Proposed Transaction Rationale

§ Public company costs are high and increasing

• The costs of complying with the Sarbanes-Oxley Act, increased D&O insurance expenses, audit costs and

implementation of related corporate governance reforms have become significant

• The costs associated with retaining public status, servicing stockholders and continuing public communications remain

high

• The time demands on management and employees associated with public company status are significant

§ Preparing public reports, filings, press releases and Regulation FD compliance

• Since the Company has relatively few executive personnel, these costs can be material

• Investor relations and communications with stockholders take management time

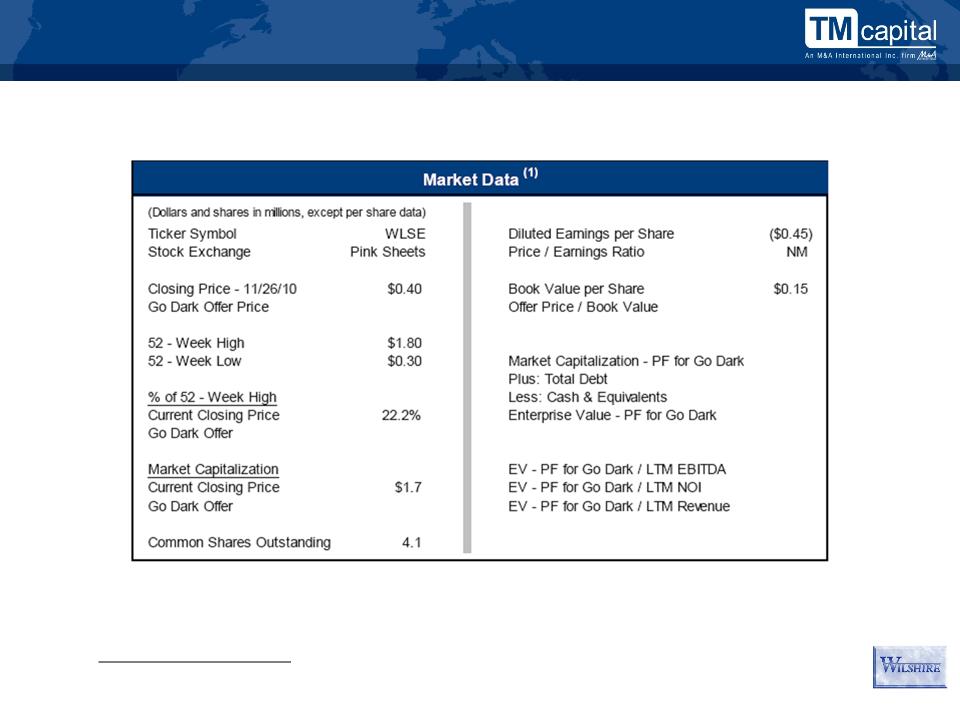

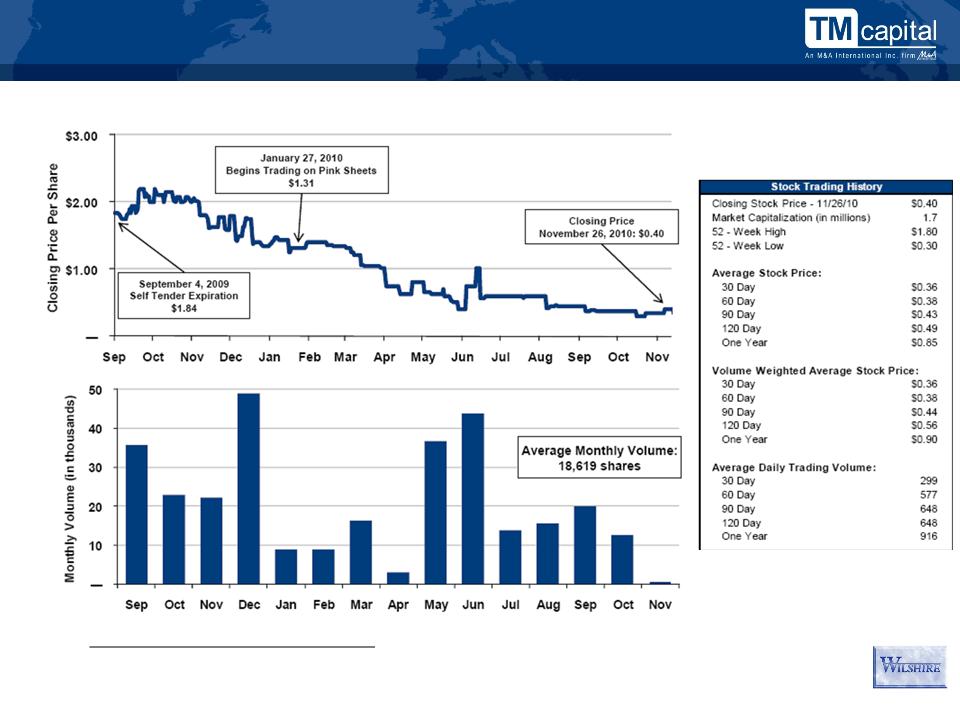

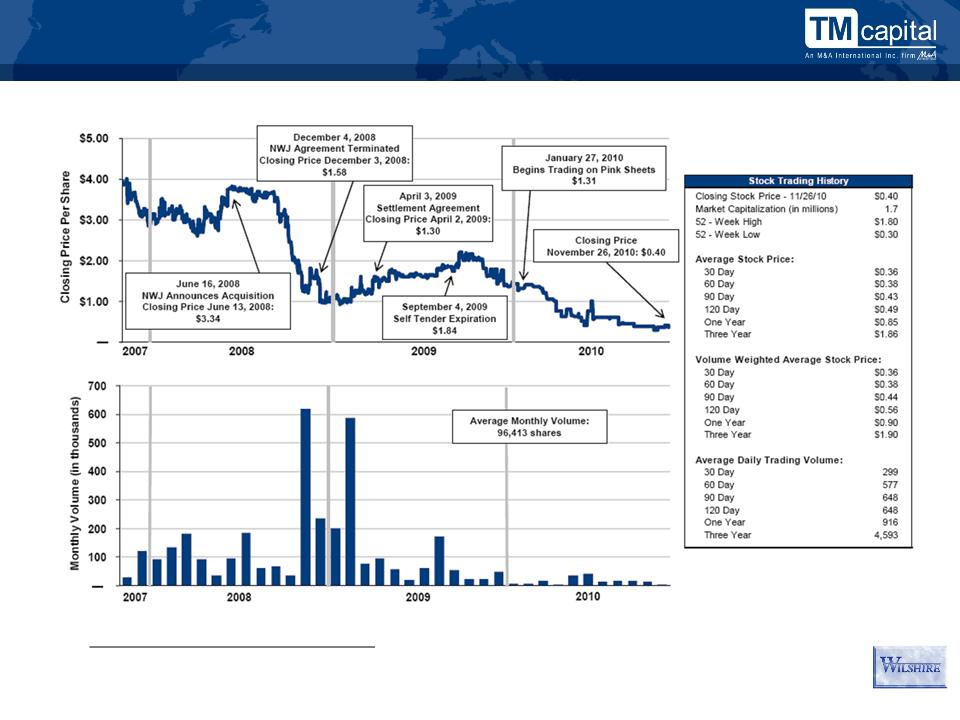

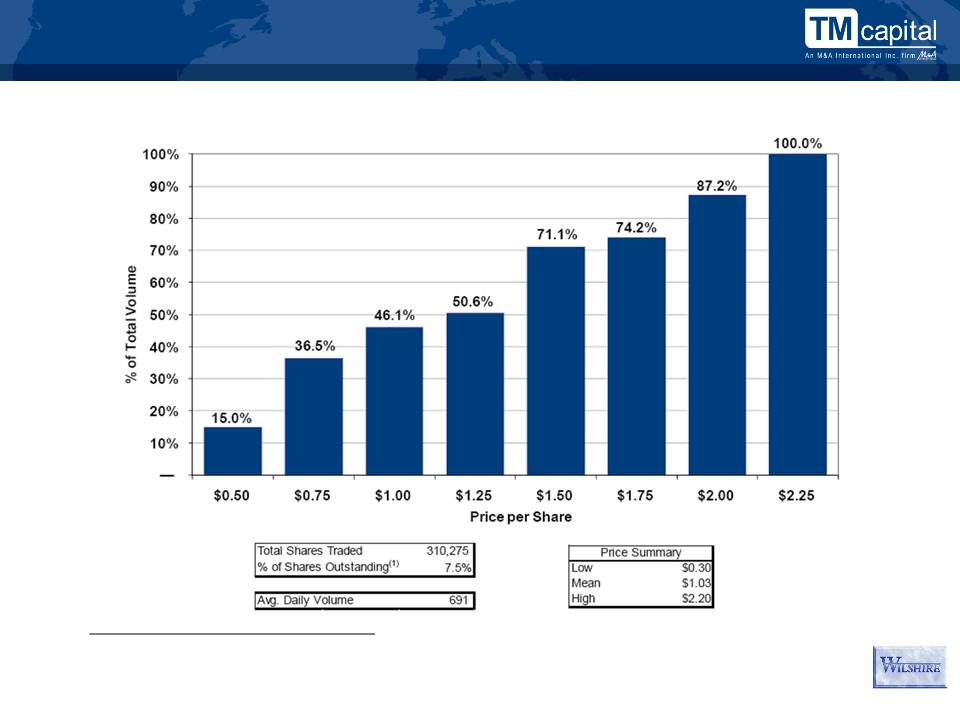

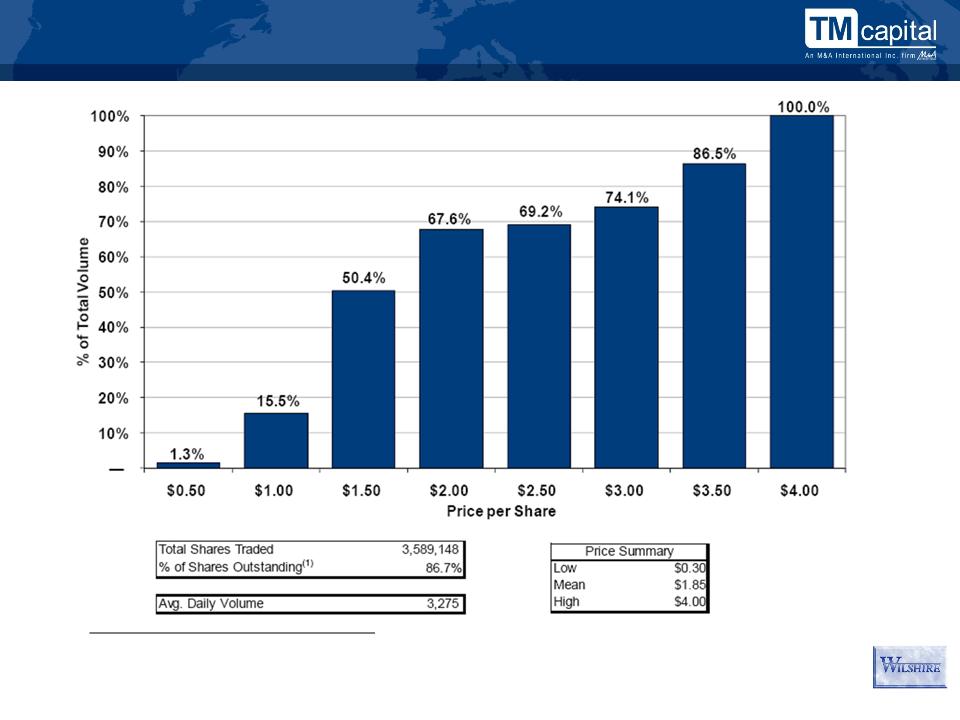

• Stockholders are unable to benefit fully from public company status due to limited liquidity and the Company’s micro-

cap classification

§ Stockholders are not able to move into, or out of, stock positions without materially impacting the

market price

• The Company is not able to raise capital conventionally in public markets

• The Company has not been able to attract any significant institutional investor interest in the public equity

• The Company is not able to effectively use shares for acquisitions

§ Reduced competitive risks with increased focus

• Management can focus more time on long-term financial results and goals rather than short-term market concerns

• The Company no longer has to disclose competitive business or other sensitive information

2