The Annual Report to Shareholders for the period ended May 31, 2010 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1)is filed herewith.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

President's Letter & Management's Discussion of Fund Performance

May 31, 2010

Dear AMIDEXTM Funds, Inc. Shareholder,

Enclosed please find the Annual Report for the AMIDEXTM Funds, Inc. for the fiscal year ended May 31, 2010.

Over the last year, despite continued turbulence in world markets, our AMIDEX35TM Israel Mutual Fund benefited from the ongoing growth and development in Israel. The drive, innovation and creativity of the Israeli people remains one of the most exciting stories in the world. Israel has weathered the world economic storm well, with no government sponsored bailouts and no loss of credibility of its major financial institutions. Due to ongoing privatization efforts, tight fiscal control, and relatively little exposure to the exotic financial products that decimated many of the world’s financial kingpins, the Israeli economy remains strong and resilient. Despite the ongoing worldwide recession, Israel has seen growth i n many sectors and continues to be a world leader in technological innovation. In addition to the excitement and potential of the hi-tech markets, Israel’s traditional industries, such as chemicals, banking, insurance and pharmaceuticals, continue to thrive and turned in solid performance over the last year.

We are pleased that many of our Tel Aviv traded shares performed well and that the Israeli market is continuing to rebound from the lows of 2008. Innovations continue to flow from Israel’s hi-tech startups, and Israel remains a world leader in the export and sale of the world’s most demanded products and services.

One of the Israel’s greatest challenges is overcoming the relentless stream of biased and negative media portrayals. Although political developments and news stories rarely have any long term effect on the performance of Israelis stocks, it remains difficult to motivate investors to look past perceptions and at reality. Recent developments in the region have been exploited to promote campaigns aimed at delegitimizing Israel. Those of us who believe in Israel and its people, and who strive to invest in Israeli companies for mutual benefit, must be careful to refute these anti-Israeli messages. Although negative depictions of Israel in the press still plague us, we believe that the true story of Israel’s economic miracle will ultimately prevail.

On a personal note, I had the privilege of touring some of Israel’s key hi-tech, medical equipment, and manufacturing facilities with a group of US investors in early May. Entrepreneurialism remains a national obsession, and the streets, skyscrapers, universities and labs are bustling with activity. Construction projects are seen virtually everywhere, and signs of growing national affluence abound.

We remain convinced that over the long term, Israeli entrepreneurialism coupled with Israel’s legendary investments in research and development, will lead to opportunities for portfolio growth. We intend to stay the course and to patiently wait for US markets to gradually rebound.

For the 12-month period ended May 31, 2010, the AMIDEX35TM Israel Mutual Fund Class No-Load, Class A and Class C returned +16.28%, +16.16%* and +15.30%*, respectively. For the same period, the MSCI World Index and the S&P 500 Total Return Index returned 14.27% and 20.99%, respectively. For the ten year period ended May 31, 2010, the AMIDEX35TM Israel Mutual Fund Class No-Load, Class A and Class C had annualized returns of -1.88%, -2.00%, and -2.72%. For the same period the MSCI World Index and the S&P 500 Index fell -0.12% and -0.81%, respectively.

* The returns stated above do not take into consideration transaction charges such as sales loads, redemption fees or CDSC fees. If these fees were taken into consideration, the one year and ten year returns for the AMIDEX35TM Israel Mutual Fund Class A shares would be +9.77% and -2.56%, respectively and the one year returns for the AMIDEX35TM Israel Mutual Fund Class C shares would be +14.15%. There is a maximum sales load of 5.50% on certain Class A subscriptions. A 1% contingent deferred sales charge “CDSC fee” is imposed on redemptions of Class C sha res made within thirteen months of purchase. The Fund imposes a 2% redemption fee on AMIDEX35TM Israel Mutual Fund No-Load Class shares redeemed within one year of purchase. See Total Return Table on the following pages for additional return information.

Portfolio Summary - The AMIDEX35™ Index tracks the largest Israeli companies traded either in Tel Aviv or New York, providing for the first time, an accurate benchmark for Israel's equity universe. The AMIDEX35TM Israel Mutual Fund’s total industry holdings as of May 31, 2010 were as follows:

| Israeli traded | |

| Banking & Insurance | 18.35% |

| Chemicals | 11.47% |

| Diversified Holdings | 11.45% |

| Telecommunications | 5.61% |

| Food | 3.47% |

| Oil & Gas | 2.83% |

| U.S. traded | |

| Telecommunications | 13.78% |

| Pharmaceuticals | 13.29% |

| Computer Hardware/Software | 8.89% |

| Defense Equipment | 2.39% |

| Utilities | 1.36% |

| Medical Products | 0.83% |

| Semiconductors | 0.53% |

| Electronics | 0.44% |

Portfolio holdings are subject to change. Percentages are based on net assets of the Fund at May 31, 2010.

Our primary investment strategies and objectives remain unchanged. Our Fund is based on an index, and there were no changes in the underlying index or portfolio, other than routine maintenance as outlined in the prospectus.

We continue to believe in the merits of investing in our AMIDEX35TM Israel Mutual Fund and, and we remain committed to the index methodology as the best method of holding portfolios of stocks in our specialty niche. We encourage our investors to remain focused on the long-term prospects for the Fund, and to persevere through the uncertainties that still lie ahead.

Let's hope that the future brings comfort to those who are suffering, calm to regions too long plagued by violence, and security, both physical and economic, to all Americans.

Best regards,

Cliff Goldstein

President, AMIDEXTM Funds, Inc.

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus.

The performance information quoted in this Annual Report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. An investor's return and principal value will fluctuate so that an investor's shares, when redeemed, may be more or less than their original cost. Current performance may be lower or higher than the performance data quoted. See Total Return Table on the following pages for additional return information.

Please call 215-830-8712 or visit the Fund’s website http://www.amidex.com/fund.htm for current performance data. We advise you to consider the fund’s objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Fund. Please read the prospectus carefully before you invest.

The AMIDEX35™ Index is a market capitalization weighted index, consisting of the thirty-five highest capitalized Israeli companies publicly traded on the TASE, NASDAQ, or NYSE. The AMIDEX35™ Index is not an investment product available for purchase.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

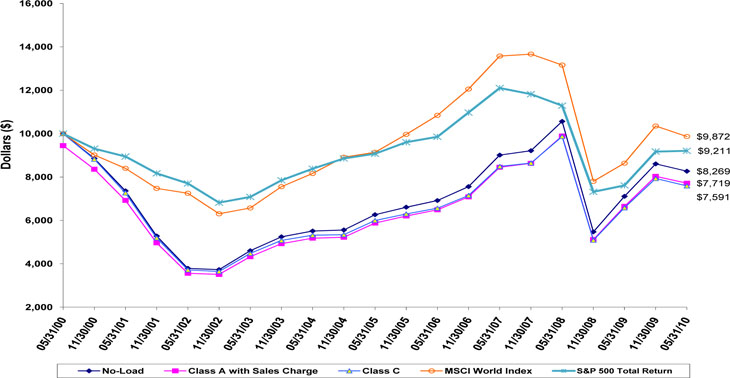

COMPARISON OF A $10,000 INVESTMENT IN THE AMIDEX35TM ISRAEL MUTUAL

FUND VERSUS THE MSCI WORLD INDEX AND THE S&P 500 TOTAL RETURN INDEX (Unaudited)

Average Annual Total Return (Unaudited)

| | Ten Years | Five Years | One Year |

| | ended | ended | Ended |

| | May 31, 2010 | May 31, 2010 | May 31, 2010 |

| No Load Class | (1.88)% | 5.71% | 16.28% |

| Class A | With sales charge | (2.56)% | 4.41% | 9.77% |

| Without sales charge | (2.00)% | 5.60% | 16.16% |

| Class C | With contingent deferred sales charge | (2.72)% | 4.83% | 14.15% |

| Without contingent deferred sales charge | (2.72)% | 4.83% | 15.30% |

| MSCI World Index | (0.12)% | 1.54% | 14.27% |

| S&P 500 Total Return | (0.81)% | 0.31% | 20.99% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the AMIDEX35™ Israel Mutual Fund versus the MSCI World Index and the S&P 500 Total Return Index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The S&P 500 Total Return Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and indiv iduals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the MSCI World Index and the S&P 500 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the AMIDEX35™ Israel Mutual Fund, which will not invest in certain securities comprising these indices.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

Information About Your Fund’s Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The table below illustrates an example investment of $1,000 at the beginning of the period (December 1, 2009) and held for the entire period of 12/01/09 through 05/31/10. Please note however that this table is unaudited. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses (relating to the example $1,000 investment made on 12/01/09). You may use the information in this row, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the

ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

Expenses and Value of a $1,000 Investment for the six months ended May 31, 2010 |

| Actual Fund Return (in parentheses) | Beginning Account Value 12/01/09 | Ending Account Value 05/31/10 | Expenses Paid During Period* |

Amidex35TM Israel Mutual Fund No-Load Class (-3.93%) | $ 1,000.00 | $ 960.70 | $ 13.10 |

Amidex35TM Israel Mutual Fund Class A (-3.95%) | 1,000.00 | 960.50 | 13.10 |

Amidex35TM Israel Mutual Fund Class C (-4.32%) | 1,000.00 | 956.80 | 16.73 |

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

Information About Your Fund’s Expenses (Unaudited) (continued) |

| Hypothetical 5% Fund Return | Beginning Account Value 12/01/09 | Ending Account Value 05/31/10 | Expenses Paid During Period* |

Amidex35TM Israel Mutual Fund No-Load Class | $ 1,000.00 | $ 1,011.57 | $ 13.44 |

Amidex35TM Israel Mutual Fund Class A | 1,000.00 | 1,011.57 | 13.44 |

Amidex35TM Israel Mutual Fund Class C | 1,000.00 | 1,007.83 | 17.17 |

Total Fund operating expense ratios as stated in the current Fund prospectus dated January 6, 2010 were as follows: |

AMIDEX35TM Israel Mutual Fund Class No-Load | 3.27% |

AMIDEX35TM Israel Mutual Fund Class A | 3.26% |

AMIDEX35TM Israel Mutual Fund Class C | 4.01% |

Total Gross Operating Expenses (Annualized) for the year ended May 31, 2010 were 2.84% for the AMIDEX35TM Israel Mutual Fund Class No-Load shares, 2.85% for the AMIDEX35TM Israel Mutual Fund Class A shares and 3.58% for the AMIDEX35TM Israel Mutual Fund Class C shares. Please see the Information About Your Fund’s Expenses, the Financial Highlights and Notes to Financial Statements (Note 4) sections of this report for expense related disclosure during the year ended May 31, 2010. |

For more information on Fund expenses, please refer to the Fund’s prospectus, which can be obtained from your investment representative or by calling 1-888-876-3566. Please read it carefully before you invest or send money.

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

AMIDEXTM Funds, Inc. (the "Company") was incorporated under the laws of the state of Maryland on April 27, 1999, and currently consists of one active portfolio, the AMIDEX35TM Israel Mutual Fund (the "Fund"). The Fund is a non-diversified Fund. As a non-diversified Fund, it may invest a significant portion of its assets in a small number of companies. The Company is registered as an open-end management investment company under the Investment Company Act of 1940 (the "1940 Act"). The Fund was registered to offer four classes of shares, Class A, Cla ss B, Class C and No-load class, with only the Class A, Class C and No-load shares currently being offered in the AMIDEX35 TM Israel Mutual. Each class differs as to sales and redemption charges, minimum investment amounts and ongoing fees. Income and realized/unrealized gains or losses are allocated to each class based on relative share balances. The Fund’s investment objective is long term growth of capital. The Fund became effective with the SEC on April 27, 1999 and commenced operations on June 8, 1999.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP").

a) Investment Valuation—A portfolio security listed or traded on an exchange in domestic or international markets is valued at the last reported sale price of the primary exchange on which it trades before the time when the Fund values assets. Securities traded on more than one market are valued using the market identified as primary based on trading volume and activity. Equity securities traded on the NASDAQ National Market System are valued at the NASDAQ Official Closing Price. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy described below. If there are no sales that day, such securities will be valued at the last bid price, if available. Other over-the-counter securities are valued at the last sale price, if published, or the last bid price, if available. Lacking any sales on the principal exchange that day, the security is valued at the last reported bid, if available and would be categorized as level 2. Debt securities with maturities of sixty days or less at the time of purchase are valued based on amortized cost which approximates fair value and would be categorized as level 2. Money market funds are valued at their asset value of $1.00 per share and are categorized as level 1. If market quotations are not readily available, or when the portfolio management team believes that a readily available market quotation or other valuation produced by the Fund's valuation policies is not reliable, the Fund values the assets at fair value using procedures established by the Board of Directors. The Board members have delegated pricing authority to the fair valuation committee of the adviser, for cert ain pricing issues, as defined in the valuation procedures. Events affecting the value of securities that occur between the time prices are established and the New York Stock Exchange closes are not reflected in the calculation of net asset value unless the fair valuation committee decides that the event would materially affect the net asset value. If the event would materially affect the Fund's net asset values, the security will be fair valued by the fair valuation committee or, at its discretion, by an independent fair valuation vendor. As of and during the year ended May 31, 2010, no securities were valued as determined by the Board of Directors.

In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, ASC 820 (formerly FASB Statement No. 157), the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy under ASC 820 are described b elow:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2010

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

The following is a summary of the inputs used, as of May 31, 2010 in valuing the Fund’s investments carried at fair value:

Security Classification (a) | | | |

| Level 1 | | | |

Common Stock - Israel (b) | | $ | 10,047,614 | |

Common Stock – United States (b) | | | 7,843,180 | |

| Short-Term Investments | | | 1,027,727 | |

| Total Level 1 | | $ | 18,918,521 | |

| | | | | |

| Level 2 | | $ | - | |

| | | | | |

| Level 3 | | $ | - | |

| | | | | |

| Total Investments | | $ | 18,918,521 | |

| | (a) | As of and during the year ended May 31, 2010, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable. |

| | (b) | All common stocks held in the Fund are Level 1 securities. For a detailed break-out of common stocks by major industry classification, please refer to the Schedule of Investments. |

b) Foreign Currency Translation—Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities and income items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments. Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized betw een the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest and foreign withholding taxes, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in foreign exchange rates on foreign currency denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c) Federal Income Taxes—No provision for federal income taxes has been made since the Fund has complied to date with sub-chapter M of the Internal Revenue Code applicable to regulated investment companies and intends to comply in the future and to distribute all of their net investment income and realized capital gains to their shareholders.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions in the open tax years of 2007, 2008 and 2009 and during the year ended May 31, 2010 and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken in the above open tax years. The Fund identifies their major tax jurisdictions as U.S. Federal and Maryland. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statements of operations. During the year ended May 31, 2010, the Fund did not incur any interest or penalties.

d) Distributions to Shareholders—Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gain.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2010

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

e) Use of Estimates—The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Redemption fees and sales charges (loads)—Shareholders of the No-load shares that redeem shares within 365 days of purchase will be assessed a redemption fee of 2.00% of the amount redeemed. The redemption fee is paid directly to and retained by the Fund, and is designed to deter excessive short-term trading and to offset brokerage commissions, market impact and other costs that may be associated with short-term money movement in and out of the Fund. A maximum sales charge of 5.50% is imposed on Class A shares. Shareholders of the Class C shares are imposed a contingent deferred sales charge ("CDSC") of 1.00% in the event of certain redemption transactions within thirteen months following such investments. The CDSC is paid directly to the Adviser to reimburse expens es incurred in providing distribution-related services to the Fund. For the year ended May 31, 2010, there were redemption fees of $13,763 paid to the Fund and CDSC fees of $654 paid to the Adviser.

g) Other—Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

2. CAPITAL SHARE TRANSACTIONS

Transactions in shares of capital stock for the Fund for the year ended May 31, 2010 were as follows:

| | | No-Load | |

| | | Shares | | | Amount | |

| Sold | | | 232,608 | | | $ | 3,444,226 | |

| Redeemed | | | (122,289 | ) | | | (1,778,052 | ) |

| Net Increase | | | 110,319 | | | $ | 1,666,174 | |

| | | Class A | |

| | | Shares | | | Amount | |

| Sold | | | 104,268 | | | $ | 1,151,459 | |

| Redeemed | | | (58,994 | ) | | | (668,091 | ) |

| Net Increase | | | 45,274 | | | $ | 483,368 | |

| | | Class C | |

| | | Shares | | | Amount | |

| Sold | | | 64,658 | | | $ | 537,903 | |

| Redeemed | | | (21,563 | ) | | | (176,499 | ) |

| Net Increase | | | 43,095 | | | $ | 361,404 | |

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2010

2. CAPITAL SHARE TRANSACTIONS (continued)

Transactions in shares of capital stock for the Fund for the year ended May 31, 2009 were as follows:

| | | No-Load | |

| | | Shares | | | Amount | |

| Sold | | | 203,183 | | | $ | 2,702,327 | |

| Redeemed | | | (205,314 | ) | | | (2,331,691 | ) |

| Net Increase (Decrease) | | | (2,131 | ) | | $ | 370,636 | |

| | | Class A | |

| | | Shares | | | Amount | |

| Sold | | | 152,418 | | | $ | 1,255,421 | |

| Redeemed | | | (167,473 | ) | | | (1,313,801 | ) |

| Net Decrease | | | (15,055 | ) | | $ | (58,380 | ) |

| | | Class C | |

| | | Shares | | | Amount | |

| Sold | | | 30,706 | | | $ | 256,462 | |

| Redeemed | | | (46,527 | ) | | | (344,601 | ) |

| Net Decrease | | | (15,821 | ) | | $ | (88,139 | ) |

3. INVESTMENT TRANSACTIONS

For the year ended May 31, 2010, aggregate purchases and sales of investment securities (excluding short-term investments) for the Fund were as follows:

| Purchases | Sales |

| $ 3,151,942 | $ 420,692 |

There were no government securities purchased or sold during the year.

| 4. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

Effective October 1, 2003, the Fund has entered into an Advisory Agreement with Index Investments, LLC ("II") to provide investment management services to the Fund. II furnishes, at its own expense, office space to the Fund and all necessary office facilities, equipment and personnel for managing the assets of the Fund. II also pays all expenses of marketing shares of the Fund and related bookkeeping. Pursuant to the Advisory Agreement, II is entitled to receive a fee, calculated daily and payable monthly at the annual rate of 0.80% as applied to the Fund’s daily net assets. For the year ended May 31, 2010, the Fund incurred $145,895 of advisory fees, with $11,190 remaining payable at May 31, 2010.

Effective October 1, 2003, the Fund has entered into an Administrative Services Agreement ("ASA") with II to provide administrative services to the Fund. Pursuant to the ASA, II is entitled to receive a fee, calculated daily and payable monthly at the annual rate of 0.10% as applied to the Fund’s daily net assets. For the year ended May 31, 2010, the Fund incurred $18,237 of administrative fees, with $1,661 remaining payable at May 31, 2010.

One director of the Fund is also an Officer of II.

The Funds have entered into an Investment Company Services Agreement ("ICSA") with Matrix Capital Group, Inc. ("Matrix"). Pursuant to the ICSA, Matrix will provide day-to-day operational services to the Fund including, but not limited to, accounting, administrative, transfer agent, dividend disbursement, registrar and record keeping services. For its services, Matrix receives $11,000 per month. For the year ended May 31, 2010, Matrix earned $126,587 with $10,653 remaining payable at May 31, 2010 from the Fund.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2010

4. ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued)

Certain Officers of the Fund are also employees of Matrix.

The Fund and II have entered into a Distribution Agreement with Matrix Capital Group, Inc. Pursuant to the Distribution Agreement, Matrix will provide distribution services to the Fund. Matrix serves as underwriter/distributor of the Fund. Pursuant to the Distribution Agreement, Matrix receives $20,000 per year from the Fund. Matrix also receives commissions from the sale of Class A Fund shares for which they are the broker of record. The allocated distribution fees are reduced by the amount of commissions received and the remainder is paid from the accruals pursuant to Rule 12b-1 under the Investment Company Act of 1940. For the year ended May 31, 2010, Matrix received net distribution fees of $17,620 from the Fund. For the year ended May 31, 2010, Matrix re ceived commissions from the sale of Fund shares of $2,029 from the Class A shares.

A separate plan of distribution has been adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940 for each class of shares. With respect to Class A and the No-load class of shares, the plan provides that the Fund may pay a servicing or Rule 12b-1 fee of up to 0.25% annually of the Fund's average net assets attributable to each class of shares, respectively, and up to 1.00% annually of the Fund’s average net assets attributable to Class C shares to persons or institutions for performing certain servicing functions for the Fund's shareholders. The distribution plan is a compensation plan, which also allows the Fund to pay or reimburse expenditures in connection with sales, and promotional services related to distribution of the Fund's shares, including personal services provided to prospective and existing shareholders.

The distribution plans for the shares in the Class A, the No-load class and Class C shares took effect November 19, 1999, June 8, 1999 and May 19, 2000, respectively. For the year ended May 31, 2010, the Fund incurred $53,348 in 12b-1 fees with $20,356 remaining payable at May 31, 2010.

5. TAX MATTERS

There were no distributions paid during the fiscal years ended May 31, 2010 and May 31, 2009 for the Fund.

For U.S. Federal income tax purposes, the cost of securities owned, gross unrealized appreciation, gross unrealized depreciation, and net unrealized appreciation (depreciation) of investments at May 31, 2010 were as follows:

| Cost | | Gross Appreciation | | Gross Depreciation | | Net Appreciation |

| $ 17,815,512 | | $ 6,644,223 | | $ (5,541,214) | | $ 1,103,009 |

The difference between book basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales for the Fund.

The Fund’s distributable earnings on a tax basis are determined only at the end of each fiscal year. As of May 31, 2010, the Fund’s most recent fiscal year-end, the components of distributable earnings on a tax basis were as follows:

| Unrealized Appreciation | | $ | 1,102,991 | |

| Capital Loss Carryforwards | | | (5,136,529 | ) |

| Post-October Capital Loss | | | (245,738 | ) |

| Post-October Currency Loss | | | (9,440 | ) |

| Total Distributable Earnings, Net | | $ | (4,288,716 | ) |

The undistributed capital gains, carryforward losses and post-October losses shown above differ from corresponding accumulated net investment loss and accumulated net realized gain (loss) figures reported in the statement of asset and liabilities due to differing book/tax treatment of short-term capital gains, and certain temporary book/tax differences due to the tax deferral of post-October losses and wash sales.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2010

5. TAX MATTERS (continued)

Under current tax law, net capital losses realized after October 31st may be deferred and treated as occurring on the first day of the following fiscal year. As of May 31, 2010, the Fund has elected to defer net capital losses as indicated in the chart below.

| Post-October Losses |

| Deferred | | Utilized |

| $ 255,178 | | $ 394,619 |

As of May 31, 2010 the Fund has capital loss carryforwards available for federal income tax purposes as follows:

| Expiring in: | 2011 | | $ | (100,824 | ) |

| | 2012 | | | (1,246,393 | ) |

| | 2013 | | | (323,400 | ) |

| | 2014 | | | (1,409,903 | ) |

| | 2015 | | | (1,009,874 | ) |

| | 2016 | | | (652,905 | ) |

| | 2017 | | | (393,230 | ) |

| | | | $ | (5,136,529 | ) |

At May 31, 2010, the Fund had available for federal income tax purposes unused capital loss carryforwards of $5,136,529, which are available for offset against future capital gains, the use of a portion of which is limited by IRS regulations. To the extent this loss carryforward is used to offset future capital gains, it is probable that the amount offset will not be distributed to shareholders. Capital loss carryforwards in the amount of $1,720,156 expired during the year ended May 31, 2010.

6. RECLASS OF CAPITAL ACCOUNTS

In accordance with accounting pronouncements, the Fund has recorded reclassifications in the capital accounts. These reclassifications have no impact on the net asset value of the Fund and are designed generally to present accumulated undistributed net investment income and accumulated realized gains/(losses) on a tax basis which is considered to be more informative to the shareholder. As of May 31, 2010, the Fund recorded reclassifications to increase (decrease) the capital accounts as follows:

Net Investment Loss | Paid-in Capital | Accumulated Capital Losses |

| $ 57,878 | $ (1,787,767) | $1,729,889 |

7. CONCENTRATION OF RISK

The Fund invests exclusively in common stock of Israeli companies. Investing in companies from one geographic region may pose additional risks inherent to a region's economical and political situation.

A large portion of investments held by the Fund are considered investments in the technology sector of the market. Investing in a single market sector may be riskier than investing in a variety of market sectors.

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2010

8. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of May 31, 2010, Merrill Lynch Pierce, Fenner & Smith, Inc. and AMERITRADE, Inc. held 34.13% and 30.15% respectively, of the Fund’s Class A shares in omnibus accounts for the sole benefit of their customers. As of May 31, 2010, Merrill Lynch Pierce, Fenner & Smith, Inc. held 44.76% of the Fund’s Class C shares in an omnibus account for the sole benefit of their customers.

9. COMMITMENTS AND CONTINGENCIES

In the normal course of business, the Company may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Company’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Shareholders and Board of Directors of

AMIDEXTMFunds, Inc.

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of AMIDEXTM Funds, Inc. (the “Fund”), comprising the AMIDEX35TM Israel Mutual Fund as of May 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of Fund management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2010 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the AMIDEX35TM Israel Mutual Fund as of May 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Westlake, Ohio

July 30, 2010

AMIDEXTM Funds, Inc. | ANNUAL REPORT |

Additional Information (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the "Commission") for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-888-876-3566; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling 1-888-876-3566; and on the Commission’s website at http://www.sec.gov.

Shareholder Tax Information – The Fund is required to advise you within 60 days of the Fund’s fiscal year end regarding the federal tax status of distributions received by shareholders during the fiscal year.

Tax information is reported from the Fund’s fiscal year and not calendar year, therefore, shareholders should refer to their Form 1099-DIV or other tax information which will be mailed in 2010 to determine the calendar year amounts to be included on their 2009 tax returns. Shareholders should consult their own tax advisors.

DIRECTORS AND OFFICERS INFORMATION (Unaudited)

Management Information—Following are the Directors and Officers of the Company, their age and address, their present position with the Company or the Portfolios, and their principal occupation during the past five years. In case a vacancy or an anticipated vacancy on the Board of Directors shall for any reason exist, the vacancy shall be filled by the affirmative vote of a majority of the remaining Directors, subject to certain restrictions under the 1940 Act. Those Directors and Officers, who are "interested persons" (as defined in the 1940 Act) by virtue of their affiliation with either the Company or the Adviser, are indicated in the table. The Company’s Statement of Additional Information includes add itional information about the Directors and Officers and is available, without charge, upon request by calling 1-888-876-3566.

Name, Address and Age1 | Position(s) Held with The Company | Term of Office and Length of Time Served2 | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Director3 | Other Directorships Held by Director4 |

| INDEPENDENT DIRECTORS | | | | |

Eli Gabay, Esq. Age 51 | Director | October 2003 | Attorney, Solomon Sherman & Gabay, Philadelphia, PA | 1 | None |

Erica Levi Age 32 | Director | October 2003 | Editor, Philadelphia Magazine; Editor Marion Publications | 1 | None |

| OFFICERS | | | | | |

Clifford A. Goldstein5 Age 51 | President and Director | 1999 | President, Index Investments, LLC, November 2002 to present; President, TransNations Investments, LLC, Executive Consultant and Attorney with The Chartwell Law Offices since 2002. | 1 | None |

Larry E. Beaver, Jr.6 630-A Fitzwatertown Road Willow Grove, PA 19090 Age 41 | Chief Accounting Officer | May 2003 | Director of Fund Administration, Matrix Capital Group, February 2005 to present; Fund Accounting Manager, InCap Service Co., May 2003 to January 2005. | N/A | N/A |

| 1 | Each Director may be contacted by writing to the Director, c/o AMIDEXTM Funds, Inc., 970 Rittenhouse Road, Eagleville, PA 19403. |

| 2 | Each Director holds office until he resigns, is removed or dies. The President and Chief Accounting Officer shall hold office for a one year term and until their respective successors are chosen and qualified, or until such officer dies or resigns. |

| 3 | The Fund Complex consists of the Company. The Company has one portfolio, the AMIDEX35 TM Israel Mutual Fund. |

| 4 | Directorships of companies required to report to the Securities and Exchange Commission under the Securities Exchange Act of 1934 (i.e., "public companies") or other investment companies registered under the 1940 Act. |

| 5 | Indicates an "interested person" as defined in the Investment Company Act of 1940. |

| 6 | The Company entered into an agreement related to its Distribution Plan with Matrix Capital Group. Larry E. Beaver, Jr. is Director of Fund Administration at Matrix. |

DIRECTORS AND OFFICERS INFORMATION (Unaudited)(continued)

Remuneration Paid to Directors and Officers—Officers of the Company and Directors who are "interested persons" of the Company or the Adviser will receive no salary or fees from the Company. Each Director who is not an "interested person" receives a fee of $500 per meeting attended. The Company reimburses each Director and officer for his or her travel and other expenses relating to attendance at such meetings.

Name of Director1 | Aggregate Compensation From the Company2 | Pension or Retirement Benefits Accrued As Part of Portfolio Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From the Company Paid to Directors2 |

| Independent Directors |

| Eli Gabay, Esq. | $3,500 | None | None | $3,500 |

| Erica Levi | $3,500 | None | None | $3,500 |

| Interested Officers |

| Clifford A. Goldstein | None | Not Applicable | Not Applicable | None |

| Larry E. Beaver, Jr. | None | Not Applicable | Not Applicable | None |

| 1 | Each of the Directors and Officers serves as a Director or Officer to the one portfolio of the Company. |

| 2 | Figures are for the fiscal year ended May 31, 2010. |

The registrant’s Board of Directors has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the registrant believes that the experience provided by each member of the audit committee together offer the registrant adequate oversight for the registrant’s level of financial complexity.

The aggregate fees billed for each of the last two fiscal years for professional services rendered by a principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory filings or engagements for those fiscal years were $14,650.00 for 2010 and $28,392.97 for 2009.

There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item.

Set forth below are the aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $4,250 for 2010 and $4,950 for 2009.

The fees were for preparation of IRS Form 1120-RIC and Form 8613 (exercise tax). No tax services were provided to the registrant’s investment adviser.

During the last two fiscal year end for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) billings for 2010 were $700 for the auditor’s consent and $900 for the auditor’s review of the semi-annual financial statements and for 2009 $1,200 for the auditor’s consent and $890 for the auditor’s reviews of the semi annual financial statements.

Registrant has adopted an audit committee charter to provide the Audit Committee with guidance. The audit committee consists of two independent members of the board of directors. The charter calls for receipt and review of the principal accountant’s written statement concerning independence,; dialogue concerning relationships or services to others (which involved all service providers including registrant’s custodian, investment adviser, transfer agent, fund accountants and administrator); and, prior to the board of directors selecting registrant’s auditor, review and assess services provided, fees charged and to be charged, and other relevant data. The audit committee charter contains, among other things, express provisions for selecting registrant’s auditor and for pre-approvi ng all permitted non-audit services. With respect to auditor selection, the charter expressly states that the audit committee is to consider.

Not applicable.

Included in annual report to shareholders filed under item 1 of this form.

Not applicable Fund is an open-end management investment company.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) AMIDEX™ Funds, Inc.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the Following persons on behalf of the registrant and in the capacities and on the dates indicated.