Exhibit 99.1

Financial Highlights

Daiichi Pharmaceutical Co., Ltd. and Consolidated Subsidiaries

Years ended March 31

| | | | | | | | | | | | |

| | | Millions of yen

| | | Thousands of

U.S. dollars

(Note)

| |

| | | 2005

| | | 2004

| | | 2005

| |

For the Year: | | | | | | | | | | | | |

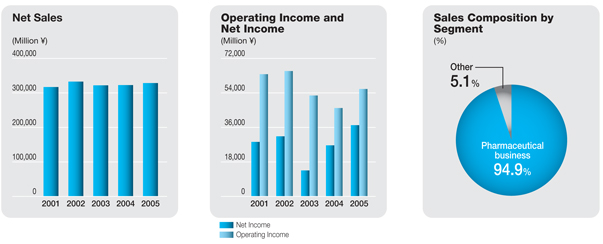

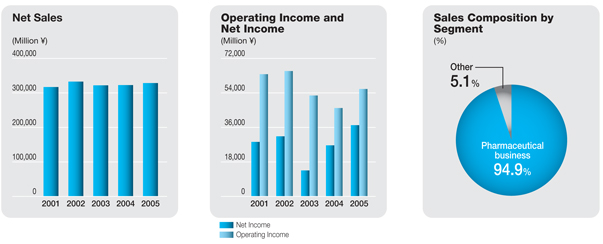

Net sales | | ¥ | 328,534 | | | ¥ | 322,767 | | | $ | 3,059,261 | |

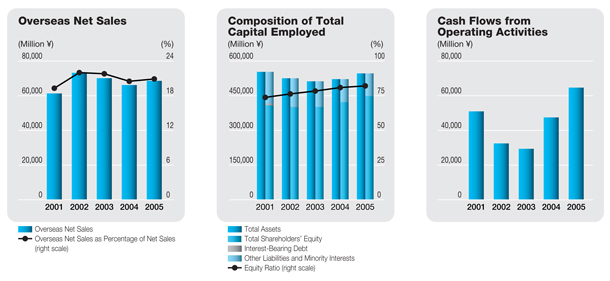

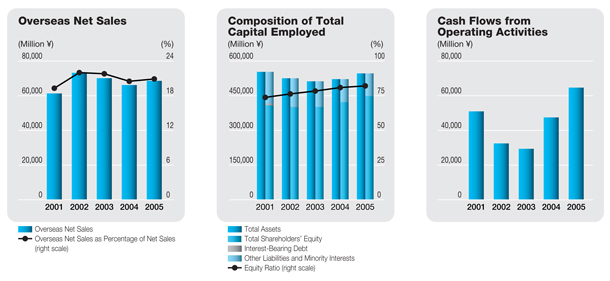

Overseas net sales | | | 68,589 | | | | 66,164 | | | | 638,691 | |

Percentage of net sales (%) | | | 20.9 | | | | 20.5 | | | | | |

Operating income | | | 56,064 | | | | 46,115 | | | | 522,060 | |

Net income | | | 37,175 | | | | 26,662 | | | | 346,168 | |

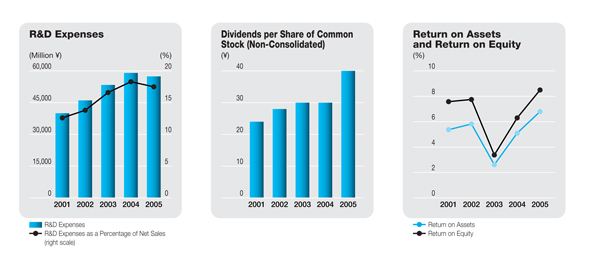

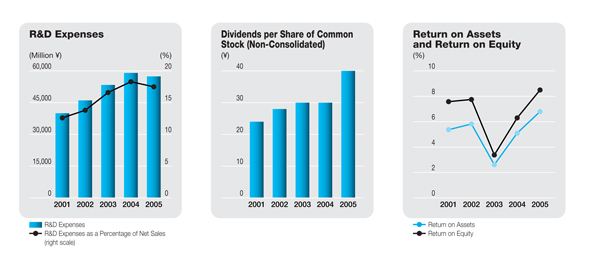

Research and development expenses | | | 57,417 | | | | 59,049 | | | | 534,659 | |

| | | | [58,605 | ]* | | | [60,721 | ]* | | | [545,721 | ]* |

Percentage of net sales (%) | | | 17.5 | | | | 18.3 | | | | | |

Capital expenditures | | | 14,798 | | | | 12,314 | | | | 137,797 | |

Depreciation | | | 15,947 | | | | 17,366 | | | | 148,496 | |

At Year-End: | | | | | | | | | | | | |

Total assets | | | 546,555 | | | | 521,809 | | | | 5,089,440 | |

Interest-bearing debt | | | 24 | | | | 42 | | | | 223 | |

Total shareholders’ equity | | | 448,563 | | | | 422,130 | | | | 4,176,953 | |

Per Share Data(yen and U.S. dollars): | | | | | | | | | | | | |

Net income | | ¥ | 137.95 | | | ¥ | 97.25 | | | $ | 1.285 | |

Cash dividends applicable to the year | | | 40.00 | | | | 30.00 | | | | 0.372 | |

Note: U.S. dollar amounts in this annual report are translated from yen, for convenience only, at the rate of ¥107.39 to US$1.00.

| * | Total amount, including production R&D costs |

Contents

Note Regarding Forward-Looking Statements

This annual report contains statements concerning forecasts for Daiichi Pharmaceutical Co., Ltd., and Sankyo Co., Ltd., and their group companies. These statements are based on assumptions and judgments made with information available at the time of preparation, and as such are subject to existing and unforeseen risks, as well as uncertainties and other factors. Risks, uncertainties, and other factors may cause business performance, management actions, and financial results to differ from those presented in this report.

| | | | |

| Daiichi Pharmaceutical Co., Ltd. | | Annual Report 2005 | | |

Profile

Since its establishment in 1915, Daiichi Pharmaceutical Co., Ltd., has been guided by its commitment to provide valuable pharmaceuticals that help to enrich the quality of life. This commitment remains as strong as ever and is expressed through our pursuit of excellence in offering prescription drugs, diagnostic agents, OTC drugs, and fine chemicals.

Having earned a strong reputation in Japan, Daiichi is gaining increasing recognition abroad through its independent marketing network as well as through licensing tie-ups with renowned pharmaceutical manufacturers in other countries.

Daiichi has advanced steadily over the years by developing innovative pharmaceuticals that have a wealth of clinical and commercial potential. The Company is now sharpening the focus of its R&D programs to emphasize therapeutic areas that reflect both Daiichi’s strengths and patients’ needs.

01

CEO Message:

Bridges to the Future

The pharmaceutical industry’s operating environment is becoming increasingly harsh due to such worldwide trends as the progressive globalization of new drug development programs, a related rise in development costs, and government efforts to reduce healthcare costs. Moreover, these trends are causing a shift from an era in which the industry saw increasing disparities in corporate competitiveness to an era in which the relatively weak companies are being winnowed out. To augment its capabilities for overcoming global competition and sustaining its corporate development amid these trends, on May 13, 2005, Daiichi Pharmaceutical Co., Ltd., signed an agreement with Sankyo Co., Ltd., that calls for the integration of the two companies’ business operations. Plans call for establishing a joint holding company named DAIICHI SANKYO COMPANY, LIMITED, on September 28, 2005, and then progressively integrating the two companies’ operations, which are to be completely integrated by April 2007. By leveraging their strong presence in Japan and maximizing synergies generated by the integration, the two companies are aiming to become a Japan-based “global pharma-innovator” with the capabilities needed to “contribute to healthier and happier lives globally” on a still-higher level.

Overview of Results

During fiscal 2004, ended March 31, 2005, overseas pharmaceutical markets were characterized by a further intensification of global competition centered on “global-mega” companies and associated with both new drug-related R&D and marketing activities. The Japanese pharmaceutical market was affected by changes in the healthcare systems—such as the growing scope of application of the comprehensive hospital therapy evaluation system and the conversion of national university hospitals and other national hospitals into independent corporations—and an average 4.2% reduction in National Health Insurance (NHI) drug reimbursement prices was implemented in April 2004.

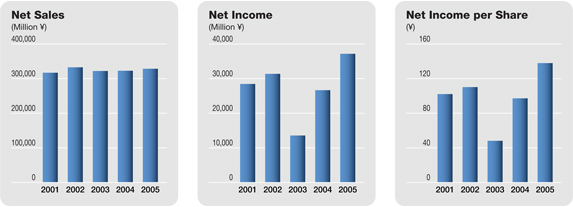

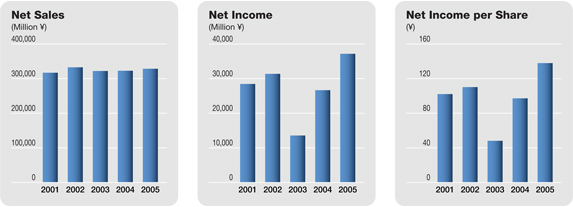

Against this backdrop, the Daiichi Group worked to expand the markets for its products while emphasizing the promotion of appropriate drug use. As a result of these efforts, a rise in revenue from domestic sales of prescription drugs and a rise in bulk exports of levofloxacin, consolidated net sales advanced 1.8% from the previous fiscal year, to ¥328,534 million. Profitability greatly improved—operating income totaled ¥56,064 million, up 21.6% from the previous fiscal year, and net income surged 39.4% from the previous fiscal year, to ¥37,175 million. The share of the Group’s consolidated net sales comprising overseas sales in total was 20.9%.

02

Kiyoshi Morita,

President and CEO

Our Structural Reforms

The Daiichi Group has been implementing its current program of concrete structural reform measures since the start of the fiscal year under review. It is continuing to implement these reforms with the goal of smoothly finishing the integration and creating a strong foundation for operations as “global pharma-innovator.”

| (1) | Expanding Global R&D Operations |

As a result of its April 2004 establishment of U.S.-based Daiichi Medical Research, Inc. (DMR) to evaluate global drug candidates and its October 2004 establishment of the R&D Division, Daiichi has integrated its research operations and development operations and created the organizational framework required to move ahead with R&D programs in line with global standards. The R&D Division is seeking to maintain progress in domestic and overseas R&D projects while promoting functional collaboration between the Tokyo Research and Development Center and DMR. Through this R&D structural reform initiative, the Company is seeking to boost R&D productivity and firmly instill global thinking and action mechanisms.

During the current fiscal year, we will comprehensively evaluate a number of promising drug candidates—including DU-176b, an oral factor-Xa inhibitor, and DJ-927, a taxane derivative anticancer chemotherapeutic agent—and make important decisions on whether to advance these candidates to the pivotal clinical trial stage. If the candidates are advanced, we will create global clinical development systems that ensure sufficient development capabilities with regard to programs’ quality, volume, and speed.

03

Following the October 2005 establishment of DAIICHI SANKYO, we will work to unify the management of Daiichi’s and Sankyo’s product development pipelines. We will determine the methods of the unification process by September and unify the priority ratings for the two companies’ pipelines from October. Subsequent to the merger we will take steps to tighten the focuses of our global development operations and concentrate resources in strategically emphasized fields.

| (2) | Strengthening the Prescription Drug Business |

Amid increasingly intense marketing competition, Daiichi maintains a policy of working to further reinforce the strong market positions enjoyed of its prescription drugs.

In the domestic prescription drug business, the Company is aiming to expand its current overall market share. To do this, it is striving to increase the number of prescriptions for established drugs—such asCravit,a broad-spectrum oral antibacterial agent;Artist,a long-acting beta-blocker;Sunrythm,an anti-arrhythmic agent; andHANP,an agent for treating acute cardiac insufficiency—while expeditiously launching and developing the markets for drugs for which applications have already been made—such asPlavix(clopidogrel sulfate), a new anti-platelet agent; and KMD-3213 (silodosin), an agent for treating dysuria. The Company is also strengthening its marketing operations aimed at the hospital market while taking steps to respond to such changes in the medical therapy environment as the creation of medical institution networks and the spread of diagnostic and therapeutic guidelines.

04

In the overseas prescription drug business, the Company is working to ensure that its licensee maintains the top share of the quinolone drug market in the United States, which is the largest export market for bulk shipments of its mainstay antibacterial agent levofloxacin, by working through Johnson & Johnson, the licensee, to obtain approval for additional indications and taking other steps to expand the market shares of products containing levofloxacin.

| (3) | Building a Resilient Corporate Structure by Resolutely Implementing Structural Reforms |

To transform the entire Daiichi Group into an enterprise featuring high levels of profitability and management efficiency as well as strong overall competitiveness, the Company has established a task force, the Structural Reform Headquarters, that is working to

| | 1) | consolidate functions within the Group and integrate and consolidate networks of research and distribution facilities, |

| | 2) | optimize the size of the Group’s workforce, and |

| | 3) | restructure ancillary businesses. |

Particularly noteworthy among functional and facility consolidation measures was the shift of the Tochigi Research Center’s protein research unit and Daiichi Fine Chemical’s drug discovery units to the Tokyo Research and Development Center, in October 2004 and April 2005, respectively. Moreover, while we currently have five distribution bases, by March 31, 2007, we plan to consolidate distribution operations at just two bases, one in Tokyo and one in Osaka, thereby helping increase operational efficiency and reduce costs.

To consolidate planning and administration functions, the Company is proceeding with the introduction of enterprise resource planning (ERP) systems that promote the consolidation of Group companies’ accounting, remuneration, and IT units. The remuneration functions of major Group companies have already been consolidated in the Company’s Business Center facility.

Aiming to optimize the size of the Group’s workforce, steps were taken to hire additional staff to work for Daiichi Medical Research, Inc. and boost the number of the parent Company’s Medical Representatives in domestic prescription drug marketing to 1,400 by March 31, 2007, from the current level of 1,200. In contrast, at many other Group companies such operational reform measures as those to reevaluate operations, consolidate functions, and introduce electronic information systems have enabled workforce streamlining.

Regarding the reorganization of non-core businesses, the Group transferred its veterinary and livestock feed products business to Meiji Seika Kaisha, Ltd. This transfer was smoothly implemented in June 2004.

Another noteworthy move was the establishment of Daiichi Pharmatech, Co., Ltd., in April 2005 following the revision of Japan’s Pharmaceutical Affairs Law. Created through the spin-off of three factories from the parent Company, Daiichi Pharmatech is working to further increase manufacturing efficiency and strengthen cost-competitiveness.

05

In fiscal 2004, we introduced new marketing systems that not only enable the unified management of customer data, marketing activity data, and other related data but that can be operated in coordination with product data management systems. These systems are expected to help increase the efficiency of information sharing throughout the company— particularly information sharing involving medical representatives. We intend to sustain our efforts to augment the Group’s operational efficiency.

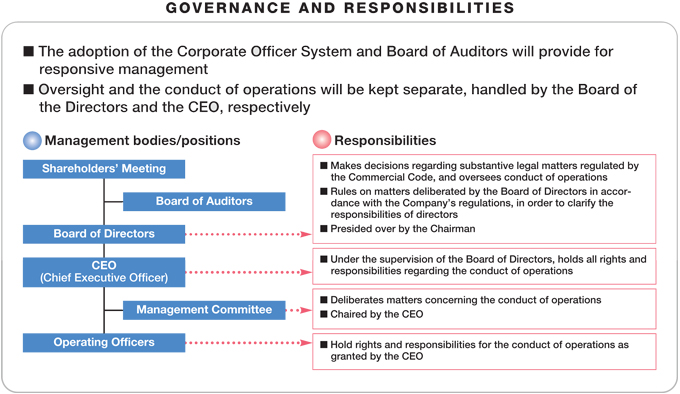

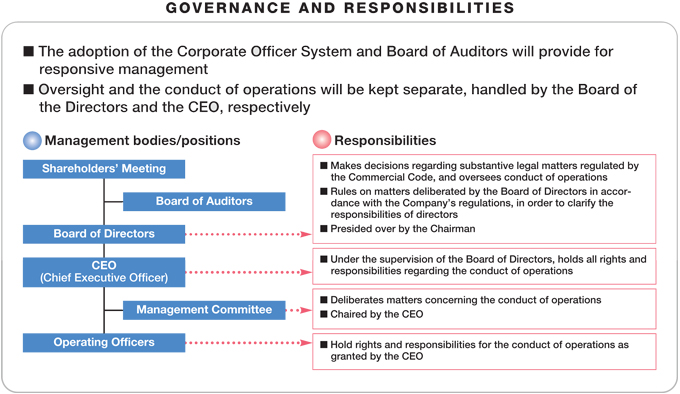

Corporate Sustainability

The Daiichi Group is dedicated to its mission as a pharmaceutical company of promoting the use of superior drugs and thereby maximizing its contribution to the betterment of human health throughout the world. However, because the Group also recognizes its responsibility for the important task of maximizing shareholder value, it has been taking various steps to strengthen its corporate governance and compliance systems. With respect to corporate governance, we have made moves to increase management transparency and upgrade capabilities for expeditious and appropriate decision making. In particular, we have reduced the terms of directors from two years to one, introduced a corporate officer system and nominated outsidedirectors, and reevaluated the management council.

Regarding compliance, Daiichi Group companies have uniformly instituted the “Daiichi Conduct Guidelines” and are making sustained efforts to ensure rigorous legal compliance through such measures as the establishment of the Ethics Committee, which includes two outside lawyers as members, and the setting up of employee hot lines. Aiming to ensure that all Daiichi drug promotion activities are appropriate, we have also established the Daiichi Pharmaceutical Prescription Drug Promotion Code, which clearly describes the standards of behavior to which we expect our medical representatives to conform.

To augment our efforts in the area of personal information protection, we established the Daiichi Pharmaceutical Personal Information Protection Policy in April 2005 and have taken various measures to create a personal information protection system, including designating personal information protection managers at the parent Company and Group companies and establishing the Personal Information Protection Committee. At the same time, we have taken steps to ensure the maintenance of rigorous safety management standards and have implemented awareness-enhancement and educational programs for employees.

Regarding disclosure, we have earned a good reputation for the timely release of information-rich reports on financial performance and other relevant subjects. We are continuing to do our utmost to sustain a high level of management transparency and undertake other activities that enhance our corporate social responsibility performance.

06

Business Integration of Daiichi and Sankyo

During the current fiscal year, Daiichi will mark the 90th anniversary of its founding and also begin a totally new era of corporate development due to the decision to integrate its operations with those of Sankyo, which was recently approved by our general meeting of shareholders.

The business integration is designed to create a Japan-based “global pharma-innovator” with “the creative power needed for revolutionary new drugs, the highest level of operational efficiency in the global pharmaceutical industry, a solid presence in the world’s principal markets, superior competitiveness in the Japanese market, and a high rate of growth in profitability.” By making optimal use of the distinctive strengths of both Daiichi and Sankyo, we intend to generate strong international competitiveness, and we are seeking to maximize the potential synergies between the two companies effectively in order to boost our integrated net sales and operating income to ¥932.0 billion and ¥255.0 billion, respectively, in the fiscal year ending March 31, 2010. I hope for the continued understanding and support of all stakeholders as we continue to strive to boost Daiichi’s corporate value.

July 2005

|

|

|

| Kiyoshi Morita |

| President and CEO |

07

Special Feature:

Building Strong Bridges

Daiichi’s mission is to develop innovative technologies and distribute superior drugs that promote better human health worldwide.

During the current fiscal year Daiichi will celebrate the 90th anniversary of its founding as well as the beginning of a new stage in its corporate history in the wake of its agreement with Sankyo Co., Ltd., to cooperate in the September 28, 2005, establishment of a joint holding company to be named DAIICHI SANKYO COMPANY, LIMITED.

Integrating the operations of Daiichi and Sankyo will generate synergistic benefits that will enable the new company to overcome the challenges presented by global competition and make a still-greater contribution to human health throughout the world.

Daiichi’s Pipeline

Currently, Daiichi is focusing the bulk of its R&D resources on programs in four therapeutic domains—infectious diseases, thrombosis and other cardiovascular diseases, cancer, and allergies and other immune system disorders.

Regarding the domestic pipeline, in fiscal 2005, Daiichi has launchedAdenoscan,an adjunctive agent for myocardial scintigraphy imaging, and plans to launch such promising new products asPlavix,a new anti-platelet agent.

In fiscal 2006, Daiichi plans to launch KMD-3213 (silodosin), an agent for treating dysuria;ActHIB, Haemophilus influenzaetype b conjugate vaccine; and theGabalon Intrathecal Injectionsystem. It is possible that KMD-3213 and theGabalon Intrathecal Injectionsystem might be launched as early as some time during fiscal 2005.Memantine,an agent for treating Alzheimer’s disease, had previously scheduled for launch in Japan during fiscal 2006; however, the failure of efforts to use bridging with overseas data has necessitated the initiation of domestic Phase III trial programs and the scheduled launch date has been delayed to 2009 or later.

08

DAIICHI SUNTORY PHARMA DEVELOPMENT PIPELINE

| | | | | | | | | | |

Development Code Number

| | Generic Name

| | Class or Application

| | Product Origin

| | Region

| | Development Stage

|

SUN Y4001 | | adenosine | | Diagnosis (coronary ischemia and angina) | | King | | Japan | | Approval (05.04) |

SUN A0026 | | faropenem daloxate | | Antibiotic agent (penem-type) | | DSP | | Overseas | | Registration preparation |

SUN Y7017 | | memantine hydrochloride | | Dementia of Alzheimer’s type (NMDA receptor antagonist) | | Merz | | Japan | | (mild to moderate) P-III |

| | | | | | (severe) P-III preparation |

SUN 0588r | | sapropterin hydrochloride (tetrahydro- biopterin) | | BH4-responsive hyperphenylalaninemia | | DSP | | Overseas | | P-III |

SUN 4936h | | carperitide | | Acute heart failure (a-human atrial natriuretic peptide) | | DSP | | Overseas | | P-II |

SUN N4057 | | — | | Acute ischemic stroke (serotonin 1A receptor agonist) | | DSP | | Japan | | — |

| | | | | Overseas | | P-II |

SUN E3001 | | human parathyroid hormone (hPTH) | | Osteoporosis | | DSP | | Japan | | P-II |

| | | | | Overseas | | — |

SUN N8075 | | — | | Acute ischemic stroke (NA/Ca channel dual blocker) | | DSP | | Japan | | — |

| | | | | Overseas | | P-I |

SUN E7001 | | glucagon-like peptide-1(GLP-1) | | Diabetes mellitus | | DSP | | Japan | | P-I |

| | | | | Overseas | | — |

SUN 11031 | | human ghrelin | | Cachexia, Anorexia nervosa | | DSP | | Japan | | P-I |

| | | | | Overseas | | IND preparation |

DAIICHI PHARMACEUTICAL R&D PIPELINE

| | | | | | | | | | | | |

Therapeutic Area

| | Development

Code Number

| | Generic Name

| | Class or Application

| | Product Origin

| | Region

| | Development Stage

|

Anti-infective | | DU-6859a | | sitafloxacin hydrate | | Quinolone | | DAIICHI | | Japan | | P-III |

| | | | | | USA | | P-II |

| | DX-619 | | — | | Quinolone (Drug-resistant gram-positive bacteria infections) | | DAIICHI | | Japan | | P-I preparation |

| | | | | | USA/EU | | P-I |

| | ActHIB (DF-098) | | Haemophilus influenzae type b conjugate vaccine | | Haemophilus influenzae type b conjugate vaccine for pediatric use | | AVENTIS PASTEUR-DAIICHI VACCINES (Sales Agreement) | | Japan | | Application (03.03) |

Anti-cancer | | DJ-927 | | — | | Cancer chemotherapeutic (taxane deriv.) | | DAIICHI | | Japan | | P-I |

| | | | | | USA/EU | | P-II |

| | Topotecin (CPT-11*) | | irinotecan hydrochloride | | Cancer chemotherapeutic (camptothecin deriv.) pancreatic cancer | | YAKULT | | Japan | | Application (04.05) |

Anti-thrombotic & Cardiovascular | | Plavix (DV-7314) | | clopidogrel sulfate | | Anti-platelet agent | | SANOFI-AVENTIS** | | Japan | | (cerebral infarction) Application (04.02) |

| | | | | | | (myocardial infarction) P-III |

| | DX-9065a | | — | | Specific factor Xa inhibitor (anti-coagulant) | | DAIICHI | | Japan | | P-II |

| | | | | | USA/EU | | P-II (USA) |

| | DU-176b | | — | | Specific factor Xa inhibitor (anti-coagulant) | | DAIICHI | | Japan | | P-I |

| | | | | | USA/EU | | P-II |

| | DZ-697b | | — | | Anti-platelet agent | | DAIICHI | | Japan | | P-I preparation |

| | | | | | USA/EU | | P-I preparation |

| | HGF | | hepatocyte growth factor DNA plasmid | | Vascular regeneration therapy by HGF-DNA | | ANGES MG (Sales Agreement) | | Japan | | (PAD) P-III (CAD) P-I preparation |

| | | | | | USA/EU | | (PAD) P-II (CAD) P-I |

Diagnostics | | Sonazoid (DD-723) | | — | | Ultrasound contrast medium | | AMERSHAM HEALTH | | Japan | | Application (04.05) |

Others | | DL-404 | | Intrathecal baclofen (ITB) | | Intrathecal baclofen (ITB) therapy (Orphan Drug) | | MEDTRONIC | | Japan | | Approval (05.04) |

| | | KMD-3213 | | silodosin | | Treatment of dysuria (selective alpha 1A blocker) | | KISSEI | | Japan | | Application (04.06) |

| | | | | | China | | P-II |

| | | DW-908e | | — | | Anti-allergy agent (adhesive molecule VLA-4 inhibitor) | | DAIICHI | | Japan | | P-I preparation |

| | | | | | USA/EU | | P-I |

| | | DL-8234* | | interferon-ß | | Hepatitis C liver cirrhosis/ Hepatitis C with ribavirin | | TORAY | | Japan | | (Hepatitis C liver cirrhosis) Application (05.02) |

| | | | | | | (Hepatitis C with ribavirin) P-III |

| * | Additional indication or usage |

| ** | Subsequent to the end of fiscal 2004, all commercial rights forPlavixin Japan were transferred from Daiichi and a jointly held partnership to Sanofi-Aventis. (July 5, 2005, News release) |

09

In fiscal 2007, Daiichi is hoping to launch the new quinolone drug DU-6859a and HGF, a DNA plasmid for treating peripheral artery diseases. Having begun accelerating its registration of patients for domestic and overseas clinical trials for HGF, clinical trial in the United States has already finished registering 100 peripheral artery disease patients.

During fiscal 2007, Daiichi is also hoping to obtain approval for the additional indication of heart disease forPlavix,and patient registration for the related clinical trials has proceeded much faster than originally anticipated. In addition, we are planning to launch the dysuria treatment KMD-3213 (silodosin) in China in fiscal 2007.

From fiscal 2009 onward, Daiichi expects to launch new quinolone drugs for treating drug-resistant infections and oral Xa inhibitors, and our clinical trials of these products are proceeding very smoothly. In particular, we expect to complete the compilation of proof of concept (PoC) trial results for the oral Xa inhibitor DU-176b and start Phase IIb trials during 2005. DX-619, a new quinolone compound being developed for treating drug-resistant infections, is demonstrating high efficiency against various drug-resistant organisms, and it may become an important drug of last resort. Another promising candidate considered to have great potential as a successor drug toCravitupon the expiry of that drug’s U.S. patent in 2011 is scheduled to move ahead to Phase I trials in 2006. Regarding our oral anti-allergy agent VLA-4 inhibitor, we are suspending clinical trials due to safety issues of a compound with similar method of action and are working to confirm its safety through pre-clinical trials.

To augment the Daiichi Group’s competitiveness with respect to drug discovery, since 2000 Daiichi has proceeded with research facility reforms that have enabled the creation of high-quality drug discovery systems. The Group has reformed its global development system through measures that include the April 2004 establishment of U.S.-based DMR, which focuses exclusively on the development and accurate evaluation of drug candidates, and the October 2004 establishment of the R&D Division, which offers a seamless framework for all activities from the investigation of drug discovery “seeds” through the subsequent development and commercialization processes. Through these and other measures, the Company is striving to create systems for speeding up R&D programs and thoroughly evaluating drug candidates’ commercial potential at early development stages.

Regarding the business integration with Sankyo, the overlapping parts of the two companies’ R&D programs are in the fields of arteriosclerosis and thrombosis. The combination of Daiichi’s and Sankyo’s efforts will enable still-deeper research programs in these overlapping domains, and particular growth can be expected in the fields of thrombosis, diabetes, and hyperlipidemia. All of these fields are characterized by very high drug development costs, numerous competitors, and low success rates. However, by combining their resources and selecting the most promising from among both companies’ drug candidates, the two partners expect to develop products in all of the aforementioned fields that can be marketed in Japan, the United States, and Europe.

Plans call for building a structural framework for unifying the development pipelines of Daiichi and Sankyo by September 2005 and unifying the priority ratings for the two companies’ pipelines from October. Subsequently, the partners will progressively tighten the focuses of their global development operations and concentrate resources in strategically emphasized fields.

10

The Business Integration of Daiichi and Sankyo

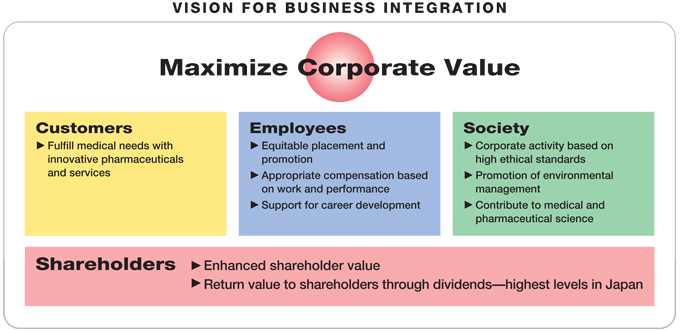

| • | | Business Integration Vision |

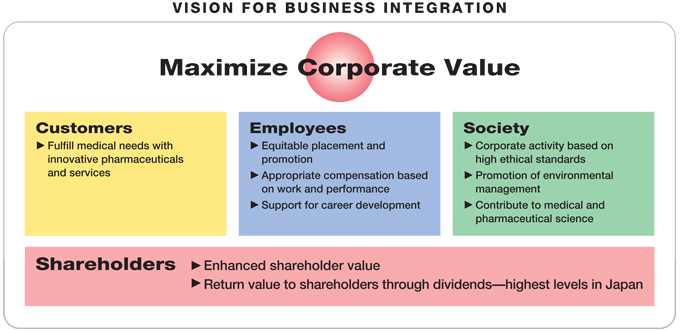

Daiichi and Sankyo have decided to integrate their operations with the goal of becoming a Japan-based “global pharma-innovator” with autonomous competitive strength in the world’s pharmaceutical markets and solid capabilities for sustaining a supply of innovative products and services that meet the needs of patients and medical professionals.

In particular, the integration is designed to maximize corporate value for the benefit of customers, employees, shareholders, and society at large by helping realize

| | – | | powerful drug discovery capabilities for creating innovative drugs, |

| | – | | the highest level of operational efficiency in the industry |

| | – | | a solid presence in the world’s markets, |

| | – | | superior competitive power in the Japanese market, and |

| | – | | rapid growth in profitability. |

11

| • | | Basic Corporate Strategies and Post-Integration Goals |

Plans call for establishing a solid profit base in Japan by consolidating pharmaceutical operations and then nurturing profit growth by expanding overseas operations centered on the United States. The rate of profit growth is expected to increase; in fiscal 2009, the integrated company is aiming for ¥932.0 billion in net sales and ¥255.0 billion in operating income, for a substantial operating income ratio of 27.4%. This high level of profitability is expected to create the funds required to meet the R&D expenses the new company will incur as a global pharma-innovator. To help maximize shareholder value, the integrated company will seek to maximize synergistic benefits that boost sales revenue and reduce costs in a manner that allows it to sustain its commitment to setting its dividend payout ratio at the highest level in the industry. The Company is aiming to have a dividend on equity ratio of 5% in fiscal 2009.

While the business integration entails such potential dissynergies as those stemming from the overlap of the two companies’ product portfolios, plans call for generating synergistic benefits of a substantially greater magnitude and thereby providing a considerable boost to profitability. Specific measures aimed at generating synergistic benefits include the following.

| | – | | The integration is expected to boost annual consolidated operating income from prescription drug operations ¥56.0 billion by fiscal 2009. |

| | – | | Regarding cost synergies in prescription drug operations, the integration is expected to enable the reduction of procurement and outsourcing costs and the consolidation of facility networks in Japan and overseas. These and other cost cuts are projected to reduce annual consolidated operating costs ¥57.0 billion by fiscal 2009. |

| | – | | Regarding the size of the workforce in prescription drug operations, by fiscal 2009 the number of employees in prescription drug operations is projected to total 15,000, and the progressive expansion of overseas operations is expected to boost the overseas share of the workforce to above 40%. |

| | – | | Regarding sales synergies in prescription drug operations, by fiscal 2009 growth, primarily in sales of highly profitable in-house developed products, in Japan and overseas is projected to raise net sales and operating income ¥40.0 billion and ¥36.0 billion, respectively. |

12

| • | | Corporate Governance and Integration Schedule |

Regarding corporate governance for the joint holding company, plans call for establishing a board of auditors and adopting the corporate officer system to promote expeditious decision making and operational execution. While making sure to maximize the synergistic benefits of the business integration, the company will progressively move ahead with the actual integration of operations. Specific integration schedule items include the following.

| | – | | October 2005: Start of marketing collaboration in Japan; start of development pipeline unification |

| | – | | April 2006: Integration of marketing functions in the United States; integration of development functions in the United States and Europe; integration of OTC drug operations |

| | – | | March 2007: Completion of moves to spin off non-pharmaceutical operations as an autonomous unit outside the Group |

| | – | | April 2007: Completion of Group integration, completion of operational and information system integration, introduction of new personnel system |

Daiichi’s mission is to attain global competitiveness so that it can contribute to better human health throughout the world. The upcoming business integration is designed to create a company that can sustain innovation in line with global standards during the 21st century. This entails accelerating the Company’s evolution into a Japan-based “global pharma innovator.” Daiichi will retain its commitment to contributing to healthier and happier lives globally, and the business integration will facilitate the realization of this mission.

13

CSR:

Making a Difference

In line with the slogan “Enriching the Quality of Life,” Daiichi considers its primary corporate mission to be contributing to society through the provision of superior pharmaceutical products. In addition, the Company undertakes various types of corporate social responsibility (CSR) activities, such as those to promote rigorous standards of corporate ethics; help protect the environment; and support sports, arts, and other cultural activities as well as various other programs that help improve social welfare. These initiatives have been highly evaluated from a global perspective, and Daiichi has continued to be included in the FTSE4Good Index Series, which is a leading global socially responsible investment index.

Protecting the Environment

All Daiichi Group units are working concertedly to decrease energy and natural resource consumption while also reducing waste generation. In addition, the Company is progressing with the design of products that feature improved environment friendliness.

Among noteworthy environmental protection initiatives during the fiscal year under review, Daiichi introduced a calcium fluoride reuse system at its Akita Factory. The factory employs fluorine in its bulk powder manufacturing operations, generating calcium fluoride as a waste product. While the calcium fluoride was previously disposed of in landfills, from the fiscal year under review it is being supplied for use as a raw material for cement manufacturing. This system has the potential for reducing the volume of waste disposed of by the Tokyo Research and Development Center and Daiichi Pharmatech’s three factories by 70% during the current fiscal year.

| | | | | | | | |

Organic fluorine compounds | | è | | Sodium fluoride | | è | | Calcium fluoride (for reuse) |

| | | | |

| | | (combustion) | | (salt exchange, solid/liquid separation, purification) |

| | | | |

For more information on these and other environmental activities, please refer to Daiichi’s annual environmental reports, which it has published since fiscal 2001. These reports can be accessed via the Company’s website.

An event at the “Enriching the Quality of Life Health Forum” public lecture series

14

A scene from Daiichi’s chemistry education programs for children

Contributing to Society

Aiming to make special contributions to society as a pharmaceutical manufacturer, Daiichi responded to the major December 2004 earthquake in the Gulf of Sumatra and associated tsunami by providing pharmaceutical products that help prevent the spread of infectious diseases. Working through its representative office in Jakarta, the Company donated 10,000 vials ofCravitinjectable and a considerable amount of orally administered ofloxacin (1,780 250mg tablets ofReskinand 12,000 200mg tablets ofDanoflox) to the local Tsunami Relief Medical Committee. The Company’s consolidated subsidiary in Thailand, Daiichi Pharmaceutical (Thailand) Ltd., (DPT), donated 5,000 100mg tablets ofCravitand 500 vials ofTarivid Otic Solutionto the Thai Red Cross. Additional financial donations to disaster relief programs were made by many employees in the parent Company and other Group companies.

Regarding long-term programs, Daiichi has since 1997 organized a series of twice-yearly public lectures, the “Enriching the Quality of Life Health Forum,” that help promote greater health consciousness within the general populace. Since 1995, the Company has annually organized custom-designed chemistry education programs for children that involve easy-to-understand science lessons along with tours of its manufacturing and research facilities. In this way, the Company makes good use of its facilities to encourage young people to take greater interest in natural sciences while also contributing to local communities.

Shiki Theatre Company’s production of Phantom of the Opera

photo courtesy of Atsutoshi Shimosaka

Among its various activities for promoting the appreciation of art and culture, Daiichi has supported the Shiki Theatre Company musical and drama group for 20 years and the Mito Chamber Orchestra for 11 years. Both groups have been highly evaluated, and we are considering contributing to society through continued support for these groups in the future.

In connection with commemorating the 90th anniversary of its founding during the current fiscal year, Daiichi is planning to implement various special CSR activities that foster still-closer ties with communities near its facilities. These activities include the donation of ambulances to the local governments of the communities surrounding the Tokyo R&D Center and Daiichi Pharmatech’s factories in Osaka, Shizuoka, and Akita.

For more information on these activities, please take a look at Daiichi’s website.

Start of the Children’s Soccer Project!

A soccer clinic

In the current fiscal year, Daiichi began a children’s soccer project as part of various activities designed to commemorate the 90th anniversary of the Company’s founding and is also designed to promote contributions to society involving the direct participation of employees.

Aimed at supporting the development of children’s soccer activities, the program will encompass

| 1. | Specially designed soccer clinics that include soccer classes for children taught by professional soccer players as well as health seminars for children’s parents/guardians taught by team doctors, |

| 2. | Special sponsorship of the 19th annual National Boys’ and Girls’ Grass Soccer Tournament, and |

| 3. | Sponsorship of the International Friendship Games. |

15

Board of Directors

(As of June 29, 2005)

| | | | |

Back row (from left): | | | | |

| Tsutomu Une, Ph.D. | | Hidetoshi Imaizumi | | Ryuzo Takada |

| Managing Director | | Managing Director | | Managing Director |

| | |

Front row: | | | | |

| Kenichi Mizutani | | Kiyoshi Morita | | Tadao Suzuki, Ph.D. |

| Senior Managing Director | | President and Chief Executive Officer | | Senior Managing Director |

Kiyoshi Morita

President and Chief Executive Officer

(Representative Director)

Kenichi Mizutani

Senior Managing Director

(Representative Director)

Tadao Suzuki, Ph.D.

Senior Managing Director

Hidetoshi Imaizumi

Managing Director

Tsutomu Une, Ph.D.

Managing Director

Ryuzo Takada

Managing Director

Hiroshi Sugiyama

Board Director

Teruo Takayanagi, Ph.D.

Board Director

Toru Kuroda

Board Director

Akira Nagano

Board Director

George Nakayama

Board Director

Yoshifumi Nishikawa

Board Director

Jotaro Yabe

Board Director

Yutaka Hirata

Senior Corporate Auditor

Shigemi Oda

Corporate Auditor

Tadashi Takauji

Corporate Auditor

Koukei Higuchi

Corporate Auditor

16

Six-Year Summary

Daiichi Pharmaceutical Co., Ltd. and Consolidated Subsidiaries

Years ended March 31

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Millions of yen

| |

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Operating Results: | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | ¥ | 328,534 | | | ¥ | 322,767 | | | ¥ | 322,011 | | | ¥ | 332,753 | | | ¥ | 317,072 | | | ¥ | 300,539 | |

Cost of sales | | | 100,834 | | | | 103,474 | | | | 106,904 | | | | 112,515 | | | | 109,984 | | | | 108,091 | |

Selling, general and administrative expenses | | | 114,219 | | | | 114,129 | | | | 109,093 | | | | 108,746 | | | | 103,322 | | | | 97,274 | |

Research and development expenses | | | 57,417 | | | | 59,049 | | | | 53,377 | | | | 46,082 | | | | 39,990 | | | | 34,204 | |

| | | | [58,605 | ]* | | | [60,721 | ]* | | | [55,177 | ]* | | | [48,521 | ]* | | | [42,060 | ]* | | | [36,229 | ]* |

Interest expense | | | 1 | | | | 1 | | | | 16 | | | | 129 | | | | 368 | | | | 966 | |

Income before income taxes and minority interests in net income of consolidated subsidiaries | | | 64,671 | | | | 47,608 | | | | 36,284 | | | | 58,279 | | | | 53,532 | | | | 47,676 | |

Net income | | | 37,175 | | | | 26,662 | | | | 13,567 | | | | 31,375 | | | | 28,463 | | | | 24,065 | |

Net income per share of common stock (yen) | | ¥ | 137.95 | | | ¥ | 97.25 | | | ¥ | 48.15 | | | ¥ | 110.18 | | | ¥ | 102.13 | | | ¥ | 87.69 | |

Cash dividends paid | | ¥ | 8,072 | | | ¥ | 8,218 | | | ¥ | 8,034 | | | ¥ | 7,161 | | | ¥ | 6,688 | | | ¥ | 4,958 | |

| | | | | | |

Financial Position: | | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | ¥ | 299,837 | | | ¥ | 283,206 | | | ¥ | 289,155 | | | ¥ | 288,373 | | | ¥ | 322,386 | | | ¥ | 353,603 | |

Net property, plant and equipment | | | 105,603 | | | | 107,286 | | | | 112,422 | | | | 109,925 | | | | 108,582 | | | | 108,097 | |

Total assets | | | 546,555 | | | | 521,809 | | | | 512,384 | | | | 525,511 | | | | 553,376 | | | | 505,288 | ** |

Total current liabilities | | | 74,339 | | | | 71,536 | | | | 75,358 | | | | 84,636 | | | | 100,435 | | | | 127,346 | |

Total long-term liabilities | | | 22,071 | | | | 23,183 | | | | 29,111 | | | | 33,984 | | | | 39,146 | | | | 31,280 | |

Total shareholders’ equity | | | 448,563 | | | | 422,130 | | | | 401,472 | | | | 401,208 | | | | 408,247 | | | | 341,335 | ** |

| | | | | | |

Financial Ratios (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Pre-tax profit margin (Income before income taxes and minority interests in net income of consolidated subsidiaries to net sales) | | | 19.7 | % | | | 14.7 | % | | | 11.3 | % | | | 17.5 | % | | | 16.9 | % | | | 15.9 | % |

Net profit margin (Net income to net sales) | | | 11.3 | | | | 8.3 | | | | 4.2 | | | | 9.4 | | | | 9.0 | | | | 8.0 | |

Return on shareholders’ equity (Net income to average shareholders’ equity) | | | 8.5 | | | | 6.5 | | | | 3.4 | | | | 7.8 | | | | 7.6 | | | | 7.3 | ** |

Shareholders’ equity to total assets | | | 82.1 | | | | 80.9 | | | | 78.4 | | | | 76.3 | | | | 73.8 | | | | 67.6 | ** |

Research and development expenses as a percentage of net sales | | | 17.5 | | | | 18.3 | | | | 16.6 | | | | 13.8 | | | | 12.6 | | | | 11.4 | |

| | | | | | |

Number of Employees | | | 7,333 | | | | 7,379 | | | | 7,428 | | | | 7,060 | | | | 6,958 | | | | 6,944 | |

| * | Total amount, including production R&D costs. |

| ** | Effective April 1, 2000, the Company and its consolidated subsidiaries adopted a revised accounting standard for foreign currency translation. Under the revised accounting standard, a foreign currency translation adjustment is reported in minority interests and shareholders’ equity. The amount for 2000, which was included in assets, has been reclassified to conform to the 2001 presentation. |

17

Financial Review

Overview

During the year, overseas pharmaceutical markets were characterized by a further intensification of global competition centered on “global-mega” companies and associated with both new drug-related R&D and marketing activities. The Japanese pharmaceutical market was affected by changes in the healthcare systems—such as the growing scope of application of the comprehensive hospital therapy evaluation system and the conversion of national university hospitals and other national hospitals into independent corporations—and an average 4.2% reduction in National Health Insurance (NHI) drug reimbursement prices that was implemented in April 2004.

Against this backdrop, the Daiichi Group worked to expand the markets for its products while emphasizing the promotion of appropriate drug use through the provision of information related to drug efficacy and safety. As a result, higher revenue from domestic sales of prescription drugs and a rise in bulk levofloxacin (a quinolone antibiotic) exports more than offset a revenue decline associated with the transfer of veterinary and livestock feed products business to another company.

Consequently, net sales advanced 1.8% from the previous fiscal year, to ¥328.5 billion. Reflecting the reduction in cost of sales as well as cost-cutting measures with respect to R&D expenses, operating income totaled ¥56.1 billion, up 21.6% from the previous fiscal year. While a ¥7.3 billion extraordinary restructuring charge associated with the spin-off of the parent Company’s manufacturing operations was recorded, this was more than offset by an extraordinary gain of ¥11.7 billion on the release from the substitutional portion of the Employee’s Pension fund to the government and a ¥3.8 billion extraordinary gain on the transfer to the defined contribution pension plan. Thus, net income surged 39.4% from the previous fiscal year, to ¥37.2 billion.

Results of Operations

Net Sales

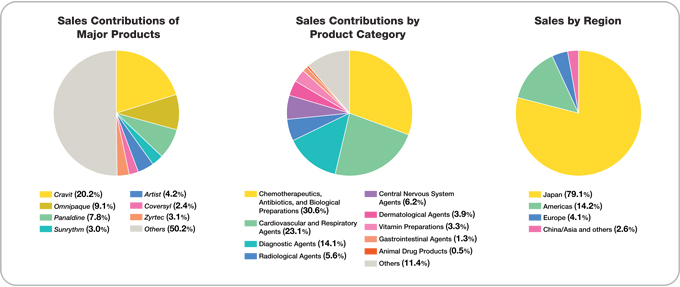

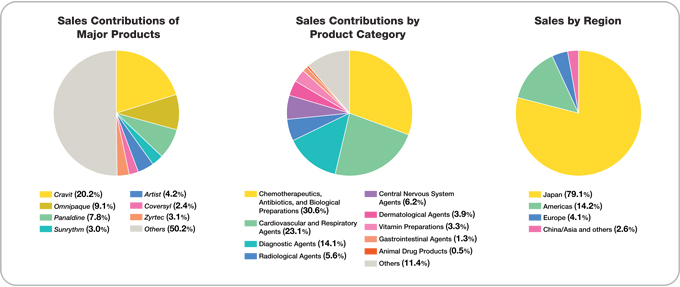

The consolidated net sales of the Daiichi Pharmaceutical Group during the period under review were ¥328.5 billion, up 1.8% from the previous fiscal year. Sales in the core prescription drugs business advanced 2.4%, to ¥311.8 billion, and accounted for 94.9% of net sales, 0.5 percentage point more than in the previous fiscal year. Overseas sales grew 3.7%, to ¥68.6 billion, and accounted for 20.9% of total net sales, up 0.4 percentage point.

A breakdown of performance by business segment follows.

Prescription Drugs

Although domestic prescription drug sales were negatively affected by the April 2004 revision of drug reimbursement prices, which reduced the domestic prices of the Company’s products by approximately 5%, sales of the mainstay broad-spectrum oral antibacterial agentCravitwere steady, and increased sales were recorded for such mainstay products asMobic,a nonsteroidal anti-inflammatory agent marketed in Japan exclusively by Daiichi since July 2004;Artist,a long-acting beta-blocker for treating high blood pressure, angina, and chronic cardiac insufficiency; andZyrtec,an anti-allergy agent. As a result, total domestic prescription drug sales advanced 1.9% from the previous fiscal year, to ¥205.9 billion.

Overseas prescription drug sales were negatively affected by a decline in a U.S. subsidiary’s sales ofFLOXIN Otic, an antibacterial otic solution for treating ear infections, as well as by the appreciation of the yen. However, the completion of U.S. inventory adjustments for levofloxacin enabled a recovery in bulk sales of this product, and patent licensing royalty income grew. Thus, overseas sales of prescription drugs rose 6.2% from the previous fiscal year, to ¥61.3 billion.

18

Diagnostics and Radiopharmaceuticals

Measures aimed at restraining medical costs kept market conditions challenging, and sales of such products as in vivo radiopharmaceuticals for cardiac imaging applications declined. However, strong sales of such in vitro diagnostics products as testing kits for influenza—which was prevalent in Japan during the year under review and mainstay cholesterol measuring agents for export boosted total sales of diagnostics and radiopharmaceuticals products 2.1% from the previous fiscal year, to ¥32.9 billion.

OTC Drugs

Karoyan Gush, a hair-growth accelerator launched in June 2004, made a significant contribution to performance during the year, and sales of such products asPatecsanti-inflammatory analgesic poultices and the vitamin C productCystina Cwere robust.

Accordingly, OTC Drug sales advanced 16.3% from the previous fiscal year, to ¥10.2 billion.

Animal Drug Products

Reflecting the Company’s June 2004 transfer of its veterinary and livestock feed products business to Meiji Seika Kaisha, Ltd., segment sales dropped 59.1% from the previous fiscal year, to ¥1.5 billion.

Other Businesses

Sales of fine chemical products decreased 10.6%, to ¥13.0 billion, reflecting drops in sales of such products as calcium pantothenate to customers in North America and Europe. Total sales in the other businesses segment, which includes fine chemicals, declined 8.3%, to ¥16.7 billion.

Costs, Expenses, and Earnings

The cost of sales for the period under review decreased 2.6% from the previous fiscal year, to ¥100.8 billion. The gross profit ratio rose 1.4 percentage points, to 69.3%. Selling, general, and administrative (SG&A) expenses were ¥114.2 billion, edging up 0.1% from the previous fiscal year, and R&D expenses decreased 2.8%, to ¥57.4 billion. As a result, operating income surged 21.6%, to ¥56.1 billion. The Group’s concerted efforts to reduce the cost of sales boosted gross profit ¥8.4 billion and R&D expenses decreased ¥1.6 billion, as these expenses increased overseas but were down in Japan owing to the end of certain domestic R&D projects and to efficiency measures. Thus, operating income grew considerably and the ratio of operating income to net sales increased 2.8 percentage points to 17.1%,

Other income (expenses), net, improved from net income of ¥1.5 billion in the previous fiscal year to net income of ¥8.6 billion for the fiscal year under review. While a ¥7.3 billion extraordinary restructuring charge associated with the spin-off of the parent Company’s manufacturing operations was recorded, this was more than offset by an extraordinary gain of ¥11.7 billion on the release of the substitutional portion of the Employee’s Pension fund to the government and a ¥3.8 billion extraordinary gain on the transfer to the defined contribution pension plan.

As a result, income before income taxes and minority interests in net income of consolidated subsidiaries for the fiscal year under review was ¥64.7 billion, an increase of ¥17.1 billion from the previous fiscal year, and its value as a percentage of net sales increased 5.0 percentage points, to 19.7%.

19

As a percentage of income before income taxes and minority interests in net income of consolidated subsidiaries, provision for income taxes, reflecting tax effect accounting, decreased 2.5 percentage points, from 47.1% to 44.6, a number relatively close to the 40.5% statutory rate.

As a result of the above, net income for the fiscal year under review surged 39.4%, to ¥37.2 billion, and the net profit margin rose 3.0 percentage points, to 11.3%. The return on shareholders’ equity improved 2.0 percentage points, to 8.5%.

Total R&D expenses (both research and development expenses and production R&D cost included in the cost of sales and SG&A expenses) amounted to ¥58.6 billion, down 3.5%. A rise in overseas R&D expenses due to the start of full-scale operations by DMR was more than offset by a decrease in domestic R&D expenses. The decrease in domestic R&D expenses reflected a peaking out of expenses associated withSonazoidandSilodosinfollowing the submission of applications for those products in February 2004 and May 2004, respectively, as well as measures to increase the efficiency of domestic exploratory clinical research following the start of operations by DMR. The ratio of total R&D expenses to net sales decreased 0.8 percentage points to 17.5%.

Financial Condition

At the end of the fiscal year, total assets amounted to ¥546.6 billion, up ¥24.7 billion, or 4.7%, from the previous fiscal year end. Total current assets grew ¥16.6 billion, to ¥299.8 billion. This reflected a ¥7.8 billion increase, to ¥123.9 billion, in liquidity on hand—including cash and time deposits along with marketable securities—and a ¥7.2 billion rise in trade notes and accounts receivable, net. Investments and long-term loans receivable decreased ¥7.0 billion; however, within other assets, other jumped ¥17.1 billion, mainly reflecting the recording of ¥15.5 billion in prepaid expenses associated with the shift to a defined contribution pension plan.

Total liabilities grew ¥1.7 billion, or 1.8%, to ¥96.4 billion. Current liabilities increased ¥2.8 billion, or 3.9%, to ¥74.3 billion, mainly owing to a ¥4.3 billion rise in trade notes and accounts payable. Long-term liabilities decreased ¥1.1 billion, or 4.8%, to ¥22.1 billion. This principally reflected a ¥14.3 billion drop in reserves for employees’ retirement benefits, to ¥4.8 billion, which more than compensated for a ¥9.1 billion increase in deferred income taxes, to ¥9.8 billion.

Total shareholders’ equity grew ¥26.4 billion, or 6.3%, to ¥448.6 billion. This mainly reflected a ¥28.2 billion rise in retained earnings, less a ¥2.5 billion rise in treasury stock.

As a result of the small increase in total liabilities and relatively large increase in shareholders’ equity, the shareholders’ equity ratio grew 1.2 percentage points in the fiscal year under review, to 82.1%. As the debt-to-equity ratio is approximately zero, the Company is effectively being managed without incurring debt. Moreover, the current ratio improved 7.4 percentage points, to 403.3%, and the ratio of net income to shareholders’ equity rose 2.0 percentage points, to 8.5%. Thus, considerable improvement was achieved in all principal financial ratios.

20

Cash Flows

Net cash provided by operating activities for the fiscal year under review decreased ¥11.9 billion, to ¥35.6 billion, despite a ¥17.1 billion rise in income before income taxes and minority interests in net income of consolidated subsidiaries. The decrease reflected an ¥8.8 billion decrease in retirement benefits, a ¥15.5 billion increase in prepaid pension costs, a ¥6.8 billion decrease in trade receivables compared with a ¥7.4 billion increase in the previous fiscal year due to such factors as a rise in royalty income, and a ¥1.3 billion increase in inventories compared with a ¥6.6 billion decrease a year earlier.

Net cash used in investing activities during the fiscal year under review totaled ¥22.0 billion, down ¥5.4 billion from the previous fiscal year. This mainly resulted from a decrease in payments for purchases of investment securities.

Net cash used in financing activities for the fiscal year under review totaled ¥12.4 billion, down ¥6.1 billion from the previous fiscal year, largely because of a decrease in purchases of treasury stock.

As a result, cash and cash equivalents at the end of the fiscal year under review amounted to ¥91.6 billion, up ¥1.2 billion.

Dividends

Positioning the distribution of profits earned from business activities as one of its most important management tasks, Daiichi emphasizes distributing profits to shareholders in a manner that reflects corporate performance. The level of cash dividends is determined in line with this emphasis while reflecting the comprehensive consideration of such factors as the need to bolster internal reserves to build a foundation for corporate growth.

With regard to cash dividends, the Company seeks to maintain stable growth in cash dividends and in the dividend payout ratio while concurrently being flexible and timely in the repurchase of its own outstanding shares with the goal of boosting income per share. Turning to the use of internal reserves, the Company plans to use such reserves to fund investments aimed at realizing the goal of becoming a global pharma-innovator, including investments aimed at engaging in leading-edge research, strengthening the product development pipeline, engaging in corporate alliances, and strengthening the foundations for international operations.

Based on this policy, the Company decided to increase its year-end cash dividends ¥10 per share and disburse total year-end cash dividends of ¥25 per share. Including the ¥15 per share interim cash dividends, cash dividends applicable to the fiscal year under review thus totaled ¥40 per share. As a result, the dividend payout ratio for the parent Company on a non-consolidated basis rose 26.6 percentage points, to 55.9%, and ratio of dividends to shareholders’ equity increased 0.6 percentage point, to 2.6%. The dividend payout ratio on a consolidated basis rose was 29.0%, which the Company considers sufficient.

Forward-Looking Statement

Regarding overseas pharmaceutical markets, while industrialized countries are making sustained efforts to reduce healthcare costs, competition related to marketing is becoming increasingly intense in the United States and other countries, and development competition in the search for breakthrough products necessitates the use of leading-edge technologies that are accompanied by increased R&D expenses. These and other factors are making the overseas operating environment more challenging.

In Japan, growth in the pharmaceutical market is being slowed by healthcare system reform measures implemented against a backdrop of demographic graying, and the growing domestic market presence of companies whose home bases are overseas is contributing to an intensification of competition for market share.

Aiming to leverage new global development drug candidates to realize its corporate objectives, the Daiichi Group has designated the period through fiscal 2006 for reforms that will create the foundation required for achievement of these objectives. Accordingly, it is taking measures to attain such objectives as the expansion of global R&D activities, the strengthening of domestic and overseas prescription drug business, and the implementation of structural reforms that create a resiliently strong corporate structure.

The Company’s forecasts for the current fiscal year are as follows.

Net Sales

In the domestic prescription drug business, Daiichi projects that it will face a severe operating environment due to such factors as the increasing effect of government measures aimed at restraining medical costs and the rising market share of major global drug companies. Against this backdrop, the Company will concentrate its efforts on maintaining the top market share of its mainstay productCravit,as well as increasing sales of such major products for cardiovascular diseases asArtist, Sunrythm,andHANP.In addition, the Company anticipates that the launch of such new products during the latter half of the year asPlavixwill help increase domestic prescription drug sales.

In the overseas prescription drug business, the Company expects that revenues from its mainstay bulk exports of levofloxacin to the United States will continue to increase in light of the favorable growth in sales by its licensee. The Company is basing its projections on the premise that exchange rates during the fiscal year will be approximately US$1=¥105 and €1=¥130.

Rising sales are projected in OTC drug operations due to such factors as expanding sales of the hair-growth acceleratorKaroyan Gush.Sales of diagnostics and radiopharmaceuticals, for which market conditions are severe, are expected to be approximately unchanged.

Consequently, net sales are projected to increase, albeit by a small margin.

21

Profitability

Having started operating Daiichi Pharmatech in April 2005, the Company is further stepping up its efforts to reduce the cost of sales, and it intends to place still greater emphasis on reducing non-strategic expenses. The Company is seeking to restrain R&D expenses by strengthening its capabilities for accurately evaluating drug candidates at early development stages and continuing to concentrate its operations in core therapeutic domains; nevertheless, R&D expenses are projected to increase approximately ¥10.0 billion owing to the full-scale start of clinical trials in the United States and Europe for DU-176b, an oral factor-Xa inhibitor, during the next fiscal year.

While the domestic and overseas operating environments are expected to be more challenging, the Company is doing its utmost to secure the profits required to fund the R&D programs needed to build new corporate growth paths, expeditiously realize the medium-to-long-term corporate growth capabilities that its R&D results make possible, and proceed steadily and quickly with such structural reform measures as those aimed at merging and eliminating certain distribution facilities. The Company plans to implement these strategies in a manner that maximizes the benefits of the upcoming business integration.

Based on the above projections, Daiichi anticipates that it will record higher sales but lower profits during the fiscal year ending March 31, 2006. Specifically, the Company is aiming to record ¥333.0 billion in consolidated net sales, ¥53.0 billion in operating income, and ¥52.0 billion in ordinary income. In view of an extraordinary loss of approximately ¥10.0 billion in goodwill in connection with the conversion of Daiichi Suntory Pharma into a wholly owned subsidiary, net income is expected to amount to ¥18.0 billion.

Note Regarding Forward-Looking Statements

This annual report contains statements concerning forecasts for Daiichi, Sankyo, and their group companies. These statements are based on assumptions and judgments made with information available at the time of preparation, and as such are subject to existing and unforeseen risks, as well as uncertainties and other factors. Risks, uncertainties, and other factors may cause business performance, management actions, and financial results to differ from those presented in this report.

Business Risk and Other Risks

With regard to business activities, financial accounting, and other items described in this report, issues that could potentially exert a large influence on investors’ decisions include those described below. Forward-looking statements are based on judgments made by the Group as of March 31, 2005.

(1) R&D Risks

The R&D of new drug development candidates entails large financial expenditures over lengthy time periods. If during those time periods, the expected efficacy of a drug under development cannot be confirmed, there is a possibility that the relevant R&D project will be terminated. Moreover, in the case of cooperative R&D activities in collaboration with other parties, such events as contract changes or annulments could cause a project to fail.

(2) Manufacturing and Procurement Risks

The Group manufactures products at its own factories using its own technologies, and it depends on specific suppliers for a portion of the products and materials used in the manufacture of certain products. Because of this, if for some reason manufacturing or procurement activities are delayed or halted, there is a possibility that such event would affect the Group’s profitability and financial situation.

The Group conducts manufacturing operations in accordance with regulations based on the Pharmaceutical Affairs Law; however, if a product quality problem requiring a product recall or similar event should occur, there is a possibility that it would affect the Group’s profitability and financial situation.

(3) Marketing Risks

In the case of such an event as the occurrence of an unanticipated side effect, the launch by other companies of products that compete in the same therapeutic domains as the Group’s products, or the launch of competing generic versions of the Group’s products after the expiration of relevant patents, there is a possibility that the Group’s sales could be adversely affected and therefore the Group’s profitability and financial situation could also be affected.

In the case of such an event as the expiration or annulment of marketing or technology out-licensing contracts or a change in the terms of such contracts, the Group’s profitability and financial situation could be affected.

Aggregate sales ofCravit, Panaldine,andOmnipaqueaccount for more than 40% of the Group’s consolidated net sales. If side effects or other factors that have the effect of decreasing sales of these products were to arise, there is a possibility that such an event would have a large influence on the Group’s profitability and financial situation.

22

(4) Legislative, Regulatory, and Government Administration Risks

Prescription drug products in Japan are subject to a variety of regulations and administrative procedures based on the Pharmaceutical Affairs Law. Moreover, trends in other government measures related to healthcare systems and health insurance systems, such as the biannual revision of National Health Insurance (NHI) drug reimbursement prices, may affect the Group’s profitability and financial situation. Similarly, drug-related operations are liable to be affected by diverse regulations in other countries.

(5) Intellectual Property Risks

If some of the Group’s business activities are alleged to infringe on the patent rights or other intellectual property rights of another party, there is a possibility that such activities might have to be discontinued or related litigation undertaken. On the other hand, if another party should infringe on the patent rights or other intellectual property rights of the Group, there is a possibility that related litigation might have to be undertaken to defend those rights. These possibilities could affect the Group’s profitability and financial situation.

(6) Environmental Risks

Chemical substances used in drug-related research and manufacturing processes include substances that can affect human health and natural ecosystems. Each of the Group’s facilities is implementing measures to prevent air and water pollution, shifting to the use, where possible, of substances with relatively small environmental impact, and making other environmental conservation efforts. However, in the unlikely case of a determination that it is determined that the Group’s activities have caused serious adverse environmental impact, there is a possibility that the Group’s profitability and financial situation could be affected.

(7) Litigation Risks

In addition to fair trade issues, the Group’s activities have the potential for other difficulties with regard to various other issues—such as drug side effects, manufacturer’s liability issues, and labor issues—that could become the subject of litigation. There is a possibility that such litigation could affect the Group’s profitability and financial situation.

(8) Currency Exchange Risks

Most of the Group’s overseas sales transactions are conducted in foreign currencies. Moreover, the revenues and assets of overseas subsidiaries are translated into yen for inclusion in the Group’s consolidated accounting items. Because of these circumstances, there is a possibility that changes in currency exchange rates could affect the Group’s profitability and financial situation.

(9) Other Risks

In addition to risks already described, other types of risks that could affect the Group’s profitability and financial situation include those associated with the interruption of business activities due to earthquakes or other large-scale disasters, the interruption of computer system operations due to network viruses or other technical problems, fluctuations in stock prices and interest rates, and the emergence of uncollectable accounts receivable or loans that could follow the deterioration of transactional partners’ financial position or of the state of affairs in a relevant country.

23

Consolidated Balance Sheets

Daiichi Pharmaceutical Co., Ltd. and Consolidated Subsidiaries

March 31, 2005 and 2004

| | | | | | | | | | | | |

| | | Millions of yen

| | | Thousands of U.S. dollars (Note 1)

| |

| | | 2005

| | | 2004

| | | 2005

| |

ASSETS | | | | | | | | | | | | |

Current Assets: | | | | | | | | | | | | |

Cash and time deposits (Note 3) | | ¥ | 16,395 | | | ¥ | 21,978 | | | $ | 152,668 | |

Marketable securities (Notes 3 and 4) | | | 107,515 | | | | 94,124 | | | | 1,001,164 | |

Trade notes and accounts receivable, net of allowance of ¥51 million ($475 thousand) in 2005 and ¥256 million in 2004 | | | 88,117 | | | | 80,956 | | | | 820,533 | |

Inventories (Note 6) | | | 40,486 | | | | 39,146 | | | | 377,000 | |

Deferred income taxes (Note 9) | | | 13,827 | | | | 16,111 | | | | 128,755 | |

Other current assets | | | 33,497 | | | | 30,891 | | | | 311,918 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total current assets | | | 299,837 | | | | 283,206 | | | | 2,792,038 | |

| | | |

Investments and Long-Term Loans Receivable: | | | | | | | | | | | | |

Investment securities (Note 4) | | | 105,461 | | | | 112,077 | | | | 982,037 | |

Long-term loans receivable, net of allowance of ¥323 million ($3,008 thousand) in 2005 and ¥62 million in 2004 | | | 440 | | | | 863 | | | | 4,097 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total investments and long-term loans receivable | | | 105,901 | | | | 112,940 | | | | 986,134 | |

| | | |

Property, Plant and Equipment(Note 8): | | | | | | | | | | | | |

Land | | | 17,526 | | | | 17,722 | | | | 163,200 | |

Buildings | | | 141,984 | | | | 141,606 | | | | 1,322,134 | |

Machinery and equipment | | | 150,695 | | | | 152,023 | | | | 1,403,250 | |

Construction in progress | | | 6,029 | | | | 1,245 | | | | 56,141 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | | | 316,234 | | | | 312,596 | | | | 2,944,725 | |

Accumulated depreciation | | | (210,631 | ) | | | (205,310 | ) | | | (1,961,365 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Net property, plant and equipment | | | 105,603 | | | | 107,286 | | | | 983,360 | |

| | | |

Other Assets: | | | | | | | | | | | | |

Deferred income taxes (Note 9) | | | 3,167 | | | | 3,437 | | | | 29,491 | |

Other | | | 32,047 | | | | 14,940 | | | | 298,417 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total other assets | | | 35,214 | | | | 18,377 | | | | 327,908 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total assets | | ¥ | 546,555 | | | ¥ | 521,809 | | | $ | 5,089,440 | |

| | |

|

|

| |

|

|

| |

|

|

|

See accompanying notes.

24

| | | | | | | | | | | | |

| | | Millions of yen

| | | Thousands of

U.S. dollars (Note 1)

| |

| | | 2005

| | | 2004

| | | 2005

| |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | |

Current Liabilities: | | | | | | | | | | | | |

Long-term debt due within one year (Note 8) | | ¥ | 18 | | | ¥ | 18 | | | $ | 168 | |

Trade notes and accounts payable | | | 35,981 | | | | 31,666 | | | | 335,050 | |

Income taxes payable (Note 9) | | | 8,401 | | | | 9,963 | | | | 78,229 | |

Consumption tax payable | | | 966 | | | | 1,720 | | | | 8,995 | |

Accrued expenses | | | 26,311 | | | | 25,078 | | | | 245,004 | |

Other current liabilities | | | 2,662 | | | | 3,091 | | | | 24,788 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total current liabilities | | | 74,339 | | | | 71,536 | | | | 692,234 | |

| | | |

Long-Term Liabilities: | | | | | | | | | | | | |

Long term debt (Note 8) | | | 6 | | | | 24 | | | | 56 | |

Employees’ severance and retirement benefits (Note 10) | | | 4,754 | | | | 19,091 | | | | 44,269 | |

Directors’ and corporate auditors’ retirement benefits | | | 2,201 | | | | 2,671 | | | | 20,495 | |

Deferred income taxes (Note 9) | | | 9,792 | | | | 680 | | | | 91,182 | |

Other long-term liabilities | | | 5,318 | | | | 717 | | | | 49,520 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total long-term liabilities | | | 22,071 | | | | 23,183 | | | | 205,522 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total liabilities | | | 96,410 | | | | 94,719 | | | | 897,756 | |

| | | |

Minority Interests | | | 1,582 | | | | 4,960 | | | | 14,731 | |

| | | |

Contingent Liabilities(Note 12) | | | | | | | | | | | | |

| | | |

Shareholders’ Equity(Note 11): | | | | | | | | | | | | |

Common stock: | | | | | | | | | | | | |

Authorized—789,000,000 shares in 2005 and 2004 Issued—286,453,235 shares in 2005 and 2004 | | | 45,247 | | | | 45,247 | | | | 421,333 | |

Capital surplus | | | 49,130 | | | | 48,961 | | | | 457,491 | |

Retained earnings | | | 376,144 | | | | 347,973 | | | | 3,502,598 | |

Net unrealized holding gains on securities | | | 18,215 | | | | 17,873 | | | | 169,615 | |

Foreign currency translation adjustment | | | (1,305 | ) | | | (1,524 | ) | | | (12,151 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

| | | | 487,431 | | | | 458,530 | | | | 4,538,886 | |

Treasury stock, at cost | | | (38,868 | ) | | | (36,400 | ) | | | (361,933 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Total shareholders’ equity | | | 448,563 | | | | 422,130 | | | | 4,176,953 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total liabilities, minority interests and shareholders’ equity | | ¥ | 546,555 | | | ¥ | 521,809 | | | $ | 5,089,440 | |

| | |

|

|

| |

|

|

| |

|

|

|

25

Consolidated Statements of Income

Daiichi Pharmaceutical Co., Ltd. and Consolidated Subsidiaries

Years ended March 31, 2005, 2004 and 2003

| | | | | | | | | | | | | | | | |

| | | Millions of yen

| | | Thousands of

U.S. dollars (Note 1)

| |

| | | 2005

| | | 2004

| | | 2003

| | | 2005

| |

Net Sales(Note 13) | | ¥ | 328,534 | | | ¥ | 322,767 | | | ¥ | 322,011 | | | $ | 3,059,261 | |

| | | | |

Costs and Expenses(Note 13): | | | | | | | | | | | | | | | | |

Cost of sales | | | 100,834 | | | | 103,474 | | | | 106,904 | | | | 938,951 | |

Selling, general and administrative expenses | | | 114,219 | | | | 114,129 | | | | 109,093 | | | | 1,063,591 | |

Research and development expenses | | | 57,417 | | | | 59,049 | | | | 53,377 | | | | 534,659 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 272,470 | | | | 276,652 | | | | 269,374 | | | | 2,537,201 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating Income(Note 13) | | | 56,064 | | | | 46,115 | | | | 52,637 | | | | 522,060 | |

| | | | |

Other Income (Expenses): | | | | | | | | | | | | | | | | |

Interest and dividend income | | | 1,474 | | | | 1,211 | | | | 1,634 | | | | 13,726 | |

Interest expense | | | (1 | ) | | | (1 | ) | | | (16 | ) | | | (9 | ) |

Gain on the release from the substitutional portion of the Employees’ Pension Fund to the government | | | 11,747 | | | | — | | | | — | | | | 109,386 | |

Gain on the transfer to the defined contribution pension plan | | | 3,769 | | | | — | | | | — | | | | 35,096 | |

Gain on sale of the business for the veterinary and livestock feed product | | | 800 | | | | ��� | | | | — | | | | 7,449 | |

Lump-sum amortization of consolidation difference (Note 3) | | | — | | | | — | | | | (11,728 | ) | | | — | |

Loss on devaluation of investment securities | | | (32 | ) | | | (61 | ) | | | (3,722 | ) | | | (298 | ) |

Losses on bulk vitamin litigation | | | (111 | ) | | | — | | | | (239 | ) | | | (1,034 | ) |

Restructuring charge | | | (7,316 | ) | | | — | | | | — | | | | (68,126 | ) |

Loss on settlement of an Employees’ Pension Fund Plan | | | (381 | ) | | | — | | | | — | | | | (3,548 | ) |

Equity in net losses of affiliated companies | | | (400 | ) | | | — | | | | — | | | | (3,725 | ) |

Other, net | | | (942 | ) | | | 344 | | | | (2,282 | ) | | | (8,770 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 8,607 | | | | 1,493 | | | | (16,353 | ) | | | 80,147 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | |

Income before Income Taxes and Minority Interests in Net Income of Consolidated Subsidiaries | | | 64,671 | | | | 47,608 | | | | 36,284 | | | | 602,207 | |

| | | | |

Income Taxes(Note 9): | | | | | | | | | | | | | | | | |

Current | | | 17,358 | | | | 21,465 | | | | 24,680 | | | | 161,635 | |

Deferred | | | 11,486 | | | | 954 | | | | (1,882 | ) | | | 106,956 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before Minority Interests | | | 35,827 | | | | 25,189 | | | | 13,486 | | | | 333,616 | |

| | | | |

Minority Interests in Net Income of Consolidated Subsidiaries | | | 1,348 | | | | 1,473 | | | | 81 | | | | 12,552 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Income | | ¥ | 37,175 | | | ¥ | 26,662 | | | ¥ | 13,567 | | | $ | 346,168 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | |

| | | Yen

| | | U.S. dollars (Note 1)

| |

Amounts per Share of Common Stock (Note 2): | | | | | | | | | | | | | | | | |

Net income | | ¥ | 137.95 | | | ¥ | 97.25 | | | ¥ | 48.15 | | | $ | 1.28 | |

Diluted net income | | | 137.90 | | | | 97.23 | | | | — | | | | 1.28 | |

Cash dividends applicable to the year | | | 40.00 | | | | 30.00 | | | | 30.00 | | | | 0.37 | |

See accompanying notes.

26

Consolidated Statements of Shareholders’ Equity

Daiichi Pharmaceutical Co., Ltd. and Consolidated Subsidiaries

Years ended March 31, 2005, 2004 and 2003

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of

shares of

common stock

(thousands)

| | Millions of yen

| |

| | | Common

stock

| | Capital

surplus

| | Retained

earnings

| | | Net

unrealized

holding gains

on securities

| | | Foreign

currency

translation

adjustment

| | | Treasury

stock,

at cost

| |

Balance at March 31, 2002 | | 286,453 | | ¥ | 45,247 | | ¥ | 48,961 | | ¥ | 324,428 | | | ¥ | 7,191 | | | ¥ | 786 | | | ¥ | (25,405 | ) |

Net income | | — | | | — | | | — | | | 13,567 | | | | — | | | | — | | | | — | |

Adjustment from translation of foreign currency financial statements | | — | | | — | | | — | | | — | | | | — | | | | (1,355 | ) | | | — | |

Adjustment of net unrealized holding gains on securities | | — | | | — | | | — | | | — | | | | (2,902 | ) | | | — | | | | — | |

Treasury stock | | — | | | — | | | — | | | — | | | | — | | | | — | | | | (781 | ) |