SELECTED CONSOLIDATED FINANCIAL DATA

The summary information presented below under "Selected Balance Sheet Data" and "Selected Operations Data" for, and as of the end of, each of the years ended September 30 is derived from our audited consolidated financial statements. The following information is only a summary and you should read it in conjunction with our consolidated financial statements and notes beginning on page 38.

| | | September 30, | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004(1) | |

| | | (Dollars in thousands) | |

| Selected Balance Sheet Data: | | | | | | | | | | | |

| Total assets | | $8,055,249 | | $7,675,886 | | $8,199,073 | | $8,409,687 | | $8,541,124 | |

| Loans receivable, net | | 5,320,780 | | 5,290,071 | | 5,221,117 | | 5,464,130 | | 4,747,530 | |

| Investment securities: | | | | | | | | | | | |

| Available-for-sale (“AFS”), at market value | | 49,586 | | 102,424 | | 189,480 | | -- | | -- | |

| Held-to-maturity (“HTM”), at cost | | 92,773 | | 421,744 | | 240,000 | | 430,499 | | 638,079 | |

| Mortgage-related securities (“MBS”): | | | | | | | | | | | |

| Trading, at market value | | -- | | -- | | 396,904 | | -- | | -- | |

| AFS, at market value | | 1,484,055 | | 402,686 | | 556,248 | | 737,638 | | 1,201,800 | |

| HTM, at cost | | 750,284 | | 1,011,585 | | 1,131,634 | | 1,407,616 | | 1,446,908 | |

| Capital stock of Federal Home Loan Bank (“FHLB”) | | 124,406 | | 139,661 | | 165,130 | | 182,259 | | 174,126 | |

| Deposits | | 3,923,883 | | 3,922,782 | | 3,900,431 | | 3,960,297 | | 4,127,774 | |

| Advances from FHLB | | 2,447,129 | | 2,732,183 | | 3,268,705 | | 3,426,465 | | 3,449,429 | |

| Other borrowings | | 713,581 | | 53,524 | | 53,467 | | 53,410 | | 53,348 | |

| Stockholders’ equity | | 871,216 | | 867,631 | | 863,219 | | 865,063 | | 832,414 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Year Ended September 30, | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004(1) | |

| | | (Dollars and counts in thousands, except per share amounts) | |

| Selected Operations Data: | | | | | | | | | | | |

| Total interest and dividend income | | $ 410,806 | | $ 411,550 | | $ 410,928 | | $ 400,107 | | $ 384,833 | |

| Total interest expense | | 276,638 | | 305,110 | | 283,905 | | 244,201 | | 268,642 | |

| Net interest and dividend income | | 134,168 | | 106,440 | | 127,023 | | 155,906 | | 116,191 | |

| Provision (recovery) for loan losses | | 2,051 | | (225) | | 247 | | 215 | | 64 | |

| Net interest and dividend income after provision | | | | | | | | | | | |

| (recovery) for loan losses | | 132,117 | | 106,665 | | 126,776 | | 155,691 | | 116,127 | |

| Retail fees and charges | | 17,805 | | 16,120 | | 17,007 | | 16,029 | | 15,119 | |

| Other income | | 12,222 | | 7,846 | | 7,788 | | 7,286 | | 8,428 | |

| Total other income | | 30,027 | | 23,966 | | 24,795 | | 23,315 | | 23,547 | |

| Prepayment penalty on FHLB advances | | -- | | -- | | -- | | -- | | 236,109 | |

| Total other expenses | | 81,989 | | 77,725 | | 72,868 | | 73,631 | | 309,000 | |

| Income (loss) before income tax expense (benefit) | | 80,155 | | 52,906 | | 78,703 | | 105,375 | | (169,326) | |

| Income tax expense (benefit) | | 29,201 | | 20,610 | | 30,586 | | 40,316 | | (63,051) | |

| Net income (loss) | | 50,954 | | 32,296 | | 48,117 | | 65,059 | | (106,275) | |

| | | | | | | | | | | | |

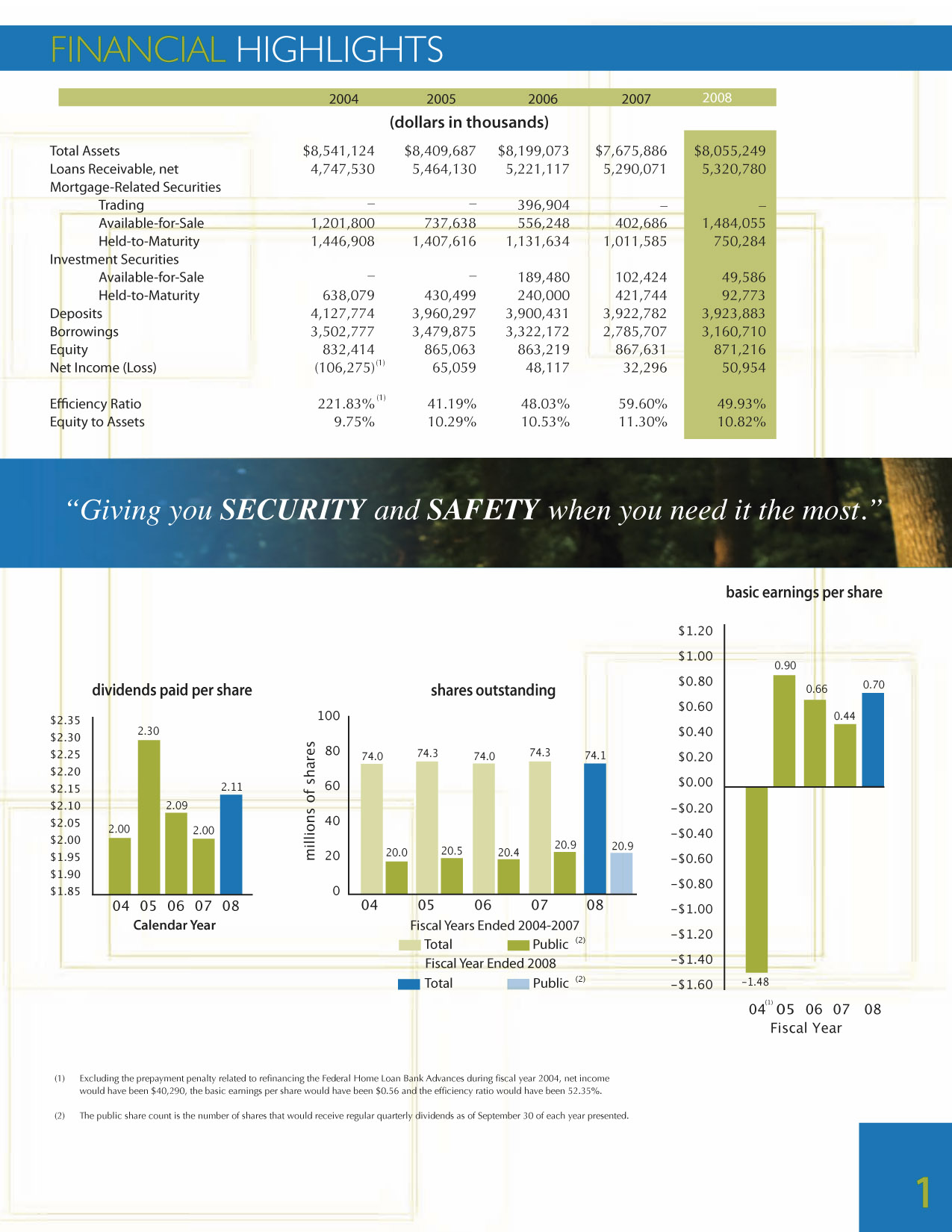

| Basic earnings (loss) per share | | $ 0.70 | | $ 0.44 | | $ 0.66 | | $ 0.90 | | $ (1.48) | |

| Average shares outstanding | | 72,939 | | 72,849 | | 72,595 | | 72,506 | | 71,599 | |

| Diluted earnings (loss) per share | | $ 0.70 | | $ 0.44 | | $ 0.66 | | $ 0.89 | | $ (1.48) | |

| Average diluted shares outstanding | | 73,013 | | 72,970 | | 72,854 | | 73,082 | | 71,599 | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004(1) |

| Selected Performance and Financial Ratios | | | | | | | | | | |

| and Other Data: | | | | | | | | | | |

| Performance Ratios: | | | | | | | | | | |

| Return on average assets | | 0.65 | % | 0.41 | % | 0.58 | % | 0.77 | % | (1.25)% |

| Return on average equity | | 5.86 | | 3.72 | | 5.58 | | 7.62 | | (11.36) |

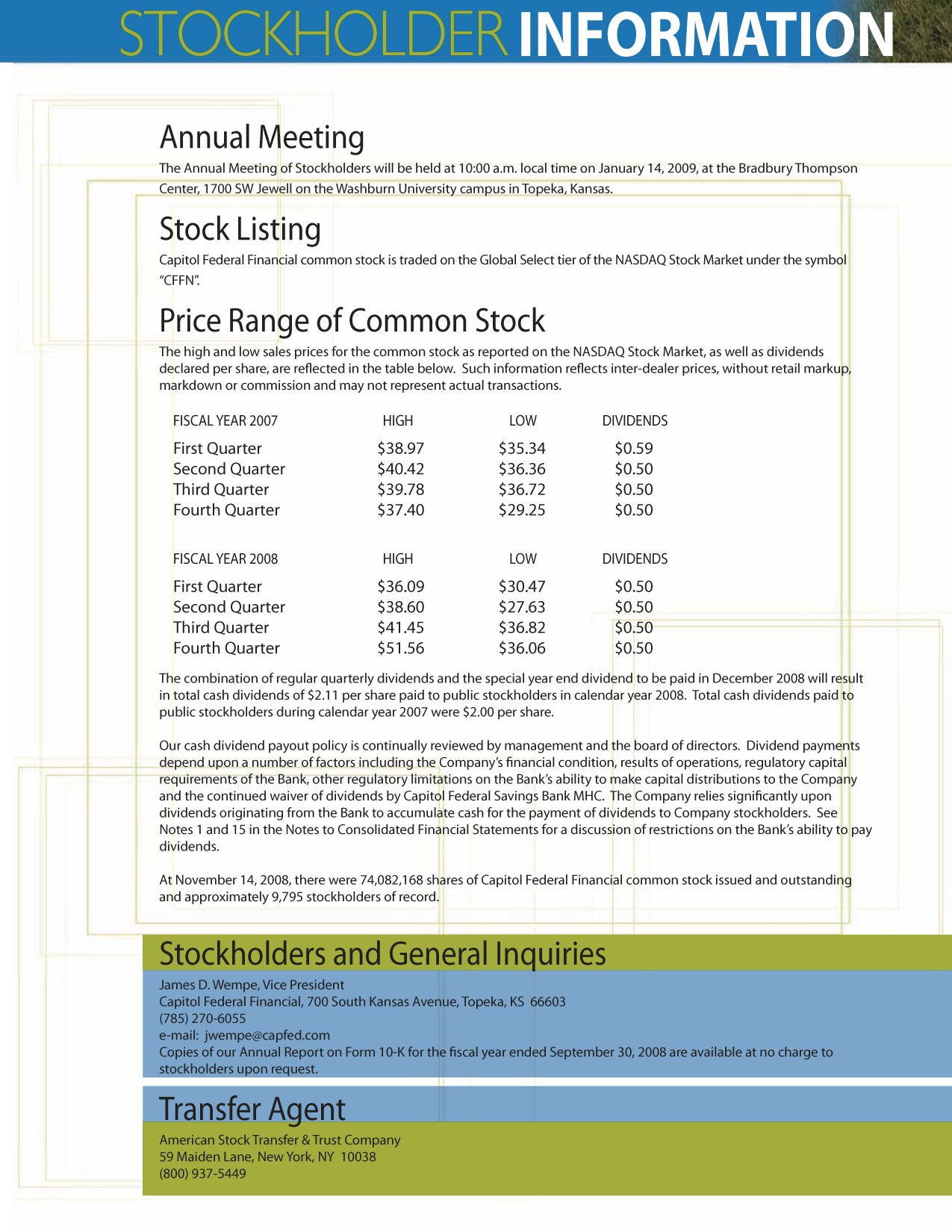

Dividends paid per public share(2) | | $ 2.00 | | $ 2.09 | | $ 2.30 | | $ 2.00 | | $ 2.81 |

| Dividend payout ratio | | 81.30 | % | 133.14 | % | 97.41 | % | 62.59 | % | n/a |

| Ratio of operating expense to | | | | | | | | | | |

| average total assets | | 1.04 | | 0.98 | | 0.88 | | 0.87 | | 3.64% |

| Efficiency ratio | | 49.93 | | 59.60 | | 48.03 | | 41.19 | | 221.83 |

| Ratio of average interest-earning assets | | | | | | | | | | |

| to average interest-bearing liabilities | | 1.12 | | 1.12 | | 1.11 | | 1.10 | | 1.12 |

| Interest rate spread information: | | | | | | | | | | |

| Average during period | | 1.35 | | 0.93 | | 1.19 | | 1.59 | | 1.05 |

| End of period | | 1.70 | | 0.89 | | 1.07 | | 1.46 | | 1.77 |

| Net interest margin | | 1.75 | | 1.36 | | 1.57 | | 1.87 | | 1.39 |

| Asset Quality Ratios: | | | | | | | | | | |

| Non-performing assets to total assets | | 0.23 | | 0.12 | | 0.10 | | 0.08 | | 0.12 |

| Non-performing loans to total loans | | 0.26 | | 0.14 | | 0.11 | | 0.09 | | 0.13 |

| Allowance for loan losses to | | | | | | | | | | |

| non-accruing loans | | 42.37 | | 56.87 | | 79.03 | | 89.14 | | 74.04 |

| Allowance for loan losses to | | | | | | | | | | |

| loans receivable, net | | 0.11 | | 0.08 | | 0.08 | | 0.08 | | 0.09 |

| Capital Ratios: | | | | | | | | | | |

| Equity to total assets at end of period | | 10.82 | | 11.30 | | 10.53 | | 10.29 | | 9.75 |

| Average equity to average assets | | 11.05 | | 10.91 | | 10.47 | | 10.05 | | 11.03 |

| | | | | | | | | | | |

| Regulatory Capital of Bank: | | | | | | | | | | |

| Core capital | | 10.0 | | 10.3 | | 9.5 | | 9.1 | | 8.8 |

| Tier I risk-based capital | | 23.1 | | 22.9 | | 22.6 | | 21.3 | | 21.6 |

| Total risk-based capital | | 23.0 | | 22.8 | | 22.5 | | 21.3 | | 21.6 |

| | | | | | | | | | | |

| Other Data: | | | | | | | | | | |

| Number of traditional offices | | 30 | | 29 | | 29 | | 29 | | 28 |

| Number of in-store offices | | 9 | | 9 | | 9 | | 8 | | 8 |

(1) During 2004, Capitol Federal Savings Bank refinanced $2.40 billion of its FHLB advances that were not hedged by interest rate swaps. In doing so, Capitol Federal Savings Bank incurred a $236.1 million prepayment penalty.

(2) For all years shown, Capitol Federal Savings Bank MHC, which owns a majority of the outstanding shares of Capitol Federal Financial common stock, waived its right to receive dividends paid on the common stock with the exception of the $0.50 per share dividend paid on 500,000 shares in February 2005. Public shares exclude shares held by Capitol Federal Savings Bank MHC, as well as unallocated shares held in the Capitol Federal Financial Employee Stock Ownership Plan (“ESOP”). See page 23 for additional information.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General Overview

Capitol Federal Financial (the “Company”) is the mid-tier holding company and the sole shareholder of Capitol Federal Savings Bank (the “Bank”). Capitol Federal Savings Bank MHC (“MHC”), a federally chartered mutual holding company, is the majority owner of the Company. MHC owns 52,192,817 shares of the 74,079,868 voting shares outstanding on September 30, 2008. The Company’s common stock is traded on the NASDAQ Stock Market LLC under the symbol “CFFN.” The Bank comprises almost all of the consolidated assets and liabilities of the Company and the Company is dependent primarily upon the performance of the Bank for the results of its operations. Because of this relationship, references to management actions, strategies and results of actions apply to both the Bank and the Company.

We may from time to time make written or oral "forward-looking statements", including statements contained in our filings with the Securities and Exchange Commission (“SEC”). These forward-looking statements may be included in this annual report to stockholders and in other communications by the Company, which are made in good faith by us pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements include statements about our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond our control. The words "may", "could", "should", "would", "believe", "anticipate", "estimate", "expect", "intend", "plan" and similar expressions are intended to identify forward-looking statements. The following factors, among others, could cause our future results to differ materially from the plans, objectives, goals, expectations, anticipations, estimates and intentions expressed in the forward-looking statements:

| · | our ability to continue to maintain overhead costs at reasonable levels; |

| · | our ability to continue to originate a significant volume of one- to four-family mortgage loans in our market area; |

| · | our ability to acquire funds from or invest funds in wholesale or secondary markets; |

| · | the future earnings and capital levels of the Bank, which could affect the ability of the Company to pay dividends in accordance with its dividend policies; |

| · | fluctuations in deposit flows, loan demand, and/or real estate values, which may adversely affect our business; |

| · | the credit risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses; |

| · | the strength of the U.S. economy in general and the strength of the local economies in which we conduct operations; |

| · | the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; |

| · | the effects of, and changes in, foreign and military policies of the United States Government; |

| · | inflation, interest rates, market and monetary fluctuations; |

| · | our ability to access cost-effective funding; |

| · | the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users, including the features, pricing and quality compared to competitors' products and services; |

| · | the willingness of users to substitute competitors' products and services for our products and services; |

| · | our success in gaining regulatory approval of our products, services and branching locations, when required; |

| · | the impact of changes in financial services laws and regulations, including laws concerning taxes, banking, securities and insurance and the impact of other governmental initiatives affecting the financial services industry; |

| · | implementing business initiatives may be more difficult or expensive than anticipated; |

| · | acquisitions and dispositions; |

| · | changes in consumer spending and saving habits; and |

| · | our success at managing the risks involved in our business. |

This list of important factors is not exclusive. We do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company or the Bank.

The following discussion is intended to assist in understanding the financial condition and results of operations of the Company. The discussion includes comments relating to the Bank, since the Bank is wholly owned by the Company and comprises the majority of assets and is the principal source of income for the Company.

Executive Summary

The following summary should be read in conjunction with our Management’s Discussion and Analysis of Financial Condition and Results of Operations in its entirety.

Our principal business consists of attracting deposits from the general public and investing those funds primarily in permanent loans secured by first mortgages on owner-occupied, one- to four-family residences. We also originate consumer loans, loans secured by first mortgages on non-owner-occupied one- to four-family residences, permanent and construction loans secured by one- to four-family residences, commercial real estate loans, and multi-family real estate loans. While our primary business is the origination of one- to four-family mortgage loans funded through retail deposits, we also purchase whole loans and invest in certain investment securities and MBS, and use FHLB advances and repurchase agreements as additional funding sources.

The Company is significantly affected by prevailing economic conditions including federal monetary and fiscal policies and federal regulation of financial institutions. Deposit balances are influenced by a number of factors including interest rates paid on competing personal investment products, the level of personal income, and the personal rate of savings within our market areas. Lending activities are influenced by the demand for housing and other loans, changing loan underwriting guidelines, as well as interest rate pricing competition from other lending institutions. The primary sources of funds for lending activities include deposits, loan repayments, investment income, borrowings, and funds provided from operations.

The Company’s results of operations are primarily dependent on net interest income, which is the difference between the interest earned on loans, MBS, investment securities and cash, and the interest paid on deposits and borrowings. On a weekly basis, management reviews deposit flows, loan demand, cash levels, and changes in several market rates to assess all pricing strategies. We generally price our loan and deposit products based upon an analysis of our competition and changes in market rates. The Bank generally prices its first mortgage loan products based upon prices available in the secondary market if it were to sell them at prices near par. Generally, deposit pricing is based upon a survey of peers in the Bank’s market areas, and the need to attract funding and retain maturing deposits. The majority of our loans are fixed-rate products with maturities up to 30 years, while the majority of our deposits have maturity or reprice dates of less than two years.

In fiscal year 2008, the consequences of steep declines in credit quality and asset quality due largely to subprime lending and real estate devaluations were felt economy-wide, but predominantly in the financial services sector. Record levels of asset write-downs and credit losses were experienced by companies across the United States, leaving some companies in the financial services sector critically undercapitalized and without liquidity. The severity of these conditions is illustrated by the placement of the Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”) into government conservatorships, the collapse of several large Wall Street firms, and the closing of a number of banks during the year by the Federal Deposit Insurance Corporation (“FDIC”). The Federal Open Market Committee of the Federal Reserve (“FOMC”) lowered the overnight lending rate 275 basis points during fiscal year 2008, from 4.75% to 2.00%. The Federal Reserve also provided emergency funding to struggling firms through a number of new term lending programs that accepted higher risk assets as collateral, in an effort to keep capital markets functioning. On October 3, 2008, the Emergency Economic Stabilization Act of 2008 (the “EESA”) was signed into law. The EESA is not expected to have a material impact on the Company’s future financial position, results of operations, cash flows, or liquidity.

The Bank continues to maintain access to liquidity in excess of forecasted needs by diversifying its funding sources and maintaining a strong retail oriented deposit portfolio. In addition, the investments of the Bank are government-agency backed securities which are highly liquid, which have not been credit impaired, compared to other classes of investments in recent months, and are available as collateral for additional borrowings or for sale if the need or unforeseen conditions warrant. See additional discussion regarding liquidity in the section entitled “Liquidity and Capital Resources.”

Subprime mortgage lending is not a market in which we participate. The loans we originate and purchase are fully documented and adhere to underwriting guidelines generally more restrictive than used by other lenders. See additional discussion of asset quality in Part I, Item 1 of the Annual Report on Form 10-K. While the subprime lending market essentially does not exist today, past practices have caused considerable strain in the credit markets from rising delinquencies, lower real estate valuations and liquidity pressures. This strain has resulted in tightened lending practices and negative impacts on many real estate markets, as well as negative perceptions of our business and industry. The continued decline in the real estate markets, as well as the overall economic environment, contributed to an increase in our non-performing loans during the year. Due to our level of geographic diversification, we are sheltered but not immune to negative consequences arising from overall economic weakness and, in particular, a sharp downturn in the housing industry nationally. Despite the increase in non-performing loans at September 30, 2008, our non-performing loans continue to remain at low levels relative to the size of our loan portfolio. We continue to closely monitor the local and national real estate markets and other factors related to risks inherent in our loan portfolio. Based on our evaluation of the quality of the loans in our residential loan portfolio, real estate markets, the

overall economic environment, and the increase in and composition of our delinquencies and non-performing loans, management determined a $2.1 million provision for loan losses was prudent and warranted for the year ended September 30, 2008.

Net income for the year ended September 30, 2008 was $51.0 million compared to $32.3 million for the year ended September 30, 2007. The $18.7 million increase in net income was primarily a result of a decrease in interest expense on FHLB advances and deposits. The decrease in interest expense on FHLB advances was a result of a decrease in the balance as maturing advances were not renewed in their entirety and a decrease in the weighted average rate due to the termination of $575.0 million of interest rate swap agreements during the first quarter. The decrease in interest expense on deposits was due to a decrease in the rate on the money market, certificate and savings portfolios due to the portfolios repricing to lower market rates.

During fiscal year 2008, we entered into $660.0 million of repurchase agreements as a means of expanding our funding sources and borrowed $825.0 million of FHLB advances, while $1.13 billion of FHLB advances matured. The amount of total borrowings is a function of balancing investment opportunities, liquidity requirements, and managing the interest rate sensitivity of the Bank. Management monitors the Bank’s investment opportunities and balances those opportunities with the cost of FHLB advances or other funding sources for various terms to maturity. During the year, management utilized some of the borrowings and cash flows from the investment securities portfolio to purchase MBS as the interest rate spreads were at attractive levels at certain points during the year when considering the related interest rate and credit risk exposure. Management intends to continue such transactions for the foreseeable future as long as interest rate spreads and the related interest rate and credit risk exposure are at acceptable levels. See additional discussion of interest rate risk in "Quantitative and Qualitative Disclosure About Market Risk."

The Bank opened one new branch in our Wichita market area in October 2008. The Bank has plans to open two additional branches in fiscal year 2009, located in our market area in south Johnson County, Kansas. The Bank has preliminary plans to open three additional branches in our market areas in Kansas City and Wichita by September 30, 2010.

Critical Accounting Policies

Our most critical accounting policies are the methodologies used to determine the allowance for loan losses and the other than temporary declines in the value of securities. These policies are important to the presentation of our financial condition and results of operations, involve a high degree of complexity, and require management to make difficult and subjective judgments that may require assumptions or estimates about highly uncertain matters. The use of different judgments, assumptions, and estimates could cause reported results to differ materially. These critical accounting policies and their application are reviewed at least annually by our audit committee and board of directors. The following is a description of our critical accounting policies and an explanation of the methods and assumptions underlying their application.

Allowance for Loan Losses. Management maintains an allowance for loan losses to absorb losses known and inherent in the loan portfolio based upon ongoing quarterly assessments of the loan portfolio. Our methodology for assessing the appropriateness of the allowance consists of several key elements, which includes a formula analysis for general valuation allowances, specific valuation allowances for identified problem loans and portfolio segments, and knowledge of economic conditions which may lead to credit risk concerns about the loan portfolio or segments of the loan portfolio.

All loans that are not impaired, as defined in Statement of Financial Accounting Standards (“SFAS”) No. 114, “Accounting by Creditors for Impairment of a Loan, an Amendment of Financial Accounting Standards Board (“FASB”) Statements No. 5 and 15” and No. 118 “Accounting by Creditors for Impairment of a Loan – Income Recognition and Disclosures, an Amendment of FASB Statement No. 114”, are included in a formula analysis, as permitted by SFAS No. 5, “Accounting for Contingencies”. Management uses the formula analysis to evaluate the adequacy of the general valuation allowance. Each quarter, the loan portfolio is segregated into categories in the formula analysis based upon certain risk characteristics such as loan type (one- to four-family, multi-family, etc.), interest payments (fixed-rate, adjustable-rate), loan source (originated or purchased), and payment status (i.e. current or number of days delinquent). Impaired loans and loans with known potential losses are excluded from the analysis and evaluated for specific valuation allowances. Potential loss factors are assigned to each category in the analysis based on management’s assessment of the potential risk inherent in each category. The greater the risks associated with a particular category, the higher the loss factor. Loss factors increase as individual loans become classified, delinquent, the foreclosure process begins or as economic conditions warrant. The loss factors are periodically reviewed by management for appropriateness giving consideration to historical loss experience, delinquency and non-performing loan trends, the results of foreclosed property transactions and the status of the local and national economies and housing markets, in order to ascertain that the loss factors cover probable and estimable losses inherent in the loan portfolio. Management’s evaluation of the inherent loss with respect to these conditions is subject to a higher degree of uncertainty because they are not identified with a specific problem loan or portfolio segments.

The amounts actually observed with respect to these losses can vary significantly from the estimated amounts. Our methodology permits adjustments to any loss factor used in the computation of the formula analysis in the event that, in management’s judgment, significant factors which affect the collectibility of the portfolio or any category of the

loan portfolio, as of the evaluation date, are not reflected in the current loss factors. By assessing the estimated losses inherent in our loan portfolio on a quarterly basis, we can adjust specific and inherent loss estimates based upon more current information.

During fiscal year 2008, the loss factors in our formula analysis were increased on certain purchased loans in our portfolio as a result of changes in the real estate markets, borrower credit attributes, economic environment, and composition of our delinquencies and non-performing loans. The increase in the loss factors was based on when the loan was originated, the lender from whom the loan was purchased, and changes in credit scores and loan-to-value (“LTV”) ratios since the time of origination. Since we rely primarily on the collateral securing a one-to four-family mortgage loan if the loan were to enter foreclosure, management believes the increase in the loss factor on these loans was necessary. The majority of our non-performing purchased loans were purchased from one nationwide lender. The Bank has discontinued purchasing loans from this nationwide lender. Management reviewed the pool of loans purchased from this nationwide lender and increased the loss factors on loans that met certain LTV and credit score criteria. Management also reviewed the pool of purchased loans from all other nationwide lenders and increased the loss factors, but to a lesser extent, on loans that met certain LTV and credit score criteria.

Specific valuation allowances are established in connection with individual loan reviews of specifically identified problem loans and the asset classification process, including the procedures for impairment recognition under SFAS No. 114 and SFAS No. 118. Such evaluations include a review of loans on which full collectibility is not reasonably assured, evaluation of the estimated fair value of the underlying collateral, and other factors that determine risk exposure to arrive at an adequate specific valuation allowance amount. Loans with an outstanding balance of $1.5 million or more are reviewed annually if secured by property in one of the following categories: multi-family (five or more units) property, unimproved land, other improved commercial property, acquisition and development of land projects, developed building lots, office building, single-use building, or retail building. Specific valuation allowances are established if the review determines a quantifiable impairment. If a loan is not impaired, it is included in the formula analysis.

Management reviews the appropriateness of the allowance for loan losses based upon its evaluation of then-existing economic and business conditions affecting our key lending areas. Other conditions management considers in determining the appropriateness of the allowance for loan losses include, but are not limited to, changes in our underwriting standards, credit quality trends (including changes in the balance and characteristics of non-performing loans expected to result from existing economic conditions), trends in collateral values, loan volumes and concentrations, and recent loss experience in particular segments of the portfolio as of the balance sheet date. Management also measures the impact these conditions were believed to have had on the collectibility of impaired loans.

Assessing the adequacy of the allowance for loan losses is inherently subjective. Actual results could differ from our estimates as a result of changes in economic or market conditions. Changes in estimates could result in a material change in the allowance for loan losses. In the opinion of management, the allowance for loan losses, when taken as a whole, is adequate to absorb reasonable estimated losses inherent in our loan portfolio. However, future adjustments may be necessary if portfolio performance or economic or market conditions differ substantially from the conditions that existed at the time of the initial determinations.

Securities Impairment. Management continually monitors the investment and mortgage-related security portfolios for impairment on a security by security basis. Many factors are considered in determining whether the impairment is deemed to be other-than-temporary, including, but not limited to, the nature of the investment, the length of time the security has had a market value less than the cost basis, the cause(s), severity of the loss, the intent and ability of the Bank to hold the security for a period of time sufficient for a substantial recovery of its investment, expectation of an anticipated recovery period, recent events specific to the issuer or industry including the issuer’s financial condition and current ability to make future payments in a timely manner, external credit ratings and recent downgrades in such ratings. If management deems the decline to be other-than-temporary, the carrying value of the security is adjusted and an impairment amount is recorded in the consolidated statements of income. Currently, all securities are rated investment grade, and there is a market for the securities. At September 30, 2008, no securities had been identified as other-than-temporarily impaired.

Recent Accounting Pronouncements. In September 2006, the FASB issued SFAS No. 157 “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a framework for measuring fair value, and expands disclosures regarding fair value measurements. The statement applies whenever other standards require or permit that assets or liabilities be measured at fair value. The statement does not require new fair value measurements, but rather provides a definition and framework for measuring fair value which will result in greater consistency and comparability among financial statements prepared under generally accepted accounting principles in the United States of America (“GAAP”). The statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, which for the Company is October 1, 2008. The provisions are to be applied prospectively as of the beginning of the fiscal year in which the statement is initially applied, with certain exceptions. A transition adjustment, measured as the difference between the carrying amounts and the fair values of certain specific financial instruments at the date SFAS No. 157 is initially applied may be required. SFAS No. 157 will affect certain fair value disclosures, but is not expected to have a material impact on the Company’s financial condition or results of

operations. The portion of the Company’s assets and liabilities with fair values based on unobservable inputs is not significant.

In February 2007, FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” which permits an entity to measure certain financial assets and financial liabilities at fair value. The objective of SFAS No. 159 is to improve financial reporting by allowing entities to mitigate volatility in reported earnings caused by the measurement of related assets and liabilities using different attributes, without having to apply complex hedge accounting provisions. The election for the fair value option is a one-time election for existing instruments and once fair value is elected for a particular instrument, that instrument is carried throughout the holding period at fair value. If elected, SFAS No. 159 is effective for fiscal years beginning after November 15, 2007, which for the Company is October 1, 2008. The Company has elected not to use the fair value option.

In November 2007, the SEC issued Staff Accounting Bulletin (“SAB”) 109, “Written Loan Commitments Recorded at Fair Value Through Earnings.” SAB 109 supersedes SAB 105, “Miscellaneous Accounting – Loan Commitments Accounted for as Derivative Instruments.” SAB 109 requires a company to include the value of the mortgage servicing asset in the estimated fair value of the commitments on loans to be sold. SAB 105 had stated that this treatment was inappropriate. The new guidance should be applied prospectively to commitments accounted for at fair value that are issued or modified in fiscal quarters beginning after December 15, 2007, which for the Company was January 1, 2008. The adoption of SAB 109 did not have a material impact on the Company’s financial statements.

In December 2007, the SEC codified SAB 110 as part of SAB Topic 14.D.2, “Share-Based Payment: Certain Assumptions Used in Valuation Methods – Expected Term.” SAB 110 permits companies, under certain circumstances, to continue to use the simplified method when calculating the expected term of “plain vanilla” share options. Originally, the simplified method was due to expire on December 31, 2007. A company may use the simplified method if it concludes that it is not reasonable to base its estimate of expected term on its experience with exercising historical share options. SAB 110 was effective for the Company on January 1, 2008. Management determined there was sufficient history of stock option exercises to develop an expected term based on historical experience so the simplified method will no longer be used to calculate expected term when stock options are granted. The adoption of SAB 110 did not have a material impact on the Company’s financial statements.

In December 2007, the FASB issued SFAS No. 141(R) “Business Combinations” and SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51.” These statements change the way companies account for business combinations and noncontrolling interests (minority interests in current GAAP) and continue the FASB’s push toward more fair value reporting in financial statements. These Statements should both be applied prospectively for fiscal years beginning on or after December 15, 2008, which for the Company is October 1, 2009. However, Statement No. 160 requires entities to apply the presentation and disclosure requirements retrospectively to comparative financial statements, if presented. Both Statements prohibit early adoption. Management is assessing the impact of the adoption of FASB Statements No. 141(R) and No. 160.

In March 2008, the FASB issued SFAS No. 161 “Disclosures about Derivative Instruments and Hedging Activities – an amendment of FAS 133.” SFAS No. 161 requires an entity with derivatives to describe how and why it uses derivative instruments, how derivative instruments and related hedged items are accounted for under SFAS No. 133 “Accounting for Derivative Instruments and Hedging Activities” and related interpretations, and how derivative instruments and related hedged items affect the entity's financial position, financial performance, and cash flows. SFAS No. 161 is effective for the Company beginning January 1, 2009. The Company's adoption of SFAS No. 161 is not expected to have a material impact on its financial condition or results of operations.

In May 2008, the FASB issued SFAS No. 162 “The Hierarchy of Generally Accepted Accounting Principles.” The purpose of SFAS No. 162 is to improve financial reporting by providing a consistent framework for determining what accounting principles should be applied when preparing GAAP financial statements. The FASB believes that issuing the GAAP hierarchy as an FASB standard, recategorizing the existing GAAP hierarchy into two levels of accounting literature (authoritative and nonauthoritative), and elevating the conceptual framework within the GAAP hierarchy are key objectives of achieving the FASB’s goal of improving the quality of accounting standards and the standard-setting process. SFAS No. 162 is effective 60 days following the SEC’s approval of Public Company Accounting Oversight Board (“PCAOB”) amendment to AU Section 411. The Company’s adoption of SFAS No. 162 is not expected to have a material impact on its financial condition or results of operations.

In June 2008, the FASB issued Staff Position (“FSP”) Emerging Issues Task Force (“EITF”) 03-6-1, “Determining Whether Instruments Granted in Share-Based Payment Transactions are Participating Securities,” which addresses whether instruments granted in share-based payment transactions are participating securities prior to vesting and, therefore, need to be included in the earnings allocation in computing EPS under the two-class method described in SFAS No. 128, “Earnings per Share.” EITF 03-6-1 states that unvested share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents are participating securities and shall be included in the computation of EPS pursuant to the two-class method. EITF 03-6-1 is effective for fiscal years beginning after December 15, 2008, and interim periods within those years, which for the Company is October 1, 2009. Early application is prohibited. The Company has not yet completed its assessment of the impact of EITF 03-6-1.

Management Strategy

Our strategy is to operate a retail-oriented financial institution dedicated to serving the needs of customers in our market areas. Our commitment is to provide the broadest possible access to home ownership through our mortgage lending programs and to offer a complete set of personal banking products and services. We strive to enhance stockholder value while maintaining a strong capital position. To achieve our strategy, we focus on the following:

| · | Portfolio Lending. We are one of the largest originators of one- to four-family mortgage loans in the state of Kansas. We have primarily originated these loans for our own portfolio, rather than for sale, and generally we service the loans we originate. We provide retail customers with alternatives for their borrowing needs by offering both fixed- and adjustable-rate products with various terms to maturity and pricing alternatives. We offer special programs to individuals who may be first time home buyers, have low or moderate incomes or may have certain credit risk concerns in order to maximize our ability to deliver home ownership opportunities. Through our strong relationships with real estate agents and marketing efforts which reflect our reputation and pricing, we attract mortgage loan business from walk-in customers, customers that apply online, and existing customers. We also purchase one- to four-family mortgage loans from correspondent lenders secured by property primarily located within our market areas and select market areas in Missouri and nationwide lenders. |

| · | Retail Financial Services. We offer a wide array of deposit products and retail services for our customers. These products include checking, savings, money market, certificates of deposit and retirement accounts. These products and services are provided through a branch network of 39 locations which includes traditional branch and retail store locations, our call center which operates on extended hours, telephone bill payment services and Internet-based transaction services. |

| · | Cost Control. We generally are very effective at controlling our costs of operations, outside of the expense portion of our employee benefit plans which are tied to the Company’s stock price. By using technology, we are able to centralize our lending and deposit support functions for efficient processing. Our retail orientation allows us to serve a broad range of customers through relatively few branch locations. Our average deposit base per traditional branch at September 30, 2008 and 2007 was over $119.5 million and $123.3 million, respectively. This large average deposit base helps to control costs. Our one- to four-family mortgage lending strategy, through effective management of credit risk, allows us to service a large portfolio of loans at efficient levels because it costs less to service a portfolio of performing loans. |

| · | Asset Quality. We utilize underwriting standards for our lending products that are designed to limit our exposure to credit risk, and have a portfolio of predominately one- to four-family mortgage loans which has resulted in minimal levels of delinquent and non-performing loans. At September 30, 2008, our ratio of non-performing assets to total assets was 0.23%, which continues to remain at low levels relative to the size of our loan portfolio. See additional discussion of asset quality in Part I, Item 1 of the Annual Report on Form 10-K. |

| · | Capital Position. Our policy has always been to protect the safety and soundness of the Bank through conservative credit and operational risk management, balance sheet strength, and sound operations. The end result of these activities is a capital ratio in excess of the well-capitalized standards set by the Office of Thrift Supervision (“OTS”). We believe that maintaining a strong capital position safeguards the long-term interests of the Bank, the Company and our stockholders. |

| · | Stockholder Value. We strive to enhance stockholder value while maintaining a strong capital position. We continue to provide returns to stockholders through our dividend payments. Total dividends declared and paid during fiscal year 2008 were $2.00 per share. In October 2008, the board of directors declared a $0.50 per share dividend which was paid on November 21, 2008 to holders of record on November 7, 2008. Due to MHC's waiver of dividends, the dividend of $0.50 per share was paid only on public shares. On November 10, 2008, the board of directors approved a special year end cash dividend of $0.11 per share which will be paid on December 5, 2008 to stockholders of record on November 21, 2008. The Company’s cash dividend payout policy is reviewed quarterly by management and the board of directors, and the ability to pay dividends under the policy depends upon a number of factors including the Company’s financial condition, results of operations, regulatory capital requirements of the Bank, other regulatory limitations on the Bank’s ability to make capital distributions to the Company and the continued waiver of dividends by MHC. It is management’s and the board of directors’ intention to continue to pay regular quarterly dividends of $0.50 per share for the foreseeable future and a special dividend each year, to the extent justified by earnings, under the Company’s stated special dividend formula. |

| · | Interest Rate Risk Management. Changes in interest rates are our primary market risk as our balance sheet is almost entirely comprised of interest-earning assets and interest-bearing liabilities. As such, fluctuations in interest rates have a significant impact not only upon our net income but also upon the cash flows related to those assets and liabilities and the market value of our assets and liabilities. To manage interest rate risk, the Asset and Liability Committee (“ALCO”) meets weekly to discuss and monitor the current interest rate environment compared to interest rates offered on our loan and deposit products. Additionally, ALCO meets once a month to review information regarding the sensitivity of our assets and liabilities to changes in rates. The members of ALCO are the Chairman, the Chief Executive Officer, the Chief Financial Officer (chair of |

| ALCO), the Executive Vice President for Corporate Services, the Chief Lending Officer, the Executive Vice President for Retail Operations and the Chief Investment Officer. |

| · | Liquidity Management. The Bank must manage its daily cash flows. Cash flow management is accomplished through establishing interest rates on loan and deposit products, investing cash flows not placed into mortgage loans, purchasing securities that meet the long term objectives of earnings, liquidity management and interest rate risk management and borrowing funds if cash flows are not sufficient to meet local loan demand or to leverage excess capital. Generally, management manages the Bank’s asset and liability portfolios, including the available-for-sale securities portfolio, as held-to-maturity portfolios. As such, changes in the balance or mix of products in these portfolios typically do not occur quickly, especially in a rising rate environment. Because of this, management looks at changes over a period of time to determine trends that can be changed through various strategies in our local markets, by the investments and mortgage loans we purchase or by borrowings we incur. |

Quantitative and Qualitative Disclosure about Market Risk

Asset and Liability Management and Market Risk

The rates of interest we earn on assets and pay on liabilities generally are established contractually for a period of time. Fluctuations in interest rates have a significant impact not only upon our net income, but also upon the cash flows of those assets and liabilities and the market value of our assets and liabilities. Our results of operations, like those of other financial institutions, are impacted by these changes in interest rates and the interest rate sensitivity of our interest-earning assets and interest-bearing liabilities. The risk associated with changes in interest rates on the earnings of the Bank and the market value of its financial assets and liabilities is known as interest rate risk. Interest rate risk is our most significant market risk and our ability to adapt to these changes is known as interest rate risk management.

Based upon management’s recommendations, the board of directors sets the asset and liability management policies of the Bank. These policies are implemented by ALCO. The purpose of ALCO is to communicate, coordinate and control asset and liability management consistent with the business plan and board-approved policies. ALCO sets goals for and monitors the volume and mix of assets and funding sources taking into account relative costs and spreads, interest rate sensitivity and liquidity needs. The objectives are to manage assets and funding sources to produce the highest profitability balanced against liquidity, capital adequacy and risk management objectives. At each monthly meeting, ALCO recommends appropriate strategy changes. The Chief Financial Officer, or his designee, is responsible for executing, reviewing and reporting on the results of the policy recommendations and strategies to the board of directors, generally on a monthly basis.

The ability to maximize net interest income is dependent largely upon the achievement of a positive interest rate spread that can be sustained despite fluctuations in prevailing interest rates. The asset and liability repricing gap is a measure of the difference between the amount of interest-earning assets and interest-bearing liabilities which either reprice or mature within a given period of time. The difference provides an indication of the extent to which an institution's interest rate spread will be affected by changes in interest rates. A gap is considered positive when the amount of interest-earning assets exceeds the amount of interest-bearing liabilities, maturing or repricing during the same period. A gap is considered negative when the amount of interest-bearing liabilities exceeds the amount of interest-earning assets maturing or repricing during the same period. Generally, during a period of rising interest rates, a negative gap within shorter repricing periods adversely affects net interest income, while a positive gap within shorter repricing periods results in an increase in net interest income. During a period of falling interest rates, the opposite would generally be true. As of September 30, 2008, the ratio of our one-year gap to total assets was 1.90%.

Management recognizes that dramatic changes in interest rates within a short period of time can cause an increase in our interest rate risk relative to the balance sheet. At times, ALCO may recommend increasing our interest rate risk position in an effort to increase our net interest margin, while maintaining compliance with established board limits for interest rate risk sensitivity. Management believes that maintaining and improving earnings is the best way to preserve a strong capital position. Management recognizes the need, in certain interest rate environments, to limit the Bank's exposure to changing interest rates and may implement strategies to reduce our interest rate risk which could, as a result, reduce earnings in the short-term. To minimize the potential for adverse effects of material and prolonged changes in interest rates on our results of operations, we have adopted asset and liability management policies to better balance the maturities and repricing terms of our interest-earning assets and interest-bearing liabilities based on existing local and national interest rates.

During periods of economic uncertainty, rising interest rates or extreme competition for loans, the Bank’s ability to originate or purchase loans may be adversely affected. In such situations, the Bank alternatively may invest its funds into investments or MBS. These alternate investments may have rates of interest lower than rates we could receive on loans, if we were able to originate or purchase them, potentially reducing the Bank’s interest income.

Qualitative Disclosure about Market Risk

For each period presented in the following table, the percentage change in the Bank’s estimated net interest income based on the indicated instantaneous, parallel and permanent change in interest rates are presented. The percentage change in each interest rate environment represents the difference between estimated net interest income in the 0 basis point interest rate environment (“base case”, assumes forward market and product interest rates implied by the yield curve are realized) and estimated net interest income in each alternative interest rate environment (assumes market and product interest rates have a parallel shift in rates across all maturities by the indicated change in rates). At September 30, 2008, the three-month Treasury bill yield was less than two percent, so the -200 basis point scenario is not presented. Estimations of net interest income used in preparing the table below are based upon the assumptions that the total composition of interest-earning assets and interest-bearing liabilities does not change materially and that any repricing of assets or liabilities occurs at anticipated product and market rates for the alternative rate environments as of the dates presented. The estimation of net interest income does not include any projected gain-on-sale related to the sale of loans or securities or the effect of the use of new interest rate swaps or income derived from non-interest income sources, but does include the use of different prepayment assumptions in the alternative interest rate environments. It is important to consider that the changes in estimated net interest income are for a cumulative four-quarter period. These do not reflect the earnings expectations of management.

| Percentage Change in Net Interest Income |

| Change | | | | |

| (in Basis Points) | | At September 30, |

in Interest Rates(1) | | 2008 | | 2007 |

| | | | | |

| -100 bp | | -0.67% | | 14.10% |

| 000 bp | | -- | | -- |

| +100 bp | | -2.20% | | -8.31% |

| +200 bp | | -5.08% | | -23.10% |

| +300 bp | | -8.62% | | -38.32% |

| | | | | |

| (1) | Assumes an instantaneous, permanent and parallel change in interest rates at all maturities. |

The primary driver for the decrease in the estimated net interest income in the increasing rate environments is the anticipated increase in the cost of interest-bearing liabilities in excess of increases in the yields on interest-earning assets. The increase in the cost of interest-bearing liabilities is primarily a result of the relatively short average maturity of the Bank’s certificate of deposit portfolio. The increase in the cost of interest-bearing liabilities is also due to anticipated increases in the cost of money market accounts. Increases in yield do not occur as quickly for interest-earning assets since changes in the rates on the mortgage loan and MBS portfolios happen at a slower pace, compared to the interest-bearing liabilities, because only the amount of cash flow received on the repayment of these portfolios is reinvested at the higher rates. Principal repayments on the mortgage loan and MBS portfolios decrease significantly in the rising rate scenario resulting in less cash flow being reinvested. In addition, caps on adjustable-rate mortgage products limit the increase in rates in these assets when rates rise.

The decrease in the sensitivity of estimated net interest income since September 30, 2007 in the increasing rate scenarios was primarily driven by rolling borrowings that matured during the year into longer-term borrowings. During the fiscal year, $525.0 million in borrowings that matured were rolled into fixed-rate borrowings with maturities of five years or longer. The Bank also terminated $575.0 million of interest rate swaps during the year. The interest rate swaps effectively converted long-term fixed-rate advances into adjustable-rate advances that repriced monthly. Once the swaps were terminated, the advances remained as long-term, fixed-rate liabilities that will not reprice in the upcoming year.

The decrease in the estimated net interest income if interest rates were to decrease 100 basis points is primarily the result of a higher amount of assets expected to reprice in the next 12 months (see gap table below) in the base case interest rate scenario. The amount of assets repricing will increase further in the down 100 scenario due to an increase in the anticipated cash flows from mortgage related assets due to lower interest rates.

The following table sets forth the percentage change in estimated market value of portfolio equity (“MVPE”) at each period presented based on the indicated instantaneous, parallel and permanent change in interest rates. The MVPE is defined as the net of the present value of the cash flows of an institution’s existing assets, liabilities and off-balance sheet instruments. The percentage change in each interest rate environment represents the difference between MVPE in the base case and MVPE in each alternative interest rate environment. At September 30, 2008, the three-month Treasury bill was less than two percent, so the -200 basis point scenario is not presented. The estimations of MVPE used in preparing the table below are based upon the assumptions that the total composition of interest-earning assets and interest-bearing liabilities does not change, that any repricing of assets or liabilities occurs at current product or market rates for the alternative rate environments as of the dates presented and that different

prepayment rates are used in each alternative interest rate environment. The estimated MVPE results from the valuation of cash flows from financial assets and liabilities over the anticipated lives of each for each interest rate environment. The table presents the effects of the change in interest rates on our assets and liabilities as they mature, repay or reprice, as shown by the change in the MVPE in changing interest rate environments.

| Percentage Change in MVPE | | |

| Change | | | | |

| (in Basis Points) | | At September 30, |

in Interest Rates(1) | | 2008 | | 2007 |

| | | | | |

| -100 bp | | 0.36% | | 4.77% |

| 000 bp | | -- | | -- |

| +100 bp | | -6.99% | | -13.05% |

| +200 bp | | -19.37% | | -29.99% |

| +300 bp | | -34.88% | | -49.00% |

| (1) | Assumes an instantaneous, permanent and parallel change in interest rates at all maturities. |

Changes in the estimated market values of our financial assets and liabilities drive changes in estimates of MVPE. The market value of shorter term-to-maturity financial instruments is less sensitive to changes in interest rates than the market value of longer term-to-maturity financial instruments. Because of this, our certificates of deposit (which have relatively short average lives) tend to display less sensitivity to changes in interest rates than do our mortgage-related assets (which have relatively long average lives). However, the average life expected on our mortgage-related assets varies under different interest rate environments because customers have the ability to prepay their mortgage loans. Prepayment assumptions change on mortgage-related assets under various interest rate environments because many customers with mortgage debt look to obtain financing at the lowest cost available. Generally, there is no penalty to prepay a mortgage loan we have originated or purchased. If rates decrease, the customer has an economic incentive to lower the cost of his mortgage (through a lower interest rate) with only the fees associated with the new mortgage or loan modification to obtain the lower cost mortgage. In a decreasing rate environment, prepayments increase and the average life of a mortgage shortens compared to higher rate environments. When interest rates increase, the economic incentive for customers to modify their mortgage debt is reduced, resulting in lower prepayment speed assumptions and longer average lives.

The Bank’s MVPE declines in the rising interest rate environments. As rates increase, the estimated fair values of the liabilities with short average lives do not respond to rates in the same manner as the longer maturity assets, such as our fixed-rate loans, which have longer average lives. The prepayment assumptions on the fixed-rate loans in particular, and all mortgage-related assets in general, anticipate prepayment rates in the increasing rate environments that would likely only be realized through normal changes in customers lives, such as divorce, death, job-related relocations, and other life changing events. The lower prepayment assumptions extend the expected average lives on these assets, relative to assumptions in the base case, thereby increasing their sensitivity to changes in interest rates. The net effect of these characteristics of short-lived liabilities and long-lived assets is to increase the sensitivity of the Bank to changes in interest rates the more rates increase.

The sensitivity of the Bank’s MVPE as of September 30, 2008 decreased from September 30, 2007. This was primarily due to lower interest rates at September 30, 2008 that resulted in shorter average lives of mortgage-related assets. In addition, the Bank extended the average lives of borrowings during the year. This was accomplished primarily by rolling borrowings that matured during the year into longer-term borrowings, and terminating $575.0 million of interest rate swaps.

The Bank’s measure of its MVPE sensitivity to declining interest rates indicates little change from the base case interest rate scenario at September 30, 2008. The increase in MVPE, if interest rates drop 100 basis points, is primarily driven by the short-term nature of our liabilities compared to the decrease in the expected lives of our assets, relative to the base case rate scenario, as a result of an assumed increase in prepayment speeds on mortgage-related assets, primarily our fixed-rate loan portfolio. Given the current composition of our loan portfolio and the current interest rate environment, it is likely that many of our customers would be economically enticed to refinance or modify their mortgage loans with a 100 basis point decline in rates compared to the base case scenario.

General assumptions used by management to evaluate the sensitivity of our financial performance to changes in interest rates presented in the tables above are utilized in, and set forth under, the gap table and related notes beginning on page 17. Although management finds these assumptions reasonable given the constraints described above, the interest rate sensitivity of our assets and liabilities and the estimated effects of changes in interest rates on our net interest income and MVPE indicated in the above tables could vary substantially if different assumptions were used or actual experience differs from these assumptions.

Gap Table: The gap table summarizes the anticipated maturities or repricing of our interest-earning assets and interest-bearing liabilities as of September 30, 2008, based on the information and assumptions set forth in the notes below.

| | Within Three Months | Three to Twelve Months | More Than One Year to Three Years | More Than Three Years to Five Years | Over Five Years | Total |

| | |

| | |

| Interest-earning assets: | (Dollars in thousands) |

Loans receivable(1) (2): | | | | | | |

| Mortgage loans: | | | | | | |

| Fixed | $ 152,551 | $ 553,997 | $ 1,119,251 | $ 602,752 | $ 1,267,965 | $ 3,696,516 |

| Adjustable | 122,267 | 632,992 | 611,785 | 74,679 | 6,094 | 1,447,817 |

| Other loans | 134,177 | 24,805 | 30,100 | 10,644 | 12,032 | 211,758 |

| Securities: | | | | | | |

Non-mortgage(3) | 17,629 | 2,892 | 14,238 | 50,896 | 58,818 | 144,473 |

Mortgage-related(4) | 209,348 | 688,368 | 608,284 | 287,046 | 448,773 | 2,241,819 |

| Other interest-earning assets | 70,401 | -- | -- | -- | -- | 70,401 |

| Total interest-earning assets | 706,373 | 1,903,054 | 2,383,658 | 1,026,017 | 1,793,682 | 7,812,784 |

| | | | | | | |

| Interest-bearing liabilities: | | | | | | |

| Deposits: | | | | | | |

Savings(5) | 121,872 | 7,189 | 16,927 | 13,397 | 72,718 | 232,103 |

Checking(5) | 9,698 | 32,406 | 74,714 | 72,771 | 210,872 | 400,461 |

Money market(5) | 34,906 | 96,269 | 177,626 | 138,515 | 325,007 | 772,323 |

| Certificates | 494,370 | 986,016 | 916,993 | 120,670 | 947 | 2,518,996 |

Borrowings(6) | 53,609 | 620,000 | 1,446,000 | 920,000 | 120,000 | 3,159,609 |

| Total interest-bearing liabilities | 714,455 | 1,741,880 | 2,632,260 | 1,265,353 | 729,544 | 7,083,492 |

| | | | | | | |

| Excess (deficiency) of interest-earning assets over | | | | | | |

| interest-bearing liabilities | $ (8,082) | $ 161,174 | $ (248,602) | $ (239,336) | $ 1,064,138 | $ 729,292 |

| | | | | | | |

| Cumulative excess (deficiency) of interest-earning | | | | | | |

| assets over interest-bearing liabilities | $ (8,082) | $ 153,092 | $ (95,510) | $ (334,846) | $ 729,292 | |

| | | | | | | |

| Cumulative excess (deficiency) of interest-earning | | | | | | |

| assets over interest-bearing liabilities as a | | | | | | |

| percent of total assets at September 30, 2008 | (0.10)% | 1.90% | (1.19)% | (4.16)% | 9.05% | |

| | | | | | | |

| Cumulative one-year gap at September 30, 2007 | | (11.57)% | | | | |

| | | | | | | |

| Cumulative one-year gap at September 30, 2006 | | (13.62)% | | | | |

(1) Adjustable-rate loans are included in the period in which the rate is next scheduled to adjust or in the period in which repayments are expected to occur, or prepayments are expected to be received, prior to their next rate adjustment, rather than in the period in which the loans are due. Fixed-rate loans are included in the periods in which they are scheduled to be repaid, based on scheduled amortization and prepayment assumptions.

(2) Balances have been reduced for non-performing loans, which totaled $13.7 million at September 30, 2008.

(3) Based on contractual maturities, terms to call date or pre-refunding dates as of September 30, 2008, and excludes the unrealized loss adjustment of $2.1 million on AFS investment securities.

(4) Reflects estimated prepayments of MBS in our portfolio, and excludes the unrealized loss adjustment of $7.5 million on AFS MBS.

(5) Although our checking, savings and money market accounts are subject to immediate withdrawal, management considers a substantial amount of such accounts to be core deposits having significantly longer effective maturities. The decay rates (the assumed rate at which the balance of existing accounts would decline) used on these accounts are based on assumptions developed from our actual experience with these accounts. If all of our checking, savings and money market accounts had been assumed to be subject to repricing within one year, interest-bearing liabilities which were estimated to mature or reprice within one year would have exceeded interest-earning assets with comparable characteristics by $949.5 million, for a cumulative one-year gap of (11.8)% of total assets.

(6) Borrowings exclude the $1.1 million deferred gain on the terminated interest rate swap agreements and $28 thousand of capitalized debt issuance costs on other borrowings.

The change in the one-year gap to positive 1.90% from a negative 11.57% from September 30, 2007 to September 30, 2008, respectively, occurred for two reasons. The first was a reduction of liabilities repricing in the upcoming year, caused primarily by the termination of $575.0 million of interest rate swaps hedging FHLB advances. These interest rate swaps effectively converted long-term fixed-rate advances to adjustable-rate advances that repriced monthly. Once the swaps were terminated the advances became long-term fixed-rate liabilities that will not reprice in the upcoming year. The Bank also had FHLB advances that matured and were extended. The second reason for the change in the one-year gap was the decrease in interest rates, which are expected to cause an increase in the projected cash flows in the upcoming year from mortgage loan prepayments. This results in shorter average lives and quicker repricing of assets than the September 30, 2007 projections.

The gap table summarizes the anticipated maturities or repricing of our interest-earning assets and interest-bearing liabilities as of September 30, 2008, based on the information and assumptions set forth in the notes above. Cash flow projections for mortgage loans and MBS are calculated based on current interest rates. Prepayment projections are subjective in nature, involve uncertainties and assumptions and, therefore, cannot be determined with a high degree of accuracy. Although certain assets and liabilities may have similar maturities or periods to repricing, they may react differently to changes in market interest rates. Assumptions may not reflect how actual yields and costs respond to market changes. The interest rates on certain types of assets and liabilities may fluctuate in advance of changes in market interest rates, while interest rates on other types of assets and liabilities may lag behind changes in market interest rates. Certain assets, such as adjustable-rate mortgage (“ARM”) loans, have features that restrict changes in interest rates on a short-term basis and over the life of the asset. In the event of a change in interest rates, prepayment and early withdrawal levels likely would deviate significantly from those assumed in calculating the gap table. For additional information regarding the impact of changes in interest rates, see the “Percentage Change in Net Interest Income” and “Percentage Change in MVPE” tables above.

Financial Condition

Total assets increased $379.4 million from $7.68 billion at September 30, 2007 to $8.06 billion at September 30, 2008. The increase in assets was primarily attributed to an increase in MBS of $820.1 million which was partially offset by a decrease in investment securities of $381.8 million. The increase in the MBS portfolio was a result of cash flows from the investment securities portfolio being reinvested into the MBS portfolio at a higher average yield, and funds from repurchase agreements being used to purchase MBS. The decrease in the investment securities portfolio was a result of calls and maturities that were not replaced in their entirety. The yields on MBS were more attractive than the yields on investment securities during the year due to the broad disruption in the mortgage market that led to a decrease in the demand for MBS from other market participants, resulting in higher yields on MBS relative to other investment alternatives.

Total liabilities increased $375.8 million from $6.81 billion at September 30, 2007 to $7.18 billion at September 30, 2008. The increase in liabilities was primarily a result of entering into $660.0 million of repurchase agreements, partially offset by a decrease in FHLB advances of $285.1 million. The repurchase agreements replaced certain maturing FHLB advances, as the rate and term offerings on the repurchase agreements were more favorable than other funding options on those dates. Additionally, funds from repurchase agreements were used to purchase MBS. The interest rate spreads between borrowing costs and investment options, at certain times during fiscal year 2008, were at levels above historical averages when considering the related interest rate and credit risk exposure. Management intends to continue to borrow funds to purchase securities when interest rate spreads are at acceptable levels. Management believes that such transactions, if completed, will contribute to improving the earnings of the Company and not create excessive interest rate or credit risk exposure.

Stockholders’ equity increased $3.6 million from $867.6 million at September 30, 2007 to $871.2 million at September 30, 2008.

Loans Receivable. The loan portfolio increased $30.7 million from $5.29 billion at September 30, 2007 to $5.32 billion at September 30, 2008. Loans purchased from nationwide lenders represented 14% of the loan portfolio at September 30, 2008 compared to 17% at September 30, 2007. As of September 30, 2008, the average balance of a purchased mortgage loan was approximately $350 thousand while the average balance of an originated mortgage loan was approximately $125 thousand.

The yield on our loan portfolio decreased 4 basis points from 5.73% at September 30, 2007 to 5.69% at September 30, 2008. The decrease in the yield was a result of a decrease in the rate on home equity loans tied to the Prime rate during the current fiscal year.

Included in the loan portfolio at September 30, 2008 were $336.7 million of interest-only loans, which were primarily purchased from nationwide lenders during fiscal year 2005. These loans do not typically require principal payments during their initial term, and primarily have initial interest-only terms of either five or ten years. At September 30, 2008, $327.3 million, or 97%, of these loans were still in their interest-only payment term. As of September 30, 2008, $142.3 million will begin to amortize principal within two years, $30.2 million will begin amortizing principal within two-to-five years, and the remaining $154.8 million will begin to amortize principal within five-to-ten years. Loans of this type generally are considered to be of greater risk to the lender because of the possibility that the borrower may default once principal payments are required. We attempt to mitigate the risk of interest-only loans by using prudent underwriting criteria. Interest-only loans we purchased had an average credit score greater than 700 and an average LTV ratio of 80% or less at the time of purchase.

The Bank’s underwriting guidelines have provided the Bank with loans of high quality and generally historically low delinquencies and low levels of non-performing assets compared to national levels. Of particular importance is the complete documentation required for each loan the Bank originates and purchases. This allows the Bank to make an informed credit decision based upon a thorough assessment of the borrower’s ability to repay the loan compared to underwriting methodologies that do not require full documentation. The continued decline in the real estate markets, as well as the overall economic environment, contributed to an increase in our non-performing loans during the year. The balance of our non-performing loans increased from $7.4 million at September 30, 2007 to $13.7 million at September 30, 2008. Our ratio of non-performing loans to total loans increased from 0.14% at September 30, 2007 to 0.26% at September 30, 2008. Despite the increase in non-performing loans at September 30, 2008, our non-performing loans continue to remain at low levels relative to the size of our loan portfolio. At September 30, 2008, our allowance for loan losses was $5.8 million or 0.11% of the total loan portfolio and 42% of total non-accruing loans. This compares with an allowance for loan losses of $4.2 million or 0.08% of the total loan portfolio and 57% of total non-accruing loans as of September 30, 2007. See additional discussion of asset quality in Part I, Item 1 of the Annual Report on Form 10-K.

During the fiscal year ended September 30, 2008, the rate on the Bank’s 30-year fixed-rate loans, with no points paid by the borrower, were approximately 220 basis points above the average 10-year Treasury rate, while the rate on the Bank’s 15-year fixed-rate loans were approximately 175 basis points above the average 10-year Treasury rate. The Bank’s loan pricing is benchmarked to the secondary market mortgage pricing.

The following tables summarize the activity in the loan portfolio for the periods indicated, excluding changes in undisbursed loan funds, unearned loans fees and deferred costs and allowance for loan losses. The weighted average contractual life of our mortgage loan portfolio was 23 years at both September 30, 2008 and 2007.

| | | For the Three Months Ended | |

| | | September 30, 2008 | | June 30, 2008 | | March 31, 2008 | | | December 31, 2007 | |

| | | Amount | | | Rate | | | Amount | | | Rate | | | Amount | | | Rate | | | Amount | | | Rate | |

| | | (Dollars in thousands) | |

| Beginning balance | | $ | 5,389,901 | | | | 5.63 | % | | $ | 5,352,278 | | | | 5.66 | % | | $ | 5,366,186 | | | | 5.71 | % | | $ | 5,346,626 | | | | 5.68 | % |

| Originations and refinances | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed | | | 140,565 | | | | 6.08 | | | | 213,098 | | | | 5.72 | | | | 167,003 | | | | 5.67 | | | | 131,345 | | | | 6.14 | |

| Adjustable | | | 45,333 | | | | 5.69 | | | | 47,641 | | | | 5.82 | | | | 32,596 | | | | 6.24 | | | | 43,254 | | | | 6.96 | |

| Purchases | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed | | | 7,309 | | | | 6.12 | | | | 18,209 | | | | 5.51 | | | | 10,191 | | | | 5.71 | | | | 12,086 | | | | 6.20 | |

| Adjustable | | | 17,225 | | | | 5.76 | | | | 14,509 | | | | 5.51 | | | | 20,322 | | | | 5.51 | | | | 19,780 | | | | 5.85 | |

| Repayments | | | (216,090 | ) | | | | | | | (254,784 | ) | | | | | | | (242,391 | ) | | | | | | | (185,913 | ) | | | | |

Other (1) | | | (4,398 | ) | | | | | | | (1,050 | ) | | | | | | | (1,629 | ) | | | | | | | (992 | ) | | | | |

| Ending balance | | $ | 5,379,845 | | | | 5.66 | % | | $ | 5,389,901 | | | | 5.63 | % | | $ | 5,352,278 | | | | 5.66 | % | | $ | 5,366,186 | | | | 5.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended | | | | | | | | | | | | | | | | |

| | | 2008 | | 2007 | | | | | | | | | | | | | | | | |

| | | Amount | | | Rate | | | Amount | | | Rate | | | | | | | | | | | | | | | | | |

| | | (Dollars in thousands) | | | | | | | | | | | | | | | | |

| Beginning balance | | $ | 5,346,626 | | | | 5.68 | % | | $ | 5,257,473 | | | | 5.55 | % | | | | | | | | | | | | | | | | |

| Originations and refinances | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed | | | 652,011 | | | | 5.87 | | | | 612,066 | | | | 6.17 | | | | | | | | | | | | | | | | | |

| Adjustable | | | 168,824 | | | | 6.16 | | | | 191,384 | | | | 6.96 | | | | | | | | | | | | | | | | | |

| Purchases | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed | | | 47,795 | | | | 5.82 | | | | 53,094 | | | | 6.12 | | | | | | | | | | | | | | | | | |

| Adjustable | | | 71,836 | | | | 5.67 | | | | 91,241 | | | | 6.04 | | | | | | | | | | | | | | | | | |

| Repayments | | | (899,178 | ) | | | | | | | (855,980 | ) | | | | | | | | | | | | | | | | | | | | |

Other (1) | | | (8,069 | ) | | | | | | | (2,652 | ) | | | | | | | | | | | | | | | | | | | | |

| Ending balance | | $ | 5,379,845 | | | | 5.66 | % | | $ | 5,346,626 | | | | 5.68 | % | | | | | | | | | | | | | | | | |

| (1) | Amount consists of transfers to real-estate owned and net fees advanced. |

Mortgage-Related Securities. The balance of MBS increased $820.1 million from $1.41 billion at September 30, 2007 to $2.23 billion at September 30, 2008. The increase in the balance was a result of cash flows from the investment securities portfolio being reinvested into the MBS portfolio and funds from repurchase agreements being used to purchase MBS. Management primarily purchases MBS issued by U.S. Government sponsored enterprises or agencies.

The following tables provide a summary of the activity in our portfolio of MBS for the periods presented. The yields and weighted average life (“WAL”) for purchases are presented as recorded at the time of purchase. The yields for the beginning and ending balances are as of the period presented and are generally derived from recent prepayment activity on the securities in the portfolio as of the dates presented. The beginning and ending WAL is the estimated remaining maturity after projected prepayment speeds have been applied. The weighted average yield of the MBS portfolio increased between September 30, 2007 and September 30, 2008 due to the purchase of MBS with yields higher than the existing portfolio, the maturity and repayment of securities with lower yields, and adjustable-rate MBS resetting to higher coupons. The increase in the WAL at September 30, 2008 compared to September 30, 2007 was due to purchases of MBS with WALs greater than the existing portfolio. The WAL of the purchased securities increased further due to higher interest rates since the time of purchase. The WAL of the existing portfolio increased due to maturities and repayments of shorter securities during the year.

| | | For the Three Months Ended | |

| | | September 30, 2008 | | | June 30, 2008 | | | March 31, 2008 | | | December 31, 2007 | |

| | | Amount | | | Yield | | | WAL | | | Amount | | | Yield | | | WAL | | | Amount | | | Yield | | | WAL | | | Amount | | | Yield | | | WAL | |

| | | (Dollars in thousands) | |