stock certificates and properly completed letters of transmittal, the transfer agent will issue the appropriate new stock certificates and/or make the appropriate cash payment within approximately 20 business days.

No service charges will be payable by our stockholders in connection with the exchange of certificates or the payment of cash in lieu of issuing fractional shares because we will bear those expenses. We will not pay interest on cash sums due to any stockholder in connection with the Reverse Stock Split.

All stock certificates outstanding immediately prior to the Effective Time evidencing ownership of our Common Stock will be deemed cancelled without further action by their holders as of the Effective Time. Please do not send any stock certificates to our transfer agent or us in connection with the Reverse Stock Split until you receive and complete a letter of transmittal.

Provision for Unaffiliated Stockholders

Neither we, nor any executive officer or director of our Company nor any person controlling us has made any provision in connection with the Reverse Stock Split to grant unaffiliated stockholders access to our corporate files or to obtain counsel or appraisal services for such stockholders. The consent of a majority of the unaffiliated shareholders is not required, and a majority of directors who are not employees of Davel did not hire an unaffiliated representative for the unaffiliated shareholders.

Source of Funds and Financial Effect of the Reverse Stock Split

Given that the actual number of shares of Common Stock that we will purchase is unknown at this time, the total cash we will pay to stockholders is currently unknown, but is estimated to be approximately $450,000. We expect to pay the Cash Consideration in connection with the Reverse Stock Split and other expenses for the Reverse Stock Split through our available cash or advances from Mobilepro. The Reverse Stock Split and the use of approximately $600,000 in cash to complete the Reverse Stock Split, which includes professional fees and other expenses related to the transaction and cash payments to be made in lieu of issuing fractional shares, are not expected to adversely affect in any material respect our capitalization, liquidity, results of operations or cash flow.

We estimate that the fractional shares that would otherwise be issued in the Reverse Stock Split would aggregate to approximately 30,000,000 pre-split whole shares of Common Stock, resulting in cash payments to Cashed-Out Stockholders of approximately $450,000 (30,000,000 whole shares at $0.015).

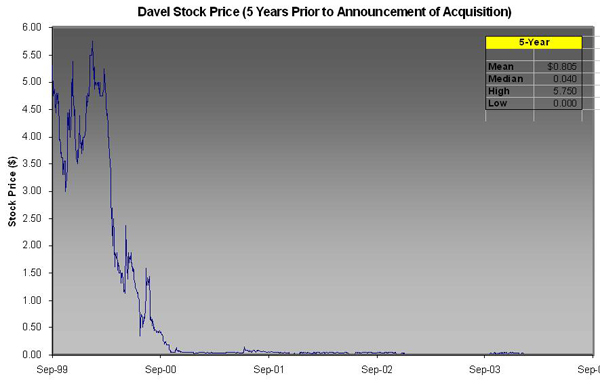

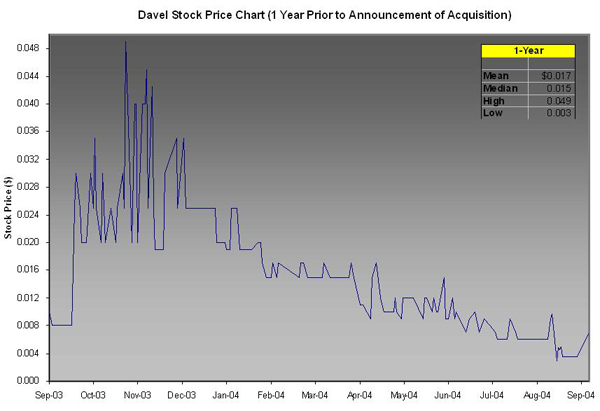

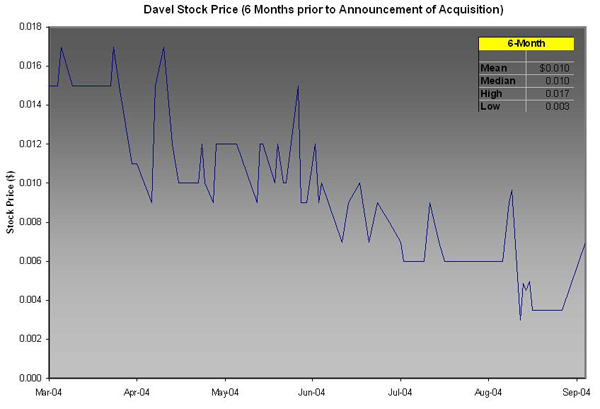

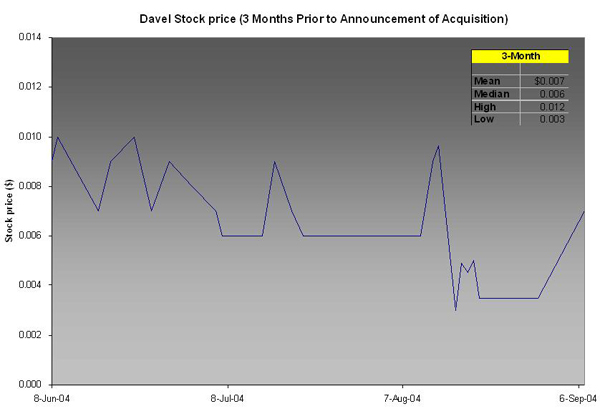

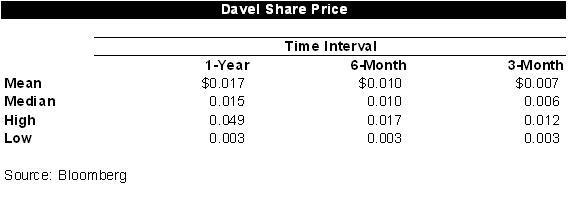

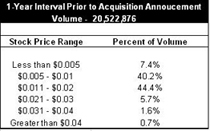

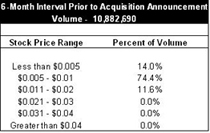

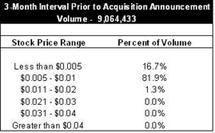

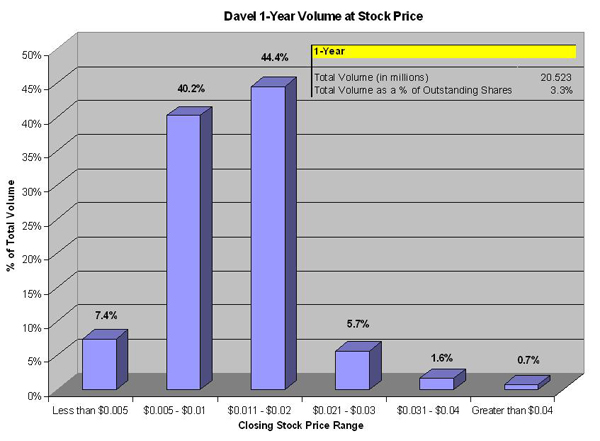

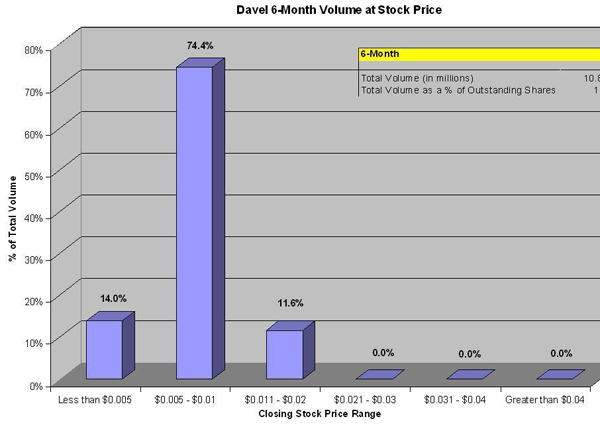

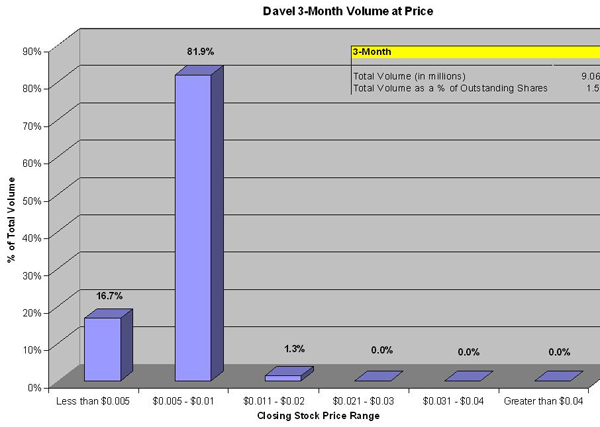

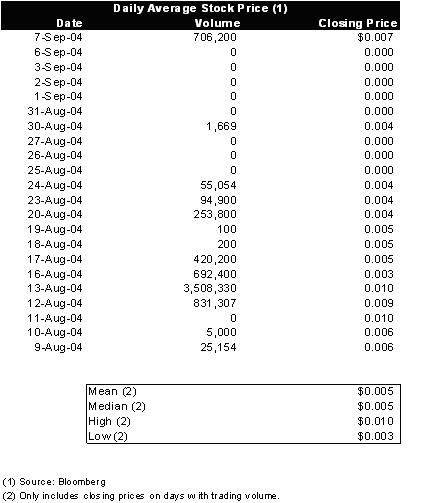

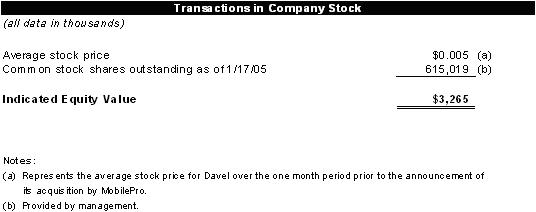

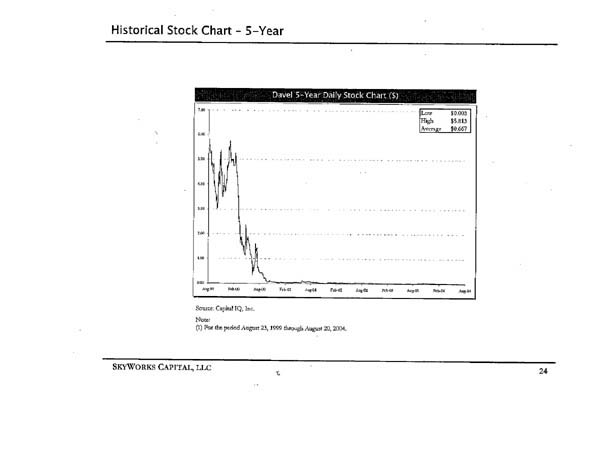

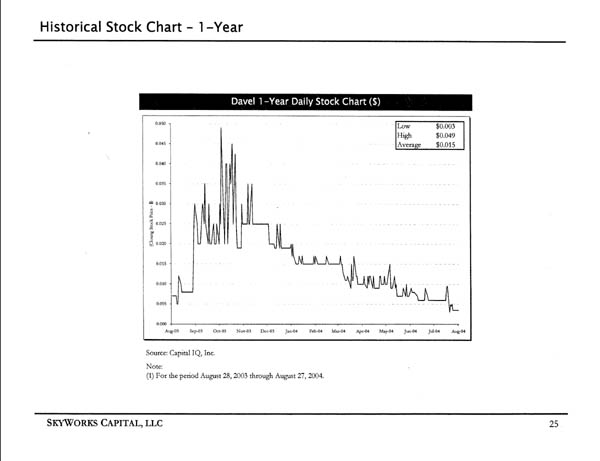

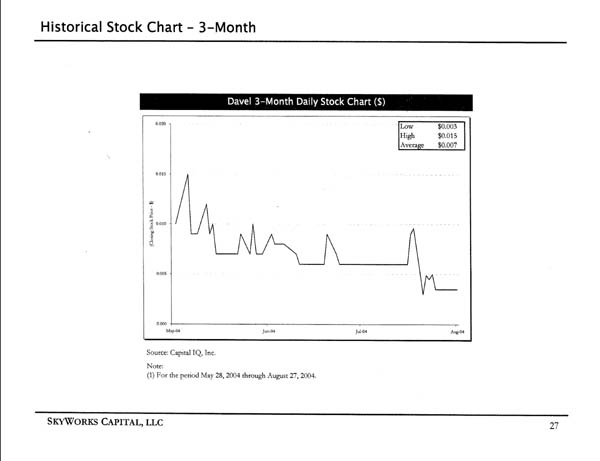

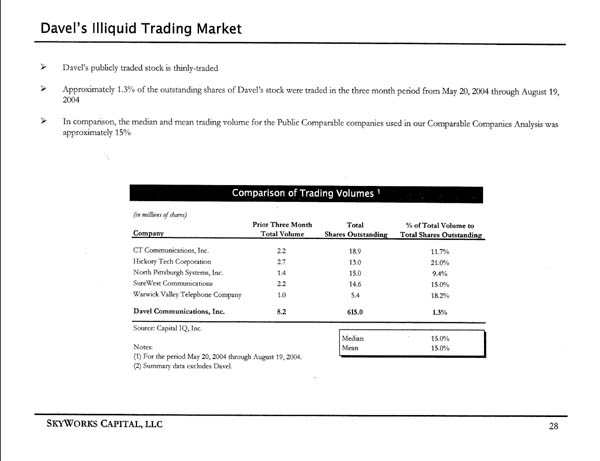

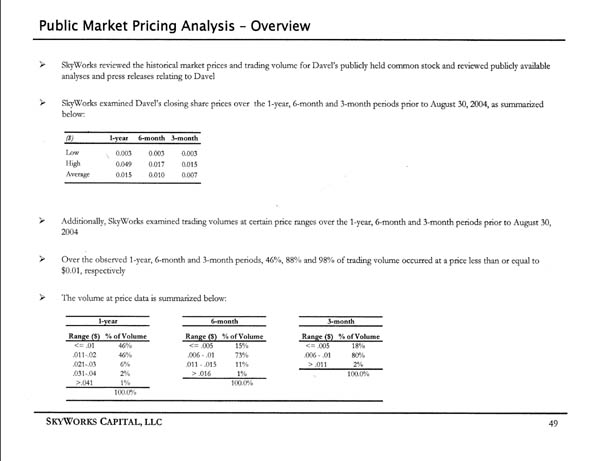

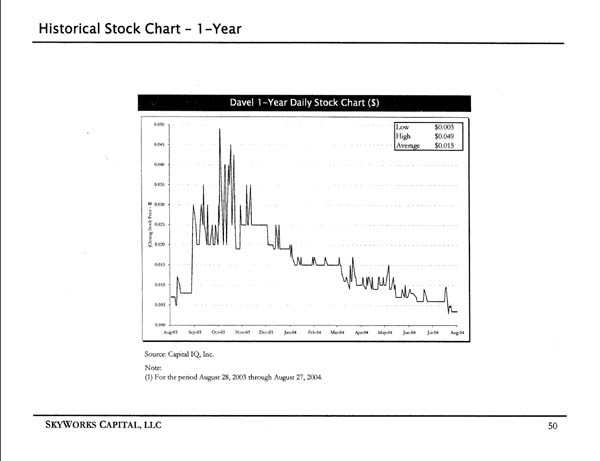

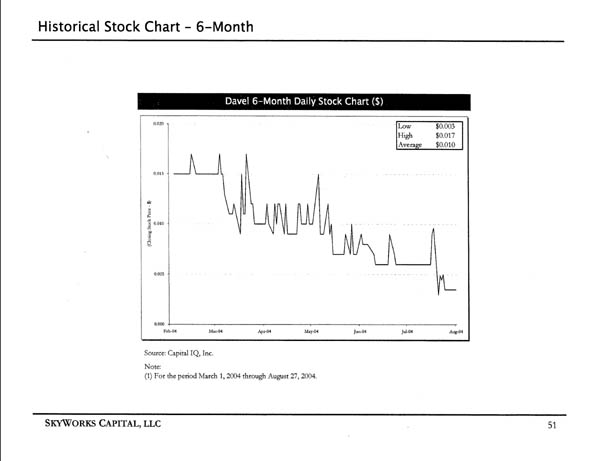

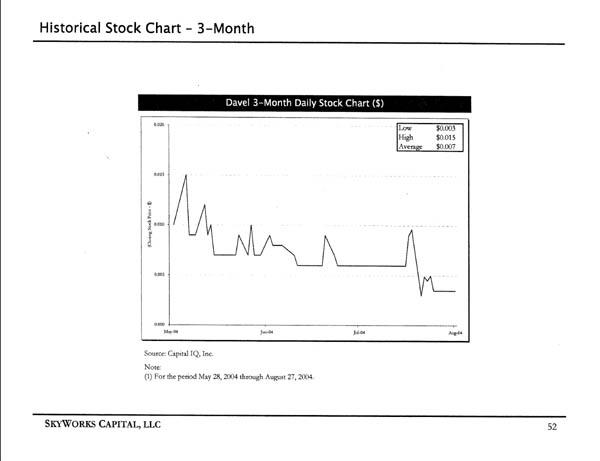

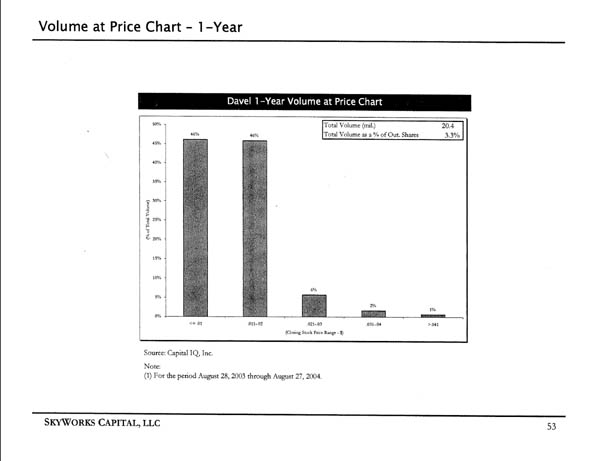

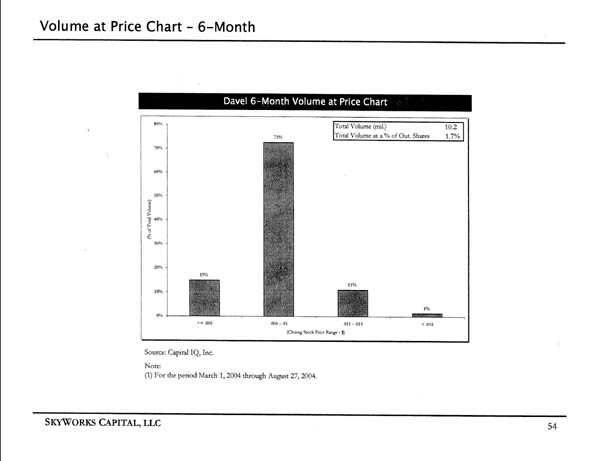

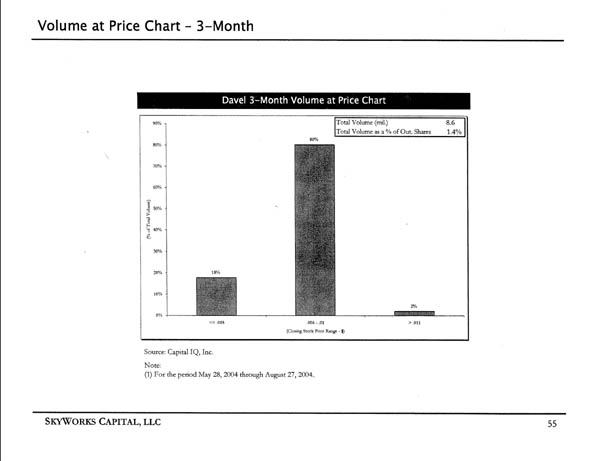

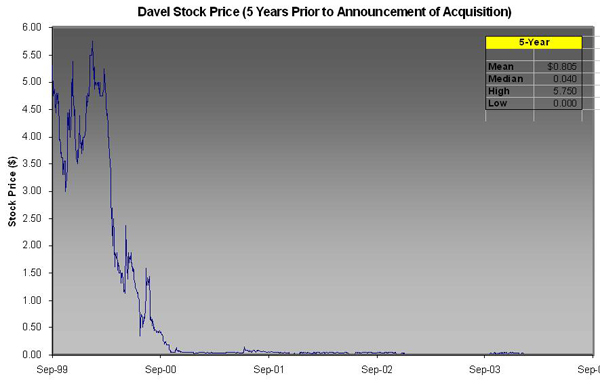

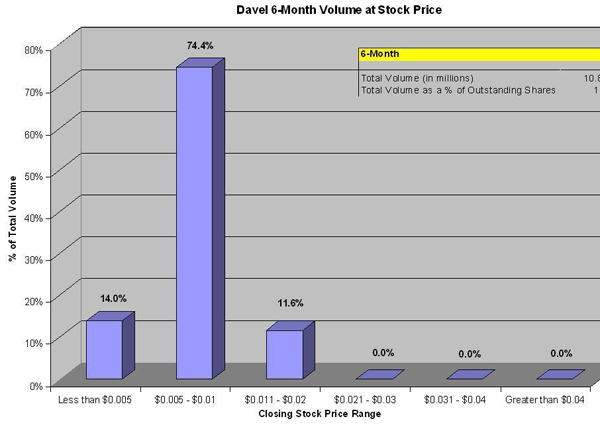

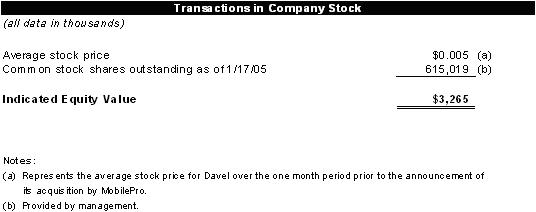

Our Common Stock is traded over-the-counter on the OTC Bulletin Board under the symbol “DAVL.OB”. On September 7, 2004, the last trading price for our Common Stock prior to the announcement of the Loan Purchase Agreement was $0.007. The Cash Consideration represents a premium [discount] of approximately 114%, 50%, and [11.8]% over the weighted average closing trading price of the Common Stock over the three-month, six-month, and one-year periods, respectively, prior to the announcement of the Reverse Stock Split. See “Market Prices of Our Common Stock and Dividend Policy”.

Following the Reverse Stock Split, we plan to terminate our Registration and Periodic Reporting Obligations, which means that our Common Stock will not qualify to be traded on any automated quotation system operated by a national securities association and will no longer be traded on the OTC Bulletin Board. Our Common Stock may be eligible to trade in the “Pink Sheet”; however we have no present plans to apply for our Common Stock to be traded in the Pink Sheets.

Fees and Expenses

The following is a reasonably itemized statement of the fees and expenses that have been incurred or that are estimated to be incurred in connection with the Reverse Stock Split and the transactions related thereto: $450,000 in Cash Consideration to the Cashed-Out Stockholders; $35,000 to our legal counsel; $61,500 for printing and other costs in connection with the mailing of this information statement; $28,500 for the preparation and issuance of a fairness opinion by Reznick Fedder & Silverman Financial Advisors Group, L.L.C.; and $25,000 for exchange agent services.

Accounting Consequences

The Reverse Stock Split will not affect the par value of our Common Stock, which remains $0.01 per share. The Reverse Stock Split will result in an increase in per share net income or loss and net book value of our Common Stock because fewer shares of our Common Stock will be outstanding. Our financial statements, supplementary financial information and quantitative and qualitative disclosures about market risk, included in Appendices B and C of this information statement, do not reflect the Reverse Stock Split.

Certain Legal Matters

We are not aware of any license or regulatory permit that appears to be material to our business that might be adversely affected by the Reverse Stock Split, nor any approval or other action by any governmental, administrative or regulatory agency or authority, domestic or foreign, that would be required to consummate the Reverse Stock Split, other than approvals, filings or notices required under federal and state securities laws and the corporate laws of the State of Delaware.

Regulatory Filings and Approvals

We have filed a Schedule 13E-3 with the Securities and Exchange Commission (“Commission”), to notify the Commission of our intent to go private. We anticipate that following the completion of the Reverse Stock Split and the filing of a Form 15 with the Commission, our Registration and Periodic Reporting Obligations will immediately terminate. See “Other Information - Where You Can Find More Information”.

We are not aware of any governmental or regulatory approval required for completion of the Reverse Stock Split, other than compliance with applicable federal and state securities laws and the corporate laws of the State of Delaware. See “Regulatory Approvals”.

Following the Reverse Stock Split and the termination of our Registration and Periodic Reporting Obligations, we will no longer be a public-reporting company, but rather will operate as a private company. We expect our business and operations to continue as they are currently being conducted and, except as disclosed in this information statement, the Reverse Stock Split is not anticipated to materially affect the conduct of our business. We expect to be subject to substantially the same risks and uncertainties after the Reverse Stock Split. See “Conduct of our Business after the Reverse Stock Split - Future Company Plans”.

We believe the Reverse Stock Split will be treated as a tax-free “recapitalization” for federal income tax purposes, which will result in no material federal income tax consequences to us. Depending on each stockholder’s individual situation, the Reverse Stock Split may give rise to certain income tax consequences for stockholders. See “Certain Material Federal Income Tax Consequences”.

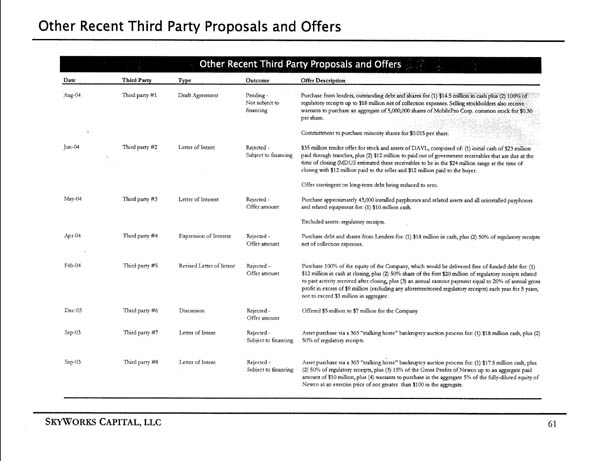

Background of the Transaction

During the spring and summer of 2003, Davel Communications, Inc. (“Davel” or the “Company”) had engaged in conversations with a third party (the “First Interested Party”) that was interested in entering into a joint venture or similar arrangement in order to deploy a wireless technology on the Davel owned pay telephones. The deployment of the wireless technology on the Davel owned pay telephones would require a significant capital investment by the First Interested Party. In light of Davel’s then current financial condition, the First Interested Party determined it was unwilling to make the necessary capital investment; however, determined that it would be interested in purchasing the Company. During the fall of 2003, due to a stock price that remained near historically low levels, the challenges faced by Davel in its business, including the Company’s ability to satisfy its obligations under a Senior Credit Agreement (the “Senior Debt”) (as further discussed below under “—Analysis of the Board; Fairness of the Merger”), the First Interested Party made an unsolicited offer regarding a possible sale, merger, consolidation or other business combination of Davel (the “First Offer”).

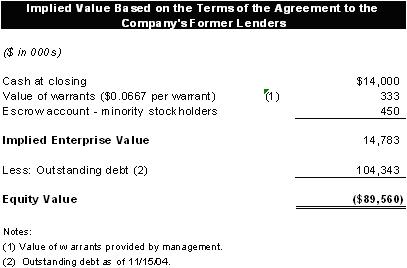

The First Offer contemplated an asset purchase and required that the assets be transferred free of the liens and encumbrances associated with the Senior Debt. The First Offer required that the assets be purchased in a Federal Bankruptcy Court auction proceeding (the “363 Proceeding”) to allow for the Senior Debt to be eliminated. In light of the structure contemplated by the First Offer, the transaction contemplated thereby could only be effectuated with the approval of the holders of the Senior Debt (the “Lenders”), since the Lenders would need to be willing to sell their interest in the Senior Debt at a substantial discount. At the time of the First Offer the carrying value of the Senior Debt was in excess of $120 million. The First Offer provided the Lenders with $17.5 million in cash at closing and provided the opportunity for deferred compensation equal to fifty percent of certain future regulatory receipts received by the Company, as well as fifteen percent of the future gross profits generated from the acquired assets up to an aggregate amount of $10 million. The First Offer also provided the Lenders with warrants to purchase in the aggregate five percent of the fully-diluted equity of the acquiring company. Since the First Offer contemplated the 363 Proceeding, it did not provide any consideration to the unsecured creditors or the shareholders of the Company. The First Offer was also subject to the First Interested Party obtaining a committed financing source. The Company continued to have ongoing conversations with the First Interested Party through the end of 2003 and into January of 2004.

During the summer of 2003 and unrelated to the foregoing conversations with the First Interested Party, the Company commenced conversations with another pay telephone provider (the “Second Interested Party”) to determine whether there would be any opportunities to create a strategic alliance or other initiative beneficial to the respective companies and their shareholders. The discussions considered various concepts, including a merger of the companies. As a result of those conversations, on or about September 23, 2003 the Company received a letter of intent from the Second Interested Party (the “Second Offer”). The Second Offer contemplated cash consideration to the Lenders at closing of $18 million, in addition to deferred consideration of up to fifty percent of certain future regulatory receipts received by the Company. The Second Offer required that the assets be transferred free of the liens and encumbrances associated with the Senior Debt to be effectuated by virtue of a 363 Proceeding. As such, the Second Offer did not provide any consideration to the unsecured creditors or the shareholders of the Company. The Second Offer was also subject to the Second Interested Party obtaining a financing commitment. In light of the financing commitment contingency and the questionable financial condition of the Second Interested Party, the Company and the Lenders declined to proceed under the terms of the Second Offer.

In December 2003, Davel entered into discussions with another third party (the “Third Interested Party”) concerning the purchase of the Company. The Third Interested Party displayed informal interest in pursuing a formal offer at a consideration price of between $5 million to $7 million. The expression of interest from the Third Interested Party was conveyed to the Lenders by the Company; however, in light of the low consideration price discussed, further discussions did not lead to an offer worthy of additional consideration.

After further negotiations with the Company and the Lenders on or around January 30, 2004 the First Interested Party revised its First Offer (the “Third Offer”) which contemplated the same 363 Proceeding as required by the First Offer; however, modified certain economic terms contained in the First Offer. The cash consideration to be paid to the Lenders in connection with the First Offer was increased to $18 million in cash, with the deferred consideration and equity components remaining the same. The terms of the Third Offer were memorialized in a non-binding letter of intent and executed by the parties. The non-binding letter of intent provided a forty-five day period during which time the First Interested Party was required to obtain committed financing to consummate the transaction. In light of the 363 Proceeding required by the Third Offer and the potential negative impact to its business associated therewith, the Company and the Lenders were unwilling to execute a binding definitive agreement until such time as the First Interested Party could provide evidence that committed financing could be secured.

During the time period in which the First Interested Party attempted to obtain a financing commitment, the Company continued to operate its business and implement various cost savings strategies and initiatives implemented by its previously appointed Chief Executive Officer. After multiple extensions of the time period set forth in the letter of intent the First Interested Party was unable to secure a financing commitment. As a result the non-binding letter of intent was terminated by the Company on May 2, 2004. The reason that the committed financing was not secured by the First Interested Party is unknown to the Company.

On or about February 13, 2004, the Company received a non-binding letter of intent from an unrelated third party (the “Fourth Interested Party”) that offered to purchase one hundred percent of the equity of the company, to be delivered free of the Senior Debt in consideration for $12 million in cash at closing, plus fifty percent of the first $20 million of certain future regulatory receipts to be received by the Company, plus deferred consideration in the form of an annual earnout payment equal to twenty percent of annual gross profit in excess of $9 million each year for five years, not to exceed $3 million in the aggregate (the “Fourth Offer”). The Fourth Offer did not specify the method by which the Senior Debt would be eliminated.

After receipt of the Fourth Offer, on or about February 24, 2004 the Company established the Special Committee of the Board of Directors. Two disinterested directors were appointed to serve on the Special Committee, Messrs. James Chapman and Andrew Barrett. Mr. Chapman served as the Chairman of the Special Committee. The Special Committee was organized in order to review, evaluate and consider the terms of the Fourth Offer and any future proposed transaction that it deemed to be in the best interests of the stakeholders of the Company. The Special Committee was authorized, if necessary, to engage legal counsel and a financial advisor as it deemed appropriate in order to evaluate the Fourth Offer and any future proposed transaction. In light of the pending non-binding letter of intent with the First Interested Party and given the low cash consideration contemplated by the Fourth Offer, the Special Committee and the Company did not accept the Fourth Offer. Further discussions did not result in any increase in the amounts contemplated by the Fourth Offer.

On or around April 28, 2004 the Company received a non-binding expression of intent from another third party (the “Fifth Interested Party”) for the purchase of the Senior Debt and the common shares of equity held by the Lenders. The consideration offered to the Lenders in connection with the expression of intent was $18 million in cash at closing, plus fifty percent of certain future regulatory receipts received by the Company, net of collection expenses (the “Fifth Offer”). No consideration was to be provided for the minority shareholders as part of the Fifth Offer. In light of the pending non-binding letter of intent with the First Interested Party, and as a result of the operating improvements at the Company, the Special Committee recommended to the Company not to proceed with the Fifth Offer. The Company accepted the recommendation of the Special Committee and it, and its Lenders, did not proceed with the Fifth Offer.

In May 2004 the Company received a letter of interest from an unrelated third party (the “Sixth Interested Party”) for the purchase of approximately 43,000 installed payphones and related assets and all uninstalled payphones and related equipment for consideration equal to $10 million in cash at closing (the “Sixth Offer”). The Chairman of the Special Committee commenced discussions with the Lenders, and accordingly, the Special Committee recommended to the Company that it not proceed with the Sixth Offer on the basis that the cash consideration amount was too low. The Company and the Lenders rejected the Sixth Offer. Further discussions with the Sixth Interested Party ensued but did not result in any increase of the consideration contemplated by the Sixth Offer.

On June 2, 2004 the Company received a non-binding letter of intent from a third party (the “Seventh Interested Party”) to purchase approximately ninety percent of the Company’s Common Stock. The non-binding letter of intent provided a cash consideration amount of $23 million to be paid over time, plus deferred consideration equal to $12 million to be paid from certain future regulatory receipts to be received by the Company (the “Seventh Offer”). The Seventh Offer was contingent on, among other things, the Company’s long-term debt being reduced to a zero balance, current liabilities equaling less than $30 million and the absence of lease and other encumbrances against the current assets of the Company. The Seventh Offer was also subject to the Seventh Interested Party obtaining committed financing. The Special Committee reviewed the Seventh Offer and recommended to the Company that it be rejected since the Special Committee and the Company did not believe it could satisfy the conditions set forth therein, and because the Seventh Offer was subject to the Seventh Interested Party obtaining a financing commitment.

On or about May 29, 2004 the Company and the Lenders received a letter of intent from Mobilepro in which it detailed its interest in the Company. The terms of the letter of intent provided for a purchase price of up to $33 million to purchase the Senior Debt and the Common Stock held by the Lenders. The purchase price consisted of $15 million in cash at closing, together with one hundred percent of certain future regulatory receipts received by the Company up to $18 million. The letter of intent was conditioned on, among other things, completion of due diligence, the absence of pending or threatened litigation against the Company on the date of closing, the absence of payments of debt with regulatory receipts or otherwise, continued operations of the Company business in the ordinary course and documentation of the definitive agreement. The letter of intent contained a provision that prohibited the Company from soliciting or entering into any negotiations or agreements with another prospective purchaser of the Senior Debt. The letter of intent was also subject to Mobilepro obtaining final financing. The Special Committee reviewed the terms of the Mobilepro letter of intent.

From May 29, 2004 through June 1, 2004 the Special Committee directed the Company’s Chief Executive Officer to engage in continuing negotiations with Mobilepro representatives. On or about June 2, 2004 Mobilepro presented the Company and Lenders with a letter, which confirmed and revised certain aspects of the May 29, 2004 letter of intent. The Special Committee reviewed the June 2, 2004 letter of intent which confirmed that Mobilepro had engaged a committed financing source, and therefore, the financing contingency in the previous letter of intent was eliminated. Furthermore, it provided a $500,000 deposit to secure the no shop provision through August 31, 2004 and requested that the Company and Lenders agree to a “topping fee” in the amount of $750,000 in the event a superior third party offer was received and accepted by the Company and Lenders prior to August 31, 2004.

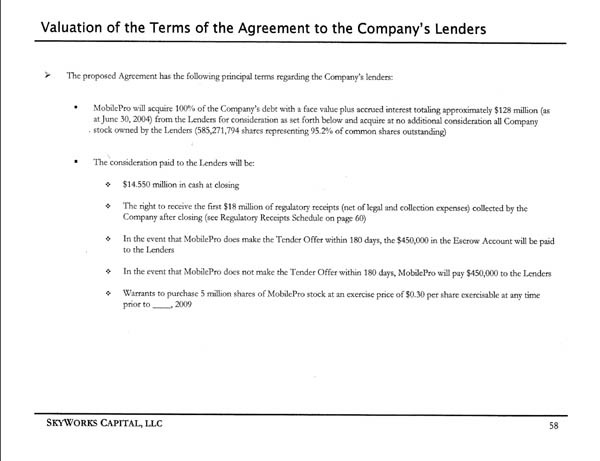

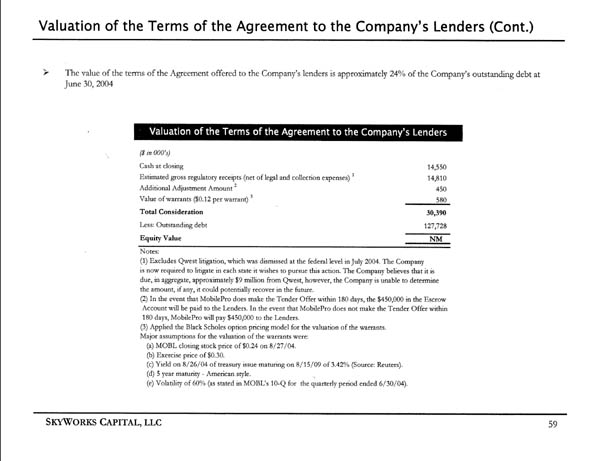

The Special Committee reviewed the terms of the June 2, 2004 letter of intent with the Company and its Lenders. The Special Committee expressed its concern that the June 2, 2004 letter of intent did not make any provision for the treatment of the shareholders that were not the Lenders (the “Minority Stockholders”), which it believed to be of particular import since the proposed transaction would result in Mobilepro obtaining a controlling interest of the Company’s Common Stock. After further negotiations directed by the Special Committee between the Company, the Lenders and Mobilepro, on or about June 14, 2004 Mobilepro presented the Company with a revised letter of intent. The terms of the letter of intent provided for a purchase price of up to $33 million to purchase the Senior Debt and the Common Stock retained by the Lenders. The purchase price consisted of $15 million in cash at closing, together with one hundred percent of certain future regulatory receipts to be received by the Company up to $18 million. As additional consideration, Mobilepro agreed to provide the Lenders with five million warrants to purchase Mobilepro common stock at an exercise price of $0.20 per share. The warrants were to have a five-year term and were to be exercisable on a cash basis. Mobilepro also agreed to provide the Lenders with piggy-back registration rights for the underlying shares to be issued in connection with the exercise of the warrants. Additionally, Mobilepro agreed to, within 120 days after closing date of the transaction, make a tender offer for the remaining shares of Common Stock not owned by the Lenders. The June 14, 2004 letter of intent was subject to due diligence and required that the parties execute definitive agreements on or before August 31, 2004. The June 14, 2004 letter of intent also provided that Mobilepro would advise the Company on or before July 23, 2004 whether it had completed its due diligence and whether it intended to proceed with the transaction as contemplated by the letter of intent. The Special Committee reviewed the terms of the June 14, 2004 letter of intent and recommended to the Company that it be accepted. The parties executed the letter of intent dated June 14, 2004.

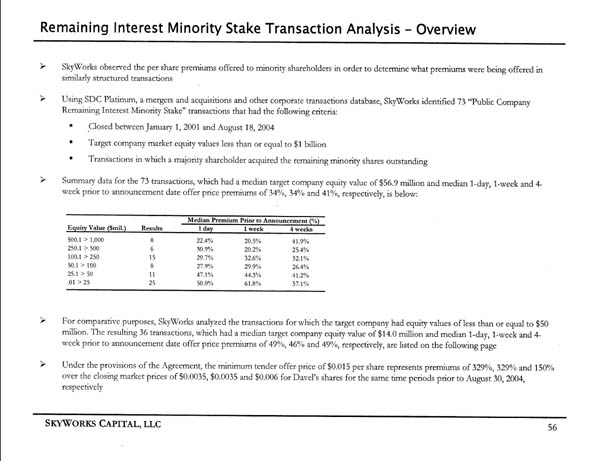

Thereafter, Mobilepro commenced its financial and legal due diligence of the Company, and on or around July 23, 2004, confirmed that it intended to move forward with the transaction in accordance with the terms of the letter of intent. The parties commenced the negotiation and drafting of the definitive agreements. During this time period the parties negotiated the specific provisions of the definitive agreements, including the provisions relating to the buyout of the Minority Stockholders. The Special Committee reviewed the historical stock trading price and trading volumes of the Company’s Common Stock and determined that the Minority Stockholders interests would be best served if the Company were able to negotiate a buyout of the Minority Stockholder’s interests. After reviewing the Company’s actual and projected financial results, including the Company’s inability to meet its debt obligations to the Lenders and other liquidity concerns, together with the historical market prices and trading volumes of its publicly traded Common Stock, the Special Committee determined that a fair consideration price for each share of Common Stock held by the Minority Stockholders would be $0.015. Further negotiations resulted in a provision being included in the Loan Purchase Agreement requiring Mobilepro to purchase all of the approximately 4.8% of the shares of Common Stock of the Company held by the Minority Stockholders. The buyout of the Minority Stockholders was to be completed by Mobilepro within 180 days after the closing date of the Loan Purchase Agreement and could be conducted by Mobilepro, at its sole discretion, by tender offer, short-form merger or such other transaction deemed appropriate by Mobilepro. The purchase price offered to the Minority Stockholders was to be an amount per share of not less than $0.015, which amount could be paid in cash or securities of Mobilepro. Prior to conducting the Minority Stockholder buyout, Mobilepro was required to retain a reputable investment banker or other financial advisor to render an opinion as to the fairness, from a financial point of view, of the terms of the consideration paid to the Minority Stockholders.

On or about August 5, 2004 the Special Committee retained the services of Skyworks Capital, LLC in order to evaluate the transaction and issue an opinion as to the fairness, from a financial point of view, of the consideration to be received by the Minority Stockholders in connection with Mobilepro transaction. During the following weeks the parties completed the documentation surrounding the transaction, including but not limited to, the Loan Purchase Agreement and ancillary documentation. At a meeting of the Special Committee, on September 3, 2004 Skyworks Capital, LLC made a presentation and issued an opinion confirming that, from a financial point of view, the consideration to be received by the Minority Stockholders was fair. Immediately thereafter, the Company held a meeting of its Board of Directors during which the Special Committee recommended to the Board of Directors that the Company proceed with the Mobilepro transaction. The Board of Directors unanimously agreed to proceed with the Mobilepro transaction and to execute the definitive agreements. The definitive agreements were executed on September 3, 2004 and the transaction closed on November 15, 2004. Upon the closing of the transaction, Messrs. Chapman, Genda and Barrett resigned their positions as Directors of the Company, at which time Messrs. Jay Wright, Kurt Gordon, Kevin Kuykendall and Geoffrey Amend, each of whom were executive officers of Mobilepro, were appointed to the Board of Directors of the Company. Kevin Kuykendall later resigned his position from the Davel Board of Directors in January 2005. Mobilepro did not file a Schedule 13D or a Schedule 14f-1 at this time. While it does not believe that its purchase of certain debt from certain debtholders of Davel required it to file either such schedule, nevertheless, Mobilepro intends to file both disclosure documents on or about March 29, 2005.

In connection with the obligation of Mobilepro to buyout the Minority Stockholders, on January 6, 2005 the Company retained the services of Reznick Fedder & Silverman (“Reznick”) to provide an opinion as to the fairness, from a financial point of view, of the terms of the consideration paid to the Minority Stockholders in order to fulfill its obligations under the terms of the Loan Purchase Agreement. On or about January 15, 2005 Reznick completed its preparation of a written presentation to the Board of Directors of the Company. Prior to a meeting of the Board of Directors scheduled for February 9, 2005 Reznick submitted the written presentation materials to the Board of Directors. On February 9, 2005 Reznick made an oral presentation to the Board of Directors of the Company and issued an opinion to the Company, from a financial perspective, that the consideration of $0.015 to be paid to the Minority Stockholders was fair. Upon a review of the opinion, the Board of Directors voted unanimously to approve the filing of the Amendment to effectuate the Reverse Stock Split.

Approval of the Reverse Stock Split

Purpose of the Reverse Stock Split

The purpose of the Reverse Stock Split is to enable Mobilepro to effectively purchase all of our outstanding Common Stock that it does not beneficially own. On November 15, 2004, Mobilepro acquired approximately 95.2% of our issued and outstanding Common Stock. As part of the Loan Purchase Agreement, Mobilepro agreed to purchase all of our remaining Common Stock by means of a tender offer, short-form merger or other similar transaction. Additionally, the acquisition of our Common Stock will enable us to terminate our Registration and Periodic Reporting Obligations and enable us to continue future operations as a private company, thereby relieving us of the costs, administrative burdens and competitive disadvantages associated with operating as a public company. We intend to accomplish this purpose by reducing the number of holders of record of our Common Stock to fewer than 300 by cashing out the fractional shares that would otherwise result from the Reverse Stock Split.

Alternatives Considered by the Board of Directors

Faced with the obligation to purchase all of our outstanding Common Stock that it did not already own, and its interest in increasing our working capital and reducing our administrative expenses, Mobilepro determined, along with us, that maintaining our public company status imposed a significant cost on us with no significant benefit. We determined that terminating our Registration and Periodic Reporting Obligations would result in substantial cost savings and better competitive positioning, which would help us maximize stockholder value. In order to terminate our Registration and Periodic Reporting Obligations, we must reduce the number of record holders of our Common Stock to fewer than 300.

Our Board of Directors reviewed several alternatives for purchasing the shares held by the the Minority Stockholders. The first alternative involved a tender offer. In a tender offer, publicly held shares are purchased directly from a company’s stockholders. The proponent of the transaction approaches the target company to consider the proposal. When the two sides reach an agreement, the acquiror sends the stockholders a written offering document, the “offer to purchase,” which contains disclosures required by Commission rules, and a letter of transmittal, which stockholders may use to tender their shares. The target company issues a press release announcing, among other things, that the company recommends that stockholders accept the offer and tender their shares. Tender offers are commonly conditioned on the acquiror holding at least 90% of each class of stock of the company following the closing of the offer, which provides the acquiror with the ability to complete a short-form merger without holding a meeting of stockholders or soliciting proxies. In a short-form merger, the shares that were not tendered are typically converted into the right to receive the same consideration that was paid to the tendering stockholders or the right to assert appraisal rights. At the conclusion of the short-form merger, the target company (or merger sub) typically has one stockholder, a subsidiary of the acquiror.

The second alternative considered was a merger with a third party. A common form is a reverse triangular merger in which an entity formed by the acquirer merges with and into the target company, which survives the merger. As a result of the merger, the outstanding shares of the target company’s stock, other than shares owned by the acquiror, are converted into the right to receive the merger consideration. The merger consideration is the cash paid to the stockholders of the target corporation. A merger typically leaves the surviving company with one stockholder, the parent.

The final alternative considered was the Reverse Stock Split. Because the results of a Reverse Stock Split are more predictable and automatic, our Board of Directors believes that the Reverse Stock Split is the most expeditious and economical way of effectively purchasing the shares of the Minority Stockholders and reducing the number of holders of record to fewer than 300 thereby positioning us to effect the termination of our Registration and Periodic Reporting Obligations. As a result, on February 17, 2005, our Board of Directors, approved a l-for-97,500,000 Reverse Stock Split of our Common Stock, subject to stockholder approval. The selected split ratio was a result of calculations intended to determine how many record holders needed to be cashed out to achieve our goal of going private and reducing the number of stockholders to one.

Reasons for the Reverse Stock Split

Cost Savings

We incur direct and indirect costs associated with our status as a public company. Among the most significant are the costs associated with compliance with the Registration and Periodic Reporting Obligations imposed by the Commission. Direct costs associated with compliance with the Registration and Periodic Reporting Obligations include, but are not limited to auditing fees, legal fees, financial printer fees and miscellaneous clerical and other administrative expenses, such as word processing, conversion to EDGAR, telephone and fax charges associated with the preparation and filing of periodic reports, proxy materials and other reports and statements with the Commission.

Based on our experience in prior years, our direct costs of complying with the Registration and Periodic Reporting Obligations are estimated to be approximate $540,000 annually, based on estimated annual audit and accounting fees of $130,000, estimated annual legal fees of $50,000, estimated financial printer fees of $40,000, estimated transfer agent fees of $25,000, estimated costs associated with filing reports with the Commission (including internal administrative staff) of $50,000, estimated costs for directors’ and officers’ insurance of $155,000, estimated ongoing costs associated with Sarbanes-Oxley compliance of $40,000 (estimated at $50,000 in 2005) and estimated miscellaneous costs of $50,000. Indirect costs associated with compliance with the Registration and Periodic Reporting Obligations include, among other things, the time our executive officers expend to prepare and review our periodic reports. Because we have only a few executive personnel, these indirect costs are substantial. Due to additional regulations and compliance procedures required of public companies under the Sarbanes-Oxley Act of 2002, including our independent auditors’ report on our management’s assessment of our internal controls for financial reporting purposes under section 404 of that Act, we expect that the direct and indirect costs identified above will increase in the future.

The cost of administering each registered stockholder’s account is the same regardless of the number of shares held in that account. As of the record date, our Common Stock was held of record by approximately 1,615 stockholders, and approximately 1,614 stockholders of record held fewer than 97,500,000 shares, representing approximately 99.9 percent of the total number of holders of record of our Common Stock. These accounts holding fewer than 97,500,000 shares represented less than 4.8% of the total number of outstanding shares of our Common Stock. Assuming that the Reverse Stock Split does not occur, the estimated cost relating to our Registration and Periodic Reporting Obligations for each stockholder account, will be approximately $334 in 2005.

Our Board of Directors considered the cost to us of continuing to file periodic reports with the Commission and complying with the proxy and annual report requirements under the Exchange Act compared to the benefits to us and our stockholders of continuing to operate as a public company. Under the circumstances, our Board of Directors determined that the benefits that we and our stockholders would typically expect to derive from our status as a public company are not being realized and are not likely to be realized in the foreseeable future. As a result, our Board of Directors concluded that the elimination of the costs of complying with our Registration and Periodic Reporting Obligations outweighed the benefits of continuing to incur such costs. We are, therefore, undertaking the Reverse Stock Split at this time to save us the substantial costs, which we expect to increase over time, and resources required to comply with the Registration and Periodic Reporting Obligations and other obligations associated with operating as a public reporting company. However, the actual savings to be realized from terminating our Registration and Periodic Reporting Obligations may be higher or lower than our estimates.

Financial Information

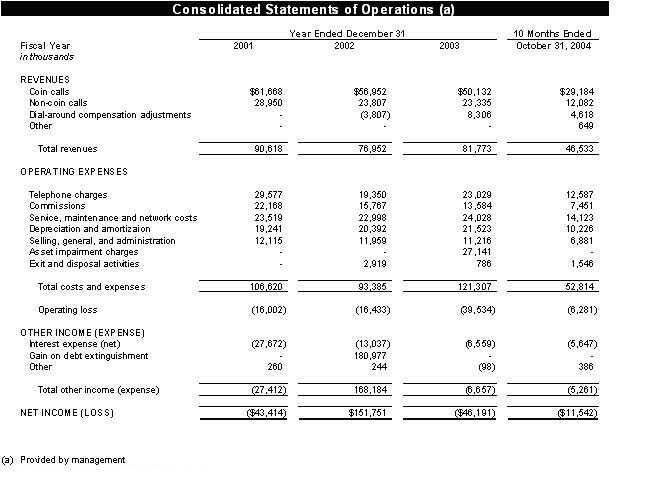

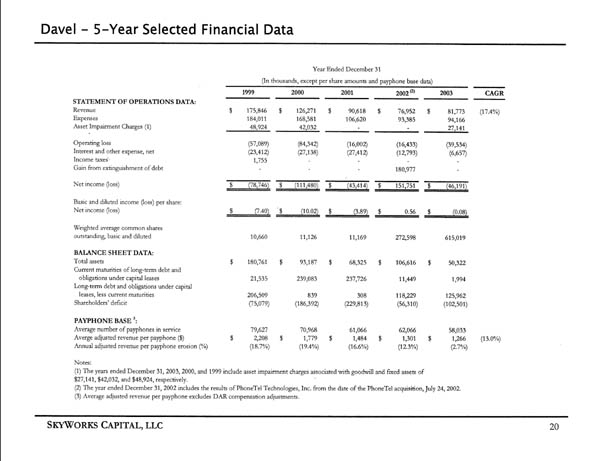

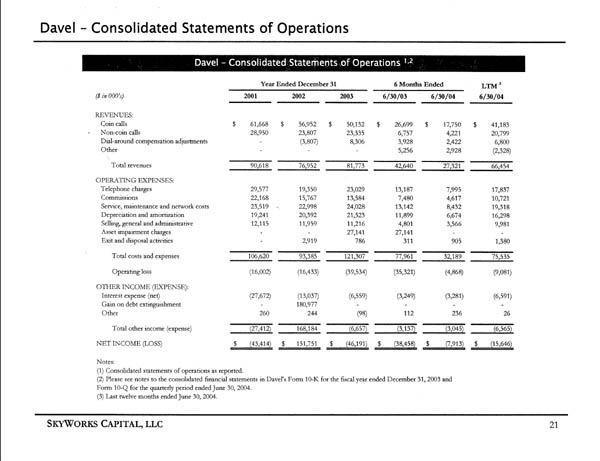

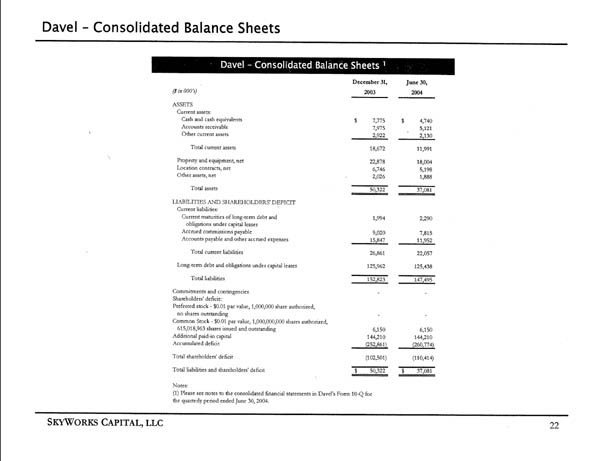

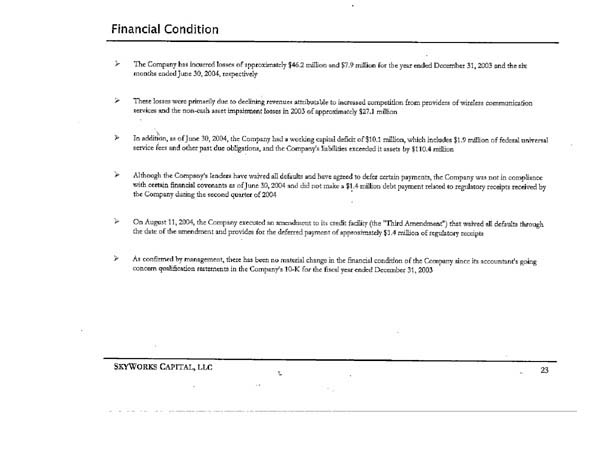

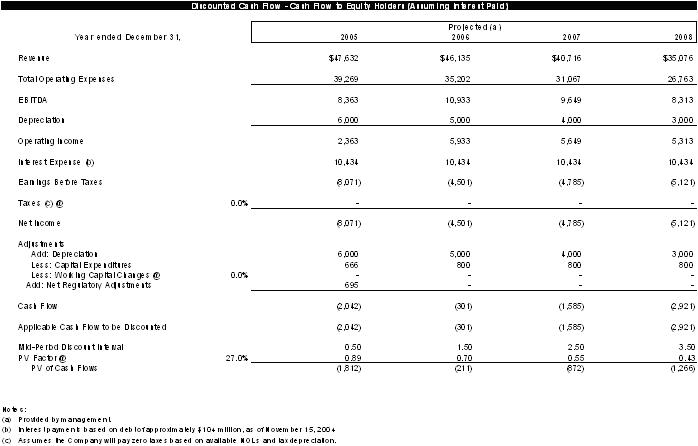

Our ratio of earnings to fixed charges for the year ended December 31, 2003 was less than one-to-one, and for the year ended December 31, 2002 was 11.05 to 1. The deficient amount of earnings that would have been required to attain one-to-one coverage for the year ended December 31, 2003 was $46,191,000. Our ratio of earnings to fixed charges for each of the nine-month periods ended September 30, 2004 and September 30, 2003 was less than one-to-one. The deficient amount of earnings that would have been required to attain one-to-one coverage for the nine-month periods ended September 30, 2004 and September 30, 2003 would have been $10,055,000 and $39,139,000, respectively. Net book value [deficit] per share of our Common Stock as of September 30, 2004 was [$0.183].

Competitive Disadvantage

As a public company, we are required to make certain disclosures in connection with our Registration and Periodic Reporting Obligations. Those public disclosures can place us at a competitive disadvantage by providing our non-public competitors with strategic information about our business, operations and results while not having access to similar information about those competitors. In light of our limited size and resources, competitive disadvantages related to our public reporting obligations and our lack of intent to raise capital through a public offering or effect acquisitions using our stock, our Board of Directors does not believe the costs associated with maintaining our Registration and Periodic Reporting Obligations and maintaining our stockholder accounts are justified. Our Board of Directors believes that it is in the best interests of us and our stockholders as a whole to eliminate the administrative burden and costs associated with maintaining our Registration and Periodic Reporting Obligations and maintaining stockholder accounts.

Procedural Factors Favoring the Reverse Stock Split

Our Board of Directors, Mobilepro and Davel Acquisition have analyzed the Reverse Stock Split and its anticipated effects on our stockholders and have deemed the Reverse Stock Split and related termination of our Registration and Periodic Reporting Obligations to be substantively and procedurally fair to, and in the best interests of, our affiliated and unaffiliated stockholders, whether they are cashed out or remain as stockholders following the Reverse Stock Split. In reaching this conclusion, our Board of Directors also considered, in no particular order and without preference, the factors described below.

The Reverse Stock Split Provides our Stockholders with Liquidity

The average daily trading volume for our Common Stock over the three months preceding the announcement date of the Reverse Stock Split on September 7, 2004 was approximately 140,000 shares, deeming it illiquid by most standards. The Reverse Stock Split will provide stockholders who hold fewer than 97,500,000 shares at the Effective Time the opportunity to liquidate their investment in us.

No Unusual Conditions to the Reverse Stock Split

Our Board of Directors also considered the likelihood that the Reverse Stock Split would be implemented. In this regard, it considered that there are no unusual requirements or conditions to the Reverse Stock Split, and that we have the financial resources to implement the Reverse Stock Split expeditiously.

The Reverse Stock Split Ratio was Calculated Without Bias Toward Any Particular Group of Stockholders and Will Apply Equally to All Shares of our Common Stock

The purpose of the Reverse Stock Split is to purchase the Common Stock held by the Minority Stockholders and reduce the number of record holders to fewer than 300 so that we can file to terminate our Registration and Periodic Reporting Obligations and continue future operations as a private company. The split ratio is a result of calculations that were intended to determine how many stockholders needed to be cashed out in order to reduce the number of record holders to one. Our Board of Directors feels the current ratio of l-for-97,500,000 is fair because it was calculated without bias toward any one group of stockholders. The ratio will be applied equally to all shares of our Common Stock.

Procedural Factors Disfavoring the Reverse Stock Split; Interests of Mobilepro in the Reverse Stock Split

The Reverse Stock Split Will be Approved by Mobilepro, Without a Vote by Unaffiliated Stockholders

With respect to the fact that Mobilepro holds sufficient shares of our Common Stock to approve the Reverse Stock Split, our Board of Directors, Davel Acquisition Corp., and Mobilepro believe that this potential conflict is outweighed by the substantive features and procedural safeguards of the Reverse Stock Split, including the equal application of the Reverse Stock Split to all shares of our Common Stock and the fairness of the price offered to all stockholders.

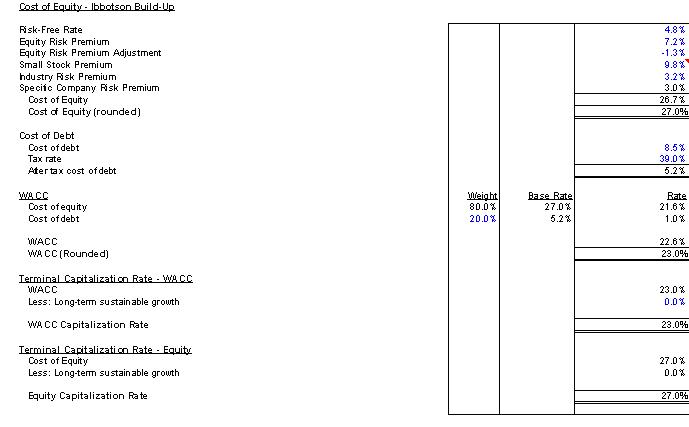

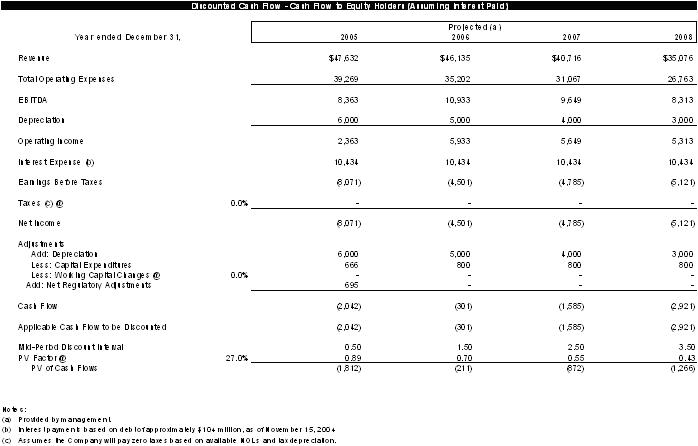

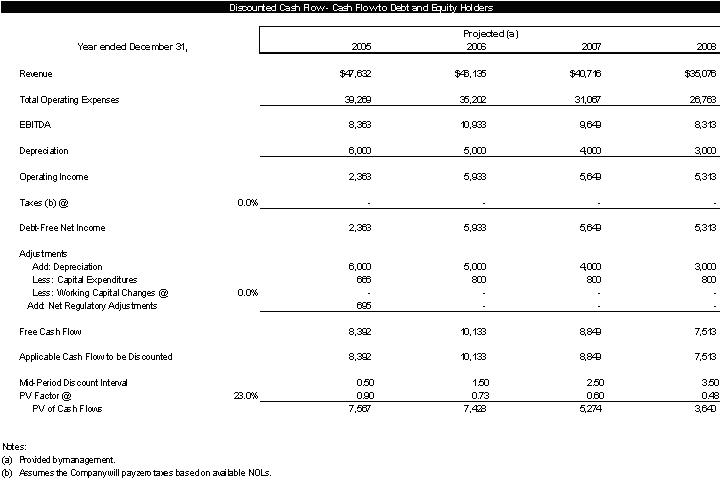

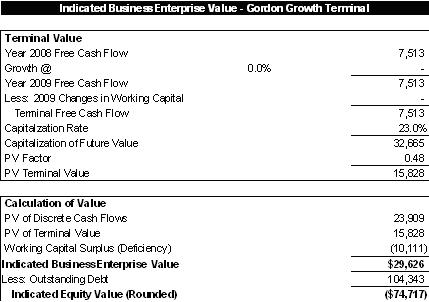

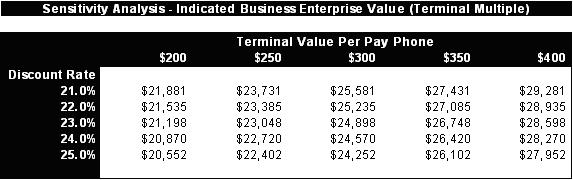

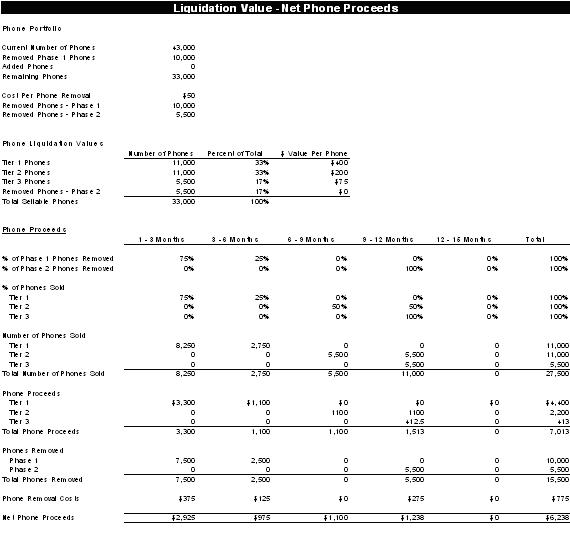

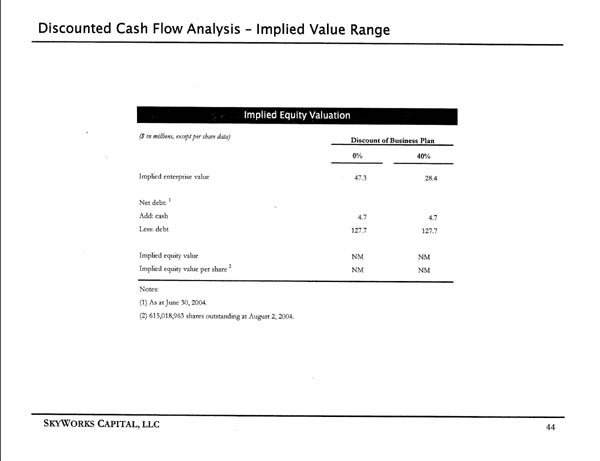

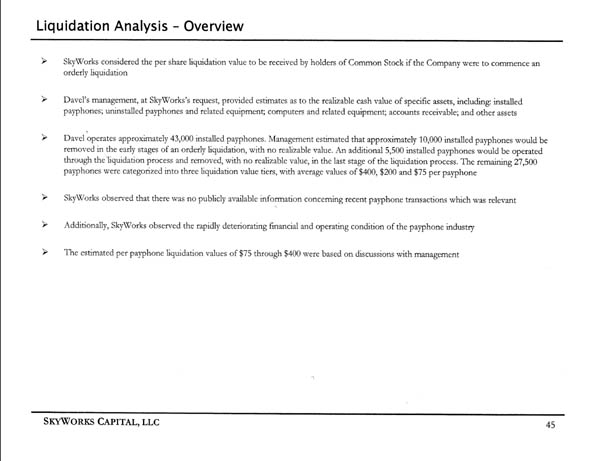

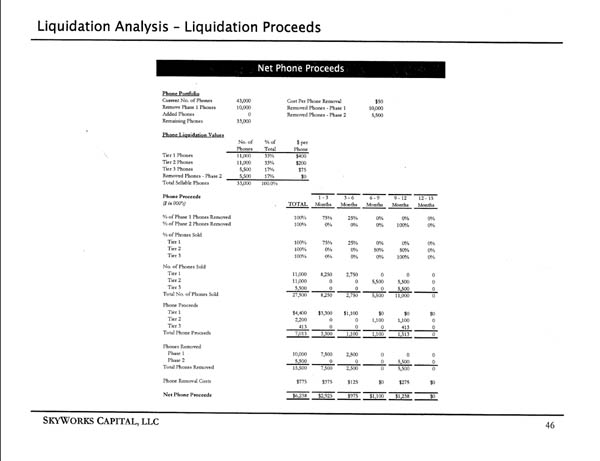

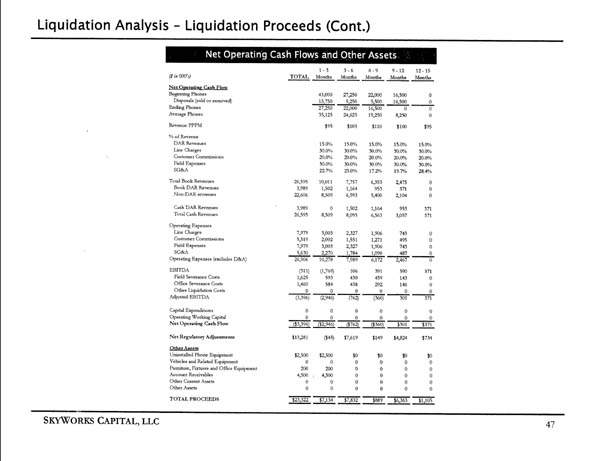

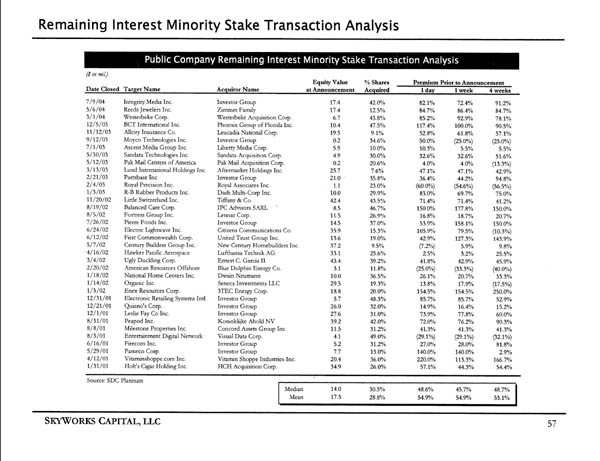

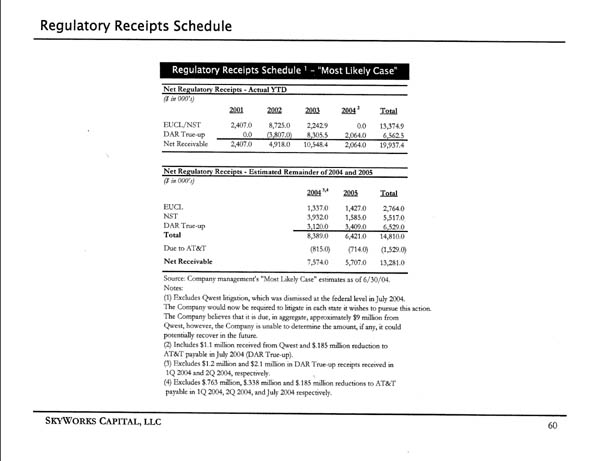

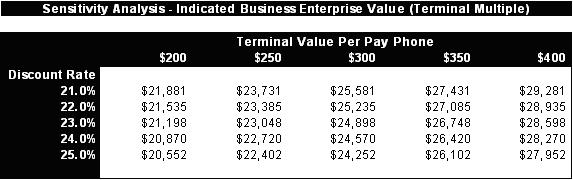

The Board of Directors has adopted the analysis and conclusions of its financial advisor. It adopts each of the following of the advisor’s analyses: comparable company, discounted cash flow, liquidation, public market pricing, minority stake transaction, comparable transaction, the valuation implied by the terms of the agreement with the former lenders, and other recent proposals made by third parties. The Board of Directors set the consideration being offered to stockholders.

The consideration was first derived by the Special Committee of the Board of Directors of the Company, prior to execution of the Loan Purchase Agreement. The cash amount was initially derived based primarily from an evaluation of the historical stock trading price and trading volumes, together with a premium thereto. The Board of Directors also considered the historical operating results of the Company, the projected operating results of the Company, and the Company’s existing financial condition. Skyworks Capital, L.L.C. provided a opinion as to the fairness of the price to the Minority Shareholders of the Company. The fairness opinion was substantiated using a similar analysis to the one utilized by Reznick. The reverse split ratio was derived in order that Mobilepro would be the sole shareholder.

As a Result of the Reverse Stock Split, Mobilepro will own 100% of our Common Stock

Based on information and estimates of record ownership of shares of Common Stock as of the Record Date, the beneficial ownership percentage of Mobilepro will increase from 95.2% to 100% as a result of the Reverse Stock Split. This increase in ownership percentage is a result of the reduction by an estimated 30,000,000 pre-split whole shares in the number of shares of our Common Stock outstanding due to the payment of cash in lieu of issuance of fractional shares.

Substantive Factors Favoring the Reverse Stock Split

Agreement To Purchase Interests of Minority Stockholders

As discussed above under “Approval of the Reverse Stock Split - Reasons for the Reverse Stock Split ” we agreed to purchase the Common Stock of the Minority Stockholders within six months of the closing of the Loan Purchase Agreement. The Reverse Stock Split accomplishes that covenant in a cost effective and expeditious manner.

Direct and Indirect Cost Savings

As discussed above under “Reasons for the Reverse Stock Split - Cost Savings,” we incur direct and indirect costs associated with our status as a public company. Among the most significant are the costs associated with compliance with the Registration and Periodic Reporting Obligations imposed by the Commission. We estimate that we will save approximately $540,000 annually in direct general and administrative costs by being a private company. We also believe that because of the Sarbanes-Oxley Act, such direct costs would increase in the future. Additionally, the indirect cost to our company in terms of senior management time spent on complying with the Registration and Periodic Reporting Obligations will also be saved.

The Reverse Stock Split Offers Stockholders the Opportunity to Receive Cash at a Premium In Lieu of Fractional Shares

Our Board of Directors considered several methods for valuing our Common Stock to determine the $0.015 price per share to be paid to stockholders in lieu of issuing fractional shares of our Common Stock as a result of the Reverse Stock Split. The Cash Consideration to be paid to holders of fractional shares represents a premium of approximately 114 % and 50% over the weighted average closing trading price of the Common Stock over three-month and six-month periods, respectively, prior to the announcement of the Loan Purchase Agreement. The $0.015 price per share also represented an 11.8% discount, compared to the weighted average closing trading price of the Company’s Common Stock over the one-year period prior to the announcement of the Loan Purchase Agreement. Although the Board of Directors considered this in their determination of the price per share, they placed greater emphasis on the more recent stock trading prices of the Company’s Common Stock in establishing the price per share to be received by the Minority Shareholders.

Substantive Factors Disfavoring the Reverse Stock Split

Inability to Participate in Any Future Increase in the Value of Our Common Stock

All Minority Stockholders will be cashed-out and have no further equity interest in us with respect to their shares. Accordingly, they will no longer have the opportunity to participate in the potential increase in the value of our Common Stock. Our Board of Directors determined that this factor does not make the transaction unfair to unaffiliated stockholders because unaffiliated stockholders will receive a fair price for the shares of their Common Stock and may elect to use the proceeds to acquire shares of our parent company, Mobilepro, on the open market or invest in other financial alternatives providing potentially comparable returns on investment.

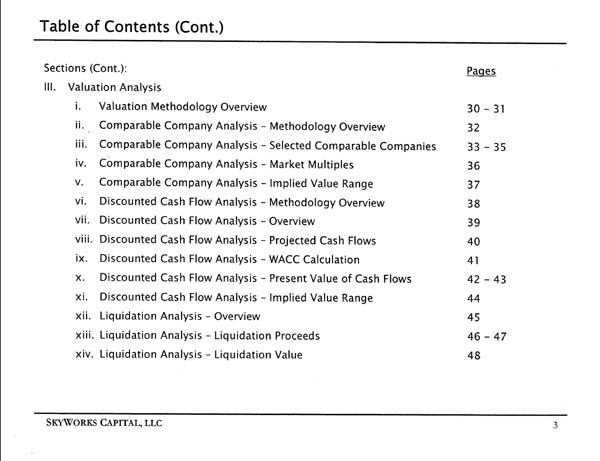

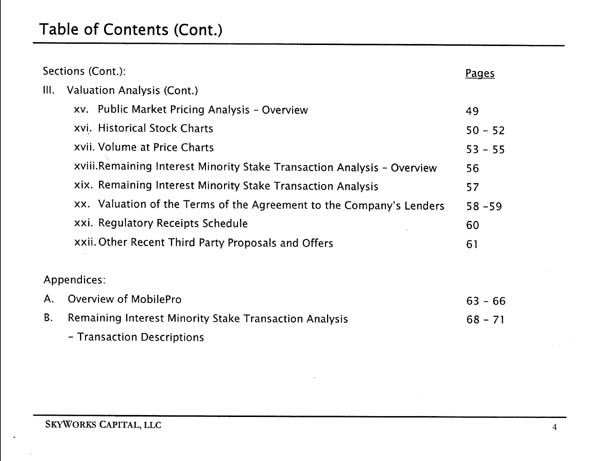

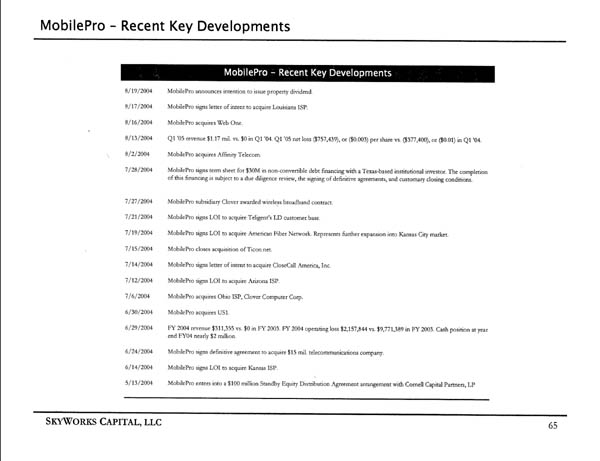

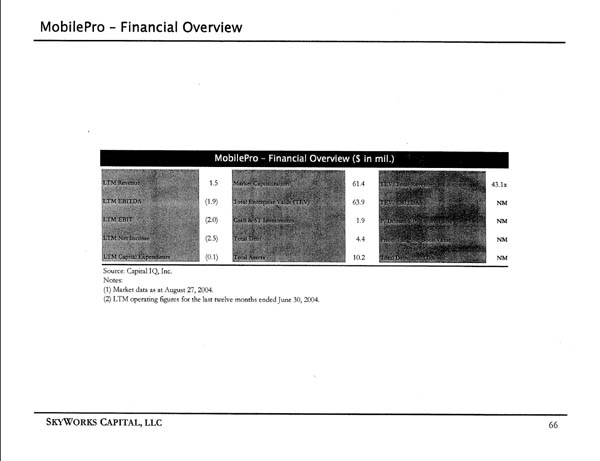

Analysis of Skyworks Securities

The Special Committee of the former Davel Board of Directors searched for a financial advisor that had the experience and qualifications necessary to provide an opinion regarding the fairness, from a financial point of view, of the consideration to be received by the Minority Stockholders of Davel. The Chairman of the Special Committee contacted financial advisors he had previously worked with and requested bids regarding the fee that would be charged for their services. The Special Committee received proposals to provide the requisite services from each of the financial advisors and evaluated the proposals and the merits of each. On the basis of the qualifications, experience and fees, the Special Committee awarded the engagement to Skyworks Capital, LLC (“Skyworks”).

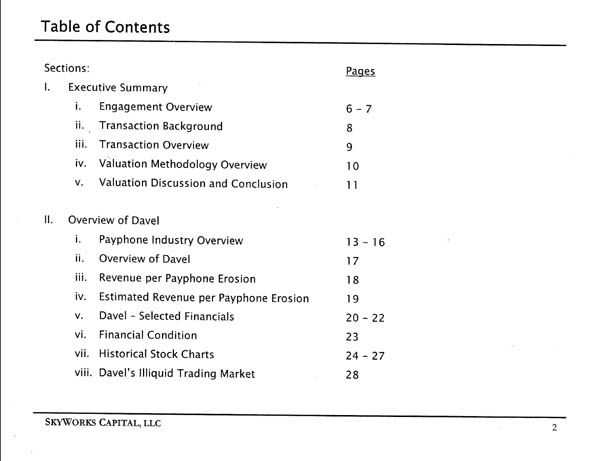

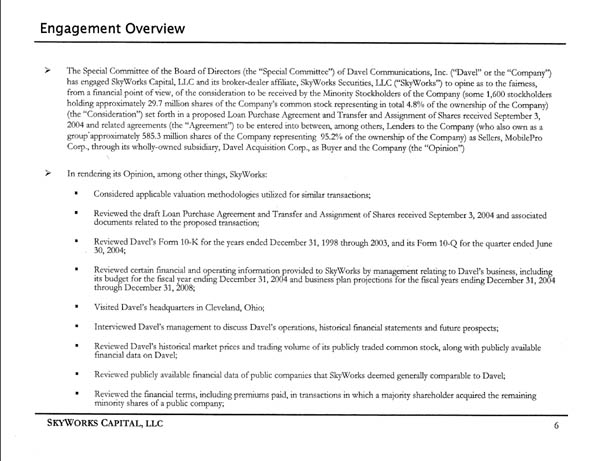

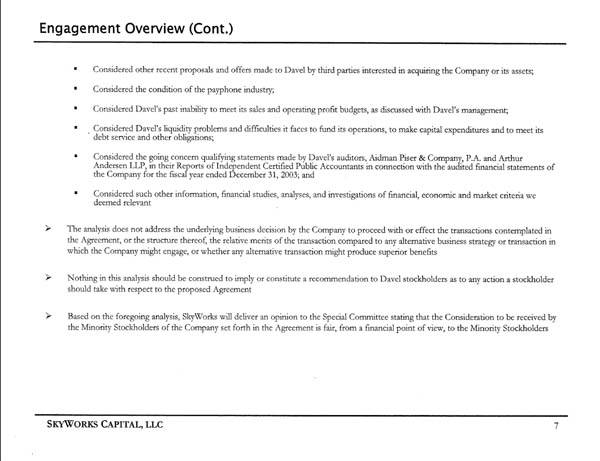

On behalf of Davel, the Special Committee signed an engagement letter with Skyworks to opine as to the fairness, from a financial point of view, of the $0.015 per share to be received by the Minority Stockholders of the Company (some 1,600 stockholders holding approximately 29.8 million shares of the Company’s Common Stock representing in total 4.8% of the ownership of the Company) set forth in the Loan Purchase Agreement entered into between, among others, the former Lenders to the Company as Sellers, MobilePro Corp. as Buyer and the Company (the “Skyworks’ Opinion”). On September 3, 2004, Skyworks delivered to the Board its oral opinion, noting that such Skyworks’ Opinion would be delivered subsequently in writing to the effect that, based upon and subject to the assumptions and qualifications stated in its opinion, the $0.015 per share to be received by the Minority Stockholders of the Company was fair, from a financial point of view, to such stockholders. Prior to delivering its oral opinion, Skyworks delivered to the Board a Fairness Opinion Supplement dated September 3, 2004.

The full text of Skyworks’ written opinion, dated September 3, 2004, is attached as Appendix F to this information statement and is incorporated by reference. You are urged to read the entire opinion carefully to learn about the assumptions made, procedures performed, matters considered and limits on the scope of the analysis undertaken by Skyworks in rendering the Skyworks’ Opinion. Skyworks’ Opinion relates only to the fairness, from a financial point of view, to the Minority Stockholders of the $0.015 per share to be received by such stockholders set forth in the Loan Purchase Agreement, does not address any other aspect of the proposed Reverse Stock Split or any related transaction and does not constitute a recommendation to any stockholder. Skyworks’ Opinion was directed to the Board of Directors for its benefit and use in evaluating the fairness of the $0.015 per share to be received by the Minority Stockholders. We encourage you to carefully read the opinion in its entirety.

While Skyworks rendered the Skyworks’ Opinion and provided certain financial analyses, the Skyworks’ Opinion was only one of the factors taken into consideration by the Board of Directors in determining the price to be paid to the Minority Stockholders. Skyworks was not engaged to, and did not perform a valuation analysis or appraisal of Davel’s Common Stock and, accordingly, did not render an opinion or conclusion as to the fair value of the Common Stock. Skyworks did not recommend to the Board of Directors the amount of consideration that should be paid in any proposed transaction. The Board of Directors determined the amount of consideration to be paid and the decision to recommend the proposed transaction was solely that of the Board of Directors.

In preparing the Skyworks’ Opinion, Skyworks performed a variety of analyses, some of which are summarized below. In arriving at the Skyworks’ Opinion, Skyworks considered the results of all such analysis as a whole and did not attribute any particular weight to any specific analysis or factor. As such, consideration of only a portion of the analyses could create an incomplete view of the process underlying Skyworks’ Opinion.

In performing its analyses, Skyworks made assumptions with respect to industry performance, general business and economic conditions and other matters, many of which are beyond the control of Davel. The analyses performed by Skyworks are not necessarily indicative of actual values or actual future results, which may be significantly different than suggested by such analyses. Such analyses were prepared solely as part of Skyworks’ analysis of the fairness of the cash consideration to be paid to the Minority Stockholders and were delivered to the Board of Directors as part of the Skyworks’ Opinion. The analyses do not purport to be appraisals of the business or assets of Davel or to reflect the price that might be obtained in an actual transaction. Skyworks utilized in their analysis various projections of operations prepared by the management of Davel. The projections are based on numerous variables and assumptions that are inherently unpredictable and may not occur as projected. Accordingly, actual results could vary significantly from those set forth in management’s projections.

In rendering the Skyworks’ Opinion, among other analyses, Skyworks performed the following procedures:

| • | | Considered applicable valuation methodologies utilized for similar transactions; |

| | | |

| • | | Reviewed Davel’s Form 10-K for the years ended December 31, 1998 through 2003, and its Form 10-Q for the quarter ended June 30, 2004; |

| | | |

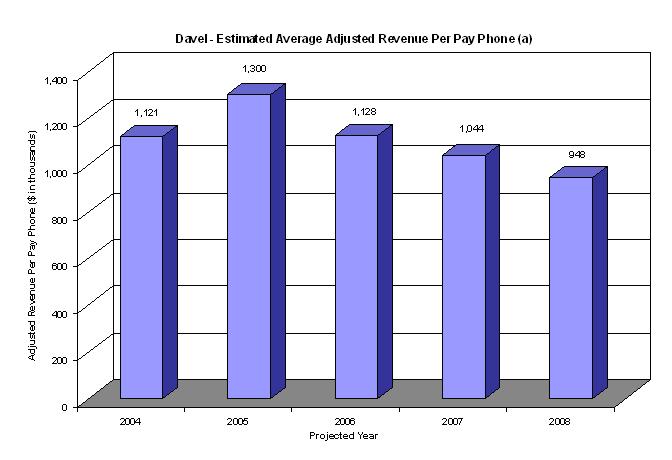

| • | | Reviewed certain financial and operating information provided to Skyworks by management relating to Davel’s business, including business plan projections for the fiscal years ending December 31, 2004 through December 31, 2008; |

| | | |

| • | | Interviewed Davel’s management to discuss Davel’s operations, historical financial statements and future prospects; |

| | | |

| • | | Reviewed Davel’s historical market prices and trading volume of its publicly traded common stock, along with publicly available financial data on Davel; |

| | | |

| • | | Reviewed publicly available financial data to identify public companies to compare to Davel; |

| | | |

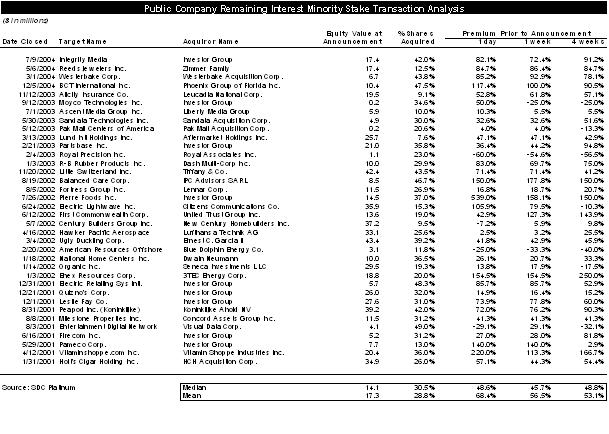

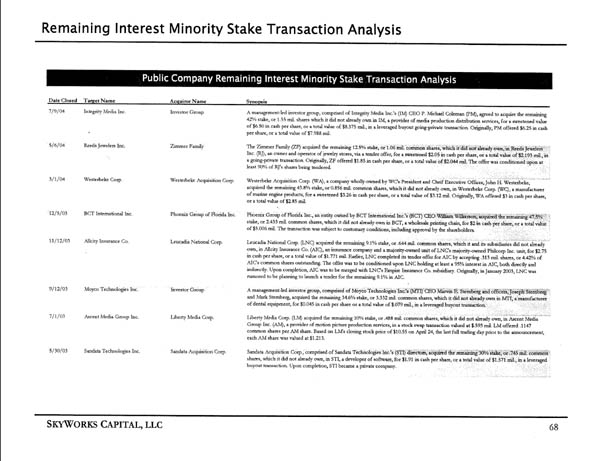

| • | | Reviewed the financial terms, including premiums paid in transactions in which a majority shareholder acquired the remaining minority shares of a public company; |

| | | |

| • | | Considered other recent proposals and offers made to Davel by third parties interested in acquiring the Company or its assets; |

| | | |

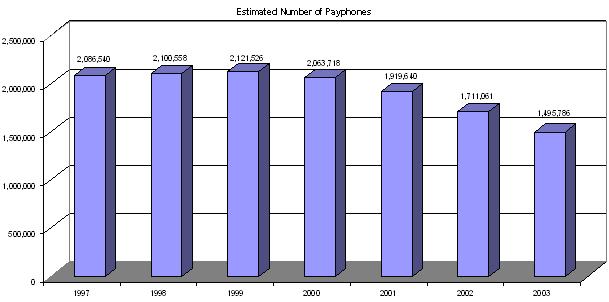

| • | | Considered the economic outlook and outlook of the payphone industry; |

| | | |

| • | | Considered Davel’s liquidity problems and difficulties it faces in funding its operations, to make capital expenditures and to meet its debt service and other obligations; |

| | | |

| • | | Considered the going concern opinion made by Davel’s auditor, Aidman Piser & Company, P.A., in its Report of Independent Certified Public Accountants for the fiscal year ended December 31, 2003; and |

| | | |

| • | | Considered such other information, financial studies, analyses, and investigations of financial, economic and market criteria Skyworks deemed relevant. |

Skyworks held discussions with members of the senior management regarding the foregoing. In addition, Skyworks considered other matters and performed such research, inquiries and analysis that it deemed relevant in rendering the Skyworks Opinion.

In rendering the Skyworks’ Opinion, Skyworks assumed and relied upon, with the consent of the Board and without independent verification, the accuracy and completeness of all the information provided to it by Davel and other third parties, including, without limitation, the projections. Skyworks was advised by the senior management of Davel that the projections had been reasonably prepared on bases reflecting the best available estimates and judgments of the senior management of the Company at the time they were prepared. In that regard, Skyworks assumed, with the consent of the Board of Directors, that the projections will be achieved and that all material assets and liabilities (contingent or otherwise) of the Company are as set forth in the Company’s financial statements or other information made available to Skyworks. Skyworks expressed no opinion or any form of assurance with respect to the projections or any of the underlying data utilized in its analyses.

Skyworks did not make or obtain an independent valuation or appraisal of the assets, liabilities or solvency of the Company. Furthermore, Skyworks’ Opinion does not in any way address the Reverse Stock Split or its merits as compared to any alternative business strategies that might exist for the Company or the effect of any other transaction in which the Company might engage. Skyworks assumed without verification the accuracy and adequacy of the legal advice given by counsel to the Company and by counsel to the Board of Directors on all legal matters.

Skyworks did not express any opinion as to the price at which the Company’s Common Stock would trade at any future time. Those trading prices could be affected by a number of factors, including but not limited to:

| • | | changes in the prevailing interest rates and other factors that generally influence the price of securities; |

| | | |

| • | | adverse changes in the current capital markets; |

| | | |

| • | | the occurrence of adverse changes in the financial condition, business, assets, results of operations or prospects of the Company or in the product markets it serves; |

| | | |

| • | | any necessary actions by or restrictions of federal, state or other governmental agencies or regulatory authorities; and |

| | | |

| • | | timely completion of the Reverse Stock Split on the terms and conditions that are acceptable to all parties at interest. |

Skyworks’ Opinion was based upon economic, market, financial and other conditions existing on, and other information disclosed to Skyworks as of the date of the Skyworks’ Opinion. Although subsequent developments may affect its opinion, Skyworks does not have any obligation to update, revise or reaffirm its opinion.

The following is a summary of certain quantitative analyses performed and material factors considered by Skyworks to arrive at the Skyworks’ Opinion. Skyworks performed certain procedures, including each of the financial analyses described below, and reviewed with the Board the assumptions upon which such analyses were based, as well as other factors. The summary does not purport to describe all of the analyses performed or factors considered by Skyworks in this regard.

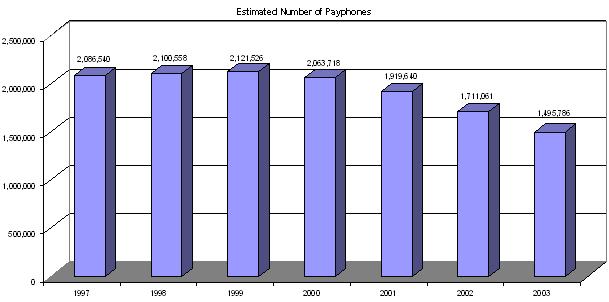

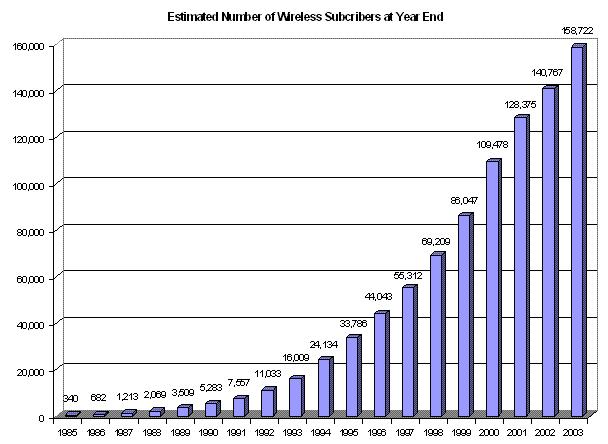

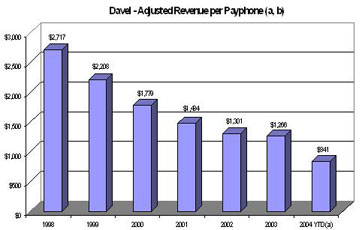

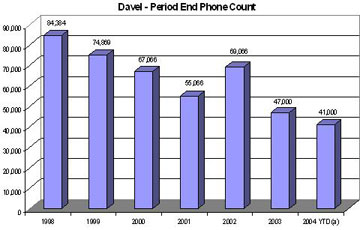

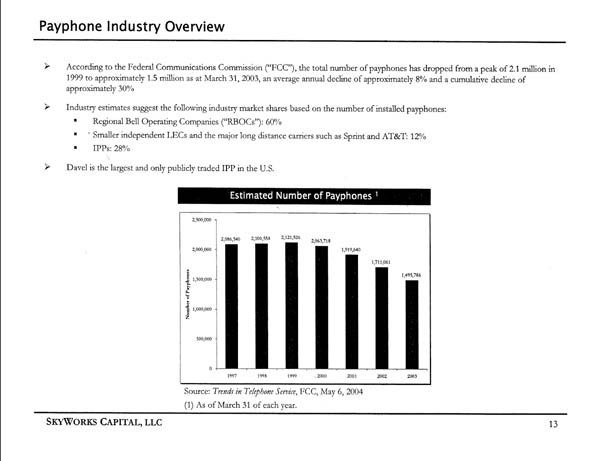

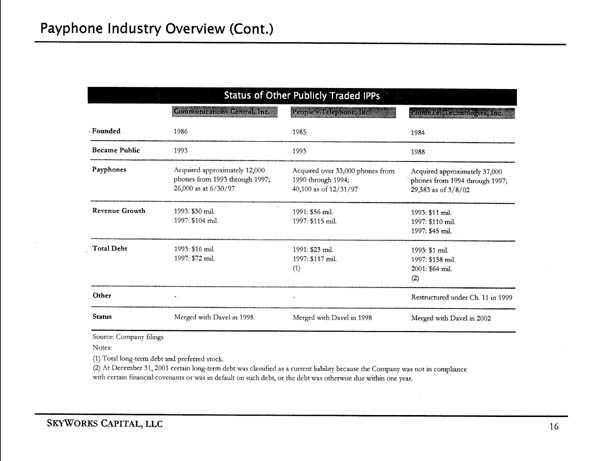

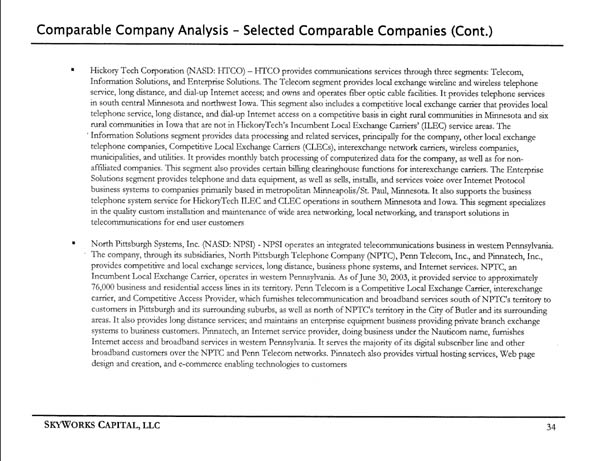

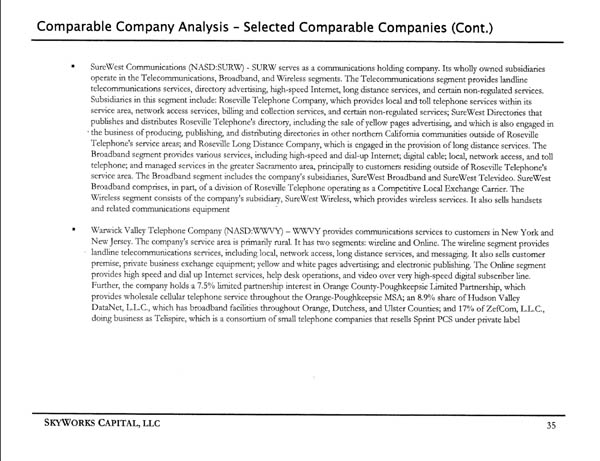

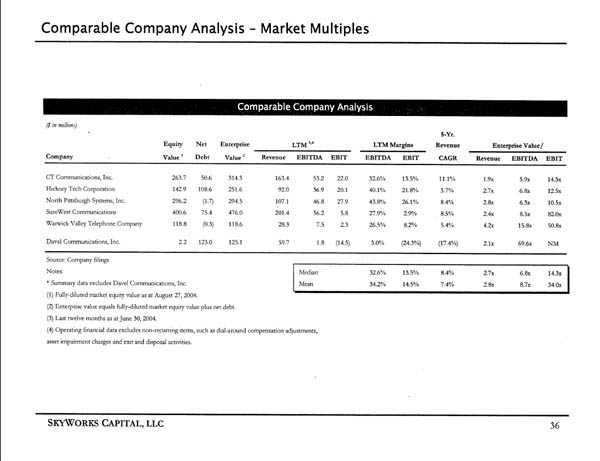

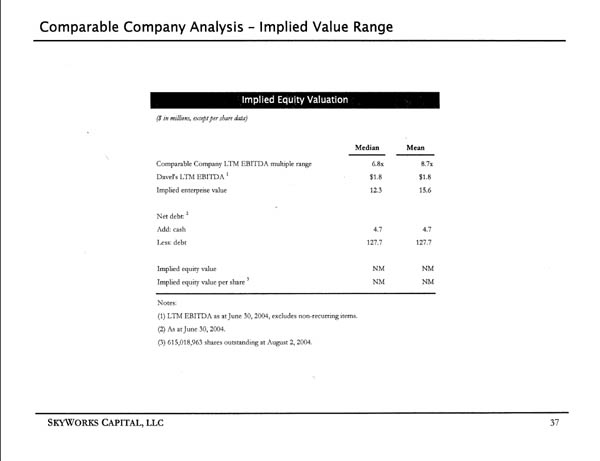

Comparable Public Company Analysis