Investor Relations Presentation November 2018

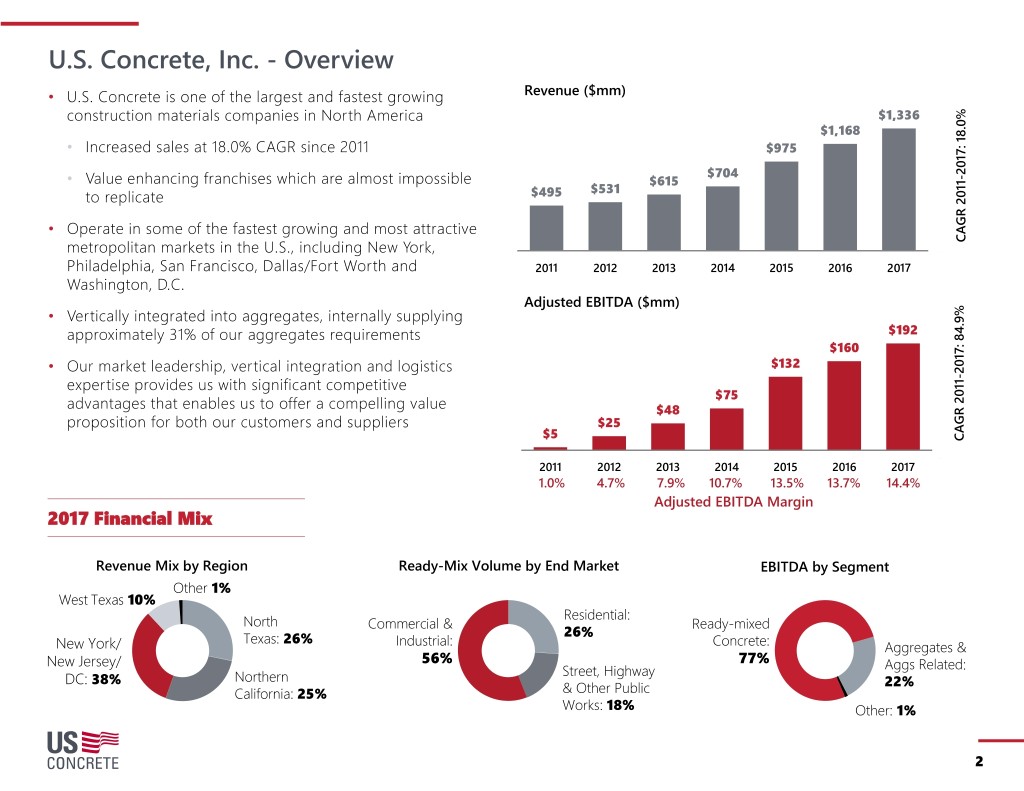

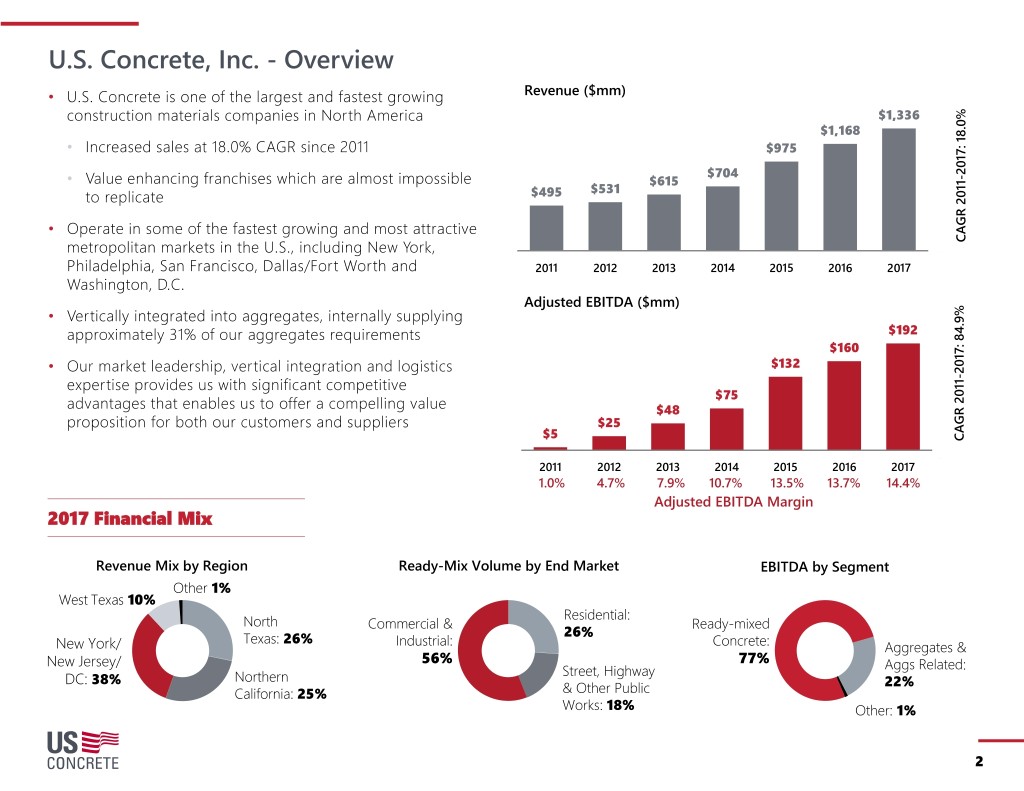

U.S. Concrete, Inc. - Overview • U.S. Concrete is one of the largest and fastest growing Revenue ($mm) construction materials companies in North America $1,336 $1,168 • Increased sales at 18.0% CAGR since 2011 $975 2017: 18.0% 2017: $704 - • Value enhancing franchises which are almost impossible $615 $531 to replicate $495 • Operate in some of the fastest growing and most attractive metropolitan markets in the U.S., including New York, CAGR 2011 Philadelphia, San Francisco, Dallas/Fort Worth and 2011 2012 2013 2014 2015 2016 2017 Washington, D.C. Adjusted EBITDA ($mm) • Vertically integrated into aggregates, internally supplying approximately 31% of our aggregates requirements $192 $160 $132 • Our market leadership, vertical integration and logistics 84.9% 2017: expertise provides us with significant competitive - $75 advantages that enables us to offer a compelling value $48 proposition for both our customers and suppliers $25 $5 CAGR CAGR 2011 2011 2012 2013 2014 2015 2016 2017 1.0% 4.7% 7.9% 10.7% 13.5% 13.7% 14.4% Adjusted EBITDA Margin 2017 Financial Mix Revenue Mix by Region Ready-Mix Volume by End Market EBITDA by Segment Other 1% West Texas 10% Residential: North Commercial & Ready-mixed Texas: 26% 26% New York/ Industrial: Concrete: Aggregates & New Jersey/ 56% 77% Street, Highway Aggs Related: DC: 38% Northern 22% California: 25% & Other Public Works: 18% Other: 1% 2

USCR has Transformed Over the Last 7 Years Into a Leading and Highly Profitable Construction Materials Supplier Significant Growth Markets 2011 2017 Asset Base Ready-Mixed Concrete Aggregates Producing Aggregates (‘000 tons) 2,741 6,197 Operating Facilities Facilities Ready-Mix (‘000 CYDs) 4,047 8,984 2011 Current 2011 Current Sales ($mm) $495 $1,336 West Region 18 26 0 1 EBITDA ($mm) $5 $192 Atlantic Region 26 49 3 5 Vertical Integration % 23% 26% Texas/Oklahoma 69 119 4 12 Ready-Mixed Concrete Plants 113 179 U.S. Virgin Islands 0 4 0 2 Aggregates Facilities 7 18 Total 113 198 7 20 3

U.S. Concrete Plays a Critical Role in the Construction Materials Value Chain Construction Materials Value Chain Materials Production Ready-Mix Manufacturing Customers and Supplying Commercial (medium-large projects) • High service complexity, scale critical, rigorous quality standard, ability to differentiate on product. • A core focus of USCR Residential (small projects) • Service complexity low, not a core focus of USCR Infrastructure (medium-large projects) • Service complexity, need scale, ability to differentiate on product. A core focus of USCR U.S. Concrete’s Value Proposition • Serves as a critical raw material producer and finished good manufacturer to highly fragmented and diverse contractor customer base • Supplying ready-mixed concrete requires a high degree of product, logistic and services expertise due to its unique attributes (short product life span, value-to-weight ratio) • Given the logistical proficiency required in the delivery process we are able to differentiate ourselves from our competitors based on scale, service and product quality, enabling us to earn attractive returns 4

Strategic Focus has Driven Superior Operating Acumen that Facilitates Industry Leading Profitability USCR’s Core Competencies and Competitive Advantages • A uniquely comprehensive urban asset base: • Well positioned to supply large, complex urban projects from unique plant networks in large metro markets that are difficult to serve • Comprehensive asset base enables greater efficiencies and asset utilization • Logistics and scheduling expertise • Increased investment in technology to drive continued improvements • Scale leverages purchasing power advantages, delivery and asset utilization efficiencies • Proven ability to create value through M&A • Deep industry relationships facilitate proprietary sourcing of acquisitions • Repeatable acquisition and integration processes to maximize synergies • Concrete mix design expertise • Ability to meet stringent specifications • National Research Laboratory • Developing industry leading solutions • Regional laboratories 5

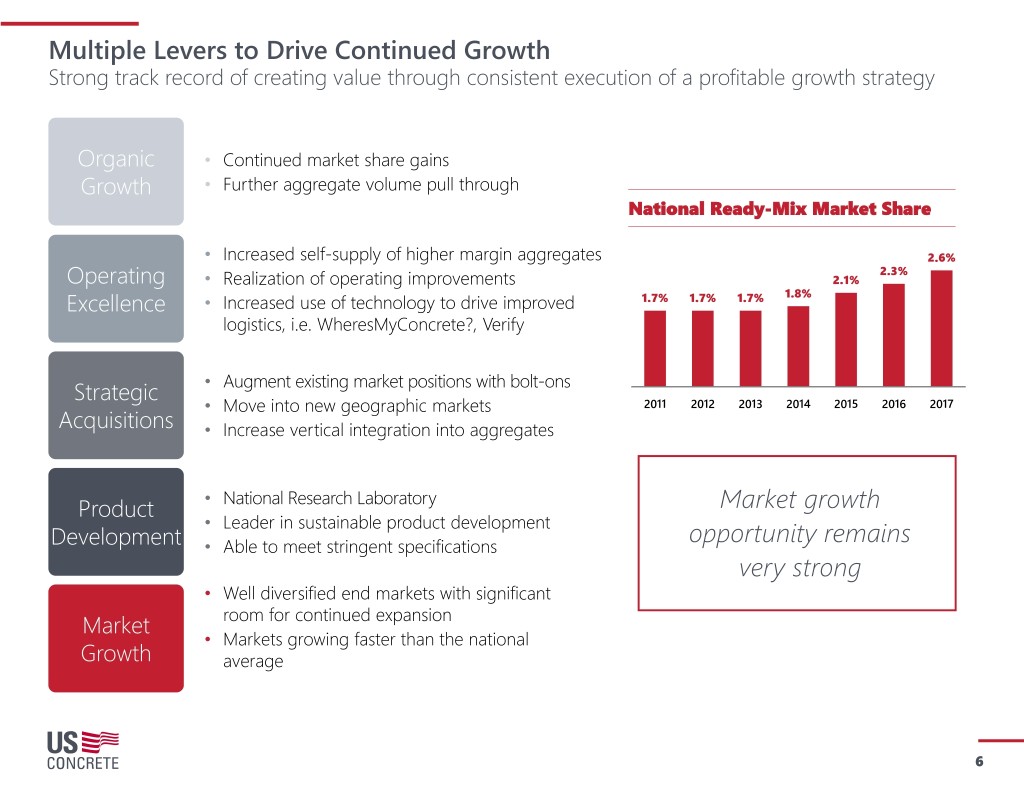

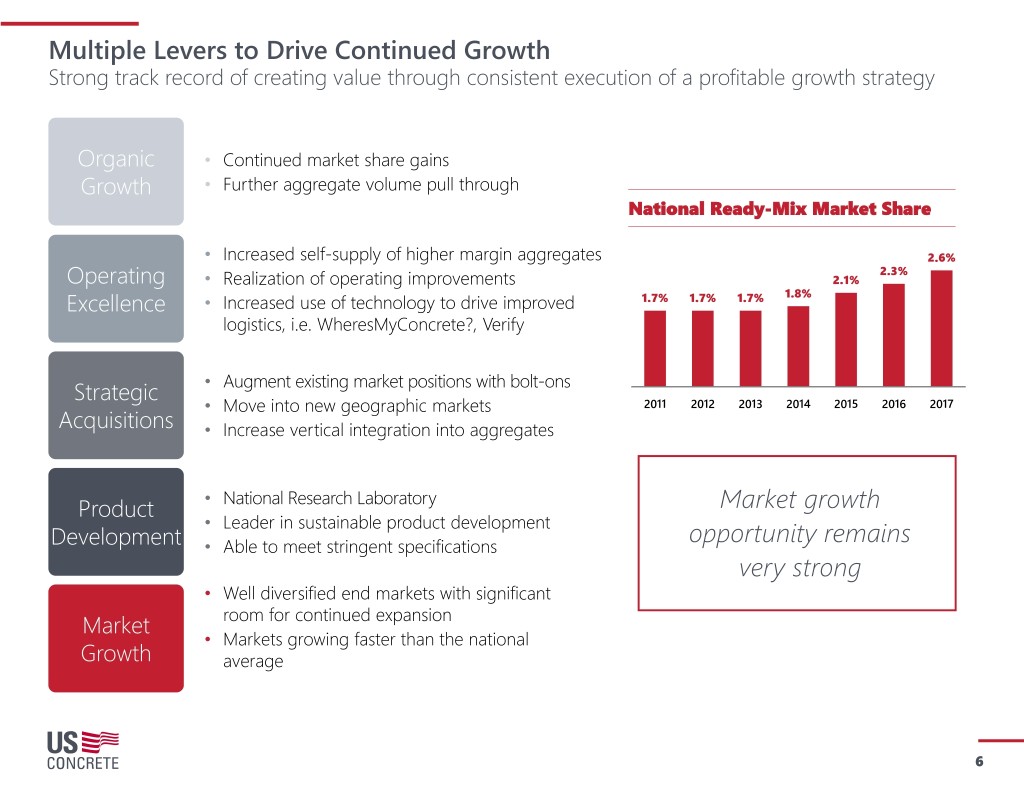

Multiple Levers to Drive Continued Growth Strong track record of creating value through consistent execution of a profitable growth strategy Organic • Continued market share gains Growth • Further aggregate volume pull through National Ready-Mix Market Share • Increased self-supply of higher margin aggregates 2.6% 2.3% Operating • Realization of operating improvements 2.1% 1.8% Excellence • Increased use of technology to drive improved 1.7% 1.7% 1.7% logistics, i.e. WheresMyConcrete?, Verify Strategic • Augment existing market positions with bolt-ons • Move into new geographic markets 2011 2012 2013 2014 2015 2016 2017 Acquisitions • Increase vertical integration into aggregates Product • National Research Laboratory Market growth • Leader in sustainable product development opportunity remains Development • Able to meet stringent specifications very strong • Well diversified end markets with significant Market room for continued expansion • Markets growing faster than the national Growth average 6

Well-Positioned to Continue to Capitalize on the Construction Cycle Strong prospects for an elongated period of cyclical growth Ready-Mix Concrete Consumption Per Capita Private Construction Investment % of GDP 1.4 7.0% Cubic Yards 6.0% 5.0% 4.0% 3.0% 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 Private Construction % of GDP 1997-2017 Average Public Construction Investment % of GDP 1.1 2.2% Cubic Yards 2.0% 1.8% 1.6% 1.4% 1997-2007 Average 2017 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 Public Construction % of GDP 1997-2017 Average 7

GDP, Infrastructuregrowthcatalysts for continued Cyclewith FarOpportunity Growth FromPeak Volume (in mm cubic yards (“CYDs”)) 400 450 200 250 300 350 500 100 150 50 0 1997 Source: NRMCA Source: 348 Current demand levels remain below those seen in prior decades prior in seen those below remain levels demand Current 1998 372 U.S. Production 1999 391 2000 396 2001 406 2002 390 2003 404 2004 432 2005 Avg. 441 Avg. 458 2006 457 2007 415 2008 352 2009 259 2010 257 2011 Growth Drivers Growth 266 • • • • Attractive MSA markets MSA Attractive Spending Highway & Infrastructure GDP Population U.S. 2012 290 • • • • 2013 2017 1997 2017 1997 300 – – – – 2014 325 trillion 17.3 trillion 11.2 million 325.7 million 272.6 2015 Avg. 339 Avg. 336 2016 343 2017 351 8

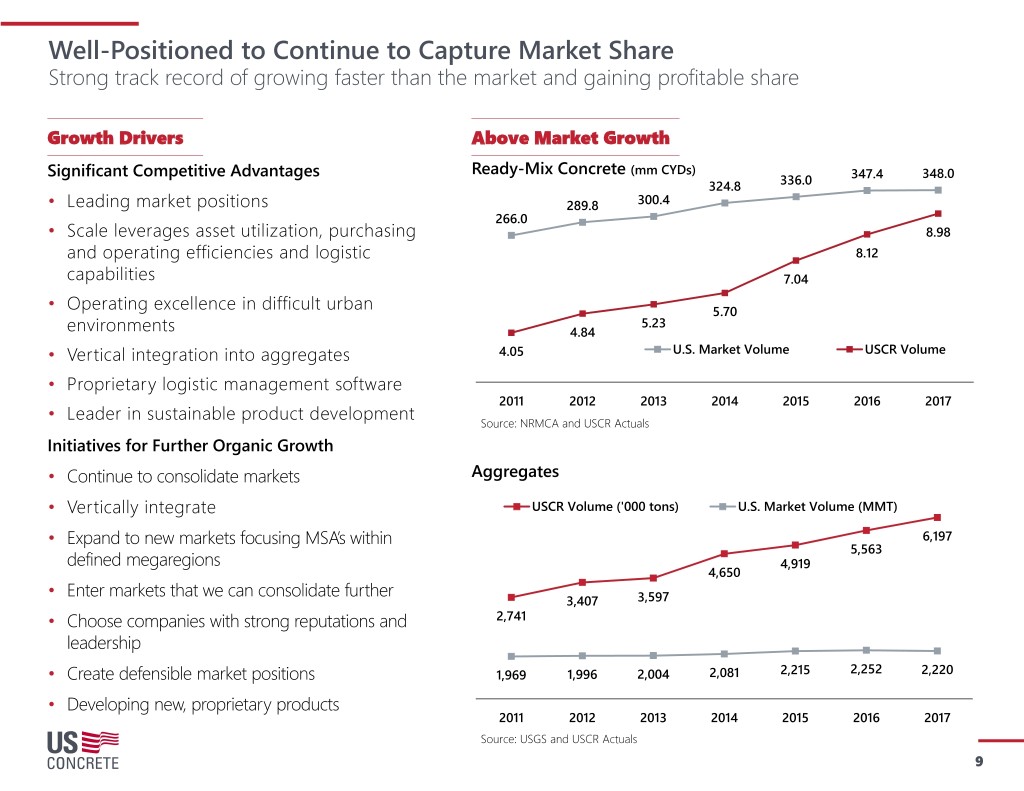

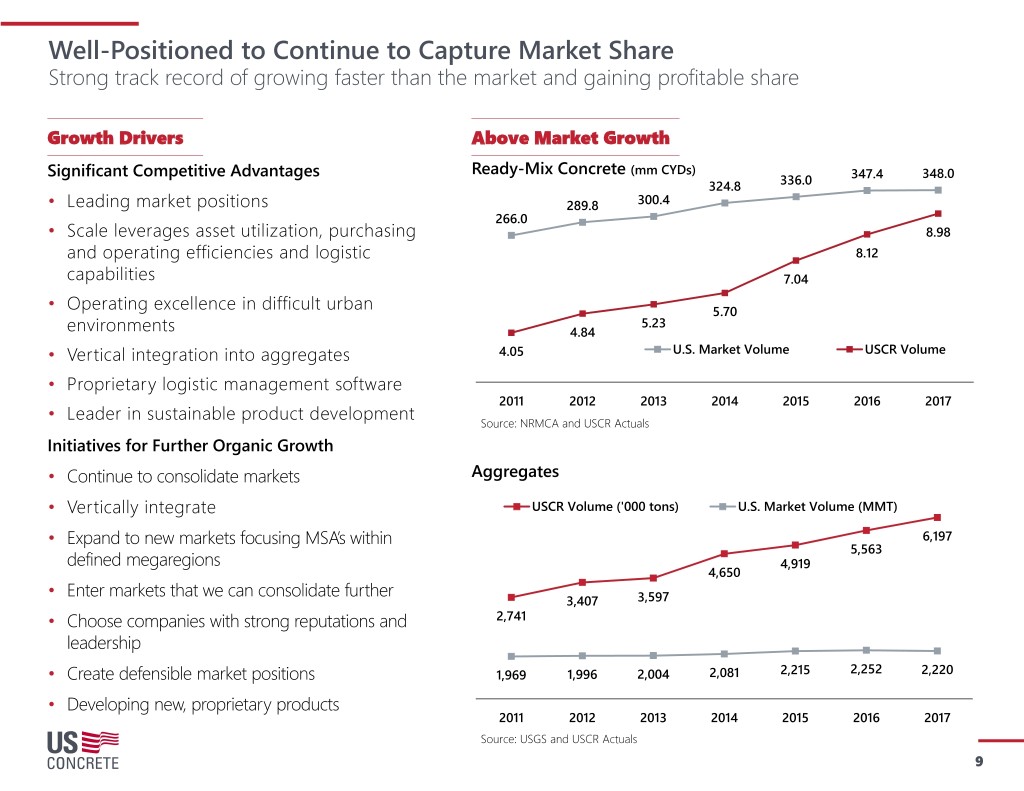

Well-Positioned to Continue to Capture Market Share Strong track record of growing faster than the market and gaining profitable share Growth Drivers Above Market Growth Significant Competitive Advantages Ready-Mix Concrete (mm CYDs) 347.4 348.0 324.8 336.0 • Leading market positions 289.8 300.4 266.0 • Scale leverages asset utilization, purchasing 8.98 and operating efficiencies and logistic 8.12 capabilities 7.04 • Operating excellence in difficult urban 5.70 5.23 environments 4.84 • Vertical integration into aggregates 4.05 U.S. Market Volume USCR Volume • Proprietary logistic management software 2011 2012 2013 2014 2015 2016 2017 • Leader in sustainable product development Source: NRMCA and USCR Actuals Initiatives for Further Organic Growth • Continue to consolidate markets Aggregates • Vertically integrate USCR Volume ('000 tons) U.S. Market Volume (MMT) • Expand to new markets focusing MSA’s within 6,197 5,563 defined megaregions 4,919 4,650 • Enter markets that we can consolidate further 3,407 3,597 • Choose companies with strong reputations and 2,741 leadership • Create defensible market positions 1,969 1,996 2,004 2,081 2,215 2,252 2,220 • Developing new, proprietary products 2011 2012 2013 2014 2015 2016 2017 Source: USGS and USCR Actuals 9

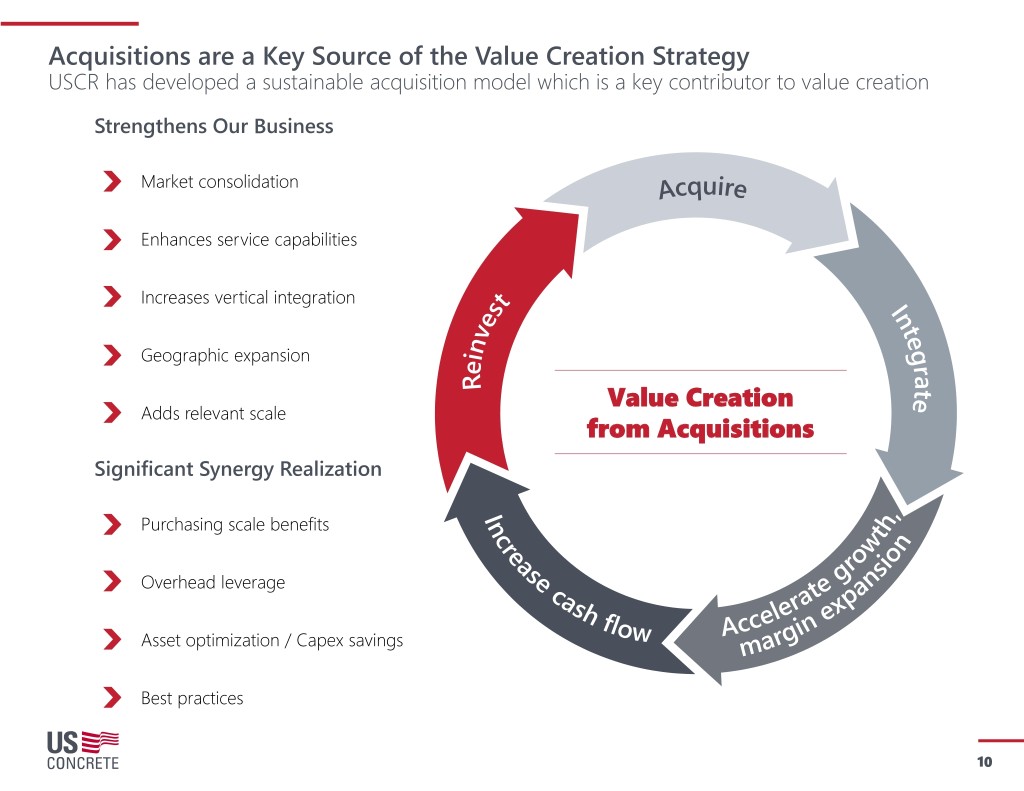

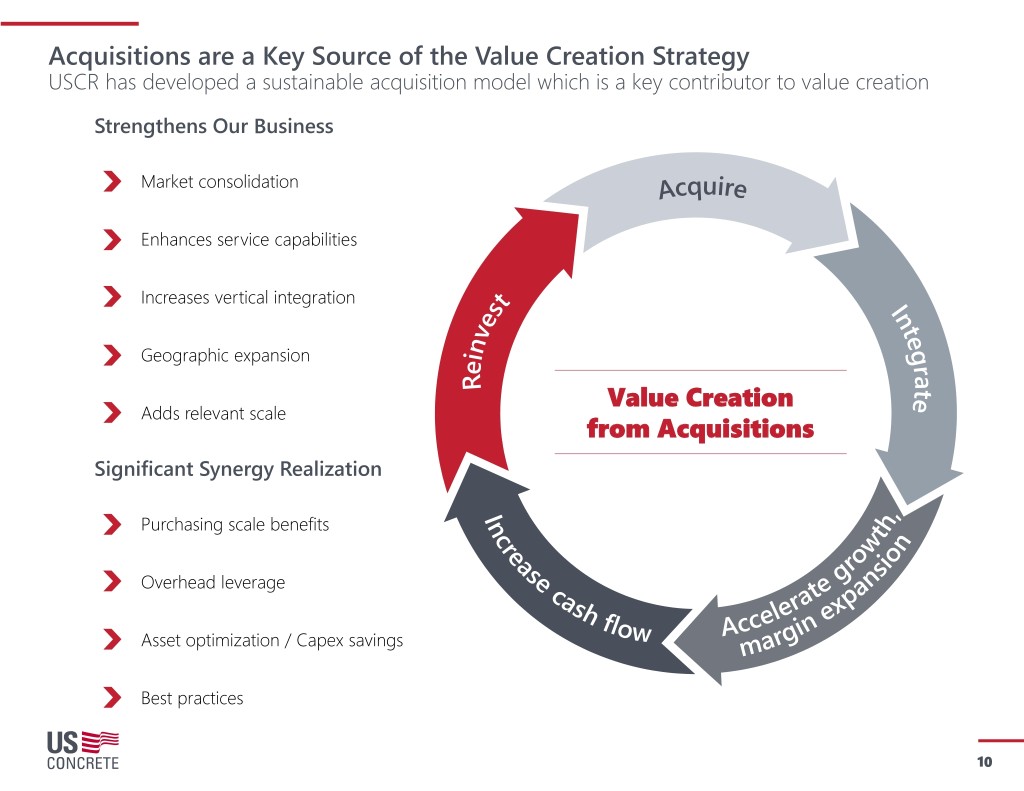

Acquisitions are a Key Source of the Value Creation Strategy USCR has developed a sustainable acquisition model which is a key contributor to value creation Strengthens Our Business Market consolidation Enhances service capabilities Increases vertical integration Geographic expansion Value Creation Adds relevant scale from Acquisitions Significant Synergy Realization Purchasing scale benefits Overhead leverage Asset optimization / Capex savings Best practices 10

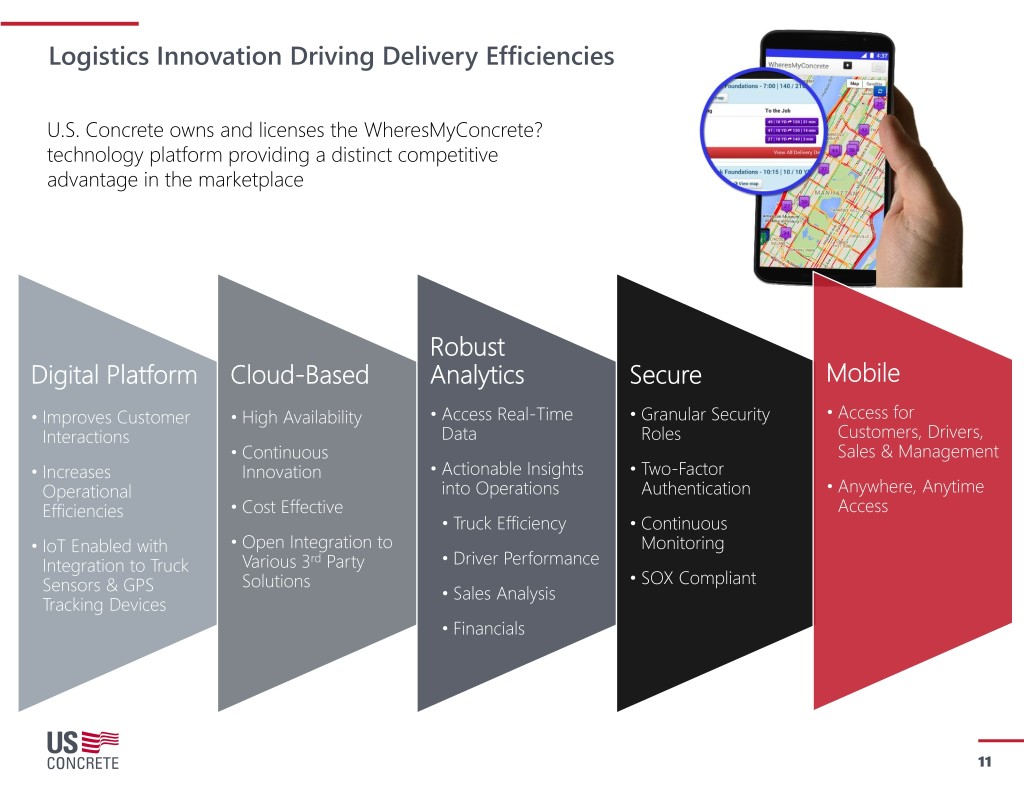

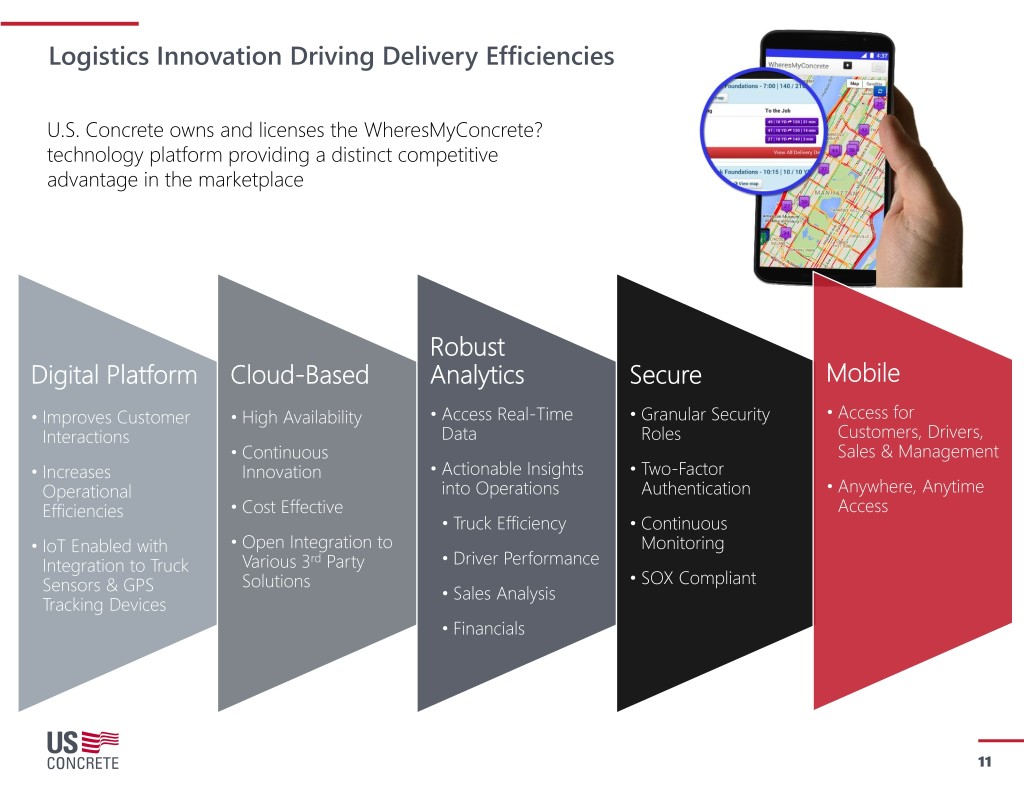

Logistics Innovation Driving Delivery Efficiencies U.S. Concrete owns and licenses the WheresMyConcrete? technology platform providing a distinct competitive advantage in the marketplace Robust Digital Platform Cloud-Based Analytics Secure Mobile • Improves Customer • High Availability • Access Real-Time • Granular Security • Access for Interactions Data Roles Customers, Drivers, • Continuous Sales & Management • Increases Innovation • Actionable Insights • Two-Factor Operational into Operations Authentication • Anywhere, Anytime Efficiencies • Cost Effective Access • Truck Efficiency • Continuous • IoT Enabled with • Open Integration to Monitoring Integration to Truck Various 3rd Party • Driver Performance Solutions • SOX Compliant Sensors & GPS • Sales Analysis Tracking Devices • Financials 11

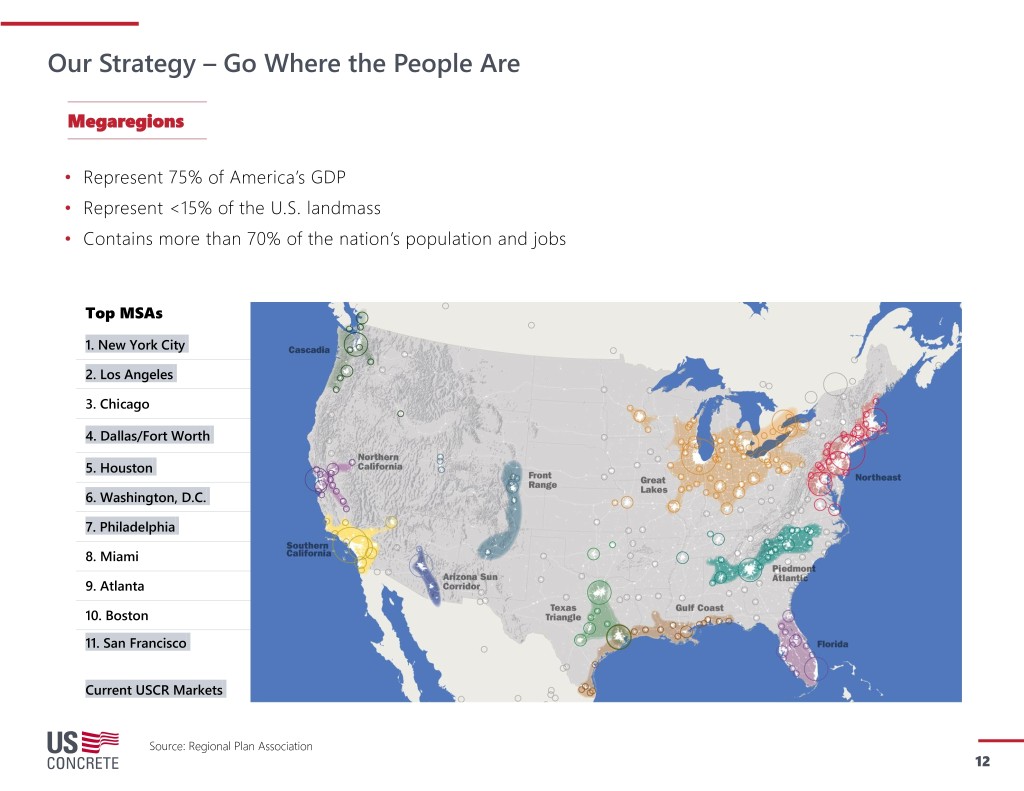

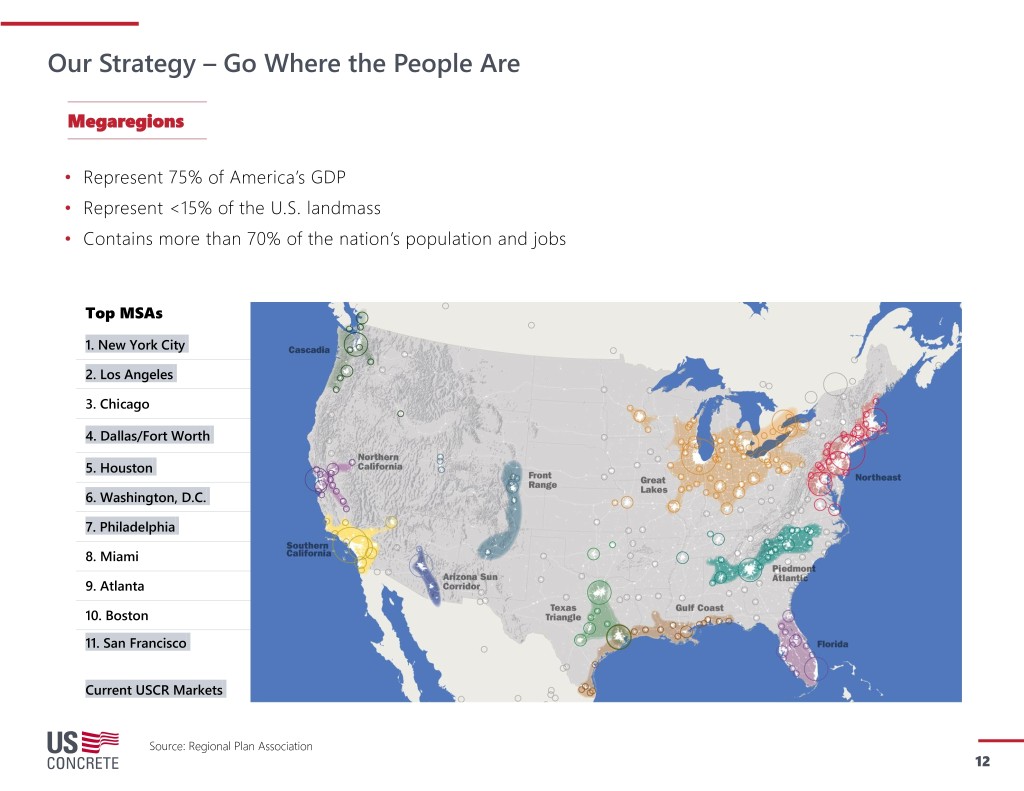

Our Strategy – Go Where the People Are Megaregions • Represent 75% of America’s GDP • Represent <15% of the U.S. landmass • Contains more than 70% of the nation’s population and jobs Top MSAs 1. New York City 2. Los Angeles 3. Chicago 4. Dallas/Fort Worth 5. Houston 6. Washington, D.C. 7. Philadelphia 8. Miami 9. Atlanta 10. Boston 11. San Francisco Current USCR Markets Source: Regional Plan Association 12

Track Record of Growth and Improving Profitability Revenue and Organic RMX Growth Raw Material Spread and Margin Material Spread Material Spread Margin Organic RMX Revenue ($mm) 49.8% $1,336 49.2% 49.5% USCR Revenue ($mm) $1,168 47.8% $975 46.6% 45.9% $704 $615 $495 $531 44.1% 451 1,091 911 171 254 436 497 591 674 218 600 388 302 522 2011 2012 2013 2014 2015 2016 2017 2011 2012 2013 2014 2015 2016 2017 Gross Profit and Margin Adjusted EBITDA and Margin Adjusted EBITDA Gross Profit Gross Profit Margin Adjusted EBITDA Margin 20.9% 14.4% 21.1% 21.0% 13.5% 13.7% 18.5% 16.3% 10.7% 14.2% 11.8% 7.9% 4.7% 1.0% 246 58 279 100 130 48 132 160 192 75 206 75 25 2011 2012 2013 2014 2015 2016 2017 2011 2012 2013 2014 2015 2016 2017 13

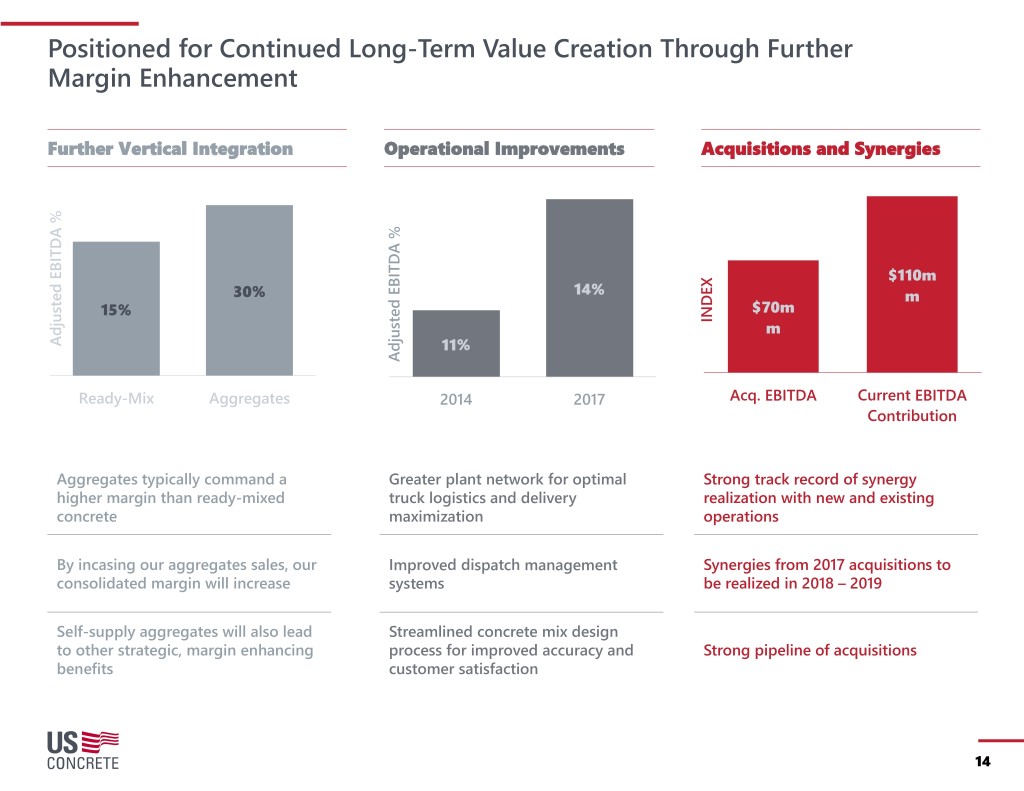

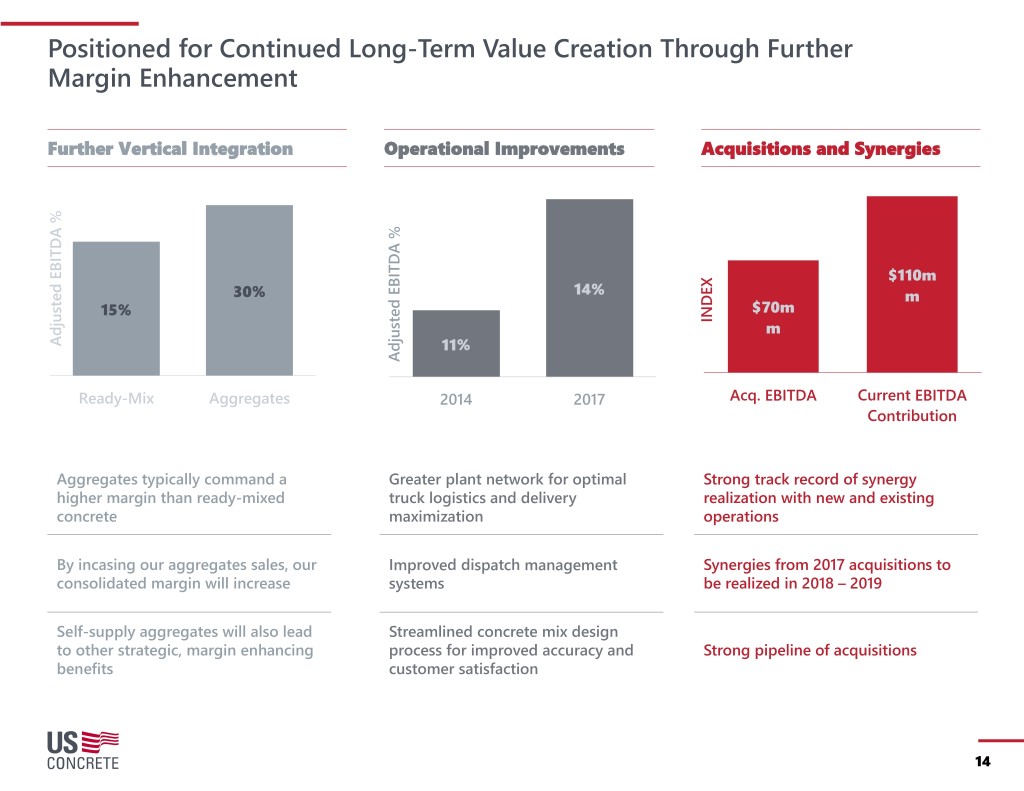

Positioned for Continued Long-Term Value Creation Through Further Margin Enhancement Further Vertical Integration Operational Improvements Acquisitions and Synergies $110m 30% 14% m 15% $70m INDEX m Adjusted EBITDA % EBITDA Adjusted 11% Adjusted EBITDA % EBITDA Adjusted Ready-Mix Aggregates 2014 2017 Acq. EBITDA Current EBITDA Contribution Aggregates typically command a Greater plant network for optimal Strong track record of synergy higher margin than ready-mixed truck logistics and delivery realization with new and existing concrete maximization operations By incasing our aggregates sales, our Improved dispatch management Synergies from 2017 acquisitions to consolidated margin will increase systems be realized in 2018 – 2019 Self-supply aggregates will also lead Streamlined concrete mix design to other strategic, margin enhancing process for improved accuracy and Strong pipeline of acquisitions benefits customer satisfaction 14

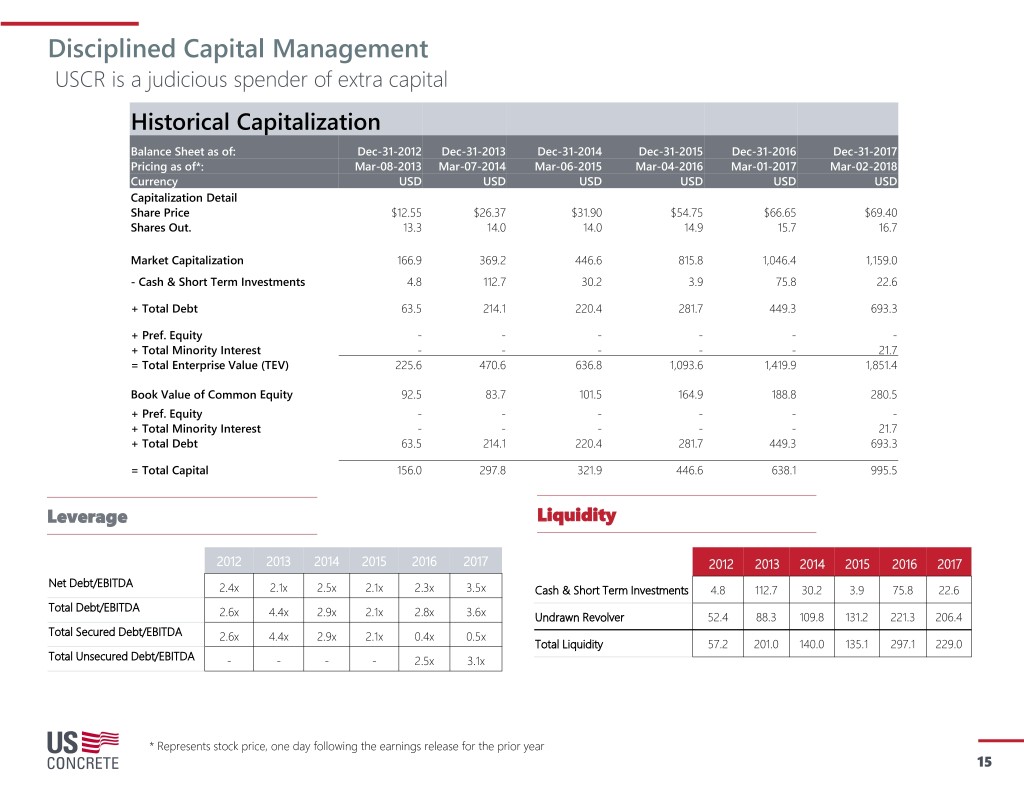

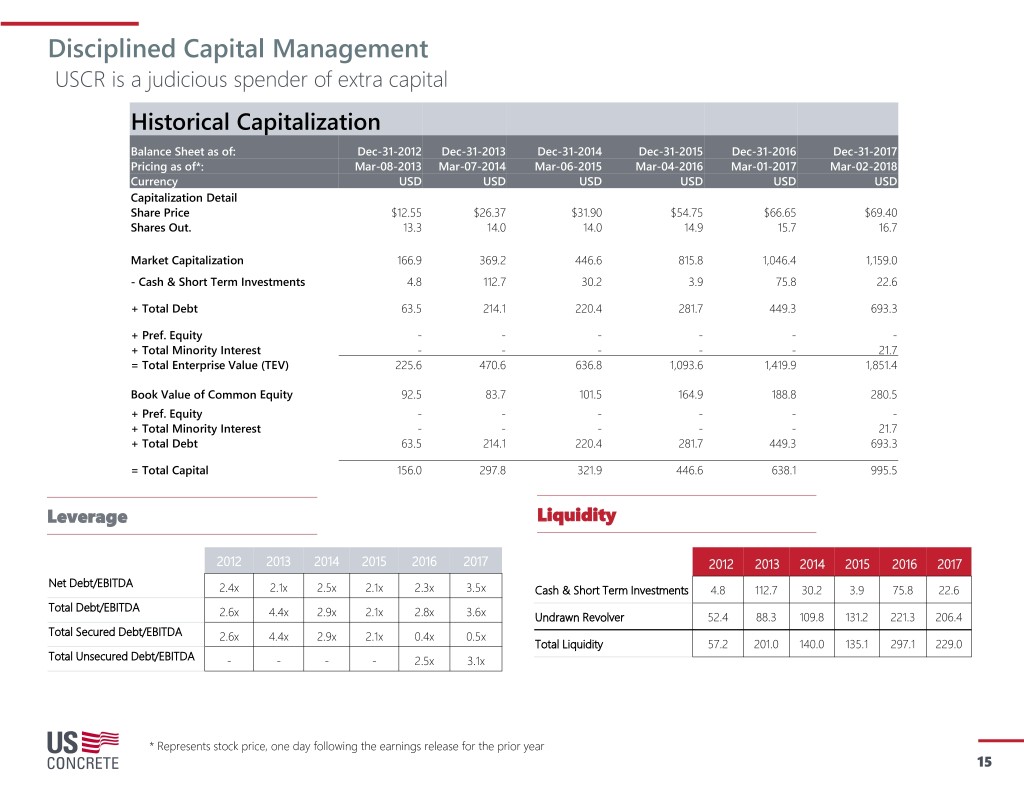

Disciplined Capital Management USCR is a judicious spender of extra capital Historical Capitalization Balance Sheet as of: Dec-31-2012 Dec-31-2013 Dec-31-2014 Dec-31-2015 Dec-31-2016 Dec-31-2017 Pricing as of*: Mar-08-2013 Mar-07-2014 Mar-06-2015 Mar-04-2016 Mar-01-2017 Mar-02-2018 Currency USD USD USD USD USD USD Capitalization Detail Share Price $12.55 $26.37 $31.90 $54.75 $66.65 $69.40 Shares Out. 13.3 14.0 14.0 14.9 15.7 16.7 Market Capitalization 166.9 369.2 446.6 815.8 1,046.4 1,159.0 - Cash & Short Term Investments 4.8 112.7 30.2 3.9 75.8 22.6 + Total Debt 63.5 214.1 220.4 281.7 449.3 693.3 + Pref. Equity - - - - - - + Total Minority Interest - - - - - 21.7 = Total Enterprise Value (TEV) 225.6 470.6 636.8 1,093.6 1,419.9 1,851.4 Book Value of Common Equity 92.5 83.7 101.5 164.9 188.8 280.5 + Pref. Equity - - - - - - + Total Minority Interest - - - - - 21.7 + Total Debt 63.5 214.1 220.4 281.7 449.3 693.3 = Total Capital 156.0 297.8 321.9 446.6 638.1 995.5 Leverage Liquidity 2012 2013 2014 2015 2016 2017 2012 2013 2014 2015 2016 2017 Net Debt/EBITDA 2.4x 2.1x 2.5x 2.1x 2.3x 3.5x Cash & Short Term Investments 4.8 112.7 30.2 3.9 75.8 22.6 Total Debt/EBITDA 2.6x 4.4x 2.9x 2.1x 2.8x 3.6x Undrawn Revolver 52.4 88.3 109.8 131.2 221.3 206.4 Total Secured Debt/EBITDA 2.6x 4.4x 2.9x 2.1x 0.4x 0.5x Total Liquidity 57.2 201.0 140.0 135.1 297.1 229.0 Total Unsecured Debt/EBITDA - - - - 2.5x 3.1x * Represents stock price, one day following the earnings release for the prior year 15

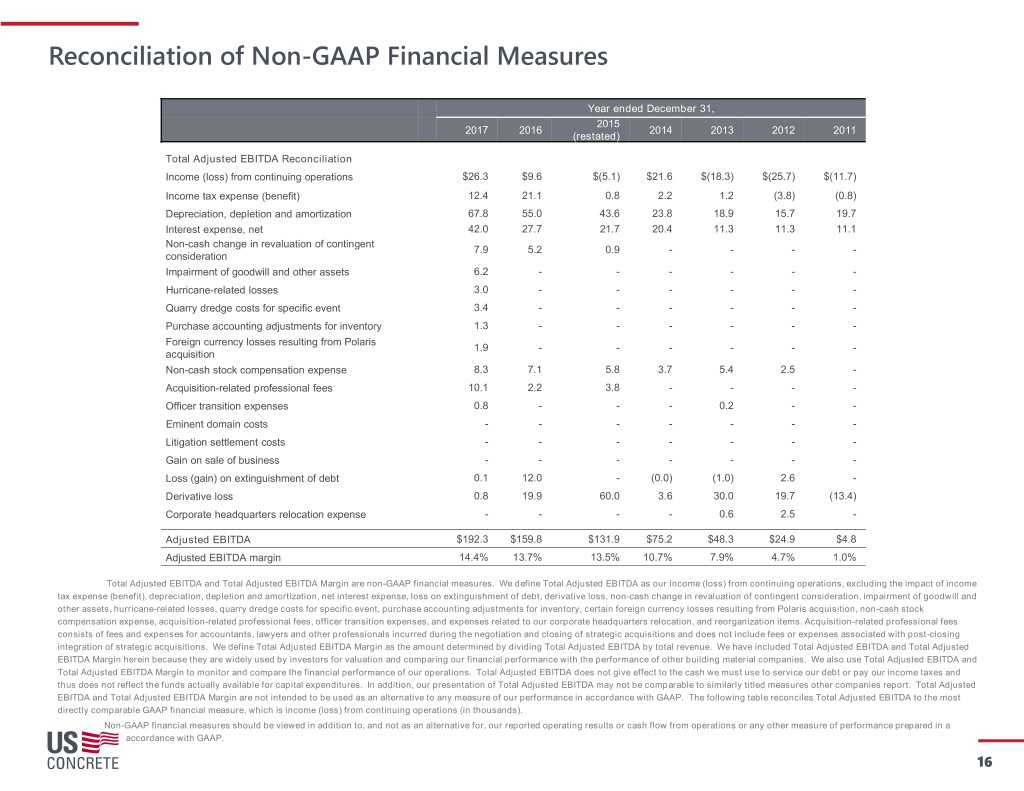

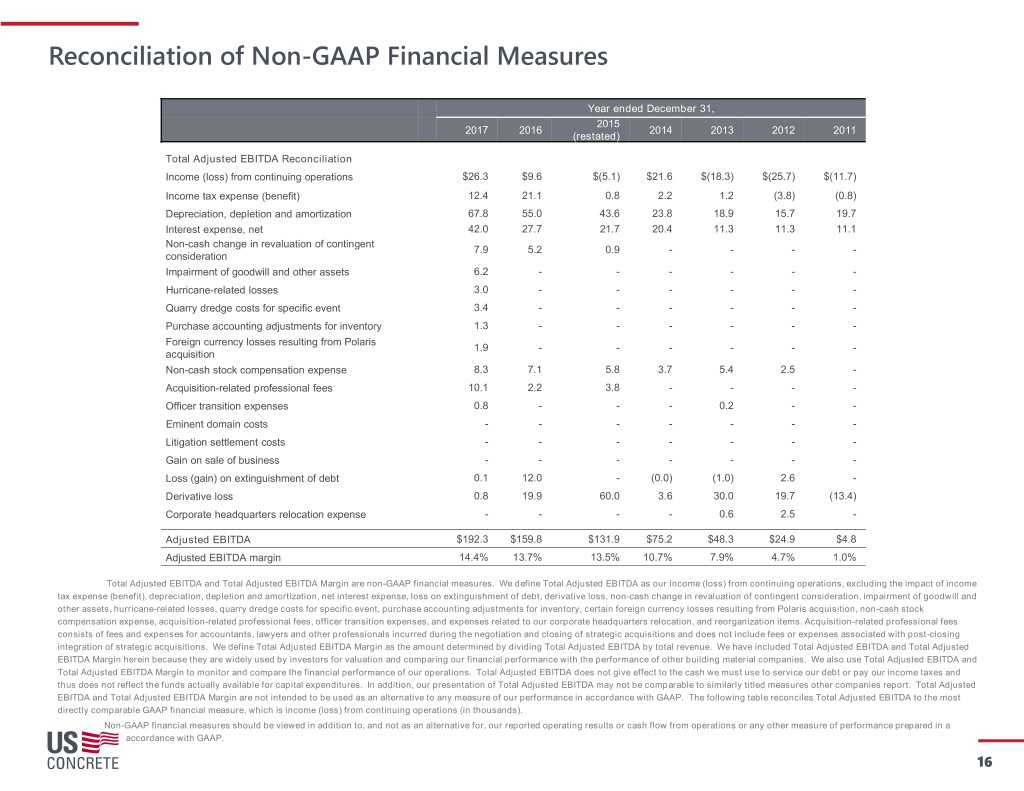

Reconciliation of Non-GAAP Financial Measures Year ended December 31, 2015 2017 2016 2014 2013 2012 2011 (restated) Total Adjusted EBITDA Reconciliation Income (loss) from continuing operations $26.3 $9.6 $(5.1) $21.6 $(18.3) $(25.7) $(11.7) Income tax expense (benefit) 12.4 21.1 0.8 2.2 1.2 (3.8) (0.8) Depreciation, depletion and amortization 67.8 55.0 43.6 23.8 18.9 15.7 19.7 Interest expense, net 42.0 27.7 21.7 20.4 11.3 11.3 11.1 Non-cash change in revaluation of contingent 7.9 5.2 0.9 - - - - consideration Impairment of goodwill and other assets 6.2 - - - - - - Hurricane-related losses 3.0 - - - - - - Quarry dredge costs for specific event 3.4 - - - - - - Purchase accounting adjustments for inventory 1.3 - - - - - - Foreign currency losses resulting from Polaris 1.9 - - - - - - acquisition Non-cash stock compensation expense 8.3 7.1 5.8 3.7 5.4 2.5 - Acquisition-related professional fees 10.1 2.2 3.8 - - - - Officer transition expenses 0.8 - - - 0.2 - - Eminent domain costs - - - - - - - Litigation settlement costs - - - - - - - Gain on sale of business - - - - - - - Loss (gain) on extinguishment of debt 0.1 12.0 - (0.0) (1.0) 2.6 - Derivative loss 0.8 19.9 60.0 3.6 30.0 19.7 (13.4) Corporate headquarters relocation expense - - - - 0.6 2.5 - Adjusted EBITDA $192.3 $159.8 $131.9 $75.2 $48.3 $24.9 $4.8 Adjusted EBITDA margin 14.4% 13.7% 13.5% 10.7% 7.9% 4.7% 1.0% Total Adjusted EBITDA and Total Adjusted EBITDA Margin are non-GAAP financial measures. We define Total Adjusted EBITDA as our income (loss) from continuing operations, excluding the impact of income tax expense (benefit), depreciation, depletion and amortization, net interest expense, loss on extinguishment of debt, derivative loss, non-cash change in revaluation of contingent consideration, impairment of goodwill and other assets, hurricane-related losses, quarry dredge costs for specific event, purchase accounting adjustments for inventory, certain foreign currency losses resulting from Polaris acquisition, non-cash stock compensation expense, acquisition-related professional fees, officer transition expenses, and expenses related to our corporate headquarters relocation, and reorganization items. Acquisition-related professional fees consists of fees and expenses for accountants, lawyers and other professionals incurred during the negotiation and closing of strategic acquisitions and does not include fees or expenses associated with post-closing integration of strategic acquisitions. We define Total Adjusted EBITDA Margin as the amount determined by dividing Total Adjusted EBITDA by total revenue. We have included Total Adjusted EBITDA and Total Adjusted EBITDA Margin herein because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use Total Adjusted EBITDA and Total Adjusted EBITDA Margin to monitor and compare the financial performance of our operations. Total Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of Total Adjusted EBITDA may not be comparable to similarly titled measures other companies report. Total Adjusted EBITDA and Total Adjusted EBITDA Margin are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. The following table reconciles Total Adjusted EBITDA to the most directly comparable GAAP financial measure, which is income (loss) from continuing operations (in thousands). Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in a accordance with GAAP. 16

Thank You 331 N. Main Street Euless, TX 76039 844-828-4774 www.us-concrete.com