| For Immediate Release | | NEWS RELEASE |

| TSX: PFN OTCQX: PAWEF FSE: P7J | Toll Free 1.800.667.1870 | www.pfncapital.com |

New NI43-101 Resource on the Rock & Roll Gold-Silver-Polymetallic Project, Significantly increases Historic Resource

- New NI43-101 Technical significantly increases historic resource

- Indicated Resource:

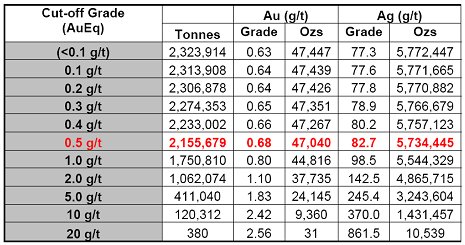

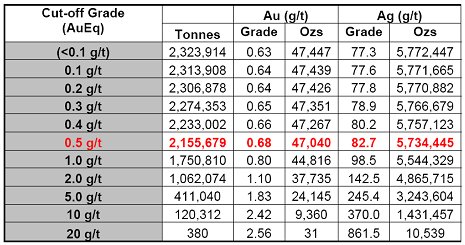

- 2,155,679 tonnesgrading 0.68 g/t gold (47,040 contained oz of Au), and 82.7 g/t silver (5,734,445 contained oz of Ag) at a cut-off grade of 0.5 g/t AuEq

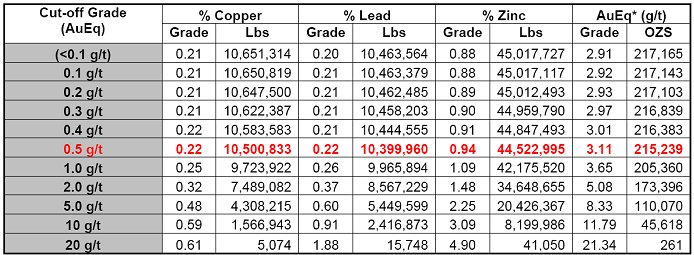

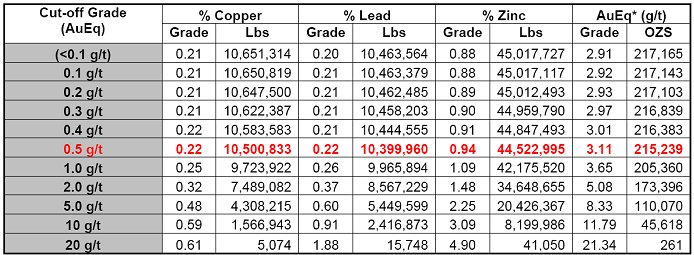

- including 0.22% Copper (10,500,833 lbs Cu), 0.22% Lead (10,399,960 lbs Pb), and 0.94% Zinc (44,522,995 lbs Zn)

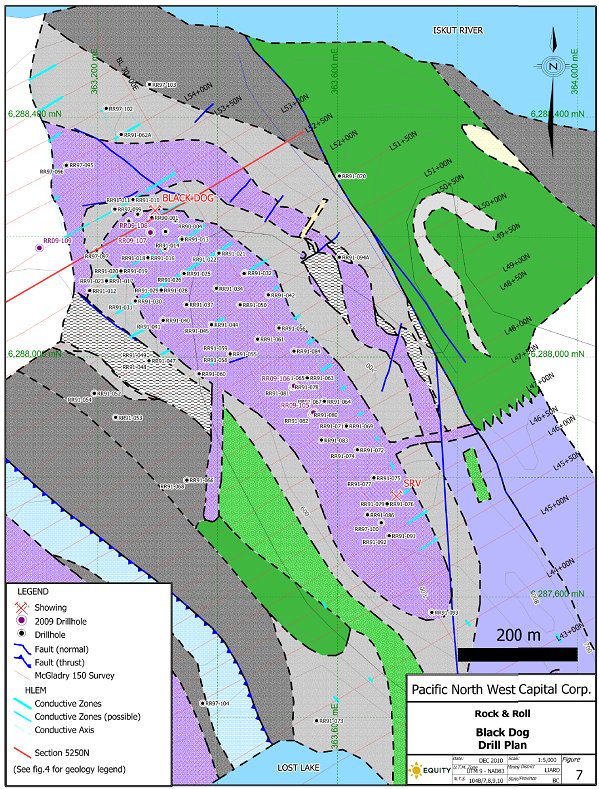

- The Black Dog Deposit is a part of a larger area that includes the SRV Zone hosting precious metal-rich volcanogenic sulphide (VMS) mineralization

- Mineralized occurrences display similarities to Eskay Creek

- Aggressive 2011/12 exploration program slated to expand resource and drill test new areas

April 27, 2011, Vancouver, BC – Pacific North West Capital Corp. ("PFN") TSX: PFN; OTCQX: PAWEF; FSE: P7J is pleased to announce the Completion of an NI43-101 Technical Report (the Report), including a new Mineral Resource Estimate for the Black Dog Deposit, on the Rock and Roll Gold-Silver-Polymetallic Project, located in Northern BC. This report will be posted to SEDAR within 45 days of this News Release. The Report was prepared by Equity Exploration Consultants Ltd. (Equity) and GeoVector Management Inc. (GeoVector). The resource was estimated by Geovector Management Inc. (Geovector) and incorporated the mineralized zones of the historic drill core and the 540 metres (1772 ft) of the 5 diamond drill holes that were completed by PFN in 2009/2010. Through this work, PFN significantly increased the resources contained within the Black dog deposit over the previous resource estimate, completed prior to the implementation of the NI 43-101 standards of disclosure. The NI43-101 compliant mineral resource estimate in the “indicated” category consists of 2,155,679 tonnes grading 0.68 g/t Au (47,040 contained oz of Au), and 82.7 g/t Ag (5,734,445 contained oz of Ag) at a gold-equivalent cut-off grade of 0.5 g/t. The deposit also contains 0.22% Cu (10,500,833 lbs Cu), 0.22% Pb (10,399,960 lbs Pb), and 0.94% Zn (44,522,995 lbs Zn) or 3.11 g/t gold equivalent (AuEq) for an additional 215,239 oz of Au Eq at the 0.5 g/t AuEq cut-off. The AuEq grade is based on $1000/oz Au, $15.80/oz Ag, $2.92/lb Cu, $0.86/lb Pb and $0.86/lb Zn. Table 1 and 2 gives the mineral resource estimate for the Black Dog deposit at varying cut-off grades. |  |

| News Release | 1 | April 27, 2011 |

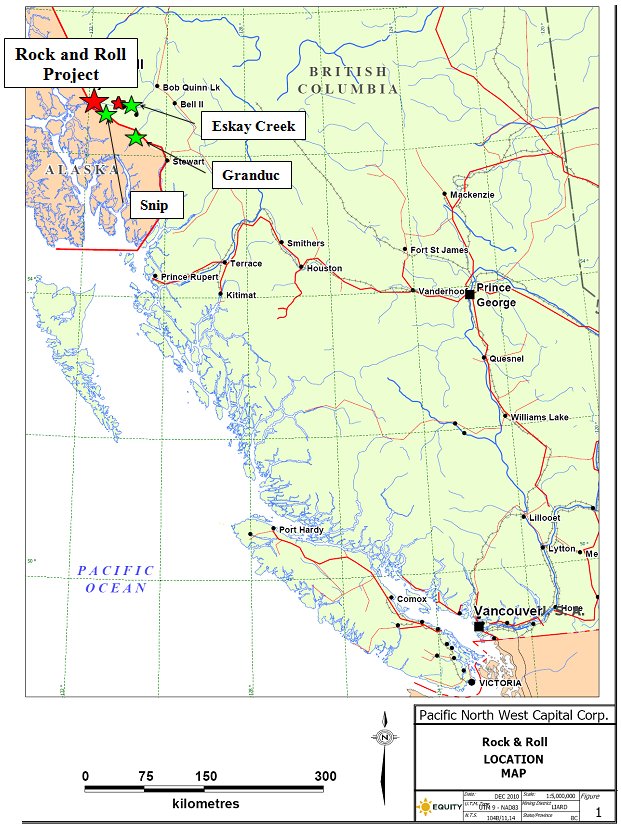

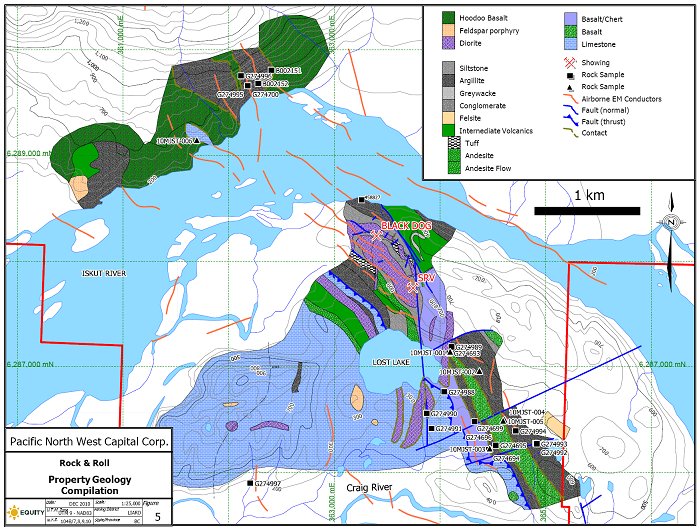

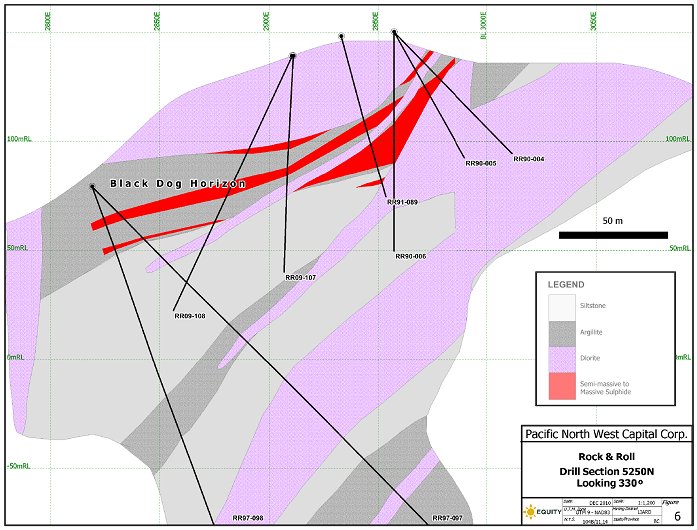

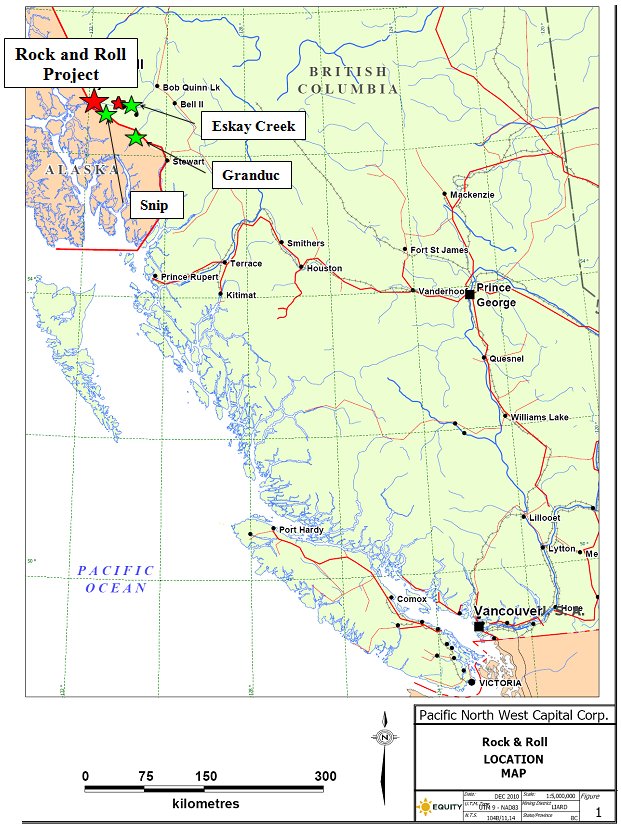

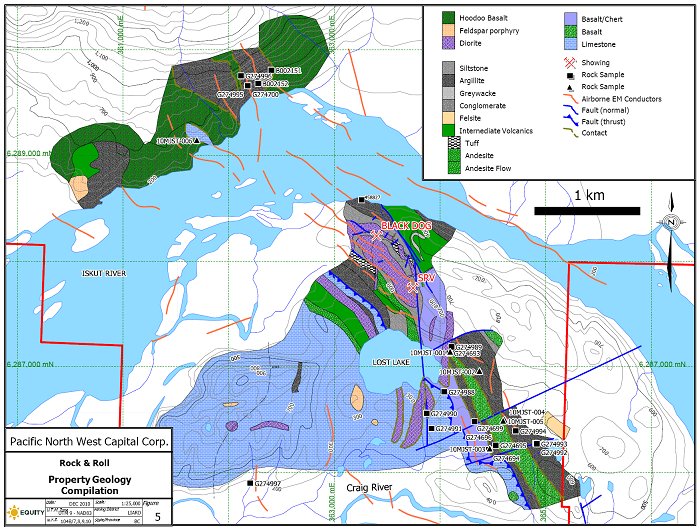

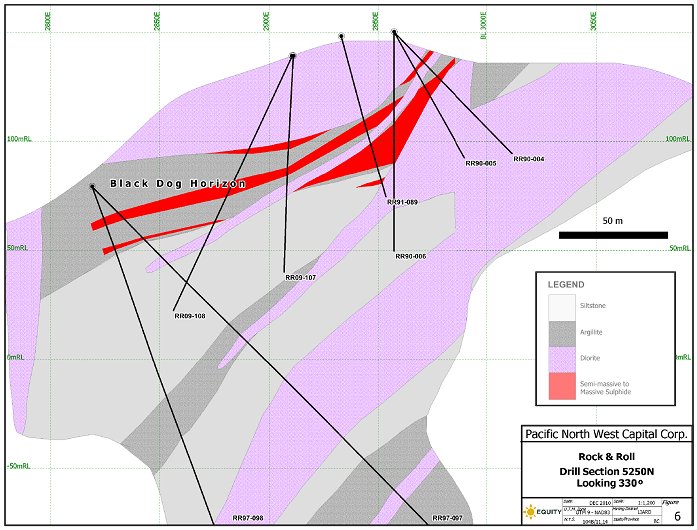

The Black Dog massive sulphide deposit is part of a larger area that includes the SRV Zone hosting precious metal-rich volcanogenic massive sulphide (VMS) mineralization. These occurrences display similarities to other precious metal-rich deposits such as Eskay Creek (50 km to the east-southeast), Greens Creek, and other deposits of the Canadian Cordillera (Figure 1). The mineralization on the Rock and roll property is hosted by graphitic argillite to siltstone. The Black Dog and SRV zones are dominated by massive pyrrhotite with blebs and lenses of chalcopyrite and sphalerite. Massive pyrite-sphalerite forms finely laminated lenses locally, with minor pyrrhotite, galena and chalcopyrite.

Indicated Mineral Resources, consistent with CIM definitions required by NI43-101, are reported at various cut-off grades in Table 1 (for Au and Ag) and Table 2 (for Cu, Pb, Zn and gold equivalent values). Inverse distances squared interpolation restricted to mineralized domains were used to estimate gold (grams/tonne Au), silver (grams/tonne Ag), copper (% Cu), lead (% Pb), and zinc (% Zn) grades into the block models. Gold, silver, copper, lead and zinc content were combined into a gold equivalent value (using to the prices given above) for resource reporting.

A $1.8 million Phase I Program is recommended in the report for further exploration at the Black Dog zone which includes initial metallurgical testing, baseline environmental work and a major diamond drilling program. The relatively shallow dips of the stratigraphy and conductive cover material have hampered exploration efforts in the past. Diamond drilling is recommended to test the conductive horizons for new mineral occurrences and also to extend the known mineralization at the Black Dog and SRV zones that are open along strike and down dip.

Table 1: Gold and Silver Indicated Mineral Resource Estimate at various gold-equivalent cut-off grades. Metallurgical recoveries and net smelter returns are assumed to be 100%.

Table 2: Copper, Lead, Zinc and gold equivalent Indicated Mineral Resource Estimate at various gold-equivalent cut-off grades.

| News Release | 2 | April 27, 2011 |

Figure 1: Location of the Rock and Roll project and some adjacent VMS deposits.

| News Release | 3 | April 27, 2011 |

Figure 2: Rock and Roll property geology showing the Black Dog and SRV Zones.

About the Rock and Roll Polymetallic Project

The Rock and Roll Polymetallic Project is under option from Equity Exploration Consultants Ltd., First Fiscal Enterprises Ltd. and Pamicon Developments Ltd. Under the terms of the option agreement, PFN can earn a 100% interest in the property over a four year period by completing $2,000,000 in exploration expenditures, paying $130,000 and providing a total of 600,000 PFN shares to the vendors. The property consists of 11 claims totalling 4244 ha (10,487 acres) and is located in the Liard Mining District approximately 9 km west of the Bronson airstrip and exploration camp in northern British Columbia.

The Rock & Roll Project hosts precious metals rich, volcanogenic massive sulphide mineralization in a volcano-sedimentary host rock package. The mineralization shows similarities to the gold and silver rich mineralization of Barrick Gold’s past producing Eskay Creek mine.

| News Release | 4 | April 27, 2011 |

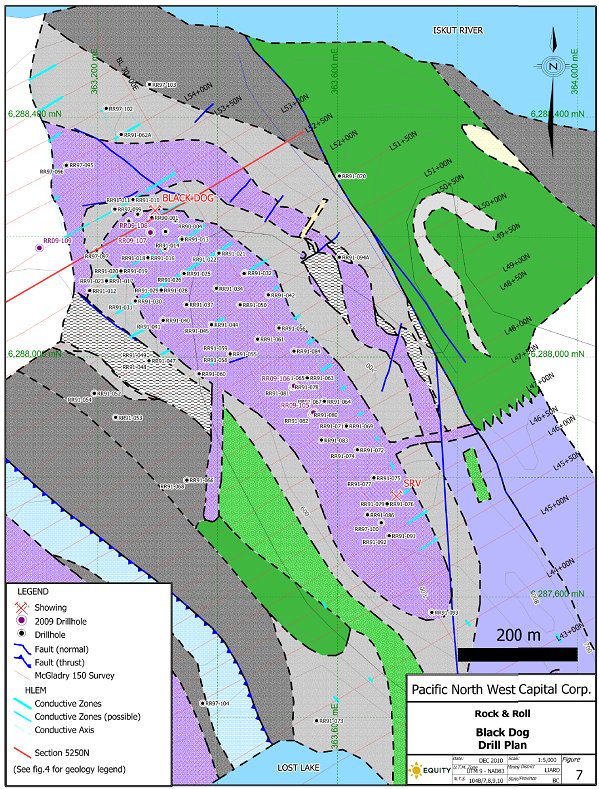

Figure 3: Location of drill holes for the Black Dog and SRV Zones.

| News Release | 5 | April 27, 2011 |

Figure 4: Schematic cross section through the Black Dog mineral horizon.

Mineralization on the Rock and Roll Property occurs in multiple stacked sulphide lenses in two zones, the Black Dog and SRV zones, over a strike length of approximately 950 m. A total of approximately 14,000 metres of core drilling in 110 drill holes was completed on the property from 1991 to 1997. Only six drill holes tested the host stratigraphy outside of the known mineralization, but at least 5 km of strike length of the prospective lithologies is present on the Property.

In 2009, PFN conducted a drilling program consisted of a total of 540 metres of core drilling in five holes and flew a 350 line kilometre airborne Time Domain EM survey.

Highlights of the 2009 drilling program includes intersections up to 1.31 g/t gold, 296.2 g/t silver, 0.46% copper, 1.25% lead, and 3.99% zinc over 3.14 metres in drill hole RR09-107.

A 2010 Geological mapping and prospecting program was designed to verify several geophysical electromagnetic anomalies identified by the 2009 Aeroquest AEM survey. The exploration program was carried out under the supervision of Murray Jones, P. Geo. of Equity Exploration Consultants Ltd. Mr. Jones is a Qualified Person as defined under the terms of National Instrument 43-101.

| News Release | 6 | April 27, 2011 |

PFN has also entered into the second year of a Public Geoscience Partnership agreement with the Geological Survey Branch (GSB) of the BC Ministry of Energy, Mines and Petroleum Resources. Under this agreement, two senior geologists from the GSB have now completed the geological mapping and sampling on the Rock and Roll Project, as well as in the district as a whole as part of the Iskut River Regional Mapping Project. The goal of this work was to define the age and stratigraphic association of the host rocks to the Black Dog and SRV mineralization, and to evaluate the potential for this type of mineralization elsewhere on the property and throughout the district. The results of this study has been published on an ongoing basis through various publications of the GSB, including the annual review of fieldwork. The field work portion of the Public Geoscience Partnership agreement is now complete on the Rock and Roll project area.

Pacific North West Capital has carried out approximately $450,000 of exploration on Rock and Roll Project to date. The 2009 drill program tested the Black Dog Zone and its extensionsand consisted of a total of 540 meters of core drilling completed in five holes. The first four holes were designed to test gaps in the historic drilling on the Black Dog Zone in order to establish the degree of continuity of the mineralization and to confirm the historic geological model. Each of the infill drill holes encountered the target mineralization, confirming the continuity of the sulphide lenses and the validity of previous geological interpretations.

The final drill hole of the program tested a strong electromagnetic anomaly that may represent the westward continuation of the Black Dog Zone. Drilling at this location encountered minor sulphide mineralization near the bottom of the hole, but failed to return any significant assays as the hole intersected a diorite dyke at the projection of the Black Dog horizon. (see December 16th, 2009 Press Release).

Qualified Person Statement

This news release has been reviewed and approved for technical content by Allan Armitage, a qualified person under the provisions of national instrument NI 43-101.

About Pacific North West Capital Corp

Pacific North West Capital Corp. is a mineral exploration company whose corporate philosophy is to be a project generator, explorer and project operator with the objective of option / joint venturing its projects through to production. In January 2011, Pacific North West Capital successfully negotiated the 100% acquisition of the River Valley PGM Project from Anglo Platinum Limited, making Anglo Platinum the largest shareholder of PFN holding approximately 12% of the Company (see news release dated January 31, 2011). In special situations, like our 100% owned River Valley PGM Project, the Company is prepared to fund the project through to feasibility and up to production. The River Valley PGM project is one of North America's newest and largest primary platinum group metals (PGM) deposits. The project is located in the Sudbury region of Ontario.

On April 7, 2011, PFN announced the closing of the River Valley acquisition from Anglo Platinum (see news release dated April 7 2011).

| News Release | 7 | April 27, 2011 |

On April 20, 2011, PFN announced that it has commenced the Phase I of the $5 million, 15,500 metre drill program for its 100% owned River Valley PGM Project and results are expected in May 2011. Work to date at River Valley suggest that the best potential for economic accumulations of PGM-Cu-Ni sulphide mineralization is within the Breccia Zone. This Zone includes the main mineralized breccia or Main Zone. The Main Zone occurs within about 20 metres of the intrusive contact with Archean gneisses. This contact zone extends for over 9 km of prospective strike length, holds the current defined resource and is the main target of the Company's renewed exploration efforts.

In January 2011, Pacific North West Capital successfully negotiated the 100% acquisition of the River Valley PGM Project from Anglo Platinum Limited, making Anglo Platinum the largest shareholder of PFN holding approximately 12% of the Company (see news release dated January 31, 2011).

On January 24, 2011, PFN announced a new NI43-101 mineral resource estimate on the Destiny Gold Project which is situated 75 km near Val-d'Or, Québec (see news release dated January 24, 2011). The Destiny Project is under option from Alto Ventures Ltd. (“Alto”). Under the terms of the option agreement, PFN can earn a 60% interest in the property over a four-year period by completing $3.5 million in exploration expenditures, paying $200,000 and providing a total of 250,000 PFN shares to Alto. The Company also has PGM, gold and base metal projects in BC, Québec, Ontario, Saskatchewan and Alaska and continues to aggressively look for new acquisition of additional platinum group metals, precious metals on an international scale.

In addition, PFN is a significant shareholder of Fire River Gold Corp (FAU:TSX.V) which company is developing the Nixon Fork Gold Mine in Alaska, which is slated for production in summer of 2011. (click here to view Fire River Gold’s 2011 President’s Message)

Pacific North West Capital Corp. is well funded with an experienced management team and the ability to take advantage of its growing asset base in Platinum Group Metals, gold and base metals. To that end, the Company is in the process of adding key technical and financial people to our management, advisory team and our board of directors. PFN has approximately $8 million in working capital and securities and no debt.

Pacific North West Capital Corp. is an International Metals Group Company.

(www.internationalmetalsgroup.com)

On behalf of the Board of Directors

Further Information: Tel: +1.604.685.1870 Fax: +1.604.685.8045

Email: info@pfncapital.com, or visit www.pfncapital.com

2303 West 41st Avenue, Vancouver, B.C., Canada, V6M 2A3 |

Harry Barr

President & C.E.O.

Disclaimer: This news release may contain certain "Forward-Looking Statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included herein are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations are disclosed in the Company's documents filed from time to time with The Toronto Stock Exchange, British Columbia Securities Commission and the United States Securities & Exchange Commission.

| News Release | 8 | April 27, 2011 |