Exhibit 99.1

Message from the President

President & CEO

Kiyoshi Morita

I am pleased to report on the performance of Daiichi Pharmaceuticals Co., Ltd., during its 127th fiscal period (fiscal 2004, or the period from April 1, 2004, through March 31, 2005).

In line with its slogan “Enriching the Quality of Life,” the Daiichi Group’s mission is to contribute to better human health around the world by developing innovative technologies and promoting the use of superior products. To obtain promising new global development candidates and realize the corporate transformation we are aiming for, we are positioning the period through fiscal 2006 as a period for undertaking reform that will reinforce our business base. During this period, we will be taking measures to attain the following three emphasized management goals — expanding global R&D operations, strengthening domestic and overseas prescription drug business, and building a resilient corporate structure by resolutely implementing structural reforms.

In view of such trends as globalization and worldwide efforts to restrain healthcare costs, however, it has become necessary to adopt new management strategies for strengthening our corporate base and augmenting our capabilities for surviving the challenges of global competition.

Daiichi and Sankyo Co., Ltd., have a common perception of the nature of changes in their operating environment. Based on this agreement and the desire to realize the philosophy and vision jointly held by the two companies, Daiichi and Sankyo on February 25 signed a basic agreement calling for the establishment of a joint holding company to be named DAIICHI SANKYO COMPANY, LIMITED. A contract providing for the integration of the two companies’ operations was signed on May 13, and this contract has subsequently been approved by the regular general shareholders’ meetings of each company.

We are doing our utmost to move ahead on schedule with preparations for the integration, including the establishment of the joint holding company on September 28, 2005, and the creation of an operational holding company in April, 2007. After the integration, DAIICHI SANKYO will draw on unique competitive strengths in the world’s principal markets as it endeavors to quickly transform itself into a Japan-based “global pharma-innovator.” We will strive to realize the potential synergistic benefits of the integration as effectively and expeditiously as possible, and we are confident that these efforts will help maximize shareholder value.

I hope for your continued understanding and support.

1

To Our Shareholders

Regarding the distribution of profit to shareholders, we are comprehensively considering such factors as our current performance and business development plans along with the possibility of increasing our dividend pay-out ratio, and we hope to progressively raise the level of cash dividends per share.

The Company decided to increase year-end cash dividends by ¥10 per share and disburse total year-end cash dividends of ¥25 per share on June 30, 2005. (Including ¥15 per share interim cash dividends, cash dividends applicable to the fiscal year under review totaled ¥40 per share).

We are planning to distribute ¥50 per share in cash dividends applicable to the current fiscal year. In lieu of disbursing ¥25 per share interim dividends, however, we will pay a ¥25 per share stock transfer payment to shareholders registered as of September 27, 2005.

I hope for shareholders’ continued understanding and support.

Enriching the Quality of Life

Concentrating on lives rich in health and happiness,

and working through pharmaceutical business operations

to contribute to better health worldwide.

This is our corporate ideal.

CONTENTS

2

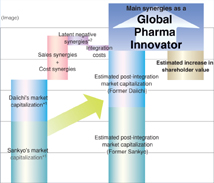

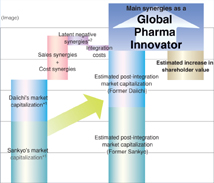

Reasoning Behind the Integration and the Benefits to be Gained

We expect to achieve synergies spanning R&D, domestic marketing, and overseas development.

The Integration

Amid an increasingly global pharmaceutical industry and structural changes in the operating environment, Daiichi and Sankyo have decided to take their individual businesses to a new level through integration so that they may continue their missions as leaders in the Japanese industry in the 21st century and enhance corporate value.

The purpose of the integration is to create a global pharma-innovator that holds a competitive position in the world major markets and provides innovative products and services to fulfill the unmet medical needs of patients and healthcare professionals.

Notes:

| 1. | Market capitalization calculations are based on the company’s closing share price on February 19, 2005. |

| 2. | Risk of decreased sales and/or profits as a result of changes in control, product cannibalization, etc. |

Benefits of Integration

We expect to gain five key benefits from this integration. Of these advantages, the synergies that we will achieve in R&D constitute the bedrock of the integration.

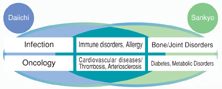

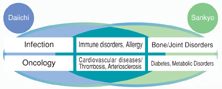

| Benefit 1: | Strong R&D Franchise Categories |

Fiscal 2009 R&D Budget ¥170 Billion

(target)

The integration will enable us to increase the R&D budget for each franchise field as well as the number of compounds under development by concentrating solely on areas of focus for both Daiichi and Sankyo — cardiovascular disease, infection, oncology, diabetes and metabolic disorders, bone and joint disorders, and immune disorders and allergies.

We will reinforce our franchise fields and promote the selective development of promising compounds through the appropriate prioritization of projects to speed up development and increase our chances of success.

We will combine our product portfolios and development pipelines to build a seamless pipeline, which will be critical to achieving stable growth in the future.

3

| Benefit 2: | Global Reach and Overwhelming Domestic Sales Strength |

Daiichi and Sankyo both have product portfolios that include many products with the leading domestic market share in their respective therapeutic categories in such fields as cardiovascular disease, an MR force that carries out highly productive detailing activities and is extremely well versed in the company’s products and franchise fields, and strong alliances with wholesalers. The integration will result in a solid distribution base and overwhelming domestic sales strength.

Overseas, the integration will facilitate new product launches and the creation of a strong, efficient framework for in-house sales.

| Benefit 3: | Expansion of Corporate Strategy Options Arising from Increased Scale |

We will leverage the domestic sales prowess that we acquire via the integration to reinforce our position as a licensing partner for introducing and developing innovative products in the Japanese market. In addition, the enhanced financing capabilities that we gain through the merger will increase our opportunities to further acquire external resources, including opportunities for M&As, to expand our global business.

| Benefit 4: | Increased Operational Efficiency |

Both companies are strengthening their operations — through structural reforms in the case of Daiichi and through the realignment of Group functions in the case of Sankyo, but the integration will allow for bolder joint initiatives that will boost operational efficiency to a level unattainable by the individual companies, creating a strong revenue base.

| Benefit 5: | Outstanding Human Resources |

By putting the right people in the right jobs worldwide throughout the DAIICHI SANKYO Group, we will bolster our ability as an organization to deal with intense change in the environment.

4

Point-by-Point Explanation

Complementary Combinations of Special Strengths and Emphasized Fields Expected to Augment Drug Discovery and Drug Marketing Capabilities

| Point 1 | Bolstering R&D Capabilities by Establishing Strong Franchise Categories |

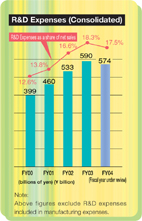

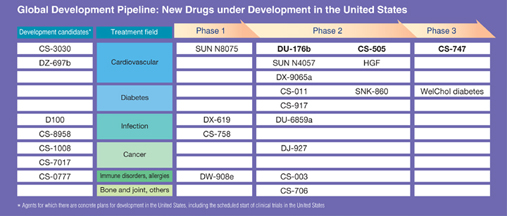

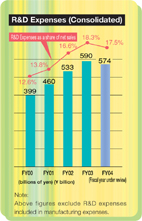

Conditions in the pharmaceutical industry worldwide continue to make developing new drugs a challenge. As a result, the volume of funds necessary to secure critical mass in R&D is increasing. Through the integration, we will secure combined annual R&D expenditures of ¥170 billion (fiscal 2009 target), placing us squarely among the top players in the Japanese pharmaceutical industry in terms of R&D budget, which, in turn, will enable us to bring our R&D prowess to an even higher level. Moreover, we will be able to build a seamless development pipeline because we are concentrating on many of the same therapeutic categories. This will be critical to achieving stable growth going forward.

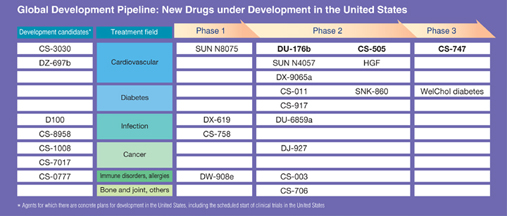

Looking at both companies’ development pipelines, Daiichi currently has several prospective blockbusters in the cardiovascular field, including the highly promising anticoagulant DU-176b, and Sankyo has CS-505, an agent for treating arteriosclerosis, and CS-747, an agent for treating ischemia. In the field of infectious diseases, Daiichi has the new quinolone compounds DU-6859a and DX-619 in its pipeline as well as several development candidates that are about to enter clinical trials and Sankyo possesses a vast store of knowledge and experience in this field that we expect to be fully leveraged in the future development of these and other products.

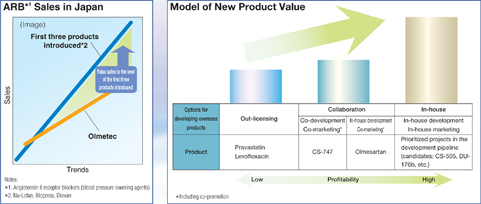

| Point 2 | Global Reach and Overwhelming Domestic Sales Strength |

Integration Benefits in Domestic Marketing

Here we will examine the overwhelming sales strength that we will gain through the integration. Our product lineup and marketing strength will take the industry by storm. First, let’s look at the product lineup. Cardiovascular disease is a field emphasized by both companies. With several products that command the leading domestic market share in their respective therapeutic categories, we stand to gain a rock-solid presence in the cardiovascular field through the integration. As for marketing strength, together our companies boast a 2,500-strong team of medical representatives in Japan — one of the largest sales forces in the industry. In addition, the integration will reinforce our relationships with pharmaceutical wholesalers.

5

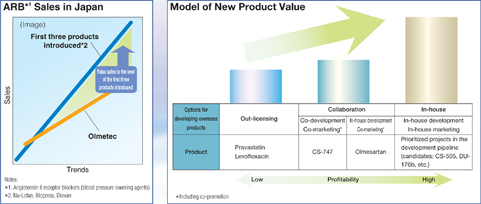

We will generate sales synergies by focusing these marketing resources on leading products in major therapeutic markets, including the oral antibacterial agent Cravit, the antihypertensive agent Olmetec (, the antihyperlipidemic Mevalotin (, the oral antibacterial agent Cravit (, and the antihypertensive agent Calblock (, and making over 10 million details a year. For instance, we aim to leverage domestic marketing collaboration to boost sales of Olmetec (to ¥100 billion (based on the current National Health Insurance price) in fiscal 2009, making it a blockbuster product.

Integration Benefits in Overseas Development

Overseas strategies will enter full-fledged development as operating bases and the MR force gains additional strength.

The integration will give us an overseas sales force comprising 33 locations and approximately 2,200 MRs, which, in turn, will increase our corporate strategy options, including allowing for more aggressive global operations.

For instance, the integration will enable us to select the most profitable method of bringing to market revolutionary new drugs overseas, namely, through in-house development and sales, which is expected to dramatically boost profits.

Overseas, both companies are developing their businesses in the United States, and Sankyo is building a sales network in Europe. Regarding Asia, Daiichi has established sales channels in China and South Korea, while Sankyo’s operations in China are gaining momentum. The integration will give us an overseas sales force comprising 33 locations and approximately 2,200 MRs, which, in turn, will increase our corporate strategy options, including allowing for more aggressive global operations.

6

Post-Integration

We will leverage integration benefits to maximize shareholder value.

Integration Process

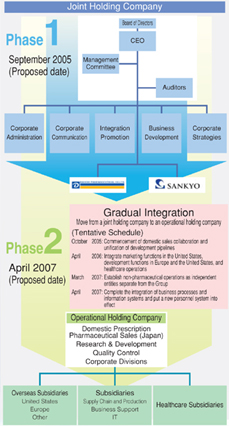

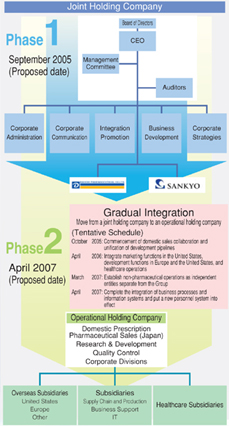

In Phase I of the integration, Daiichi and Sankyo plan to create a joint holding companyóDAIICHI SANKYO COMPANY, LIMITED, in September 2005, under which both companies will become wholly owned subsidiaries.

As for the management structure of the joint holding company, the Board of Directors will be charged with making decisions regarding important operational matters under the leadership of a Representative Director and Chairman, and a Management Committee will operate under the Board of Directors, executing management and business operations under the supervision of the President and CEO. The joint holding company’s headquarters will comprise a relatively small organization that will oversee the wholly owned subsidiaries Daiichi and Sankyo and its operations will be rather limited in scope, covering business planning, consolidated accounting for the Group, and such corporate communications activities as public and investor relations. In the future, the headquarters will also promote the integration of the two companies’ businesses.

The second phase of the integration will commence a year and a half after the first phase is initiated, with the move to a pure holding company on April 1, 2007. At that time, the companies’ R&D, domestic marketing, quality assurance, and corporate departments will be integrated. Under the operational holding company, Daiichi and Sankyo’s overseas subsidiaries, supply chain and production, business support, and IT subsidiaries, and healthcare subsidiaries will be positioned as companies within the Group.

The New Company’s Medium-Term Targets

In fiscal 2009, we expect to generate prescription pharmaceutical sales of ¥932 billion, representing a 20% rise from ¥758 billion in fiscal 2004, for an average annual growth rate of 4%, and operating income of ¥255 billion, double that of the fiscal 2004 level of ¥127 billion, for an average annual growth rate of 15%.

The integration is expected to produce a rise in revenues by bolstering marketing prowess and focusing management resources on pharmaceutical operations. This, coupled with other benefits, including cost reductions stemming from lower procurement, outsourcing, promotion, advertising, and IT costs, the optimization of investments, the consolidation and increased efficiency of operations, and the strategic use of outsourcing are anticipated to lead to an increase in operating income. In addition, the operating margin is forecast to rise sharply from 16.8% in fiscal 2004 to 20.6% in fiscal 2007 and 27.4% in fiscal 2009.

Moreover, these profit gains will be achieved in part by boosting annual R&D investment between 17% and 21% from the current level of ¥140 billion to the ¥165 billion to ¥170 billion level, bringing us a step closer toward becoming a global pharma-innovator.

Returns to Shareholders Following the Integration

As in the past, we regard returning profits to shareholders as one of our highest priorities and are committed to raising the return to shareholders to the highest level among Japanese pharmaceutical companies. Specifically, we aim to raise the ratio of cash dividends per share to shareholders’ equity (DOE) to 5% in fiscal 2009. Daiichi paid an annual dividend of ¥30 per share in fiscal 2003, and plans to pay an annual dividend of ¥40 per share in fiscal 2004. Thus, the DOE for fiscal 2003 was 2.0% and that for fiscal 2004 will be 2.6%. In fiscal 2005, we intend to distribute an annual dividend exceeding that of fiscal 2004, and will make ongoing efforts to increase shareholder returns.

7

The New Company’s Medium-Term Targets

| | | | | | | | | | | |

| | | (billions of yen) | |

| | | | |

| | | | | Fiscal 2004

| | | Fiscal 2007

| | | Fiscal 2009

| |

Sales | | | | | | | | | | | |

Pharmaceutical Operations | | Japan | | 4,470 | | | 4,610 | | | 5,040 | |

| | | Overseas | | 2,560 | | | 2,530 | | | 3,760 | |

Healthcare Operations, | | Other | | 550 | | | 480 | | | 520 | |

Total | | | | 7,580 | | | 7,620 | | | 9,320 | |

| | | | |

Cost of sales + SG&A | | | | 6,310 | | | 6,050 | | | 6,770 | |

R&D costs | | | | 1,400 | | | 1,650 | | | 1,700 | |

Operating income | | | | 1,270 | | | 1,570 | | | 2,550 | |

Integration benefits | | | | — | | | 390 | | | 560 | |

Operating margin | | | | 16.8 | % | | 20.6 | % | | 27.4 | % |

Note: Figures for fiscal 2007 and fiscal 2009 are targets. Figures for fiscal 2004 reflect the simple addition of results for Daiichi and Sankyo. Integration benefits reflect the difference from the simple addition of the two companies’ results.

Overview of DAIICHI SANKYO

| | |

| Company name: | | DAIICHI SANKYO COMPANY, LIMITED |

| |

| Headquarters: | | 3-5-1 Nihonbashi-honcho, Chuo-ku, Tokyo, Japan |

| |

| Delisting date for Sankyo and Daiichi: | | September 21, 2005 |

| |

| Share transfer date: | | September 28, 2005 |

| |

| Listing date for the holding company: | | September 28, 2005 |

| |

| Stock transfer ratio: | | New Company 1.159: Daiichi 1 |

| |

| | | New company 1: Sankyo 1 |

| |

| Stock exchange listings: | | Tokyo, Nagoya, and Osaka |

| |

| Representative Director and Chairman | | Kiyoshi Morita (Currently President and Representative Director of Daiichi) |

| |

| Representative Director, President, and CEO | | Takashi Shoda (Currently President and Representative Director of Sankyo) |

| |

| Directors | | Hiroyuki Nagasako (Previously Executive Vice President of Daiichi) |

| |

| | | Hideo Kawamura (Currently Executive Vice President and Representative Director of Sankyo) |

| |

| | | Yasuhiro Ikegami (Currently Executive Vice President and Representative Director of Sankyo) |

| |

| | | Tsutomu Une (Currently Managing Director of Daiichi) |

| |

| External Directors | | Kunio Nihira (Currently Outside Director of Sankyo) |

| |

| | | Yoshifumi Nishikawa (Currently Outside Director of Daiichi) |

| |

| | | Jotaro Yabe (Currently Outside Director of Daiichi) |

| |

| | | Katsuyuki Sugita (Currently Outside Director of Sankyo) |

8

Research & Development

Research & Development Report

By conducting research programs that enable the identification of additional drug target molecules and the acquisition of innovative new drug discovery “seeds,” Daiichi is seeking to continuously generate high-quality drug development candidates. Moreover, the Company is proactively undertaking PoC testing programs coordinated by Daiichi Medical Research.

Regarding collaborative research initiatives, Daiichi is collaborating with the U.S.-based UCSF Cancer Research Institute and U.S.-based Rigel Pharmaceuticals Inc., in research aimed at developing molecularly-targeted anti-cancer agents and is conducting research related to genomic drug discovery with Japan-based Kazusa DNA Research Institute and Celestar Lexico-Sciences, Inc. All of these research programs are expected to facilitate new drug discovery.

Recognizing the importance of strategies for obtaining additional leading-edge technologies, Daiichi and MediBIC ALLIANCE jointly established a drug development venture investment fund in March 2005. The objectives of this fund are to facilitate the collection of information on drug discovery technologies as well as collaborative research activities.

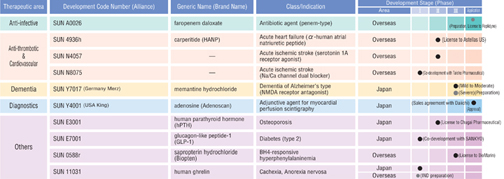

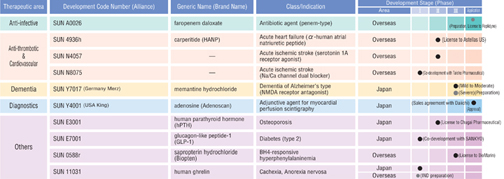

With respect to drug development operations, Daiichi has applications pending in Japan forPlavix (clopidogrel sulfate), an antiplatelet agent;Sonazoid (DD-723), an ultrasonic contrast medium product; andKMD-3213 (silodosin), an agent for treating dysuria jointly developed with Kissei Pharmaceutical Co., Ltd. In addition, Aventis Pasteur-Daiichi Vaccines Co., Ltd. has an application pending in Japan forAct-HIB, the first haemophilus influenzae type b conjugate vaccine for pediatric use.

In May 2004, Daiichi submitted a supplemental application for the anticancer agentTopotecin (irinotecan hydrochloride), for the additional indication of pancreatic cancer. In February 2005, the Company submitted a supplemental application for the natural interferon beta agentFERON, for the additional indication of Hepatitis C-induced liver cirrhosis.

In April 2005, approval was received for the anti-spasticity agentGabalon Intrathecal Injection (continuous administration of baclofen into the intrathecal cavity) developed as an orphan drug (an agent for rare diseases). The agent is used with a programmable pump system, which was developed by Medtronic Japan Co., Ltd. and approval was given for the system in March 2005.

Also in April 2005, approval was received forAdenoscan (adenosine), an adjunctive agent for myocardial scintigraphy imaging for which the domestic application was submitted by Daiichi Suntory Pharma.

Other noteworthy products under development includeDU-6859a (Gracevit, sitafloxacin), a quinolone antibacterial agent that was discovered and developed in-house, and HGF DNA plasmid, an agent for treating peripheral artery disease and ischemic heart disease for which exclusive marketing rights for Japan, the United States, and Europe have been obtained from AnGes MG, Inc.

Daiichi Suntory Pharma is proceeding with domestic clinical trials ofSUN Y7017 (memantine hydrochloride), an agent for treating dementia of Alzheimer’s type.

9

| | |

| Daiichi Pharmaceutical Development Pipeline (Principal Items) | | (As of April, 2005) |

Note: DX-619, DU-176b, DZ-697b, and DW-908e are listed because they are representative drug candidates with regard to their targets and concepts.

| | | | | | | | | | | | | | | | |

| Daiichi Suntory Pharma Development Pipeline (Principal Items) | | (As of April, 2005) |

Note: Additional indications are not listed.

Reference:

Phase I: Testing with a small number of healthy subjects to study such drug candidate characteristics as safety, absorption, diffusion, metabolism, and excretion.

Phase II: Testing with a small number of patients to study usage methods, doses, and efficacy while continuing to give top priority to safety.

Phase III: Sometimes referred to as large-scale clinical testing, this involves testing with several hundred to several thousand patients to confirm efficacy and safety characteristics as well as usefulness (benefit/utility). Only candidates with confirmed usefulness are approved for manufacturing as new drug products.

10

Environmental Report

The Daiichi Group recognizes its corporate social responsibility to increase its environment-friendliness and supply superior pharmaceutical products. The Group is concertedly working to reduce the environmental impact of each stage of its operations, from product development activities through manufacturing and marketing activities. To protect the world’s priceless natural environment, we are striving to reduce consumption of resources and energy, decrease the generation of waste products, and prevent pollution at each Group facility, including factories and R&D centers as well as the head office and other offices. We are intent on increasing the harmony of our operations with the natural environment and helping build a sustainable, recycling-based society.

Situation in Fiscal 2004

| 1 | Efforts to Reduce Environmental Impact(Daiichi Pharmaceutical Co., Ltd.) |

| | | | |

Theme

| | FY2004 Action Objectives

| | FY2004 Achievements

|

| Energy conservation/Global warming prevention | | Reduce 2010 CO2 emissions to below the 1990 level | | CO2 emissions were 156% of the FY1990 level |

| | |

| Reduce paper consumption | | Reduce copy/printer paper consumption | | Copy/printer paper consumption rose 3% |

| | |

| Reduce emissions of harmful substances | | Switch to chlorine solvent alternatives | | Created technology for replacing chlorine solvents in the Transamine manufacturing process |

| | |

| Reduce Generation of Waste | | Reduce volume of waste disposed of as waste to 30% of the FY1990 level | | Volume of waste disposed of as waste was 77% of the FY1990 level |

| | |

| Green Procurement | | Raise green procurement rate to above 95% | | Raised green procurement rate to 93.6% |

| | |

| Packaging | | Make containers and packaging more environment-friendly, taking into account information from clinical settings | | Completed discontinuation of use of dechlorinated vinyl sheet use for principal products |

| | |

| Revision of marketing tools | | Use materials with low environmental impact | | Printed materials using soy ink on recycled paper |

| | |

| Environmental management systems | | Introduce PDCA (plan-do-check-act) cycle methodology for on-site environment committees | | • Obtained IS014001 certification of Osaka factory and Shizuoka factory |

| | |

| Environmental communications | | Consider issuing a corporate social responsibility (CSR) report | | • Group environmental report issued in October • Issuance of FY2005 CSR report scheduled |

11

Recycling Promotion Poster

Paper Cup recovery Box

The paper cups supplied at the tea machines on each floor of Daiichi’s head office building were previously incinerated, but the Company began recycling them from September 2004 as a CSR initiative. Having solved challenges related to covering the cup recovery cost and finding trucking routes and recyclers, we began recycling all of the approximately 320,000 paper cups used at the head office annually and have begun considering additional waste items that can be recycled.

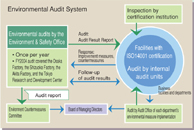

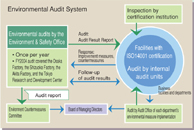

The Environment & Safety Office has arranged for the Chairman of the Environmental Countermeasures Committee to conduct environmental audits at Daiichi Group’s three main factories and the central R&D facility once per year based on internal environmental auditing rules. The audits confirmed the facilities’ responses to environmental laws and regulations and responses to global environmental issues and environmental risks. By using the environmental audit results to draft environmental program goals for the subsequent fiscal year, the Daiichi Group has created a system for sustaining a reduction in its overall environmental impact.

Plan for Fiscal 2005

Additional environmental protection efforts are planned based on the fiscal 2005 Companywide management policies and the results of environmental protection programs during fiscal 2004. The Daiichi Group is intent on carrying out its business activities in harmony with the natural environment, reducing its CO2 emissions, lowering the volume of waste products it generates, and decreasing the volume of waste products disposed of as waste.

| * | “CSR Report 2005” (provisional name for the CSR report covering fiscal 2004) is scheduled to be published in September 2005. |

12

Business Performance (Consolidated basis)

| | |

| Consolidated Overview of Performance during the Fiscal Year | | (Billions of Yen) |

| | | | | | | |

| | | FY2004

| | FY2003

| | Change

| |

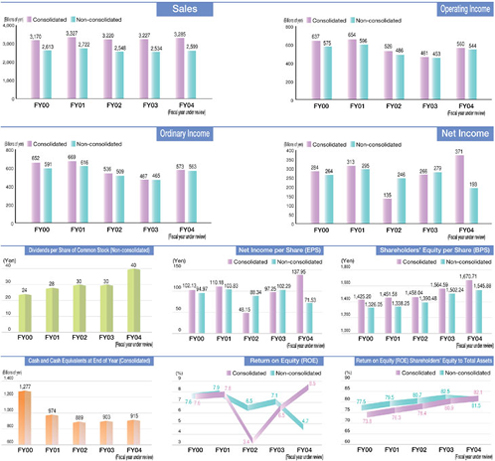

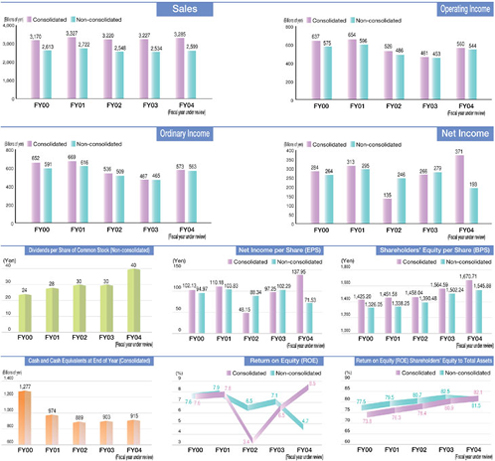

Net sales | | 3,285 | | 3,227 | | 1.8 | % |

Operating income | | 560 | | 461 | | 21.6 | % |

Ordinary income | | 573 | | 467 | | 22.7 | % |

Net income | | 371 | | 266 | | 39.4 | % |

Overview of Consolidated Accounts

During the year, overseas pharmaceutical markets were characterized by a further intensification of global competition centered on “global-mega” companies and associated with both new drug-related R&D and marketing activities. The Japanese pharmaceutical market was affected by changes in the healthcare systems — such as the growing scope of application of the comprehensive hospital therapy evaluation system and the conversion of national university hospitals and other national hospitals into independent corporations — and an average 4.2% reduction in National Health Insurance (NHI) drug reimbursement prices was implemented in April 2004.

Against this backdrop, the Daiichi Group worked to expand the markets for its products while emphasizing the promotion of appropriate drug use through the provision of information related to drug efficacy and safety. As a result, higher revenue from domestic sales of prescription drugs and a rise in bulkLevofloxacin exports more than offset a revenue decline associated with the transfer of veterinary and livestock feed products business to another company. Consequently, net sales advanced 1.8% from the previous fiscal year, to ¥328,534 million. Reflecting the reduction in cost of sales as well as cost-cutting measures with respect to R&D expenses, operating income totaled ¥56,063 million, up 21.6% from the previous fiscal year, and double-digit growth was achieved in ordinary income, which amounted to ¥57,320 million, up 22.7% from the previous fiscal year. While ¥7.3 billion in extraordinary restructuring expenses associated with the spin-off of the parent Company’s manufacturing operations was recorded, this was more than offset by extraordinary gains of ¥11.7 billion on the return of the substitutional retirement portion of its Employee’s Pension Fund and ¥3.8 billion on the shift to a new retirement payment system. Thus, net income surged 39.4% from the previous fiscal year, to ¥37,175 million.

13

| | |

| Overview of Performance by Business Segment | | (Millions of yen) |

| | | | | | | |

| | | FY2004

| | FY2003

| | Change

| |

Business Segment | | | | | | | |

Pharmaceutical business | | 311,845 | | 304,564 | | 7,280 | |

Other | | 16,689 | | 18,203 | | (1,513 | ) |

Total | | 328,534 | | 322,767 | | 5,766 | |

Manufacturing and Technologies

Aiming to realize considerable reduction in cost of sales, the Daiichi Group has introduced a newLevofloxacin manufacturing method involving a new synthesis technology. The switch to the new manufacturing method has been completed with respect to levofloxacin exported to the United States, which is the principal market for this product.

Daiichi Suntory Pharma began constructing a bio bulk manufacturing facility at its Chiyoda Pharma Factory that is designed to meet needs associated with growing sales ofHANP injectable 1000 as well as newly developed products. This facility is scheduled to be completed in October 2005.

Group-wide Initiatives

Daiichi has undertaken various reforms designed to increase the soundness and stability of its pension system. Along with completing the return of its Employees’ Welfare Pension Fund’s substitutional portion, the Company has undertaken fundamental reform aimed at unification of the pension plans of domestic Group companies. These companies have introduced new pension systems involving defined contributions and benefits.

Regarding moves to introduce and upgrade electronic information systems, the Company is been proceeding with the introduction of enterprise resource planning (ERP) systems at major domestic Group companies. Consolidated accounting, personnel, and remuneration systems have already been inaugurated and the Company is moving forward steadily with the introduction of supply-chain management systems.

Overview of Performance by Business Segment

Pharmaceutical Business

Prescription Drugs

Mobic, a nonsteroidal anti-inflammatory agent

Artist, a long-acting beta-blocker for treating high blood pressure, angina, and chronic cardiac insufficiency

Although conditions in the domestic prescription drug market were negatively affected by the April 2004 revision of drug reimbursement prices, sales of the mainstay broad-spectrum oral antibacterial agentCravit were steady, and increased sales were recorded for such products asMobic, a nonsteroidal anti-inflammatory agent marketed in Japan exclusively by Daiichi since July 2004;Artist, a long-acting beta-blocker for treating high blood pressure, angina, and chronic cardiac insufficiency; andZyrtec, an anti-allergy agent. As a result, total domestic prescription drug sales advanced 1.9% from the previous fiscal year, to ¥205,859 million.

14

Business Performance (Consolidated basis)

Overseas prescription drug sales were negatively affected by a decline in a U.S. subsidiary’s sales ofFLOXIN Otic, an antibacterial otic solution for treating ear infections, as well as by the appreciation of the yen. However, the completion of U.S. inventory adjustments forLevofloxacin enabled a recovery in bulk sales of this product, and patent licensing royalty income grew. Thus, overseas sales of prescription drugs rose 6.2% from the previous fiscal year, to ¥61,318 million.

Diagnostics and Radiopharmaceuticals

Cholestest LDL, cholesterol measuring agents

Measures aimed at restraining medical costs kept market conditions challenging, and sales of such products as in vivo radiopharmaceuticals for cardiac imaging applications declined. However, strong sales of such in vitro diagnostics products as testing kits for influenza — which was prevalent in Japan during the year under and mainstay cholesterol measuring agents for export boosted total sales of diagnostics and radiopharmaceuticals products 2.1% from the previous fiscal year, to ¥32,923 million.

OTC Drugs

Karoyan Gush, a hair-growth accelerator

Karoyan Gush, a hair-growth accelerator launched in June 2004, made a significant contribution to performance during the year, and sales of such products asPatecs anti-inflammatory analgesic poultices and the vitamin C productCystina C were robust. Accordingly, OTC Drug sales advanced 16.3% from the previous fiscal year, to ¥10,199 million.

Veterinary and Livestock Feed Products

Reflecting the Company’s June 2004 transfer of its veterinary and livestock feed products business to Meiji Seika Kaisha, Ltd., segment sales dropped 59.1% from the previous fiscal year, to ¥1,544 million.

Other Businesses

Sales of fine chemical products decreased 10.6%, to ¥12,967 million, reflecting drops in sales of such products asCalcium Pantothenate to customers in North America and Europe. Total sales in the other businesses segment, which includes fine chemicals, declined 8.3%, to ¥16,689 million.

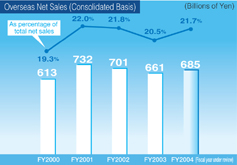

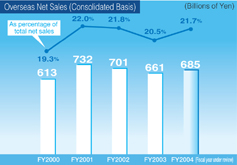

Overseas sales rose 3.7%, to ¥68,589 million, and overseas sales as a share of the consolidated net sales amounted to 20.9%.

15

Fiscal 2004 Highlights

16

Overview of Consolidated Accounts

Point 1 Fixed liabilities

Because changes made to the employee pension plan were accompanied by external contributions, the reserve for retirement benefits decreased and fixed liabilities decreased ¥11.1 billion from the previous year.

Point 2 Cost of sales

The use of a new compounding method for the manufacture of levofloxacin bulk powder and other measures enabled a 1.4 percentage point reduction in the cost of sales ratio, to 31.6%.

Point 3 Extraordinary losses

Restructuring expenses associated with the splitting off of three factories and other factors led to an ¥8.1 billion rise in extraordinary losses.

Consolidated Statements of Cash Flow (Summary)

(Millions of yen)

| | | | | | |

Accounting Items

| | Fiscal Year 2004 (April 1, 2004, to

March 31, 2005)

| | | Fiscal Year 2003 (April 1, 2003, to

March 31, 2004)

| |

Net cash provided by (used in) operating activities | | 35,571 | | | 47,505 | |

Net cash provided by (used in) investing activities | | (21,989 | ) | | (27,419 | ) |

Net cash provided by (used in) financing activities | | (12,369 | ) | | (18,470 | ) |

Effect of exchange rate changes on cash and cash equivalents | | 12 | | | (207 | ) |

Increase (decrease) in cash and cash equivalents | | 1,225 | | | 1,407 | |

Cash and cash equivalents, beginning of year | | 90,346 | | | 88,938 | |

Cash and cash equivalents at end of year | | 91,571 | | | 90,346 | |

Consolidated Balance Sheets

(Unit: millions of yen)

| | | | | | |

Accounting Items

| | Fiscal Year 2004 (As of March 31, 2005)

| | | Fiscal Year 2003 (As of March 31, 2004)

| |

Assets | | | | | | |

Current assets | | 299,836 | | | 283,205 | |

Cash and time deposits | | 16,395 | | | 21,977 | |

Trade notes and accounts receivable | | 88,168 | | | 81,211 | |

Investment securities | | 107,514 | | | 94,124 | |

Mortgage-backed securities | | 20,000 | | | 20,000 | |

Inventories | | 40,486 | | | 39,145 | |

Deferred tax assets | | 13,826 | | | 16,111 | |

Other current assets | | 13,496 | | | 10,891 | |

Allowance for doubtful accounts | | (50 | ) | | (256 | ) |

Non-current assets | | 246,718 | | | 238,603 | |

Property, plant and equipment | | 105,602 | | | 107,286 | |

Buildings and structures | | 55,969 | | | 58,660 | |

Machinery, equipment and vehicles | | 19,705 | | | 22,975 | |

Land | | 17,526 | | | 17,722 | |

Construction in progress | | 6,029 | | | 1,244 | |

Other fixed assets | | 6,372 | | | 6,683 | |

Intangible assets | | 6,796 | | | 7,564 | |

Investments and other assets | | 134,319 | | | 123,752 | |

Investment securities | | 105,461 | | | 112,077 | |

Long-term loans | | 763 | | | 924 | |

Prepaid pension costs | | 15,493 | | | — | |

Deferred tax assets | | 3,167 | | | 3,437 | |

Other assets | | 9,756 | | | 7,375 | |

Allowance for doubtful accounts | | (323 | ) | | (62 | ) |

Total assets | | 546,555 | | | 521,808 | |

Liabilities | | | | | | |

Current liabilities | | 74,339 | | | 71,536 | |

Trade notes and accounts payable | | 17,182 | | | 14,115 | |

Short-term bank loans | | 18 | | | 18 | |

Liabilities and expenses payable | | 44,205 | | | 42,368 | |

Income taxes payable | | 8,401 | | | 9,962 | |

Allowances | | 1,869 | | | 1,980 | |

Other current liabilities | | 2,661 | | | 3,092 | |

Point 1 Non-current liabilities | | 22,070 | | | 23,182 | |

Long-term liabilities payable | | 4,513 | | | — | |

Long-term debt | | 5 | | | 23 | |

Deferred tax liabilities | | 9,791 | | | 679 | |

Accrued retirement and severance costs | | 4,754 | | | 19,090 | |

Accrued directors’ retirement and severance costs | | 2,200 | | | 2,670 | |

Other non-current liabilities | | 805 | | | 717 | |

Total liabilities | | 96,409 | | | 94,718 | |

Minority interests | | | | | | |

Minority interests | | 1,582 | | | 4,959 | |

Shareholders’ Equity | | | | | | |

Common stock | | 45,246 | | | 45,246 | |

Additional paid-in-capital | | 49,130 | | | 48,961 | |

Retained earnings | | 376,144 | | | 347,973 | |

Net unrealized holding gains on securities | | 18,215 | | | 17,873 | |

Foreign currency translation adjustments | | (1,305 | ) | | (1,524 | ) |

Treasury stock at cost | | (38,867 | ) | | (36,400 | ) |

Total shareholders’ equity | | 448,563 | | | 422,130 | |

Total liabilities, minority interests and shareholders’ equity | | 546,555 | | | 521,808 | |

17

Consolidated Financial Statements of Income

(Unit: millions of yen)

| | | | |

Accounting Items

| | Fiscal Year 2004 (April 1, 2004, to

March 31, 2005)

| | Fiscal Year 2003 (April 1, 2003, to

March 31, 2004)

|

Net sales | | 328,534 | | 322,767 |

Point 2 Cost of sales | | 100,834 | | 103,474 |

Gross profit | | 227,699 | | 219,293 |

Research and development expenses | | 57,416 | | 59,048 |

Selling, general and administrative | | 114,219 | | 114,129 |

Operating income | | 56,063 | | 46,114 |

Non-operating income | | 2,795 | | 2,380 |

Interest income and dividend income | | 1,474 | | 1,211 |

Other income | | 1,321 | | 1,168 |

Non-operating expenses | | 1,538 | | 1,764 |

Loss on disposal and write-down of inventories | | 626 | | 682 |

Equity in net losses of affiliated companies | | 399 | | — |

Other expenses | | 511 | | 1,081 |

Ordinary income | | 57,320 | | 46,731 |

Extraordinary gains | | 16,983 | | 2,325 |

Gain from the return of the substitutional portion of the employees’ pension fund to the government | | 11,747 | | — |

Gain from the transfer to the defined contribution pension plan | | 3,769 | | — |

Gain on sale of the veterinary and livestock feed product business | | 800 | | — |

Gain on sale of land | | 384 | | 881 |

Realized gain on sale of investment securities | | 283 | | 1,331 |

Reversal of allowance for doubtful accounts | | — | | 113 |

Point 3 Extraordinary losses | | 9,633 | | 1,448 |

Restructuring charge | | 7,316 | | — |

Loss on settlement of an employee pension fund plan | | 381 | | — |

Loss on settlement of vitamin-related anti-trust litigations | | 111 | | — |

Impairment of investment securities | | 32 | | 61 |

Loss on disposal of fixed assets | | 1,792 | | 1,387 |

Net income before income taxes and minority interests | | 64,670 | | 47,608 |

Income tax expense – current | | 17,357 | | 21,465 |

Income tax expense – deferred | | 11,486 | | 953 |

Minority interests in net losses of subsidiaries | | 1,348 | | 1,472 |

Net income | | 37,175 | | 26,661 |

| Note: | In addition to the research and development expenses item above, R&D expenses included within manufacturing expense amounted to ¥1,188 million in the year under review and ¥1,671 million in the previous year. |

18

Overview of Non-Consolidated Accounts

Point 1 Treasury stock

In April 2004, the Company acquired 2.1 million shares of treasury stock.

Point 2 Extraordinary gains

Gains on the return of the substitutional portion of the employee pension plan and other factors boosted extraordinary gains to ¥14.1 billion.

Point 3 Extraordinary losses

Provisions for losses on investment in subsidiaries and restructuring expenses associated with the splitting off of three factories and other factors led to a ¥25.8 billion rise in extraordinary losses.

| | |

| Appropriation Plan Of Retained Earnings | | (Unit: millions of yen) |

| | | |

Unappropriated retained earnings, end of year | | 24,442 | |

Reversal of special reserve | | 40,000 | |

Total | | 64,442 | |

Proposed treatment of appropriated funds | | | |

Dividends (¥25.00 per share) | | 6,710 | |

Bonuses to Directors and corporate auditors (Portion corresponding to bonuses to Corporate Auditors) | | 100

(— |

) |

Reserve for reduction in fixed assets (cost basis) | | 48 | |

Total | | 6,858 | |

Retained earnings carried forward to the next fiscal year | | 57,584 | |

(Other capital surplus allocation) Other capital surplus | | 169 | |

Allocated as follows | | | |

Other capital surplus carried forward to the subsequent fiscal period | | 169 | |

| Note: | Interim dividends (15.00 yen per share) in the aggregate amount of 4,026 million yen were paid on December 1, 2004. |

| | |

| Non-Consolidated Balance Sheet – Assets | | (Unit: millions of yen) |

| | | | | | |

Accounting Items

| | Fiscal Year 2004 (As of March 31, 2005)

| | | Fiscal Year 2003 (As of March 31, 2004)

| |

Assets | | | | | | |

Current assets | | 269,185 | | | 244,540 | |

Cash and time deposits | | 6,455 | | | 6,145 | |

Trade notes receivable | | 6,771 | | | 7,063 | |

Accounts receivable | | 63,046 | | | 59,218 | |

Investment securities | | 107,514 | | | 94,080 | |

Mortgage-backed securities | | 20,000 | | | 20,000 | |

Inventories | | 31,560 | | | 28,035 | |

Deferred tax assets | | 10,850 | | | 12,050 | |

Other current assets | | 22,987 | | | 18,148 | |

Allowance for doubtful accounts | | — | | | (200 | ) |

Non-current assets | | 239,747 | | | 246,993 | |

Property, plant and equipment | | 58,133 | | | 62,152 | |

Buildings and structures | | 36,357 | | | 38,949 | |

Machinery and equipment | | 10,124 | | | 12,142 | |

Land | | 7,241 | | | 7,241 | |

Other fixed assets | | 4,410 | | | 3,819 | |

Intangible assets | | 7,915 | | | 7,505 | |

Investments and other assets | | 173,698 | | | 177,335 | |

Investment securities | | 104,045 | | | 107,693 | |

Stock and advances of affiliated companies | | 61,433 | | | 58,326 | |

Prepaid pension cost | | 15,385 | | | — | |

Deferred tax assets | | — | | | 576 | |

Other assets | | 12,180 | | | 10,749 | |

Allowance for doubtful accounts | | (676 | ) | | (10 | ) |

Allowance reserve for investment losses | | (18,671 | ) | | — | |

Total assets | | 508,932 | | | 491,534 | |

| | |

Liabilities | | | | | | |

Current liabilities | | 79,985 | | | 72,953 | |

Accounts payable | | 16,163 | | | 13,048 | |

Other payables and accrued expenses | | 30,105 | | | 29,536 | |

Income taxes payable | | 7,023 | | | 8,165 | |

Consumption taxes payable | | 502 | | | 1,262 | |

Advances receipts | | 24,320 | | | 18,959 | |

Allowance for sales returns | | 448 | | | 491 | |

Allowance for sales discounts | | 1,421 | | | 1,488 | |

Non-current liabilities | | 13,926 | | | 13,306 | |

Long-term payables | | 3,467 | | | — | |

Deferred tax liabilities | | 9,035 | | | — | |

Accrued retirement and severance costs | | 213 | | | 11,521 | |

Accrued directors’ retirement and severance costs | | 1,208 | | | 1,785 | |

Total liabilities | | 93,912 | | | 86,259 | |

Shareholders’ Equity | | | | | | |

Common stock | | 45,246 | | | 45,246 | |

Additional paid-in-capital | | 49,130 | | | 48,961 | |

Capital surplus | | 48,961 | | | 48,961 | |

Other capital surplus | | 169 | | | — | |

Retained earnings | | 341,395 | | | 330,284 | |

Legally appropriated retained earnings | | 7,599 | | | 7,599 | |

Voluntary retained earnings reserve | | 309,353 | | | 289,361 | |

Unappropriated retained earnings | | 24,442 | | | 33,322 | |

Net unrealized gain on investment securities | | 18,115 | | | 17,182 | |

Point 1 Treasury stock at cost | | (38,867 | ) | | (36,400 | ) |

Total shareholders’ equity | | 415,020 | | | 405,274 | |

Total liabilities and shareholders’ equity | | 508,932 | | | 491,534 | |

19

| | |

| Financial Statements of Income | | (Unit: millions of yen) |

| | | | |

Accounting Items

| | Fiscal Year 2004 (April 1, 2004, to

March 31, 2005)

| | Fiscal Year 2003 (April 1, 2003, to

March 31, 2004)

|

Net sales | | 259,912 | | 253,486 |

Cost of sales | | 82,004 | | 83,420 |

Gross profit on sales | | 177,908 | | 170,066 |

Selling, general and administrative | | 123,467 | | 124,713 |

Operating income | | 54,440 | | 45,353 |

Non-operating income | | 2,928 | | 2,248 |

Interest income and dividend income | | 2,024 | | 1,739 |

Other income | | 904 | | 508 |

Non-operating expenses | | 1,046 | | 1,074 |

Loss on disposal and write-down of inventories | | 384 | | 623 |

Provision for possible loan loss | | 297 | | — |

Other expense | | 363 | | 451 |

Ordinary income | | 56,322 | | 46,527 |

Point 2 Extraordinary gains | | 15,520 | | 1,392 |

Gain from the return of the substitutional portion of the employees’ pension fund to the government | | 11,747 | | — |

Gain from the transfer to the defined contribution pension plan | | 3,073 | | — |

Gain on sale of the veterinary and livestock feed products business | | 679 | | — |

Realized gain on sale of Investment securities | | 20 | | 1,322 |

Reversal of allowance for doubtful accounts | | — | | 70 |

Point 3 Extraordinary losses | | 26,978 | | 1,143 |

Provision for allowance for investment losses | | 18,671 | | — |

Restructuring charge | | 7,042 | | — |

Loss on settlement of vitamin-related anti-trust litigations | | 111 | | — |

Impairment of investment securities | | 28 | | 61 |

Loss on disposal of fixed assets | | 1,124 | | 1,081 |

Net income before income taxes | | 44,865 | | 46,776 |

Income tax expense – current | | 15,400 | | 18,410 |

Income tax expense – deferred | | 10,161 | | 370 |

Net income | | 19,303 | | 27,996 |

Unappropriated retained earnings, beginning of year | | 9,165 | | 9,415 |

Less interim dividends | | 4,026 | | 4,089 |

Unappropriated retained earnings, end of year | | 24,442 | | 33,322 |

20

Stock Information(As of March 31, 2005)

| | |

Total number of shares authorized to be issued by the Company | | 789,000,000 |

Total number of shares issued and outstanding | | 286,453,235 |

Number of new shares issued during the current fiscal period | | 0 |

Number of shareholders | | 19,250 |

Major shareholders | | |

| | | | |

Name of Company

| | Holdings

(Shares in Thousands)

| | Shareholding ratio

(Percentage)

|

Nippon Life Insurance Company | | 14,225 | | 4.97 |

Japan Trustee Service Bank, Ltd. (Trust account) | | 10,252 | | 3.58 |

The Master Trust Bank of Japan, Ltd. (Trust account) | | 9,569 | | 3.34 |

Sumitomo Mitsui Banking Corporation | | 8,540 | | 2.98 |

The Bank of Tokyo-Mitsubishi, Ltd. | | 8,169 | | 2.85 |

Trust & Custody Services Bank, Ltd. (Mizuho Corporate Bank, Ltd., Retirement Benefit Trust Account re-entrusted by Mizuho Trust & Banking Co., Ltd.) | | 7,331 | | 2.56 |

The Tokio Marine & Nichido Fire Insurance Co., Ltd. | | 6,966 | | 2.43 |

State Street Bank and Trust Company 505103 | | 6,660 | | 2.33 |

Mitsui Sumitomo Insurance Co., Ltd. | | 6,479 | | 2.26 |

Mellon Bank Treaty Clients Omnibus | | 5,806 | | 2.03 |

Composition of Shareholders

| | |

Shareholder

| | Shareholding ratio

|

Financial Institutions | | 38.63 |

Securities Companies | | 1.77 |

Corporations and Others | | 8.36 |

Foreign Corporations and | | 33.37 |

Individuals | | 11.57 |

Treasury Stock | | 6.30 |

Composition of Shareholdings

| | |

Holdings

| | Shareholding ratio

|

Less than 100 | | 0.03 |

More than 100 | | 0.39 |

More than 500 | | 0.29 |

More than 1,000 | | 4.80 |

More than 5,000 | | 1.81 |

More than 10,000 | | 3.87 |

More than 50,000 | | 1.66 |

More than 100,000 | | 87.14 |

Shareholder Questionnaire Results

Daiichi received many questionnaire responses from shareholders in response to its request in the “Interim Business Report for the half of 127th Fiscal Period.” The compiled answers are as follows.

Opinions expressed to the Company

| 1. | The most frequently expressed opinion was that Daiichi should concentrate its resources in R&D operations and seek to develop epochal new drugs. |

| 2. | The next most frequently expressed opinion was that Daiichi should give preferential treatment to shareholders, including measures to increase shareholder returns. Many opinions were appreciative of the Company’s policy of steadily increasing dividends. |

We are very grateful for the cooperation of those who took the trouble to complete the questionnaire. We will work to make use of the results in IR activities.

21

Information regarding the stock transfer and related procedures Q&A

| Q. 1 | Where can I have the stock transfer-related procedures performed? |

Daiichi changed its stock transfer agent to UFJ Trust Bank Limited as of June 30, 2005.

On September 28, 2005, Daiichi and Sankyo will create a joint holding company — DAIICHI SANKYO COMPANY, LIMITED — under which both companies will become wholly owned subsidiaries.

UFJ Trust Bank is scheduled to become the stock transfer agent for DAIICHI SANKYO. To facilitate the smooth continuation of stock-related procedures, Daiichi has shifted its stock transfer agent work from Mizuho Trust Bank Limited to UFJ Trust Bank Limited in advance of the joint holding company’s establishment.

The address and contact information for UFJ Trust Bank is shown in the Corporate Information section at the end of this brochure.

| Q. 2 | When can I submit my stock certificates? |

We plan to send a brochure entitled “Stock Submission Procedures Guide” to shareholders in late August 2005, and the start of procedures is scheduled to start subsequently.

Please refer to “Stock Submission Procedures Guide” for more detailed information related to procedures.

| Q. 3 | What is the stock submission period? |

Shareholders holding physical share certificates are requested to submit their certificates by September 27, 2005 (the day before the planned stock transfer).

Shareholders using the certificate custody and transfer system do not need to perform any procedure, and shareholders who are not yet using this system are invited to consider using the system.

| Q. 4 | When will I receive my DAIICHI SANKYO stock certificates? |

We plan to send DAIICHI SANKYO stock certificates to the registered addresses of shareholders who have presented Daiichi stock certificates in mid-November, 2005.

| Q. 5 | How will the shares in the holding company be awarded following the stock transfer? |

We will award 1.159 share of the holding company DAIICHI SANKYO for each share of Daiichi to shareholders listed or recorded in the final register (including the actual shareholder register) on September 27, 2005. In concrete terms, the stock allotment will be as follows.

(Example) In the case of ownership of 1,000 Daiichi shares

1,000 shares x 1.159 = 1,159 shares (the number of shares awarded)

| Q. 6 | What will happen in the case of incomplete stock trading units (less than 100 shares)? |

(1) Treatment of incomplete stock trading units

Regarding shares in DAIICHI SANKYO numbering less than a stock trading unit (100 shares) resulting from the allocation, a stock certificate will not be issued, but the shares will be registered on September 28, 2005, in the DAIICHI SANKYO shareholder register. Shareholders can choose to handle their incomplete stock trading units in one of the following ways.

(Example) In the case of ownership of 1,000 Daiichi shares

1,000 shares x 1.159 = 1,159 shares (the number of shares awarded)

(including 59 shares constituting an incomplete stock trading unit)

The 59 shares of registered shares may

| | 2) | be purchased by DAIICHI SANKYO upon request, or |

| | 3) | be transformed into a full trading unit upon submission of a request that DAIICHI SANKYO sell an additional 41 shares. |

(2) Treatment of incomplete shares (units less than one share)

Shares in DAIICHI SANKYO numbering less than a single share resulting from the allocation will all be disposed of in the legally stipulated manner, with payments for the disposed incomplete shares paid to shareholders in direct proportion to the size of the incomplete shares. Shareholders will be provided with more-detailed information such factors as the payment time at a later date.

| Q. 7 | In the future, how will transactions in Daiichi stocks be handled in the stock market? |

Transactions in Daiichi stocks in the stock market will be handled as follows.

| | |

Time Period

| | Conditions

|

Period through September 20, 2005 (Tuesday) | | Trading transactions may be performed as usual. * September 20 is the final day of trading |

| |

| September 21, 2005 (Wednesday) | | Stock exchange listing is eliminated |

| |

| September 27, 2005 (Tuesday) | | Final day for submission of stock certificates * Shareholders using the certificate custody and transfer system do not need to perform any stock certificate submission procedure. |

| |

| September 28, 2005 (Wednesday) | | DAIICHI SANKYO COMPANY, LIMITED is newly listed * Shareholders using the certificate custody and transfer system will be able to sell their shares from this time. |

| |

| Mid-November 2005 | | Shareholders who have submitted their share certificates may sell their DAIICHI SANKYO shares after receiving them. |

22

Business Condition(As of March 31, 2005)

Corporate Information

| | |

| Corporate Name | | DAIICHI PHARMACEUTICAL CO., LTD. |

| Date of Foundation | | October 1, 1915 |

| Paid-in Capital | | 45.2 billion |

| Number of Employees | | 3,799 |

Board of Directors and Corporate Auditors

| | |

President and CEO (Representative Director) | | Kiyoshi Morita |

| |

Senior Managing Director (Representative Director) | | Kenichi Mizutani |

| |

Senior Managing Director | | Tadao Suzuki |

| |

Managing Director | | Hidetoshi Imaizumi |

| |

Managing Director | | Tsutomu Une |

| |

Managing Director | | Ryuzo Takada |

| |

Director | | Hiroshi Sugiyama |

| |

Director | | Teruo Takayanagi |

| |

Director | | Toru Kuroda |

| |

Director | | Akira Nagano |

| |

Director | | George Nakayama |

| |

Director | | Yoshifumi Nishikawa |

| |

Director | | Jotaro Yabe |

| |

Senior Corporate Auditor (Full-time) | | Yutaka Hirata |

| |

Corporate Auditor (Full-time) | | Shigemi Oda |

| |

Corporate Auditor | | Tadashi Takauji |

| |

Corporate Auditor | | Koukei Higuchi |

Notes:

| 1. | Of the directors, Yoshifumi Nishikawa and Jotaro Yabe are external directors in accordance with Article 188-2-7-2 of the Commercial Code. |

| 2. | Of the corporate auditors, Tadashi Takauji and Koukei Higuchi are external corporate auditors in accordance with Article 18-1 of the Law Concerning Exceptional Provisions to the Commercial Code Concerning Corporate Auditors etc. |

Principal Offices (Domestic/Overseas)(As of June 29, 2005)

| • | | Tokyo (metropolitan area) |

| • | | Tokyo (nothern Kanto and outlying areas) |

| • | | Tokyo Research & Development Center |

| • | | Higashifuji Training Center |

Shareholders’ Information

| • | | Fiscal year-end March 31 |

| • | | Shareholder confirmation date for year-end dividend payments March 31 |

| • | | Shareholder confirmation date for interim dividend payments September 30 |

| • | | Regular general shareholders’ meeting In June each year |

| • | | Record date March 31 each year (other dates as necessary with prior announcement) |

| • | | Stock transfer agent UFJ Trust Bank Limited |

| • | | Office handling stock transfer |

UFJ Trust Bank Limited

Stock Transfer Agency Department

10-11 Higashisuna 7-chome, Koto-ku, Tokyo

137-8081

Tel: 0120-232-711 Toll free

Head office and branches of UFJ Trust Bank Limited

Head office and branches of Nomura Securities Co., Ltd.

| • | | Stock Exchange Listings Tokyo and Osaka |

| • | | Newspaper for public announcements |

Nippon Keizai Shimbun

| | * | In lieu of fiscal accounting report advertisements, the Company makes its balance sheets and profit statement available at its website (http://www.daiichipharm.co.jp/) |

4-10, Nihonbashi 3-chome, Chuo-ku, Tokyo, Japan

Tel: 03-3272-0611