March 2018 INVESTOR PRESENTATION

1 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Forward-Looking Statements Certain statements and information provided in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us and do not include the impact of future acquisitions. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially. The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely unduly upon these forward-looking statements. The Company undertakes no obligation to update these forward-looking statements, except as required by law. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, general economic and business conditions, which will, among other things, affect demand for new residential and commercial construction; our ability to successfully identify, manage, and integrate acquisitions; the cyclical nature of, and changes in, the real estate and construction markets, including pricing changes by our competitors; governmental requirements and initiatives, including those related to mortgage lending or mortgage financing, funding for public or infrastructure construction, land usage, and environmental, health, and safety matters; disruptions, uncertainties or volatility in the credit markets that may limit our, our suppliers' and our customers' access to capital; our ability to successfully implement our operating strategy; weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms of our indebtedness; our ability to maintain favorable relationships with third parties who supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; and product liability, property damage, and other claims and insurance coverage issues. For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see “Risk Factors” in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. All written and oral forward-looking statements in this presentation are expressly qualified by these “Risk Factors.”

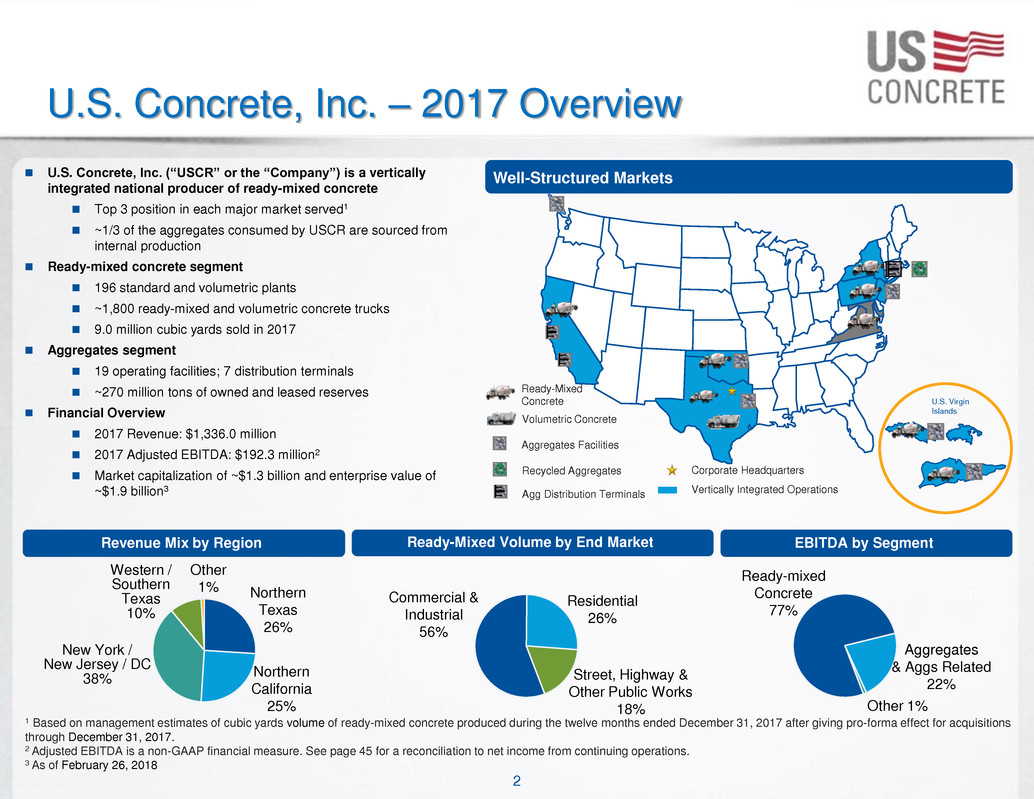

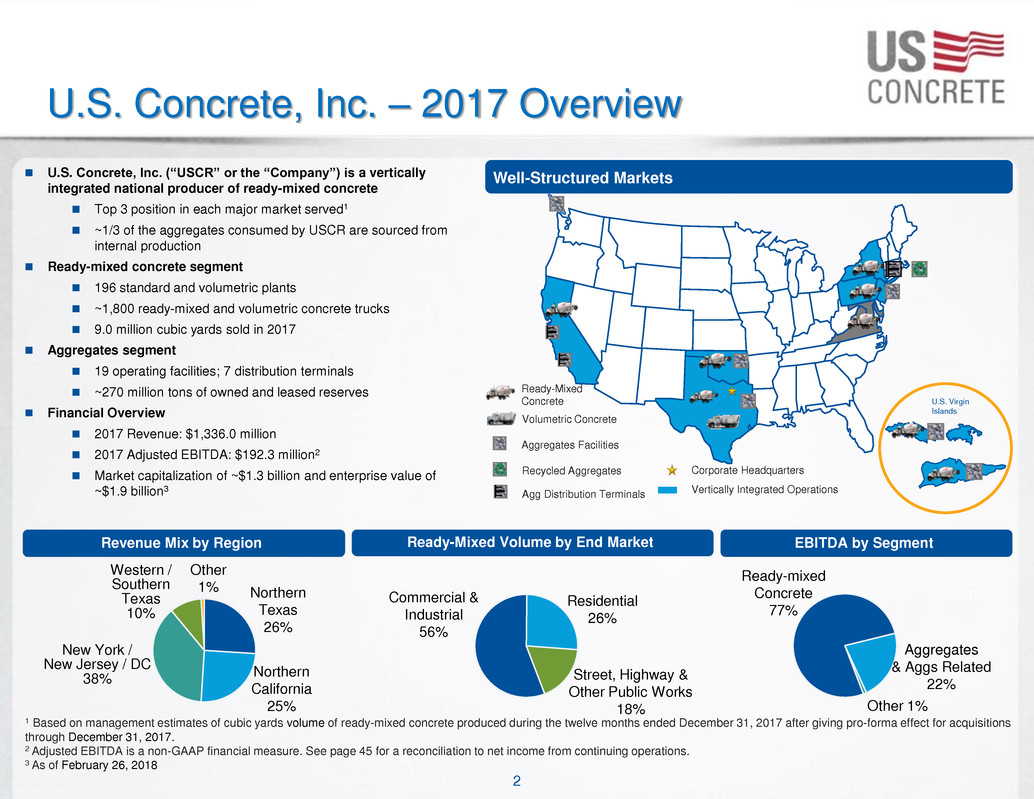

2 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 U.S. Concrete, Inc. – 2017 Overview U.S. Concrete, Inc. (“USCR” or the “Company”) is a vertically integrated national producer of ready-mixed concrete Top 3 position in each major market served1 ~1/3 of the aggregates consumed by USCR are sourced from internal production Ready-mixed concrete segment 196 standard and volumetric plants ~1,800 ready-mixed and volumetric concrete trucks 9.0 million cubic yards sold in 2017 Aggregates segment 19 operating facilities; 7 distribution terminals ~270 million tons of owned and leased reserves Financial Overview 2017 Revenue: $1,336.0 million 2017 Adjusted EBITDA: $192.3 million2 Market capitalization of ~$1.3 billion and enterprise value of ~$1.9 billion3 Commercial & Industrial 56% Residential 26% 1 Based on management estimates of cubic yards volume of ready-mixed concrete produced during the twelve months ended December 31, 2017 after giving pro-forma effect for acquisitions through December 31, 2017. 2 Adjusted EBITDA is a non-GAAP financial measure. See page 45 for a reconciliation to net income from continuing operations. 3 As of February 26, 2018 Revenue Mix by Region Street, Highway & Other Public Works 18% Well-Structured Markets Ready-Mixed Volume by End Market EBITDA by Segment Aggregates & Aggs Related 22% Ready-mixed Concrete 77% Ready-Mixed Concrete Aggregates Facilities Recycled Aggregates Corporate Headquarters Vertically Integrated Operations Volumetric Concrete Agg Distribution Terminals S C U.S. Virgin Islands Northern Texas 26% Northern California 25% New York / New Jersey / DC 38% Other 1% Western / Southern Texas 10% Other 1%

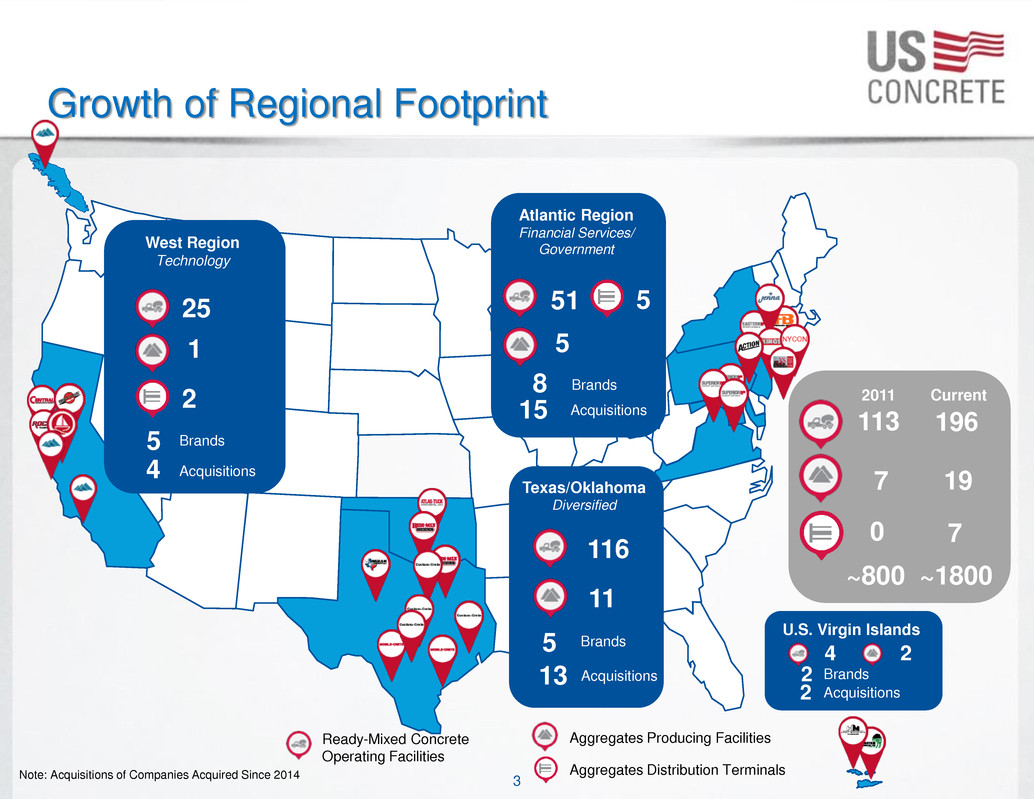

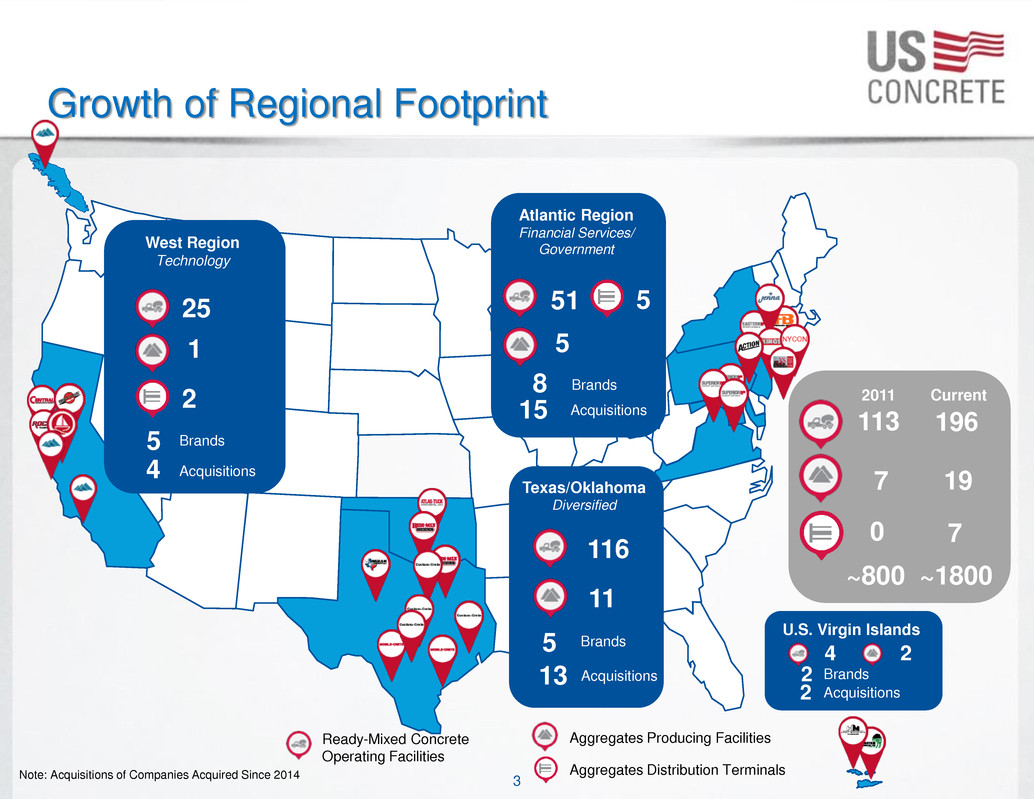

3 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Growth of Regional Footprint U.S. Virgin Islands Atlantic Region Financial Services/ Government Texas/Oklahoma Diversified West Region Technology 25 5 8 5 51 116 5 11 2 4 2 Brands 15 Acquisitions Brands 4 Acquisitions Brands 13 Acquisitions Brands 2 Acquisitions Ready-Mixed Concrete Operating Facilities Aggregates Producing Facilities 2011 Current ~800 ~1800 7 113 Aggregates Distribution Terminals 5 0 Note: Acquisitions of Companies Acquired Since 2014 19 196 7 2 1

4 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Regional Market: Metro NYC 17 Plants Serving five boroughs Commercial / Residential / Infrastructure Focus Complex Urban Operating Environment Significant Labor Union Position Active / Well Structured Market New York City Ready-Mixed Concrete Operating Facilities Aggregates Producing Facilities Aggregates Distribution Terminals

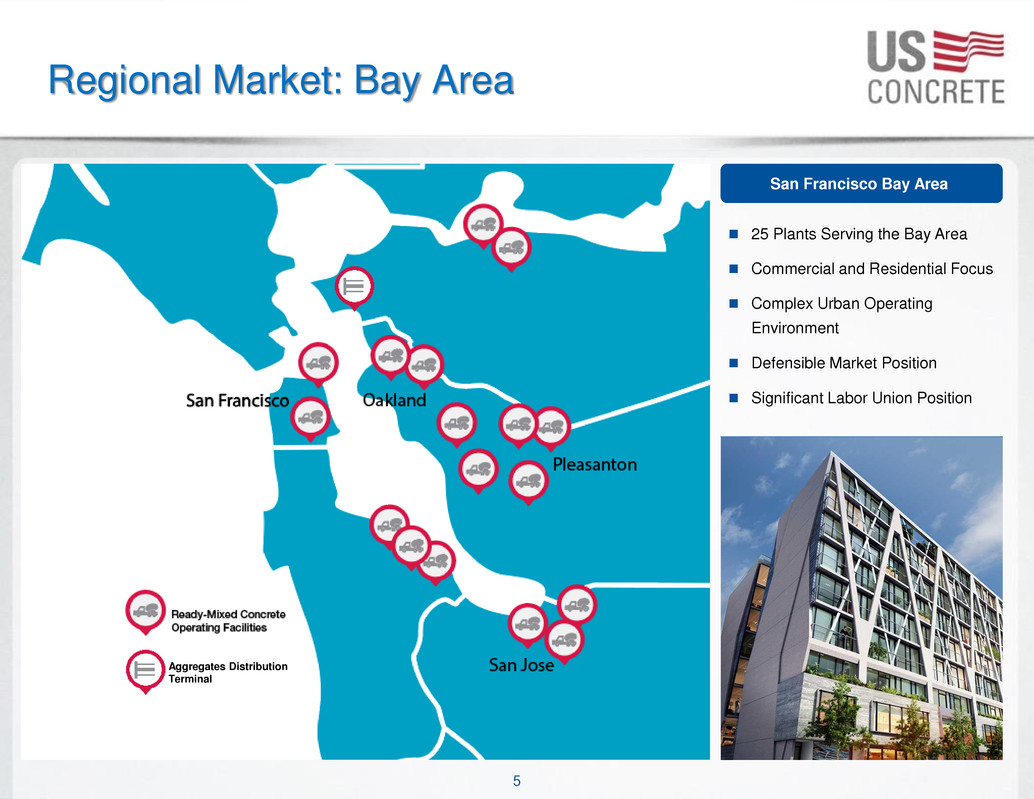

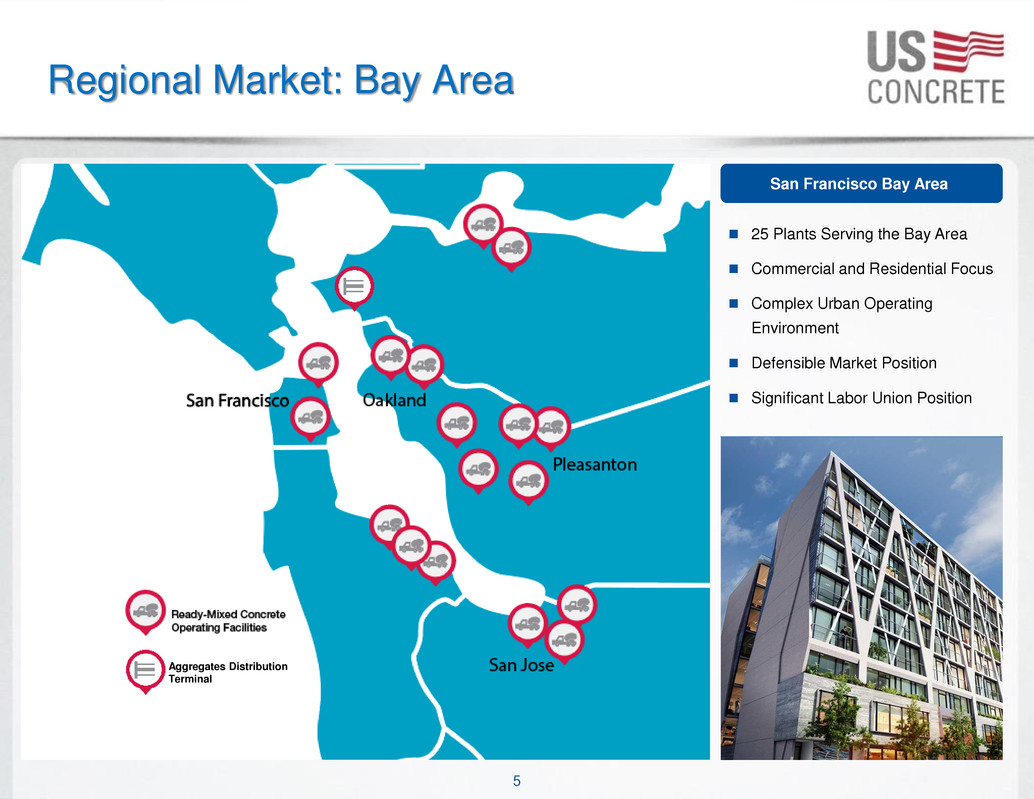

5 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Regional Market: Bay Area 25 Plants Serving the Bay Area Commercial and Residential Focus Complex Urban Operating Environment Defensible Market Position Significant Labor Union Position San Francisco Bay Area Ready-Mixed Concrete Operating Facilities Aggregates Distribution Terminal

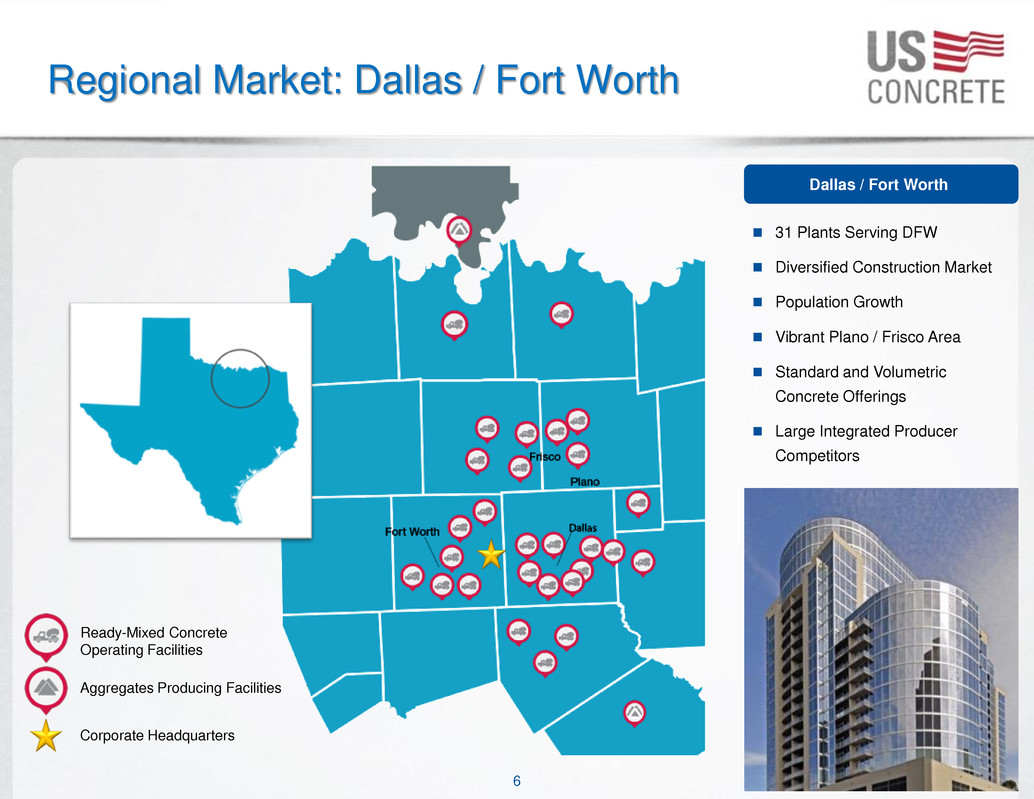

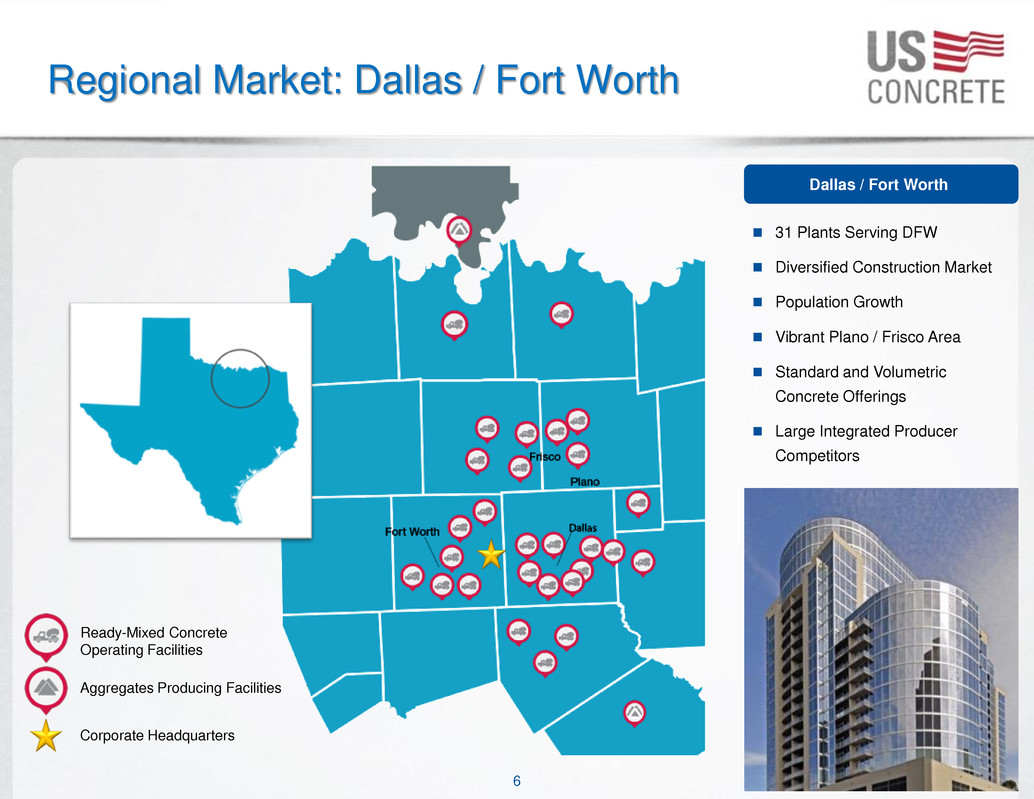

6 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Regional Market: Dallas / Fort Worth 31 Plants Serving DFW Diversified Construction Market Population Growth Vibrant Plano / Frisco Area Standard and Volumetric Concrete Offerings Large Integrated Producer Competitors Dallas / Fort Worth Ready-Mixed Concrete Operating Facilities Aggregates Producing Facilities Corporate Headquarters

7 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Strategic Position in Attractive Markets Industry Leading Performance Strong Financial Performance, Conservative Balance Sheet and Solid Returns on Capital Top 1,2 or 3 Position in Well-Structured Markets with Attractive Fundamentals Long-Term Diversified Customer Base Across Sectors and Regions Top Supplier to Commercial Projects with High Margins Vertical Integration into Aggregates Enhances Value Chain Successful Track Record of Acquisition Integration and a Robust Pipeline Disciplined Pricing Mechanics Drive Superior Margin Performance Through the Cycle Purchasing Power Due to Size in Highly Fragmented Markets Experienced Management Team with Long-Term Strategic Focus

8 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Extended Construction Cycle Management’s View of USCR Position in Cycle Administration's Regulatory and Tax Reform Agendas Combined with the Prospect of Increased Infrastructure Spending Will Potentially Extend the Cycle Early Mid Late Growth Consistent Heavy Previous position in cycle New position in cycle

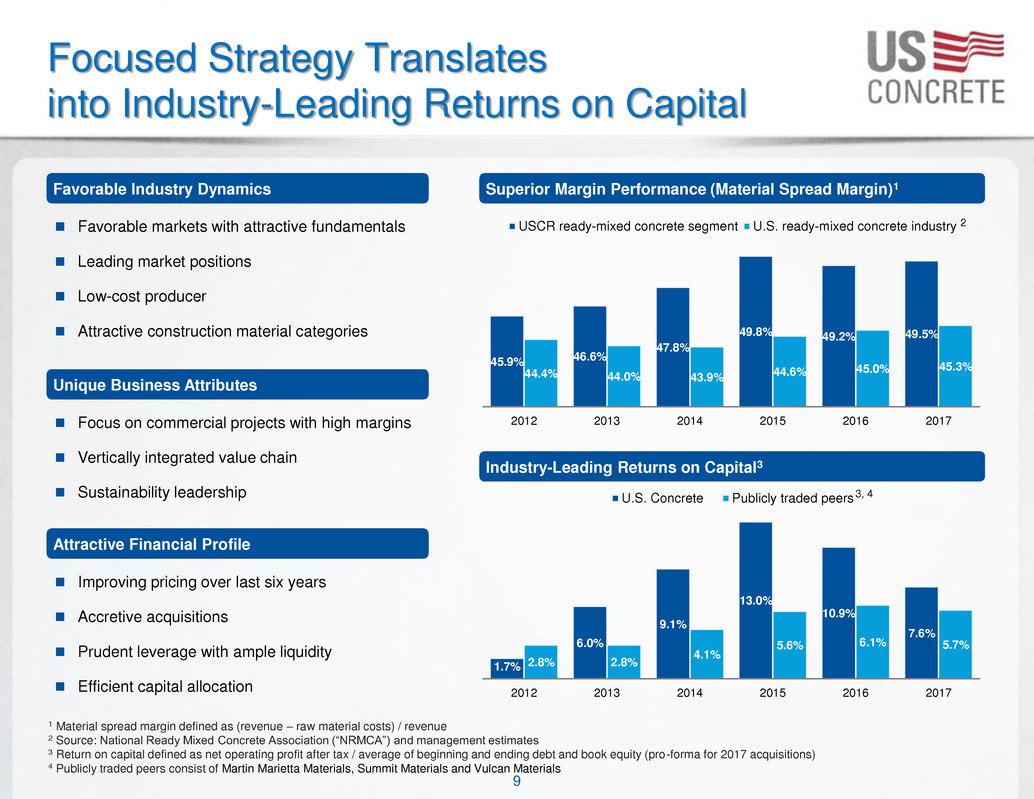

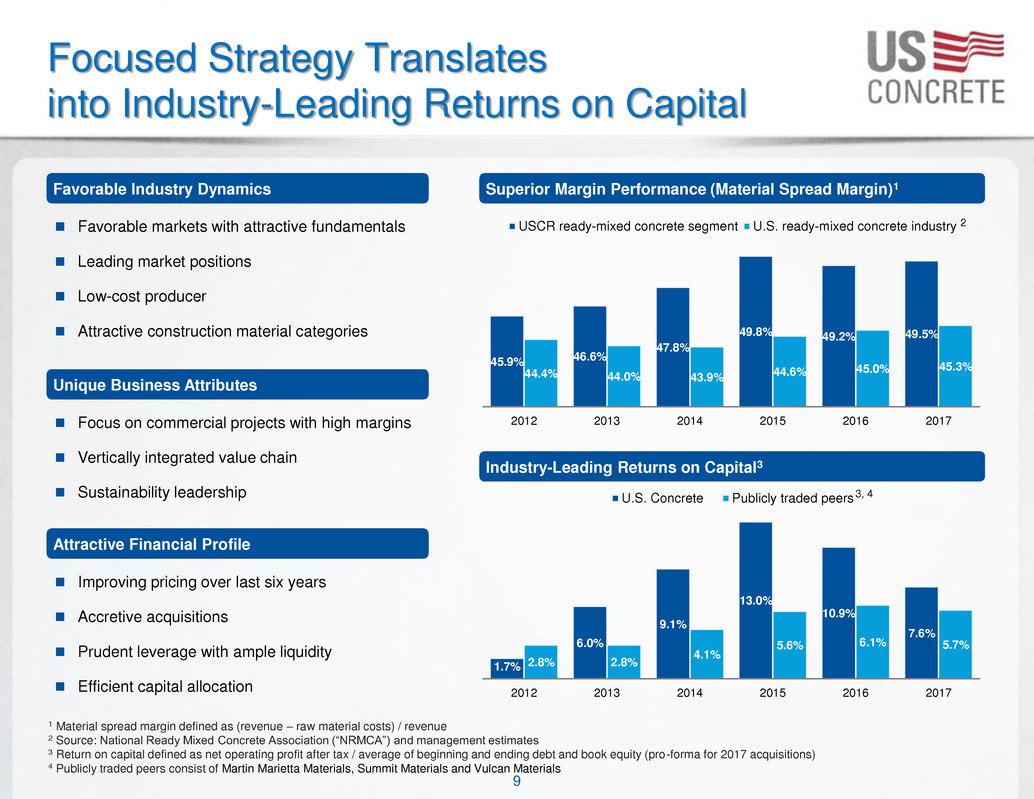

9 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Focused Strategy Translates into Industry-Leading Returns on Capital 1 Material spread margin defined as (revenue – raw material costs) / revenue 2 Source: National Ready Mixed Concrete Association (“NRMCA”) and management estimates 3 Return on capital defined as net operating profit after tax / average of beginning and ending debt and book equity (pro-forma for 2017 acquisitions) 4 Publicly traded peers consist of Martin Marietta Materials, Summit Materials and Vulcan Materials Favorable Industry Dynamics Favorable markets with attractive fundamentals Leading market positions Low-cost producer Attractive construction material categories Unique Business Attributes Focus on commercial projects with high margins Vertically integrated value chain Sustainability leadership Attractive Financial Profile Improving pricing over last six years Accretive acquisitions Prudent leverage with ample liquidity Efficient capital allocation Superior Margin Performance (Material Spread Margin)1 45.9% 46.6% 47.8% 49.8% 49.2% 49.5% 44.4% 44.0% 43.9% 44.6% 45.0% 45.3% 2012 2013 2014 2015 2016 2017 USCR ready-mixed concrete segment U.S. ready-mixed concrete industry 2 1.7% 6.0% 9.1% 13.0% 10.9% 7.6% 2.8% 2.8% 4.1% 5.6% 6.1% 5.7% 2012 2013 2014 2015 2016 2017 U.S. Concrete Publicly traded peers Industry-Leading Returns on Capital3 3, 4

10 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Top Supplier to Commercial Projects with High Margins Selected precedent commercial projects Higher Margins due to Rigorous Specifications, Complex Projects, High Customization Requirements and Significant Plant and Truck Capacity Demands Project and Location Cubic Yards Status 1. Facebook NA-4 Data Center – Fort Worth, TX 382,000 In Progress 2. LaGuardia Airport1 – Queens, NY 375,000 In Progress 3. I-35W – Ft. Worth, TX 160,000 In Progress 4. Google Bayview Campus – Mountain View, CA 125,000 In Progress 5. The Union Tower – Dallas, TX 112,000 In Progress 6. Grandscape – The Colony, TX 92,000 In Progress 7. Dallas Love Field Parking Garage – Dallas, TX 87,000 In Progress 8. Goethals Bridge – Staten Island, NY 85,000 In Progress 9. Charles Schwab Westlake Campus – Westlake, TX 80,000 In Progress 10. The Village Town Center – Dallas, TX 80,000 Backlog 11. Workday Campus – Pleasanton, CA 70,000 In Progress 12. Gotham 1 & 3 – Queens, NY 70,000 In Progress 13. Manhattan West Tower – Manhattan, NY 70,000 In Progress 14. Hudson Yards Tower E – Manhattan, NY 65,000 In Progress 15. Pioneer Natural Resources – Irving, TX 64,000 In Progress 1 Joint venture with a third-party supplier

11 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 2 6 1 3 2 9 3 4 8 3 7 2 3 9 1 3 9 6 4 0 6 3 9 0 4 0 4 4 3 2 4 5 8 4 5 7 4 1 5 3 5 2 2 5 9 2 5 7 2 6 6 2 9 0 3 0 0 3 2 5 3 3 6 3 4 3 3 4 8 $111.89 $134.86 $20 $40 $60 $80 $100 $120 $140 $160 0 50 100 150 200 250 300 350 400 450 500 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 A v g . S el lin g P rice (“ A S P ” ) V o lum e (in m m cu b ic y ar d s (“ CY Ds” )) US Production Industry ASP/CYD USCR ASP/CYD Premium Price Position Leads the Industry 1 Source: NRMCA and Management Estimates for 2017 Industry Pricing 1 1

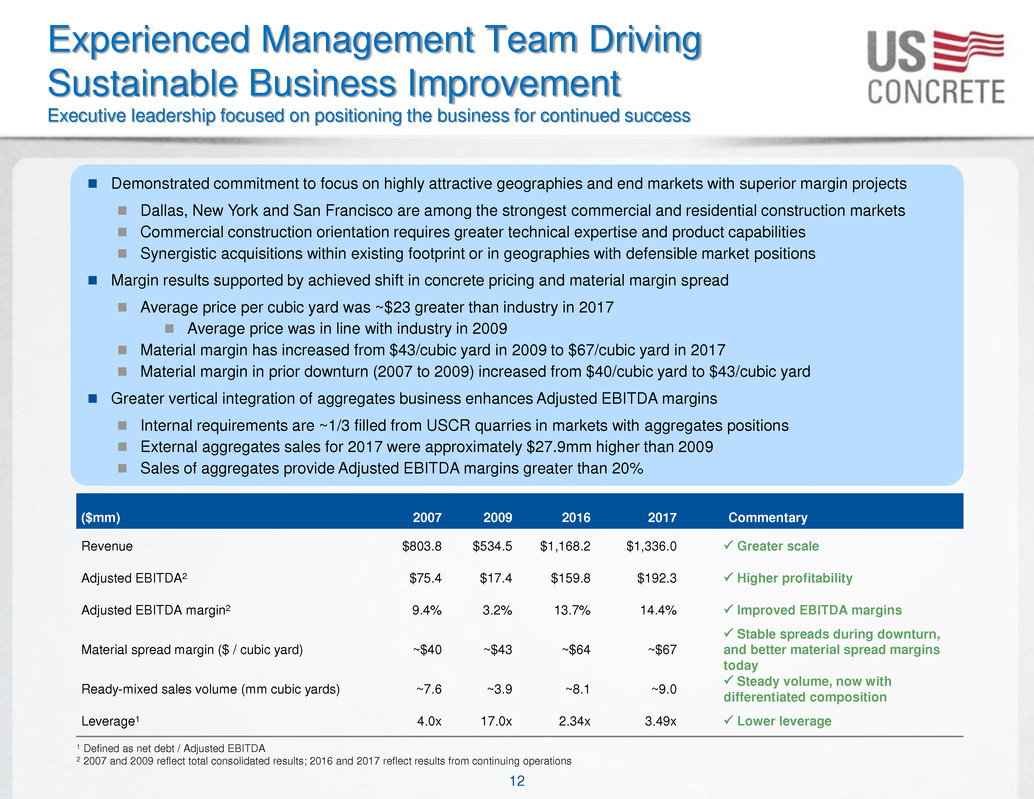

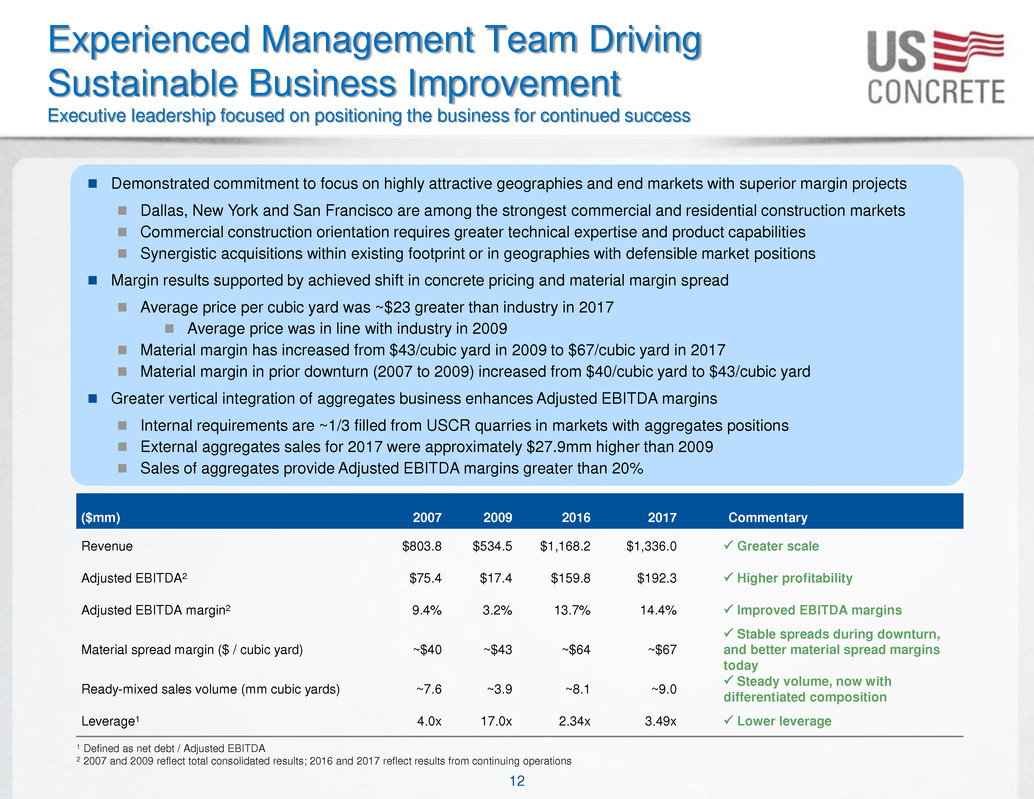

12 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Experienced Management Team Driving Sustainable Business Improvement Executive leadership focused on positioning the business for continued success Demonstrated commitment to focus on highly attractive geographies and end markets with superior margin projects Dallas, New York and San Francisco are among the strongest commercial and residential construction markets Commercial construction orientation requires greater technical expertise and product capabilities Synergistic acquisitions within existing footprint or in geographies with defensible market positions Margin results supported by achieved shift in concrete pricing and material margin spread Average price per cubic yard was ~$23 greater than industry in 2017 Average price was in line with industry in 2009 Material margin has increased from $43/cubic yard in 2009 to $67/cubic yard in 2017 Material margin in prior downturn (2007 to 2009) increased from $40/cubic yard to $43/cubic yard Greater vertical integration of aggregates business enhances Adjusted EBITDA margins Internal requirements are ~1/3 filled from USCR quarries in markets with aggregates positions External aggregates sales for 2017 were approximately $27.9mm higher than 2009 Sales of aggregates provide Adjusted EBITDA margins greater than 20% ($mm) 2007 2009 2016 2017 Commentary Revenue $803.8 $534.5 $1,168.2 $1,336.0 Greater scale Adjusted EBITDA2 $75.4 $17.4 $159.8 $192.3 Higher profitability Adjusted EBITDA margin2 9.4% 3.2% 13.7% 14.4% Improved EBITDA margins Material spread margin ($ / cubic yard) ~$40 ~$43 ~$64 ~$67 Stable spreads during downturn, and better material spread margins today Ready-mixed sales volume (mm cubic yards) ~7.6 ~3.9 ~8.1 ~9.0 Steady volume, now with differentiated composition Leverage1 4.0x 17.0x 2.34x 3.49x Lower leverage 1 Defined as net debt / Adjusted EBITDA 2 2007 and 2009 reflect total consolidated results; 2016 and 2017 reflect results from continuing operations

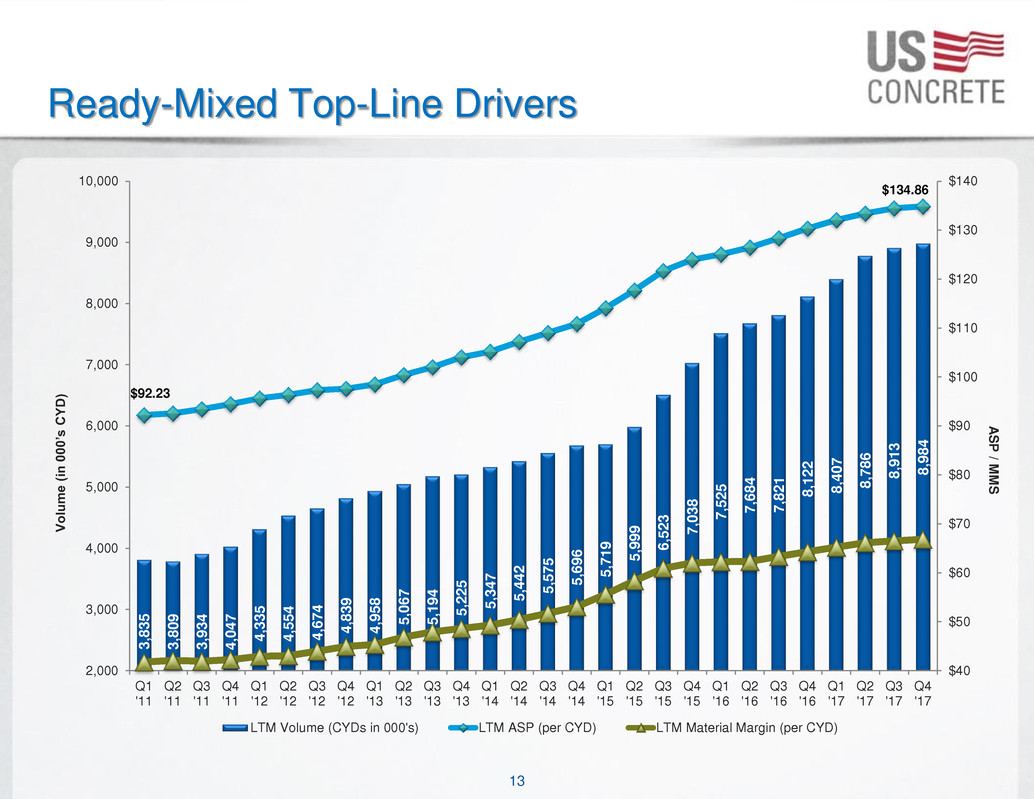

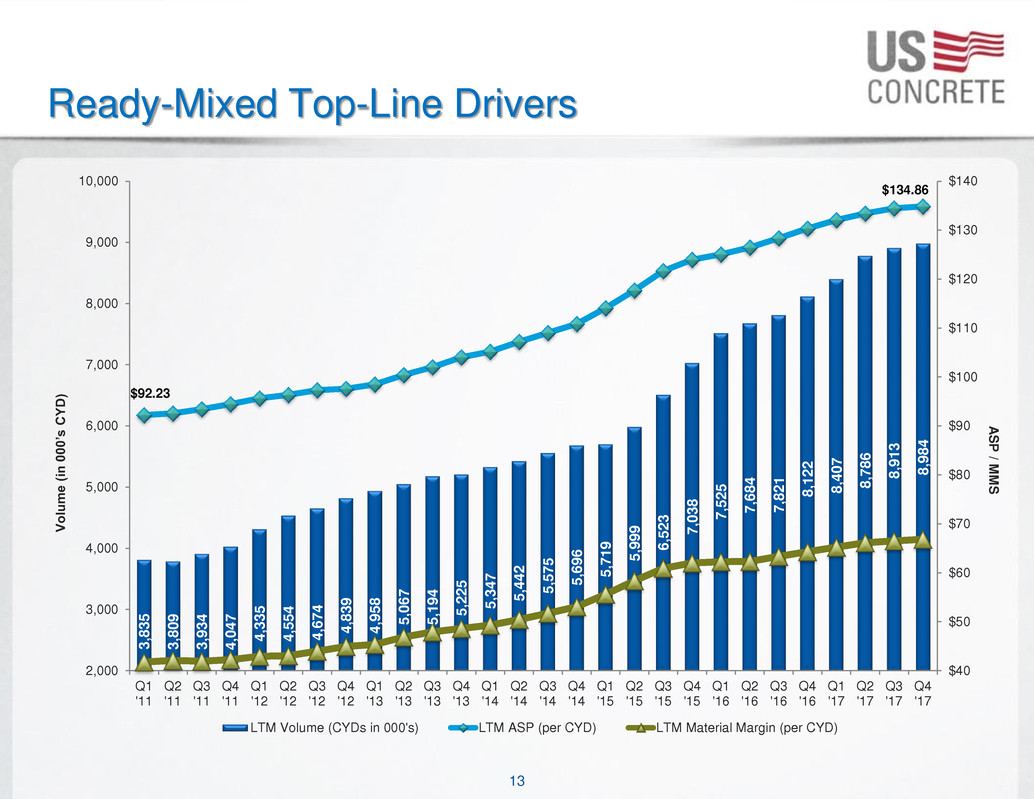

13 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ready-Mixed Top-Line Drivers 3,8 3 5 3,80 9 3,93 4 4,04 7 4,33 5 4,55 4 4,67 4 4,83 9 4,95 8 5,06 7 5,1 9 4 5,22 5 5,34 7 5,44 2 5,57 5 5,69 6 5,71 9 5,99 9 6,52 3 7,03 8 7,5 2 5 7,68 4 7,82 1 8,12 2 8,40 7 8,78 6 8,91 3 8,98 4 $92.23 $134.86 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17 Q4 '17 A S P / M M S V o lum e (in 000 ‟s CY D) LTM Volume (CYDs in 000's) LTM ASP (per CYD) LTM Material Margin (per CYD)

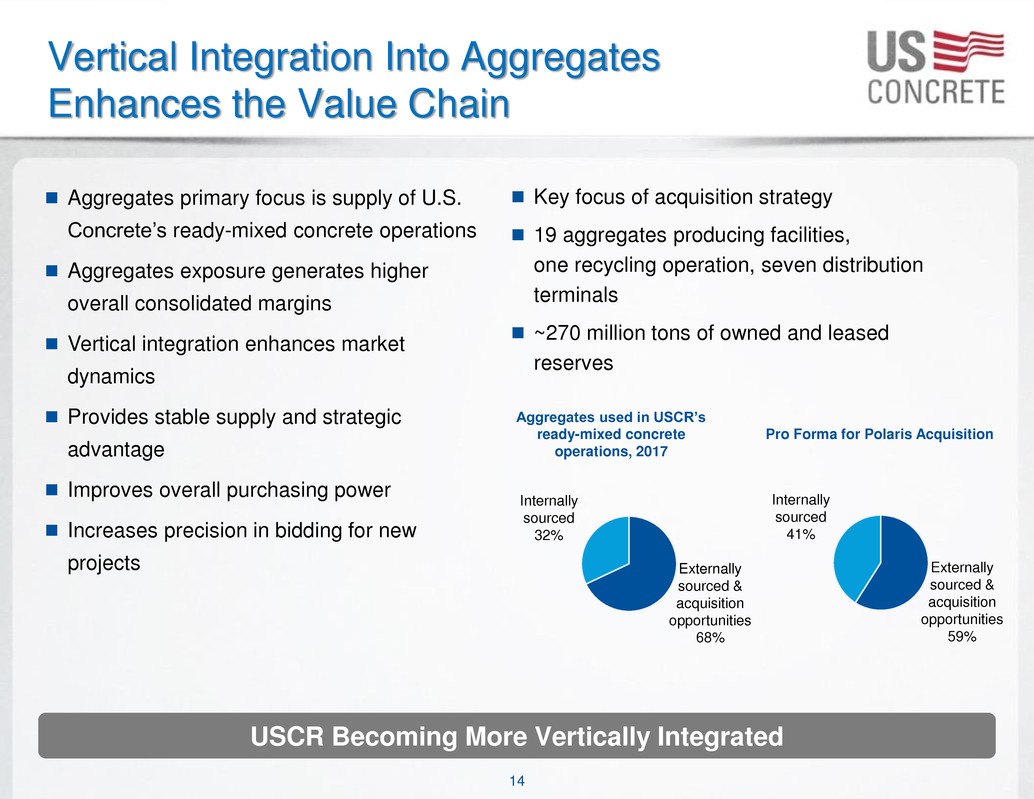

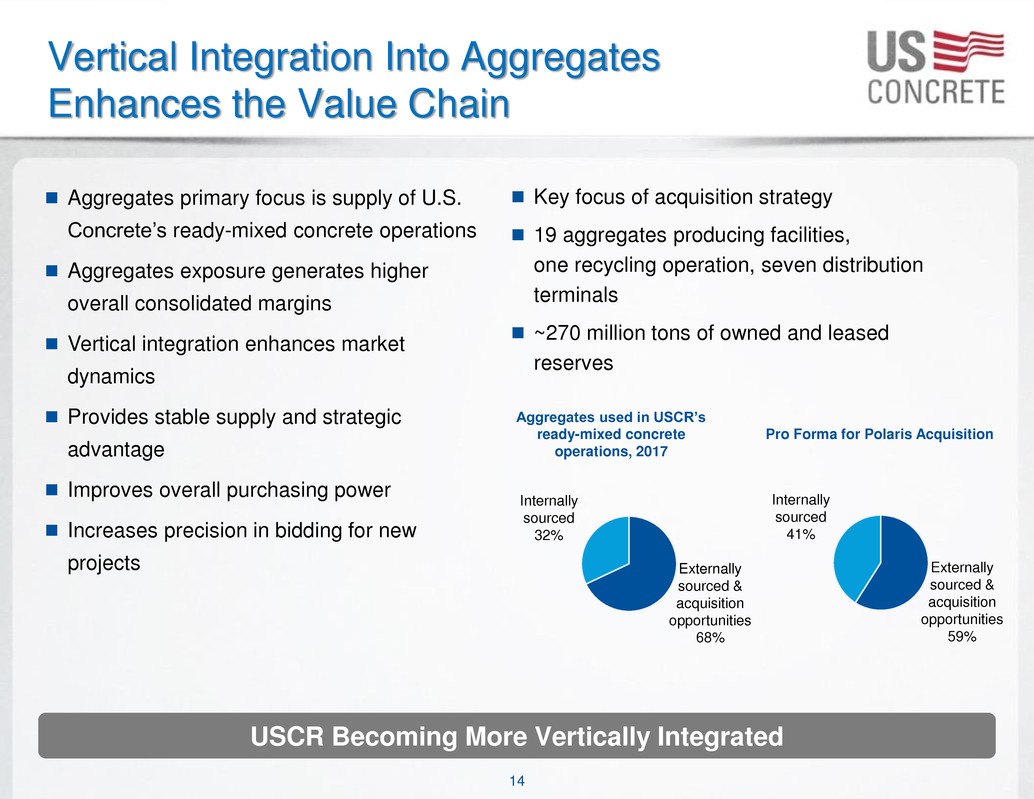

14 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Vertical Integration Into Aggregates Enhances the Value Chain Aggregates primary focus is supply of U.S. Concrete’s ready-mixed concrete operations Aggregates exposure generates higher overall consolidated margins Vertical integration enhances market dynamics Provides stable supply and strategic advantage Improves overall purchasing power Increases precision in bidding for new projects Aggregates used in USCR‟s ready-mixed concrete operations, 2017 Externally sourced & acquisition opportunities 68% Internally sourced 32% Key focus of acquisition strategy 19 aggregates producing facilities, one recycling operation, seven distribution terminals ~270 million tons of owned and leased reserves USCR Becoming More Vertically Integrated Pro Forma for Polaris Acquisition Externally sourced & acquisition opportunities 59% Internally sourced 41%

15 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Significant Industry Consolidation Opportunities Exist to Enable Scaling of Ready-Mixed Business Ready-Mixed Concrete Market Size for U.S. (2017) Deal opportunities remain robust USCR is an acquirer of choice in established markets through decades long relationships amongst local and national management teams Aggregates provide additional expansion opportunities and strengthen vertically integrated capabilities Increasing vertical integration of cement, aggregates and concrete producers represents favorable market dynamic Annual Revenue $30.0 B Ready-Mixed Concrete Producers 2,200 Ready-Mixed Concrete Plants 6,500 Source: NRMCA; IBISWorld

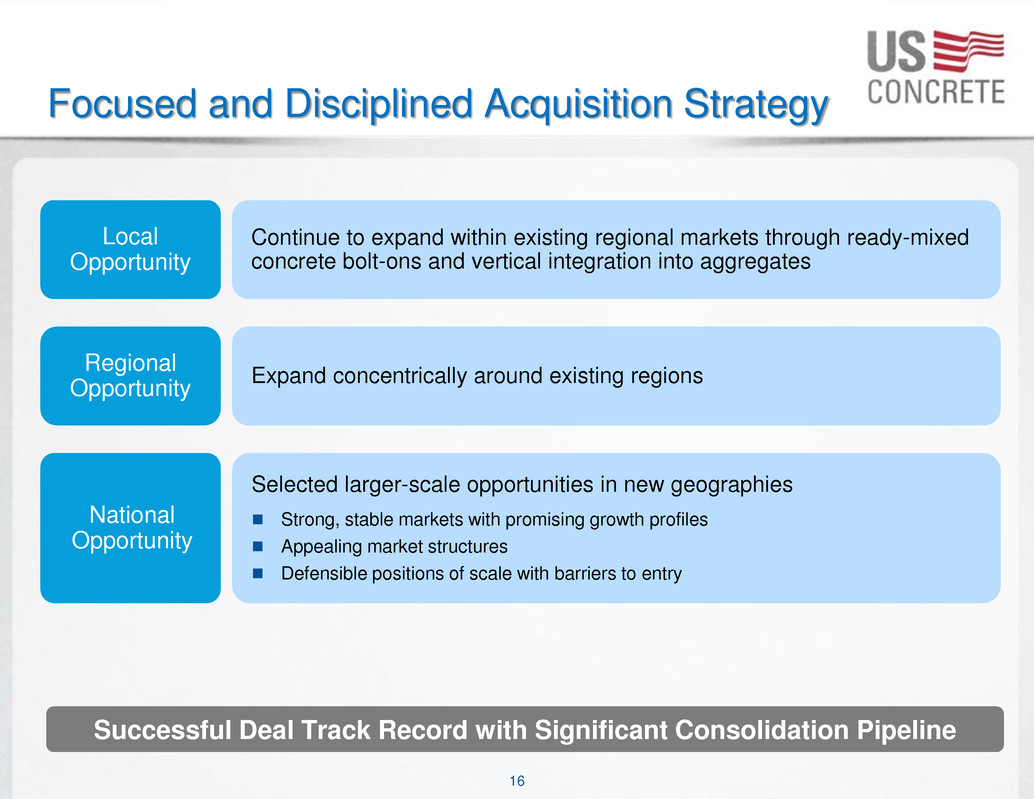

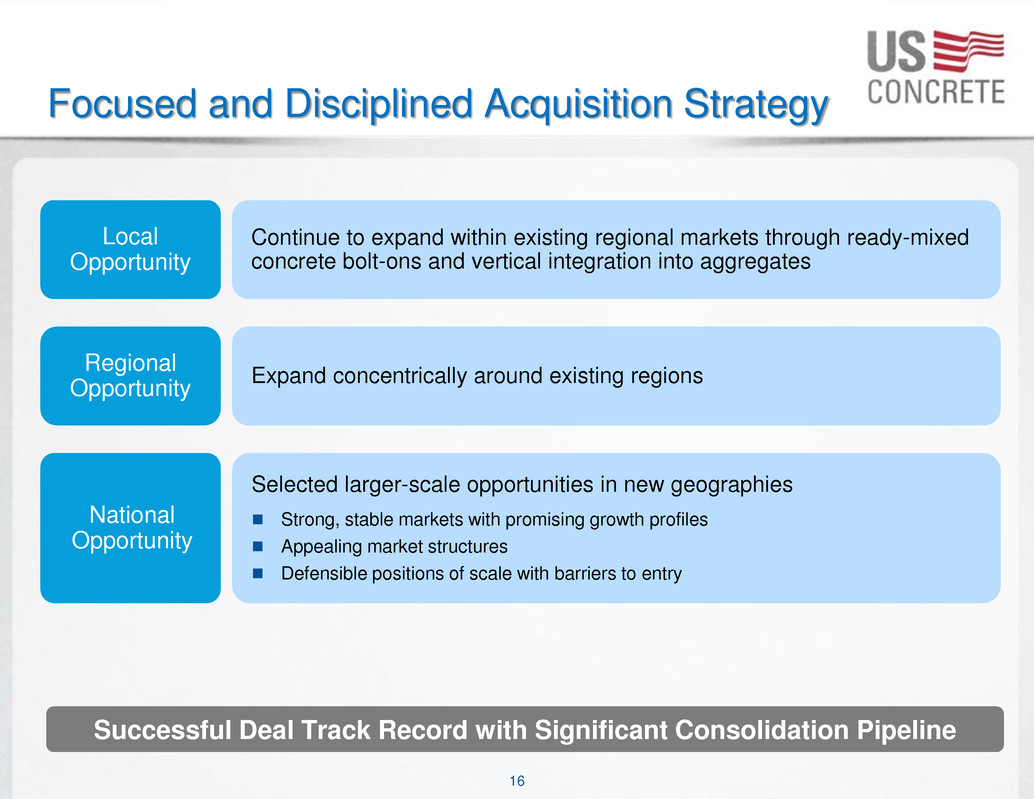

16 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Focused and Disciplined Acquisition Strategy Continue to expand within existing regional markets through ready-mixed concrete bolt-ons and vertical integration into aggregates Local Opportunity Expand concentrically around existing regions Regional Opportunity Selected larger-scale opportunities in new geographies Strong, stable markets with promising growth profiles Appealing market structures Defensible positions of scale with barriers to entry National Opportunity Successful Deal Track Record with Significant Consolidation Pipeline

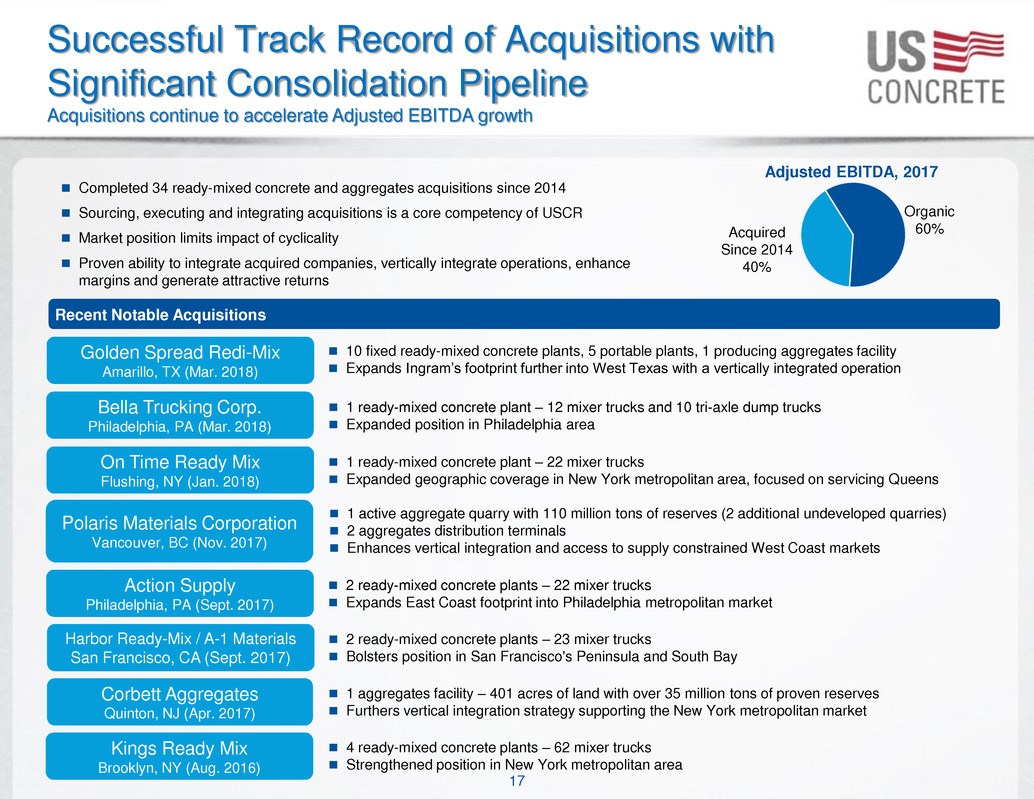

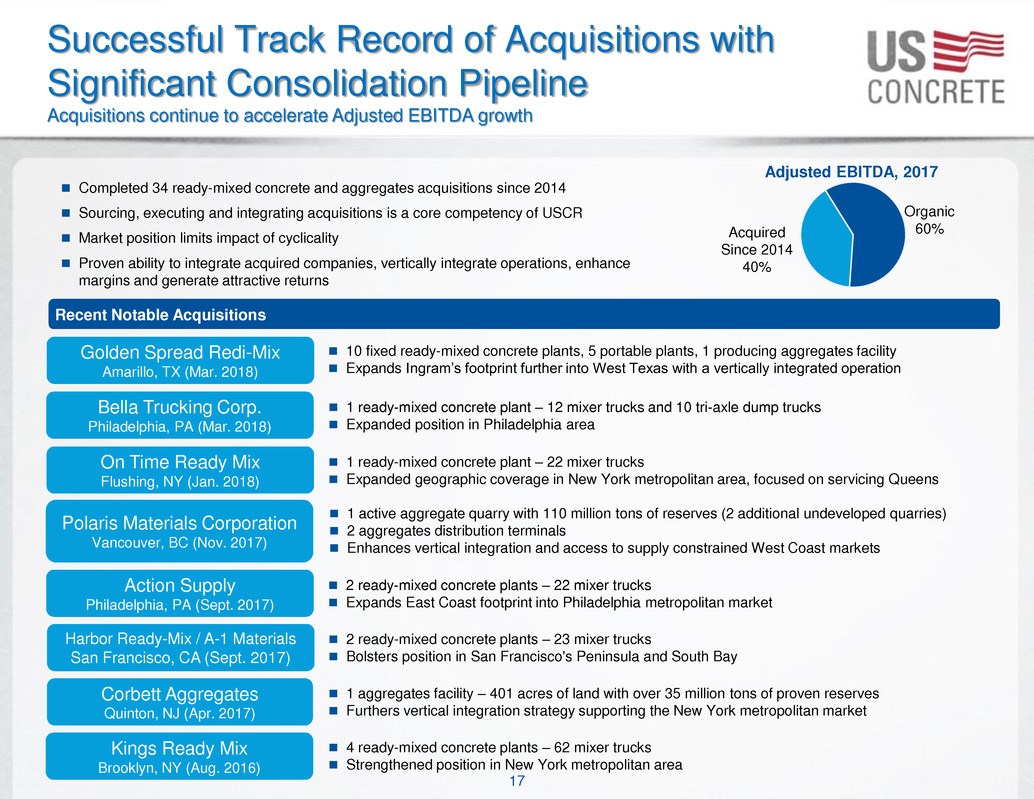

17 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Completed 34 ready-mixed concrete and aggregates acquisitions since 2014 Sourcing, executing and integrating acquisitions is a core competency of USCR Market position limits impact of cyclicality Proven ability to integrate acquired companies, vertically integrate operations, enhance margins and generate attractive returns Kings Ready Mix Brooklyn, NY (Aug. 2016) 1 ready-mixed concrete plant – 22 mixer trucks Expanded geographic coverage in New York metropolitan area, focused on servicing Queens Bella Trucking Corp. Philadelphia, PA (Mar. 2018) 4 ready-mixed concrete plants – 62 mixer trucks Strengthened position in New York metropolitan area Recent Notable Acquisitions Acquired Since 2014 40% Organic 60% Adjusted EBITDA, 2017 1 ready-mixed concrete plant – 12 mixer trucks and 10 tri-axle dump trucks Expanded position in Philadelphia area On Time Ready Mix Flushing, NY (Jan. 2018) Action Supply Philadelphia, PA (Sept. 2017) 2 ready-mixed concrete plants – 22 mixer trucks Expands East Coast footprint into Philadelphia metropolitan market Successful Track Record of Acquisitions with Significant Consolidation Pipeline Acquisitions continue to accelerate Adjusted EBITDA growth 10 fixed ready-mixed concrete plants, 5 portable plants, 1 producing aggregates facility Expands Ingram’s footprint further into West Texas with a vertically integrated operation Golden Spread Redi-Mix Amarillo, TX (Mar. 2018) Corbett Aggregates Quinton, NJ (Apr. 2017) 1 aggregates facility – 401 acres of land with over 35 million tons of proven reserves Furthers vertical integration strategy supporting the New York metropolitan market Harbor Ready-Mix / A-1 Materials San Francisco, CA (Sept. 2017) 2 ready-mixed concrete plants – 23 mixer trucks Bolsters position in San Francisco's Peninsula and South Bay Polaris Materials Corporation Vancouver, BC (Nov. 2017) 1 active aggregate quarry with 110 million tons of reserves (2 additional undeveloped quarries) 2 aggregates distribution terminals Enhances vertical integration and access to supply constrained West Coast markets

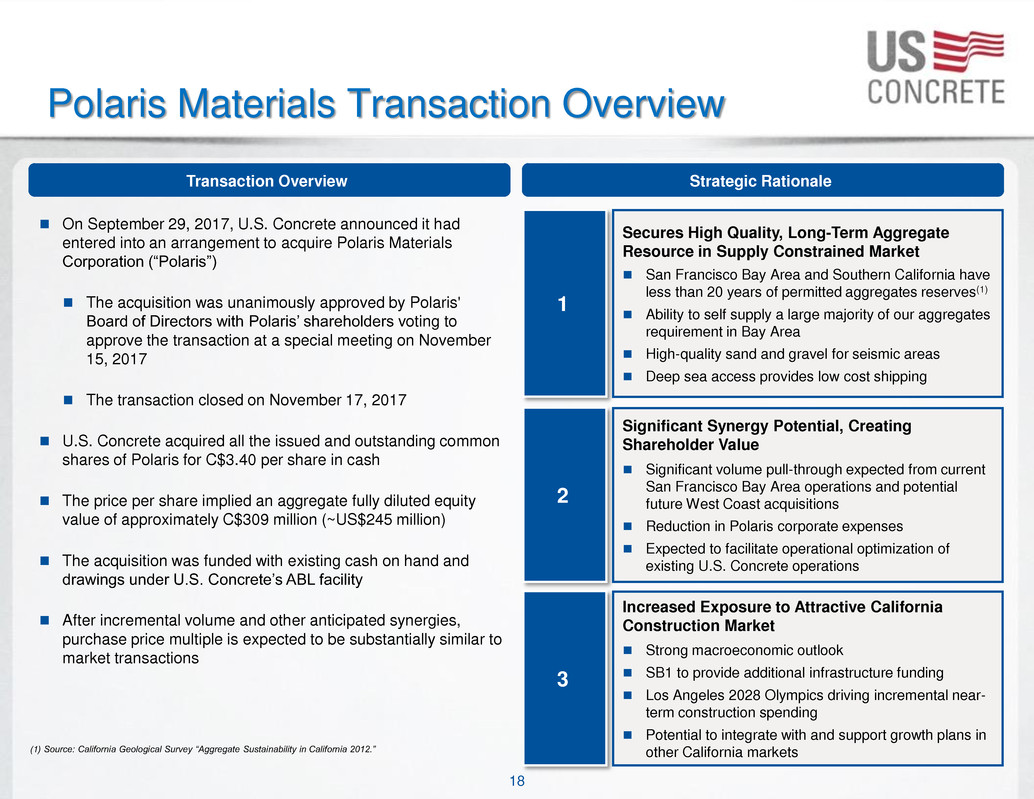

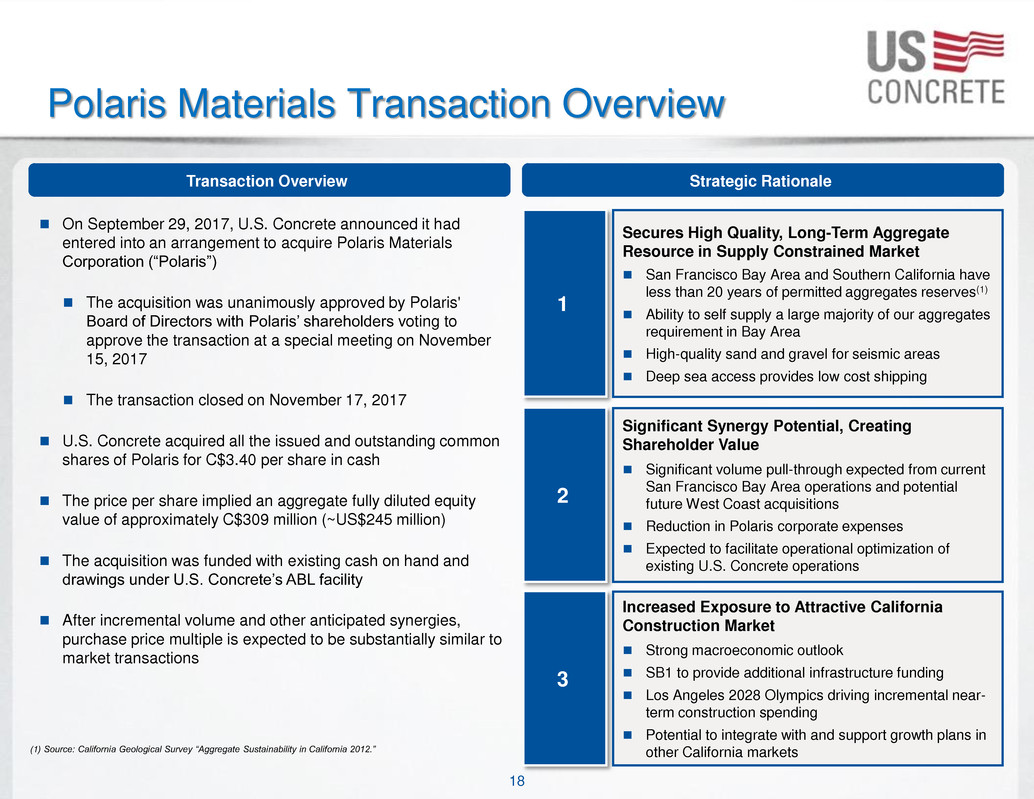

18 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Polaris Materials Transaction Overview Transaction Overview Strategic Rationale On September 29, 2017, U.S. Concrete announced it had entered into an arrangement to acquire Polaris Materials Corporation (“Polaris”) The acquisition was unanimously approved by Polaris' Board of Directors with Polaris’ shareholders voting to approve the transaction at a special meeting on November 15, 2017 The transaction closed on November 17, 2017 U.S. Concrete acquired all the issued and outstanding common shares of Polaris for C$3.40 per share in cash The price per share implied an aggregate fully diluted equity value of approximately C$309 million (~US$245 million) The acquisition was funded with existing cash on hand and drawings under U.S. Concrete’s ABL facility After incremental volume and other anticipated synergies, purchase price multiple is expected to be substantially similar to market transactions 1 Secures High Quality, Long-Term Aggregate Resource in Supply Constrained Market San Francisco Bay Area and Southern California have less than 20 years of permitted aggregates reserves(1) Ability to self supply a large majority of our aggregates requirement in Bay Area High-quality sand and gravel for seismic areas Deep sea access provides low cost shipping 2 3 Significant Synergy Potential, Creating Shareholder Value Significant volume pull-through expected from current San Francisco Bay Area operations and potential future West Coast acquisitions Reduction in Polaris corporate expenses Expected to facilitate operational optimization of existing U.S. Concrete operations Increased Exposure to Attractive California Construction Market Strong macroeconomic outlook SB1 to provide additional infrastructure funding Los Angeles 2028 Olympics driving incremental near- term construction spending Potential to integrate with and support growth plans in other California markets (1) Source: California Geological Survey “Aggregate Sustainability in California 2012.”

19 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Secures High Quality, Long-Term Aggregates Resource in Supply-Constrained Market 1 Overview Aggregates Resource Depletion(1) Location % of 50-Year Demand Permitted 50-Year Demand Permitted Reserves Time to Depletion San Francisco Bay Area Northern San Francisco Bay 521 110 11 – 20 Years South San Francisco Bay 1,381 404 11 – 20 Years Los Angeles / Long Beach San Fernando Valley – Saugus Newhall 476 77 <10 Years San Gabriel Valley 809 322 11 – 20 Years Claremont – Upland 203 109 21 – 30 Years San Bernardino 993 241 11 – 20 Years Temescal Valley 1,077 297 11 – 20 Years (1) Source: California Geological Survey “Aggregate Sustainability in California 2012.” Permitted Aggregates Reserves 50-Year Demand Not Met By Existing Permitted Reserves San Francisco Bay and Los Angeles area current sourced aggregate reserves are expected to only cover the next 11 – 20 years of demand before depletion(1) without supplemental material from Polaris Particularly acute shortages are expected in some of USCR’s key ready- mixed concrete markets of San Jose and the West Bay, which are markets that Polaris is expected to serve economically The Polaris acquisition should allow USCR to internally source the majority of its San Francisco Bay Area aggregates requirements USCR to move to a net long aggregates position on the West Coast Low cost shipping via Panamax vessels should provide competitively priced product to the West Coast and Hawaii High-quality sand and gravel ideal for use in high-strength seismic applications

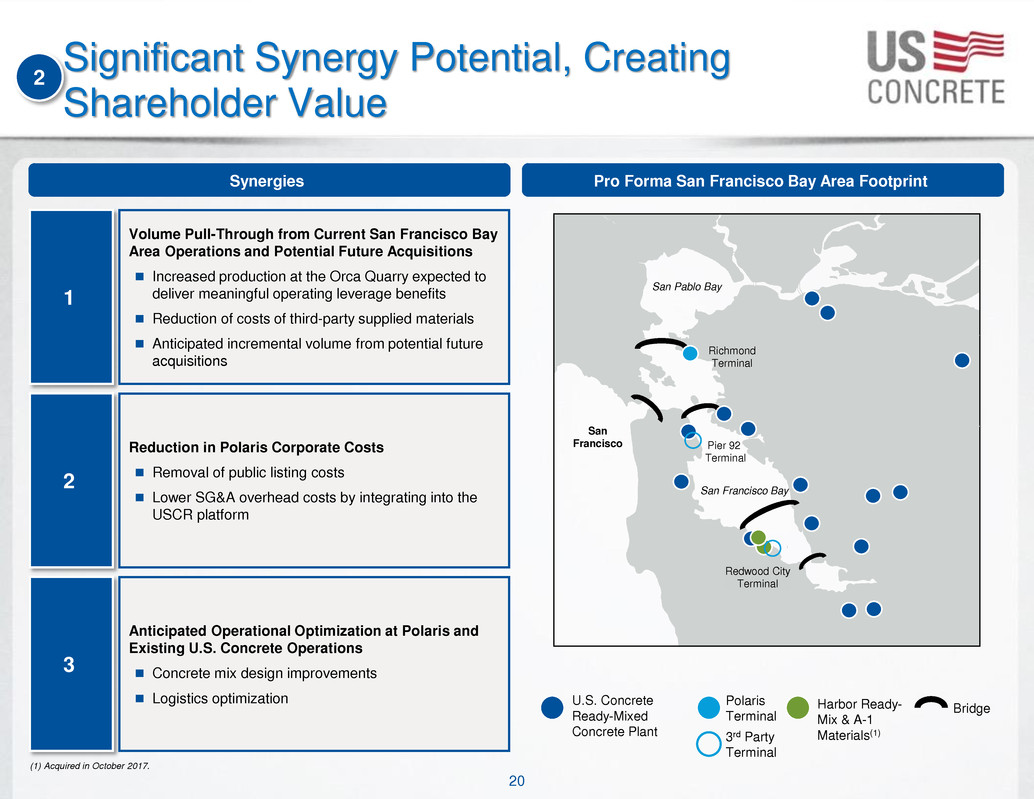

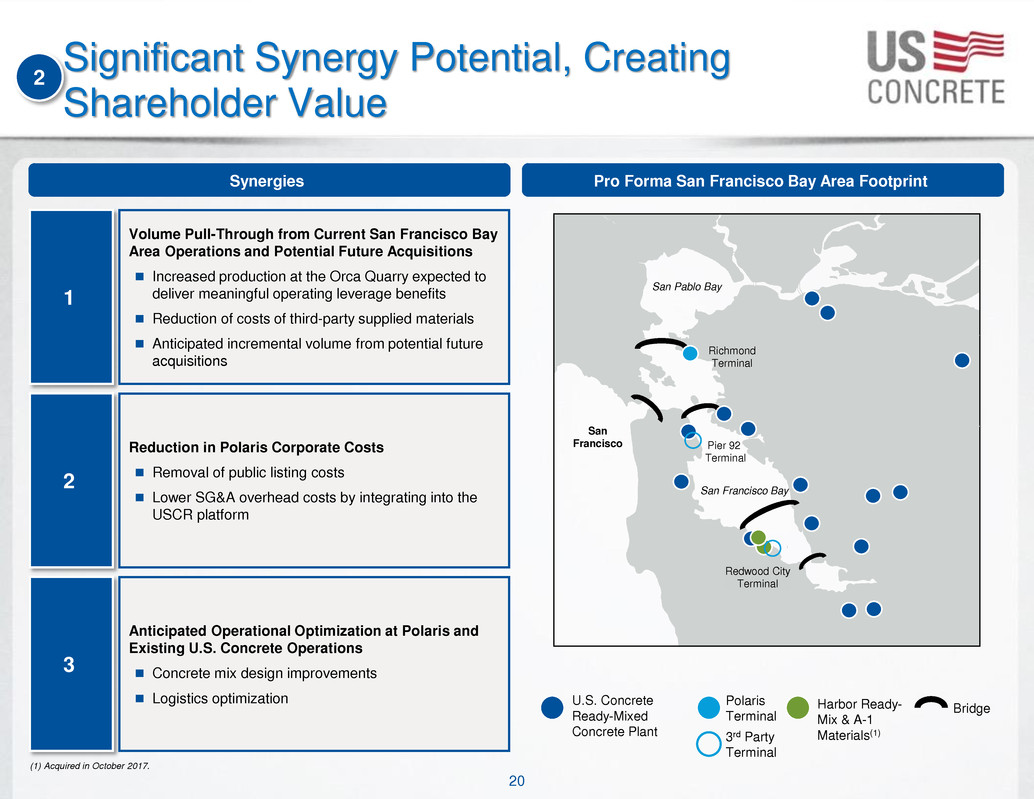

20 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Significant Synergy Potential, Creating Shareholder Value 2 Synergies Pro Forma San Francisco Bay Area Footprint 1 Volume Pull-Through from Current San Francisco Bay Area Operations and Potential Future Acquisitions Increased production at the Orca Quarry expected to deliver meaningful operating leverage benefits Reduction of costs of third-party supplied materials Anticipated incremental volume from potential future acquisitions 2 3 Reduction in Polaris Corporate Costs Removal of public listing costs Lower SG&A overhead costs by integrating into the USCR platform Anticipated Operational Optimization at Polaris and Existing U.S. Concrete Operations Concrete mix design improvements Logistics optimization U.S. Concrete Ready-Mixed Concrete Plant Polaris Terminal San Pablo Bay San Francisco Bay San Francisco Richmond Terminal Bridge Harbor Ready- Mix & A-1 Materials(1) (1) Acquired in October 2017. Redwood City Terminal Pier 92 Terminal 3rd Party Terminal

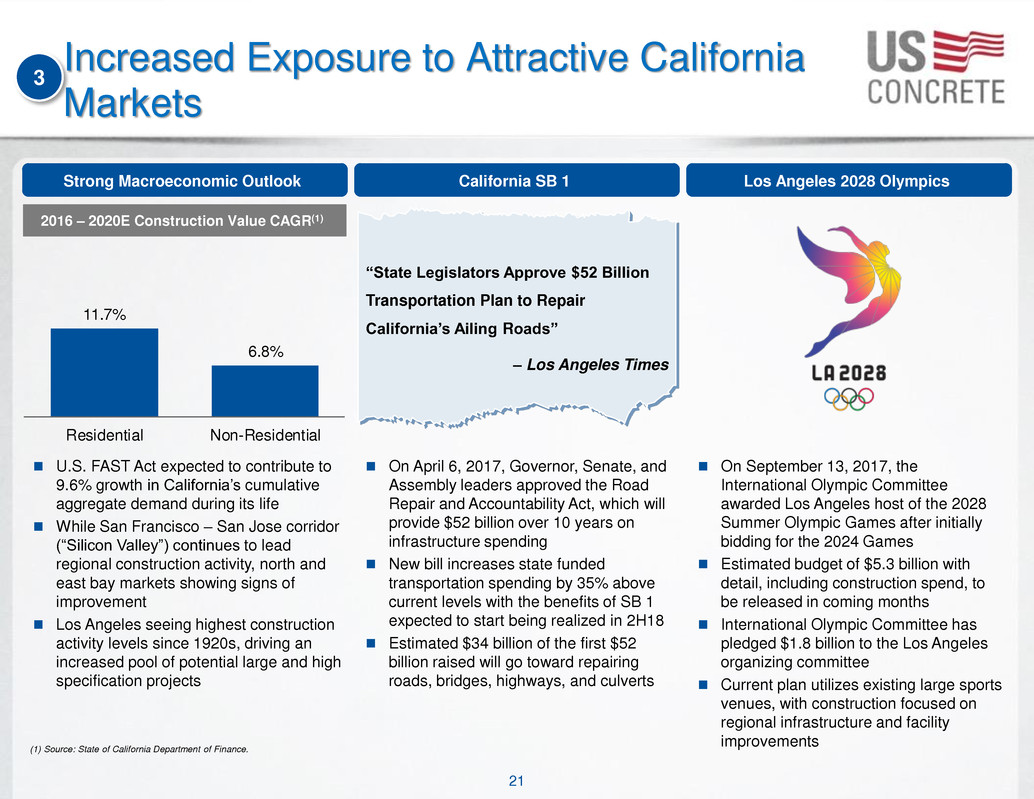

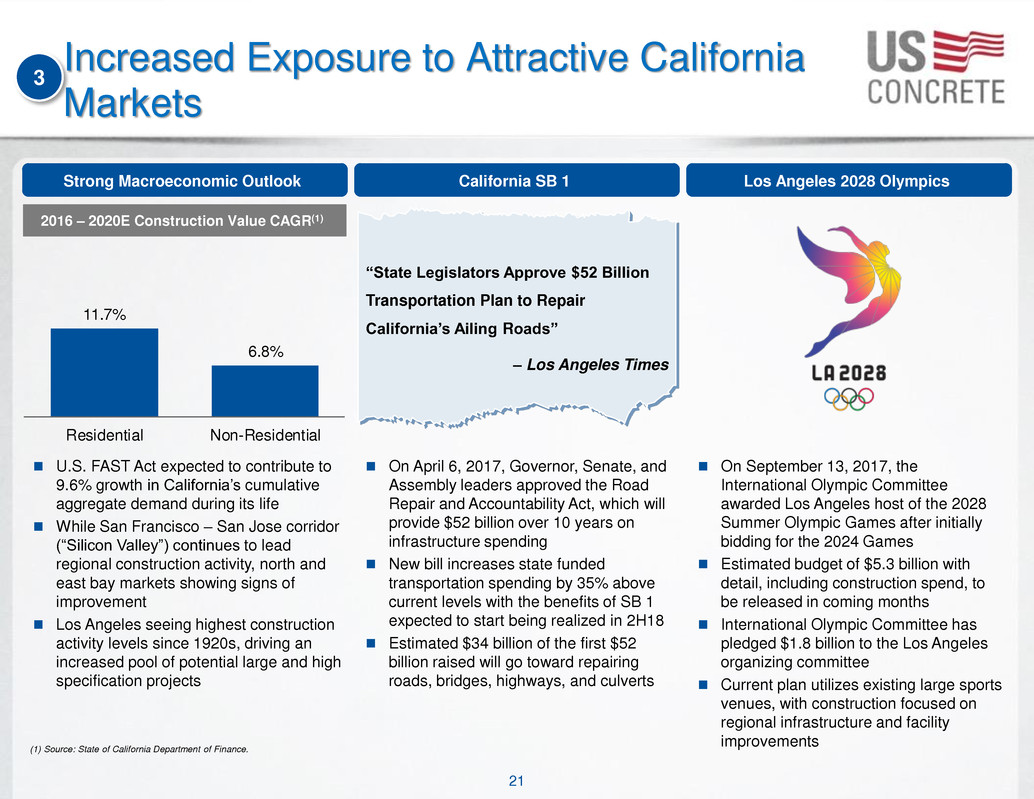

21 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Increased Exposure to Attractive California Markets 3 Strong Macroeconomic Outlook California SB 1 Los Angeles 2028 Olympics U.S. FAST Act expected to contribute to 9.6% growth in California’s cumulative aggregate demand during its life While San Francisco – San Jose corridor (“Silicon Valley”) continues to lead regional construction activity, north and east bay markets showing signs of improvement Los Angeles seeing highest construction activity levels since 1920s, driving an increased pool of potential large and high specification projects On April 6, 2017, Governor, Senate, and Assembly leaders approved the Road Repair and Accountability Act, which will provide $52 billion over 10 years on infrastructure spending New bill increases state funded transportation spending by 35% above current levels with the benefits of SB 1 expected to start being realized in 2H18 Estimated $34 billion of the first $52 billion raised will go toward repairing roads, bridges, highways, and culverts On September 13, 2017, the International Olympic Committee awarded Los Angeles host of the 2028 Summer Olympic Games after initially bidding for the 2024 Games Estimated budget of $5.3 billion with detail, including construction spend, to be released in coming months International Olympic Committee has pledged $1.8 billion to the Los Angeles organizing committee Current plan utilizes existing large sports venues, with construction focused on regional infrastructure and facility improvements (1) Source: State of California Department of Finance. 2016 – 2020E Construction Value CAGR(1) 11.7% 6.8% Residential Non-Residential “State Legislators Approve $52 Billion Transportation Plan to Repair California‟s Ailing Roads” – Los Angeles Times

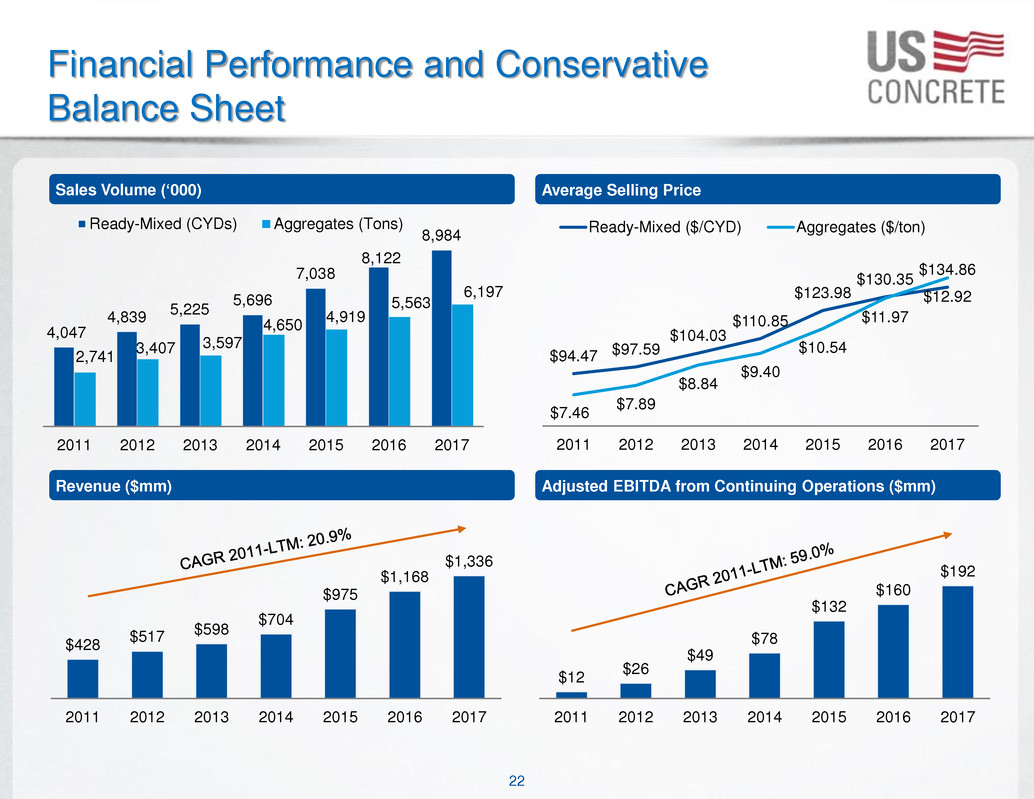

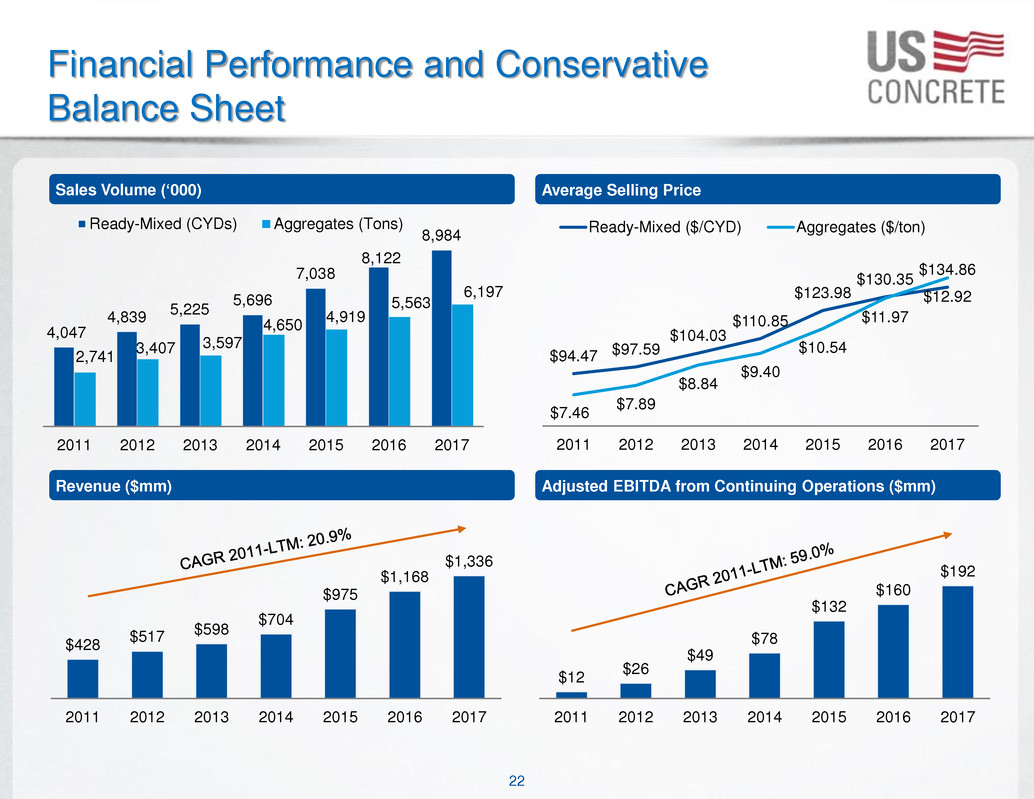

22 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Average Selling Price Sales Volume („000) 4,047 4,839 5,225 5,696 7,038 8,122 8,984 2,741 3,407 3,597 4,650 4,919 5,563 2011 2012 2013 2014 2015 2016 2017 Ready-Mixed (CYDs) Aggregates (Tons) $94.47 $97.59 $104.03 $110.85 $123.98 $130.35 $134.86 $7.46 $7.89 $8.84 $9.40 $10.54 $11.97 $12.92 2011 2012 2013 2014 2015 2016 2017 Ready-Mixed ($/CYD) Aggregates ($/ton) Adjusted EBITDA from Continuing Operations ($mm) Revenue ($mm) $428 $517 $598 $704 $975 $1,168 $1,336 2011 2012 2013 2014 2015 2016 2017 Financial Performance and Conservative Balance Sheet 6,197 $12 $26 $49 $78 $132 $160 $192 2011 2012 2013 2014 2015 2016 2017

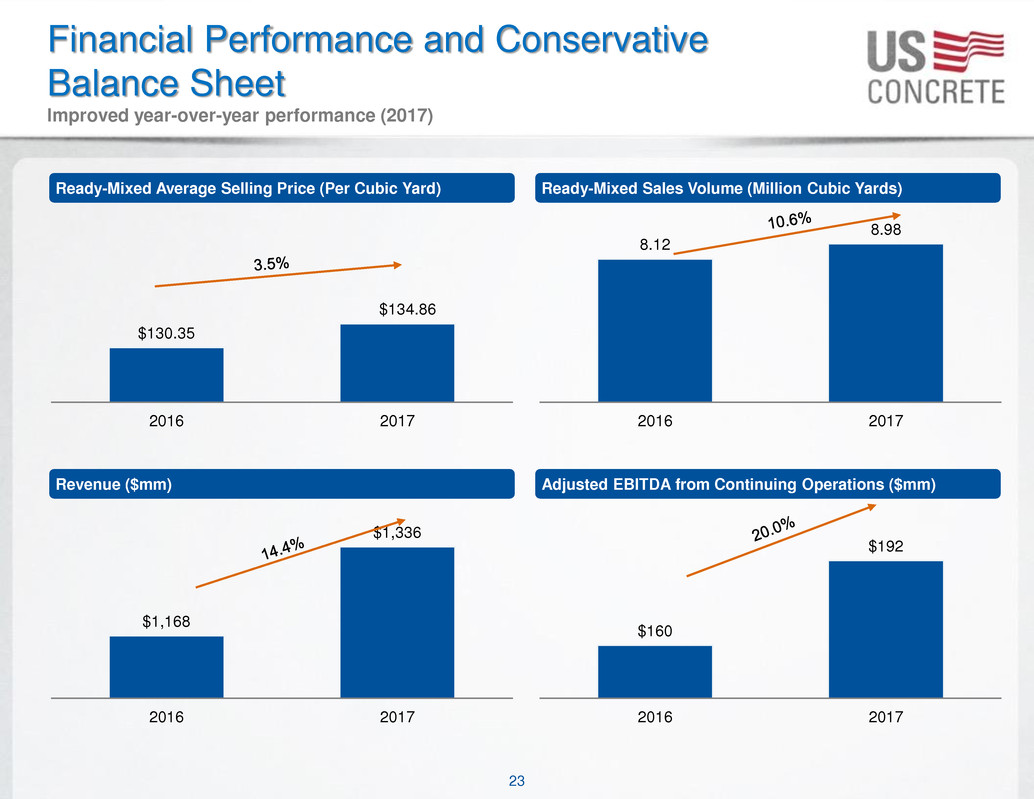

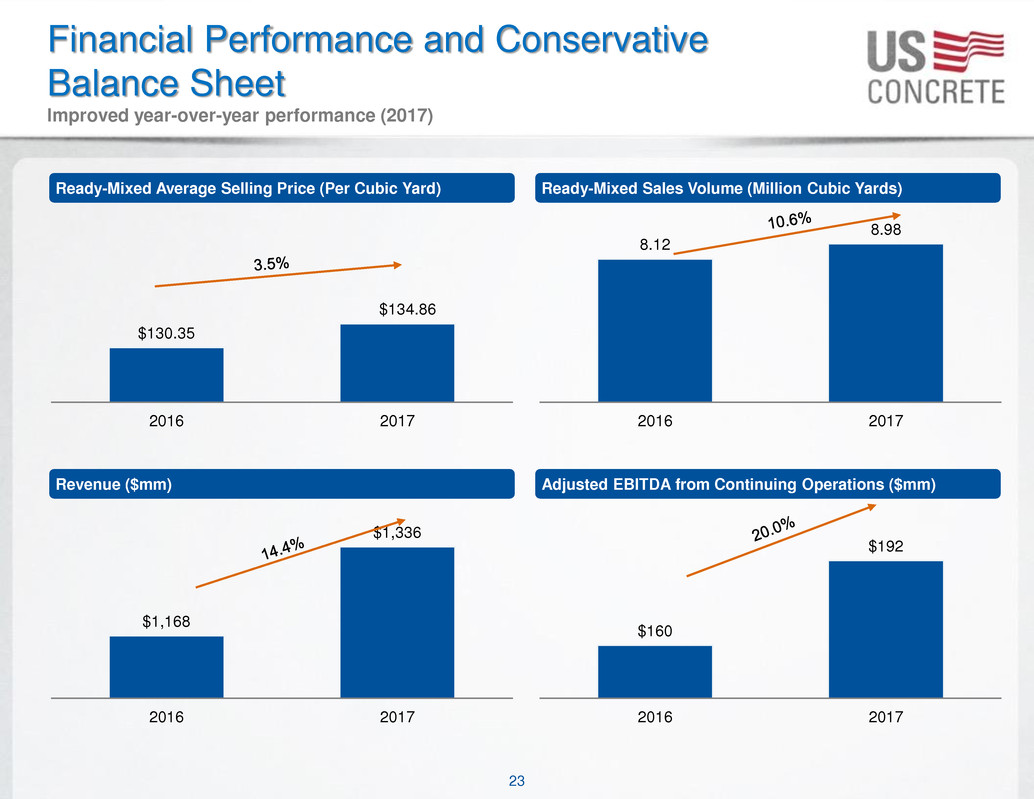

23 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ready-Mixed Sales Volume (Million Cubic Yards) Ready-Mixed Average Selling Price (Per Cubic Yard) $1,168 $1,336 2016 2017 Adjusted EBITDA from Continuing Operations ($mm) Revenue ($mm) 8.12 8.98 2016 2017 $160 $192 2016 2017 $130.35 $134.86 2016 2017 Financial Performance and Conservative Balance Sheet Improved year-over-year performance (2017)

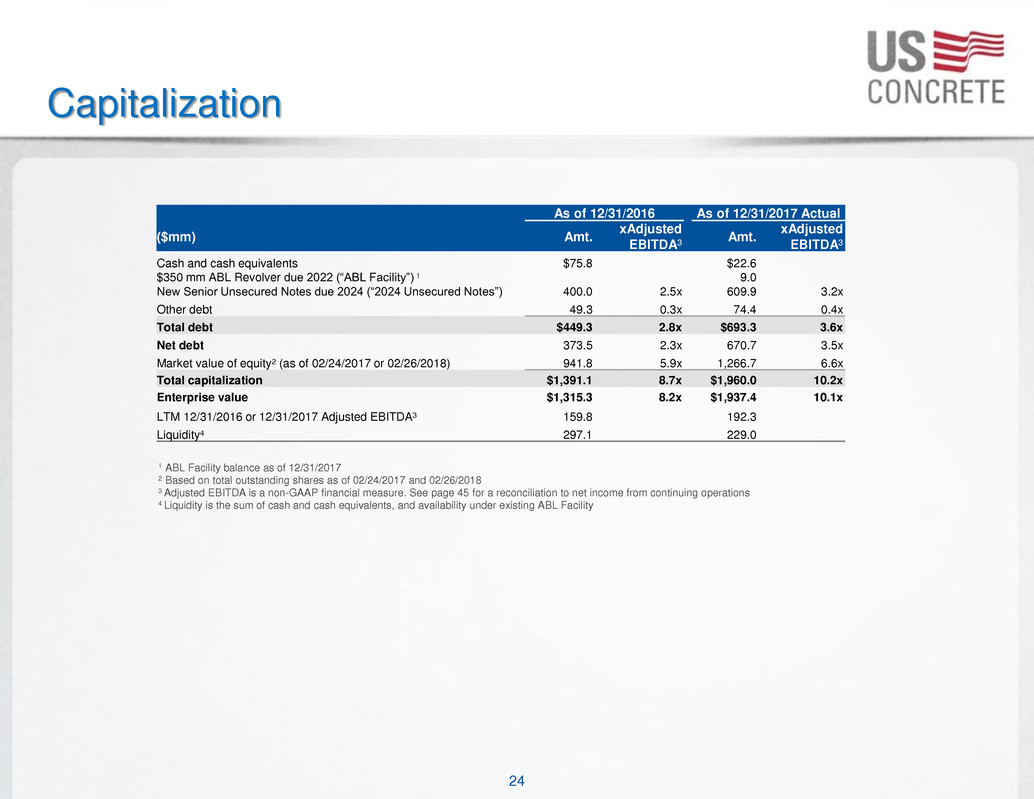

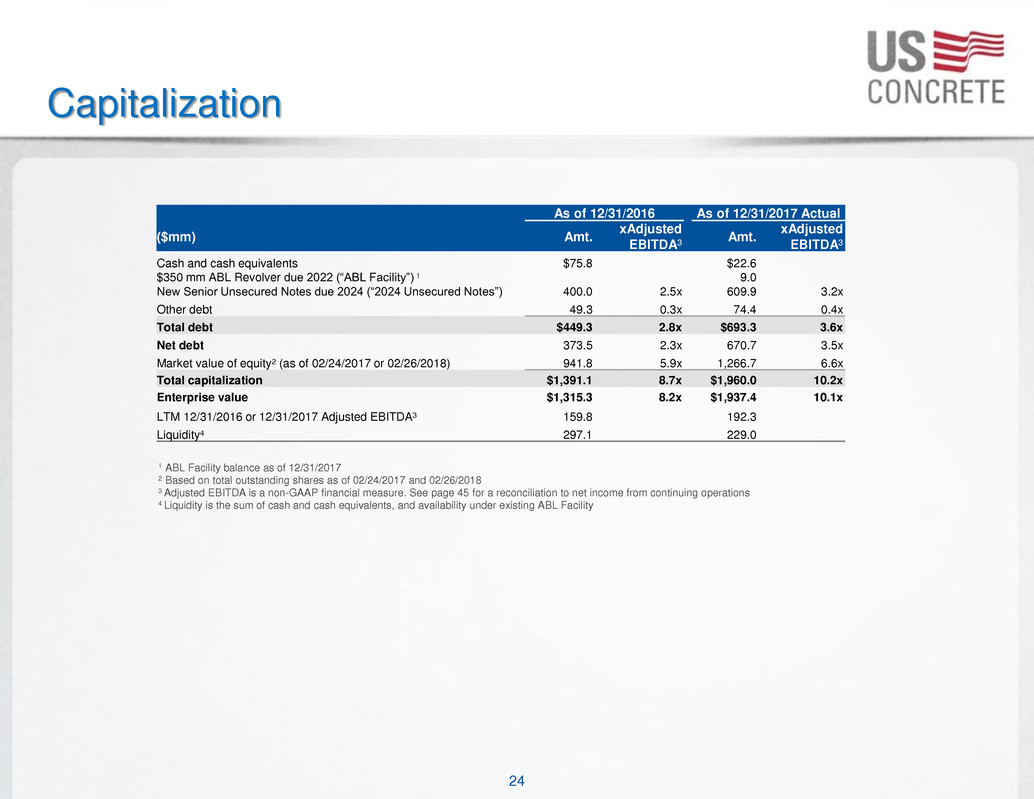

24 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Capitalization As of 12/31/2016 As of 12/31/2017 Actual ($mm) Amt. xAdjusted EBITDA3 Amt. xAdjusted EBITDA3 Cash and cash equivalents $75.8 $22.6 $350 mm ABL Revolver due 2022 (“ABL Facility”) 1 9.0 New Senior Unsecured Notes due 2024 (“2024 Unsecured Notes”) 400.0 2.5x 609.9 3.2x Other debt 49.3 0.3x 74.4 0.4x Total debt $449.3 2.8x $693.3 3.6x Net debt 373.5 2.3x 670.7 3.5x Market value of equity2 (as of 02/24/2017 or 02/26/2018) 941.8 5.9x 1,266.7 6.6x Total capitalization $1,391.1 8.7x $1,960.0 10.2x Enterprise value $1,315.3 8.2x $1,937.4 10.1x LTM 12/31/2016 or 12/31/2017 Adjusted EBITDA3 159.8 192.3 Liquidity4 297.1 229.0 1 ABL Facility balance as of 12/31/2017 2 Based on total outstanding shares as of 02/24/2017 and 02/26/2018 3 Adjusted EBITDA is a non-GAAP financial measure. See page 45 for a reconciliation to net income from continuing operations 4 Liquidity is the sum of cash and cash equivalents, and availability under existing ABL Facility

Appendix

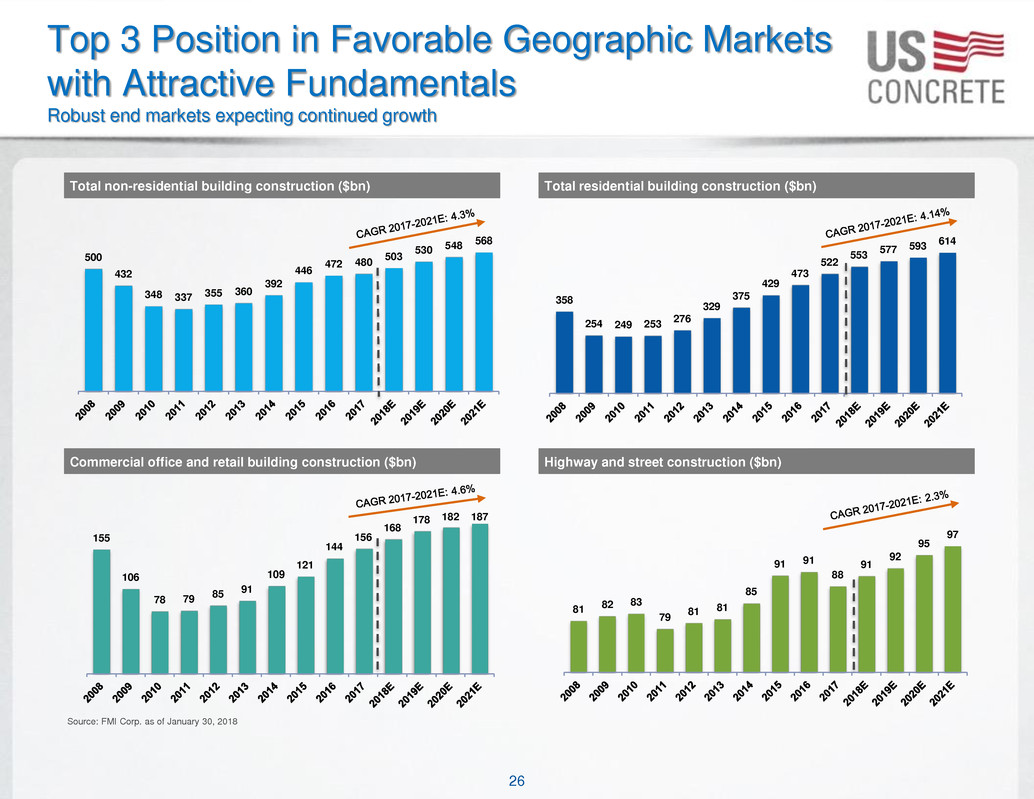

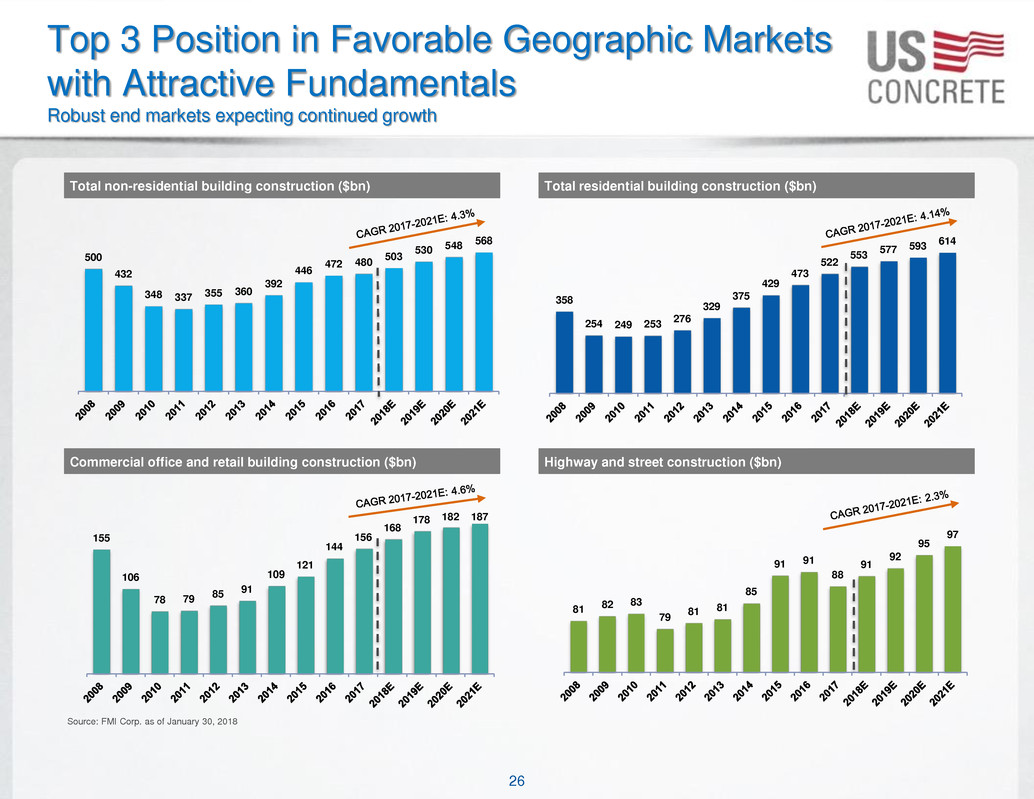

26 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 155 106 78 79 85 91 109 121 144 156 168 178 182 187 358 254 249 253 276 329 375 429 473 522 553 577 593 614 500 432 348 337 355 360 392 446 472 480 503 530 548 568 Total non-residential building construction ($bn) 81 82 83 79 81 81 85 91 91 88 91 92 95 97 Highway and street construction ($bn) Commercial office and retail building construction ($bn) Total residential building construction ($bn) Source: FMI Corp. as of January 30, 2018 Top 3 Position in Favorable Geographic Markets with Attractive Fundamentals Robust end markets expecting continued growth

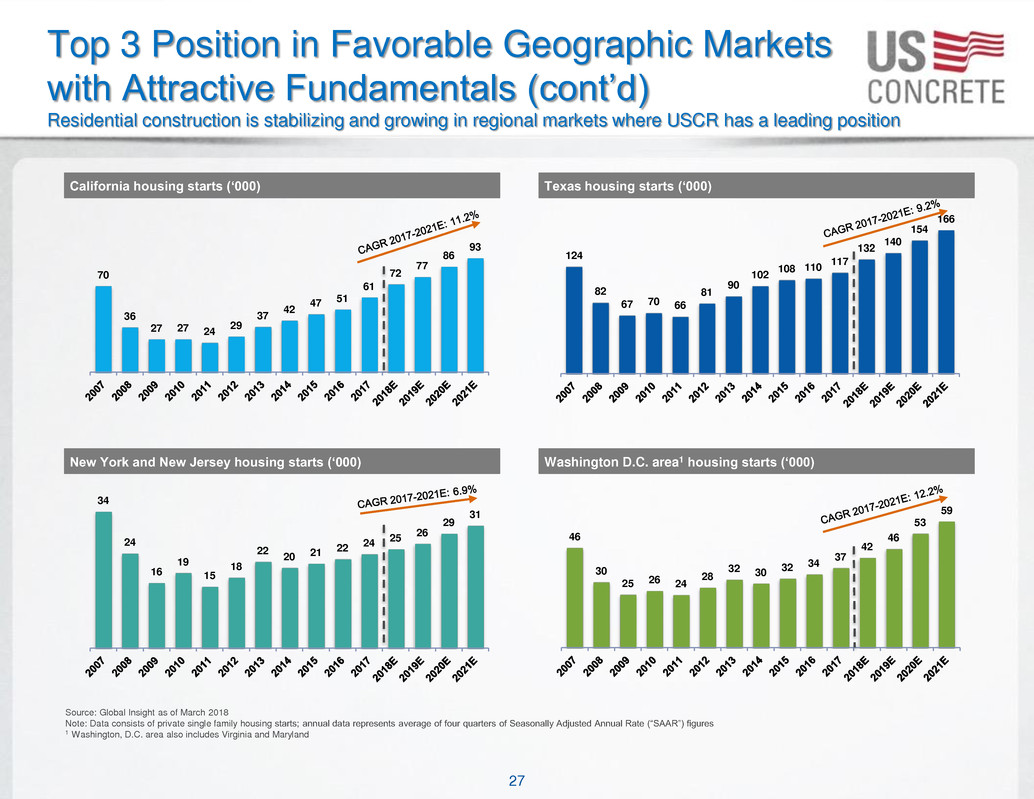

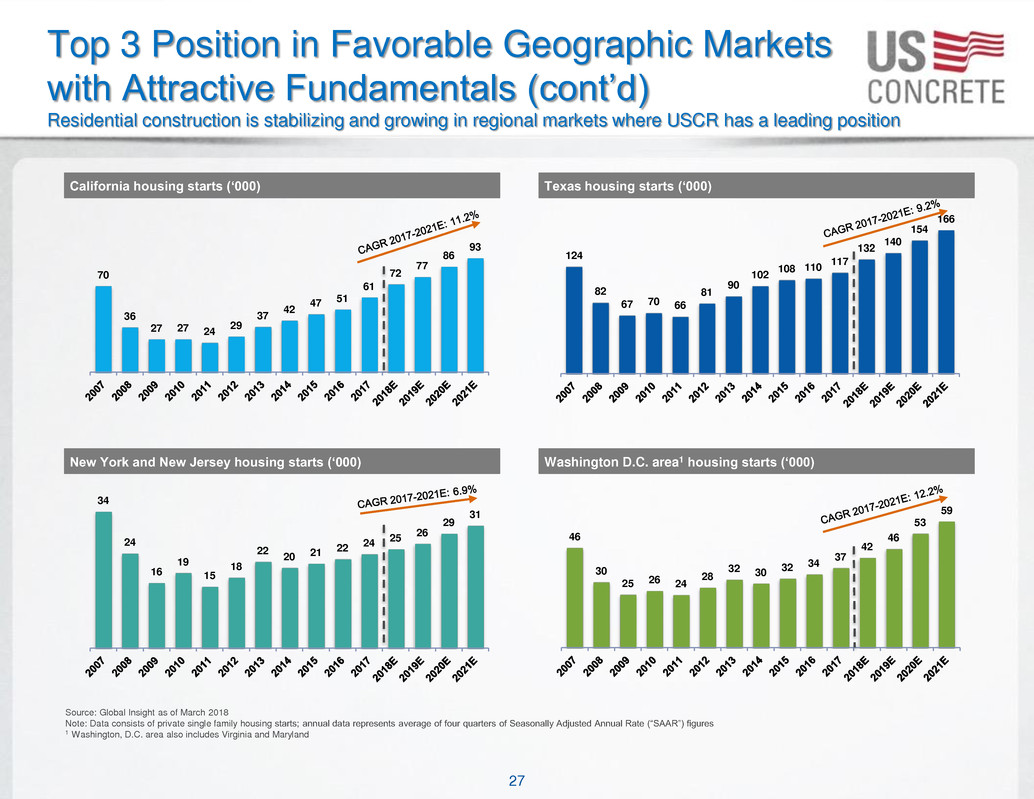

27 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Top 3 Position in Favorable Geographic Markets with Attractive Fundamentals (cont’d) Residential construction is stabilizing and growing in regional markets where USCR has a leading position 70 36 27 27 24 29 37 42 47 51 61 72 77 86 93 California housing starts („000) 46 30 25 26 24 28 32 30 32 34 37 42 46 53 59 Washington D.C. area1 housing starts („000) 34 24 16 19 15 18 22 20 21 22 24 25 26 29 31 New York and New Jersey housing starts („000) 124 82 67 70 66 81 90 102 108 110 117 132 140 154 166 Texas housing starts („000) Source: Global Insight as of March 2018 Note: Data consists of private single family housing starts; annual data represents average of four quarters of Seasonally Adjusted Annual Rate (“SAAR”) figures 1 Washington, D.C. area also includes Virginia and Maryland

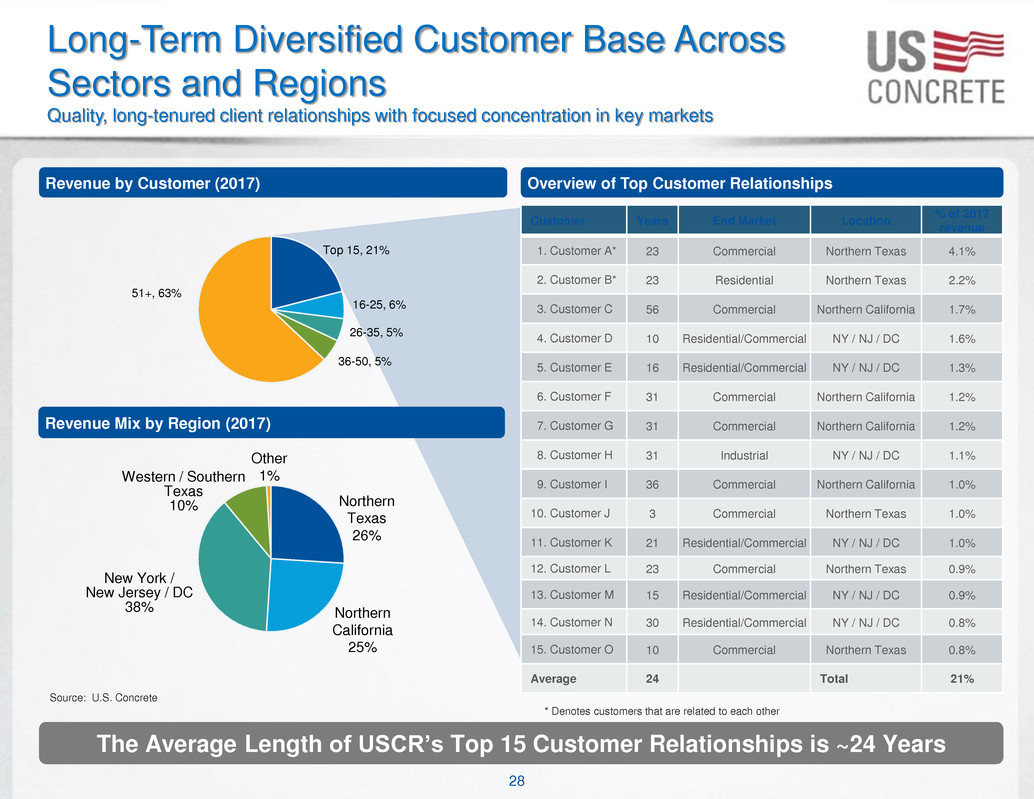

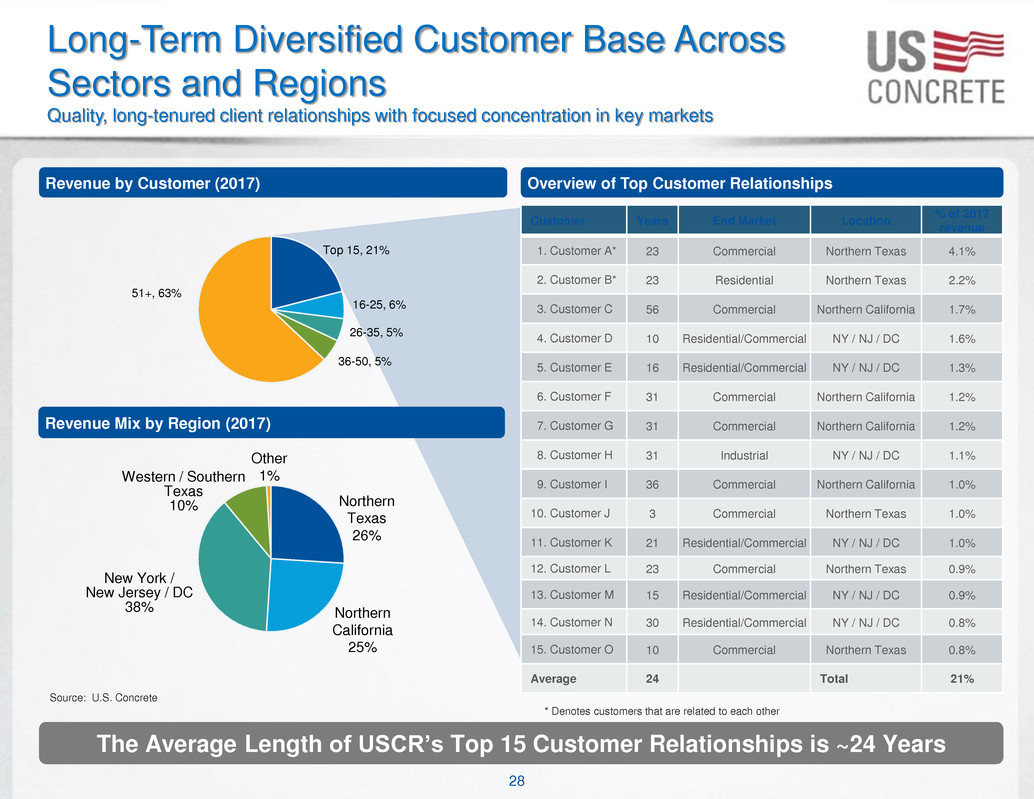

28 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Top 15, 21% 16-25, 6% 26-35, 5% 36-50, 5% 51+, 63% Overview of Top Customer Relationships Revenue by Customer (2017) Source: U.S. Concrete Customer Years End Market Location % of 2017 revenue 1. Customer A* 23 Commercial Northern Texas 4.1% 2. Customer B* 23 Residential Northern Texas 2.2% 3. Customer C 56 Commercial Northern California 1.7% 4. Customer D 10 Residential/Commercial NY / NJ / DC 1.6% 5. Customer E 16 Residential/Commercial NY / NJ / DC 1.3% 6. Customer F 31 Commercial Northern California 1.2% 7. Customer G 31 Commercial Northern California 1.2% 8. Customer H 31 Industrial NY / NJ / DC 1.1% 9. Customer I 36 Commercial Northern California 1.0% 10. Customer J 3 Commercial Northern Texas 1.0% 11. Customer K 21 Residential/Commercial NY / NJ / DC 1.0% 12. Customer L 23 Commercial Northern Texas 0.9% 13. Customer M 15 Residential/Commercial NY / NJ / DC 0.9% 14. Customer N 30 Residential/Commercial NY / NJ / DC 0.8% 15. Customer O 10 Commercial Northern Texas 0.8% Average 24 Total 21% The Average Length of USCR‟s Top 15 Customer Relationships is ~24 Years Long-Term Diversified Customer Base Across Sectors and Regions Quality, long-tenured client relationships with focused concentration in key markets * Denotes customers that are related to each other Revenue Mix by Region (2017) Northern Texas 26% Northern California 25% New York / New Jersey / DC 38% Other 1% Western / Southern Texas 10%

29 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 400,000+ Cubic Yards of Concrete Required One WTC, 3 WTC, 4 WTC Complete WTC Tower 2 Under Construction Low CO2 Concrete Highest Height Concrete Pumped Into a High Rise Structure in N.A. One WTC 14,000 PSI Ultra High Strength Concrete World Trade Center Construction World Trade Center Complex

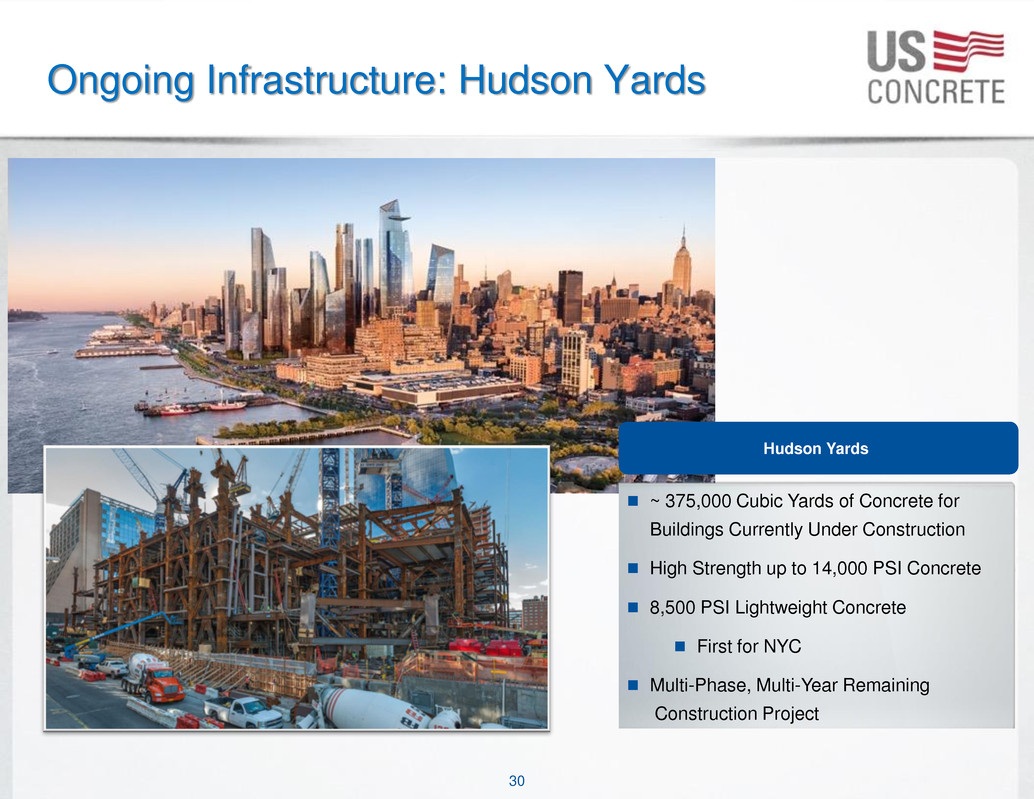

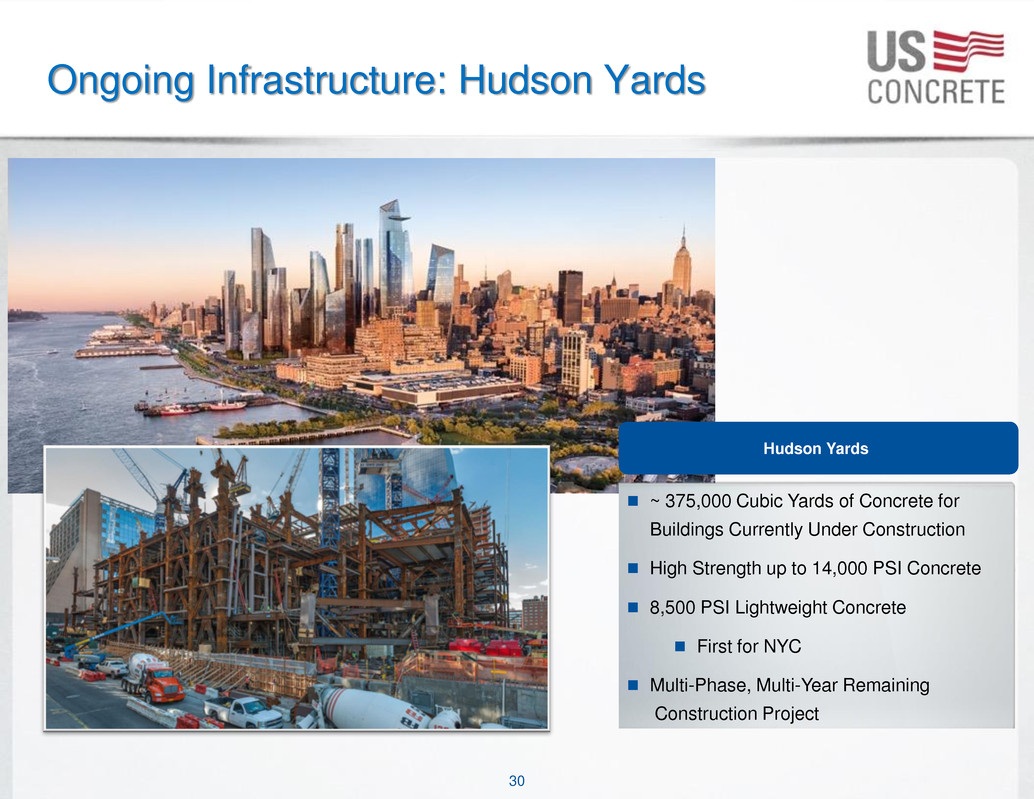

30 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Infrastructure: Hudson Yards Hudson Yards ~ 375,000 Cubic Yards of Concrete for Buildings Currently Under Construction High Strength up to 14,000 PSI Concrete 8,500 PSI Lightweight Concrete First for NYC Multi-Phase, Multi-Year Remaining Construction Project

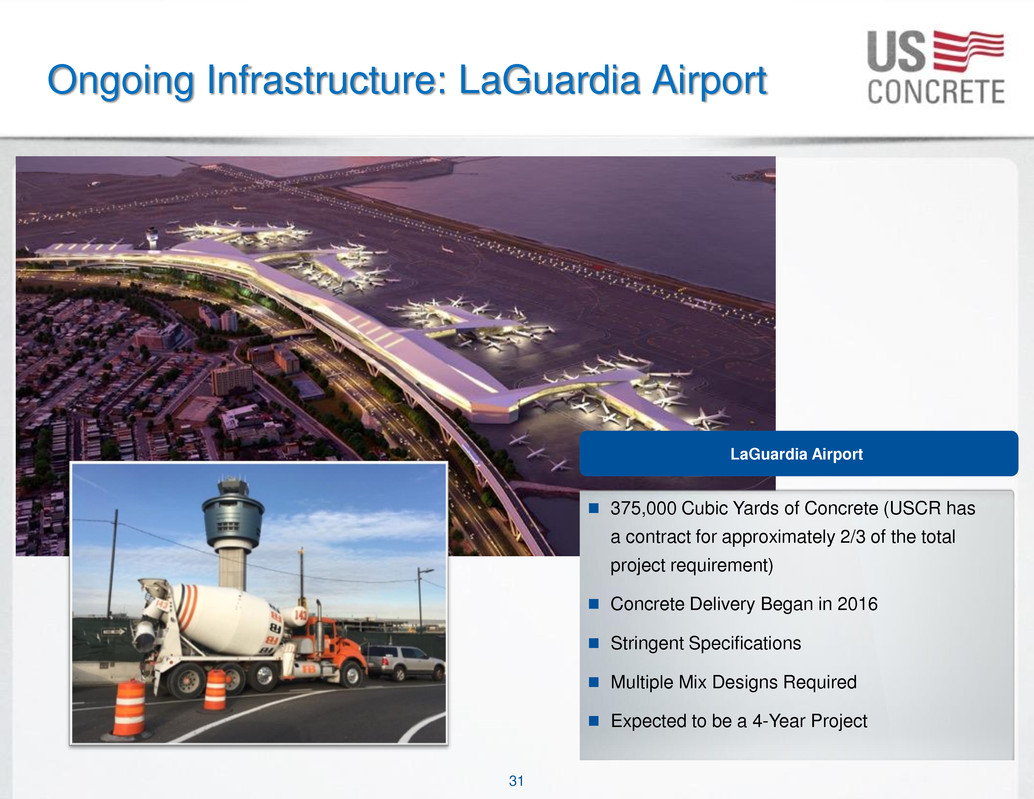

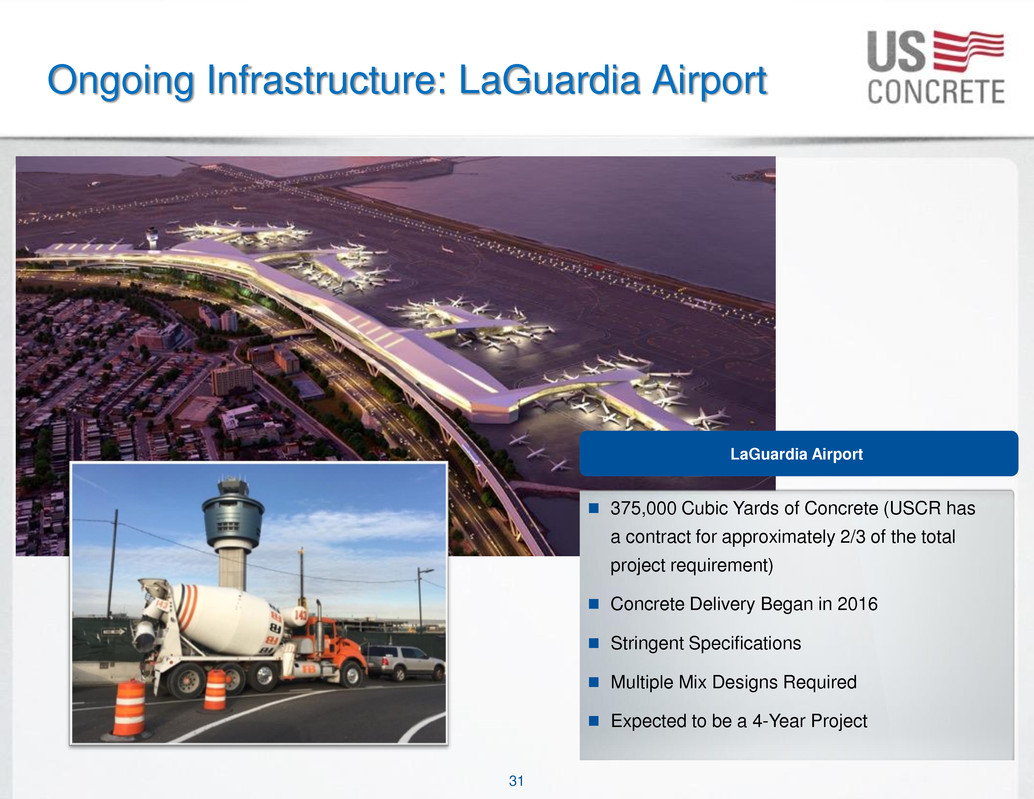

31 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Infrastructure: LaGuardia Airport 375,000 Cubic Yards of Concrete (USCR has a contract for approximately 2/3 of the total project requirement) Concrete Delivery Began in 2016 Stringent Specifications Multiple Mix Designs Required Expected to be a 4-Year Project LaGuardia Airport

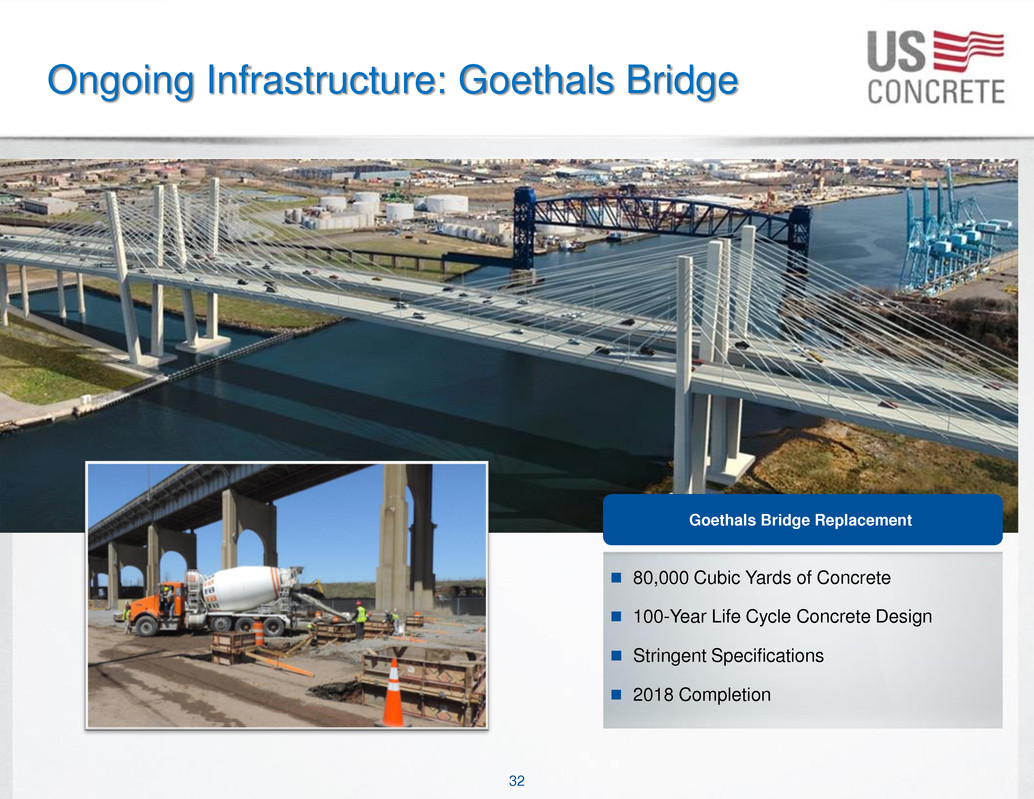

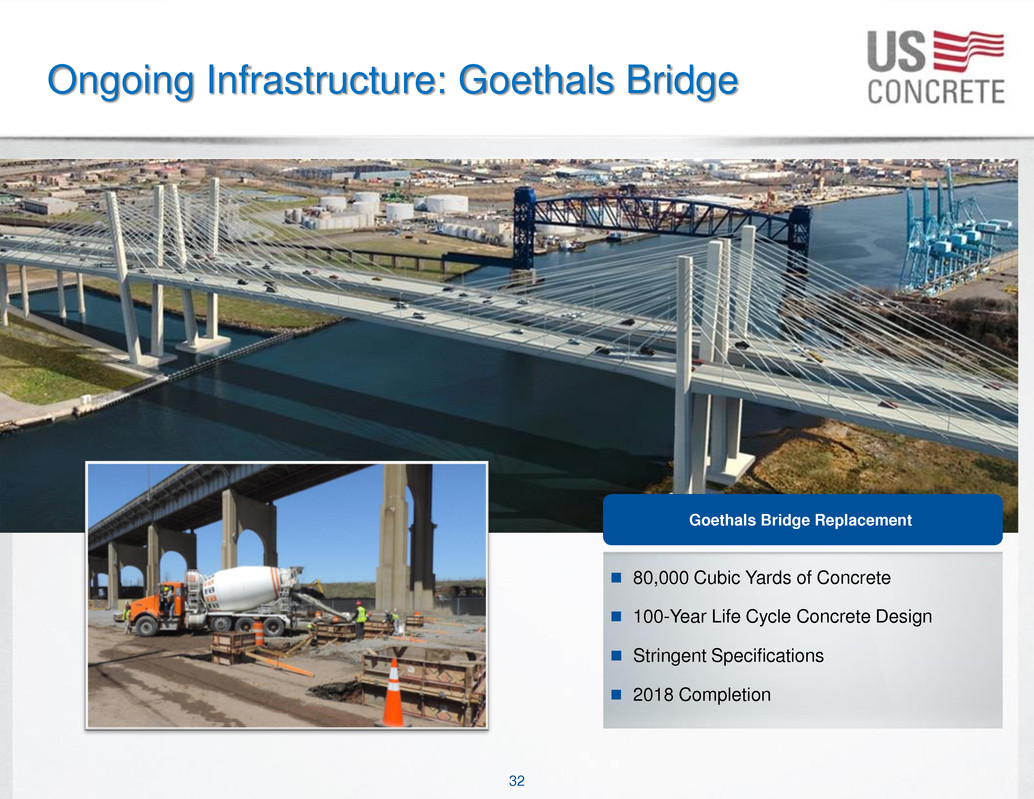

32 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Infrastructure: Goethals Bridge Goethals Bridge Replacement 80,000 Cubic Yards of Concrete 100-Year Life Cycle Concrete Design Stringent Specifications 2018 Completion

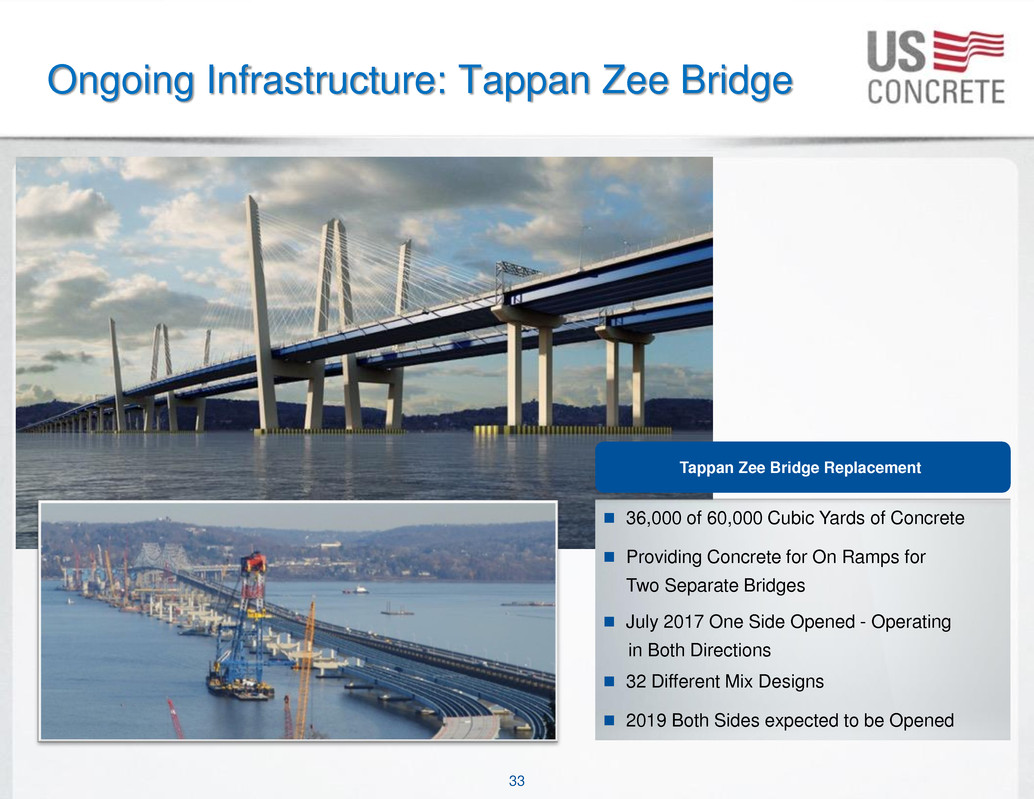

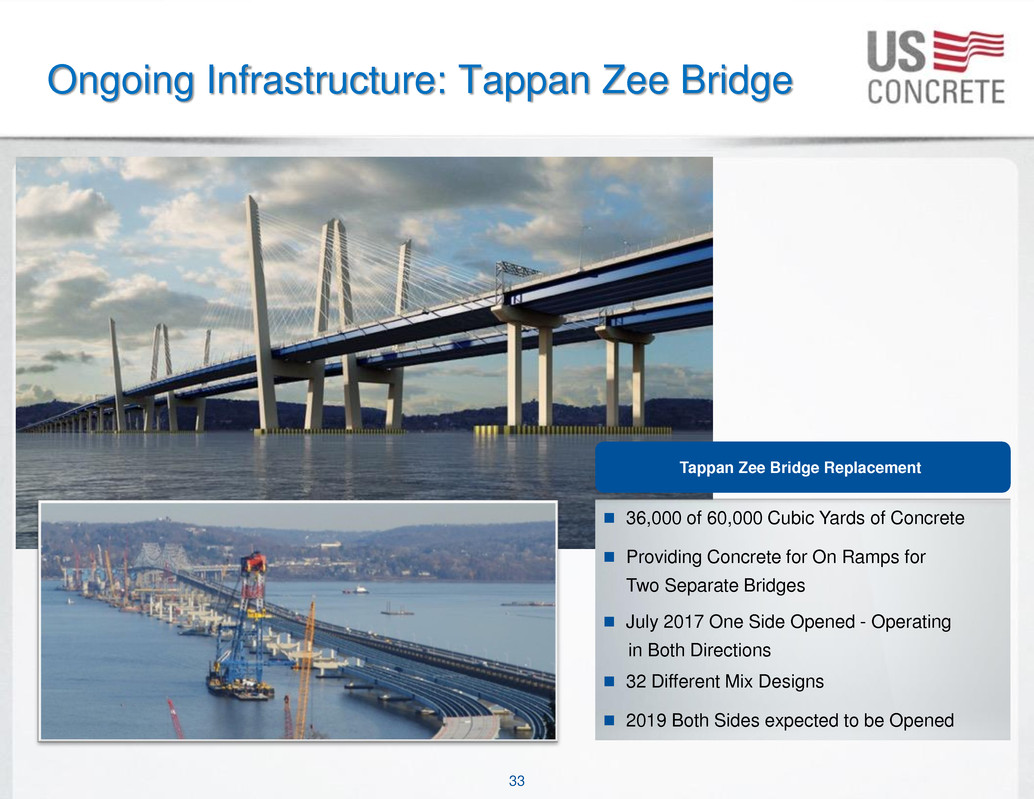

33 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Infrastructure: Tappan Zee Bridge Tappan Zee Bridge Replacement 36,000 of 60,000 Cubic Yards of Concrete Providing Concrete for On Ramps for Two Separate Bridges July 2017 One Side Opened - Operating in Both Directions 32 Different Mix Designs 2019 Both Sides expected to be Opened

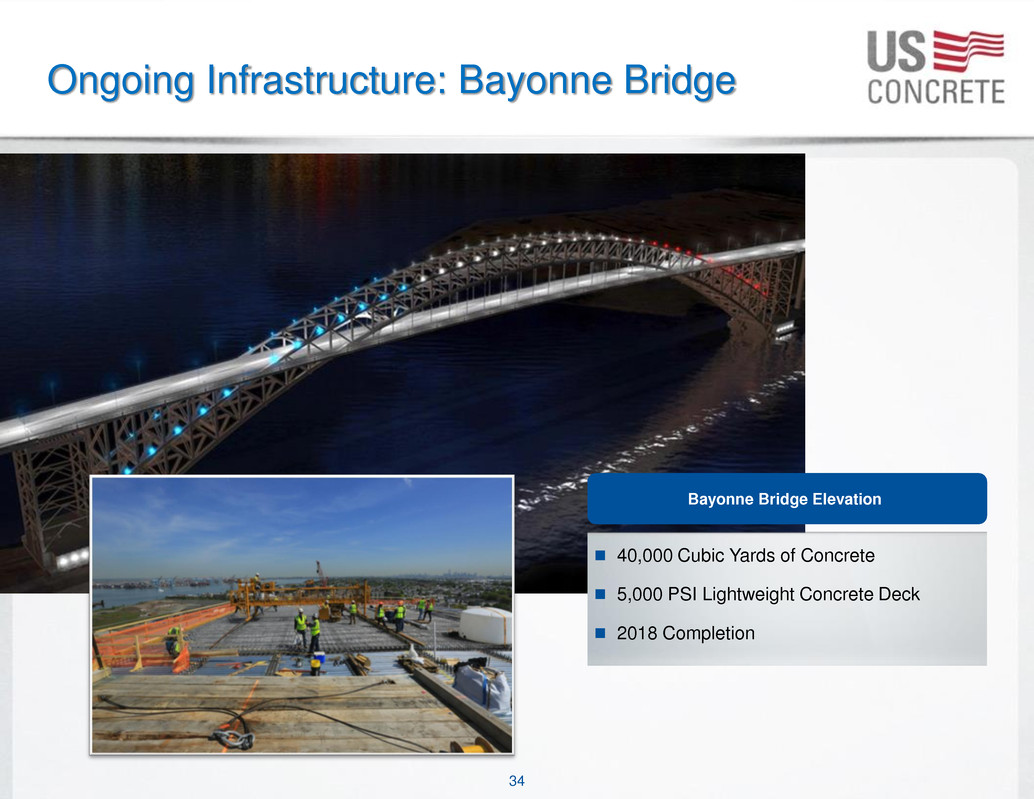

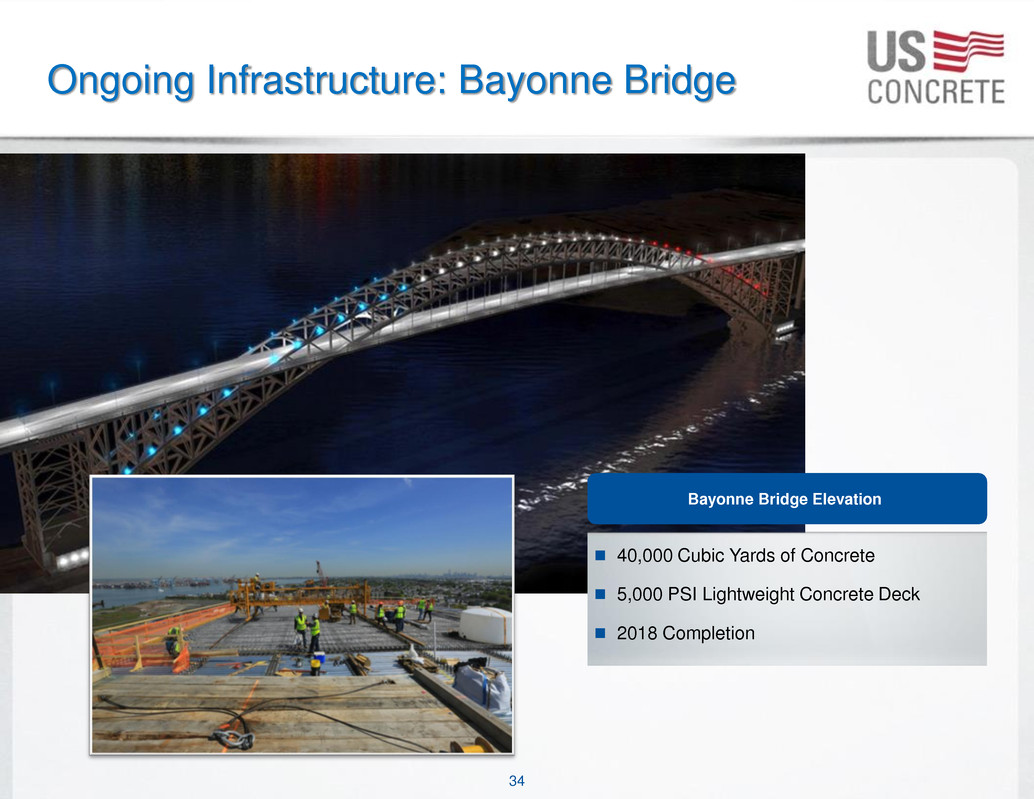

34 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Infrastructure: Bayonne Bridge Bayonne Bridge Elevation 40,000 Cubic Yards of Concrete 5,000 PSI Lightweight Concrete Deck 2018 Completion

35 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Northern California: Levi’s Stadium Levi‟s Stadium 80,000 Cubic Yards of Concrete Low CO2 Concrete 23 Million Pounds of CO2 Reduction LEED Gold Certification Completed in 2013

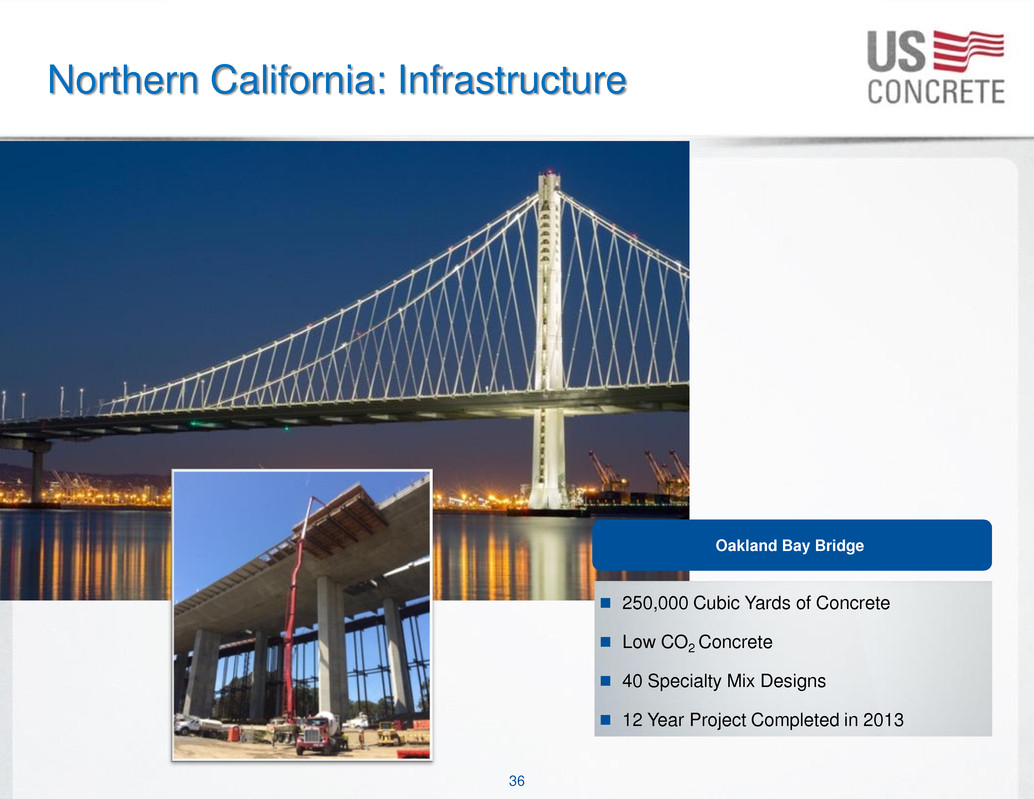

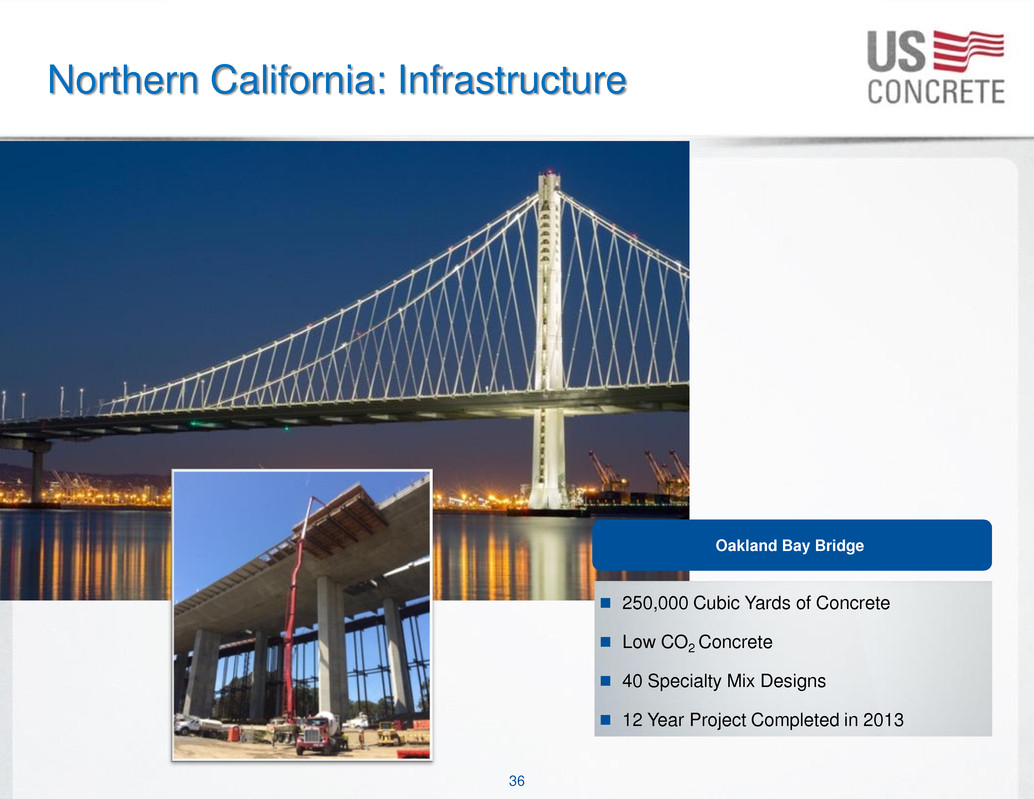

36 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Northern California: Infrastructure Oakland Bay Bridge 250,000 Cubic Yards of Concrete Low CO2 Concrete 40 Specialty Mix Designs 12 Year Project Completed in 2013

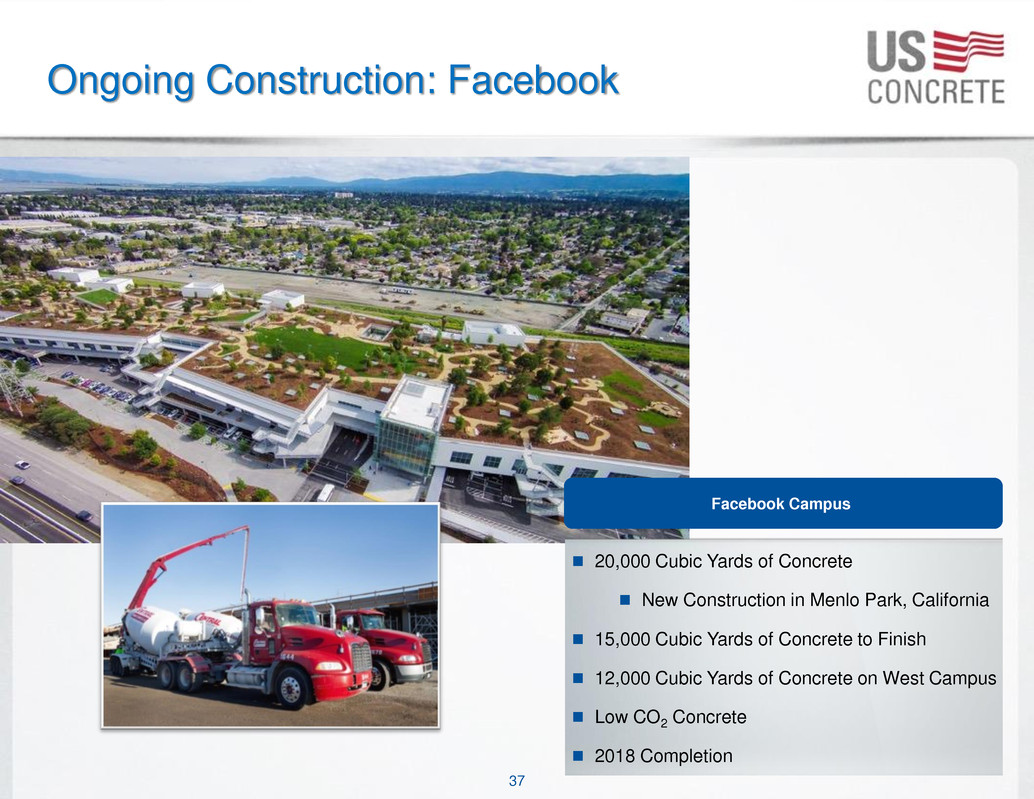

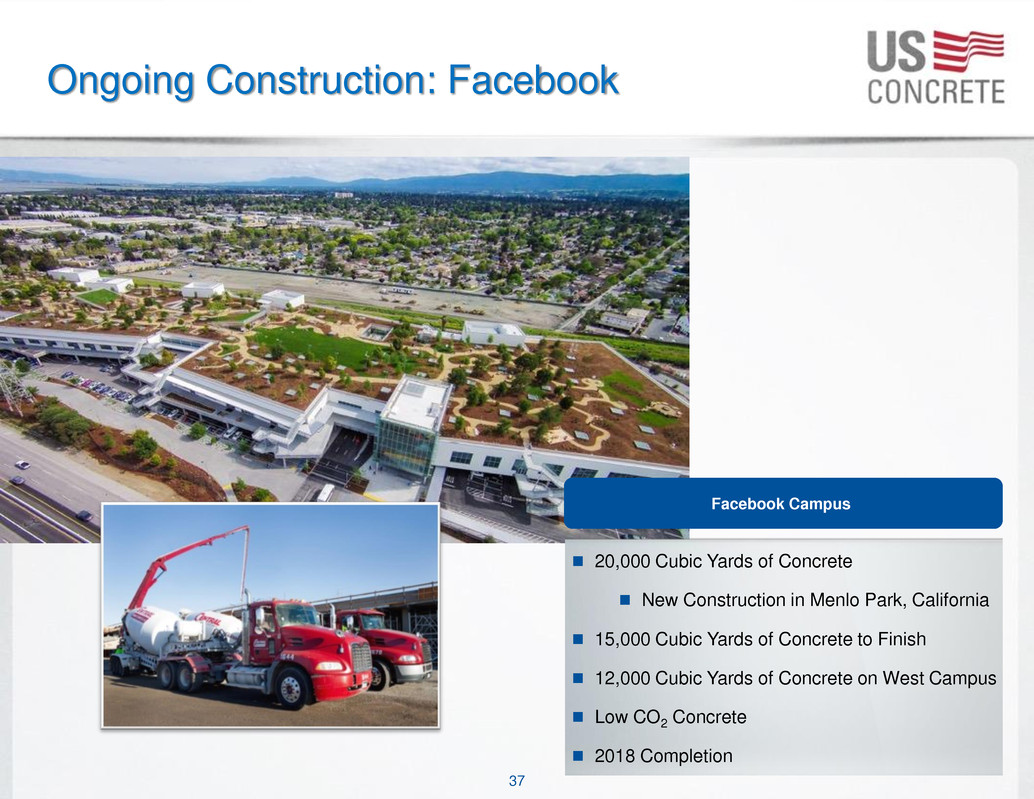

37 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Construction: Facebook Facebook Campus 20,000 Cubic Yards of Concrete New Construction in Menlo Park, California 15,000 Cubic Yards of Concrete to Finish 12,000 Cubic Yards of Concrete on West Campus Low CO2 Concrete 2018 Completion

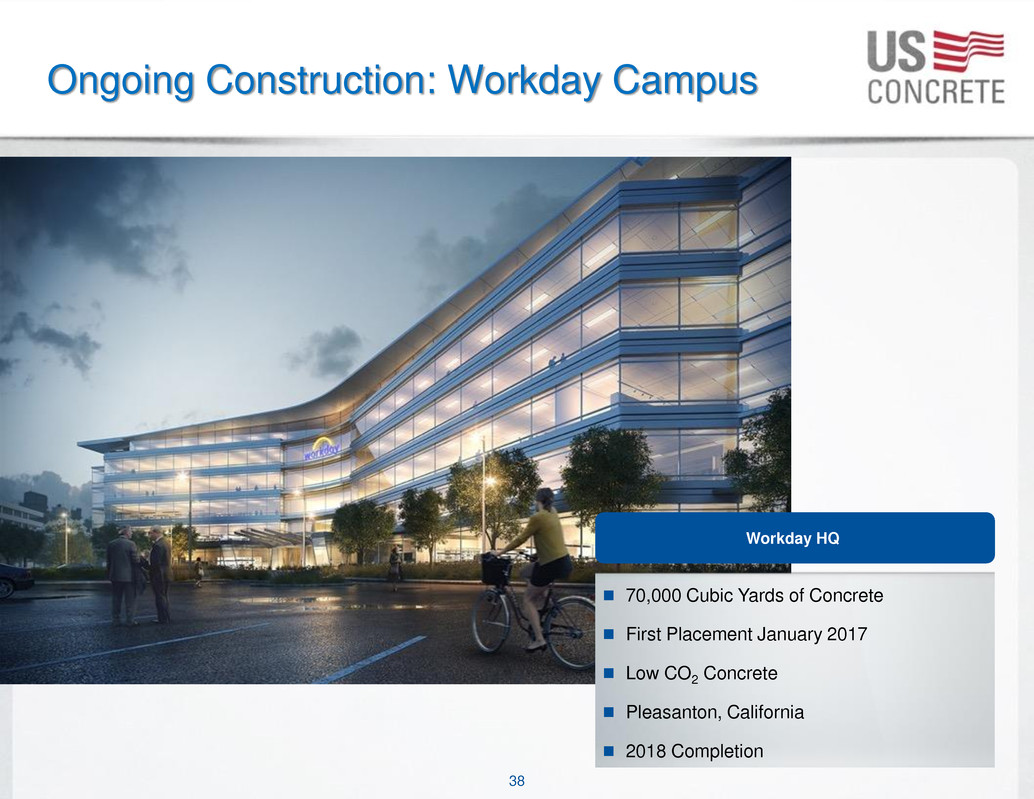

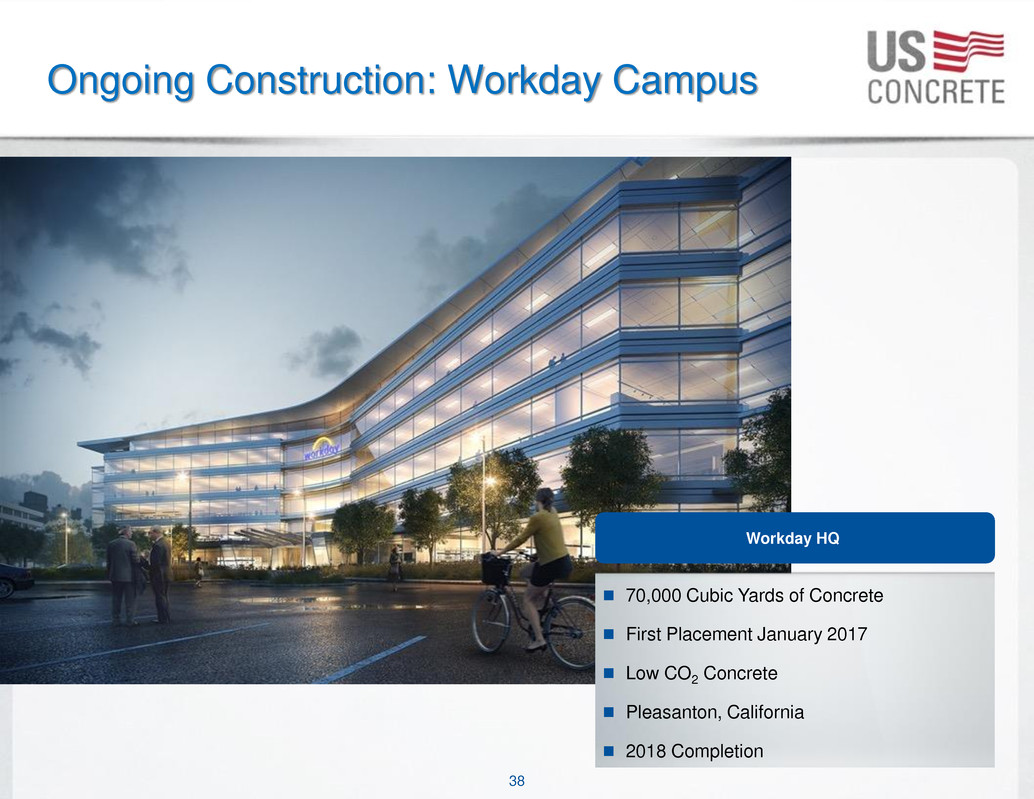

38 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Construction: Workday Campus Workday HQ 70,000 Cubic Yards of Concrete First Placement January 2017 Low CO2 Concrete Pleasanton, California 2018 Completion

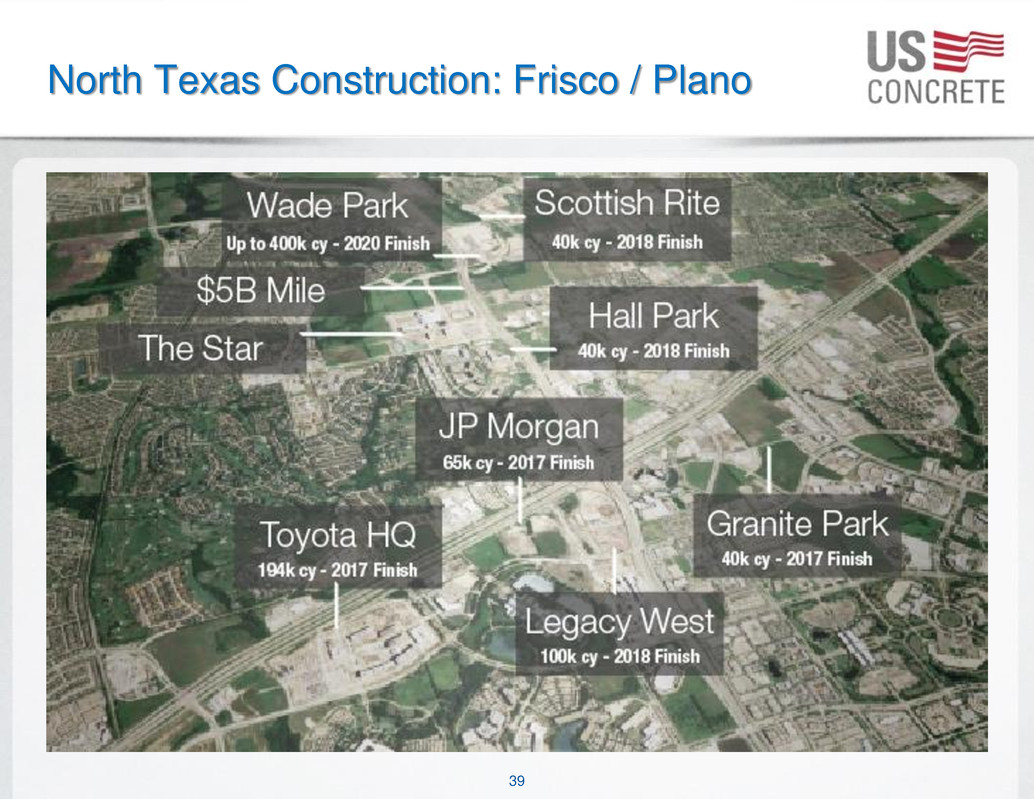

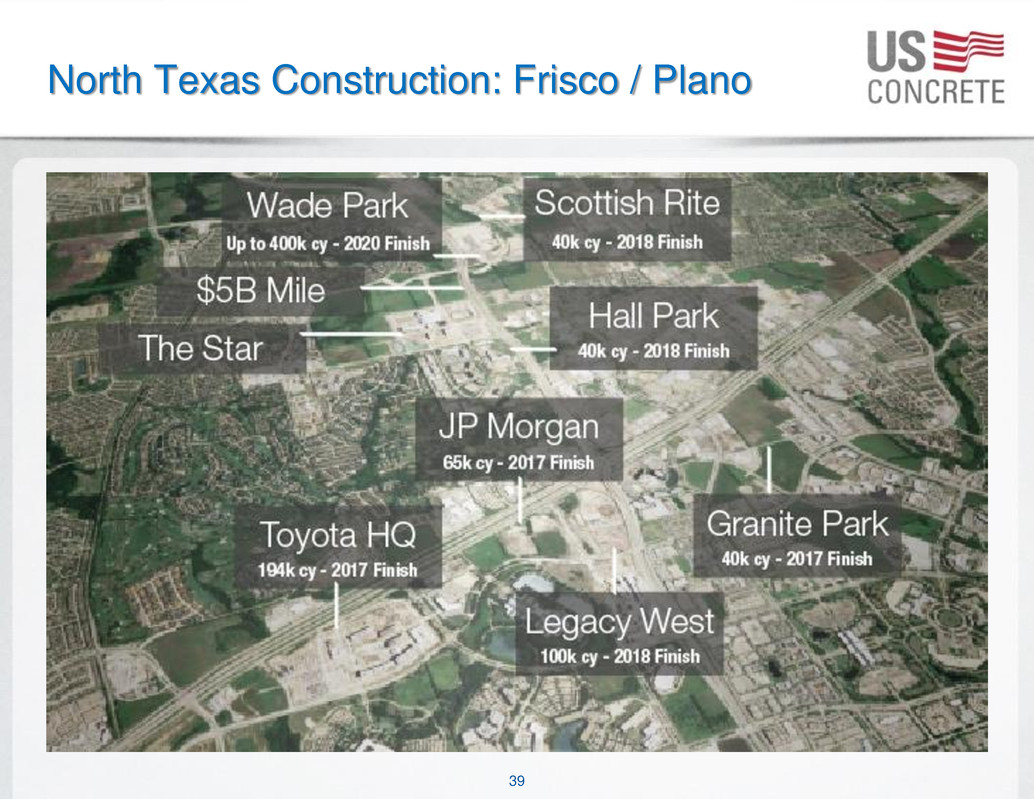

39 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 North Texas Construction: Frisco / Plano

40 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Construction: Toyota HQ Toyota of North America Headquarters 194,000 Cubic Yards of Concrete Premier North Texas Corporate Headquarters Project 2017 Completion

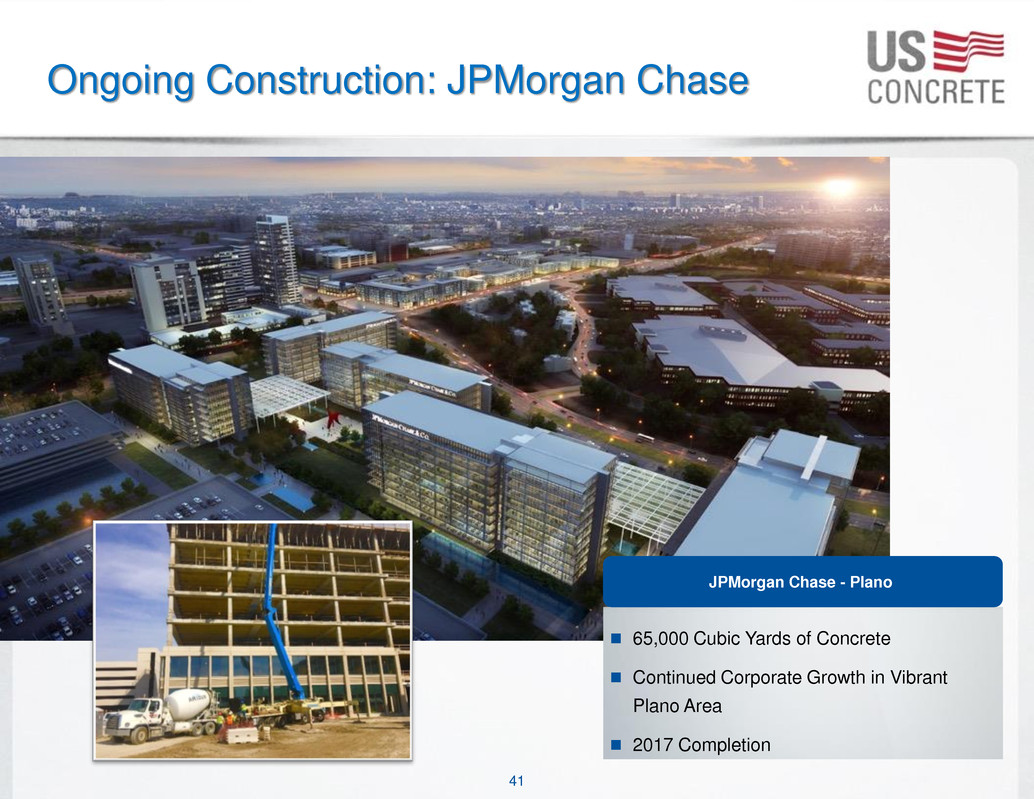

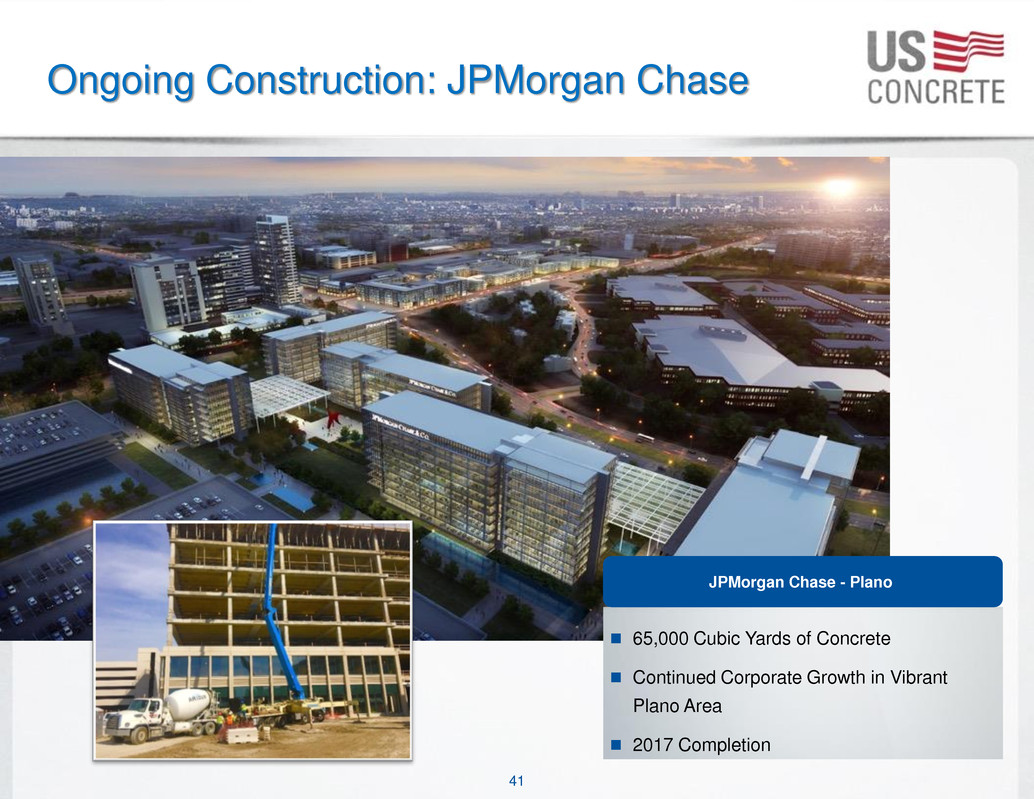

41 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Construction: JPMorgan Chase JPMorgan Chase - Plano 65,000 Cubic Yards of Concrete Continued Corporate Growth in Vibrant Plano Area 2017 Completion

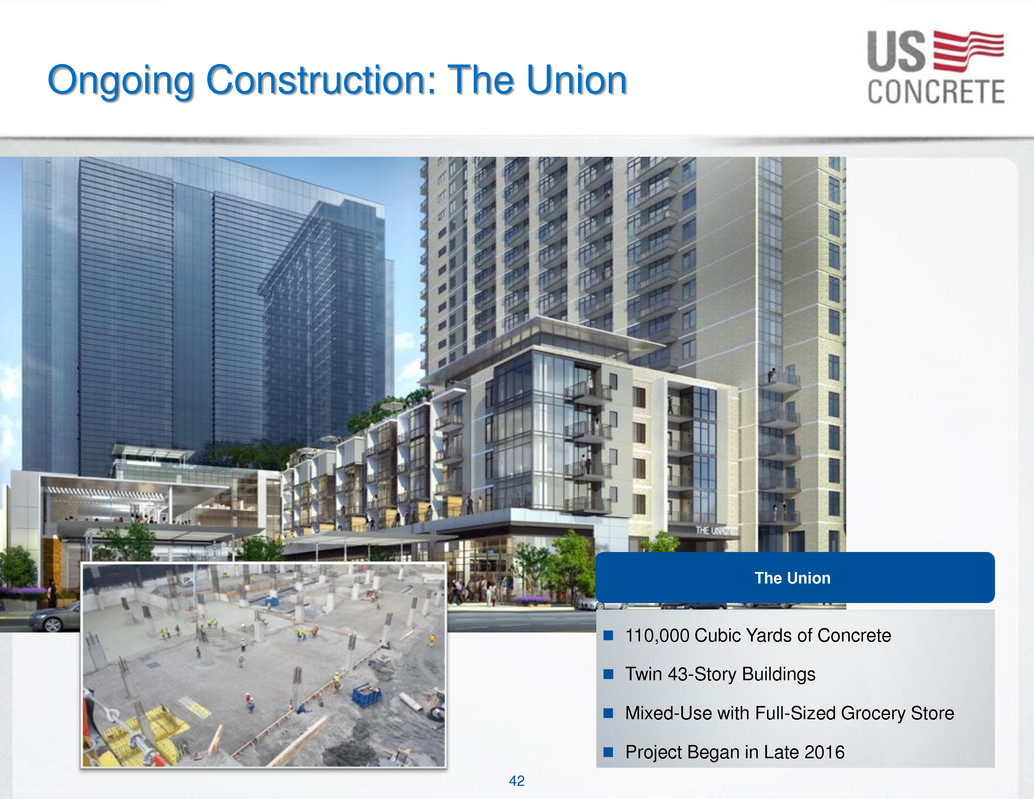

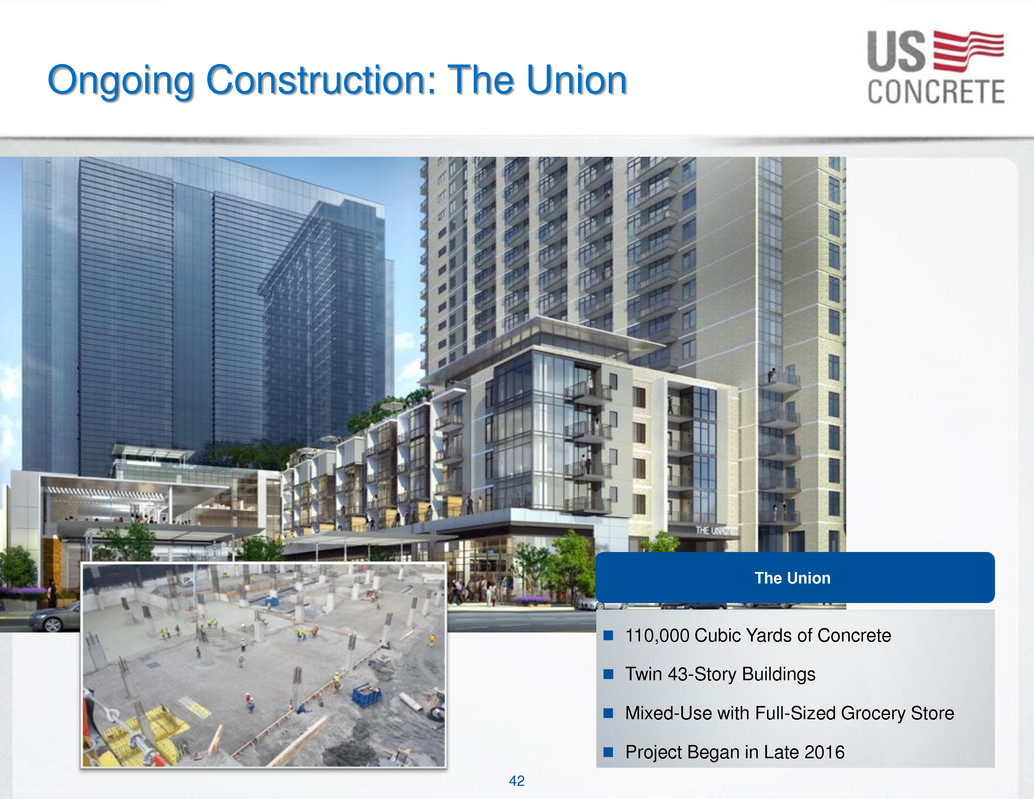

42 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ongoing Construction: The Union The Union 110,000 Cubic Yards of Concrete Twin 43-Story Buildings Mixed-Use with Full-Sized Grocery Store Project Began in Late 2016

43 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Dallas: Infrastructure I-635 Dallas Over 310,000 Cubic Yards of Concrete USCR One of Three Concrete Suppliers 24-Hour Concrete Placements Multi-Level Highway Project Three-Phase Project Completed in 2015

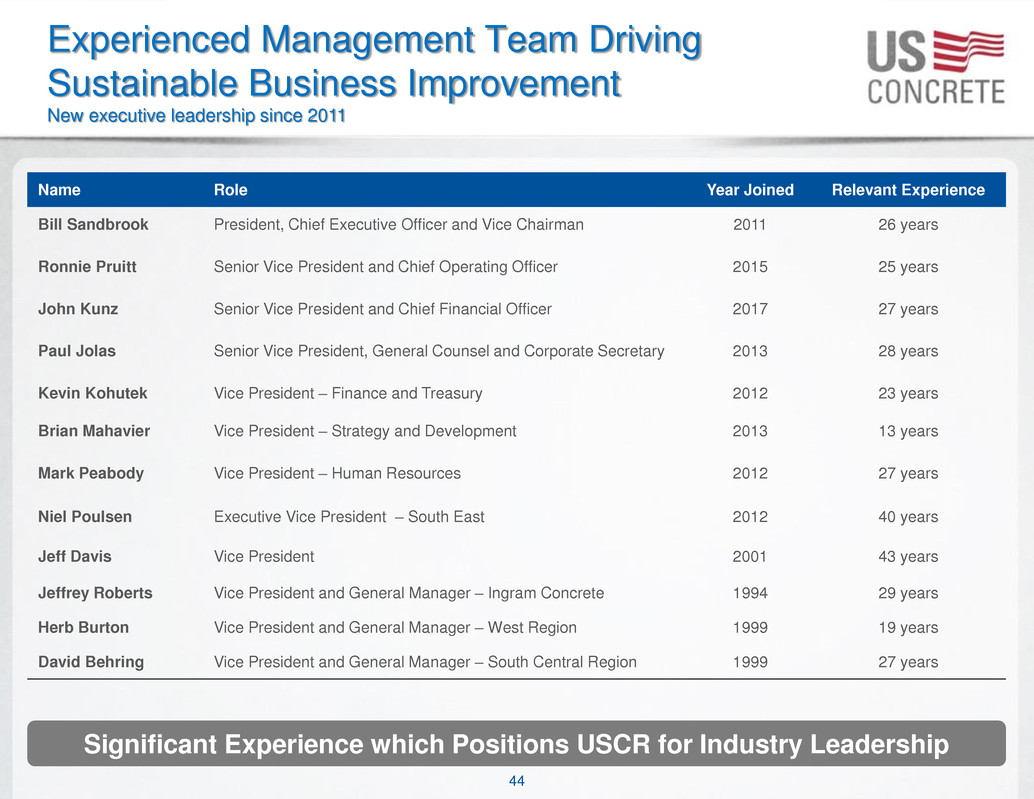

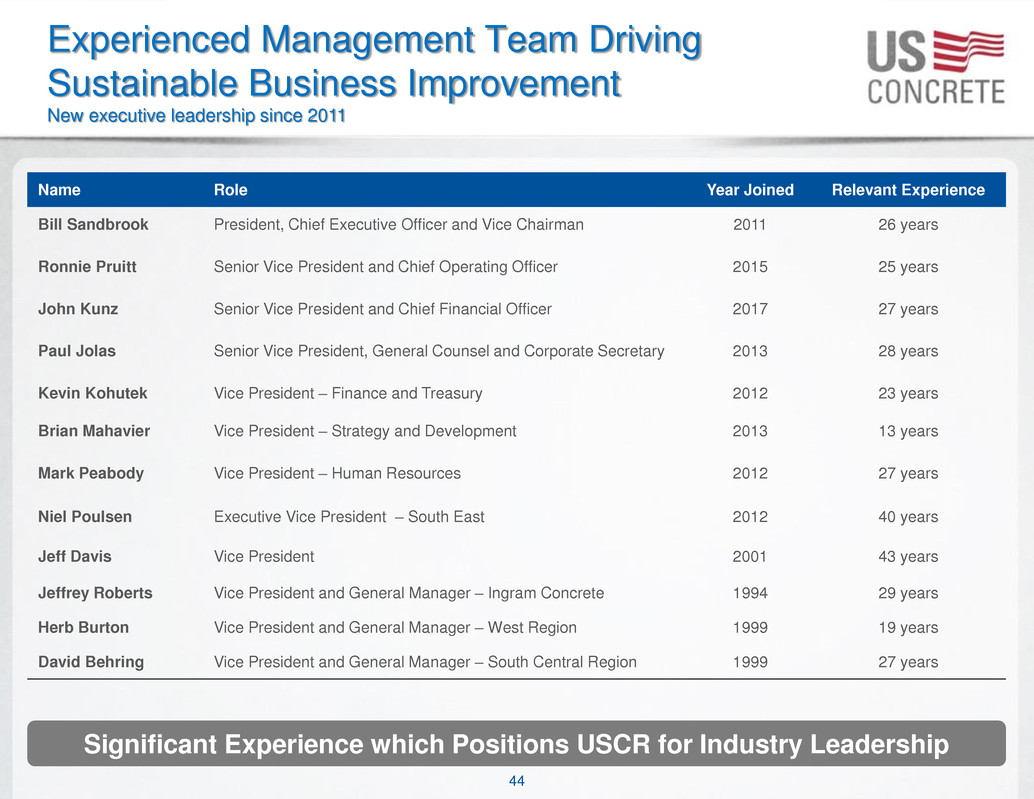

44 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Name Role Year Joined Relevant Experience Bill Sandbrook President, Chief Executive Officer and Vice Chairman 2011 26 years Ronnie Pruitt Senior Vice President and Chief Operating Officer 2015 25 years John Kunz Senior Vice President and Chief Financial Officer 2017 27 years Paul Jolas Senior Vice President, General Counsel and Corporate Secretary 2013 28 years Kevin Kohutek Vice President – Finance and Treasury 2012 23 years Brian Mahavier Vice President – Strategy and Development 2013 13 years Mark Peabody Vice President – Human Resources 2012 27 years Niel Poulsen Executive Vice President – South East 2012 40 years Jeff Davis Vice President 2001 43 years Jeffrey Roberts Vice President and General Manager – Ingram Concrete 1994 29 years Herb Burton Vice President and General Manager – West Region 1999 19 years David Behring Vice President and General Manager – South Central Region 1999 27 years Experienced Management Team Driving Sustainable Business Improvement New executive leadership since 2011 Significant Experience which Positions USCR for Industry Leadership

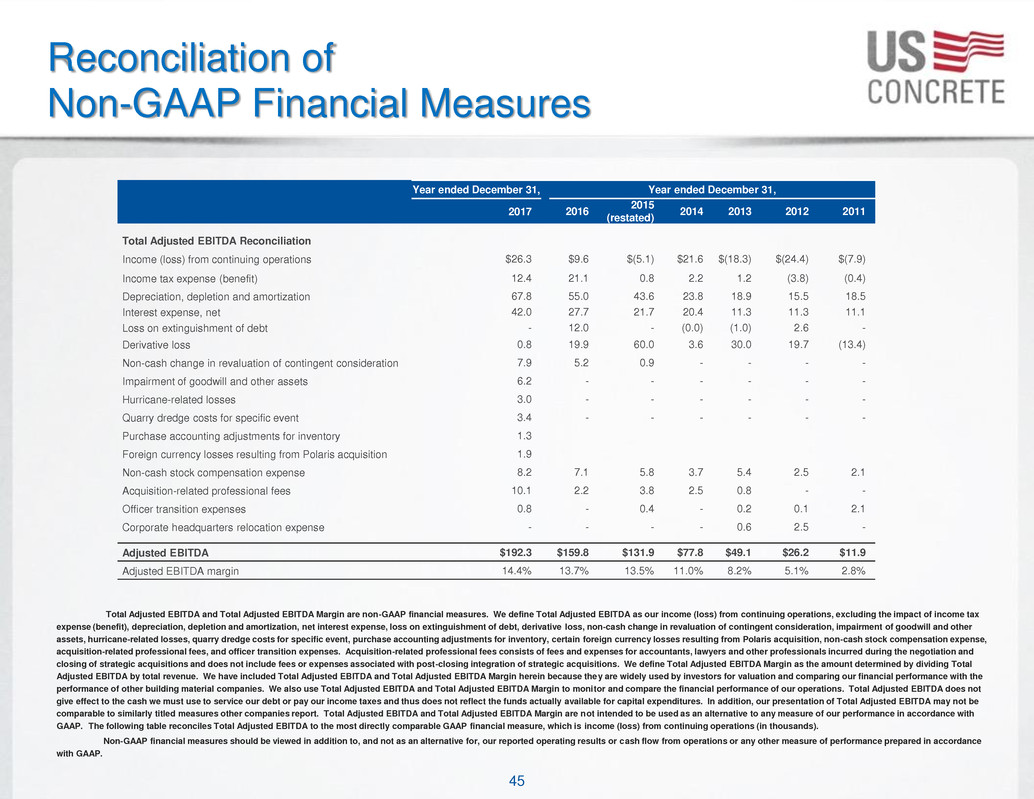

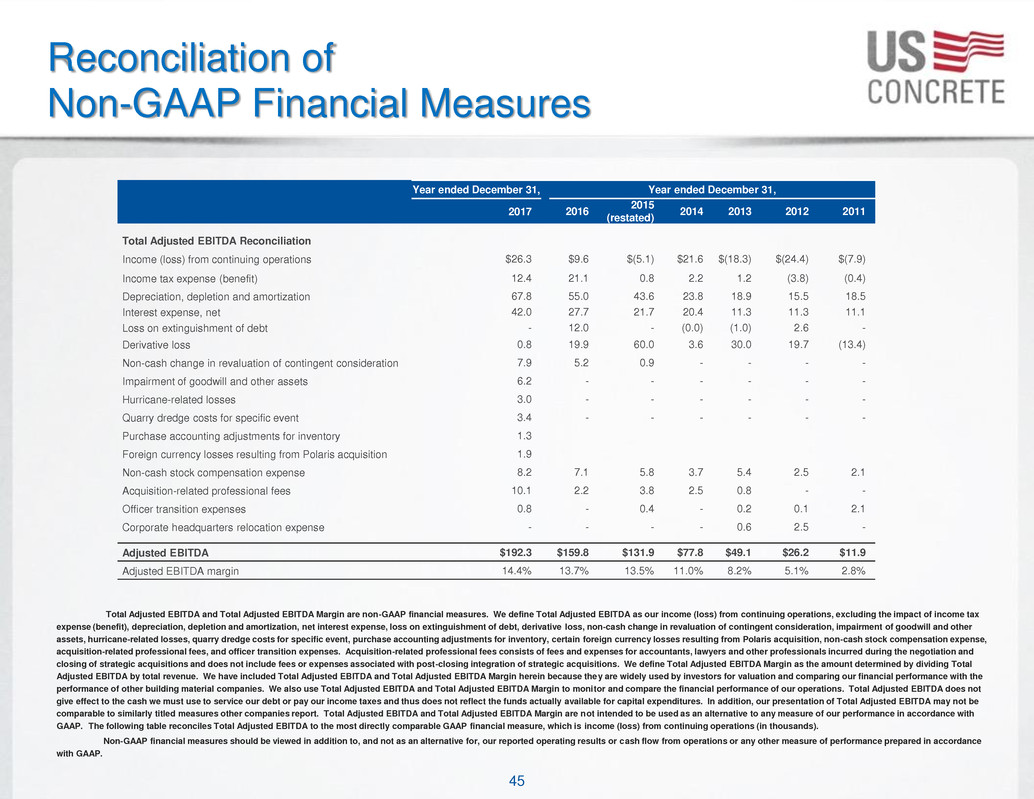

45 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Reconciliation of Non-GAAP Financial Measures Total Adjusted EBITDA and Total Adjusted EBITDA Margin are non-GAAP financial measures. We define Total Adjusted EBITDA as our income (loss) from continuing operations, excluding the impact of income tax expense (benefit), depreciation, depletion and amortization, net interest expense, loss on extinguishment of debt, derivative loss, non-cash change in revaluation of contingent consideration, impairment of goodwill and other assets, hurricane-related losses, quarry dredge costs for specific event, purchase accounting adjustments for inventory, certain foreign currency losses resulting from Polaris acquisition, non-cash stock compensation expense, acquisition-related professional fees, and officer transition expenses. Acquisition-related professional fees consists of fees and expenses for accountants, lawyers and other professionals incurred during the negotiation and closing of strategic acquisitions and does not include fees or expenses associated with post-closing integration of strategic acquisitions. We define Total Adjusted EBITDA Margin as the amount determined by dividing Total Adjusted EBITDA by total revenue. We have included Total Adjusted EBITDA and Total Adjusted EBITDA Margin herein because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use Total Adjusted EBITDA and Total Adjusted EBITDA Margin to monitor and compare the financial performance of our operations. Total Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of Total Adjusted EBITDA may not be comparable to similarly titled measures other companies report. Total Adjusted EBITDA and Total Adjusted EBITDA Margin are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. The following table reconciles Total Adjusted EBITDA to the most directly comparable GAAP financial measure, which is income (loss) from continuing operations (in thousands). Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP. Year ended December 31, Year ended December 31, 2017 2016 2015 (restated) 2014 2013 2012 2011 Total Adjusted EBITDA Reconciliation Income (loss) from continuing operations $26.3 $9.6 $(5.1) $21.6 $(18.3) $(24.4) $(7.9) Income tax expense (benefit) 12.4 21.1 0.8 2.2 1.2 (3.8) (0.4) Depreciation, depletion and amortization 67.8 55.0 43.6 23.8 18.9 15.5 18.5 Interest expense, net 42.0 27.7 21.7 20.4 11.3 11.3 11.1 Loss on extinguishment of debt - 12.0 - (0.0) (1.0) 2.6 - Derivative loss 0.8 19.9 60.0 3.6 30.0 19.7 (13.4) Non-cash change in revaluation of contingent consideration 7.9 5.2 0.9 - - - - Impairment of goodwill and other assets 6.2 - - - - - - Hurricane-related losses 3.0 - - - - - - Quarry dredge costs for specific event 3.4 - - - - - - Purchase accounting adjustments for inventory 1.3 Foreign currency losses resulting from Polaris acquisition 1.9 Non-cash stock compensation expense 8.2 7.1 5.8 3.7 5.4 2.5 2.1 Acquisition-related professional fees 10.1 2.2 3.8 2.5 0.8 - - Officer transition expenses 0.8 - 0.4 - 0.2 0.1 2.1 Corporate headquarters relocation expense - - - - 0.6 2.5 - Adjusted EBITDA $192.3 $159.8 $131.9 $77.8 $49.1 $26.2 $11.9 Adjusted EBITDA margin 14.4% 13.7% 13.5% 11.0% 8.2% 5.1% 2.8%

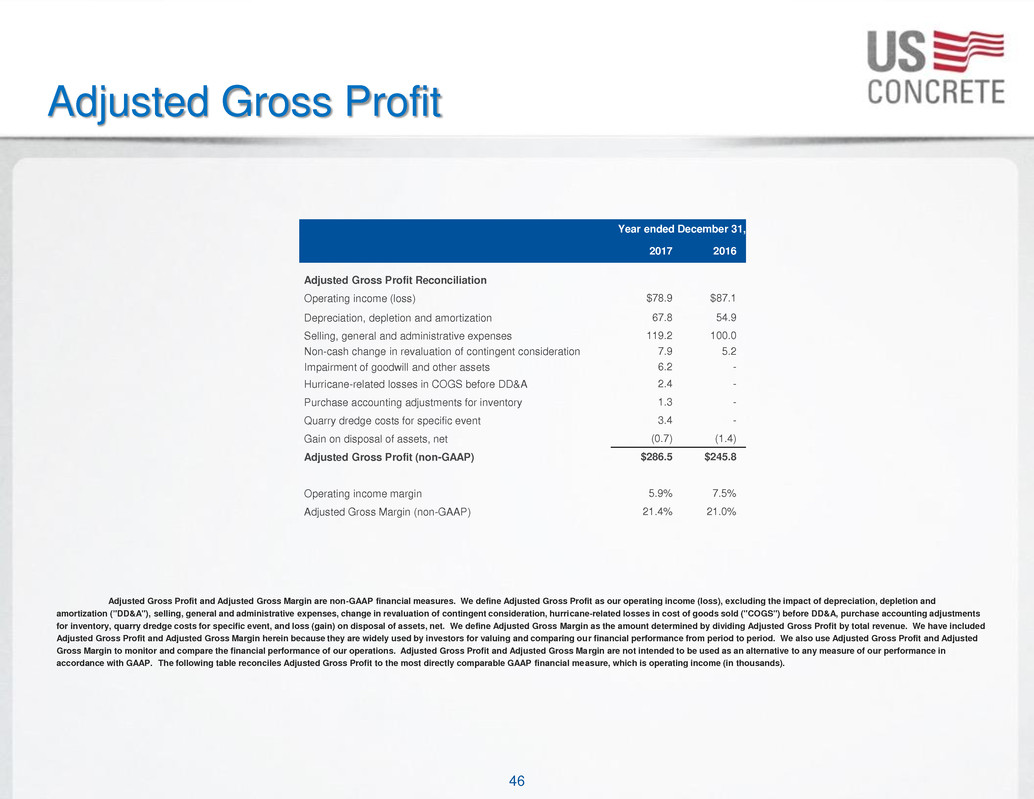

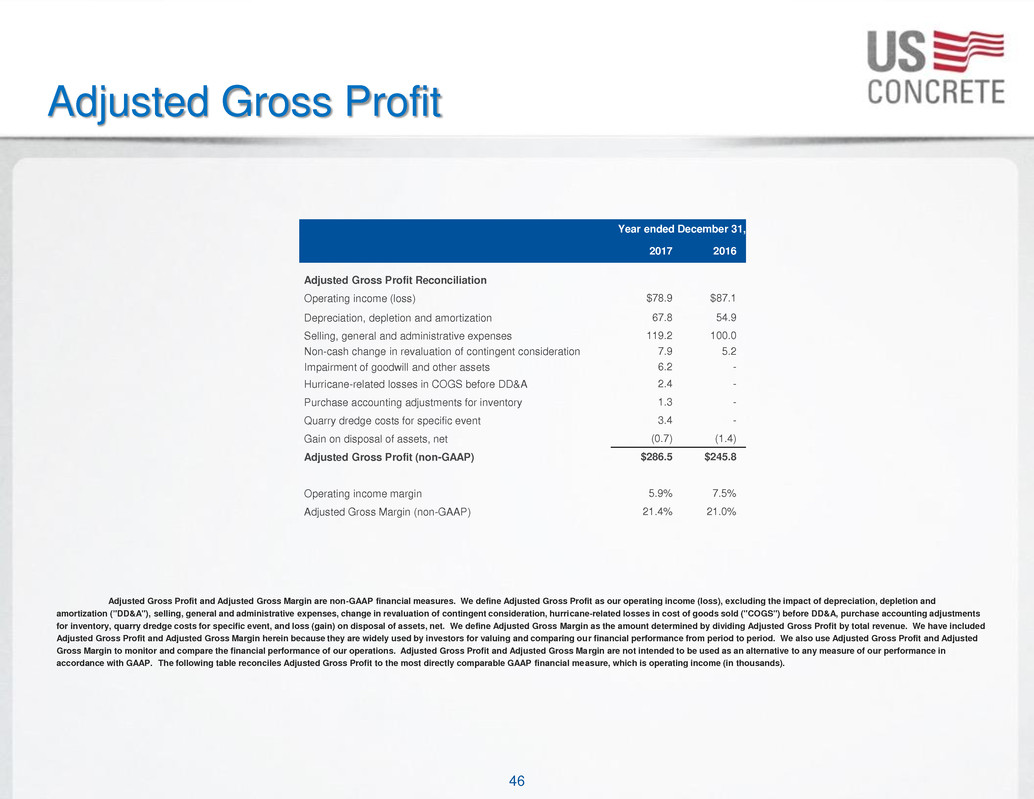

46 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Adjusted Gross Profit Adjusted Gross Profit and Adjusted Gross Margin are non-GAAP financial measures. We define Adjusted Gross Profit as our operating income (loss), excluding the impact of depreciation, depletion and amortization ("DD&A"), selling, general and administrative expenses, change in revaluation of contingent consideration, hurricane-related losses in cost of goods sold ("COGS") before DD&A, purchase accounting adjustments for inventory, quarry dredge costs for specific event, and loss (gain) on disposal of assets, net. We define Adjusted Gross Margin as the amount determined by dividing Adjusted Gross Profit by total revenue. We have included Adjusted Gross Profit and Adjusted Gross Margin herein because they are widely used by investors for valuing and comparing our financial performance from period to period. We also use Adjusted Gross Profit and Adjusted Gross Margin to monitor and compare the financial performance of our operations. Adjusted Gross Profit and Adjusted Gross Margin are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. The following table reconciles Adjusted Gross Profit to the most directly comparable GAAP financial measure, which is operating income (in thousands). Year ended December 31, 2017 2016 Adjusted Gross Profit Reconciliation Operating income (loss) $78.9 $87.1 Depreciation, depletion and amortization 67.8 54.9 Selling, general and administrative expenses 119.2 100.0 Non-cash change in revaluation of contingent consideration 7.9 5.2 Impairment of goodwill and other assets 6.2 - Hurricane-related losses in COGS before DD&A 2.4 - Purchase accounting adjustments for inventory 1.3 - Quarry dredge costs for specific event 3.4 - Gain on disposal of assets, net (0.7) (1.4) Adjusted Gross Profit (non-GAAP) $286.5 $245.8 Operating income margin 5.9% 7.5% Adjusted Gross Margin (non-GAAP) 21.4% 21.0%