FORM 51-102F3

Material Change Report

| Item 1: | Name and Address of Company |

| | Pacific North West Capital Corp.

650-555 West 12th Avenue

Vancouver, B.C. V5Z 3X7 |

| Item 2: | Date of Material Change: |

| | News release dated & issued on October 12, 2012 was disseminated through Canada News Wire. |

| Item 4: | Summary of Material Change: |

| | The Company announced a non-brokered flow-through and non flow- through private placement of up to a combined 15,714,285 units for gross proceeds of up to $1,100,000. |

| Item 5: | Full Description of Material Change: |

| | Pacific North West Capital Corp. announced a non-brokered flow-through and non flow- through private placement of up to a combined 15,714,285 units for gross proceeds of up to $1,100,000. |

| | Each non flow-through unit (“NFT Unit”) at a price of $0.07 per unit will consist of one common share and one-half of one, non-transferable, share purchase warrant (“Warrant”). Each whole Warrant will entitle the holder to purchase one common share of the Company at a price of $0.13 for a period of 18 months from the closing date, subject to an accelerated expiry, such expiry to be accelerated to 30 days in the event the Company’s shares have closed at or above a price of $0.23 per share for 10 consecutive trading days on the Toronto Stock Exchange (“TSX”). |

| | Each flow-through unit (“FT Unit”) at a price of $0.08 per unit will consist of one common flow-through share and one-half of one non flow-through, non-transferable, share purchase warrant. Each whole Warrant will entitle the holder to purchase one additional non flow-through common share of the Company at $0.14 for a period of 18 months from the closing date, subject to an accelerated expiry, such expiry to be accelerated to 30 days in the event the Company’s shares have closed at or above a price of $0.24 per share for 10 consecutive trading days on the TSX. |

| | The proceeds from the private placement received from the sale of the units will be used for the further development and exploration of the River Valley PGM Project and exploration of two large adjacent properties, all located in the Sudbury region of Ontario. The proceeds from the sale of NFT Units will be used as working capital and for the additional projects that the Company currently holds in its portfolio situated in Ontario and Alaska, and for the evaluation and potential acquisition of additional platinum group metals and precious metal projects in Canada and the United States. Finder’s fees may be paid in connection with this private placement. The foregoing is subject to regulatory approval. |

| | See the full news release dated October 12, 2012 attached hereto. |

| Item 6: | Reliance on subsection 7.1(2) of National Instrument 51-102: |

| | If this Report is being filed on a confidential basis in reliance on subsection 7.1(2) or (3) of National Instrument 51-102, state the reasons for such reliance. |

| Item 7: | Omitted Information |

| | Coreena Hansen, Corporate Secretary

Telephone: 604-648-1420 Facsimile: 604-685-8045 |

| For Immediate Release | | NEWS RELEASE |

| TSX: PFN OTCQX: PAWEF Frankfurt: P7J | Toll Free 1.800.667.1870 | www.pfncapital.com |

Pacific North West Capital Corp. Announces $1,100,000 Non-Brokered Private Placement

October 12, 2012 Vancouver, Canada – Pacific North West Capital Corp. (TSX: PFN; OTCQX: PAWEF; Frankfurt: P7J) (the “Company”) is pleased to announce a non-brokered flow-through and non flow- through private placement of up to a combined 15,714,285 units for gross proceeds of up to $1,100,000.

Each non flow-through unit (“NFT Unit”) at a price of $0.07 per unit will consist of one common share and one-half of one, non-transferable, share purchase warrant (“Warrant”). Each whole Warrant will entitle the holder to purchase one common share of the Company at a price of $0.13 for a period of 18 months from the closing date, subject to an accelerated expiry, such expiry to be accelerated to 30 days in the event the Company’s shares have closed at or above a price of $0.23 per share for 10 consecutive trading days on the Toronto Stock Exchange (“TSX”).

Each flow-through unit (“FT Unit”) at a price of $0.08 per unit will consist of one common flow-through share and one-half of one non flow-through, non-transferable, share purchase warrant. Each whole Warrant will entitle the holder to purchase one additional non flow-through common share of the Company at $0.14 for a period of 18 months from the closing date, subject to an accelerated expiry, such expiry to be accelerated to 30 days in the event the Company’s shares have closed at or above a price of $0.24 per share for 10 consecutive trading days on the TSX.

The proceeds from the private placement received from the sale of the units will be used for the further development and exploration of the River Valley PGM Project and exploration of two large adjacent properties, all located in the Sudbury region of Ontario. The proceeds from the sale of NFT Units will be used as working capital and for the additional projects that the Company currently holds in its portfolio situated in Ontario and Alaska, and for the evaluation and potential acquisition of additional platinum group metals and precious metal projects in Canada and the United States. Finder’s fees may be paid in connection with this private placement. The foregoing is subject to regulatory approval.

About Pacific North West Capital Corp

PFN is a mineral exploration company whose philosophy is to be a project generator, explorer and project operator in order to option/joint venture its projects through to production. PFN is focused on the discovery, exploration and development of PGM and nickel‐copper sulphide deposits in geologically prospective regions in North America, particularly Canada. The Company’s key asset is its 100% owned River Valley PGM Project in the Sudbury region of northern Ontario. River Valley is one of the largest undeveloped primary PGM projects in North America. PFN also has PGM and nickel‐copper projects in northwest Ontario, Saskatchewan, and Alaska. The Company continues to evaluate PGM and nickel‐copper properties and projects in North America for potential acquisition opportunities.

About River Valley Project

In January 2011, Pacific North West Capital Corp. successfully negotiated the 100% acquisition of the River Valley PGM Project from Anglo Platinum Limited. The River Valley Project is one of the largest undeveloped primary PGM projects in North America. The project has excellent infrastructure support and is located 100 km from the city of Sudbury, Ontario, Canada’s largest nickel‐copper‐PGM mining and metal recovery centre.

| News Release | | October 12, 2012 |

In May 2011, Pacific North West Capital Corp. commenced a $5 million drill program on the project. The program was successfully completed in May 2012. Data from 2011-2012 resource drilling was combined with holes drilled previously up to 2005, and delivered to Wardrop Engineering for a mineral resource update.

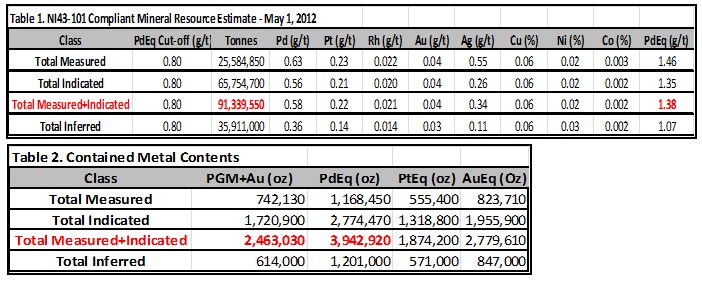

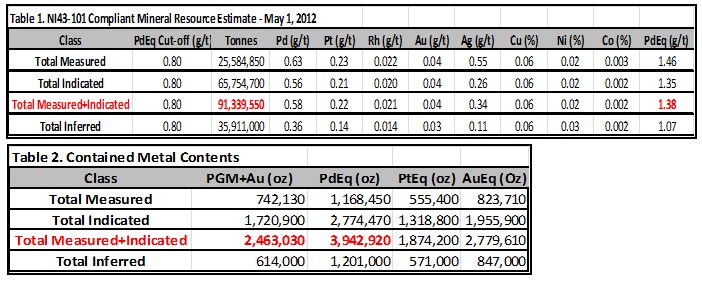

The NI43‐101 compliant mineral resources for the River Valley Project effective May 1, 2012 are illustrated in the table below:

- Mineral resources which are not mineral reserves do not have demonstrated economic viability . The estimate of mineral resources may be materially effected by environmental, permitting legal, title, socio-political, marketing, or other relevant issues.

- Please see Press Release dated May 1st 2012 for Notes to Mineral Resources

With these mineral resources, the River Valley Project is to be assessed for development potential as a large open pit PGM‐Cu‐Ni mining and milling operation as the project advances towards a Preliminary Economic Assessment Study. In support of this study, a metallurgical test program is in progress.

Qualified Persons Statement

This news release has been reviewed and approved for technical content by Dr. William Stone Ph.D., P.Geo. and Mr. Ali Hassanalizadeh M.Sc., P.Geo. both Qualified Persons under the provisions of National Instrument 43‐101.

Pacific North West Capital Corp. is an International Metals Group Company.

(www.internationalmetalsgroup.com)

On behalf of the Board of Directors

Further Information: Tel: +1.604.685.1870 Fax: +1.604.685.8045

Email: info@pfncapital.com, or visit www.pfncapital.com

Suite 650 – 555 West 12th Ave., Vancouver, B.C., Canada, V5Z 3X7 |

Harry Barr

Chairman and CEO

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release

Disclaimer: This news release may contain certain "Forward-Looking Statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included herein are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations are disclosed in the Company's documents filed from time to time with The Toronto Stock Exchange, British Columbia Securities Commission and the United States Securities & Exchange Commission.