KeyBanc Capital Markets

Basic Materials & Packaging Conference

September 16, 2009

2

Certain statements provided in this presentation, including those that express a belief, expectation or intention and

those that are not of historical fact, are “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve a

number of risks and uncertainties and are intended to qualify for the safe harbors from liability established by the

Private Securities Litigation Reform Act of 1995. These risks and uncertainties may cause actual results to differ

materially from expected results and are described in detail in filings made by U.S. Concrete, Inc. (the “Company”)

with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the year

ended December 31, 2008 and subsequent Quarterly Reports on Form 10-Q.

The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely

unduly on them. Many of these forward-looking statements are based on expectations and assumptions about

future events that may prove to be inaccurate. The Company’s management considers these expectations and

assumptions to be reasonable, but they are inherently subject to significant business, economic, competitive,

regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which

are beyond the Company’s control. The Company undertakes no obligation to update these statements unless

required by applicable securities laws.

Also, this presentation will contain various financial measures not in conformity with generally accepted accounting

principles (“GAAP”). A reconciliation to the most comparable GAAP financial measure can be found at the end of

this presentation.

Forward-Looking Statement

Company Overview

4

Company Overview

Ready mixed concrete

6.5 million cubic yards in 2008

129 fixed concrete and 12 portable plants

Leading market position in 5 regions

Aggregate business

7 producing aggregate facilities

2 aggregate facilities leased to third parties

Precast products

Seven production facilities

Solid operating margins

Internal and external growth

opportunities

Top 10 Producer of ready-mixed concrete in the U.S.

SAN FRANCISCO

SANTA ROSA

SAN JOSE

MD

NJ

DE

NY

PA

FIXED READY-MIXED

PRECAST

BLOCK

AGGREGATES

Broad Geographic Footprint

HEADQUARTERS

5

6

Aggressively manage through current economic cycle

Implement cost controls throughout organization

Control capital spending

Manage balance sheet and capital structure

Evaluate existing asset base

Ensure assets are delivering appropriate returns

Increase focus on value-added and engineered sales

Conservatively evaluate internal and external growth

Our Strategy Today

Industry Overview

8

Over $60 billion in annual revenue

More than 2,300 independent ready-

mixed concrete producers

More than 3,500 precast concrete

manufacturers

Increasing vertical integration among

cement, aggregates and concrete

producers

Cemex / Rinker

Hanson / Heidelberg

Vulcan / Florida Rock

Votorantim / Prairie Materials

$27 billion

$26 billion

Source: National Ready-Mixed Concrete Association and National Precast Concrete Association

Large, Fragmented Market

($ in billions)

Concrete Products Market Size

$26.0

$36.0

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

Pre-Cast

Ready Mixed

Route to Market

Ready mixed concrete and concrete products are the

principle route to market for both cement and aggregates

9

CEMENTITIOUS

AGGREGATES

BITUMEN

MORTAR

READY MIX

CONCRETE PRODUCTS

ASPHALT + CONSTRUCTION

SERVICES

CUSTOMERS

Cement

Blended cement

Fly

-

ash

Slag

5%

75%

15%

2%

22%

15%

25%

36%

5%

%

Indicates amount of volume moved through each product

Home Builders

General Contractors/

Self Builders

Merchants/DIY

Civil Engineering

Contractors

Local Authorities /

Highway Agency

10

Ready-Mixed Concrete End Use Markets

Source: McGraw-Hill Construction

U.S. Concrete

Source: Company filings - 2008

Total U.S. Market

Commercial and industrial sectors generate higher margins

Streets and highways often self- performed by construction companies

U.S. Cement Consumption Forecast

11

(000 Metric Tons)

Source: Portland Cement Association – Summer 2009

Residential Demand

12

(26.0%)

Note: PCA Summer 2009

Stimulus Package

Construction Related Projects

$48 billion

$38 billion

$30 billion

$21 billion

Concrete Intensive

14

ARRA – Highway Stimulus Tracking

Source: PCA 2009 Summer Forecast

15

($ in 000)

U.S. Concrete

Gross

States

Apportionments

Obligations

Outlays

Obligated

Paid Out

Arizona

521,598

$

309,082

$

2,301

$

59.2%

0.4%

California

2,569,568

1,775,448

3,225

69.1%

0.1%

District of Columbia

123,508

112,714

163

91.3%

0.1%

Maryland

431,035

283,268

14,562

65.7%

3.4%

Michigan

847,205

478,108

14,120

56.4%

1.7%

New Jersey

651,774

463,189

841

71.1%

0.1%

New York

1,120,685

749,360

9,125

66.9%

0.8%

Oklahoma

464,655

405,028

56,470

87.2%

12.2%

Pennsylvania

1,026,429

852,435

18,093

83.0%

1.8%

Texas

2,250,015

1,125,866

11,719

50.0%

0.5%

TOTAL

10,006,472

$

6,554,498

$

130,619

$

65.5%

1.3%

Affect on U.S. Concrete

Significantly increased marketing focus on public works and

infrastructure spending for the past several months

Attempting to exploit current cost differential between

concrete and asphalt

Road paving

Parking lots

Aggressively bidding state DOT projects

Recently secured projects tied directly to the Stimulus Plan

Numerous projects are currently being bid

16

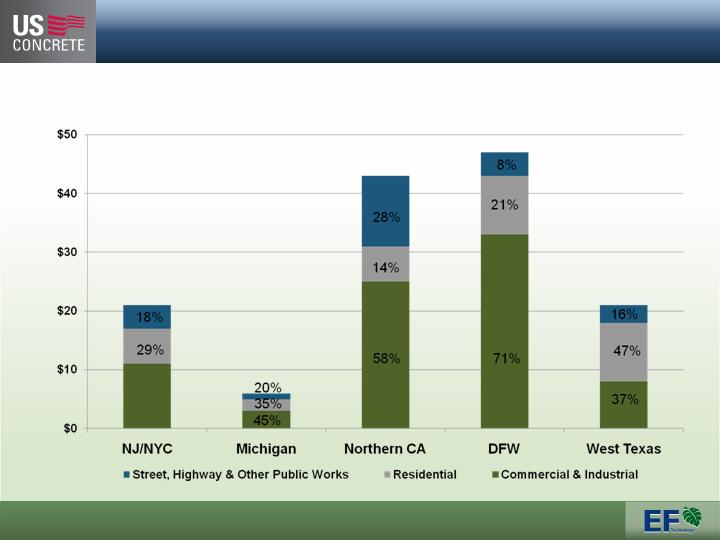

Company End Use Markets

Annual Revenue Trend

$402.2

$426.9

$526.4

$736.5

$804.0

$754.3

18

Annual Revenue Trend

19

Revenues by Segment

20

54%

Second Quarter YTD Comparison

Revenues by Major Market – Ready Mixed Concrete

21

37%

Second Quarter 2009 Revenues by Major Market

($ in millions)

Revenues by Major Market – Ready Mixed Concrete

22

53%

Second Quarter 2008 Revenues by Major Market

($ in millions)

Financial Highlights

2008 Performance Summary Analysis

Note 1: Included goodwill impairment expense, net of tax, of $119.8 million, $76.4 million and 26.8 million in 2008, 2007 and 2006, respectively

Goodwill EPS impact was ($3.17, ($1.99) and ($.72) per share for 2008, 2007, 2006, respectively

24

1

2008

2007

2006

2007 vs. 2008

2006 vs. 2008

Volume

6,517.0

7,176.0

6,679.0

-9.2%

-2.4%

Revenue

754.3

$

803.8

$

728.5

$

-6.2%

3.5%

EBITDA

40.7

$

75.4

$

74.7

$

-46.0%

-45.5%

EBITDA Margin

5.4%

9.4%

10.3%

-400

bps

-490

bps

Net Loss

1

(132.4)

$

(63.8)

$

(7.3)

$

N/A

N/A

EPS

1

(3.48)

$

(1.67)

$

(0.20)

$

N/A

N/A

Operating Cash Flow

29.7

$

44.3

$

39.5

$

-33.0%

-24.8%

Capital Expenditures, net

23.4

$

27.1

$

38.2

$

-13.7%

-38.7%

Free Cash Flow

6.3

$

17.2

$

1.3

$

-63.4%

384.6%

% Change

2Q09 Highlights

2Q09 revenues of $143.7 were 30.2% below 2Q08

Average ready-mixed sales prices increased 0.3% in 2Q09 compared to 2Q08

Higher Texas and Michigan pricing offset by northern New Jersey and California declines

Ready-mixed sales volumes (1,228,227 cubic yards) were 31.2% below 2Q08 (1,786,433 cubic

yards), same-store-sales volumes were down 35.3%

Ready-mixed material spread was 44.8% ($42.49 per cubic yard) vs. 42.0% ($39.76 per

cubic yard) in 2Q08. Material spread improved significantly in our Texas operations

and decreased in New Jersey.

Precast operations segment reflected 7.7% decrease in revenue compared to 2Q08. 2Q09

results, down $1.1 million (62.4%) from 2Q08

25

2Q09 Highlights

SG&A costs were $17.6 million or 12.3% of revenue, while 2Q08 was 8.6% of revenue.

Lower incentive and stock-based compensation accruals, lower T&E and lower office

expenses were offset by higher bad debt provision and professional fees.

Bad debt expense increased $1.1 million related to collection risks in Michigan and Atlantic

Legal fees $715K for the quarter $1.2 million YTD

2Q09 EBITDA was $9.6 million (6.7% margin), 2Q08 was $19.2 million (9.3% margin).

Income tax reflects “no benefit” on current losses. Full-year expected tax rate will

reflect valuation allowance on current losses.

Purchased $5.0 million face value of bonds for $2.0 million (40%), recorded gain of

$2.9 million.

26

2Q09 Highlights

2Q09 continuing EPS was $(0.11) compared to $0.08 in 2Q08.

Capital expenditures, net of disposals, were $2.1 million, down $1.8 million compared

to 2Q08.

Free cash flow decreased $15.4 million and was $(14.2) million compared with $1.2

million in 2Q08 on lower profitability in 2Q09. YTD 2009 free cash flow was $(8.5)

million, a decrease of $8.5 million from YTD 2008, due to lower profits, partially offset

by lower capital expenditures.

Cash at June 30, 2009 was $4.5 million, and revolving credit facility borrowings

were $26 million.

Available credit at June 30, 2009 was $48.1 million, down $43.0 million from

December 31, 2008. June 30, 2008 available credit was $91.1 with $3.7 million

outstanding.

27

28

Company Ready Mix Average Selling Prices

2Q09

2Q09

Market

vs. 2Q08

vs. 1Q09

DFW

4.9%

-0.2%

West Texas

5.9%

-0.4%

New Jersey / NYC

-4.4%

-5.3%

Northern California

-6.5%

-9.6%

Michigan

2.3%

-4.9%

Consolidated

0.3%

-4.2%

% Change

29

Percent of Sales

Company Ready Mix Material Spread – Second Quarter

2Q09

2Q08

1Q09

2Q09 vs 2Q08

2Q09 vs 1Q09

DFW

39.9%

32.7%

39.1%

720

80

West Texas

48.0%

44.0%

47.4%

400

60

New Jersey / NYC

45.2%

47.9%

45.7%

-270

-50

Northern California

47.1%

46.4%

46.3%

70

80

Michigan

45.6%

45.4%

47.5%

20

-190

Consolidated

44.8%

42.0%

44.1%

280

70

Basis Point Differential

Leverage Profile

30

June 30,

2009

,

200

9

December 31,

200

8

(in thousands except where otherwise indicated)

Cash and Cash Equivalents

$

4

,

468

$

5,323

Total Debt

3

11

,

065

305,988

Net Debt

30

6

,

597

300,665

Equity

65

,

873

80,363

LTM EBITDA (Bank Define

d)

33

,

474

44,703

LTM Fixed Charges

29,1

70

29,136

Total Debt to LTM EBITDA

9.3

x

6.8x

Net Debt to LTM EBITDA

9.2

x

6.7x

Fixed charge coverage

.

6x

1.1x

Debt to Capital

82.

5

%

79.2%

Weighted Average Cost of Debt

7

.

86

%

8.

14%

Available borrowing capacity (in

millions)

$

48

.1

$

91.1

31

Managing Through the Economic Cycle

Cost control initiatives continue

Headcount reductions

Reducing discretionary spending

Disposing of excess equipment

Temporarily idling plants

Controlling capital expenditures

Divesting underperforming assets

Limiting external growth initiatives

Focusing on value-added and engineered sales program and

infrastructure projects

32

Disclosure of Non-GAAP Financial Measures

U.S. CONCRETE, INC.

ADDITIONAL STATISTICS

(In thousands, unless otherwise noted; unaudited)

We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”).

However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in

managing our business, may provide users of this financial information additional meaningful comparisons between current results

and results in prior operating periods. See the table below for presentations of our EBITDA and EBITDA margin for years 2006

through 2008 and Free Cash Flow for the years 2006 through 2008.

We define EBITDA as our net income (loss) from continuing operations plus the provision (benefit) for income taxes, net

interest expense, and noncash impairments, depreciation, depletion and amortization. We define EBITDA margin as the amount

determined by dividing EBITDA by total sales. We have included EBITDA and EBITDA margin in the accompanying tables because

they are often used by investors for valuation and for comparing our financial performance with the performance of other building

material companies. We also use EBITDA to monitor and compare the financial performance of our operations. EBITDA does not give

effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for

capital expenditures. In addition, our presentation of EBITDA may not be comparable to similarly titled measures other companies

report.

We define Free Cash Flow as cash provided by (used in) operations less capital expenditures for property, plant and

equipment, net of disposals. We consider Free Cash Flow to be an important indicator of our ability to service our debt and generate

cash for acquisitions and other strategic investments. Non-GAAP financial measures should be viewed in addition to, and not as an

alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in

accordance with GAAP.

Disclosure Non-GAAP Financial Measures

33

U.S. Concrete, Inc. and Subsidaries

Reconciliation of Net Loss to EBITDA

(unaudited)

(amounts in thousands)

FY

FY

FY

2Q09

2Q08

2008

2007

2006

Net loss attributable to stockholders

(3,994)

$

3,303

$

(132,297)

$

(63,760)

$

(7,303)

$

Addback:

Interest Expense, net

6,562

6,668

27,056

27,978

21,588

Income Tax Expense (Benefit)

(431)

2,202

(19,601)

48

1,348

Asset and Goodwill Impairments

-

-

135,631

82,242

38,948

Depreciation, Depletion, and Amortization Expense

7,450

7,035

29,902

28,882

20,141

EBITDA

9,587

$

19,208

$

40,691

$

75,390

$

74,722

$

EBITDA margin

6.7%

9.3%

5.4%

9.4%

10.3%

34

Disclosure of Non-GAAP Financial Measures

U.S. Concrete, Inc. and Subsidaries

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

(amounts in millions)

FY

FY

FY

2Q09

2Q08

2008

2007

2006

Net Cash Provided by Operating Activities

(12,103)

$

5,033

$

30,113

$

44,338

$

39,851

$

Purchases of property, plant and equiment

(2,470)

(6,616)

(28,425)

(29,529)

(41,931)

Proceeds from disposls of property, plant and equipment

387

2,736

3,968

2,574

3,699

Free Cash Flow

(14,186)

$

1,153

$

5,656

$

17,383

$

1,619

$

35

Disclosure Non-GAAP Financial Measures

U.S. Concrete, Inc. and Subsidaries

Reconciliation of Net Debt

(unaudited)

(amounts in thousands)

As of

As of

June 30, 2009

December 31, 2008

Total Debt, including current maturities and capital leas obligations

311

$

306

$

Less cash and cash equivalents

4

5

Net Debt

307

$

301

$

KeyBanc Capital Markets

Basic Materials & Packaging Conference

September 16, 2009