Filed pursuant to Rule 424(b)(3)

Registration No. 333-125430

| | |

DAIICHI PHARMACEUTICAL CO., LTD. | | SANKYO COMPANY, LIMITED |

| |

| |  |

Joint Share Transfer of Shares of Daiichi Pharmaceutical Co., Ltd. and

Sankyo Company, Limited for Shares of Daiichi Sankyo Company, Limited

The boards of directors of Daiichi Pharmaceutical Co., Ltd. and Sankyo Company, Limited have agreed to a joint share transfer (kyoudo-kabushiki iten) under the Commercial Code of Japan pursuant to which all of the shares of Daiichi and Sankyo will be exchanged for shares of Daiichi Sankyo Company, Limited. On May 13, 2005, the two companies entered into a joint share transfer agreement setting forth the exchange ratio and other terms of the transaction. In the joint share transfer, Daiichi’s shareholders will receive 1.159 shares of Daiichi Sankyo common stock for each share of Daiichi common stock and Sankyo’s shareholders will receive one share of Daiichi Sankyo common stock for each share of Sankyo common stock. As a result, former shareholders of Daiichi will hold approximately 42.0% and former shareholders of Sankyo will hold approximately 58.0% of the outstanding common stock of Daiichi Sankyo after the joint share transfer. In addition, shareholders of Daiichi will receive ¥25 in cash per share of Daiichi and shareholders of Sankyo will receive ¥25 in cash per share of Sankyo from Daiichi Sankyo in the joint share transfer. Daiichi and Sankyo expect that, upon the closing of the transaction, the shares of Daiichi Sankyo will be listed on the First Sections of the Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange. The joint share transfer is subject to approval of the terms of the joint share transfer at each of the two companies’ general meetings of shareholders. Under the current schedule, the joint share transfer, if approved, will become effective on or around September 28, 2005.

The dates, times and places of the general meetings of shareholders are as follows:

| | |

For Daiichi shareholders: June 29, 2005 at 10:00 a.m. Daiichi Pharmaceutical Co., Ltd. Head Office 14-10, Nihonbashi 3-chome Chuo-ku, Tokyo 103-8234 Japan | | For Sankyo shareholders: June 29, 2005 at 10:00 a.m. Sankyo Company, Limited Head Office 5-1, Nihonbashi Honcho 3-chome Chuo-ku, Tokyo 103-8426 Japan |

With respect to each company, shareholders of record of such company as of March 31, 2005 will be entitled to vote at that company’s general meeting. To attend and vote at the general meetings, shareholders of each of Daiichi and Sankyo must follow the procedures outlined in the convocation notice and the mail-in-ballot material which each of the companies will distribute to them.

The joint share transfer can only be completed if the terms of the joint share transfer are approved by the shareholders of each of Daiichi and Sankyo and several other conditions are satisfied. The additional conditions and other terms of the joint share transfer are more fully described in this prospectus. For a discussion of these conditions, please see “The Joint Share Transfer Agreement”.

This prospectus has been prepared for shareholders of Daiichi and Sankyo resident in the United States to provide them with detailed information in connection with the joint share transfer. It also provides important information about the shares of Daiichi Sankyo to be issued and delivered to such shareholders in connection with the joint share transfer. You are encouraged to read this prospectus in its entirety.

You should carefully consider therisk factors beginning on page 13 of this prospectus.

NEITHER DAIICHI NOR SANKYO IS ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in connection with the joint share transfer or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated June 6, 2005.

REFERENCE TO ADDITIONAL INFORMATION

Neither Daiichi nor Sankyo has previously had a reporting obligation in the United States under the Securities Exchange Act of 1934. Following the date of this prospectus until the completion of the joint share transfer, Daiichi and Sankyo will be, and after the joint share transfer, Daiichi Sankyo will be subject to reporting obligations and any filings they make will be available via the website of the United States Securities and Exchange Commission, or SEC, atwww.sec.gov. You can also obtain any filed documents or other information which may be incorporated by reference herein regarding Daiichi or Sankyo without charge by written or oral request to:

| | |

Daiichi Pharmaceutical Co., Ltd. Corporate Communications Department 14-10, Nihonbashi 3-chome Chuo-ku, Tokyo 103-8234 Japan Telephone: (81-3) 3273-7107 | | Sankyo Company, Limited Corporate Communications Department 5-1, Nihonbashi Honcho 3-chome Chuo-ku, Tokyo 103-8426 Japan Telephone: (81-3) 5255-7034 |

Please note that copies of documents provided to you will not include exhibits, unless the exhibits are specifically incorporated by reference into the documents or this prospectus.

In order to receive timely delivery of requested documents in advance of the general meetings of the companies, you should make your request no later than June 22, 2005, which is five business days before you must make a decision regarding the joint share transfer.

See “Where You Can Find More Information” on page 201.

TABLE OF CONTENTS

| | | | |

Appendix A | | – | | English Translation of Joint Share Transfer Agreement |

Appendix B | | – | | English Translation of Fairness Opinion Delivered by Merrill Lynch Japan Securities Co., Ltd. |

Appendix C | | – | | English Translation of Fairness Opinion Delivered by Nomura Securities Co., Ltd. |

Appendix D | | – | | Press Release of Daiichi, dated April 27, 2005, announcing its unaudited Japanese GAAP results for the fiscal year ended March 31, 2005 |

Appendix E | | – | | Unaudited Reverse Reconciliation of Selected Financial Information of Daiichi |

Appendix F | | – | | Press Release of Sankyo, dated May 13, 2005, announcing its unaudited Japanese GAAP results for the fiscal year ended March 31, 2005 |

Appendix G | | – | | Unaudited Reverse Reconciliation of Selected Financial Information of Sankyo |

Appendix H | | – | | English translation of Articles 371, 355, 245-3 and 245-4 of the Commercial Code of Japan |

i

(This page is intentionally left blank)

ii

QUESTIONS AND ANSWERS ABOUT THE JOINT SHARE TRANSFER AND VOTING PROCEDURES FOR THE GENERAL MEETINGS

| Q1: | What am I being asked to vote on? |

| A1: | You are being asked to vote to approve the terms of a joint share transfer between Daiichi and Sankyo. |

| Q2: | What will I receive in the joint share transfer? |

| A2: | In the transaction, each share of Daiichi common stock will be exchanged for 1.159 shares of Daiichi Sankyo common stock and each share of Sankyo common stock will be exchanged for one share of Daiichi Sankyo common stock. The ratio at which each share of Daiichi or Sankyo common stock will be exchanged for shares of Daiichi Sankyo common stock is referred to as the exchange ratio. |

| | Neither shareholders of Daiichi nor Sankyo will receive any fractional shares of Daiichi Sankyo common stock in the joint share transfer. Instead, the shares representing the aggregate of all such fractional shares will be sold in the Japanese market or sold to Daiichi Sankyo itself and the net cash proceeds from the sale will be distributed to the former holders of Daiichi and Sankyo fractional shares on a proportionate basis, with any fractional yen amounts to be rounded up. |

| | In addition, in the joint share transfer, shareholders of Daiichi will receive ¥25 in cash per share of Daiichi and shareholders of Sankyo will receive ¥25 in cash per share of Sankyo from Daiichi Sankyo as a substitute for interim dividends otherwise payable by each of Daiichi and Sankyo. Instead of paying its interim dividends for the six-month period ending September 30, 2005 directly to the former shareholders of Daiichi and Sankyo, each of Daiichi and Sankyo will pay such interim dividends to Daiichi Sankyo, which will be the sole holder of record of Daiichi and Sankyo common stock as of September 30, 2005, subsequent to the closing of the joint share transfer. |

| Q3: | How will such shareholders of Daiichi and Sankyo that will hold fewer than 100 shares, or a “unit”, of Daiichi Sankyo shares be treated after the joint share transfer? |

| A3: | In its proposed articles of incorporation, Daiichi Sankyo will provide that 100 shares of its common stock will constitute one unit. Some holders of Daiichi or Sankyo shares may receive less than a unit of Daiichi Sankyo shares upon the joint share transfer. Stock certificates of shares constituting less than one unit will not be issued, but holders of such shares will be registered in Daiichi Sankyo’s register of shareholders. Any shares held by a holder with less than a unit of shares will not carry voting rights. A holder of less than a unit of Daiichi Sankyo shares may request Daiichi Sankyo to purchase such shares at their market value. In addition, Daiichi Sankyo’ articles of incorporation will provide that a holder of less than a unit of Daiichi Sankyo shares may request that Daiichi Sankyo sell to such holder such amount of shares which will, when added together with the shares constituting less than one unit, constitute one unit of shares, as long as Daiichi Sankyo has treasury stock to sell upon such request. |

| Q4: | How does the Daiichi board of directors recommend that Daiichi shareholders vote? |

| A4: | The Daiichi board of directors unanimously recommends approval of the terms of the joint share transfer. |

| Q5: | How does the Sankyo board of directors recommend that Sankyo shareholders vote? |

| A5: | The Sankyo board of directors unanimously recommends approval of the terms of the joint share transfer. |

| Q6: | What vote of Daiichi shareholders and what vote of Sankyo shareholders is required in connection with the transaction? |

| A6: | The affirmative vote of the holders of at least two-thirds of the voting rights of each |

1

| | of Daiichi and Sankyo represented at the relevant general meeting of shareholders at which shareholders holding at least one-third of the total voting rights are present is required to approve the terms of the joint share transfer. With respect to each company, 100 shares constitute one voting right. Holders of Daiichi and Sankyo shares as of March 31, 2005 will be eligible to vote at the relevant annual general meeting of shareholders. |

| | Daiichi intends to vote the approximately 0.61% of the outstanding shares of Sankyo it owns in favor of the transaction. Sankyo also intends to vote the approximately 1.07% of the outstanding shares of Daiichi it owns in favor of the transaction. |

| Q7: | What is the structure of the transaction? |

| A7: | In the transaction, all of the issued and outstanding shares of common stock of each of Daiichi and Sankyo will be exchanged for shares of Daiichi Sankyo common stock at the exchange ratio described in Q2 above. Daiichi and Sankyo expect that, upon the closing of the transaction, the shares of Daiichi Sankyo will be listed on the First Sections of the Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange. The former shareholders of Daiichi and Sankyo will be shareholders of Daiichi Sankyo, and each of Daiichi and Sankyo will be wholly-owned subsidiaries of Daiichi Sankyo. See “The Joint Share Transfer—General” beginning on page 48. |

| Q8: | Can the number of shares of Daiichi Sankyo common stock for which the shares of Daiichi or Sankyo common stock are exchanged change between now and the time the transaction is completed? |

| A8: | No. The exchange ratios are fixed and will not change even if the trading price of either the Daiichi or Sankyo common stock changes between now and the time the joint share transfer is completed. See “Risk Factors” beginning on page 13. |

| Q9: | How much of Daiichi Sankyo will Daiichi shareholders own? How much of Daiichi Sankyo will Sankyo shareholders own? |

| A9: | After the transaction, Daiichi shareholders will own approximately 42.0% and Sankyo shareholders will own approximately 58.0% of the shares of Daiichi Sankyo common stock (based on shares outstanding as of March 31, 2005). |

| Q10: | What are the Japanese tax consequences of the joint share transfer? |

| A10: | In the opinion of Nagashima Ohno & Tsunematsu, Japanese counsel to Daiichi on Japanese tax matters, and Mori Hamada & Matsumoto, Japanese counsel to Sankyo on Japanese tax matters, each of which is based on representations made by Daiichi and Sankyo and customary factual assumptions and subject to certain qualifications, the joint share transfer as contemplated herein will be a tax-free transaction for Japanese tax purposes, except with respect to any cash received from Daiichi Sankyo as a substitute for interim dividends and any cash received instead of fractional shares of Daiichi Sankyo common stock. Subject to such exceptions, Daiichi and Sankyo expect that a non-resident holder of either of their shares will recognize no gain for Japanese tax purposes upon the holder’s exchange of its shares for shares of Daiichi Sankyo common stock. See “Taxation – Japanese Tax Consequences” beginning on page 189. Each non-resident holder should, however, obtain advice of its own tax advisers for its tax status in each jurisdiction. |

| Q11: | What are the U.S. tax consequences of the joint share transfer? |

| A11: | The proper U.S. federal income tax treatment of the joint share transfer is uncertain. Unless Daiichi Sankyo notifies U.S. holders of Daiichi or Sankyo shares otherwise, it intends to take the position that the joint share transfer will be treated as a taxable exchange for U.S. federal income tax purposes. According to this position, a |

2

| | U.S. holder will generally recognize taxable gain or loss measured by the difference between (i) the sum of (A) the fair market value (in U.S. dollars) of the Daiichi Sankyo shares received in exchange for Daiichi or Sankyo shares and (B) the amount of cash received in the joint share transfer and (ii) the tax basis of the Daiichi or Sankyo shares exchanged. Daiichi Sankyo undertakes, as soon as practicable after the form of the subsequent combination of Daiichi’s and Sankyo’s operations is chosen, to notify U.S. holders of Sankyo or Daiichi shares who participate in the joint share transfer whether the joint share transfer and the subsequent business combination, viewed as an integrated transaction, qualify as a tax-free “reorganization” with respect to Sankyo shareholders and (separately) with respect to Daiichi shareholders. However, such notification may not be made until shortly before the date of the subsequent integration of the prescription pharmaceutical operations of the companies as currently contemplated. Each U.S. shareholder of Daiichi or Sankyo is strongly urged to consult its own tax advisor concerning the U.S. federal income tax consequences of the transaction. See “Taxation—United States Tax Consequences” beginning on page 192. |

| Q12: | When do you expect the joint share transfer to be completed? |

| A12: | Daiichi and Sankyo expect to complete the joint share transfer promptly after the companies receive approval of each of their shareholders at their annual general meeting of shareholders and after the companies follow the procedures required by the Commercial Code of Japan and receive all required regulatory approvals. The companies currently anticipate closing on or around September 28, 2005. However, it is possible that factors outside the control of Daiichi and Sankyo could require Daiichi and Sankyo to complete the joint share transfer at a later time or not complete it at all. See “The Joint Share Transfer—Regulatory Matters” beginning on page 74. |

| Q13: | If I own Daiichi or Sankyo shares, how do I vote at that company’s general meeting of shareholders? |

| A13: | If you have 100 or more shares of Daiichi or Sankyo common stock, you will have a voting right with respect to each such unit of 100 shares of common stock. You may exercise voting rights by attending the general meeting of shareholders of the relevant company in person or by arranging to return the voting card distributed to you by that company. Completed voting cards must be received by the relevant company at least one day before the meeting. For this purpose, if you are not residing in Japan, you are encouraged to contact your standing proxy in Japan. |

| | Each of Daiichi and Sankyo will distribute voting materials, including a mail-in voting card, to shareholders resident in Japan that will enable them to exercise their voting rights. For shareholders not resident in Japan, each of Daiichi and Sankyo will distribute voting materials to their standing proxies in Japan. Therefore, if you are a non-resident shareholder, you are encouraged to contact your standing proxy in Japan. |

| Q14: | How will shares represented by mail-in voting cards at the general meetings of shareholders be treated? |

| A14: | The voting cards used for the general meetings of shareholders will list the proposals to be voted on by shareholders at the general meetings, including approval of the terms of the joint share transfer. The voting cards will allow shareholders to indicate a “for” or “against” vote with respect to each proposal. In accordance with Japanese law and practice, each of Daiichi and Sankyo intends to count towards the quorum requirements for its general meeting of shareholders the shares represented by voting cards that are returned without indicating a “for” or “against” vote for any of the proposals, and count these voting cards as having voted “for” approval of the terms of the joint share transfer and the other proposals referred to in the voting cards. |

3

| Q15: | May I change my vote after I have submitted a mail-in voting card? |

| A15: | Yes. If you want to change your previously returned voting card, you must attend the general meeting of shareholders personally or through another shareholder having voting rights, whom you appoint as your attorney-in-fact. By attending the meeting in person or having another shareholder entitled to vote your shares attend the meeting on your behalf, you will automatically revoke your mail-in voting card. |

| Q16: | If my shares are held in “street name” by my broker, will my broker vote them for me without instructions? |

| A16: | Whether your broker will vote your shares without your instructions depends on the terms and conditions of the agreement entered into by you and your broker. Therefore, you are encouraged to contact your broker directly to confirm the applicable voting procedure. |

| Q17: | Should I send in my share certificates now? |

| A17: | No. After the terms of the joint share transfer are approved at the general meetings of shareholders of Daiichi and Sankyo, your standing proxy in Japan will, on your behalf, receive written instructions from an exchange agent on how to exchange your Daiichi or Sankyo share certificates for Daiichi Sankyo share certificates. Please do not send your share certificates until your standing proxy in Japan contacts you. |

| Q18: | What if I cannot find my share certificate? |

| A18: | There will be a procedure for you to receive Daiichi Sankyo share certificates in the joint share transfer, even if you have lost one or more of your Daiichi or Sankyo share certificates. This procedure, however, may take time to complete. In order to ensure that you will be able to receive your Daiichi Sankyo share certificates quickly after thejoint share transfer is completed, if you cannot locate your share certificates after looking for them carefully, Daiichi urges its shareholders to contact Mizuho Trust & Banking Co., Ltd. at 2-1, Yaesu 1-chome, Chuo-ku, Tokyo 103-0028, Japan and Sankyo urges its shareholders to contact UFJ Trust Bank Limited at 4-3, Marunouchi, 1-chome, Chiyoda-ku, Tokyo 100-0005, Japan as soon as possible and follow the procedure for replacing your share certificates. |

| Q19: | How will trading in Daiichi and Sankyo shares be affected in connection with the completion of the joint share transfer? |

| A19: | Under the current schedule, Daiichi shares will be delisted from the Tokyo Stock Exchange and the Osaka Securities Exchange and Sankyo shares will be delisted from those exchanges and also from the Nagoya Stock Exchange, the Sapporo Securities Exchange and the Fukuoka Stock Exchange on or around September 21, 2005. The companies plan to take steps in order to list the shares of Daiichi Sankyo on the First Sections of the Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange upon the closing of the transaction. |

| Q20: | Will Daiichi and Sankyo shareholders receive dividends on common stock for the year ended March 31, 2005? |

| A20: | Each of Daiichi and Sankyo expects to pay dividends in late July or early August 2005 to holders of record of its common stock as of March 31, 2005, subject to approval at the annual general meetings of shareholders in June 2005. |

| Q21: | Will I receive interim dividends for the six-month period ending September 30, 2005? |

| A21: | You will not receive interim dividends from Daiichi or Sankyo for the six-month period ending September 30, 2005. Instead, you |

4

| | will receive from Daiichi Sankyo in the joint share transfer a payment of ¥25 in cash per share of Daiichi if you are a Daiichi shareholder and ¥25 in cash per share of Sankyo if you are a Sankyo shareholder. The payment in each case is a substitute for interim dividends otherwise payable by each of Daiichi and Sankyo, respectively. Instead of paying its interim dividends for the six-month period ending September 30, 2005 directly to the former shareholders of Daiichi and Sankyo, each of Daiichi and Sankyo will pay such interim dividends to Daiichi Sankyo, which will be the sole holder of record of Daiichi and Sankyo common stock as of September 30, 2005, subsequent to the closing of the joint share transfer. |

| Q22: | How do the legal rights of Daiichi and Sankyo shares differ from those of Daiichi Sankyo shares? |

| A22: | There is no material difference between the legal rights of holders of Daiichi and Sankyo shares and the proposed legal rights of holders of Daiichi Sankyo shares. |

| Q23: | Who can help answer my questions? |

| A23: | For Daiichi shareholders, if you have questions about the joint share transfer, you should contact: |

Mr. Toshio Takahashi

Corporate Communications Department

Daiichi Pharmaceutical Co., Ltd.

14-10, Nihonbashi 3-chome

Chuo-ku, Tokyo 103-8234

Japan

Telephone: (81-3) 3273-7107

For Sankyo shareholders, if you have questions about the joint share transfer, you should contact:

Mr. Shigemichi Kondo

Corporate Communications Department

Sankyo Company, Limited

5-1, Nihonbashi Honcho 3-chome

Chuo-ku, Tokyo 103-8426

Japan

Telephone: (81-3) 5255-7034

5

SUMMARY

This summary highlights selected information from this prospectus. It does not contain all of the information that may be important to you. You should carefully read this entire prospectus and the other documents to which this document refers for a more complete understanding of the joint share transfer being considered at the general meetings of Daiichi and Sankyo shareholders.

| | |

| The Companies |

| |

Daiichi Pharmaceutical Co., Ltd. 14-10, Nihonbashi 3-chome Chuo-ku, Tokyo 103-8234 Japan (81-3) 3272-0611 | | Sankyo Company, Limited 5-1, Nihonbashi Honcho 3-chome Chuo-ku, Tokyo 103-8426 Japan (81-3) 5255-7111 |

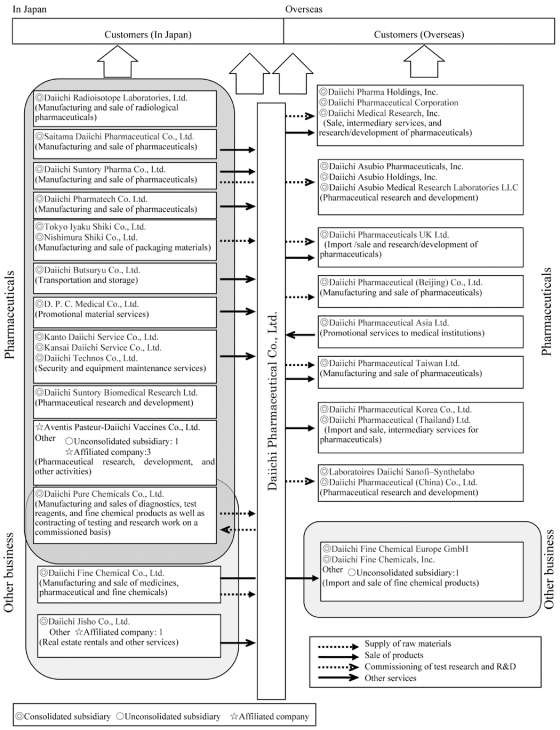

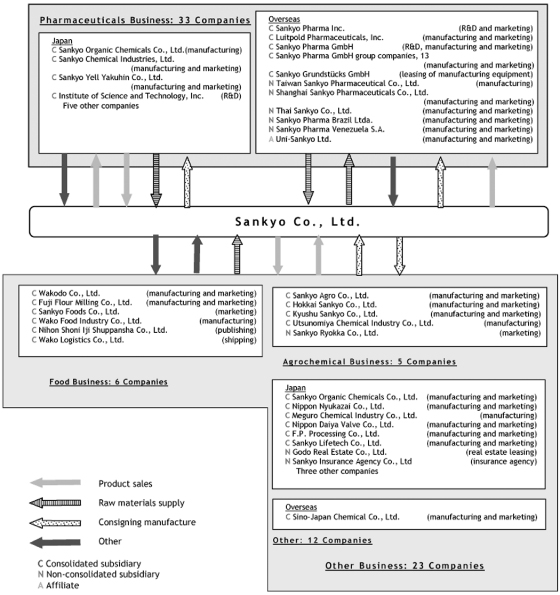

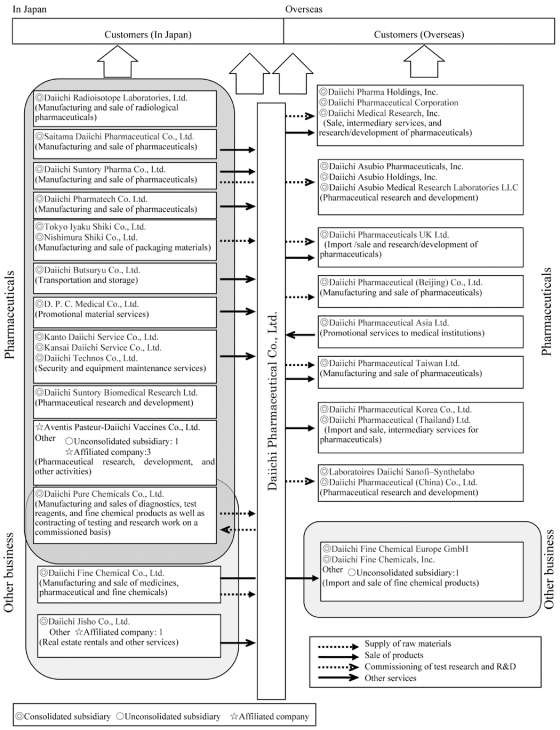

Daiichi and Sankyo are two of the largest pharmaceutical companies in Japan. According to a survey published by the Japan Pharmaceutical Manufacturers Association, for the six months ended September 30, 2004, Sankyo was the second largest Japanese pharmaceutical company and Daiichi was the sixth largest Japanese pharmaceutical company in terms of consolidated net sales in Japan. Each of Daiichi and Sankyo offers, by itself or through subsidiaries or licensees, a broad range of pharmaceutical and other products.

Daiichi is headquartered in Tokyo, Japan at the above address and, as of March 31, 2005, operated in Japan, the United States, Europe and other parts of the world. Daiichi’s main areas of research include infectious diseases, cardiovascular disorders, cancer, and asthma and allergies. For the six months ended September 30, 2004, Daiichi had net sales of ¥157.8 billion and net income of ¥16.1 billion. For the fiscal year ended March 31, 2004, Daiichi had net sales of ¥323.0 billion and net income of ¥30.7 billion.

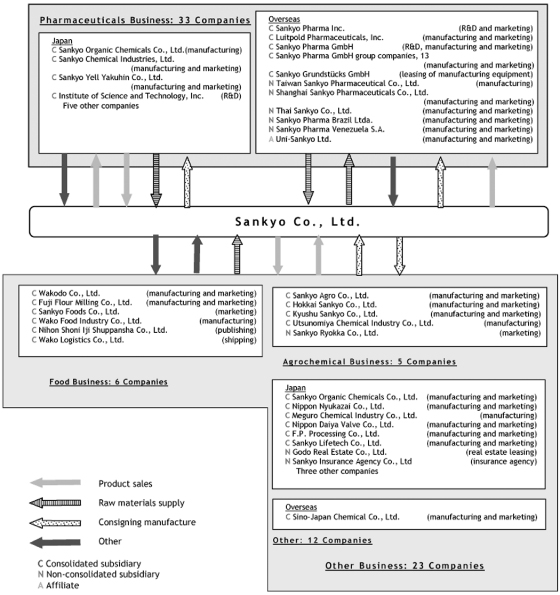

Sankyo is headquartered in Tokyo, Japan at the above address and, as of March 31, 2005, operated in Japan, the United States, Europe and other countries and territories worldwide. Sankyo’s main areas of research include cardiovascular diseases, glucose metabolic disorders, immune/allergic disorders, bone/articular disorders, cancer and infectious diseases. Sankyo has a particular focus on the treatment of lifestyle-related diseases such as hyperlipidemia, hypertension and diabetes. For the six months ended September 30, 2004, Sankyo had net revenue of ¥294.1 billion and net income of ¥38.8 billion. For the fiscal year ended March 31, 2004, Sankyo had net revenue of ¥601.3 billion and net income of ¥38.2 billion.

The Joint Share Transfer

(page 48)

In the joint share transfer, each share of Daiichi common stock will be exchanged for 1.159 shares of common stock of Daiichi Sankyo, and each share of Sankyo common stock will be exchanged for one share of common stock of Daiichi Sankyo. As a result of the joint share transfer, each of Daiichi and Sankyo will be a wholly-owned subsidiary of Daiichi Sankyo, and the shareholders of each of Daiichi and Sankyo will be the shareholders of Daiichi Sankyo in proportion to the applicable exchange ratios.

Shareholders of Daiichi and Sankyo will not receive any fractional shares of common stock of Daiichi Sankyo in the joint share transfer. Instead, the shares representing the aggregate of all such fractional shares will be sold in the Japanese market or sold to Daiichi Sankyo itself and the net cash proceeds from the sale will be distributed to the former holders of Daiichi and Sankyo fractional shares on a proportionate basis, with any fractional yen amounts to be rounded up.

In addition, in the joint share transfer, shareholders of Daiichi will receive ¥25 in cash per share of Daiichi and shareholders of Sankyo will receive ¥25 in cash per share of Sankyo from Daiichi Sankyo as a substitute for

6

interim dividends otherwise payable by each of Daiichi and Sankyo. Instead of paying its interim dividends for the six-month period ending September 30, 2005 directly to the former shareholders of Daiichi and Sankyo, each of Daiichi and Sankyo will pay such interim dividends to Daiichi Sankyo, which will be the sole holder of record of Daiichi and Sankyo common stock as of September 30, 2005, subsequent to the closing of the joint share transfer.

Reasons for the Joint Share Transfer

(page 50)

Daiichi and Sankyo are conducting the joint share transfer, and combining their management under a single holding company, Daiichi Sankyo, in an effort to realize the potential synergies available from integrating their pharmaceutical businesses. The pharmaceutical industry, both within Japan and globally, is in a period of consolidation. Daiichi and Sankyo believe a combined entity will enjoy significant advantages over their independent operations, in particular:

| | • | | greater potential to introduce major new products due to the complementary nature of the companies’ existing development pipelines and combined annual R&D expenditures of over ¥150 billion; |

| | • | | the critical mass necessary to enhance sales of existing products in Japan as well as to develop and market pharmaceutical products in key global markets; |

| | • | | expanded ability to pursue strategic options through acquisitions or other partnerships or collaborations resulting from the combined entity’s financial position and strength in the Japanese market; and |

| | • | | greater efficiency through the combination of existing operations, targeting annual cost savings of approximately ¥50 billion in the year ending March 31, 2008, primarily in domestic pharmaceutical operations, and the eventual disposal of non-pharmaceutical operations, any gains from which would be used to offset integration expenses. |

Daiichi and Sankyo believe the joint share transfer will improve their joint prospects for long-term growth and profitability in the increasingly competitive pharmaceutical industry and believe that this will in turn deliver greater returns to their shareholders.

Ongoing Challenges

Although the companies believe the proposed business combination will be beneficial, the pharmaceutical industry is highly competitive and Daiichi Sankyo will continue to face significant ongoing challenges, including:

| | • | | the planned lengthy integration process, expected to culminate in the merger of the two subsidiary companies into Daiichi Sankyo in or around April 2007, may divert management’s focus from other matters and there can be no assurance that targeted operational efficiencies will be achieved; |

| | • | | the combined entity will still be significantly smaller than the largest global pharmaceutical companies, which have a greater number of products, greater financial resources and more geographically diverse operations; |

| | • | | the combined entity may not be successful in expanding the direct development of new products in markets outside of Japan; and |

| | • | | an expected decrease in combined revenue in the near term due to the planned disposal of non-pharmaceutical operations and a potential negative impact of up to approximately ¥16 billion on operating income in the year ending March 31, 2008 attributable to cannibalization due to competing products and the potential loss of licensing rights. |

7

The companies also believe the integration process will result in aggregate one-time costs of approximately ¥118 billion, most of which will be incurred prior to March 31, 2007 and consisting primarily of personnel-related items such as retirement incentive payments. You are also urged to consider carefully the matters described in the “Risk Factors” section of this prospectus in evaluating the benefits of the proposed joint share transfer and the business strategy of Daiichi Sankyo.

The Annual General Meetings of Shareholders

(page 42 and page 45)

When and Where. The Daiichi general meeting of shareholders will be held at 10:00 a.m., local time, on June 29, 2005 at Daiichi’s head office, 14-10, Nihonbashi 3-chome, Chuo-ku, Tokyo 103-8234, Japan, unless it is postponed or adjourned. The Sankyo general meeting of shareholders will be held at 10:00 a.m., local time, on June 29, 2005 at Sankyo’s head office, 5-1, Nihonbashi Honcho 3-chome, Chuo-ku, Tokyo 103-8426, Japan, unless it is postponed or adjourned.

Record Date; Voting Power. With respect to each company, shareholders of record of such company as of March 31, 2005 will be entitled to vote at that company’s meeting. To attend and vote at the respective shareholders’ meetings, shareholders of Daiichi and Sankyo must follow the procedures outlined in the convocation notice and the mail-in-ballot material which the companies will distribute to them. With respect to both Daiichi and Sankyo, shareholders who own at least 100 shares of such company’s common stock will have a voting right with respect to each such 100 shares of common stock.

Required Vote. The affirmative vote of the holders of at least two-thirds of the voting rights of each of Daiichi and Sankyo represented at the respective general meeting of shareholders is required to approve the terms of the joint share transfer. The quorum required for each of the general meetings is shareholders holding one-third of the total voting rights.

Based on the register of shareholders of Daiichi dated March 31, 2005, and the register of shareholders of Sankyo dated March 31, 2005, which in each case is the record date for determination of shareholders having voting rights at the applicable annual general shareholders’ meetings, approximately 0.07% of the outstanding shares of Daiichi that would be entitled to vote, and 0.04% of the outstanding shares of Sankyo that would be entitled to vote were held directly or indirectly by the directors and corporate auditors of those companies, respectively. The total number of shares outstanding as of that date was 268,404,023 in the case of Daiichi and 429,508,509 in the case of Sankyo.

Recommendation of the Boards of Directors of Daiichi and Sankyo with Respect to the Joint Share Transfer

(page 52 and page 53)

Daiichi Shareholders. The Daiichi board of directors has determined that the terms of the joint share transfer are advisable and in the best interests of Daiichi and its shareholders and unanimously recommends that the Daiichi shareholders vote to approve the joint share transfer.

Sankyo Shareholders. The Sankyo board of directors has determined that the terms of the joint share transfer are advisable and in the best interests of Sankyo and its shareholders and unanimously recommends that the Sankyo shareholders vote to approve the joint share transfer.

Factors Considered by the Boards of Daiichi and Sankyo. In determining whether to approve the joint share transfer, the boards of directors of each of Daiichi and Sankyo consulted with their respective senior managements and legal and financial advisors and considered the respective strategic, financial and other considerations referred to under “The Joint Share Transfer - Reasons for the Joint Share Transfer” beginning on page 50.

8

Material Japanese Income Tax Consequences of the Joint Share Transfer

(page 189)

In the opinion of Nagashima Ohno & Tsunematsu, Japanese counsel to Daiichi on Japanese tax matters, and Mori Hamada & Matsumoto, Japanese counsel to Sankyo on Japanese tax matters, each of which is based on representations made by Daiichi and Sankyo and customary factual assumptions and subject to certain qualifications, the joint share transfer as contemplated herein will be a tax-free transaction for Japanese tax purposes, except with respect to any cash received from Daiichi Sankyo as a substitute for interim dividends and any cash received instead of fractional shares of Daiichi Sankyo common stock. Subject to such exceptions, Daiichi and Sankyo expect that a non-resident holder of either of their shares will recognize no gain for Japanese tax purposes upon the holder’s exchange of its shares for shares of Daiichi Sankyo common stock. Please see “Taxation-Japanese Tax Consequences” for a more detailed description of Japanese taxation matters. Each non-resident holder should, however, obtain advice of its own tax advisers for its tax status in each jurisdiction.

Material United States Federal Income Tax Consequences of the Joint Share Transfer

(page 192)

The proper U.S. federal income tax treatment of the joint share transfer is uncertain. Unless Daiichi Sankyo notifies U.S. holders of Daiichi or Sankyo shares otherwise, it intends to take the position that the joint share transfer will be treated as a taxable exchange for U.S. federal income tax purposes. According to this position, a U.S. holder will generally recognize taxable gain or loss measured by the difference between (i) the sum of (A) the fair market value (in U.S. dollars) of the Daiichi Sankyo shares received in exchange for Daiichi or Sankyo shares and (B) the amount of cash received in the joint share transfer and (ii) the tax basis of the Daiichi or Sankyo shares exchanged. Daiichi Sankyo undertakes, as soon as practicable after the form of the subsequent combination of Daiichi’s and Sankyo’s operations is chosen, to notify U.S. holders of Sankyo or Daiichi shares who participate in the joint share transfer whether the joint share transfer and the subsequent business combination, viewed as an integrated transaction, qualify as a tax-free “reorganization” with respect to Sankyo shareholders and (separately) with respect to Daiichi shareholders. However, such notification may not be made until shortly before the date of the subsequent integration of the prescription pharmaceutical operations of the companies as currently contemplated. Each U.S. shareholder of Daiichi or Sankyo is strongly urged to consult its own tax advisor concerning the U.S. federal income tax consequences of the transaction. See “Taxation—United States Tax Consequences” beginning on page 192.

Accounting Treatment

(page 73)

The joint share transfer will be accounted for by Daiichi Sankyo under the purchase method of accounting in accordance with U.S. GAAP. Based on the Daiichi exchange ratio of 1.159 Daiichi Sankyo shares for each share of common stock of Daiichi and the Sankyo exchange ratio of one Daiichi Sankyo share for each share of Sankyo common stock, as set forth in the joint share transfer agreement, after the closing of the joint share transfer, former Daiichi shareholders will own approximately 42.0% and former Sankyo shareholders will own approximately 58.0% of Daiichi Sankyo. Based on these projected ownership percentages, Sankyo is the accounting acquiror for financial reporting purposes. Under the purchase method of accounting, in accordance with Statement of Financial Accounting Standards No. 141, “Business Combinations”, Sankyo will record the tangible and intangible assets acquired and liabilities of Daiichi assumed at their fair values. Management of Daiichi Sankyo will be required to exercise significant judgments by making estimates and determining underlying assumptions in order to value such assets and liabilities. The fair values used to record each of the tangible and intangible assets and liabilities of Daiichi, and the resulting excess of the purchase price over the fair

9

value of net assets acquired (goodwill) will have a material effect on the financial position and the results of operations of Daiichi Sankyo subsequent to the acquisition. The reported financial condition and results of operations of Daiichi Sankyo to be issued after the closing of the joint share transfer will reflect Daiichi’s balances and results from the date of the acquisition in addition to Sankyo’s balances and results. If a different set of fair values were to be used at the time of the acquisition, Daiichi Sankyo’s results of operations and financial position could differ materially. Following the completion of the joint share transfer, the earnings of Daiichi Sankyo will reflect purchase accounting adjustments, including in-process research and development write-offs and increased amortization and depreciation expense for acquired assets. In accordance with Statement of Financial Accounting Standard No. 142, “Goodwill and Other Intangible Assets”, goodwill will not be subject to amortization for financial reporting purposes but will be evaluated annually for impairment. Subsequent to the acquisition, if a reporting unit to which such goodwill is assigned reports a carrying amount in excess of its estimated fair value, an impairment charge is recognized for any excess of the carrying amount of that goodwill over its implied far value.

Regulatory Approvals

(page 74)

In general, the consummation of the joint share transfer and the establishment of Daiichi Sankyo will not require the approval or clearance of governmental authorities in Japan. In practice, Daiichi and Sankyo expect to consult with the Fair Trade Commission in Japan with regards to antitrust implications of the transaction. The consultation is expected to be completed successfully before the effective date of the joint share transfer. Daiichi Sankyo is also required to give formal notice to the Fair Trade Commission of Japan of the effectiveness of the joint share transfer within 30 days after the effective date thereof.

The Hart-Scott-Rodino Antitrust Improvements Act of 1976, or the HSR Act, prohibits Daiichi and Sankyo from completing the joint share transfer until each of them notifies and furnishes required information to the Antitrust Division of the U.S. Department of Justice and to the U.S. Federal Trade Commission and the required waiting period has expired or been earlier terminated. Daiichi and Sankyo expect to file a pre-transaction notification form under the Hart-Scott-Rodino Antitrust Improvements Act prior to their general meetings of shareholders.

Dissenters’ Rights of Appraisal

(page 74)

Under the Commercial Code of Japan, you may have opposition rights of appraisal in connection with the joint share transfer. Please see “The Joint Share Transfer – Dissenters’ Rights of Appraisal” for a complete discussion of these rights.

Conditions to the Joint Share Transfer

(page 78)

The respective obligations of each of Daiichi and Sankyo to effect the transaction are conditioned upon the satisfaction of the following conditions:

| | • | | Daiichi’s shareholders having approved the terms of the joint share transfer by the requisite vote at the annual general meeting of Daiichi shareholders; |

| | • | | Sankyo’s shareholders having approved the terms of the joint share transfer by the requisite vote at the annual general meeting of Sankyo shareholders; and |

10

| | • | | all regulatory approvals and consents or other requirements necessary to effect the joint share transfer having been obtained or satisfied. |

An English translation of the joint share transfer agreement is attached as Appendix A to this document. Daiichi and Sankyo urge you to read the entire document because it is the legal document governing the joint share transfer.

Termination

(page 78)

Daiichi and Sankyo can mutually agree to terminate the joint share transfer agreement prior to the effective time of the joint share transfer. Also, either party may terminate the joint share transfer agreement at any time prior to the effective time of the joint share transfer without the consent of the other:

| | • | | upon the failure, after negotiation between the parties for a period of 30 days, to agree on a revised exchange ratio upon the discovery or occurrence of any event with respect to the other party which would have a significantly material adverse effect on the exchange ratio agreed in the joint share transfer agreement; |

| | • | | upon the failure of the shareholders of the other party to approve the terms of the joint share transfer at the annual general meeting of shareholders of such party; |

| | • | | if the other party materially breaches any representation or warranty and the breach would have a significantly material adverse effect on the exchange ratio; or |

| | • | | if the other party breaches any provision of the agreement and such breach is material, when such breach has not been remedied within two weeks after notification to the breaching party of such breach by the non-breaching party. |

The joint share transfer agreement may be terminated by either party if the joint share transfer shall not have taken effect by March 31, 2006 as a result of the failure of the parties, acting in good faith, to resolve any problems which may arise related to the completion of the joint share transfer under the anti-monopoly laws of Japan or other anti-trust laws of any applicable country after good faith consultation with regard to measures to resolve such problems.

Comparative Per Share Market Price Data

(page 39)

The shares of Daiichi common stock are listed on the First Sections of the Tokyo Stock Exchange and the Osaka Securities Exchange. The shares of Sankyo common stock are listed on the First Sections of the Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange, and on the Sapporo Securities Exchange and the Fukuoka Stock Exchange. The companies plan to take steps in order to list the shares of Daiichi Sankyo on the First Sections of the Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange upon the closing of the transaction. The following table sets forth the closing sale prices of Daiichi and Sankyo common stock as reported on the First Section of the Tokyo Stock Exchange on February 25, 2005, the last trading day before the public announcement of the joint share transfer by Daiichi and Sankyo,

11

and June 3, 2005, the last practicable trading day before the distribution of this prospectus. The table also sets forth the implied equivalent value on these dates. Daiichi and Sankyo urge you to obtain current market quotations for both the Daiichi and Sankyo common stock.

| | | | | | | | | | | | |

| | | Daiichi Common Stock

| | Sankyo Common Stock

|

| | | (historical)

| | (implied

equivalent

value) (1)

| | (historical)

| | (implied

equivalent

value) (2)

|

At February 25, 2005 | | ¥ | 2,485 | | ¥ | 2,839.55 | | ¥ | 2,450 | | ¥ | 2,450 |

At June 3, 2005 | | | 2,445 | | | 2,834 | | | 2,175 | | | 2,175 |

| | (1) | The implied equivalent value per share of Daiichi is calculated by multiplying the closing price of Sankyo common stock on the Tokyo Stock Exchange by the Daiichi exchange ratio of 1.159:1. |

| | (2) | The implied equivalent value per share of Sankyo is calculated by multiplying the closing price of Sankyo common stock on the Tokyo Stock Exchange by the Sankyo exchange ratio of 1:1. |

Each of Daiichi and Sankyo may from time to time repurchase shares of its common stock. Purchases will be made subject to market circumstances and applicable regulatory requirements.

As used in this prospectus, references to “Daiichi” are to Daiichi Pharmaceutical Co., Ltd. and references to “Sankyo” are to Sankyo Company, Limited. References to the “joint share transfer” are to the proposed joint share transfer between Daiichi and Sankyo, the terms of which are set out in the joint share transfer agreement dated May 13, 2005 between Daiichi and Sankyo, and references to “Daiichi Sankyo” are to Daiichi Sankyo Company, Limited, the company that will be established upon the joint share transfer. Unless the context otherwise requires, references in this prospectus to the financial results or business of “Daiichi” refer to those of Daiichi and its consolidated subsidiaries, references to the financial results or business of “Sankyo” refer to those of Sankyo and its consolidated subsidiaries, and references to the financial results or business of “Daiichi Sankyo” refer to those of Daiichi Sankyo and its consolidated subsidiaries, including Daiichi and Sankyo.

As used in this prospectus, “dollar” or “$” means the lawful currency of the United States of America, and “yen” or “¥” means the lawful currency of Japan.

As used in this prospectus, “U.S. GAAP” means accounting principles generally accepted in the United States, and “Japanese GAAP” means accounting principles generally accepted in Japan. The consolidated financial information contained in this prospectus has been presented in accordance with U.S. GAAP, except for certain specifically identified information which was prepared in accordance with Japanese GAAP. Unless otherwise stated or the context otherwise requires, all amounts in the financial statements contained in this prospectus are expressed in Japanese yen.

12

RISK FACTORS

In addition to the other information included or incorporated by reference into this prospectus, including the matters addressed under the caption “Cautionary Statement Concerning Forward-Looking Statements,” you should carefully consider the matters described below in evaluating the matters described in this prospectus before making a decision on the joint share transfer.

Risks Relating to the Joint Share Transfer

Daiichi and Sankyo may fail to realize the anticipated benefits of the joint share transfer due to the challenges of integrating their operations.

The success of the joint share transfer will depend, in part, on Daiichi Sankyo’s ability to realize the anticipated growth opportunities and cost savings from combining the businesses of Daiichi and Sankyo under Daiichi Sankyo. The joint transfer agreement calls for an ongoing integration process, including the combination of the prescription pharmaceutical operations of the two companies in or around April 2007. The lengthy period required for the merger and the preparation for it may divert management’s focus and resources from other strategic opportunities and from day-to-day operation matters during the integration process.

Daiichi and Sankyo expect to face significant challenges in integrating the organizations, business cultures, procedures and operations of Daiichi and Sankyo and also expect to incur integration costs of approximately ¥118 billion. If they are not able to successfully manage the integration process and create a unified business culture, the anticipated benefits of the joint share transfer and subsequent integration may not be realized fully or at all or may take longer to realize than expected.

The exchange ratio is fixed and will not be adjusted to reflect changes in the market values of Daiichi and Sankyo common stock; as a result, the value of Daiichi Sankyo common stock you receive in the transaction may be less than when you vote on the joint share transfer.

Upon the completion of the joint share transfer, each share of Daiichi common stock will be exchanged for 1.159 shares of Daiichi Sankyo common stock, and each share of Sankyo common stock will be exchanged for one share of Daiichi Sankyo common stock. The ratios at which Daiichi and Sankyo common stock will be exchanged for Daiichi Sankyo common stock are fixed, and will not be adjusted for changes in the market prices of either company’s common stock. Therefore, even if the relative market values of Daiichi or Sankyo common stock change, there will be no change in the number of shares of Daiichi Sankyo common stock which shareholders of those companies will receive in the joint share transfer.

Any change in the prices of either company’s common stock occurring prior to the effective date of the joint share transfer will affect the value that holders of Daiichi or Sankyo common stock receive in the transaction. The value of the Daiichi Sankyo common stock to be received in the joint share transfer (which will occur approximately three months after the general meetings of shareholders) may be higher or lower than the indicative value as of the date of this prospectus and/or as of the date of the general meetings of shareholders, depending on the then prevailing market prices of Daiichi and Sankyo common stock.

The share prices of Daiichi and Sankyo common stock are subject to the general price fluctuations in the market for publicly traded equity securities and have experienced significant volatility in the past. Stock price changes may result from a variety of factors that are beyond the control of Daiichi and Sankyo, including actual changes in, or investor perception of, Daiichi’s and Sankyo’s businesses, operations and prospects. Regulatory developments, as well as current or potential legal proceedings, and changes in general market and economic conditions may also affect the stock price of Daiichi or Sankyo.

You should obtain and review recent market quotations for Daiichi and Sankyo common stock before voting on the joint share transfer. There can be no assurances as to the future market prices of Daiichi and Sankyo common stock before the completion of the joint share transfer, nor of the market price of Daiichi Sankyo’s common stock at any time after the completion of the joint share transfer.

13

The joint share transfer is subject to regulatory approvals and various conditions set forth in the joint share transfer agreement and, even though it may be approved by both sets of shareholders, the joint share transfer nonetheless may not be completed as scheduled or at all.

Under the joint share transfer agreement, the respective obligations of Daiichi and Sankyo to complete the joint share transfer are subject to a number of specified conditions, including obtaining or satisfying all regulatory approvals, permits, consents and requirements necessary for the consummation of the transaction. Regulatory authorities in Japan or elsewhere may seek to block or delay the joint share transfer, or may impose conditions that reduce the anticipated benefits of the joint share transfer or make it difficult to complete as planned. Shareholder approval of the joint share transfer will be subject to fulfillment of conditions imposed on the joint share transfer by Japanese regulatory authorities. Daiichi and Sankyo will be required to obtain further shareholder approval in the event that any of the conditions imposed by Japanese regulatory authorities materially alter any aspect of the joint share transfer as previously approved. In addition, Daiichi and Sankyo have the right to terminate the joint share transfer agreement at any time prior to the completion of the transaction, upon the parties’ mutual written consent. Either party may also terminate the joint share transfer agreement upon an unremedied breach of the agreement by the other party that has a material adverse effect on either party or the ability of either party to perform its obligations under the joint share transfer agreement. Accordingly, even if the terms of the joint share transfer are approved at the general meetings of shareholders of Daiichi and Sankyo, there is no assurance that the joint share transfer will ultimately be completed as scheduled or at all.

Significant costs will be incurred in the course of the joint share transfer and subsequent integration of the business operations of the two companies.

Daiichi and Sankyo expect to incur significant costs related to the joint share transfer and subsequent integration of the business operations of the two companies. Daiichi estimates that its transaction-related costs associated with the joint share transfer will amount to approximately ¥2.5 billion and Sankyo estimates that its transaction-related costs associated with the joint share transfer will amount to approximately ¥2.0 billion. These expenses include financial advisory, legal and accounting fees and expenses, severance/employee benefit-related expenses, filing fees, printing expenses and other related charges. Additionally, Daiichi and Sankyo may also incur significant costs in compensating dissenting shareholders who exercise their appraisal rights. Daiichi and Sankyo may also incur additional unanticipated expenses in connection with the joint share transfer and the integration of the operations, information systems, domestic and overseas branch office network and personnel of the two companies.

Uncertainties associated with the joint share transfer, or Daiichi Sankyo as a new owner, may damage Daiichi Sankyo’s relationships with customers and business partners of Daiichi and Sankyo and, in some cases, may result in the termination of existing joint venture and/or licensing agreements of Daiichi and Sankyo pursuant to change of control provisions.

Current customers and business partners of Daiichi or Sankyo may, in response to the announcement of the joint share transfer or to subsequent steps taken to integrate the pharmaceutical businesses of Daiichi and Sankyo, delay or defer decisions concerning their relationships with Daiichi or Sankyo because of uncertainties related to the joint share transfer, including that there can be no assurances that the joint share transfer will be consummated. The existence of competing products could contribute to these uncertainties. Sankyo’s product Ketek® competes with Daiichi’s leading product Cravit®. In addition, both companies market anti-allergy and anti-inflammatory agents in Japan, including Zyrtec® and Mobic® in the case of Daiichi and Alesion® and Loxonin® in the case of Sankyo. Any of these matters could have an adverse effect on Daiichi Sankyo’s business, results of operations or financial condition following the joint share transfer.

Each of Daiichi and Sankyo is currently party to joint venture, licensing and other agreements which permit the counterparties thereto to terminate such agreements upon a change of control of Daiichi or Sankyo, as

14

applicable. Some of these agreements also limit Daiichi’s or Sankyo’s ability to research, develop and market competing products. If the relevant counterparties do not waive their rights under such agreements, including because they view the combined entity as a more direct competitor, the joint share transfer could result in the termination of joint ventures, licensing rights or otherwise adversely affect Daiichi Sankyo’s results of operations. Daiichi and Sankyo currently estimate the potential negative impact on annual operating income of Daiichi Sankyo due to factors such as cannibalization by competing products and loss of licensing rights could be as much as ¥16 billion in the year ending March 31, 2008. If that negative impact materializes, and Daiichi Sankyo is unable to achieve the positive synergies the companies have targeted, the results of operations of the combined entity will be negatively affected.

In connection with the completion of the joint share transfer, it will not be possible to trade shares of Daiichi, Sankyo or Daiichi Sankyo common stock during certain periods.

In connection with the joint share transfer, Daiichi and Sankyo shares will be delisted from the Tokyo Stock Exchange and the Osaka Securities Exchange and Sankyo shares will be delisted from those exchanges and also from the Nagoya Stock Exchange, the Sapporo Securities Exchange and the Fukuoka Stock Exchange. The delistings of Daiichi and Sankyo shares are expected to occur on or around September 21, 2005, about four trading days before September 28, 2005, the date Daiichi Sankyo shares are expected to be listed on the First Sections of the Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange. As a result, holders of Daiichi and Sankyo shares will not be able to trade those shares, or the Daiichi Sankyo shares they will be entitled to receive when the joint share transfer is completed, during the applicable gap in trading. Accordingly, these holders will be subject to the risk of not being able to liquidate their shares during a falling market, whether for Japanese equities generally or for Daiichi, Sankyo or Daiichi Sankyo shares in particular.

In addition, holders of Daiichi and Sankyo shares who choose to receive their Daiichi Sankyo shares in share certificate form are not expected to receive those share certificates until late November, 2005. As a result, these holders will not be able to trade their Daiichi Sankyo shares during this period following the completion of the joint share transfer, since they will not be able to deliver share certificates to settle those trades.

Risks Relating to the Business of Daiichi Sankyo

If Daiichi Sankyo is unable to successfully develop or commercialize new products, its results of operations will suffer.

The future results of operations of Daiichi Sankyo will depend to a significant extent upon its ability to successfully commercialize new products in a timely manner. There are numerous difficulties in developing and commercializing new pharmaceutical products, including:

| | • | | developing, testing and manufacturing products in compliance with regulatory standards in a timely manner; |

| | • | | receiving requisite regulatory approvals for such products in a timely manner; and |

| | • | | the availability on commercially reasonable terms of raw materials, including active pharmaceutical ingredients and other key ingredients. |

Developing and commercializing a new product is time consuming, costly and subject to numerous factors that may delay or prevent the development and commercialization of new products. Products currently in development by Daiichi or Sankyo, and products to be developed by Daiichi Sankyo in the future, may or may not receive the regulatory approvals necessary for marketing by Daiichi Sankyo or other third-party partners. This risk particularly exists with respect to the development of proprietary products because of the uncertainties, higher costs and lengthy timeframes associated with research and development of such products and the inherent unproven market acceptance of such products.

15

If any of the products of Daiichi Sankyo, when acquired or developed and approved, cannot be successfully or timely commercialized, the combined entity’s results of operations could be adversely affected. No guarantee can be given that any investment made in developing products will be recouped, even if Daiichi Sankyo is successful in commercializing those products.

Daiichi Sankyo product candidates may not gain acceptance among physicians, patients and the medical community, thereby limiting potential to generate revenues.

Even if Daiichi Sankyo’s product candidates are approved for commercial sale by the Japanese Ministry of Labor, Health and Welfare, or the MLHW, the United States Federal Drug Administration, or the FDA, or other regulatory authorities, the degree of market acceptance of any approved product candidate by physicians, healthcare professionals and third-party payors and Daiichi Sankyo’s profitability and growth will depend on a number of factors, including:

| | • | | relative convenience and ease of administration; |

| | • | | the prevalence and severity of any adverse side effects; |

| | • | | availability of alternative treatments; |

| | • | | pricing and cost effectiveness, which may be subject to regulatory control; |

| | • | | the effectiveness of the sales and marketing strategy employed by Daiichi Sankyo and its business partners; and |

| | • | | Daiichi Sankyo’s ability to obtain sufficient third-party insurance coverage or reimbursement. |

If any product candidate that Daiichi Sankyo develops does not provide a treatment regimen that is as beneficial as the current standard of care or otherwise does not provide sufficient benefits to patients, that product likely will not achieve market acceptance.

If Daiichi Sankyo is unsuccessful in its efforts to increase direct involvement in the development and marketing of products outside Japan, its results of operations could suffer.

Although, historically, Daiichi and Sankyo have each conducted a substantial portion of its sales outside Japan by licensing its products to third-party pharmaceutical companies and through marketing partnerships, Daiichi and Sankyo have each recognized the strategic importance of increased direct involvement in the development and marketing of products in markets outside Japan. The companies expect that Daiichi Sankyo will continue to try to increase direct overseas development and marketing activities. Direct development and, if approval is received, marketing of products in overseas markets will entail significant initial expenditures by Daiichi Sankyo as compared to licensing to a third party and thus the corresponding risk of losing its entire investment if the product candidate is not successfully commercialized. Daiichi and Sankyo have historically had relatively limited operations in markets such as the United States and Europe when compared to the largest global pharmaceutical companies. Daiichi Sankyo will incur additional costs in building its presence in overseas markets, including increased headcount, particularly in the United States, and research and development expenditures, and it is uncertain if the anticipated long-term benefits, including its enjoyment of economies of scale, and the reach of its operations in major global markets, will materialize. If Daiichi Sankyo is unable to generate increased revenues through the direct development and marketing strategy, its results of operations could suffer.

If Daiichi Sankyo is unsuccessful in obtaining or renewing licenses from third parties or in entering into collaborative marketing arrangements, Daiichi Sankyo’s results of operations could suffer.

Each of Daiichi and Sankyo enters into a variety of licensing, co-marketing and co-promotional agreements in the conduct of its business and Daiichi Sankyo expects to use these and other methods to develop

16

or commercialize products in the future. These arrangements typically involve other pharmaceutical companies as partners that may be competitors of Daiichi Sankyo in certain markets. Both companies sell numerous products in Japan pursuant to licenses from third parties, and Daiichi Sankyo may need to obtain or renew such licenses. If Daiichi Sankyo is unable to timely obtain or renew these licenses on commercially reasonable terms or to continue to secure similar licensing opportunities in the future, its results of operations may be adversely affected. Daiichi Sankyo’s results of operations may also suffer if counterparties to which Daiichi Sankyo grants licenses or marketing rights withdraw, or if the relevant products are not timely developed, approved or successfully commercialized by the licensees.

If Daiichi Sankyo is unable to adequately protect its technology or enforce its patents, its business could suffer.

The success of the products that Daiichi Sankyo develops will depend, in part, on the company’s ability to obtain patent protection for these products. The process of seeking patent protection can be long and expensive. Effective patent protection is unavailable or limited in some countries. Each of Daiichi and Sankyo currently has a number of Japanese, U.S. and foreign patents issued and pending. Neither Daiichi nor Sankyo can be sure that Daiichi Sankyo, Daiichi or Sankyo will receive patents for any of their pending patent applications. If the current and future patent applications are not approved or, if approved, if such patents are not upheld in a court of law, it may reduce Daiichi Sankyo’s ability to competitively exploit its patented products. Also, such patents may or may not provide competitive advantages for their respective products or they may be challenged or circumvented by competitors.

Daiichi and its U.S. licensee have had to bring suit in the United States to prevent a competitor from marketing a generic version of levofloxacin. Although the district court has enjoined the competitor from producing, importing or selling levofloxacin until Daiichi’s U.S. patent expires in 2010, Daiichi must still contest the ongoing appeal from that decision.

Once basic composition patents expire, Daiichi and Sankyo’s products generally become subject to increased competition. Daiichi’s compound patent for levofloxacin expires in 2006 in Japan, and the corresponding patents expire in 2010 in the United States and 2011 in Europe. Sankyo’s compound patent for pravastatin expired in 2002 in Japan and the corresponding patent in the United States, as extended by a six-month extension for pediatric exclusivity, expires in April 2006. Sankyo’s compound patent for olmesartan expires in February 2012 in Japan, April 2016 in the United States, February 2017 in Germany and Great Britain, and February 2012 in France.

Daiichi and Sankyo also rely on trade secrets and proprietary know-how that the companies seek to protect, in part, through confidentiality agreements with their partners, customers, employees and consultants. It is possible that these agreements will be breached or that they will not be enforceable in every instance, and that Daiichi Sankyo will not have adequate remedies for any such breach. It is also possible that trade secrets of Daiichi, Sankyo or Daiichi Sankyo will become known or independently developed by Daiichi Sankyo’s competitors. If Daiichi Sankyo is unable to adequately protect its technology or enforce its patents, its results of operations, financial condition and cash flows could suffer.

Third parties may claim that Daiichi, Sankyo or Daiichi Sankyo infringes their proprietary rights and may prevent Daiichi Sankyo from manufacturing and selling some of its products.

The manufacture, use and sale of new products that are the subject of conflicting patent rights have been the subject of substantial litigation in the pharmaceutical industry. These lawsuits relate to the validity and infringement of patents or proprietary rights of third parties. Daiichi Sankyo may have to defend against charges that it or Daiichi or Sankyo violated patents or proprietary rights of third parties. Litigation may be costly and time-consuming, and could divert the attention of management and technical personnel. In addition, if any of Daiichi Sankyo, Daiichi or Sankyo infringes on the rights of others, they could lose the right to develop or manufacture products or could be required to pay monetary damages or royalties to license proprietary rights from third parties, or even suspend production and marketing of the challenged products. If they fail to obtain a license where one is required, Daiichi Sankyo could be forced to suspend the production and marketing of the

17

challenged products. Although the parties to patent and intellectual property disputes in the pharmaceutical industry have often settled their disputes through licensing or similar arrangements, the costs associated with these arrangements may be substantial and could include ongoing royalties. Furthermore, Daiichi Sankyo, Daiichi and Sankyo cannot be certain that the necessary licenses would be available on acceptable terms. As a result, an adverse determination in a judicial or administrative proceeding or failure to obtain necessary licenses could prevent Daiichi Sankyo from manufacturing and selling a number of products, which could harm its business, financial condition, results of operations and cash flows.

The highly regulated nature of the pharmaceutical industry subjects Daiichi Sankyo to uncertainty with respect to the initial and continued approval of its products, pricing of pharmaceuticals and potential sanctions for any compliance failures.

As a pharmaceutical company, Daiichi Sankyo’s activities will be subject to extensive governmental regulation. Typically, the primary thrusts of governmental inquiry and action are toward determining drug safety and effectiveness as well as controlling the prices of prescription drugs and the profits of prescription drug companies. In many jurisdictions, a company is required to obtain and maintain regulatory approvals to market or manufacture pharmaceutical products. For example, the European Union has adopted directives concerning the classification, labeling, advertising, wholesale distribution and approval for marketing of medicinal products for human use. In addition, acts of governments may affect the price or availability of raw materials needed for the development or manufacture of Daiichi Sankyo’s products. Daiichi Sankyo will also be subject to potential administrative actions. Such actions may include seizures of products and other civil and criminal sanctions. Daiichi Sankyo may incur significant cost and may be required to devote substantial time and resources to comply with applicable rules and regulations.

The design, development, manufacture and sale of pharmaceutical products involve the risk of product liability claims by consumers and other third parties, and insurance against such potential claims is expensive and may be difficult to obtain.

The design, development, manufacture and sale of pharmaceutical products involve an inherent risk of product liability claims and the associated adverse publicity. Unexpected side effects manifesting after the approval of a product could give rise to claims and even cause the withdrawal of regulatory approval. Insurance coverage is expensive and may be difficult to obtain, and may not be available in the future on acceptable terms, or at all. Although each of Daiichi and Sankyo currently maintains, and after the joint share transfer, Daiichi Sankyo will maintain, product liability insurance for its products in amounts believed to be commercially reasonable, if the coverage limits of these insurance policies are not adequate, a claim brought against Daiichi Sankyo, Daiichi and Sankyo, whether covered by insurance or not, could have a material adverse effect on Daiichi Sankyo’s results of operations, financial condition and cash flows.

The pharmaceutical industry is highly competitive.

Each of Daiichi and Sankyo faces, and expects that after the joint share transfer, Daiichi Sankyo will face, strong competition in its pharmaceutical business, both for prescription drugs and over-the-counter products. The intensely competitive environment requires an ongoing, extensive search for technological innovations and the ability to market products effectively, including the ability to communicate the effectiveness, safety and value of each company’s products to healthcare professionals in hospitals, private practice, group practices and managed care organizations. The companies’ competitors vary depending upon product categories, and within each product category, upon dosage strengths and drug-delivery systems. Based on pro forma total assets, annual revenues, and market capitalization, Daiichi Sankyo is smaller than certain of its competitors. Many competitors have a greater number of products on the market and have greater financial and other resources than Daiichi, Sankyo or Daiichi Sankyo. If Daiichi Sankyo directly competes with them for the same markets and/or products, their financial strength could prevent Daiichi Sankyo from capturing a profitable share of those markets. It is possible that developments by competitors will make Daiichi Sankyo’s products or technologies noncompetitive or obsolete.

18

Daiichi Sankyo’s results of operations could be adversely affected by global efforts to control the prices of prescription drugs and healthcare costs generally.

Healthcare policy makers in Japan, the United States and other countries have identified controlling healthcare costs, and the prices of prescription drugs in particular, as an important long-term goal. In April 2003, Japan increased the share of medical costs borne by patients with employees’ health insurance to 30%. A manufacturer of pharmaceutical products in Japan must have a new pharmaceutical product listed on a National Health Insurance, or NHI, price list. The NHI price list provides rates for calculating the costs of pharmaceutical products used in medical services given under various public medical care insurance systems. Prices on the NHI price list are subject to revision, generally once every two years, on the basis of the actual prices at which the pharmaceutical products are purchased by medical institutions. The most recent price revision occurred in April 2004 with the result that each of Daiichi and Sankyo has been required to reduce the prices for its pharmaceutical products in Japan by an average of 5.2% and 6.7%, respectively. Please see “Governmental Regulation - Japanese Regulation – Price Regulation”. In December 2004, U.S. President Bush enacted Medicare reform measures, including a new prescription drug benefit and reforms intended to speed the approval process for generic drug equivalents to pharmaceutical products under patent. The effect of these measures, in addition to increasing competition in the market, may result in downward pressure on the prices of prescription drugs and other pharmaceutical products which could have an adverse impact on Daiichi Sankyo’s results of operations.

Daiichi Sankyo’s consolidated results of operations may be negatively impacted by foreign currency fluctuations.

A portion of the net revenues of each of Daiichi and Sankyo is originally earned in currencies other than Japanese yen, primarily U.S. dollars and euros. Daiichi Sankyo expects to continue to report its financial results in Japanese yen and to translate the revenues and expenses of Daiichi Sankyo denominated in non-Japanese currencies into Japanese yen. If the Japanese yen were to strengthen relative to non-Japanese currencies, the amount of net income reported in Daiichi Sankyo’s consolidated statement of operations from non-Japanese yen denominated business would decrease. Accordingly, if the Japanese yen were to strengthen significantly against the U.S. dollar, Daiichi Sankyo’s consolidated net income could be adversely affected.

The high and low exchange rates of Japanese yen for U.S. dollars, expressed in yen per $1.00 and based on the noon buying rate in the City of New York, were ¥120.55 and ¥104.18 for the year ended March 31, 2004 and ¥114.30 and ¥102.26 for the year ended March 31, 2005. The high and low exchange rates of Japanese yen for euros, expressed in yen per €1.00 and based on the average of buying and selling rates of telegraphic transfers from The Bank of Tokyo Mitsubishi, Ltd., were ¥141.61 and ¥126.49 for the year ended March 31, 2004 and ¥141.61 and ¥126.49 for the year ended March 31, 2005.

Daiichi Sankyo will be subject to stringent environmental regulations in Japan and abroad that may require additional expenditures or other compliance measures.