August 2016 INVESTOR PRESENTATION

1 Forward-Looking Statements Certain statements and information provided in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us and do not include the impact of future acquisitions. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially. The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely unduly upon these forward-looking statements. The Company undertakes no obligation to update these forward-looking statements, except as required by law. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, general economic and business conditions, which will, among other things, affect demand for new residential and commercial construction; our ability to successfully identify, manage, and integrate acquisitions; the cyclical nature of, and changes in, the real estate and construction markets, including pricing changes by our competitors; governmental requirements and initiatives, including those related to mortgage lending or mortgage financing, funding for public or infrastructure construction, land usage, and environmental, health, and safety matters; disruptions, uncertainties or volatility in the credit markets that may limit our, our suppliers' and our customers' access to capital; our ability to successfully implement our operating strategy; weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms of our indebtedness; our ability to maintain favorable relationships with third parties who supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; and product liability, property damage, and other claims and insurance coverage issues. For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see “Risk Factors” in our Amendment No. 1 to our Annual Report on Form 10-K/A and our Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. All written and oral forward-looking statements in this presentation are expressly qualified by these “Risk Factors.”

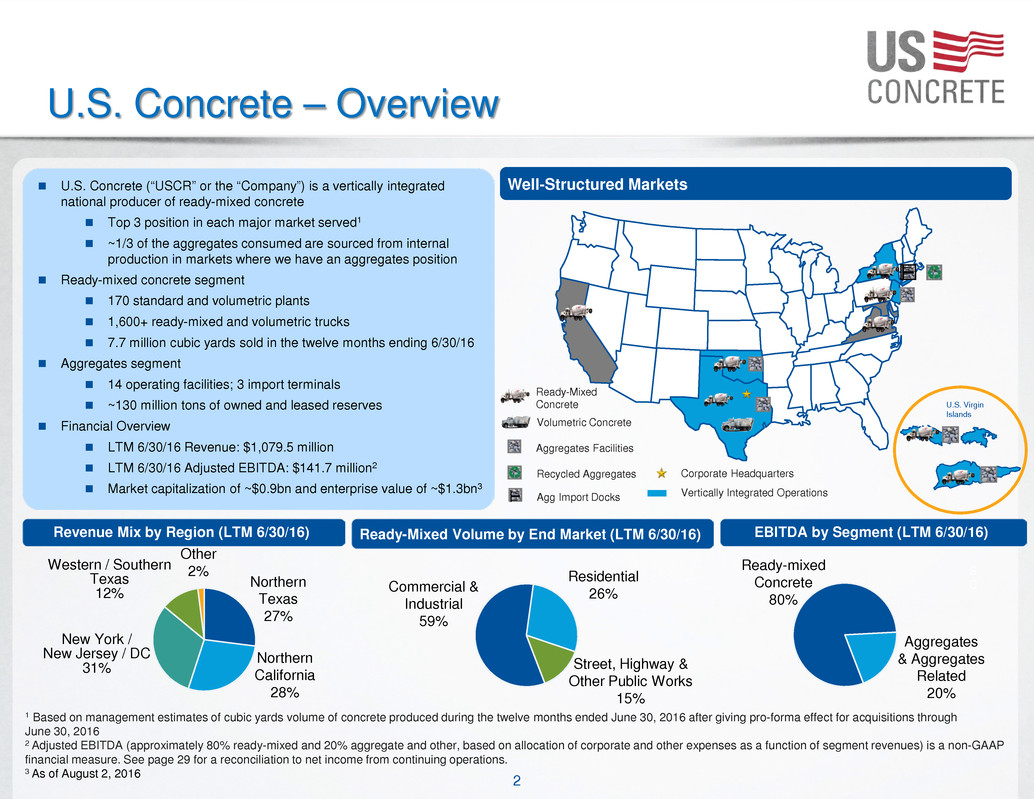

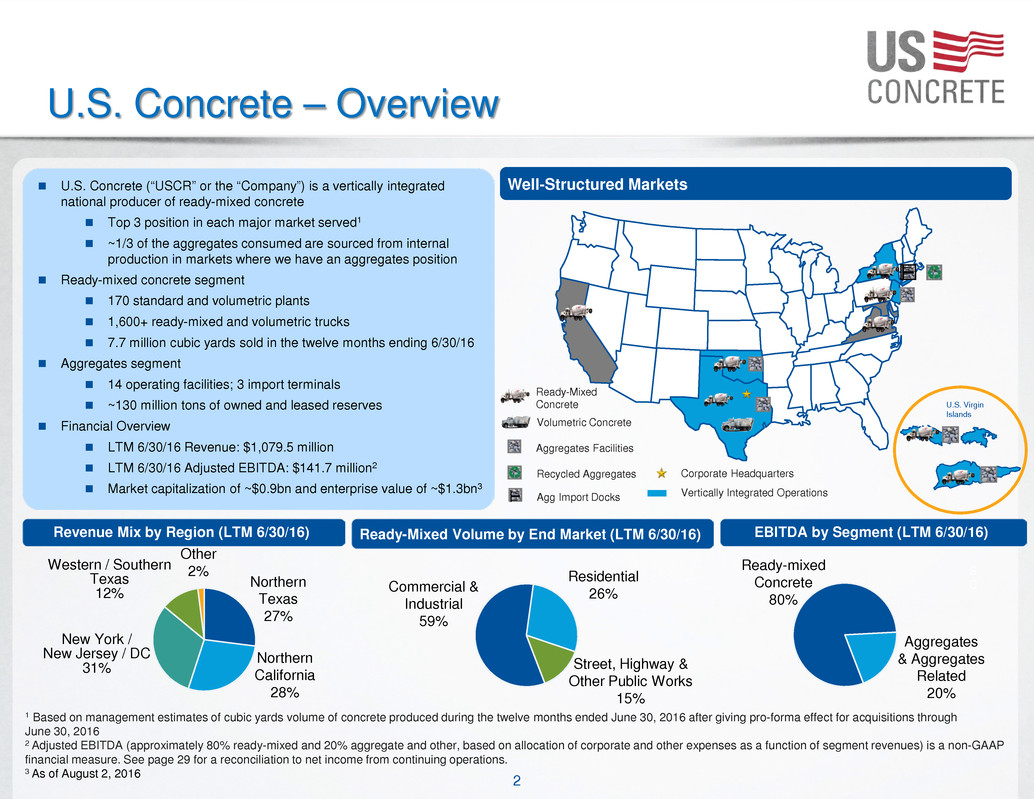

2 U.S. Concrete – Overview U.S. Concrete (“USCR” or the “Company”) is a vertically integrated national producer of ready-mixed concrete Top 3 position in each major market served1 ~1/3 of the aggregates consumed are sourced from internal production in markets where we have an aggregates position Ready-mixed concrete segment 170 standard and volumetric plants 1,600+ ready-mixed and volumetric trucks 7.7 million cubic yards sold in the twelve months ending 6/30/16 Aggregates segment 14 operating facilities; 3 import terminals ~130 million tons of owned and leased reserves Financial Overview LTM 6/30/16 Revenue: $1,079.5 million LTM 6/30/16 Adjusted EBITDA: $141.7 million2 Market capitalization of ~$0.9bn and enterprise value of ~$1.3bn3 Commercial & Industrial 59% Residential 26% 1 Based on management estimates of cubic yards volume of concrete produced during the twelve months ended June 30, 2016 after giving pro-forma effect for acquisitions through June 30, 2016 2 Adjusted EBITDA (approximately 80% ready-mixed and 20% aggregate and other, based on allocation of corporate and other expenses as a function of segment revenues) is a non-GAAP financial measure. See page 29 for a reconciliation to net income from continuing operations. 3 As of August 2, 2016 Revenue Mix by Region (LTM 6/30/16) Street, Highway & Other Public Works 15% Well-Structured Markets Ready-Mixed Volume by End Market (LTM 6/30/16) EBITDA by Segment (LTM 6/30/16) Aggregates & Aggregates Related 20% Ready-mixed Concrete 80% Ready-Mixed Concrete Aggregates Facilities Recycled Aggregates Corporate Headquarters Vertically Integrated Operations Volumetric Concrete Agg Import Docks S C U.S. Virgin Islands Northern Texas 27% Northern California 28% New York / New Jersey / DC 31% Other 2%Western / SouthernTexas 12%

3 Strategic Position in Attractive Markets Industry Leading Performance Strong Financial Performance, Conservative Balance Sheet and Solid Returns on Capital Top 1,2 or 3 Position in Well-Structured Markets with Attractive Fundamentals Long-Term Diversified Customer Base Across Sectors and Regions Top Supplier to Commercial Projects with High Margins Vertical Integration into Aggregates Enhances Value Chain Successful Track Record of Accretive Acquisitions and a Robust Pipeline Disciplined Pricing Mechanics Drive Superior Margin Performance Through the Cycle Purchasing Power Due to Size in Highly Fragmented Markets Experienced and New Management Team Since 2011 with Long- Term Strategic Focus

4 Strategic Footprint Generates Competitive Advantage Strong leadership Operating excellence Group-wide sourcing Centralized IT Focused R&D Expansion opportunities nationally Seasoned strategic development team Healthy regional economies Favorable markets Vertically integrated Best practice execution Concentrated purchasing power Synergistic opportunities High-end product High margin focus Excellent reputation Extensive market knowledge Comprehensive plant network Deep customer relationships Fast, flexible delivery Acquiror of choice Significant share Superior returns Diverse footprint Vertically integrated supplier of choice Accelerated growth potential Accretive acquisitions National Platform Leading Regional Producer Strong Local Presence Success Large Company Resources & Local Company Entrepreneurship

5 Focused Strategy Translates into Industry-Leading Returns on Capital 1 Material spread margin defined as (revenue – raw material costs) / revenue 2 Source: National Ready Mixed Concrete Association (“NRMCA”) and management estimates 3 Return on capital defined as net operating profit after tax / average of beginning and ending debt and book equity 4 Publicly traded peers consist of Martin Marietta Materials, Summit Materials and Vulcan Materials Favorable Industry Dynamics Favorable markets with attractive fundamentals Leading market positions Low cost producer Attractive construction material categories Unique Business Attributes Focus on commercial projects with high margins Vertically integrated value chain Sustainability leadership Attractive Financial Profile Disciplined pricing Accretive acquisitions Prudent balance sheet leverage Efficient capital allocation Superior Margin Performance (Material Spread Margin)1 45.9% 46.6% 47.8% 49.8% 44.4% 44.0% 43.9% 44.6% 2012 2013 2014 2015 USCR ready-mixed concrete segment U.S. ready-mixed concrete industry 2 3.4% 6.3% 9.5% 13.0% 2.2% 3.2% 4.4% 5.5% 2012 2013 2014 2015 U.S. Concrete Publicly traded peers Industry-Leading Returns on Capital3 3, 4

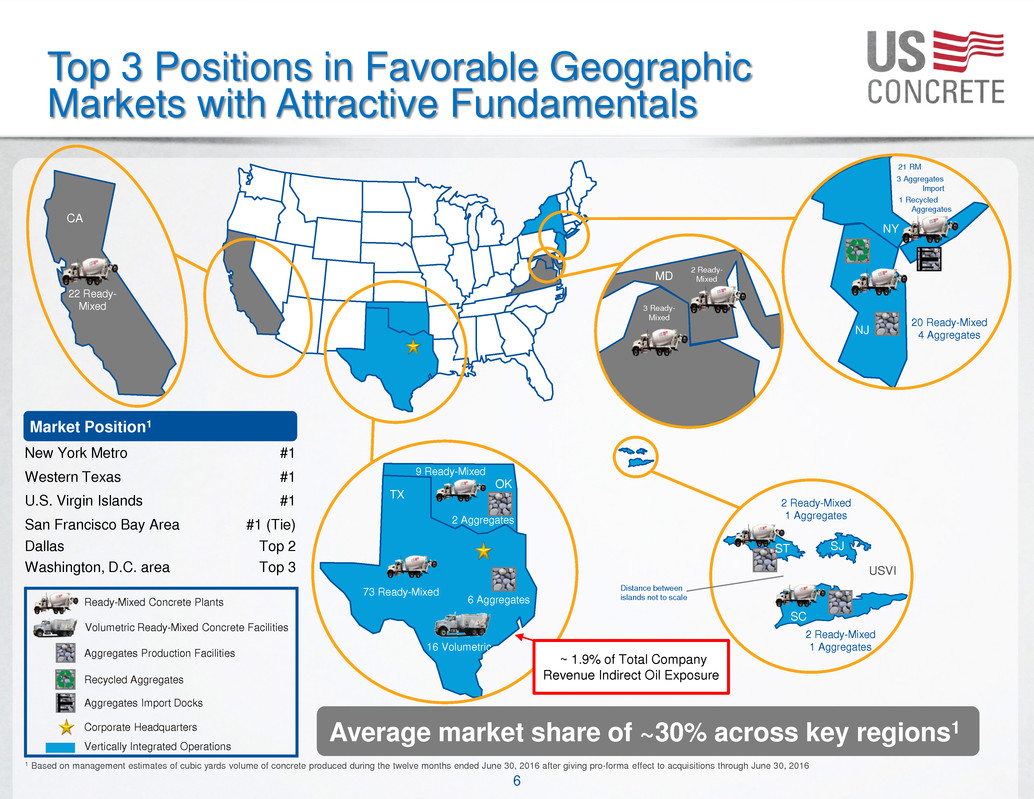

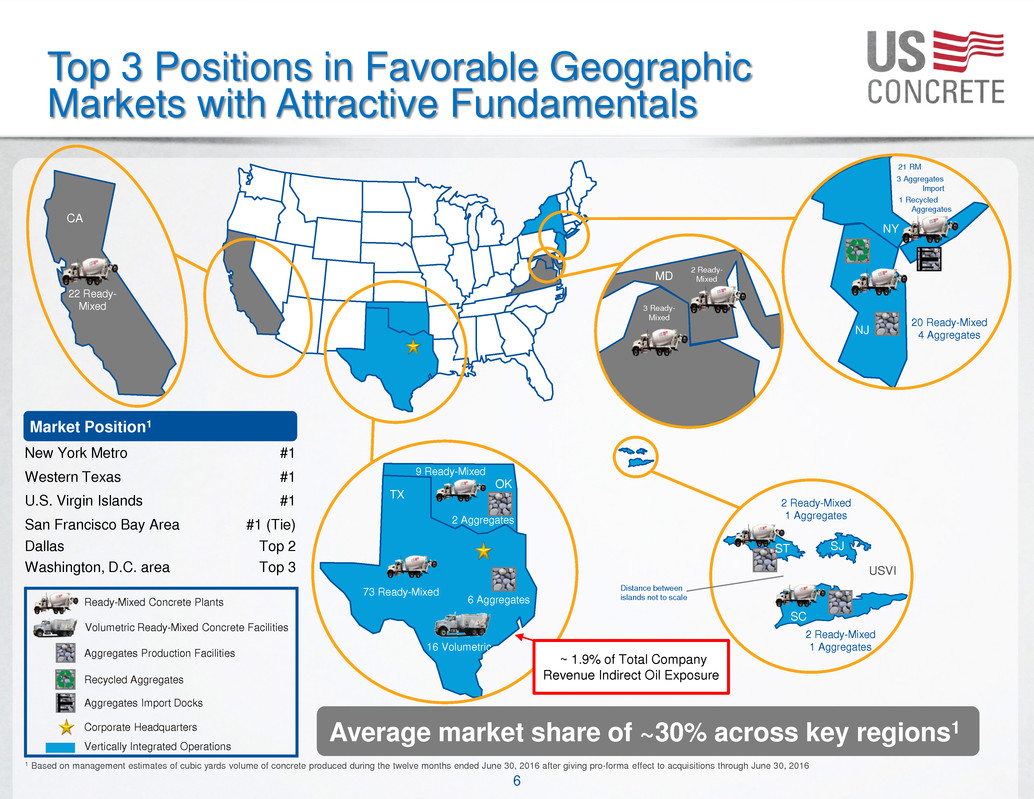

6 NJ 1 Recycled Aggregates NY 3 Aggregates Import 21 RM MD 3 Ready- Mixed 2 Ready- Mixed New York Metro #1 Western Texas #1 U.S. Virgin Islands #1 San Francisco Bay Area #1 (Tie) Dallas Washington, D.C. area Top 2 Top 3 Ready-Mixed Concrete Plants Aggregates Production Facilities Recycled Aggregates Corporate Headquarters Vertically Integrated Operations Volumetric Ready-Mixed Concrete Facilities Aggregates Import Docks 73 Ready-Mixed 6 Aggregates 16 Volumetric 9 Ready-Mixed 2 Aggregates 22 Ready- Mixed Market Position1 Average market share of ~30% across key regions1 20 Ready-Mixed 4 Aggregates 2 Ready-Mixed 1 Aggregates 2 Ready-Mixed 1 Aggregates Distance between islands not to scale SJ SC ST TX CA OK USVI Top 3 Positions in Favorable Geographic Markets with Attractive Fundamentals 1 Based on management estimates of cubic yards volume of concrete produced during the twelve months ended June 30, 2016 after giving pro-forma effect to acquisitions through June 30, 2016 t~ 1.9% of Total Company Revenue Indirect Oil Exposure

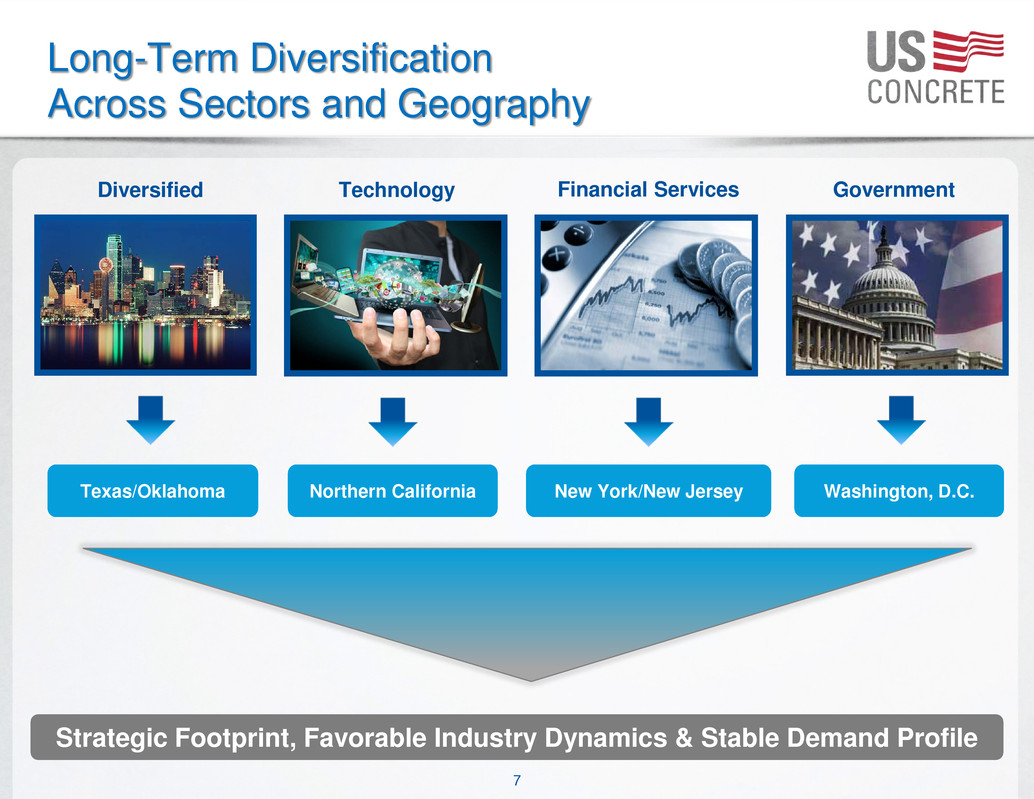

7 Long-Term Diversification Across Sectors and Geography Texas/Oklahoma Northern California New York/New Jersey Washington, D.C. Diversified Technology Financial Services Government Strategic Footprint, Favorable Industry Dynamics & Stable Demand Profile

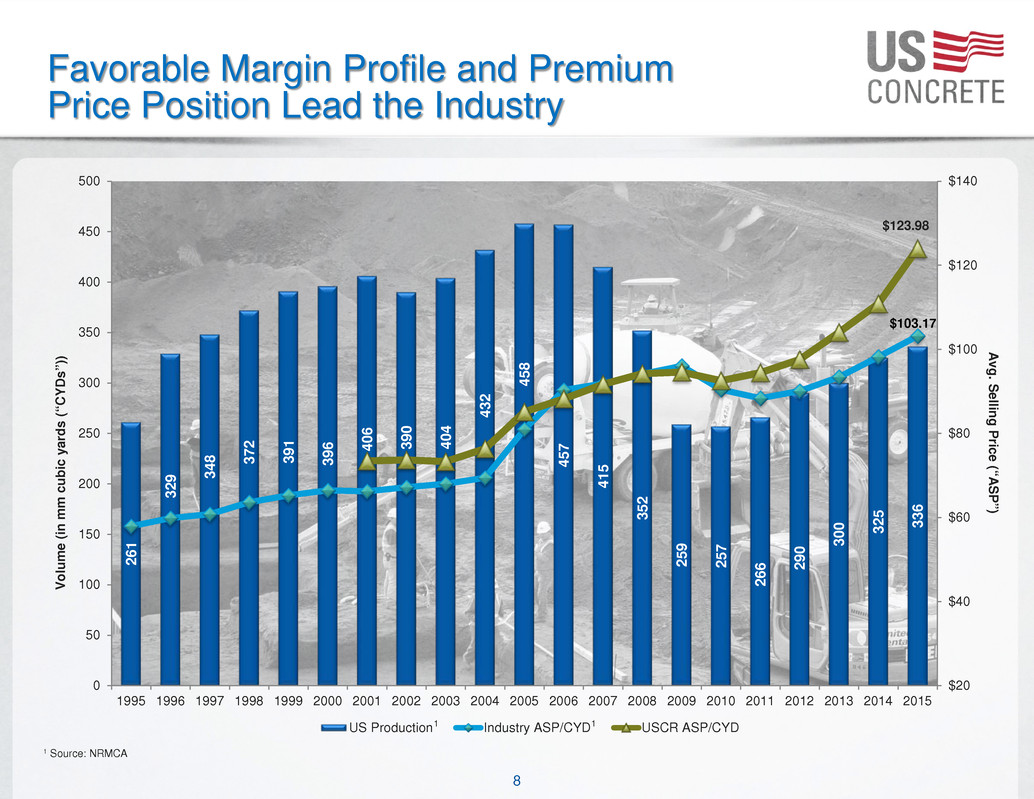

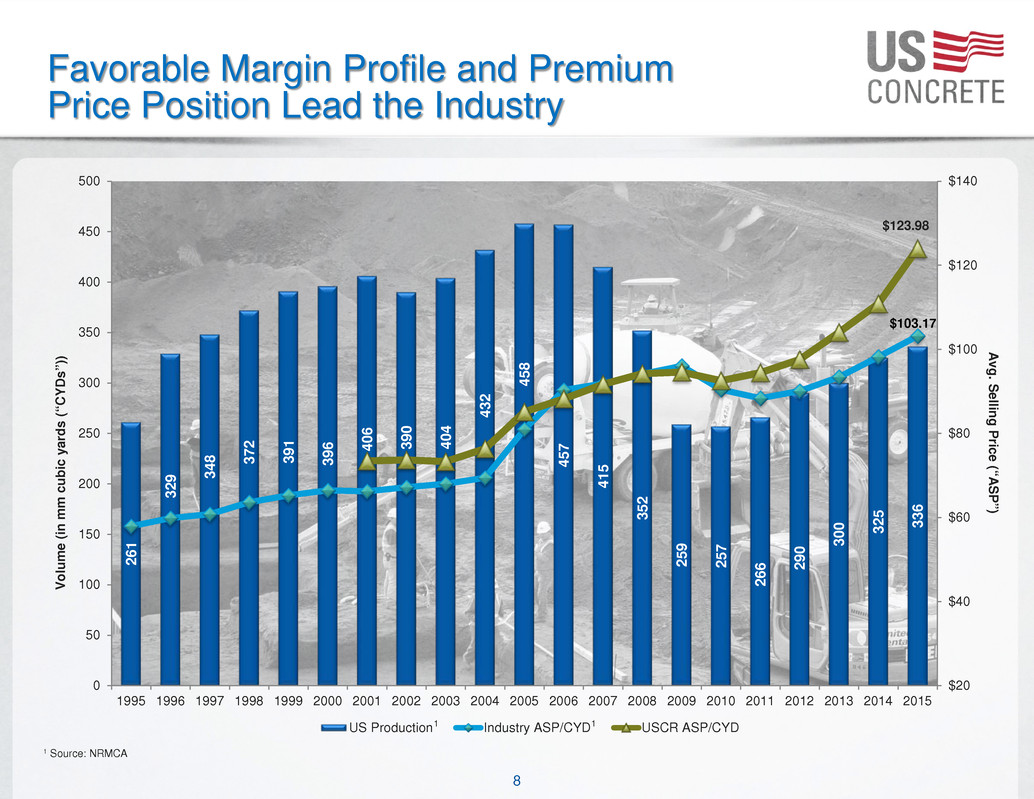

8 26 1 32 9 3 48 3 72 39 1 39 6 40 6 39 0 40 4 43 2 45 8 45 7 41 5 35 2 25 9 25 7 26 6 29 0 3 00 3 25 33 6 $103.17 $123.98 $20 $40 $60 $80 $100 $120 $140 0 50 100 150 200 250 300 350 400 450 500 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 A vg. S elling P rice (“A S P ”) V ol um e (in m m c ub ic y ar ds ( “C Y D s” )) US Production Industry ASP/CYD USCR ASP/CYD Favorable Margin Profile and Premium Price Position Lead the Industry 1 Source: NRMCA 1 1

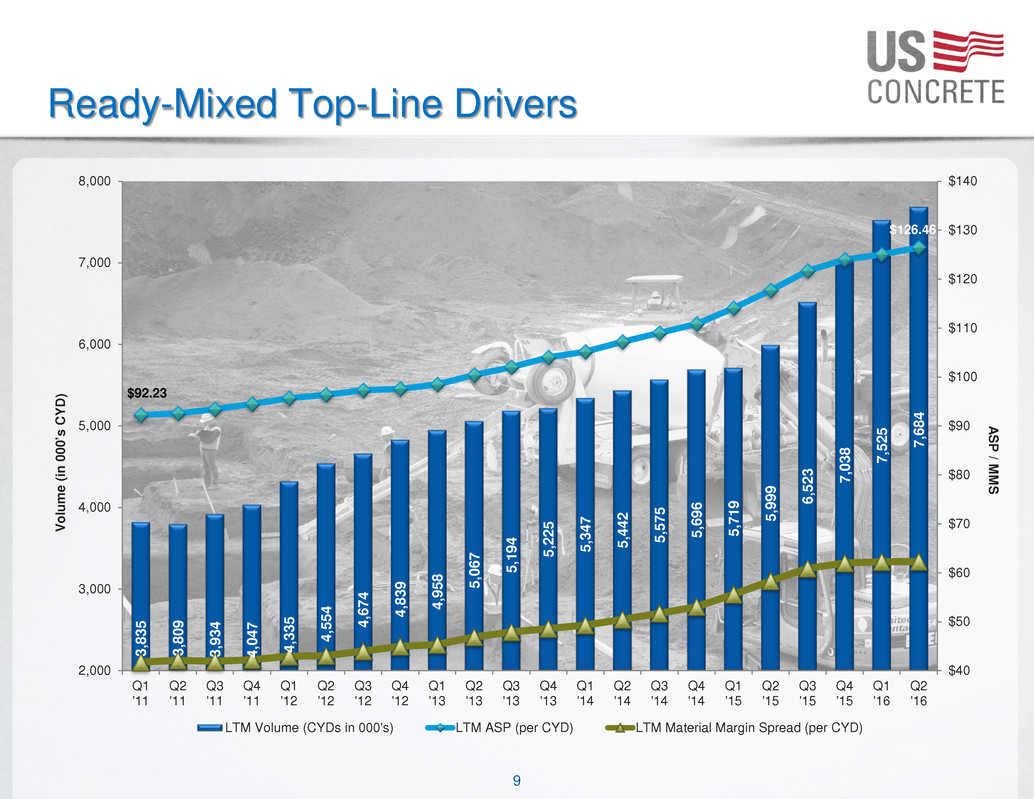

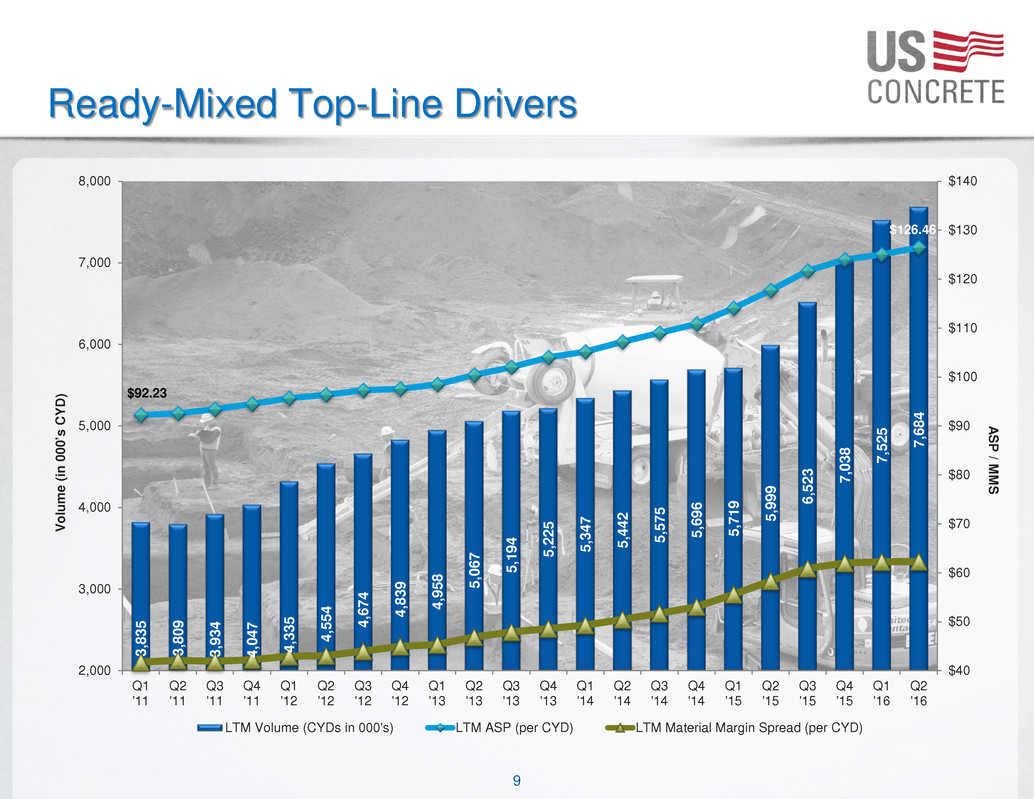

9 Ready-Mixed Top-Line Drivers 3, 83 5 3, 80 9 3, 93 4 4, 04 7 4, 33 5 4, 55 4 4, 67 4 4, 83 9 4, 95 8 5, 06 7 5, 19 4 5, 22 5 5, 34 7 5, 44 2 5, 57 5 5, 69 6 5, 71 9 5, 99 9 6, 52 3 7, 03 8 7, 52 5 7, 68 4 $92.23 $126.46 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 2,000 3,000 4,000 5,000 6,000 7,000 8,000 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 A S P / M M S V ol um e (in 0 00 ’s C Y D ) LTM Volume (CYDs in 000's) LTM ASP (per CYD) LTM Material Margin Spread (per CYD)

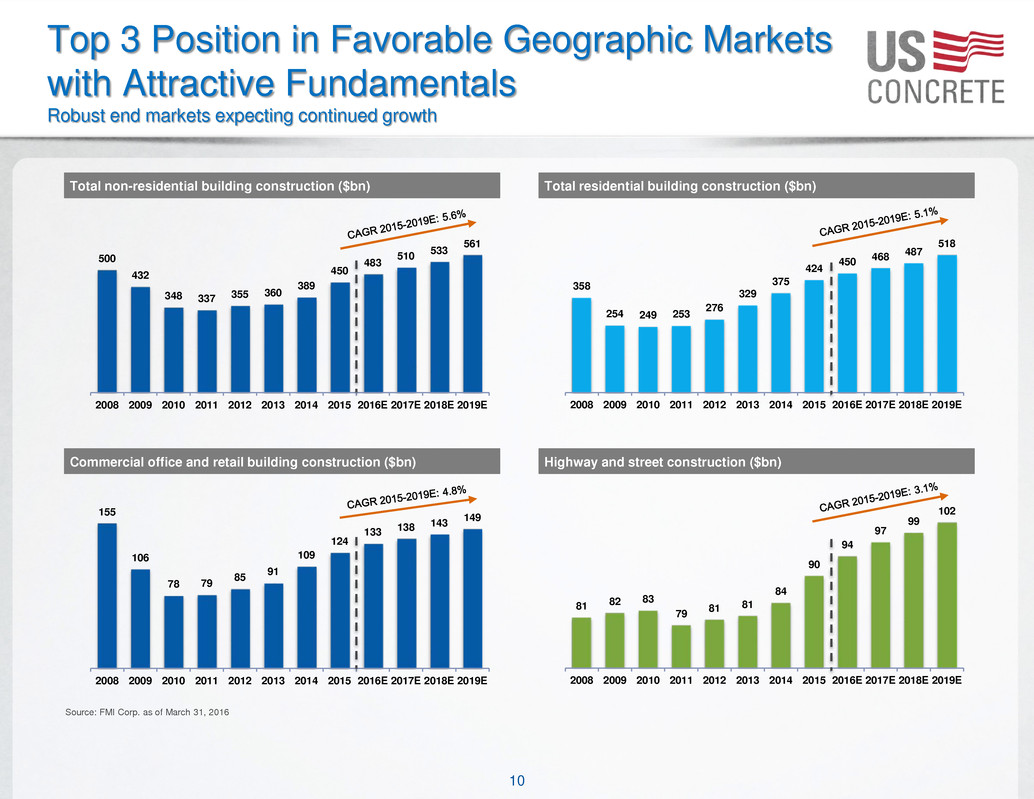

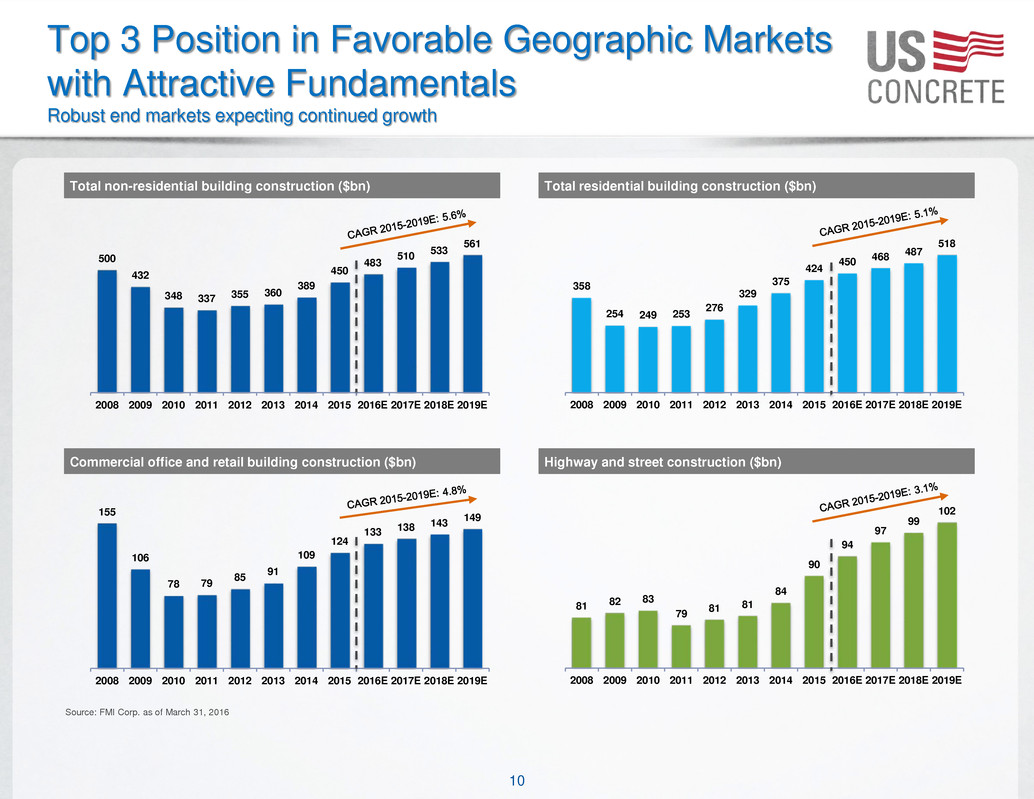

10 500 432 348 337 355 360 389 450 483 510 533 561 2008 2009 2010 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E Total non-residential building construction ($bn) 81 82 83 79 81 81 84 90 94 97 99 102 2008 2009 2010 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E Highway and street construction ($bn) 155 106 78 79 85 91 109 124 133 138 143 149 2008 2009 2010 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E Commercial office and retail building construction ($bn) 358 254 249 253 276 329 375 424 450 468 487 518 2008 2009 2010 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E Total residential building construction ($bn) Source: FMI Corp. as of March 31, 2016 Top 3 Position in Favorable Geographic Markets with Attractive Fundamentals Robust end markets expecting continued growth

11 418 433 433 604 609 551 621 689 681 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E 1,338 1,340 1,500 1,479 1,381 1,444 1,568 1,614 1,572 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E 1,340 1,293 1,411 1,652 1,769 1,981 2,106 2,155 2,114 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E 1,666 1,994 2,559 3,221 3,076 3,115 3,248 3,322 3,289 2011 2012 2013 2014 2015 2016E 2017E 2018E 2019E San Francisco MSA1 Washington, D.C. MSA1New York City MSA1 Dallas-Fort Worth MSA1 Source: Dodge Data & Analytics Note: Non-residential construction defined as cubic yards of concrete used 1 “Metropolitan Statistical Area” Top 3 Position in Favorable Geographic Markets with Attractive Fundamentals (cont’d) USCR regional markets expecting continued growth Annual new non-residential construction (‘000 cubic yards)

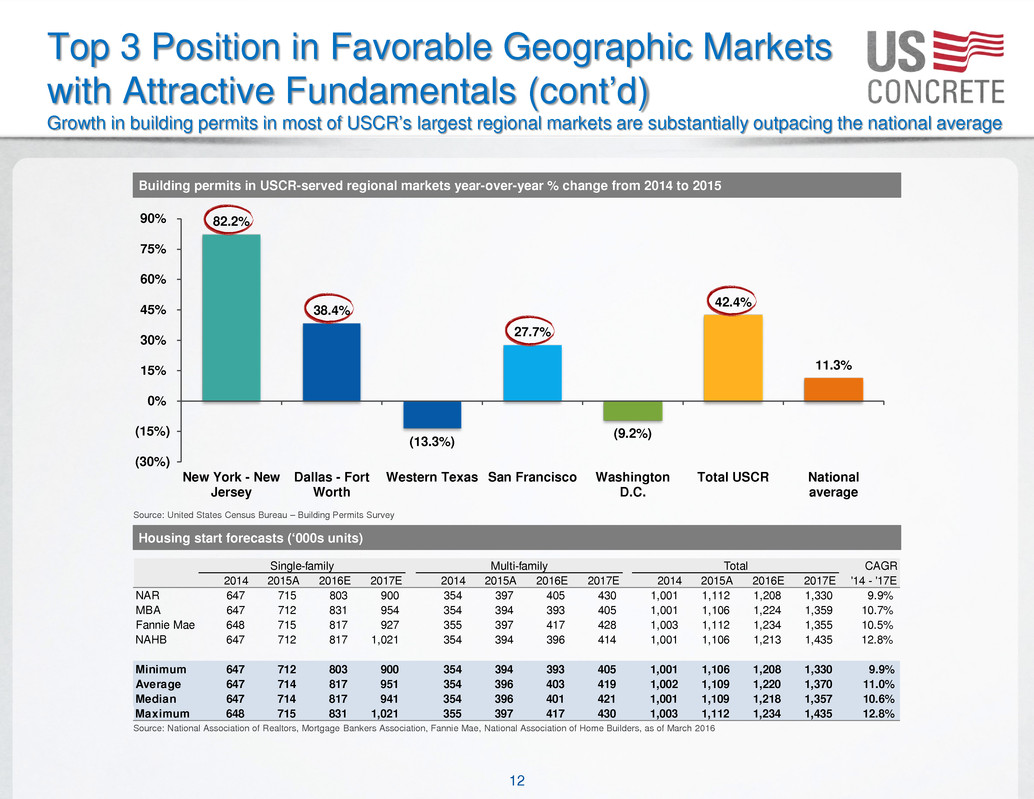

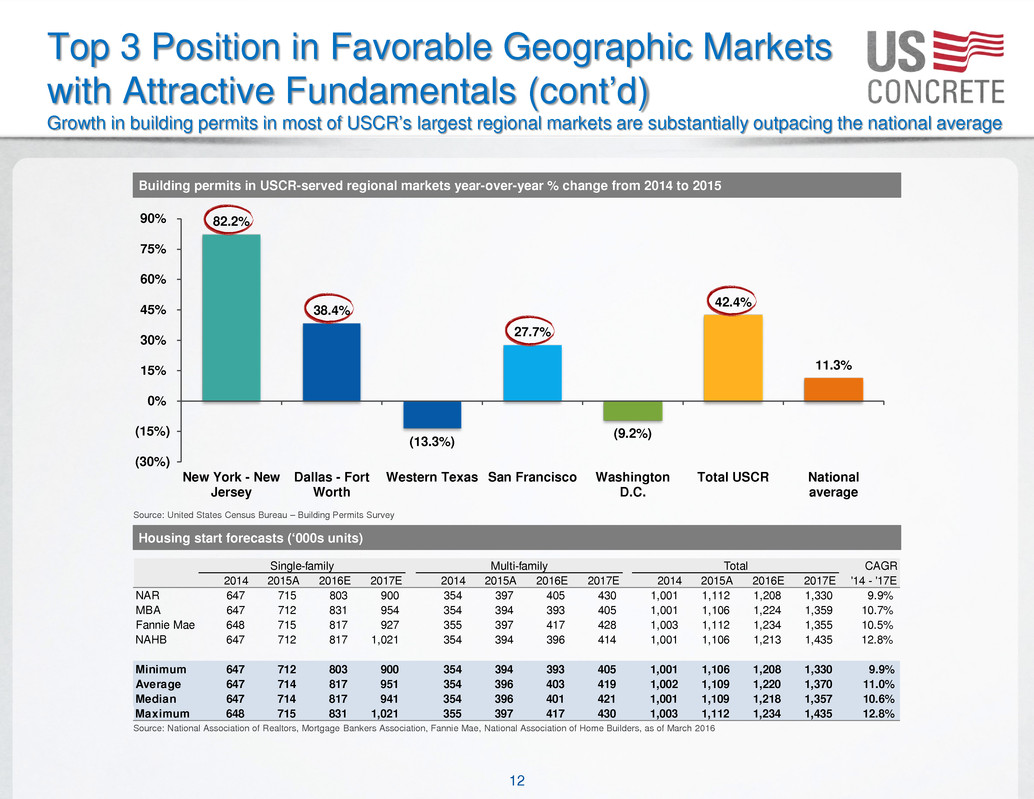

12 82.2% 38.4% (13.3%) 27.7% (9.2%) 42.4% 11.3% (30%) (15%) 0% 15% 30% 45% 60% 75% 90% New York - New Jersey Dallas - Fort Worth Western Texas San Francisco Washington D.C. Total USCR National average Source: United States Census Bureau – Building Permits Survey Top 3 Position in Favorable Geographic Markets with Attractive Fundamentals (cont’d) Growth in building permits in most of USCR’s largest regional markets are substantially outpacing the national average Building permits in USCR-served regional markets year-over-year % change from 2014 to 2015 Housing start forecasts (‘000s units) Source: National Association of Realtors, Mortgage Bankers Association, Fannie Mae, National Association of Home Builders, as of March 2016 Single-family Multi-family Total CAGR 2014 2015A 2016E 2017E 2014 2015A 2016E 2017E 2014 2015A 2016E 2017E '14 - '17E NAR 647 715 803 900 354 397 405 430 1,001 1,112 1,208 1,330 9.9% MBA 647 712 831 954 354 394 393 405 1,001 1,106 1,224 1,359 10.7% Fannie Mae 648 715 817 927 355 397 417 428 1,003 1,112 1,234 1,355 10.5% NAHB 647 712 817 1,021 354 394 396 414 1,001 1,106 1,213 1,435 12.8% Minimum 647 712 803 900 354 394 393 405 1,001 1,106 1,208 1,330 9.9% Average 647 714 817 951 354 396 403 419 1,002 1,109 1,220 1,370 11.0% Median 647 714 817 941 354 396 401 421 1,001 1,109 1,218 1,357 10.6% Maximum 648 715 831 1,021 355 397 417 430 1,003 1,112 1,234 1,435 12.8%

13 Top 3 Position in Favorable Geographic Markets with Attractive Fundamentals (cont’d) Residential construction is stabilizing and growing in regional markets where USCR has a leading position 70 37 27 27 24 29 37 42 47 71 91 95 94 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E2017E2018E2019E California housing starts (‘000) 46 30 25 26 24 28 32 30 33 41 50 55 56 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E2017E2018E2019E Washington D.C. area1 housing starts (‘000) 34 24 16 19 15 18 22 20 22 24 27 28 27 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E2017E2018E2019E New York and New Jersey housing starts (‘000) 124 82 67 70 66 81 90 100 108 116 137 145 146 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E2017E2018E2019E Texas housing starts (‘000) Source: Global Insight as of February 2016 Note: Data consists of private single family housing starts; annual data represents average of four quarters of Seasonally Adjusted Annual Rate (“SAAR”) figures 1 Washington, D.C. area also includes Virginia and Maryland

14 Vertical Integration Into Aggregates Enhances the Value Chain Aggregates primary focus is supply of U.S. Concrete’s ready-mixed operations Aggregates exposure generates higher overall corporate margins Vertical integration enhances market dynamics Provides stable supply and strategic advantage Improves overall purchasing power Increases precision in bidding for new projects Aggregates used in USCR’s ready-mixed operations1, LTM 6/30/16 Externally sourced & acquisition opportunities 65% Internally sourced 35% Key focus of acquisition strategy 14 aggregates production facilities, 1 recycling operation, 3 import docks Over 130 million tons of owned and leased reserves Increasingly Vertically Integrated ¹ From regions where USCR has aggregates

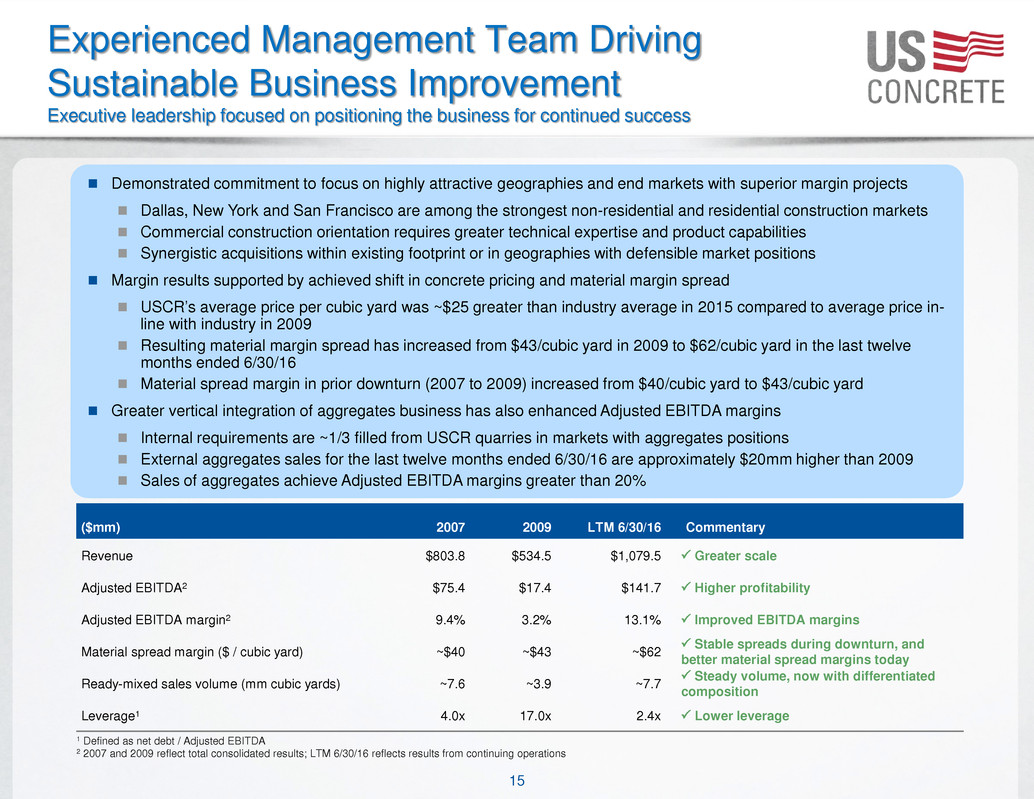

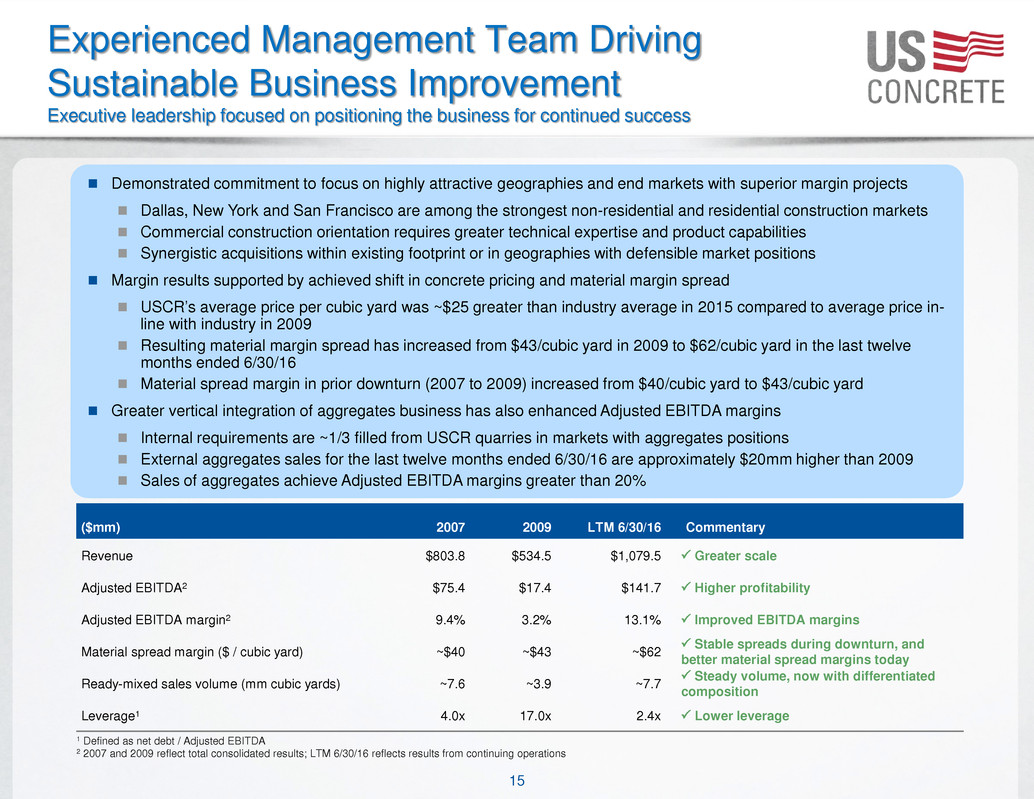

15 Experienced Management Team Driving Sustainable Business Improvement Executive leadership focused on positioning the business for continued success Demonstrated commitment to focus on highly attractive geographies and end markets with superior margin projects Dallas, New York and San Francisco are among the strongest non-residential and residential construction markets Commercial construction orientation requires greater technical expertise and product capabilities Synergistic acquisitions within existing footprint or in geographies with defensible market positions Margin results supported by achieved shift in concrete pricing and material margin spread USCR’s average price per cubic yard was ~$25 greater than industry average in 2015 compared to average price in- line with industry in 2009 Resulting material margin spread has increased from $43/cubic yard in 2009 to $62/cubic yard in the last twelve months ended 6/30/16 Material spread margin in prior downturn (2007 to 2009) increased from $40/cubic yard to $43/cubic yard Greater vertical integration of aggregates business has also enhanced Adjusted EBITDA margins Internal requirements are ~1/3 filled from USCR quarries in markets with aggregates positions External aggregates sales for the last twelve months ended 6/30/16 are approximately $20mm higher than 2009 Sales of aggregates achieve Adjusted EBITDA margins greater than 20% ($mm) 2007 2009 LTM 6/30/16 Commentary Revenue $803.8 $534.5 $1,079.5 Greater scale Adjusted EBITDA2 $75.4 $17.4 $141.7 Higher profitability Adjusted EBITDA margin2 9.4% 3.2% 13.1% Improved EBITDA margins Material spread margin ($ / cubic yard) ~$40 ~$43 ~$62 Stable spreads during downturn, and better material spread margins today Ready-mixed sales volume (mm cubic yards) ~7.6 ~3.9 ~7.7 Steady volume, now with differentiated composition Leverage1 4.0x 17.0x 2.4x Lower leverage 1 Defined as net debt / Adjusted EBITDA 2 2007 and 2009 reflect total consolidated results; LTM 6/30/16 reflects results from continuing operations

16 Significant Industry Consolidation Opportunities Exist to Enable Scaling of USCR’s Ready-Mixed Business Ready-Mixed Concrete Market Size (as of August 2016) Deal opportunities remain robust USCR is an acquiror of choice in established markets through decades long relationships amongst local and national management teams Aggregates provide additional expansion opportunities and strengthen vertically integrated capabilities Increasing vertical integration among cement, aggregates and concrete producers represents favorable market dynamic Annual Revenue $30.0 B Ready-Mixed Concrete Producers 2,200 Ready-Mixed Concrete Plants 6,500 Source: NRMCA; IBISWorld

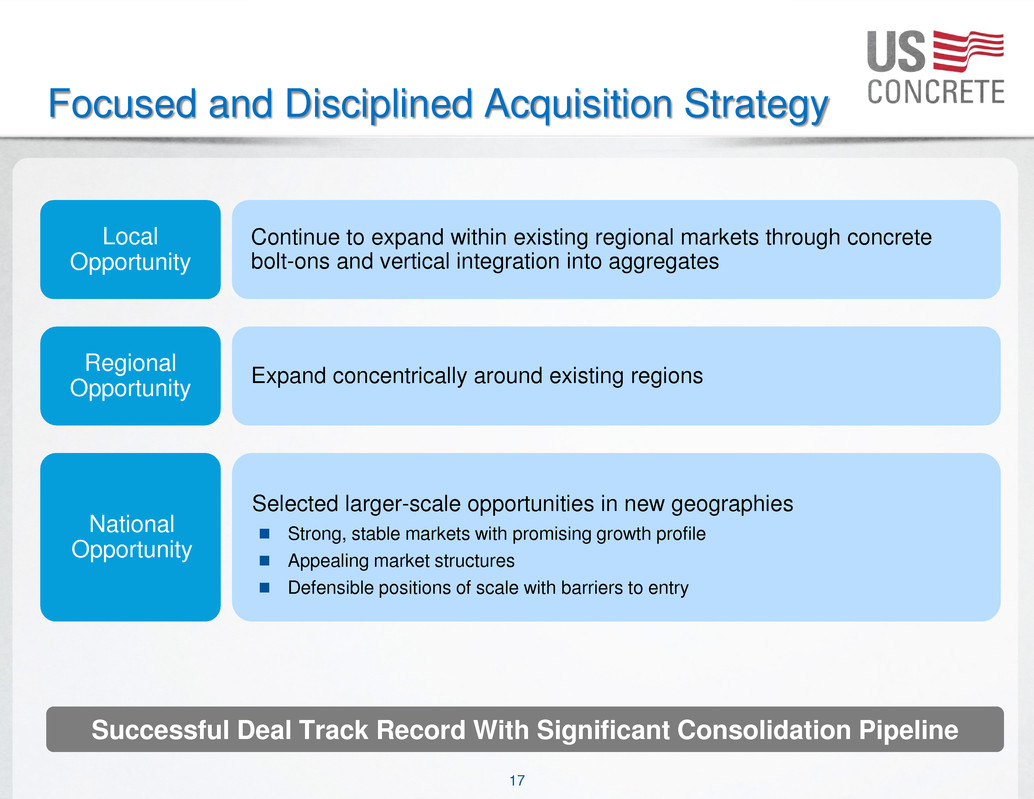

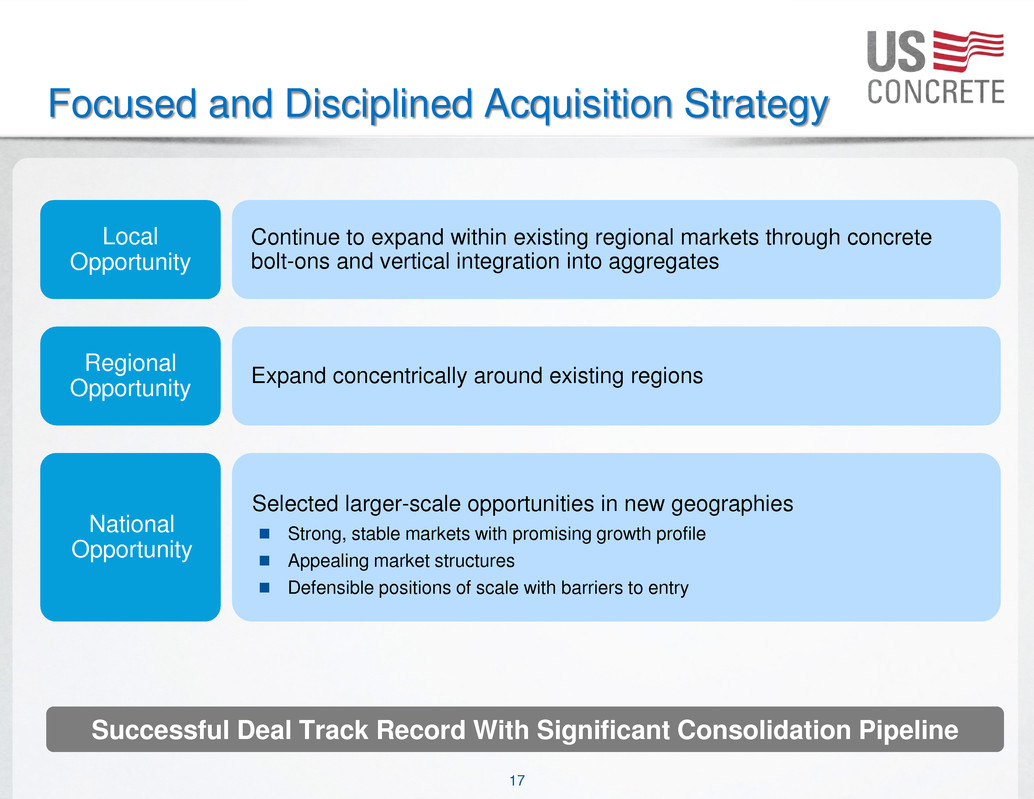

17 Focused and Disciplined Acquisition Strategy Continue to expand within existing regional markets through concrete bolt-ons and vertical integration into aggregates Local Opportunity Expand concentrically around existing regionsRegionalOpportunity Selected larger-scale opportunities in new geographies National Opportunity Strong, stable markets with promising growth profile Appealing market structures Defensible positions of scale with barriers to entry Successful Deal Track Record With Significant Consolidation Pipeline

18 Completed 23 ready-mixed concrete and aggregates acquisitions since 2014 Sourcing, executing and integrating acquisitions is a core competency of USCR Rationalizing existing markets limits impact of cyclicality Proven ability to consolidate markets, vertically integrate operations, enhance margins and generate attractive returns Greco Brothers Concrete Brooklyn, NY (Feb. 2016) 3 ready-mixed concrete plants and 1 block plant – 32 mixer trucks Vertically integrated with 2 aggregates quarries; ~40 million tons of reserves and export capability Spartan Concrete Products St. Croix, USVI (Oct. 2015) 2 ready-mixed concrete plants – 37 mixer trucks Strengthened position in New York metropolitan area Recent Notable Acquisitions Acquired Since 2014 25% Organic 75% Adjusted EBITDA, LTM 6/30/16 1 ready-mixed concrete plant – 16 mixer trucks Vertically integrated St. Croix with Heavy Materials aggregates supply Heavy Materials St. Thomas / St. Croix, USVI (Oct. 2015) 3 ready-mixed concrete plants – 42 mixer trucks Expanded metro D.C. footprint into northern Virginia DuBrook Concrete, Inc. Chantilly, VA (May 2015) Kings Ready Mix Brooklyn, NY (Aug. 2016) 4 ready-mixed concrete plants – 62 mixer trucks Strengthened position in New York metropolitan area Successful Track Record of Accretive Acquisitions with Significant Consolidation Pipeline Accretive acquisitions continue to accelerate Adjusted EBITDA growth 6 ready-mixed concrete plants – 89 mixer trucks in NYC Expanded service coverage to all of Manhattan Ferrara Bros. New York, NY (Apr. 2015) NYCON Supply Corp. Queens, NY (June 2016) 2 ready-mixed concrete plants – 38 mixer trucks Expanded position in Western Queens and Midtown Manhattan area Jenna Concrete Corp. Bronx, NY (Aug. 2016) 2 ready-mixed concrete plants – 52 mixer trucks Expanded geographic coverage in Manhattan market and establishes footprint in the Bronx borough

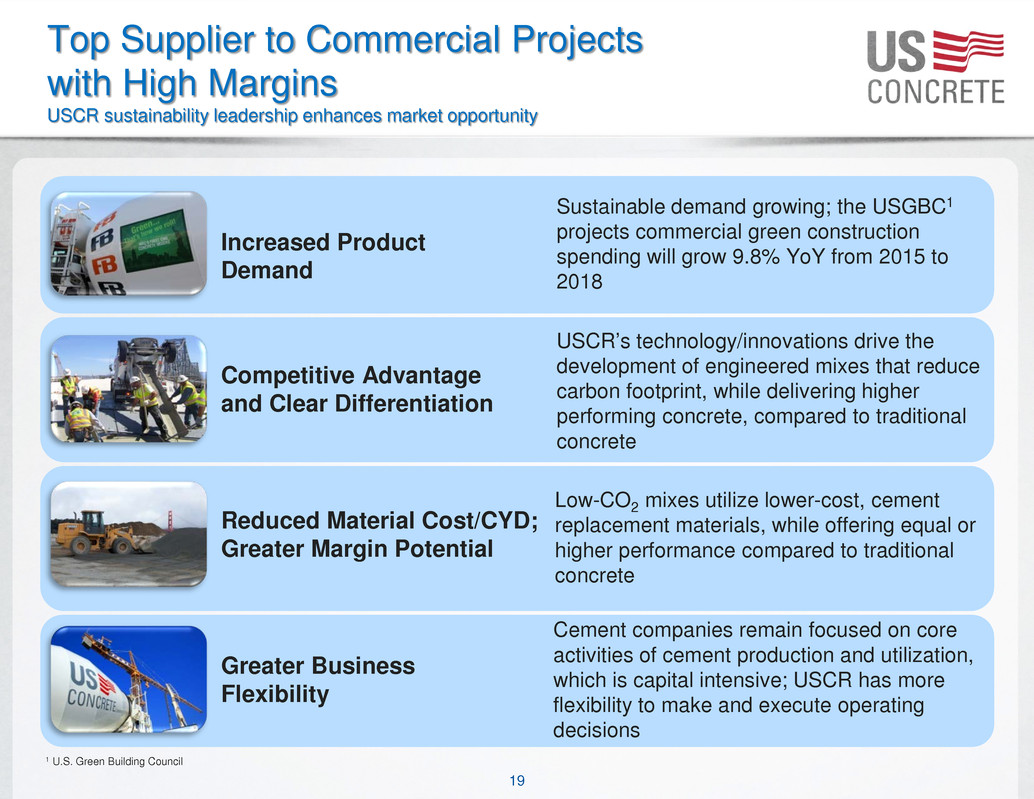

19 Sustainable demand growing; the USGBC1 projects commercial green construction spending will grow 9.8% YoY from 2015 to 2018 Increased Product Demand USCR’s technology/innovations drive the development of engineered mixes that reduce carbon footprint, while delivering higher performing concrete, compared to traditional concrete Competitive Advantage and Clear Differentiation Low-CO2 mixes utilize lower-cost, cement replacement materials, while offering equal or higher performance compared to traditional concrete Reduced Material Cost/CYD; Greater Margin Potential Cement companies remain focused on core activities of cement production and utilization, which is capital intensive; USCR has more flexibility to make and execute operating decisions Greater Business Flexibility Top Supplier to Commercial Projects with High Margins USCR sustainability leadership enhances market opportunity 1 U.S. Green Building Council

20 Average Selling Price Sales Volume (‘000) 4,047 4,839 5,225 5,696 7,038 7,684 2,741 3,407 3,597 4,650 4,919 5,508 2011 2012 2013 2014 2015 LTM 6/30/16 Ready-Mixed (CYDs) Aggregates (Tons) $94.47 $97.59 $104.03 $110.85 $123.98 $126.46 $7.46 $7.89 $8.84 $9.40 $10.54 $11.19 2011 2012 2013 2014 2015 LTM 6/30/16 Ready-Mixed ($/CYD) Aggregates ($/ton) Adjusted EBITDA from Continuing Operations ($mm)Revenue ($mm) $428 $517 $598 $704 $975 $1,080 2011 2012 2013 2014 2015 LTM 6/30/16 $12 $26 $49 $78 $132 $142 2011 2012 2013 2014 2015 LTM 6/30/16 Financial Performance and Conservative Balance Sheet

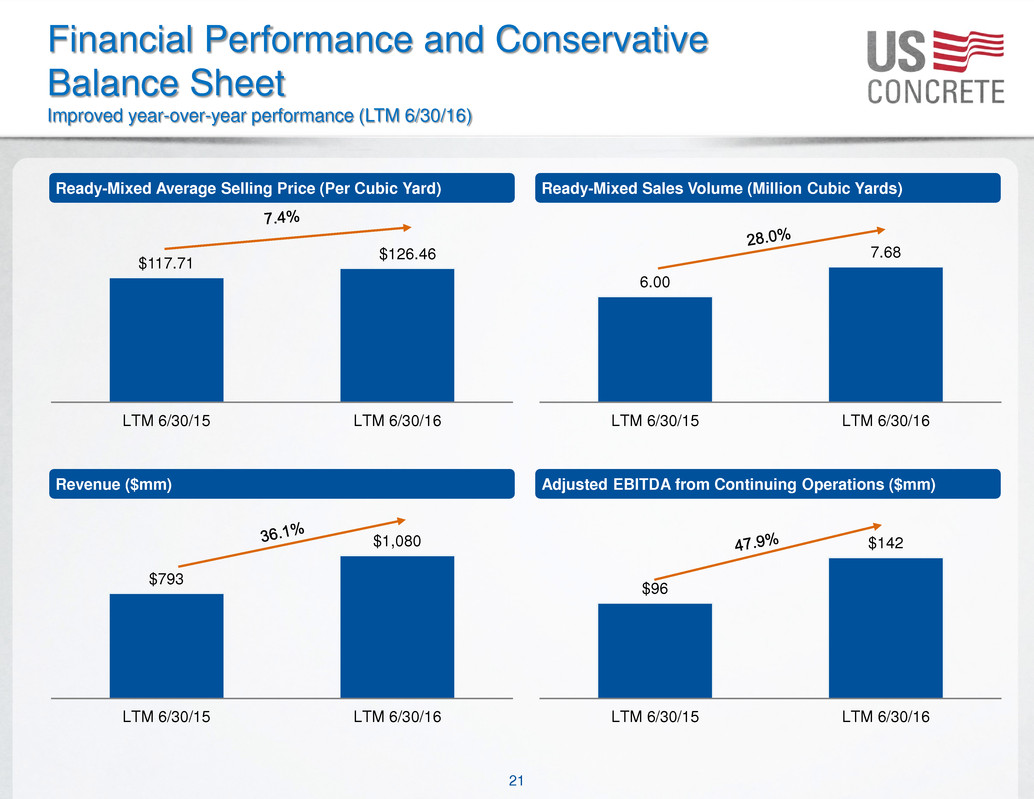

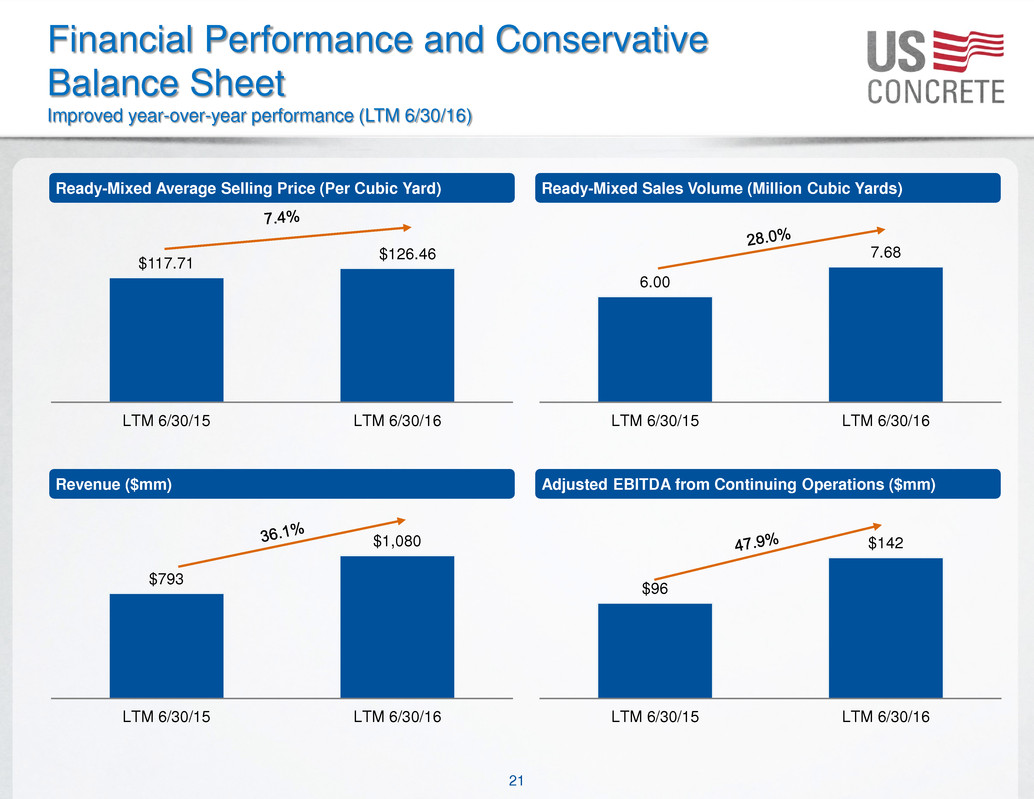

21 Ready-Mixed Sales Volume (Million Cubic Yards)Ready-Mixed Average Selling Price (Per Cubic Yard) $793 $1,080 LTM 6/30/15 LTM 6/30/16 Adjusted EBITDA from Continuing Operations ($mm)Revenue ($mm) 6.00 7.68 LTM 6/30/15 LTM 6/30/16 $96 $142 LTM 6/30/15 LTM 6/30/16 $117.71 $126.46 LTM 6/30/15 LTM 6/30/16 Financial Performance and Conservative Balance Sheet Improved year-over-year performance (LTM 6/30/16)

22 Ready-Mixed Average Selling Price (Per Cubic Yard) Adjusted EBITDA from Continuing Operations ($mm)1 Ready-Mixed Sales Volume (Million Cubic Yards) $123.24 $129.01 Q2 2015 Q2 2016 Financial Performance and Conservative Balance Sheet Improved year-over-year performance (Q2 2016) $33.7 $34.1 Q2 2015 Q2 2016 Revenue ($mm) $245 $276 Q2 2015 Q2 2016 1.77 1.93 Q2 2015 Q2 2016 1 North Texas weather impacted results. (1) (1)

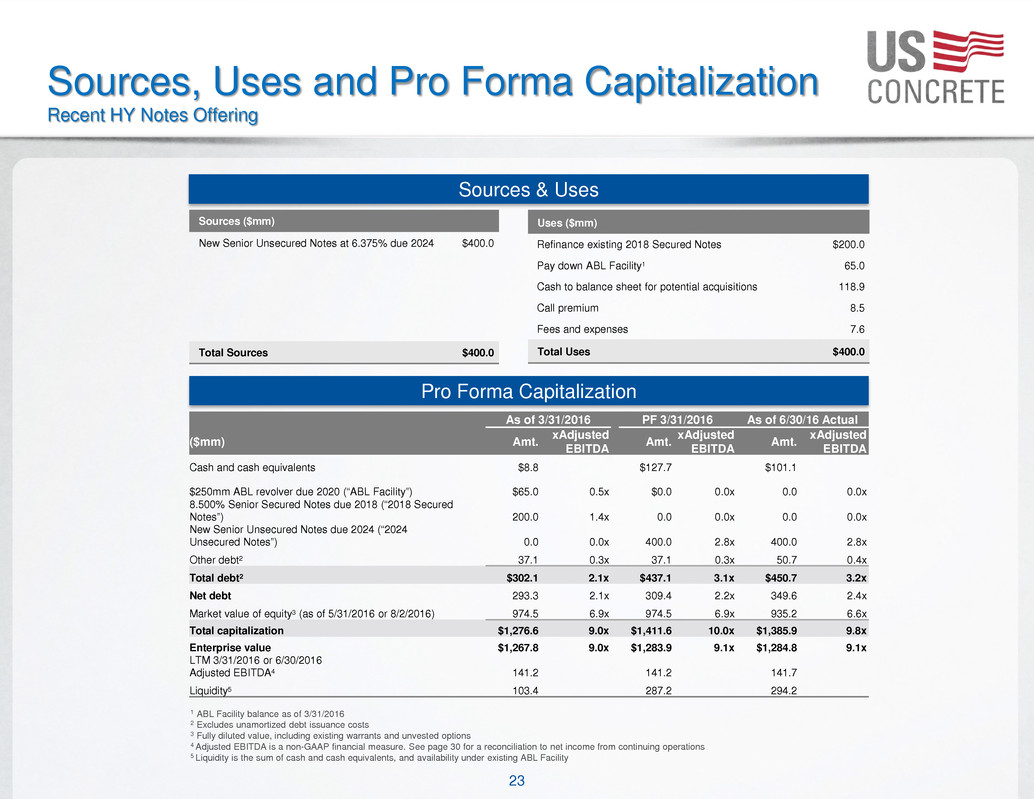

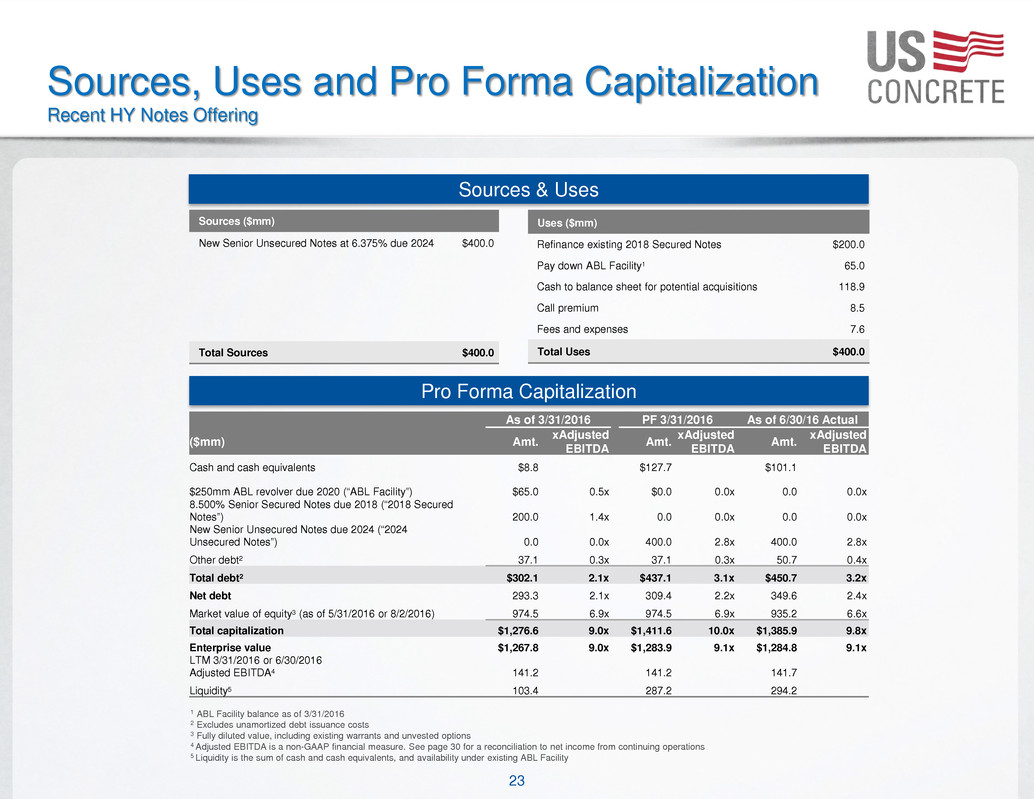

23 Sources, Uses and Pro Forma Capitalization Recent HY Notes Offering Sources ($mm) New Senior Unsecured Notes at 6.375% due 2024 $400.0 Total Sources $400.0 Sources & Uses Pro Forma Capitalization Uses ($mm) Refinance existing 2018 Secured Notes $200.0 Pay down ABL Facility1 65.0 Cash to balance sheet for potential acquisitions 118.9 Call premium 8.5 Fees and expenses 7.6 Total Uses $400.0 As of 3/31/2016 PF 3/31/2016 As of 6/30/16 Actual ($mm) Amt. xAdjustedEBITDA Amt. xAdjusted EBITDA Amt. xAdjusted EBITDA Cash and cash equivalents $8.8 $127.7 $101.1 $250mm ABL revolver due 2020 (“ABL Facility”) $65.0 0.5x $0.0 0.0x 0.0 0.0x 8.500% Senior Secured Notes due 2018 (“2018 Secured Notes”) 200.0 1.4x 0.0 0.0x 0.0 0.0x New Senior Unsecured Notes due 2024 (“2024 Unsecured Notes”) 0.0 0.0x 400.0 2.8x 400.0 2.8x Other debt2 37.1 0.3x 37.1 0.3x 50.7 0.4x Total debt2 $302.1 2.1x $437.1 3.1x $450.7 3.2x Net debt 293.3 2.1x 309.4 2.2x 349.6 2.4x Market value of equity3 (as of 5/31/2016 or 8/2/2016) 974.5 6.9x 974.5 6.9x 935.2 6.6x Total capitalization $1,276.6 9.0x $1,411.6 10.0x $1,385.9 9.8x Enterprise value $1,267.8 9.0x $1,283.9 9.1x $1,284.8 9.1x LTM 3/31/2016 or 6/30/2016 Adjusted EBITDA4 141.2 141.2 141.7 Liquidity5 103.4 287.2 294.2 1 ABL Facility balance as of 3/31/2016 2 Excludes unamortized debt issuance costs 3 Fully diluted value, including existing warrants and unvested options 4 Adjusted EBITDA is a non-GAAP financial measure. See page 30 for a reconciliation to net income from continuing operations 5 Liquidity is the sum of cash and cash equivalents, and availability under existing ABL Facility

Appendix

25 Top 15, 19% 16-25, 6% 26-35, 4% 36-50, 2% 51+, 69% Overview of Top Customer RelationshipsRevenue by Customer (2015) Source: U.S. Concrete Customer Years End Market Location % of 2015 revenue 1. Customer A* 21 High Rise, Commercial, Gov't Northern Texas 3.2% 2. Customer B* 21 Residential Northern Texas 2.2% 3. Customer C 30 Commercial Northern California 2.0% 4. Customer D 12+ High Rise, Commercial NY / NJ / DC 1.5% 5. Customer E* 21 Commercial Northern Texas 1.3% 6. Customer F 7 Commercial Office / Multi family / hotel NY / NJ / DC 1.3% 7. Customer G 30 Commercial Northern California 1.3% 8. Customer H 20 Commercial Northern California 1.1% 9. Customer I 20 Commercial Northern California 1.0% 10. Customer J 30 Commercial Northern California 0.8% 11. Customer K 21 Government Northern Texas 0.8% 12. Customer L 30 Industrial, Trans, Gov’t NY / NJ / DC 0.7% 13. Customer M 10 Commercial Northern California 0.7% 14. Customer N 3 High Rise, Commercial NY / NJ / DC 0.7% 15. Customer O 10 Commercial Northern California 0.7% Average 20 Total 19.3% The average length of USCR’s top 15 customer relationships is ~20 years Long-Term Diversified Customer Base Across Sectors and Regions Quality, long-tenured client relationships with focused concentration in key markets * Denotes customers that are related to each other Revenue Mix by Region (LTM 6/30/16) (2014A) Northern Texas 27% Northern California 28% New York / New Jersey / DC 31% Other 2%Western / Southern Texas 12% No direct oil and gas exposure

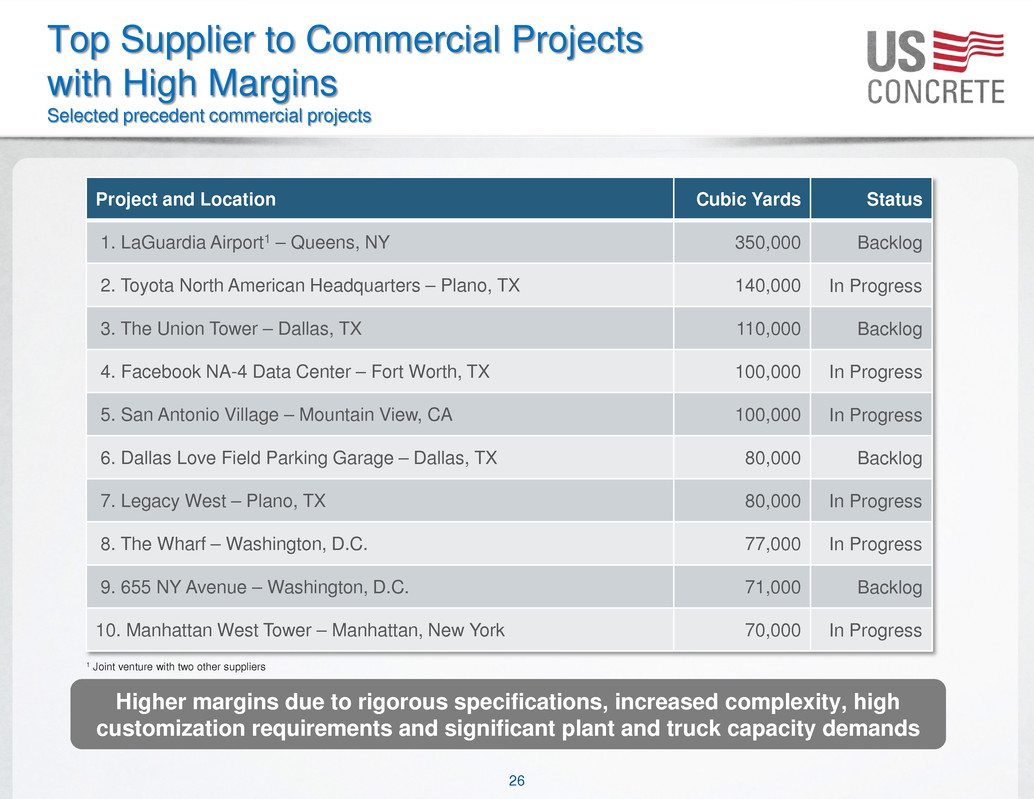

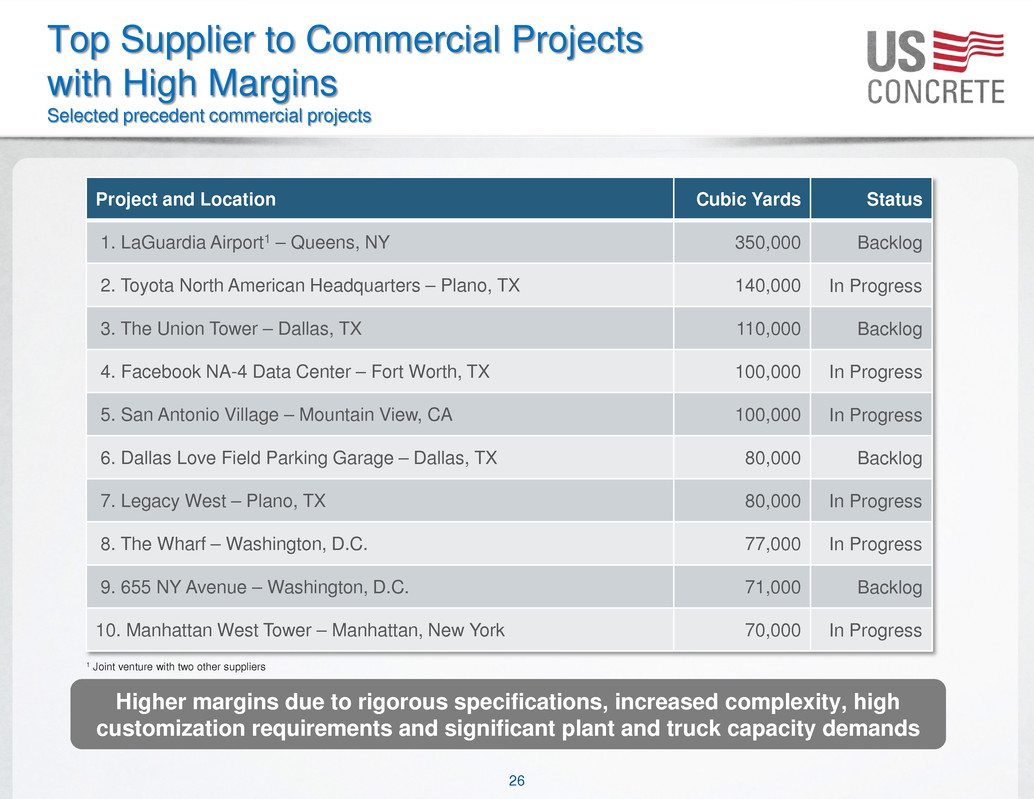

26 Top Supplier to Commercial Projects with High Margins Selected precedent commercial projects Higher margins due to rigorous specifications, increased complexity, high customization requirements and significant plant and truck capacity demands Project and Location Cubic Yards Status 1. LaGuardia Airport1 – Queens, NY 350,000 Backlog 2. Toyota North American Headquarters – Plano, TX 140,000 In Progress 3. The Union Tower – Dallas, TX 110,000 Backlog 4. Facebook NA-4 Data Center – Fort Worth, TX 100,000 In Progress 5. San Antonio Village – Mountain View, CA 100,000 In Progress 6. Dallas Love Field Parking Garage – Dallas, TX 80,000 Backlog 7. Legacy West – Plano, TX 80,000 In Progress 8. The Wharf – Washington, D.C. 77,000 In Progress 9. 655 NY Avenue – Washington, D.C. 71,000 Backlog 10. Manhattan West Tower – Manhattan, New York 70,000 In Progress 1 Joint venture with two other suppliers

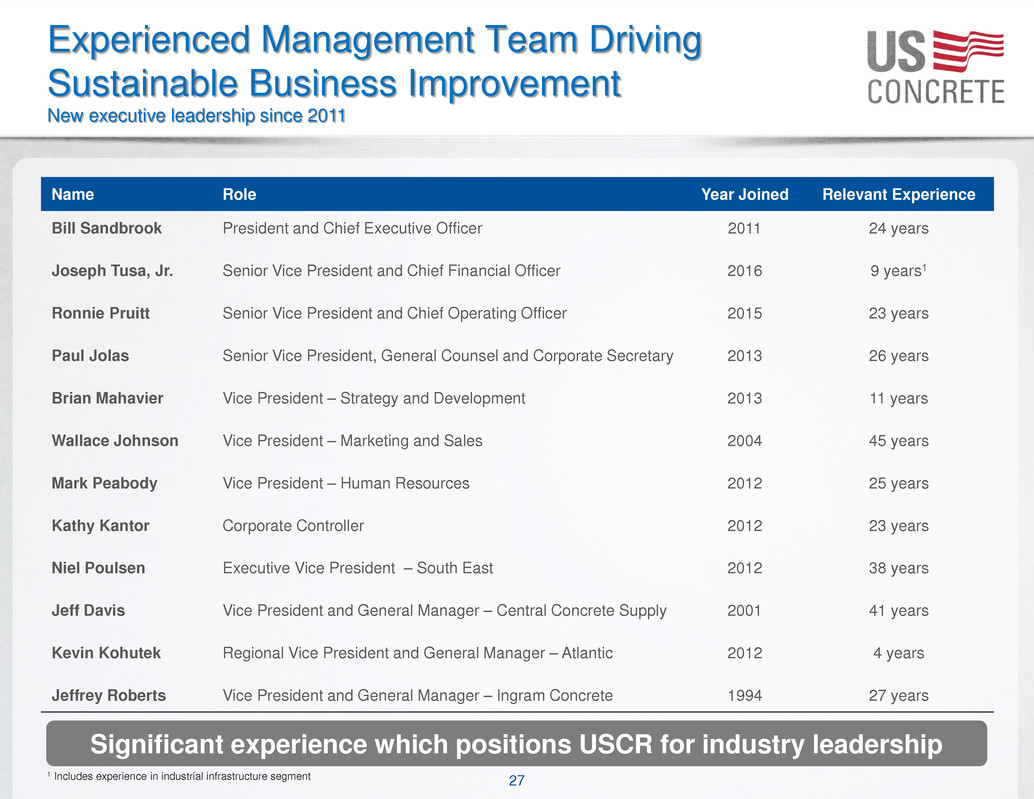

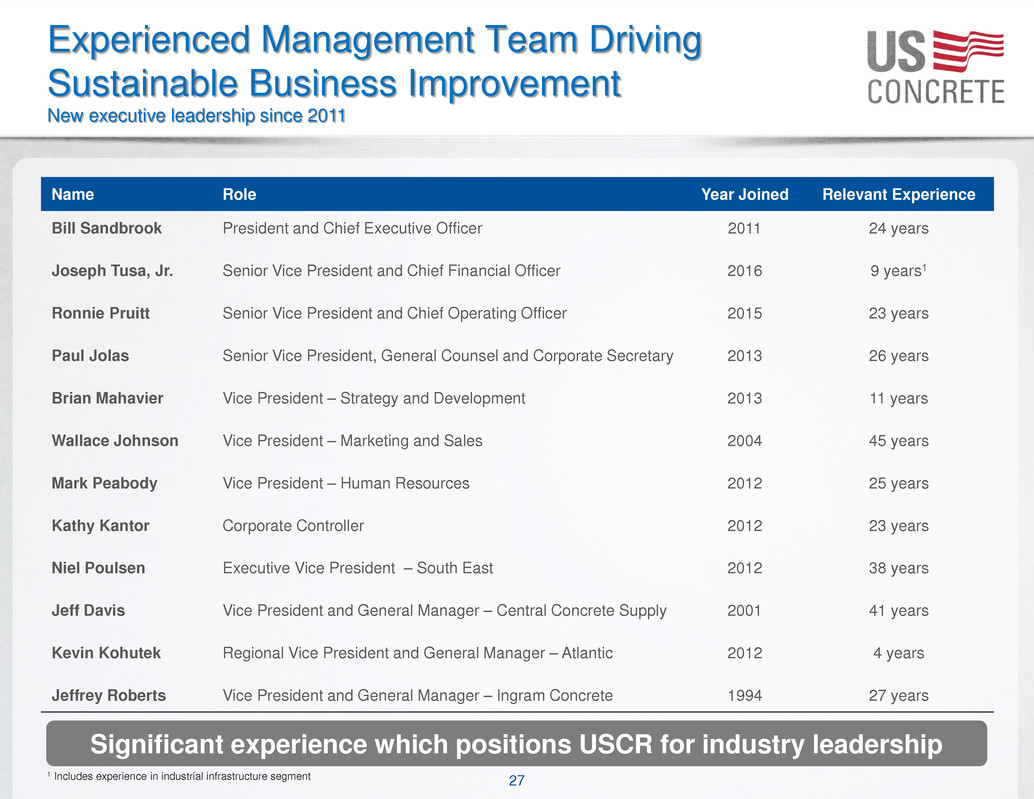

27 Name Role Year Joined Relevant Experience Bill Sandbrook President and Chief Executive Officer 2011 24 years Joseph Tusa, Jr. Senior Vice President and Chief Financial Officer 2016 9 years1 Ronnie Pruitt Senior Vice President and Chief Operating Officer 2015 23 years Paul Jolas Senior Vice President, General Counsel and Corporate Secretary 2013 26 years Brian Mahavier Vice President – Strategy and Development 2013 11 years Wallace Johnson Vice President – Marketing and Sales 2004 45 years Mark Peabody Vice President – Human Resources 2012 25 years Kathy Kantor Corporate Controller 2012 23 years Niel Poulsen Executive Vice President – South East 2012 38 years Jeff Davis Vice President and General Manager – Central Concrete Supply 2001 41 years Kevin Kohutek Regional Vice President and General Manager – Atlantic 2012 4 years Jeffrey Roberts Vice President and General Manager – Ingram Concrete 1994 27 years Experienced Management Team Driving Sustainable Business Improvement New executive leadership since 2011 Significant experience which positions USCR for industry leadership 1 Includes experience in industrial infrastructure segment

28 Organizational Structure U.S. Concrete, Inc. & Subsidiaries Alliance Haulers, Inc. Beall Industries, Inc. Ingram Concrete LLC Redi-Mix, LLC Atlas-Tuck Concrete, Inc. Texas / Oklahoma USC Atlantic, Inc. New York / New Jersey Eastern Concrete Materials, Inc. California Central Concrete Supply Co., Inc. Bode Gravel Co. Washington D.C. Superior Concrete Materials, Inc. ABL Facility 2024 Unsecured Notes U.S. Virgin Islands1 Heavy Materials, LLC Spartan Products, LLC 1 Our USVI subsidiaries do not guarantee our ABL Facility and will not guarantee the 2024 Unsecured Notes Ferrara Bros., LLC

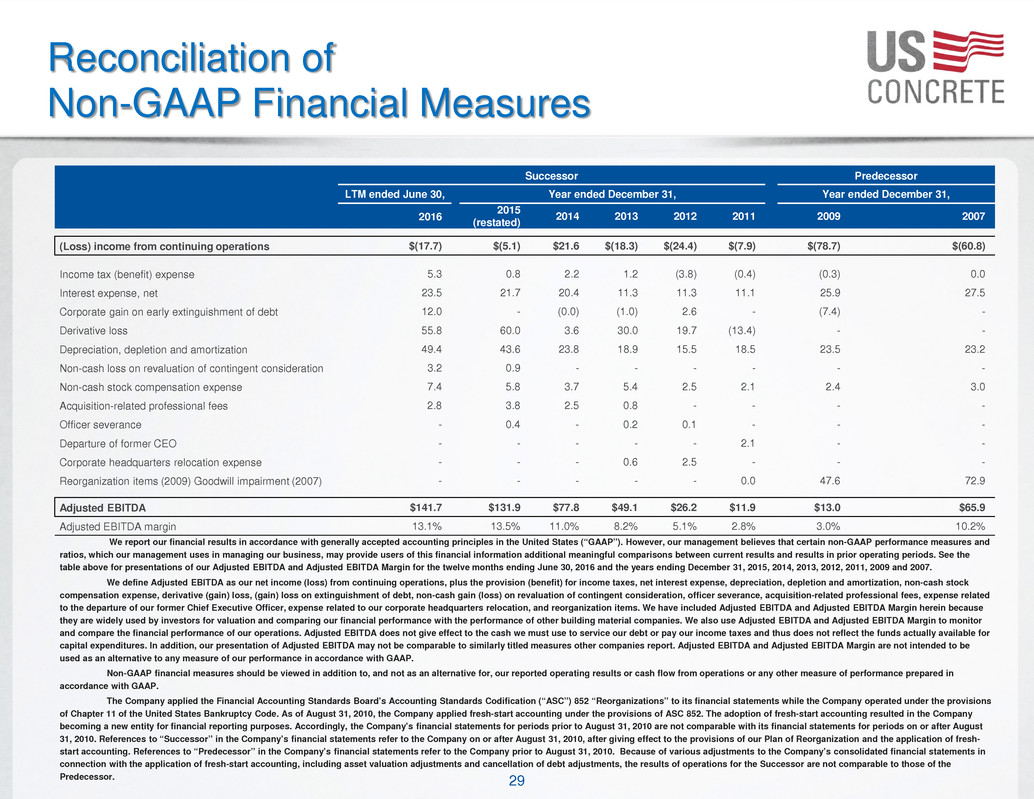

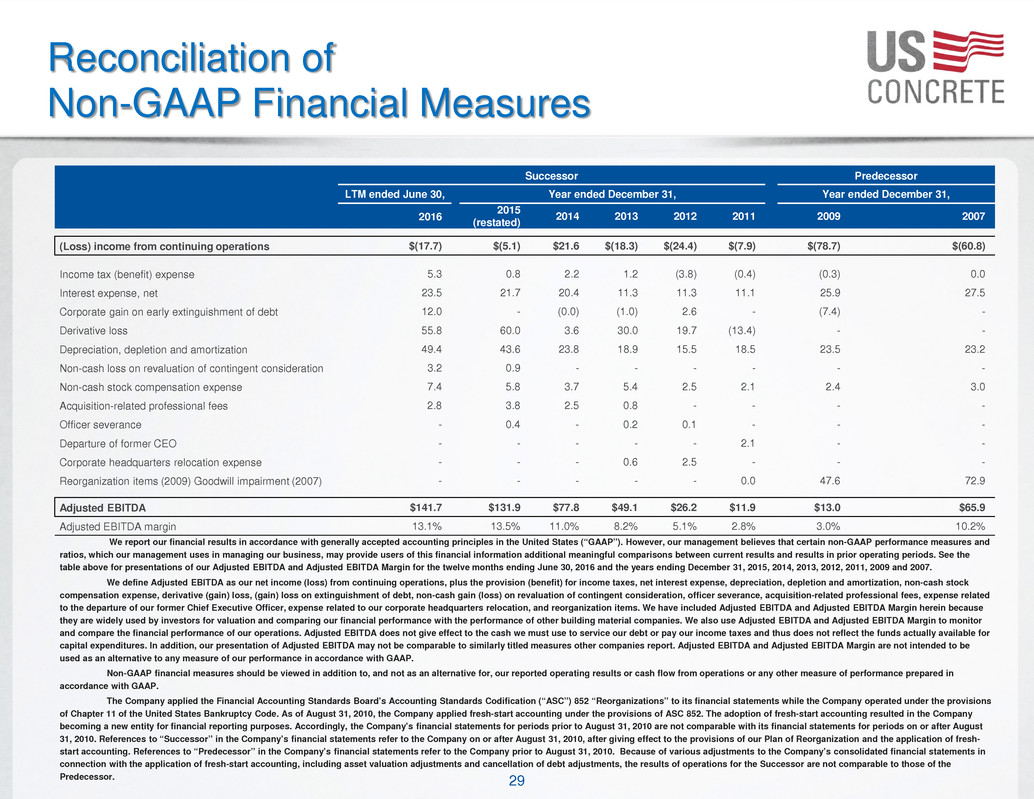

29 Reconciliation of Non-GAAP Financial Measures We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the table above for presentations of our Adjusted EBITDA and Adjusted EBITDA Margin for the twelve months ending June 30, 2016 and the years ending December 31, 2015, 2014, 2013, 2012, 2011, 2009 and 2007. We define Adjusted EBITDA as our net income (loss) from continuing operations, plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, non-cash stock compensation expense, derivative (gain) loss, (gain) loss on extinguishment of debt, non-cash gain (loss) on revaluation of contingent consideration, officer severance, acquisition-related professional fees, expense related to the departure of our former Chief Executive Officer, expense related to our corporate headquarters relocation, and reorganization items. We have included Adjusted EBITDA and Adjusted EBITDA Margin herein because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use Adjusted EBITDA and Adjusted EBITDA Margin to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of Adjusted EBITDA may not be comparable to similarly titled measures other companies report. Adjusted EBITDA and Adjusted EBITDA Margin are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP. The Company applied the Financial Accounting Standards Board’s Accounting Standards Codification (“ASC”) 852 “Reorganizations” to its financial statements while the Company operated under the provisions of Chapter 11 of the United States Bankruptcy Code. As of August 31, 2010, the Company applied fresh-start accounting under the provisions of ASC 852. The adoption of fresh-start accounting resulted in the Company becoming a new entity for financial reporting purposes. Accordingly, the Company’s financial statements for periods prior to August 31, 2010 are not comparable with its financial statements for periods on or after August 31, 2010. References to “Successor” in the Company’s financial statements refer to the Company on or after August 31, 2010, after giving effect to the provisions of our Plan of Reorganization and the application of fresh- start accounting. References to “Predecessor” in the Company’s financial statements refer to the Company prior to August 31, 2010. Because of various adjustments to the Company’s consolidated financial statements in connection with the application of fresh-start accounting, including asset valuation adjustments and cancellation of debt adjustments, the results of operations for the Successor are not comparable to those of the Predecessor. Successor Predecessor LTM ended June 30, Year ended December 31, Year ended December 31, 2016 2015 (restated) 2014 2013 2012 2011 2009 2007 (Loss) income from continuing operations $(17.7) $(5.1) $21.6 $(18.3) $(24.4) $(7.9) $(78.7) $(60.8) Income tax (benefit) expense 5.3 0.8 2.2 1.2 (3.8) (0.4) (0.3) 0.0 Interest expense, net 23.5 21.7 20.4 11.3 11.3 11.1 25.9 27.5 Corporate gain on early extinguishment of debt 12.0 - (0.0) (1.0) 2.6 - (7.4) - Derivative loss 55.8 60.0 3.6 30.0 19.7 (13.4) - - Depreciation, depletion and amortization 49.4 43.6 23.8 18.9 15.5 18.5 23.5 23.2 Non-cash loss on revaluation of contingent consideration 3.2 0.9 - - - - - - Non-cash stock compensation expense 7.4 5.8 3.7 5.4 2.5 2.1 2.4 3.0 Acquisition-related professional fees 2.8 3.8 2.5 0.8 - - - - Officer severance - 0.4 - 0.2 0.1 - - - Departure of former CEO - - - - - 2.1 - - Corporate headquarters relocation expense - - - 0.6 2.5 - - - Reorganization items (2009) Goodwill impairment (2007) - - - - - 0.0 47.6 72.9 Adjusted EBITDA $141.7 $131.9 $77.8 $49.1 $26.2 $11.9 $13.0 $65.9 Adjusted EBITDA margin 13.1% 13.5% 11.0% 8.2% 5.1% 2.8% 3.0% 10.2%