UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT UNDER

SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

Santander Consumer USA Holdings Inc.

(Name of Subject Company)

Canyon Capital Advisors LLC

Mitchell R. Julis

Joshua S. Friedman

(Name of Persons Filing Statement)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

80283M101

(CUSIP Number of Class of Securities)

Canyon Partners, LLC

2000 Avenue of the Stars, 11th Floor

Los Angeles, CA 90067

(310) 272-1000

Attention: Jonathan M. Kaplan

(Name, address and telephone numbers of person authorized to receive notices

and communications on behalf of the persons filing statement)

with a copy to:

Eleazer Klein, Esq. Schulte Roth & Zabel LLP 919 Third Avenue New York, New York 10022 (212) 756-2000 |

| ☐ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

| Item 1. | Subject Company Information. |

Name and Address

The name of the subject company to which this Solicitation/Recommendation Statement on Schedule 14D-9 (this “Statement”) relates is Santander Consumer USA Holdings Inc., a Delaware corporation (the “Company”). The address of the Company’s principal executive office is 1601 Elm Street, Suite 800, Dallas, Texas 75201. The Company’s telephone number at this address is (214) 634-1110.

Securities

This Statement relates to the common stock, par value $0.01 per share (the “Shares”), of the Company. Based solely on the information set forth in the Company’s Offer to Purchase, dated January 30, 2020 (as amended or supplemented from time to time, the“Offer to Purchase”), filed as Exhibit 99.(a)(1)(i) to the Company’s Schedule TO filed with theSecurities and Exchange Commission (the “SEC”) on January 30, 2020 (as amended or supplemented from time to time, and together with the exhibits thereto, the “Schedule TO”), there were 339,201,748 Shares issued and outstanding as of January 29, 2020.

| Item 2. | Identity and Background of Filing Person. |

Name and Address

Canyon Capital Advisors LLC, a Delaware limited liability company (“CCA”), Mitchell R. Julis, a citizen of the United States (“Mr. Julis”), and Joshua S. Friedman, a citizen of the United States (“Mr. Friedman” and together with CCA and Mr. Julis, “Canyon” or the “Filing Persons”), are the persons filing this Statement. The business address of each of the Filing Persons is 2000 Avenue of the Stars, 11th Floor, Los Angeles, CA 90067. The business telephone number of each of the Filing Persons is (310) 272-1000.

The principal business of each of the Filing Persons is investment and/or investment management.

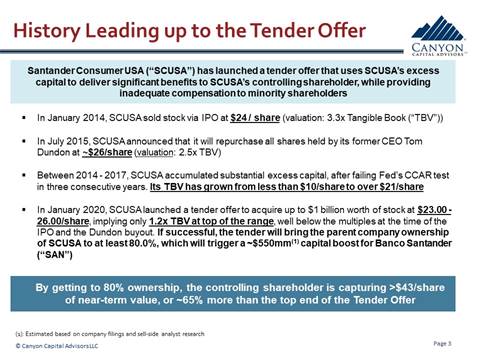

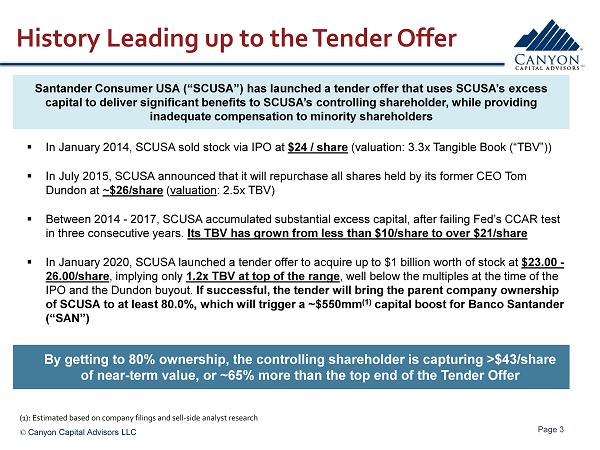

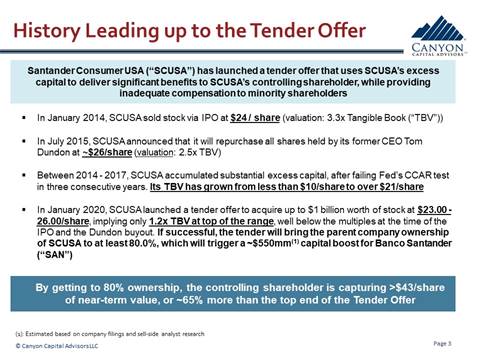

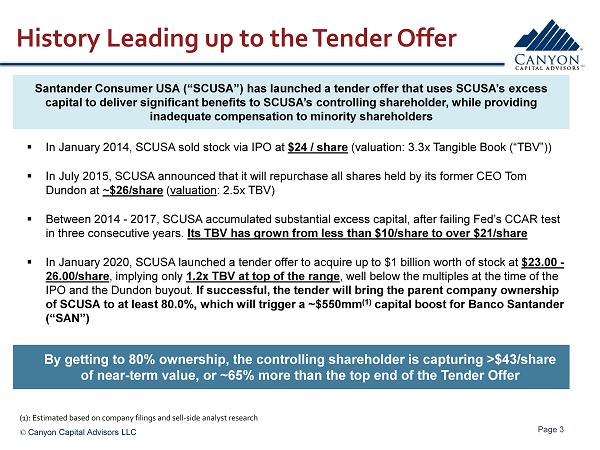

Tender Offer

This Statement relates to the tender offer (the “Tender Offer”) by the Company, asdisclosed in a Tender Offer Statement on the Schedule TO, to purchase for cash up to $1,000,000,000 of the Shares, at a price per Share of not less than $23 and not more than $26 in cash, without interest and subject to any applicable withholding taxes. The Tender Offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase and in the accompanying Letter of Transmittal.

| Item 3. | Past Contacts, Transactions, Negotiations and Agreements. |

None.

| Item 4. | The Solicitation or Recommendation. |

Recommendation

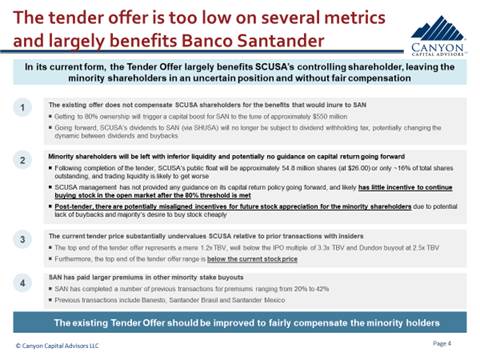

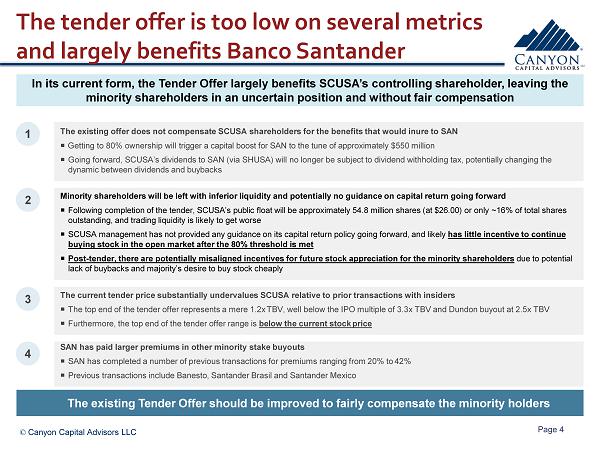

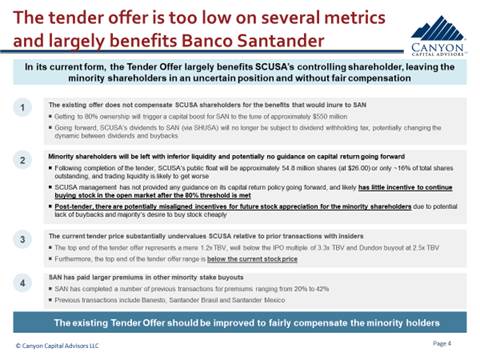

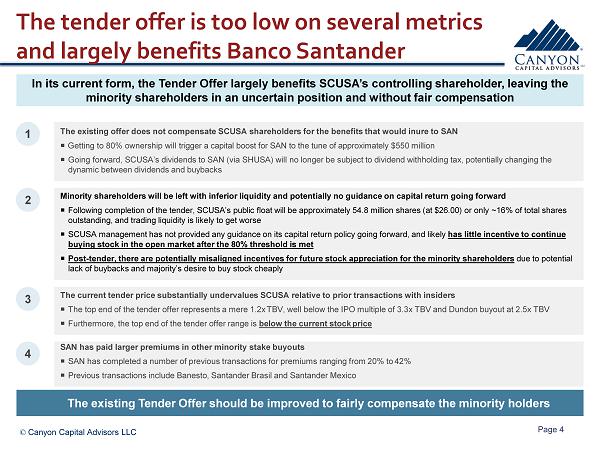

The Filing Persons recommend that stockholders of the Company not tender their Shares in the Tender Offer.

Reasons

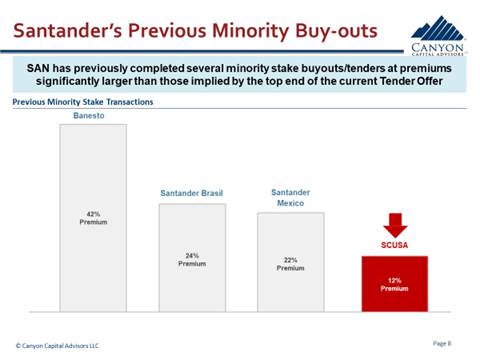

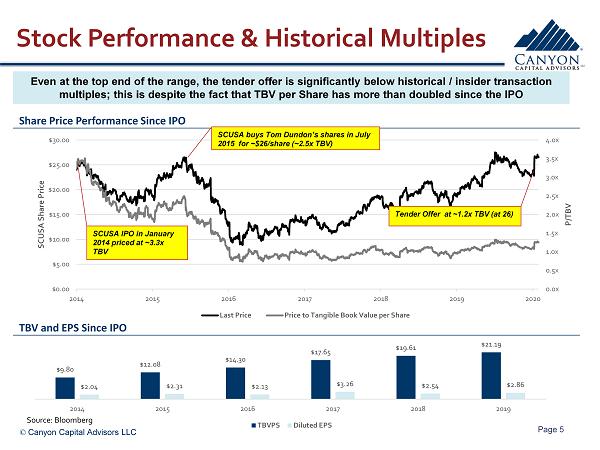

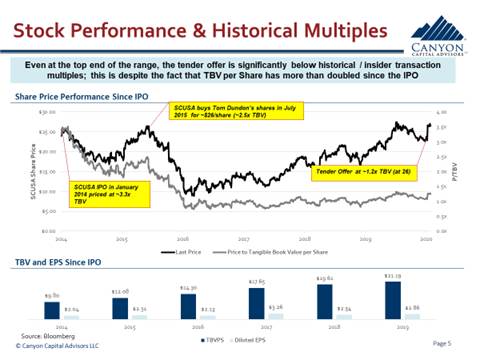

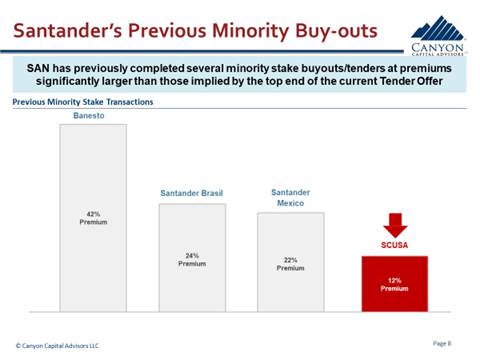

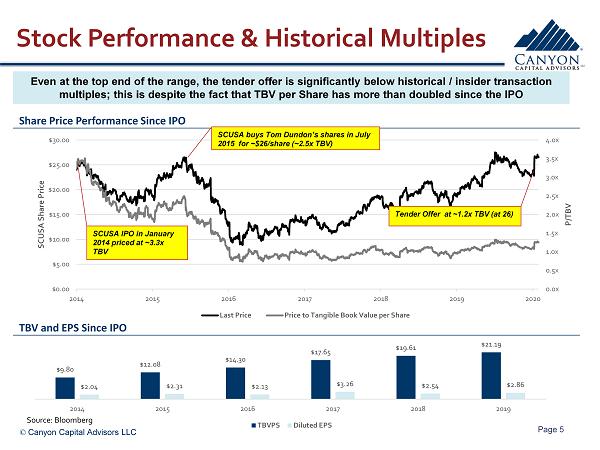

On February 26, 2020, CCA issued a press release and an investor presentation expressing its views on the Tender Offer, copies of which are filed asExhibit 1 andExhibit 2, respectively, and are incorporated by reference herein.

Intent to Not Tender

The Filing Persons do not intend to tender any of their Shares in the Tender Offer in its current form and in light of current market conditions. The Filing Persons intend to review their investment in the Company on a continuing basis and may change their intention with respect to tendering such Shares based upon future events.

| Item 5. | Person/Assets, Retained, Employed, Compensated or Used. |

The Filing Persons have not directly or indirectly employed, retained or compensated any person to make solicitations or recommendations on its behalf in connection with the Tender Offer.

| Item 6. | Interest in Securities of the Subject Company. |

The following table sets forth all transactions with respect to the Shares have been effected by the Filing Persons or, to the best of the Filing Persons’ knowledge, any of their directors, executive officers, subsidiaries, affiliates or associates. All such transactions were effected in the open market through brokers and the price per share is net of commission. The Filing Persons will undertake to provide to the staff of the SEC, upon request, full information regarding the number of Shares sold at each separate price.

| Trade Date | Shares Purchased

(Sold) | Price Per Share ($) | | |

| 12/23/2019 | 78,094 | 23.6493 | | |

| 12/24/2019 | 40,000 | 23.6527 | | |

| 12/26/2019 | 50,000 | 23.5996 | | |

| 12/27/2019 | 50,000 | 23.3592 | | |

| 12/30/2019 | 50,000 | 23.2686 | | |

| 12/31/2019 | 50,000 | 23.3443 | | |

| 01/02/2020 | 2,966 | 23.2387 | | |

| 01/03/2020 | 20,071 | 23.1616 | | |

| 01/10/2020 | 61,986 | 22.8879 | | |

| 01/28/2020 | 150,000 | 23.2490 | | |

| 01/29/2020 | (155,625) | 26.0559 | | |

| 01/30/2020 | (100,000) | 26.5037 | | |

| Item 7. | Purposes of the Transaction and Plans or Proposals. |

Not applicable.

| Item 8. | Additional Information. |

Not applicable.

| Exhibit No. | Description |

| 1 | Press Release, dated February 26, 2020 |

| 2 | Investor Presentation, dated February 26,2020 |

SIGNATURE

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: February 26, 2020

| | | | | |

| CANYON CAPITAL ADVISORS LLC | | | | |

| | | | | |

| | | | | |

| /s/ Doug Anderson | | | | |

| Name: Doug Anderson | | | | |

| Title: Chief Compliance Officer | | | | |

| | | | | |

| | | | | |

| /s/ Mitchell R. Julis | | | | |

| MITCHELL R. JULIS | | | | |

| | | | | |

| | | | | |

| /s/ Joshua S. Friedman | | | | |

| JOSHUA S. FRIEDMAN | | | | |

EXHIBIT 1

Canyon Partners Sends Presentation to Santander Consumer USA Holdings Inc.

LOS ANGELES, Feb. 26, 2020 /PRNewswire/ -- Canyon Capital Advisors LLC, the investment advisor to funds and accounts (together with Canyon Capital Advisors LLC, “Canyon”) that beneficially own, in the aggregate, approximately 13.9 million shares, or 4.1% of the outstanding common stock of Santander Consumer USA Holdings Inc. (“Santander” or the “Company”) (NYSE: SC), sent the following presentation to the Company via the dealer manager.

The presentation sent to the Company is as follows:

About Canyon Partners LLC

Founded and partner owned since 1990, Canyon employs a deep value, credit intensive approach across its investment platform. Canyon specializes in value-oriented special situation investments for endowments, foundations, pension funds, sovereign wealth funds, family offices and other institutional investors. The firm invests across a broad range of asset classes, including distressed loans, corporate bonds, convertible bonds, securitized assets, direct investments, real estate, arbitrage, and event-oriented equities. For more information visit: www.canyonpartners.com.

Media Contact:

Brian Schaffer

Prosek Partners

(646) 818-9229

bschaffer@prosek.com

SOURCE Canyon Partners LLC

EXHIBIT 2

SCUSA Discussion © Canyon Capital Advisors LLC Page 1

• THIS THE INFORMATION OR VIEWS CONTAINED HEREIN .. • INCLUDED IN THIS PRESENTATION HAVE BEEN OBTAINED FROM OUTSIDE SOURCES THAT CANYON BELIEVES TO BE RELIABLE OR REPRESENT THE BEST JUDGMENT OF CANYON AS OF THE DATE OF THIS PRESENTATION . • CANYON RESERVES THE RIGHT TO CHANGE OR MODIFY ANY OF ITS OPINIONS EXPRESSED HEREIN AT ANY TIME AS IT DEEMS APPROPRIATE . CANYON DISCLAIMS ANY OBLIGATION TO UPDATE THE INFORMATION CONTAINED HEREIN . • THIS PRESENTATION MAY NOT BE REPRODUCED WITHOUT PRIOR WRITTEN PERMISSION FROM CANYON . THE INFORMATION CONTAINED WITHIN THE BODY OF THIS PRESENTATION IS SUPPLEMENTED BY FOOTNOTES WHICH IDENTIFY C

▪ In January 2014,filings and sell - side analyst research

The

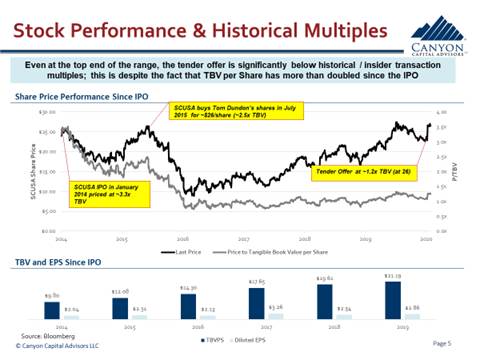

Stock

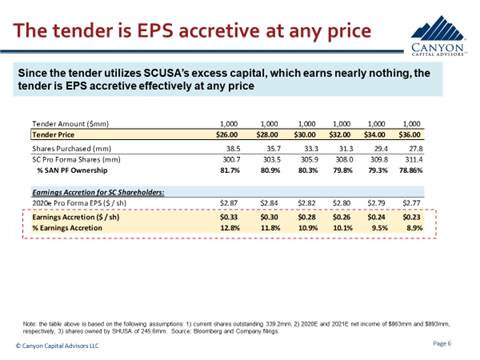

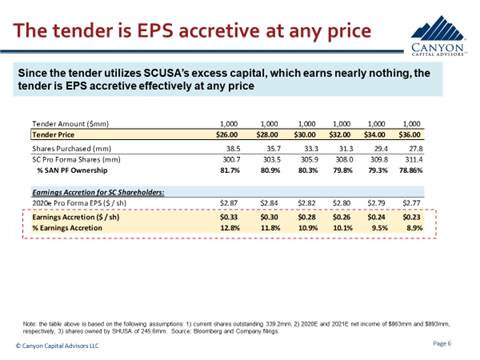

Tender Amount ($mm) 1,000 1,000 1,000 1,000 1,000 1,000 Tender Price $26.00 $28.00 $30.00 $32.00 $34.00 $36.00 Shares Purchased (mm) 38.5 35.7 33.3 31.3 29.4

e.

S