UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

JULY 27, 2007

| | | | | | | | | | |

| Registration Statement Pursuant to Section 12(b) Or (g) of the Securities Exchange Act of 1934 |

OR |

X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| FOR THE FISCAL YEAR ENDED | APRIL 30, 2007 |

OR |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

DATE OF EVENT REQUIRING THIS SHELL COMPANY REPORT |

| |

| FOR THE TRANSITION PERIOD FROM ______________ TO _________________ |

COMMISSION FILE NUMBER: |

0-29928 |

| |

Pacific North West Capital Corp. |

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) |

Not Applicable |

(TRANSLATION OF REGISTRANT’S NAME INTO ENGLISH) |

British Columbia, Canada |

(JURISDICTION OF INCORPORATION OR ORGANIZATION) |

2303 West 41st Avenue, Vancouver, British Columbia V6M 2A3 |

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) |

|

SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12 (b) OF THE ACT. |

| TITLE OF EACH CLASS | | NAME ON EACH EXCHANGE ON WHICH REGISTERED |

|

None | |

Not Applicable |

| | | |

SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT. |

Common Shares Without Par Value |

(TITLE OF CLASS) |

| | | | | | | | | | | | | | | | |

SECURITIES FOR WHICH THERE IS A REPORTING OBLIGATION PURSUANT TO SECTION 15(d) OF THE ACT. |

None |

(TITLE OF CLASS) |

INDICATE THE NUMBER OF OUTSTANDING SHARES OF EACH OF THE ISSUER’S CLASSES OF CAPITAL OR COMMON SHARES AS OF THE CLOSE OF THE PERIOD COVERED BY THE ANNUAL REPORT. |

41,996,202Shares |

Indicate by check mark whether the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| YES | | NO | X | | |

|

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| YES | | NO | X | | |

|

Note – Checking the box above will not relieve any registrant required to filed reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections. |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| YES | X | NO | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchanage Act (Check one): |

|

Large accelerated filer |

|

Accelerated filer |

|

Non-accelerated filer |

X |

|

Indicate by check mark which financial statement item the registrant has elected to follow. |

|

| X | Item 17 | | Item 18 | | |

|

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of this Exchange Act). |

| | | | | | |

| YES | | NO | X | | |

|

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS) |

|

Indicate by check mark whether the registrant has filed all documents and reports to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. |

| YES | | NO | X | | |

| | | | | | |

2

TABLE OF CONTENTS

| |

| Page |

| |

Glossary of Mining Terms | 6 |

PART I | |

| |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 8 |

| |

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | 8 |

| |

ITEM 3. KEY INFORMATION | 8 |

A. Selected Financial Data | 8 |

B. Capitalization and Indebtedness | 9 |

C. Reasons for the Offer and Use of Proceeds | 9 |

D. Risk Factors | 9 |

| |

ITEM 4. INFORMATION ON THE COMPANY | 13 |

A. History and Development of the Company | 13 |

B. Business Overview | 14 |

C. Organizational Structure | 14 |

D. Property, Plants, and Equipment | 14 |

Ontario, Canada | 14 |

I. River Valley Farm-In and Joint Venture Project | 14 |

II. Sargesson Lake and Kelly-Davis Properties | 26 |

III. West Timmins Nickel Project | 26 |

IV. South Renfrew | 27 |

Quebec, Canada | 27 |

I. Glitter Lake Property | 27 |

II. Soquem Taureau Property | 29 |

North West Territories | 29 |

I. Winter Lake | 29 |

Saskatchewan Project | 30 |

I. Nickel Plat Project | 30 |

Newfoundland and Labrador, Canada | 30 |

I. Konrad Mineral License 972M | 30 |

II. Labrador Nickel Project | 30 |

Alaska, USA | 31 |

I. Union Bay Platinum Property | 31 |

II. Kane Property | 32 |

III. Goodnews Bay Property | 32 |

IV. Tonsina Property | 33 |

| |

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 34 |

A. Operating Results | 34 |

Twelve Months Ended April 30, 2007 Compared to Twelve Months Ended April 30, 2006 | 34 |

Twelve Months Ended April 30, 2006 Compared to Twelve Months Ended April 30, 2005 | 37 |

B. Liquidity and Capital Reserves | 40 |

Fiscal Year Ended April 30, 2007 Compared to Twelve Months Ended April 30, 2006 | 40 |

| 41 |

C. Research and Development, Patents and Licenses, etc. | 41 |

D. Trend Information | 41 |

E. Off-Balance Sheet Arrangements | 41 |

F. Tabular Disclosure of Contractual Obligations | 42 |

G. Safe Harbour | 42 |

| |

3

| |

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 42 |

A. Directors and Senior Management | 42 |

B. Compensation | 44 |

C. Board Practices | 48 |

D. Employees | 52 |

E. Share Ownership | 52 |

| |

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 57 |

A. Major Shareholders | 57 |

B. Related Party Transactions | 57 |

C. Interests of Experts and Counsel | 57 |

| |

ITEM 8. FINANCIAL INFORMATION | 57 |

A. Consolidated Statements and Other Financial Information | 57 |

B. Significant Changes | 57 |

| |

ITEM 9. THE OFFER AND LISTING | 58 |

A. Offer and Listing Details | 58 |

B. Plan of Distribution | 60 |

C. Markets | 60 |

D. Selling Shareholders | 60 |

E. Dilution | 60 |

F. Expense of the Issue | 60 |

G. Performance Graph | 60 |

| |

ITEM 10. ADDITIONAL INFORMATION | 61 |

A. Share Capital | 61 |

B. Memorandum and Articles of Association | 61 |

C. Material Contracts | 61 |

D. Exchange Controls | 61 |

E. Taxation | 62 |

F. Dividends and Paying Agents | 68 |

G. Statements by Experts | 68 |

H. Documents on Display | 69 |

I. Subsidiary Information | 69 |

| |

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | 69 |

| |

PART II | |

| |

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 69 |

| |

ITEM 13. DEFAULTS, DIVIDEND ARREARS AND DELINQUENCIES | 69 |

| |

ITEM 14. MATERIAL MODICIATION STO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

69 |

| |

ITEM 15. CONTROLS AND PROCEDURES | 69 |

| |

ITEM 16. (RESERVED) | 70 |

| |

ITEM 16A. AUDIT COMMITTEE FINANCIAL REPORT | 70 |

| |

ITEM 16B. CODE OF ETHICS | 73 |

| |

4

| |

ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 73 |

| |

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 73 |

| |

ITEM 16E. PURCHASE OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

73 |

| |

PART III | |

| |

ITEM 17. FINANCIAL STATEMENTS | 74 |

| |

ITEM 18. FINANCIAL STATEMENTS | 74 |

| |

ITEM 19. EXHIBITS | 74 |

| |

EXHIBIT 1. Financial Statements | |

EXHIBIT 2. Management Discussion and Analysis | |

EXHIBIT 3. CEO Certification of Annual Filings During Transition Period | |

EXHIBIT 4. CFO Certification of Annual Filings During Transition Period | |

EXHIBIT 5. Certification of CEO and CFO pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

EXHIBIT 6. CEO Certification pursuant to 18 USC Section 1350, adopted pursuant to Section 906 of the Sarbanes Oxley Act of 2002 | |

EXHIBIT 7. CFO Certification pursuant to 18 USC Section 1350, adopted pursuant to Section 906 of the Sarbanes Oxley Act of 2002 | |

EXHIBIT 8. Pacific North West Capital Corp. Code of Business Conduct and Ethics | |

EXHIBIT 9. Certificate of Ethics for the Chief Executive Officer and the Chief Financial Officer | |

| |

SIGNATURES | 74 |

5

GLOSSARY

The following are definitions of mining terms and certain other terms used in this Statement.

| |

Anglo Platinum | Anglo American Platinum Corporation Limited |

Au | The chemical symbol for gold. |

Assay | A chemical test performed on a sample of rocks or core to determine the amount of contained metals. |

Assessment Work | The amount of work, specified by mining law, that must be performed each year in order to retain legal control of mining claims. |

Breccia | A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

Chalcopyrite | A sulphide mineral of copper and iron; an important ore mineral of copper. |

Channel Sample | A sample from a small trench or channel, cut on a rock surface, usually about 5-10 cm wide and 2 cm deep, to provide accurate distribution of mineralization |

Chip Sample | A method of sampling a rock exposure whereby a regular series of small chips of rock is broken off along a line across the face. |

Diabase | A common basic intrusive igneous rock usually occurring in dykes or sills. |

Diamond Drill | A rotary type of rock drill that cuts a core of rock that is recovered in long cylindrical sections, two cm or more in diameter. |

Diorite | An intrusive igneous rock composed chiefly of plagioclase, hornblende, biotite or pyroxene |

Geophysical Surveys | The use of one or more geophysical techniques in geophysical exploration. |

EM Survey | A geophysical survey method which measures the electromagnetic properties of rocks. |

Exploration | Prospecting, sampling, mapping, diamond drilling and other work involved in searching and defining ore bodies |

Falconbridge | Falconbridge Limited |

Grab Samples | A sample of rock or sediment taken more or less indiscriminately at any place. |

Granite | A coarse-grained intrusive igneous rock consisting of quartz, feldspar and mica. |

gpt or g/t | Grams per tonne. |

Induced Polarization | A geophysical survey method which measures the conductivity properties of rocks. |

g/t Au | Grams per tonne gold. |

Km | A measure of distance known as a kilometre. |

Mineralization | The concentration of metals and their chemical compounds within a body of rock. |

Ni | The chemical symbol for nickel |

Nickel | A hard white silver metallic chemical element |

NSR | Net Smelter Returns. |

opt | Ounce per tonne |

6

| |

Ore | A natural aggregate of one or more minerals, which at a specified time and place, may be mined and sold at a profit, or which from some part may be profitably separated. |

Oz | A measure of weight known as an ounce. |

Pd | The chemical symbol for Palladium. |

PGM | Platinum Group Metals. |

PGE | Platinum Group Elements. |

ppm | Parts per million. |

Pt | The chemical symbol for Platinum. |

RVI | River Valley Intrusion |

SIC | Sudbury Igneous Complex |

Sample | A small portion of rock or mineralization taken so that the metal content can be determined by assaying. |

Sampling | Selecting a fractional but representative part of a rock or mineralization for analysis. |

Strike | The bearing of a bed or layer of rock |

Vein | A fissure, fault or crack in a rock filled by minerals that have traveled upwards from some deep source. |

7

PART I

ITEM 1.

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

ITEM 2.

OFFER STATISTICS AND EXPECTED TIMETABLE

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

ITEM 3.

KEY INFORMATION

A.

Selected Financial Data

Pacific North West Capital Corp. ("PFN" or the "Company") has a limited history of operations and has not generated any operating revenues. The following table sets forth, for the periods and the dates indicated, selected financial and operating data for the Company. This information should be read in conjunction with the Company's financial statements and notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere herein. The selected financial data provided below are not necessarily indicative of the future results of operations or financial performance of the Company. To date the Company has not paid any dividends on the common shares and it does not expect to pay dividends in the foreseeable future.

The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in Canada ("Canadian GAAP"). There are material differences between Canadian GAAP and the United States Generally Accepted Accounting Principles ("U.S. GAAP") as applied to the Company including disclosure items. For a comparison of these differences, refer to footnote No. 11 to the April 30, 2007 Audited Financial Statements.

Selected Financial Data

(In Canadian Dollars)

| | | | | |

| Year Ended April 2007 | Year Ended April 2006 | Year Ended April 2005 | Year Ended April 2004 | Year Ended April 2003 |

| | | | | |

Canadian GAAP | | | | | |

| | | | | |

Interest income | 147,301 | 115,571 | 112,423 | 73,513 | 47,597 |

Project management fees | 49,209 | 140,474 | 317,329 | 280,354 | 237,207 |

Net Loss | 1,230,764 | 1,344,822 | 1,894,297 | 1,276,008 | 1,323,658 |

Loss per common share | (0.03) | (0.04) | (0.06) | (0.05) | (0.06) |

| | | | | |

Weighted Average No. Shares | 37,743,307 | 34,553,930 | 31,733,575 | 25,151,992 | 20,811,158 |

| | | | | |

Working capital | 4,298,776 | 3,474,322 | 4,518,026 | 5,566,082 | 1,085,456 |

Mineral properties | 2,795,717 | 2,072,383 | 1,336,348 | 534,529 | 330,172 |

Total assets | 7,315,871 | 5,681,742 | 6,070,616 | 7,202,319 | 1,785,530 |

Capital stock | 16,906,926 | 14,227,882 | 13,381,700 | 13,228,572 | 6,739,319 |

Dividends declared per share | - | - | - | - | - |

| | | | | |

8

Selected Financial Data

(In Canadian Dollars)

| | | | | |

| Year Ended April 2007 | Year Ended April 2006 | Year Ended April 2005 | Year Ended April 2004 | Year Ended April 2003 |

| | | | | |

US GAAP | | | | | |

| | | | | |

Interest income | 147,301 | 115,571 | 112,423 | 73,513 | 47,597 |

Project management fees | 49,209 | 140,474 | 317,329 | 280,354 | 237,207 |

Net loss for period | 2,257,084 | 2,468,506 | 2,696,116 | 1,480,365 | 1,367,014 |

Loss per common share | (0.06) | (0.07) | (0.08) | (0.05) | (0.07) |

Weighted Average No. Shares | 37,743,307 | 34,553,930 | 31,733,575 | 25,151,992 | 20,811,158 |

| | | | | |

Working Capital | 3,567,904 | 3,333,963 | 4,518,026 | 4,662,282 | 1,085,456 |

Mineral properties | - | - | - | - | - |

Total assets | 4,520,154 | 3,609,359 | 4,734,268 | 6,667,790 | 1,455,358 |

Capital stock | 16,906,926 | 14,227,882 | 13,381,700 | 13,228,572 | 6,739,319 |

Dividends declared per share | - | - | - | - | - |

| | | | | |

B.

Capitalization and Indebtedness

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

C.

Reasons for the Offer and Use of Proceeds

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

D.

Risk Factors

As resource exploration is a speculative business, which is characterized by a number of significant risks including, among other things, unprofitable efforts resulting from the failure to discover mineral deposits. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

To date, the Company’s properties have no proven commercially viable reserves and are currently at the exploration stage and as such prospective purchasers of the Company’s common shares should consider carefully, among other things, that the Company’s exploration of its properties involves significant risks. Our current Management while considerably experienced in managing exploration projects has limited production experience and as such is dependent upon the production expertise of our joint venture partners.

(i)

Exploration Risks

Mineral exploration involves a high degree of risk and few properties which are explored are ultimately developed into producing mines. There is no assurance that the Company’s mineral exploration activities will result in any discoveries of commercial bodies of mineralization. The long-term profitability of the Company’s operations will be in part directly related to the cost and success of its exploration programs, which may be affected by a number of factors.

9

Substantial expenditures are required to establish reserves through drilling, metallurgical processes to extract the metal from the ore and, in the case of new properties, to build the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities and grades to justify commercial operations or that the funds required for further expansion can be obtained on a timely basis. All of the Company’s projects are currently in exploration stages. Estimates and mineral projects can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors and unforeseen technical difficulties, as well as unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results.

(ii)

Lack of Cash Flow and Non Availability of Additional Funds

The Company's properties are currently being explored or assessed for exploration and as a result, the Company has no source of operating cash flow. The Company has limited financial resources and there is no assurance that if additional funding were needed, that it would be available to the Company on terms and conditions acceptable to it. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and the possible, partial or total loss of the Company's interest in current properties. The Company presently has sufficient financial resources to undertake all of its currently planned exploration programs. The Company’s joint venture partner Kaymin Resources Limited (Kaymin), a fully owned subsidiary of Anglo American Platinum Corporation Limited (Anglo Platinum), is currently funding the exploration program on the River Valley property. The C ompany is also currently exploring the West Timmins Nickel Project in conjunction with joint venture partner Falconbridge Limited (Falconbridge).

The exploration of any ore deposits found on the Company's exploration properties depends upon the Company's ability to obtain financing through debt financing, equity financing or other means. There is no assurance that the Company will be successful in obtaining the required financing. Failure to obtain additional financing on a timely basis could cause the Company to forfeit all or parts of its interests in some or all of its properties or joint ventures and reduce or terminate its operations.

None of the Company's properties has commenced commercial production and the Company has no history of earnings or cash flow from its operations. As a result there can be no assurance that the Company will be able to develop any of its property profitably or that its activities will generate positive cash flow. The Company has not declared or paid dividends on its shares since incorporation and does not anticipate doing so in the foreseeable future. The only present source of funds available to the Company is through the sale of its common shares. Even if the results of exploration are encouraging, the Company may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists on any property. While the Company may generate additional working capital through the operation, sale or possible joint venture expansion of i ts properties, there is no assurance that any such funds will be available for operations.

(iii)

Operating Hazards and Risks

Mineral exploration involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, of PGMs and other metals, such as unusual or unexpected formations, cave-ins, pollution, all of which could result in work stoppages, damage to property, and possible environmental damage. The Company does have $5,000,000 commercial general liability insurance covering its operations. Payment of any liabilities in excess of its insurance could have a materially adverse effect upon the Company's financial condition.

(iv)

No Proven Reserves

All of the properties in which the Company holds an interest are considered to be in the exploration stage only and do not contain a known body of commercial ore.

10

(v)

Title Risks

Due to the large number and diverse legal nature of the mineral properties described herein, full investigation of legal title to each such property has not been carried out at this time. Much of the River Valley property was covered by the Temagami Land Caution and was not in fact open for staking and as such was closed for mineral exploration and development for twenty or more years. In June 1996, the Ontario Government passed legislation allowing the area open for staking mineral claims and on September 17, 1996, the area was re-opened for staking. Consequently, management believes that the area will not be substantially impacted by native land claim issues. However, the Company cannot be certain that land claim issues may not arise.

Many of the Company's properties may be subject to prior unregistered agreements of transfer or native land claims (including Innu land claims which are currently outstanding against all properties in the Labrador Region of Newfoundland), and title may be affected by undetected defects. The Company's properties consist of recorded mineral claims which have not been surveyed, and therefore the precise area and location of such claims is undefined.

While the Company has reviewed and is satisfied with the title for any claim in which it has a material interest and, to the best of its knowledge, such title is in good standing, there is no guarantee that title to such claim will not be challenged or impugned. The properties may be subject to prior unregistered agreements of transfer or native land claims and title may be affected by undeeded claims.

(vi)

Uncertainty or Contestation of Contract Rights

The Company owns or has the right to earn interests in properties under contract with a number of individuals and corporations. Although the Company believes these individuals or corporations have the full legal right to enter into an agreement, the Company has no control should any legal action be taken against the vendors of the properties. As well, should the Company not be able be meet its financial commitments to the vendor of a property this may result in the forfeiture of Company’s right to earn an interest in the property.

(vii)

Conflicts of Interest

Certain of the directors of the Company are directors of other mineral resource companies and, to the extent that such other companies may participate in ventures in which the Company may participate, the directors of the Company may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of the directors of the Company, a director who has such a conflict will abstain from voting for or against the approval of such a participation or such terms. In appropriate cases the Company will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. From time to time several companies may participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participating in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program. It may also occur that a particular company will assign all or a portion of its interest in a particular program to another of these companies due to the financial position of the company making the assignment. In accordance with the laws of the Province of British Columbia, the directors of the Company are required to act honestly, in good faith and in the best interest of the Company. In determining whether the Company will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the potential benefits to the Company, the degree of risk to which the Company may be exposed and its financial position at that time. Other than as indicated, the Company has no other procedures or mechanisms to deal with conflicts of interest. The Company is not aware of the existence of any conflict of interes t as described herein.

(viii)

Competition and Agreements with Other Parties

The mineral resources industry is intensely competitive and the Company competes with many companies that have greater financial resources and technical facilities than itself. Significant competition exists for the limited number of mineral acquisition opportunities available in the Company's sphere of operations. As a result of this competition, the Company's ability to acquire additional attractive mining properties on terms it considers acceptable may be adversely affected.

11

The Company may, in the future, be unable to meet its share of costs incurred under agreements to which it is a party and the Company may have its interests in the properties subject to such agreements reduced as a result. Furthermore, if other parties to such agreements do not meet their share of such costs, the Company may be unable to finance the costs required to complete the recommended programs.

(ix)

Fluctuating Mineral Prices

The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of mineral resources are developed, a profitable market will exist for the sale of same. Factors beyond the control of the Company may affect the marketability of any minerals discovered. There is no assurance that commodity prices will remain at current levels; significant price movements over short periods of time may be affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, the U.S. dollar relative to other currencies), interest rates and global or regional consumption patterns, and speculative activities. The effect of these factors on the price of minerals and therefore the economic viability of any of the Company's exploration projects cannot accurately be p redicted. As the Company is in the exploration stage, the above factors have had no material impact on operations or income.

(x)

Shares Reserved for Future Issuance; Potential Dilution

As of April 30, 2007, the Company had reserved, 5,185,791 common shares for issuance upon the exercise of warrants, incentive stock options and performance shares. Such common shares represent a potential equity dilution of approximately 12% based upon the number of outstanding common shares at April 30, 2007, of 41,996,202. Furthermore, the Company may enter into commitments in the future which would require the issuance of additional common shares and may grant additional stock options and/or issue additional warrants. As at April 30, 2007, the Company had unlimited authorized but unissued and unreserved number of common shares. Issuance of additional shares would be subject to stock exchange regulatory approval and compliance with applicable securities legislation. The Company currently has no plans to issue common shares other than for the purposes of raising funds for property acquisition, propert y exploration and general working capital requirements which issuances would be subject to regulatory approval.

(xi)

Environmental Regulation

All phases of the Company's operations in Canada are subject to environmental regulations. It is the Company's belief that if environmental legislation in Canada evolved and required stricter standards and enforcement, in conjunction with increased fines and penalties for non-compliance, including more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees, the cost of compliance therewith may substantially increase and thereby effect the Company's operations. However, the Company is not aware of any pending environmental litigation or amendments to existing environmental litigation which will affect the Company's current or prepared operations or which would otherwise have a material adverse effect on the Company or its operations. There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Company's operations.

(xii)

Compliance with Applicable Canadian Laws and Regulations

Exploration in the Sudbury area shall be conducted in accordance with the Mining Act of Ontario. The Mining Act of Ontario sets out the guidelines by which exploration can and should be conducted, highlights of which include the notification of the intent to perform work on mineral claims, and the obligation to perform valid assessment work to keep the claims in good standing.

12

Legislation and implementing regulations implemented by the Newfoundland Department of Natural Resources directly affect the mining industry in the Province of Newfoundland and Labrador where the Company holds mineral claims. In particular, the Company must provide prior notice and a description of the planned exploration work before the commencement of the work.

Work on the Union Bay property is carried out in accordance with the necessary permits from the US Forest Service.

Work on the Good News Bay property is carried out in accordance with the necessary permits and under agreements with local land and native corporations.

(xiii)

Canadian Jurisdictional and Enforceability of Judgments, Risks

The Company is a Canadian corporation and is governed in its conduct by the Laws of Canada. Four of its directors are residents of Canada and one director is a resident of the United Kingdom and all its assets are located in Canada, United States and New Zealand.

(xiv)

Adequate Labor and Dependence Upon Key Personnel

The Company will depend upon recruiting and maintaining other qualified personnel to staff its operations. The Company believes that such personnel currently are available at reasonable salaries and wages in the geographic areas in which the Company intends to operate. There can be no assurance, however, that such personnel will always be available in the future. In addition, it cannot be predicted whether the labor staffing at any of the Company's projects will be unionized. The success of the operations and activities of the Company is dependent to a significant extent on the efforts and abilities of its management. The loss of services of any of its management could have a material adverse effect on the Company.

(xv)

South African Reserve Bank

The export by Kaymin of the funds required to participate in the Farm-In agreement on the River Valley Properties may, pursuant to the South African Exchange Control Regulations, require the approval of the Exchange Control Department of the South African Reserve Bank.

(xvi)

Forward Looking Statements

This document contains forward looking statements concerning the Company's operations, economic performance and financial condition, including in particular, the likelihood of the Company's success in operating as an independent company and developing and expanding its business. These statements are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company, and reflect future business decisions which are subject to change. Some of these assumptions inevitably will not materialize, and unanticipated events will occur which will affect the Company's future results.

ITEM 4.

INFORMATION OF THE COMPANY

A.

History and Development of the Company

The Company was incorporated pursuant to the provisions of the Business Corporations Act (Alberta) on May 29, 1996. The Company amended its articles by certificate of amendment dated October 22, 1997 to remove the private company restrictions. On July 13, 2004 the Company continued out of the Province of Alberta into the Province of British Columbia.

The Company's registered and executive office is located at 2303 West 41st Avenue, Vancouver, British Columbia Canada V6M 2A3, telephone number (604) 685-1870. The Company is a reporting issuer in the Province of Alberta, British Columbia and Ontario, Canada. The Company’s common shares have traded on the Toronto Venture Exchange since December 19, 1997 under the trading symbol “PFN” and on the Toronto Stock Exchange from June 8, 2001 under the trading symbol “PFN” and on the OTCBB from August 30, 2001 under the trading symbol “PAWEF” and on the Frankfurt Stock Exchange, Open Market under the trading symbol P7J.

13

B.

Business Overview

PFN primarily explores for platinum group metals (PGM) and Nickel in North America.

The Company’s primary business is mineral exploration as such there is no assurance that a commercially viable deposit exists on any of the Company’s projects. Further exploration is necessary in order to determine if such a deposit may exist. In the event that a viable economic deposit is delineated considerable addition funds, drilling and engineering studies will need to be completed in order to determine the project’s economic viability.

The Company’s main material property is the River Valley PGM property on which it is currently in a joint venture with Anglo Platinum. An updated Mineral Resource Estimate was recently completed on the property. Exploration on the property is generally not affected by seasonal change, with drill programs being carried out year round and surface bedrock exploration limited only by snow cover and spring thaw conditions. Exploration activities are dependent upon the availability of subcontractors, in particular drilling activities. These sub-contractors are generally available, however, may vary in price depending upon availability. The material effects of government regulations on the Company’s business are disclosed in Item 3 – Risk Factors.

C.

Organizational Structure

The Company is the sole shareholder of Pacific North West Capital Corp. USA.

D.

Property, Plants, and Equipment

ONTARIO, CANADA

(I)

River Valley Farm-In and Joint Venture Project

Property Description and Location

![[pacific20f073107001.jpg]](https://capedge.com/proxy/20-F/0001137171-07-001065/pacific20f073107001.jpg)

Ownership

By agreement dated 14 July 1999, the Company granted to Kaymin Resources Limited (“Kaymin”), a wholly owned subsidiary of Anglo American Platinum Corporation Ltd., an option to earn up to a 65% interest in the Company’s portion of certain properties, including the River Valley property, the Goldwright property, the Frontier property, the Washagami property, the Razor property and the Western Front property(Notes 4b(i) - 4b(vi) respectively), in the Sudbury Region of Ontario. During a prior year, Kaymin elected to vest obtaining a 50% interest in the properties upon having paid the Company $300,000 (received in a prior year) and advanced and spent in excess of $4,000,000 for exploration on the properties.

14

A joint venture is now in force. Under this joint venture agreement Kaymin is responsible for funding all exploration until a feasibility study is completed, which earns Kaymin an additional 10% interest. In addition, if Kaymin arranges financing for a mine it receives an additional 5% interest, increasing its ownership up to a possible 65% interest. As Kaymin controls all financing, investing and operating decisions during this second earn-in phase, the consolidated financial statements of the River Valley Joint Venture have not been incorporated on a proportionate basis into these consolidated financial statements. As at 30 April 2007, $101,165 (2006 - $104,734) is receivable from the joint venture ($100,000) payable on demand and management fees ($1,165).

The above agreement is subject to various Net Smelter Return (“NSR”) royalties under the terms of the underlying agreements ranging from 2% to 3%.

a)

River Valley Property. By an agreement dated January 15, 1999 and amended March 11, 1999, the Company has acquired a 100% interest in the Luhta Bailey-Orchard property for the following consideration: 600,000 shares over four years (issued) and cash payments of $265,000 (paid). These claims are subject to a total 3% net smelter royalty (NSR) to the three vendors; 2% of the NSR can be purchased outright by PFN for $2 million cash. Under the joint venture with Kaymin, both PFN and Kaymin hold a 50% interest in these claims.

In addition to the main Luhta, Bailey, Orchard agreement the Company holds various other properties which together comprise the River Valley joint venture property as follows:

b)

Goldwright Property. By agreement dated June 30, 1998 and subsequently amended, the Company earned a 25% interest in certain mineral claims known as the Janes property, located in the Janes Township, Sudbury Mining District, Ontario, by incurring in excess of $350,000 of exploration expenditures on the properties by May 31, 2001. Certain of the above claims are subject to a 2% NSR.

c)

Frontier Property. The Company acquired a 100% interest in certain properties located in the Kelly and Davis Townships, Sudbury Mining District, Ontario for consideration of $30,000. The property is subject to a 2% NSR.

d)

Washagami Lake Property consists of 16 unpatented mining claim units (256 ha) located in the Janes Township, Sudbury Mining District, Ontario immediately south of the Frontier property. On February 23, 1999, the Company and Brian Wright, Michael Loney and Scott Jobin-Bevans (the “Vendors”) entered into an Option to Purchase agreement whereby the Company can earn a 100% interest by making cash payments of $28,200. The original agreement was amended and the payment structure is summarized after taking into account the amendments. The Company has relinquished several of these claims. The Company has made these payments and holds a 100% ownership interest in the property The property is subject to a 2% NSR. There are no plans to expend monies on this portion of the property at this time.

e)

Razor Property. The Company acquired a 100% interest in certain mineral claims located in the McWilliams Township, Sudbury Mining District for a consideration of $30,000. The property is subject to a 2% NSR.

f)

Western Front Property. By agreement dated November 16, 2001, the Company has acquired a 70% interest in certain mineral claims from a company (the Optionor) with certain directors in common. As consideration the Company, paid $55,000 and issued 20,000 common shares to the Optionors. In addition an exploration expenditure of $50,000 was completed. The Company has the right to purchase an additional 30% interest in the property by paying $750,000 to the Optionor. The property is subject to a 3% NSR the first 1% of which the Company can purchase for $1,000,000 the second 1% can be purchased for $2,000,000. The Company and the Optionor will share the NSR buyout privileges in proportion to their respective interest.

15

The following “italicized text” has been excerpted from technical reports titled "Review of Exploration Results River Valley property & Agnew property for Pacific North West Capital Corp. (as of January 31, 2001 with revisions to March 22, 2001)" and dated March 26, 2001 was completed by Derry, Michener, Booth & Wahl Consultants Limited and “Mineral Resource Estimate of the Dana Lake and Lismer’s Ridge Deposits on the River Valley PGM property, Ontario for Pacific North West Capital Corp (as of September 26, 2001) dated October 15, 2001 and was completed by Derry Michener Booth and Wahl Consultants Ltd.). and a “Revised Mineral Resource Estimate, Dana Lake and Lismer’s Ridge Deposits incorporating the Phase VI Drilling, River Valley PGM Project, Ontario for Pacific North West Capital Corp”, dated June 10, 2004, by Derry, Michener, Booth and Wahl Consulta nts Ltd.

Property Location and Access

The River Valley property lies within Dana and Pardo Townships and is located about 100 road kilometres (50 km direct) northeast of the City of Sudbury, Ontario. The coordinates of the centre of the property are approximately 555356mE and 5172290mN (UTM 17, NAD 27).

The River Valley property claim group consists of 333 unpatented mining claim units that cover 5688 hectares (56.8 km2). The majority of the claims are located in Dana Township with 4 of the 30 blocks located immediately to the north in Pardo Township. The claim group is contiguous, with the exception of claim S-1229380, located south of the main group in Dana Township. Both Dana and Pardo Townships are in the Sudbury Mining District. The townships are unsurveyed.

The property is road accessible.

The claims have been legally surveyed, and the final lease approval is being reviewed by the different Ontario government Ministries.

In May 2004, Anglo Platinum approved a $3.0 million exploration budget which was used to fund a minimum 20,740 metre drill and surface exploration program aimed at increasing the existing River Valley property Resource Estimate.

To the best of PFN’s knowledge there are no environmental liabilities against the mining claims.

All exploration to date has been carried out with appropriate work permits from the MNR permits. For the future drilling phases a more elaborate permit may be applied for but to PFN’s knowledge there is no impediment to receiving one.

![[pacific20f073107002.jpg]](https://capedge.com/proxy/20-F/0001137171-07-001065/pacific20f073107002.jpg)

16

Expiration Date of Claims

| | | | |

Township/Area | Claim Number | Claim Due Date | # of Units | |

DANA | 1227988 | 2011-Oct-19 | 8 | LBO |

DANA | 1227989 | 2011-Oct-19 | 8 | LBO |

DANA | 1227990 | 2011-Oct-19 | 12 | LBO |

DANA | 1227991 | 2011-Oct-19 | 10 | LBO |

DANA | 1229216 | 2011-Oct-19 | 6 | LBO |

DANA | 1229217 | 2011-Oct-19 | 16 | LBO |

DANA | 1229218 | 2011-Oct-19 | 16 | LBO |

DANA | 1229219 | 2011-Oct-19 | 12 | LBO |

DANA | 1229220 | 2011-Oct-19 | 16 | LBO |

DANA | 1229221 | 2011-Oct-19 | 16 | LBO |

DANA | 1229222 | 2011-Oct-19 | 16 | LBO |

DANA | 1229223 | 2011-Oct-19 | 12 | LBO |

DANA | 1229224 | 2011-Oct-19 | 10 | LBO |

DANA | 1229230 | 2011-Sep-21 | 16 | LBO |

DANA | 1229231 | 2011-Sep-21 | 16 | LBO |

DANA | 1229232 | 2011-Sep-21 | 14 | LBO |

PARDO | 1229233 | 2011-Sep-21 | 16 | LBO |

PARDO | 1229234 | 2011-Sep-21 | 6 | LBO |

DANA | 1229380 | 2009-Jul-26 | 3 | PFN |

DANA | 1229542 | 2011-May-07 | 6 | PFN |

DANA | 1230038 | 2011-May-07 | 12 | PFN |

DANA | 1237228 | 2011-May-25 | 8 | PFN |

DANA | 1237304 | 2011-Apr-13 | 12 | PFN |

DANA | 1237305 | 2011-Apr-13 | 8 | PFN |

DANA | 1244338 | 2011-Jun-14 | 6 | PFN |

DANA | 1244427 | 2011-Jun-05 | 7 | PFN |

DANA | 1244435 | 2011-Jun-05 | 4 | PFN |

DANA | 1244444 | 2011-Jun-05 | 16 | PFN |

PARDO | 1244445 | 2011-May-07 | 8 | PFN |

PARDO | 1244332 | 2011-May-07 | 8 | PFN |

PARDO | 3017059c | 2009-Apr-08 | 16 | PFN |

PARDO | 3017060 | 2009-Apr-08 | 16 | PFN |

PARDO | 3017061 | 2009-Apr-08 | 16 | PFN |

PARDO | 3017062 | 2009-Apr-08 | 16 | PFN |

PARDO | 3017085 | 2009-Apr-08 | 16 | PFN |

DANA | 3004262 | 2010-Aug-29 | 2 | PFN |

DANA | 3010281 | 2011-Oct-29 | 1 | RAZOR |

DANA | 3010282 | 2011-Oct-29 | 1 | RAZOR |

DANA | 1191268 | 2011-Oct 13 | 1 | RAZOR |

MCWILLIAMS | 1229840 | 2011-Feb 12 | 9 | RAZOR |

JANES | 1231107 | 2012-Dec-17 | 6 | Western Front |

JANES | 1235822 | 2012-Dec-17 | 12 | Western Front |

JANES | 1235888 | 2012-Dec-17 | 12 | Western Front |

JANES | 1235889 | 2012-Dec-17 | 16 | Western Front |

JANES | 1235891 | 2012-Dec-17 | 7 | Western Front |

JANES | 1235892 | 2012-Dec-17 | 16 | Western Front |

JANES | 1235893 | 2012-Dec-17 | 7 | Western Front |

JANES | 1235894 | 2012-Dec-17 | 9 | Western Front |

JANES | 1235896 | 2012-Dec-17 | 2 | Western Front |

DANA | 1246498 | 2012-Jan-12 | 8 | Western Front |

JANES | 1229744 | 2007-Dec-09 | 16 | Washagami |

Accessibility, Climate, Local Resources Infrastructure and Physiography

Accessibility

The River Valley property lies within Dana, Pardo Janes and McWilliams Townships and is located about 100 road kilometres (50 km direct) northeast of the City of Sudbury, Ontario.

17

Climate and Local Resources

Climate is temperate, with four distinct seasons, typical of the Southern Shield, and moderated by the proximity to the Great Lakes. Other than over small lakes drilling and geophysical surveys can be carried out year round from skidder roads. Drilling water is sufficient. Surface bedrock exploration can be done for about 7-8 months of the year. An environmental base line study has not been necessary to date.

Sudbury, a major mining and manufacturing city, can provide all of the infrastructure and technical needs for any exploration work.

Physiography

The property lies at a mean elevation of about 325 metres ASL. Relief is moderate and typical of upland Precambrian Shield topography. The eastern part around Azen Creek is lower and marshy. Forest cover is mainly poplar with about 25-33% white pine regrowth.

Outcrop exposure on the property is limited to about 20% with the remaining areas covered mostly by a thin (<1 m) veneer of glacial till; locally gravel, outwash sand and silt reach 10’s of metres in thickness. Most of the area around the Dana Lake and Azen Creek areas has been logged within the past 10 years and new logging took place in the Azen Creek Area during the summer of 2000.

History and Previous Work

Introduction

In 1973, the Province of Ontario placed more than 110 Townships in a withdrawn area referred to as the “Temagami Land Caution” – this region was excluded from any type of resource exploration and/or development until June 1996. The River Valley Property was covered by this withdrawn area and as a result, most of the River Valley Intrusion was never explored for its PGM-Cu-Ni potential.

The earliest recorded work on the River Valley property was by Kennco Explorations (Canada) Ltd. in 1968, at which time they conducted an airborne Mag-EM survey over Janes, Davis, Henry and Dana Townships.

Prospecting in the Dana Lake area by prospectors L. Luhta, R. Bailey and R. Orchard, (August 1998) resulted in the initial discovery of mineralization in the Dana Lake and Azen Creek areas. Property Geology

Geological Setting

Regional Geology

The River Valley property is primarily underlain by rocks of the River Valley Intrusion (RVI), a large Paleoproterozoic (ca. 2.56 to 2.47 Ga) intrusion that forms part of the Huronian-Nipissing Magmatic Province (HNMP) or the Huronian Metallogenic Province (HMP)

Local Geology

The RVI covers more than 100 km2 and lies adjacent to, and straddles the Grenville Front within the Grenville Province and the Grenville Front Tectonic Zone (GFTZ). The GFTZ represents a complex zone, several kilometres wide and consisting of generally southeast-dipping imbricate thrust faults. In the area of the River Valley property, the GFTZ is located along the westernmost edge of the claims where it is represented by a system of eastward-dipping (10-25°) thrust faults. This fault system separates the intrusive rocks of the RVI from younger sedimentary and intrusive rocks of the Huronian Supergroup (includes Nipissing Diabase). It is likely that intrusive rocks of the RVI interdigitated within Huronian rocks along the fault-bound western contact.

18

Within Pardo Township, a north-trending apophysis of the RVIappears to be in fault contact with older (Archean Superior Province) mylonitic granitic rocks. In Dana Township the western boundary is in fault contact with rocks of the Southern Province, and the eastern and northern boundaries are in igneous contact with Archean migmatite and paragneiss of the Superior Province. The eastern and northern boundaries were previously mapped as being in contact with rocks of the Grenville Province (cf. Lumbers, 1973).

The RVI can be separated into two main areas on the basis of structural coherence and preservation of primary igneous features such as contacts and layering. The eastern part of the RVI, located primarily in Dana and Crerar Townships, is represented by the best preserved portions of the intrusion and as such the most prospective areas for discovery. PFN’s River Valley property covers about 40% of this area including about 10 km of highly prospective northern igneous contact. Further to the west, in Henry, Janes, Loughrin, Street and Awrey Townships, the geology of the western part of the RVI is complicated by the effects of Grenville metamorphism. In this area the rocks are attenuated, folded and structurally modified such that most of the primary features are absent.

Property Geology

The River Valley property as mapped by PFN, includes three main mineralized areas with anomalous PGM-Cu-Ni sulphide mineralization: the Dana Lake Area, Lismer’s Ridge, and Azen Creek Area.

The Dana Lake Area of the River Valley property lies within a north-trending portion of the River Valley Intrusion (RVI). This region of the RVI likely represents an offshoot of the main intrusive body and appears to be an up-thrust and rotated portion of the intrusion. In its current position, the Dana Lake Area represents a lower stratigraphic position in the intrusion that is now oriented sub-vertical relative to its original, near-horizontal position. The basal contact of the intrusion undulates in both the horizontal and vertical direction and this undulation is probably a primary igneous contact feature. However, the area has been structurally disturbed with evidence for dip-slip, strike-slip and rotational displacement on the centimetre to metre scale. Steeply dipping (>80°), decimetre- to metre-scale, modally layered rocks of the River Valley intrus ion overly the contact-related, mineralized breccia unit and are truncated along the western edge of the intrusion by the Grenville Front Fault.

Located about 1.3 km southeast of the Dana Lake Area, Lismer’s Ridge appears to be located within a similar geological setting to that of the Dana Lake Area with the major geological units dipping steeply (70-90°) to the southwest. However, unlike the Dana Lake Area, a much thicker stratigraphic section exists above (south to southwest) the mineralized breccia unit. In contrast to the Dana Lake Area, the rocks that are exposed at Lismer’s Ridge are generally more foliated and contain a higher proportion of chlorite-actinolite.

The Azen Creek Area, located about 6 km southeast of the Dana Lake Area appears to be situated stratigraphically higher (south) in the intrusion than the mineralized breccia at the Dana Lake Area and at Lismer’s Ridge. In general, the rocks of the RVI in this area appear to dip shallowly (<60°) toward the south-southeast.

Exploration - Current and Future

In 1999, Pacific North West Capital Corp. (PFN) optioned the Luhta, Bailey and Orchard claims and with joint-venture partners Anglo American Platinum Corporation Ltd. (Amplats) subsequently completed an approximately $350,000 surface exploration program. An exploration program consisting of detailed and regional work was undertaken and samples were assayed for PGE, Ni, Cu and Au.

In 2000, Pacific North West Capital Corp. and joint-venture partners Anglo American Platinum Corporation Ltd. completed an approximately $1,650,000 Phase II surface exploration program which included an expansion of the previously completed detailed and regional work, geological mapping and sampling. In addition geophysical surveys were undertaken which included both induced polarization and magnetometer surveys. A total of 6778 metres of diamond drilling was undertaken in three phases. A total of 40 holes were completed with the majority of holes being drilled in the Dana Lake area. Samples were assayed for for Au, Pt, Pd, Ni, Cu and selected ones for Rh and 30 element ICP analysis was carried out on many of the samples.

19

Following consultation with Anglo Platinum, a $2 million CDN Phase IV exploration program was implemented for the project budget year November 1, 2000 - October 31, 2001. The majority of the program was focused on drilling and targeted the Dana North, Dana South and Lismer's Ridge Zones.

The majority of the exploration work conducted in 2002 and 2003 was drilling. Please see the drilling section of this annual report for a continued discussion of Exploration History for exploration conducted in the ensuing years. PFN believes that the data generated from the work conducted on its property to be reliable. The 2004/2005 program consisted of additional drilling in conjunction with surface mapping and sampling.

In 2005-2006 (Phase 8), additional mapping and drilling was carried out. In 2006 and 2007 (Phase 9), further mapping was completed and will continue with detail sampling..

Mineralization

The River Valley project includes three main areas of PGM-Cu-Ni sulphide mineralization: Dana Lake Area, Lismer’s Ridge, and Azen Creek. Dana Lake, located within the northwest corner of the claim group, consists of 7 main areas from north to southThese seven zones of PGM-Cu-Ni mineralization extend intermittently over a strike length of >900 m. The first six are now combined as Dana North Zone and seventh as Dana South Zone. At Lismer’s Ridge, surface mineralization is intermittently exposed over a NW-SE strike length of greater than 800 m, where it occurs within a similar geological environment to the Dana Lake Area.

At the Azen Creek Area, located about 6 km southeast of the Dana Lake Area, breccia-hosted mineralization is exposed in outcrop, located about 200 m south of the intrusive contact. The mineralization at the Azen Creek Main showing represents a different style of mineralization than at Dana Lake Area or Lismer’s Ridge in the hanging wall in a setting akin to Mustang Minerals Ltd. / Implats mineralization on the adjacent property to the south.

Exploration of the River Valley property from 1999 to 2001 has shown that PGM mineralization (Pt+Pd+Au±Rh) exceeding 200 ppb PGE occurs extensively within a sequence of felsic to mafic magmatic breccias and fragment-bearing units that have been intermittently exposed and drill-tested along a prospective +10 km long intrusive contact.

The following italicized text was excerpted from a report entitled, “Revised Mineral Resource Estimate, Dana Lake and Lismer’s Ridge Deposits incorporating the Phase VI Drilling, River Valley PGM Project, Ontario for Pacific North West Capital Corp”, dated June 10th, 2004, by Derry, Michener, Booth and Wahl Consultants Ltd. In March 2006, The mineral resources table was updated by Mr Ron Simpson of GeoSim services. Mr Simpson was responsible for the calculation of the resources estimate in the Derry Mitchener and Wahl report. The March 2006 report included all of the drill holes from the phase 7 program.

Drilling

Drilling of 416 holes, totalling 83,838 metres, was been carried out in six phases between February 28, 2000 and April 30, 2004.

NDS Drilling of Timmins, Ontario, supplied drilling services under contact to PFN for Phases I-IV. Bradley Bros. Drilling of Noranda was used for Phase V and VI. All core produced was of NQ diameter.

Phase I to V and early Phase VI drilling was focussed primarily on the Dana Lake and the Lismer’s Ridge Area. Phase VI drilling was later expanded to include several new zones in the central and south-eastern parts of the property including the Varley area.

20

A summary of each phase of drilling is as follows:

Phase I: This was completed between February 28 and March 19, 2000. It consisted of 2000 metres in 13 holes and was designed to test the strike and depth of the known surface mineralization at the Dana Lake Area. In addition, the drill program was aimed at testing the correlation between induced polarisation anomalies and subsurface sulphide mineralization.

Phase II: This was completed between June 12 and July 18, 2000. 2820.8 metres were drilled in 14 holes to further test the strike and depth of known surface mineralization at the Dana Lake Area.

Phase III: This was completed between September 6 and 25, 2000 and consisted of 1958.50 metres in 13 holes. The program was designed to further test the strike and depth of known surface mineralization at the Dana Lake Area, and to provide an initial test of subsurface mineralization at Lismer’s Ridge.

Phase IV: 31 drill holes were completed between February 1 and March 22, 2001 when the program was temporarily shut down for data consolidation. The program resumed May 14th and 67 more holes were completed by July 25th. Assay results for the last 14 holes of the total of 98 holes (16012.44 metres) were released September 26, 2001. This program was designed to increase drill density on the Dana North, Dana South and Lismer’s Ridge Zones, thus improving the confidence level, so that an indicated mineral resource could be estimated.

Phase V: A total of 43 holes were completed on Dana South and Lismer’s Ridge between February 28,2002 and March 2, 2002 in the first stage. The program resumed on April 22,2002 and 33 additional holes were completed by July 16, 2002. A total of 7 holes (1302 metres) were drilled in an initial test of the Banshee Zone, located about 600 metres south of the Dana Lake South Zone.

Phase VI: A total of 107 holes were completed at Dana Lake and Lismer’s Ridge between November 7, 2002 and June 26, 2003. Total metres drilled amounted to 25,365. Phase VI drilling continued elsewhere on the property until May, 2004

Phase VII: A total of 103 holes were completed in the Pardo, Banshee, Lismer Extension, Lismer, Casson, Drop, Varley, Azen South, Azen North and Jackson Flats areas. Drilling in these areas was largely reconnaissance in nature and based on the sampling, mapping and geophysical surveys carried out on the property during the Phase VII exploration program, and resulted in the discovery of the zones outlined.

Phase VIII (2005): A program of detailed surface mapping was undertaken across the eastern half of the property, and followed up by drill holes to test the RVI stratgraphy.

Phase IX (2006): A further program of detailed surface mapping and detail sampling was carried out on the western and southern portions of the property to further define geological features of interest to define future drill targets.

Phase X (2007): Surface mapping and detail sampling will continue in the southwestern portions of the property to define future drill targets.

Sampling and Analysis

A rigorous program of sampling and analysis was undertaken. The core samples are taken continuously from drilling at widths with a maximum of 1.0 metres. The samples taken are based on the following criteria, geology and sulphide content. In cases where mineralised is non existent or weakly mineralised the sample interval is increased to 1.5 metres. In general core recovery is excellent with recoveries on average exceeding 95%.

“At XRAL laboratory all shipments are unpacked and arranged in numeric order. All drill core samples are first crushed such that 90% of the sample passes a -10 mesh (coarse) screen; all crushed rejects are stored for the client. The crushing equipment is cleaned with air and/or a brush between samples. After crushing, a 500g riffle-split sample is collected and pulverized such that 90% passes a -200 mesh (74mm openings) screen. As before, all equipment is cleaned with air and/or brush between samples. A 30g sample is then taken from this fine-grained pulp material.

21

Core samples are analyzed for Pt-Pd-Au using standard lead fire assay, followed by dissolution with aqua regia, and measurement with an ICP finish. Lower limits of detection (30g sample) are 1ppb for Au and Pd and 10 ppb for Pt; upper limits are 10,000 ppb for Au-Pt-Pd by ICP. Concentrations of Cu-Ni are determined by aqua regia / ICP methods and generally have lower limits of detection of 0.5 ppm for Cu and 1 ppm for Ni; upper limit for both Cu and Ni is 10,000 ppm (1%).”

Security of Samples

Samples are logged initially in the field by a field geologist and secured for transport and driven to the PFN core shack. The core is then logged by a geologist and the data is entered into a drill core logging program. The core is cut in even sections and then rinsed to remove any excess material. Half of the core is placed in a plastic bag with a tag to be sent for assay.. The samples are trucked to X-Ral Labs, Mississauga, Ontario for preparation and then shipped to XRAL Labs in Rouyn- Noranda, where they are assayed for Pt, Pd, Au, Cu, and Ni; from time to time a limited number of specified samples are analyzed for Rh.

The remaining section is placed into a core box and is duly tagged as well. The outside of the core box has metal tag stapled to it which indicates the hole number and meter interval. Lids are then strapped tightl closed and then are stored at the core storage compound located on the grounds of the Fielding Road core shack; the main building itself is secured via a monitored alarm system (motion and door detectors).”

DMBW observed the core handling and transportation from the field to the secure core shack and fenced compound, and the core sampling process and found that all procedures were carried out in a proper and workmanlike manner.

It should be stressed that all technical work is also reviewed by Anglo Platinum personnel who visit the property periodically and provide insight into interpretation and drill targets.

Mineral Resource and Mineral Reserve Estimation – Mineral Deposits

Mineral Resource, the terms “mineral resource”, “inferred mineral resource”, “indicated mineral resource” and “measured mineral resource” have the meanings ascribed to those terms by the Canadian Institute of Mining, Metallurgy and Petroleum, as the CIM Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by CIM Council on August 20, 2000, as those definitions may be amended from time to time by the Canadian Institute of Mining, Metallurgy and Petroleum.

Measured Mineral Resource

A ‘Measured Mineral Resource’ is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

Indicated Mineral Resource

An ‘Indicated Mineral Resource’ is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

22

Cautionary Note to US Investors concerning estimates of Inferred Resources. This section uses the terms “inferred resources”. We advise US investors while those terms are recognized and required by Canadian regulations, the US Securities and Exchange Commission does not recognize it. “Inferred Resourcs” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category orwill ever be converted into reserves. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or prefeasibility studies, except in rare cases. US investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

Inferred Mineral Resource

An ‘Inferred Mineral Resource’ is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The following is a summary of the March 2006 Resources update, prepared by Geosim Services Inc.:

·

Table 1: Measured and Indicated Resources of 30.5 million tonnes containing 953,900 ounces of palladium (0.97 g/t), 329,500 ounces of platinum (0.34 g/t) and 59,500 ounces of gold (0.061g/t) with an additional 2.3 million tonnes containing 67,000 ounces of palladium (0.87g/t), 23,800 ounces of platinum (0.31g/t) and 4,000 ounces of gold (0.05 g/t) of Inferred Resources using a 0.7 g/t cut off (pt/pd).

·

Table 2: Containing Higher Grade Measured and Indicated Resources of 19.3 million tonnes containing 733,000 ounces palladium (1.18 g/t), 245,100 ounces of platinum (0.39 g/t) and 43,600 ounces of gold (0.07 g/t) with an additional 881,000 tonnes containing 38,400 ounces of palladium (1.36 g/t), 13,100 ounces of platinum (0.46 g/t) and 2,100 ounces of gold (0.07 g/t) of Inferred Resources using a 1.0 g/t cut off (pt/pd).

The updated mineral resource estimate was completed by Ron Simpson of Geosim Services Inc., in conjunction with John Londry, VP Exploration for PFN. Resource block modeling was carried out by Geosim based upon geological modeling conducted in-house by PFN, and incorporated all diamond drilling to March 31st, 2005 (86,557 metres of drilling and 422 drill holes).

A summary of the mineral resources follows. The summary uses a 0.7 g/t cut off grade. Table 2 uses a significantly higher cut off of 1.0 g/t.

| | | | | | | | | | | | | | |

Table 1: 2006 River Valley Updated Resource Estimate (cut-off grade 0.70 g/t Pt+Pd) |

Measured Resource | COMPARATIVE 3E |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000's) | 2004 Resource Estimate (0.7g/t cutoff) |

000s | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | Pt+Pd | 3E | Oz (000) |

Dana North | 2,623 | 0.080 | 0.428 | 1.327 | 0.12 | 0.02 | 1.755 | 1.835 | 6.8 | 36.1 | 111.9 | 148.0 | 154.8 | 154.8 |

Dana South | 1,496 | 0.100 | 0.625 | 2.122 | 0.16 | 0.03 | 2.747 | 2.847 | 4.8 | 30.1 | 102.0 | 132.1 | 136.9 | 136.9 |

Lismer's Ridge | 4,411 | 0.062 | 0.357 | 0.982 | 0.10 | 0.02 | 1.339 | 1.401 | 8.8 | 50.6 | 139.2 | 189.8 | 198.6 | 198.6 |

Lismer North | - | - | - | - | - | - | - | - | - | - | - | | - | 0.0 |

Varley | - | - | - | - | - | - | - | - | - | - | - | | - | 0.0 |

Total | 8,530 | 0.074 | 0.426 | 1.288 | 0.12 | 0.02 | 1.714 | 1.788 | 20.4 | 116.8 | 353.2 | 470.0 | 490.4 | 490.4 |

| | | | | | | | | | | | | | |

23

| | | | | | | | | | | | | | |

Table 1: 2006 River Valley Updated Resource Estimate (cut-off grade 0.70 g/t Pt+Pd) - Continued |

Indicated Resource | COMPARATIVE 3E |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000's) | 2004 Resource Estimate (0.7g/t cutoff) |

000's | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | Pt+Pd | 3E | |

Dana North | 5,881 | 0.054 | 0.278 | 0.777 | 0.09 | 0.02 | 1.055 | 1.109 | 10.2 | 52.6 | 146.9 | 199.5 | 209.6 | 209.6 |

Dana South | 3,516 | 0.071 | 0.380 | 1.229 | 0.11 | 0.02 | 1.609 | 1.680 | 8.0 | 42.9 | 138.9 | 181.9 | 189.9 | 189.9 |

Lismer's Ridge | 7,439 | 0.046 | 0.255 | 0.667 | 0.08 | 0.02 | 0.922 | 0.968 | 11.1 | 61.0 | 159.4 | 220.5 | 231.5 | 231.5 |

Lismer North | 1,333 | 0.058 | 0.316 | 0.911 | 0.11 | 0.03 | 1.227 | 1.285 | 2.5 | 13.5 | 39.0 | 52.6 | 55.0 | 0.0 |

Varley | 3,855 | 0.059 | 0.345 | 0.939 | 0.07 | 0.02 | 1.283 | 1.342 | 7.3 | 42.7 | 116.3 | 159.1 | 166.3 | 0.0 |

Total | 22,024 | 0.055 | 0.300 | 0.848 | 0.09 | 0.02 | 1.149 | 1.204 | 39.0 | 212.8 | 600.7 | 813.4 | 852.4 | 631.0 |

| | | | | | | | | | | | | | |

Measured + Indicated | COMPARATIVE |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000's) | 2004 Resource Estimate (0.7g/t cutoff) |

000's | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | Pt+Pd | 3E | |

Dana North | 8,504 | 0.062 | 0.324 | 0.947 | 0.10 | 0.02 | 1.271 | 1.333 | 17.0 | 88.6 | 258.9 | 347.4 | 364.4 | 364.4 |

Dana South | 5,012 | 0.079 | 0.453 | 1.496 | 0.13 | 0.02 | 1.949 | 2.028 | 12.8 | 73.0 | 241.1 | 314.1 | 326.8 | 326.8 |

Lismer's Ridge | 11,850 | 0.052 | 0.293 | 0.784 | 0.09 | 0.02 | 1.077 | 1.129 | 19.9 | 111.7 | 298.6 | 410.3 | 430.2 | 430.2 |

Lismer North | 1,333 | 0.058 | 0.316 | 0.911 | 0.11 | 0.03 | 1.227 | 1.285 | 2.5 | 13.5 | 39.0 | 52.6 | 55.0 | 0.0 |

Varley | 3,855 | 0.059 | 0.345 | 0.939 | 0.07 | 0.02 | 1.283 | 1.342 | 7.3 | 42.7 | 116.3 | 159.1 | 166.3 | 0.0 |

Total | 30,554 | 0.061 | 0.335 | 0.971 | 0.10 | 0.02 | 1.306 | 1.367 | 59.5 | 329.5 | 953.9 | 1283.3 | 1342.8 | 1121.4 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Inferred | COMPARATIVE |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000's) | 2004 Resource Estimate n (0.7g/t cutoff) |

000's | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | Pt+Pd | 3E | |

Dana North | 41 | 0.035 | 0.209 | 0.559 | 0.07 | 0.02 | 0.769 | 0.803 | 0.0 | 0.3 | 0.7 | 1.0 | 1.1 | 1.1 |

Dana South | 552 | 0.047 | 0.229 | 0.648 | 0.08 | 0.02 | 0.876 | 0.923 | 0.8 | 4.1 | 11.5 | 15.5 | 16.4 | 16.4 |

Lismer's Ridge | 330 | 0.039 | 0.219 | 0.529 | 0.08 | 0.02 | 0.748 | 0.788 | 0.4 | 2.1 | 5.1 | 7.2 | 7.7 | 7.7 |

Lismer North | 546 | 0.073 | 0.419 | 1.224 | 0.12 | 0.03 | 1.644 | 1.717 | 1.3 | 7.4 | 21.5 | 28.9 | 30.2 | 0.0 |

Varley | 948 | 0.050 | 0.326 | 0.925 | 0.07 | 0.02 | 1.251 | 1.301 | 1.5 | 9.9 | 28.2 | 38.1 | 39.6 | 102.0 |

Total | 2,389 | 0.053 | 0.309 | 0.873 | 0.09 | 0.02 | 1.182 | 1.235 | 4.0 | 23.8 | 67.0 | 90.8 | 94.9 | 127.1 |

| | | | | | | | | | | | | | |

Table 2: 2006 River Valley Updated Resource Estimate (cut-off grade 1.0 g/t Pt+Pd) |

Measured Resource |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000s) |

000s | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | 3E |

Dana North | 2,523 | 0.082 | 0.435 | 1.354 | 0.12 | 0.02 | 1.790 | 1.871 | 6.6 | 35.3 | 109.8 | 151.8 |

Dana South | 1,495 | 0.100 | 0.626 | 2.122 | 0.16 | 0.03 | 2.748 | 2.848 | 4.8 | 30.1 | 102.0 | 136.9 |

Lismer's Ridge | 3,976 | 0.064 | 0.368 | 1.018 | 0.10 | 0.02 | 1.385 | 1.449 | 8.2 | 47.0 | 130.1 | 185.3 |

Lismer North | - | - | - | - | - | - | - | - | - | - | - | - |

Varley | - | - | - | - | - | - | - | - | - | - | - | - |

Total | 7,994 | 0.076 | 0.437 | 1.331 | 0.12 | 0.02 | 1.768 | 1.844 | 19.6 | 112.4 | 342.0 | 474.0 |

| | | | | | | | | | | | |

24

| | | | | | | | | | | | | | | | | | | | | |

Indicated Resource |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000s) |

000s | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | 3E |

Dana North | 3,067 | 0.061 | 0.320 | 0.920 | 0.09 | 0.02 | 1.240 | 1.301 | 6.0 | 31.5 | 90.7 | 128.3 |

Dana South | 3,304 | 0.072 | 0.389 | 1.266 | 0.11 | 0.02 | 1.655 | 1.727 | 7.6 | 41.3 | 134.5 | 183.4 |

Lismer's Ridge | 2,140 | 0.054 | 0.302 | 0.824 | 0.09 | 0.02 | 1.127 | 1.180 | 3.7 | 20.8 | 56.7 | 81.2 |

Lismer North | 716 | 0.071 | 0.394 | 1.183 | 0.13 | 0.03 | 1.577 | 1.648 | 1.6 | 9.1 | 27.2 | 37.9 |

Varley | 2,082 | 0.075 | 0.448 | 1.224 | 0.09 | 0.02 | 1.671 | 1.747 | 5.1 | 30.0 | 81.9 | 117.0 |

Total | 11,309 | 0.066 | 0.365 | 1.076 | 0.10 | 0.02 | 1.441 | 1.506 | 24.0 | 132.6 | 391.1 | 547.7 |

Measured + Indicated |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000s) |

000s | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | 3E |

Dana North | 5,590 | 0.070 | 0.372 | 1.116 | 0.11 | 0.02 | 1.488 | 1.558 | 12.6 | 66.8 | 200.6 | 280.0 |

Dana South | 4,800 | 0.080 | 0.463 | 1.533 | 0.13 | 0.02 | 1.995 | 2.076 | 12.4 | 71.4 | 236.5 | 320.3 |

Lismer's Ridge | 6,116 | 0.060 | 0.345 | 0.950 | 0.10 | 0.02 | 1.295 | 1.356 | 11.9 | 67.8 | 186.8 | 266.6 |

Lismer North | 716 | 0.071 | 0.394 | 1.183 | 0.13 | 0.03 | 1.577 | 1.648 | 1.6 | 9.1 | 27.2 | 37.9 |

Varley | 2,082 | 0.076 | 0.448 | 1.224 | 0.08 | 0.02 | 1.672 | 1.747 | 5.1 | 30.0 | 81.9 | 117.0 |

Total | 19,303 | 0.070 | 0.395 | 1.181 | 0.11 | 0.02 | 1.576 | 1.646 | 43.6 | 2451 | 733.0 | 1021.7 |

| | | | | | | | | | | | |

Inferred |

DEPOSIT | Tonnes | Au | Pt | Pd | Cu | Ni | Pt+Pd | 3E | Contained Ounces (000s) |

000s | g/t | g/t | g/t | % | % | g/t | g/t | Au | Pt | Pd | 3E |

Dana North | - | - | - | - | - | - | - | - | - | - | - | - |

Dana South | 104 | 0.053 | 0.276 | 0.819 | 0.09 | 0.02 | 1.094 | 1.147 | 0.2 | 0.9 | 2.7 | 3.8 |

Lismer's Ridge | - | - | - | - | - | - | - | - | - | - | - | - |

Lismer North | 345 | 0.091 | 0.524 | 1.586 | 0.14 | 0.03 | 2.110 | 2.201 | 1.0 | 5.8 | 17.6 | 24.4 |

Varley | 432 | 0.063 | 0.464 | 1.301 | 0.07 | 0.01 | 1.765 | 1.828 | 0.9 | 6.4 | 18.1 | 25.4 |

Total | 881 | 0.073 | 0.465 | 1.356 | 0.10 | 0.02 | 1.821 | 1.894 | 2.1 | 13.1 | 38.4 | 53.6 |

The new resource estimate includes results only from the North Lismer and Varley Zone.

Resource estimation was constrained by 3 dimensional solid models using Surpac© Vision software, developed from geological and analytical data. Block estimation was carried out by ordinary kriging and inverse distance to the third power using 2 metre downhole composites. For the North Lismer model, one high outlier was capped at 3 g/5 Pt and 9 g/t Pd and for Varley, one high assay interval was capped at 10 g/t Pd prior to compositing.

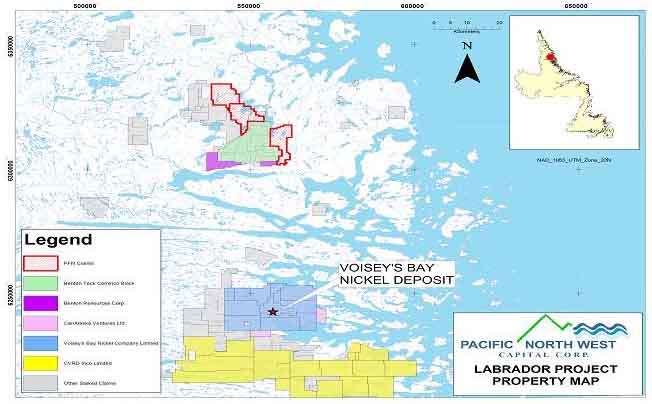

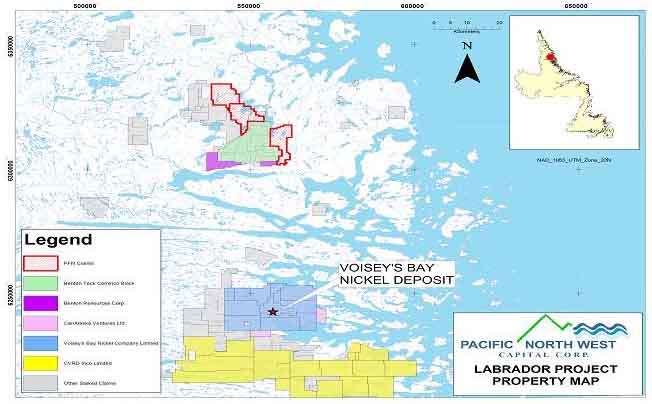

Cut-off Parameters