UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

[ ] Registration Statement Pursuant to Section 12(b) Or (g) of the Securities Exchange Act of 1934

or

[ X] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended APRIL 30, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934 or

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from ______________ to _________________

Commission File Number:0-29928

Pacific North West Capital Corp.

(Exact name of Registrant as specified in its Charter)

Not Applicable

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

2303 West 41st Avenue, Vancouver, British Columbia V6M 2A3

(Address of principal offices)

Harry Barr, President – info@pfncapital.com, telephone: (604) 685-1870,

facsimile: (604) 685-6550

(Name, telephone, email and/or facsimile number and address of company contact person)

Securities Registered or to be Registered Pursuant to Section 12 (b) of the Act.

| Title of Each Class | Name on Each Exchange On Which Registered |

| Not Applicable | Not Applicable |

Securities Registered or to be Registered Pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Exhibits Index is on page 89

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

85,737,788

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statement included in this filing:

U.S. GAAP [ ] International Financial Reporting Standards as issued Other [X]

by the International Accounting Standards Board

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[X] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act.)

Yes [ ] No [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be field in Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

[ ] Yes [X] Not applicable

2

TABLE OF CONTENTS

| | | | | Page |

| General Information | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 5 |

| CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESERVE AND RESOURCE | 6 |

| ESTIMATES MEASUREMENT CONVERSION INFORMATION | 6 |

| Glossary of Mining Terms | 7 |

| Mineral Reserves - Definitions | 10 |

| PART I | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 11 |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 11 |

| ITEM 3. | KEY INFORMATION | 11 |

| | A. Selected Financial Data | 10 |

| | B. Capitalization and Indebtedness | 13 |

| | C. Reasons for the Offer and Use of Proceeds | 13 |

| | D. Risk Factors | 13 |

| ITEM 4. | INFORMATION ON THE COMPANY | 17 |

| | A. History and Development of the Company | 17 |

| | B. Business Overview | 18 |

| | C. Organizational Structure | 18 |

| | D. Property, Plants, and Equipment | 18 |

| | | Ontario, Canada | 19 |

| | | I. River Valley Joint Venture Project | 19 |

| | | II. Sargesson Lake and Kelly-Davis Properties | 33 |

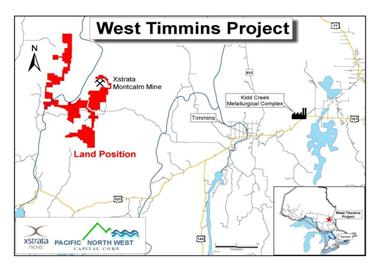

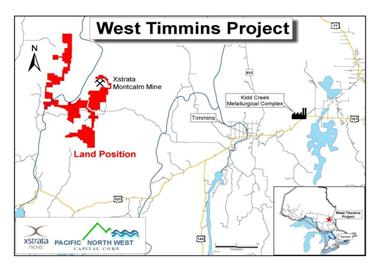

| | | III. West Timmins Nickel Project | 34 |

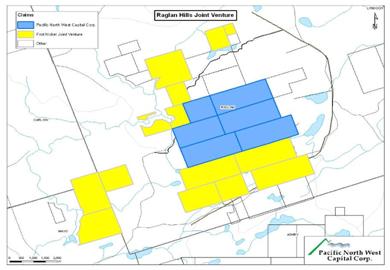

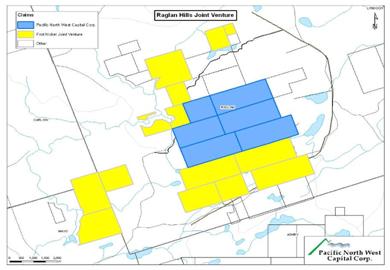

| | | IV. Raglan Hills (formerly South Renfrew) | 35 |

| | | V. Coldwell Properties | 36 |

| | | VI. Goodchild Property | 36 |

| | | VII. East Sudbury Property | 36 |

| | | VIII. Swayze Joint Venture | 37 |

| | | IX. North Duluth Property | 38 |

| | | Quebec, Canada | 38 |

| | | I. Glitter Lake Property | 38 |

| | | II. SOQUEM Taureau & Chenneville Projects | 39 |

| | | III. Fiedmont Property | 40 |

| | | IV Destiny Gold Project | 40 |

| | | Northwest Territories | 44 |

| | | I. Winter Lake | 44 |

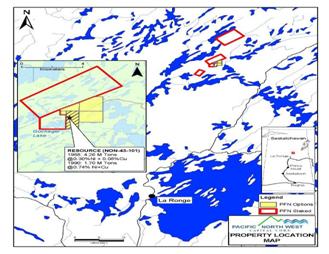

| | | Saskatchewan Project | 44 |

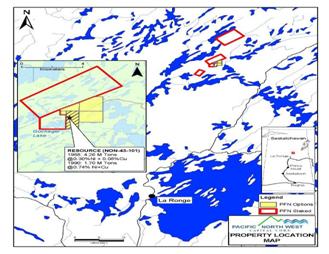

| | | I. Nickel Plats Project | 44 |

| | | British Columbia | 45 |

| | | I Rock & Roll Property | 45 |

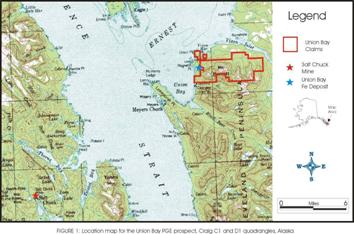

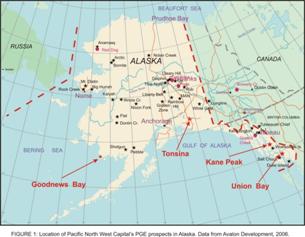

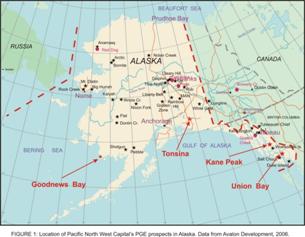

| | | Alaska>, USA | 49 |

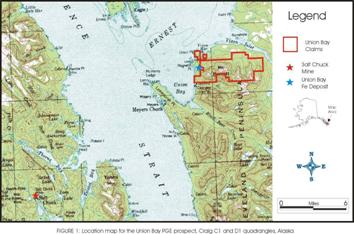

| | | I. Union Bay Platinum Property | 49 |

| | | II. Kane Property | 49 |

| | | III. Tonsina Property | 50 |

| | | IV. Nixon Fork Project | 50 |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 50 |

| | | A. | Operating Results | 54 |

| | | | Twelve Months Ended April 30, 2011 Compared to Twelve Months Ended April 30, 2010 | 54 |

| | | | Twelve Months Ended April 30, 2010 Compared to Twelve Months Ended April 30, 2009 | 55 |

| | | | Twelve Months Ended April 30, 2009 Compared to Twelve Months Ended April 30, 2008 | 56 |

| | | B. | Liquidity and Capital Reserves | 57 |

| | | | Twelve Months Ended April 30, 2011 Compared to Twelve Months Ended April 30, 2010 | 57 |

| | | | Twelve Months Ended April 30, 2010 Compared to Twelve Months Ended April 30, 2009 | 57 |

| | | | Twelve Months Ended April 30, 2009 Compared to Twelve Months Ended April 30, 2008 | 59 |

| | | C. | Research and Development, Patents and Licenses, etc. | 58 |

| | | D. | Trend Information | 58 |

| | | E. | Off-Balance Sheet Arrangements | 58 |

| | | F. | Tabular Disclosure of Contractual Obligations | 58 |

| | | G. | Safe Harbour | 59 |

3

4

GENERAL INFORMATION

All references in this annual report on Form 20-F to the terms “we”, “our”, “us”, “the Company” and “PFN” refer to Pacific North West Capital Corp.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report includes "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward looking statements". Such statements are included, among other places in this Registration Statement, in the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations. Forward-looking statements are based on expectations, estimated and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. These include, but are not limited to, the risks of mining industry (for example, operational risks of exploring for, developing and producing crude oil and natural gas, risks and uncertainties involving geology of mineral deposits, the uncertainty of reserve estimates and estimates relating to production volumes, cost and expense projections, potential cost overruns and health, safety and environmental risks), risks relating to the Company's properties (for example, lack of operating history and transportation), fluctuations in mineral prices and exchange rates and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures (collectively "Cautionary Statements"). Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct.

5

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING RESERVE AND RESOURCE ESTIMATES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission Industry Guide 7 (“SEC Industry Guide 7”) under the Securities Act of 1933, as amended. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Under SEC Industry Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the United States Securities and Exchange Commission. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves or that they can be mined economically or legally. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or that it can be economically or legally mined. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the United States Securities and Exchange Commission normally only permits issuers to report mineralization that does not constitute “reserves” by Securities and Exchange Commission standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this annual report and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

MEASUREMENT CONVERSION INFORMATION

In this Annual Report on Form 20-F, metric measures are used with respect to mineral properties described herein. For ease of reference, the following conversion factors are provided:

| 1 mile | = 1.609 kilometres | | 2,240 pounds | = 1 tonne |

| 1 yard | = 0.9144 metre | | 2,000 pounds/short ton | = 0.907 tonnes |

| 1 acre | = 0.405 hectare | | 1 troy ounce | = 31.103 grams |

6

GLOSSARY

The following are definitions of mining terms and certain other terms used in this Statement.

| Ag | Periodic symbol for Silver |

| | |

| Alto | Alto Ventures Ltd. |

| | |

| Anglo Platinum | Anglo American Platinum Corporation Limited |

| | |

| Au | Periodic symbol for Gold |

| | |

| assay | A chemical test performed on a sample of rocks or core to determine the amount of contained metals |

| | |

| assessment work | The amount of work, specified by mining law, that must be performed each year in order to retain legal control of mining claims |

| | |

| BHEM | Borehole electromagnetic induction geophysics |

| | |

| breccia | A rock in which angular fragments are surrounded by a mass of fine-grained minerals |

| | |

| Calista | Calista Corporation |

| | |

| CanAlaska | CanAlaska Uranium Ltd. |

| | |

| chalcopyrite | A sulphide mineral of Copper and Iron; an important ore mineral of Copper |

| | |

| channel sample | A sample from a small trench or channel, cut on a rock surface, usually about 5-10 cm wide and 2 cm deep, to provide accurate distribution of mineralization |

| | |

| chip sample | A method of sampling a rock exposure whereby a regular series of small chips of rock is broken off along a line across the face |

| | |

| CIM | Canadian Institute of Mining, Metallurgy, and Petroleum Standards on Mineral Resources and Mineral Reserves(see “Mineral Reserves – Definitions” below) |

| | |

| Cu | Periodic symbol for Copper |

| | |

| diabase | A common basic intrusive igneous rock usually occurring in dykes or sills |

| | |

| diamond drill | A rotary type of rock drill that cuts a core of rock that is recovered in long cylindrical sections, two cm or more in diameter |

| | |

| diorite | An intrusive igneous rock composed chiefly of plagioclase, hornblende, biotite or pyroxene |

| | |

| EM Survey | A geophysical survey method which measures the electromagnetic properties of rocks |

| | |

| Equity | Equity Exploration Consultants Ltd. |

| | |

| exploration | Prospecting, sampling, mapping, diamond drilling and other work involved in searching and defining or bodies |

| | |

| Feasibility Study | A detailed report showing the feasibility of placing a prospective ore body or deposit of the minerals within a mineral property into production, which report typically includes, inter alia, the specific portion or portions of the property that should be included, in a development block, conclusions and recommendations regarding any adjustments that should be made to the boundaries of a development block, a description of the work to be performed in order to develop the mineral resources within the development block and to construct a mine or mines and related facilities on the development block, the estimated capital and operating costs thereof, a proposed schedule for the timing of development and mine construction, and the information obtained and evaluations made in respect thereof |

|

7

| Freegold | Freegold Ventures Limited |

| | |

| FireRiver | Fire River Gold Corp. – a company trading on the TSX Venture Exchange and having purchased a 100% interest in the Nixon Fork Gold Mine, Alaska, from the Company |

| | |

| First Nickel | First Nickel Inc. - the Company’s joint venture partner on the Raglan Hills project |

| | |

| geophysical survey | The use of one or more geophysical techniques in geophysical exploration |

| | |

| GeoSim | GeoSim Services Inc., a mineral resource estimate consulting firm |

| | |

| GeoSim Report | “Revised Mineral Resources Estimate, Lismer’s North and Varley Areas (Incorporating VII Drilling), River Valley PGM Project, Ontario, for Pacific North West Capital Corp., dated May 2006” (the “GeoSim Report”) prepared by Ron Simpson, P.Geo., of GeoSim, and John Londry, then-Vice President of Exploration for the Company |

| | |

| Geovector | Geovector Management Inc. |

| | |

| gpt or g/t | Grams per tonne |

| | |

| grab samples | A sample of rock or sediment taken more or less indiscriminately at any place |

| | |

| granite | A coarse-grained intrusive igneous rock consisting of quartz, feldspar and mica |

| | |

| ha | Hectare - a unit for measuring an area of land equal to 10,000 square metres |

| | |

| Induced Polarization | A geophysical survey method which measures the conductivity properties of rocks |

| | |

| Kaymin | Kaymin Resources Limited, a wholly-owned subsidiary of Anglo Platinum |

| | |

| Kinbauri | Kinbauri Gold Corp. |

| | |

| km | A measure of distance known as a kilometre |

| | |

| Pb | Periodic symbol for lead |

| | |

| m | A measure of distance known as a metre |

| | |

| mineral | An inorganic substance having usually a definite chemical composition and, if formed under favourable conditions, having a certain characteristic atomic structure which is expressed in its crystalline form and other physical properties |

| | |

| mineralization | The concentration of metals and their chemical compounds within a body of rock |

| | |

| Ni | Periodic symbol for Nickel |

| | |

| Nickel | A hard white silver metallic chemical element |

| | |

| NI 43-101 | National Instrument 43-101,Standards of Disclosure for Mineral Projects – a Canadian instrument |

| | |

| NSR | Net Smelter Return Royalty |

| | |

| opt | Ounces per ton |

| | |

| ore | A natural aggregate of one or more minerals, which at a specified time and place, may be mined and sold at a profit, or which from some part may be profitably separated |

| | |

| oz | A measure of weight known as an ounce |

| | |

| Pd | Periodic symbol for Palladium |

| | |

| PGE | Platinum Group Elements |

8

| PGM | Platinum Group Metals |

| | |

| ppb | Parts per billion |

| | |

| ppm | Parts per million |

| | |

| Pt | Periodic symbol for Platinum |

| | |

| Rh | Periodic symbol for Rhodium |

| | |

| Rock & Roll Report | NI 43-101 compliant report on the Rock and Roll Property, entitled “2010 Technical Report on the Rock and Roll Property” by Murray Jones, P. Geo. of Equity, and Allan Armitage, Ph.D., P. Geol. and Joe Campbell, P.Geo., of Geovector, dated February 23, 2011 and filed on the Company’s Form 6-K for May 2011 |

| | |

| RVI | River Valley Intrusion |

| | |

| sample | A small portion of rock or mineralization taken so that the metal content can be determined by assaying |

| | |

| sampling | Selecting a fractional but representative part of a rock or mineralization for analysis |

| | |

| Stillwater | Stillwater Mining Company is engaged in the development, extraction, processing, smelting, refining, and marketing of palladium, platinum and associated metals from a geological formation in southern Montana known as the J-M Reef. This is the only known significant source of platinum group metals in the United States and one of the significant resources outside Russia and South Africa. Stillwater’s corporate office is located in Columbus, Montana. |

| | |

| strike | The bearing of a bed or layer of rock |

| | |

| ton | 2,000 pounds |

| | |

| tonne | A metric ton (2,204 pounds) |

| | |

| vein | A fissure, fault or crack in a rock filled by minerals that have traveled upwards from some deep source |

| | |

| Wardrop Report | NI 43-101 compliant “Technical Report and Resource Estimation of the DAC Deposit, Destiny Property, Québec” (the “Destiny Tech Report”) for Alto Ventures Ltd. and Pacific North West Capital Corp. dated March 1, 2011, by Todd McCracken, P.Geo.”, of Wardrop, filed on the Company’s Form 6-K for March 2011 |

| | |

| Wardrop | Wardrop - a Tetra Tech Company |

| | |

| Zn | Periodic symbol for Zinc |

| | |

| 3E | Pt+Pd+Au |

| | |

| 4E | Pt+Pd+Au+Rh |

9

Mineral Reserves – Definitions

| Indicated Mineral Resource | An Indicated Mineral Resource is part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| | |

| Inferred Mineral Resource | An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. |

| | |

| Measured Mineral Resource | A Measured Mineral Resource is part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on a detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| | |

| Mineral Reserve | As defined by CIM, a Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| | |

| Mineral Resource | A Mineral Resource is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | |

| Probable Mineral Reserve | A Probable Mineral Reserve is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| | |

| Proven Mineral Reserve | A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| | |

| Qualified Person or QP | As defined by CIM, a “Qualified Person” means an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association. |

10

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

Pacific North West Capital Corp. ("PFN" or the "Company") has a limited history of operations and has not generated any operating revenues. The following table sets forth, for the periods and the dates indicated, selected financial and operating data for the Company. This information should be read in conjunction with the Company's audited consolidated financial statements and notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere herein. The selected financial data provided below are not necessarily indicative of the future results of operations or financial performance of the Company. To date the Company has not paid any dividends on its common shares and it does not expect to pay dividends in the foreseeable future.

The audited consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in Canada ("Canadian GAAP"). There are material differences between Canadian GAAP and the United States Generally Accepted Accounting Principles ("U.S. GAAP") as applied to the Company including disclosure items. For a comparison of these differences, refer to Note 15 to the April 30, 2011 Audited Consolidated Financial Statements.

Selected Financial Data

(In Canadian Dollars)

| | Year Ended April 2011 | Year Ended April 2010 | Year Ended April 2009 | Year Ended April 2008 | Year Ended April 2007 |

| | | | | | |

| Canadian GAAP | | | | | |

| | | | | | |

| Interest and other income | 52,293 | 52,616 | 222,252 | 314,082 | 147,301 |

| Project management fees | - | 6,680 | 25,628 | 297,622 | 49,209 |

| Net loss | 4,153,650 | 771,019 | 5,354,466 | 883,378 | 1,230,764 |

Loss per common share –

continuing operations | 0.06 | 0.06 | 0.09 | 0.02 | 0.03 |

Income per common share –

discontinued operation | - | 0.04 | - | - | - |

| Weighted Average No. Shares – Basic | 69,399,792 | 62,675,963 | 61,721,508 | 53,358,393 | 37,743,307 |

| Weighted Average No. Shares – Diluted | 69,399,792 | 62,954,534 | 61,721,508 | 53,358,393 | 37,743,307 |

11

Selected Financial Data continued

(In Canadian Dollars)

| | Year Ended April 2011 | Year Ended April 2010 | Year Ended April 2009 | Year Ended April 2008 | Year Ended April 2007 |

| | | | | | |

| Working capital | 8,686,132 | 7,249,616 | 5,418,885 | 10,088,901 | 4,298,776 |

| Mineral properties | 6,362,048 | 3,899,594 | 4,333,979 | 6,622,731 | 2,795,717 |

| Total assets | 15,575,641 | 11,353,054 | 15,095,336 | 17,087,029 | 7,315,871 |

| Capital stock | 30,276,368 | 25,170,802 | 24,779,281 | 25,677,015 | 16,906,926 |

| Dividends declared per share | - | - | - | - | - |

Selected Financial Data

(In Canadian Dollars)

| | Year Ended April 2011 | Year Ended April 2010 | Year Ended April 2009 | Year Ended April 2008 | Year Ended April 2007 |

| | | | | | |

| USGAAP | | | | | |

| | | | | | |

| Interest and other income | 52,293 | 52,616 | 222,252 | 314,082 | 147,301 |

| Project management fees | - | 6,680 | 25,628 | 297,622 | 49,209 |

| Net loss for period | 3,447,365 | 571,680 | 3,535,052 | 4,939,262 | 2,257,084 |

| Loss per common share | 0.05 | 0.01 | 0.05 | 0.09 | 0.06 |

| Weighted Average No. Shares | 69,399,792 | 62,675,963 | 61,721,508 | 53,358,393 | 37,743,307 |

| | | | | | |

| Working Capital | 8,608,818 | 7,249,616 | 5,418,885 | 8,031,041 | 3,567,904 |

| Mineral properties | 3,398,943 | 230,204 | 199,750 | 173,650 | - |

| Total assets | 12,612,536 | 7,683,664 | 10,961,107 | 10,464,298 | 4,520,154 |

| Capital stock | 31,877,709 | 26,849,457 | 26,192,436 | 25,677,015 | 16,906,926 |

| Dividends declared per share | - | - | - | - | - |

In this Annual Report on Form 20-F, unless otherwise specified, all monetary amounts are expressed in Canadian dollars. On July 22, 2011, the exchange rate, based on the noon buying rate published by the Bank of Canada, for the conversion of United States dollars into Canadian dollars (the “Noon Rate of Exchange”) was $0.9502.

The following table sets out the high and low exchange rates for each of the last six (s) months.

| | 2011 |

| | June | May | April | March | February | January |

| High for period | 0.9861 | 0.9809 | 0.9691 | 0.9918 | 0.9955 | 1.0022 |

| Low for period | 0.9643 | 0.9486 | 0.9486 | 0.9686 | 0.9739 | 0.9862 |

The following table sets out the average exchange rates for the five most recent financial years calculated by using the average of the Noon Rate of Exchange on the last day of each month during the period.

| | Year Ended April 30 |

| | 2011 | 2010 | 2009 | 2008 | 2007 |

| Average for the period | 1.0123 | 1.0721 | 1.1444 | 1.0225 | 1.1377 |

12

B. Capitalization and Indebtedness

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

C. Reasons for the Offer and Use of Proceeds

This Form 20F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

D. Risk Factors

As resource exploration is a speculative business, which is characterized by a number of significant risks including, among other things, unprofitable efforts resulting from the failure to discover mineral deposits. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

To date, the Company’s properties have no proven commercially viable reserves and are currently at the exploration stage and as such prospective purchasers of the Company’s common shares should consider carefully, among other things, that the Company’s exploration of its properties involves significant risks. Our current Management while considerably experienced in managing exploration projects has limited production experience and as such is dependent upon the production expertise of our joint venture partners.

| | Mineral exploration involves a high degree of risk and few properties which are explored result in any discoveries of commercial bodies of mineralization or are ultimately developed into producing mines. The long-term profitability of the Company’s operations will be in part directly related to the cost and success of its exploration programs, which may be affected by a number of factors. |

| | Substantial expenditures are required to establish reserves through drilling, metallurgical processes to extract the metal from the ore and, in the case of new properties, to build the mining and processing facilities and infrastructure at any site chosen for mining. Minerals may not be discovered in sufficient quantities and grades to justify commercial operations or funds required for further expansion may not be obtained on a timely basis. All of the Company’s projects are currently in exploration stages. Estimates and mineral projects can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors and unforeseen technical difficulties, as well as unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. |

| (ii) | Lack of Cash Flow and Non-Availability of Additional Funds |

| | The Company's properties are currently being explored or assessed for exploration and as a result, the Company has no source of operating cash flow. The Company has limited financial resources and, if additional funding were needed it may not be available to the Company on terms and conditions acceptable to it. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and the possible, partial or total loss of the Company's interest in current properties. The Company presently has sufficient financial resources to undertake all of its currently planned exploration programs |

| | The exploration of any ore deposits found on the Company's exploration properties depends upon the Company's ability to obtain financing through debt financing, equity financing or other means. Failure to obtain additional financing on a timely basis could cause the Company to forfeit all or parts of its interests in some or all of its properties or joint ventures and reduce or terminate its operations. |

13

| | None of the Company's properties has commenced commercial production and the Company has no history of earnings or cash flow from its operations. As a result there can be no assurance that the Company will be able to develop any of its properties profitably or that its activities will generate positive cash flow. The Company has not declared or paid dividends on its common shares since incorporation and does not anticipate doing so in the foreseeable future. The only present source of funds available to the Company is through the sale of its common shares. Even if the results of exploration are encouraging, the Company may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists on any property. |

| (iii) | Operating Hazards and Risks |

| | Mineral exploration involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, of PGMs and other metals, such as unusual or unexpected formations, cave-ins, pollution, all of which could result in work stoppages, damage to property, and possible environmental damage. The Company does have $10,000,000 commercial general liability insurance covering its operations. Payment of any liabilities in excess of its insurance could have a materially adverse effect upon the Company's financial condition. |

| | All of the properties in which the Company holds an interest are considered to be in the exploration stage only and do not contain a known body of commercial ore. |

| | Due to the large number and diverse legal nature of the mineral properties described herein, full investigation of legal title to each such property has not been carried out at this time. Much of the River Valley property was covered by the Temagami Land Caution and was not in fact open for staking and as such was closed for mineral exploration and development for twenty or more years. In June 1996, the Ontario Government passed legislation allowing the area open for staking mineral claims and on September 17, 1996, the area was re-opened for staking. The Company cannot be certain that native land claim issues may not arise. |

| | Many of the Company's properties may be subject to prior unregistered agreements of transfer or native land claims and title may be affected by undetected defects. The Company's properties consist of recorded mineral claims which have not been surveyed, and therefore the precise area and location of such claims is undefined. |

| | There is no guarantee that title to any claim will not be challenged or impugned. |

| (vi) | Uncertainty or Contestation of Contract Rights |

| | The Company owns or has the right to earn interests in properties under contract with a number of individuals and corporations. The Company has no control over whether these individuals or corporation have the full right to enter into an agreement and no control should any legal action be taken against the vendors of the properties. Should the Company not be able be meet its financial commitments to the vendor of a property this may result in the forfeiture of Company’s right to earn an interest in the property. |

| (vii) | Conflicts of Interest |

| | Harry Barr, Linda Holmes and John Londry, directors of the Company, are directors of other mineral resource companies and, to the extent that such other companies may participate in ventures in which the Company may participate, these directors of the Company may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. (See Item 6, Directors, Senior Management and Employees, A. Directors and Senior Management, for detailed disclosure regarding each of Messrs. Barr and Londry and Ms. Holmes and other mineral resource companies which with each is affiliated.) In the event that such a conflict of interest arises at a meeting of the directors of the Company, a director who has such a conflict will abstain from voting for or against the approval of such a participation or such terms. In appropriate cases the Company will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. From time to time several companies may participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participating in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program. It may also occur that a particular company will assign all or a portion of its interest in a particular program to another of these companies due to the financial position of the company making the assignment. In accordance with the laws of the Province of British Columbia, the directors of the Company are required to act honestly, in good faith and in the best interest of the Company. In determining whether the Company will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the potential benefits to the Company, the degree of risk to which the Company may be exposed and its financial position at that time. Other than as indicated, the Company has no other procedures or mechanisms to deal with conflicts of interest. The Company is not aware of the existence of any conflict of interest as described herein |

14

| (viii) | Competition and Agreements with Other Parties |

| | The mineral resources industry is intensely competitive and the Company competes with many companies that have greater financial resources and technical facilities than itself. Significant competition exists for the limited number of mineral acquisition opportunities available in the Company's sphere of operations. As a result of this competition, the Company's ability to acquire additional attractive mining properties on terms it considers acceptable may be adversely affected. |

| | The Company may, in the future, be unable to meet its share of costs incurred under agreements to which it is a party and the Company may have its interests in the properties subject to such agreements reduced as a result. Furthermore, if other parties to such agreements do not meet their share of such costs, the Company may be unable to finance the costs required to complete the recommended programs. |

| (ix) | Fluctuating Mineral Prices |

| | The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of mineral resources are developed, a profitable market will exist for the sale of same. Factors beyond the control of the Company may affect the marketability of any minerals discovered. Commodity prices may not remain at current levels and significant price movements over short periods of time may be affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, the U.S. dollar relative to other currencies), interest rates and global or regional consumption patterns, and speculative activities. The effect of these factors on the price of minerals and therefore the economic viability of any of the Company's exploration projects cannot accurately be predicted. As the Company is in the exploration stage, the above factors have had no material impact on operations or income. |

| (x) | Shares Reserved for Future Issuance; Potential Dilution |

| | As of April 30, 2011, the Company had reserved 19,509,309 common shares for issuance upon the exercise of warrants, incentive stock options and performance shares. Such common shares represent a potential equity dilution of approximately 22.75% based upon the number of outstanding common shares at April 30, 2011, of 85,737,788. Furthermore, the Company may enter into commitments in the future which would require the issuance of additional common shares and may grant additional stock options and/or issue additional warrants. As at April 30, 2011, the Company had an unlimited number of authorized but unissued and unreserved common shares. Issuance of additional common shares would be subject to stock exchange regulatory approval and compliance with applicable securities legislation. The Company currently has no plans to issue common shares other than for the purposes of raising funds for property acquisition, property exploration and general working capital requirements which issuances would be subject to regulatory approval. |

15

| (xi) | Environmental Regulation |

| | All phases of the Company's operations in Canada are subject to environmental regulations. It is the Company's belief that if environmental legislation in Canada evolved and required stricter standards and enforcement, in conjunction with increased fines and penalties for non-compliance, including more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees, the cost of compliance therewith may substantially increase and thereby effect the Company's operations. |

| (xii) | Compliance with Applicable Laws and Regulations |

| | The current or future operations of the Company, including development activities and commencement of production on its properties, require permits from various governmental authorities and such operations are and will be subject to laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs, and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. There can be no assurance that approvals and permits required to commence production on its various properties will be obtained. Additional permits and studies, which may include environmental impact studies conducted before permits can be obtained, may be necessary prior to operation of the properties in which the Company has interests and the Company may not be able to obtain or maintain all necessary permits that may be required to commence construction, development or operation of mining facilities at these properties on terms which enable operations to be conducted at economically justifiable costs. |

| | The Company’s potential mining and processing operations and exploration activities are subject to various federal and state or provincial and municipal laws and by-laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, mine safety and other matters. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies. Permits that the Company may require for construction of mining facilities and conduct of mining operations may not be obtainable on reasonable terms. |

| | Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. |

| | Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or abandonment or delays in advancement of new exploration properties. |

| (xiii) | Canadian Jurisdictional and Enforceability of Judgments, Risks |

| | The Company is a Canadian corporation and is governed in its conduct by the Laws of Canada. All of the Company’s directors are residents of Canada and all its assets are located in Canada and United States. Consequently, it may be difficult for U.S. investors to effect service of process within the United States upon the Company or upon such persons who are not residents of the United States, or to realize in the United States upon judgments of U.S. courts predicated upon civil liabilities under U.S. securities laws. A judgment of a U.S. court predicated solely upon such civil liabilities may be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities. |

16

| (xiv) | Adequate Labor and Dependence upon Key Personnel |

| | The Company will depend upon recruiting and maintaining other qualified personnel to staff its operations. The Company believes that such personnel currently are available at reasonable salaries and wages in the geographic areas in which the Company intends to operate. Such personnel may not always be available in the future. In addition, it cannot be predicted whether the labor staffing at any of the Company's projects will be unionized. The success of the operations and activities of the Company is dependent to a significant extent on the efforts and abilities of its management. The loss of services of any of its management could have a material adverse effect on the Company. |

| (xv) | Forward Looking Statements |

| | This document contains forward looking statements concerning the Company's operations, economic performance and financial condition, including in particular, the likelihood of the Company's success in operating as an independent company and developing and expanding its business. These statements are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company, and reflect future business decisions which are subject to change. Some of these assumptions inevitably will not materialize, and unanticipated events will occur which will affect the Company's future results. |

| | The Company has a history of losses and no revenues. |

| | The Company is a mineral exploration company without operations and has historically incurred losses. To date, the Company has not recorded any revenues from its operations nor has the Company commenced commercial production on any of its properties. The Company does not expect to receive revenues from operations in the foreseeable future, if at all. The Company expects to continue to incur losses unless and until such time as properties enter into commercial production and generate sufficient revenues to fund its continuing operations. Until such time, the Company will be dependent upon future financings in order to meet its capital requirements and continue its plan of operations. The Company cannot guarantee that it will obtain necessary future financing. The development of the Company’s properties will require the commitment of substantial resources to conduct the time-consuming exploration and development of properties. The amounts and timing of expenditures will depend on the progress of ongoing exploration, assessment and development, the results of consultants’ analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners, the Company’s acquisition of additional properties and other factors, many of which are beyond the Company’s control. The Company may never generate any revenues or achieve profitability. |

ITEM 4. INFORMATION OF THE COMPANY

A. History and Development of the Company

The Company was incorporated pursuant to the provisions of the Business Corporations Act (Alberta) on May 29, 1996. The Company amended its articles by certificate of amendment dated October 22, 1997 to remove the private company restrictions. On July 13, 2004 the Company continued out of the province of Alberta into the province of British Columbia pursuant to the Business Corporations Act (British Columbia).

The Company's registered and executive office is located at 2303 West 41st Avenue, Vancouver, British Columbia, Canada V6M 2A3, telephone (604) 685-1870, facsimile (604) 685-8045.

17

The Company is a reporting issuer in the provinces of Alberta, British Columbia and Ontario, Canada.

The Company’s common shares traded on the Toronto Venture Exchange from December 19, 1997 and on the Toronto Stock Exchange (“TSX”) from June 8, 2001, under the trading symbol “PFN”; on the Over-the-Counter Bulletin Board (“OTCBB”) since August 30, 2001 and the OTCQX™ since October 26, 2010 under the trading symbol “PAWEF”; and are included for trading on the Frankfurt Stock Exchange, Open Market, under the trading symbol “P7J.F”.

B. Business Overview

The Company is a mineral exploration company focused on the acquisition, exploration and development of platinum group metals (PGMs), precious and base metals minerals properties.

The Company has not determined whether these properties contain ore reserves that are economically recoverable and the Company is considered to be in the exploration stage.

Management's corporate philosophy is to be a project generator, explorer and project operator with the objective of optioning/joint venturing projects with major and junior mining companies through to production.

The Company’s primary project is the River Valley PGM project in Ontario.

Exploration on the property is generally not affected by seasonal change, with drill programs being carried out year round and surface bedrock exploration limited only by snow cover and spring thaw conditions. Exploration activities are dependent upon the availability of subcontractors, in particular drilling activities. These sub-contractors are generally available, however, may vary in price depending upon availability. The material effects of government regulations on the Company’s business are disclosed in Item 3 – Risk Factors.

The mineral resources industry is intensely competitive and the Company competes with many companies that have greater financial resources and technical facilities.

C. Organizational Structure

The Company owns 100% of Pacific North West Capital Corp. USA, and 99.98% of Pacific North West Capital de México, S.A. de C.V. in México (Mr. Harry Barr, President and CEO of the Company, owns 0.02%).

D. Property, Plants, and Equipment

PFN rents executive and administrative office space located at 2303 West 41st Avenue, Vancouver, British Columbia, V6M 2A3, Canada, for the sum of $17,043 per month.

18

Mineral Properties

None of the Company’s mineral exploration properties contain a known commercially mineable mineral deposit.

ONTARIO, CANADA

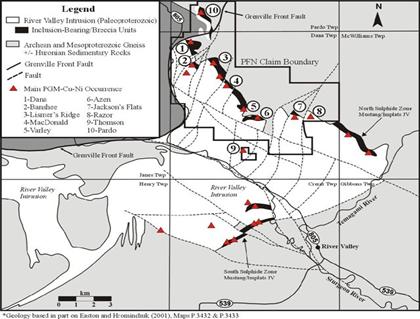

(I) River Valley PGM Project

The River Valley mineral claims are located in the Sudbury Region of Ontario. PFN optioned the River Valley claims following the discovery of highly anomalous PGM values in grab samples in the Dana Lake and Azen Creek areas. By an agreement dated January 15, 1999 and amended March 11, 1999 (collectively, the “Agreement”), the Company acquired a 100% interest in the River Valley claims from Bailey Resources Ltd., Luhta Resources Ltd. and Pardo Resources Ltd. by issuing 600,000 common shares of PFN and $265,000 in cash over four years. The River Valley claims are subject to a total 3% NSR, of which PFN can purchase up to 2% of the NSR from the vendors for $2,000,000.

On July 14, 1999, PFN entered into an unincorporated 50/50 joint venture agreement (“JV”) over the River Valley property with Kaymin whereby Kaymin was responsible for funding all exploration to completion of a feasibility study, which would give Kaymin an additional 10% interest. In addition, if Kaymin arranged financing for a mine, it would receive another 5% interest, for a total interest of 65%.

Kaymin continued to fund exploration under the terms of JV until 2007and invested over $22M in the exploration of the property; however, as a result of capital expenditure reductions during the global financial crisis in 2008, no new funds were allocated to the River Valley Project above and beyond the minimal holding costs.

By way of a Mineral Interest Assignment Agreement dated for reference December 13, 2010, as amended April 6, 2011 (“Assignment Agreement”), on April 7, 2011, PFN completed the purchase from Kaymin of Kaymin’s 50% interest in the River Valley claims, providing PFN with an undivided 100% interest in the River Valley PGM Project. Under the terms of the Assignment Agreement, Kaymin exchanged its 50% interest in the JV, for a 12% interest in PFN, based on the issued and outstanding common shares of PFN as of November 30, 2010 (67,643,008 common shares). The aggregate purchase price for the 50% interest in the River Valley PGM project was:

| | a. | 8,117,161 fully paid and non-assessable common shares of PFN (issued); and |

| | b. | three-year warrants exercisable to purchase 3,000,000 common shares of PFN at a price of $0.30 per common share. |

There are no other encumbrances on the River Valley PGM Project associated with the terms of the Assignment Agreement, after an 18-month early disposition period lapses, and there are no back-in rights or take-off agreements between PFN and Kaymin.

In addition to the River Valley claims, PFN holds various other properties that together comprise the River Valley Project as shown below:

| a) | Goldwright Property. By agreement dated June 30, 1998 and subsequently amended, the Company earned a 25% interest from Goldwright Explorations Inc. in certain mineral claims known as the Janes property, located in Janes Township, Sudbury Mining District, Ontario, by incurring in excess of $350,000 of exploration expenditures on the properties by May 31, 2001. Certain of these claims are subject to a 2% NSR. |

| b) | Washagami Lake Property. The Company entered into an option to purchase agreement dated February 23, 1999, as amended, whereby the Company could earn a 100% interest in 1 unpatented mining claim unit (16 ha) located in Janes Township, Sudbury Mining District, Ontario, immediately south of the Frontier property, by making cash payments of $28,200 (paid). On December 10, 2008, the claim was allowed to lapse. |

| c) | Razor Property. The Company acquired a 100% interest in certain mineral claims located in the Dana Township, Sudbury Mining District for a consideration of $30,000. The property is subject to a 2% NSR. |

19

| d) | Western Front Property. Under an agreement dated November 16, 2001, the Company earned a 70% interest in certain mineral claims from a company (the Optionor) that previously had certain directors in common. As consideration the Company paid $55,000 and issued 20,000 common shares to the Optionors. In addition, exploration expenditures of $50,000 were completed. The Company has the right to purchase an additional 30% interest in the property by paying $750,000 to the Optionor. The property is subject to a 3% NSR the first 1% of which the Company can purchase for $1,000,000 the second 1% can be purchased for $2,000,000. The Company and the Optionor will share the NSR buyout privileges in proportion to their respective interest. |

| Location of the River Valley

PGM Property |

Property Location and Access

The River Valley claims, consisting of 226 claim units (1 claim unit = 16 ha), lie within Dana and Pardo Townships, and are located about 60 km northeast of the City of Sudbury, Ontario.

Claim Status

All the River Valley claims are in good standing at the time of writing. The River Valley claim block has been legally surveyed, and the final mining lease applications are being reviewed by the different Ontario government Ministries. The mining lease approvals are expected in 2011.

To the best of PFN’s knowledge there are no environmental or other liabilities associated with the River Valley Joint Venture claims.

All exploration to date has been carried out with appropriate work permits from the Ontario Ministry of Natural Resources. For the future exploration activities a more elaborate permit may be required, but to PFN’s knowledge there is no impediment to receiving one.

20

Claim list and anniversary dates - River Valley and River Valley Joint Venture Properties

| Township | Claim Number | Claim Due Date | Units |

| DANA | 1227988 | 2011-Oct-19 | 8 |

| DANA | 1227989 | 2011-Oct-19 | 8 |

| DANA | 1227990 | 2011-Oct-19 | 12 |

| DANA | 1227991 | 2011-Oct-19 | 10 |

| DANA | 1229216 | 2011-Oct-19 | 6 |

| DANA | 1229217 | 2011-Oct-19 | 16 |

| DANA | 1229218 | 2011-Oct-19 | 16 |

| DANA | 1229219 | 2012-Oct-19 | 12 |

| DANA | 1229220 | 2011-Oct-19 | 16 |

| DANA | 1229221 | 2011-Oct-19 | 16 |

| DANA | 1229222 | 2011-Oct-19 | 16 |

| DANA | 1229223 | 2011-Oct-19 | 12 |

| DANA | 1229224 | 2011-Oct-19 | 10 |

| DANA | 1229230 | 2011-Sep-21 | 16 |

| DANA | 1229231 | 2011-Sep-21 | 16 |

| DANA | 1229232 | 2011-Sep-21 | 14 |

| PARDO | 1229233 | 2011-Sep-21 | 16 |

| PARDO | 1229234 | 2011-Sep-21 | 6 |

| DANA | 1229542 | 2012-May-07 | 6 |

| DANA | 1230038 | 2012-May-07 | 12 |

| DANA | 1237228 | 2012-May-25 | 8 |

| DANA | 1237304 | 2012-Apr-13 | 12 |

| DANA | 1237305 | 2012-Apr-13 | 8 |

| PARDO | 1244332 | 2012-Jun-05 | 8 |

| DANA | 1244338 | 2012-Jun-14 | 6 |

| DANA | 1244427 | 2012-Jun-05 | 7 |

| DANA | 1244435 | 2012-Jun-05 | 4 |

| PARDO | 1244445 | 2012-Jun-05 | 8 |

| DANA | 1244444 | 2012-Jun-05 | 16 |

| JANES | 1235822 | 2012-Dec-10 | 12 |

| JANES | 1231107 | 2012-Dec-17 | 6 |

| JANES | 1235892 | 2012-Jan-04 | 16 |

| JANES | 1235893 | 2012-Jan-04 | 7 |

| JANES | 1235889 | 2012-Jan-04 | 16 |

| JANES | 1235891 | 2012-Jan-04 | 7 |

| JANES | 1235888 | 2012-Jan-06 | 12 |

| JANES | 1235896 | 2012-Jan-06 | 2 |

| JANES | 1235894 | 2012-Jan-06 | 9 |

| DANA | 1246498 | 2012-Jan-12 | 8 |

| MCWILLIAMS | 1229840 | 2012-Feb-12 | 9 |

| DANA | 1191268 | 2012-Oct-13 | 1 |

| DANA | 3010281 | 2012-Oct-29 | 1 |

| DANA | 3010282 | 2012-Oct-29 | 1 |

| DANA | 3004262 | 2011-Aug-29 | 2 |

| PARDO | 3017059 | 2011-Apr-08(1) | 16 |

| PARDO | 3017060 | 2011-Apr-08(1) | 16 |

| PARDO | 3017061 | 2011-Apr-08(1) | 16 |

| PARDO | 3017062 | 2011-Apr-08(1) | 16 |

| PARDO | 3017085 | 2011-Apr-08(1) | 16 |

| JANES | 1230271 | 2013-Jun-29 | 15 |

(1) Extensions to these dates have been applied for and are pending.

21

Climate and Local Resources

Climate is temperate, with four distinct seasons, typical of the Southern Shield, and moderated by the proximity to the Great Lakes. Other than over small lakes, drilling and geophysical surveys can be carried out year round from skidder roads. Drilling water is sufficient. Surface bedrock exploration can be done for about 7‑8 months of the year. An environmental base line study has not been necessary to date.

Infrastructure

Sudbury, a major mining and manufacturing city, can provide all of the infrastructure and technical needs for any exploration work.

Physiography

The property lies at a mean elevation of about 325 metres (m) ASL. Relief is moderate and typical of upland Precambrian Shield topography. The eastern part around Azen Creek is lower and marshy. Forest cover is mainly poplar with about 25-33% white pine regrowth.

Outcrop exposure on the property is limited to about 20% with the remaining areas covered mostly by a thin (<1 m) veneer of glacial till; locally gravel, outwash sand and silt reach 10’s of metres in thickness. Most of the area around the Dana Lake and Azen Creek areas has been logged within the past 10 years and new logging took place in the Azen Creek Area during the summer of 2000.

History and Previous Work

In 1973, the Province of Ontario placed more than 110 Townships in a withdrawn area referred to as the “Temagami Land Caution” – this region was excluded from any type of resource exploration and/or development until June 1996. The River Valley Property was covered by this withdrawn area and as a result, most of the River Valley Intrusion was never explored for its PGM-Cu-Ni potential.

The earliest recorded work on the River Valley property was by Kennco Explorations (Canada) Ltd. in 1968, at which time they conducted an airborne Mag-EM survey over Janes, Davis, Henry and Dana Townships.

Geological Setting

Regional Geology

The River Valley property is primarily underlain by rocks of the RVI, a large Paleoproterozoic intrusion that forms part of the Huronian-Nipissing Magmatic Province or the Huronian Metallogenic Province.

Local Geology

The RVI covers more than 100 square kilometres (km2) and lies adjacent to, and straddles, the Grenville Front within the Grenville Province and the Grenville Front Tectonic Zone (“GFTZ”). The GFTZ represents a complex zone, several km wide and consisting of generally southeast-dipping imbricate thrust faults. In the area of the River Valley property, the GFTZ is located along the westernmost edge of the claims where it is represented by a system of eastward-dipping (10-25°) thrust faults. This fault system separates the intrusive rocks of the RVI from younger sedimentary and intrusive rocks of the Huronian Supergroup (includes Nipissing Diabase). It is likely that intrusive rocks of the RVI interdigitated within Huronian rocks along the fault-bound western contact.

Within Pardo Township, a north-trending apophysis of the RVI appears to be in fault contact with older (Archean Superior Province) mylonitic granitic rocks. In Dana Township the western boundary is in fault contact with rocks of the Southern Province, and the eastern and northern boundaries are in igneous contact with Archean migmatite and paragneiss of the Superior Province. The eastern and northern boundaries were previously mapped as being in contact with rocks of the Grenville Province.

22

The RVI can be separated into two main areas on the basis of structural coherence and preservation of primary igneous features such as contacts and layering. The eastern part of the RVI, located primarily in Dana and Crerar Townships, is represented by the best preserved portions of the intrusion and as such the most prospective areas for discovery. PFN’s River Valley property covers about 40% of this area including about 10 km of highly prospective northern igneous contact. Further to the west, in Henry, Janes, Loughrin, Street and Awrey Townships, the geology of the western part of the RVI is complicated by the effects of Grenville metamorphism. In this area the rocks are attenuated, folded and structurally modified such that most of the primary features are absent.

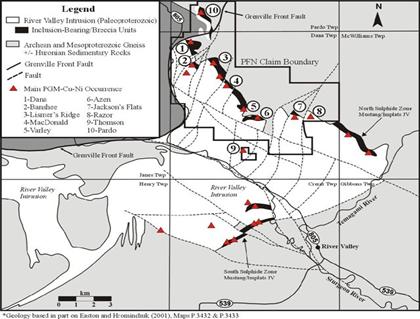

Property Geology

The River Valley property as mapped by the Company, includes three main mineralized areas with anomalous PGM-Cu-Ni sulphide mineralization: the Dana Lake Area, Lismer’s Ridge, and Azen Creek Area.

The Dana Lake Area of the River Valley property lies within a north-trending portion of the River Valley Intrusion (RVI). This region of the RVI likely represents an offshoot of the main intrusive body and appears to be an up-thrust and rotated portion of the intrusion. In its current position, the Dana Lake Area represents a lower stratigraphic position in the intrusion that is now oriented sub-vertical relative to its original, near-horizontal position. The basal contact of the intrusion undulates in both the horizontal and vertical direction and this undulation is probably a primary igneous contact feature. However, the area has been structurally disturbed with evidence for dip-slip, strike-slip and rotational displacement on the centimetre to metre scale. Steeply dipping (>80°), decimetre- to metre-scale, modally layered rocks of the River Valley intrusion overly the contact-related, mineralized breccia unit and are truncated along the western edge of the intrusion by the Grenville Front Fault.

| Locations of mineralized

zones in the River Valley

Intrusion |

Mineralization

The River Valley project includes three main areas of PGM-Cu-Ni sulphide mineralization: Dana Lake Area, Lismer’s Ridge, and Azen Creek. Dana Lake, located within the northwest corner of the claim group, consists of 7 main areas from north to southThese seven zones of PGM-Cu-Ni mineralization extend intermittently over a strike length of >900 m. The first six are now combined as Dana North Zone and seventh as Dana South Zone. At Lismer’s Ridge, surface mineralization is intermittently exposed over a NW-SE strike length of greater than 800 m, where it occurs within a similar geological environment to the Dana Lake Area.

At the Azen Creek Area, located about 6 km southeast of the Dana Lake Area, breccia-hosted mineralization is exposed in outcrop, located about 200 m south of the intrusive contact. The mineralization at the Azen Creek Main showing represents a different style of mineralization than at Dana Lake Area or Lismer’s Ridge in the hanging wall in a setting akin to Mustang Minerals Ltd./Implats mineralization on the adjacent property to the south.

23

Exploration of the River Valley property from 1999 to 2001 has shown that PGM mineralization (Pt+Pd+Au±Rh) exceeding 200 ppb PGE occurs extensively within a sequence of felsic to mafic magmatic breccias and fragment-bearing units that have been intermittently exposed and drill-tested along a prospective +10 km long intrusive contact.

Joint Venture Exploration Programs (1999-2008)

Phase 1 Surface (July – December, 1999)

The Phase1 Surface program commenced on December 15, 1999 and included:

| | 1. | Establishing detailed and regional exploration grids |

| | 2. | Regional prospecting and sampling |

| | 3. | Grid prospecting and sampling |

| | 4. | Preliminary geological grid mapping (1:1000 scales) |

| | 5. | Stripping and cleaning of selected outcrop areas |

| | 6. | Detailed sampling (2.5 x 2.5 m grid) of cleaned outcrop areas |

| | 7. | Preliminary mapping (1:250 scale) of cleaned outcrop areas |

| | 8. | Orientation biogeochemical survey in area of South and Trench zones; and |

| | 9. | Orientation induced polarisation and ground magnetometer geophysical surveys. |

More than 2300 surface samples (27 grabs from regional prospecting, 392 grabs from grid prospecting, and 1636 samples from detailed sampling) were collected during the exploration program. Background was calculated to be 7 ppb Au, 25 ppb Pt, 23 ppb Pd, 1 ppb Rh, (57 ppb 4E), 82 ppm Cu and 137 ppm Ni; average ratios include 0.82 Pd:Pt and 0.81 Cu:Ni.

Regional prospecting led to the discovery of 2 new areas of highly anomalous PGM values:

| | 1. | Central Reef, located about 1.0 km northwest of the Azen Creek Area main showing (up to 10.38 g/t 4E, 2970 ppm Cu, 530 ppm Ni), |

| | 2. | East Reef, located about 2 km east of the Azen Creek Area main showing (up to 0.7 g/t 4E, 707 ppm Cu and 765 ppm Ni. |

The highest value from surface sampling was 12.11 g/t 4E, collected from a ridge several metres south of the Central Zone.

Detailed sampling of cleared outcrop areas returned highly anomalous average values from the 2.5m x 2.5m sample grid: all 1636 detailed samples averaged 958 ppb 4E; 632 samples from the South Zone averaged 975 ppb 4E; 99 samples from the Trench Zone averaged 1168 ppb 4E; and, 165 samples from the Central Zone averaged 1449 ppb 4E. The highest surface sample was 16.4 g/t 4E (South Zone).

Phase 1 Drilling (February – March, 2000)

The phase 1, 2000 m and 13 hole drilling program was completed between February 28and March 2000. The program concentrated on mineralization at the Dana Lake Area (claim S-1229230). A total of 1649 samples were taken from split drill core and sent to XRAL Laboratories in Rouyn-Noranda, Quebec for Pt-Pd-Au-Rh-Cu-Ni assay.

Drilling program was very successful and the highest drill samples was 10,206 ppb 4E (Au+ Pt+Pd+Rh) over 2.3 metres.

Phase 2 Drilling (June – July, 2000)

Phase 2 drilling concentrated on mineralization at the Dana Lake Area (claim S-1229230) where PGMs are associated with disseminated Cu-Ni sulphide mineralization that is hosted by mafic magmatic breccia which is proximal to the footwall contact. The Phase 2 program was designed to augment Phase 1 drilling, testing the down dip extension of surface mineralization and in-fill drilling of untested areas.

24

The Phase 2 program consisted of 2820.8m in 14 holes and was completed between June 12th and July 18th, 2000. Core logging and sampling was fully completed by October 15th; drill hole RV00-03 was extended 27.3 m. A total of 2177 samples (2158 from RV00-14 to 26 and 19 from RV00-03) were taken from split drill core and sent to XRAL Laboratories (Rouyn-Noranda, Quebec & Don Mills, Ontario) for Pt-Pd-Au, Rh and Cu-Ni assays. A total of 296 pulps were sent to Accurassay Laboratory in Thunder Bay for sample check assays.

Significant intervals were encountered in holes number DDH 15, 20 and 25 with 1143.2 ppb 4E over 39.10m, 2342.9 ppb 4E over 15.85 and 1948.2 ppb 4E over 11.10 meters respectively.

Phase 3 Drilling (September 2000)

Phase 3 drilling consisted of 10 drill holes at the Dana Lake Area (claim S-1229230) and 3 drill holes at Lismer’s Ridge (claims S-1229542 & S-1229216). In both areas, PGMs are associated with disseminated and bleb Cu-Ni sulphide mineralisation that is hosted by a heterolithic breccia which is proximal to the intrusive contact. The Phase 3 program was designed to augment Phases 1 & 2 drilling, testing the down dip extension of surface mineralisation and in-fill drilling of untested areas at the Dana Lake Area, and testing newly discovered surface mineralisation at Lismer’s Ridge.

The Phase 3 program (1958.50 m in 13 holes) was completed September 6 - 25, 2000; core logging and sampling was fully completed by October 30, 2000. A total of 1142 samples were collected from split drill core and assayed for Pt, Pd, Au, Cu and Ni at XRAL Laboratories (Rouyn-Noranda, Quebec & Don Mills, Ontario).

Significant intervals were encountered in holes number RV0028 and RV0036, with 1022.2 ppb 3E (Au+Pt+Pd) over 42.35m, including 1386.4 ppb 3E over 7.85m and 7215.8 ppb over 8.8m respectively.

Phase 2 Surfaces (March – October, 2000)

The Phase 2 program consisted of:

| | 3. | Regional mapping/prospecting and detailed mapping/sampling of newly-cleared areas. |

Detailed sampling produced a total of 2133 samples; 831 were collected from newly cleared areas in the Dana Lake Area (S-1229230); 1282 samples were collected from Lismer Ridge (S-1229542, S-1229216). Regional mapping and prospecting produced an additional 233 samples from regional work across the property.

Phase 4 Drilling (February – July 2001)

The Phase 4 program was separated into two time blocks, to accommodate for the changing weather conditions between seasons: February 1st to March 21, 2001 and May 14 - July 2001. Core logging and sampling was fully completed by August 31, 2001. A total of 10,529 samples from Dana and 7,501 from Lismer Ridge were collected from split drill core and assayed for Pt, Pd, Au, Cu and Ni at XRAL Laboratories (Rouyn-Noranda, Quebec & Don Mills, Ontario).

The highest value from drilling program was as follow:

3.7 g/t 3E over 71.4m including 9.6 g/t 3E over 4.2m in DL-08 drilled in Dana Lake Area and 4.71 g/t 3E over 18 metres including 13.2 g/t 3E over 5.2m and 28.14 g/t over 2m in hole number LR-02 drilled in Lismer Ridge Area.

At the completion of Phase 4 Drilling, an Independent Mineral Resource Study was carried out by Derry Michener Booth and Wahl (DMBW), which incorporated assay data from the 138 holes drilled to date on the property. The Report estimated an in situ resource at Dana Lake and Lismer Ridge totaling ~593,000 ounces (Pd+ Pt+ Au) at a 0.7 g/t cut-off in 12 million tonnes (measured + indicated + inferred). The report notes that “there is significant potential to increase resources on the property through further drilling both along strike from and down dip on the currently defined mineralized zones”.

25

Phase 3 Surface (June – September, 2001)

During the Phase 3 program a total of 1,111 samples were collected from the property with concentrations in the south eastern and western contact areas.

The highest value from surface sampling was 3.9 g/t 3E, collected from the Razor area.

Phase 5 Drilling (November, 2001 – August, 2002)

This Phase 5 program was completed in its entirety between November 17, 2001 and August 31, 2002; drilling was employed from November 22, 2001 to June 24, 2002 (Part 1: November 22, 2001 to March 3, 2002 and Part 2: April 21, 2002 to June 24, 2002).

A total of 22,319 core samples were collected consisting of 10,325 from Lismer Ridge, 10,289 from Dana South, and 1,705 from Banshee Lake. The core samples were collected from split drill core and assayed for Pt, Pd, Au, Cu and Ni at XRAL Laboratories, located in Rouyn-Noranda, Quebec and Don Mills, Ontario.

Highlights from Phase 5 Drilling: Dana Lake Area, River Valley Property (weighted averages).

| DDH | From | To | Int | Au | Pt | Pd | 3E* | 3E* | Pd:Pt |

| | m | m | m | ppb | ppb | ppb | ppb | g/t | |

| DL-55 | 198.00 | 215.50 | 17.50 | 162 | 942 | 3388 | 4492 | 4.49 | 3.6 |

| incl. | 210.50 | 212.85 | 2.35 | 221 | 1798 | 6001 | 8020 | 8.02 | 3.3 |

| DL-58 | 146.30 | 174.00 | 27.70 | 110 | 641 | 2147 | 2898 | 2.90 | 3.3 |

| incl. | 155.50 | 159.00 | 3.50 | 188 | 1256 | 4580 | 6024 | 6.02 | 3.6 |

| DL-59 | 192.00 | 200.00 | 8.00 | 101 | 734 | 2292 | 3127 | 3.13 | 3.1 |

| incl. | 193.00 | 197.00 | 4.00 | 136 | 1060 | 3433 | 4629 | 4.63 | 3.2 |

| DL-80 | 270.00 | 277.50 | 7.50 | 166 | 1319 | 4091 | 5576 | 5.58 | 3.1 |

| incl. | 271.00 | 274.00 | 3.00 | 208 | 1519 | 4810 | 6537 | 6.54 | 3.2 |