1 NEWS RELEASE Contact: Matt Brown Senior Vice President and CFO U.S. Concrete, Inc. 817-835-4105 FOR IMMEDIATE RELEASE U.S. CONCRETE REPORTS FOURTH QUARTER AND FULL-YEAR 2013 RESULTS Full-Year Highlights • Adjusted EBITDA increased 92.1% year-over-year, to $48.3 million • Consolidated revenue increased 15.8%, to $615.0 million • Ready-mixed concrete volume rose 8.0%, to approximately 5.2 million cubic yards • Ready-mixed concrete average sales price improved 6.6%, to $104.03 per cubic yard • Gross profit increased $25.0 million with margin improvement of 210 basis points Fourth Quarter Highlights • Adjusted EBITDA increased 51.9% year-over-year, to $9.1 million • Consolidated revenue increased 12.1%, to $151.2 million • Ready-mixed concrete volume rose 2.6%, to approximately 1.3 million cubic yards • Ready-mixed concrete average sales price improved 8.7%, to $107.36 per cubic yard • Gross profit increased $1.5 million on strength of aggregates segment EULESS, TEXAS – March 6, 2014 – U.S. Concrete, Inc. (NASDAQ: USCR) today reported adjusted EBITDA of $48.3 million for the year ended December 31, 2013, compared to adjusted EBITDA of $25.1 million in the prior year. Adjusted EBITDA margin, which is adjusted EBITDA as a percentage of revenue, was 7.9% for the year ended December 31, 2013, compared to 4.7% in the prior year. Adjusted net income was $15.1 million, or $1.13 per diluted share, for the year ended December 31, 2013, compared to adjusted net income of $1.9 million, or $0.15 per diluted share, in the prior year. William J. Sandbrook, President and Chief Executive Officer of U.S. Concrete, stated “We are pleased to finish 2013 with a strong fourth quarter, despite significant weather disruptions to our volume during the three-month period. Our EBITDA improvement continues to be driven by operating leverage and growth in both volume and pricing. In addition, we were successful during the quarter in improving our liquidity with the issuance of $200 million in senior

2 secured notes. We are very excited by the opportunities developing to utilize our strong cash position and growing profitability to capitalize on opportunities in the expanding construction market.” FULL-YEAR 2013 RESULTS Consolidated revenue increased 15.8% to $615.0 million compared to $531.0 million in 2012. Revenue from the ready-mixed concrete segment increased $71.5 million, or 15.1%, over 2012 driven by growth in both volume and pricing. The Company's ready-mixed concrete sales volume was 5.2 million cubic yards, up 8.0% over 2012. Ready-mixed concrete average sales price per cubic yard increased $6.44, or 6.6%, to $104.03 compared to $97.59 in the prior year. Aggregate products segment revenue increased $6.2 million, or 19.4%, compared to 2012, on increased sales volume of 190 thousand tons, a 5.6% growth over the prior year. Consolidated gross profit increased $25.0 million with a 210 basis point expansion in margin year-over-year. Consolidated adjusted EBITDA of $48.3 million, increased $23.1 million with a 320 basis point expansion in margin year-over-year. Selling, general and administrative ("SG&A") expenses were $60.2 million for the year ended December 31, 2013 compared to $59.0 million in the prior year. As a percentage of total revenue, SG&A expenses decreased to 9.8% in 2013, a 130 basis point improvement over prior year. Free cash flow for the year ended December 31, 2013 was $2.5 million compared to $34.5 million in the prior year. The decrease in free cash flow was due to increased capital expenditures and changes in trade working capital. In addition, in 2012, we received $27.0 million in proceeds from the sale of our precast operations and a parcel of land in California. Capital expenditures for the year ended December 31, 2013 were $20.0 million, an increase of $11.6 million over the prior year. The increase in capital expenditures was due to higher spending on mixer trucks and plant equipment and improvements to allow the Company to meet the growing demand in our markets. FOURTH QUARTER 2013 RESULTS Consolidated revenue increased 12.1% to $151.2 million, compared to $134.9 million in the prior year. Revenue from the ready-mixed concrete segment increased $13.9 million, or 11.4%, over prior year driven by growth in both volume and pricing. The Company’s ready-mixed concrete sales volume was 1.3 million cubic yards, up 2.6% over prior year. Ready-mixed concrete average sales price per cubic yard increased $8.55, or 8.7%, to $107.36 compared to $98.81 in the prior year. Aggregate products segment revenue increased $1.3 million, or 15.1%, compared to fourth quarter of 2012, on increased sales volume of 13 thousand tons, a 1.5% growth over prior year. Consolidated gross profit increased $1.5 million year-over-year for the quarter. Consolidated adjusted EBITDA of $9.1 million, increased $3.1 million with a 150 basis point expansion in margin year-over-year. SG&A expenses were $14.7 million in the fourth quarter of 2013 compared to $16.7 million in the fourth quarter of 2012. As a percentage of total revenue, SG&A expenses decreased to 9.7%, a 270 basis point improvement over the fourth quarter of 2012.

3 During the fourth quarter of 2013, the Company recorded a $4.1 million non-cash loss related to derivatives. This non-cash loss was comprised of fair value changes in the Company’s warrants. This is compared to a non-cash loss of $13.2 million during the fourth quarter of 2012 from fair value changes in the Company’s warrants and convertible notes. These changes were due primarily to the increase in the price of the Company’s common stock during the fourth quarters of 2013 and 2012. The Company had cash used in operations of $2.7 million for the fourth quarter of 2013, compared to $18.7 million provided by operations for the fourth quarter of 2012. The decrease in the fourth quarter of 2013 was due to changes in trade working capital. The Company’s free cash flow for the fourth quarter of 2013 was ($8.9) million, compared to $22.4 million for the fourth quarter of 2012. The decrease in the fourth quarter of 2013 was due to changes in trade working capital and higher capital spending. The Company implemented an aggressive trade working capital management program in the fourth quarter of 2012. This program continued through 2013 and has become a standard, ongoing best practice. These efforts generated an initial increase in cash flow related to working capital changes in the fourth quarter of 2012. In addition, during the fourth quarter of 2012, we received $7.6 million of cash proceeds related to the sale of our precast operations and a parcel of land in California. Capital expenditures increased $2.7 million to $6.6 million for the fourth quarter of 2013, as compared to $3.9 million for the fourth quarter of 2012. The increase in capital spend was due to higher spending on plant equipment and improvements to allow the Company to meet the growing demand in our markets. The Company’s net debt at December 31, 2013 was approximately $101.5 million, up $42.8 million from December 31, 2012. The increase in net debt was due to multiple financing transactions executed by the Company during the year. In the first quarter of the year, we completed an exchange offer for our convertible notes at 126% of par in order to remove the potential shareholder dilution represented by the convertible feature in the notes. The exchange offer resulted in an increase in net debt of approximately $20 million, including a $7.3 million book discount related to the exchanged convertible notes that was written off as part of the transaction. In the fourth quarter, the Company issued $200 million aggregate principal amount of 8.5% Senior Secured Notes due 2018. A portion of the net proceeds were used to repay all of the outstanding borrowings under the revolving credit facility and redeem all of the 9.5% Senior Secured Notes due 2015 that were issued as part of the previously mentioned exchange offer. The Company separately obtained financing for $11.9 million of capital expenditures related to mixer trucks purchased in 2013. The Company incurred approximately $9.1 million in debt issuance costs for the year. Net debt at December 31, 2013 was comprised of total debt of $214.1 million, less cash and cash equivalents of $112.7 million. Ready-mix backlog at the end of 2013 was approximately 4.0 million cubic yards, up 31% compared to the end of 2012. CONFERENCE CALL U.S. Concrete has scheduled a conference call for Thursday, March 6, 2014 at 10:00 a.m. Eastern time, to review its fourth quarter and full year 2013 results. To participate in the call, dial Toll-free: (877) 312-8806 – Conference ID: 4812399 at least ten minutes before the conference call begins and ask for the U.S. Concrete conference call. A replay

4 of the conference call will be available after the call under the investor relations section of the Company’s website at www.us-concrete.com. Investors, analysts and the general public will also have the opportunity to listen to the conference call over the Internet by accessing www.us-concrete.com. To listen to the live call on the Web, please visit the Web site at least 15 minutes early to register, download and install any necessary audio software. For those who cannot listen to the live Web cast, an archive will be available shortly after the call under the investor relations section of the Company’s website at www.us-concrete.com. USE OF NON-GAAP FINANCIAL MEASURES This press release uses the non-GAAP financial measures “adjusted EBITDA,” “adjusted net income (loss),” “adjusted EBITDA margin,” “free cash flow” and “net debt.” The Company has included adjusted EBITDA and adjusted EBITDA margin in this press release because it is widely used by investors for valuation and comparing the Company’s financial performance with the performance of other building material companies. The Company also uses adjusted EBITDA and adjusted EBITDA margin to monitor and compare the financial performance of its operations. Adjusted EBITDA does not give effect to the cash the Company must use to service its debt or pay its income taxes, and thus does not reflect the funds actually available for capital expenditures. In addition, the Company’s presentation of adjusted EBITDA and adjusted EBITDA margin may not be comparable to similarly titled measures that other companies report. The Company considers free cash flow to be an important indicator of its ability to service debt and generate cash for acquisitions and other strategic investments. The Company believes that net debt is useful to investors as a measure of its financial position. The Company presents adjusted net income (loss) and adjusted net income (loss) per share to provide more consistent information for investors to use when comparing operating results for the fourth quarter and full-year of 2013 to the fourth quarter and full-year of 2012. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported operating results or cash flow from operations or any other measure of performance as determined in accordance with GAAP. See the attached “Additional Statistics” for reconciliation of each of these non-GAAP financial measures to the most comparable GAAP financial measures for the quarters and years ended December 31, 2013 and 2012. ABOUT U.S. CONCRETE U.S. Concrete services the construction industry in several major markets in the United States through its two business segments: ready-mixed concrete and aggregate products. The Company has 105 fixed and 10 portable ready- mixed concrete plants and eight producing aggregates facilities. During 2013, these plant facilities produced approximately 5.2 million cubic yards of ready-mixed concrete and approximately 3.6 million tons of aggregates. For more information on U.S. Concrete, visit www.us-concrete.com. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This press release contains various forward-looking statements and information that are based on management's belief, as well as assumptions made by and information currently available to management. These forward-looking statements speak only as of the date of this press release. The Company disclaims any obligation to update these statements and cautions you not to rely unduly on them. Forward-looking information includes, but is not limited to, statements regarding: the stability of the business; encouraging

5 nature of third quarter volume and pricing increases; ready-mix backlog; ability to maintain our cost structure and the improvements achieved during our restructuring and monitor fixed costs; ability to maximize liquidity, manage variable costs, control capital spending and monitor working capital usage; and the adequacy of current liquidity. Although U.S. Concrete believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that those expectations will prove to have been correct. Such statements are subject to certain risks, uncertainties and assumptions, including, among other matters: general and regional economic conditions; the level of activity in the construction industry; the ability of U.S. Concrete to complete acquisitions and to effectively integrate the operations of acquired companies; development of adequate management infrastructure; departure of key personnel; access to labor; union disruption; competitive factors; government regulations; exposure to environmental and other liabilities; the cyclical and seasonal nature of U.S. Concrete's business; adverse weather conditions; the availability and pricing of raw materials; the availability of refinancing alternatives; and general risks related to the industry and markets in which U.S. Concrete operates. Should one or more of these risks materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those expected. These risks, as well as others, are discussed in greater detail in U.S. Concrete's filings with the Securities and Exchange Commission, including U.S. Concrete's Annual Report on Form 10-K for the year ended December 31, 2012 and subsequent Quarterly Reports on Form 10-Q. (Tables Follow)

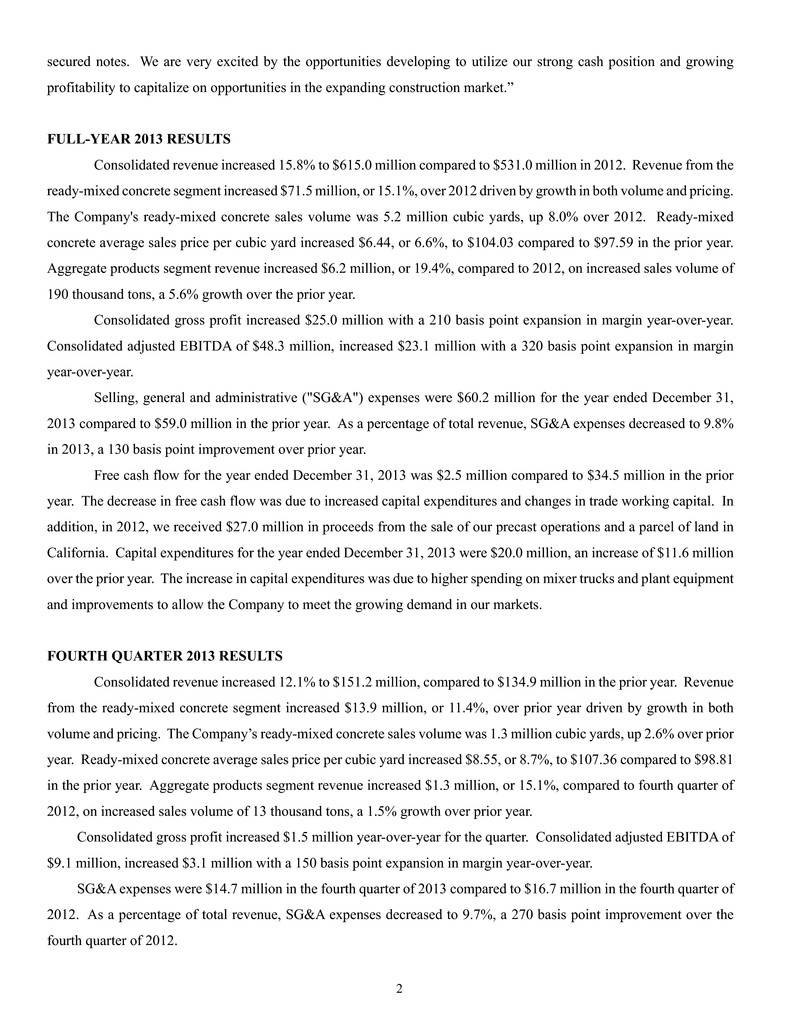

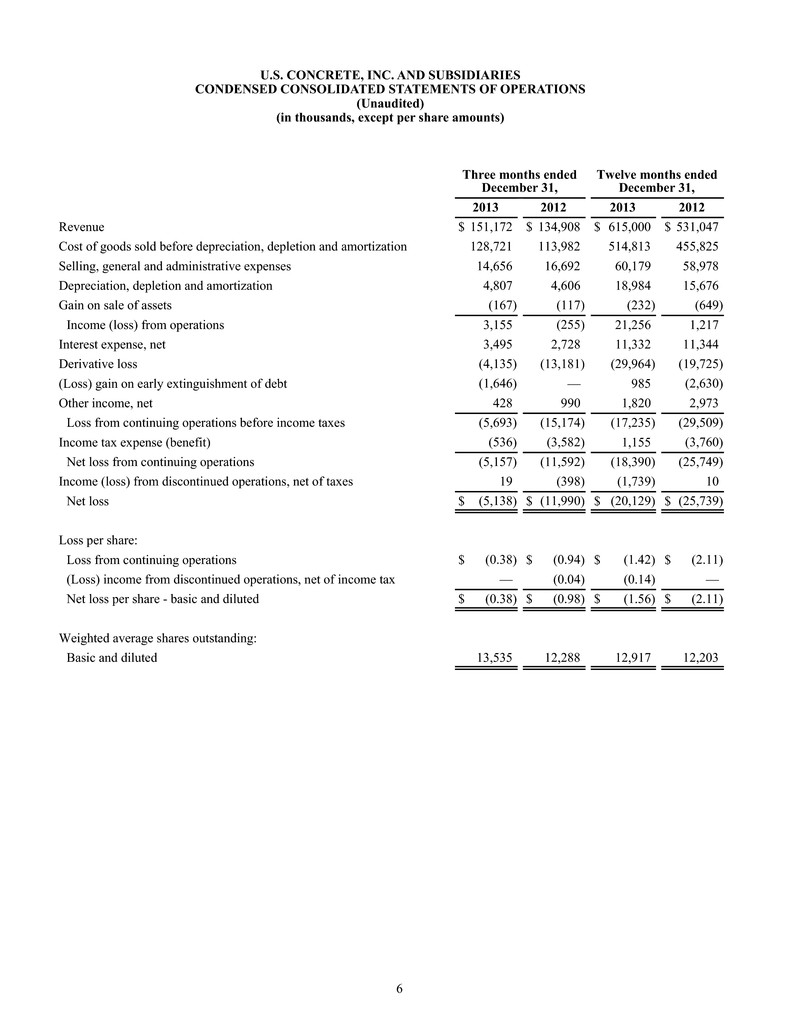

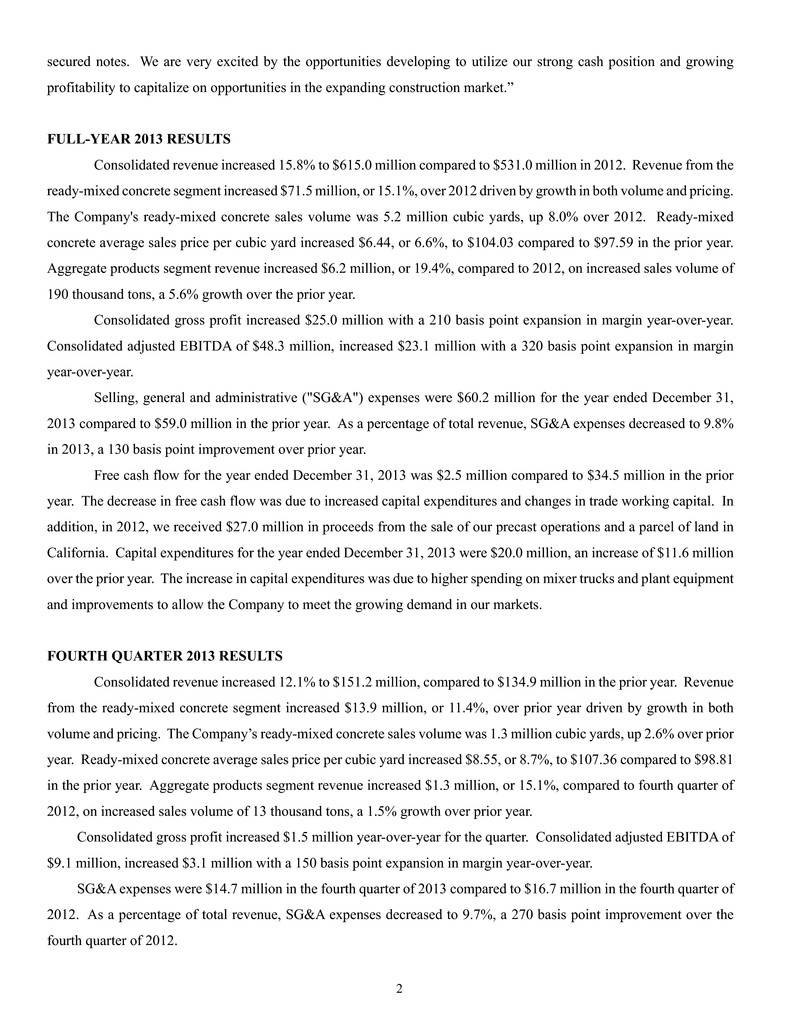

6 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (in thousands, except per share amounts) Three months ended December 31, Twelve months ended December 31, 2013 2012 2013 2012 Revenue $ 151,172 $ 134,908 $ 615,000 $ 531,047 Cost of goods sold before depreciation, depletion and amortization 128,721 113,982 514,813 455,825 Selling, general and administrative expenses 14,656 16,692 60,179 58,978 Depreciation, depletion and amortization 4,807 4,606 18,984 15,676 Gain on sale of assets (167) (117) (232) (649) Income (loss) from operations 3,155 (255) 21,256 1,217 Interest expense, net 3,495 2,728 11,332 11,344 Derivative loss (4,135) (13,181) (29,964) (19,725) (Loss) gain on early extinguishment of debt (1,646) — 985 (2,630) Other income, net 428 990 1,820 2,973 Loss from continuing operations before income taxes (5,693) (15,174) (17,235) (29,509) Income tax expense (benefit) (536) (3,582) 1,155 (3,760) Net loss from continuing operations (5,157) (11,592) (18,390) (25,749) Income (loss) from discontinued operations, net of taxes 19 (398) (1,739) 10 Net loss $ (5,138) $ (11,990) $ (20,129) $ (25,739) Loss per share: Loss from continuing operations $ (0.38) $ (0.94) $ (1.42) $ (2.11) (Loss) income from discontinued operations, net of income tax — (0.04) (0.14) — Net loss per share - basic and diluted $ (0.38) $ (0.98) $ (1.56) $ (2.11) Weighted average shares outstanding: Basic and diluted 13,535 12,288 12,917 12,203

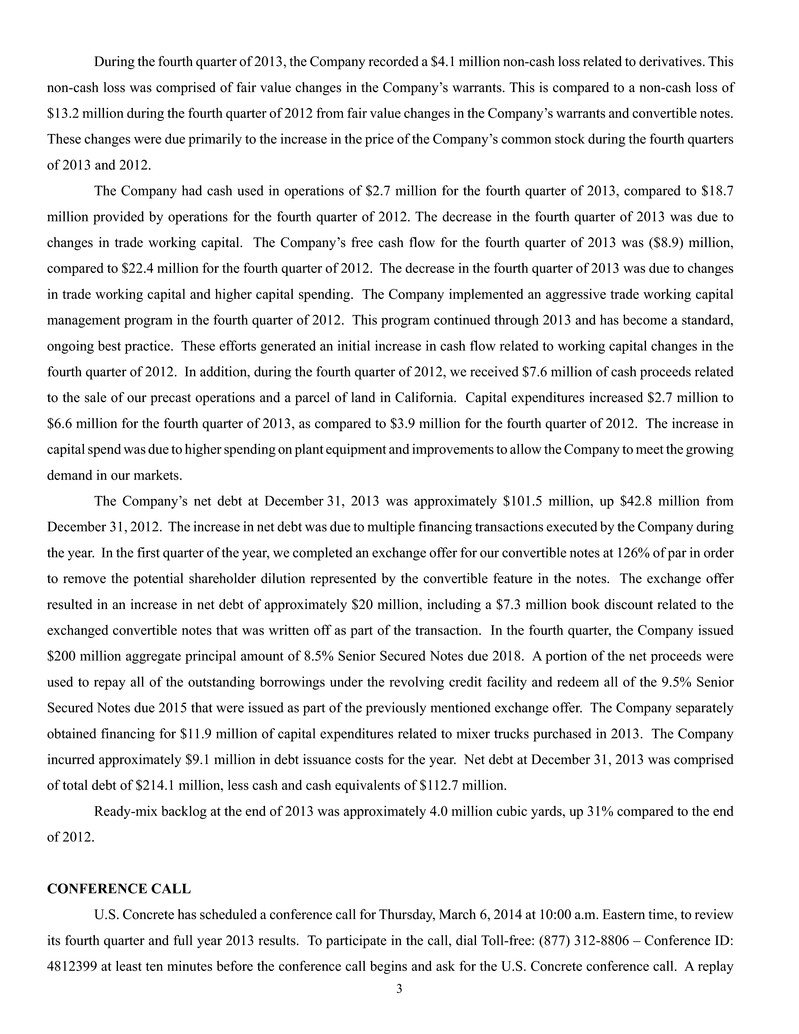

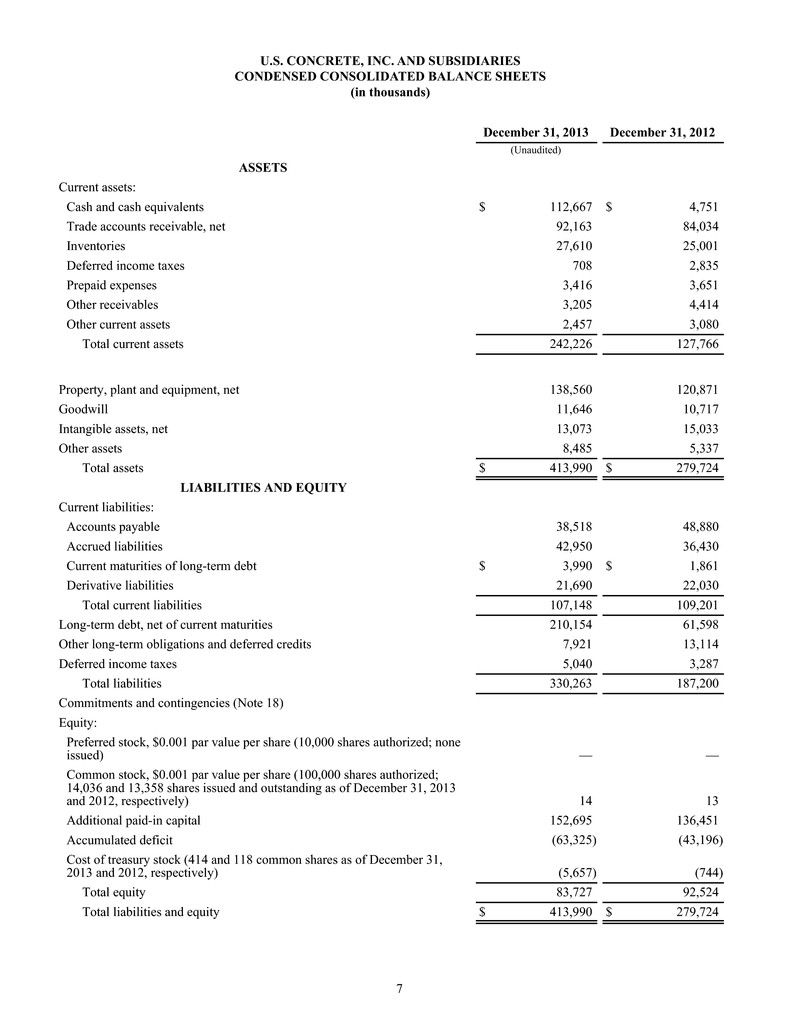

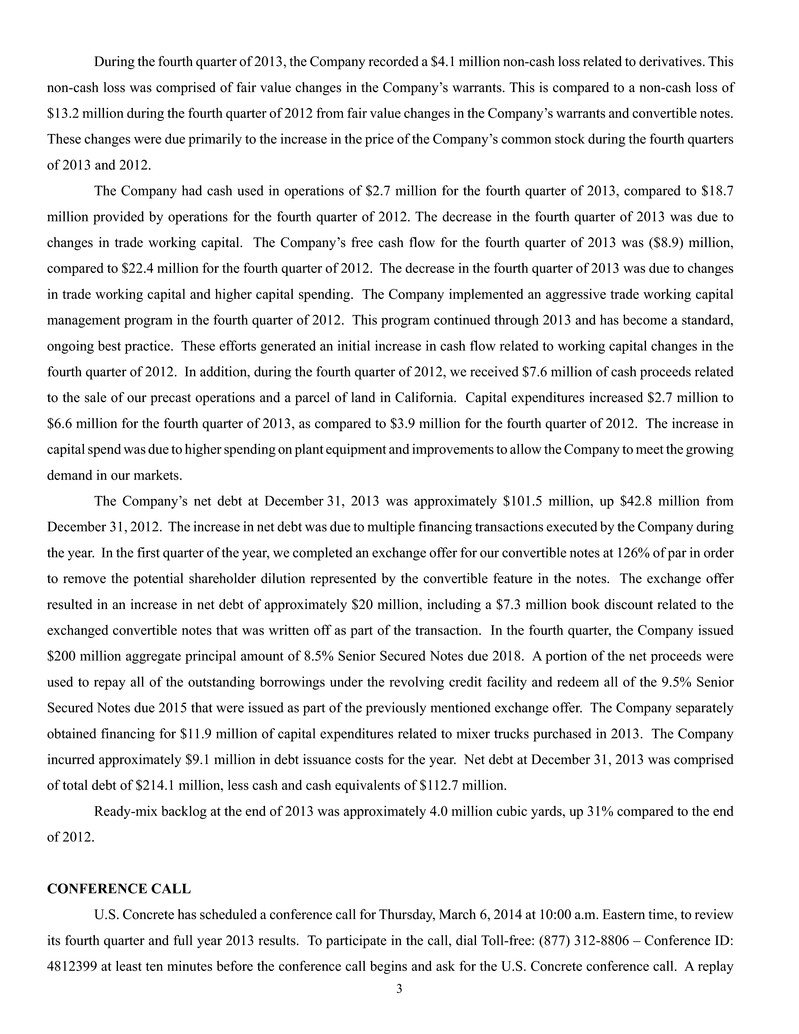

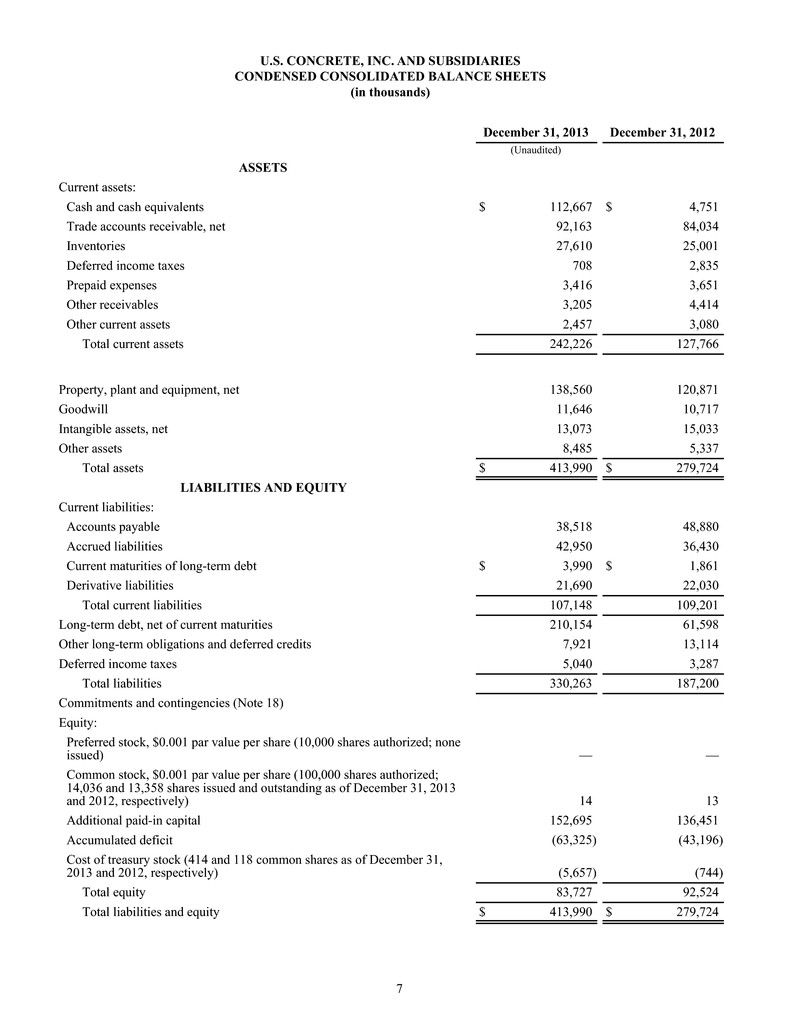

7 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) December 31, 2013 December 31, 2012 (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 112,667 $ 4,751 Trade accounts receivable, net 92,163 84,034 Inventories 27,610 25,001 Deferred income taxes 708 2,835 Prepaid expenses 3,416 3,651 Other receivables 3,205 4,414 Other current assets 2,457 3,080 Total current assets 242,226 127,766 Property, plant and equipment, net 138,560 120,871 Goodwill 11,646 10,717 Intangible assets, net 13,073 15,033 Other assets 8,485 5,337 Total assets $ 413,990 $ 279,724 LIABILITIES AND EQUITY Current liabilities: Accounts payable 38,518 48,880 Accrued liabilities 42,950 36,430 Current maturities of long-term debt $ 3,990 $ 1,861 Derivative liabilities 21,690 22,030 Total current liabilities 107,148 109,201 Long-term debt, net of current maturities 210,154 61,598 Other long-term obligations and deferred credits 7,921 13,114 Deferred income taxes 5,040 3,287 Total liabilities 330,263 187,200 Commitments and contingencies (Note 18) Equity: Preferred stock, $0.001 par value per share (10,000 shares authorized; none issued) — — Common stock, $0.001 par value per share (100,000 shares authorized; 14,036 and 13,358 shares issued and outstanding as of December 31, 2013 and 2012, respectively) 14 13 Additional paid-in capital 152,695 136,451 Accumulated deficit (63,325) (43,196) Cost of treasury stock (414 and 118 common shares as of December 31, 2013 and 2012, respectively) (5,657) (744) Total equity 83,727 92,524 Total liabilities and equity $ 413,990 $ 279,724

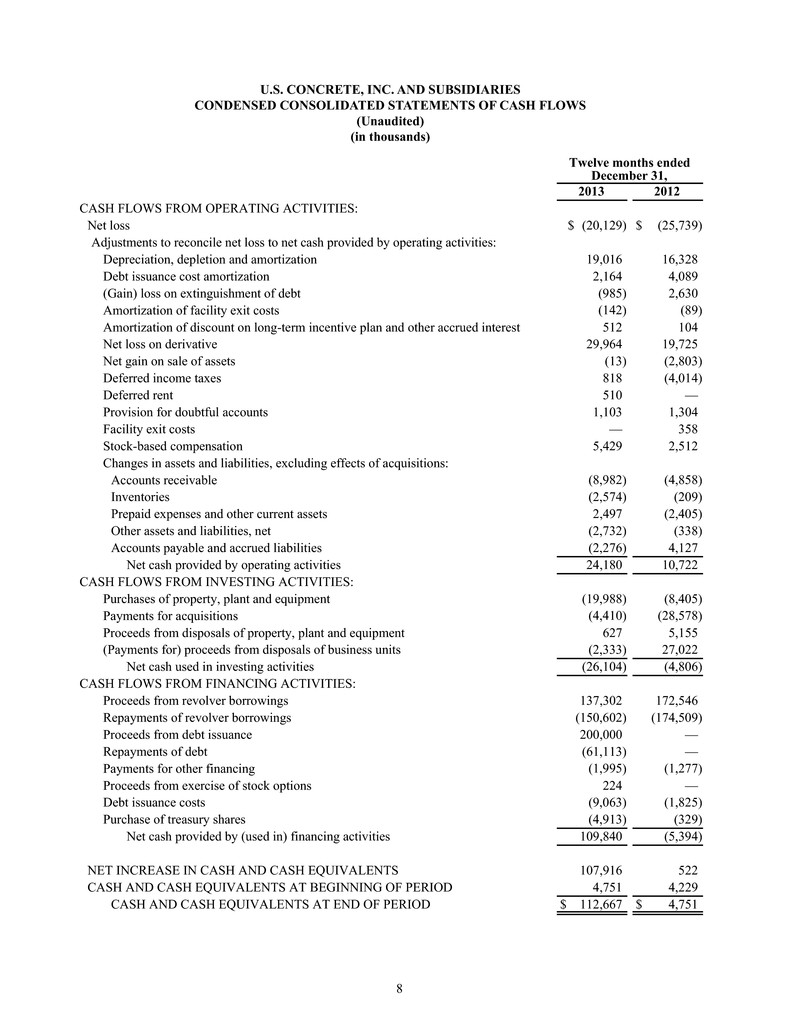

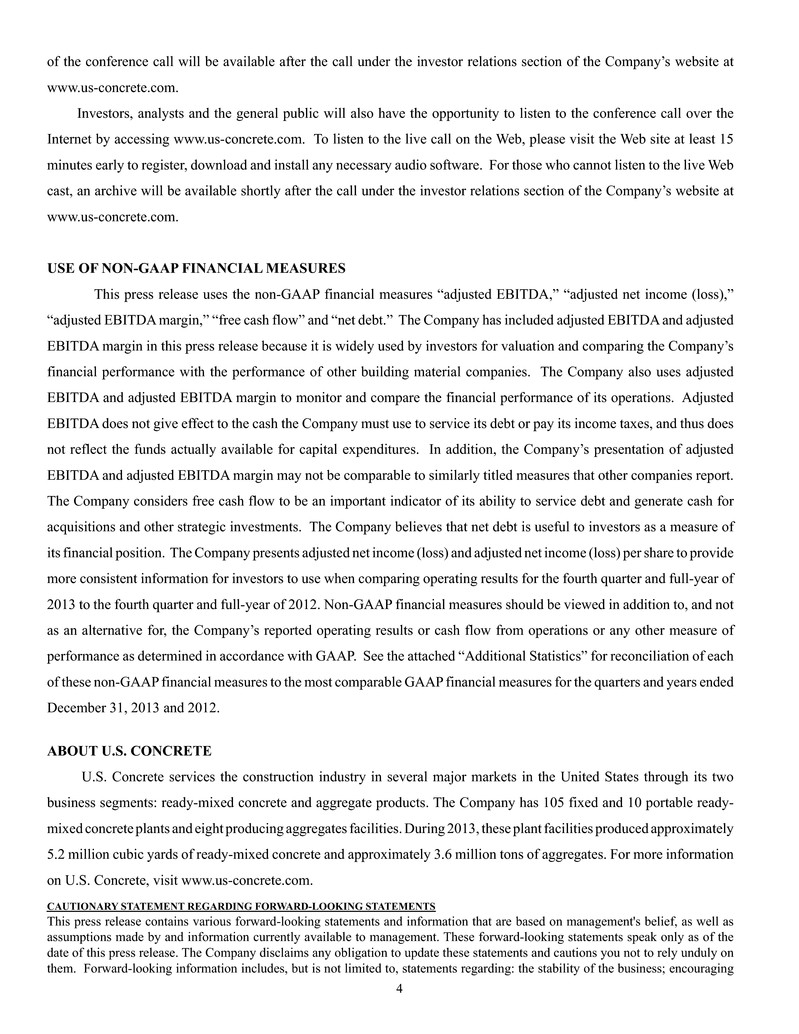

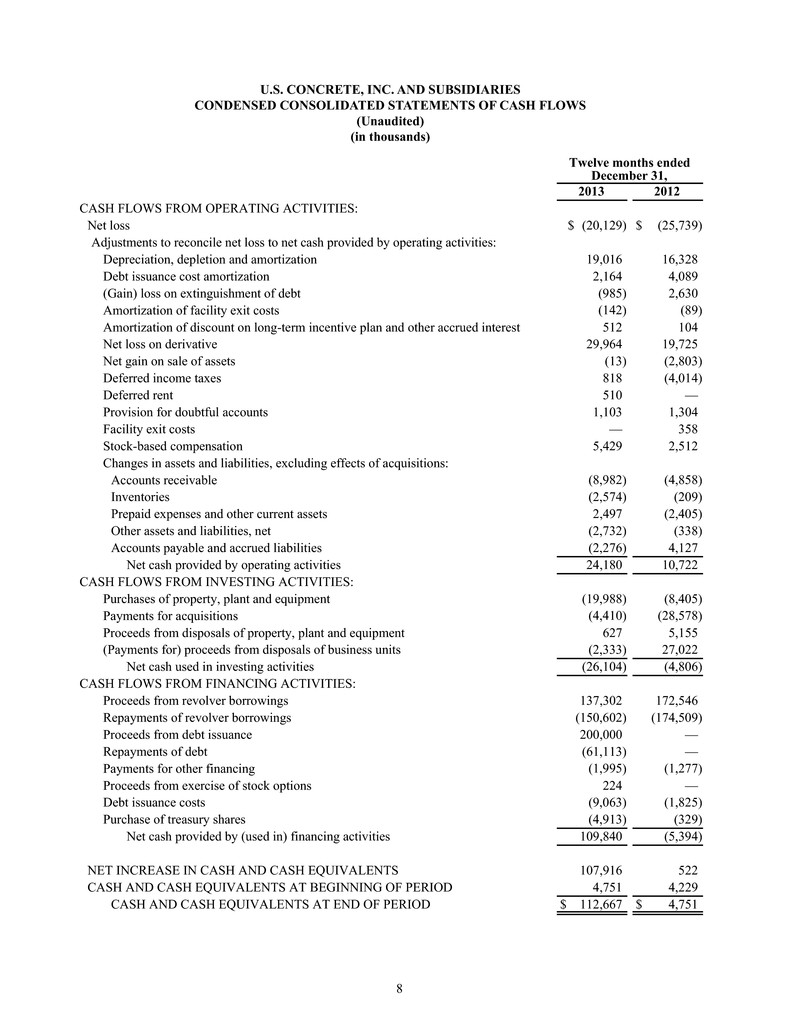

8 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (in thousands) Twelve months ended December 31, 2013 2012 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (20,129) $ (25,739) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation, depletion and amortization 19,016 16,328 Debt issuance cost amortization 2,164 4,089 (Gain) loss on extinguishment of debt (985) 2,630 Amortization of facility exit costs (142) (89) Amortization of discount on long-term incentive plan and other accrued interest 512 104 Net loss on derivative 29,964 19,725 Net gain on sale of assets (13) (2,803) Deferred income taxes 818 (4,014) Deferred rent 510 — Provision for doubtful accounts 1,103 1,304 Facility exit costs — 358 Stock-based compensation 5,429 2,512 Changes in assets and liabilities, excluding effects of acquisitions: Accounts receivable (8,982) (4,858) Inventories (2,574) (209) Prepaid expenses and other current assets 2,497 (2,405) Other assets and liabilities, net (2,732) (338) Accounts payable and accrued liabilities (2,276) 4,127 Net cash provided by operating activities 24,180 10,722 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property, plant and equipment (19,988) (8,405) Payments for acquisitions (4,410) (28,578) Proceeds from disposals of property, plant and equipment 627 5,155 (Payments for) proceeds from disposals of business units (2,333) 27,022 Net cash used in investing activities (26,104) (4,806) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from revolver borrowings 137,302 172,546 Repayments of revolver borrowings (150,602) (174,509) Proceeds from debt issuance 200,000 — Repayments of debt (61,113) — Payments for other financing (1,995) (1,277) Proceeds from exercise of stock options 224 — Debt issuance costs (9,063) (1,825) Purchase of treasury shares (4,913) (329) Net cash provided by (used in) financing activities 109,840 (5,394) NET INCREASE IN CASH AND CASH EQUIVALENTS 107,916 522 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 4,751 4,229 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 112,667 $ 4,751

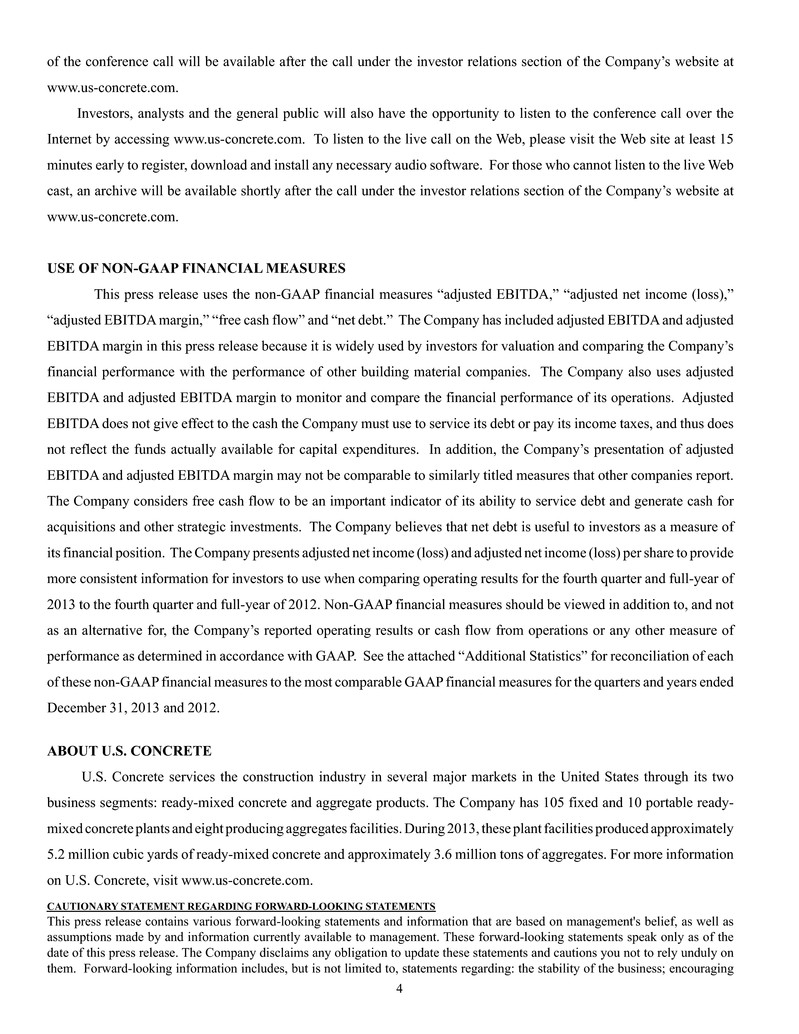

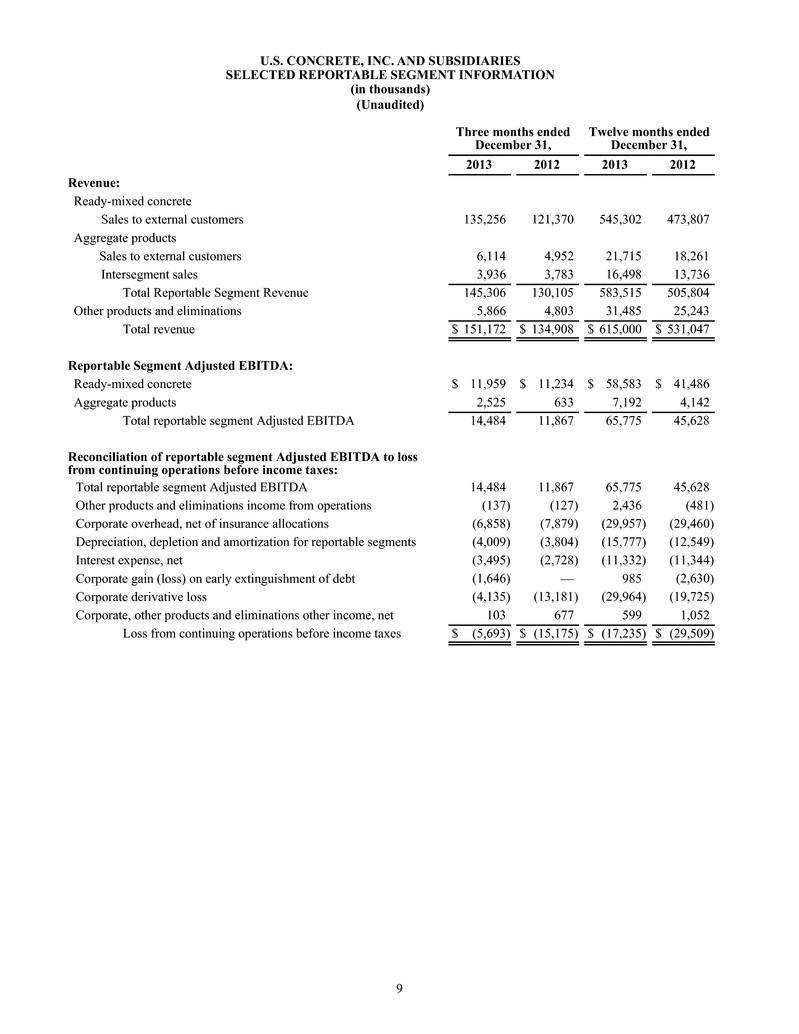

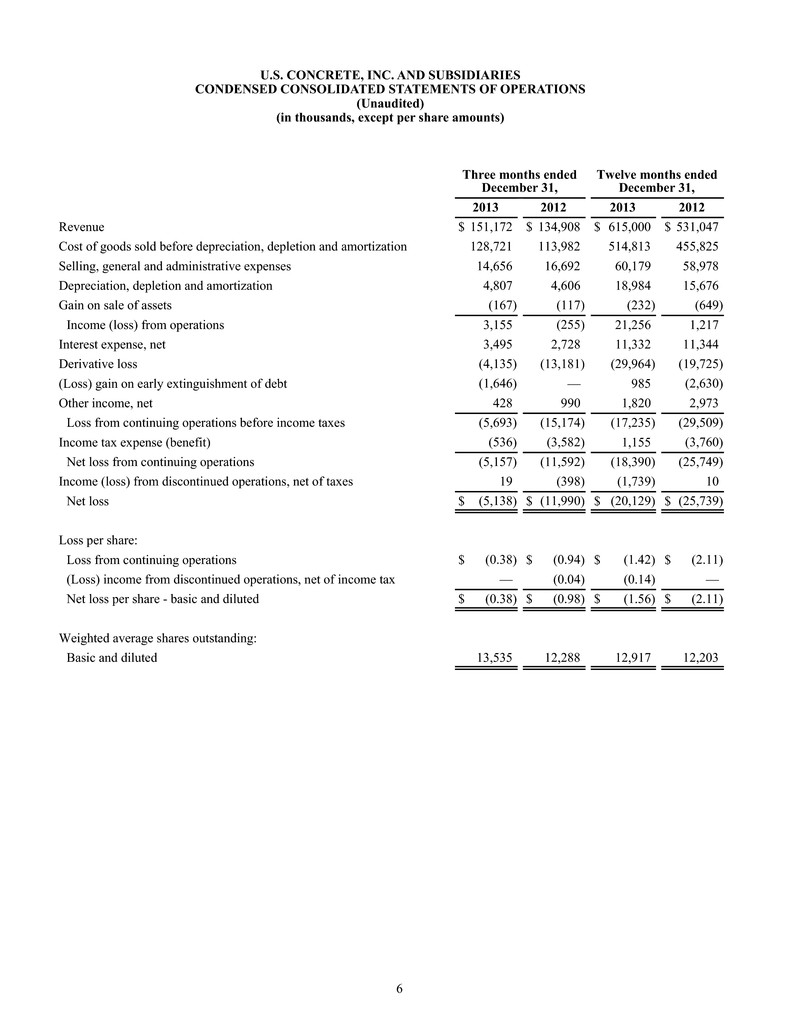

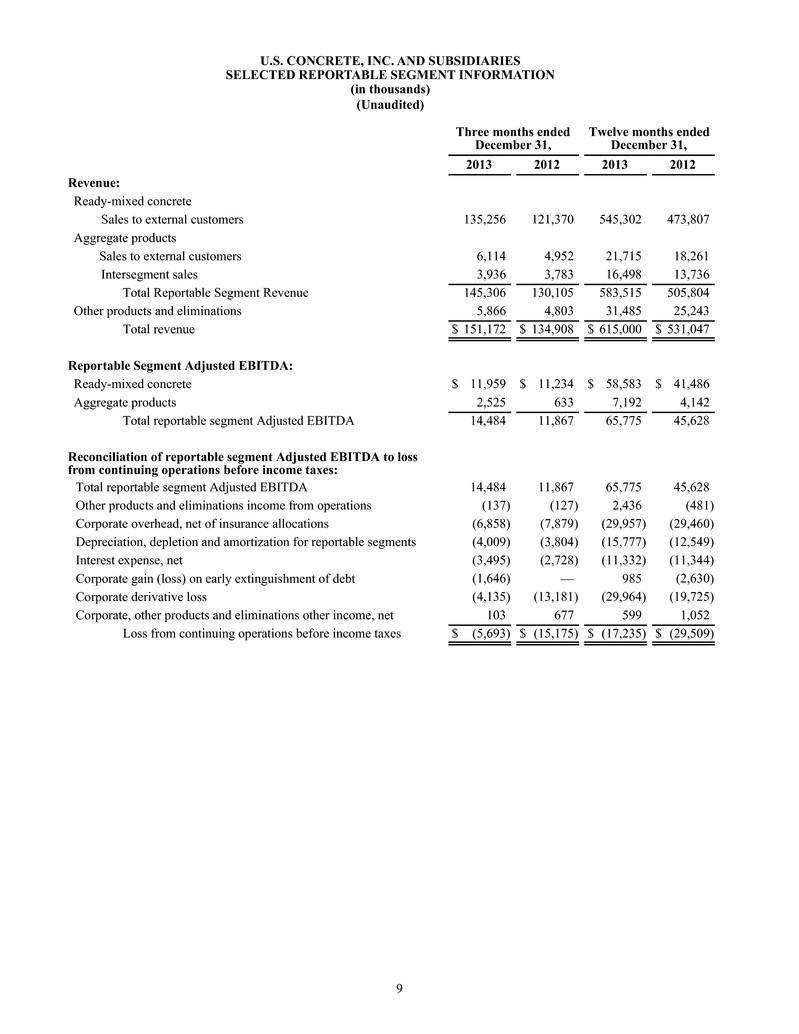

9 U.S. CONCRETE, INC. AND SUBSIDIARIES SELECTED REPORTABLE SEGMENT INFORMATION (in thousands) (Unaudited) Three months ended December 31, Twelve months ended December 31, 2013 2012 2013 2012 Revenue: Ready-mixed concrete Sales to external customers 135,256 121,370 545,302 473,807 Aggregate products Sales to external customers 6,114 4,952 21,715 18,261 Intersegment sales 3,936 3,783 16,498 13,736 Total Reportable Segment Revenue 145,306 130,105 583,515 505,804 Other products and eliminations 5,866 4,803 31,485 25,243 Total revenue $ 151,172 $ 134,908 $ 615,000 $ 531,047 Reportable Segment Adjusted EBITDA: Ready-mixed concrete $ 11,959 $ 11,234 $ 58,583 $ 41,486 Aggregate products 2,525 633 7,192 4,142 Total reportable segment Adjusted EBITDA 14,484 11,867 65,775 45,628 Reconciliation of reportable segment Adjusted EBITDA to loss from continuing operations before income taxes: Total reportable segment Adjusted EBITDA 14,484 11,867 65,775 45,628 Other products and eliminations income from operations (137) (127) 2,436 (481) Corporate overhead, net of insurance allocations (6,858) (7,879) (29,957) (29,460) Depreciation, depletion and amortization for reportable segments (4,009) (3,804) (15,777) (12,549) Interest expense, net (3,495) (2,728) (11,332) (11,344) Corporate gain (loss) on early extinguishment of debt (1,646) — 985 (2,630) Corporate derivative loss (4,135) (13,181) (29,964) (19,725) Corporate, other products and eliminations other income, net 103 677 599 1,052 Loss from continuing operations before income taxes $ (5,693) $ (15,175) $ (17,235) $ (29,509)

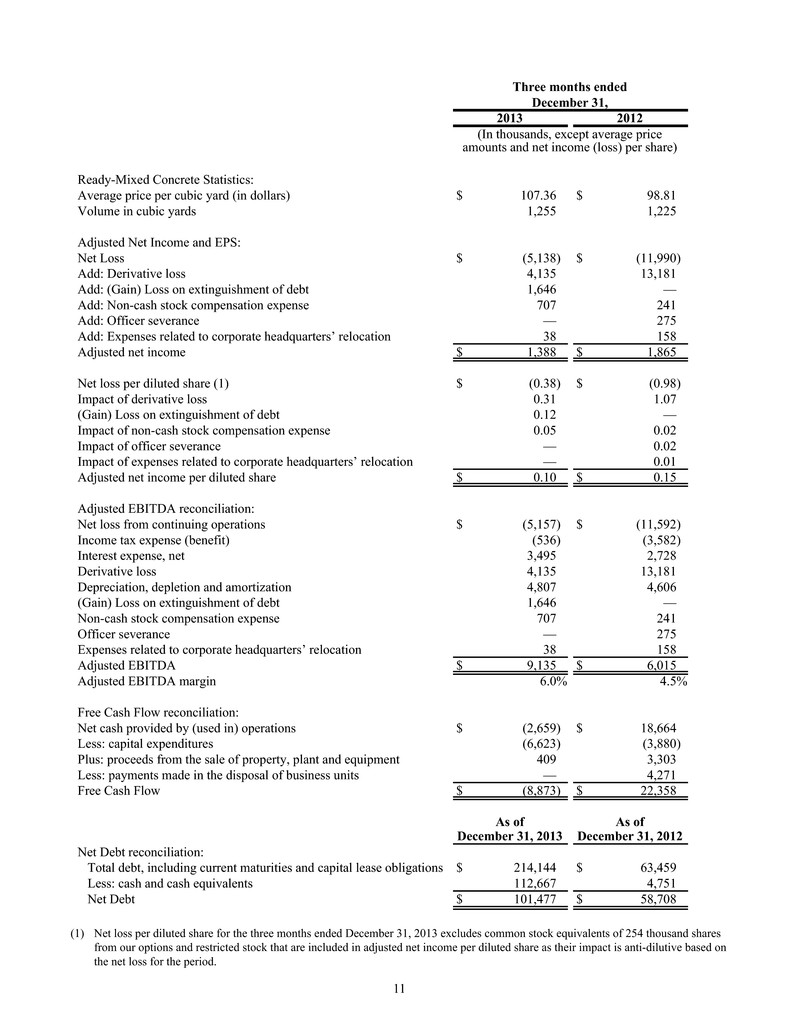

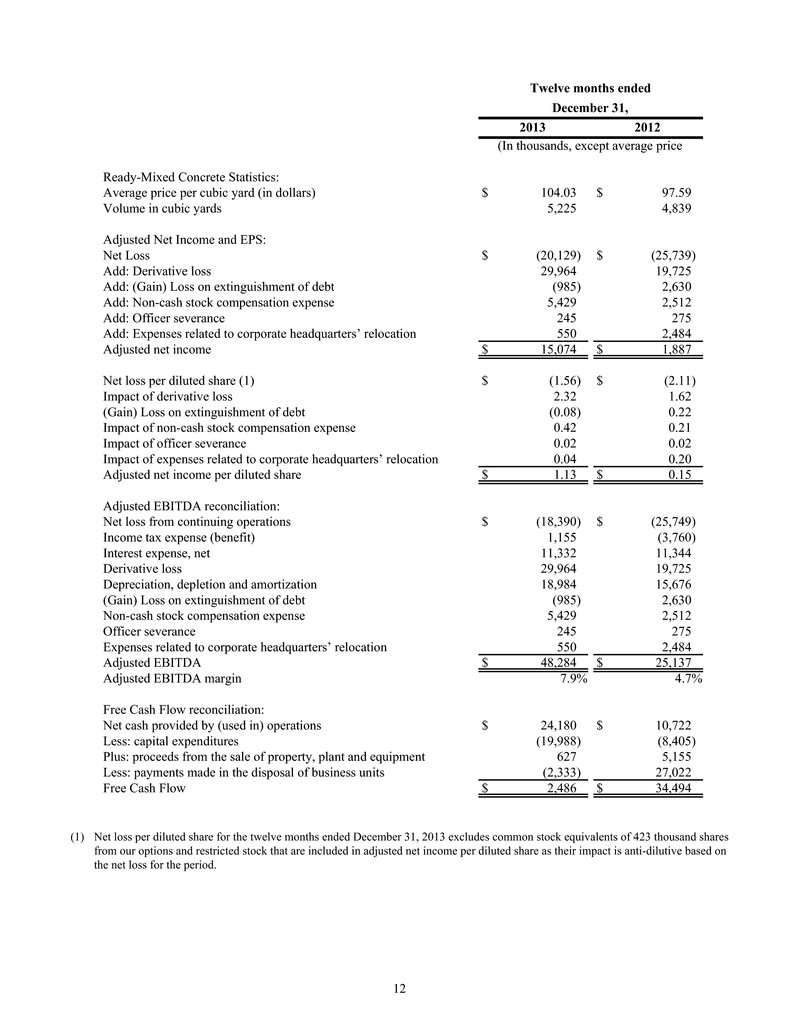

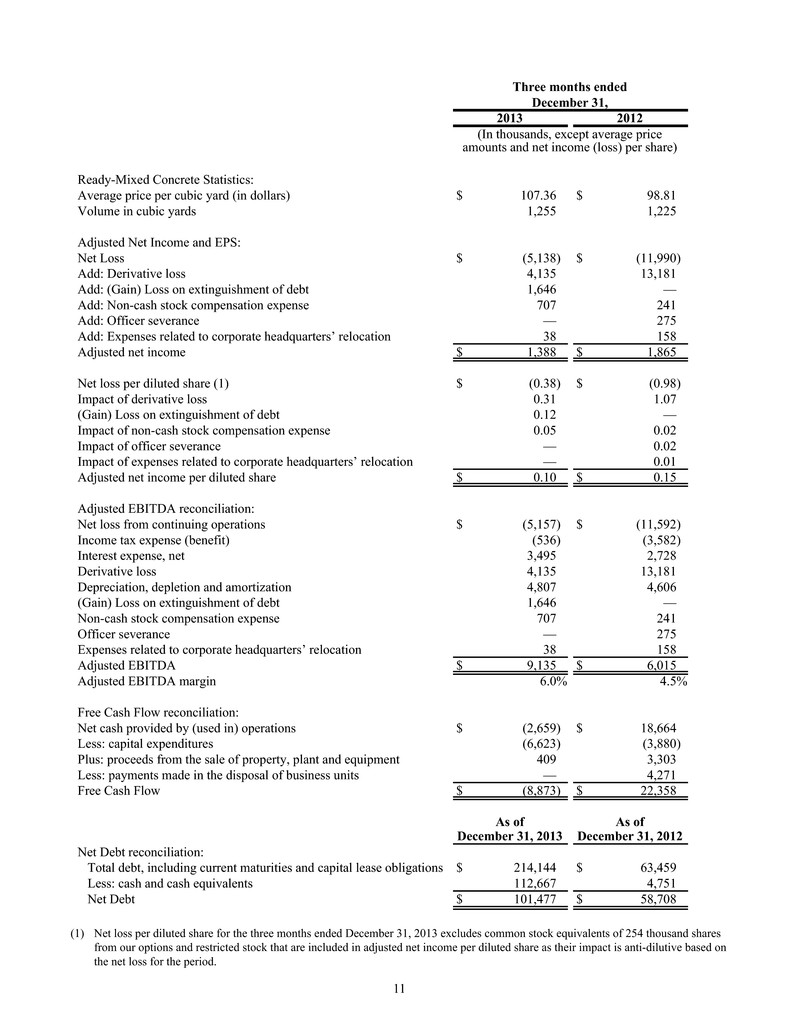

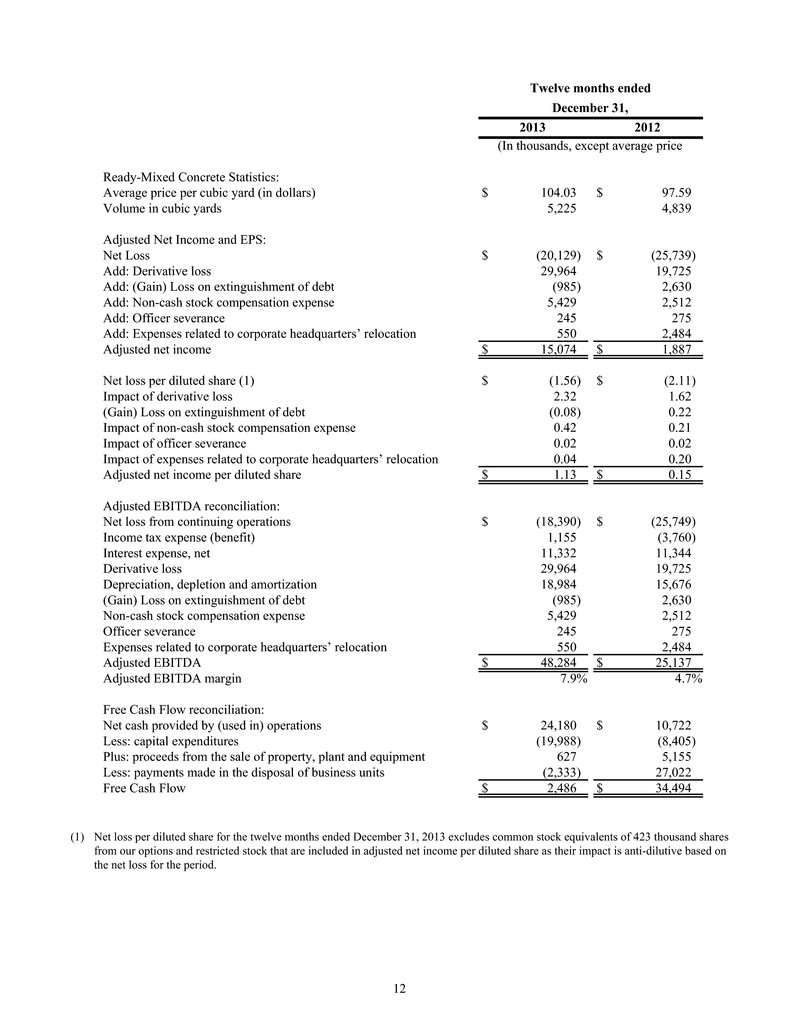

10 U.S. CONCRETE, INC. ADDITIONAL STATISTICS (Unaudited) We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the table below for (1) presentations of our adjusted EBITDA, adjusted EBITDA margin and Free Cash Flow for the quarters and years ended December 31, 2013 and 2012, and Net Debt as of December 31, 2013 and December 31, 2012 and (2) corresponding reconciliations to GAAP financial measures for the quarters and years ended December 31, 2013 and 2012 and as of December 31, 2013 and December 31, 2012. We have also provided below (1) the impact of non-cash stock compensation expense, derivative losses, gain (loss) on extinguishment of debt, officer severance and expenses related to the Company’s relocation of the corporate headquarters on net income (loss) and net income (loss) per share and (2) corresponding reconciliations to GAAP financial measures for the quarters and years ended December 31, 2013 and 2012. We have also shown below certain Ready-Mixed Concrete Statistics for the quarters and years ended December 31, 2013 and 2012. We define adjusted EBITDA as our net income (loss) from continuing operations, plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, non-cash stock compensation expense, derivative loss, gain (loss) on extinguishment of debt, officer severance and expense related to the Company’s relocation of the corporate headquarters. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA and adjusted EBITDA margin to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report. We define adjusted net income (loss) and adjusted net income (loss) per share as net income (loss) and net income (loss) per share excluding non-cash stock compensation expense, derivative loss, gain (loss) on extinguishment of debt, officer severance and expense related to the Company’s relocation of the corporate headquarters. We present adjusted net income (loss) and adjusted net income (loss) per share to provide more consistent information for investors to use when comparing operating results for the quarters and years ended December 31, 2013 and 2012. We define Free Cash Flow as cash provided by (used in) operations less capital expenditures for property, plant and equipment, net of disposals. We consider Free Cash Flow to be an important indicator of our ability to service our debt and generate cash for acquisitions and other strategic investments. We define Net Debt as total debt, including current maturities and capital lease obligations, minus cash and cash equivalents. We believe that Net Debt is useful to investors as a measure of our financial position. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP.

11 Three months ended December 31, 2013 2012 (In thousands, except average price amounts and net income (loss) per share) Ready-Mixed Concrete Statistics: Average price per cubic yard (in dollars) $ 107.36 $ 98.81 Volume in cubic yards 1,255 1,225 Adjusted Net Income and EPS: Net Loss $ (5,138) $ (11,990) Add: Derivative loss 4,135 13,181 Add: (Gain) Loss on extinguishment of debt 1,646 — Add: Non-cash stock compensation expense 707 241 Add: Officer severance — 275 Add: Expenses related to corporate headquarters’ relocation 38 158 Adjusted net income $ 1,388 $ 1,865 Net loss per diluted share (1) $ (0.38) $ (0.98) Impact of derivative loss 0.31 1.07 (Gain) Loss on extinguishment of debt 0.12 — Impact of non-cash stock compensation expense 0.05 0.02 Impact of officer severance — 0.02 Impact of expenses related to corporate headquarters’ relocation — 0.01 Adjusted net income per diluted share $ 0.10 $ 0.15 Adjusted EBITDA reconciliation: Net loss from continuing operations $ (5,157) $ (11,592) Income tax expense (benefit) (536) (3,582) Interest expense, net 3,495 2,728 Derivative loss 4,135 13,181 Depreciation, depletion and amortization 4,807 4,606 (Gain) Loss on extinguishment of debt 1,646 — Non-cash stock compensation expense 707 241 Officer severance — 275 Expenses related to corporate headquarters’ relocation 38 158 Adjusted EBITDA $ 9,135 $ 6,015 Adjusted EBITDA margin 6.0% 4.5% Free Cash Flow reconciliation: Net cash provided by (used in) operations $ (2,659) $ 18,664 Less: capital expenditures (6,623) (3,880) Plus: proceeds from the sale of property, plant and equipment 409 3,303 Less: payments made in the disposal of business units — 4,271 Free Cash Flow $ (8,873) $ 22,358 As of As of December 31, 2013 December 31, 2012 Net Debt reconciliation: Total debt, including current maturities and capital lease obligations $ 214,144 $ 63,459 Less: cash and cash equivalents 112,667 4,751 Net Debt $ 101,477 $ 58,708 (1) Net loss per diluted share for the three months ended December 31, 2013 excludes common stock equivalents of 254 thousand shares from our options and restricted stock that are included in adjusted net income per diluted share as their impact is anti-dilutive based on the net loss for the period.

12 Twelve months ended December 31, 2013 2012 (In thousands, except average price Ready-Mixed Concrete Statistics: Average price per cubic yard (in dollars) $ 104.03 $ 97.59 Volume in cubic yards 5,225 4,839 Adjusted Net Income and EPS: Net Loss $ (20,129) $ (25,739) Add: Derivative loss 29,964 19,725 Add: (Gain) Loss on extinguishment of debt (985) 2,630 Add: Non-cash stock compensation expense 5,429 2,512 Add: Officer severance 245 275 Add: Expenses related to corporate headquarters’ relocation 550 2,484 Adjusted net income $ 15,074 $ 1,887 Net loss per diluted share (1) $ (1.56) $ (2.11) Impact of derivative loss 2.32 1.62 (Gain) Loss on extinguishment of debt (0.08) 0.22 Impact of non-cash stock compensation expense 0.42 0.21 Impact of officer severance 0.02 0.02 Impact of expenses related to corporate headquarters’ relocation 0.04 0.20 Adjusted net income per diluted share $ 1.13 $ 0.15 Adjusted EBITDA reconciliation: Net loss from continuing operations $ (18,390) $ (25,749) Income tax expense (benefit) 1,155 (3,760) Interest expense, net 11,332 11,344 Derivative loss 29,964 19,725 Depreciation, depletion and amortization 18,984 15,676 (Gain) Loss on extinguishment of debt (985) 2,630 Non-cash stock compensation expense 5,429 2,512 Officer severance 245 275 Expenses related to corporate headquarters’ relocation 550 2,484 Adjusted EBITDA $ 48,284 $ 25,137 Adjusted EBITDA margin 7.9% 4.7% Free Cash Flow reconciliation: Net cash provided by (used in) operations $ 24,180 $ 10,722 Less: capital expenditures (19,988) (8,405) Plus: proceeds from the sale of property, plant and equipment 627 5,155 Less: payments made in the disposal of business units (2,333) 27,022 Free Cash Flow $ 2,486 $ 34,494 (1) Net loss per diluted share for the twelve months ended December 31, 2013 excludes common stock equivalents of 423 thousand shares from our options and restricted stock that are included in adjusted net income per diluted share as their impact is anti-dilutive based on the net loss for the period.