Exhibit 99.1

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

and

MANAGEMENT INFORMATION CIRCULAR

For an

Annual General and Special Meeting of Shareholders

to be held on

July 13, 2010

at

10:00 a.m.

at

Fasken Martineau DuMoulin LLP

333 Bay Street, Suite 2400

Bay Adelaide Centre

Toronto, Ontario

M5H 2T6

_______________________________

Dated June 10, 2010

STARFIELD RESOURCES INC.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

Notice is hereby given that the Annual General and Special Meeting (the “Meeting”) of the shareholders (“Shareholders”) of Starfield Resources Inc. (the “Company”) will be held on July 13, 2010 at Fasken Martineau DuMoulin LLP, 333 Bay Street, Suite 2400, Bay Adelaide Centre, Toronto, Ontario, at 10:00 am (local time in Toronto, Ontario) for the following purposes:

| 1. | to receive and consider the consolidated financial statements of the Company for the financial year ended February 28, 2010, together with the auditor’s report thereon; |

| 2. | to approve an ordinary resolution setting the number of directors at 7 for the ensuing year; |

| 3. | to elect the Board of Directors of the Company for the ensuing year; |

| 4. | to appoint KPMG LLP, Chartered Accountants, as the auditor of the Company for the ensuing year and to authorize the directors to fix the auditors’ remuneration; |

| 5. | to adopt, with or without variation, a special resolution to consolidate its issued and outstanding common shares (the “Shares”) on the basis of a ration within the range of one post-consolidation Share for every 15 pre-consolidation Shares to one post-consolidation Share for every 5 pre-consolidation Shares, with the ration to be selected and implemented by the Board of Directors in its sole discretion, if at all; and |

| 6. | to transact such further or other business as may properly come before the Meeting or any adjournment thereof. |

Accompanying this Notice of Meeting is a Management Proxy Circular, form of Proxy/Voting Instruction Form and the Audited Financial Statements and Management’s Discussion and Analysis for the year ended February 28, 2010.

If you are a registered Shareholder of the Company and are unable to attend the Meeting in person, please date, sign and return the accompanying Instrument of Proxy and deposit it at the offices of Computershare Investor Services Canada., via fax at (416) 263-9524 or 1-866-249-7775, or via mail as follows: Attention: Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 not less than forty-eight (48) hours, excluding Saturdays, Sundays and holidays, before the day of the Meeting, or any adjournment of the Meeting. A person appointed as proxy need not be a Shareholder of the Company.

If you are a non-registered Shareholder of the Company and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or by the intermediary. If you are a non-registered Shareholder and you fail to follow these instructions, your shares may not be eligible to be voted at the Meeting, either in person or by proxy.

Only holders of Common shares of record as of the close of business on June 8, 2010 are entitled to receive notice of the Meeting.

DATED at Toronto, Ontario this 10th day of June, 2010.

ON BEHALF OF THE BOARD OF DIRECTORS

(signed)

| | President and Chief Executive Officer |

STARFIELD RESOURCES INC.

MANAGEMENT INFORMATION CIRCULAR

FOR THE ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON TUESDAY JULY 13, 2010

(All information as at June 10, 2010 unless otherwise stated)

SOLICITATION OF PROXIES

This Management Information Circular is provided in connection with the solicitation by management of Starfield Resources Inc. (“Starfield” or the “Company”) of proxies for the annual general meeting of Shareholders (the “Meeting”) of the Company to be held on July 13, 2010 at 10:00 a.m. (Toronto time), at Fasken Martineau DuMoulin LLP, 333 Bay Street, Suite 2400, Bay Adelaide Centre, Toronto, Ontario.

Management’s solicitation of proxies will primarily be by mail, but some proxies may be solicited personally or by facsimile or telephone by regular employees of the Company at nominal cost. All costs of such solicitations will be borne by the Company.

APPOINTMENT OF PROXIES

A Shareholder has the right to designate a person (who need not be a Shareholder of the Company), other than André Douchane or Greg Van Staveren, both officers of the Company and the Management designees, to attend and act for the Shareholder at the Meeting. Such right may be exercised by inserting in the blank space provided in the enclosed Form of Proxy, the name of the person to be designated or by completing another proper Form of Proxy and delivering same to the Toronto office of the Company’s registrar and transfer agent, Computershare Investor Services Inc. (“Computershare”), Proxy Dept. 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, not later than 10:00 am (Toronto time) on Jul y 9, 2010.

A form of proxy will not be valid for the Meeting or any adjournment unless it is signed by the Shareholder or by his attorney authorized in writing as set out above and delivered to Computershare as set out above.

If a Shareholder or intermediary is a corporation, the form of proxy must be executed by a duly authorized attorney or officer of the corporation

REVOCATION OF PROXIES

In addition to revocation in any manner permitted by law, a proxy may be revoked by an instrument in writing signed by the Shareholder or by the Shareholder’s attorney duly authorized in writing or, if the Shareholder is a corporation or association, the instrument in writing must be executed by an officer or by an attorney duly authorized in writing, and deposited with the Company’s registered office, c/o Fasken Martineau DuMoulin LLP, Suite 2900, 550 Burrard Street, Vancouver, British Columbia, V6C 0A3, at any time up to and including the last business day preceding the day of the Meeting or any adjournment thereof, or, as to any matter in respect of which a vote shall not already have been cast pursuant to such proxy, with the Chairman of the Meeting on the day of the Meeting, or at any adjournment thereof, and upon either of such deposits the proxy is revoked.

VOTING OF PROXIES

The persons named in the enclosed form of proxy are officers of the Company and have indicated their willingness to represent as proxy the Shareholder who appoints them. Each Shareholder may instruct his or her proxy how to vote his or her shares of the Company by completing the enclosed proxy form, and his or her shares will be voted or withheld from voting in accordance with the instructions of the Shareholder.

The person indicated in the accompanying form of proxy shall vote the shares in respect of which they are appointed in accordance with the instructions of the Shareholder appointing them. In the absence of such direction, the shares shall be voted for the approval of each matter for which no specification has been made.

The enclosed form of proxy confers discretionary authority upon the person indicated in the proxy with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting.

At the time of preparing this Management Information Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice of Meeting and this Management Information Circular. If any matters which are not now known to the directors and senior officers of the Company should properly come before the Meeting, the persons named in the accompanying form of proxy will vote on such matters in accordance with their best judgment.

SPECIAL INSTRUCTIONS FOR VOTING BY NON-REGISTERED HOLDERS

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Some shareholders of the Company are “non-registered” shareholders because the shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the shares. More particularly, a person is not a registered shareholder in respect of shares which are held on behalf of that person (the “Non-Registered Holder”) but which are registered in the name of an intermediary that the Non-Registered Holder deals with in respect of the shares. Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-ad ministered RRSP’s, RRIF’s, RESP’s and similar plans; or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited) of which the Intermediary is a participant. In accordance with the requirements of National Instrument 54-101 of the Canadian Securities Administrators, the Company has distributed copies of the Notice of Meeting, this Management Proxy Circular, the Form of Proxy and Notes to Proxy and related documents together with the February 28, 2010 Audited Financial Statements and MD&A (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless, in the case of certain proxy-related materials, a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. With those Meeting Materials, Intermediaries or their service companies should provide Non-Registered Holders with a request for voting instruction form and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions which the Intermediary must follow. The purpose of this procedure is to permit Non-Registered Holders to direct the voting of the shares which t hey beneficially own. Should a Non-Registered Holder wish to vote at the Meeting in person, the Non-Registered Holder should follow the procedure in the request for voting instructions provided by or on behalf of the Intermediary and request a form of legal proxy which will grant the Non-Registered Holder the right to attend the Meeting and vote in person. Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the completed request for voting instructions is to be delivered.

Only registered Shareholders have the right to revoke a proxy. Non-Registered Holders who wish to change their vote must in sufficient time in advance of the Meeting, arrange for their respective Intermediaries to change their vote and if necessary revoke their proxy in accordance with the revocation procedures set above.

RECORD DATE

The directors of the Company have set June 8, 2010 (the “Record Date”) as the record date with respect to the Meeting. Only shareholders of record at the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting. To the extent that a person has transferred any shares of the Company after the Record Date, the new holders of such shares will be entitled to vote the shares transferred to them upon producing properly endorsed certificates evidencing such shares or otherwise establishing that they own such shares, and demand that their names be included in the list of shareholders entitled to vote, in which case, such transferees are entitled to vote such shares at the Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Company is authorized to issue an unlimited number of Common shares, of which 521,912,607 are issued and outstanding as at June 10, 2010, and an unlimited number of First Preferred and Second Preferred Shares, none of which are outstanding.

Voting at the Meeting shall be by show of hands, except when a ballot is demanded by a shareholder or proxyholder at the Meeting. Each Common share entitles the holder to one vote on all matters to come before the Meeting. No group of shareholders has the right to elect a specified number of directors nor are there cumulative or similar voting rights attached to the shares of the Company.

A quorum for the transaction of business at the Meeting is two persons who are, or who represent by proxy, shareholders who, in the aggregate, hold at least 5% of the issued shares entitled to be voted at the Meeting.

To the knowledge of the management of the Company, as of March 31, 2010, no person or company beneficially owned, controlled or directed, directly or indirectly, voting securities of the Company carrying 10% or more of the voting rights attached to any class of voting securities of the Company, except as set out in the table below:

| Name and Municipality of Residence | Number of Common Shares Beneficially Held | Percentage of Outstanding Common Shares |

| FMR LLC | 65,204,436 | 12.5% |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Governance, Nominating and Compensation Committee is responsible for making recommendations to the Board of Directors regarding the compensation to be paid to the Named Executive Officers (“NEOs”). The Company’s compensation package for its NEOs consists of base salary, bonuses and the granting of stock options under the Incentive Stock Option Plan described below. Executive compensation is linked to both the performance of the Company and the individual, with the goal of ensuring that the total compensation is at a level that ensures the Company is capable of attracting, motivating and retaining individuals with exceptional executive skills. In addition, the program is designed so that a portion of the compensation of the Company’s executives aligns their interests with those of the Company’s s hareholders in both the short and long term.

Base Salaries

Salaries form an essential component of the Company’s compensation mix as they are the first base measure to compare and remain competitive relative to peer groups, are fixed and therefore, are not subject to uncertainty and are used as the base to determine other elements of compensation and benefits. Salaries are determined by discussion of the Compensation Committee. One of the main considerations in establishing base salary ranges for NEOs is the evaluation of market comparables for similar positions. Within those ranges, individual rates will vary based upon experience, past or expected performance, level of responsibility, impact on the business, tenure and retention concerns. There is no mandatory framework that determines which of these additional factors may be more or less important and the emphasis placed on any of these additional factors may vary among the NEOs.

No increase in base salary was recommended by the Compensation Committee for fiscal 2010 as the base salaries for the NEOs are considered to be competitive within the industry.

Short-Term Incentive Compensation

Short-term incentive compensation, in the form of cash bonuses are used to reward executive officers for achievement of objectives during a fiscal year. The designation of these objectives is intended to create a strong alignment across the management group with the direction of the Company. Currently, no formal written bonus plan has been adopted by the Company and as such, the bonus component of the NEOs’ compensation is at the discretion of the Compensation Committee and the Board. Bonus target levels are calculated according to the specific level of responsibility of the particular executive, and included in the NEO’s employment contract. For NEOs other than Mr. Douchane, the target bonus level is a maximum of 70% of base salary. For Mr. Douchane, the maximum bonus he is eligible to earn is $250,000. T he performance of the particular NEO, as well as the Company’s performance, is considered in determining whether a bonus will be paid and the amount of such bonus. Following are the key goals/performance criteria for each of the NEOs.

Andre Douchane

| | • | Well organized and successful drilling and exploration programs |

| | • | Advancement of hydromet process |

Greg Van Staveren

| | • | Improve quality and timeliness of financial and shareholder reporting under US and Canadian jurisdictions |

Fred Mason

| | • | Development and organization of camp infrastructure and other operating needs |

| | • | Meeting cost budgets in camp management |

Raymond Irwin

| | • | Well organized and successful exploration programs on all properties |

The NEOs met their goals and objectives for the year as determined by the Compensation Committee. The Board approved payment of bonuses based on the recommendation of the Compensation Committee.

Stock Options

The Company utilizes grants of stock options under its Incentive Stock Option Plan as the long-term incentive portion of its overall compensation package for its executive officers. The goal is to ensure that an incentive exists to maximize shareholder value by linking executive compensation to share price performance and to reward those executives making a long-term commitment and contribution to the Company. Stock options are granted according to the specific level of responsibility of the particular executive and the number of options for each level of responsibility is determined by the Compensation Committee. The number of outstanding options is also considered by the Compensation Committee when determining the number of new options to be granted in any particular year due to the limited number of options which are availabl e for grant under the Incentive Stock Option Plan. The terms of the Incentive Stock Option Plan are described below.

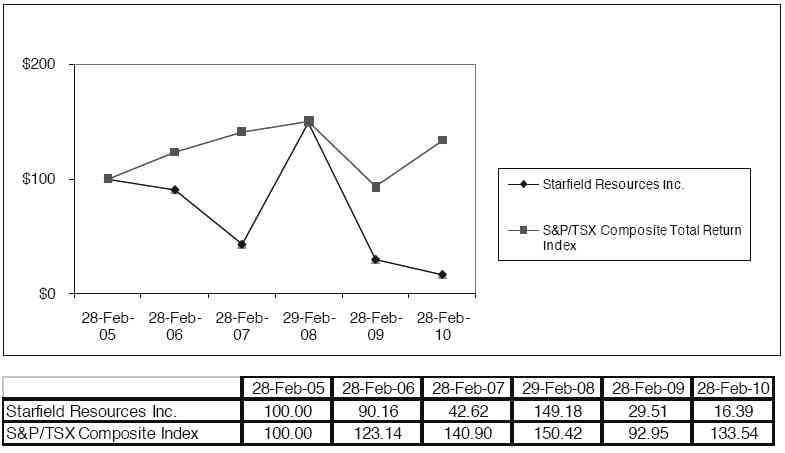

Performance Graph

The following table compares the yearly percentage change in the cumulative total shareholder return on the common shares compared with the cumulative total return of the S&P/TSX Composite Index for the five most recently completed financial years of the Company assuming an investment of $100 purchased on February 28, 2005.

The Company’s common shares are listed and posted for trading on the TSX under the symbol “SRU”. Prior to April 24, 2007, the Company’s common shares were traded on the TSX Venture Exchange under the same symbol.

Trend

The Company and the Board of Directors considers the decrease in the market price of the common shares in fiscal 2010 to be a result of general market volatility, and that the Compensation paid to the NEOs is appropriate given such circumstances.

Incentive Stock Option Plan

The current Incentive Stock Option Plan of the Company was approved and adopted by the shareholders of the Company on November 28, 1997, and an amended and restated version of such Plan was confirmed by shareholders of the Company at its 2006 annual shareholders’ meeting held on July 28, 2006 (the “Option Plan”).

The purpose of the Option Plan is to attract and retain superior directors, officers, advisors, employees and other persons or companies engaged to provide ongoing services to the Company an incentive for such persons to put forth maximum effort for the continued success and growth of the Company and in combination with these goals, to encourage their participation in the performance of the Company.

Under the Option Plan, the aggregate number of Common shares reserved for issuance may not exceed 10% of the issued and outstanding Common shares. Options which have expired, were cancelled or otherwise terminated without having been exercised are available for subsequent grants under the Option Plan. As of the date hereof options to purchase 41,712,364 Common shares (representing approximately 8.0% of the issued and outstanding Common shares) are issued and outstanding under the Option Plan, and to date an aggregate of 15,693,750 Common shares of the Company have been issued upon the exercise of options granted under the Option Plan.

The Option Plan provides that the Board of Directors may from time to time grant options to acquire all or part of the Common shares subject to the Option Plan to directors, officers, advisors, employees and other persons or companies engaged to provide ongoing services to the Company. The options are non-assignable and non-transferable otherwise than by will or by laws governing the devolution of property in the event of death. Each option entitles the holder to purchase one Common share. The exercise price for options granted pursuant to the Option Plan will be determined by the Board of Directors on the date of the grant, which price may not be less than the market value. Market value is defined under the Option Plan where the shares are not listed on an Exchange, as the fair market value of a share on that day determined by the Board in good faith; and where the shares are listed on an Exchange, the last daily closing price per share on the Exchange on the trading day immediately preceding the relevant date and if there was no sale on the Exchange on such date, then the last sale prior thereto. The term of the options granted is determined by the Board of Directors, which term may not exceed a maximum of ten years from the date of the grant. The Board also has the authority to determine the vesting conditions of the options, and certain other terms and conditions of the options. Options granted under the Amended Plan may be exercised as soon as they have vested. The Option Plan does not contemplate that the Company will provide financial assistance to any optionee in connection with the exercise of options.

Options granted under the Option Plan will be subject to certain restrictions which include:

| | (a) | the number of Common shares which may be issued pursuant to the Option Plan (or any other employee related plan or options for services) to any one person may not exceed 5% of the Common shares issued and outstanding on a non-diluted basis from time to time; |

| | (b) | the number of Common shares which may be reserved for issuance pursuant to the Option Plan (or any other employee-related plan or options for services) to all insiders of the Company may not exceed 10% of the issued and outstanding Common shares on a non-diluted basis from time to time; and |

| | (c) | the number of Common shares which may be issued pursuant to the Option Plan (or any other employee related plan or options for services) to all insiders of the Company within a one-year period may not exceed 10% of the issued and outstanding Common shares on a non-diluted basis from time to time. |

An optionee whose employment with the Company is terminated as a result of retirement, disability or redundancy will have 60 days from the date of termination to exercise any options that had vested as of the termination date. An optionee whose employment with the Company is terminated, other than for cause, at any time in the six months following a change of control of the Company shall have 90 days from the date of termination to exercise any option granted, and all options granted will immediately vest on the date of the termination. In the event of the death of an optionee, either prior to termination or after retirement or disability, the optionee’s legal representative will have one year from the date of the optionee’s death to exercise any options that had vested on the date of the optionee’s death. In t he event of any other termination, the optionee shall have 30 days from the date of termination to exercise any options that had vested on the termination date. In the event that an optionee is terminated for cause, any options not exercised prior to the termination shall lapse.

In the event that the Company:

| | (a) | subdivides, consolidates, or reclassifies the Company's outstanding Common shares, or makes another capital adjustment or pays a stock dividend, the number of Common shares receivable under the Option Plan will be increased or reduced proportionately; and |

| | (b) | amalgamates, consolidates with or merges with or into another body corporate, holders of Options under the Option Plan will, upon exercise thereafter of such Option, be entitled to receive and compelled to accept, in lieu of Common shares, such other securities, property or cash which the holder would have received upon such amalgamation, consolidation or merger if the Option was exercised immediately prior to the effective date of such amalgamation, consolidation or merger. |

Subject, where required, to Exchange and/or applicable securities regulatory authorities, the Board may, from time to time amend, suspend or terminate the Option Plan in whole or in part. Shareholder approval is required for amendments to the Option Plan that involve:

| | (c) | amendments to the number of securities issuable under the arrangement, including an increase to a fixed maximum number or a fixed maximum percentage or a change from a fixed maximum number to a fixed maximum percentage; |

| | (d) | any change to the eligible participants which would have the potential of broadening or increasing insider participation; |

| | (e) | the addition of any form of financial assistance; |

| | (f) | any amendment to a financial assistance provision which is more favourable to participants; |

| | (g) | the addition of a cashless exercise feature, payable in cash or securities, which does not provide for a full deduction of the number of underlying securities from the reserved shares; |

| | (h) | the addition of a deferred or restricted share unit or any other provision which results in participants receiving securities while no cash consideration is received by the issuer; and |

| | (i) | in circumstances where the amendment could lead to a significant or unreasonable dilution in the issuer's outstanding securities or may provide additional benefits to eligible participants, especially insiders at the expense of the issuer and its existing securityholders. |

In addition, the Option Plan and any outstanding options may be amended or terminated by the Board if the amendment or termination is required by any securities regulators, a stock exchange or a market as a condition of approval to a distribution to the public of the Common shares or to obtain or maintain a listing or quotation of the Company's Common shares. The Board may also amend or terminate any outstanding option, including, but not limited to, substituting another award of the same or of a different type or changing the date of exercise; provided, however, that the holder of the Option must consent to such action if it would materially and adversely affect the holder.

A copy of the Option Plan is available on request from the Secretary of the Company.

Restricted Share Unit Plan

On January 30, 2009, the Board of Directors approved the adoption of a restricted share unit plan of the Corporation (the “RSU Plan”). The RSU Plan provides that restricted share unit awards (the “RSUs”) may be granted to directors and full-time key employees, including officers, of the Corporation to promote a greater alignment of interests between these individuals and the shareholders of the Corporation. Each RSU entitles the holder (the “Participant”), subject to the terms of the RSU Plan, to receive a payment in cash on the date when the RSU is fully vested in an amount that is equivalent to the weighted average trading price per common share of the Corporation on the Toronto Stock Exchange for the five trading days immediately preceding the payment date. The RSUs granted have a performance period expiring no later than March 1 of the second calendar year commencing after the date the RSUs are awarded. The performance period is subject to the discretion of the Board of Directors. As at March 1, 2010, the Company had 2,648,308 RSUs issued and outstanding under the RSU Plan.

RSUs do not entitle any Participant to exercise voting rights or any other rights attaching to the ownership of common shares or other securities of the Corporation. Participants have no right to participate if a takeover bid is made for securities of the Corporation with voting rights superior to those attached to the RSUs. However, if a takeover bid is made pursuant to a takeover bid circular or an issuer bid is made pursuant to an issuer bid circular or if the Corporation proposes a going private transaction, the Board of Directors in its sole discretion may permit all unvested RSUs awarded under the RSU Plan to Participants in respect of such performance period to vest immediately and payment to be made to all such Participants in accordance with the RSU Plan.

Securities Reserved for Issuance under Equity Compensation Plans

The following table sets out information relating to the Company’s equity compensation plans as at February 28, 2010:

| Plan Category | Number of securities to be issued upon exercise of outstanding options | Weighted-average exercise price of outstanding options | Number of securities remaining available for future issuance under equity compensation plans |

| Equity Compensation Plans approved by securityholders | 41,712,354 | 0.56 | 9,018,156 |

| Equity Compensation Plans not approved by securityholders | Nil | N/A | N/A |

| Total | 41,712,364 | 0.56 | 9,018,156 |

Summary Compensation Table

The compensation information contained below discloses compensation paid to the following individuals:

| | (a) | the Company's Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”); |

| | (b) | each of the Company's three most highly compensated executive officers, other than the CEO and CFO, who were serving as executive officers as at the end of the most recently completed financial year and whose total salary and bonus exceeds $150,000 per year; and |

| | (c) | any additional individuals for whom disclosure would have been provided under (b) except that the individual was not serving as an officer of the Company at the end of the most recently completed financial year-end; |

(each referred to as a “Named Executive Officer” or “NEO”).

During the most recently completed fiscal year of the Company, the Company had four NEOs: André J. Douchane, the President and Chief Executive Officer, Greg Van Staveren, Chief Financial Officer of the Company, Fred Mason, VP, Operations and Raymond Irwin, VP, Exploration. 1726582 Ontario Inc., a company of which Mr. Douchane is a principal, has a management agreement with the Company. 2013026 Ontario Inc., a company controlled by Mr. Van Staveren, has a management agreement with the Company. Mr. Mason is an employee of the Company. Raymond Irwin Consulting, a company controlled by Mr. Irwin, has a management agreement with the Company.

| Name and Principal Position | Year | Salary ($) | Option-based awards ($)(3) | Non-equity incentive plan compensation Annual incentive plans ($) | Total Compensation ($) |

André Douchane(1) President & Chief Executive Officer | 2010 2009 | 103,855 250,000 | 246,000 Nil | Nil 250,000 | 349,855 500,000 |

Greg Van Staveren(2) Chief Financial Officer | 2010 2009 | 133,125 200,000 | 41,000 Nil | 40,000 140,000 | 214,125 340,000 |

Fred Mason VP, Operations | 2010 2009 | 149,000 200,000 | 32,800 Nil | 35,000 140,000 | 216,800 340,000 |

Raymond Irwin(4) VP, Exploration | 2010 2009 | 135,000 209,550 | 32,800 678,625 | 31,500 147,218 | 199,300 1,035,393 |

| (1) | Appointed February 1, 2007 |

| (2) | Appointed September 14, 2007 |

| (3) | The fair value of the stock options granted, estimated using the Black-Scholes fair value option pricing model is in compliance with Canadian generally accepted accounting principles (“Canadian GAAP”) in accordance with Section 3870 of the Canadian Institute of Chartered Accountants handbook. The key assumptions used are determined at each grant date and a life of five years is assumed. |

| (4) | Mr. Irwin’s compensation was paid in U.S. dollars. The compensation was translated at the average rate for the year of 1.27 Canadian dollars per U.S. dollar. |

Outstanding option-based awards at year end

The following table provides details of option-based awards outstanding as of February 28, 2010 for each of the Named Executive Officers.

| | Option-Based Awards |

Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in the money options ($) |

Andre Douchane | 1,500,000 200,000 3,000,000 | 0.285 1.05 0.11 | Feb. 1, 2012 Jan. 15, 2013 Jan 21, 2015 | Nil Nil Nil |

Greg Van Staveren | 1,750,000 175,000 500,000 | 1.18 1.05 0.11 | Sept. 13, 2012 Jan. 15, 2013 Jan 21, 2015 | Nil Nil Nil |

Fred Mason | 1,250,000 125,000 400,000 | 1.59 1.05 0.11 | Sept. 28, 2012 Jan. 15, 2013 Jan 21, 2015 | Nil Nil Nil |

Raymond Irwin | 1,250,000 400,000 | 0.87 0.11 | Apr. 1, 2013 Jan 21, 2015 | Nil Nil |

Value Vested or Earned during the Year

The following table sets forth for each Named Executive Officer the aggregate dollar value that such Named Executive Officer would have realized had he exercised all options that vested during 2009, on the date such options vested. The following table does not include any options that were already vested prior to 2009 or any options that remained unvested as at February 28, 2010. The following table also sets forth the dollar value of the cash bonus that such Named Executive Officer earned and received in 2010.

Name | Option-based awards - Value vested during the year ($)(1) | Non-equity incentive plan compensation - Value earned during the year ($)(2) |

| Andre Douchane | 94,475 | Nil |

| Greg Van Staveren | 323,041 | 40,000 |

| Fred Mason | 301,622 | 35,000 |

| Raymond Irwin | 347,513 | 31,500 |

(1) All option-based awards are derived from options granted under the Stock Option Plan. A description of the Stock Option Plan and its terms is included on pages 6 to 9 of this Circular.

(2) All non-equity incentive plan compensation is derived from the annual bonus component of the Named Executive’s compensation. A description of the annual bonus and how it is calculated is included on pages 4 and 5 of this Circular.

The number of options vesting to Named Executive Officers under the Stock Option Plan during the most recently completed financial year is 2,575,000, of which no options were exercised by the Named Executive Officers during the most recently completed financial year.

Termination and Change of Control Benefits

All of the contracts with the NEOs can be terminated by providing 90 days notice of termination, or pay in lieu of notice. In the case of Mr. Douchane, in the event of a change in control, the amount to be paid is $750,000. In the case of Mr. Van Staveren, in the event of a change in control, the amount to be paid is the equivalent of two times his annual base salary at the annual rate in effect on the effective date of the change in control and a further amount equal to the average bonus paid to him in the prior three fiscal years. In the case of Messrs. Mason and Irwin, assuming the termination, without cause, occurred on February 28, 2010, the estimated incremental payments and benefits that might be paid to each of them would total $83,500 and $46,500, respectively

As of February 28, 2010, the aggregate value of the liability under the termination provisions for the NEO’s is approximately $242,500 based on current year salaries.

Board of Director Compensation

Director Compensation Table

The following table shows the compensation provided to non-executive directors of the Corporation for the year ended February 28, 2010.

| Name | Fees Earned ($) | Total Compensation ($) |

| Norman Betts | 63,000 | 63,000 |

| Stuart Bottomley | 32,500 | 32,500 |

| Ross Glanville | 37,000 | 37,000 |

| Shirley Mears | 41,500 | 41,500 |

| Henry Giegerich | 17,000 | 17,000 |

| Ulrich Rath | 15,500 | 15,500 |

| Timothy Read | 17,500 | 17,500 |

| Philip Martin | 14,000 | 14,000 |

For the year ended February 28, 2010, it is intended that non-executive directors receive a basic board retainer of $24,000 plus $1,000 per meeting for meetings attended in person or $500 per meeting for meetings attended by phone. A fee of $8,000 will be paid to the chair of the audit committee, and $3,000 to the chair of any other committee. A travel fee for board meetings of $1,000 per day will also be paid with a one day travel allowance for each set of board meetings. The Chairman of the Board will receive an annual retainer of $60,000 plus travel fees.

During the year ended February 28, 2010, the Corporation paid a total of $238,000 in directors’ fees. No other pension or retirement benefits have been paid to any of the directors of the Corporation. All directors of the Corporation are reimbursed for their travel and other expenses incurred in connection with fulfilling their responsibilities as directors of the Corporation.

Outstanding option-based awards of Non-executive directors at year end:

Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in the money options ($) |

Norman Betts | 562,500 525,000 175,000 500,000 | 0.285 0.32 1.05 0.11 | Feb. 2, 2012 Apr. 23, 2012 Jan. 15, 2013 Jan 21, 2015 | Nil Nil Nil Nil |

Stuart Bottomley | 150,000 750,000 140,000 500,000 | 0.285 0.32 1.05 0.11 | Feb. 2, 2012 Apr. 23, 2012 Jan. 15, 2013 Jan 21, 2015 | Nil Nil Nil Nil |

Ross Glanville | 100,000 250,000 375,000 140,000 500,000 | 0.60 0.285 0.32 1.05 0.11 | Mar. 11, 2011 Feb. 2, 2012 Apr. 23, 2012 Jan. 15, 2013 Jan 21, 2015 | Nil Nil Nil Nil Nil |

Shirley Mears | 1,400,000 140,000 500,000 | 1.71 1.05 0.11 | Jul. 12, 2012 Jan. 15, 2013 Jan 21, 2015 | Nil Nil Nil |

Philip Martin | 217,500 435,000 1,250,000 | 0.26 0.52 0.11 | Oct 8,2010 Oct 8,2010 Jan 21, 2015 | Nil Nil Nil |

Timothy Read | 217,500 652,500 1,250,000 | 0.26 0.52 0.11 | Oct 8,2010 Oct 8,2010 Jan 21, 2015 | Nil Nil Nil |

Value Vested or Earned during the Year

The following table sets forth for each non-executive directors the aggregate dollar value that such non-executive directors would have realized had he exercised all options that vested during 2010, on the date such options vested. The following table does not include any options that were already vested prior to 2010 or any options that remained unvested as at February 28, 2010.

Name | Option-based awards - Value vested during the year ($)(1) |

| Norman Betts | 39,103 |

| Stuart Bottomley | 33,333 |

| Ross Glanville | 33,333 |

| Shirley Mears | 33,333 |

| Henry Giegerich | 23,083 |

| Ulrich Rath | 23,083 |

| Philip Martin | 25,625 |

| Timothy Read | 25,625 |

(1) All option-based awards are derived from options granted under the Stock Option Plan. A description of the Stock Option Plan and its terms is included on pages 6 to 9 of this Circular.

The number of options vesting to non-executive directors under the Stock Option Plan during the most recently completed financial year is 1,343,750, of which no options were exercised by the non-executive directors during the most recently completed financial year.

Composition of the Governance, Nominating and Compensation Committee

The members of the Governance, Nominating and Compensation Committee are Norman Betts (Chair), Henry Giegerich and Shirley Mears, all of whom are independent directors of the Company. None of the Company’s executive officers have served on the Governance, Nominating and Compensation Committee, or any predecessor thereof, (or in the absence of such committee the entire board of directors) of another issuer whose executive officer is a member of the Governance, Nominating and Compensation Committee or Board of Directors.

Indemnification of Directors or Officers

There is no indemnification payable this financial year to directors or officers of the Company.

Directors and Officers’ Insurance

The Company maintains liability insurance for its directors and officers in the aggregate amount of $10,000,000, subject to a $100,000 deductible loss payable by the Company for any claims. The current annual premium of $89,500 is paid by the Company.

Key Management Insurance

The Company does not maintain key management insurance.

MANAGEMENT CONTRACTS

Management functions of the Company are substantially performed by directors and senior officers of the Company and not, to any substantial degree, by any other person with whom the Company has contracted. The Company has a Management Agreement with 1726582 Ontario Inc., a company of which Mr. Douchane is a principal; and with 2013026 Ontario Inc., a company controlled by Mr. Van Staveren. Please refer to the section entitled “Termination of Employment, Change in Responsibilities and Employment Contracts”.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

No director or executive officer has been indebted to the Company or any of its subsidiaries at any time since the beginning of the last completed financial year of the Company.

CORPORATE GOVERNANCE

National Instrument 58-101 Disclosure of Corporate Governance Practices (“NI 58-101”) requires issuers to disclose the corporate governance practices that they have adopted. National Policy 58-201 Corporate Governance Guidelines (“NP 58-201”) provides guidance on corporate governance practices.

The directors and management of the Company believe that sound corporate governance practices are essential to the performance of the Company. To this end, governance practices and policies have been developed by the Company and are reviewed regularly as to their appropriateness. The following sets out the Company’s approach to corporate governance and addresses the Company’s compliance with NI 58-101.

Board of Directors

The Board of Directors is elected by the shareholders and oversees the conduct of the business and affairs of the Company, supervises its management and uses reasonable efforts to ensure that all major issues affecting the Company are given appropriate consideration. In fulfilling its responsibilities, the Board delegates to management the authority to manage the Company’s day-to-day business, while reserving the ability to review management’s decisions and strategies. The Board discharges its responsibilities directly, through its Committees and through management.

The directors are kept informed of the Company’s operations at meetings of the Board and its Committees and through reports and discussions with management. In addition to its primary roles of overseeing corporate performance and providing quality, depth and continuity of management to meet the Company’s strategic objectives, the Board, among other things:

| | • | approves business, strategic, financial and succession plans and monitors the implementation of such plans; |

| | • | approves financial communications to shareholders; |

| | • | oversees the Company’s financial reporting and disclosure; |

| | • | appoints officers and reviews their performance at least annually; |

| | • | approves items such as dividend payments, the issue, purchase and redemption of securities, acquisition and disposition of capital assets, short and long term objectives and human resource and other plans, Executive Officer compensation and employee benefits, including profit sharing and incentive award plans; and |

| | • | approves changes in the Notice of Articles and Articles of the Company and submits them to shareholders for approval, as required. |

In order to carry out its responsibilities, the Board meets on a regularly scheduled basis and otherwise as required by circumstances and on each such occasion, meets for a portion of the time without management present. During the most recently completed financial year, the Board met six times.

Directors are considered to be independent if they have no direct or indirect material relationship with the Company. Generally, a material relationship is a relationship which could, in the view of the Company’s Board of Directors, be reasonably expected to interfere with the exercise of a director’s independent judgment.

The board facilitates its independent supervision over management by having at least a majority of independent directors. Other than Mr. Douchane the board is comprised of completely independent directors.

Directors | Board of Directors (8 meetings) | Audit Committee (4 meetings) | Governance, Nomination and Compensation Committee (2 meetings) | Technical Committee (1 meeting) |

| Norman Betts | 8 of 8 | 4 of 4 | 2 of 2 | - |

Stuart Bottomley13 | 7 of 8 | - | 1 of 1 | 1 of 1 |

Henry Giegerich3 | 2 of 5 | - | 1 of 1 | 1 of 1 |

Ross Glanville2 | 8 of 8 | 3 of 3 | - | 1 of 1 |

Shirley Mears3 | 8 of 8 | 4 of 4 | 1 of 1 | - |

| Ulrich Rath | 4 of 5 | - | - | 1 of 1 |

Andre Douchane4 | 3 of 3 | - | | |

Philip Martin2 | 2 of 3 | 1 of 1 | 1 of 1 | |

Timothy Read3 | 3 of 3 | - | | |

| | 1. | Mr. Bottomley was a member of the audit committee until July 2008. |

| | 2. | Mr. Glanville was replaced by Mr. Martin on the audit committee on October 9, 2009 |

| | 3. | Mr. Geigerich and Ms. Mears were replaced by Mr. Bottomley and Mr. Read on the Compensation Committee on October 9, 2009 |

| | 4. | Mr. Douchane is a member of the Technical Committee on October 9, 2009 |

Directorships

The following table provides information about the proposed directors of Starfield who are also directors of other publicly-traded companies. See “Particulars of Matters to be Acted Upon - Election of Directors” for further information.

| Name | Names of Other Publicly-traded Companies | Position |

| Norman M. Betts | Tembec Holdings Inc. (TSX:TMB) Tanzanian Royalty Exploration Corp. (TSX:TNX;AMEX:TRE) RTICA Inc. (NEX:RTN) Chairman Capital Corporation (TSXV:CMN-P) Adex Mining Inc. (TSXV:ADE) | Director Director Director Director Director |

| H. Stuart Bottomley | Centamin Egypt Plc (AIM:CEY;TSX:CEE;AX:CNT) African Consolidated Resources Plc (LSE:AFCR.L) Polar Star Mining Corporation (TSXV:PSR) Verona Pharma Plc (AIM:VRP) | Director Director Director Director |

| Ross Glanville | Archon Minerals Limited (TSXV:ACS) Baja Mining Corp. (TSX:BAJ) Clifton Star Resources Inc. (TSXV:CFO) | Director Director Director |

| Shirley Mears | None | None |

| Andre Douchane | North American Palladium Ltd. (TSX:PDL) Osisko Mining Corporation (TSX:OSK) | Director Director |

| Philip Martin | Advanced Primary Minerals Corporation (TSXV:APD) Bear Lake Gold Ltd. (TSXV:BLG) | Director Director |

| Timothy Read | Faroe Petroleum plc (LSE:FPM) Metminco Limited (LSE:MNC) Capital Drilling Limited (LSE:CAPD) | Director Director Director |

Board Mandate

The Board’s mandate is disclosed in Schedule A of this Management Information Circular.

Orientation and Continuing Education

When new directors are appointed, they receive orientation commensurate with their previous experience on the Company’s industry, on the responsibilities of directors, and a tour of the Ferguson Lake site. Board meetings may also include presentations by the Company’s management and employees to give the directors additional insight into the Company’s business. The Company will reimburse reasonable costs for directors taking approved continuing education.

Ethical Business Conduct

The Board has adopted a Code of Ethics and Business Conduct. It deals with conflicts, corporate assets, and confidentiality, compliance with laws and regulations and reporting of illegal or unethical behavior. The board’s mandate includes responsibility for monitoring compliance with the Code.

Nomination of Directors

The Board considers its size each year when it considers the number of directors to recommend to the shareholders for election at the annual meeting of shareholders, taking into account the number required to carry out the Board’s duties effectively and to maintain a diversity of views and experience.

The Governance, Nominating and Compensation Committee consists of three directors, Norman Betts, Stuart Bottomley, and Timothy Read, all of whom are considered independent as defined under applicable stock exchange rules and securities legislation. The committee is responsible for developing the Company’s approach to corporate governance issues and advising the Board in filling vacancies on the Board. In addition, it periodically reviews the size and composition of the Board, the effectiveness of the Board and its individual members and appropriate committee structures, mandates, composition, membership and effectiveness. This Committee takes into account the qualifications of prospective members and takes into account the current Board composition and the anticipated skills required to round out the capabilities of the Bo ard.

Compensation

The Governance, Nominating and Compensation Committee reviews and makes recommendations to the Board regarding the adequacy and form of the compensation for independent directors to ensure that such compensation realistically reflects the responsibilities and risks involved, without compromising a Director’s independence. The Committee regularly reviews the compensation practices of comparable companies with a view to align the Company’s independent directors’ compensation with a comparative group median.

The committee ensures that it has high calibre executive management in place and a total compensation plan that is competitive, motivating and rewarding for participants. The Governance, Nominating and Compensation Committee reviews and makes recommendations to the Board regarding the appointment of the executive officers, and the establishment of, and any material changes to, executive compensation programs, including that of the Chief Executive Officer. This committee also reviews the Chief Executive Officer's goals and objectives at the start of each year and provides an appraisal of the Chief Executive Officer's performance for the most recently completed year. The committee approves and reports to the Board on management succession plans. It is also responsible for overseeing the Company’s employee compensation and be nefits plans.

The committee met three times in the most recently completed financial year.

Other Board Committees

In addition to the Audit Committee and the Governance, Nominating and Compensation Committee, the Company has constituted a Technical, Environmental Health and Safety Committee for the purpose of overseeing the exploration program at Ferguson Lake, the members of which are Ross Glanville (Chair), Stuart Bottomley and Andre Douchane.

Other than as set out above, the Company has no other standing committees.

Assessments

The Chairman, supported by the Governance, Nominating and Compensation Committee, is mandated to review the contribution of Board members on an annual basis and to monitor the quality of the relationship between management and the Board in order to recommend ways to improve that relationship. This process is formalized and set out in the Company’s detailed Board policy manual.

PARTICULARS OF MATTERS TO BE ACTED UPON

The number of directors for the Company is set by ordinary resolution of the shareholders of the Company. Management of the Company is seeking shareholder approval of an ordinary resolution determining the number of directors of the Company at seven (7) for the ensuing year.

The persons named in the following table are management's nominees to the board. Each director elected will hold office until the next annual general meeting or until his or her successor is duly elected or appointed unless his or her office is earlier vacated in accordance with the Articles of the Company or unless he or she becomes disqualified to act as a director.

| Name, Municipality of Residence and Date First Became a Director | Principal Occupation During Past Five Years | Voting Securities Beneficially Owned or Controlled (as at Feb. 28, 2010) |

Ross Glanville (3) Vancouver, BC August 16, 2004 | Professional Mining Engineer, President, Ross Glanville & Associates Ltd.; Director of Baja Mining Corp. and Archon Minerals Ltd. | 187,237 shares 1,365,000 options |

Norman Betts (1) (2) Fredericton, NB March 30, 2006 | Associate Professor at University of New Brunswick. Cabinet Minister, Province of New Brunswick. | 512,500 shares 1,762,500 options |

Stuart Bottomley(2) (3) Iden, East Sussex January 19, 2007 | Consultant, Self Employed. | 2,650,000 shares 1,540,000 options |

Shirley Mears(1) Kanata, ON July 12, 2007 | Chartered Accountant, Vice President, Finance of Edgewater Computer Systems, Inc. from May 2007 to August 2008, Consultant, March 2006 to May 2007. Senior Vice President and Chief Financial Officer, Hydro Ottawa Holding Inc. from October 2003 to March 2006. | 117,000 shares 2,040,000 options |

Andre Douchane(3) Toronto, Ontario October 8, 2010 | CEO, Starfield Resources | 1,500,000 shares 4,700,000 options |

Philip Martin(1) Oakville, Ontario October 8, 2010 | Mining finance consultant | 2,087,522 shares 1,902,500 options |

Timothy Read(2) London, England October 8, 2010 | Independent resource industry consultant. President and CEO of Adastra Minerals Inc until 2006 | 635,000 shares 2,120,000 options |

(1) Member of the Audit Committee.

(2) Member of the Governance, Nominating and Compensation Committee.

(3) Member of the Technical, Environmental, Health and Safety Committee.

None of the nominees for election as a director of the Company is, as at the date of this information circular, or has been, within 10 years before the date of the information circular:

| | (a) | a director, chief executive officer or chief financial officer of any company (including the company in respect of which the information circular is being prepared) that, |

| | (i) | was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| | (ii) | was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer, |

| | (b) | a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, state the fact; or |

| | (c) | has, within the 10 years before the date of the information circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director. |

No proposed director of the Company has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority or been subject to any other penalties or sanctions imposed by a court, or regulatory body that would likely be considered important to a reasonable security holder in deciding to vote for a proposed director.

The following are brief biographies of Management’s proposed nominee directors.

Ross Glanville, age 63, Director (B.A.Sc., P.Eng, MBA; CGA) - Mr. Glanville specializes in valuations of public and private producing mines and mineral exploration properties. He was formerly the president of a TSX-listed mining company, and the vice-president of a large engineering company. Mr. Glanville has valued more than five hundred mining and exploration companies in Canada, the U.S.A., Australia, and Mexico, as well as over one hundred and fifty in many other areas of the world, including Africa, South America, Europe, and Asia. He has formed public companies (listed on the Toronto Stock Exchange, the Australian Stock Exchange, NASDAQ, and the TSX Venture Exchange) and has served on the Boa rds of Directors of four companies with producing mines. He has written several articles, and given many presentations, related to the valuations of exploration and mining companies, and some of these articles were published by the United Nations, the Society of Mining Engineers, and by various Canadian magazines and newspapers.

Norman Betts, age 56, Director and Chair (BBA; C.A., Ph.D., FCA) - Mr. Betts is an associate professor, at the Faculty of Business Administration, with the University of New Brunswick. Mr. Betts is currently a director or chair of six public organizations, as well as New Brunswick Power Corporation, a provincial Crown corporation and Export Development Canada, a federal crown corporation. In addition to teaching, he has served in research and administrative positions, including assistant dean of the Master of Business Administration program and associate dean of the faculty. Norman Betts served as a member of the Legislative Assembly of New Brunswick from 1999 to 2003 and served as both Minister of Finance and Minister of Business during this time.

Stuart Bottomley, age 65, Director - Mr. Bottomley worked initially as a stockbroker in the City of London and became a portfolio manager in 1972. He worked with the Target Group of Unit Trusts for 12 years, the last 4 under the ownership of Jacob Rothschild. In 1984, he joined Fidelity International in London, working for the ERISA group, focused on UK and European markets. Since leaving Fidelity, Mr. Bottomley has consulted for numerous private and public companies. He is currently a Non-executive Director of Centamin Egypt Plc., African Consolidated Resources Plc., Polar Star Mining Corporation and Verona Pharma Plc.

Shirley Mears, age 55, Director (B.Comm. (Hon); C.A.) - Ms. Mears was a Tax Manager and Senior Staff Accountant for Ernst & Young from 1977 to 1983 before joining Motel Corporation where she was Vice President, Human Resources Canada and Tax from 1983 through 1991 and Vice President and Treasurer from 1992 through 2000. In 2000 she worked at Marlin Semiconductor Inc. where she was responsible for implementing worldwide mergers and acquisitions as Vice President and Treasurer until August 2003. From October 2003 until March, 2006, Ms. Mears was the Senior Vice President and Chief Financial Officer of Hydro Ottawa Holding Inc. Ms. Mears currently serves on the board of directors of and is the Cha ir of the Audit Committee of New Brunswick Power Holding Corporation, a provincial Crown corporation (including all of its wholly owned subsidiaries).

Andre Douchane, age 59, Nominee Director (B.Sc.) - Mr. Douchane joined the Corporation in February 2007 and was appointed a Director in October 2009. He is a graduate of the New Mexico Institute of Mining and Technology. From 1991 to 1995, he was Vice President of Operations for Battle Mountain Gold, President, Battle Mountain North America, where he was responsible for six mining operations world-wide (two in the United States, two in South America, and two in Australia) and for all development projects. From 1996 to 2001, Mr. Douchane was Vice President of Operations for Franco-Nevada Mining Corp, where he was responsible for putting together the team that permitted, designed, engineered, develop ed, constructed, and managed the operations of Franco-Nevada’s high-grade underground gold mine and mill in Midas, Nevada. From 2001 to 2002, he was President and Chief Operating Officer of Chief Consolidated Mining Co, where he was responsible for operations at Utah holdings, underground gold mine and mill. From 2002 to 2003, he was President of Management Inc., a full service management consulting company. From 2003 to 2005, Mr. Douchane was President and Chief Executive Officer of North American Palladium Ltd. He currently services as Chairman of the Board of North American Palladium Ltd and is a director of Osisko Mining Corporation.

Philip Martin, age 65, Nominee Director (B.Sc. Eng., MBA, P.Eng.) - Mr. Martin was recently on the Board of Directors for Nevoro Inc, and as an independent director, he chaired both Nevoro's Audit Committee and its Nominating and Corporate Governance Committee. He was also a member of its Compensation Committee and its Environmental Occupational Health & Safety Committee. Mr. Martin is a professional Engineer with an MBA from Cranfield University, Bedfordshire, UK, and has extensive experience in the finance and investment business. He has worked with Toronto Dominion Bank (in corporate banking), Gordon Capital Corporation (analyst and investment banking) and First Associates Investment Inc. (investment banking). He is currently a director of several mining and exploration companies listed in Canada and acts as a mining finance consultant.

Timothy Read, age 63, Nominee Director (B.A. Econ.) - Mr. Read was recently the Chairman of the Board of Directors for Nevoro Inc. An independent director, he was a member of Nevoro's Audit Committee, its Nominating and Corporate Governance Committee and its Compensation Committee. Mr. Read was the President and CEO of Adastra Inc. until 2006, when it was acquired by First Quantum Minerals Inc. Prior to this, he was a Managing Director of Investment Banking for Merrill Lynch (UK) and the Head of Investment Banking of the Mining Group at London-based Smith New Court PLC (acquired by Merrill Lynch in 1995). Mr. Read is a graduate of economics from the University of Strathclyde, Glasgow, Scotland and is a Fellow of the Securities and Investment Institute He is a director of Faroe Petroleum plc, Metminco Limited, and Capital Drilling Limited.

As of the date hereof, the directors and executive officers of the Company, as a group beneficially own, directly or indirectly, or exercise control or direction over an aggregate 8,610,575 shares or 1.6% (29,890,575 shares or 5.8% on a fully diluted basis) of the Company’s issued and outstanding Common shares as of the date hereof.

Unless otherwise instructed, proxies received pursuant to this solicitation will be voted for the appointment of KPMG LLP, Chartered Accountants, as the auditor of the Company, to hold office until the close of the next annual general meeting, or until a successor is appointed. It is proposed that the remuneration to be paid to the auditor be determined by the Board of Directors of the Company.

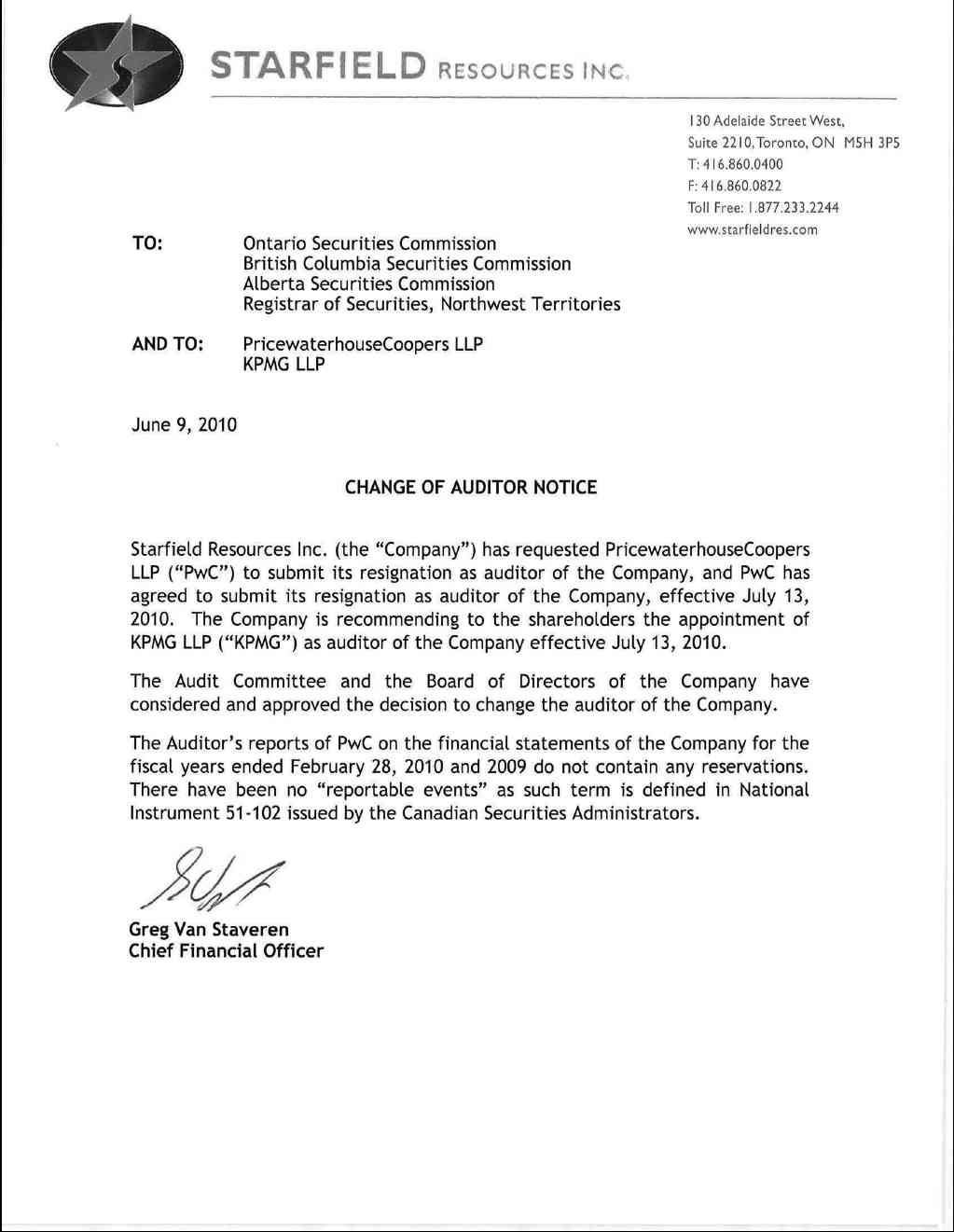

The resignation of PricewaterhouseCoopers LLP and the appointment of KPMG LLP was considered and approved by the Company’s Audit Committee, which has reviewed all the documents related to the change of auditor. As required by securities regulatory authorities, a copy of the Reporting Package respecting the change of auditor is attached as Schedule B to this Management Information Circular. There have been no reservations contained in the reports of PricewaterhouseCoopers LLP for the recently completed fiscal year. There are no reportable events between the Company and PricewaterhouseCoopers LLP and there have been no qualified opinions or denials of opinion of PricewaterhouseCoopers LLP.

Shareholders are being asked to consider and, if thought fit, approve a special resolution to consolidate its issued and outstanding Shares (the “Share Consolidation”). If the special resolution is approved, the Board will have the authority, in its sole discretion, to select the exact consolidation ratio, provided that (i) the ratio may be no smaller than one post-consolidation Share for every 5 pre-consolidation Shares and no larger than one post-consolidation Share for every 15 pre-consolidation Shares, and (ii) the number of pre-consolidation Shares in the ratio must be a whole number of Shares. Approval of the special resolution by holders of Shares would give the Board authority to implement the Share Consolidation at any time, subject to any required regulatory approvals. In addition, notwithstanding approval of the proposed Share Consolidation by Shareholders, the Board, in its sole discretion, may revoke the special resolution, and abandon the Share Consolidation without further approval or action by or prior notice to Shareholders.

To be effective the Share Consolidation must be approved by not less than 66.66% of the votes cast by holders of Shares present in person or represented by proxy and entitled to vote at the Meeting.

The background to and reasons for the Share Consolidation, and certain risks associated with the Share Consolidation and related information, are described below.

Background to and Reasons for the Share Consolidation

The current financial position of the Corporation necessitates that it avail itself of all reasonable opportunities to seek additional financing on a timely basis. The management of the Corporation is of the view that both the number of Shares outstanding and the current market price of the Shares may limit the ability of the Corporation to attract significant investors, especially in the United States. The Corporation believes that a higher anticipated Share price may meet investing guidelines for certain institutional investors and investment funds that are currently prevented under their investing guidelines from investing in the Shares at current price levels. The Corporation also believes that a higher Share price may provide it with the ability to obtain a United States stock exchange listing for its Sha res should the opportunity arise and the Board determines that it is in the best interest of the Corporation. Shareholders may also benefit from relatively lower trading costs associated with a higher Share price. It is likely that many investors pay commissions based on the number of Shares traded when they buy or sell Shares. If the Share price were higher, investors may pay lower commissions to trade a fixed dollar amount than they would if the Share price is lower. In addition, the combination of potentially lower transaction costs and increased interest from some investors could potentially positively impact the trading liquidity of the Shares.

Our Board believes that Shareholder approval of a range of potential consolidation ratios (rather than a single consolidation ratio) would provide the Board with the flexibility to achieve the desired results of the Share Consolidation. If the special resolution is approved, the Share Consolidation would be implemented, if at all, only upon a determination by the Board that it is in the best interests of the Corporation at that time. In connection with any determination to implement a consolidation, the Board will set the timing for such consolidation and select the specific ratio from within the range of ratios set forth in the special resolution. The Board’s selection of the specific ratio would be based primarily on the price level of the Shares at that time and the expected stability of that price level. Currently, our Bo ard believes that an initial post-consolidation price in the range of $1.00 to $5.00 per Share would be an appropriate initial price level for the Shares. However, the Board may, in its sole discretion, select a ratio from within the range set forth in the special resolution that would be expected to result in an initial post-consolidation Share price that is above or below this range. No further action on the part of Shareholders would be required in order for the Board to implement the Share Consolidation.

The special resolution also authorizes the Board to elect not to proceed with, and abandon, the Share Consolidation at any time if it determines, in its sole discretion, to do so. The Board would exercise this right if it determined that the Share Consolidation was no longer in the best interests of the Corporation and its Shareholders. No further approval or action by or prior notice to Shareholders would be required in order for the Board to abandon the Share Consolidation.

Despite the immediate increase of the market value of the Shares following the Share Consolidation, the future effect of the Share Consolidation on the market price of the Shares cannot be accurately predicted. In particular, there is no assurance that the market price for the Shares after the Share Consolidation will equal or exceed a direct arithmetic result of the Share Consolidation, since there are numerous factors and contingencies which would affect such price, including the status of the market for the Shares at the time, the Corporations’ reported results of operations in future periods and general economic, political, stock market and industry conditions.

There can be no assurance that any increase in the market price of the Shares resulting from the Share Consolidation will be sustainable. If the Share Consolidation is implemented and the market price of the Shares declines, the percentage decline may be greater than would occur in the absence of the Share Consolidation. There can also be no assurance that the Share Consolidation will result in a per share market price that will attract institutional investors or investment funds or that such price will satisfy the investment policies of the institutional investors or investment funds.

No Fractional Shares to be Issued

No fractional Shares will be issued in connection with the Share Consolidation and, in the event that the consolidation would otherwise result in the issuance of a fractional share, each fractional share that is less than ½ of a share will be cancelled and each fractional share that is at least ½ of a share will be changed to one whole share.

Principal Effects of the Share Consolidation

If approved and implemented, the Share Consolidation will occur simultaneously for all of the Shares and the consolidation ratio will be the same for all of such Shares. The Share Consolidation will affect all Shareholders uniformly. Except for any variances attributable to fractional shares, the change in the number of issued and outstanding Shares that will result from the Share Consolidation will cause no change in the capital attributable to the Shares and will not materially affect any Shareholders’ percentage ownership in the Corporation, even though such ownership will be represented by a smaller number of Shares.

In addition, the Share Consolidation will not affect any Shareholder’s proportionate voting rights. Each Share outstanding after the Share Consolidation will be entitled to one vote and will be fully paid and non-assessable. The principal effects of the Share Consolidation will be that:

| | • | Reduction in number of Shares outstanding. The number of Shares issued and outstanding will be reduced from approximately 521,912,607 Shares as of June 10, 2010 to between approximately 34,800,000 and 104,400,000 Shares, depending on the ratio selected by the Board; and |

| | • | Reduction in number of Shares reserved for issuance under Stock Option Plans and Warrants. The numbers of Shares reserved for issuance under the Corporation’ Stock Option Plans and the number of Warrants to purchase Shares will be reduced proportionately based on the consolidation ratio selected by the Board. |

Effect on Non-registered Shareholders

Non-registered Shareholders holding their Shares through a bank, broker or other nominee should note that such banks, brokers or other nominees may have different procedures for processing the Share Consolidation than those that will be put in place by the Corporation for registered Shareholders. If you hold your Shares with such a bank, broker or other nominee and if you have questions in this regard, you are encouraged to contact your nominee.

Effect on Share Certificates

If the proposed Share Consolidation is approved by Shareholders and implemented, registered Shareholders will be required to exchange their share certificates representing pre-consolidation Shares for new share certificates representing post-consolidation Shares. Following the announcement by the Corporation of the consolidation ratio selected by the Board and the effective date of the Share Consolidation, registered Shareholders will be sent a letter of transmittal from the Corporation’s transfer agent, Computershare, as soon as practicable after the effective date of the Share Consolidation. The letter of transmittal will contain instructions on how to surrender your certificate(s) representing your pre-consolidation Shares to the transfer agent. The transfer agent will forward to each registered Shareholder who has sent th e required documents a new share certificate representing the number of post-consolidation Shares to which the Shareholder is entitled.

Until surrendered, each share certificate representing pre-consolidation Shares will be deemed for all purposes to represent the number of whole post-consolidation Shares, to which the holder is entitled as a result of the Share Consolidation.

Shareholders should not destroy any share certificate(s) and should not submit any share certificate(s) until requested to do so.

Procedure for Implementing the Share Consolidation.

If the Shareholders approve the special resolution and the Board decides to implement the Share Consolidation, the Directors will set the consolidation ratio and effective date by resolution provided that, in any event.

No Dissent Rights

Under the BCBCA, Shareholders do not have dissent and appraisal rights with respect to the proposed Share Consolidation.

For the reasons indicated above, the Board and management of the Corporation believe that the proposed Share Consolidation is in the best interests of the Corporation and its Shareholders and, accordingly, recommend that Shareholders vote FOR the special resolution.

Unless you have specified in the enclosed form of proxy that the votes attaching to the Shares represented by the proxy are to be against the adoption of the special resolution to permit the Share Consolidation, on any ballot that may be called for in the special resolution to permit the Share Consolidation, the management representatives designated in the enclosed form of proxy intend to vote the Shares in respect of which they are appointed proxy FOR the special resolution to permit the Share Consolidation.

SHARE CONSOLIDATION RESOLUTION

RESOLVED, AS A SPECIAL RESOLUTION, THAT:

| (1) | The authorized capital of the Corporation is altered by consolidating all of the issued and outstanding common shares (“Shares”) of the Corporation without par value on the basis of a consolidation ratio to be selected by the Corporation’s Board of Directors, in its sole discretion, provided that (i) the ratio may be no smaller than one post-consolidation Share for every 5 pre-consolidation Shares and no larger than one post-consolidation Share for every 15 pre-consolidation Shares, and (ii) the number of pre-consolidation Shares in the ratio must be a whole number of Shares. |

| (2) | In the event that the consolidation would otherwise result in the issuance of a fractional share, each fractional share that is less than ½ of a share will be cancelled and each fractional share that is at least ½ of a share will be changed to one whole share. |

| (3) | The effective date of such consolidation shall be the date of the resolutions of the directors setting the consolidation ratio and effective date. |

| (4) | Any director or officer of the Corporation is hereby authorized and directed for and in the name of and on behalf of the Corporation to execute, or to cause to be executed, whether under the corporate seal of the Corporation or otherwise, and to deliver or cause to be delivered all such other documents and instruments, and to do or cause to be done all such other acts and things as, in the opinion of such director or officer, may be necessary or desirable in order to carry out the intent of this special resolution, including, without limitation, the determination of the effective date of the consolidation and the delivery of articles of amendment in the prescribed form to the Director appointed under Business Corporations Act (British Columbia), the execution of any such document or the doing of any such other act or thing being conclusive evidence of such determination; and |

| (5) | Notwithstanding the foregoing, the directors of the Corporation are hereby authorized, without further approval of or notice to the shareholders of the Corporation, to revoke this special resolution at any time. |

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Except as disclosed elsewhere herein, none of the directors or executive officers of the Company or those persons nominated for election as a director, or any of their associates or affiliates has or has had any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any transaction to be acted on other than the election of directors and the appointment of the auditor.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as disclosed elsewhere in this Management Information Circular, no director or executive officer of the Company or of any of its subsidiaries who has held such position at any time since the beginning of the most recently completed financial year, no person or company who beneficially owns, directly or indirectly, or exercises control or direction over, voting securities or the Company or a combination of both carrying not less than 10% of the voting rights (a “10% Holder”), no person who is a director or officer of a 10% Holder, and no associate or affiliate of any of the foregoing has any direct or indirect material interest in any transaction since the commencement of the Company’s most recently completed fiscal year or in any proposed transaction which has or would materially affect the Company or an y of its subsidiaries.

SHAREHOLDERS PROPOSALS