1 U.S. CONCRETE ANNOUNCES 2015 SECOND QUARTER RESULTS Second Quarter 2015 Highlights Compared to Second Quarter 2014 • Adjusted earnings per diluted share increased 67.9% to $1.31 • Adjusted EBITDA increased 50.3% to $33.7 million • Adjusted EBITDA margin improved 140 basis points to 13.8% • Consolidated revenue increased 35.7% to $244.7 million • Ready-mixed concrete revenue increased 33.4% to $219.0 million • Ready-mixed concrete average sales price improved 11.8% to $123.24 per cubic yard • Aggregate products revenue increased 19.1% to $15.6 million • Aggregate products average sales price improved 8.4% to $10.44 per ton • Acquired three leading ready-mixed producers in key growth markets, including two which solidified the Company's established presence in the New York metro and northern New Jersey regions, and a third which expanded existing metro Washington D.C operations into Northern Virginia EULESS, TEXAS – August 6, 2015 – U.S. Concrete, Inc. (NASDAQ: USCR), a leading producer of construction materials in select major markets across the United States, today reported results for the second quarter ended June 30, 2015. In the second quarter of 2015, Adjusted EBITDA increased to $33.7 million, compared to $22.4 million in the prior year quarter. Adjusted EBITDA margin as a percentage of revenue improved to 13.8%, compared to 12.4% in the prior year quarter. William J. Sandbrook, President and Chief Executive Officer of U.S. Concrete, stated, "We are pleased with the strong improvement in our profits during the second quarter, in which we met or exceeded expectations across nearly all of our key metrics. We achieved another quarter of steady price gains while also benefiting from improved underlying volume trends in our markets, despite weather related impacts in Texas. The significant increase in consolidated revenue, Adjusted EBITDA and earnings per share is a direct result of the steps we have taken to further solidify our leadership positions within our core markets through accretive acquisitions. During the quarter we completed three highly strategic acquisitions which significantly strengthened our existing operations in the greater New York and Washington D.C areas and we are already making meaningful progress on integrating these newly added assets. In June, we sold the remaining assets of our precast operations, which was highly aligned with our strategic direction to continue expanding our Company into our attractive heavy material categories. Into the back half of 2015, we are encouraged by our healthy backlog of activity across our well- structured markets to continue growing our business and enhancing our returns.”

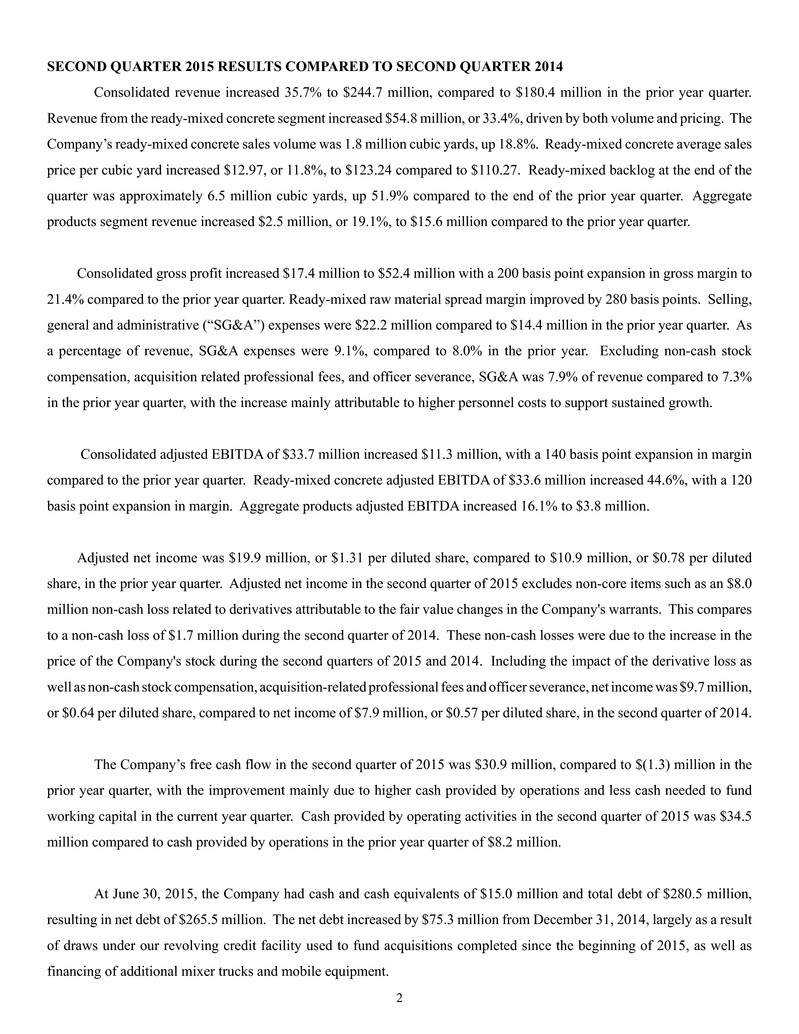

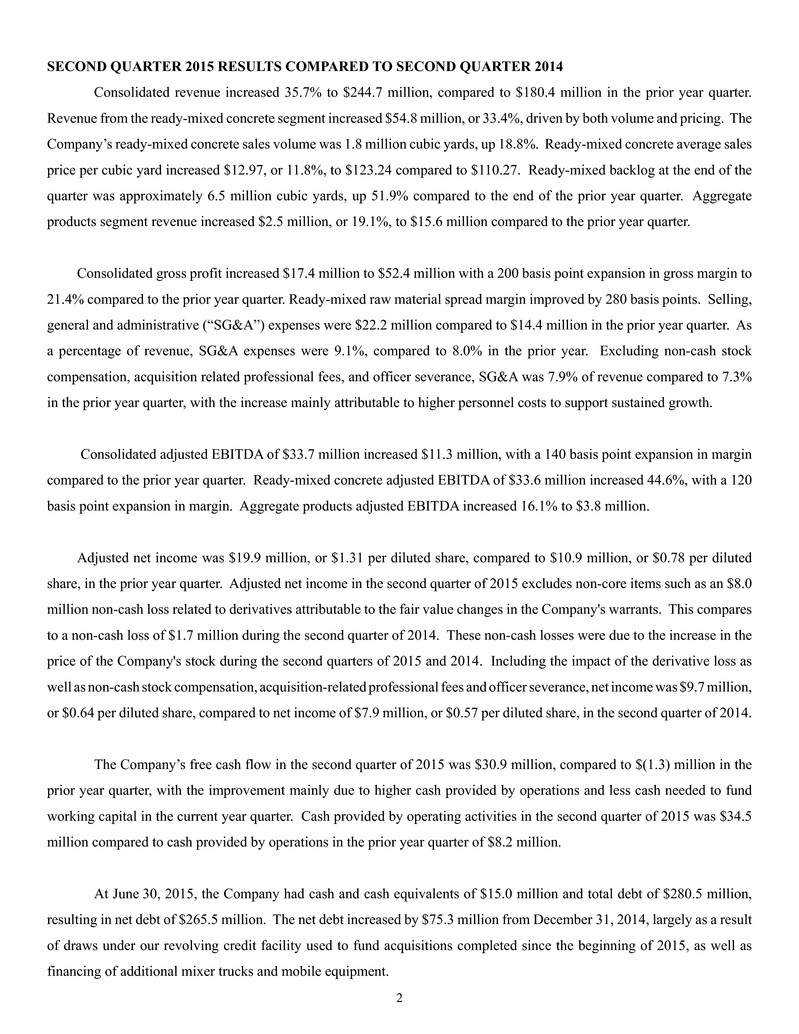

2 SECOND QUARTER 2015 RESULTS COMPARED TO SECOND QUARTER 2014 Consolidated revenue increased 35.7% to $244.7 million, compared to $180.4 million in the prior year quarter. Revenue from the ready-mixed concrete segment increased $54.8 million, or 33.4%, driven by both volume and pricing. The Company’s ready-mixed concrete sales volume was 1.8 million cubic yards, up 18.8%. Ready-mixed concrete average sales price per cubic yard increased $12.97, or 11.8%, to $123.24 compared to $110.27. Ready-mixed backlog at the end of the quarter was approximately 6.5 million cubic yards, up 51.9% compared to the end of the prior year quarter. Aggregate products segment revenue increased $2.5 million, or 19.1%, to $15.6 million compared to the prior year quarter. Consolidated gross profit increased $17.4 million to $52.4 million with a 200 basis point expansion in gross margin to 21.4% compared to the prior year quarter. Ready-mixed raw material spread margin improved by 280 basis points. Selling, general and administrative (“SG&A”) expenses were $22.2 million compared to $14.4 million in the prior year quarter. As a percentage of revenue, SG&A expenses were 9.1%, compared to 8.0% in the prior year. Excluding non-cash stock compensation, acquisition related professional fees, and officer severance, SG&A was 7.9% of revenue compared to 7.3% in the prior year quarter, with the increase mainly attributable to higher personnel costs to support sustained growth. Consolidated adjusted EBITDA of $33.7 million increased $11.3 million, with a 140 basis point expansion in margin compared to the prior year quarter. Ready-mixed concrete adjusted EBITDA of $33.6 million increased 44.6%, with a 120 basis point expansion in margin. Aggregate products adjusted EBITDA increased 16.1% to $3.8 million. Adjusted net income was $19.9 million, or $1.31 per diluted share, compared to $10.9 million, or $0.78 per diluted share, in the prior year quarter. Adjusted net income in the second quarter of 2015 excludes non-core items such as an $8.0 million non-cash loss related to derivatives attributable to the fair value changes in the Company's warrants. This compares to a non-cash loss of $1.7 million during the second quarter of 2014. These non-cash losses were due to the increase in the price of the Company's stock during the second quarters of 2015 and 2014. Including the impact of the derivative loss as well as non-cash stock compensation, acquisition-related professional fees and officer severance, net income was $9.7 million, or $0.64 per diluted share, compared to net income of $7.9 million, or $0.57 per diluted share, in the second quarter of 2014. The Company’s free cash flow in the second quarter of 2015 was $30.9 million, compared to $(1.3) million in the prior year quarter, with the improvement mainly due to higher cash provided by operations and less cash needed to fund working capital in the current year quarter. Cash provided by operating activities in the second quarter of 2015 was $34.5 million compared to cash provided by operations in the prior year quarter of $8.2 million. At June 30, 2015, the Company had cash and cash equivalents of $15.0 million and total debt of $280.5 million, resulting in net debt of $265.5 million. The net debt increased by $75.3 million from December 31, 2014, largely as a result of draws under our revolving credit facility used to fund acquisitions completed since the beginning of 2015, as well as financing of additional mixer trucks and mobile equipment.

3 ACQUISITIONS AND DISPOSITIONS In April 2015, the Company acquired Ferrara Bros. Building Materials Corp. ("Ferrara Bros."), in New York, N.Y. Ferrara Bros. operates six ready-mixed concrete batch plants from four well-situated locations in New York and New Jersey, and has a fleet of 89 mixer trucks. This acquisition significantly expanded U.S. Concrete's footprint in the New York metropolitan market and further positions the Company to serve additional construction projects in Manhattan. In May 2015, the Company acquired Colonial Concrete Company ("Colonial"), in Newark, N.J. Colonial has an established and respected market presence in New Jersey with over 35 years of operating experience serving the commercial and residential end markets through its four ready-mixed concrete batch plants and fleet of approximately 40 mixer trucks. In May 2015, the Company acquired DuBrook Concrete, Inc. located in Chantilly, VA., which significantly expanded the Company's service footprint in the Washington, D.C. metropolitan area with the addition of three ready-mixed concrete batch plants and a fleet of 42 mixer trucks. In June 2015, the Company completed the sale of the remaining assets of the U.S. Concrete Precast Group, which consisted of an architectural precast plant operating in Middleburg, PA. The transaction represented the final divestiture of the Company's formerly owned assets relating to precast concrete operations. CONFERENCE CALL AND WEBCAST DETAILS U.S. Concrete will host a conference call on Thursday, August 6, 2015 at 10:00 a.m. Eastern time (9:00 a.m. Central), to review its second quarter 2015 results. To participate in the call, please dial (877) 312-8806 – Conference ID: 93422779 at least ten minutes before the conference call begins and ask for the U.S. Concrete conference call. A live webcast will be available on the Investor Relations section of the Company's website at www.us-concrete.com. Please visit the website at least 15 minutes before the call begins to register, download and install any necessary audio software. A replay of the conference call and archive of the webcast will be available shortly after the call under the investor relations section of the Company’s website at www.us-concrete.com. ABOUT U.S. CONCRETE U.S. Concrete is a leading producer of construction materials in several major markets in the United States through its two business segments: ready-mixed concrete and aggregate products. The Company has 139 standard ready-mixed concrete plants, 16 volumetric ready-mixed concrete facilities, and 10 producing aggregates facilities. During 2014, U.S. Concrete sold approximately 5.7 million cubic yards of ready-mixed concrete and approximately 4.7 million tons of aggregates. For more information on U.S. Concrete, visit www.us-concrete.com.

4 USE OF NON-GAAP FINANCIAL MEASURES This press release uses the non-GAAP financial measures “adjusted EBITDA,” “adjusted net income (loss),” “adjusted EBITDA margin,” “free cash flow” and “net debt.” The Company has included adjusted EBITDA and adjusted EBITDA margin in this press release because it is widely used by investors for valuation and comparing the Company’s financial performance with the performance of other building material companies. The Company also uses adjusted EBITDA and adjusted EBITDA margin to monitor and compare the financial performance of its operations. Adjusted EBITDA does not give effect to the cash the Company must use to service its debt or pay its income taxes, and thus does not reflect the funds actually available for capital expenditures. In addition, the Company’s presentation of adjusted EBITDA and adjusted EBITDA margin may not be comparable to similarly titled measures that other companies report. The Company considers free cash flow to be an important indicator of its ability to service debt and generate cash for acquisitions and other strategic investments. The Company believes that net debt is useful to investors as a measure of its financial position. The Company presents adjusted net income (loss) and adjusted net income (loss) per share to provide more consistent information for investors to use when comparing operating results for the second quarter of 2015 to the second quarter of 2014. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported operating results or cash flow from operations or any other measure of performance as determined in accordance with GAAP. See the attached “Selected Reportable Operating and Financial Information” for reconciliation of each of these non-GAAP financial measures to the most comparable GAAP financial measures for the quarters ended June 30, 2015 and 2014. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This press release contains various forward-looking statements and information that are based on management's belief, as well as assumptions made by and information currently available to management. These forward-looking statements speak only as of the date of this press release. The Company disclaims any obligation to update these forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by federal securities laws, and cautions you not to rely unduly on them. Forward-looking information includes, but is not limited to, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies and anticipated trends in our business. These statements are predictions based on our current expectations and projects about future events. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that those expectations will prove to have been correct. Such forward-looking statements, by their nature, are subject to certain risks, uncertainties and assumptions, including, among other matters: general and regional economic conditions, which will, among other things, affect demand for new residential and commercial construction; our ability to successfully identify, manage and integrate acquisitions; the cyclical nature of, and changes in, the real estate and construction markets, including pricing changes of our competitors; governmental requirements and initiatives, including those related to mortgage lending or mortgage financing, funding for public or infrastructure construction, land usage and environmental, health and safety matters; disruptions, uncertainties or volatility in the credit markets that may limit our, our suppliers’ and our customers’ access to capital; our ability to successfully implement our operating strategy; weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms of our indebtedness; our ability to maintain favorable relationships with third parties who supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; and product liability, property damage and other claims and insurance coverage issues. Should one or more of these risks materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those expected. These risks, as well as others, are discussed in greater detail in U.S. Concrete's filings with the Securities and Exchange Commission, including U.S. Concrete's Annual Report on Form 10-K for the year ended December 31, 2014 and subsequent Quarterly Reports on Form 10-Q. (Tables Follow)

5 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (in thousands, except per share amounts) Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Revenue $ 244,695 $ 180,358 $ 416,033 $ 326,615 Cost of goods sold before depreciation, depletion and amortization 192,296 145,324 332,082 269,849 Selling, general and administrative expenses 22,234 14,388 40,298 28,031 Depreciation, depletion and amortization 10,567 5,484 18,846 10,382 Gain on revaluation of contingent consideration (664) — (664) — Loss (gain) on sale of assets 25 46 (38) (303) Income from operations 20,237 15,116 25,509 18,656 Interest expense, net (5,367) (5,055) (10,520) (10,065) Derivative loss (8,048) (1,748) (19,547) (2,371) Other income, net 692 537 1,291 1,026 Income (loss) from continuing operations before income taxes 7,514 8,850 (3,267) 7,246 Income tax (benefit) expense (2,709) 730 (2,783) 752 Income (loss) from continuing operations 10,223 8,120 (484) 6,494 (Loss) income from discontinued operations, net of taxes (520) (259) (297) 214 Net income (loss) $ 9,703 $ 7,861 $ (781) $ 6,708 Basic income (loss) per share: Income (loss) from continuing operations $ 0.73 $ 0.60 $ (0.04) $ 0.48 (Loss) income from discontinued operations, net of taxes (0.04) (0.02) (0.02) 0.01 Net income (loss) per share – basic $ 0.69 $ 0.58 $ (0.06) $ 0.49 Diluted income (loss) per share: Income (loss) from continuing operations $ 0.67 $ 0.59 $ (0.04) 0.47 (Loss) income from discontinued operations, net of taxes (0.03) (0.02) (0.02) 0.01 Net income (loss) per share – diluted $ 0.64 $ 0.57 $ (0.06) $ 0.48 Weighted average shares outstanding: Basic 14,049 13,557 13,806 13,562 Diluted 15,218 13,872 13,806 13,874

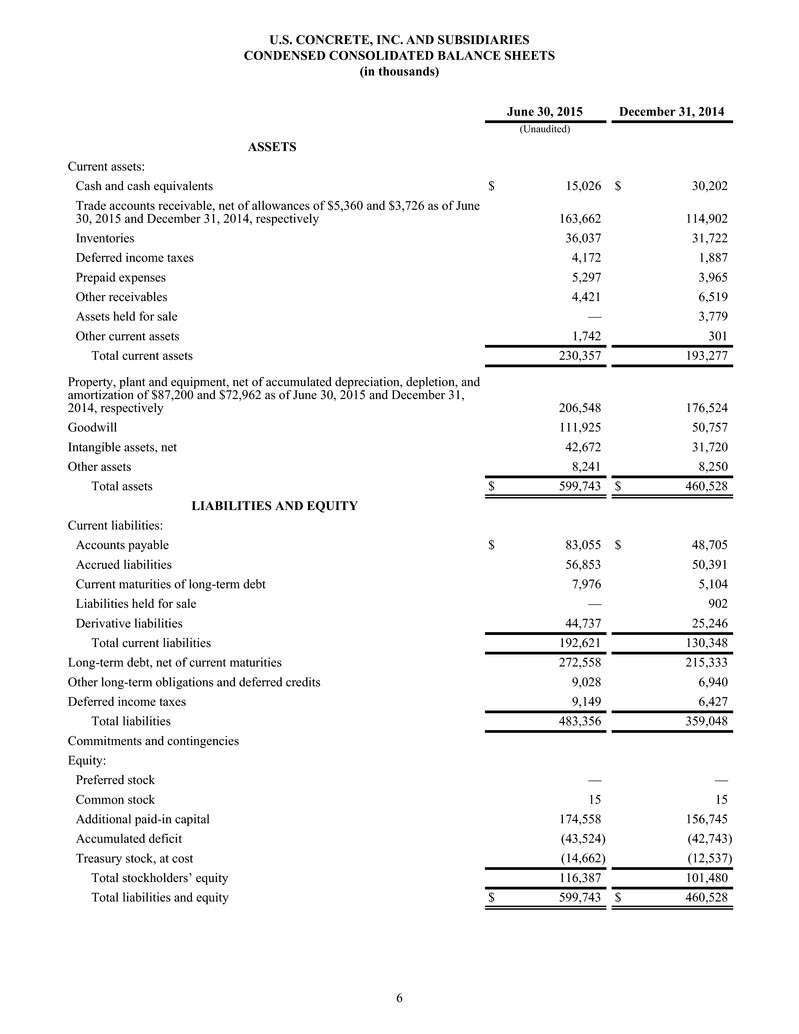

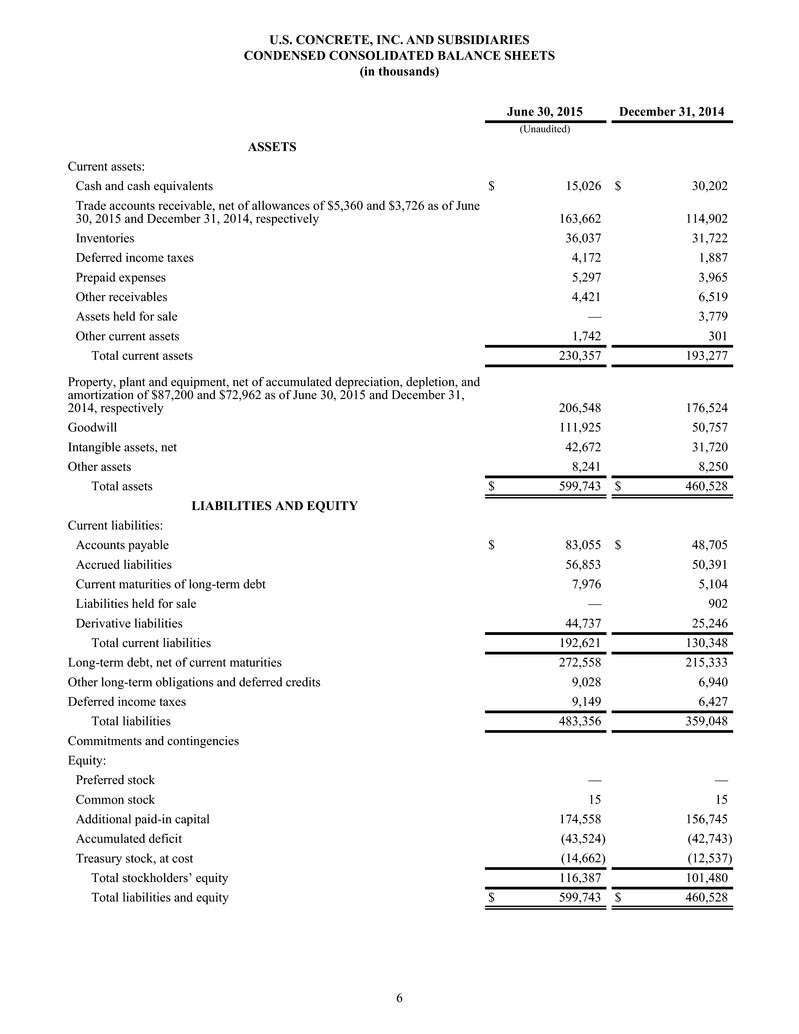

6 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) June 30, 2015 December 31, 2014 (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 15,026 $ 30,202 Trade accounts receivable, net of allowances of $5,360 and $3,726 as of June 30, 2015 and December 31, 2014, respectively 163,662 114,902 Inventories 36,037 31,722 Deferred income taxes 4,172 1,887 Prepaid expenses 5,297 3,965 Other receivables 4,421 6,519 Assets held for sale — 3,779 Other current assets 1,742 301 Total current assets 230,357 193,277 Property, plant and equipment, net of accumulated depreciation, depletion, and amortization of $87,200 and $72,962 as of June 30, 2015 and December 31, 2014, respectively 206,548 176,524 Goodwill 111,925 50,757 Intangible assets, net 42,672 31,720 Other assets 8,241 8,250 Total assets $ 599,743 $ 460,528 LIABILITIES AND EQUITY Current liabilities: Accounts payable $ 83,055 $ 48,705 Accrued liabilities 56,853 50,391 Current maturities of long-term debt 7,976 5,104 Liabilities held for sale — 902 Derivative liabilities 44,737 25,246 Total current liabilities 192,621 130,348 Long-term debt, net of current maturities 272,558 215,333 Other long-term obligations and deferred credits 9,028 6,940 Deferred income taxes 9,149 6,427 Total liabilities 483,356 359,048 Commitments and contingencies Equity: Preferred stock — — Common stock 15 15 Additional paid-in capital 174,558 156,745 Accumulated deficit (43,524) (42,743) Treasury stock, at cost (14,662) (12,537) Total stockholders’ equity 116,387 101,480 Total liabilities and equity $ 599,743 $ 460,528

7 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (in thousands) Six Months Ended June 30, 2015 2014 CASH FLOWS FROM OPERATING ACTIVITIES: Net (loss) income $ (781) $ 6,708 Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation, depletion and amortization 18,846 10,382 Debt issuance cost amortization 874 819 Amortization of discount on long-term incentive plan and other accrued interest 175 202 Net loss on derivative 19,547 2,371 Net gain on revaluation of contingent consideration (664) — Net loss (gain) on sale of assets 54 (943) Deferred income taxes (3,598) 674 Provision for doubtful accounts and customer disputes 2,761 179 Stock-based compensation 2,546 1,550 Changes in assets and liabilities, excluding effects of acquisitions: Accounts receivable (28,479) (21,075) Inventories (1,799) (844) Prepaid expenses and other current assets 591 (690) Other assets and liabilities 23 (297) Accounts payable and accrued liabilities 25,300 7,268 Net cash provided by operating activities 35,396 6,304 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property, plant and equipment (7,424) (19,894) Payments for acquisitions, net of cash acquired (86,214) (4,363) Proceeds from disposals of property, plant and equipment 540 2,487 Proceeds from disposal of business units 250 — Net cash used in investing activities (92,848) (21,770) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from revolver borrowings 107,004 159 Repayments of revolver borrowings (57,004) (159) Proceeds from exercise of stock options and warrants 123 346 Payments of other long-term obligations (2,250) (2,250) Payments for other financing (3,472) (2,169) Debt issuance costs — (696) Payments for share repurchases — (4,824) Other treasury share purchases (2,125) (735) Net cash provided by (used in) financing activities 42,276 (10,328) NET DECREASE IN CASH AND CASH EQUIVALENTS (15,176) (25,794) CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 30,202 112,667 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 15,026 $ 86,873

8 U.S. CONCRETE, INC. NON-GAAP FINANCIAL MEASURES (Unaudited) We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the table below for (1) presentations of our adjusted EBITDA, adjusted EBITDA margin and Free Cash Flow for the quarters ended June 30, 2015 and 2014, and Net Debt as of June 30, 2015 and December 31, 2014 and (2) corresponding reconciliations to GAAP financial measures for the quarters ended June 30, 2015 and 2014 and as of June 30, 2015 and December 31, 2014. We have also provided below (1) the impact of non-cash stock compensation expense, derivative losses, acquisition related professional fees, officer severance, non-cash gain on revaluation of contingent consideration on net income (loss) and net income (loss) per share and (2) corresponding reconciliations to GAAP financial measures for the quarters ended June 30, 2015 and 2014. We have also shown below certain ready- mixed concrete and aggregate products statistics for the quarters ended June 30, 2015 and 2014. We define adjusted EBITDA as our net income (loss) from continuing operations, plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, non-cash stock compensation expense, derivative (gain) loss, gain (loss) on revaluation of contingent consideration, gain (loss) on extinguishment of debt, acquisition-related professional fees, and officer severance. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA and adjusted EBITDA margin to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report. We define adjusted net income (loss) and adjusted net income (loss) per share as net income (loss) and net income (loss) per share excluding non-cash stock compensation expense, derivative loss, non-cash gain on revaluation of contingent consideration, acquisition- related professional fees, and officer severance. We present adjusted net income (loss) and adjusted net income (loss) per share to provide more consistent information for investors to use when comparing operating results for the quarters ended June 30, 2015 and 2014. We define Free Cash Flow as cash provided by (used in) operations less capital expenditures for property, plant and equipment, net of disposals. We consider Free Cash Flow to be an important indicator of our ability to service our debt and generate cash for acquisitions and other strategic investments. We define Net Debt as total debt, including current maturities and capital lease obligations, minus cash and cash equivalents. We believe that Net Debt is useful to investors as a measure of our financial position. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP.

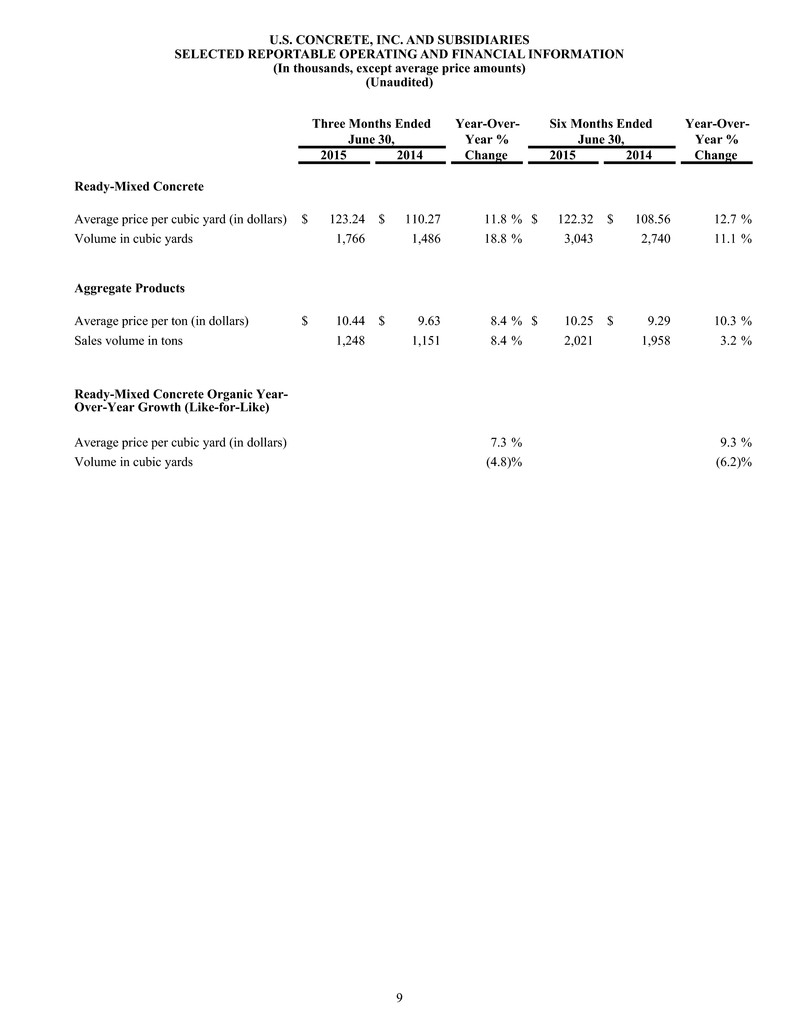

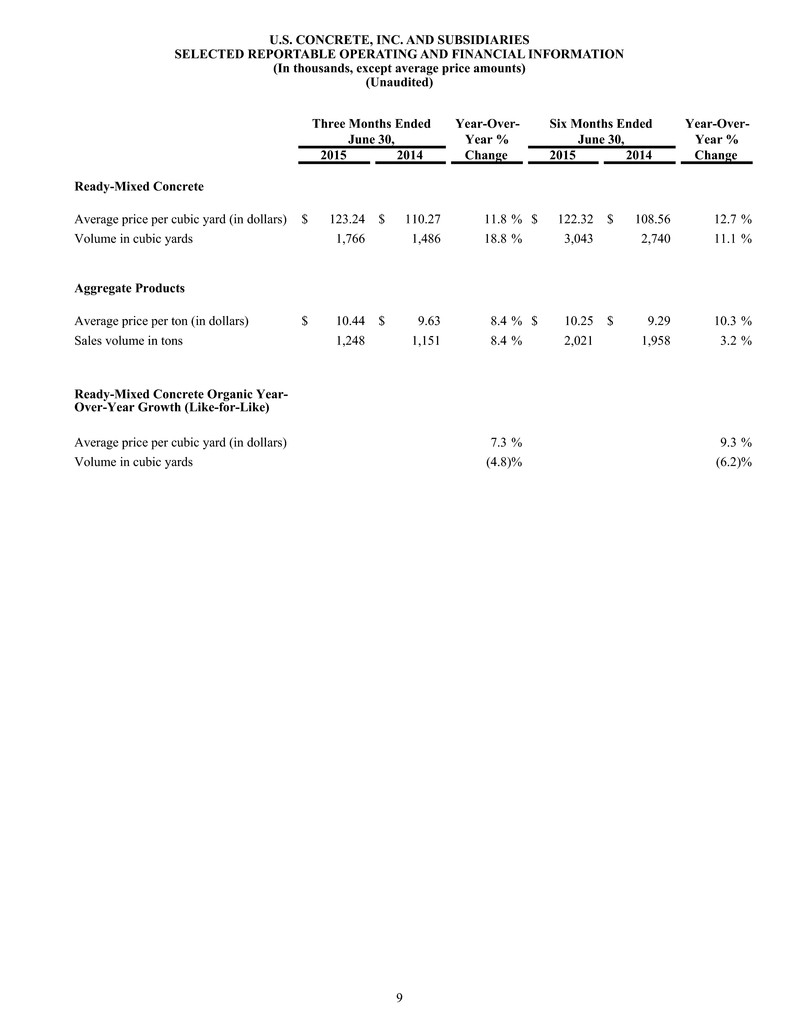

9 U.S. CONCRETE, INC. AND SUBSIDIARIES SELECTED REPORTABLE OPERATING AND FINANCIAL INFORMATION (In thousands, except average price amounts) (Unaudited) Three Months Ended Year-Over- Six Months Ended Year-Over- June 30, Year % June 30, Year % 2015 2014 Change 2015 2014 Change Ready-Mixed Concrete Average price per cubic yard (in dollars) $ 123.24 $ 110.27 11.8 % $ 122.32 $ 108.56 12.7 % Volume in cubic yards 1,766 1,486 18.8 % 3,043 2,740 11.1 % Aggregate Products Average price per ton (in dollars) $ 10.44 $ 9.63 8.4 % $ 10.25 $ 9.29 10.3 % Sales volume in tons 1,248 1,151 8.4 % 2,021 1,958 3.2 % Ready-Mixed Concrete Organic Year- Over-Year Growth (Like-for-Like) Average price per cubic yard (in dollars) 7.3 % 9.3 % Volume in cubic yards (4.8)% (6.2)%

10 U.S. CONCRETE, INC. AND SUBSIDIARIES SELECTED REPORTABLE OPERATING AND FINANCIAL INFORMATION (Unaudited) (in thousands) Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Revenue: Ready-mixed concrete Sales to external customers $ 219,019 $ 164,175 $ 374,063 $298,101 Aggregate products Sales to external customers 8,862 7,327 14,093 11,944 Intersegment sales 6,767 5,797 10,446 9,425 Total aggregate products 15,629 13,124 24,539 21,369 Total reportable segment revenue 234,648 177,299 398,602 319,470 Other products and eliminations 10,047 3,059 17,431 7,145 Total revenue $ 244,695 $ 180,358 $ 416,033 $326,615 Reportable Segment and Total Adjusted EBITDA: Ready-mixed concrete $ 33,650 $ 23,269 $ 54,220 $ 37,001 Aggregate products 3,792 3,266 3,969 3,345 Total reportable segment Adjusted EBITDA 37,442 26,535 58,189 40,346 Other products and eliminations 2,923 1,116 4,532 1,963 Corporate (9,533) (6,514) (17,739) (12,245) Non-cash stock compensation expense 1,695 1,020 2,546 1,550 Acquisition-related professional fees 1,162 246 2,088 297 Officer severance (28) — 357 — Total Adjusted EBITDA 33,661 22,403 49,973 31,911 Adjusted EBITDA margin 13.8% 12.4% 12.0% 9.8% Reconciliation Of Total Adjusted EBITDA To Income (Loss) From Continuing Operations Before Income Taxes: Total Adjusted EBITDA $ 33,661 $ 22,403 $ 49,973 $ 31,911 Depreciation, depletion and amortization (10,567) (5,484) (18,846) (10,382) Interest expense, net (5,367) (5,055) (10,520) (10,065) Derivative loss (8,048) (1,748) (19,547) (2,371) Non-cash gain on revaluation of contingent consideration 664 — 664 — Non-cash stock compensation expense (1,695) (1,020) (2,546) (1,550) Acquisition-related professional fees (1,162) (246) (2,088) (297) Officer severance 28 — (357) — Income (loss) from continuing operations before income taxes $ 7,514 $ 8,850 $ (3,267) $ 7,246

11 U.S. CONCRETE, INC. AND SUBSIDIARIES SELECTED REPORTABLE OPERATING AND FINANCIAL INFORMATION (In thousands, except net income (loss) per share) (Unaudited) Three Months Ended Six Months Ended June 30, June 30, 2015 2014 2015 2014 Adjusted Net Income and EPS Net income (loss) $ 9,703 $ 7,861 $ (781) $ 6,708 Add: Derivative loss 8,048 1,748 19,547 2,371 Add: Non-cash stock compensation expense 1,695 1,020 2,546 1,550 Add: Acquisition-related professional fees 1,162 246 2,088 297 Add: Officer severance (28) — 357 — Less: Non-cash gain on revaluation of contingent consideration (664) — (664) — Adjusted net income $ 19,916 $ 10,875 $ 23,093 $ 10,926 Net income (loss) per diluted share (1) $ 0.64 $ 0.57 $ (0.06) $ 0.48 Impact of derivative loss 0.53 0.13 1.32 0.17 Impact of non-cash stock compensation expense 0.11 0.07 0.17 0.11 Impact of acquisition-related professional fees 0.08 0.02 0.14 0.02 Impact of officer severance — — 0.02 — Impact of non-cash gain on revaluation of contingent consideration (0.04) — (0.04) — Adjusted net income per diluted share $ 1.31 $ 0.78 $ 1.56 $ 0.79 Free Cash Flow Reconciliation Net cash provided by operating activities $ 34,464 $ 8,231 $ 35,396 $ 6,304 Less: capital expenditures (3,878) (9,729) (7,424) (19,894) Plus: proceeds from the sale of property, plant and equipment 71 164 540 2,487 Plus: proceeds from the disposal of business units 250 — 250 — Free Cash Flow $ 30,907 $ (1,334) $ 28,762 $ (11,103) Net Debt Reconciliation As of As of June 30, 2015 December 31, 2014 Total debt, including current maturities and capital lease obligations $ 280,534 $ 220,437 Less: cash and cash equivalents $ 15,026 $ 30,202 Net Debt $ 265,508 $ 190,235 (1) Net loss per diluted share for the six months ended June 30, 2015 excludes common stock equivalents of 990 thousand shares from our warrants, options and restricted stock that are included in adjusted net income per diluted share as their impact is anti-dilutive based on the net loss for the period. Contact: Matt Brown Senior Vice President and CFO U.S. Concrete, Inc. 817-835-4105