March 14, 2016 © Canyon Capital Advisors LLC

Overview of Canyon Canyon Capital Advisors LLC ("Canyon") was founded in 1990 by Joshua S.FriedmanandMitchellR.Julis,bothofwhomhavebeenintimatelyinvolvedin thestressed/distressedmarketssincetheearly1980’s. ▪ Canyonhasover200investmentprofessionalsandofficesinLosAngeles,NewYork, London,ShanghaiandTokyo. Canyon invests across the corporate capital structure, primarily in US and Europeancompanies,oftenleveragingourexperiencetoprovidefinancingto entitiesthatmaynothaveaccesstotraditionalcapital. Canyonhassignificantexpertiseinstructuredfinancespace,includingRMBS, CDO/CLO,municipals,aircraftsecuritizationandotherniches,includingalltypesof wrappedsecurities. Substantial experience with distressed financials, including liquidations and recapitalizations. Canyon is a global alternative asset manager with over $20 billion in AUM Page 2 © Canyon Capital Advisors LLC

Current management oversaw a 42% stock decline in 2015, underperforming peers. We believe this decline will continue without changeintheboardroom. Despitepoorperformance,theBoardawardedtheCEOanegregiouspay packagethatcanballoontoover$40mmthrough2018,evenifheonly restoresAmbac’sstockpricetothelevelitwaswhenhebecameinterim CEO. Webelieveourslateofdirectorswillpursueastrategythatwillmaximize returnofcapitaltostockholdersasquicklyaspossible. ▪ Odeon Capital Group,a sell side researchfirm coveringAmbac, values Ambac’sadjustedbookvalueat$45pershareintheirbasecase. ▪ Webelieveournomineeswillworkexpeditiouslytoreturnthemaximum amount of capital available to stockholders, consistent with their independent judgment and exercise of their fiduciary duties to the Company'sstockholders. ▪ Ournomineeshaveatrackrecordofsuccessandareeagertoleveragetheir industryexperiencetocorrecttheCompany'scourse. Why AmbacNeeds a New Board Page 3 © Canyon Capital Advisors LLC

The Company’s Poor Performance TheCompanytouts$25ofoperatingearningspersharein2015. Themarketknowsbetter:Ambacsharesdeclinedfrom$24.50to $14.09(42%)duringthesameperiod. WebelievetheCompany'searningswereprimarilyduetochangesin futurelossassumptionsrelatedtomortgagesecurities,litigation estimatesandtheearlyrefinancingofmunicipalbonds. Ambacstillholdsover$26pershareofanInsuranceIntangibleAsset (relatedtofinancialguarantees)thatstillneedstobewrittenoff, causingadragonearningsfortheforeseeablefuture. Webelievemanagement’sexcessspendingiscostingstockholders almost$1pershareannually. 1 Unlike Assured Guaranty and MBIA, Ambac is not paying any dividendstostockholdersorrepurchasingstock. Page 4 © Canyon Capital Advisors LLC 1 Based on a comparison to MBIA'soperating expenses / net debt service outstanding ratio, pro forma for approximately $9mm in additional expenses for Mr. Tavaokli'smaximum compensation for 2016.

Management Compensation Despite the dismal stock performance, the Board awarded Mr. Tavakoli an additional cash bonus for 2015. Inexplicably, the Board awarded Mr. Tavakolipackages which could balloon to over $40mm through 2018, even if he only restores Ambac’s stock price to the level it was when he became interim CEO, creating no net stockholder value. For the year 2016, Mr. Tavakoli’starget and max compensation would equal 11% and 18% of Ambac’s total compensation expense, respectively. Mr. Tavakoli’starget pay is 3.4x that of his predecessor, whose compensation he helped determine. Unlike his predecessor, Mr. Tavakoliis not prohibited from working part time. Ambacannounced that the compensation was within market norms, but provides no factual basis; Mr. Tavakoli'sunsubstantiated claims are a consistent pattern. Page 5 © Canyon Capital Advisors LLC

Policyholder Claims and Purported Conflicts Inan attempttodistractstockholdersfromtherealissues,Ambac's managementclaimsCanyonisconflictedasapolicyholder. ButCanyonownsalmost5%ofAmbac'sstock;itspolicyinterests onlyaddtoitslargestakeintheCompany. Ambac’saccusationimpliesthataninvestorwithagreaterstakeina companysomehowhaslessinterestinitspropermanagement:that makesnosense. Infact,policyclaimsarealignedwithequity. Policyclaimsareaccruingsubstantialinterestandarerequiredtobe paiddownbeforeequitygetsanyreturnofcapital. Based on expected future losses and recoveries, the regulator overseeing the rehabilitation under the Wisconsin Insurers RehabilitationandLiquidationActconcludedclaimswillbepaidat parplusaccruedinterest. Page 6 © Canyon Capital Advisors LLC

Policyholder Claims and Purported Conflicts But meanwhile, policy claims are accruing interest at 5.1%. Properly calculated, Ambac’s investment portfolio returned only 2.78% in Q3, substantially below the level of interest accruing on its claims. 1 ▪ Returns would be lower if cash were included. By not paying off Ambac’s $3.5bn of claims, $2 per share of value is permanently lost every year. 2 Stockholders lose if Ambac does not pay down its claims and exit Rehabilitation. Page 7 © Canyon Capital Advisors LLC 1 3Q2015 Operating Supplement p. 13, table titled “Income Analysis by Type of Security”. Excludes the notional yield on Ambac'sown policies, and includes short-term investments. 2 Calculated (on a per share basis) as (x) thedifference in interest accrued on policy claims (5.1%) and the investment portfolio return (2.78%) multiplied by (y) $3.5 billion in claims. Canyon believes that the investment portfolio return would be even lower if cash were included, and may be still lower going forward this year due to the recent buildup of cash.

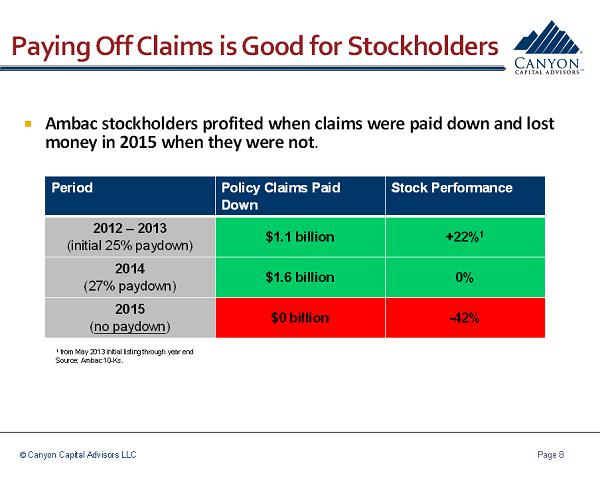

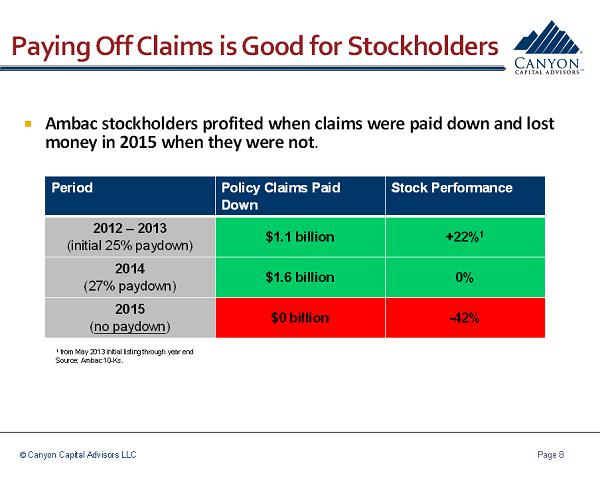

Ambac stockholders profited when claims were paid down and lost money in 2015 when they were not. Paying Off Claims is Good for Stockholders Page 8 © Canyon Capital Advisors LLC 1 from May 2013 initial listing through year end Source: Ambac10-Ks. Period Policy Claims Paid Down Stock Performance 2012 –2013 (initial 25% paydown) $1.1 billion +22% 1 2014 (27% paydown) $1.6 billion 0% 2015 (no paydown) $0 billion -42%

The Real Conflict is Between Stockholders & Entrenched Management Ambac hasn’t written any material new business since 2008 and the majority of the legacy municipal bond exposure will be callable and refinancableby the end of 2017. Management and the Board have a clear conflict in that as policies continue to run-off, so does their time at the helm. They have suggested distracting new business lines that will only further enrich and entrench managementand continue to harm stockholders. Instead of proposing amorphous plans to deploy capital, management should focus on liquidating and returning capital. ▪ Deferring distributions of capital only enriches and insulates management and the Board by unnecessarily prolonging their tenures. We believe that management should return the maximum amount of capital available to stockholders. Page 9 © Canyon Capital Advisors LLC

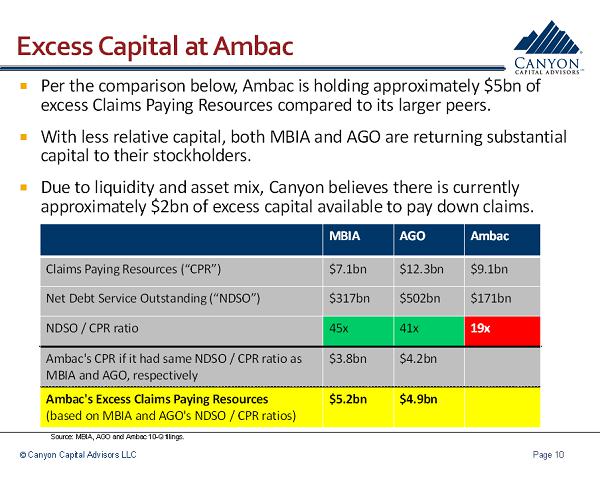

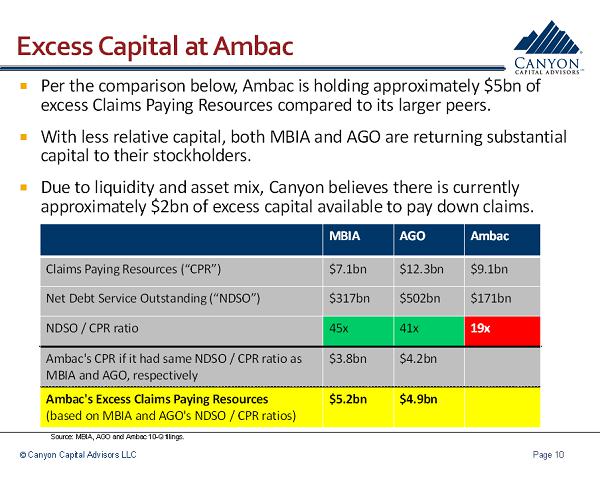

Excess Capital at Ambac Per the comparison below, Ambac is holding approximately $5bn of excess Claims Paying Resources compared to its larger peers. With less relative capital, both MBIA and AGO are returning substantial capital to their stockholders. Due to liquidity and asset mix, Canyon believes there is currently approximately $2bn of excess capital available to pay down claims. MBIA AGO Ambac Claims Paying Resources (“CPR”) $7.1bn $12.3bn $9.1bn Net Debt Service Outstanding (“NDSO”) $317bn $502bn $171bn NDSO / CPR ratio 45x 41x 19x Ambac'sCPR if it had same NDSO/ CPR ratio as MBIAand AGO, respectively $3.8bn $4.2bn Ambac'sExcess Claims Paying Resources (based on MBIAand AGO'sNDSO/ CPR ratios) $5.2bn $4.9bn Page 10 © Canyon Capital Advisors LLC Source: MBIA, AGO and Ambac10-Q filings.

© Canyon Capital Advisors LLC Page 11 Management has touted its $635mm of insured securities buybacks in 2015, but its actions have been reactive and subscale. ▪ Canyon prodded management for years to take these steps. ▪ With what we believe is at least $2bn of excess capital available to the Company, the Company's current buyback rate is clearly insufficient. ▪ The above buybacks included only approximately $500mm of policy claims. Management’s claim above suggests this is a viable process for sufficiently reducing claims. Unfortunately, the opportunity to buy back more claims in the market is limited for multiple reasons. ▪ Regulatory approval requirements. ▪ Level of market liquidity. Excess Capital at Ambac

Ambac’sLack of Strategic Vision Instead of returning capital to stockholders, Mr. Tavakolihas announced a variety of amorphous plans to invest in: ▪ Home Repair Business –Leveraging AmbacResources ? “We also initiated a new program we recently introduced which highlights leverage of our existing resources. This October we introduced a pilot program to invest in residential real estate owned propertieswithin Ambac insured transactions. The main component of the value creation of this project will be the result of making repairs to the REO properties in order to bring them up to neighborhood standards. Upon completion of necessary repairs, the properties will either be immediately resold or resold at a future date after being rented for a period of time. . . This program will be rolled out gradually in order to validate our internal investment thesis.” –Mr. Tavakoli, 3Q15 Earnings Call ▪ Asset Management Business Acquisition ? “[W]e'regiving substantial thought to deploying our capital strategically in asset management businesses”–Mr. Tavakoli, 4Q15 Earnings Call The Board should not entertain any of these preposterousideas without consulting major stockholders. Page 12 © Canyon Capital Advisors LLC

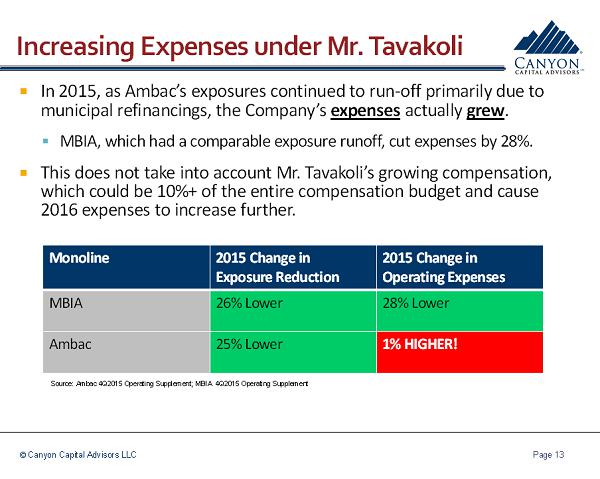

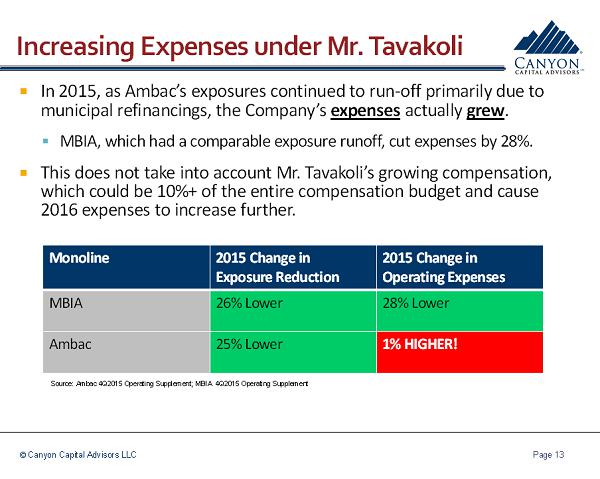

Increasing Expenses under Mr. Tavakoli In 2015, as Ambac’s exposures continued to run-off primarily due to municipal refinancings, the Company’s expensesactually grew. ▪ MBIA, which had a comparable exposure runoff, cut expenses by 28%. This does not take into account Mr. Tavakoli’sgrowing compensation, which could be 10%+ of the entire compensation budget and cause 2016 expenses to increase further. Monoline 2015 Change in Exposure Reduction 2015 Change in Operating Expenses MBIA 26% Lower 28% Lower Ambac 25% Lower 1% HIGHER! Page 13 © Canyon Capital Advisors LLC Source: Ambac4Q2015 Operating Supplement; MBIA 4Q2015 Operating Supplement

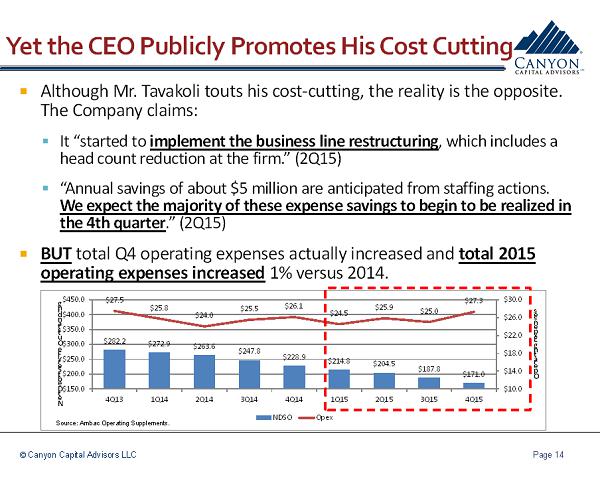

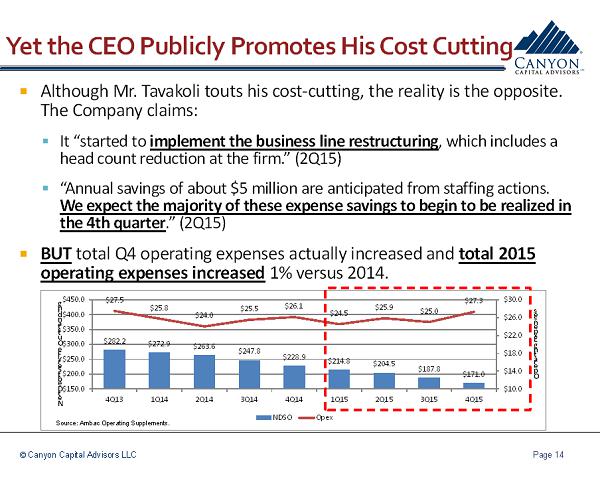

Yet the CEO Publicly Promotes His Cost Cutting Although Mr. Tavakoli touts his cost-cutting, the reality is the opposite. The Company claims: ▪ It “started to implement the business line restructuring, which includes a head count reduction at the firm.” (2Q15) ▪ “Annual savings of about $5 million are anticipated from staffing actions. We expect the majority of these expense savings to begin to be realized in the 4th quarter.” (2Q15) BUTtotal Q4 operating expenses actually increased and total 2015 operating expenses increased1% versus 2014. $282.2 $272.9 $263.6 $247.8 $228.9 $214.8 $204.5 $187.8 $171.0 $27.5 $25.8 $24.0 $25.5 $26.1 $24.5 $25.9 $25.0 $27.3 $10.0 $14.0 $18.0 $22.0 $26.0 $30.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 O p e r a t i n g E x p e n s e s N e t D e b t S e r v i c e O u t s t a n d i n g NDSO Opex Page 14 © Canyon Capital Advisors LLC Source: AmbacOperating Supplements.

Stockholders Deserve Better Stockholders deserve a Board that will be honest about earnings and value creation and not reward the performance problems highlighted above. Canyon’s Board nominees each have a track record of returning capital to stockholdersand maximizing enterprise value of financial companies, as detailed in the following biographies. Page 15 © Canyon Capital Advisors LLC

Fred Arnold –Relevant Experience Accomplished leader of financial services companies with over 30 years of experience. Particular expertise in highly complex and troubled situations typically entailing change, operational improvement and governance enhancement. Member of the post-emergence board of directors of Lehman Brothers Holdings Inc.Since Lehman’s emergence from bankruptcy, the board has been engaged in the restructuring and liquidation of the largest ever bankruptcy estate –an enterprise far larger and more complex than Ambac. Among other activities, the board of Lehman Brothers Holdings Inc. has been intimately involved in liquidating and resolving hundreds of billions of assets and claims, negotiating and settling complex legacy exposures, pursuing and settling litigation including mortgage representations & warranties. Currently Chief Financial Officer and a member of the Executive Committee of ConvergExGroup, LLC, an agency-focused global brokerage and trading related services provider, which he joined in 2015. Page 16 © Canyon Capital Advisors LLC

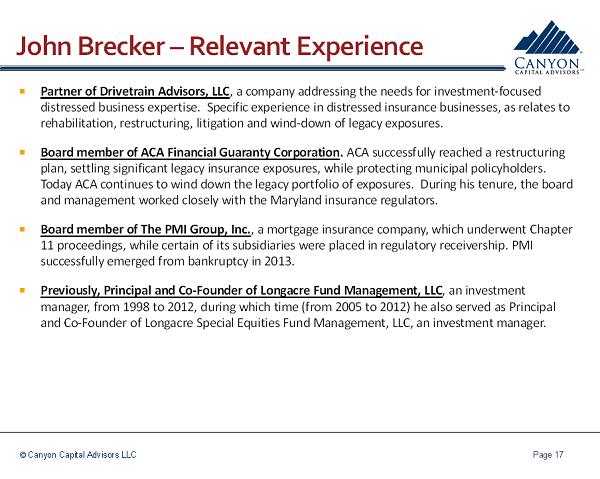

John Brecker–Relevant Experience Partner of Drivetrain Advisors, LLC, acompany addressing the needs for investment-focused distressed business expertise. Specific experience in distressed insurance businesses, as relates to rehabilitation, restructuring, litigation and wind-down of legacy exposures. Board member of ACAFinancial Guaranty Corporation.ACAsuccessfully reached a restructuring plan, settling significant legacy insurance exposures, while protecting municipal policyholders. Today ACAcontinues to wind down the legacy portfolio of exposures. During his tenure, the board and management worked closely with the Maryland insurance regulators. Board member of The PMI Group, Inc., amortgage insurance company, which underwent Chapter 11 proceedings, while certain of its subsidiaries were placed in regulatory receivership. PMI successfully emerged from bankruptcy in 2013. Previously, Principal and Co-Founder of LongacreFund Management, LLC, an investment manager, from 1998 to 2012, during which time (from 2005 to 2012) he also served as Principal and Co-Founder of LongacreSpecial Equities Fund Management, LLC, an investment manager. Page 17 © Canyon Capital Advisors LLC

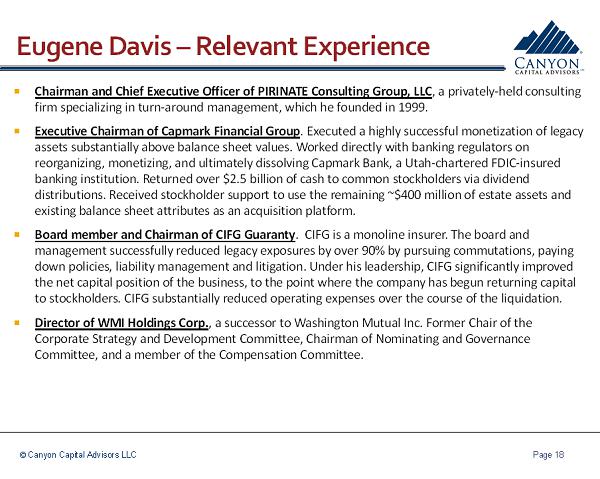

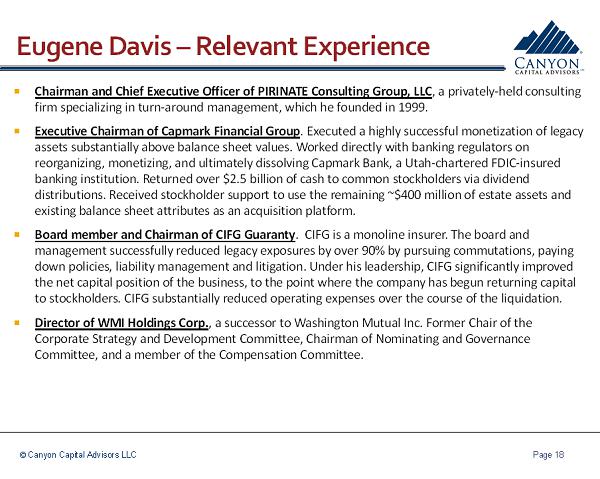

Eugene Davis –Relevant Experience Chairman and Chief Executive Officer of PIRINATE Consulting Group, LLC, a privately-held consulting firm specializing in turn-around management, which he founded in 1999. Executive Chairman of CapmarkFinancial Group. Executed a highly successful monetization of legacy assets substantially above balance sheet values. Worked directly with banking regulators on reorganizing, monetizing, and ultimately dissolving CapmarkBank, a Utah-chartered FDIC-insured banking institution. Returned over $2.5 billion of cash to common stockholders via dividend distributions. Received stockholder support to use the remaining ~$400 million of estate assets and existing balance sheet attributes as an acquisition platform. Board member and Chairman of CIFG Guaranty. CIFG is a monolineinsurer. The board and management successfully reduced legacy exposures by over 90% by pursuing commutations, paying down policies, liability management and litigation. Under his leadership, CIFGsignificantly improved the net capital position of the business, to the point where the company has begun returning capital to stockholders. CIFGsubstantially reduced operating expenses over the course of the liquidation. Director of WMI Holdings Corp., a successor to Washington Mutual Inc. Former Chair of the Corporate Strategy and Development Committee, Chairman of Nominating and Governance Committee, and a member of the Compensation Committee. Page 18 © Canyon Capital Advisors LLC

CANYON CAPITAL ADVISORS LLC, THE CANYON VALUE REALIZATION MASTER FUND, L.P., MITCHELL R. JULISAND JOSHUA S. FRIEDMAN (COLLECTIVELY, "CANYON"), FREDERICK ARNOLD, EUGENE DAVIS AND JOHN BRECKER (COLLECTIVELY WITH CANYON, THE “PARTICIPANTS”) INTEND TO FILE WITH THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC") A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED IN CONNECTION WITH THE PARTICIPANTS' SOLICITATION OF PROXIES FROM THE STOCKHOLDERS OF AMBACFINANCIAL GROUP, INC. (THE "COMPANY") FOR USE AT THE COMPANY'S 2016 ANNUAL MEETING OF STOCKHOLDERS (THE "PROXY SOLICITATION"). ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE PROXY SOLICITATION, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. WHEN COMPLETED, THE DEFINITIVE PROXY STATEMENT AND AN ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND WILL BE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'SWEBSITE AT HTTP://WWW.SEC.GOV/. INFORMATION ABOUT THE PARTICIPANTS AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS BY SECURITY HOLDINGS WILL BE CONTAINED IN AN EXHIBIT TO THE SCHEDULE 14A TO BE FILED BY CANYON WITH THE SEC ON MARCH 14,2016. THIS DOCUMENT CAN BE OBTAINED FREE OF CHARGE FROM THE SOURCE INDICATED ABOVE. Any assumptions, assessments, estimates, projections or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks or estimations, are based upon Canyon's current expectations or beliefs, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, many of which cannot be predicted or quantified and are beyond Canyon's control. Actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation or warranty is given that these Statements are now or will prove to be accurate or complete in any way in the future. Canyon has neither sought nor obtained the consent from any third party to use any statements or information contained herein that have been obtained or derived from statements made or published by such third parties. Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein. Important Information Page 19 © Canyon Capital Advisors LLC